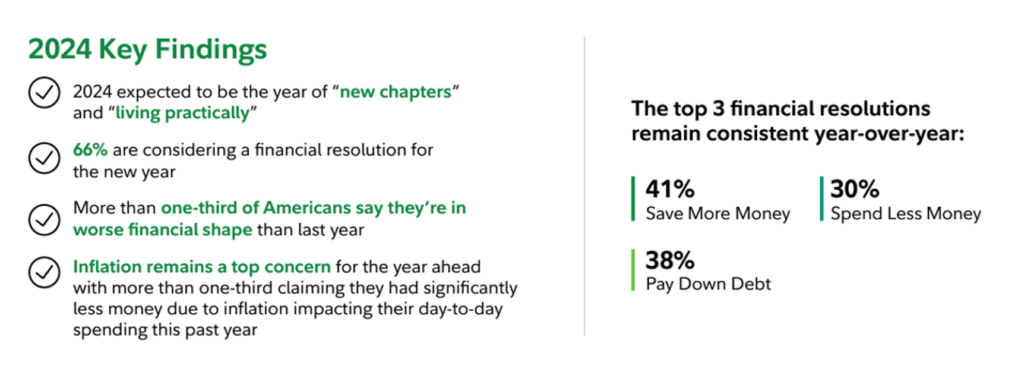

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments.

In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt.

Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024.

This is prompting people to desire turning a page on personal finances with three top resolutions to address their fiscal worries:

- 41% of Americans will resolve to save more money

- 38% of people will pay down debt, and,

- 30% will endeavor to spend less money.

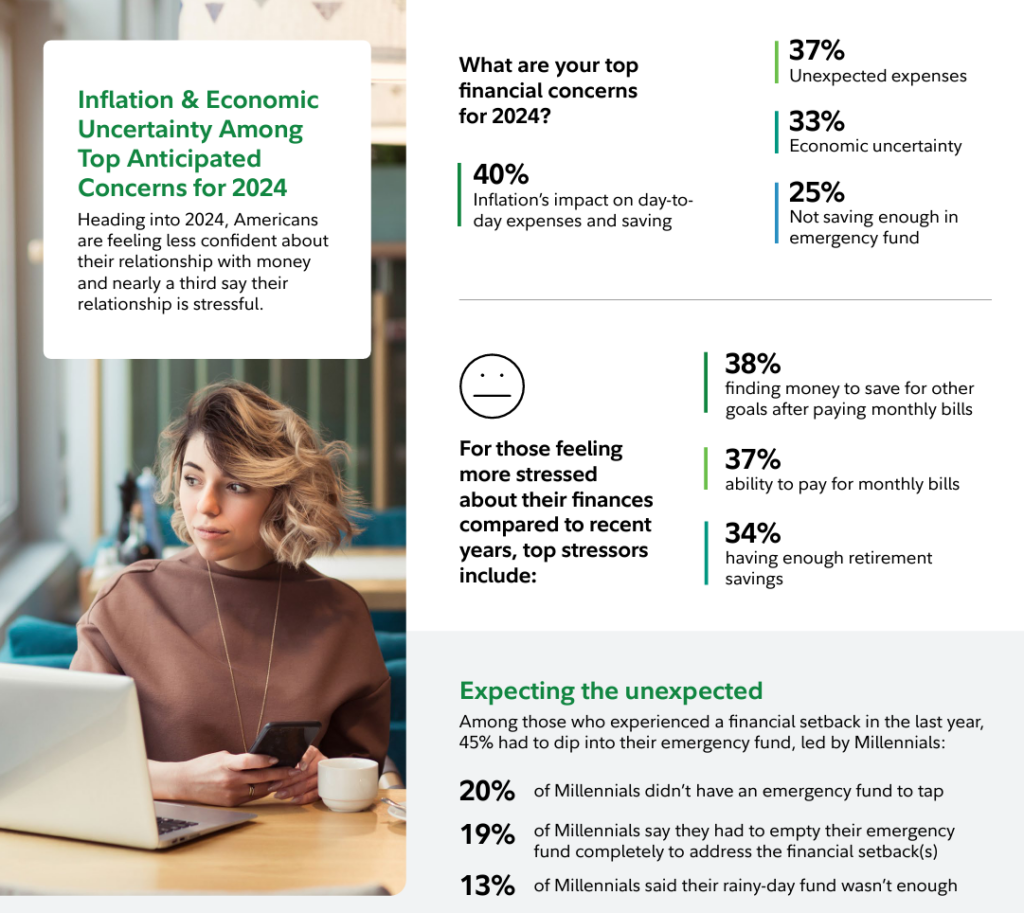

Those feeling more stressed about personal finances tend to be younger people (especially Millennials between 27 and 45) who were more likely to lack an emergency (or rainy day) fund. People more stressed about money this year were also concerned about finding cash to save for other goals after paying monthly bills, worried about their ability to pay for those monthly bills, and anxious about not having money to put away into retirement savings.

In fact, 45% pf people said they had to take money out from their emergency savings for current spending needs. That’s due to one-third of people expecting to have significantly less money due to feeling the pinch of higher costs-of-living.

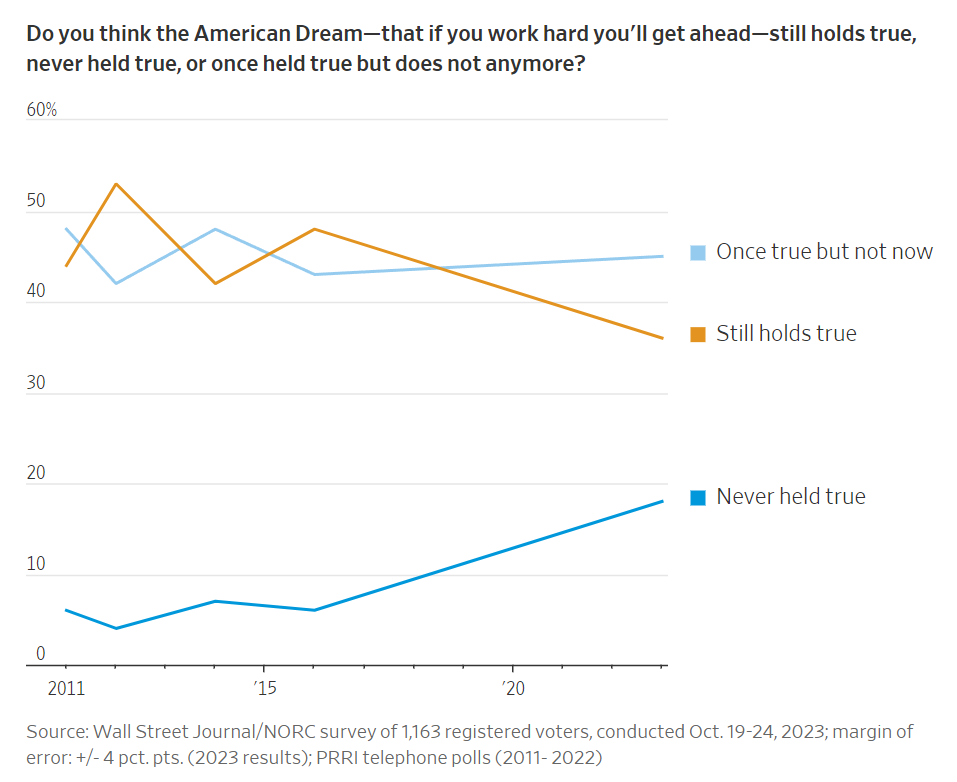

There is an important mental model to keep in mind in this context which was quantified through a WSJ/NORC poll published in November 2023: that the American Dream feels more out of reach. In the words of the Wall Street Journal, specifically,

“The American dream seemed most remote to young adults and women in the survey. Some 46% of men but only 28% of women said the ideal of advancement for hard work still holds true, as did 48% of voters age 65 or older but only about 28% of those under age 50.”

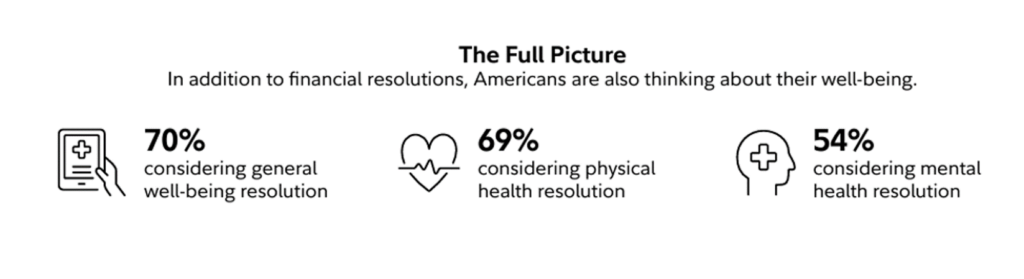

Health Populi’s Hot Points: Here in Health Populi since launching in 2007, we’ve tracked the growth of patients-as-consumers’ financial wellness as part of overall health. Entering 2024, not only are most U.S. consumers making financial resolutions for their fiscal health, but most folks are also thinking about their overall well-being in the context of their financial stress.

Furthermore, over one-half of people are also considering a mental health resolution. Since the emergence of the COVID-19 pandemic, mental and behavioral health taboos have eroded with more people mindful of their feelings of anxiety, depression and stress — and seeking services to deal with those feelings and conditions.

This has also caught the attention of employers’ HR leaders who have bolstered benefits related to mental and behavioral health for workers and families.

We can appreciate Fidelity’s call-out expecting 2024 to be a year of new chapters and living practically. Watch for consumers to start the New Year taking on Sober January approaches to alcohol consumptions, exercise and activity goals for fitness, healthy eating styles (more plant-based, lower sugar and salt, intermittent fasting), and hacking daily living for better sleep and greater resilience.

Financial wellness is part of peoples’ multi-pronged self-care strategies, part of peoples’ new-and-improved ethos for living practically in 2024.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...