The Healthcare Affordability Elections, 2026 and 2028 – Listening to the KFF Tracking Poll, January 2026

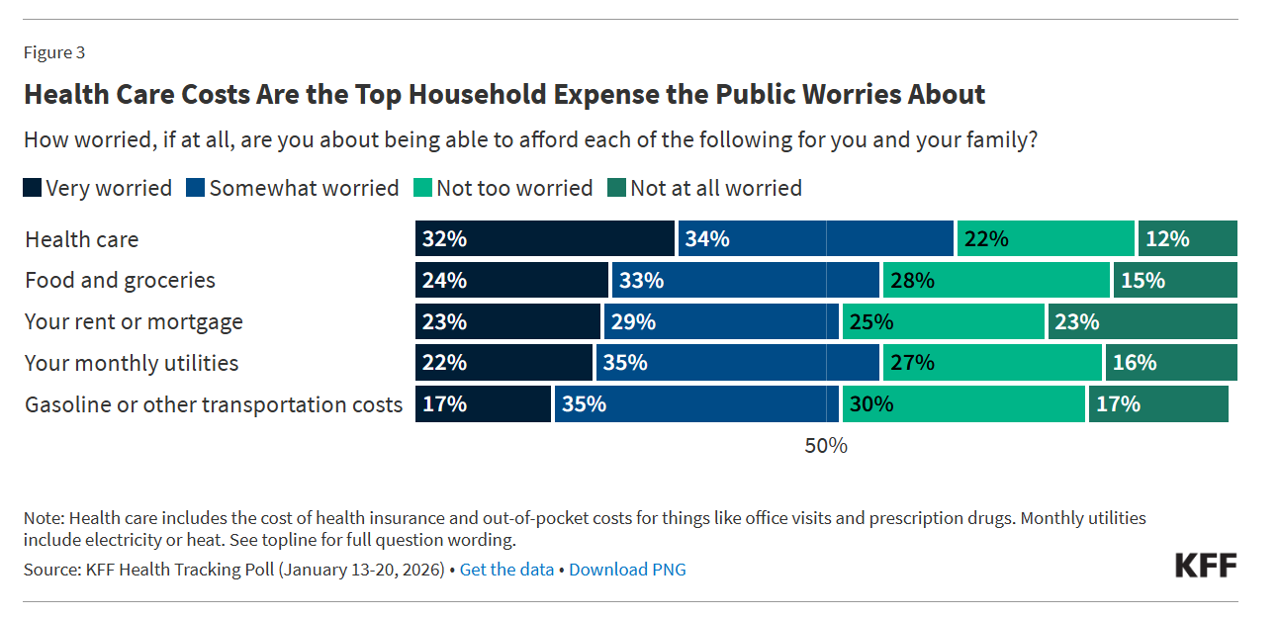

The title of KFF’s press release launching the Foundation’s January 2026 Health Tracking Poll clearly observes, “Health Care Costs Tops the Public’s Economic Worries as the Runup to the Midterms Begins.” I’ve pulled out the key details to share my lens on the 2026 midterm and 2028 Presidential election forecast, which I believe will turn out to be (in part) The Patients’ Elections. Here’s the top-line title finding — where most people in the U.S. — 2 in 3 people (66%) — are worried more about health care costs compared with other major household expenses.

While Nurses Continue to Rank Top in Honesty and Ethics, Americans’ Respect for All Professions is Tanking

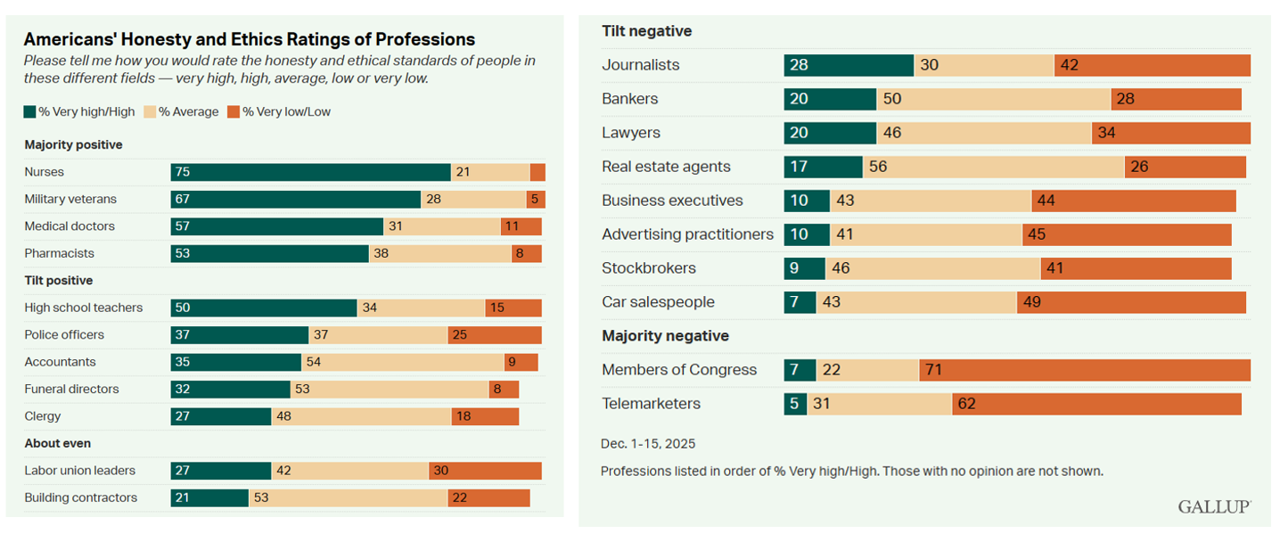

While nurses continue to rank high for honesty and ethics, Americans’ trust in the nations’ professions is tanking, found in this year’s Gallup Poll update titled, Nurses Continue to Lead in Honesty and Ethics Ratings. Nurses perennially top this chart, usually followed by doctors and pharmacists. But this year, it’s military veterans who garner the second spot in the Gallup Poll, with doctors and pharmacists in positions 3 and 4. Ranking at the bottom as least-respected for honesty and ethics are Members of Congress, again garnering the low-point in this study, with telemarketers trailing the

A Primer on Health Consumers for CES 2026 – How Macro Consumer Trends Will Shape Healthcare Consumers in 2026

Increasingly, people are engaging more in health care decision making due to many factors impacting their personal medical choices — from the cost and access to health insurance to co-payments for prescription drugs and the supply of primary care doctors, more patients developed and exercised their health consumer muscles in 2025, For 2026, the health consumer muscle-building will grow as people will be re-shaped by macro market factors we are currently gleaning from forecasts looking into the new year: for personal finances, social issues, technology adoption, views on AI and privacy, and other issues. Here are some data points to

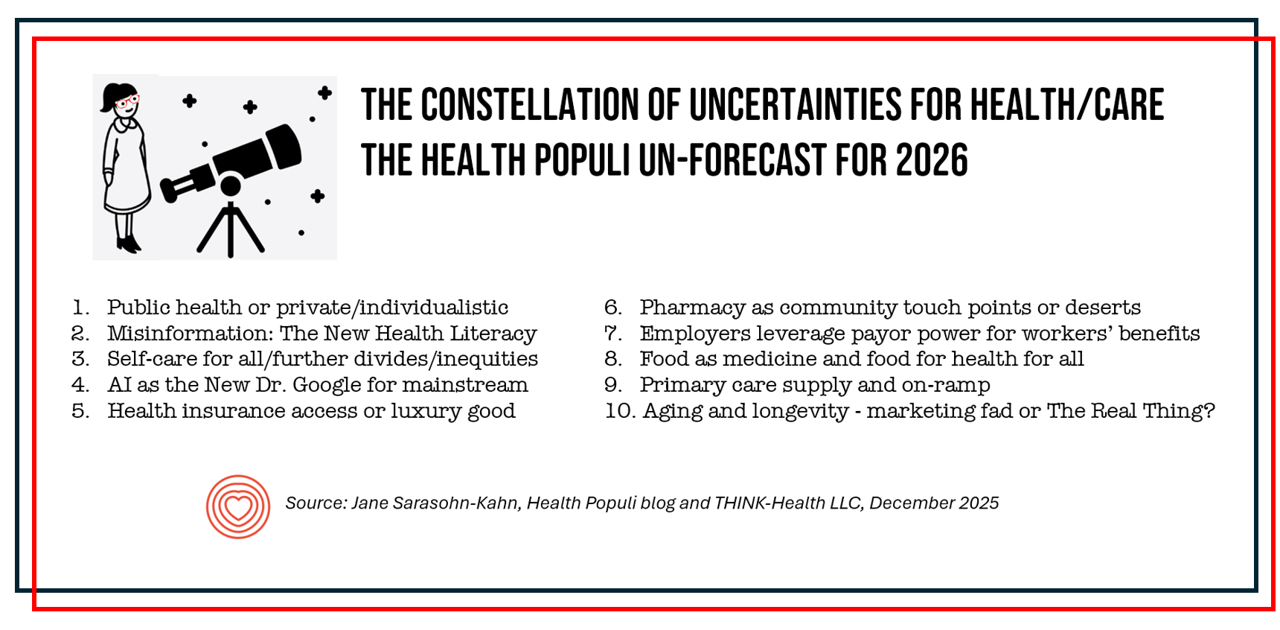

Navigating a Constellation of Uncertainties: Health/Care in 2026 (My Un-Forecast)

Almost from the first year of launching Health Populi in 2007, I’ve written a “TrendCast” for the coming year of health care. Over many years, there weren’t so many blogs devoted to health care which featured such prognostications, and so readers could divine signal from noise and move forward into new years with manageable lists of What To Expect Next Year in Healthcare. Here’s one from ten years ago that brings a sense of déjà vu: most of the findings are consistent with what we know for sure about 2026 and it’s useful to look back with today’s eyes to

The Home Economics of Family and Fertility: Men’s Financial Views on Their Fertility Journeys (My Progyny Post #2)

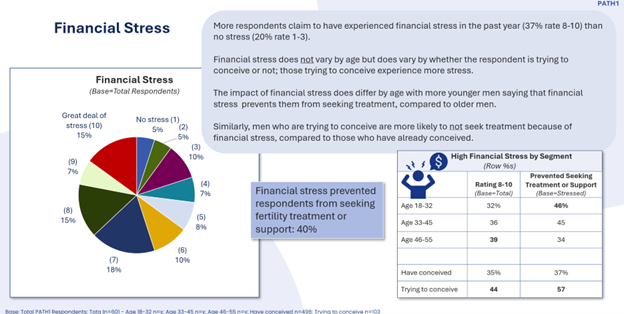

Cost is a leading reason why people say they could not obtain the fertility care they need. But the costs of IVF and other forms of fertility care lie within a larger home economics framework of family-building and -raising. The context and costs of raising a child in America. Consider the layers of a household budget starting with the home’s “macro”-economics of income. Then within that circle, especially in the U.S., the factor of whether that household is covered by employer-sponsored health insurance. The next layer of more health micro-economics in the family is the

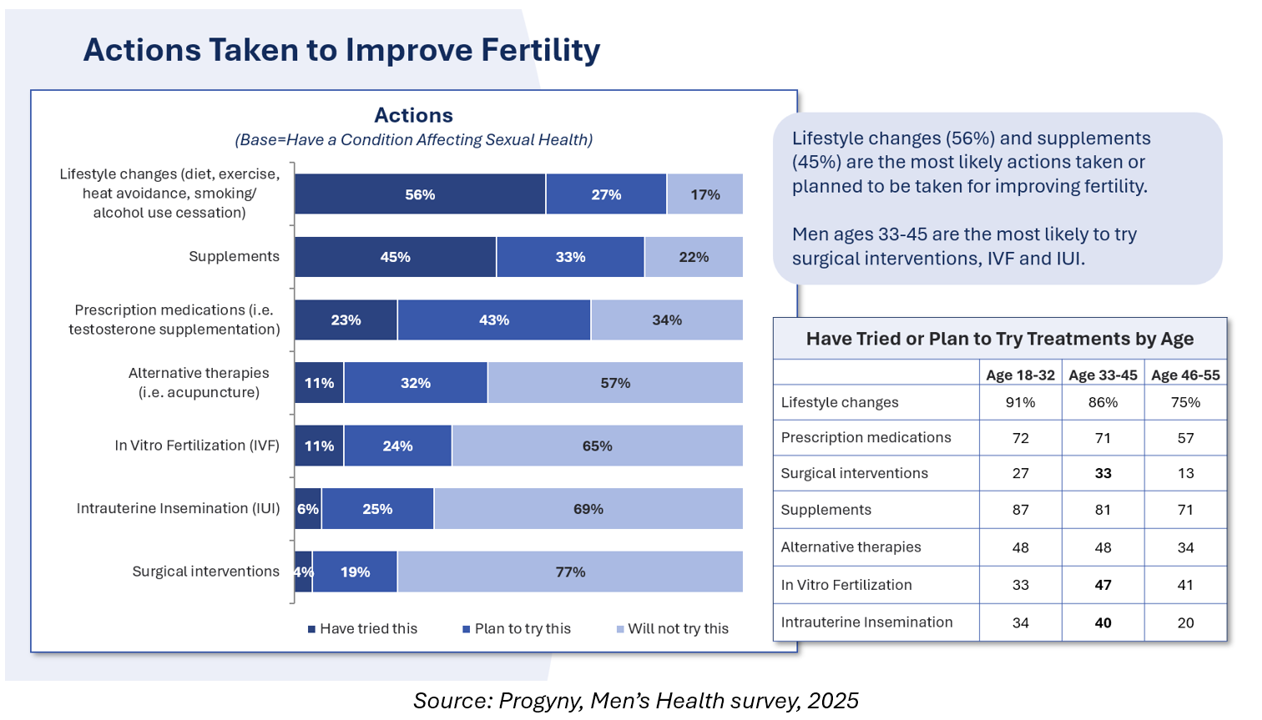

Feeling Under-Served and Overlooked: Men’s Views on Their Fertility Journeys (My Progyny Post #1)

In his latest book, Notes on Being a Man, Scott Galloway discusses his personal fertility journey in the larger social context of what it means to be a man in modern America. Galloway’s infertility challenges shared with his wife inform his views on men’s health across all dimensions — physical, mental health, social health, financial well-being — and how, of course, men’s overall health is also a women’s and children’s issue. Men can feel “left out” of infertility discussions, based on results from the first and largest multi-national study into men’s feelings about their infertility revealed. “How men feel about

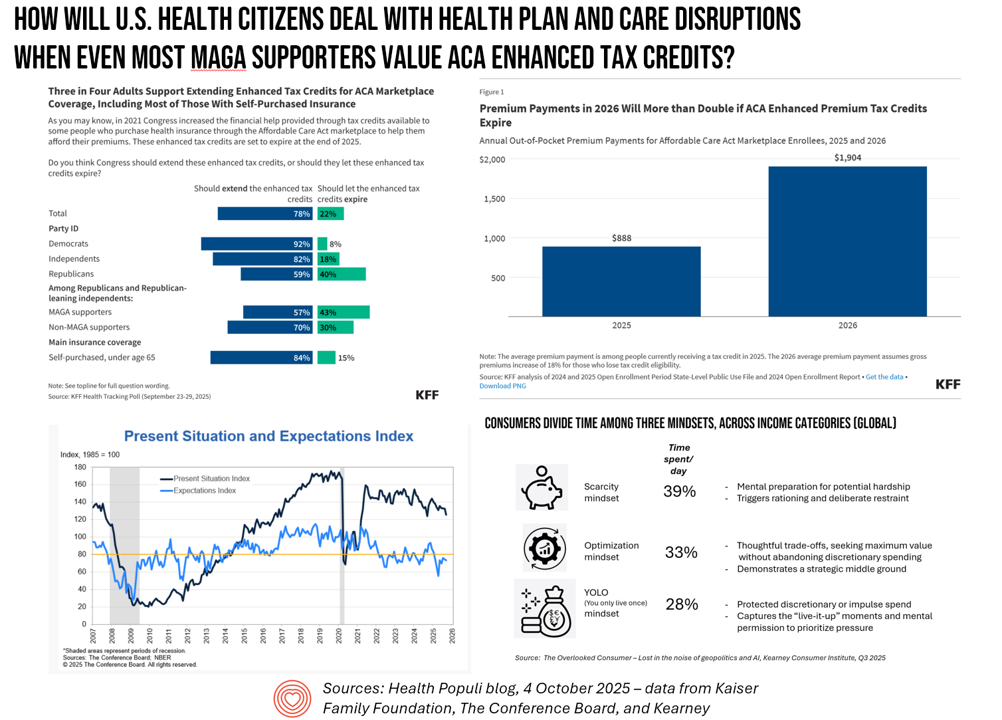

Most MAGA Supporters Support Extending the Expiring ACA Tax Credits – Will That Move Negotiations to Re-Open the Government?

A couple of days into the U.S. Federal government shutdown, there’s one message the Congressional Democrats are tending to voice: that is that health care is on the line, and that’s the issue on which they’re betting will bring negotiators back to Capitol Hill — expecting a few Republicans to join in that dialogue. Most U.S. adults across political parties would want to see Congress extend the enhanced Affordable Care Act tax credits that are set to expire next year we see in a poll from the Kaiser Family Foundation published October 3. And that includes most Republicans and MAGA

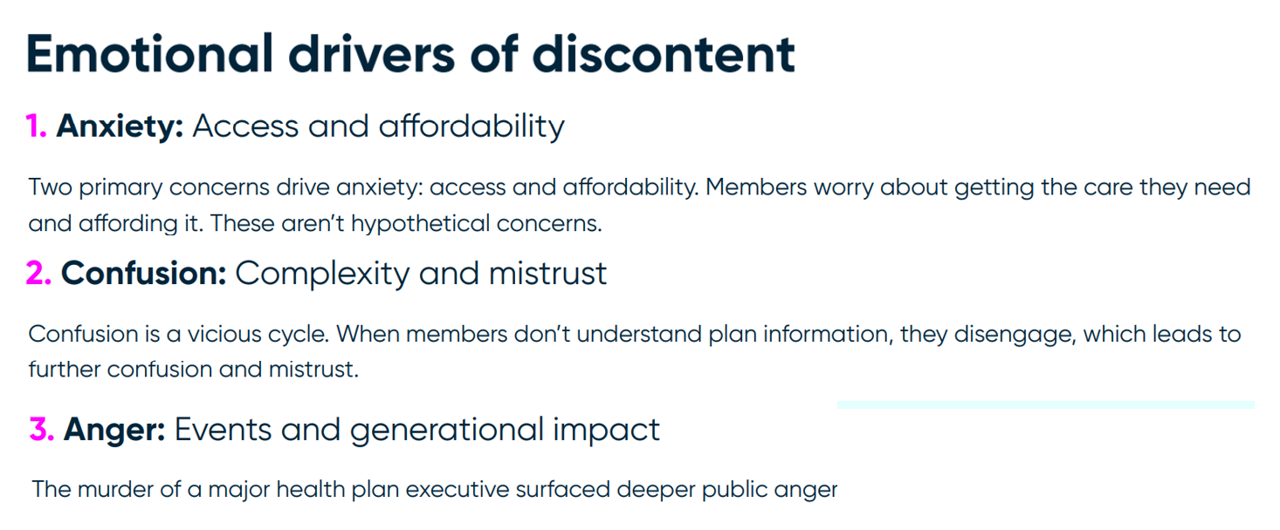

The Emotional Drivers of Healthcare Discontent – Press Ganey Points to Access and Affordability Worries Driving Anxiety and Anger

In the current era of U.S. health citizen grievance with the health care system, people feel anxious, confused, and angry — especially when it comes to access and affordability of health care. We learn more about these emotional drivers of health/care grievance in Understanding Health Plan Member Discontent, an assessment of health consumers’ views of satisfaction across health insurance plan types (commercial, Medicaid, Medicare, and marketplace plans) and age of member, from the health consumer experience team at Press Ganey. Those three underlying factors driving discontent translate to different generations differently. Overall, anxiety relates to

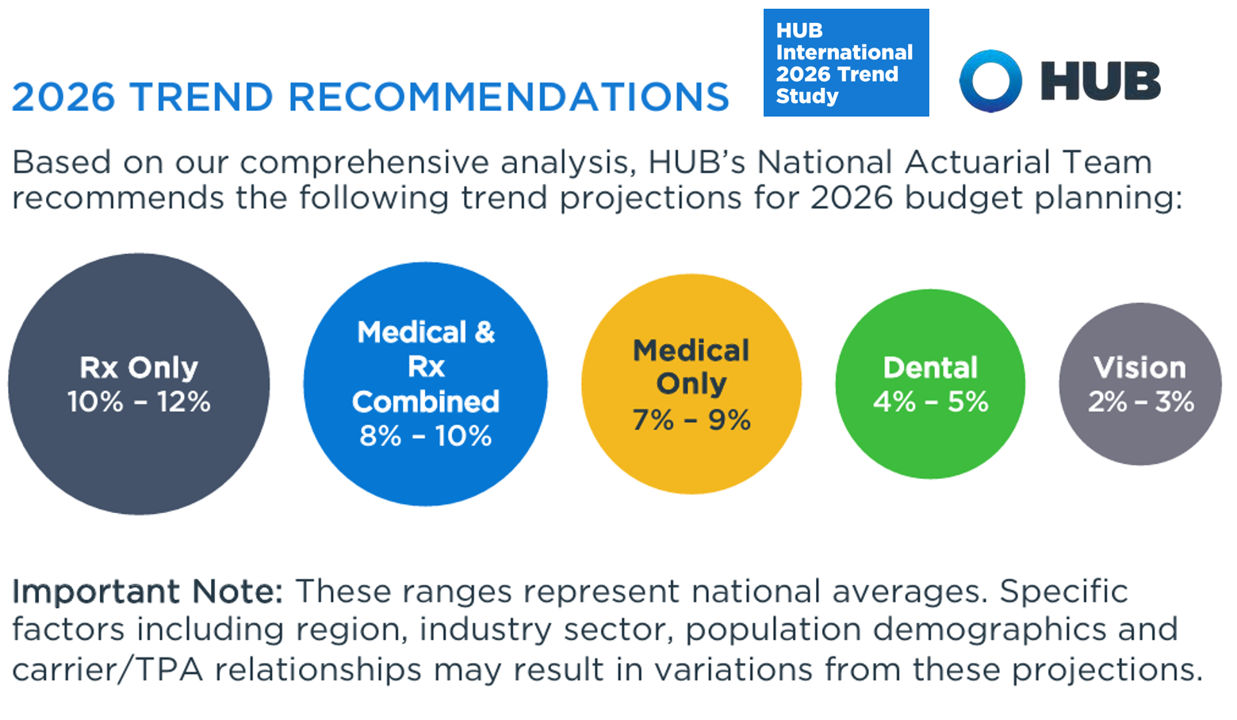

Expect Double-Digit Prescription Drug Trend Increases in 2026 – The Update from HUB International

Prescription drug price trend for 2026 will be between 10% and 12% according to the 2026 Trend Study from HUB International, a global insurance and financial services firm. Here’s HUB’s line chart of the combined medical and Rx trend, illustrating nearly double trend growth since 2022 following the peak of 10.1% (combined) in 201 as patients returned to health care services and encounters when feeling safe in the fading out of the COVID-19 pandemic. That precipitous low-point in 2022 of 3.4% was the peak of the coronavirus stay-at-home period, representing the “medical distancing” felt across

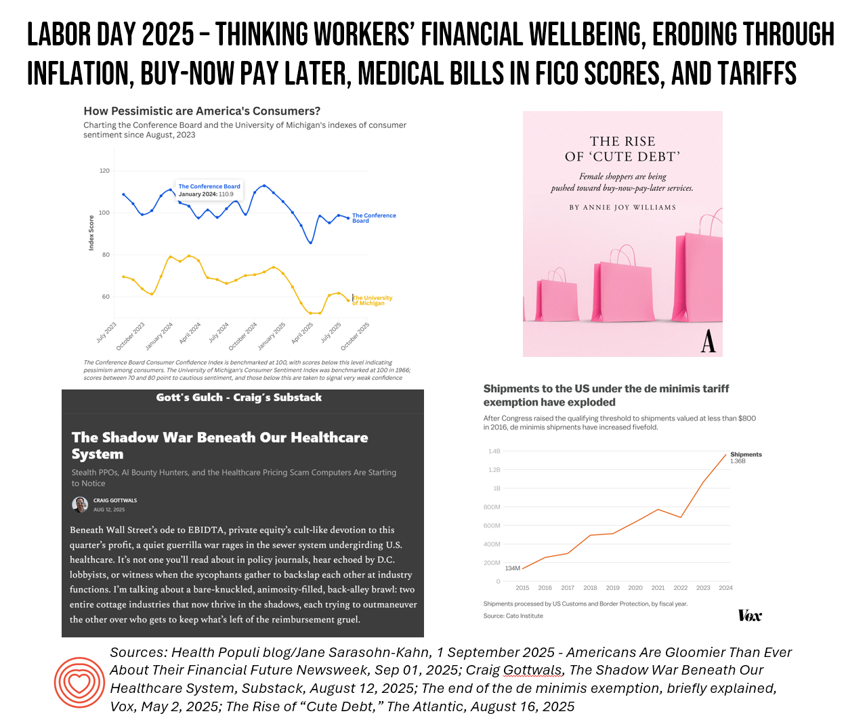

On Labor Day 2025: From Health Care “Revenue Bounty Hunters,” Medical Bills Back into FICO Scores, the Rise of “Cute Debt,” and Tariffs — U.S. Consumers’ Face Eroding Financial Health

On this U.S. Labor Day 2025, the physical and the fiscal, with the mental, converge as I ponder what working Americans are facing….packing kids up for school, sorting out college payments and loans, dealing with rising costs of daily living, and feeling a growing pinch of what President Trump’s tariffs have had in store now that they’re hitting SKUs around the household. This post will cover most days this week as my own workflows will be heavy as clients return to face returns-to-work and updating scenario plans. We start this post with a headline: “Why Hospitals Are Hiring ‘Revenue Bounty

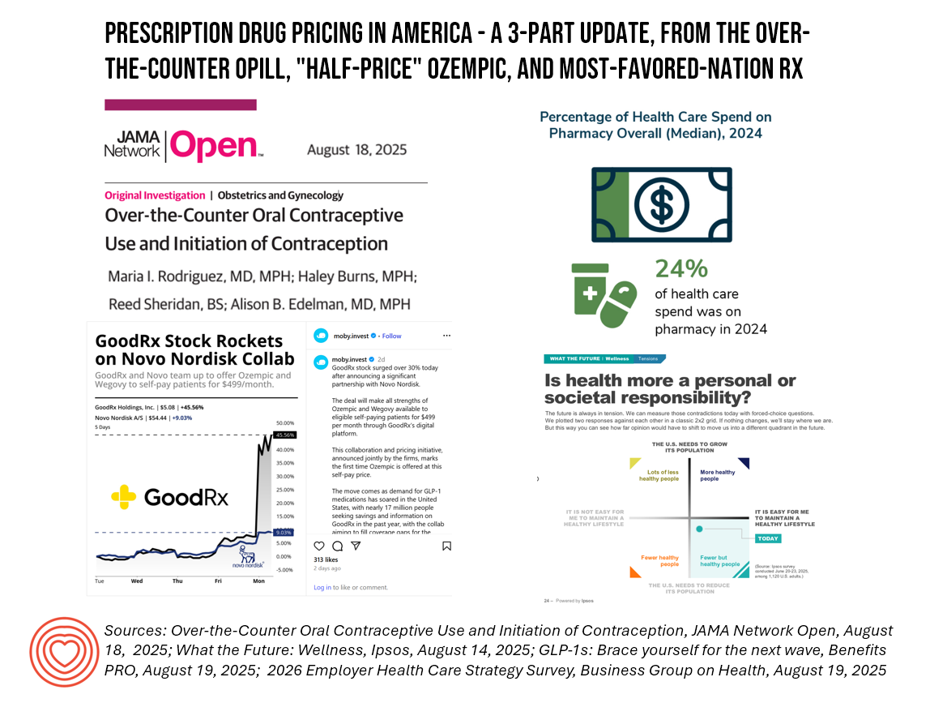

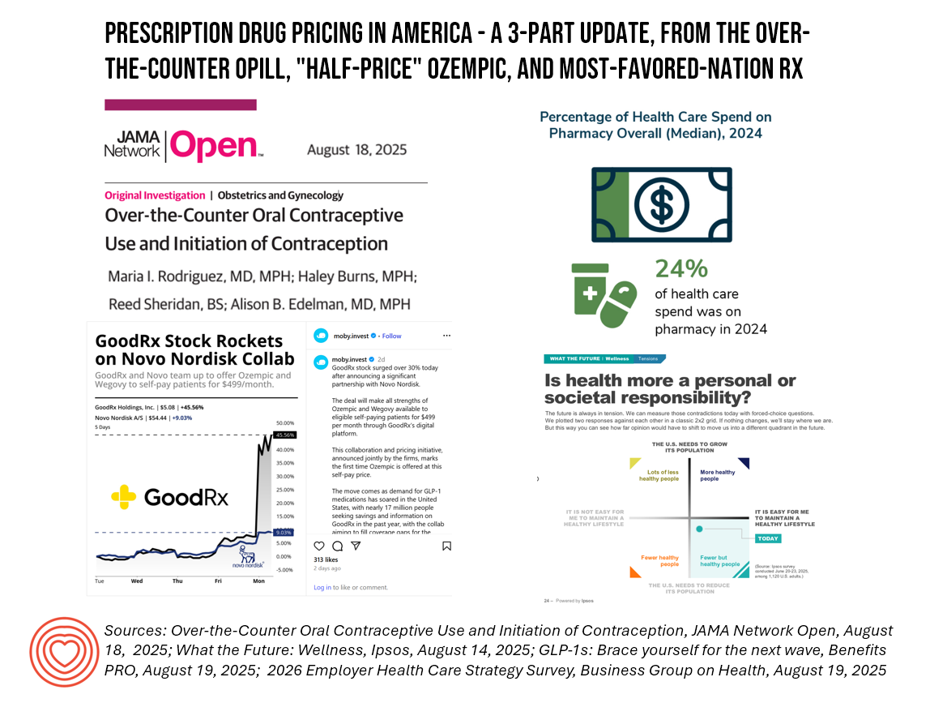

Prescription Drug Pricing in America – a 3-Part Update, From the Over- the-Counter OPill and “Half-Price” Ozempic to Most-Favored-Nation Rx (Part 3)

Welcome to Part 2 of 3 in my consideration of Prescription Drug Pricing in America. You can catch up with yesterday’s Part 1 post here, and Part 2 here. The macro-context for these 3 posts are the forecasts for health care spending for the coming year. Health care cost increases forecasted for 2026 will, in significant part, be driven by prescription drug trend. This graphic from this week’s release of the Business Group on Health’s employer survey on healthcare cost growth to 2026 illustrates a key finding that’s echoed in other similar studies recently released and covered here in Health Populi.

Prescription Drug Pricing in America – a 3-Part Update, From the Over- the-Counter OPill and “Half-Price” Ozempic to Most-Favored-Nation Rx (Part 2)

“Big Pharma has a new vision for selling drugs. It’s going to the mattresses,” writes Josh Nathan-Kazis in MSN earlier this week. That is, going direct-to-consumer (DTC) the way the mattress industry has done in the past decade, cutting out brick-and-mortar sleep shops at retail. In the case of “Make(ing” like a mattress company,” Josh explains, the pharma manufacturers “sell shots and pills straight to the consumer.” In this case, that’s cutting out the pharmacy benefits managers and other intermediaries that have taken dollars in the transactions of drug benefit claims which have added costs to payers (health plan sponsors

What U.S. Consumers Are Thinking About Tariffs’ Impacts on Health Care: Looking to Ipsos, QCentrix and Goldman Sachs

Most Americans, thinking as health consumers, believe that tariffs could impact peoples’ ability to pay for costly prescription drugs and be priced out of paying for check-ups and medical supplies, based on results from two studies on consumers’ views on tariffs and their health care from Ipsos and Q-Centrix. Ipsos’s consumer survey found that younger consumers, people earning lower incomes, and folks living in the suburbs feel even more stressed about tariffs’ impact on medical care — along with more people identifying as Democrats or Independent voters. With

Women Walk a Financial Tightrope: What That Means for Women’s Health, Mind, Body, & Wallet

Financial stress and anxiety have an ‘outsized’ negative impact on the well-being of women in America, compared to male counterparts, we learn in Health. Wealth, and Happiness – Helping to overcome roadblocks to women’s well-being, a report from the Guardian Life Insurance Company. This report is part of Guardian’s annual research program called Mind, Body, Wallet, which the company launched 14 years ago. The goal of Mind, Body. Wallet is to assess how health citizens define “well-being” in daily living, making the crucial connections between mental health (“Mind”), physical health (“Body”), and money

The Patient as Consumer – Updates from Fidelity on Retiree Health Care Costs ($172,500), Delaying Care, Tariff Impacts on Spending, and Roche Going DTPatient for Rx’s?

As of August 2025, U.S. patients of all demographics and geographies face many uncertainties with respect to their care. Issues such as health plan coverage, prescription drug costs, and access to services, among other challenges, continue to re-shape patients-as-health-consumers seeking transparency, clinical choices, and trust-worthy relationships with touchpoints in their personal health ecosystems. Four just-breaking stories across the health/care ecosystem illustrate several of these uncertainties and forces in U.S. health care — some adding friction and angst in a patient’s life, others perhaps providing some relief for certain health consumers. These news items address health care costs in retirement, the

Medicare at 60: Prior Authorizations Are a Problem for People in the U.S., Regardless of One’s Political Party, Income, or Insurance Type

Happy 60th Anniversary Medicare, today marking six decades since the passage of this law which was a landmark milestone for The Great Society, U.S. style. Since its inception and implementation, Medicare quite often leads in adoption of new medicines, new processes, new technologies in health care. But as I track the phenomenon of health citizenship in the U.S., I observe growing consensus among American patients — cross health plan type — increasingly impatient for health care access. We can now add Americans’ growing dissatisfaction with the prior authorization process, an opinion that now spans majorities of consumers regardless of their

Americans Hear More Frequently About GLP-1 Drugs Than About Menopause, Sleep, or Bird Flu

Yu In a sign of our health communications times, GLP-1s are a much more frequently health topic Americans hear about than autism and ADHD, cosmetic treatments like Botox, Bird flu, sleep issues, or menopause. The Pew Research Center polled 5,123 U.S. consumers in February and March 2025 to gauge peoples’ perspectives on health information and communications trends in America. In the study summary titled, From weight-loss drugs to raw milk, Americans hear more often about some health topics than others, the Pew Research team. The finding that

What GoFundMe and Crowdfunding Campaigns Tell Us About Healthcare in America

“Can people afford to pay for health care?” a report from the World Health Organization asked and answered, with a focus on European health citizens. The same question underpins a new research paper published in Health Affairs Scholar, Insights from crowdfunding campaigns for medical hardship, Here, crowdfunding is a proxy for “can’t afford to pay for health care” in America. Here in blazing colors we have a snapshot of the study’s data in the form of a “heatmap.” FYI, a heatmap is a data visualization format that represents the magnitude of values of a dataset as a color — generally

A Toyota RAV4 Hybrid, a Playground Set, or Healthcare for a Family of 4: What $35,119 Can Buy in 2025 According to Milliman

If you went shopping for something that cost $35,119 in 2025, which would you most value? A new 2025 Toyota RAV4 Hybrid with some extras on board? A Canyon BYO playground set for your yard, school, or social-athletic club? Or, Healthcare coverage for a family of 4 in the form of a PPO? Welcome to this year’s 20th anniversary edition of the Milliman Medical Index (MMI), which I’ve looked forward to reviewing for most of its two-decade history. [You can read my annual takes on the MMI here in Health Populi by searching “MMI” and the year of publication in

The Next Version of Medical Tourism: Medical Immigration?

One in three Americans could imagine leaving America for good as expatriates — with access to affordable and reliable health insurance the top consideration, according to research conducted by the Harris Poll on behalf of GeoBlue and International Citizens Insurance (ICI). “Thirty-one percent of potential expats cite concerns about healthcare coverage abroad being the reason they haven’t yet taken the leap to move abroad. This trumped concerns about their work and social life abroad,” the survey found. Earlier this year, The Harris Poll’s American Expats Survey, published in February 2025, found that health care accessibility

Health, Wealth, and How Business Can Support Consumers in an Era of “Uncertainty on Steroids”

Facing uncertainties across everyday life flows, U.S. consumers look to economic and health security — and welcome businesses to support these, we learn in an analysis from The Conference Board. The Conference Board (TCB) polled 3,000 U.S. consumers gauging their perspectives on uncertainties emerging out of the new Trump administration’s policy changes introduced in the first quarter of 2025. The chart details people’s financial/fiscal responses in blue, and the health (mental, social, and physical aspects) in yellow: Consumers’ fiscal strategies for coping with uncertainty are to seek out more affordable brands and retailers, adjusting

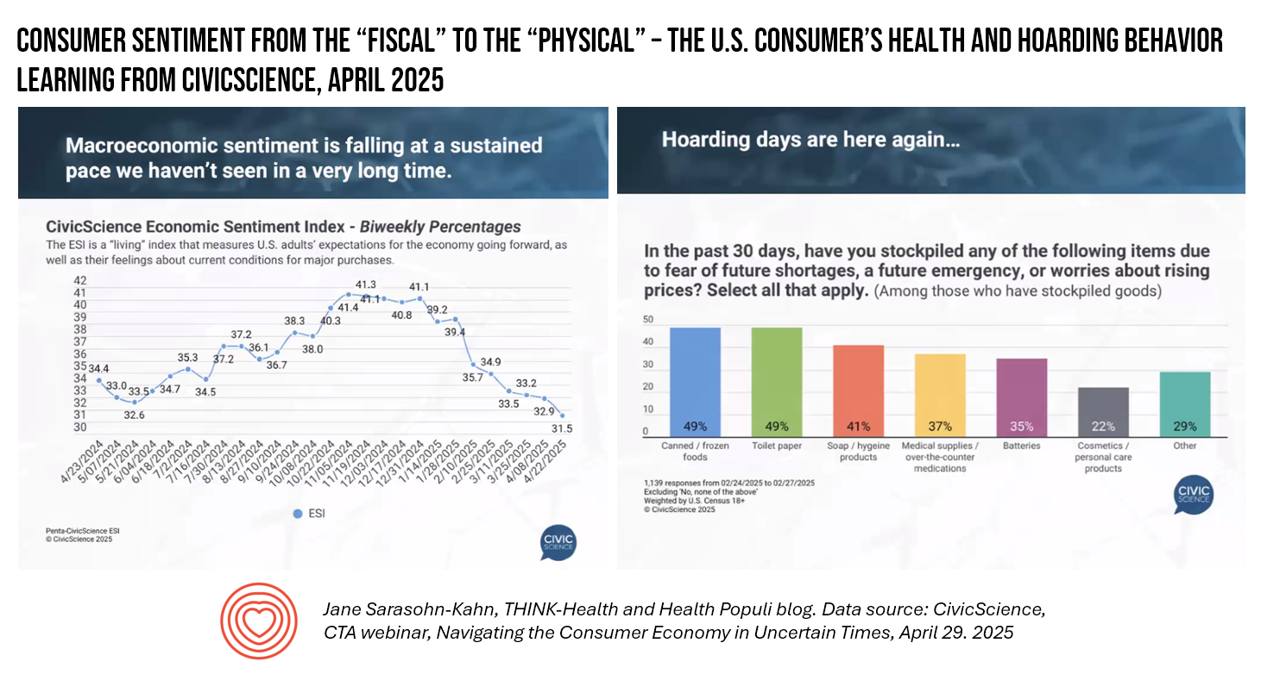

How Consumers’ Economic Sentiments Are Shaping Peoples’ Financial and Emotional Well-Being (Spoiler: Not So Good): Learning from CivicScience

When it comes to health, the words “fiscal” and “physical” are morphing as peoples’ economic feelings (the “fiscal”) are shaping physical and emotional health, we find in U.S. consumer data presented by John Dick, Founder and CEO of CivicScience. The Consumer Technology Association convened a special session with John, who painted a portrait of the U.S. consumer at a point in time — late April 2025 — reminding us more than once during the hourlong session that, “Everything is constantly changing.” One certainty that we can be sure of, in the dismal-scientist way

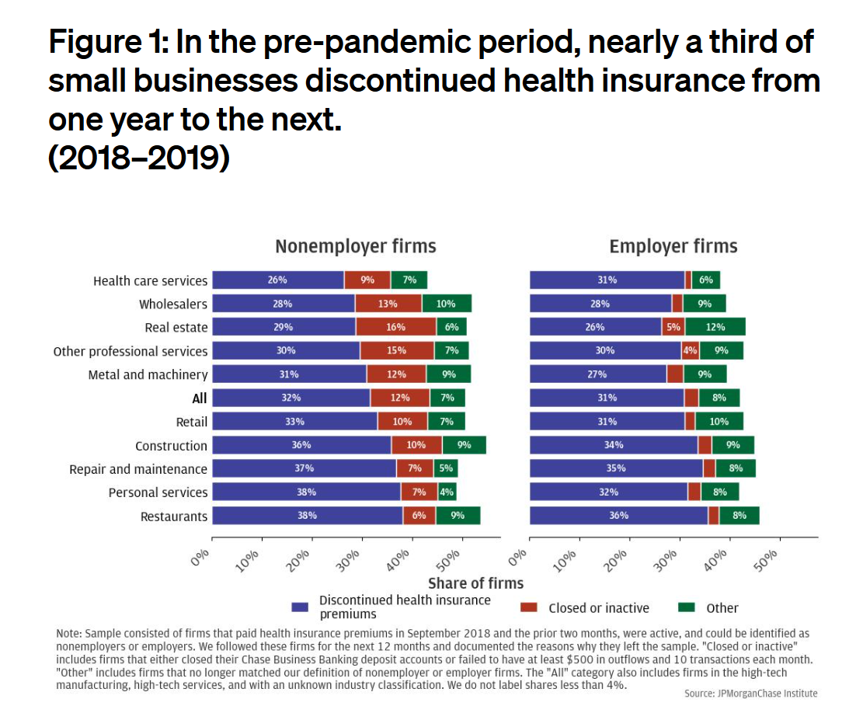

Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

U.S. Health Care in 2025 Requires Scenario Planning: The Uncertainties (AI!?) That Inspire DIY Healthcare

As Weight Watchers prepares to initiate bankruptcy proceedings, I file the news event under “thinking the unthinkable.” “Thinking about the unthinkable” is what Herman Kahn, a father of scenario planning, asked us to do when he pioneered the process. In this book, for Kahn, “the unthinkable” was thermonuclear war, and the year was 1962. The book was tag-lined as “must reading for an informed public” and in it, Kahn I’ve been drawn back to this book lately because of a more intense workflow using

Health Care Nation – How to Inspire a Rosa Parks Moment for Healthcare in America?

Tom Lawry may be best-known as a leading voice on AI in health care; after all, he’s written two very well-selling books on the topic, speaks all over the world on the subject, and in his most recent company-based gig helped lead Microsoft’s efforts in AI in health care and life sciences. When his publisher asked him to write a third book on AI in health care – still a hot topic in publishing – Tom said he’d rather turn to a subject long on his mind: the state of health care in America and how to change the conversation

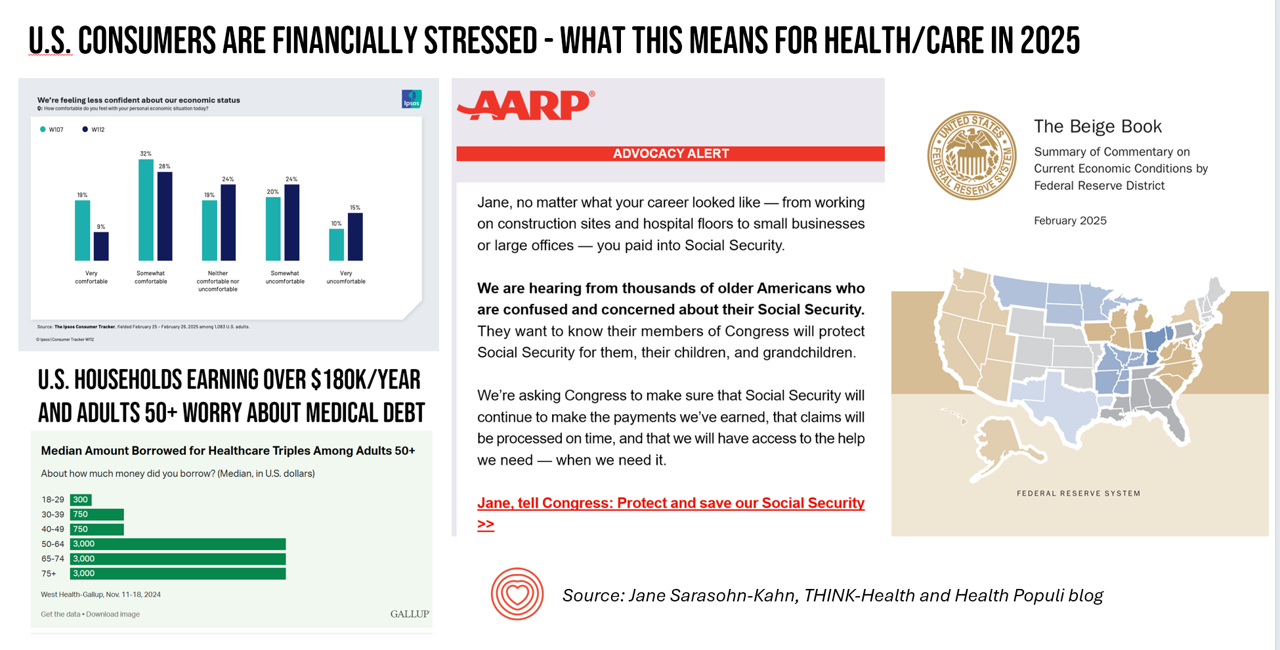

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

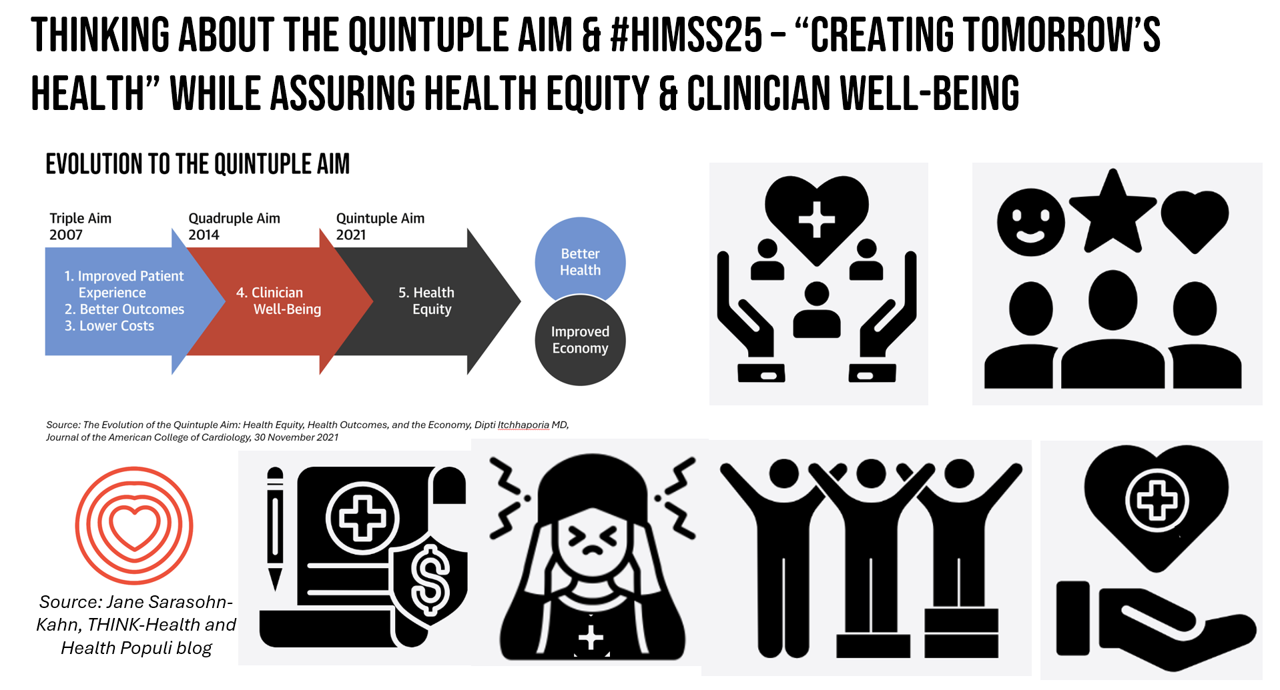

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

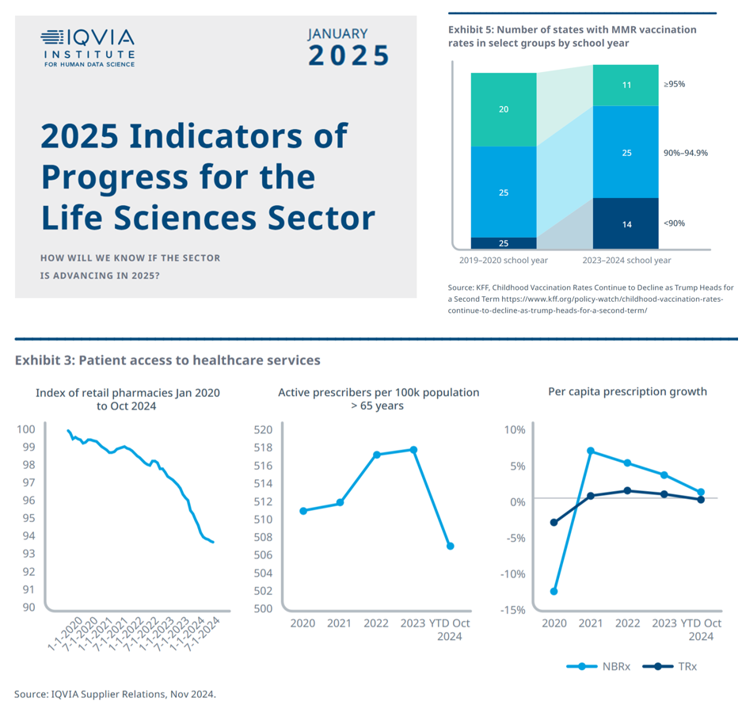

Measuring Progress for Life Sciences: Trust, Patient Access, and Prevention at a Fork in the Road of Public Health

How will we know if the life sciences sector is advancing in 2025? This is the question asked at the start of the report, a Research Brief: 2025 Indicators of Progress for the Life Sciences Sector, from the IQVIA Institute for Human Data Science (IQVIA). To answer that question, IQVIA identified ten indicators for this 2025 profile on the life sciences sector. I selected four key data points for this discussion which provide particularly informative insights for my advisory work right now at the intersection of health, people/consumers, and technology: Trust for/with/in life science

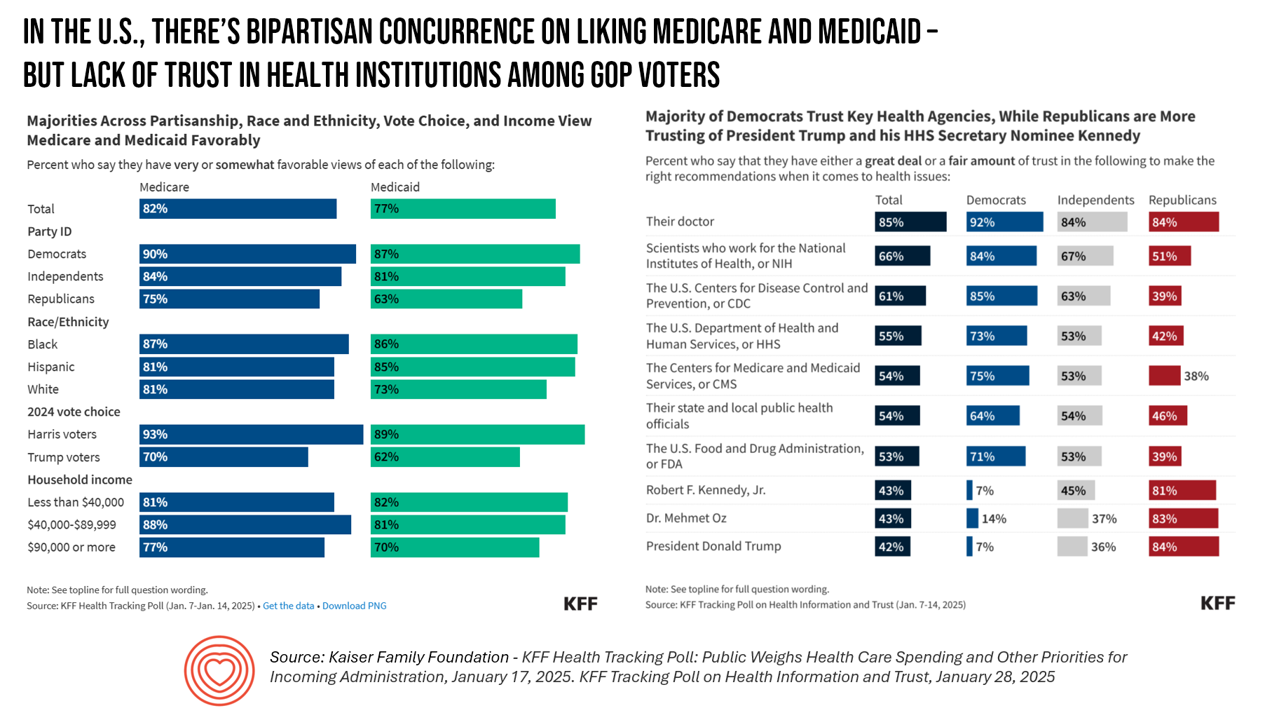

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

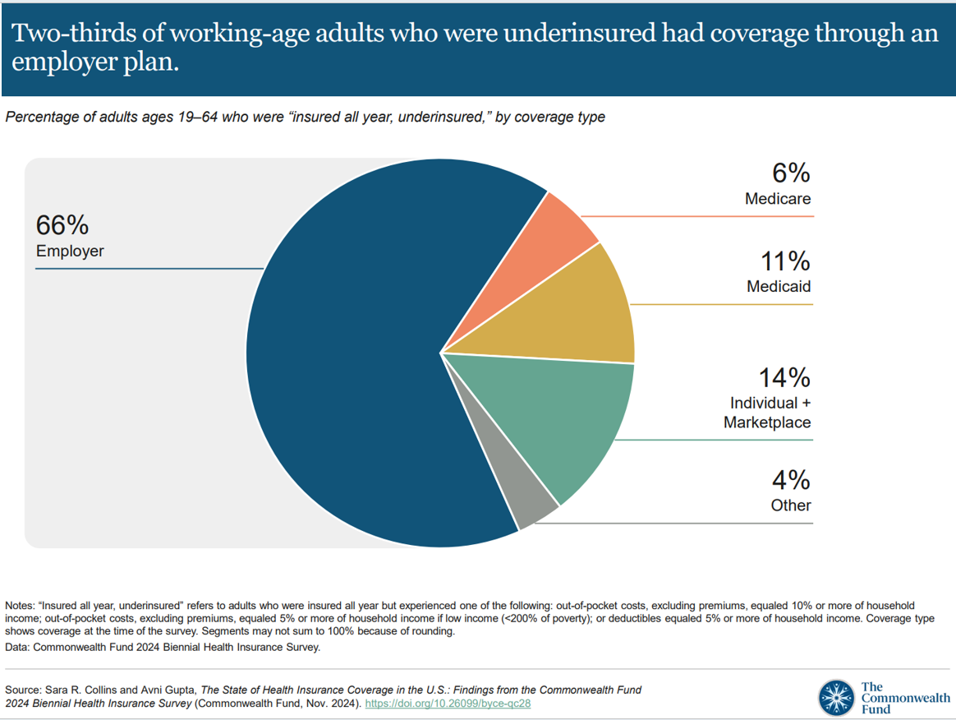

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

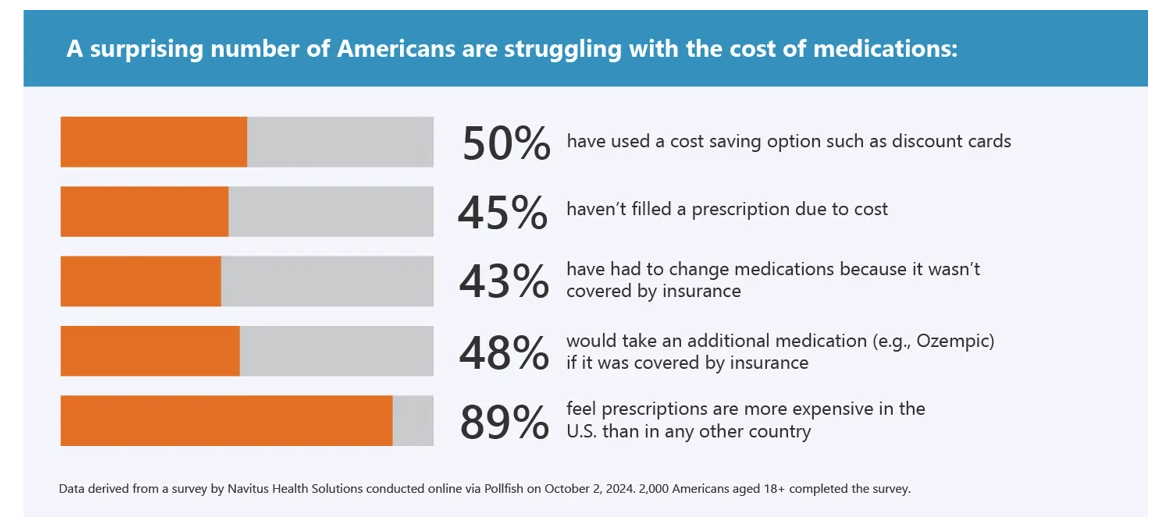

What Stays True for U.S. Health Care Post #Election2024 (1) – Consumers’ Dissatisfaction with Drug Prices

For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem. In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification. Let’s set the context with data from a recently-published

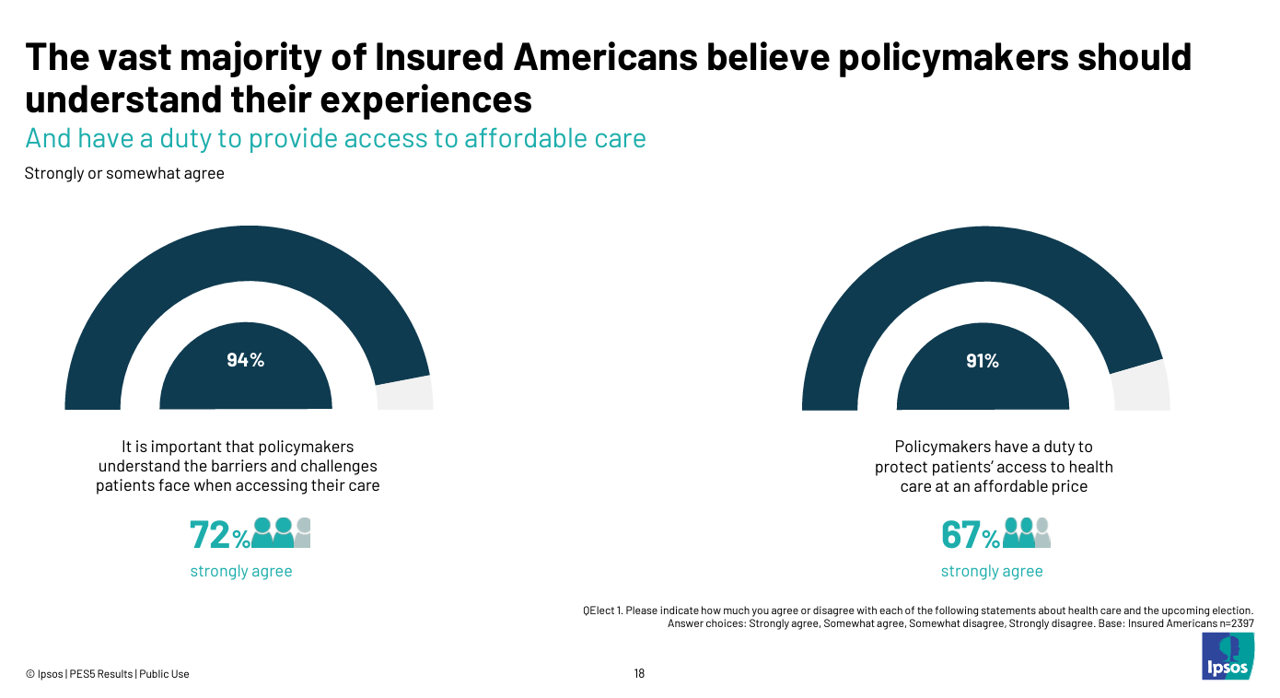

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

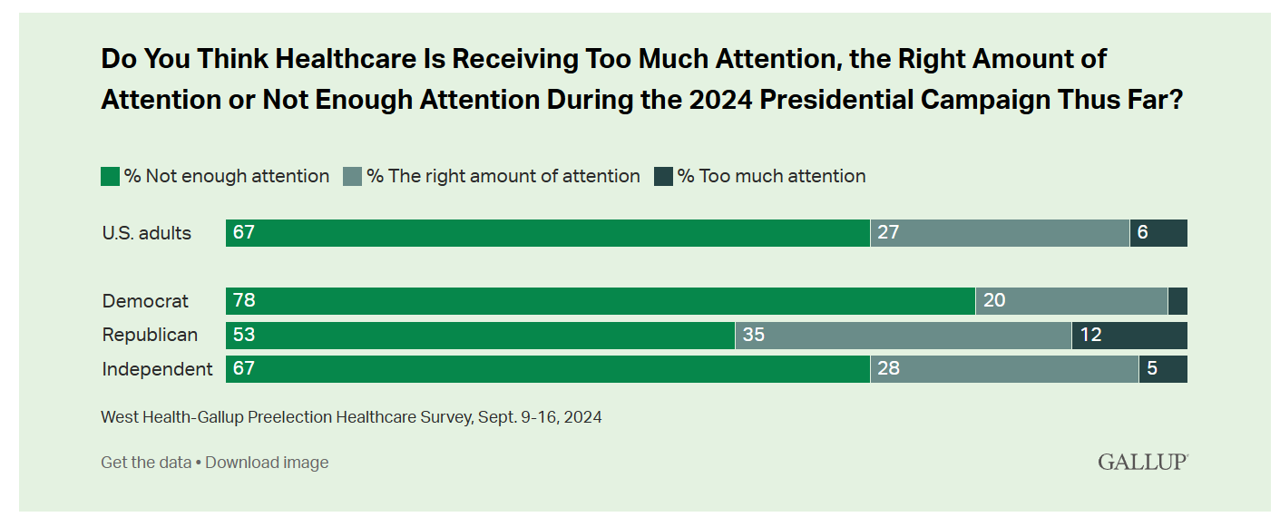

Americans Want More Health Care Issues Baked into the 2024 Elections – Gallup

Beyond women’s health and abortion politics, most Americans are looking for more health care baked into the 2024 Elections, based on a new poll from Gallup in collaboration with West Health. Two in three U.S. adults thought health care was not receiving enough attention during the 2024 Presidential campaign as of September 2024. This is a majority shared opinion for voters across the three party IDs in the U.S., shown in the first bar graph. The research polled 3,660 U.S. adults in September, about two-thirds before the presidential debate held September 10, and about one-third

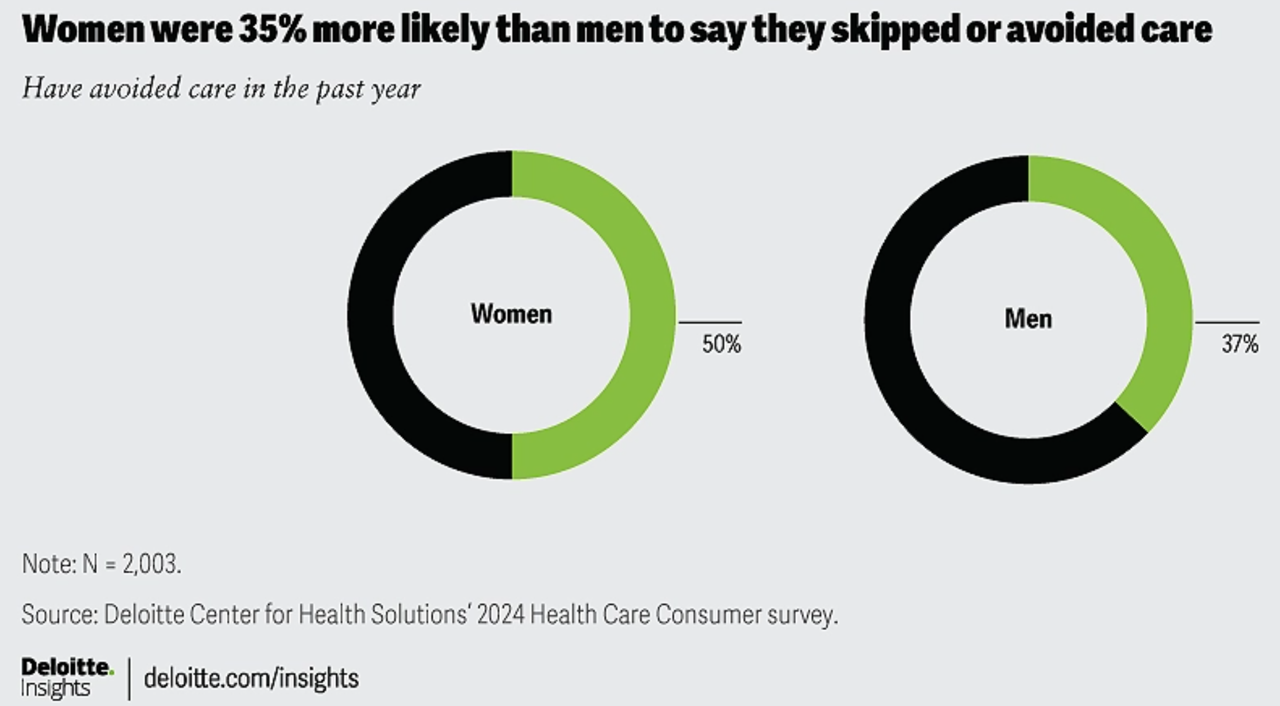

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

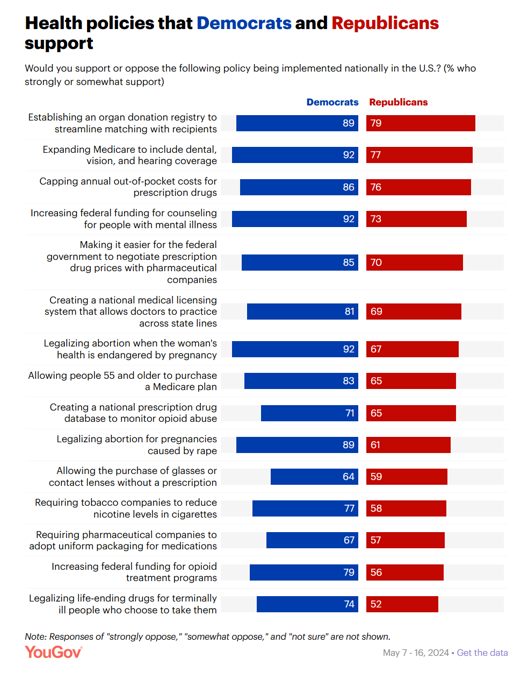

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

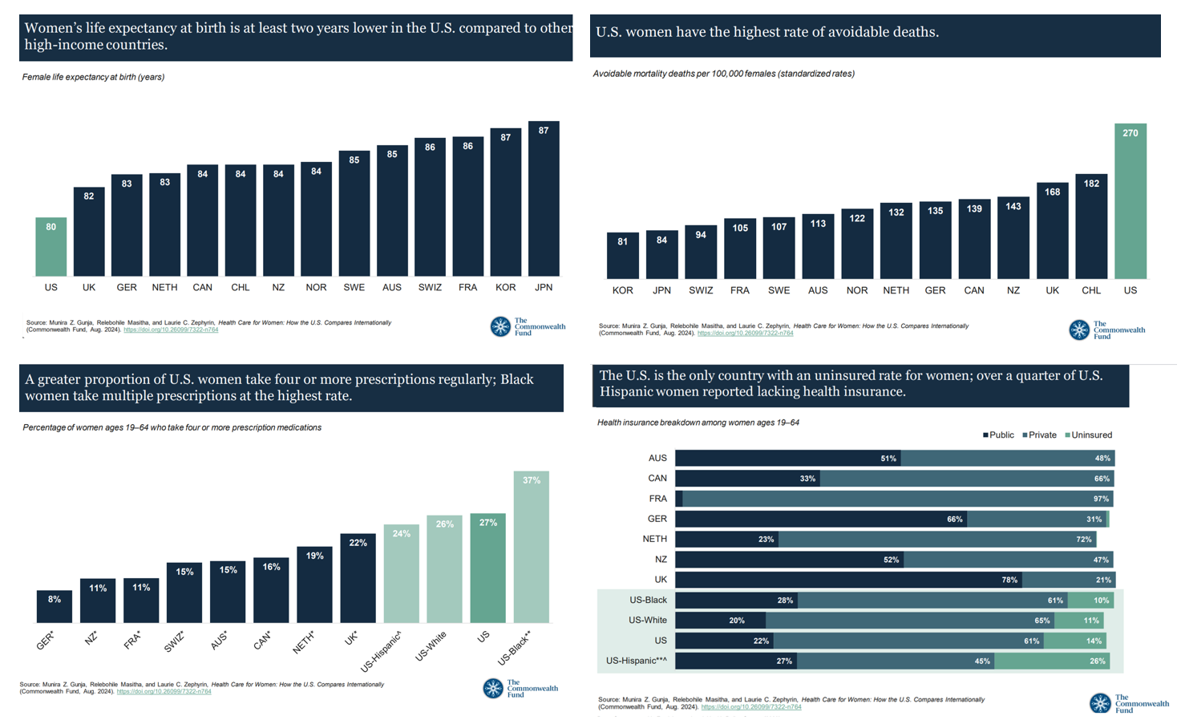

Women’s Health Outcomes in the U.S.: Spending More, Getting (Way) Less – 4 Charts from The Commonwealth Fund

Women in the U.S. have lower life expectancy, greater risks of heart disease, and more likely to face medical bills and self-rationing due to costs, we learn in the latest look into Health Care for Women: How the U.S. Compares Internationally from The Commonwealth Fund. The Fund identified four key conclusions in this global study: Mortality, shown in the first chart which illustrates women in the U.S. having the lowest life expectancy of 80 years versus women in other high-income countries; Health status, with women in the U.S. more likely to consume multiple prescription

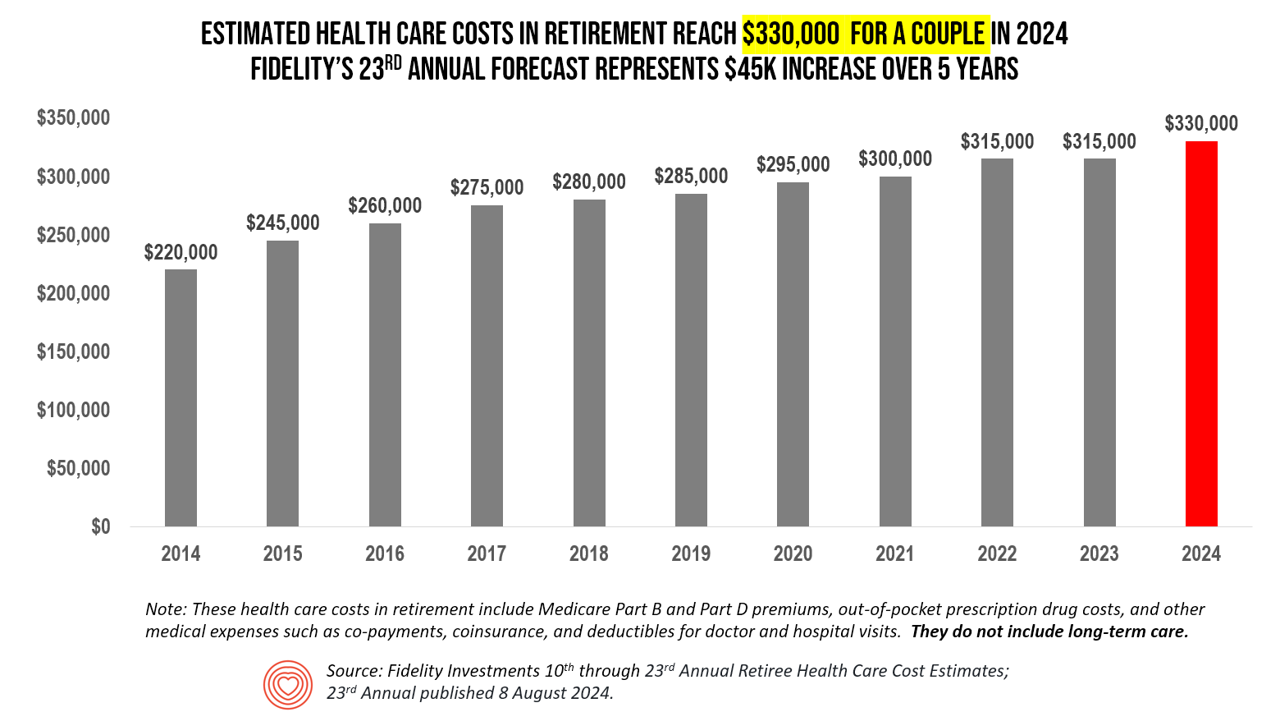

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

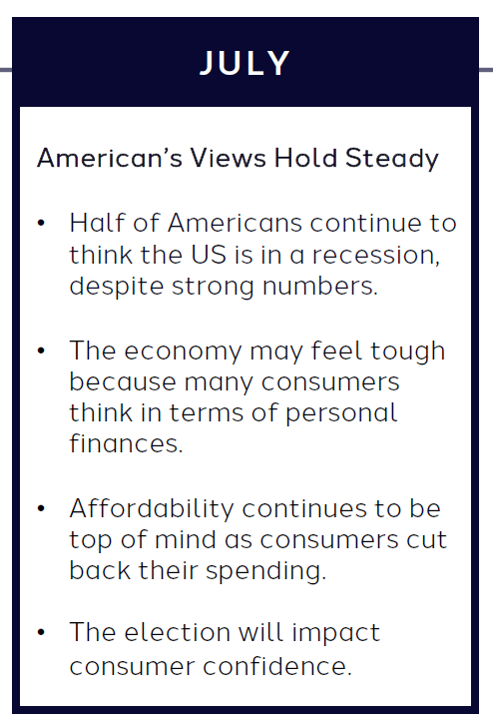

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

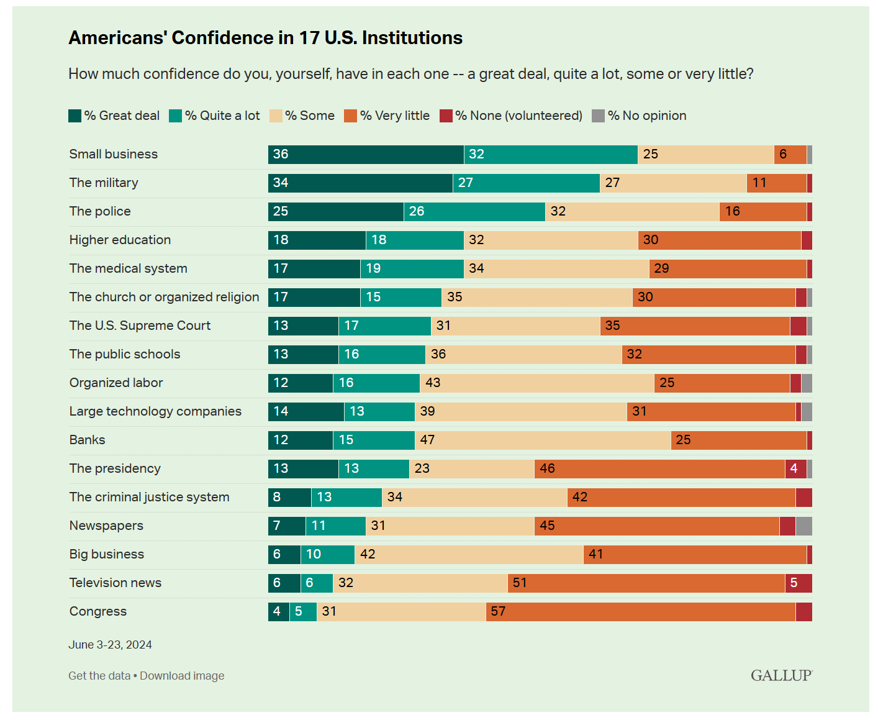

Trust in Institutions Among Americans: Small Biz, the Military and Police More than the Medical System

Two-thirds of Americans have a lot of confidence in small business in the U.S. In second place, 61% of people in the U.S. have confidence in the military, followed by 51% with the police. The Gallup Poll on Americans’ confidence in 17 U.S. institutions is out today, reflecting a snapshot of U.S. adults’ views on the organizations that touch their daily lives. And health care doesn’t fare too well in this latest read. Only 36% of Americans have confidence in the U.S. medical system, tied with peoples’ feelings of lack of confidence

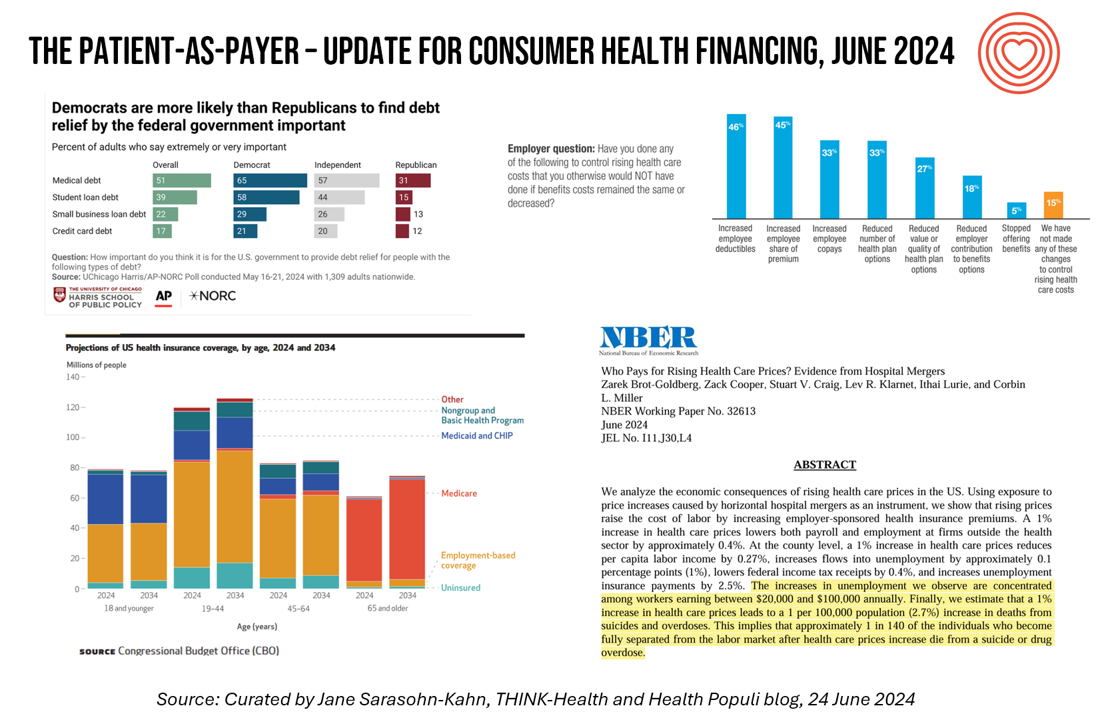

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

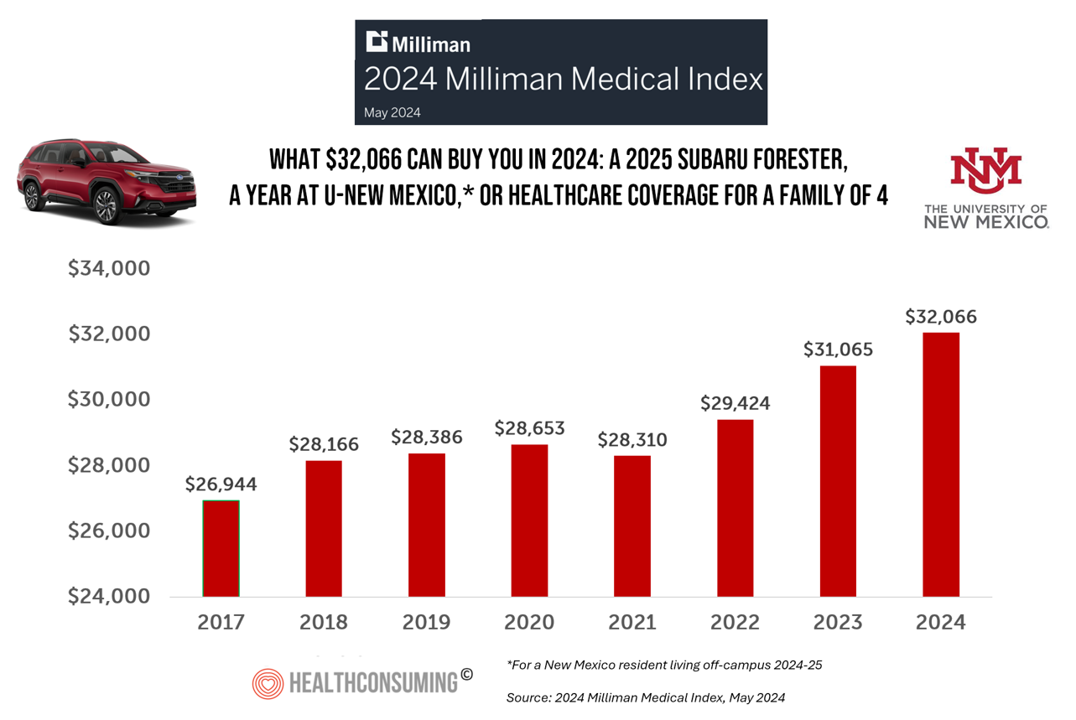

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

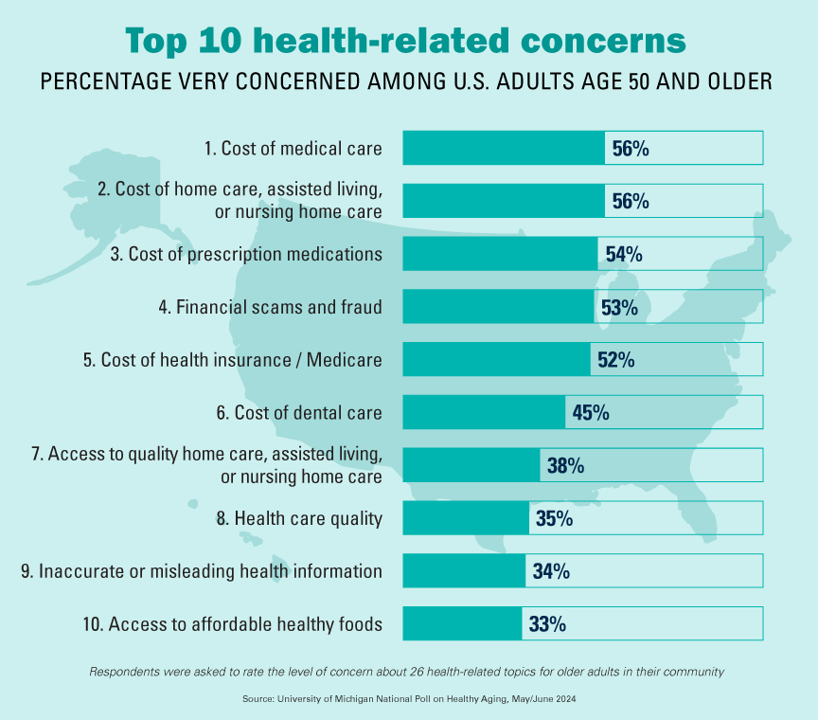

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

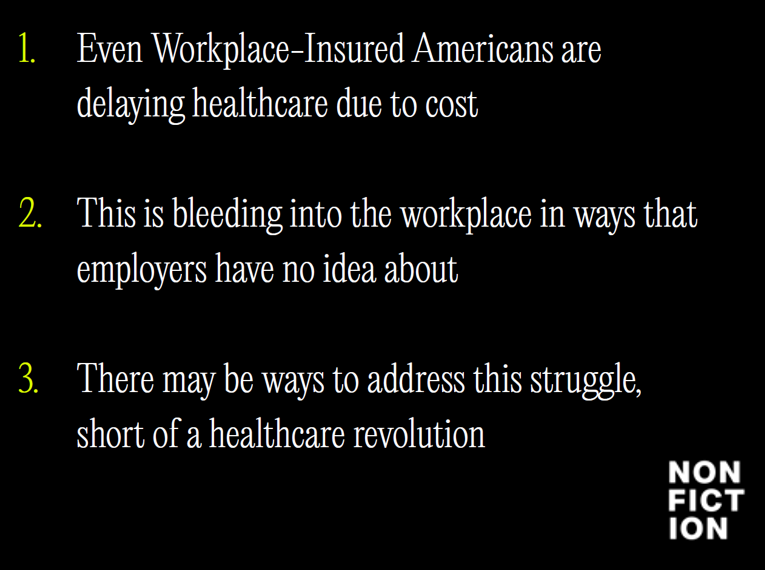

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

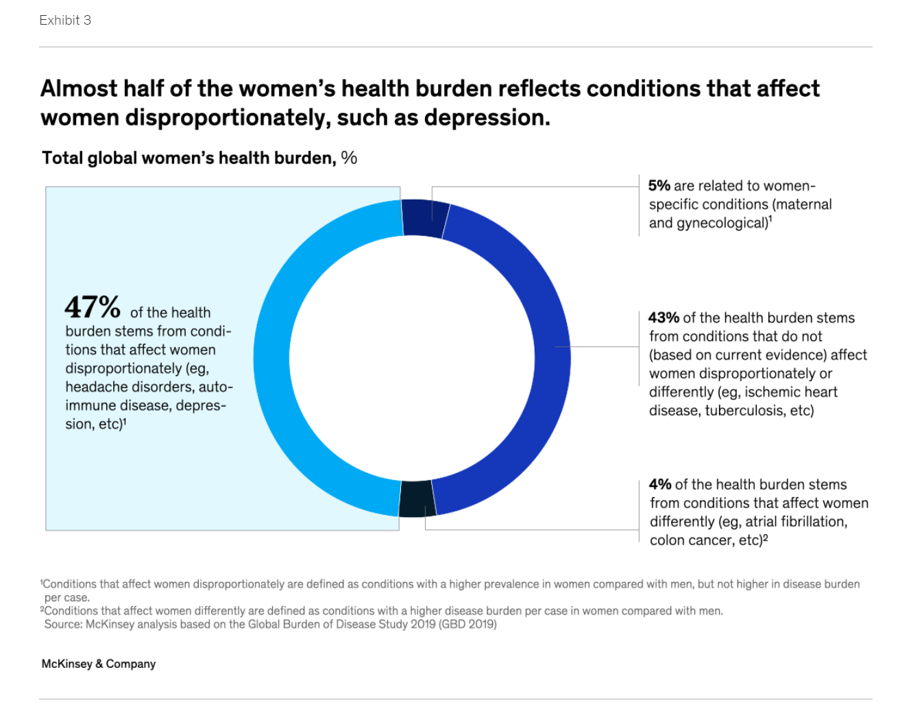

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

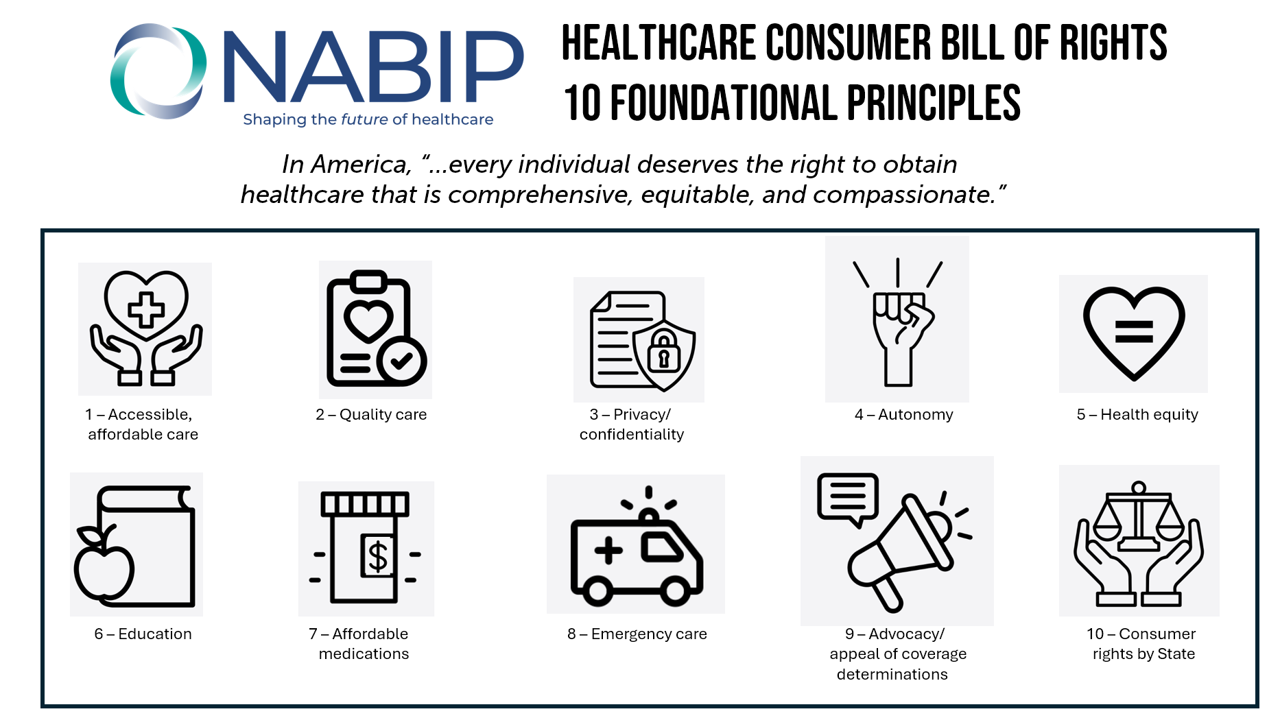

A Health Consumer Bill of Rights: Assuring Affordability, Access, Autonomy, and Equity

Let’s put “health” back into the U.S. health care system. That’s the mantra coming out of this week’s annual Capitol Conference convened by the National Association of Benefits and Insurance Professionals (NABIP). (FYI you might know of NABIP by its former acronym, NAHU, the National Association of Health Underwriters). NABIP, whose members represent professionals in the health insurance benefits industry, drafted and adopted a new American Healthcare Consumer Bill of Rights launched at the meeting. While the digital health stakeholder community is convening this week at VIVE in Los Angeles to share innovations in health tech, NABIP

Americans Come Together in Worries About Medical Bills, the Cost of Health Care, and Prescription Drug Costs

In the U.S., national news media, Federal statistics, dozens of business leaders and the Federal Reserve Bank have been talking about an historically positive American economy on a macro level. But among individual residents of the U.S., there is still a negative feeling about the economy in a personal context, revealed in the Kaiser Family Foundation Health Tracking Poll for February 2024. I’ve selected three figures of data from the KFF’s Poll which make the point that in peoples’ negative feelings about the national economy, their personal feelings about medical costs rank high

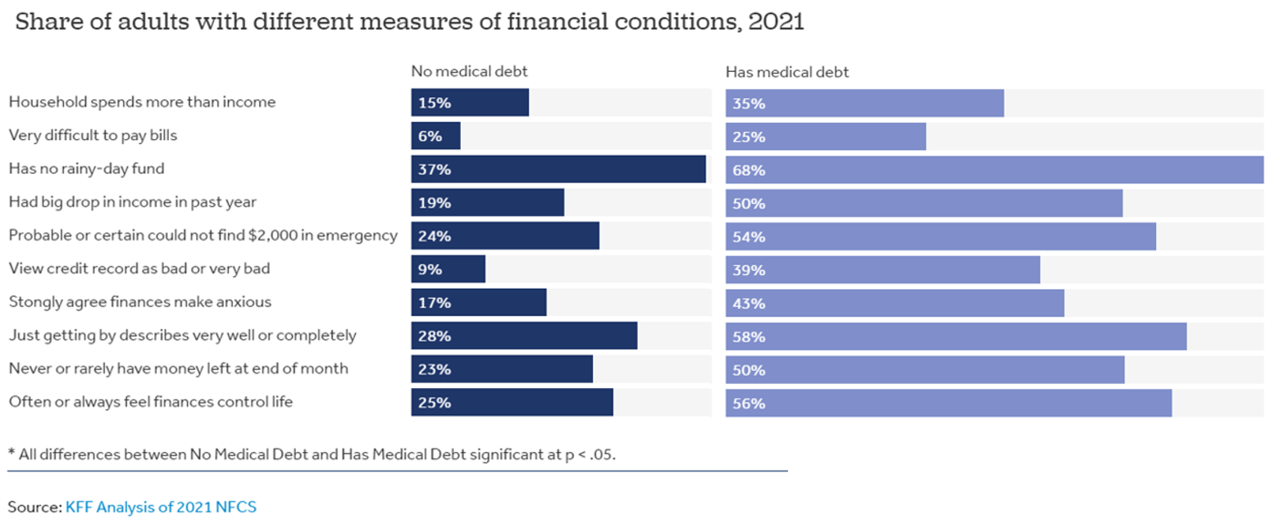

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

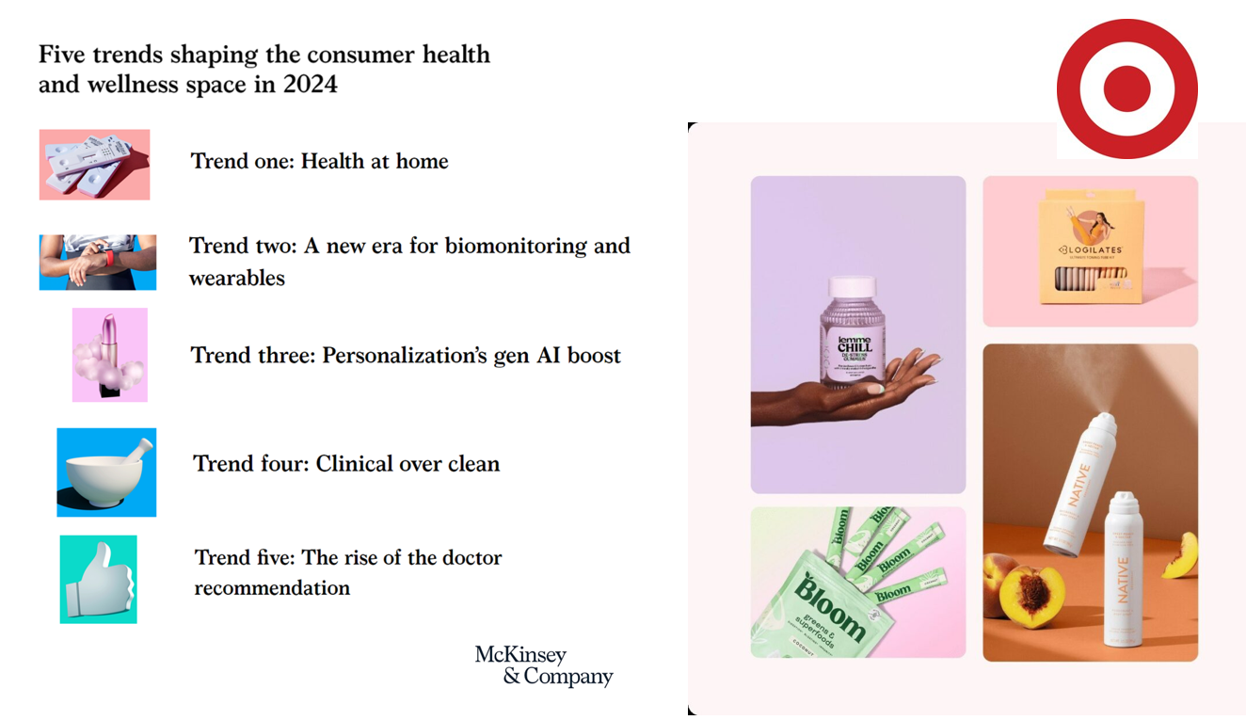

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

Thanks to Jennifer Castenson for

Thanks to Jennifer Castenson for  Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.

Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.  I'm grateful to be part of the Duke Corporate Education faculty, sharing perspectives on the future of health care with health and life science companies. Once again, I'll be brainstorming the future of health care with a cohort of executives working in a global pharmaceutical company.

I'm grateful to be part of the Duke Corporate Education faculty, sharing perspectives on the future of health care with health and life science companies. Once again, I'll be brainstorming the future of health care with a cohort of executives working in a global pharmaceutical company.