Increasingly, people are engaging more in health care decision making due to many factors impacting their personal medical choices — from the cost and access to health insurance to co-payments for prescription drugs and the supply of primary care doctors, more patients developed and exercised their health consumer muscles in 2025,

For 2026, the health consumer muscle-building will grow as people will be re-shaped by macro market factors we are currently gleaning from forecasts looking into the new year: for personal finances, social issues, technology adoption, views on AI and privacy, and other issues. Here are some data points to keep in mind for health care planning in 2026, especially relevant for the CES 2026 being held in Las Vegas 6-9th January 2026. I’ll be there for an entire week of meetings and conversations, so now in prep-mode, sharing my pre-conference thoughts with you here on Health Populi. [For my preview on all-things-health/care at #CES2026, here’s your link to learn about our journeys to our personal health operating systems, CES-tech-enabled].

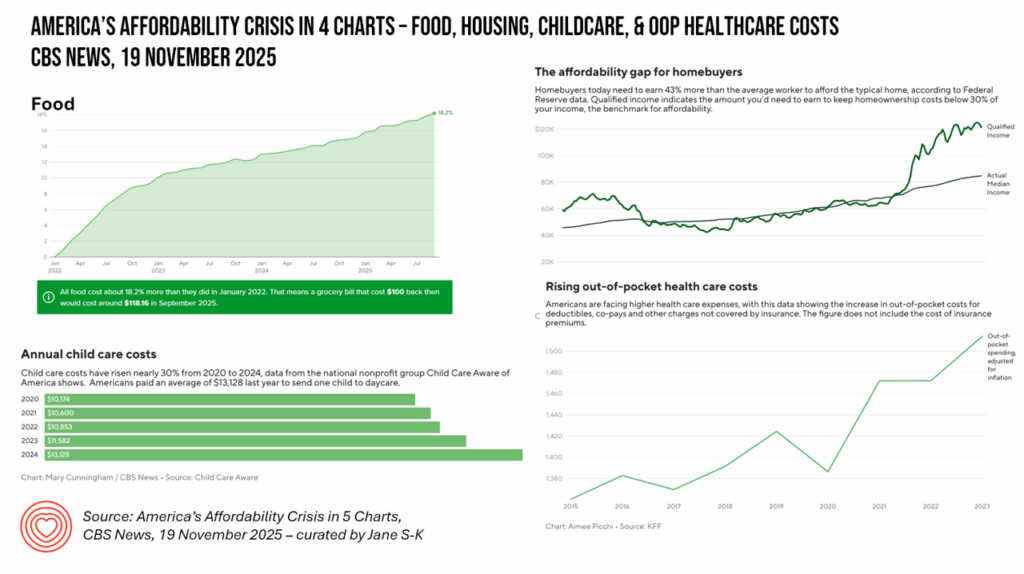

As we’re talking about “consumers,” we’ll start with peoples’ sense of financial health and home finances. “Affordability” is the watchword for both consumer goods and medical spending: whether we consider the cost of food at the grocery store, the cost of housing, the cost of childcare, or rising out-of-pocket medical costs, every patient is now dealing with personal or family-focused health care financing. I assembled this chart from four different data points published in November via CBS News.

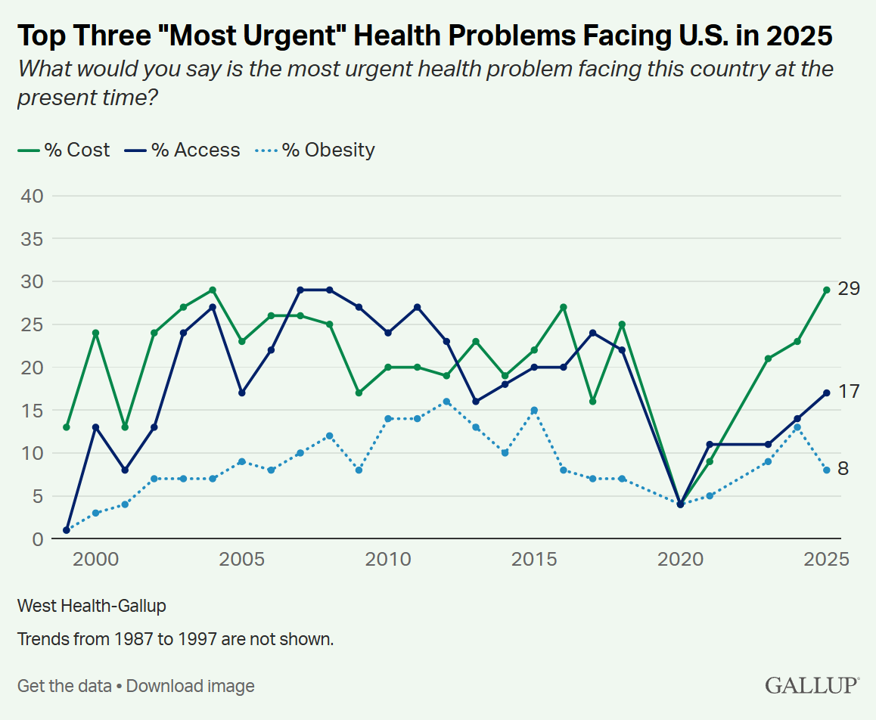

The Gallup Poll and West Health zeroed in on how health care costs fit in the affordability equation for mainstream Americans, shown in the line chart, We see hockey-stick growth in Americans’ perceptions of cost being the most urgent health problem facing the U.S. in 2025m following by increasing concerns for access.

Obesity? A drop in the proportion of U.S. health consumers’ worries, possibly owing to confidence in the roll of GLP-1 medicines having had a positive impact this year, actually lowering the rate of obesity in America.

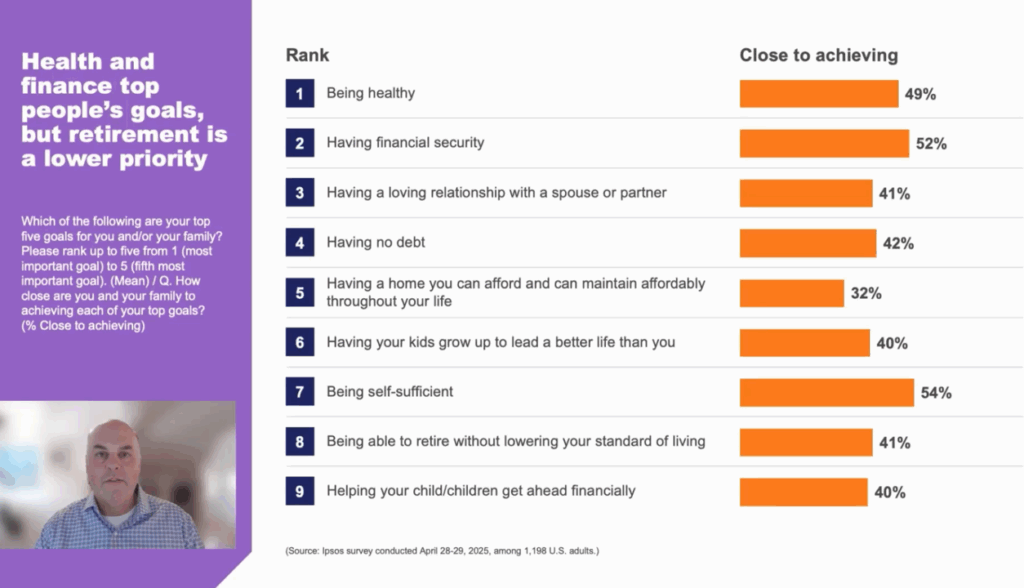

As people feel financially frustrated in their home economies, they also rank being healthy and having financial security as their top-two goals, Ipsos’s research recently revealed in the What the Future: American Dream survey. Importantly, “being self-sufficient” also registered in peoples’ top-nine priorities, which is a theme emerging strongly for self-care.

Amid economic uncertainty, as consumers in general feel the financial pinch of inflation in their wallets, their general shopping behaviors are shifting toward value, convenience, and wellness, Circana’s retail shopping data in the 2025 Consumer Pulse study revealed.

Wellness and self-care embed the Euromonitor International top global consumer trends for 2026, especially when exploring the phenomena of Comfort Zone and Rewired Wellness.

Comfort Zone addressed, “Personal safeguards….the new escapism in today’s volatile world,” in the definition divined by the Euromonitor team. “Consumers are carving out calmer, balanced and values-aligned lives to cope with seemingly perpetual chaos.”

This motivates companies to focus on holistic wellbeing, easy-to-use enchantingly designed services and products, and strategies to help people find harmony and havens at home.

Rewired Wellness has a focus on, “clinical-level, high-tech solutions as everyday wellness tools. Traditional routines are traded in for advanced therapies and precision products,” Euromonitor advises.

The company sees that brands will act as “copilots” in peoples’ ongoing personal health journeys. Here, “science meets self-care,” Euromonitor foresees.

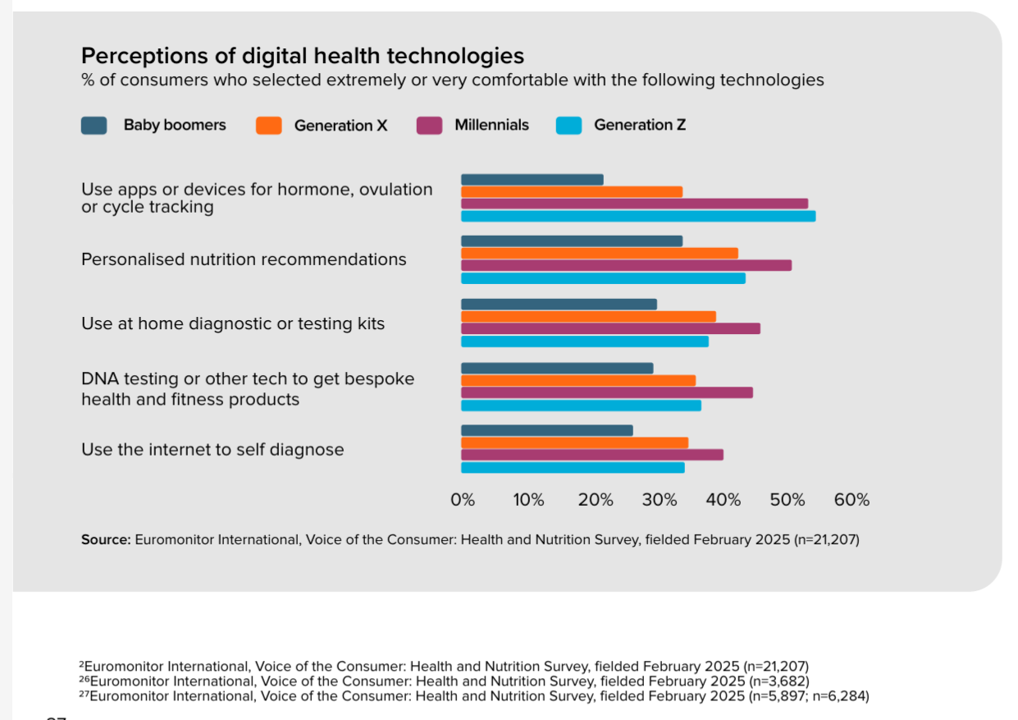

The study looked into global consumers’ perceptions of digital health technologies, the results shown here by four generations. There is majority demand among Millennials and Gen Z consumers for tracking and personal nutrition, and openness among Boomers for personalized nutrition, at-home diagnostics, DNA testing for bespoke health products, among over one-third of older people studied.

There are some important futures-health pearls in PwC’s report on The consumer-firsts era of health.

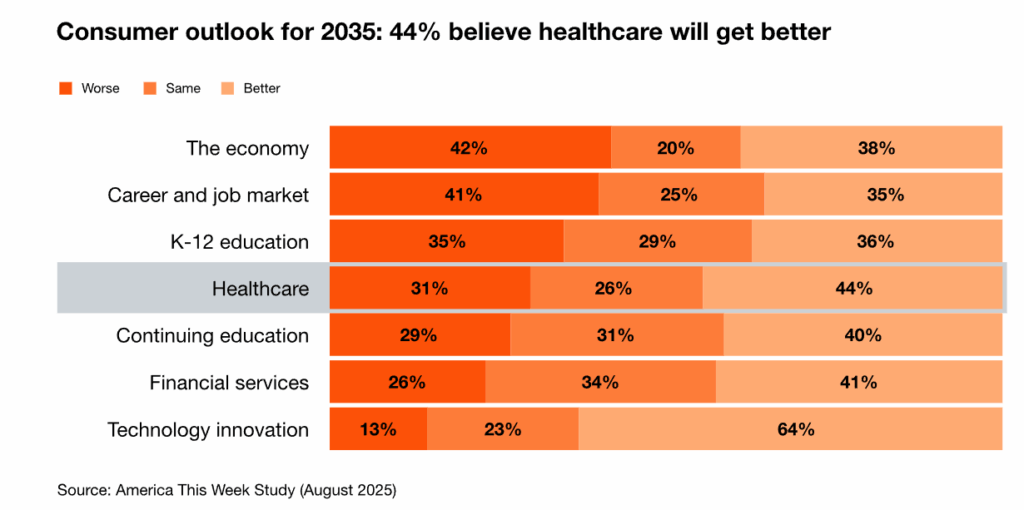

In looking to the future, PwC found that 44% of U.S. consumers believe that health care will “get better” by 2035.

Only technology innovation trumps health care improving, with 64% of American consumers anticipating that tech innovation will be better for 2035.

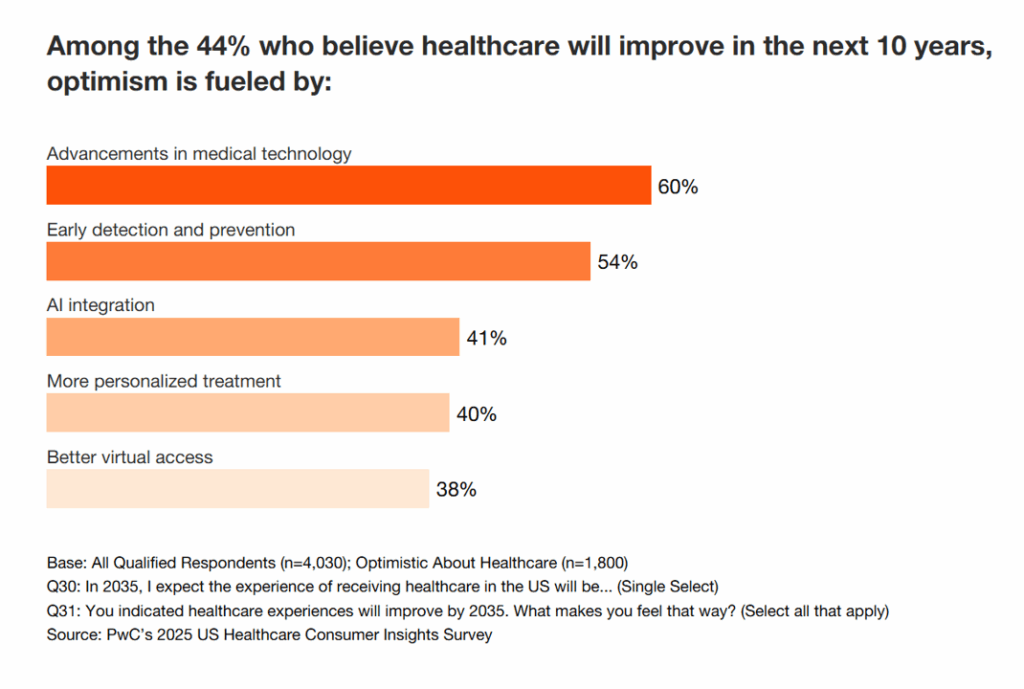

It makes sense then to see what underlies the optimism those 44% of U.S. consumers feel about health care improving by 2035 — led by advancements in medical technology (felt by 60% of people) and 54% citing early detection and prevention.

Here, AI integration, personalized treatment, and improved virtual access (e.g., telehealth) were noted by 3 in 5 consumers as enablers for improving health care by 2035.

Self-care and self-agency come through Ipsos’s What the Future-Wellness research.

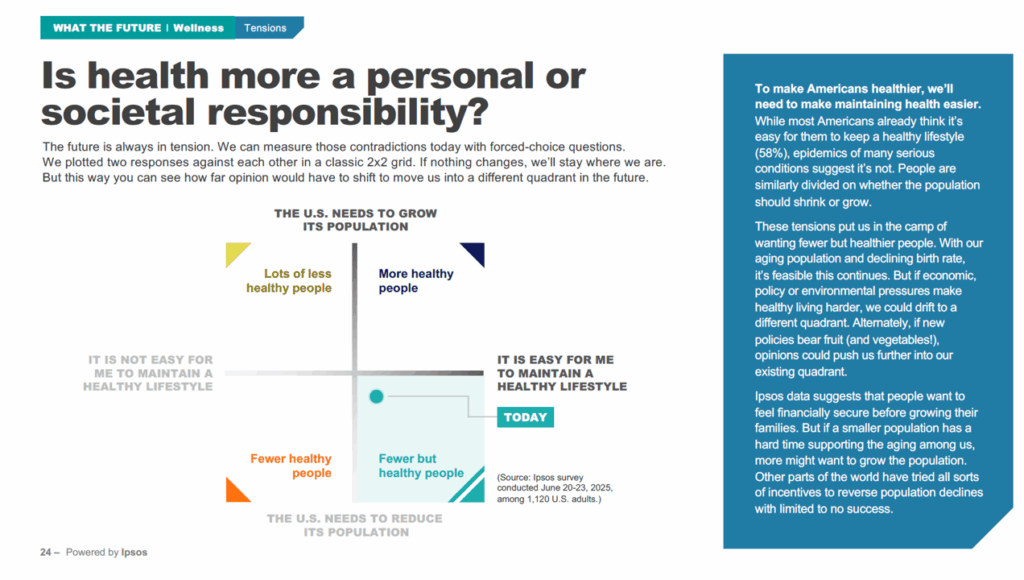

The four-quadrant matrix shown here explores the question of whether health is more a personal or societal responsibility. (This construct is similar to my recent scenario planning work discussed here in Health Populi).

Here, Ipsos arrays the x- and y-axes for tensions of population growth versus ease of maintaining a healthy lifestyle. “These tensions put us in the camp of wanting fewer but healthier people,” Ipsos’s commentary explains — based on the aging population and declining birth rate in the U.S. “If economic policy, or environmental pressures make healthy living harder, we could drift to a different quadrant,” Ipsos soberly warns.

This post outlines some key data and frameworks for us to consider as we explore the opportunities that innovative technologies offer us to improve health, equity, access, social cohesion, and other good things in 2026. The CES track of discussions led by the CTA Foundation and other collaborations will speak to these challenges and goals.

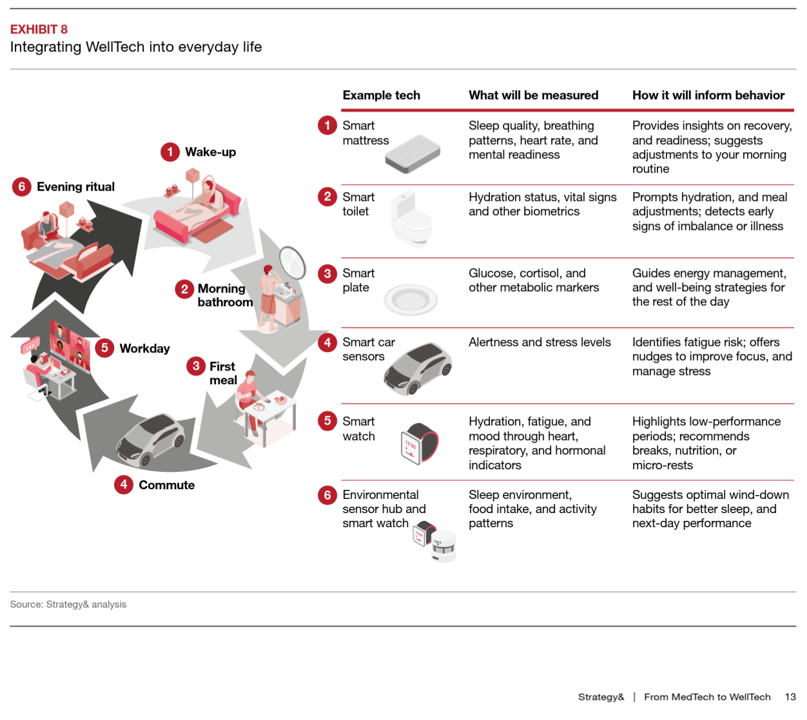

I’ll conclude with this graphic from a recent Strategy& report, From MedTech to WellTech. Here, the PwC embedded firm looks at the sick care system in contrast to a well care system, driven by several factors including, technological advancements, cultural shifts toward wellness, consumerization and patient empowerment, care beyond traditional settings, and value-based care payment regimes.

The graphic speaks to how “WellTech” can integrated into everyday life. The spokes around the 24×7 human life hub reflect the categories of technologies I’ll be exploring at #CES2026, from bedroom to bathroom to kitchen, as well as the car as platform for wellbeing. Please get in touch if you’ll be at CES in Vegas the week of 5th January and we’ll brainstorm what we’re seeing and learning about making healthcare better for all…..with the benefit of innovative technologies.

I'm once again pretty gobsmackingly happy to have been named a judge for

I'm once again pretty gobsmackingly happy to have been named a judge for  Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during

Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during  Jane collaborated on

Jane collaborated on