The Future of Wellness in 2022 is, “shifting from a ‘feel-good’ luxury to survivalism as people seek resilience,” based on the Global Wellness Institute’s forecast on this year’s look into self-care and consumer’s spending on health beyond medical care — looking beyond COVID-19.

GWI published two research papers this week on The Future of Wellness and The Global Wellness Economy‘s country rankings as of February 2021. I welcomed the opportunity to spend time for a deep dive into the trends and findings with the GWI community yesterday exploring all of the data, listening through my health economics-consumer-technology lens.

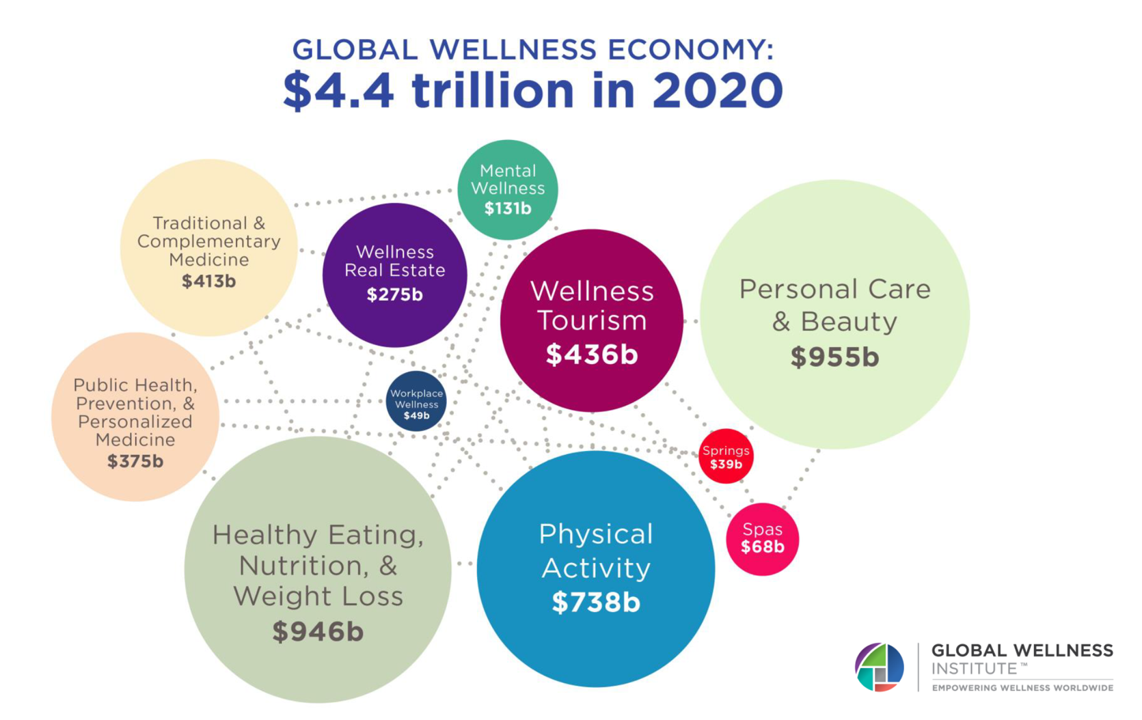

First, consider the global context and the macro-economics of wellness, pictured in the first graphic of a bubble-chart that has been GWI’s very useful template over the years the team has forecasted this health space.

First, consider the global context and the macro-economics of wellness, pictured in the first graphic of a bubble-chart that has been GWI’s very useful template over the years the team has forecasted this health space.

Now, to the country rankings, which like the OECD or Commonwealth Fund rankings on health always provide engaging thinker-toys for more questions and more research.

Note that GWI’s wellness economy comprises a broad landscape of industry segments, differentiating it from other estimates such as the McKinsey methodology which gauges the value of wellness at a much-lower $1.5 trillion (addressing health, fitness, nutrition, appearance, sleep, and mindfulness) .

GWI’s market assessment includes:

- Personal care and beauty = $955 billion

- Health eating, nutrition, and weight loss = $946 billion

- Physical activity = $738 billion

- Wellness tourism = $436 billion

- Traditional and complementary medicine = $413 billion

- Public health, prevention and personalized medicine = $375 billion

- Wellness real estate = $275 billion

- Mental wellness = $131 billion

- Spas = $68 billion

- Workplace wellness = $49 billion

- Springs = $39 billion.

Of course, there can be overlap between these segments (say, wellness tourism, spa, springs, and real estate; or mental health and healthy eating), but we can look to this GWI construct as the most inclusive (and through my Health Populi health citizen view, most realistic in the consumer’s view).

By country, spending on wellness is greatest in the U.S., China, and Japan, with the U.S. far and away the greatest wellness spender at over $1.2 trillion. China spent just over half that, and Japan less than half of China’s spend.

By country, spending on wellness is greatest in the U.S., China, and Japan, with the U.S. far and away the greatest wellness spender at over $1.2 trillion. China spent just over half that, and Japan less than half of China’s spend.

Those are just 3 of the 150 nations GWI studied by the size of their wellness economies relative to gross domestic product, population size, per capita income, and level of tourism dependence. This last factor is so impactful for the wellness industry, because some countries’ economies are highly dependent on wellness tourism as a major part of their GDP — notably, the Seychelles (with 16.8% of the economy devoted to wellness), the Maldives (14.5%), Aruba (11.9%), Costa Rica (11.4%), St. Lucia (9.6%), Panama (9.5%), and Belize (at 9.4% of the economy related to wellness tourism).

Thus, some nations are importers of wellness tourism, and others are exporters, with inbound tourism a backbone to their nation’s financial health (such as those noted above). As GWI’s report points out, for these countries wellness tourism, inbound spa traffic, and cosmetic surgery can contribute significant foreign exchange earnings and be a source of job creation.

Next, to the ten trends for 2022:

Next, to the ten trends for 2022:

- Dirty Wellness – the impact of soil exposure on human health

- Toxic Muscularity Comes Clean – the negative impacts of male body image

- From Wellness Tech to Technological Wellness – a fresh take on digital health

- Senior Living Disrupted – “A wrinkle in time no more!”

- Wellness Travel: Seekers, Welcome! – post-pandemic travel for adventure and engagement

- Innovative Tech: Closing the Gender Gap in Medical Research – how digital health tech’s can collect data to bridge gender research gaps

- Urban Bathhouses & Wellness Playgrounds – affordable wellness coming to your town

- Next-Gen Naturalism – the return of self-reliance (think Thoreau)

- Health & Wellness Coaching Gets Certified – the maturation of the health coaching industry

- Wellness Welcomes the Metaverse – the immersive Internet meets health

I’ll focus on just one of these important forecast — but technology plays a role across the entire portfolio of GWI’s 2022 read of the wellness tea leaves in this third year of the pandemic.

Let’s explore…

3. From Wellness Tech to Technological Wellness

Technology is a double-edged sword or helpful surgical scalpel when it comes to health, Skyler Hubler and Cecelia Girr of TBWA explained for this trend. Tech can harm us and help us, and this trend puts health at the center of how and how often we engage with technology.

Calls for technological wellness are growing, governments cracking down on the phenomenon, and unhealthy addictions are epidemic. Skyler and Cecelia discuss the Facebook Papers in their trend, where Frances Haugen turned whistleblower to leak documents in October 2021 detailing Facebook’s internal data on Instagram and suicidal thoughts, among other troubling insights.

This trend makes the case for the wellness industry to be part of, in the authors’ words, “a massive opportunity to reset our tech habits at scale.”

They see a future where our technology intake is akin to our food intake, noting AeBeZe Labs’ “Digital Nutrition” approach to a standardized label for tech products.

“Imagine if product designers worked with psychologists to prioritize mental health” from the ideation stage of consumer-facing technology development, they imagined.

Health Populi’s Hot Points: “Health and wellness are converging,” GWI calls out, “opening the door to honest conversations about this $4.4 trillion economy.”

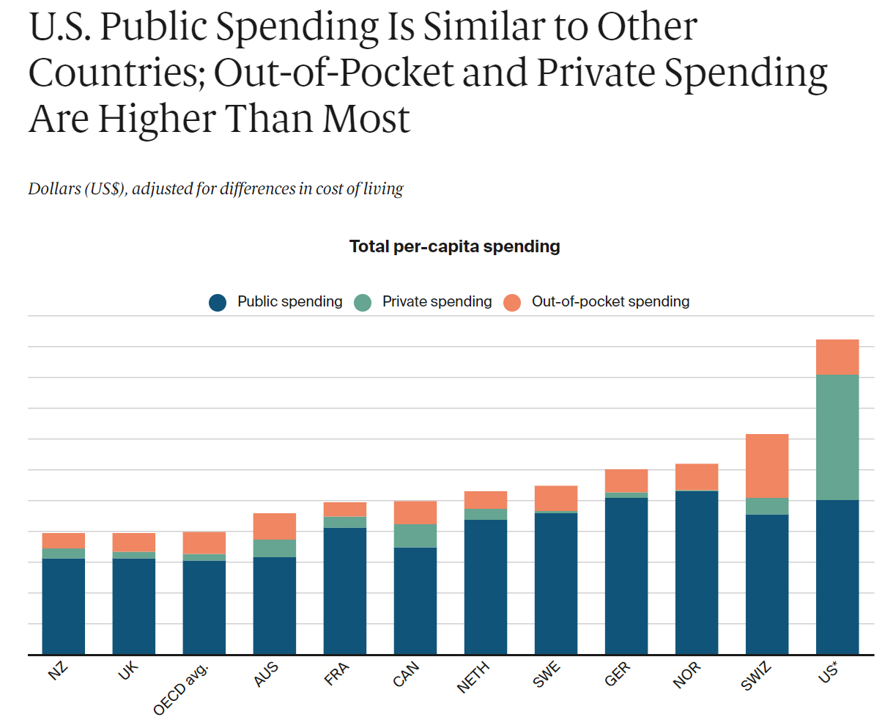

In the American $4.1 trillion medical economy, health citizens have higher out-of-pocket spending on medical care compared with most other nations’ consumers, the Commonwealth Fund calculated.

In the American $4.1 trillion medical economy, health citizens have higher out-of-pocket spending on medical care compared with most other nations’ consumers, the Commonwealth Fund calculated.

Add this together with U.S. health consumers spending on wellness, and you get roughly 20% of median family income household spending on health and wellness. That’s roughly $1 in $5 for every U.S. family (based on median family income).

Yet health outcomes in the U.S. rank relatively low compared with other OECD higher-income nations.

Life expectancy has fallen in America (especially in the pandemic, and before COVID-19 emerged due to the Deaths of Despair reality), along with higher burdens of chronic diseases, greater prevalence of obesity, and, ultimately, the highest rate of avoidable deaths.

Reflecting on GWI’s recognition that health and wellness are converging, inspiring “honest conversations” about the health economy, the fact is that the U.S. continues to spend on health care and wellness….with a very poor return-on-investment for that spending.

Furthermore, it is now mainstream, Main Street knowledge that health disparities are part of systemic inequities in American health care, notwithstanding so much money from both public coffers and private wallets being allocated to human health.

The growing retail health landscape, where services and goods will happen and be shoppable where we live, work, play, pray, learn, and shop, we must also attend to how digital health and ecommerce can help scale the benefits of that access to all health citizens. GWI gives us a lot of food for thought on this, from Trend 3 on technological wellness to affordable wellness in urban centers, closing gender gaps in research, and expanding our conception of senior living to be inclusive multi-generational environments.

Thanks to GWI for always expanding my own worldview on health, wellness, and health citizenship.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...