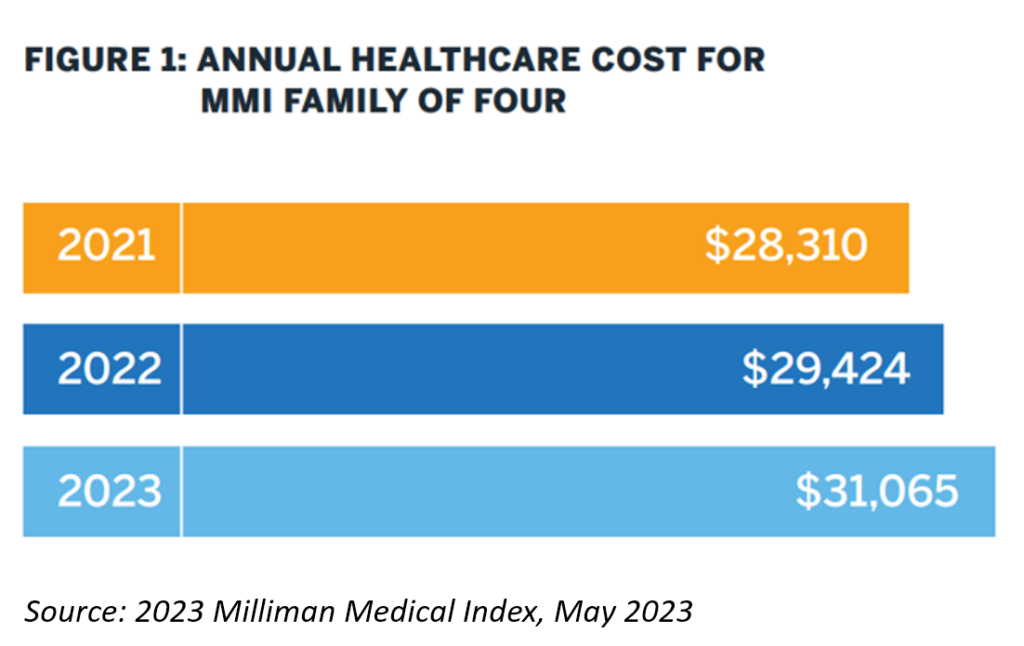

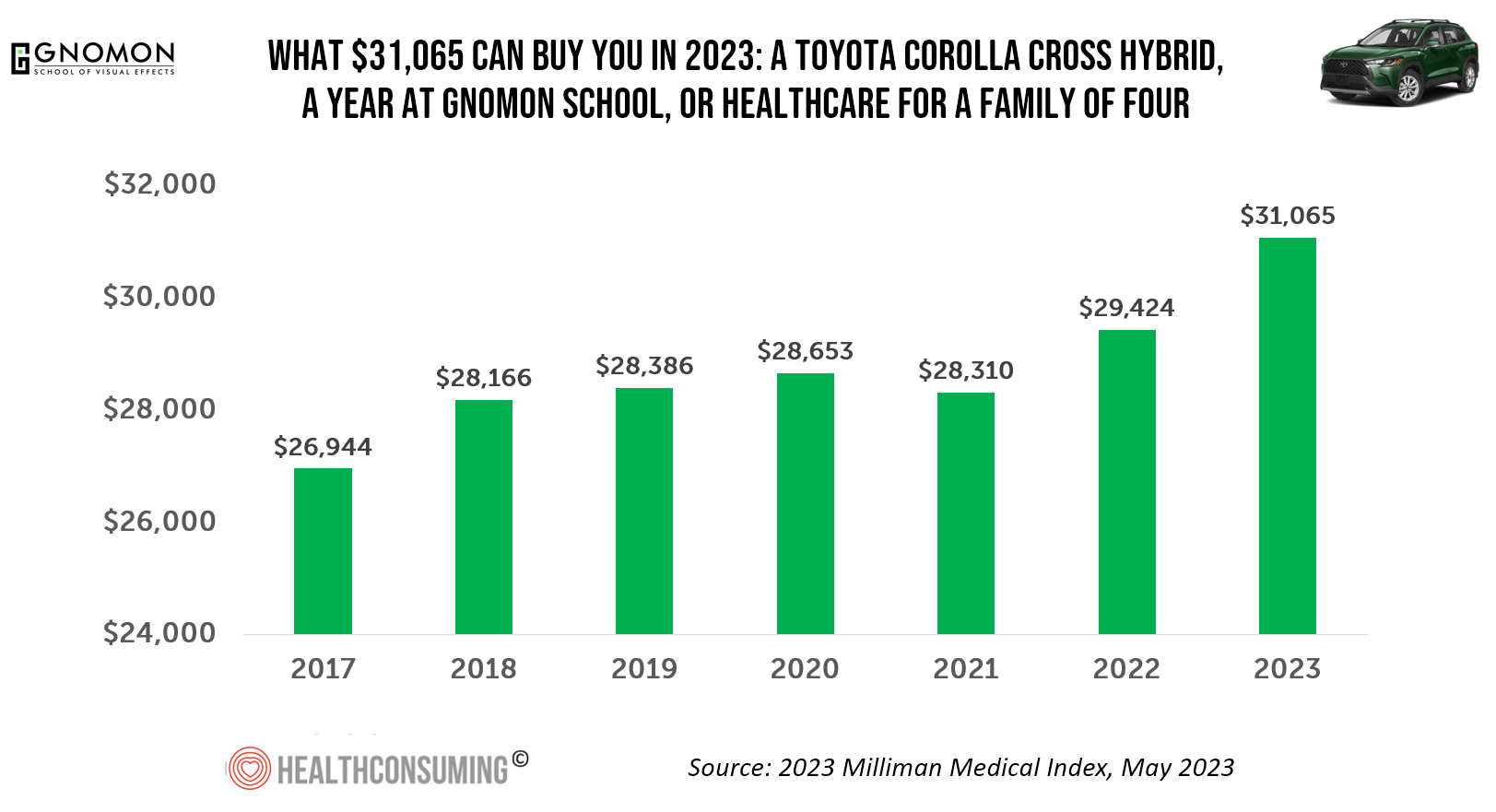

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%.

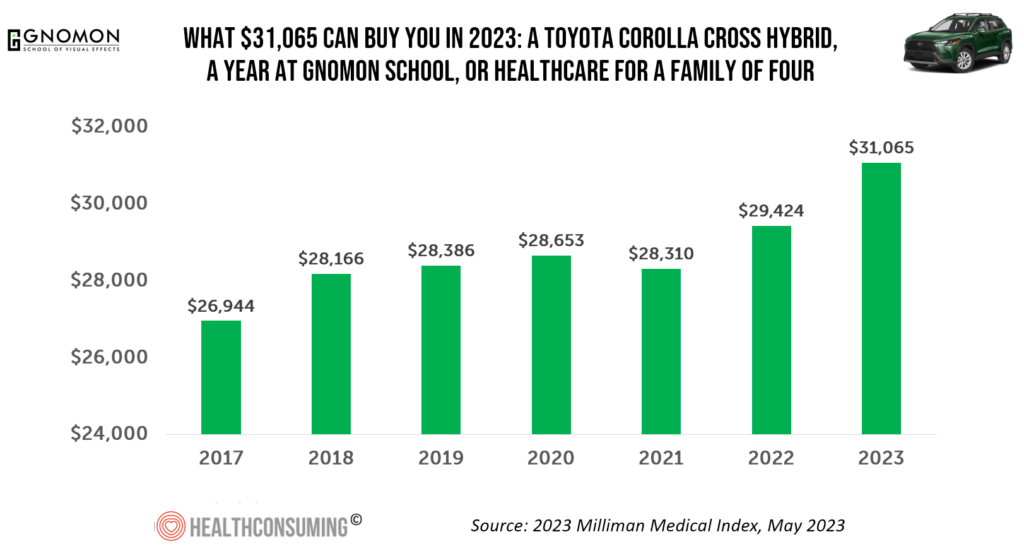

For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4.

Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

As Milliman is quick to point out, no family is “typical” or hypothetical — in this model, the family consists of a 47-year-old male, a 37-year-old female, and two children: one aged 4, and one under 1 year old.

This construct allows the Milliman actuaries to compare, year-after-year, the Index which enables a consistent look at the usually increasing nature of healthcare costs.

As we exit the long-tail of the COVID-19 pandemic, we should focus on macroeconomic forces that will set the table for health care costs, employment, consumer spending, and of course, inflation.

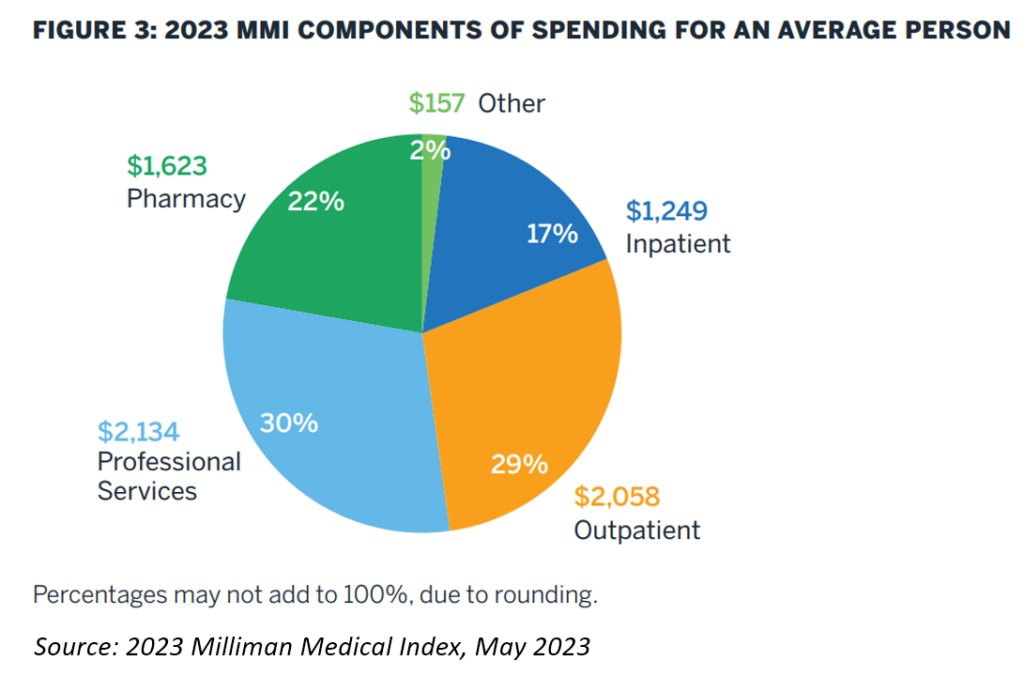

The MMI consists of five line items of health care services, shown for an individual in the pie chart:

- Inpatient hospital care, comprising 17% of the cost

- Outpatient care, making up 29% of costs in 2023 and combined with inpatient care, expected to increase by 4.2% in 2023

- Professional services, 30% of costs (the largest component) expected to grow by 9%

- Pharmacy, 22% of health care costs in this model, growing by 5.6% this year — a reduction in trend driven, potentially, by patent expirations on branded drugs and the launch of some biosimilars this year; and,

- Other services, a broad category covering home healthcare, ambulance services, durable medical equipment, prosthetics, and other items. Costs in this category are expected to increase by 9% in 2023.

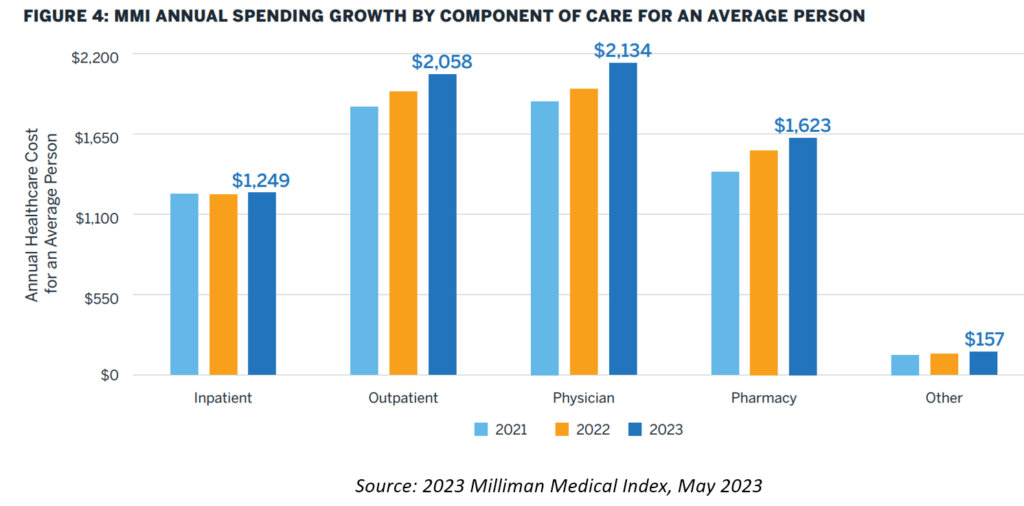

The vertical bar chart illustrates spending growth for each of these categories for an individual by year.

It is interesting to see that the annual health care cost for an individual’s inpatient hospital care remained relatively flat between 2021 and 2023, but shows an increase on the outpatient hospital side. This may be attributable to patients returning to a more regular pattern of ambulatory care encounters, a portion of which were avoided during the more intense pandemic months.

Physician costs, too, demonstrate cost growth, representing 30% of costs for the average individual in 2023. The expected 9% cost increase for 2023 is the highest growth rate across these categories, driven largely by patients’ return-to-services and inflation on material and labor costs.

Health Populi’s Hot Points: The Milliman 2023 MMI publication coincides with that of a new survey from AHIP, the health insurance advocacy organization, exploring the value of employer-provided coverage in 2023.

AHIP commissioned a survey among 1,000 U.S. consumers with employer-sponsored health insurance, conducted in April 2023.

Among key findings, AHIP learned that,

- Most employee-consumers are satisfied with their coverage

- Most prefer to get health insurance through employers versus through the Federal or State government, and

- Costs remain a top concern.

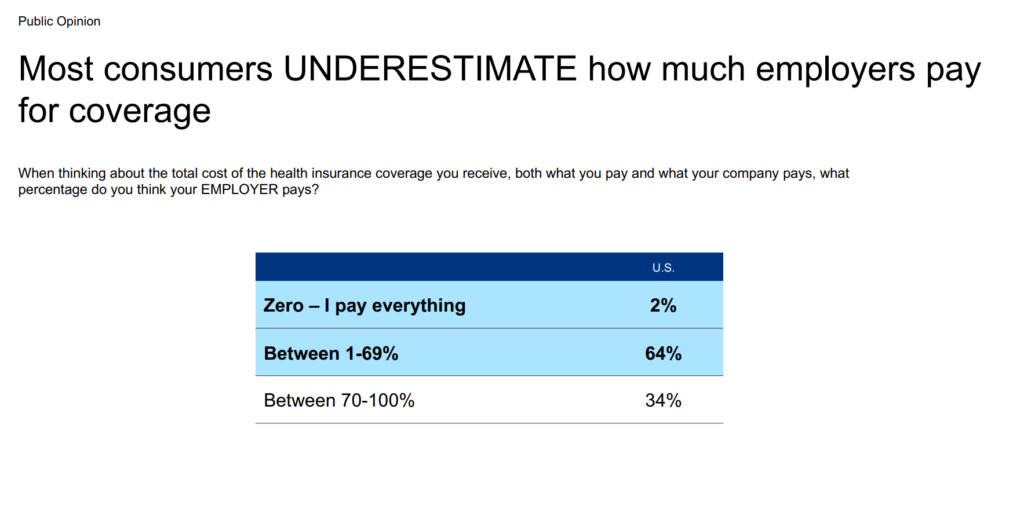

The first chart from the study shown here tells that most consumers underestimate how much employers pay for coverage — with two-thirds believing employers pay up to 69%.

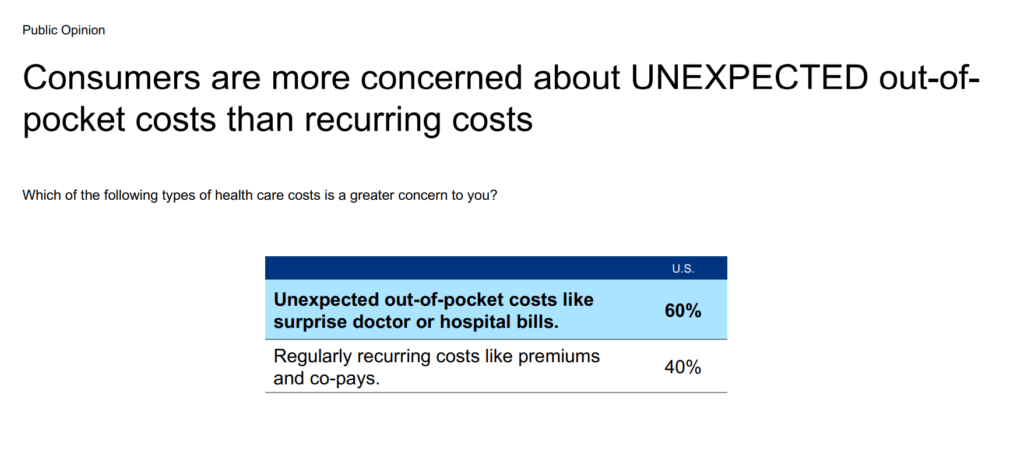

On the cost issue, most employee-consumers covered by health plans at work are also more concerned about unexpected out-of-pocket costs versus their recurring costs for premiums and co-pays.

Milliman notes in its analysis of employees’ share of health care costs, “while these payments are capped by out-of-pocket maximums, the costs can still be substantial.”

In 2023, Milliman expects that OOP costs to covered consumers will grow by 6%.

This is a household spending category that is not typical to American consumers’ market basket of goods, Milliman explains in its 2023 report. U.S. hospitals were required to start posting cost data on January 1, 2021, and payers on July 1, 2022. However, “these arrangements are still difficult to ascertain,” Milliman notes. It will take more time for this information to be consume-able by patients-as-consumers. When it is more user-friendly and accessible, personalized for the plan member-consumer, it could be a transformational trend. But for the 2023 and into 2024, minimum, the last chart shown here from the AHIP study should be concerning….especially if a patient’s worries about surprise bills dissuades them from seeking care when needed.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...