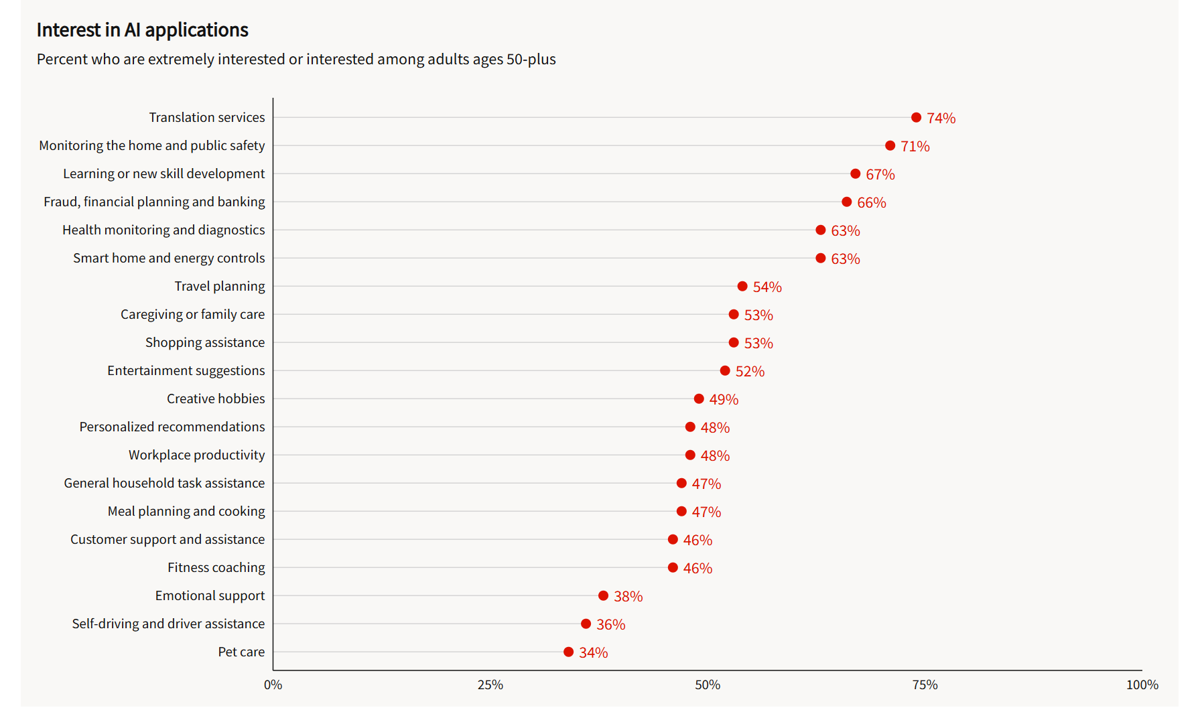

Optimistic and Skeptical: How Older Americans Are Using and Seeing AI – the View from AARP

People over 50 in America typically hold two thoughts in mind at once when it comes to AI: they’re optimistic and skeptical, depending on the “job” that AI could do, according to research from AARP explained in the report, Navigating the World of AI: Awareness, Attitudes, and How People Expect to Use It. Topline, most people 50 and over have used AI in some way, with roughly 3 in 5 older Americans saying “I am a beginner” in using AI across age groups from 50 to 70+. Most older Americans are familiar with many terms in the

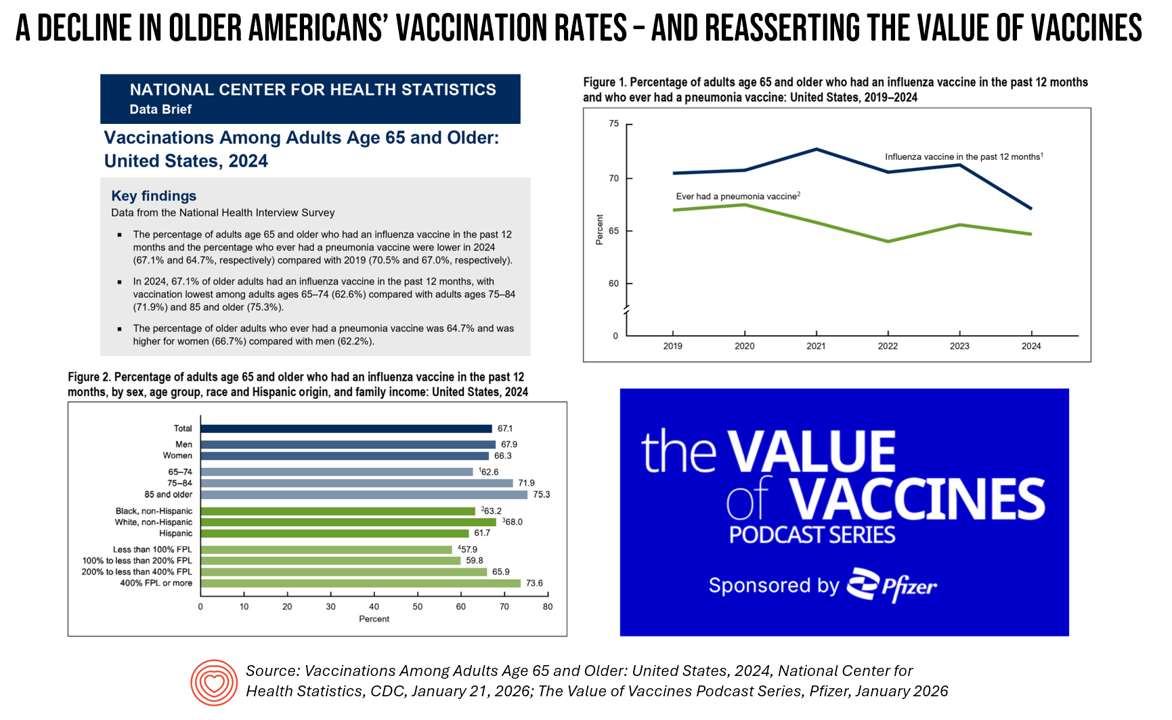

As Adult Vaccination Levels Fall, We Must Assert the Value of Vaccines

The rate of vaccinations among people 65 years of age and older has declined since 2019 — a personal health challenge for aging Americans and their caregivers and families, and a public health problem for the U.S. The Centers for Disease Control’s National Center for Health Statistics published Data Brief 547 on the situation on January 21, 2026. In the meantime, serendipity and timing are uncanny in the moment as The Value of Vaccines conversation series from Pfizer was launched this week. I am grateful to have participated in this project with several sisters-in-expertise: Elif Alyanak from Avalere, Venesa Day

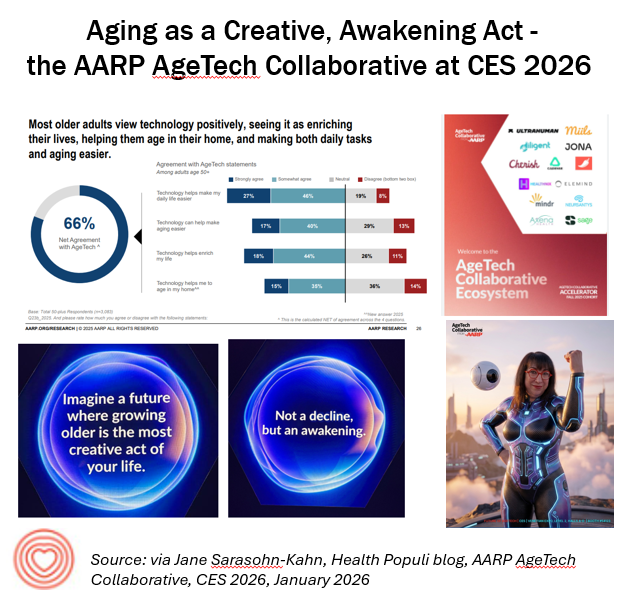

Aging is Not a Decline, but an Awakening at CES 2026 – Learning from AARP About Consumers, Lifespan, and Technology

Aging and longevity are key themes driving technology innovations and markets, and walking the miles of aisles of CES 2026 demonstrates the expanding landscape of the role of tech in healthy living across the lifespan. I spent time at the AARP AgeTech Collaborative space this week as I did last year (here was my write-up of AARP and CES 2025 for historical context). In experiencing this year’s portfolio of AgeTech collab partners, from start-ups to Fortune 100 companies in the mix, was informative, inspiring, and even energizing as someone who has been a member of AARP since turning 50 some

Tech Trends to Watch at CES 2026 – For Health, It’s About Longer Living, Smarter Living, and Better Living

Live from CES 2026 in Las Vegas…the first day of CES Media Days preceding the big show always covers a context-setting report on Tech Trends to Watch. This is one of my annual go-to programs which helps orient media and industry analysts with a lens on CES’s key tech categories and some hard data on market size and growth expectations. While I’ll focus on the health/care specifics in the trend forecast, let me first update you on the overall technology market revenues for the U.S. which are estimated at $565 billion for 2026.

The Patient as Consumer – Updates from Fidelity on Retiree Health Care Costs ($172,500), Delaying Care, Tariff Impacts on Spending, and Roche Going DTPatient for Rx’s?

As of August 2025, U.S. patients of all demographics and geographies face many uncertainties with respect to their care. Issues such as health plan coverage, prescription drug costs, and access to services, among other challenges, continue to re-shape patients-as-health-consumers seeking transparency, clinical choices, and trust-worthy relationships with touchpoints in their personal health ecosystems. Four just-breaking stories across the health/care ecosystem illustrate several of these uncertainties and forces in U.S. health care — some adding friction and angst in a patient’s life, others perhaps providing some relief for certain health consumers. These news items address health care costs in retirement, the

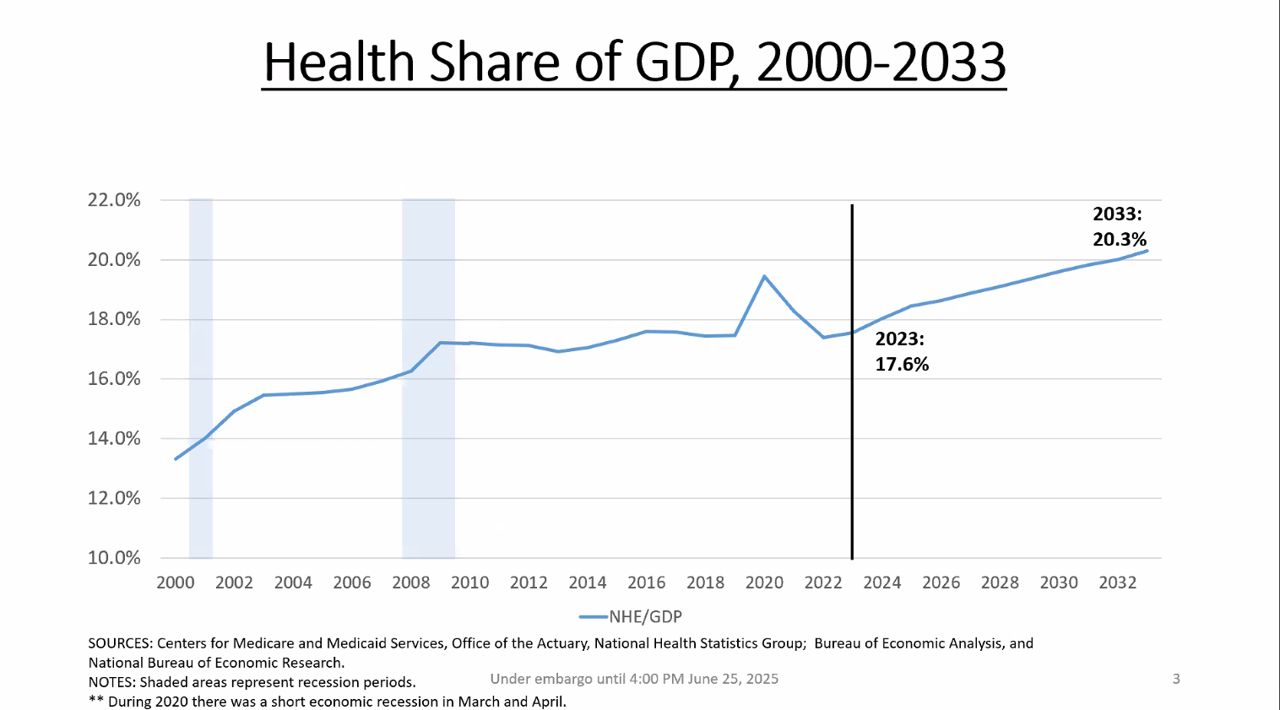

National Health Spending in the U.S. in 2033: What 20.3% of the GDP Will Be Spent On

By 2033, national health spending will comprise 20.3% of the U.S. GDP, based on the latest national health expenditure projections developed by researchers from the Centers for Medicare and Medicaid Services (CMS). This growth will be happening as CMS projects coverage of insured people to decline over the period. Earlier today, I attended a media briefing hosted by Health Affairs to receive the CMS team’s top-line forecast of NHE from 2024 to 2033 discussing these findings. Fuller details on the projections will be released in the July issue of Health Affairs on 7

In Health Care, Consumers Are Seeking Kindness Coupled with Efficiency

Kindness + efficiency + listening + personalization: together, these are the most important experiences consumers seek from health care touchpoints, we learn in Humanizing Brand Experience: Healthcare Edition from Monigle. In this 8th volume of the company’s Humanizing series, Monigle tracks a different pattern of patient engagement — to be sure, built on trust, yet not just as a health consumer dealing with a diagnosed condition — but more holistically for getting me and keeping me healthy and well. The implication and recommendation here is to deliver even more personalized care

A Profile of Health Consumer-Generations’ Use of Digital Health – Rock Health Takes Us Through the Ages

In the past year, most consumers in the U.S. have used virtual care, tracked at least one health metric digitally, and own a wearable or connected health device. Digital health has certainly gone mainstream across U.S. consumers, with varying utilization and motivation by generation, we learn in the report, Screenagers to Silver Surfers: How each generation clicks with care from Rock Health. To segment health consumers by age/generation, the RH team mined the firm’s 10th Consumer Adoption of Digital Health Survey which polled over 8,000 U.S. adults in 2024 on peoples’ perspectives

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

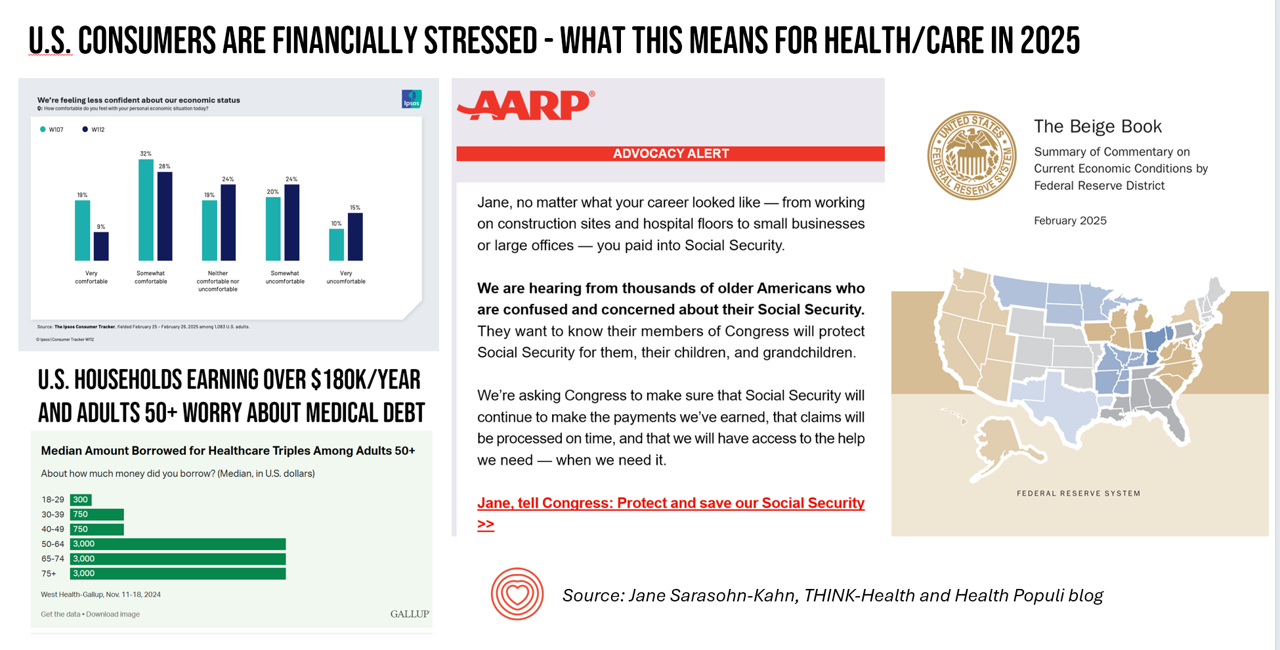

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

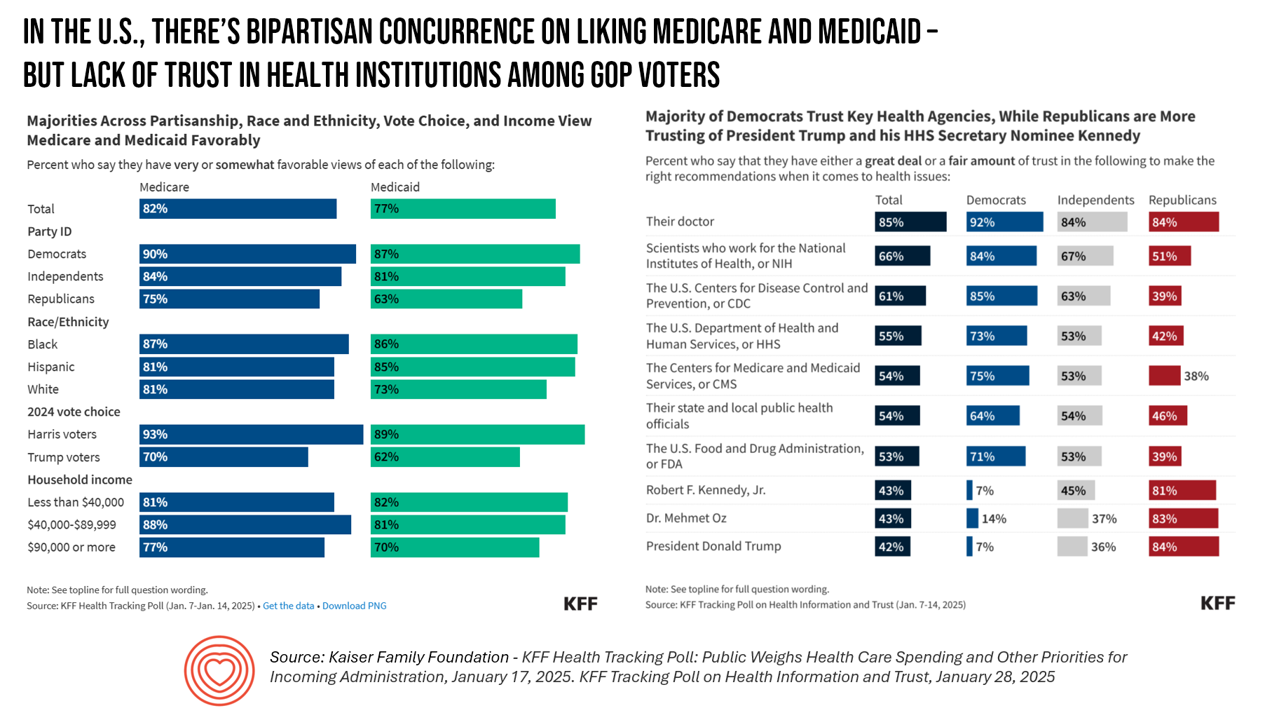

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

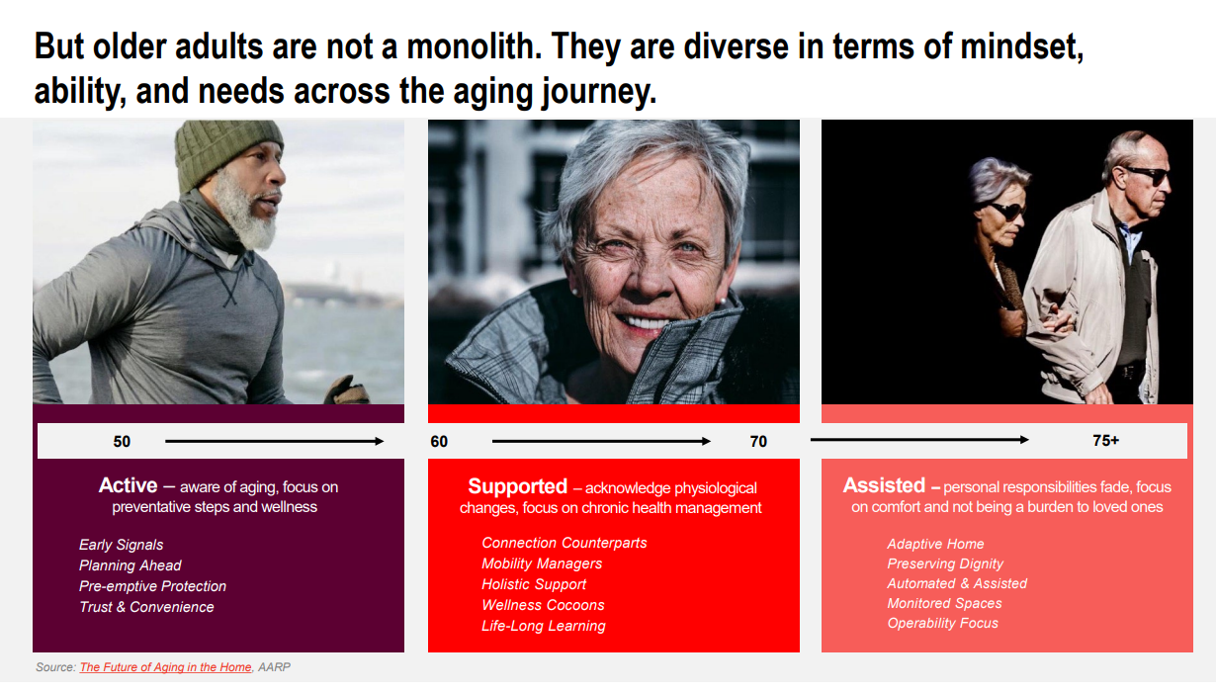

Healthy Aging at Home – Learning from AARP at #CES2025

You would expect an auto manufacturer, a Big Tech, or a big-screen TV company would commandeer the largest exhibit booths at CES 2025, the largest annual conference of consumer-facing technology stakeholders. We can add another exhibitor to the largest CES “real estate” presences at #CES2025: that would be AARP hosting the AgeTech Collaborative. And a pickleball court, too! Why feature pickleball at a AARP booth at CES? Well, IMHO health is everywhere at #CES2025, and pickleball, the fastest-growing sport in the U.S., is good for many facets of health: physical to be sure, and also social

Most People in the U.S. Trust the CDC and NIH for Health Information, and Most Want President Trump to Strengthen Health Institutions

Most health citizens in the U.S. trust the CDC, NIH, and FDA, and most people also want the 47th incoming President Donald Trump to strengthen health/care institutions — from the VA and FDA to Medicare, Medicaid, as well as the CDC and Affordable Care Act. The Axios/Ipsos American Health Index, published this week, reveals both concurrence among U.S. health consumers with some striking differences across political party ID. Axios and Ipsos fielded a survey among 1,002 U.S. adults in early December to glean peoples’ perspectives on health, trust, and a variety of health and social policies.

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

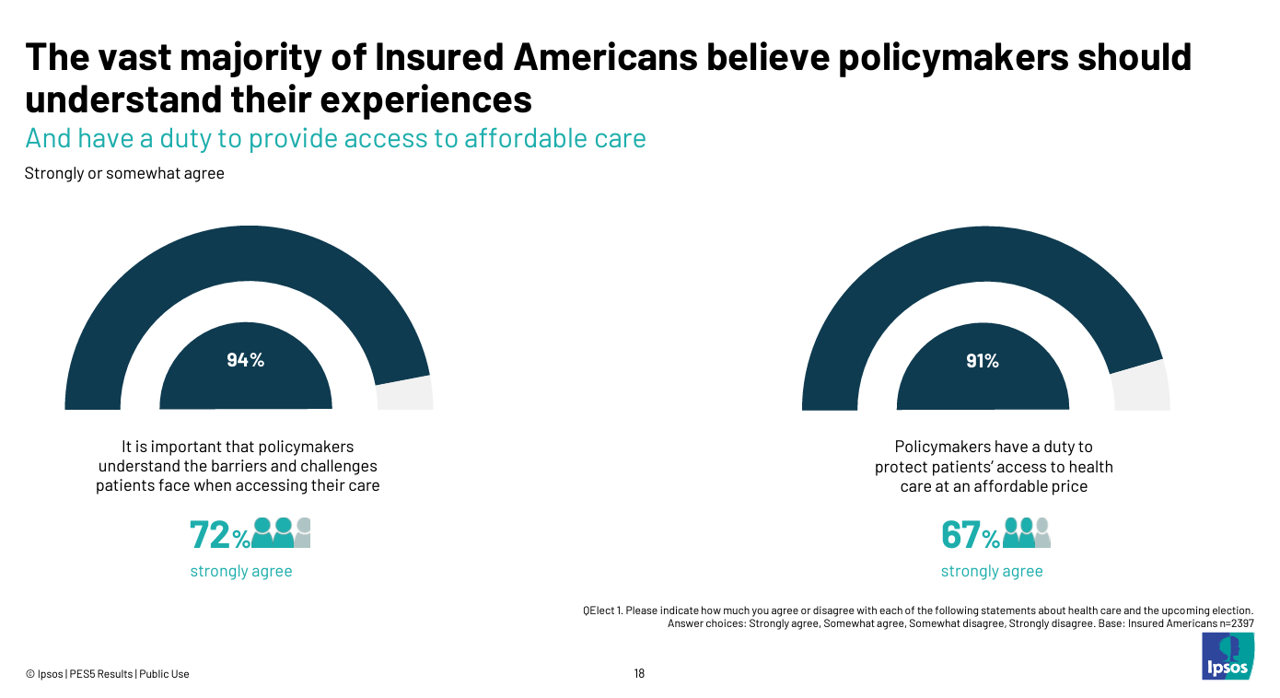

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

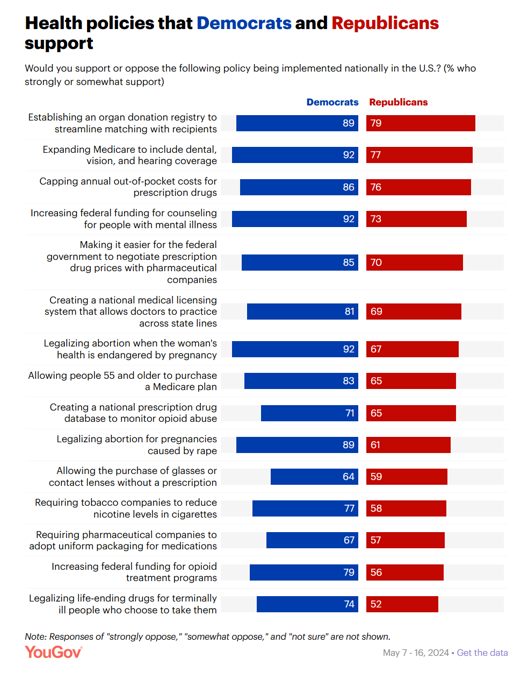

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

Best Buy Health’s Latest Insights into Technology and Care at Home

In the U.S., aging in and staying at home is a priority for most people over the age of 45 — and for nearly one-half of younger people between 18 and 44 — we learn in Best Buy Health’s Research Brief discussing the company’s survey of 1,000 U.S. consumers. Best Buy Health, the health-focused operation which is part of the electronics retailer Best Buy, worked with Sage Growth Partners to assess 1,000 U.S. consumers, 18 years and over, on their perspectives on health care, technology, aging in place, and caregiving. The research was fielded

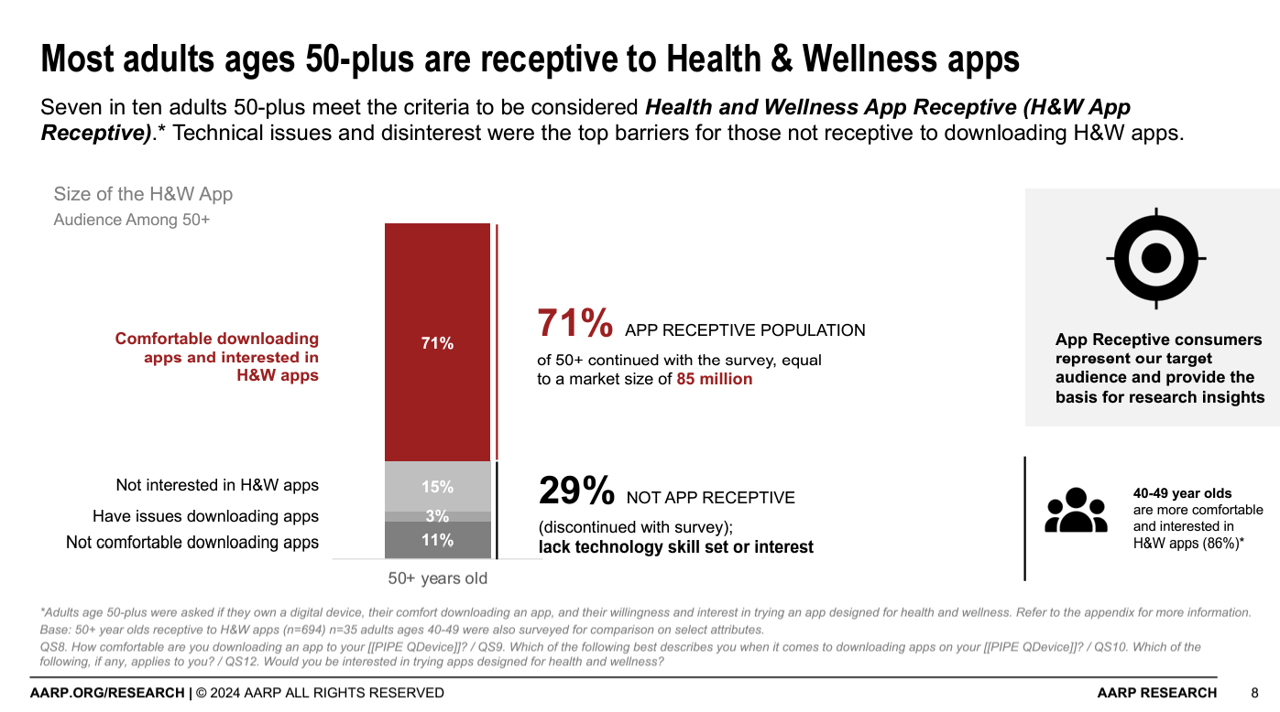

Older Americans Mostly Receptive to Apps for Health, but Chronically Ill People Could Use a Nudge (and a Payer)

AARP found that 7 in 10 people ages 50+ are “app-receptive” for health and wellness apps in Unlocking Health and Wellness Apps: Experiences of Adults Age 50-Plus, a summary of research conducted with U.S. consumers 50 and over from AARP. The methodology for this study included only older consumers who were comfortable in downloading apps to smartphones or tablets, and were willing to do so — whom AARP considered the target audience for this research. In addition, the respondents surveyed were also at least interested in trying apps designed for health and wellness, thus dubbed “health

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

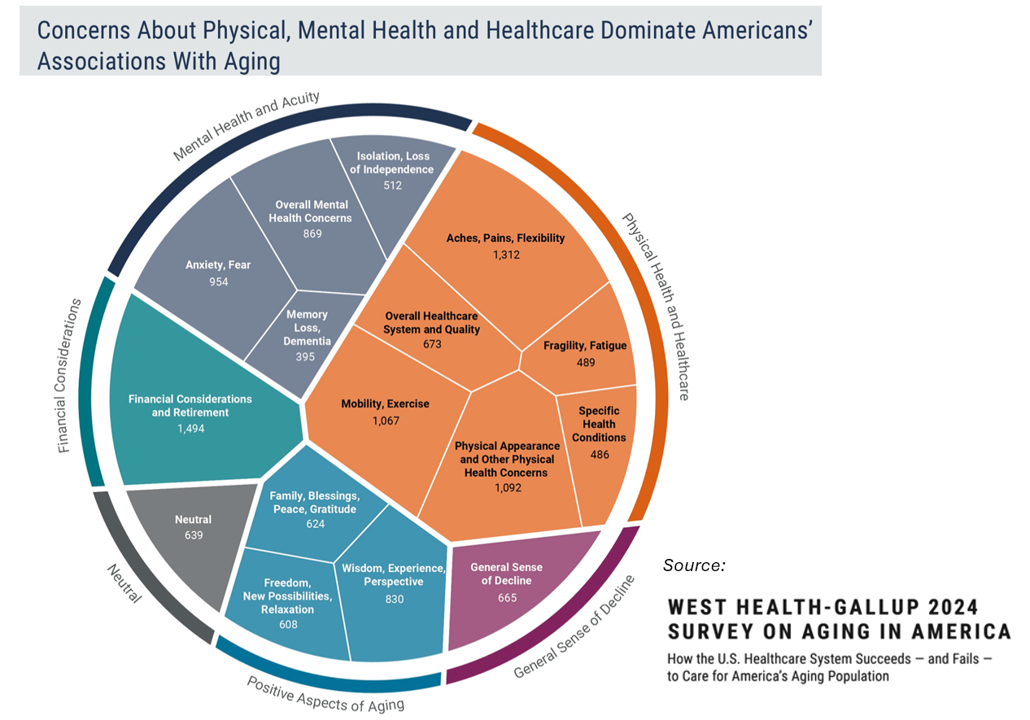

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

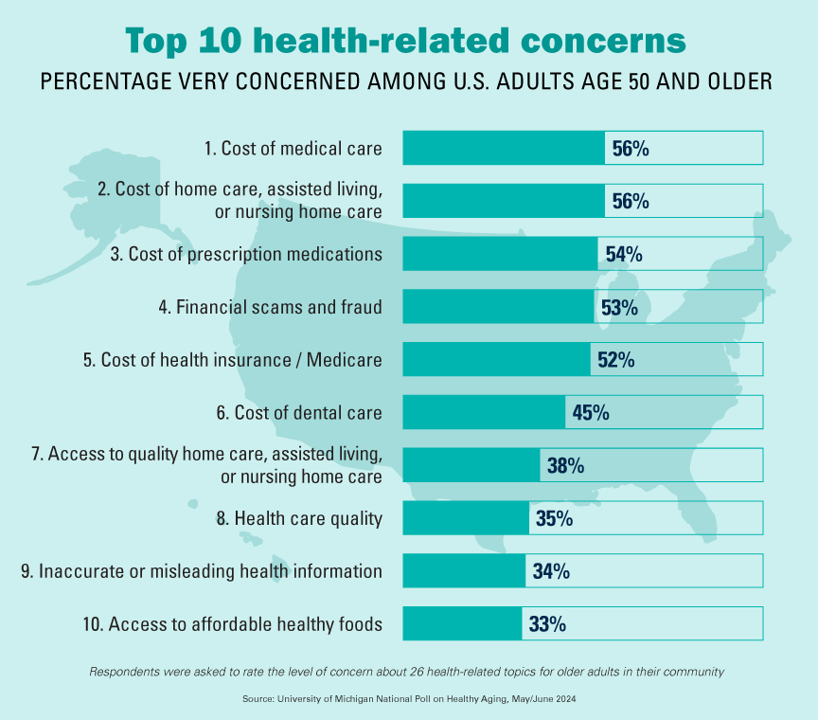

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

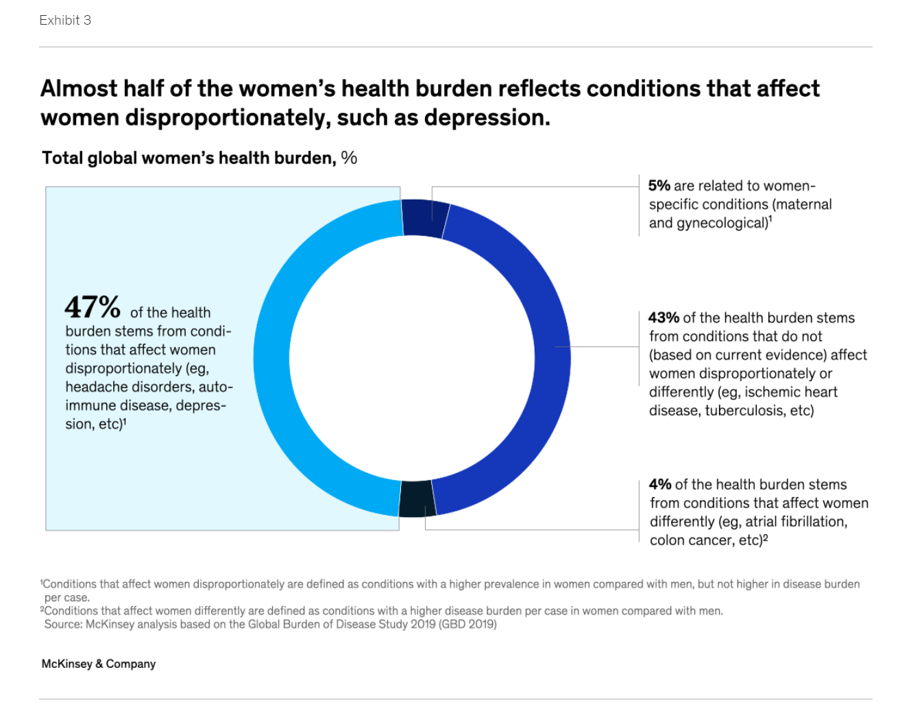

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

Telehealth and Spirituality – a View From Florence, Italy

I’m in Florence, Italy, this week, working on Slow Food as medicine and finding myself contemplating spirituality, health and wellbeing as I walk the streets of this grand city of the Renaissance. Imagine my surprise, yesterday, walking through the city center by the glorious Duomo, the great dome of the cathedral named Santa Maria del Fiore, with the beautiful Baptistry built just across the piazza. You see my initial view approaching the square here, the church and Duomo on the left and the Baptistry on the right. Now cast your eyes in the

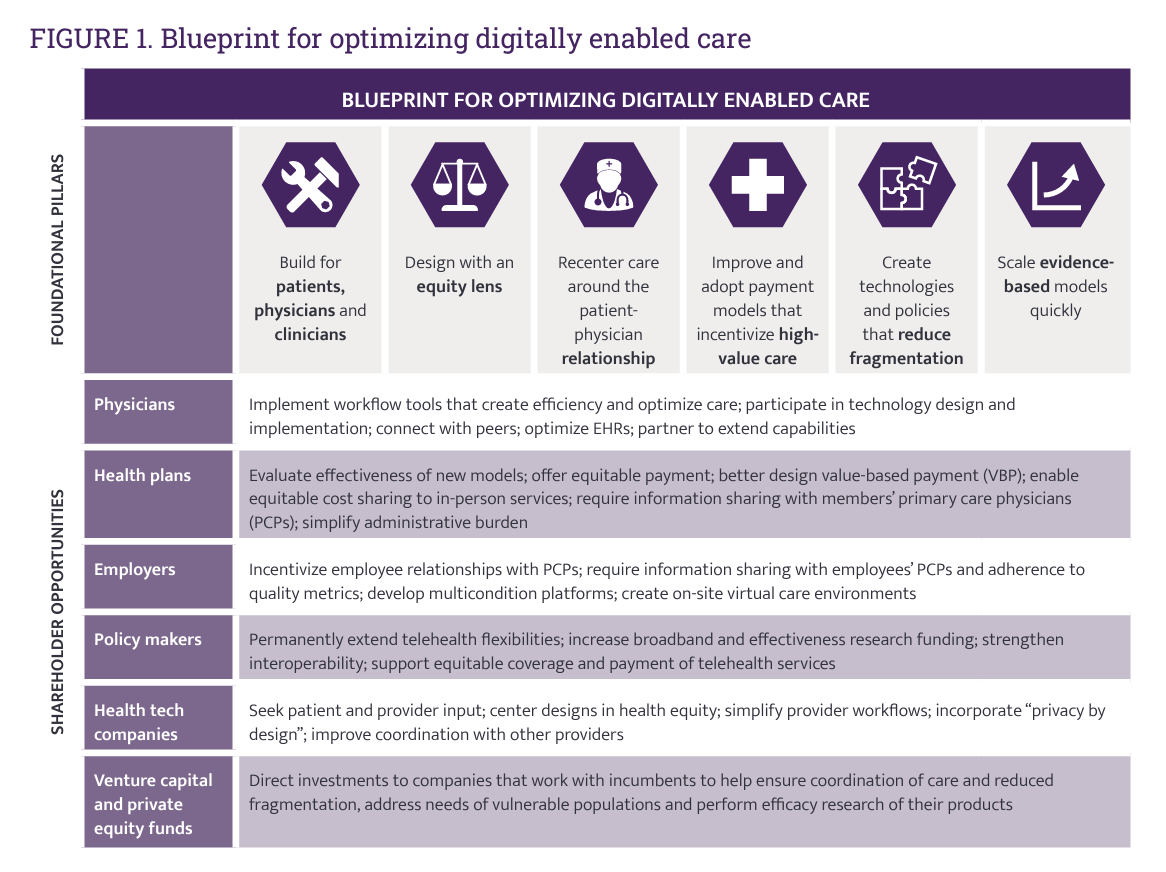

Omnichannel, Hybrid Health Care Is Happening – Let’s Bake It with Access and Equity

In just the past few months, we’ve seen the launch of Amazon Care, Instacart adding medical deliveries, and The Villages senior community welcoming virtual care to their homes. Welcome to the growing ecosystem of hybrid health care, anywhere and everywhere. In my latest post on the Medecision portal, I discuss the phenomenon and examples of early models, focusing in on Evernorth, a Cigna company. As we add new so-called “digital front doors” to health care delivery, we should be mindful to design in access and equity and avoid further fragmentation of an already-fragmented

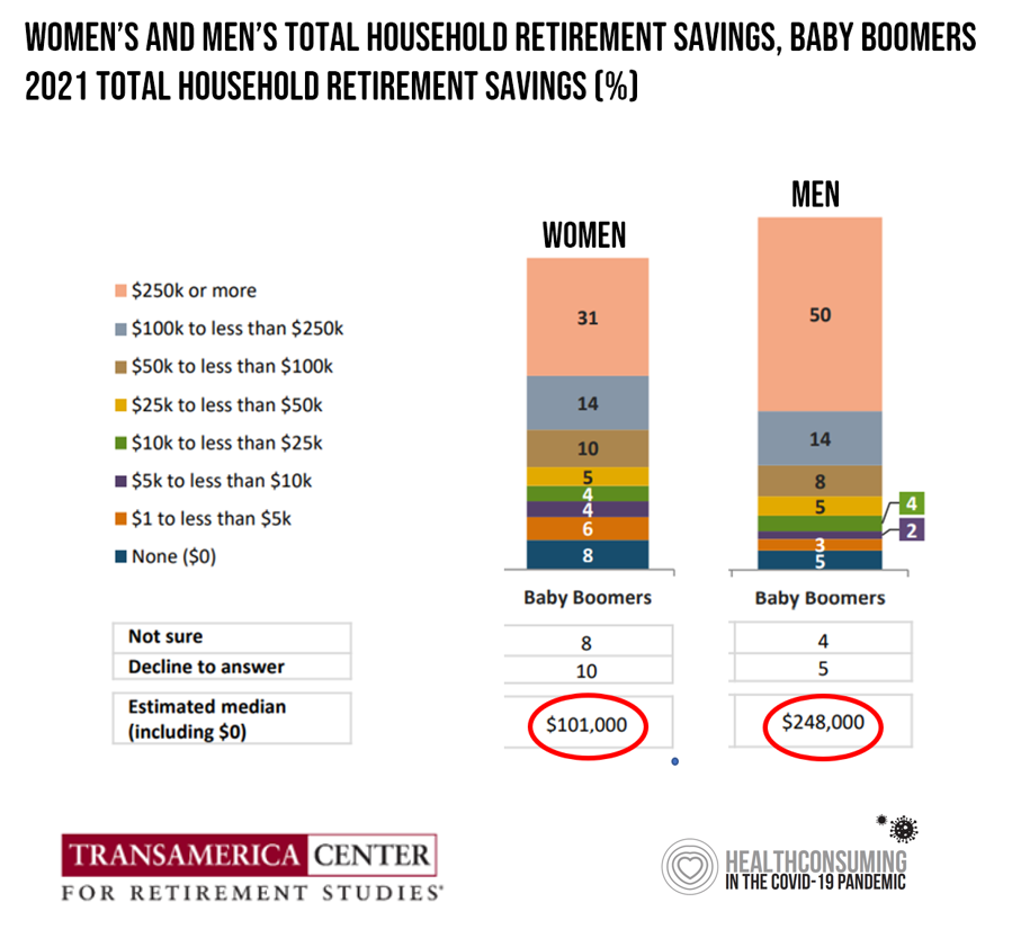

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

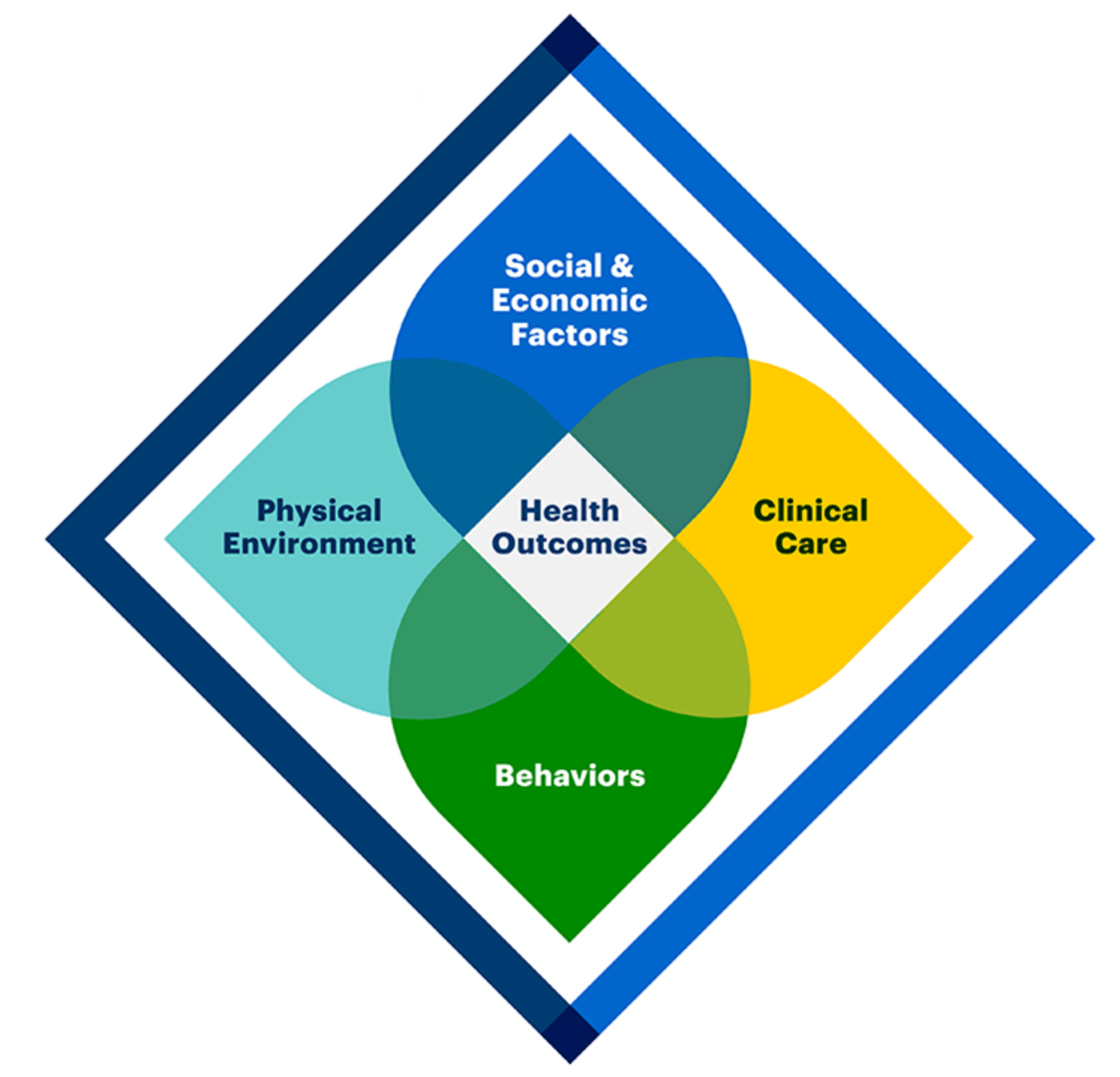

The Health of Older Americans in 2022 – Risks from the Pandemic, Isolation, and Social Determinants

For millions of older people in America, health and well-being got worse in the wake of the COVID-19 pandemic. Physical, mental and behavioral health took hits, depending on one’s living situation, social determinants of health risks, and even health plan, I write in the Medecision Liberate Health blog. In this essay on health disparities and equity for older adults, I weave together new data from, The United Health Foundation’s study on seniors’ health status in America’s Health Rankings for 2022 RAND and CMS research into seniors health disparities among Medicare Advantage

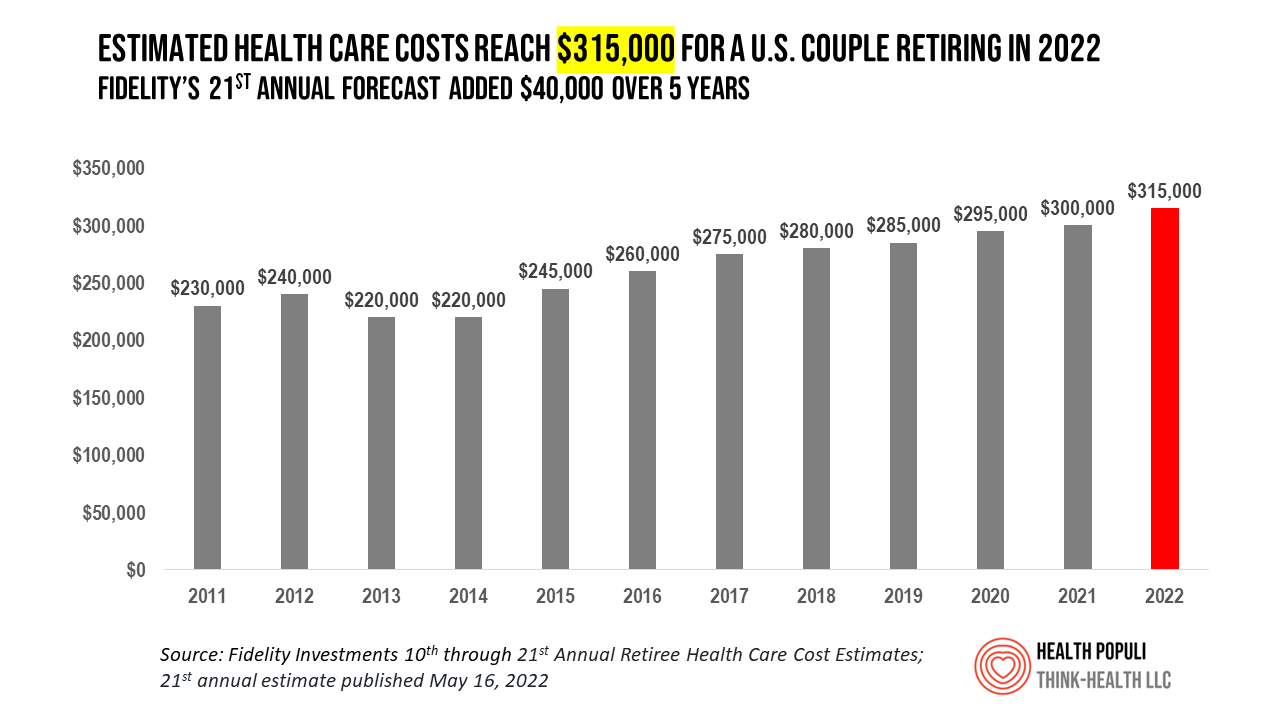

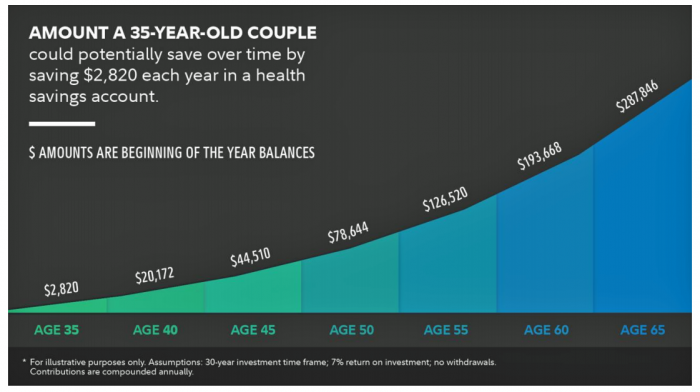

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

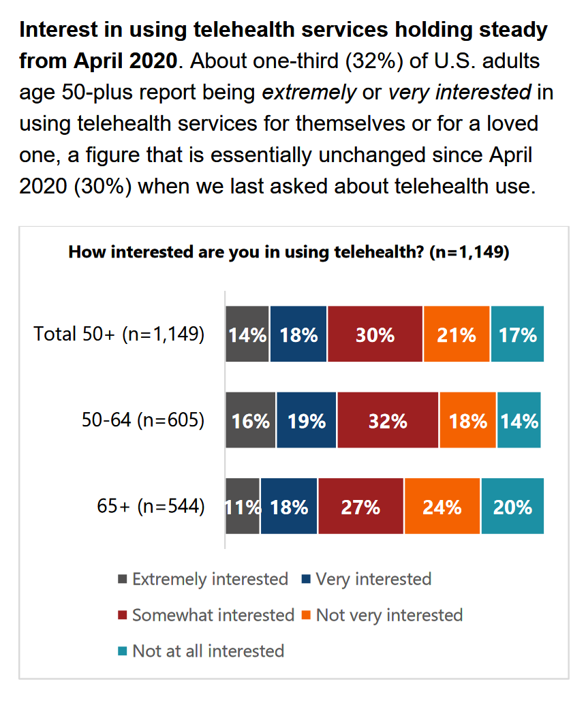

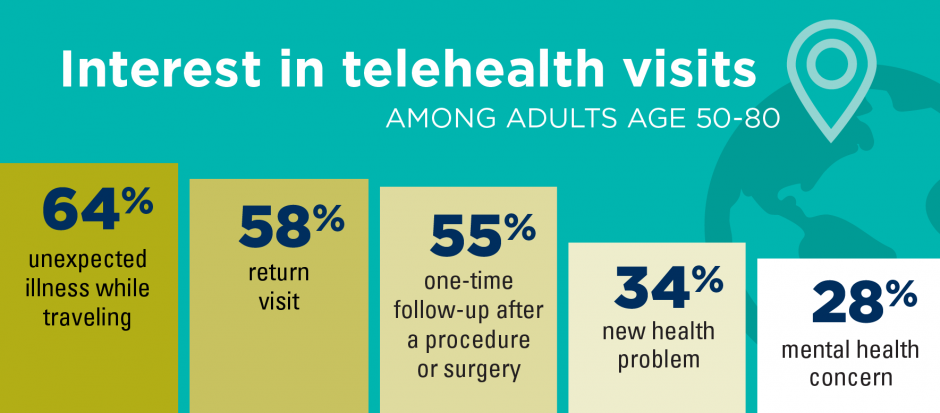

Three in Five People 50+ in the US Will Likely Use Telehealth In the Future – An Update from AARP

“Telehealth certainly appears to be here to stay,” the AARP forecasts in An Updated Look at Telehealth Use Among U.S. Adults 50-Plus from AARP. Two years after the emergence of the COVID-19 pandemic, one-half of U.S. adults over 50 said they or someone in their family had used telehealth. In early 2022, over half of those over 50 (the AARP core membership base) told the Association they would likely use telehealth in the future. This future expectation varies by race, the implications of which I discuss below in

The Wellness Economy in 2022 Finds Health Consumers Moving from Feel-Good Luxury to Personal Survival Tactics

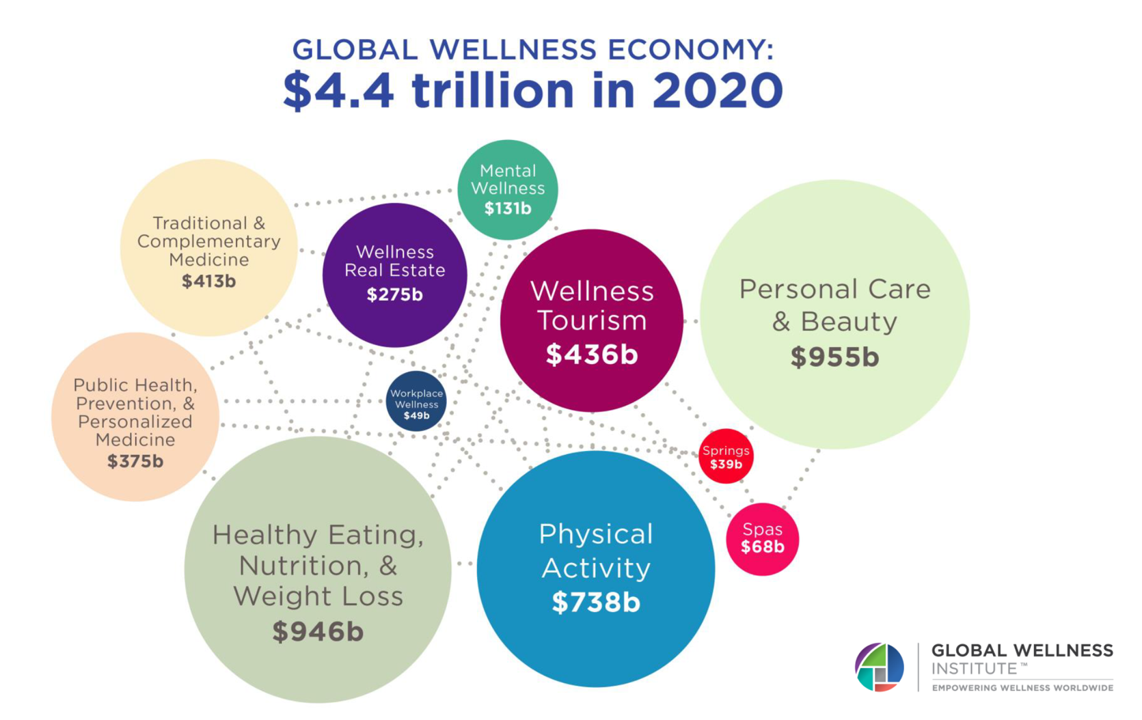

The Future of Wellness in 2022 is, “shifting from a ‘feel-good’ luxury to survivalism as people seek resilience,” based on the Global Wellness Institute’s forecast on this year’s look into self-care and consumer’s spending on health beyond medical care — looking beyond COVID-19. GWI published two research papers this week on The Future of Wellness and The Global Wellness Economy‘s country rankings as of February 2021. I welcomed the opportunity to spend time for a deep dive into the trends and findings with the GWI community yesterday exploring all of the data, listening through my health economics-consumer-technology lens. First, consider

The Digital Consumer, Increasingly Connected to Health Devices; Parks Associates Kicking Off #CES2021

In 2020, the COVID-19 pandemic drove U.S. consumers to increase spending on electronics, notably laptops, smartphones, and desktop computers. But the coronavirus era also saw broadband households spending more on connecting health devices, with 42% of U.S. consumers owning digital health tech compared with 33% in 2015, according to research discussed in Supporting Today’s Connected Consumer from Parks Associates. developed for Sutherland, the digital transformation company. Consumer electronics purchase growth was, “likely driven by new social distancing guidelines brought on by COVID-19, which requires many individuals to work and attend school from home. Among the 26% of US broadband households

Home Is the Health Hub for Older People – Learning from Laurie Orlov

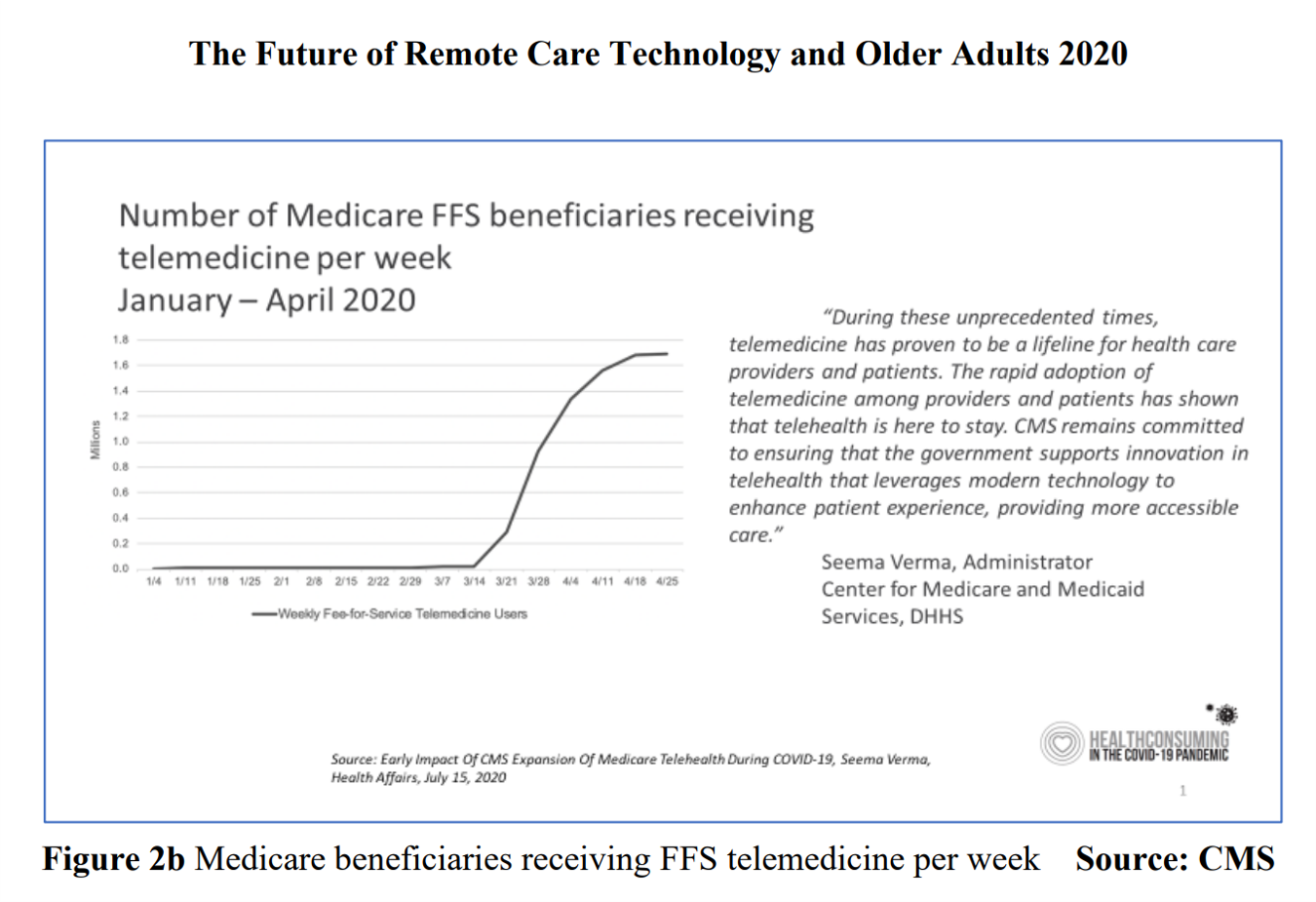

By April 2020, over one million Medicare members were receiving health care via telemedicine. The graph here shows you the hockey-stick growth for virtual care use by older Americans into the second month of the coronavirus pandemic. The COVID-19 public health crisis up-ended all aspects of daily living in America for people of all ages. For older Americans, avoiding the risk of contracting the tricky virus in public, and especially, in health care settings, became Job 1. The pandemic thus nudged older people toward adopting digital lifestyles for daily life, for shopping, for praying, and indeed, for health care. Laurie

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

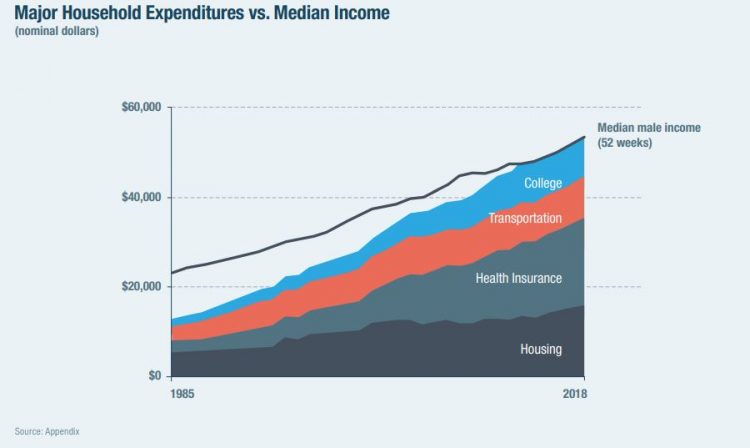

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

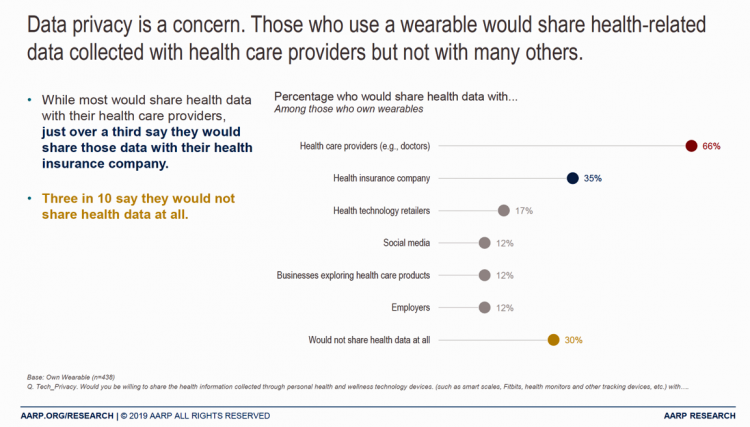

The Pace of Tech-Adoption Grows Among Older Americans, AARP Finds – But Privacy Concerns May Limit Adoption

One in two people over 50 bought a piece of digital technology in the past year. Three in four people over fifty in America now have a smartphone. One-half of 50+ Americans use a tablet, and 17% own wearable tech. The same percentage of people over 50 own a voice assistant, a market penetration rate which more than doubled between 2017 and 2019, AARP noted in the 2020 Tech and the 50+ Survey published in December 2019. For this research, AARP worked with Ipsos to survey (online) 2,607 people ages 50 and over in June and July 2019. Across all

The Promise of Telehealth for Older People – the U-M National Poll on Healthy Aging

Older people are re-framing their personal images and definitions of aging, from continuing to work past typical retirement age, Skyping and texting with grandchildren, and traveling to destinations well beyond the “snowbird” locales of Florida and Arizona to more active and often charitable/volunteer situations in developing economies. And so, too, are older folks re-imagining how and where their health care services could be delivered and consumed. Most people over 50 years of age are cautious but open to receiving health care virtually via telehealth platforms, according to the National Poll on Healthy Aging from my alma mater, the University of Michigan. U-M’s

Health Care Costs Still Americans’ Top Financial Worry Among All Money Concerns

Health care costs rank ahead of Americans’ money-worries about low wages and availability of cash, paying for college, house payments, taxes, and debt, according to the latest Gallup poll on peoples’ most important family financial problems in 2019. Medical costs have, in fact, ranked at the top of this list for three years in a row, with a five percentage point rise between 2018 and 2019. No other financial concern had that growth in increase-of-money-worries in the past year. Health care costs rank the top financial problem for people across all income levels. One in five families (19%) earning under

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

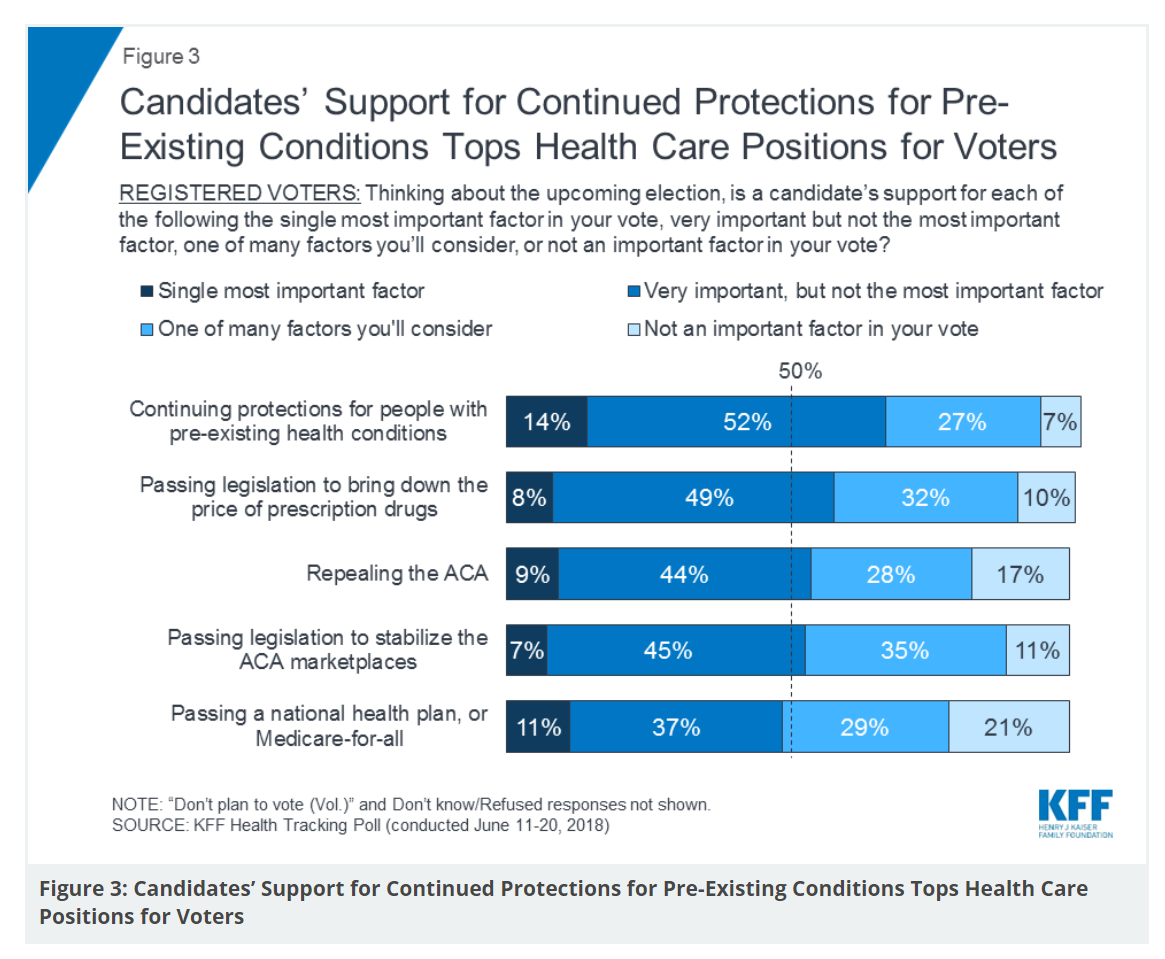

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

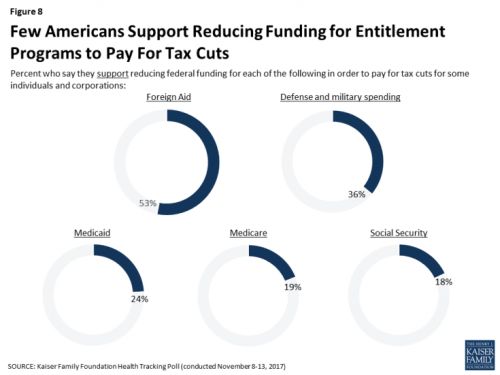

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

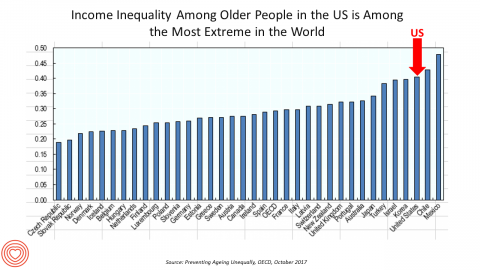

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

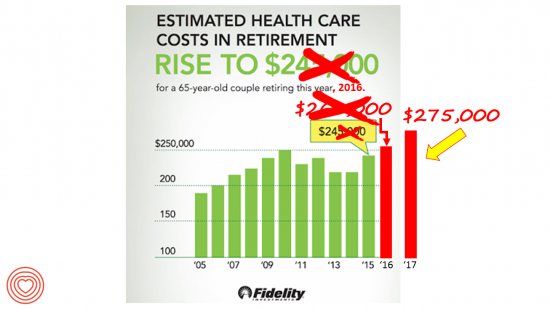

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

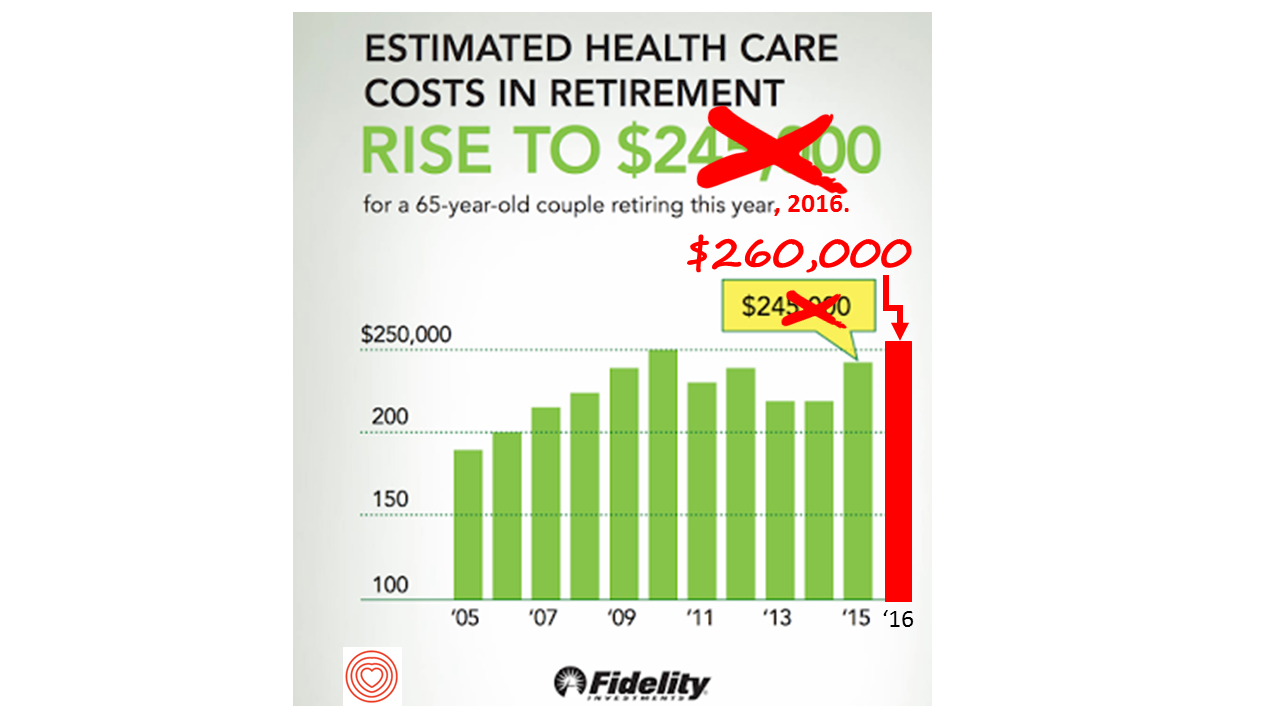

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

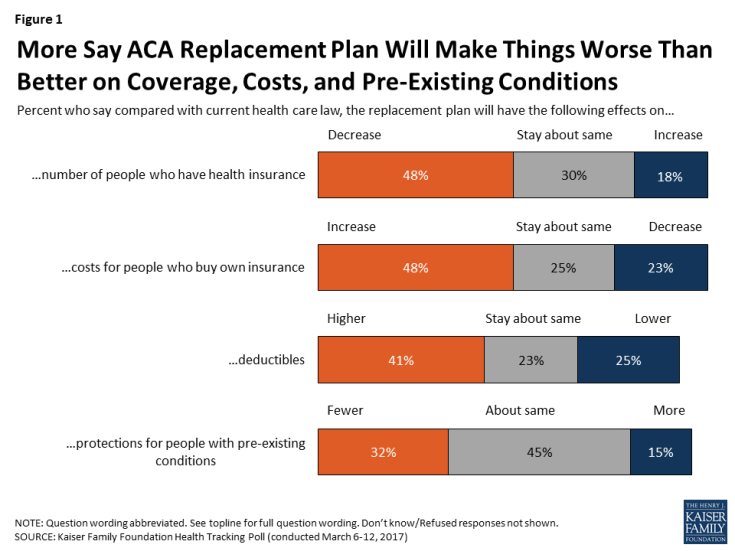

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

Images of Health, Vitality and Life at #HIMSS17

The plane has left the Orlando airport, and I’m looking back at the past week at the 2017 annual meeting of HIMSS, the annual health IT conference that has been my pleasure and (foot) pain to attend for the past two+ decades (for real). Walking the exhibition floor, I encountered some new flavors of imaging that went way beyond bits and bytes, data and technology. These images spoke to me of health, vitality, and life. I’m sharing them with you here, with no intention of selling you company products or services but simply sharing some images that speak to these

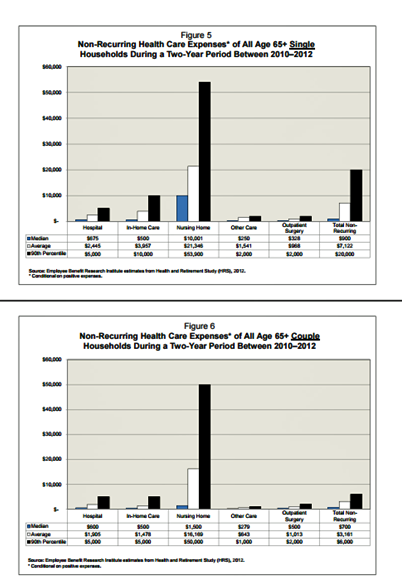

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

Aging America Is Driving Growth in Federal Healthcare Spending

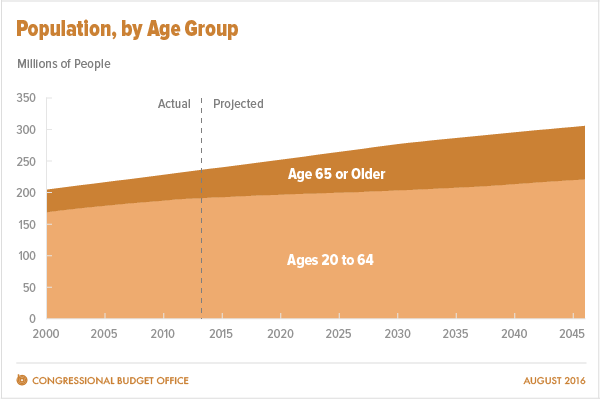

Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO). Federal spending for healthcare will increase $77 billion in 2016, about 8% over 2015, for a total of $1.1 trillion. The CBO believes that number overstates the growth in Medicare and Medicaid because of a one-time payment shift of $22 bn to Medicare (from 2017 back into 2016); adjusting for this, CBO sees Federal healthcare spending growing 6% (about $55 bn) this year. The driver

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

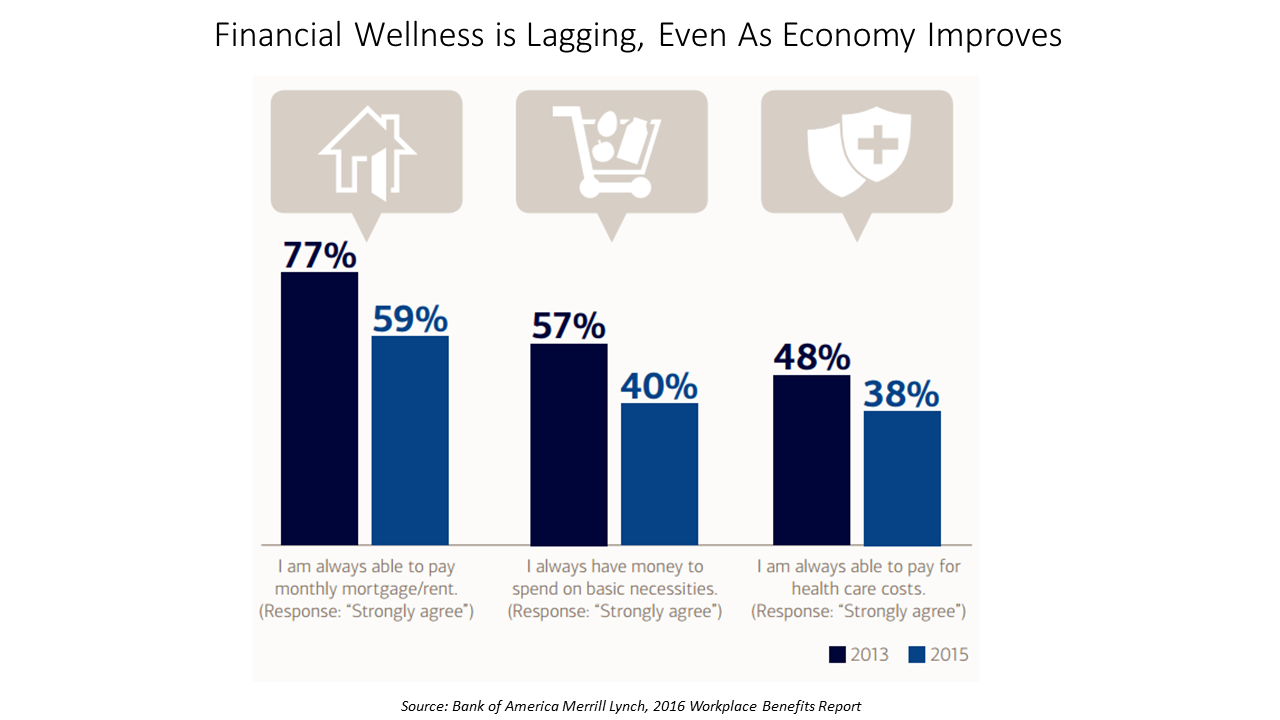

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

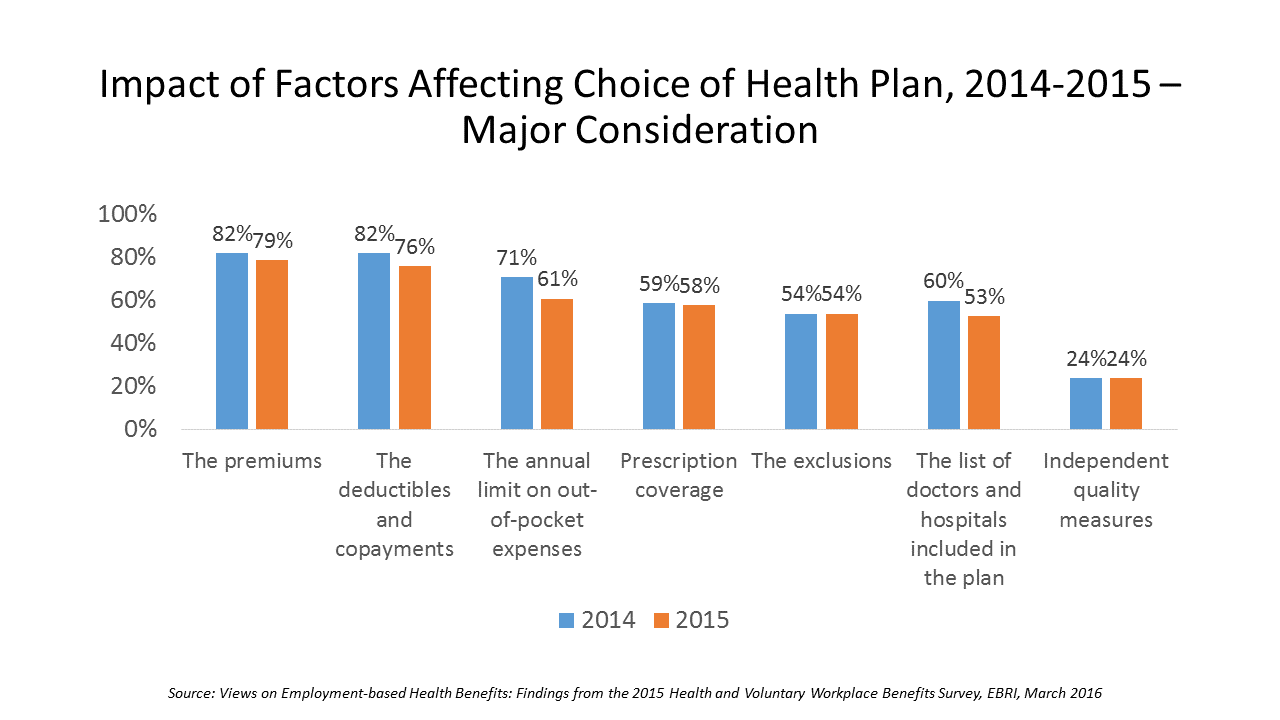

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

What Mavis Staples taught us about health at SXSW

While I am all health, all-the-time when I’m at the annual South-by-Southwest meet-up in Austin, I had the opportunity to attend the premiere of the documentary, Mavis! (exclamation point included and appropriate, given the energy and joy in the title’s subject). “Mavis” is Mavis Staples, who you should know for her music, as singer with her family’s group, The Staple Singers; and, for as a positive force for good. In fact, she’s a lesson in whole health, which is why I’m writing about here on Health Populi which is dedicated to health where we live, work, play, pray…and sing. For

Digital health love – older people who use tech like health-tech, too

As people take on self-service across all aspects of daily living, self-care in health is growing beyond the use of vitamins/minerals/supplements, over-the-counter meds, and trying out the blood-pressure cuff in the pharmacy waiting for a prescription to be filled. Today, health consumers the world over have begun to engage in self-care using digital technologies. And this isn’t just a phenomenon among people in the Millennial generation. Most seniors who regularly use technology (e.g., using computers and mobile phones) are also active in digitally tracking their weight, for example, learned in a survey by Accenture. Older people who use technology in daily

Women are natural disruptors for health

“Disruption” is a well-used word these days in business and, in the past few years, in the health care business. That’s because there’s a general consensus that the U.S. health care system is broken. “System” is a word that I shouldn’t use as my friend J.D. Kleinke smartly argued that it’s that lack of system-ness that makes using the phrase “health care system” an Oxymoron. The fragmented health care environment creates innumerable pain points when accessing, receiving, and paying for services. And it’s women who feel so much of that pain. In that context, I’m gratified and humbled to be one

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

Health costs and wellness: can digital tools bridge the gap? Altarum’s Fall 2013 consumer survey

More than twice as many people value the opinions of friends and family for health care provider choices than turn to online ratings for doctors’ bedside manner, waiting times, or clinical quality, according to the Altarum Institute Survey of Consumer Health Care Opinions, Fall 2013, released on January 8, 2014. 1 in 3 consumers also looks into the cost and quality of services recommended by nurses, doctors, labs and hospitals before choosing a provider. However, most people (4 in 5) say they are comfortable asking their doctor about how much treatment will cost: 43% are “very comfortable,” and 38% somewhat comfortable,

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

Happy today, nervous about health and money tomorrow: an Aging in America update

Most older Americans 60 years of age and up (57%) say the last year of their lives has been “normal” – a large increase from the 42% who said life was normal in 2012. And nearly 9 in 10 older Americans are confident in their ability to maintain a high quality of life in their senior years. The good news is that seniors are maintaining a positive outlook on aging and their future. The downside: older people aren’t doing much to invest in their future health for the long run. They’re also worried about the financial impact of living longer.

1 in 3 people is interested in doing mobile health, but they skew younger

The headline for the HarrisInteractive/HealthDay mobile health (mHealth) survey reads, “Lots of Americans Want Health Care Via Their Smartphones.” But underneath that bullish forecast are statistics illustrating that the heaviest users of health care services in America — people 65 and over — have the least interest in mHealth tools. Overall, 37% of U.S. adults are interested in managing health via smartphones or tablets: about 1 in 3 people. As the chart shows, the greatest interest in communicating with doctors via mobile phones and tablets is among people 25-49. Reminders to fill prescription and participate in wellness programs is also

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Thanks to Jennifer Castenson for

Thanks to Jennifer Castenson for  yeva, digital storyteller, for engaging in

yeva, digital storyteller, for engaging in  Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.

Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.