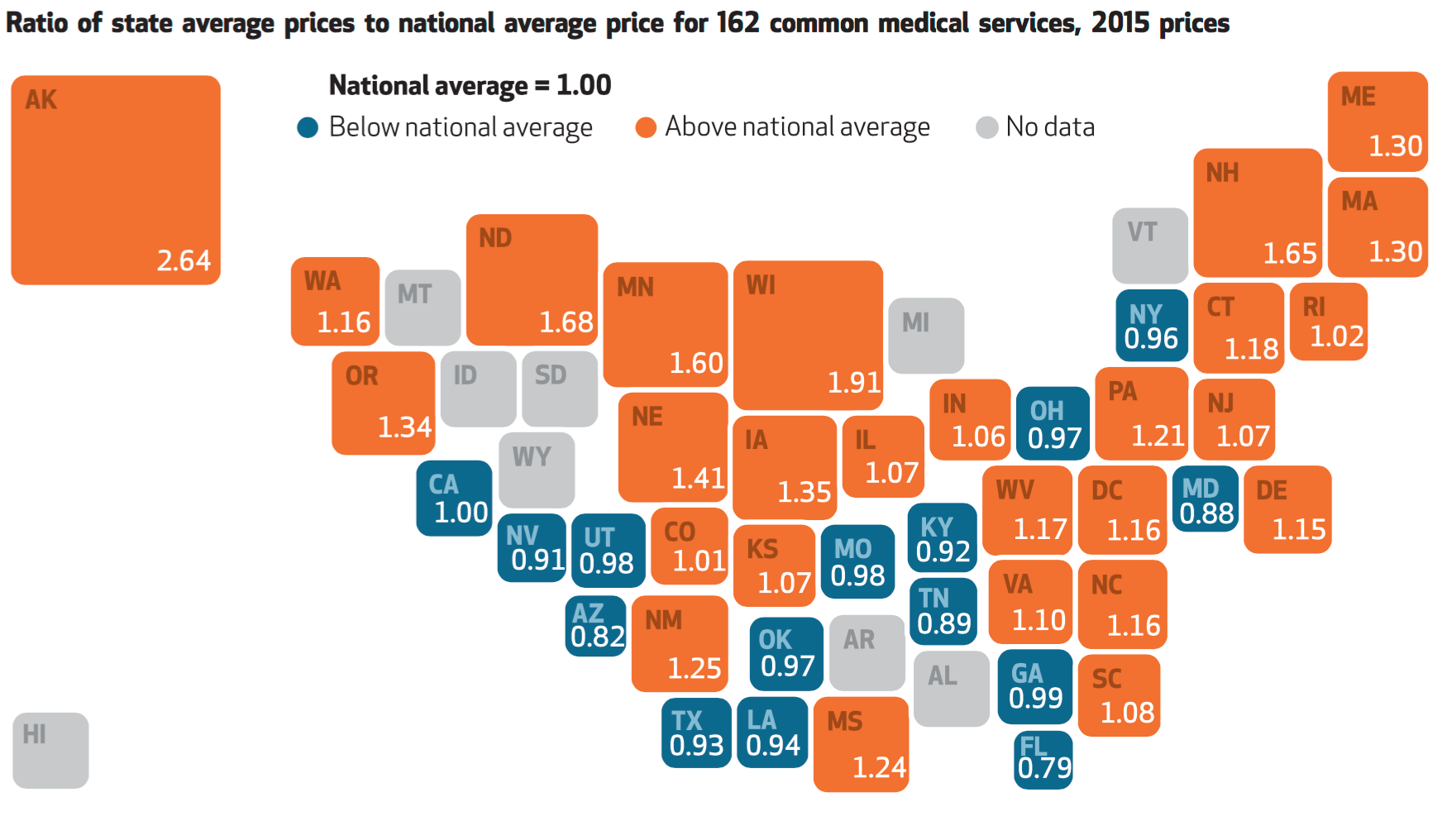

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice.

The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in Canton ($522 versus $183, respectively). [Note that the drive between Canton and Cleveland is 60 miles.]

This research was published this week by the Health Care Cost Institute in their National Chartbook of Healthcare Prices 2015.

Knee replacements, for example, ranges from a high of $57,504 in Sacramento, CA, to a low of $26,601 in Kansas City.

Knee replacements, for example, ranges from a high of $57,504 in Sacramento, CA, to a low of $26,601 in Kansas City.

Prices for healthcare varied by as much as three-fold, according to the write-up of HCCI’s research published this week in Health Affairs. For cataract removal surgery with lens replacement, researchers compared the ratio of average state prices to the average national price. They found that the variation increased from 99% in Kansas to 104% in Missouri, 129% in Illinois, and 141% in Indiana; and, dropped to 85% in Ohio.

In fact, Ohio appeared to have the lowest overall prices for healthcare: some 75% of prices for Ohio’s 240 service were at or below the national averages, the researchers learned.

The report covers 41 of the 50 states. What of the missing 9? They are Alabama, Arkansas, Hawaii, Idaho, Michigan, Montana, South Dakota, Vermont and Wyoming. In the report’s press release, HCCI Executive Director David Newman observed, “Some states’ data are locked up. This byzantine behavior stands in the way of efforts to pursue transparency and understand the root causes of rising healthcare spending.”

Health Populi’s Hot Points: In my digital filing system, I didn’t know whether to store this in my “health economics” folder or the one marked, “financial wellness.” Which one the piece ended up in depends on the lens I’m wearing. For healthcare providers, it’s about pricing, competing in a local market, contracting with insurance companies, paying for labor and capital, and attracting patients.

For patients, it’s about being that new consumer. If she has the time to compare prices for maternity, orthopedic surgery, or outpatient labs or imaging, for example, she’ll look for practical sources to inform her decision. Although we’ve been searching for price transparency in health care for years, it’s a work-in-progress.

In the meantime, providers are keen to get paid at whatever price so they can operate financially sustainable businesses in their local health economies. Enter a new player, the credit bureau, who’s working with hospitals and physician practices on revenue cycle management. A story published in HealthLeaders this week was titled, Consumerism spurs the need for patient credit checks. You shouldn’t be surprised when I tell you that there’s a growing business here for credit bureaus including Equifax, Experian and TransUnion, all of whom offer revenue cycle programs including so-called “payment predictor tools for healthcare providers.

For consumers, platforms for transparency such as ClearHealthCosts.com are squarely on that side of this market equation. This week, CHC announced their expansion in the state of Florida — found to be one of the lower-cost healthcare markets in the HCCI report. CHC began to work with media companies in Florida including WLRN, WUSF and Health News Florida, launching PriceCheck, a database that is crowdsourced through consumers’ sharing their personal healthcare price data and regional media partnering in the effort. It’s important to note that the founder of ClearHealthCosts.com is journalist Jeanne Pinder, who is fostering this media-consumer partnership model throughout the U.S.

For patients, now consumers, knowing prices helps better manage spending in high-deductible health plans where meeting that deductible comes out of “my” pocket. For healthcare providers, having financially health-literate consumers can lessen hospital CFOs’ headaches with bad debt, collections, and angry patients who resist paying medical bills. Transparency paves the way for financial wellness for both patients and providers.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...