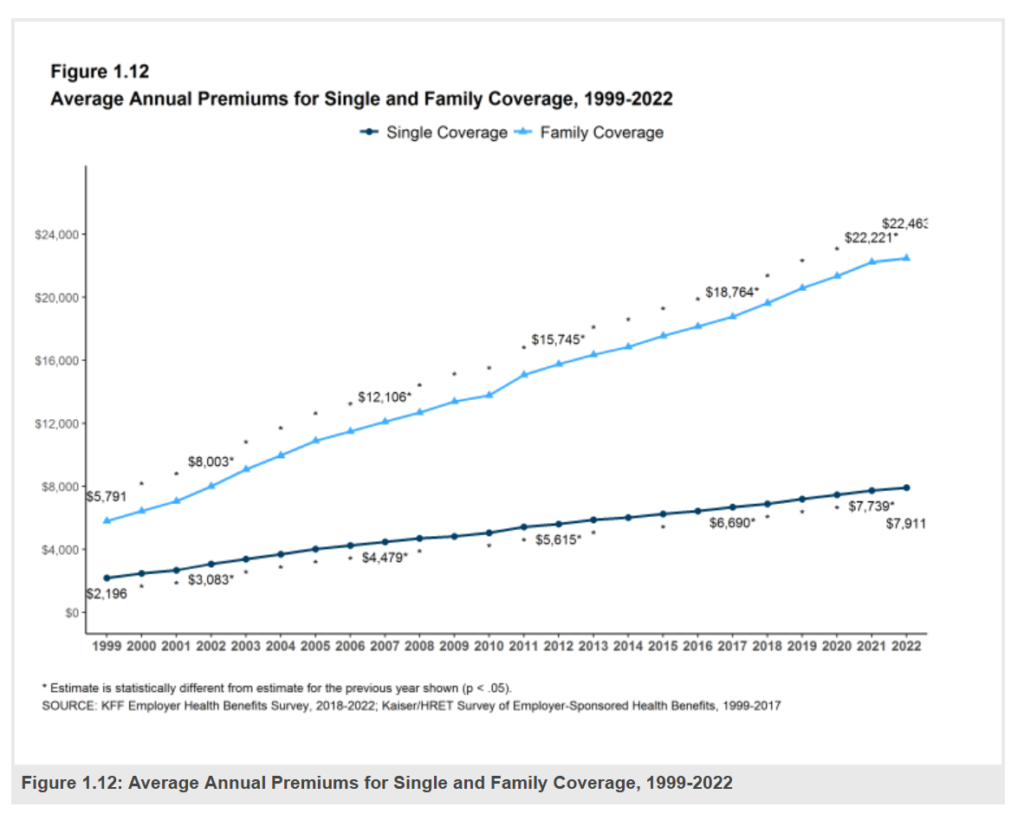

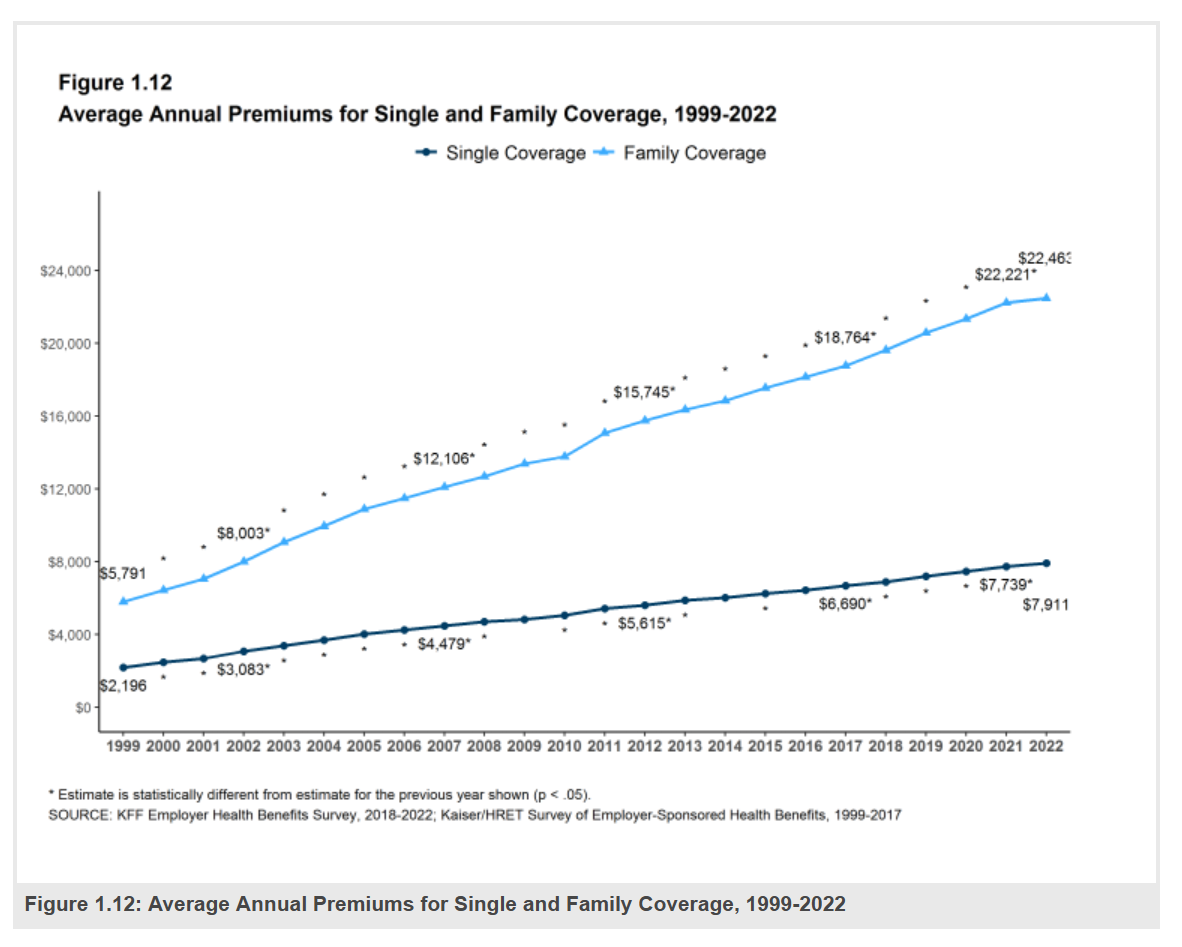

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463.

That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs.

With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care.

Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at every nook-and-cranny of employer-sponsored health care, from the macro premium picture and health plan offer rates to the more granular data on employee wellness, mental health, and telehealth — categories that weren’t part of the report’s early findings that launched 24 years ago.

First, it’s important to call out that in 2022, the percent of employers offering health benefits is expected to fall from 74% in 2021 for large firms down to 69% in 2022, and from 59% of small firms to only 51% in 2022. That’s the lowest offer-rate for small firms since the start of this study, and for the large companies, matches the historic low of 69% found in the pandemic’s emerging year in 2020 (the offer rate marginally increased for bigger companies last year to 74%).

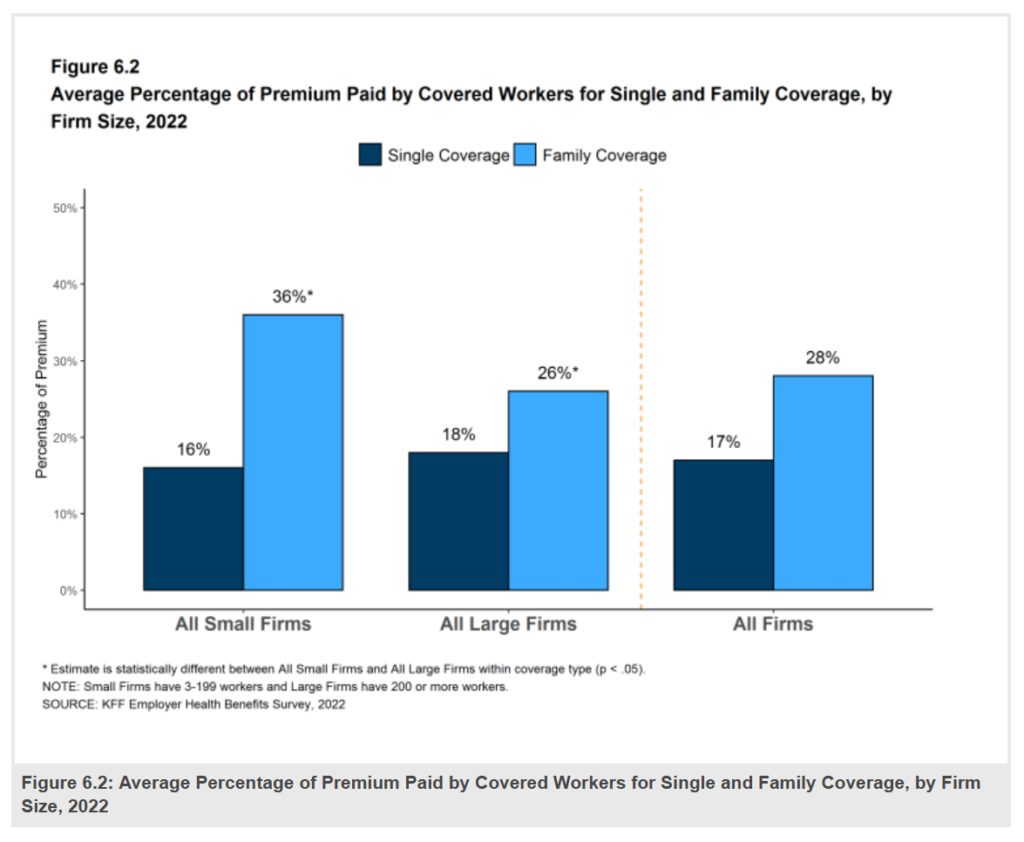

While family premiums are expected to reach an average of $22.5 K at the workplace, the premium for single workers’ plans will be $7,911.

Across large and small firms, workers would bear 28% of the premium share (about $6,300), which works out to a monthly financial cost of over $500 for the family. For singles, the share would be about $1,300, about $110 on a monthly basis.

Inflation is on our minds in 2022, so it’s useful to note KFF’s calculations on cumulative premium increases, inflation, and earnings for workers with family coverage.

For workers’ family health plans, between 2017 and 2022,

- Premiums rose 20%,

- Overall inflation increased 17%, and,

- Workers’ earning grew 22% over the five years.

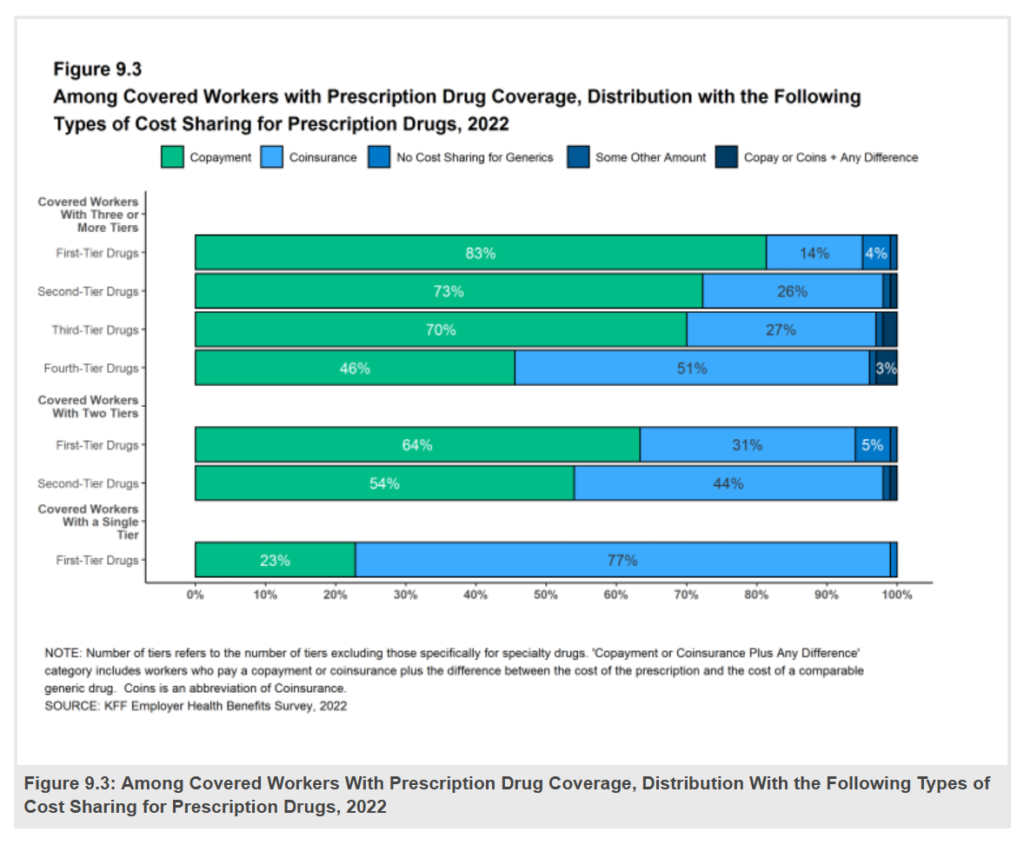

One of the most dog-eared sections of this report for my work is the analysis of prescription drug costs, which has tracked the growth of the number of drug “tiers” and dollar-share spread between them.

Here in the graphic labeled Figure 9.3, we can see the tiering of Rx medicines and their differences for copayments, coinsurance (% cost-sharing), no-cost sharing for generics, or another amount/methodology; the top section is for covered workers facing at least three tiers, which I’ll discuss here.

About 4 in 5 first-tier drugs (generics) require a co-pay (on average, $11). Three-fourths of tier-two medicines involve a co-pay with another one-fourth using coinsurance; these drugs on the 2nd tier are branded medicines, on formulary (approved lists). The average copayment for second-tier drugs is $37 in 2022.

For tier 3 prescription meds, a patient would face an average copayment of $67 and average coinsurance of 37%. These are prescription drugs that are not approved on a health plan’s formulary.

For plans with a fourth tier for prescription meds, the average copay amount would be $116, with coinsurance on average of 27%.

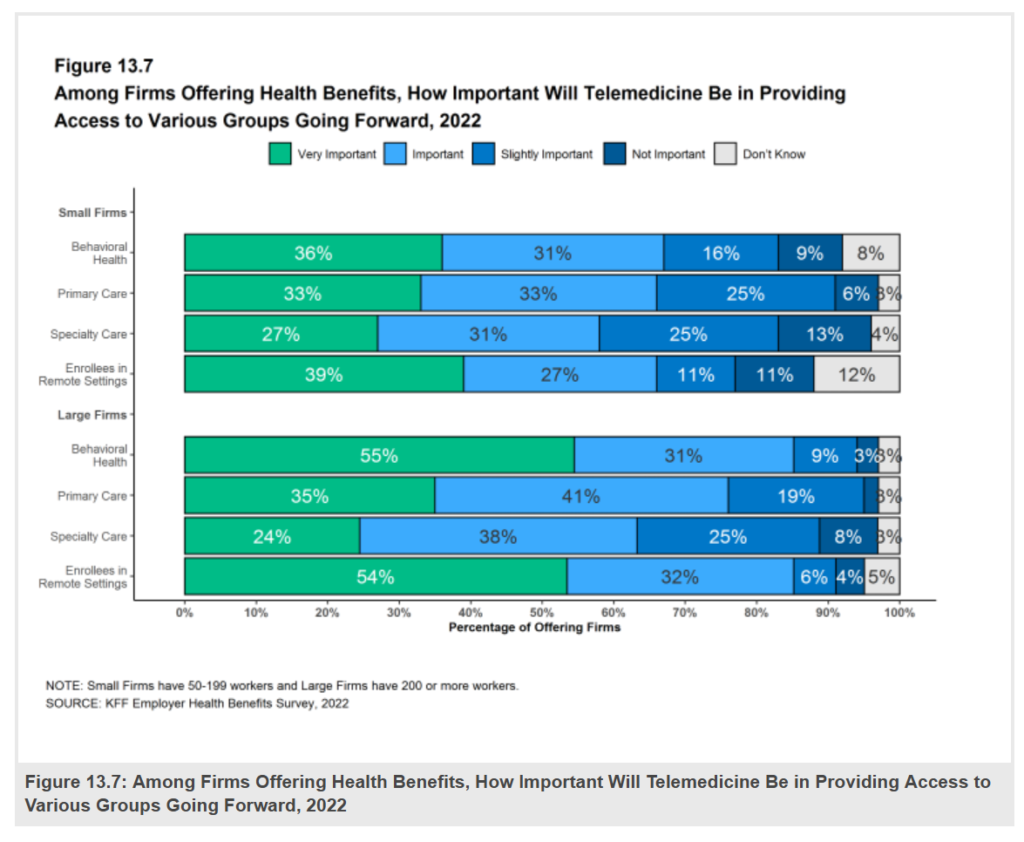

The pandemic ushered in a hockey stick growth era which ushered in most patients’ and clinicians’ virtual care experience). Employers began to cover telehealth in a couple of years approaching the COVID-19 pandemic, and the public health crisis forcing working-from-home and physical distancing from the workplace accelerated the uptake of telehealth among employers, large and small alike.

The figure 13.7 portrays employers’ views on how important telemedicine will be to provide access to various groups of people/patients going forward.

For firms large and small, behavioral health and access for workers living in remote geographies will be most important, followed by primary care for about one-third of all employers seeing virtual PCP access as “very important.”

At least one-third of employers anticipate that telehealth use will increase next year. Bolstering that utilization will be access for mental health services, which nearly one-half of large firms and one-third of small cos see growing “a great deal.”

Rounding out the mental health/digital health picture for employers is that more firms — between 41% and 62% depending on their size — expects to offer mental health self-care apps in 2022. This is part of the growing omni-channel approach to health care, including mental/behavioral health, which can expand and scale access to workers wherever they live and work.

There is so much more for you to discover and glean from the KFF report. Do check it out now and throughout the coming year. It’s one of our most-trusted sources of truth in U.S. health care.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...