How financially vulnerable are people with medical debt in the U.S.?

Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt.

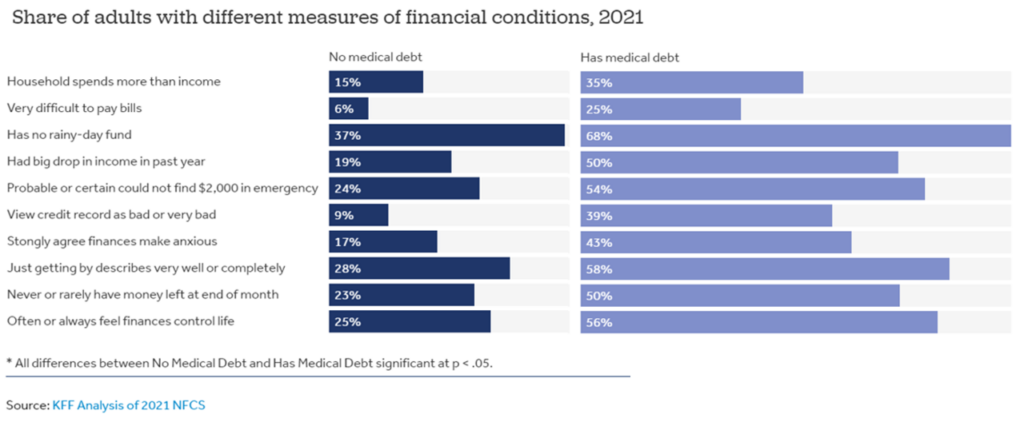

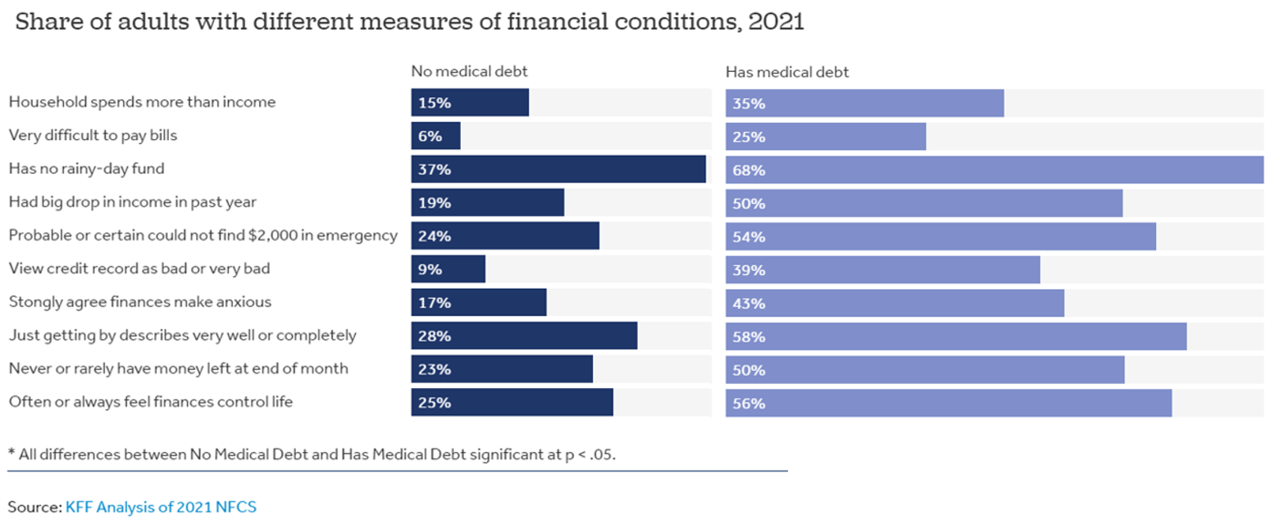

Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and could not find $2,000 to cover an emergency.

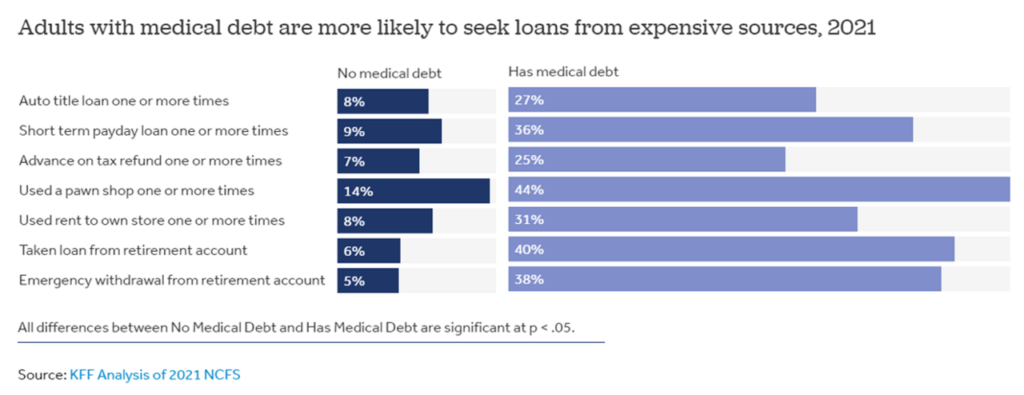

People in America with medical debt are also more likely to seek loans for places that are more expensive. Among the most expensive sources to seek a loan is one’s retirement account, which prematurely levies huge costs for withdrawals before retirement: 40% of folks with medical debt in the U.S. have taken a loan from their retirement account. 44% of people with medical debt have used a pawn shop at least once, and 36% of those with medical debt have taken out a short-term “payday loan” at least once.

Those with medical debt in the U.S. are also more likely to overdraw their checking accounts (usually resulting in stiff fees from retail banks), have credit card balances exposing them to high interest payments that compound over time, as well as being contacted by debt collection agencies.

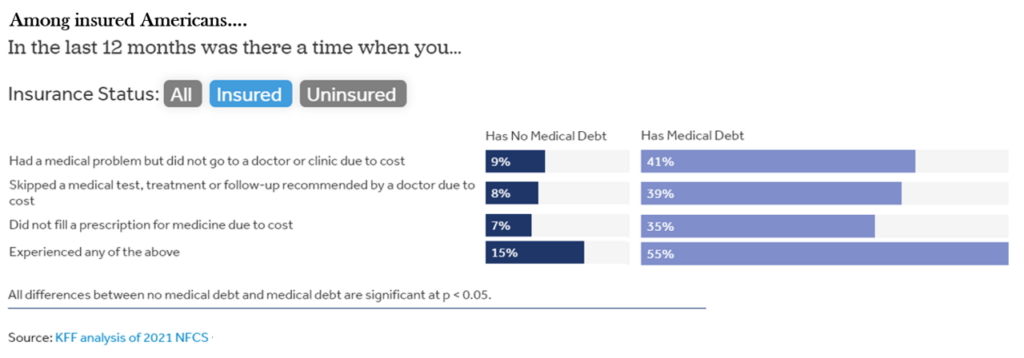

Health Populi’s Hot Points: Having health insurance in the U.S. is no guarantee of being safe from medical debt exposure. See the third chart, where KFF/Peterson Center looked at the consumer’s insurance status, state of medical debt and health care service impact — in Health Populi lingo we use the phrase, “self-rationing behavior due to cost.”

Here we see that among people who have health insurance in the U.S., 55% of those with medical debt have had at least one limiting behavior due to cost — such as not going to the doctor for necessary care, skipping a test or treatment recommended by a doctor, or not filling a drug prescribed by a clinicians.

The growing movement of Power to the Patients has gained traction by shining a light on peoples’ growing financial stress dealing with health care access and medical bills. The mantra of the movement is the “prices are now a patient’s right,” demanding transparency and accountability from health care providers and insurance companies. You can hear more from Valerie June, Jelly Roll, and Lainey Wilson in the organization’s latest PSA here.

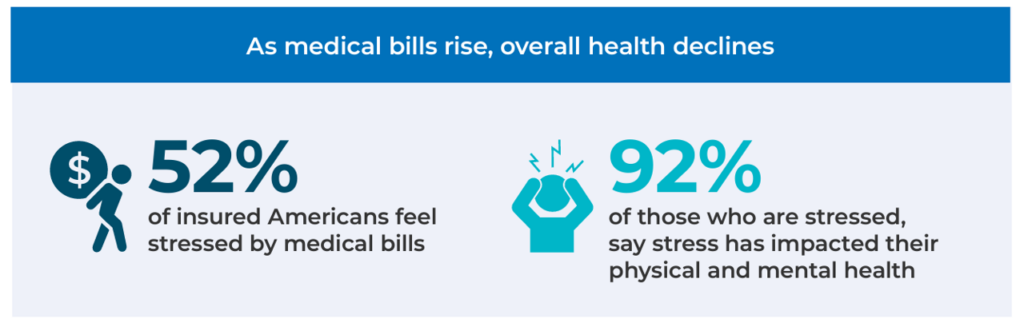

“Paying for healthcare makes Americans sicker,” a consumer survey from PayMedix toplined in January, noting that 43% of Americans who have commercial insurance have avoided care — worried about their ability to pay the portion they would owe.

As these two stats illustrate, most of those with health insurance feel stressed by medical bills, and the vast majority of those feeling that stress have felt physical and mental health impacts.

Medical bill stress has become a mainstream “normal” in the U.S. as medical bill payments compete in an American family’s inbox of bills with cash for groceries, gas for transportation, and paying down student loan debt.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...