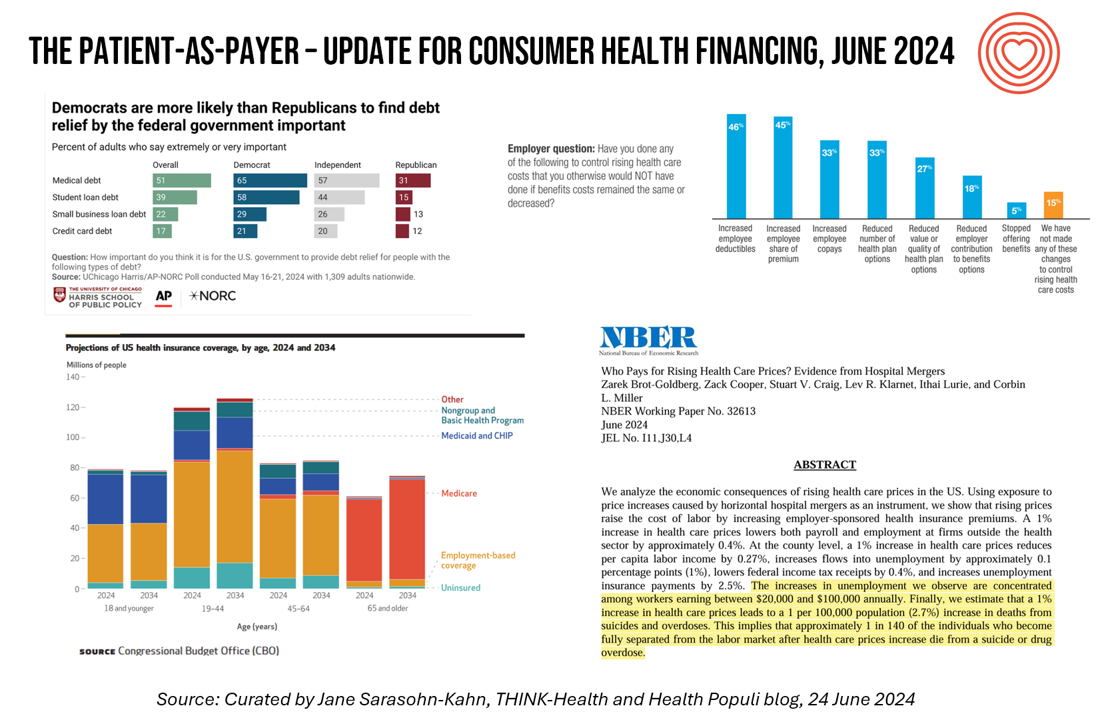

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

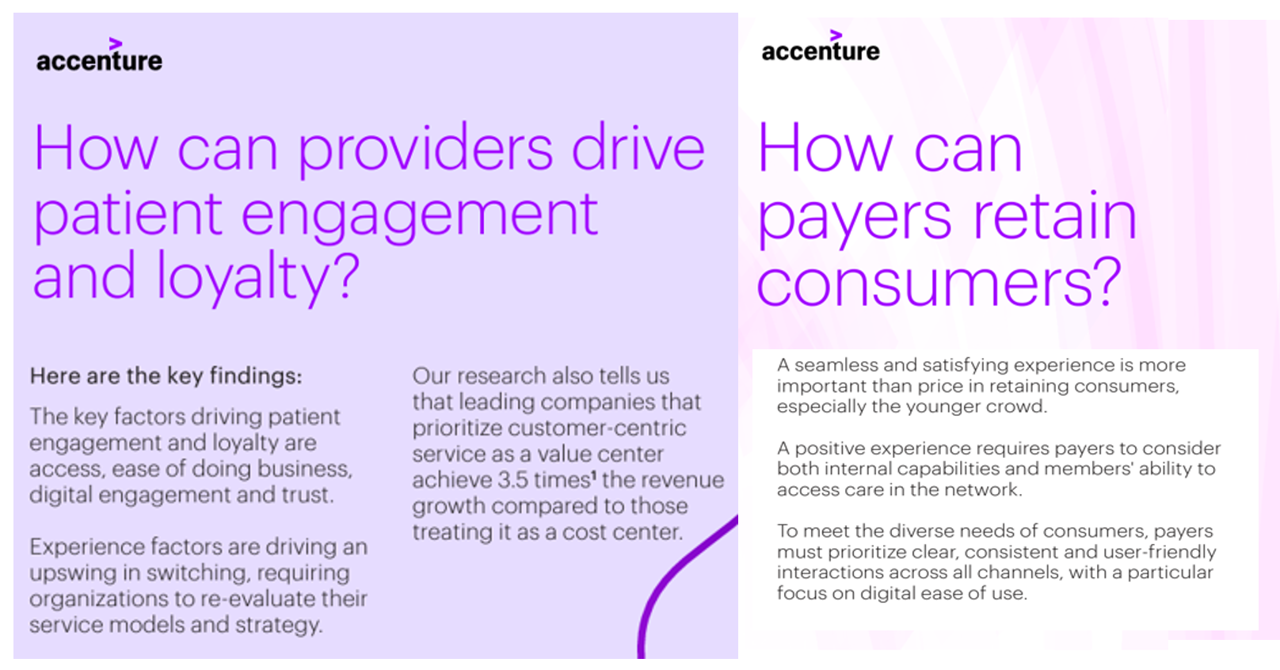

The ROI on Patient Experience = Loyalty, Trust and Revenue – Listening to Accenture

When health care providers and payers make patients’ lives easier, there’s a multiplying factor for loyalty and revenue growth, according to Accenture’s latest look into the value of experience in The Power of Trust: Unlocking patient loyalty in healthcare. Accenture conducted two surveys for this research, assessing nearly 16,000 U.S. adult consumers’ views on healthcare providers and health insurance plans. Several factors underpin patients’ selection of a new health care provider, especially: Access (70%), with a convenient location, quickly available appointments, digital/mobile/social interactions, and virtual care availability; and, The provider being a trusted source

Most Older People Want to Age in Place and Are Adopting Technologies At Home To Do So

The vast majority of older people (95%) want to “age in place” — that is, stay put in their homes and avoid moving into long-term care residences or elsewhere. One approach for enabling aging-in-place is peoples’ adoption of various technologies, a topic surveyed by U.S. News & World Report. In April 2024, U.S. News interviewed 1,500 U.S. adults ages 55 and over on their views toward technology and everyday life at home. The first graphic from U.S. News’ study report, published earlier this month, shows that older people identified six categories of

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

A Springtime Re-Set for Self-Care, From Fitness to Cozy Cardio: Peloton’s Latest Consumer Research

How many people do you know that don’t know their cholesterol or their BMI, their net worth or IQ, their credit score, astrological sign, or ancestry pie-chart? Chances are fewer and fewer as most people have gained access to medical records and lab test results on patient portals, calorie burns on smartwatches, credit scores via monthly credit card payments online, and completing spit tests from that popularly gifted Ancestry DNA test kits received during the holiday season. Meet “The Guy Who Didn’t Know His Cholesterol” conceived by Roz Chast,

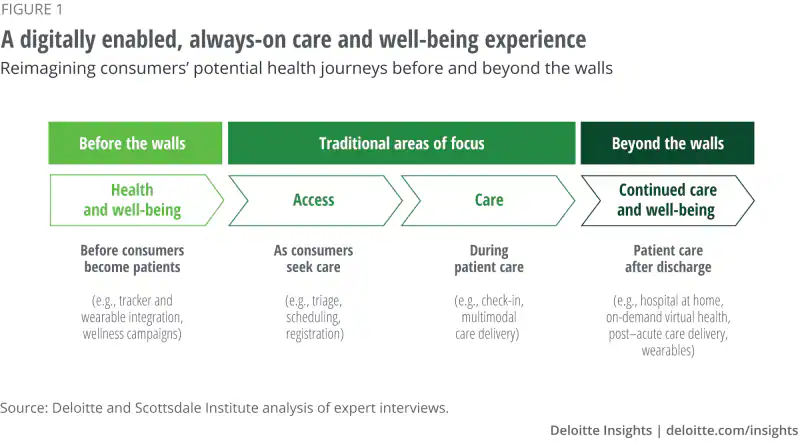

Health Systems Must Move “Beyond the Walls” to Support Consumers’ Well-Being

Hospitals’ and health systems’ core competencies have been serving patients “within the walls” of their organizations and institutions. As health systems continue to evolve value-based services while meeting patients’ consumer-oriented demands for convenience and personalization, digital transformation is required, enabling care “beyond-the-walls.” We learn more about this vision and how to map the journey to getting there in the report Integrating digital health tools to help improve the whole consumer experience from the Deloitte Center for Health Solutions and the Scottsdale Institute. This report is based on detailed interviews with experts in 30 US health

Our Homes as HealthQuarters – Finding Health and Well-Being at CES 2023

For over ten years, digital health technology has been a fast-growing area at the annual CES, the largest convention covering consumer electronics in the world. When the meet-up convenes over 100,000 tech-folk in Las Vegas at the start of 2023, we’ll see even more health and self-care tools and services at #CES23 — along with new-new things displayed in aisles well outside of the physical space on the Las Vegas Convention Center map labeled “digital health” at this year’s CES in the North Hall. Some context: my company has been a member

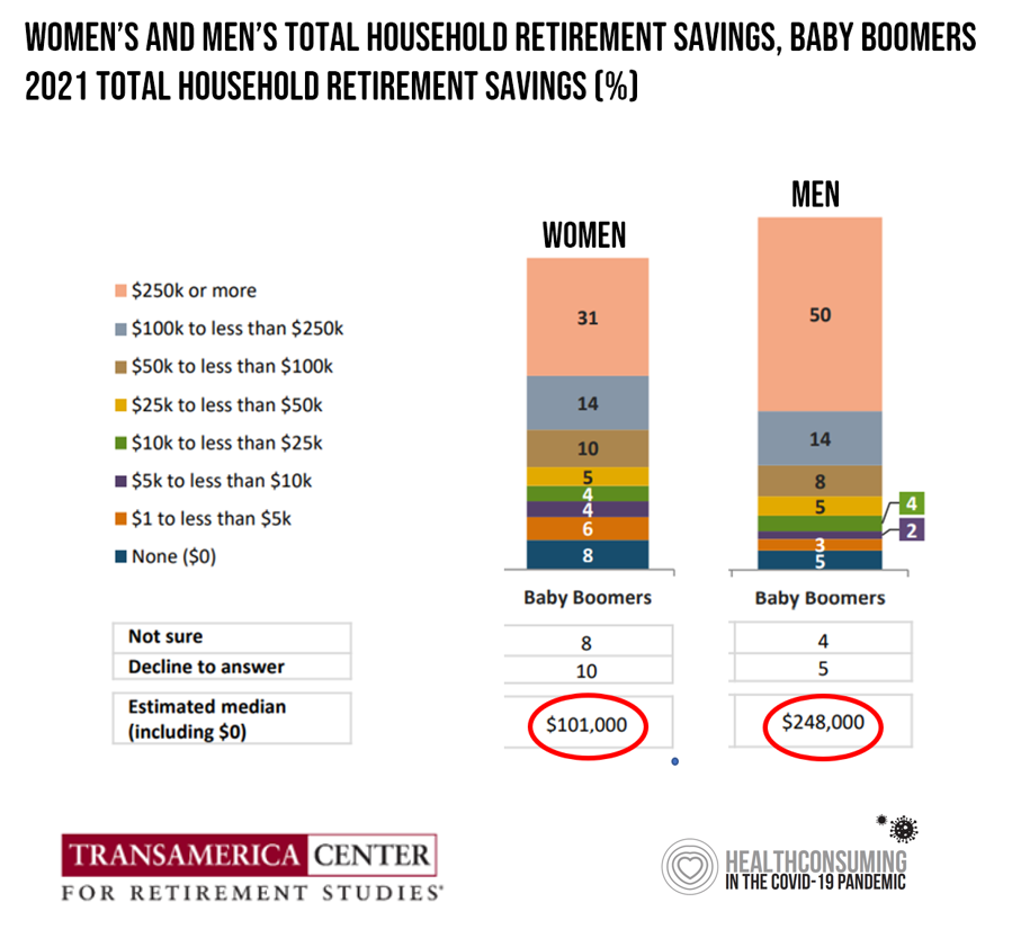

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

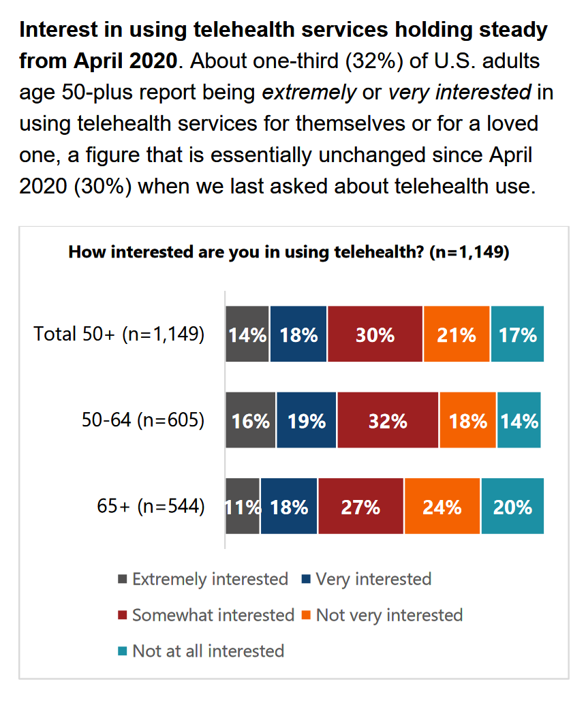

Three in Five People 50+ in the US Will Likely Use Telehealth In the Future – An Update from AARP

“Telehealth certainly appears to be here to stay,” the AARP forecasts in An Updated Look at Telehealth Use Among U.S. Adults 50-Plus from AARP. Two years after the emergence of the COVID-19 pandemic, one-half of U.S. adults over 50 said they or someone in their family had used telehealth. In early 2022, over half of those over 50 (the AARP core membership base) told the Association they would likely use telehealth in the future. This future expectation varies by race, the implications of which I discuss below in

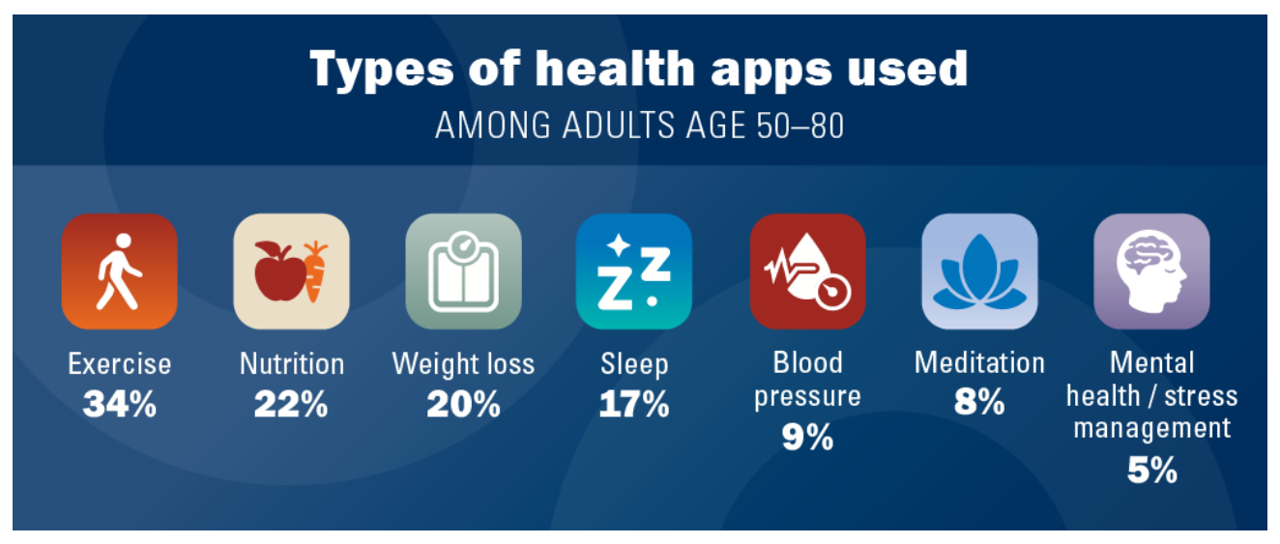

Only 1 in 4 People Over 50 Use a Mobile Health App – And They Tend to Be Healthier and Wealthier

Just over 1 in 4 people over 50 in the U.S. use at least one mobile health app, and 56% of older people have never used one. Among seven mhealth tools, the most commonly-used is to track exercise. Among older people who do not use health apps, half say it is because of their lack of interest, we learn from the research in Mobile Health App Use Among Older Adults from the University of Michigan’s National Poll on Healthy Aging, sponsored by AARP. The project is part of Michigan Medicine, U-M’s med school, and directed by the Institute for Healthcare

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

Fastest-Growing Brands for 2021 Are About Digital Money, Social Connections and Boomers’ Best Lives

Two pharmaceutical companies bubble up among the 20 fastest-growing brands for 2021 in Morning Consult’s report on the Fastest-Growing Brands of 2021. But the surprise in this year’s top 20 brand rankings was that five of them addressed consumers’ financial flows: Coinbase, AfterPay. Cash App, Mastercard, Chime, and Bitcoin. One year ago when I covered this study, I found that the fastest-growing brands of 2020 had everything to do with the pandemic. They dealt with home entertainment, digital connectivity, hygiene, and indeed, health (with Pfizer and AstraZeneca the two pharma brands top-of-mind for consumers). In this year’s update, exploring consumers’

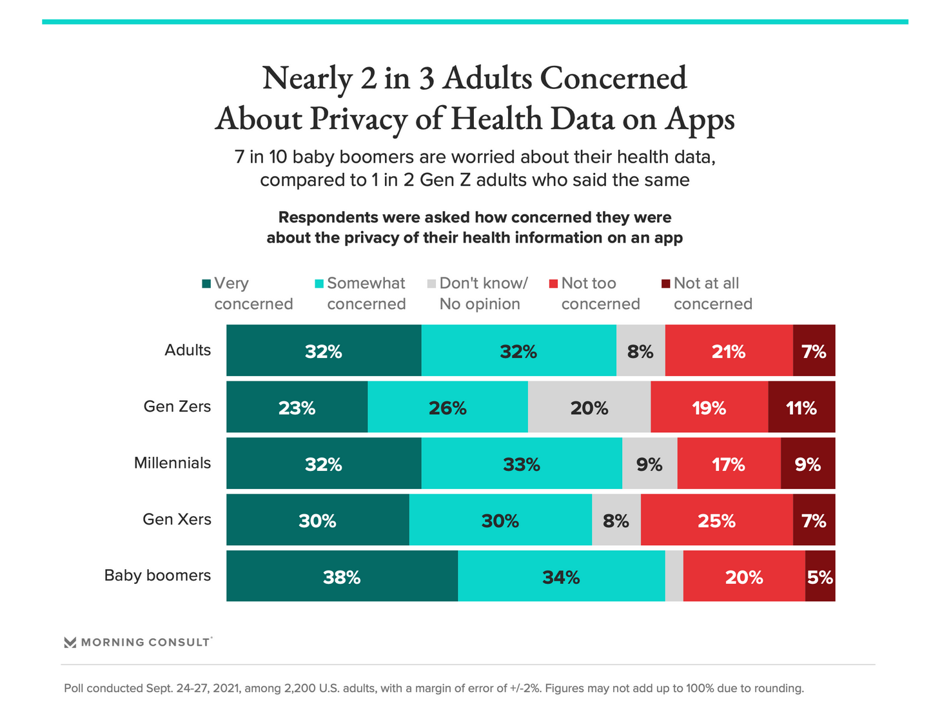

Health Privacy and Our Ambivalent Tech-Embrace – Lessons for Digital Health Innovators

A new look into Americans’ views on health privacy from Morning Consult provides a current snapshot on citizens’ concerned embrace of technology — worried pragmatism, let’s call it. This ambivalence will flavor how health citizens will adopt and adapt to the growing digitization of health care, and challenge the healthcare ecosystem’s assumption that patients and caregivers will universally, uniformly engage with medical tools and apps and technologies. More Boomers are concerned with health data app privacy than Gen Z consumers, as the chart illustrates. 46% of U.S. adults said that health monitoring apps were not an invasion of privacy; 32%

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

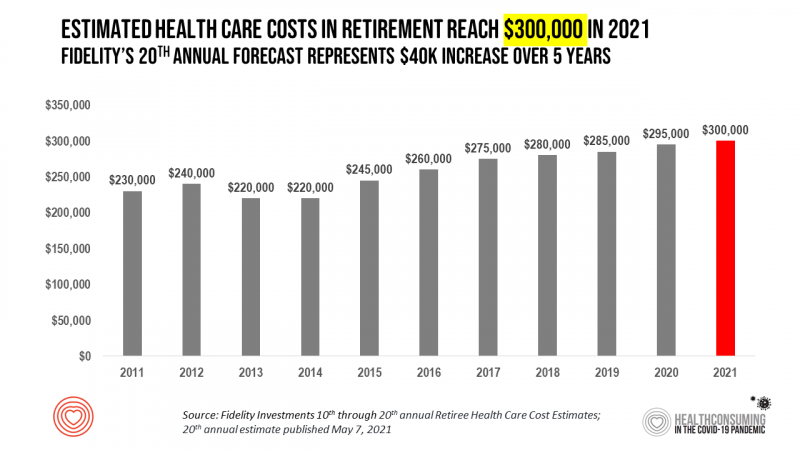

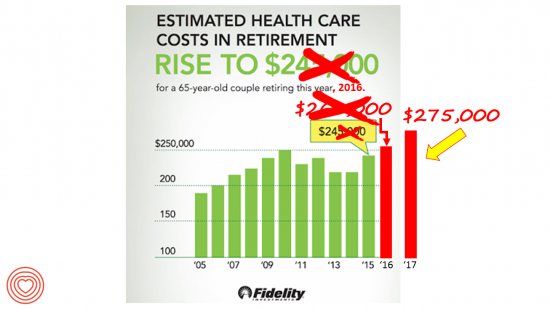

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

Health, the Great Unifier (For Most)

As the COVID-19 expanded peoples’ consciousness about infectious disease and opportunities to keep a tricky virus at bay, consumers grew new muscles about public and individual wellness…now, “more invested in achieving it,” according to In Health We Trust, a survey report from Healthline Media. To gauge Americans changing perspectives on personal health, HealthLine conducted surveys among 1,533 U.S. consumers age 18 and over in February 2020 (just about the time the coronavirus pandemic was emerging in the U.S.) and 1,577 consumers in December 2020. One of the subtle shifts in health care consumerism concerns cost, which before the pandemic has

The Post-COVID 19 Health Consumer: Ready for DIY Health Care and More Open to Telehealth

The COVID-19 pandemic has re-shaped consumers for work, school, fitness, cooking, and certainly for health care. PwC’s Health Research Institute has combed through their consumer survey data and developed insights on health consumers, shared in a summary titled Consumer health behavior and the COVID-19 pandemic: What we’ve learned. Most U.S. consumers would be likely to have a clinician visit their homes for several kinds of medical care, including: “DIY care,” as PwC exemplifies as a home strep or flu test, or remote monitoring, likely among 85% of people A chronic care visit, likely for 78% of consumers A visit for

Our Homes Are Health Delivery Platforms – The New Home Health/Care at CES 2021

The coronavirus pandemic disrupted and re-shaped the annual CES across so many respects — the meeting of thousands making up the global consumer tech community “met” virtually, both keynote and education sessions were pre-recorded, and the lovely serendipity of learning and meeting new concepts and contacts wasn’t so straightforward. But for those of us working with and innovating solutions for health and health care, #CES2021 was baked with health goodness, in and beyond “digital health” categories. In my consumer-facing health care work, I’ve adopted the mantra that our homes are our health hubs. Reflecting on my many conversations during CES

Home Is the Health Hub for Older People – Learning from Laurie Orlov

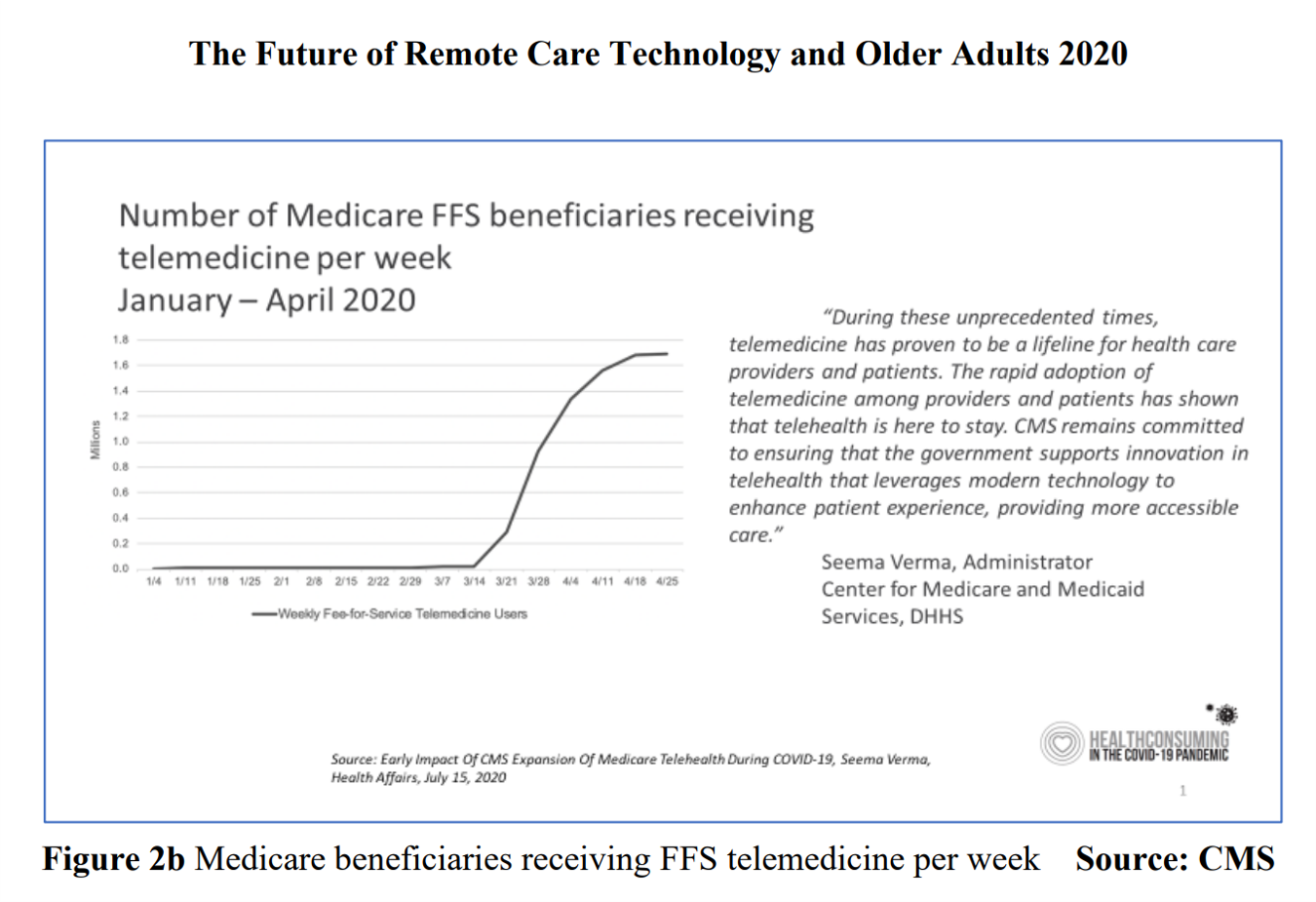

By April 2020, over one million Medicare members were receiving health care via telemedicine. The graph here shows you the hockey-stick growth for virtual care use by older Americans into the second month of the coronavirus pandemic. The COVID-19 public health crisis up-ended all aspects of daily living in America for people of all ages. For older Americans, avoiding the risk of contracting the tricky virus in public, and especially, in health care settings, became Job 1. The pandemic thus nudged older people toward adopting digital lifestyles for daily life, for shopping, for praying, and indeed, for health care. Laurie

Stress in America, Like COVID-19, Impacts All Americans

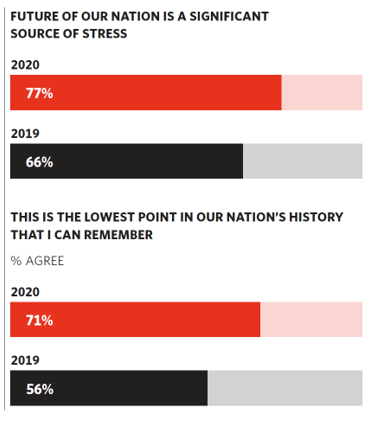

With thirteen days to go until the U.S. #2020Elections day, 3rd November, three in four Americans say the future of America is a significant source of stress, according to the latest Stress in America 2020 study from the American Psychological Association. Furthermore, seven in 10 U.S. adults believe that “now” is the lowest point in the nation’s history that they can remember. “We are facing a national mental health crisis that could yield serious health and social consequences for years to come,” APA introduces their latest read into stressed-out America. Two in three people in the U.S. say that the

Older People Are Digital Immigrants, and Best Buy Health Is Paving the Road for the Journey

The coronavirus pandemic has revealed the importance of connectivity, WiFi, broadband, as a social determinant of health and living. Connecting from our homes — now our health hubs, workplaces, schools, entertainment centers, and gyms — is necessary like air and water for survival across daily life flows. Digital connectivity can ameliorate social isolation and anxiety, bolster mental health, and access needed medical care via telehealth channels. As a result of the pandemic, staying connected is more important than ever for older people, Best Buy Health learned in a survey of U.S. adults. Insights from this study have informed the launch

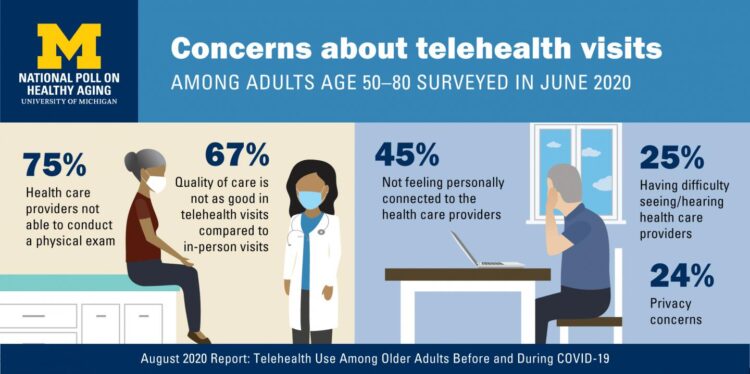

Telehealth Use Among Older Americans: Growing Interest, Remaining Concerns

In the Fear of Going Out Era spawned by the COVID-19 pandemic, many patients were loath to go to the doctor’s office for medical care, and even less keen on entering a hospital clinic’s doors. This drove health consumers to virtual care platforms in the first months of the public health crisis — including lots of older people who had never used telemedicine or even a mobile health app. In the August 2020 National Poll on Heathy Aging, the University of Michigan research team found a 26% increase in telehealth visits from 2019 to 2020, March to June 2020 year-over-year.

How the Coronavirus and Technology Are Reshaping Home-Work, -Life and -Health

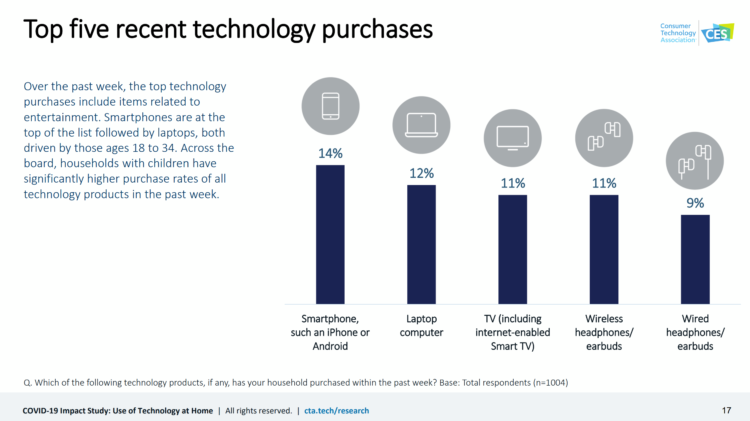

As people conform to the #StayHome lifestyle to #FlattenTheCurve of the coronavirus pandemic, technology is transforming peoples’ home lives for working, playing, and socializing. The Consumer Technology Association has conducted the COVID-19 Impact Study assessing the use of technology at home, exploring U.S. households’ changing behaviors for consuming content, stocking the pantry, engaging with social media, and using online health and fitness tools. This research surveyed 1,004 U.S. adults 18 and over in March 2020 — early in the U.S. pandemic’s national “curve.” U.S. consumers’ top five technology purchases in mid-March 2020 were for smartphones, laptop computers, TVs, and headphones/earbuds.

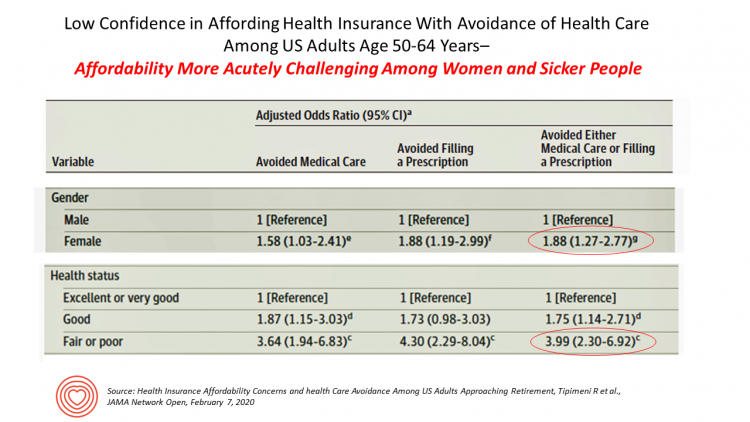

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

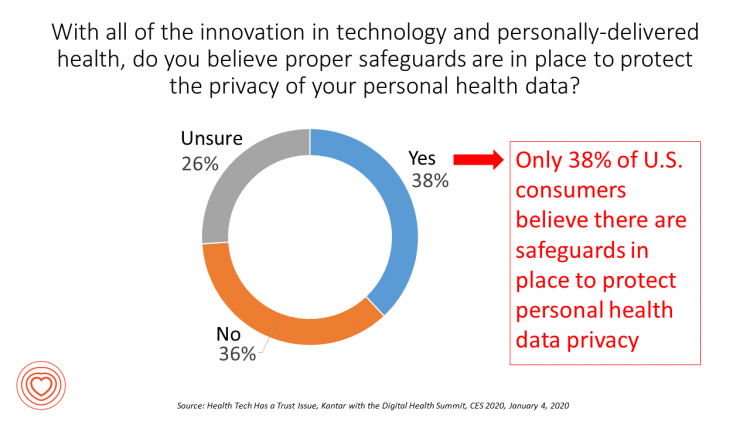

Trust Is the Currency for Consumer Health Engagement – A Bottom-Line at CES 2020

There’s less talk about Bitcoin and cryptocurrency at #CES2020. The most important currency under discussion is Trust. We have begun a consumer electronics migration from the past decade of the Internet of Things to this next decade of the Intelligence of Things. The different “I’s” signal the transition from devices that have connected to the Internet and generated data from our everyday lives, to the next ten years of gathering that data, mashing it up for meaning, and feeding back intelligence to users in the form of advising, coaching, nudging — with potentially powerful feedback loops for health, wellness and

Living in Digital Healthcare Times – Kicking off #DigitalHealthCES & #CES2020

Today is Day 1 of two Media Days at #CES2020 in Las Vegas, kicking off this manic week of the Consumer Electronics Show at the Mandalay Bay convention center. For several years, I’ve convened with journalists and industry analysts from around the world for these two days before the “official” opening of CES to hear the latest news from some of the largest tech-focused companies on Earth. Announcements come from across industry sector — from automotive and transportation, telecoms, consumer goods, entertainment, social media, travel, and retail…with platform technologies playing a role including but not limited to AI, AR/VR/XR (the

Medicare Members Are Health Consumers, Too – Our AHIP Talk About Aging, Digital Immigrants, and Personalizing Health/Care

As Boomers age, they’re adopting mobile and smart technology platforms that enable people to communicate with loved ones, manage retirement investment portfolios, ask Alexa to play Frank Sinatra’s greatest hits, and manage prescription refills from the local grocery store pharmacy. Last week, the Giant Eagle grocery chain was the first pharmacy retailer to offer a new medication management skill via Alexa. That program has the potential to change our Medicare members manage meds at home to ensure better adherence, supporting better health outcomes and personal feelings of efficacy and control. [As an aside, consumers really value pharmacies embedded in grocery

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Health Care and Consumers in 2030: A Profile from KPMG

A “one layered delivery network through which patients can move seamlessly as they age and their needs evolve” will be the new health care platform to meet patients’ demands by 2030, according to a forecast from KPMG’s Healthcare and Life Sciences Institute. In Healthcare 2030: The consumer at the center, the KPMG team explores the demographic shifts and market drivers that will challenge the health care industry in the current U.S. delivery and financing system. The lens on that 2030 future is a consumer-centric delivery model that KPMG believes will be a solution to dealing with a demographic divide between

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

The Convergence of Health/Care and Real Estate

There’s no denying the growth of telehealth, virtual visits, remote health monitoring and mHealth apps in the healthcare landscape. But these growing technologies don’t replace the role of real estate in health, wellness and medical care. Health care is a growing force in retail real estate, according to the ICSC, the acronym for the International Council of Shopping Centers, which has been spending time analyzing, in their words, “what landlords should know in eyeing tenants from a $3.5 trillion industry.” Beyond the obvious retail clinic segment, the ICSC points out a key driving growth lever for its stakeholders, recognizing that,

Health/Care Everywhere – Re-Imagining Healthcare at ATA 2019

“ATA” is the new three-letter acronym for the American Telemedicine Association, meeting today through Tuesday at the Convention Center in New Orleans. Ann Mond Johnson assumed the helm of CEO of ATA in 2018, and she’s issued a call-to-action across the health/care ecosystem for a delivery system upgrade. Her interview here in HealthLeaders speaks to her vision, recognizing, “It’s just stunning that there’s such a lag between what is possible in telehealth and what is actually happening.” I’m so keen on telehealth, I’m personally participating in three sessions at #ATA19. On Monday 15th April (US Tax Day, which is relevant

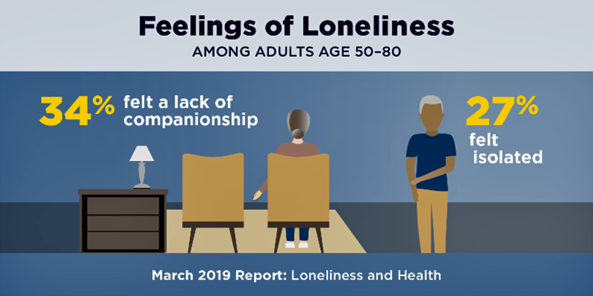

Loneliness Is A Health Risk, Especially Among Older People

In America, one in three people over 50 years of age feels a lack of companionship, and one-fourth feel isolated from other people, according to a new poll on loneliness and aging from the University of Michigan, sponsored by AARP. The University of Michigan National Poll on Healthy Aging surveyed some 2,000 U.S. adults age 50–80 in October 2018, assessing older peoples’ health, health behaviors, experiences and feelings related to companionship and social isolation. While three in four people have frequent social contact with family, friends and neighbors outside of their home, the remaining one in four have social contact once a

Retail Tomorrow, Today: A Smart Grocery Cart and Digital Samples For Paleo-Eating Moms

In our Amazon-Primed world, the future of retail is not ten years from now; it’s “tomorrow.” So GMDC, the association of retailers and brands who supply them, has formed a program called Retail Tomorrow to turbocharge the supply side with consumers who are already demanding convenience, immediate (or “soon”) gratification, and health where she/he “is.” That’s personalization, and that’s where retail health can and is making a difference in Everyday Peoples’ lives. In our DIY culture, we’re pumping our own petrol, making our own airline and hospitality reservations (from Expedia to Airbnb), trading stocks online, and cooking at home enabled by

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

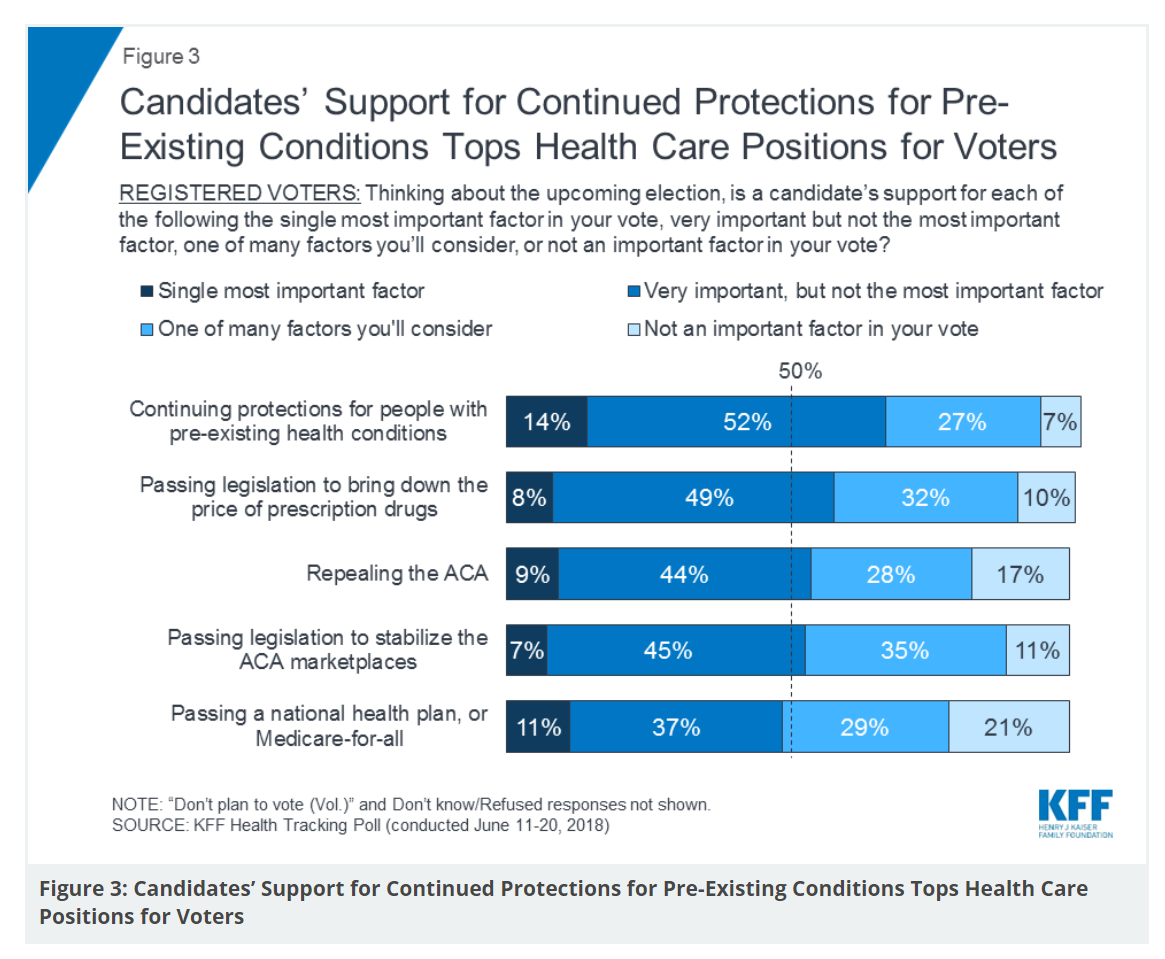

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Heart-Love – Omron’s Holy Grail of Blood Pressure Tracking on the Wrist

It’s February 1st, which marks the first of 28 days of American Heart Month – a time to get real, embrace, learn about, and engage with heart health. Heart disease kills 610,000 people in the U.S. every year, equal to 1 in 4 deaths in America. It’s the leading cause of death for both men and women in the U.S. Knowing your blood pressure is an important step for managing the risks of heart disease. That hasn’t yet been available to those of us who quantify our steps, weight, sleep, food intake, and other health metrics. In 2017, Hugh Langley

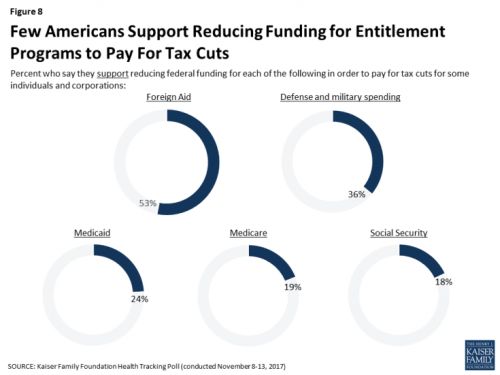

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

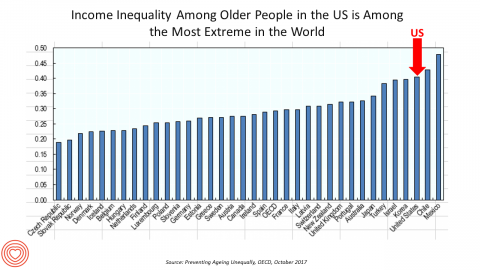

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

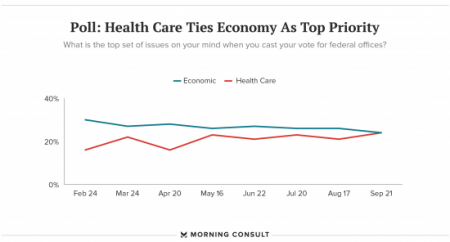

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

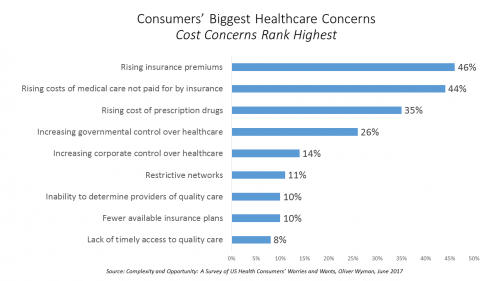

Healthcare Cost Concerns Trump All Others Across the Generations

Patients, evolving into health consumers, seek a better healthcare experience. While most people are pretty satisfied with their medical care, cost and confusion reign. This is the topline finding of a study from Oliver Wyman appropriately titled, Complexity and Opportunity, a survey of U.S. health consumers’ worries and wants. Oliver Wyman collaborated on the research with the FORTUNE Knowledge Group. Consumers’ biggest healthcare concerns deal with costs: rising insurance premiums; greater out-of-pocket costs for care not covered by insurance; and, the growing costs of prescription drugs together rank as the top 3 healthcare concerns in this study. After costs, consumers cite government

How Amazon Has Primed Healthcare Consumers – My Update with Frances Dare, Accenture

“I want what I want, when and how I want it.” If you think that sounds like a spoiled child, that’s not who I’m quoting. It’s you, if you are a mainstream consumer in the U.S., increasingly getting “primed” by Amazon which is setting a new bar for retail experience in terms of immediacy, customer service, and breadth of offerings. I talked about this phenomenon in my Health Populi post, How Amazon Has Primed Healthcare Consumers. The blog discussed my take on Accenture’s latest study into healthcare consumers based on the report’s press release. I appreciated the opportunity to sit

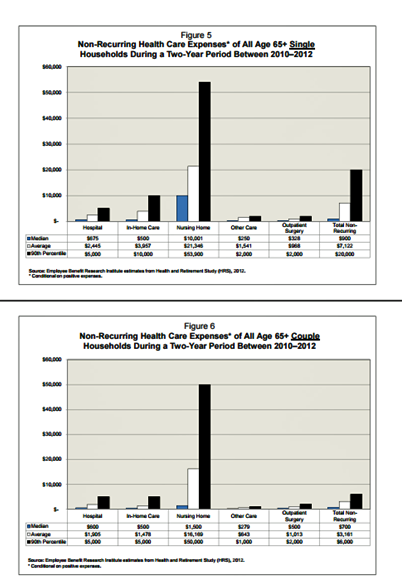

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

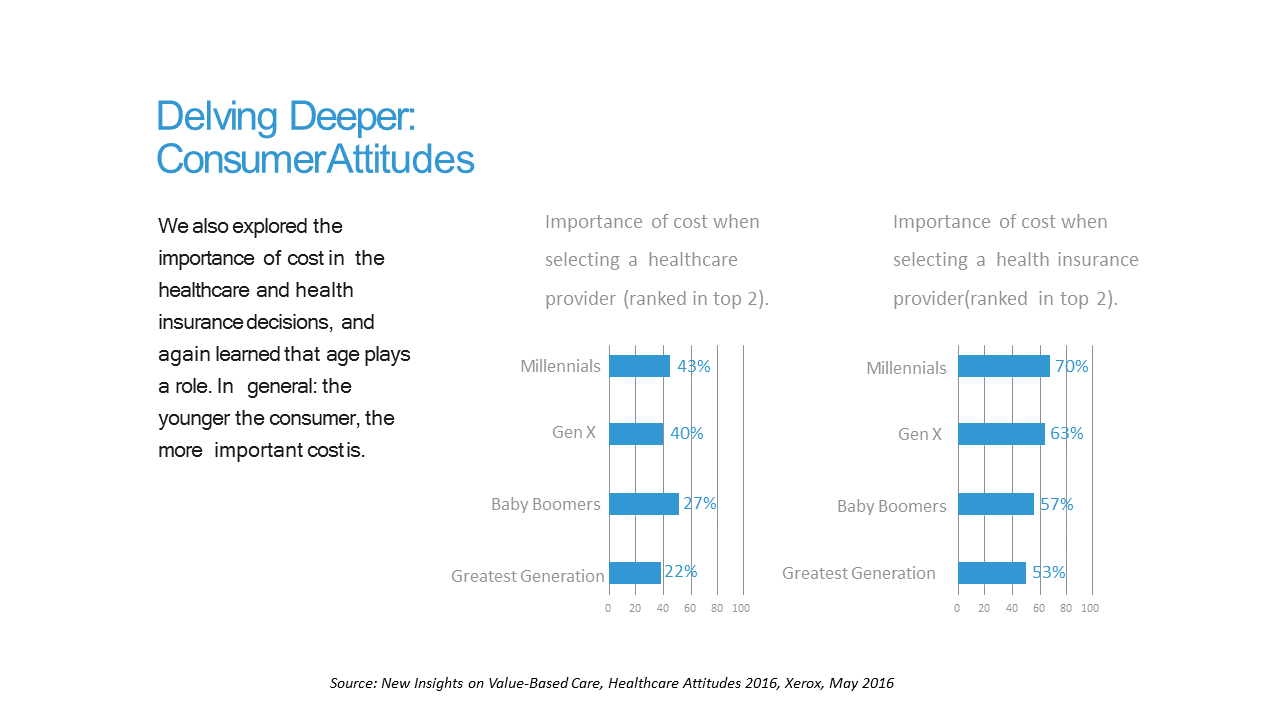

Costs and Connection At the Core of Consumers’ Health-Value Equations

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016. The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans —

Better Aging Through Technology

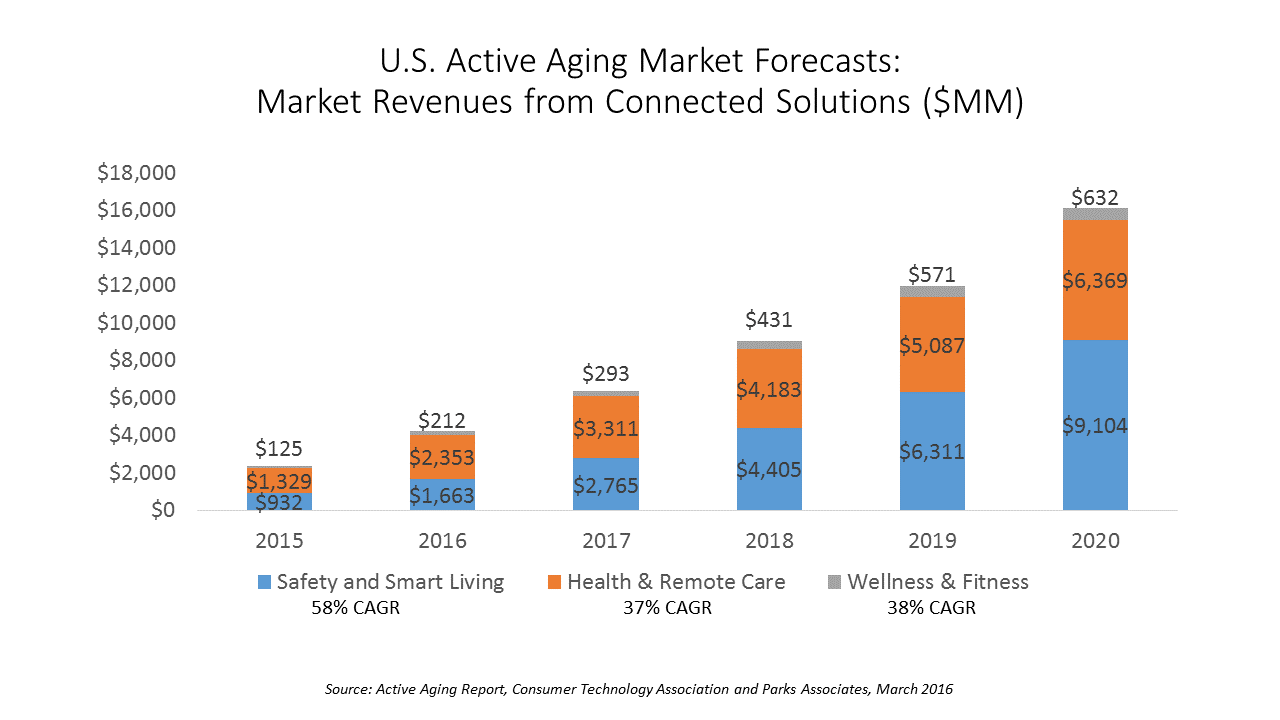

There are 85 million people getting older in America, all mindfully working to not go gentle into their good nights — that is, working hard to stay young and well for as long as they can. This is the market for “active aging” technology products, which will be worth nearly $43 billion in 2020, according to a report from the Consumer Technology Association (CTA), the Active Aging Study. CTA and Parks Associates define the active aging technology market in three segments with several categories under each: Safety and smart living, which includes safety monitoring, emergency response (PERS), smart living, and home

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...