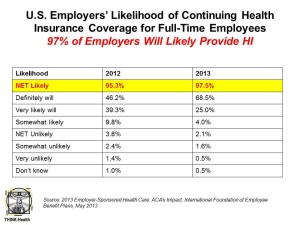

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members.

Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP). This report provides a comprehensive look at U.S. companies’ views on health insurance benefits immediately post-implementation of the Affordable Care Act for 2014.

Two in five employers are increasing their focus on wellness initiatives and incentives as a direct impact of the ACA, most prominently among larger firms with over 50 employees.

Methodology: The IFEPB survey was conducted electronically among 966 human resources and benefits professionals and industry experts in March 2013. Survey respondents represented 20 industries, ranging from small companies with fewer than 50 employees to large firms with over 10,000 workers.

Health Populi’s Hot Points: In the short/immediate term, most employers are putting on the green eyeshades and doing the math on how the ACA will impact their companies. The good news for workers already enrolled in health insurance is that their employers will largely continue to provide insurance when the health insurance exchanges (marketplaces) come on stream.

But workers should not be surprised when confronting higher costs coming out of paychecks for premium-sharing, along with higher out-of-pockets for deductibles up-front along with copays at the point-of-purchase for health products like prescription drugs.

It will take a village to implement the ACA, and teamwork between employers and employees in communicating benefits offerings and alternatives, and for employees to invest the time in understanding these options and how they will impact them personally. This will take a new kind of green eyeshade on behalf of health consumers. They will need engaging tools that will help them make increasingly complicated decisions that affect their and their families’ health.

This is an expanding area for entrepreneurs and developers to address: the growth of health plan literacy.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...