As health care industry stakeholders and policymakers have begun to recognize and address the underlying drivers of peoples’ health, there’s another acronym that is taking hold in health care beyond SDoH: that is ESG, standing for

- Environment

- Social, and

- Governance pillars of responsibility and activity.

To mark this Earth Day 2022, I’ve written a brief primer on ESG for the health care community published today in the Medecision Liberate Health blog. Here in Health Populi, I’ll give you a few highlights with graphics you won’t see in that essay to illustrate some key points.

First: a Gallup survey out this week tells us that one in three people in the U.S. have been impacted by extreme weather that then shapes peoples’ health.

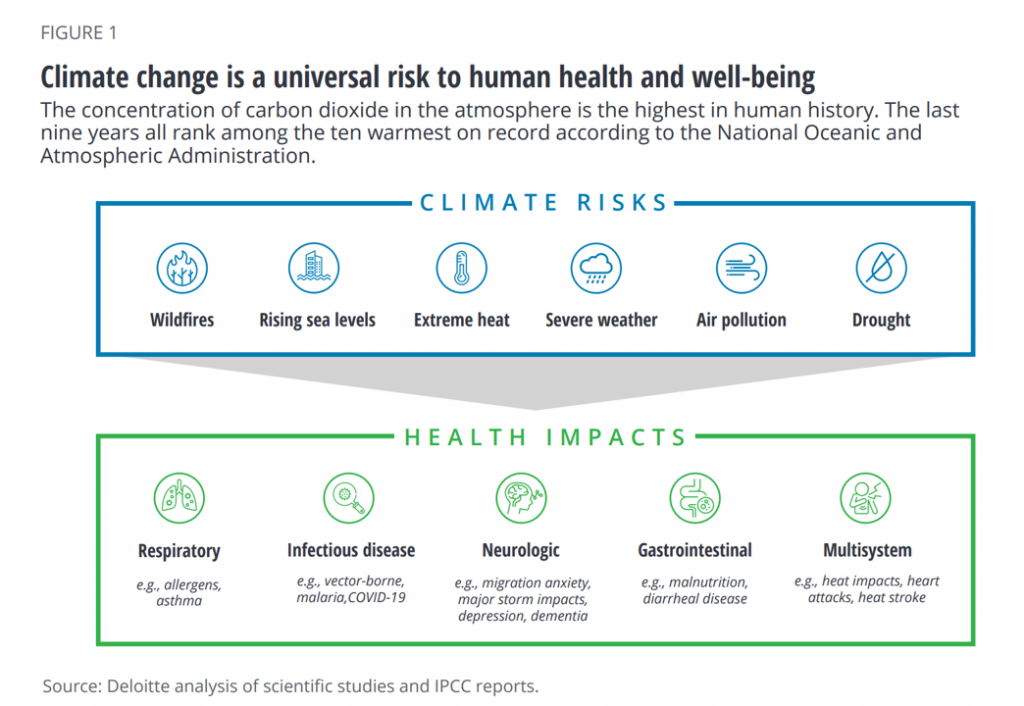

This chart on climate risks and health impacts comes from Deloitte’s latest read on climate resilience and health care, laying out the climate risks — wildfires, rising sea levels, extreme heat, severe weather, air pollution, and drought — and their direct impacts on health:

- Respiratory

- Infectious disease

- Neurologic

- Gastrointestinal, and

- Multisystem conditions such as heart disease.

I hasten to call out the mental health impacts of climate risks, quantified and identified in a growing list of peer-reviewed research reports.

Financial institutions are paying heed to “E,” along with “S” and “G” components of organizations’ operating plans and strategies. One of the leading financial services institutions active in ESG initiatives is Bank of America. The Bank has been a pioneer in its sector in studying, understanding, and supporting corporate banking customers’ ESG programs in the context of risk management.

Financial institutions are paying heed to “E,” along with “S” and “G” components of organizations’ operating plans and strategies. One of the leading financial services institutions active in ESG initiatives is Bank of America. The Bank has been a pioneer in its sector in studying, understanding, and supporting corporate banking customers’ ESG programs in the context of risk management.

The graphic here is comprised of phrases that embody Bank of America’s perspective on health care’s ESG priorities: a holistic approach that embodies sustainable energy, community health, diversity and inclusion, waste management, good partnering, and worthwhile projects.

The credit rating agency world of folks like Fitch Ratings, Moody’s, and Standard & Poors, also directly impact health care companies and health systems’ plans in that credit ratings influence these organizations’ access to capital for new projects, expansions, and innovations. Without a strong financial backbone (again, in risk management mode), health care’s pharma and life science companies, med tech suppliers, hospitals, health plans, and retail health channels cannot implement innovative visions for new services, new products, and new markets.

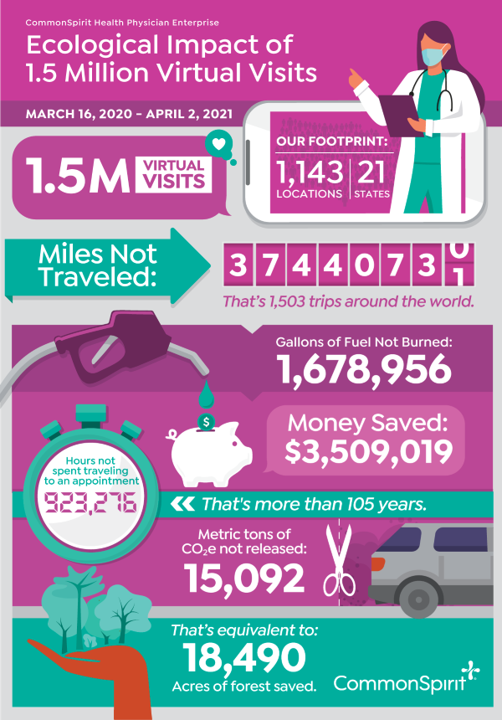

Here is an example of one health system, CommonSpirit, quantifying the impact of expanding virtual visits (telehealth) between March 16, 2020 and April 2, 2021.

The healthcare provider examined 1.5 million virtual visits, calculating that patients would have traveled 37.4 million miles to some 1,143 locations in 21 states.

The resources conserved were estimated to be,

- 1.7 million gallons of fuel not burned

- $3.5 mm of money saved

- 923,276 hours saved not traveling to appointments

- 15,092 metric tons of Coe not released, and

- 18,490 acres of forest land saved.

That’s but one impactful example of how health care can embrace one project in a portfolio of ESG strategies. Bravo, CommonSpirit!

Health care organizations can partner with organizations in adjacent industries that can help bolster well-being. Examples in complementary sectors are:

- Food systems, such as Albertson’s grocery chain’s ESG goals

- Telecomms, like Verizon’s “Citizen Verizon” program

- Retail, for example, IKEA’s work on healthy and sustainable living

- Real estate, eg., Grubb Properties ESG-related programs on affordable housing and community engagement,

- Transportation, such as automaker Subaru’s call-to-action on human rights and diversity,

among other segments and companies.

Working together will help to reduce health inequities, improve public health, and lead to greater health citizenship for individuals and the organizations that serve them.

See more details setting forth ESG principles and their critical importance for health in my latest post on the Medecision Liberate Health portal.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...