The evidence of the value of digital health tools is growing, based on research published in The Growing Value of Digital Health, from the IQVIA Institute for Human Data Science.

With this report, the IMS Institute ushers in the organization’s new name, IQVIA Institute (THINK: “I” for “IMS,” and “Q” for “Quintiles).

This is the organization’s third report on digital health, following the original analysis from 2013, updated in 2015. Here’s my take on the 2013 report, which found that 36 mobile health apps represented one-half of all downloads.

On a conference call held last week, the company’s SVP and Executive Director Murray Aitken said the research shows significant growth in the impact that digital health is having on patients and healthcare overall. The environment for health care apps is maturing, where these tools are playing a meaningful role in patient care, Aitken asserted — on both patient outcomes and the costs of care.

There are now over 318,500 consumer apps health-related available for download, double the number of apps available two years ago. Two hundred new apps are added to the marketplace each day. But it’s not just the sheer number of apps that matters, Aitken noted; their downloads, use and most importantly evidence is building with respect to the impact that use of the apps can have on patient care.

Aitken summarized five key findings in the report:

Aitken summarized five key findings in the report:

- Quantification of potential healthcare savings that can result in the U.S. from utilization of digital health apps. For the first time, IQVIA created a model that looks across five patient populations where there’s been proven reduction in acute care utilization: diabetes prevention, diabetes care, asthma, cardiac rehab, and pulmonary rehab. Taken together, if digital health apps were used across these five patient groups, the U.S. healthcare system could save about $7 billion per year. If digital apps were used across all categories, the annual savings would be $46 bn, IQVIA calculated.

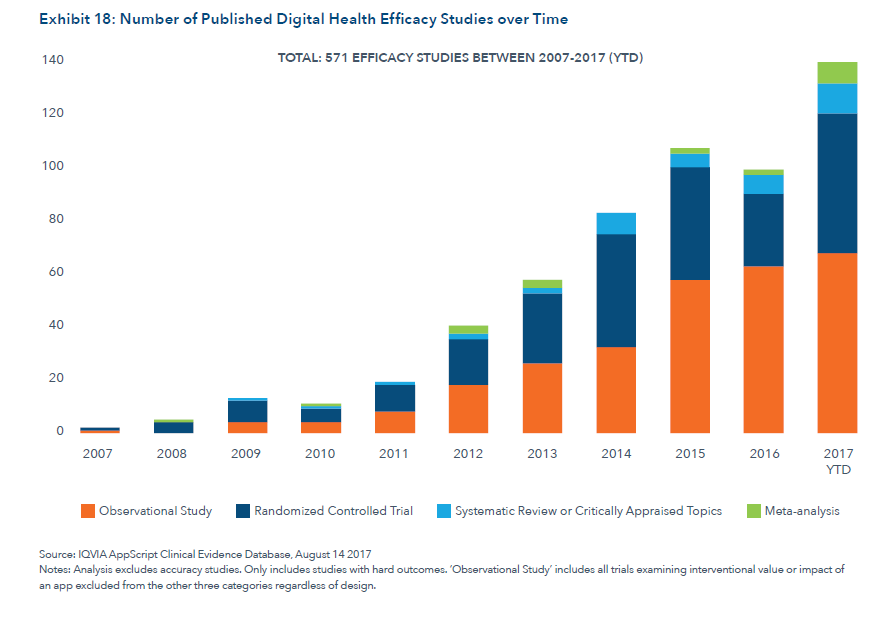

- Substantial growth in clinical evidence on efficacy of digital health in terms of improving patient outcomes and cost savings. The team reviewed published studies, numbering 571 papers including clinical trials, observational, and meta-analysis studies, with a particular focus on type 2 diabetes, depression and anxiety. Extensive evidence-building efforts are underway, with at least 860 clinical trials incorporating digital health tools happening in 2017, exploring text messaging interventions and the use of smartphones as well as remote health monitoring. These projects reflect a heightened level of interest and engagement by healthcare providers to bringing credible evidence for the appropriate use of digital health tools, Aitken said.

- App design and stickiness seems to be improving based on UX versus what we saw in 2013. 55% of the apps in the Quintiles IMS Appscripts app database have garnered 4 star ratings in the past two years compared with 31% of apps in the two years prior to 2015. IQVIA believes this means apps are getting better, including more functionality. More health apps are also increasingly available in languages beyond English, suggesting the broadening of the interest and use of apps among a more diverse patient and clinician population.

- The growing role of digital sensors linked to apps bring additional value to healthcare systems. Consider the growing use of smart devices such as asthma inhalers which link a sensor to an app. There are 18 asthma smart inhalers now available, which IQVIA inventories in the report. Other patient-facing linked apps available on the market include connected pens for diabetes patients and smart blister packs to track medication usage. Smart sensors are also being employed to improve clinical trial design helping to address productivity challenges in the R&D process.

- Barriers still exist to wider adoption of digital health, but there are substantial green shoots of adoption and proof points. The 2013 and 2015 reports clearly laid out barriers to digital health adoption. The new report shows practical movement in the digital health market on behalf of patient use and clinical evidenced proof of that use in the past two years. In particular, “curation platforms” are enabling the creation of digital therapeutics formularies – sets of apps for which evidence exists for effectiveness and used by providers with and prescribed for patients. The growth of value-based payment is expected to bolster the use of these app formularies. Data integration vendors are bridging individuals’ data flowing from personal mobile phones to healthcare professionals and integrating into the EHR. This was a barrier in the past but IQVIA identified strong positive advances here. It may take ten years for digital health to mainstream for most organizations, Aitken forecasted, but the direction is clear and the pace of adoption of these tools is accelerating.

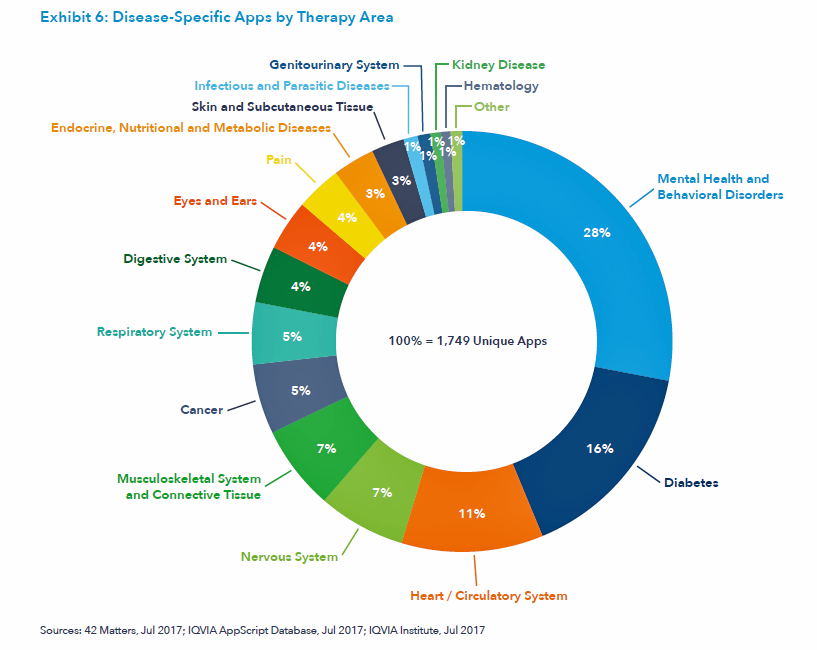

Available digital health tools cover the continuum of the patient journey, from wellness and prevention through symptom onset, diagnosis, condition monitoring, and treatment. The most common measures tracked by connected sensors cover calories burned, distance travelled (activity), steps, heart rate, and sleep. The third chart illustrates the various clinical areas now covered by the 300,000+ digital health apps. The most apps are available for mental and behavioral health, diabetes, heart/circulatory system, nervous system, musculoskeletal, and cancer.

Available digital health tools cover the continuum of the patient journey, from wellness and prevention through symptom onset, diagnosis, condition monitoring, and treatment. The most common measures tracked by connected sensors cover calories burned, distance travelled (activity), steps, heart rate, and sleep. The third chart illustrates the various clinical areas now covered by the 300,000+ digital health apps. The most apps are available for mental and behavioral health, diabetes, heart/circulatory system, nervous system, musculoskeletal, and cancer.

Health Populi’s Hot Points: The use of digital health apps can help save money and improve patient outcomes, IQVIA’s study of the growing evidence bears out. The ongoing payment migration from “volume to value” will help move that needle beyond close margins to more mainstream adoption by clinicians who are taking on more financial risk.

Health Populi’s Hot Points: The use of digital health apps can help save money and improve patient outcomes, IQVIA’s study of the growing evidence bears out. The ongoing payment migration from “volume to value” will help move that needle beyond close margins to more mainstream adoption by clinicians who are taking on more financial risk.

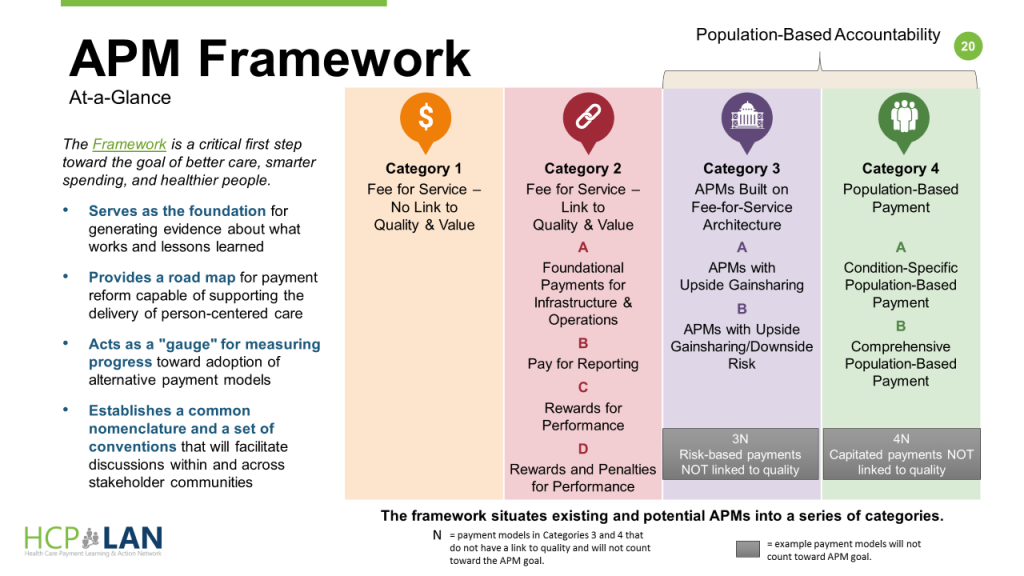

The latest report published October 30, 2017, from HCP-LAN, the Health Care Payment Learning & Action Network, provided a snapshot on “where” the U.S. on that payment journey. Overall, 29% of healthcare payments were tied to alternative payment models (APMs) in 2016 compared with 23% in 2015. LAN’s goal is to have 50% of healthcare payments tied to value in 2018, which the organization believes is on-target in terms of the pace-of-change observed. The organization’s APM framework is shown in the fourth chart.

The growth in Category 2 payments, which link quality and value, grew from 15% of payments to 28% of payments. Growth in the more advanced Category 3, which address gainsharing and downside risk (that is, more “skin in the game” for providers), grew from 23% to 29% of payments in 2016.

IQVIA and HCP-LAN are focused solely on the financial risk of clinicians and health care providers. But what of the patient and health consumer who is also taking on more financial risk in the era of high-deductibles and first-dollar coverage, along with much higher cost-exposure to specialty drugs — the fastest-growing component in consumer-facing health spending?

Our forecast at THINK-Health is that more consumers are keen to adopt DIY-healthcare tools, such as those discussed in the IQVIA report. As we approach CES 2018 in Las Vegas, where I expect to see more innovation available to healthcare consumers through mobile phone apps and home-based digital tech, more consumers will demand digital health tool “prescribing” by physicians the way consumers have learned to request prescription drugs encouraged through direct-to-consumer and unbranded ads.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...