Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

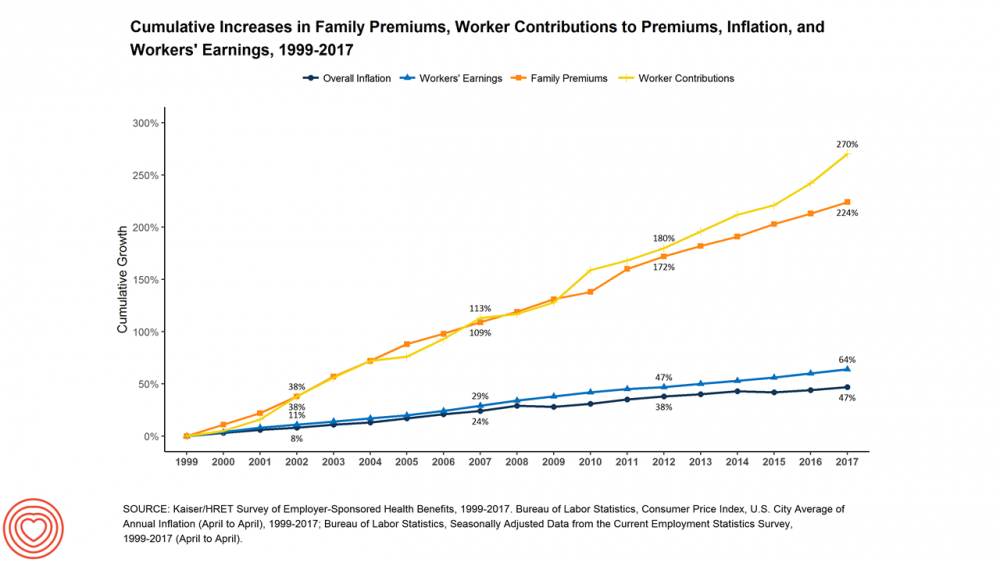

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

Celebrating 10 Years of Health Populi, 10 Healthcare Milestones and Learnings

Happy anniversary to me…well, to the Health Populi blog! It’s ten years this week since I launched this site, to share my (then) 20 years of experience advising health care stakeholders in the U.S. and Europe at the convergence of health, economics, technology, and people. To celebrate the decade’s worth of 1,791 posts here on Health Populi (all written by me in my independent voice), I’ll offer ten health/care milestones that represent key themes covered from early September 2007 through to today… 1. Healthcare is one-fifth of the national U.S. economy, and the top worrisome line item in the American

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

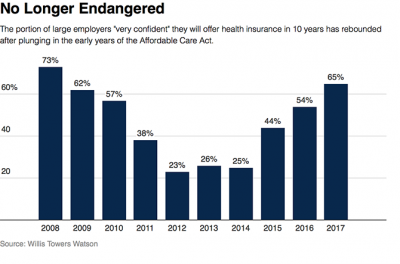

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

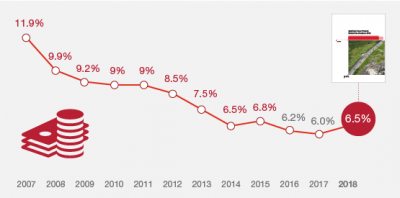

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

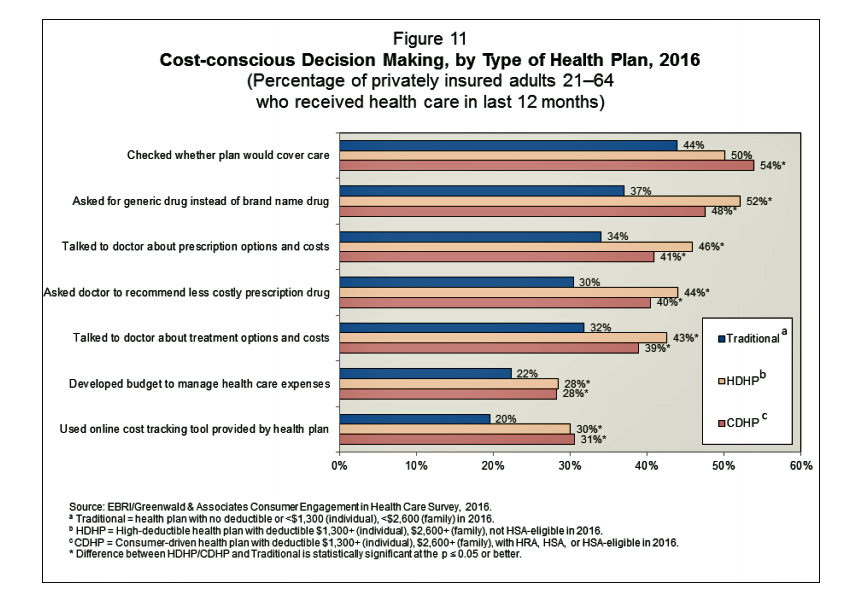

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

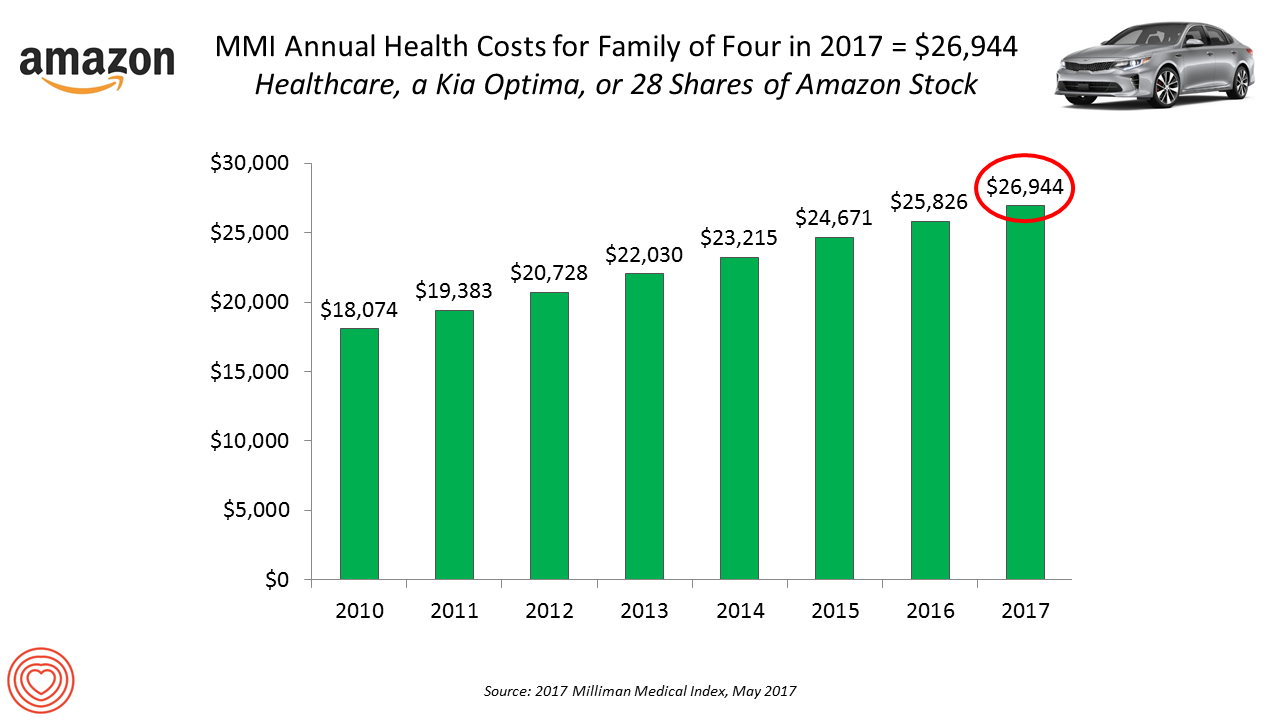

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

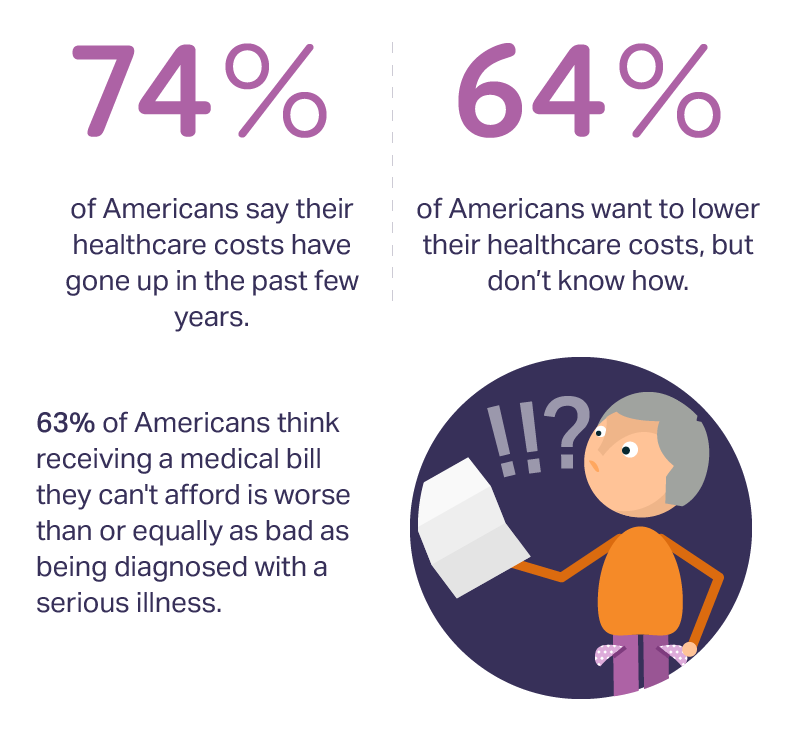

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

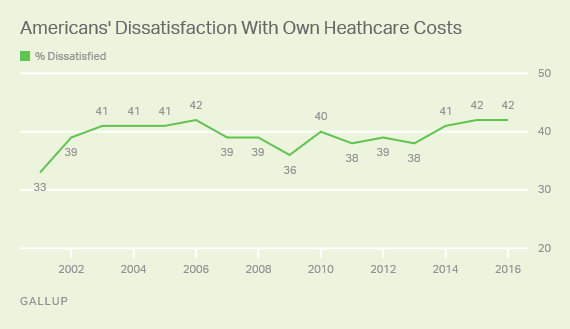

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

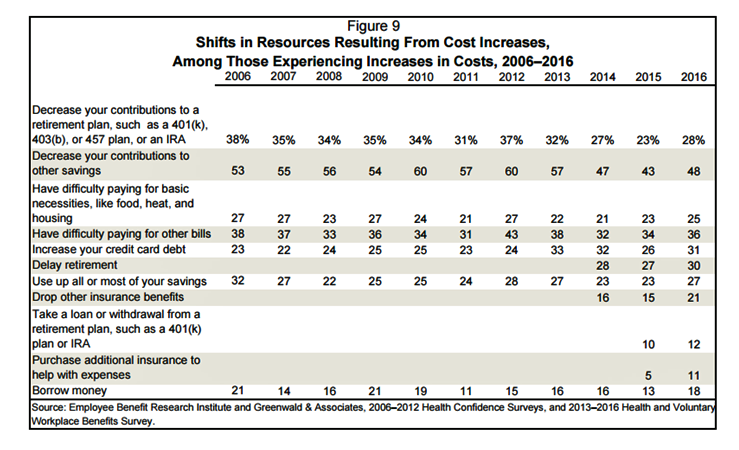

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

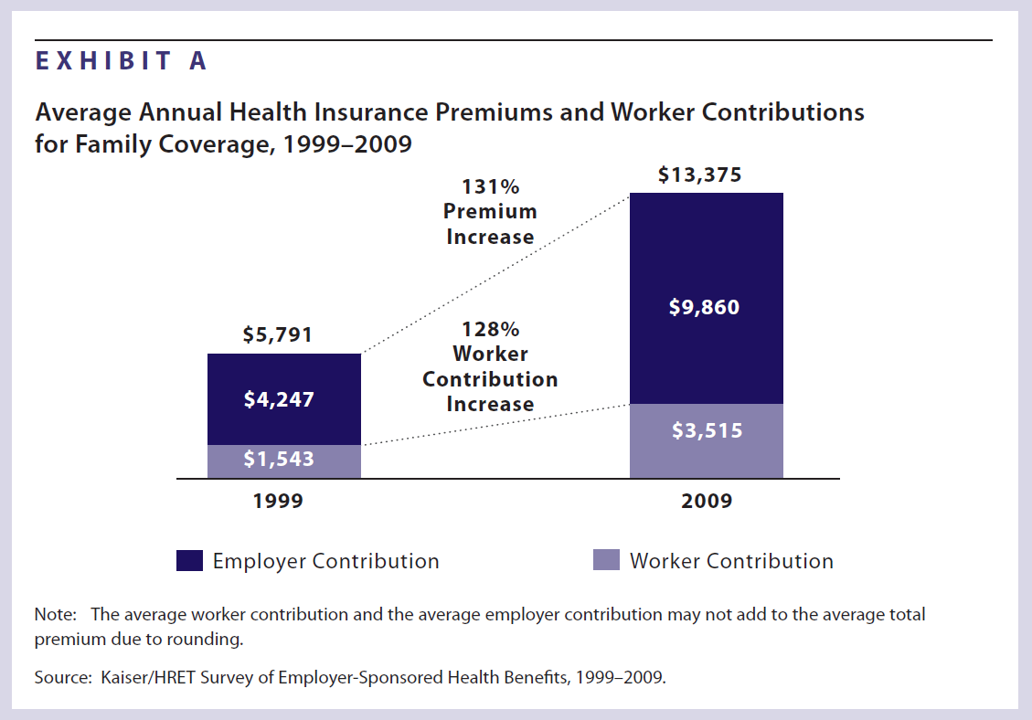

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Thanks to Feedspot for identifying

Thanks to Feedspot for identifying  Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.