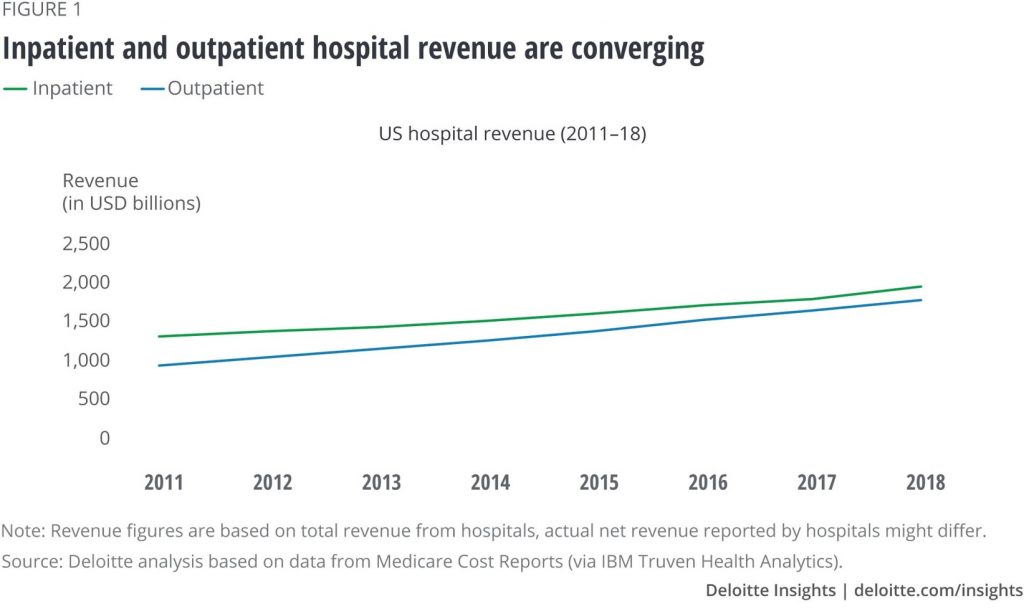

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals

This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone?

The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their traditional business model but also how to invest in and create new competing business models at the same time….Decision-makers could do better to turn their focus away from inpatient settings.”

Here’s a quote from one of the CEOs that Deloitte interviewed in researching their paper:

“All of my investment now is in outpatient — anything that is not beds. Our ability to create that network outside the hospital is huge.”

And another verbatim observation that illustrates some hospitals’ doubling-down on the outpatient opportunity:

“The focus of the past 10 years has been on preventing readmissions, and now in the next 10 years, the focus will be on preventing admissions.”

Health Populi’s Hot Points: Bloomberg reported that Walmart’s projected visit volume for the company’s new health clinic in Dallas, Georgia, exceeded expectations. Walmart recently opened the second health center, in Calhoun GA, where in the words of Bloomberg, a consumer could book a tele-mental health therapy visit for $1 a minute (that’s $60 for the initial intake session of 60 minutes and $45 for subsequent 45-minute therapy meet-ups).

Health Populi’s Hot Points: Bloomberg reported that Walmart’s projected visit volume for the company’s new health clinic in Dallas, Georgia, exceeded expectations. Walmart recently opened the second health center, in Calhoun GA, where in the words of Bloomberg, a consumer could book a tele-mental health therapy visit for $1 a minute (that’s $60 for the initial intake session of 60 minutes and $45 for subsequent 45-minute therapy meet-ups).

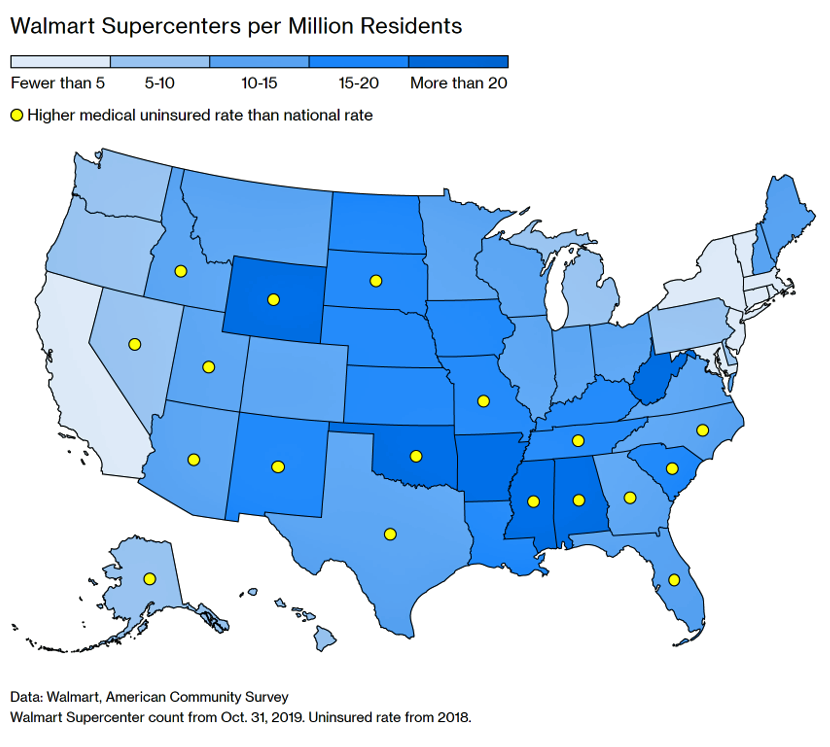

The map illustrates the density of Walmart’s Supercenters vis-à-vis the yellow dots that represent relatively higher uninsured rates. There’s no mistaking that more Supercenters are located in areas with greater levels of people without insurance based on data from 2019 (Walmart store location count) and 2018 (uninsured rates).

Walmart, clearly, is growing its primary care and mental health service supply side, planning to replicate health centers across markets where it makes sense to do so….like in under-served areas where more people live without health insurance.

This week, too, The Wall Street Journal analyzed the impact of insurer-owned retail clinics’ potential threat to hospitals.

Indeed, outpatient and ambulatory care is the New Black for hospitals and health care. This is key for serving patients’ — now health care payors’ — need for primary care, mental health bundled into that on-ramp visit, and prevention to stay the heck out of the more expensive inpatient setting that has been the core business of The Hospital. For a growing cohort of patients-as-payors, whether insured, under-insured, or uninsured, surprise medical bills and hospital costs are now part of the financial toxicity experience the way high-cost specialty drugs have been.

One final verbatim comment from a Deloitte subject matter expert in their report nails the need for hospitals to partner in the community closer to where patients live, work, play — and pay for health care:

“We are trying to take care of more people using less money. To the extent technology can allow us to deliver care in less expensive physical spaces, it gives us scale without having to make traditional capital investments.”

This hospital exec understands how digital tools via connectivity (Broadband, cellular, emerging 5G networks) will help bring the hospital to people at home and on-the-go.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...