Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare.

Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2, after proving out efficacy).

For health consumers, this new payment regime feels like self-insurance, which it is — up to the point of the deductible, when insurance payments kick in. But until that point hits the family ledger, a patient acutely feels his/her own skin in the game of healthcare payment. That adds a new hat to a person’s life-wardrobe: the new job as healthcare shopper. And most people want help managing health spending, according to Public Agenda who ask the question in a new report, “How Much Will It Cost?” looking at how Americans use prices in health care.

For health consumers, this new payment regime feels like self-insurance, which it is — up to the point of the deductible, when insurance payments kick in. But until that point hits the family ledger, a patient acutely feels his/her own skin in the game of healthcare payment. That adds a new hat to a person’s life-wardrobe: the new job as healthcare shopper. And most people want help managing health spending, according to Public Agenda who ask the question in a new report, “How Much Will It Cost?” looking at how Americans use prices in health care.

Shopping for health care means identifying choices and alternatives, and the differences between them: especially price and quality, the former of which is hard to come by, and the latter which can be quantitative (e.g., based on patient post-surgical outcomes or successful blood glucose management) or qualitative (e.g., did your friend like the clinician’s exam room manner, and was the parking accessible and location convenient?). The first chart illustrates the fact that shopping for health is social: one-half of people seek price information from family and friends. Roughly equal numbers also seek health price information from their doctor’s office or an insurance company website. Fewer people, less than 1 in 5 (17%), use other web-based resources outside of their care providers or health plans — think Castlight Health, PokitDok, Federal and State websites, or other online transparency portals.

Several recent studies capture this morphing landscape for the consumer, who paying more out-of-pocket needs support in the form of information and tools — all of which must be perceived as trusted sources.

Several recent studies capture this morphing landscape for the consumer, who paying more out-of-pocket needs support in the form of information and tools — all of which must be perceived as trusted sources.

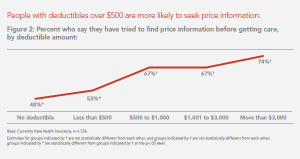

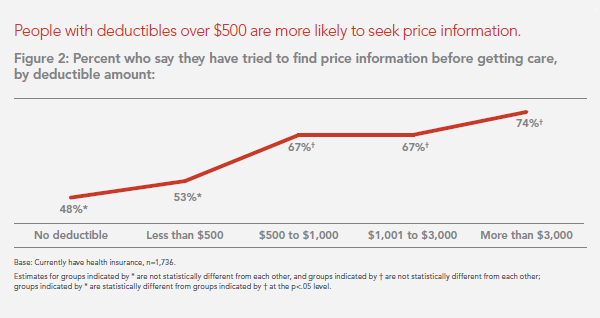

How Much Will It Cost? How Americans Use Prices in Health Care, published by Public Agenda with support from the Robert Wood Johnson Foundation, found that a majority of people with deductibles over $500 are more likely to seek health price information, shown in the second graph. Most people who seek price information say they save money, and most (rightly) believe that higher health care prices are not a signal of better quality.

While the fast growth of high-deductible health plans continues, though, there remain huge holes in information, a lack of standards for comparing providers and services, and gaps in demographics and motivation for seeking health price information. Hispanics, African-Americans, and younger people tend to compare prices across providers, while folks with over $100K incomes are less likely to compare prices.

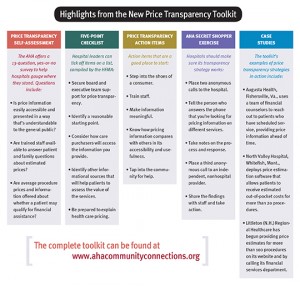

The American Hospital Association (AHA) launched a price transparency toolkit for hospitals under the organization’s Community Connections program. Community Connections was developed to bolster U.S. hospitals’ relevance in their markets as valuable health resources and economic engines in their local areas. The price transparency toolkit offers several tools on the site, such as how to institute a “mystery shopper” program to benefit consumers, provide simpler and clearer bills for patients, and establish fair and streamlined collection processes. In addition, there are many case studies linked to hospitals that have developed creative approaches to price transparency in their communities.

The American Hospital Association (AHA) launched a price transparency toolkit for hospitals under the organization’s Community Connections program. Community Connections was developed to bolster U.S. hospitals’ relevance in their markets as valuable health resources and economic engines in their local areas. The price transparency toolkit offers several tools on the site, such as how to institute a “mystery shopper” program to benefit consumers, provide simpler and clearer bills for patients, and establish fair and streamlined collection processes. In addition, there are many case studies linked to hospitals that have developed creative approaches to price transparency in their communities.

Gawker, the popular news and opinion blog, commissioned HealthSparq, one of the pioneering healthcare transparency companies, to assess price variation for surgeries across the U.S. and found the price for the same procedure can vary as much as 400%. HealthSparq compared the price of 19 popular procedures in six metro U.S. markets including Houston, LA, Miami, New York, San Francisco, and Washington, DC.

Gawker, the popular news and opinion blog, commissioned HealthSparq, one of the pioneering healthcare transparency companies, to assess price variation for surgeries across the U.S. and found the price for the same procedure can vary as much as 400%. HealthSparq compared the price of 19 popular procedures in six metro U.S. markets including Houston, LA, Miami, New York, San Francisco, and Washington, DC.

Since the advent of the Affordable Care Act, health plans have had to get serious about marketing more B2C, and have begun to develop online and mobile tools to help people manage their care and spending — as consumers assert they want, based on the Public Agenda survey data highlighted above. UnitedHealthcare launched the Health4Me app in 2014, which has been downloaded over 1.5 million times and was used by 700,000 consumers in 2014 — about 3.5% of 20 million plan members, according to . The app includes a health care cost estimator and integrates with personal health wearable technologies (like Fitbit) and enables mobile payments. The company is now piloting RewardMe, to engage consumers in fitness and wellness focused on activity, eating, lifestyle and relaxation/stress management.

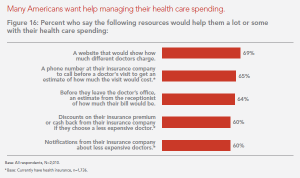

Health Populi’s Hot Points: We are in the era of Health@Retail in the U.S., and consumers get it. They’re looking for help to manage health spending the way they sought stock price/company information in the 1980s when Morningstar ratings taught people how to evaluate investment quality, and FICO scores raised peoples’ awareness of their personal credit ratings. The first graph details several areas where most people would appreciate assistance in health spending management: websites showing what different doctors charge, call centers at health plans to get price information before a medical visit, bill estimates before leaving doctor’s offices, and discounts from insurance companies if the consumer selects a less expensive doctor. Note that most consumers would also like a notification from a health plan about less expensive doctors — think Groupon and LivingSocial-meets-Health Plan 2.0. UnitedHealth’s RewardMe app is capitalizing on this incentive-seeking health consumer.

Such incentives will be important to bundle into transparency programs, as in health engagement in general. See the last chart here, from the Public Agenda consumer survey. Only one-half of U.S. consumers believe that people should be expected to compare prices in health care. That leaves a huge number of people, patients all, who aren’t so keen to engage in health care price shopping. In the era of high-deductibles, known as consumer-driven health care, that’s quite an irony – and huge motivational challenge.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...