Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland).

Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog.

“These different uses have different economic consequences,” Donovan explains:

- Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work.

- While so-called recreational GLP-1 consumers may experience these benefits, this population would be less likely to be covered by medical insurance under current obesity criteria which are in use to ration access to the medicines in Germany and the United Kingdom.

As Donovan notes, “GLP-1 medication is not cheap if purchased by a private individual,” estimating that only one in five adults has insurance that would cover anti-obesity medication.

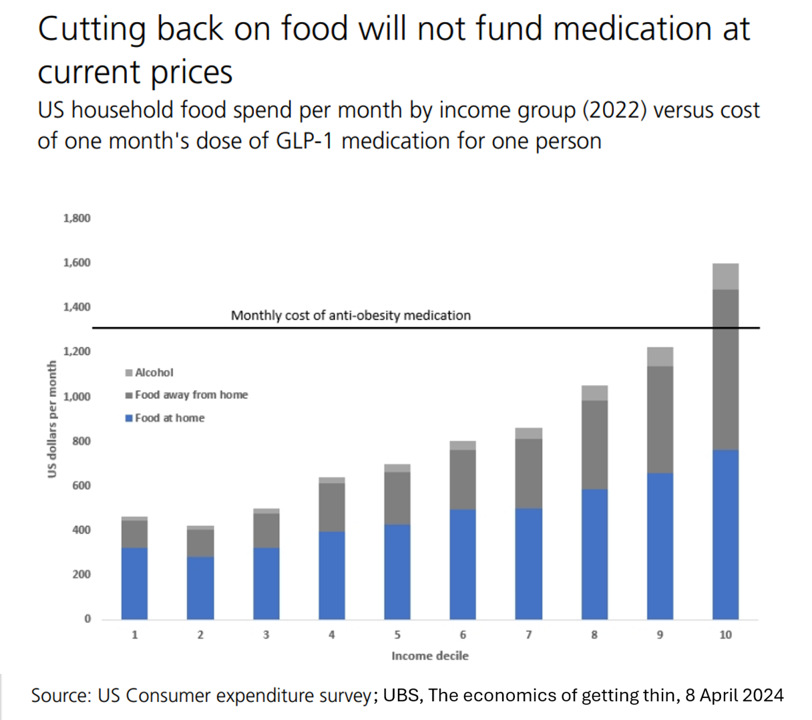

Thus, obese consumers who lack health insurance to cover a GLP-1 Rx would have to “alter consumption patterns,” in Donovan’s words, to be able to afford the treatment. He asserts that the obvious hack consumers would do is to spend less on food, but the math doesn’t add up, he shows in the first bar chart.

Why? “Only the very richest households in society have food bills close to the cost of obesity treatment. It is also worth stressing that the cost of treatment is for one person, and the food spending is for a household of people,” he notes.

He does expect “some” decline in food spending with both types of GLP-1 users, but not proportional to the decline in calorie consumption. Most likely the food categories that would be cut would include snacks and “calorie intensive” foods.

On the upside, anti-obesity meds could reduce the chronic conditions associated with obesity, with treatments for those conditions declining in their spending in the future.

Consumers would be spending in other categories, though, so the household microeconomics of the GLP-1s could increase demand for new clothing, gym memberships, and perhaps even tourism if the individual feels more mobile to travel.

Donovan includes a thought-provoking assessment of the effects of the GLP-1s in equality and society, calling out that,

- In most societies there is prejudice against people who are overweight or obese, more pronounced the case for women

- The more anti-obesity drugs are used recreationally rather than as a prescription written for obesity, the more likely patients will have to pay for the drugs out-of-pocket — restricting recreational access to people with higher incomes

- Social media has raised the importance of physical appearance and for some people increased the perceived importance of appearances.

Taking these factors together, Donovan warns of a risk to society-at-large: “The economics of being thin becomes a very visible manifestation of inequality.”

Health Populi’s Hot Points: Brand Keys published its 21st annual survey on the most innovative brands conducted among U.S. consumers between 16 and 65 years of age, and found that Ozempic topped all health care brands considered in the study — beating the companies CVS (Health), Warby Parker (a perennial health consumer favorite in other research), Pfizer (still associated with the COVID-19 vaccine) and Truvani (a brand of protein powder).

This was the first year, Brand Keys noted, that actual entertainment entities were identified as innovative brands: in this case, Taylor Swift who was the #4 most innovative brand in the Entertainment category following Mattel (think: “Barbie’s” cultural Zeitgeist in 2023), Netflix, SONY PlayStation, and ahead of YouTube and Disney.

“Expectations are the ultimate roadmap to real brand innovation,” Brand Keys’ Founder and President Robert Passikoff counsels us. In 2023 and 2924, obesity met its match quoting from the Science magazine cover lauding weight loss drugs as breakthrough of the year.

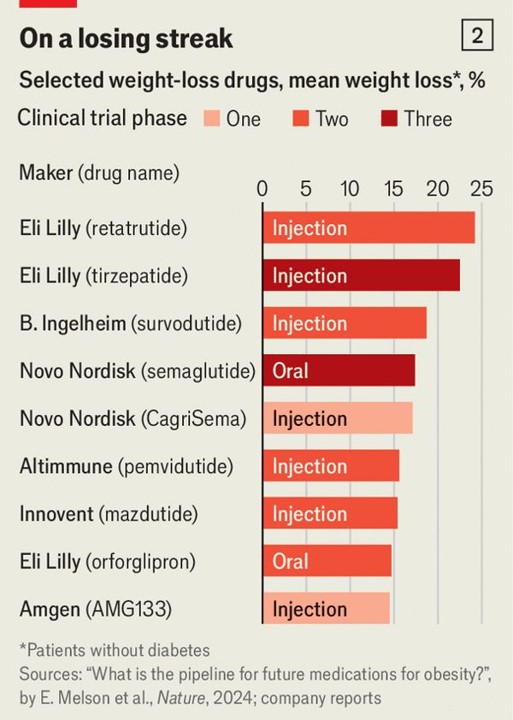

We will continue to monitor the phenomenal up-take of GLP-1 drugs (recognizing its growing pipeline shown in the chart above) and patients’ perspectives of the use of these medications — both those people prescribed them to treat medical obesity and those consumers willing to pay for them out-of-pocket. What will their respective experiences be, and will being covered by insurance make a difference in how loyal people are to the medicines?

When Ozempic and Taylor Swift show up on the same list as Doritos, Red Bull, Amazon, TikTok and Uber, we know we have experienced a next-normal in consumer marketing, health care, and home economics.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...