Existing healthcare industry players – the stakeholders of hospitals, physicians, pharma/life sciences, medical device manufacturers, and health plans – are operating in a whirlwind of change. While there are many uncertainties in this period of transition, there’s one operational certainty: learn to do more with less payment.

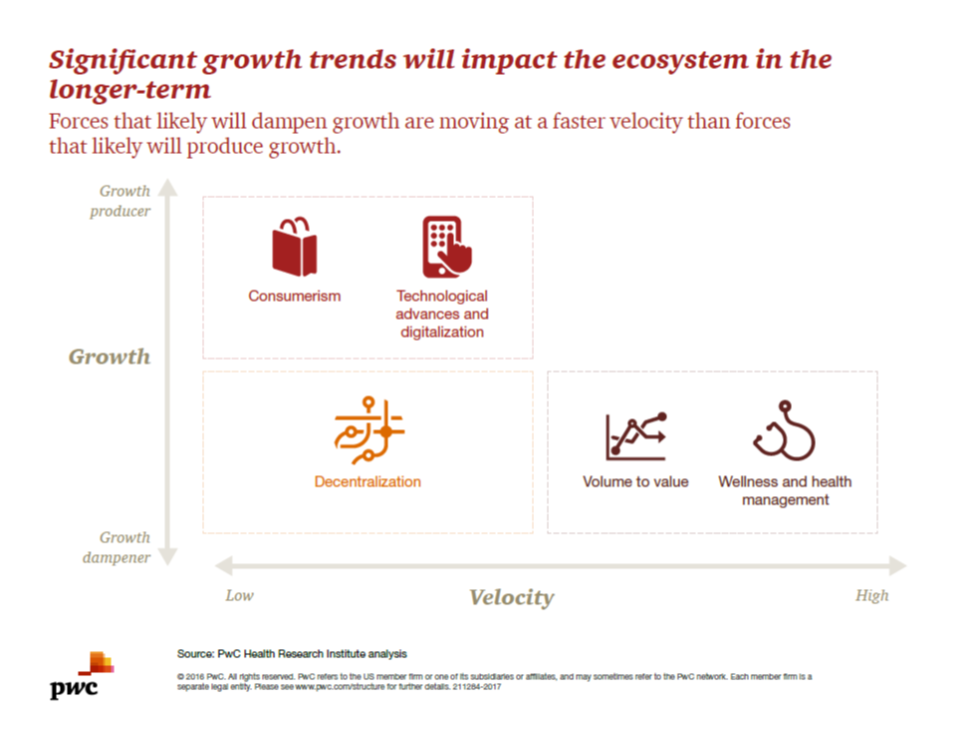

That’s due to the growing pursuit of payors paying for value, not on the basis of volume or what’s “done” to a patient in care delivery. At the same time, another force re-shaping healthcare is interest and focus on wellness and health management. Combined with the growing health economic value proposition, wellness and health compel a re-imagination of where and how health/care is served up to an increasingly demanding patient-consumer in a growing digital landscape.

PwC offers advice on Surviving seismic change: Winning a piece of the $5 trillion US health ecosystem, looking toward the next decade of the blurring health/care ecosystem. Five key trends are converging that are morphing the health ecosystem: consumerism, value-based payment, wellness and health management, value-based payment, and decentralization will together re-shape the health market and challenge legacy players.

As a result of these forces, PwC expects several shifts in the health ecosystem:

- The largest component of the market, care delivery (accounting for $2 trillion), will be challenged by the value-based payment paradigm which will reduce traditional growth opportunities. Primary care would be a prime area for growth, especially in light of the ability to leverage broadband and digital health tools in decentralized locations for care.

- Diagnostics and therapeutics, worth $1.6 trillion, could be buoyed by bringing novel products and programs to the market which can shift patients from higher-cost centralized healthcare locales to decentralized, lower-cost sites of care (such as retail clinics, pharmacies, and at home).

- Financing, payment and regulation accounts for $1 trillion, and will directly impact pharma and life science companies to deliver more value “beyond-the-pill” and device, and across the value-chain of care and patient outcomes.

- Wellness and health management, worth $276 billion, is a highly consumer-valued segment, which will increasingly be informed by Big Data and predictive analytics, and digital health tools that are enchantingly designed with the user (patient, caregiver, physician) at the center.

- Platforms and support, valued at $93 billion, will provide the infrastructure for interoperability and virtual health care delivery.

“Consumers,” who face growing options for care services and products and a pocketbook open for spending to a deductible and out-of-pocket costs, will, in the words of PwC, “try new options that make their lives easier, less complicated and more affordable.”

Health Populi’s Hot Points: This last sentence represents the new health @ retail: decentralized, served up where people (consumers, patients, caregivers) live, work, play, pray and learn — streamlining lives, at a price representing value in the eyes of the paying consumer. And payment includes time, convenience, transparency, easy billing and payment options. In other words: a 360-degree retail experience.

Health Populi’s Hot Points: This last sentence represents the new health @ retail: decentralized, served up where people (consumers, patients, caregivers) live, work, play, pray and learn — streamlining lives, at a price representing value in the eyes of the paying consumer. And payment includes time, convenience, transparency, easy billing and payment options. In other words: a 360-degree retail experience.

Retailers (literally) are coming together in various ways to deliver these kind of health care experiences: in pharmacies, groceries, Big Box stores, consumer electronics storefronts and, of course, online. With Amazon’s launch of a health data cloud (via Amazon Web Services, or AWS), the health consumer online moment of searching for an arthroscopy to be performed within 20 miles of your home will happen in PwC’s forecast period, within ten years.

For more on the retail health opportunity, see the Health Populi blog post, Healthcare Stakeholders’ Kumbaya Moment at Walmart’s Retail Health Summit.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...