Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016.

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016.

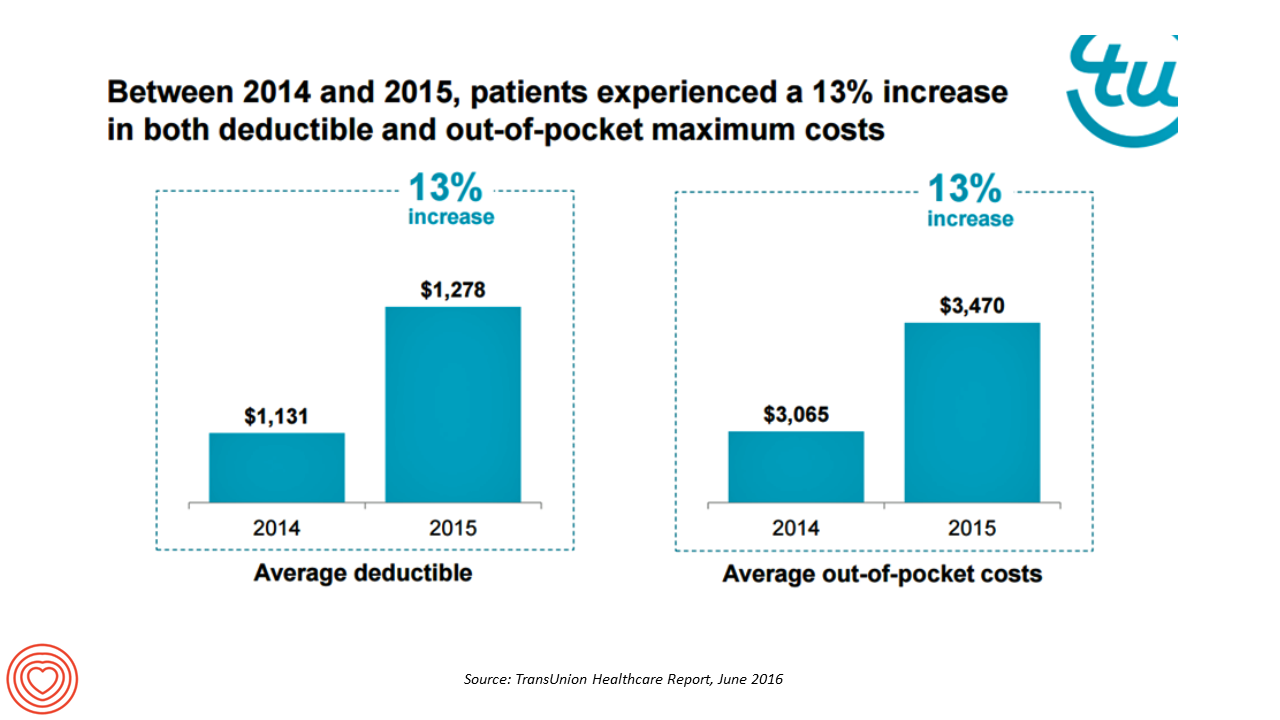

Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015.

In 2015, medical procedures with the highest out-of-pocket costs were:

- Dermatology, $2,451

- Orthopedic surgery, $2,405

- General surgery, $2,264

- Psychiatry and neurology, $2,198

- Plastic surgery, $2,195

- Cardiology, $2,020.

These out-of-pockets caused one-half of patients in the first quarter of 2016 to owe more than $1,000 to health care providers. 77% of patients owed over $500 to their providers in Q1-16.

Health Populi’s Hot Points: It’s noteworthy that TransUnion’s website positions the company’s mission, “to help people everywhere access the opportunities that lead to a higher quality of life.”

Financial un-wellness can lead to stress that compromises health and that quality of life, along with poor fiscal outcomes for health care providers whose CFOs are challenged with growing patient receivables and bad debt burdens.

The TransUnion survey demonstrates the opportunity for better service design and financial literacy programs that feature consumer-friendly bills, education programs on health costs and payments based on a person’s own health plan’s intricacies, and financial payback programs that suit a family’s budget. Check out the Healthcare Financial Management friendly billing project, along with Mad*Pow’s “A Bill You Can Understand” design project.

Furthermore, for employees who have the opportunity to contribute to a health savings account, effective communications should inform people of the triple-tax advantaged nature of the HSA — allowing people to invest pre-tax dollars, grow the dollars without being taxed, and withdraw the monies without a tax. Most consumers with an HSA investment opportunity still do not understand the benefit of that benefit.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...