Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS).

As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.”

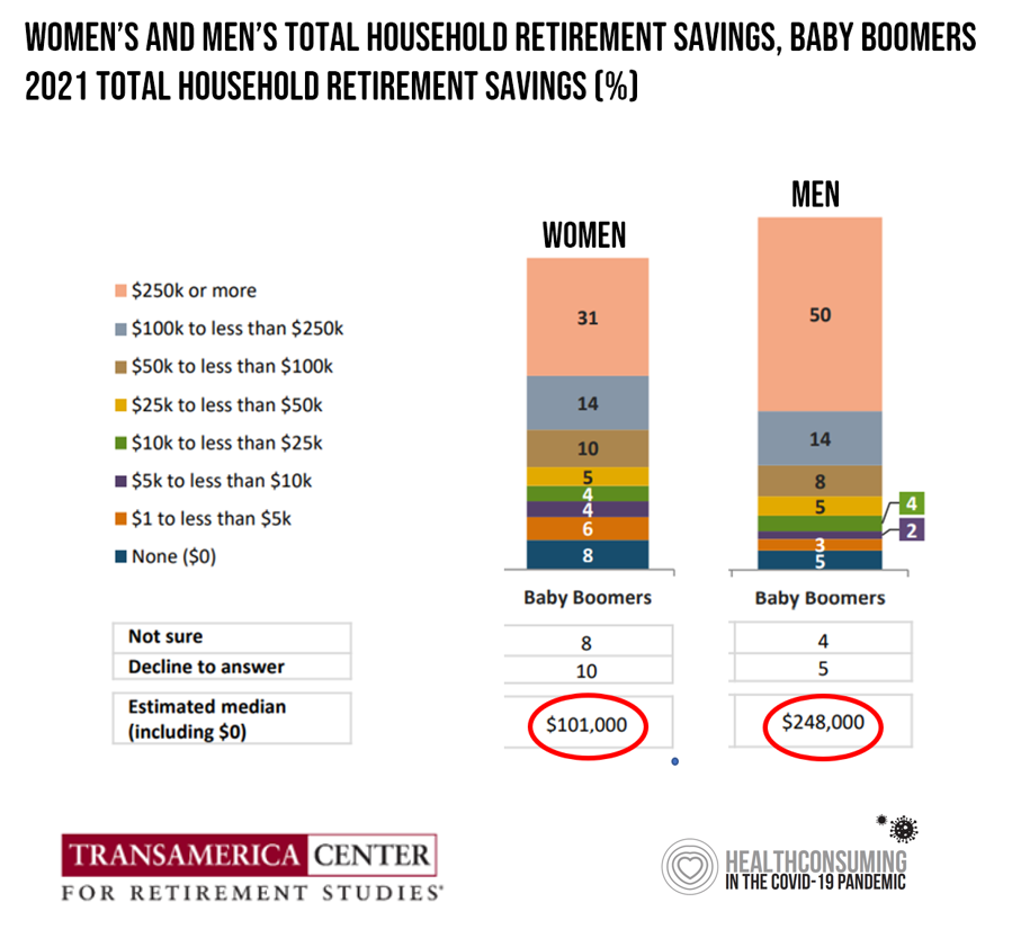

Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The chart focuses on this dramatic 2.5x differential for Baby Boomer women compared with men of the same age.

This is Transamerica’s 22nd annual retirement survey, reinforcing the chronic condition of women’s financial ill-health: that women are at much greater risk of retirement in-security than men.

The pandemic worsened women’s relative financial positions, forcing many to stay home from working and earning a paycheck, or taking time away from work for childcare and caregiving older family members.

TCRS found that more women made “work adjustments as a result of becoming a caregiver, more likely than male counterparts to miss days of work, reduce work hours, reduce job responsibilities or switch to a less demanding task.

At the same time, fewer women were able to work remotely, or take a paid leave of absence from an employer.

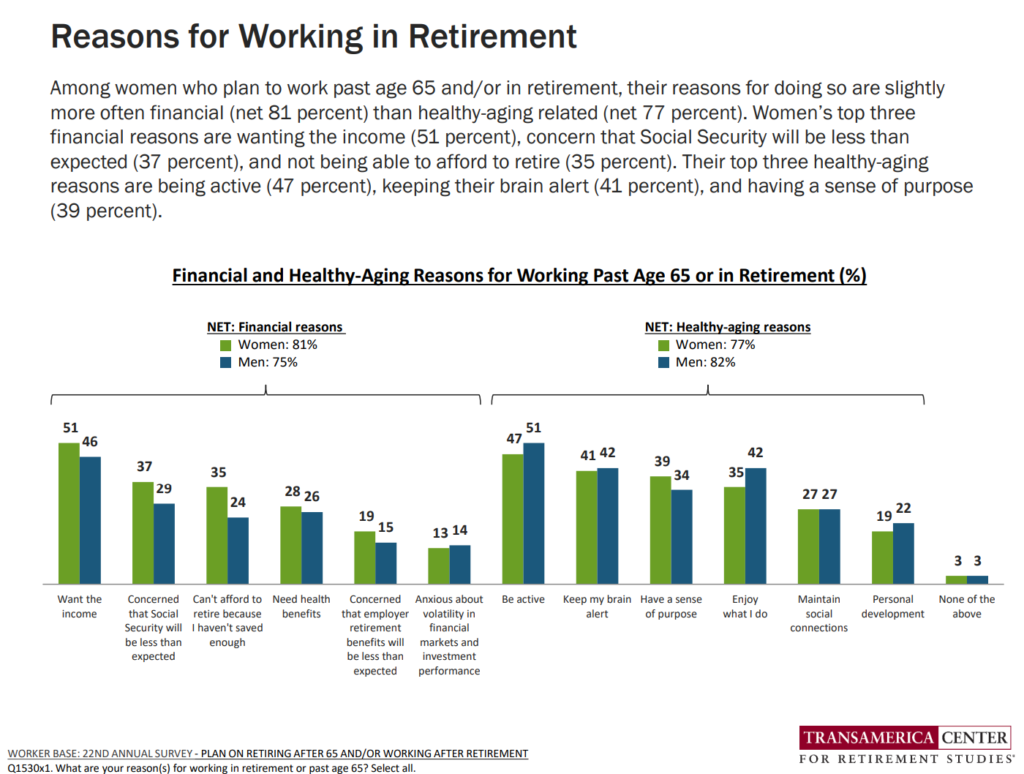

Women will tend to work in retirement due to financial reasons; men, for healthy aging reasons, a key Mars/Venus difference illustrated in the second bar chart.

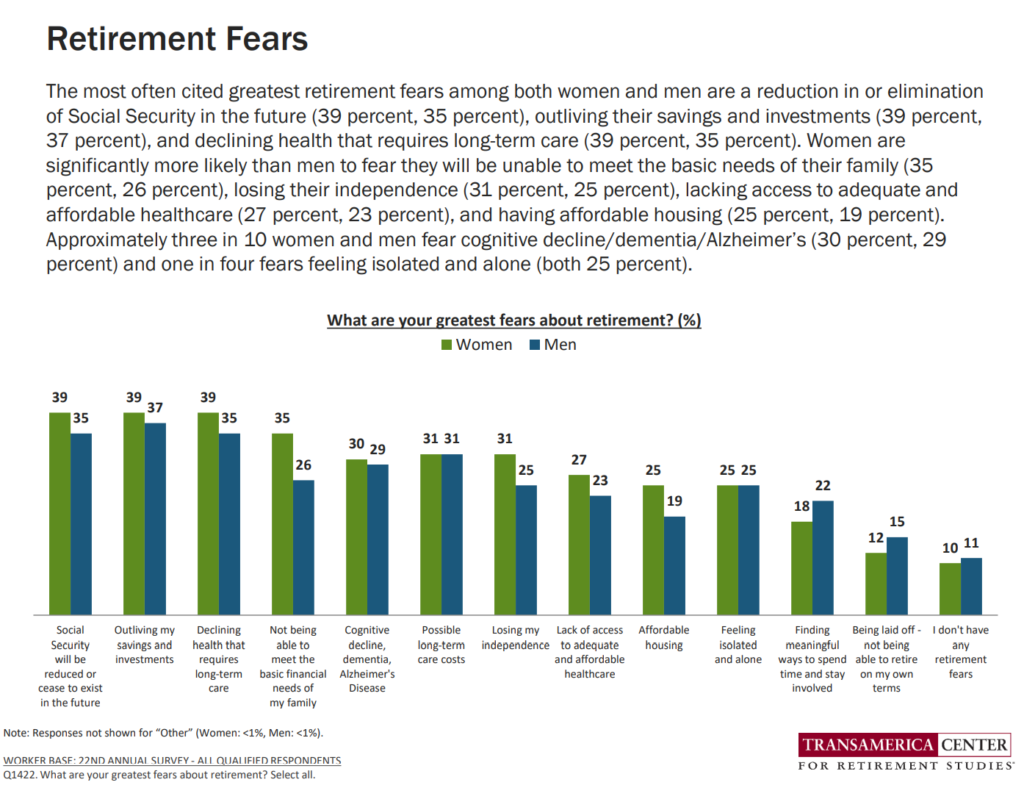

As a result of amassing less savings for retirement, more women have retirement fears for nearly all of the categories TCRS assessed. These include worries about Social Security payments being reduced in the future, outliving savings and investments, declining health requiring long term care, losing one’s independence, and finding affordable housing.

Social Security is top-of-mind for working women looking toward retirement: nearly one-half more women than men expect Social Security to be their primary source of retirement income (28% versus 20%). While 33% of women expect their 401(k) or other pre-tax savings vehicles through work will be their primary source of retirement income, 38% of men do.

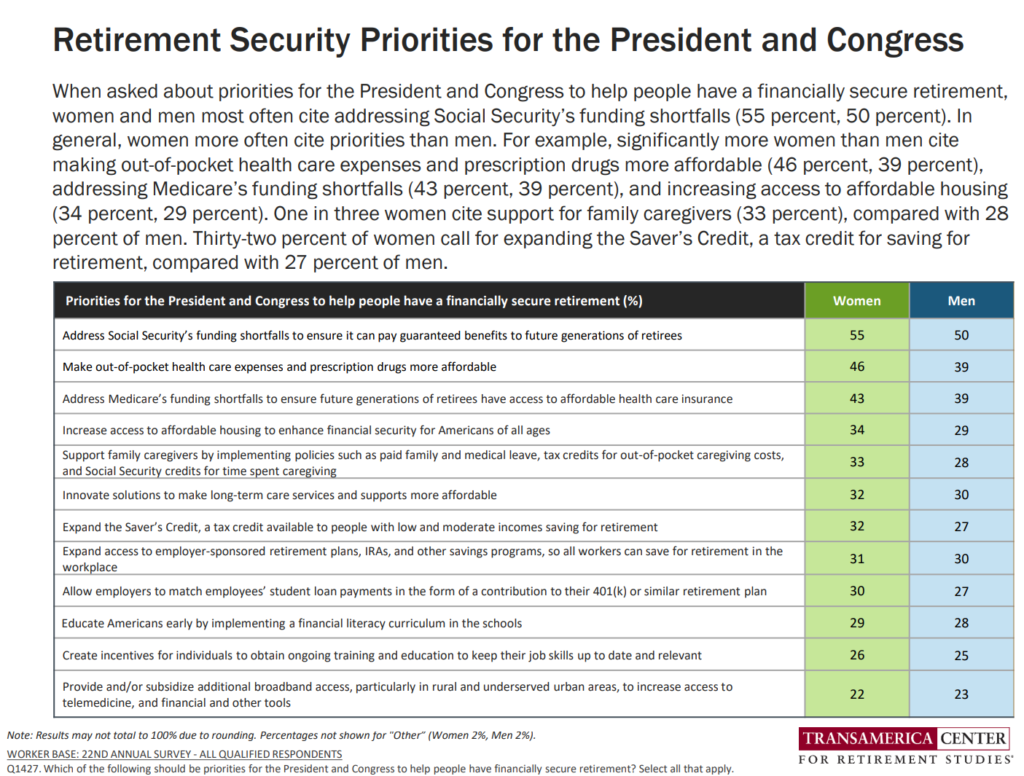

Health Populi’s Hot Points: Check out the second line item on this list of retirement security priorities for the U.S. President and Congress: after assuring Social Security funding stays secure, more women than men prioritize making out-of-pocket health care expenses and prescription drugs more affordable.

The convergence of financial health, the surety and fiscal sanctuary of Social Security, health care costs and access, and housing affordability are central to women’s home economics and personal forecasts about their future overall well-being.

The 2022 U.S. mid-term elections confirmed that these issues were on women’s minds inspiring more women to vote early in polls in various parts of America.

In the meantime, in real-time right now, women have only $2,000 in emergency savings (median), and 2 in 5 women are having trouble making ends meet, the TCRS study found. “Women workers have weathered a financial storm amid the pandemic,” Catherine Collinson, CEO and President of TCRS explained from the research. “Many experienced negative employment impact that could jeopardize both their short-term finances and future retirement,” she expects.

On the upside, women’s lack of financial planning and saving provide an opportunity for financial services companies and retail health touchpoints to collaborate and bolster women’s holistic health — mind, body, spirit, and pocketbook.

As an example, last week, coinciding with the HLTH 2022 conference, the Maven Clinic announced an influx of $90 million to support the company’s continued scaling of personalized women and family health services. Maven has over 15 million lives under its umbrella, including people enrolled in Medicaid and women in all levels of the workforce.

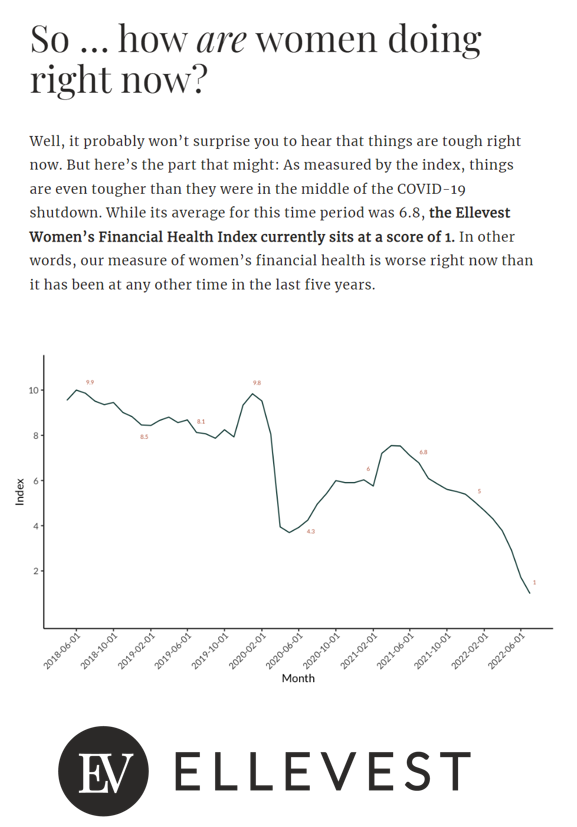

Note that women’s financial health is currently the lowest it has been in the last five years, Ellevest assessed in their latest Financial Health Index. Note the line’s curves: first, the height of financial health around February 2020, just before the COVID-19 pandemic emerged in the U.S. pre-lockdown; then a rise in financial wellbeing followed by a dramatic fall due to inflation and financial fallout due to the Russia/Ukraine conflict.

As we continue to focus more on health equity – in this case, women’s health equity – we should be mindful to think in an integrative way embedding financial wellness, mental and behavioral health, health care access and food and housing security considerations. We know gender roles produce divergent economic realities: health and well-being are built on many drivers of health, financial security among them.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...