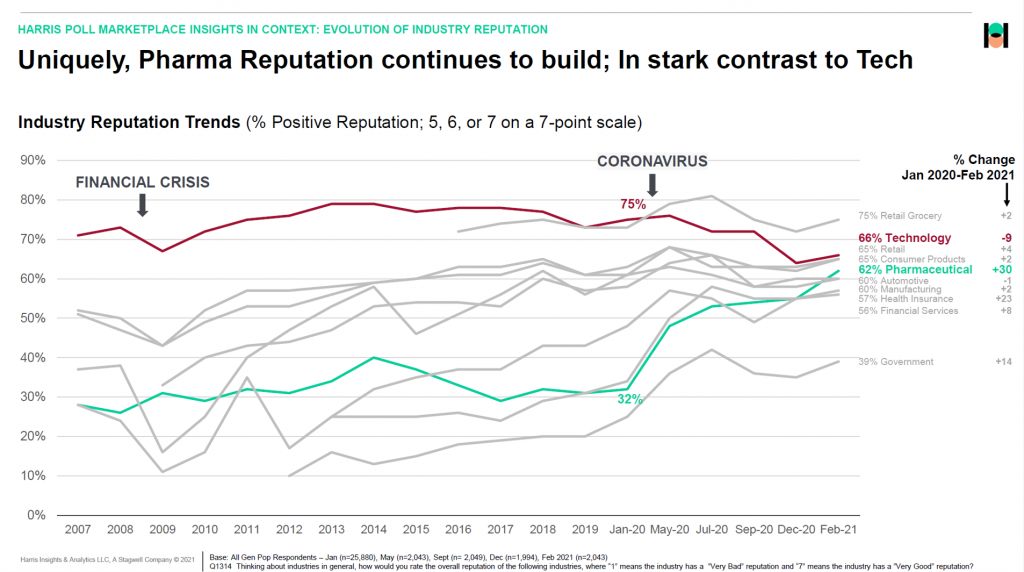

The reputation of the pharmaceutical industry gained a “whopping” 30 points between January 2020 and February 2021, based on the latest Harris Poll in their research into industries’ reputations.

The study was written up by Beth Snyder Bulik in FiercePharma.

The study was written up by Beth Snyder Bulik in FiercePharma.

Beth writes that, “a whopping two-thirds of Americans now offer a thumbs-up on pharma” as the title of her article, calling out the 30-point gain from 32% in January 2020 to 62% in February 2021.

Thanks to Rob Jekielek, Managing Director of the Harris Poll, for sharing this graph with me for us to understand the details comparing pharma’s to other industries’ reputation trends in the past year of the pandemic.

First, check out the gainers on the list: after pharma, health insurance was the second biggest rep-winner in our COVID year, gaining 23 percentage points in the poll.

Financial services took third place in reputation gains, with an 8-point growth over the year.

Financial services took third place in reputation gains, with an 8-point growth over the year.

The striking loser in reputation, perhaps surprisingly, was the technology industry which lost 9 points between January 2020 and February 2021.

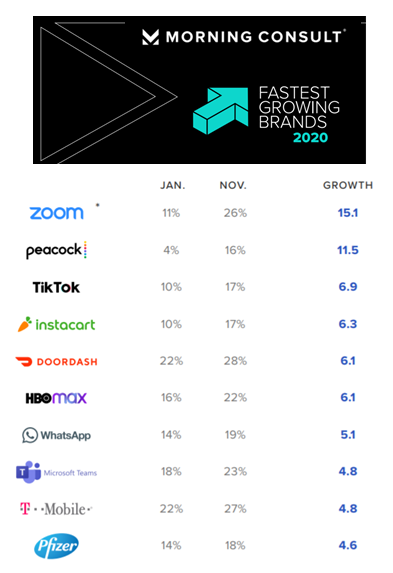

Surprising, because technology [and health] underpin virtually all of the fastest-growing brands in 2020, shown in the second chart from Morning Consult’s study of U.S. consumers. [This chart shows only the top 10 of 20 brands].

Among the top 20 in this study were two pharma brands — Pfizer and AstraZeneca.

Interestingly, these are two of the most prominent life science companies that have been part of Operation Warp Speed to accelerate the development of COVID-19 vaccines. (AstraZeneca has partnered with Oxford University for the development of their product).

To that point, Beth quotes Rob, observing that, “They’re very much part of the solution [to delivering vaccines]…As long as that continues, it’s going to have a lot of positive pull for pharma. Right now they’re very science- and research-forward versus very business-forward.”

That logic was bolstered by a finding in the 2018 Edelman Trust Barometer finding more U.S. consumers trusted the biotech health industry segment compared with the pharmaceutical segment.

Why was this the case? Return to Rob’s point that in the COVID-19 pandemic, messages of “science” and “research” are coming out of the combined bio/pharma industry. Most health citizens, hoping for a way out of the public health crisis, are counting on science to liberate both lives and livelihoods.

Health Populi’s Hot Points: This cover from Bloomberg Businessweek’s Good Business Issue featured an article titled, “The World’s Most Loathed Industry Gave Us a Vaccine in Record Time.” Loathed by late 2019 based on reputation residue of Martin Shkreli, and continued challenges with the opioid crisis (represented in part by Purdue Pharma’s misconduct, among others).

The fact that the accelerated vaccine development story made the cover photo in “The Good Business Issue” is emblematic of the growing civic and business consciousness of ESG principles — for environmental, societal, and governance pillars for responsible investment.

In my book Health Citizenship: how a virus opened up hearts and minds, I discuss how the pandemic has moved more patients as health consumers toward their health citizenship. The coronavirus re-shaped people in the U.S. to better understand what the “public” in “public health” means: that what impacts one ZIP code or community impacts others that may be well outside both the experience and socioeconomic status of a single neighborhood.

Increasingly, consumers are looking to engage with and patronize (i.e., spend money with) companies that represent their values such as sustainability, civil justice, social equity, fair wages, and the treatment of workers and local communities in which the organizations are based.

This is translating to consumers as health citizens, looking for solutions to personal, family, and community health challenges in the pandemic. This became to be expected by more patients in 2020, our Year of COVID as Dr. Osterholm has called it.

Even more health citizens will expect this kind of health industry engagement in our second year of COVID (call it the Year of Vaccines) and beyond into 2022.

Even more health citizens will expect this kind of health industry engagement in our second year of COVID (call it the Year of Vaccines) and beyond into 2022.

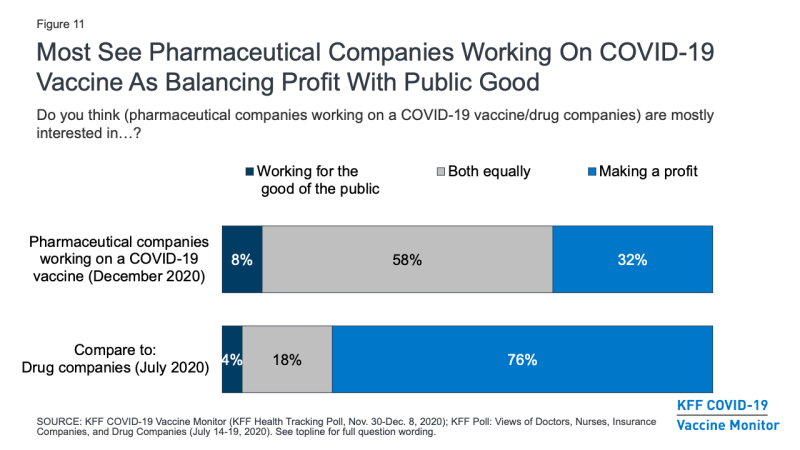

This last chart comes from the Kaiser Family Foundation Health Tracking Poll completed at the end of 2020.

Note that most people view pharma companies working on a coronavirus vaccine as balancing profit with public good, compared with drug companies in general (December 2020 tracking data compared with July 2020 survey data).

Looking forward, the test of the sustainability of upwardly-mobile pharma reputation in 2021 and 2022 will be drug pricing. President Trump’s platform when running for office in 2016 was to deal with the cost of prescription drugs, discussed in his conversation with TIME magazine when he put the drug industry “on notice,” in the words of CNN.

“The door is open for executive action on drug prices from the Biden Administration, including the introduction of new drug pricing models through CMS,” Kaiser Family Foundation opined in a new report looking into President Biden’s approach to prescription drugs.

Action on drug prices has had bipartisan support in recent years. This will be the uncertainty variable that could downgrade pharma industry reputation in the U.S. over the next couple of years.

For the most current balanced take on the Biden Administration approach to prescription drugs issues, see the Kaiser Family Foundation report.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...