The coronavirus pandemic accelerated digital transformation of organizations, including health care providers.

But another patient side-effect of COVID-19 has been the digital transformation of many patients, documented by data gathered by Rock Health and Stanford Center for Digital Health and analyzed in their latest report explaining how the public health crisis accelerated digital health “beyond its years,” noted in the title of the report.

But another patient side-effect of COVID-19 has been the digital transformation of many patients, documented by data gathered by Rock Health and Stanford Center for Digital Health and analyzed in their latest report explaining how the public health crisis accelerated digital health “beyond its years,” noted in the title of the report.

Rock Health and Stanford commissioned an online survey among 7,980 U.S. adults from early September to early October 2020 to gauge peoples’ interest in and utilization of digital health tools and telehealth. Rock Health has conducted a consumer digital health study for several years, giving us the ability to compare longitudinal findings from year to year. But this year’s research is particularly interesting and important given its timing during the COVID-19 crisis.

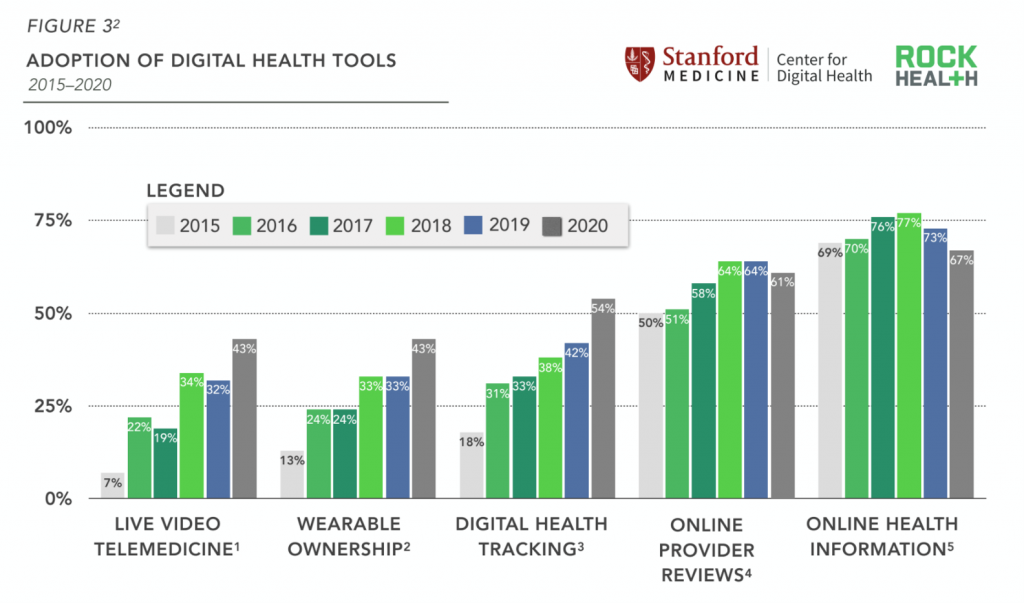

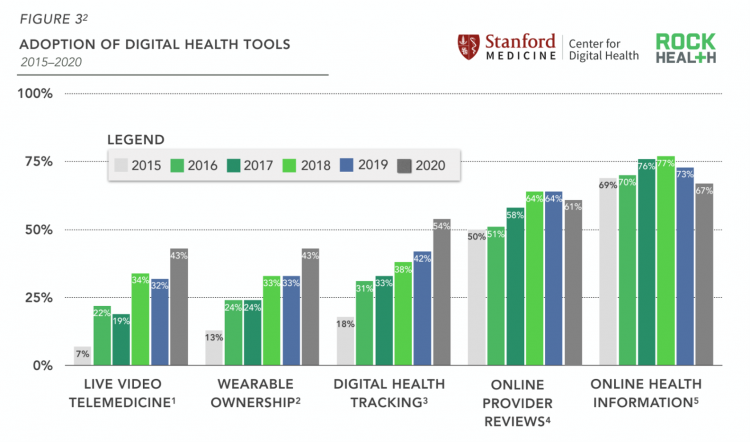

The first chart illustrates consumers’ use of digital health tools, showing that online health information and online provider reviews.

But the big growth areas were for live video telemedicine, wearable tech, and digital health tracking.

This represents a shift more to “me care” in 2020 with the sharp uptake of digital platforms and wearable tech.

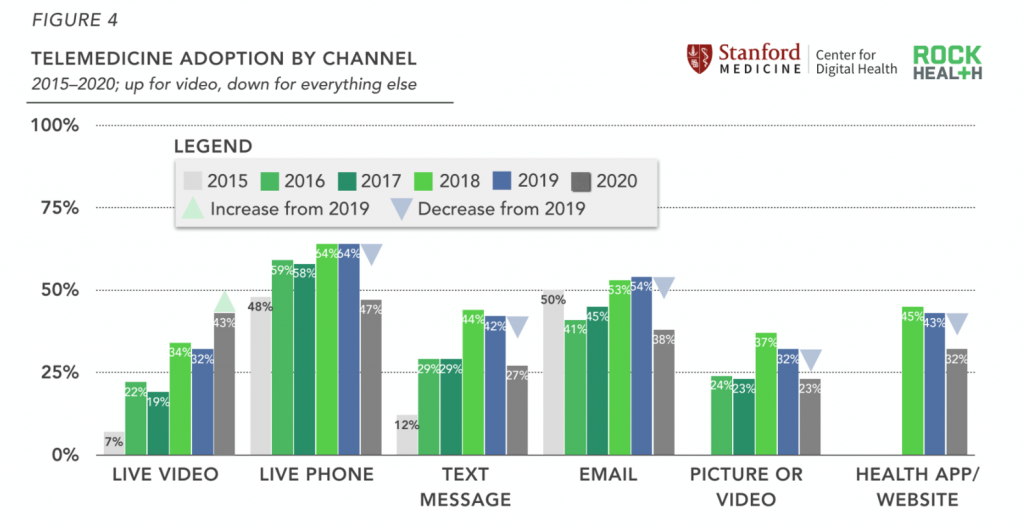

The second chart focuses in on telemedicine adoption by channel, comparing six years of Rock Health’s consumer research. The growth segment for telemedicine was for live video, with a decline in live phone, texting, email, picture/video, and health app/website.

The second chart focuses in on telemedicine adoption by channel, comparing six years of Rock Health’s consumer research. The growth segment for telemedicine was for live video, with a decline in live phone, texting, email, picture/video, and health app/website.

Live video calls were used by most people across all age groups assessed (18-34, 35-54, and 55+). Most of these live video calls were also done through a service offered by consumers’ health care providers (doctors/clinicians), followed by services offered by insurance companies.

In 2018, consumers’ tracking of at least one health metric crossed over from an analog method to digital tracking, illustrated in the line chart. The proportion of people tracking at least one health metric digitally was 38% in 2018 and grew to over one-half, 54%, in 2020. This and other studies have tracked consumers’ growing use of digital tech and wearables during the COVID-19 pandemic, and the 10%-point growth from 2019 to 2020 is notable.

![]() The most popular health metrics consumers tracked in 2020 via digital means were fertility, heart rate, physical activity, menstrual cycle, blood sugar, sleep, blood pressure, and food/diet.

The most popular health metrics consumers tracked in 2020 via digital means were fertility, heart rate, physical activity, menstrual cycle, blood sugar, sleep, blood pressure, and food/diet.

Only weight and medication tracking had a majority of people using analog formats to track.

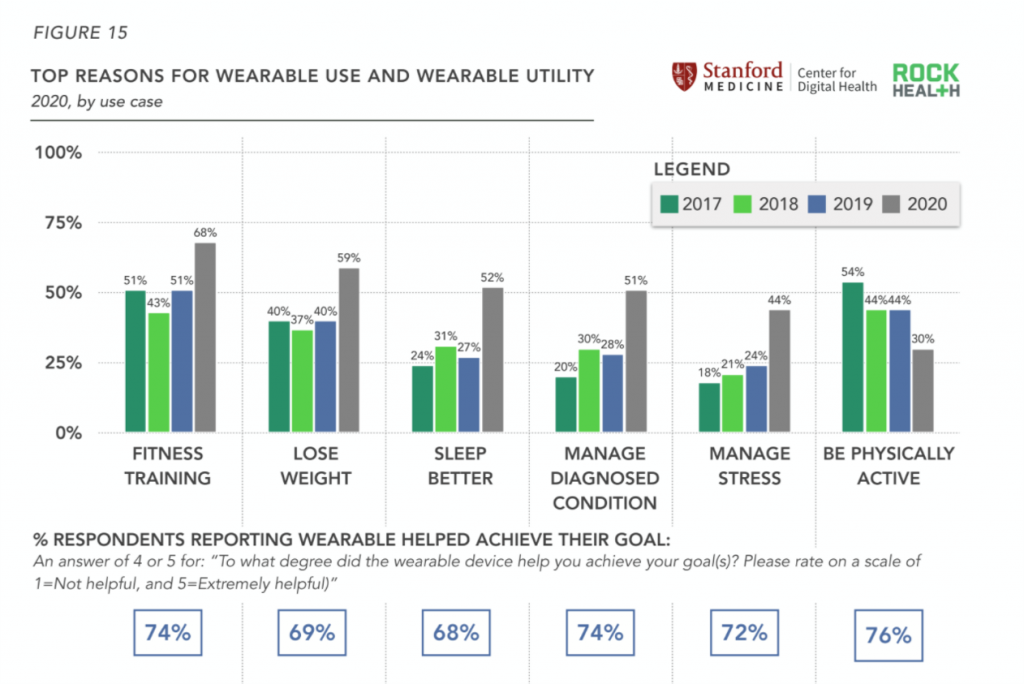

Why do people use wearable tech for health?

First and foremost, it’s for fitness training, losing weight, sleeping better, and managing a chronic condition.

But in terms of the wearable tech helping the user achieve a goal, note that 76% of people looking to be physically active said the tech was helpful in achieving that goal, followed by 74% of people lauding their fitness training wearable tech and managing chronic conditions.

The most common chronic conditions consumer tracked were for heart disease, diabetes, and obesity, where digital health tracking was especially useful for:

The most common chronic conditions consumer tracked were for heart disease, diabetes, and obesity, where digital health tracking was especially useful for:

- Heart disease, for blood pressure, heart rate, weight, and blood sugar

- Diabetes, for blood sugar, blood pressure, food or diet, and weight

- Obesity, for weight, blood pressure, food or diet, and blood sugar.

Rock Health and Stanford Center also looked into patients’ delaying medical care during the pandemic — a topic I frequently address on Health Populi most recently, here.

The largest change in people postponing care was found among mid-aged consumers between 35 and 54, along with more women than men and residents of the Northeast.

Concerningly, more people dealing with a chronic condition avoided health care more than people without a chronic disease — 48% versus 31%, meaning that 1 in 2 patients with a diagnosed condition delayed health care during the pandemic in 2020.

Furthermore, nearly one-half of people with a mental health condition also delayed care more than people who did not report mental health issues.

Health Populi’s Hot Points: Digital health tools generate data. As health consumers ramp up their adoption of wearable and digital tech for their personal medical care and wellness, they create new data points with every use of the app associated with that technology.

The most trusted source of health information continues to be “my” physician, followed by “any” physician, then friends and family, and hospital-health plan-and pharmacy websites.

Consumers’ trust in all sources of health information increased between 2018 and 2020 except for peoples’ trust in online health websites/apps and social media, both of which lost a number of consumers trusting them.

Peoples’ willingness to share their health data with physicians is also the top-trusted share-point, followed by sharing personal health information with family which substantially grew in trust between 2018 and 2020.

Peoples’ willingness to share their health data with physicians is also the top-trusted share-point, followed by sharing personal health information with family which substantially grew in trust between 2018 and 2020.

Willingness in sharing health data with insurers, pharmacies, research institutions all fell between 2019 and 2020. Interestingly, people who do not track their health data, either via digital or analog means, are less likely to be willing to share their data with any stakeholder assessed except for a physician.

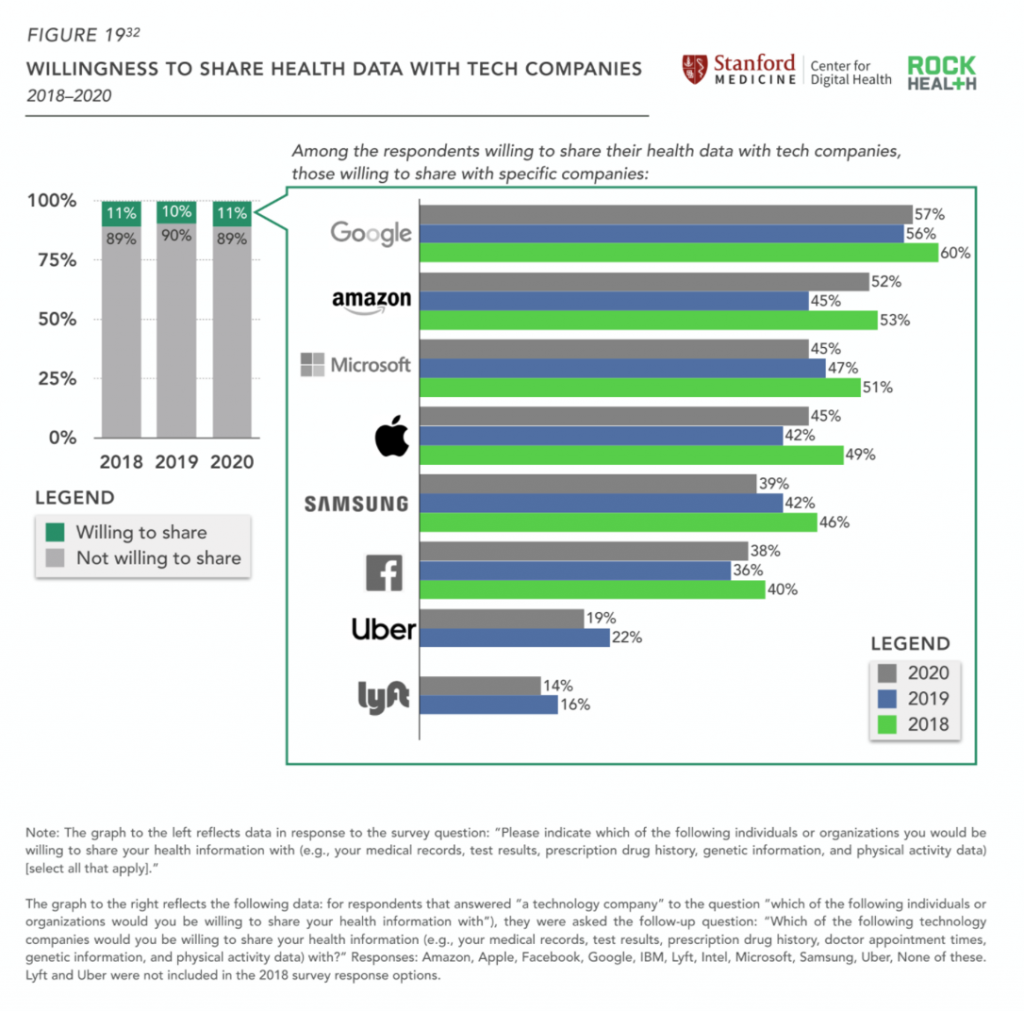

This last chart has some intriguing findings about health consumers’ views on just which tech companies with whom they’d be willing to share their health data. [Note that these data points are based on the 11% of people willing to share with any tech company, a base of about 880 consumers — that is, 11% of the near 8,000 U.S. adults polled.

In 2020, the top tech companies with whom U.S. consumers would be willing to share their health data were Google, Amazon, Microsoft, and Apple.

It is important to note that the share of consumers willing to share data with Amazon grew significantly from 45% willing in 2019 to 52% willing to share in 2020. This is the largest shift in willingness seen in this question, A hypothesis of “why?” this growing trust between health consumers and Amazon for sharing health data could be the growing use of Amazon in the pandemic for ecommerce, especially for purchasing and “hunting and gathering” food and essential goods, including hygiene products. Amazon has been a go-to for more millions of U.S. consumers, some of whom had never been members of Prime in previous years.

This research illustrates both the digital transformation of the consumer for health, as well as her maturing experience dealing with telehealth and virtual care and evolving sense of trust. Even with that digital growth and experience in a Year of Zoom that marked 2020, many more consumers would trust their personal data with their physicians and providers and families than with tech companies. This will challenge pure tech companies in finding ways to cross the trust-equity chasm they may have for people in their medical care. Will Amazon be able to build on the brand-trust equity they built in the pandemic era and translate that to their various health/care efforts? Can Google grow health-trust as they, too, expand their desired footprint in health care? And what of Apple which in this study lost a few points in the trust-share issue?

Local hospitals and health systems — that is, “my” and “our” health care in our neighborhoods and ZIP codes — continue to own the data stewardship equity relationship with patients. Tech companies are much better capitalized than health systems. Watch this dynamic continue to play out in 2021 as we emerge from the public health crisis into 2022. Collaboration between the legacy health care system — hospitals, physicians, pharma — with tech and other new and novel entrants to our health/care ecosystem — is inevitable.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...