Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making.

Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making.

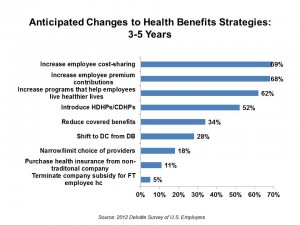

The 2012 Deloitte Survey of U.S. Employers finds them, mostly, planning to subsidize health benefits for workers over the next few years, while placing greater financial and clinical burdens on the insured and moving more quickly toward high-deductible health plans and consumer-directed plans.

In addition, wellness, prevention and targeted population health programs will be adopted by most employers staying in the health care game, shown in the chart.

Thus, most employers will couple increasing the cost-burden with tools that will help employees get and stay healthy. Think of this as health plan designs artfully combining sticks and healthy carrots. This looks to be particularly true for larger employers, who plan to increase investments in health and wellness in the shorter term of one to three years. The largest companies will look to discouraging unhealthy behavior by charging higher premiums or penalties.

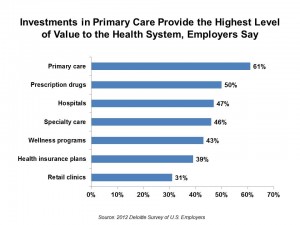

A bright spot in the survey to this health economist is that employers look to primary care investments as providing the highest level of value to the health system above other spending, followed by prescription drugs, hospitals, specialty care, wellness, insurance, and retail clinics. The second chart shows that primary care leads the value pack.

A bright spot in the survey to this health economist is that employers look to primary care investments as providing the highest level of value to the health system above other spending, followed by prescription drugs, hospitals, specialty care, wellness, insurance, and retail clinics. The second chart shows that primary care leads the value pack.

A corollary to this is that employers believe health cost increases are driven mostly by hospitals (80%), followed by inefficiencies and waste in the system (68%), unhealthy lifestyles and consumer behaviors (67%), prescription drugs (66%), insurance costs (62%), government regulation (60%), and new technology (59%). Other aspects of waste were also mentioned including fraud and abuse, and over-use of testing and procedures. A large 31% also mentioned “heroic measures to extend life” as a high cost-driver.

The survey polled 560 randomly selected employers with at least 50 employers. Respondents were CEOs, CFOs, chief HR officers, and those responsible for health benefit decisions. The survey was conducted over the web.

Health Populi’s Hot Points: At THINK-Health, we’ve been forecasting the growing financial and clinical burden on consumers for the past several years — a trend we’ve seen coming based on the larger macroeconomic context for business facing greater globalization, The Great Recession of 2008 stubbornly sticking in many regions with continued high unemployment and uncertain consumer spending, and business looking for leadership at the national level that’s been lacking.

Still, very few employers talk about dropping health insurance coverage: 9% of those surveyed by Deloitte anticipate dropping coverage, and these firms would represent about 3% of the nation’s workforce — thus, smaller companies of under 100 employees, 13% of whom anticipate dropping coverage in one to three years compared with only 2% of those with over 2,500 workers.

Health benefits are still seen as a crucial benefit that helps retain and attract talent, noted by 87% and 83% of employers in the survey.

Still, there remains a high level of consumer health benefit literacy. Deloitte recommends that companies educate boards and management about the health system to connect the dots between the health plan and compliance with how to use both the benefit and the health system. This is paramount: greater health/patient engagement will yield more rational use of the health system by all stakeholders. And primary care — highly valued by employers — is a central hub where team-based care and patient engagement can be inspired and sustained.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.