There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine.

Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan.

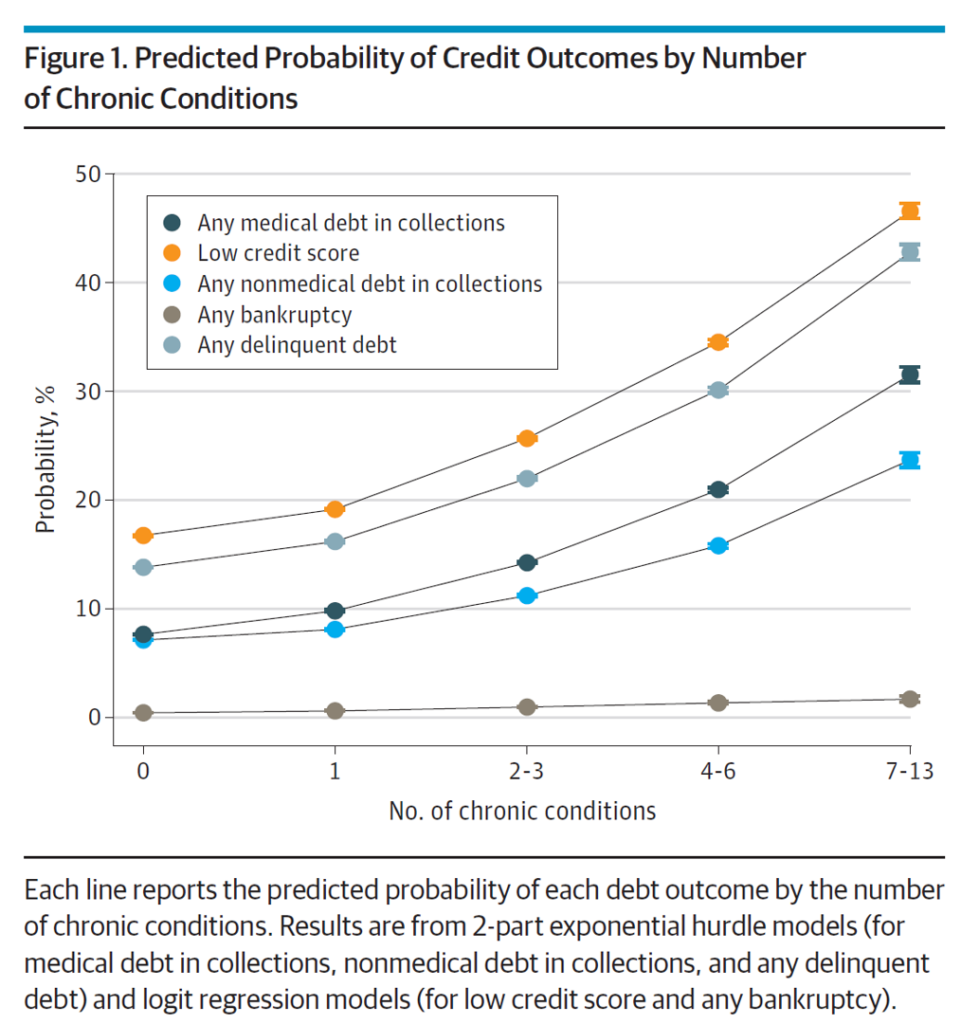

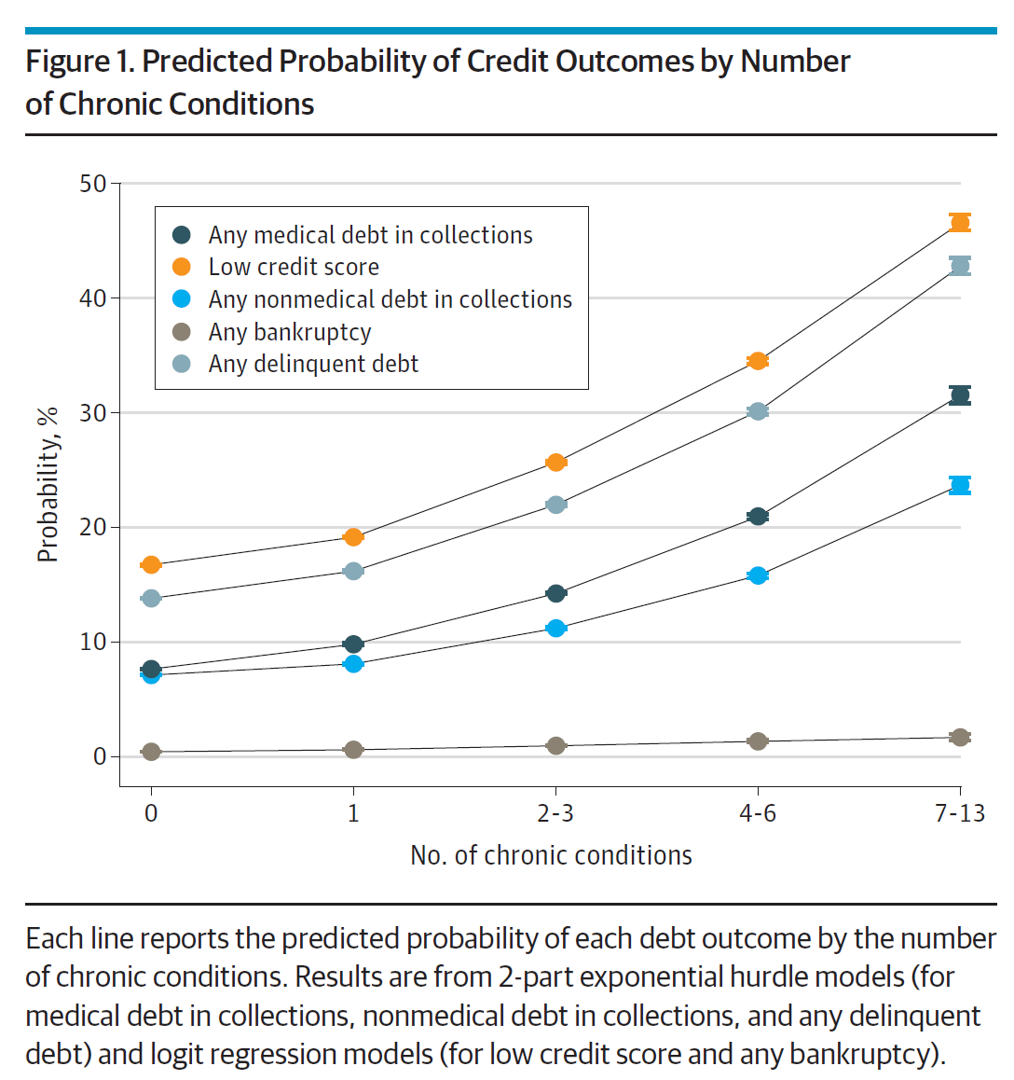

The first chart illustrates the predicted probability of credit outcomes based on the PPO member’s chronic conditions. All lines go north and to the right, diagramming the direct and positive relationship between credit outcomes (e.g., debt) by type: a low credit score, medical debt in collections, nonmedical debt in collections, bankruptcy, and any delinquent debt across all types.

The actual costs calculated for any medical debt was an increase of 60% for individuals with no (0) chronic conditions at $784 rising to $1,252 for people with 7 to 13 conditions. For people with nonmedical debt, the amounts were $1,999 for PPO members with no (0) conditions up to $2,356 for individuals with 7 to 13 conditions.

A key takeaway from this chart is that people in the U.S. dealing with multiple chronic conditions are quite likely to have a low credit score and some form of delinquent debt.

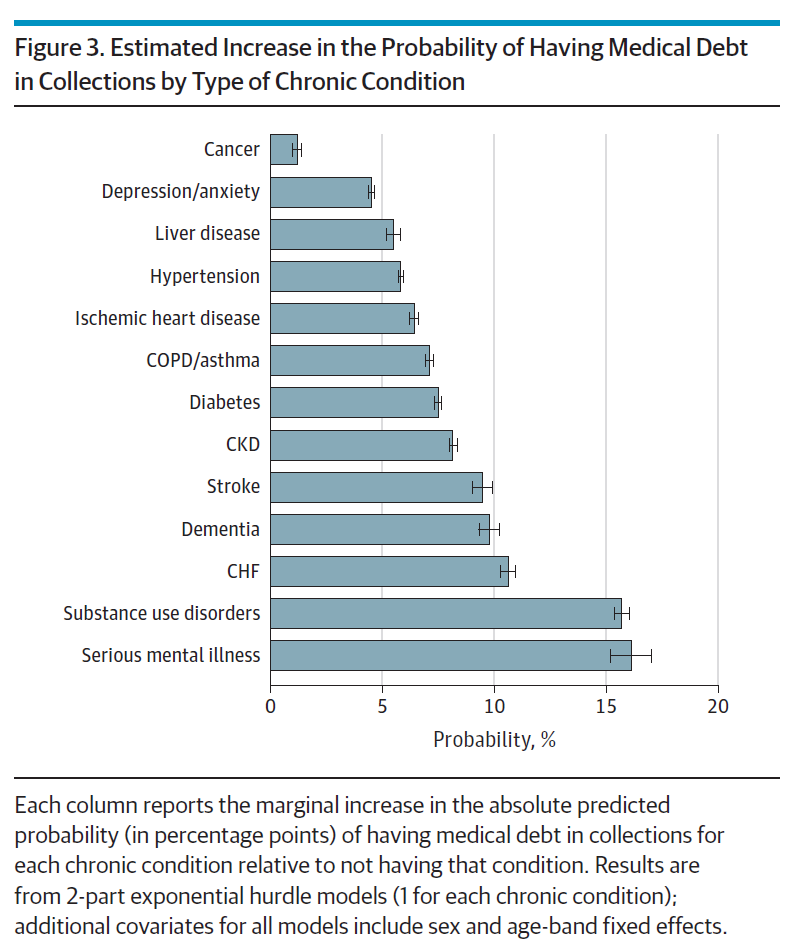

Health Populi’s Hot Points: The chart labeled Figure 3 shows us the probability of a patient dealing with a medical debt problem by the type of chronic condition they are facing. The study assessed thirteen conditions.

Serious mental illness and substance use disorders ranked the highest for risk of medical debt in collections. Cancer represented the lowest risk of medical debt in this study.

In addition to mental illness and substance use, conditions driving greater medical debt risk were stroke, congestive heart failure, and liver disease.

The authors note that these results have direct implications on patients’ financial health which negative impact rates of forgone medical care, worse physical and mental health, and increased mortality.

What was surprising to the U-M researchers (and to me as well) was that cancer “conferred the smallest increase in rates of medical debt in collections,” compared with other chronic conditions — despite growing evidence in other studies illustrating the “financial toxicity” of oncology therapies.

To explain this surprising finding, the researchers explain the methodology for this analysis: using data from claims in commercially-insured PPO among a largely working-age (younger) population which potentially left out patients with cancer consuming high-cost end-of-life care.

To that point, a just-published report from the Business Group on Health, an association of employers allied to share learnings and best practices dealing with health care costs and quality, found that cancer is the top driver of health care costs for businesses providing healthcare coverage for employees. The 2023 Large Employers’ Health Care Strategy and Plan Design survey notes, “13% of employers said they have seen more late-stage cancers and another 44% anticipate seeing such an increase in the future, likely due to pandemic-related delays in care.”

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...