“Brick-and-mortar pharmacies forge meaningful connections with customers” through conversations between pharmacists and patients, “on a first-name basis.”

This quote comes from Christopher Lis, managing director of global healthcare intelligence at J.D. Power who released the company’s annual 2023 U.S. Pharmacy Study today, the 15th year the research has been conducted.

Each year, J.D. Power gauges U.S. consumers’ views on retail pharmacies in four channels: brick and mortar chain drug stores, brick and mortar mass merchandisers, brick and mortar supermarkets, and mail order.

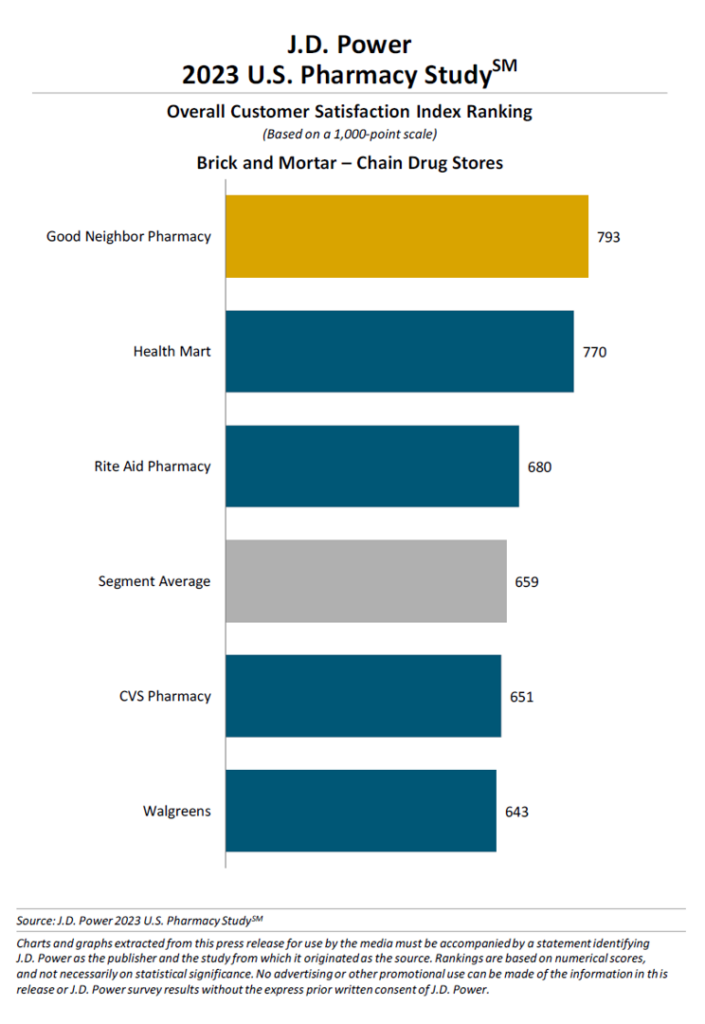

Across all four channels, the top-ranked retail pharmacy in 2023 is Good Neighbor Pharmacy, which ranked highest-rated among consumers for the seventh year in a row.

For brick and mortar chain drug stores evaluated in 2023, consumers were most satisfied with the services from Health Mart and Rite Aid, with CVS Pharmacy and Walgreens falling below the channel segment average.

“Long live the friendly neighborhood pharmacist,” J.D. Power’s press release lauds, noting that satisfaction is 102 points higher among consumers who say they know their pharmacist by name — thus, the “first-name basis” aspect in Lis’s observation of this year’s study.

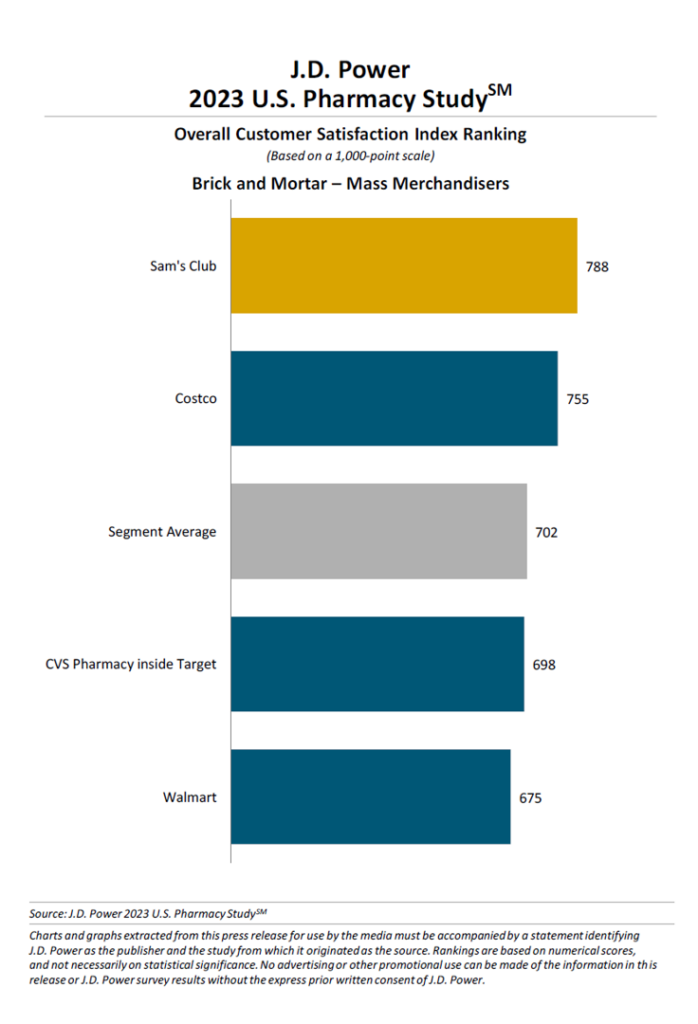

Mass merchandisers are important and valued retail channels for pharmacy purchases among health consumers who value the one-stop-shop and often deep-discounted goods purchased in volume in the rest of the store. For the eighth year in a row, Sam’s Club took first place for the mass merch channel. Costco ranked #2 in the Big Box group, with CVS Pharmacy inside Target and Walmart falling below segment average.

[As an informative sidebar for more context into health consumer satisfaction, I wrote about Costco and its iconic, and much-loved, hot dog which persisted at the high-value price of $1.50 during the COVID-19 pandemic — covered here in Health Populi in an assessment of the “Retail Health Battle Royale” that’s been in my scenario planning work for a while].

Score-wise, note that Sam’s Club in mass merchandise ranks just below Good Neighbor Pharmacy, the chain drug store and overall “winner,” by just five points this year. Furthermore, CVS Pharmacy inside Target (at 698 points) ranks higher than CVS Pharmacy as a retail chain drug store (at 651 points this year).

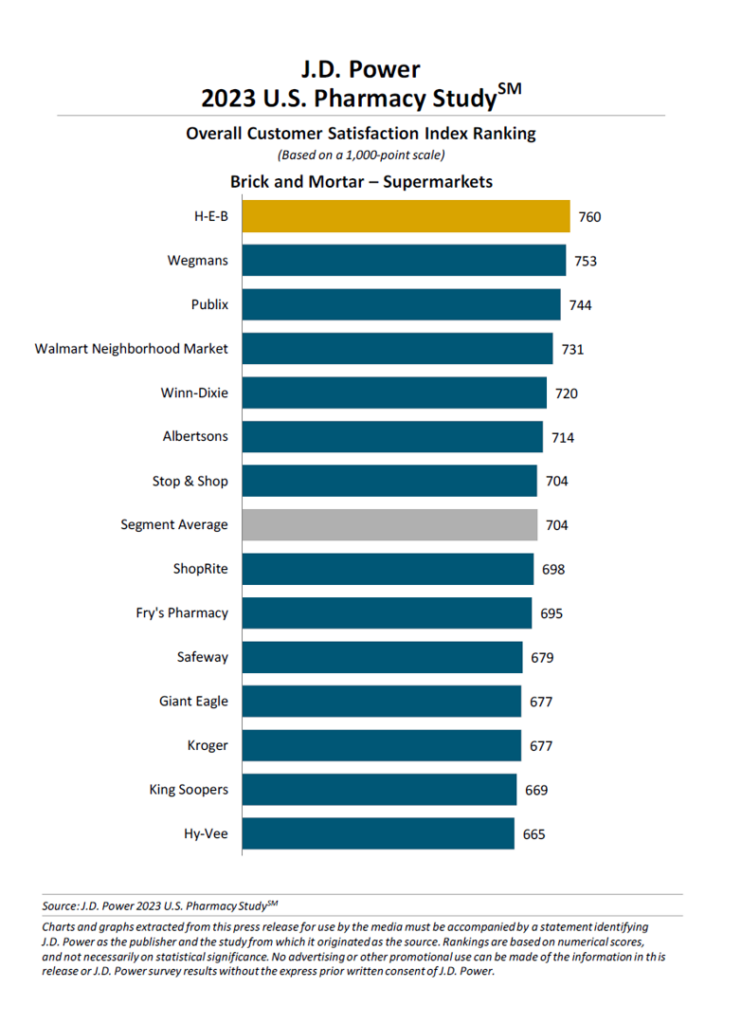

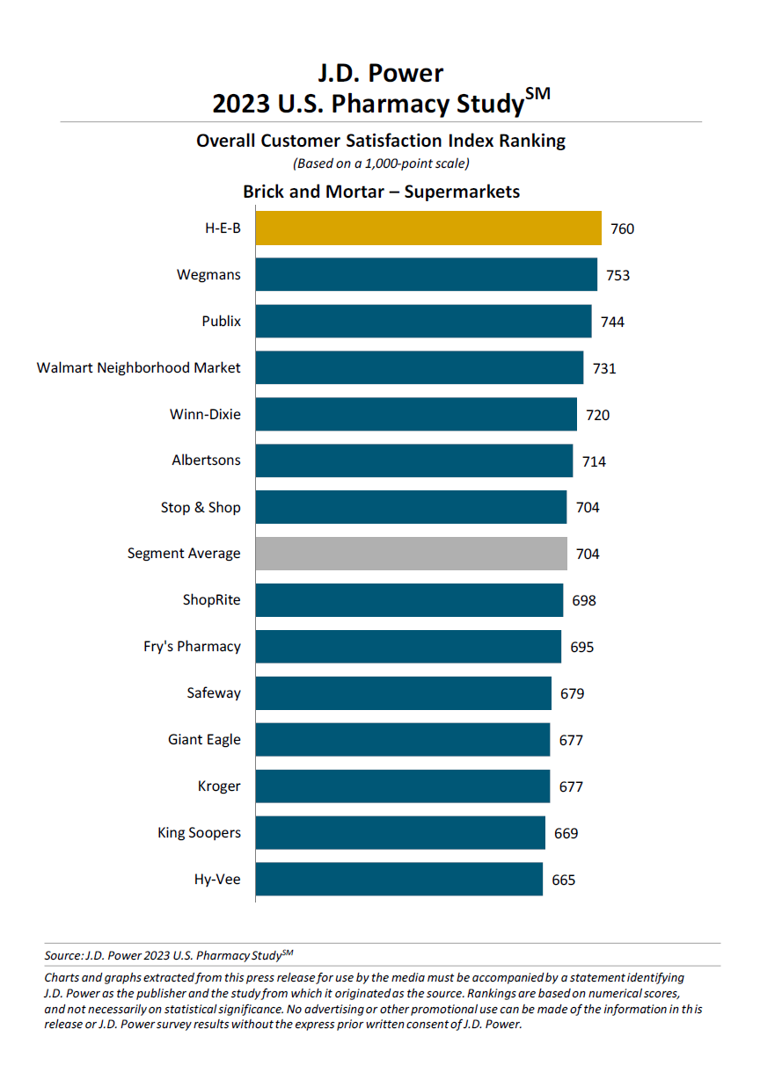

There’s more repeat top-ranking news in the supermarket pharmacy channel with H-E-B once again dominating the channel for the third year in a row. Wegmans, Publix, Walmart Neighborhood Market (distinguished from Walmart as Big Box/mass merchandiser), Winn-Dixie, Albertsons, and Stop & Shop all ranked above the segment average.

Note that Kroger, currently in a bid to merge with higher-ranked Albertsons, fell much lower in the J.D. Power research.

Note, too, the relatively longer list of brick and mortar supermarket pharmacies assessed in this study, illustrating a competitive prescription drug sales channel for consumers.

H-E-B is a frequent name featured in the Health Populi blog due to its continued innovation in retail health and bringing health and wellness services to people at home and closer-to-home — from vaccinations and flu shots to health screening and population health services. This phenomenon is part of most grocery pharmacies’ strategies that we’ll continue to watch as consumers’ desire to morph their homes into health/care sites grows in the post-pandemic environment.

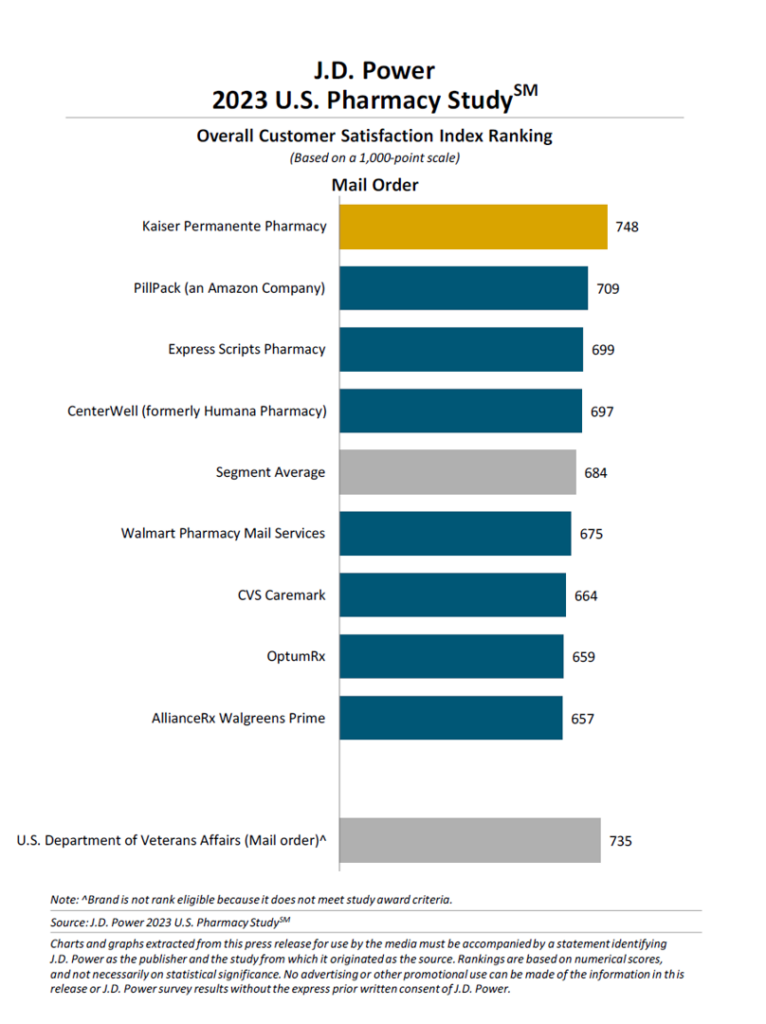

The fourth pharmacy channel is mail order, which is a popular platform for patients prescribed long-term maintenance medications for chronic conditions, and especially folks interfacing with PBMs.

For mail order, the leader in patient satisfaction was Kaiser Permanente Pharmacy which has often led this pack in the J.D. Power research.

Notably, #2 in the mail order segment was PillPack (an Amazon Company), which has not appeared in the J.D. Power pharmacy study before.

Above the segment average after PillPack were Express Scripts and CenterWell (which you might remember as Humana Pharmacy).

Below-the-group average for mail order in 2023 were Walmart’s mail services, CVS Caremark, OptumRx, and AllianceRx Walgreens Prime.

The U.S. Department of Veterans Affairs Mail Order program ranks relatively high with 735 points — ahead of PillPack for mail order, and well above the segment average for brick and mortar chain drug stores.

Bravo VA!

Health Populi’s Hot Points: We consumers trust J.D. Power as a source of truth for researching new car options, insurance companies, financial services, and travel among the many line-items in our household budgets for which we seek information to be smarter purchasers.

For 15 years, J.D. Power has known that the retail pharmacy was an important line-item in U.S. household budgets, sometimes in competition with food and gas-tank fills versus prescription drug fills/refills.

The addition of Pill Pack (an Amazon company), coupled with the long list of competing grocery store pharmacies, bolsters the reality that the pharmacy as part of the health/care ecosystem is subject to the same kinds of customer service expectations people seeks for engaging retail experiences. The additional insight that many consumers are liking the brick-and-mortar retail pharmacy and pharmacist for first-name recognition and conversation speaks to the retail experience for social health, live and in-person. This is not everyone’s preference, but it is part of an omni-channel vision for some people and some times, complemented by other touchpoints and platforms.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.