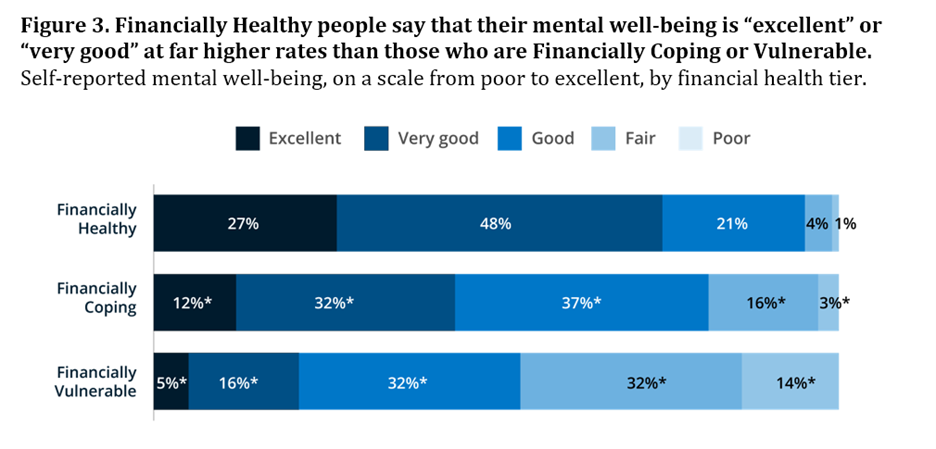

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network.

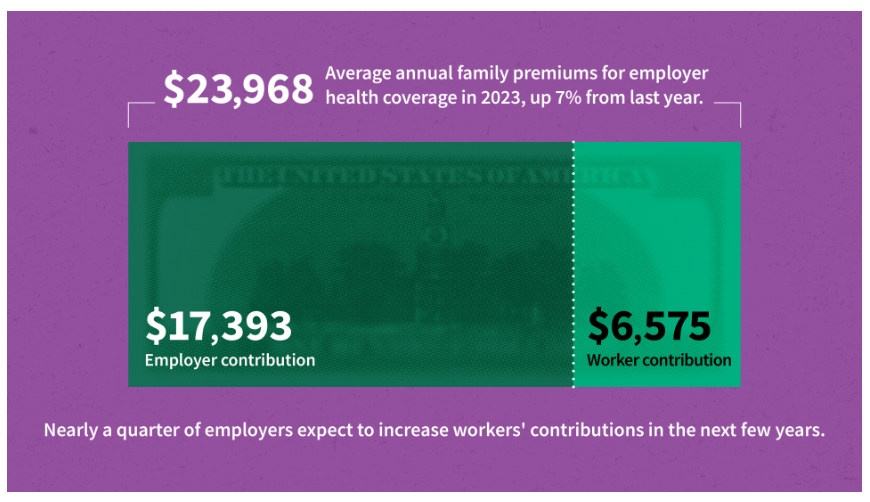

Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023.

That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that nearly 1 in 4 employers expect to increase workers’ contributions in the next few years.

Now consider FNH’s key findings: that,

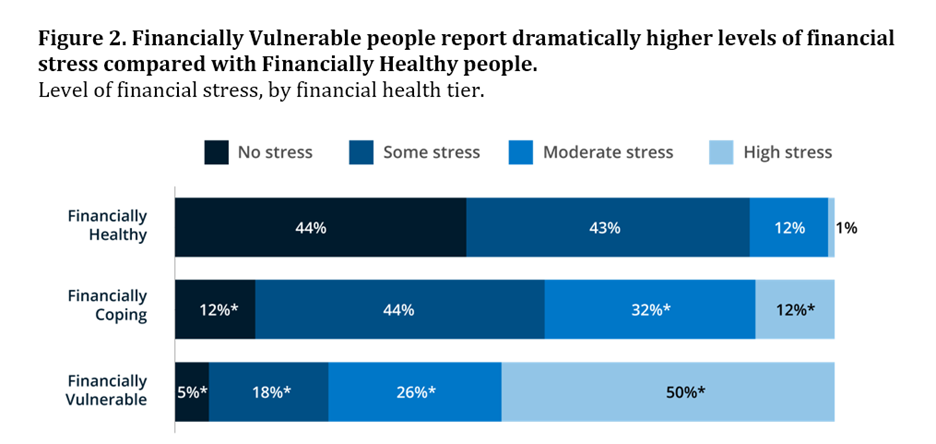

- Americans are stressed with finances a top concern — especially among women, younger people, and people in lower-income households

- Financial challenges are associated with mental health challenges: people with lowest incomes in a community at as much as 3x more likely to experience mental health issues.

- Certain kinds of debt are associated with mental health challenges – in particular, debt incurred outside of a person’s control, like medical debt.

FHN’s own data show that stress is not distributed evenly. “Some populations disproportionately report stress,” FHN noted, adding, “For many in America, stress is a way of life. ”

One in 3 U.S. adults admit that stress is “completely overwhelming,” according to the American Psychological Association. [See more on APA’s Stress in America research here in Health Populi].

The APA found in the 2022 study that stress related to money reached the highest level Americans felt since 2015.

Health Populi’s Hot Points: According to the 2024 Healthcare Financial Experience Study from Cedar, 58% of U.S. consumers said paying a health care bill was stressful.

Furthermore, nearly one-half of people said their well-being or healing was negatively impacted by difficulty paying a medical bill, Cedar’s research found.

“‘We’ve cured you of your ailment, but we’ve harmed you financially.’| the CFO of Ohio State University’s Wexner Medical Center,. Vincent Tammaro, was quoted in the Cedar report.

That’s a form of financial toxicity that has ramifications for the entire health system enterprise beyond the surgical suite or cancer center, I wrote last month here in Health Populi, referring to Cedar’s study.

“On average, even folks who are insured through some type of employer plan are ultimately paying about 30% to 33% of their health care costs,” Tammaro added. “I think that is really contributing to a lot of the angst from a patient/consumer standpoint.”

The Financial Health Network’s update on the connection between financial and mental health is timely: we learned this week from the Kaiser Family Foundation that the average cost for a family’s PPO plan through an employer-sponsored health insurance benefit is close to $24,000 this year.

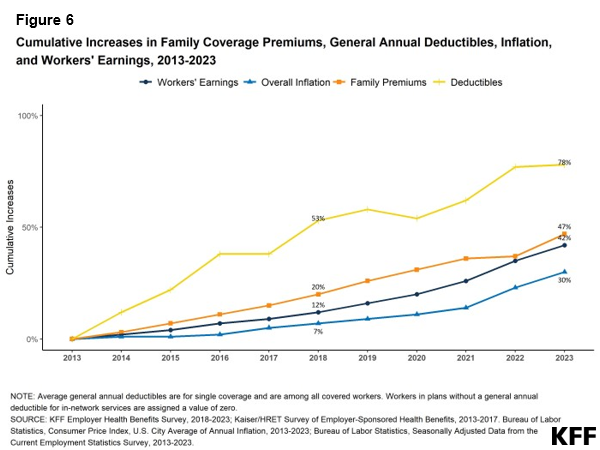

Each year, KFF’s study on employer-sponsored health benefits always includes this chart, updating cumulative increases in family coverage premiums, deductibles, inflation, and employees’ earnings. You can see the gap between the growth in deductibles and premiums versus workers’ earnings and general inflation.

We see no relief in the phenomenon of patients-as-payers in 2023 and beyond, given other studies’ projections of health insurance premiums for 2024. Given what FHN has shown us about the financial-mental health connection, we can also anticipate growing demand among workers for employer-sponsored mental health services, as well.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...