Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week.

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week.

The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions.

Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade.

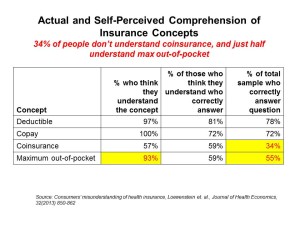

See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do. 57% of people say they understand coinsurance, but only 1 in 3 people do.

People have even greater challenges when they are asked to calculate their insurance costs. In an open-ended cost question, only 11% of people could calculate their cost of a 4 day stay in the hospital even when given a “relatively simple” fill-in-the-blank question. Only 35% of people knew how much an out-of-network primary care doctor would cost after meeting their maximum out-of-pocket spend. 41% knew what they would spend for an in-network MRI.

Why is it important for consumers to understand how health insurance works? The researchers say it’s because,

- Limited understanding can lead to sub-optimal (that is, less desirable) decisions

- When faced with something people don’t understand, they often toggle to the status quo – which may be a worse decision even though the new offering may be superior

- If people don’t understand their health insurance workings, they will likely not respond to the incentives built into the plan – leading to poor choices in terms of cost, quality, and even convenience (for example, choosing an emergency room when a visit to doctor’s office or retail clinic would be more cost-effective and far more accessible than an ER)

- If consumers are aware they don’t understand their plan, they are at-risk of being dissatisfied by that plan (and company-brand)

- When confronting information people don’t understand, they may focus on the most simple aspects of the information – allowing the insurance company to “shroud” details of the plan that may be less favorable to the consumer (say, cost-sharing elements or network exclusions).

The researchers concluded that the simpler the plan’s insurance design, the easier it is for people to demonstrate they understand how to use it. Only 14% of people could correctly answer the 4 multiple choice questions about the 4 basic components of health insurance (coinsurance, copays, deductibles, and maximum OOP costs, or MOOP). Consumers would also be more likely to make cost-reducing decisions if they had a simpler plan compared to a traditional health insurance plan — like going to a retail health clinic versus an emergency department, or asking for a generic drug instead of a branded Rx.

Health Populi’s Hot Points: With the advent of implementing the Affordable Care Act and the Health Insurance Marketplaces (aka Exchanges), there’s a baseline of health literacy assumed in the legislation: that is, that people who have been un- and under-insured will understand how to access the on-ramps to buying into health insurance. Once on the HIX highway, then, will folks morph into health consumers figuring out the differences and benefits across bronze, silver, gold and platinum plans available in their local online marketplaces?

Loewenstein and his colleagues say that “the ACA adopts a somewhat superficial approach to dealing with it that revolves around the standardization and simplified presentation of information about insurance plan features. However, presenting simplified information about something that is inherently complex introduces a risk of ‘smoothing over’ real complexities, in effect burying them in the now not-so-fine print.”

Published this week, my latest paper for California HealthCare Foundation, Help Yourself: The Rise of Online Healthcare Marketplaces, talks about the double-hurdle of digital literacy and e-health literacy. Combined, these challenges can block peoples’ engagement with health shopping and, in the case of this research, health insurance shopping. Digital literacy is peoples’ understanding of how to engage with the internet in safe and constructive ways. E-health literacy is the competence that, once online, a person knows how to access health resources on the web – and especially, trustworthy online assets.

The Department of Health and Human Services launched the Welcome to the Marketplace portal this week, a website that provides an on-ramp to getting to know the insurance marketplace and choices that can begin to be made on October 1, 2013. Bienvenido al Mercado is the Spanish-language site, which is important to have up and operating as a large proportion of uninsured people in America are Hispanic.

Several organizations are promoting the marketplaces with useful, interactive resources, including the AARP’s Health Law Answers page and WebMD‘s Health Care Reform portal. Other groups, such as Americans United for Change and Protect Your Care, are also promoting the ACA and insurance marketplaces. States and regions supportive of the law have also begun to launch their marketing campaigns — Dallas, Delaware, Hawaii, and California among them.

Ultimately, designing health insurance plans that are really simple and making plans comparable – in an apples-to-apples way – is the solution to bolstering understanding of health plans and satisfaction in using them well. This research bears this finding out – but designing that “inherently complex” product in a simple way will be heavy lifting for an industry that’s exploited complexity as a business model.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...