Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Retail and work-site clinics – medical homes for younger adults?

The use of retail and work-site health clinics is up, and their consumers skew young. Overall, 27% of all U.S. adults have stepped into a walk-in clinic in the past two years. But only 15% of people 65 and over have used such a clinic. This begs the question: are retail and on-site clinics at the workplace filling the role of medical homes for younger adult Americans? The Harris Interactive/HealthDay poll published in January 2013 discovered that use of retail clinics grew from 7% in 2008 to 27% in 2012. The largest age cohort using walk-in clinics is people between

Cost-conscious health consumers are adopting personal health IT

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012. The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled

People want more control over health care in the midst of rising costs: a tale of two surveys

Two surveys of American consumers point to their growing concern over (1) rising costs and (2) wanting control over their care. More than 1 in 3 U.S. adults put off health care due to costs in the past year, a Gallup poll found. As shown in the graph, this is the highest proportion of people forgoing care due to cost since Gallup began asking the question in 2012. This survey was conducted in November 2012. There are differences between people without insurance and those with commercial or public sector plans such as Medicare and Medicaid. Over one-half of uninsured people

Wired health: living by numbers – a review of the event

Wired magazine, longtime evangelist for all-things-tech, has played a growing role in serving up health-tech content over the past several years, especially through the work of Thomas Goetz. This month, Wired featured an informative section on living by numbers — the theme of a new Wired conference held 15-16 October 2012 in New York City. This feels like the week of digital health on the east coast of the U.S.: several major meetings have convened that highlight the role of technology — especially, the Internet, mobile platforms, and Big Data — on health. Among the meetings were the NYeC Digital Health conference, Digital

Aetna finds consumers aren’t very empowered in health

Americans find health insurance decisions the second most difficult major life decision only behind saving for retirement (36%) and slightly more difficult than purchasing a car (23%), via Aetna’s Empowered Health Index Survey. Why are health insurance choices so tough? Consumers told Aetna that the available information is confusing and complicated (88% percent), there is conflicting information (84%) and it’s difficult to know which plan is right for them (83%). Based on this survey’s findings, millions of Americans indeed feel dis-empowered by health care decision making. Who is empowered? Aetna says the empowered are likely to be more affluent, insured, married, take

Employers grow onsite health clinics, and employer-sponsored telemedicine will grow

With “Zero” large employers expecting to drop health insurance, as reported in the Washington Post, companies are getting creative and innovative about how to manage workers’ health and wellness, while addressing ever-growing costs. One strategy that’s getting more traction is the re-invention of the onsite health center. Towers Watson‘s 2012 Onsite Health Center survey report, finds that one-half of employers view establishing an onsite health center as a linchpin to enhancing productivity and health in the workplace. Following close behind productivity is the onsite health center’s promise of reducing medical costs, improving access to care, and the traditional reason for providing onsite

Wellness takes hold among large employers – and more sticks nudge workers toward health

Employee benefits make up one-third of employers’ investments in workers, and companies are looking for positive ROI on that spend. Health benefits are the largest component of that spending, and are a major cost-management focus. In 2012 and beyond, wellness is taking center stage as part of employers’ total benefits strategies. In the 2012 Wellness & Benefits Administration Benchmarking study, a new report from bswift, a benefits administration company, the vast majority of large employers (defined as those with over 500 workers) are sponsoring wellness programs, extending them to dependents as well as active workers. Increasingly, sticks accompany carrots for

Employees will bear more health costs to 2017 – certainty in an uncertain future

Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making. The 2012 Deloitte Survey of U.S. Employers finds them, mostly, planning to subsidize health benefits for workers over the next few years, while placing greater financial and clinical burdens on the insured and moving more quickly toward high-deductible health plans and consumer-directed plans. In addition, wellness, prevention and targeted population health programs will be adopted by most employers staying in the health care game, shown in

The selling of a health plan, part two

Calling Don Draper, Donny Deutsch, and the spirit of David Ogilvy: the President needs you. The President must sell the Affordable Care Act to the American people now that Justice Roberts wrote the Supreme Court’s historic 5-4 majority opinion supporting the Act, and especially the individual mandate. He argued for the majority that while the mandate is unconstitutional under the Commerce Clause which would “command people to buy insurance,” he said that the mandate is a de facto tax, as people who would choose to opt out of insurance would have an alternative of paying an IRS fine. Senator Eric

The Online Couch: how “safe Skyping” is changing the relationship for patients and therapists

Skype and videoconferencing have surpassed the tipping point of consumer adoption. Grandparents Skype with grandchildren living far, far away. Soldiers converse daily with families from Afghanistan and Iraq war theatres. Workers streamline telecommuting by videoconferencing with colleagues in geographically distributed offices. In the era of DIY’ing all aspects of life, more health citizens are taking to DIY’ing health — and, increasingly, looking beyond physical health for convenient access to mental and behavioral health services. The Online Couch: Mental Health Care on the Web is my latest paper for the California HealthCare Foundation. Among a range of emerging tech-enabled mental health

Health costs will increase in 2013, and employees will bear more: can wellness programs help stem the rise?

Health spending will increase by 7.5% in 2013, with employees’ contributions rising for in-network deductibles, prescription drugs and emergency room visits. 3 in 4 employers, seeking to control rising health expenses, will offer wellness programs, even though a vast majority can’t yet measure an ROI on them. The Health and Well-Being: Touchstone Survey Results from PriceWaterhouseCoopers (PwC). PwC points out that the 7.5% medical cost increase is historically lower than in recent years, as a result of structural changes in the health care market including: A sluggish economy Growing focus on cost containment Lower utilization of health services by patients Employers’ efforts

Trust and authenticity are the enablers of health engagement

Without trust, health consumers won’t engage with organizations who want to cure them, sell to them, promote to them, help them. Here’s what I told a group of pharmaceutical marketers at The DTC Annual Conference in Washington , DC, on April 9, 2010. Let’s start with the World Health Organization’s definition of health: that is, the state of complete physical, mental and social wellbeing, and not just the absence of disease. This definition is being embraced by health citizens long before the silos in the health industry – including pharma – get it. That’s an important mindset to take on as

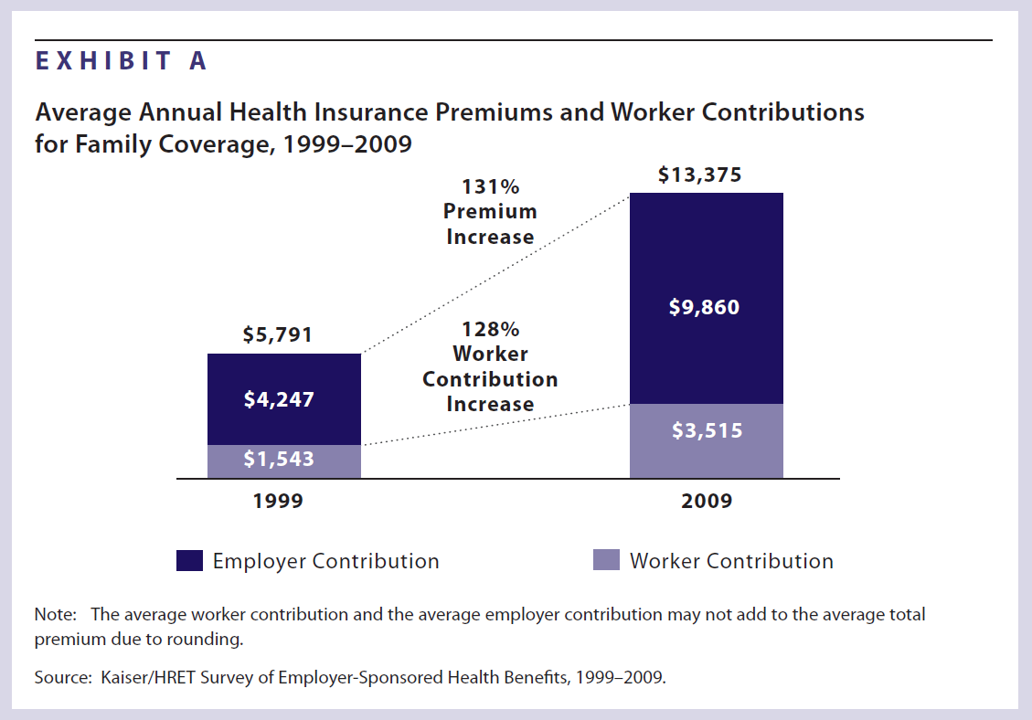

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Steel, Coffee Beans and Health Care

The UAW and GM have been debating health care as Friday’s deadline for their national contract approaches. This round of negotiation is about survival. Yesterday, I covered the rising costs of employer-sponsored health insurance. Today, let’s visit the intimately-related topic of retiree health benefits. These are eroding even faster than health benefits for employed workers. Many employers have significantly scaled back health benefits for retirees. Currently, one in three large employers offers retire benefits, compared with two in three in the late 1980s. Consider the predicament of the company ranked #3 on the 2006 Fortune 500 list, General Motors. Retirees

Thanks to Feedspot for identifying

Thanks to Feedspot for identifying  Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.