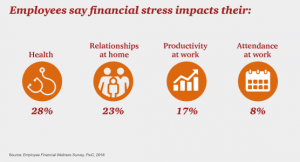

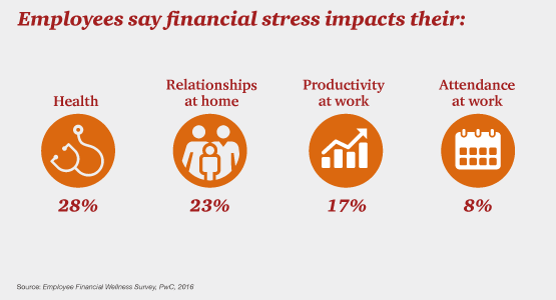

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic.

Some of the signs of the financial un-wellness malaise are that, in 2016:

- 40% of employees find it difficult to meet their household expenses on time each month

- 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers since 2015, from 37% of Boomers to 46% of Boomers)

- 36% of those who carry credit card balances find it difficult to make the minimum payment on time each month

- 26% of employees use credit cards to pay for monthly necessities because they cannot otherwise afford them. This ranges from 31% of workers earning less than $30,000 a year to 22% of people earning over $100,000

- Only 41% of employees would be able to meet their basic expenses if they were out of work for an extended period of time (36% of women vs. 45% of men).

Note that financial challenges are the top cause of stress across all generations in the U.S., from Millennials to Boomers. Millennials (37% of them) are most distracted at work by financial matters. The principal reason for Millennials’ financial stress is student loans: 42% of Millennials have a student loan, and 79% of these workers say the loans have an impact on their ability to meet their other financial goals.

The level of retirement savings among workers is less than $50,000 for 47% of working Americans — that includes 54% of women and 40% of men. The main reasons workers aren’t saving for retirement are having “too many other expenses” for 75% of people, and having debt to pay off for 42%. There was a large increase in the percent of employees saving less for retirement in 2016 than in 2015, jumping from 17% in 2015 to 28% in 2016.

Exacerbating the lower retirement savings rate is a phenomenon called “retirement fund leakage” happening among 43% of employees who say it’s likely they’ll need to use money from their retirement plans for non-retirement expenses in 2016. This statistic was 35% in 2015.

Health Populi’s Hot Points: The state of American workers’ financial un-wellness is confirmed by another study published this month, from MetLife’s 14th Annual U.S. Employer Benefit Trends Study. When considering financial fears and worries, 58% of workers say they most fear not having enough money to pay bills if someone in their household loses their job. 55% are concerned about having enough money to pay for out-of-pocket medical costs not covered by health insurance (such as premiums, deductibles and copayments). And 55% are also worried about the state of their retirement savings.

Health Populi’s Hot Points: The state of American workers’ financial un-wellness is confirmed by another study published this month, from MetLife’s 14th Annual U.S. Employer Benefit Trends Study. When considering financial fears and worries, 58% of workers say they most fear not having enough money to pay bills if someone in their household loses their job. 55% are concerned about having enough money to pay for out-of-pocket medical costs not covered by health insurance (such as premiums, deductibles and copayments). And 55% are also worried about the state of their retirement savings.

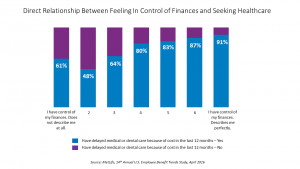

Note that there’s a direct, proportional relationship between workers’ feeling in control of their finances and their delay of medical or dental care: the greater the person’s level feeling in control of their finances, the less likely they are to have delayed health care in the past year due to costs.

Self-rationing of health care due to cost isn’t a new-new thing; as a health economist, I’ve tracked this phenomenon in the U.S. for several years, most recently here in Health Populi talking about the November 2015 Gallup Poll.

But the MetLife study puts self-rationing into the larger personal health economic context of financial wellness. In this era of growing high-deductible health plans for workers, THINK-Health’s forecast is that self-rationing will get worse before it gets better. That means people will be making short-term fiscal decisions that could end up in worse physical outcomes for some of these hard-working, health-insured health citizens.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.