“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network.

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network.

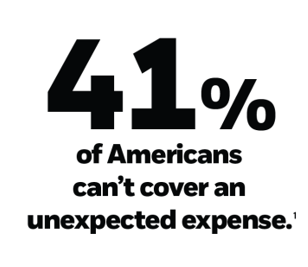

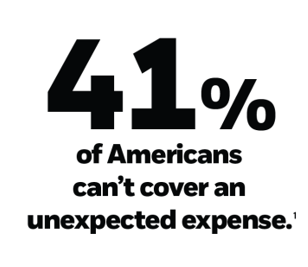

One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI).

BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common Cents Lab, along with UPS, Mastercard, Etsy (whose sellers were the subject of an ESI white paper on the pandemic and gig workers’ financial health), Brightside, Acorns, and Arizona State University.

The survey, conducted online among 2,043 U.S. adults 18 and over between May 7 and 11th 2020 by The Harris Poll, found that:

The survey, conducted online among 2,043 U.S. adults 18 and over between May 7 and 11th 2020 by The Harris Poll, found that:

- 73% of Americans said the COVID-19 pandemic reduced their income

- 80% of people said it was likely their company would reduce their hours or lay them off

- 67% of working people trusted their employer to keep their informed during the pandemic

- Nearly 1 in 2 people still working said they had skipped or stopped paying a bill compared with people not working. The percent of people not paying a bill in the pandemic was even higher among those with families — 60% of these households with children under 18 versus 20% of those without families with younger children.

The pandemic has revealed many paradoxes in American life. Here’s one found in the BlackRock ESI research: that Americans are using both emergency savings to fund spending in the pandemic, and also saving more in emergency funds. For some people, spending has fallen due to #StayHome, shelter-in-place mandates from state governors. This has reduced personal spending for some who are allocating liquid funds to savings accounts. BlackRock also notes a “salience” impact, bringing awareness in the moment to people in the midst of the pandemic which compels them to save if they can.

This has also been referred to as the “hurricane effect,” which is explained in the text, Insurance & Behavioral Economics: Improving Decisions in the Most Misunderstood Industry, by Kunreuther, Pauly and McMurrow from The Wharton School. Looking at natural disasters, people have been shown to purchase insurance after a natural disaster versus in advance to manage the risk proactively.

Bottom-line, one-half of people in the survey said they increased how much they were saving as a result of the coronavirus pandemic.

Health Populi’s Hot Points: The ESI research conducted among Etsy workers is insightful as the U.S. economy continues to morph toward a largely gig-employment economy. This week, the National Bureau of Economic Research (NBER) asserted that the U.S. entered a recession in February 2020. The NBER Board, “concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.”

Health Populi’s Hot Points: The ESI research conducted among Etsy workers is insightful as the U.S. economy continues to morph toward a largely gig-employment economy. This week, the National Bureau of Economic Research (NBER) asserted that the U.S. entered a recession in February 2020. The NBER Board, “concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.”

As millions of workers in the U.S. have cobbled together new home offices and WiFi networks, convening meetings via Zoom and Microsoft Teams and adopting virtual conference modes for the past several months, employers have been assessing just how to “return to work,” facing commercial real estate leases and office towers with elevators shooting beyond ten stories. How to ensure health and risk-manage workers’ exposures to the virus in such settings?

While designers are re-imagining the six-foot-apart office environment, we may find that there isn’t enough acrylic screening available to keep us from infectious droplets and healthy circulated air inside traditional office spaces. The advent of #WFH (work-from-home) and reducing the operating cost of office space combine as a driving force for more gig-work.

Looking at the Etsy worker experience in the pandemic, we see that the sellers’ main emergency expenses were for auto repair and repayment, and for medical bills.

Another paradox in U.S. pandemic life, at least in the past couple of months, is the very different trajectory of Wall Street compared with Main Street. This last graphic is the cover of The Economist dated 9th May 2020, which featured an in-depth discussion of “the markets versus the real economy.”

By the “real” economy, the editors were referring to most mainstream people in the U.S. who aren’t in fact invested in the stock market. In the meantime, “Wall Street” shown on the map with streets titled “Yellow Brick Road,” “Easy St.,” and “Excess Profits Drive,” has fared well in the past several weeks–optimistic about “reopening.”

For those who live mostly on the Main Street side of the map, think like an Etsy seller. In a recession, with food prices increasing in the pandemic and food being a major purchase for mainstream consumers, financial stress will persist in America along with other stressors about safety, returning to work and “opening the economy,” and hard choices about summer camps, summer vacations, and preparing for what fall school schedules will look and feel like.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...