Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job.

Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of the pandemic.

The “Dilemma” to which GWI refers is the yin/yang of poor health outcomes and inequalities vis-a-vis health consumers adopting smartwatches and health apps, consuming plant-based diets, and acknowledging anxiety, stress, and depression.

Start with the health/wealth chasm.

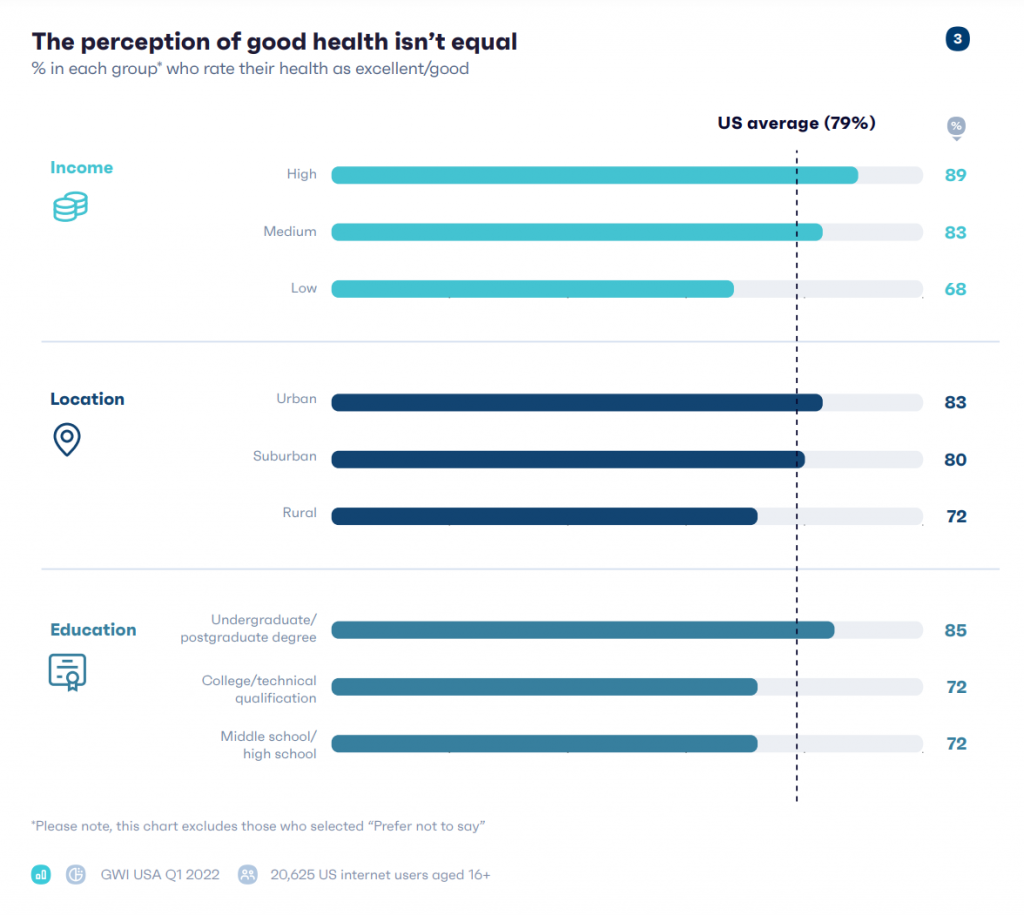

If you earn more money, live in urban or suburban communities, and have a college education, you are more likely to say you’re in good health.

The bar chart illustrates the less positive health perspectives felt among between people earning lower incomes, living in rural areas, and achieving lower levels of education.

Not only is the perception of good health not equal, but “healthcare isn’t accessible for everyone” in GWI’s words.

Low-income households were more likely to say they have had long-term conditions such as backache and pain, depression, and high blood pressure, and in the shorter-term, anxiety or insomnia.

Lower income earners face an “uphill battle” when it comes to their mental health, GWI found. Furthermore, rural Americans were 1.5 times more likely to say they have depression, also facing an under-supply of mental health providers.

People in lower-income households were also more likely to say they regularly suffer from anxiety versus people in higher-income homes.

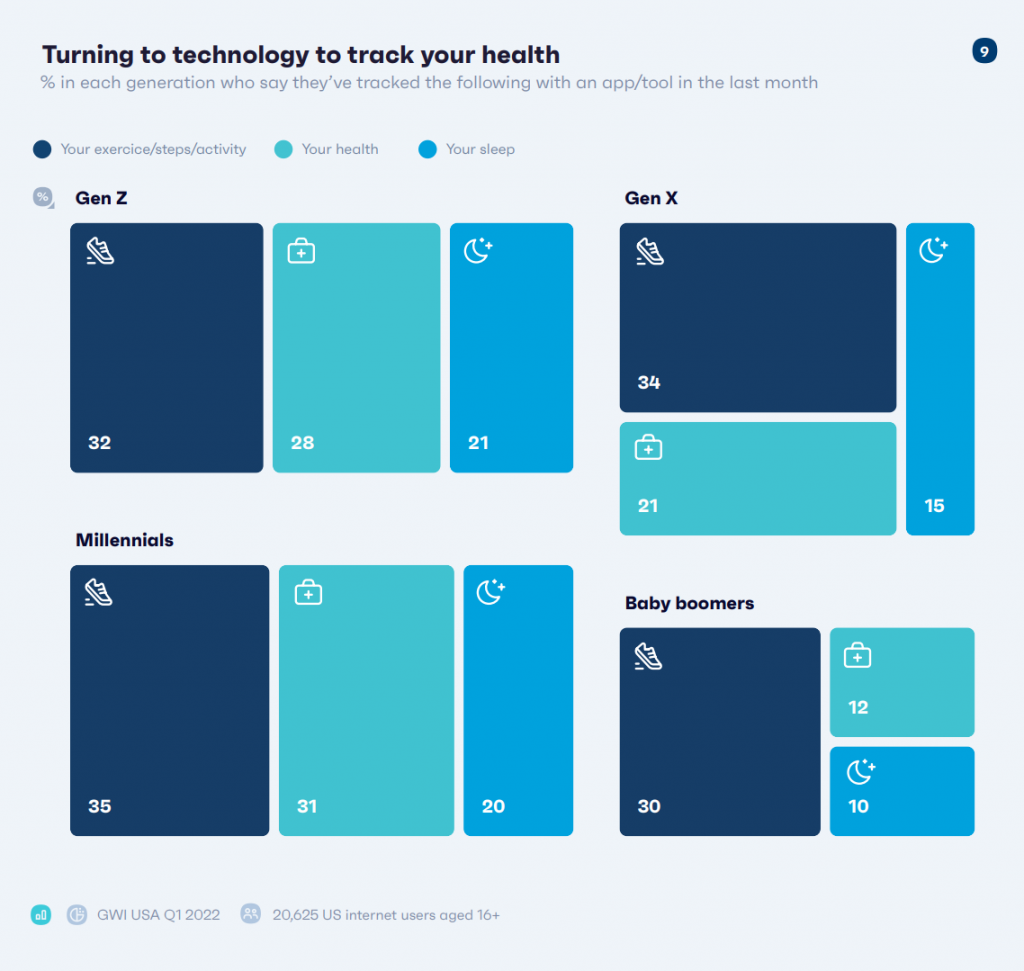

Many patients-as-consumers turned to health online and apps to manage their health during the pandemic, first in lock-down phase and subsequently in medical-distancing mode to avoid physical contact with health care providers in brick-and-mortar settings.

Spending on mental health apps, in particular, spiked up in the COVID-19 pandemic reaching at least $500 million according to Deloitte’s analysis.

Smartwatch purchases grew during the pandemic, too: since the second quarter of 2020, low-income Americans had the fastest growth in smartwatch adoption, with 1 in 5 people now owning a smartwatch — increasing 46% in that relatively short period, GWI calculated.

“While digital health won’t necessarily replace in-person therapy or treatment for many people, it will help make healthcare more readily available to those who need it most,” GWI noted.

Still — “the danger for vulnerable consumers — those with less purchasing power and healthcare access — is that they’re less likely to consult a doctor./healthcare professional or visit a doctor/nurse when they’re feeling unwell,” GWI observed in the report.

Health Populi’s Hot Points: U.S. consumers are currently facing inflation at a 40-year high, discussed here in Health Populi.

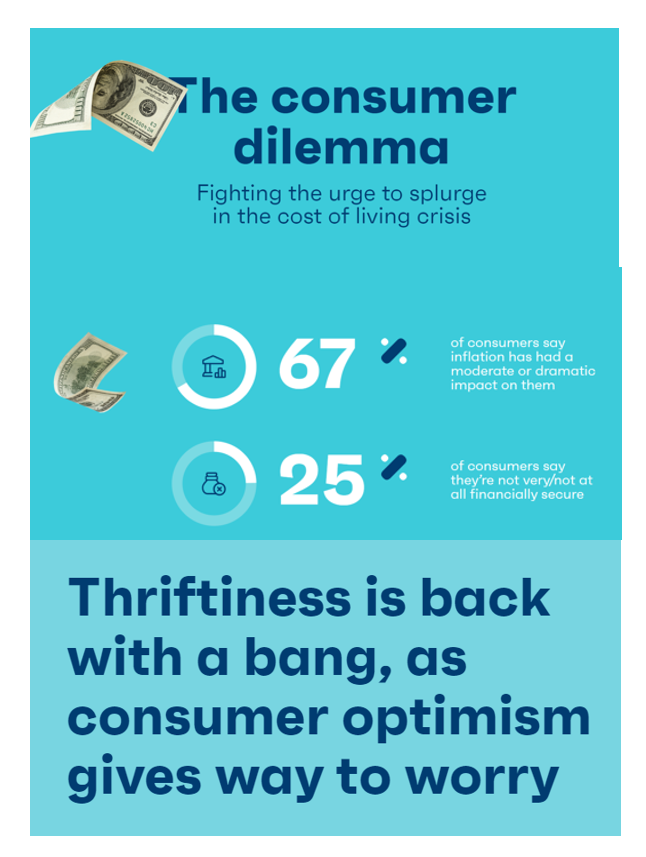

Beyond the specific health care implications of the current environment for inflation and financial stress, GWI explored consumers’ views on their home economics in a macro look at the consumer dilemma, summing up their topline: “Fighting the urge to splurge in the cost of living crisis.”

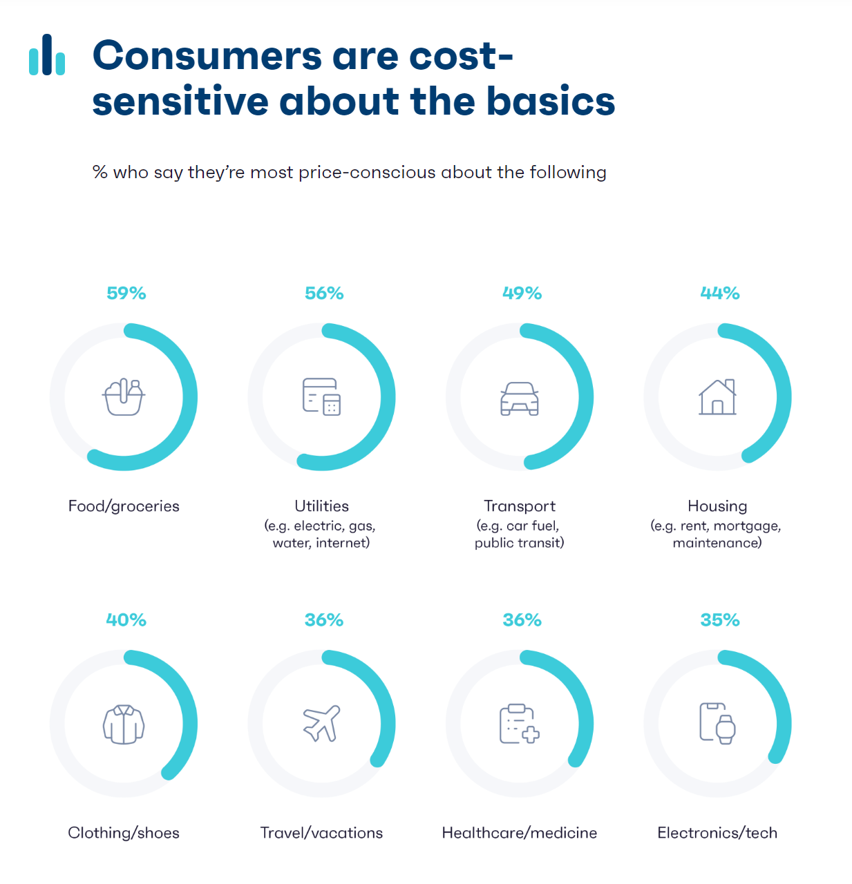

Consumers have grown cost-sensitive about basic needs, led by concerns about:

- Food and groceries, among 59%

- Utilities (electric gas, internet), 56%

- Transport (whether for a personal car or public transportation, 49%)

- Housing (rent or mortgage, 44%)

- Clothing and shoes, 40%

- Travel/vacations, 36%

- Healthcare and medicine, 36%, and

- Electronics/tech, 35%.

So, “thriftiness is back with a bang, as consumer optimism gives way to worry,” GWI calls out, based on the fact that two-thirds of consumers said inflation has had a moderate or dramatic impact on them.

With one-in-three consumers saying, in the previous multi-circle graphic, that health consumers have grown price-sensitive to healthcare and medicine costs, we can expect people turning to cost-saving tactics for their health care decisions and spending in 2022 and 2023 (when a recession in the U.S. is seen as likely among a growing consensus of economists).

Health consumers’ cost-saving tactics can take several forms, such as:

- Cutting spending on prescription drugs, whether by abandoning a prescription, cutting pills, or seeking alternatives through over-the-counter meds or substitutes like vitamins and supplements or homeopathic remedies

- Seeking patient assistance programs to help discount or otherwise defray the retail-facing cost of care or products

- Avoiding recommended follow-up care such as diagnostic tests and labs, or visits to specialists.

Patients-as-consumers and -payers will also seek out information on prices, quality measures, and access/locations. More of this information was expected to come on-line based on the healthcare price transparency rules that went live on 1 July 2022.

“Determined consumers, especially those with high-deductible health plans, may try to dig in right away and use the data to try comparing what they will have to pay at different hospitals, clinics, or doctor offices for specific services,” Julie Appleby wrote in Kaiser Health News. But it won’t be easy at first for people to find the personal, more granular pricing information for their own health plan or personal cost for, say, a hospital bed-day for a heart failure admission, or physician visit to follow up a chronic care encounter to manage Type 2 diabetes.

What will “thriftiness” look like and translate into for a health consumer-as-payer? Value will be in the eye of that beholder. What we know-we-know is that peoples’ home economics is re-shaping their personal health economics for the immediate to medium term. And that will have impacts on health consumer behaviors coming out of the economic downturn, as well.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...