Financial Strain Among Older People in America, and What Project 2025 Could Mean for Their Well-Being

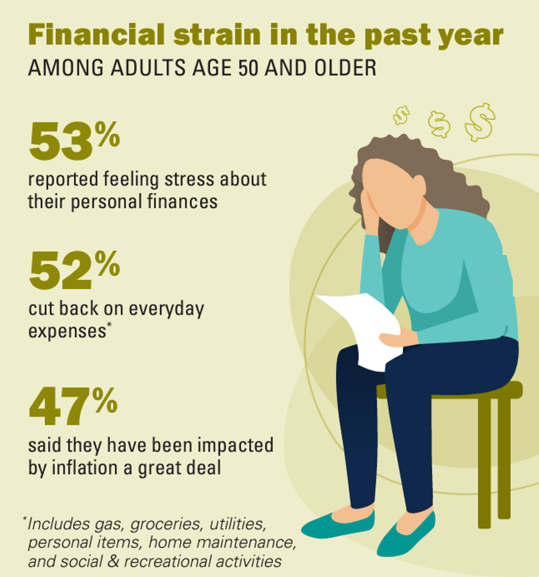

Over one-half of people 50 years of age and older in the U.S. have felt financial strain in the past year, resulting in 1 in 2 folks cutting back on everyday expenses like groceries and gas. We learn that nearly one-half of people 50 and over say they’ve been impacted by inflation “a great deal” in Making Ends Meet: Financial Strain and Well-Being Among Older Adults, the latest report from the Institute for Healthcare Policy and Innovation’s National Poll on Healthy Aging based at the University of Michigan (my alma mater). The poll was conducted by NORC at the University

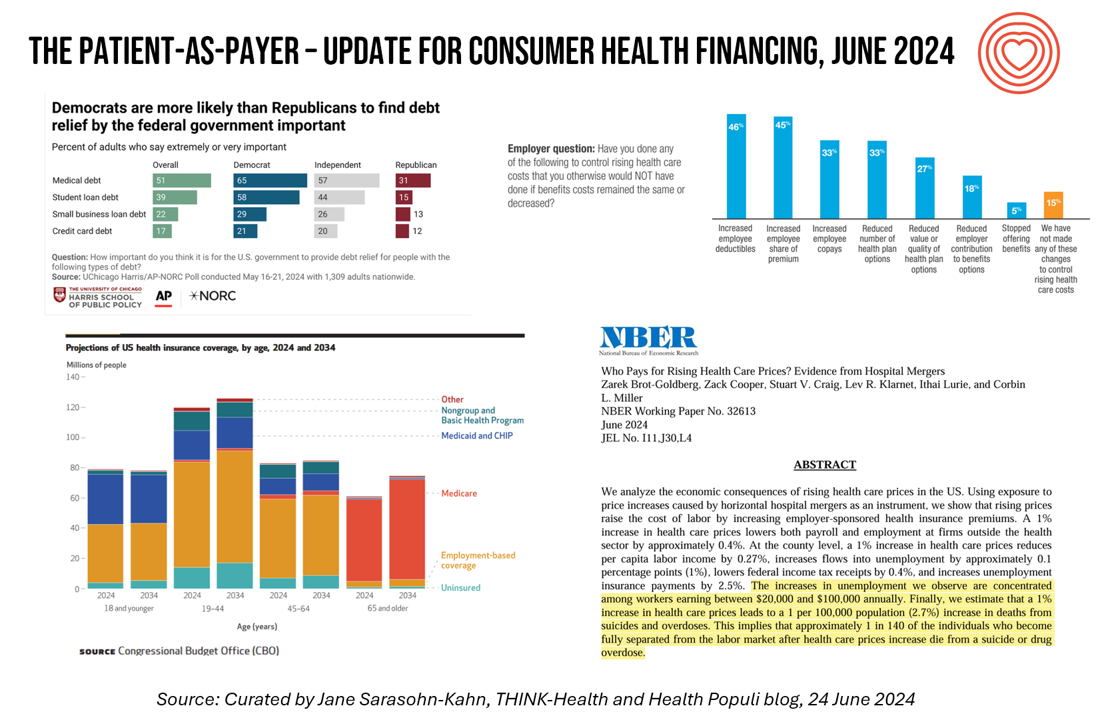

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

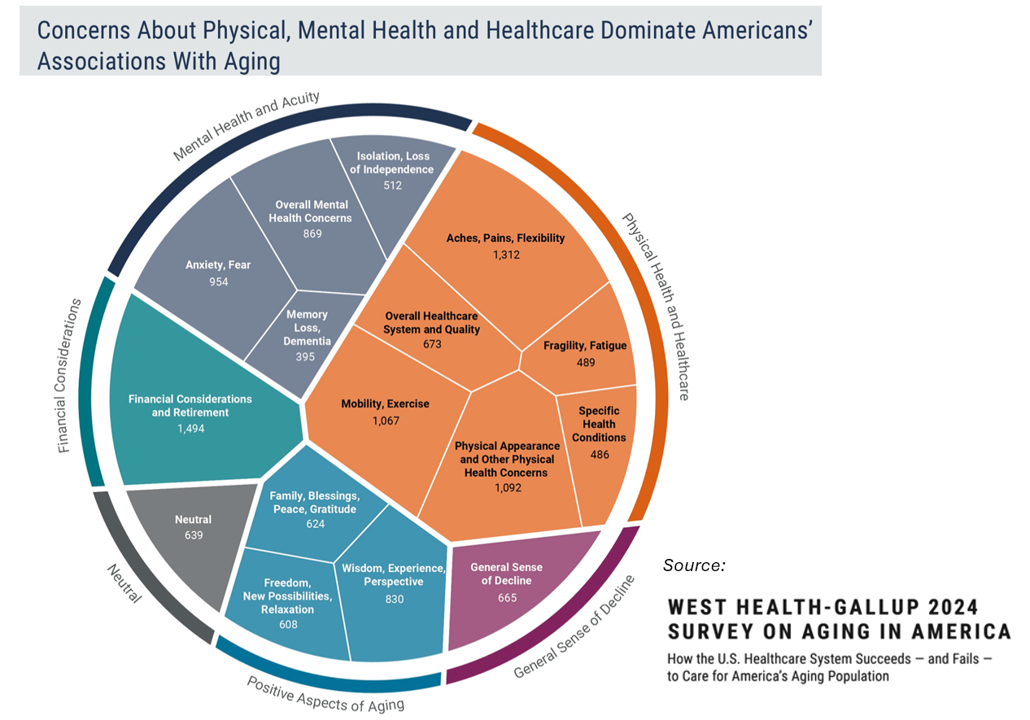

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

Most Older People Want to Age in Place and Are Adopting Technologies At Home To Do So

The vast majority of older people (95%) want to “age in place” — that is, stay put in their homes and avoid moving into long-term care residences or elsewhere. One approach for enabling aging-in-place is peoples’ adoption of various technologies, a topic surveyed by U.S. News & World Report. In April 2024, U.S. News interviewed 1,500 U.S. adults ages 55 and over on their views toward technology and everyday life at home. The first graphic from U.S. News’ study report, published earlier this month, shows that older people identified six categories of

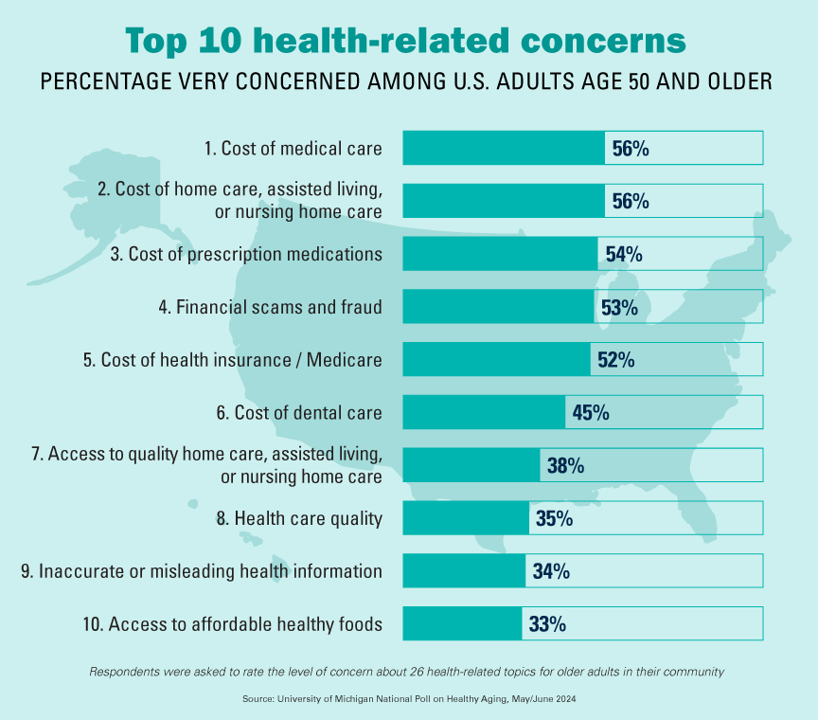

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

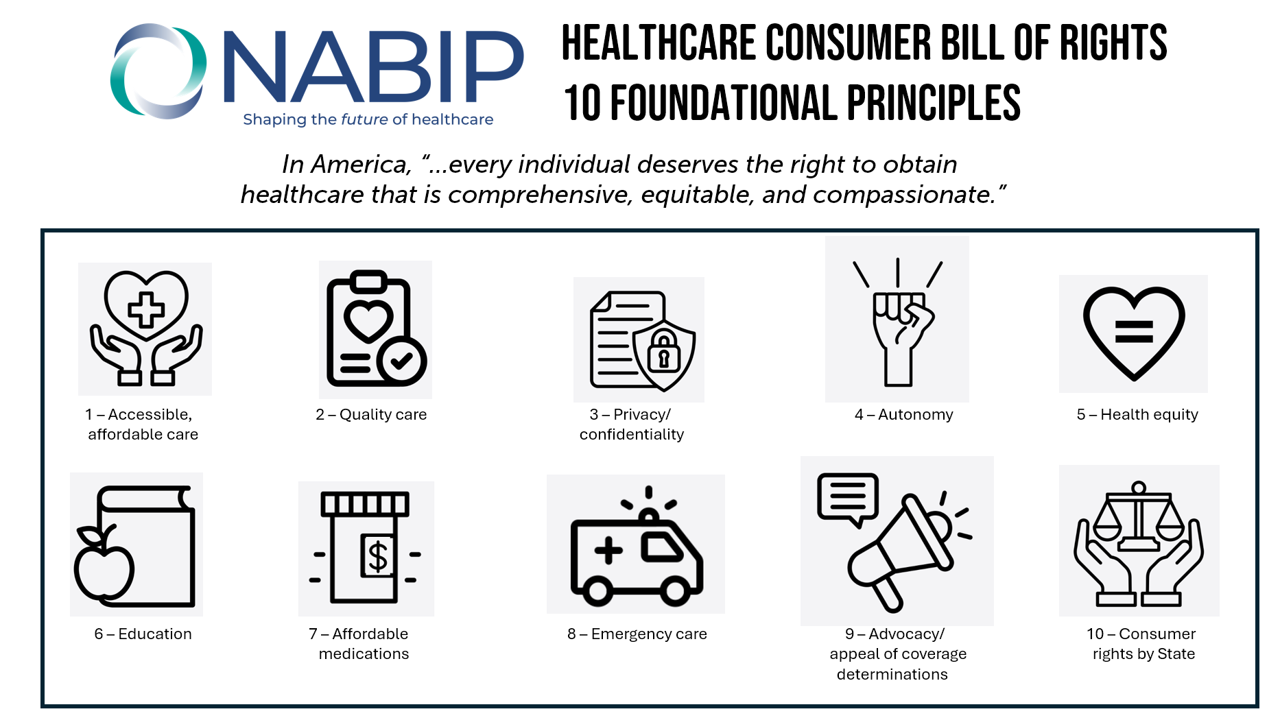

A Health Consumer Bill of Rights: Assuring Affordability, Access, Autonomy, and Equity

Let’s put “health” back into the U.S. health care system. That’s the mantra coming out of this week’s annual Capitol Conference convened by the National Association of Benefits and Insurance Professionals (NABIP). (FYI you might know of NABIP by its former acronym, NAHU, the National Association of Health Underwriters). NABIP, whose members represent professionals in the health insurance benefits industry, drafted and adopted a new American Healthcare Consumer Bill of Rights launched at the meeting. While the digital health stakeholder community is convening this week at VIVE in Los Angeles to share innovations in health tech, NABIP

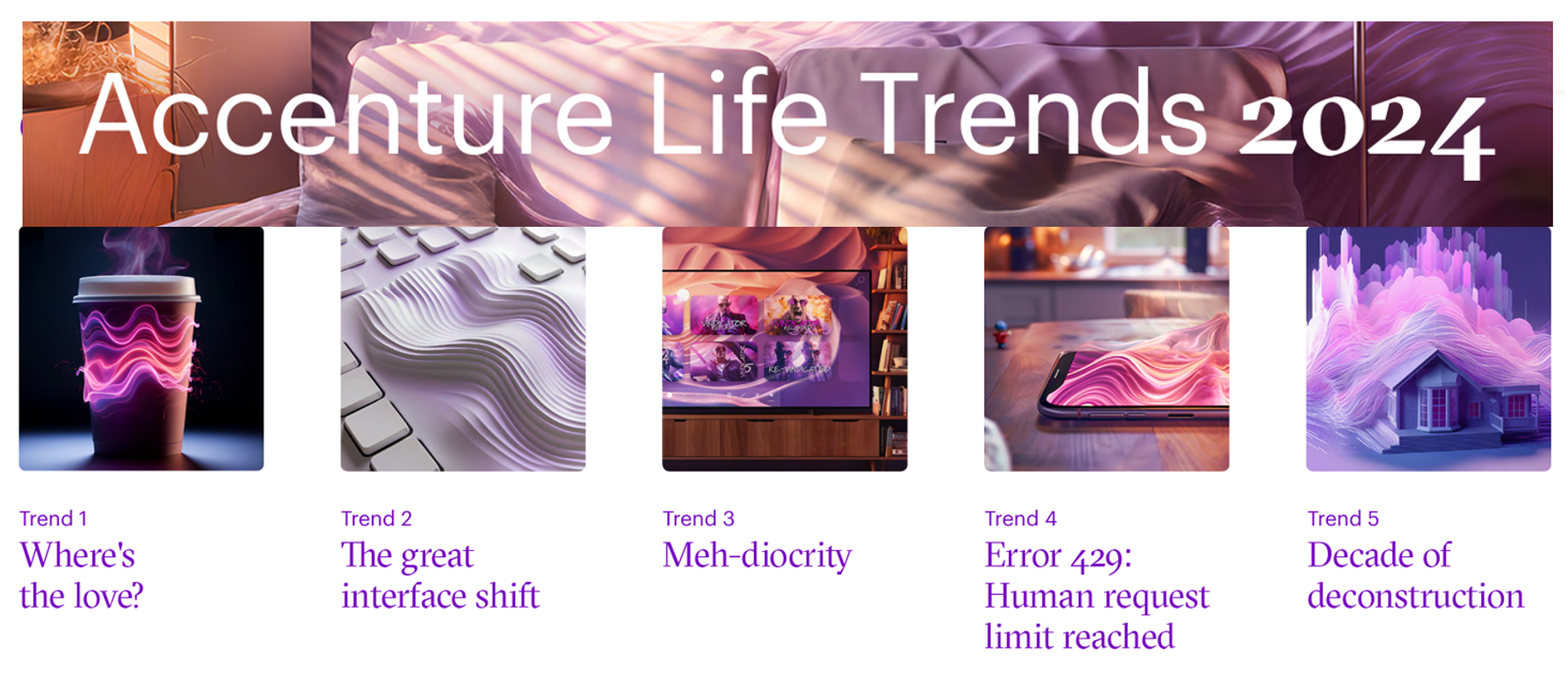

Accenture’s Great Expectations for a Decade of Deconstruction – the 2024 Life Trends Forecast

In the company’s 17th annual look into consumers’ “life trends,” Accenture finds that, top-line, “The harmony between people, tech and business is showing tensions, and society is in flux.” And these consumer-facing trends will also shape peoples’ attitudes about their health care, how they access and pay for it, and what kinds of services and support health consumers will expect in this era of “deconstruction.” Taken together, the trends noted in Accenture’s 2024 report on Life Trends finds that one-half of consumers, globally, are changing their life goals, making their jobs and retirement stability more important than

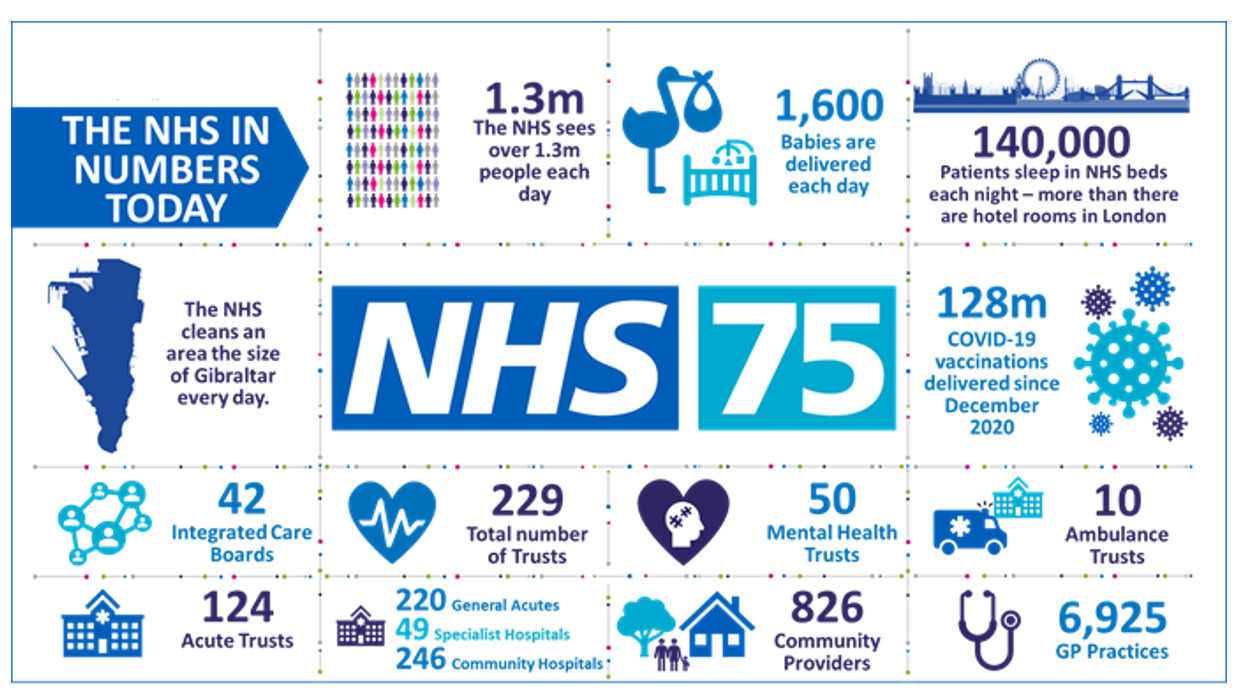

Happy 75th Birthday, NHS – Through A U.S. Health Care Lens

The UK’s National Health Service (NHS) turns 75 today. The NHS was the brainchild of Minister of Health Aneurin Bevan; he wrote in a statement to doctors and nurses in The Lancet on July 3, 1948, “My job is to give you all the facilities, resources, apparatus and help I can, and then to leave you alone as professional men and women to use your skill and judgement without hindrance.” This week in The Lancet, the editors assert, “The founding principles of the NHS put into practice 75 years ago are at risk of

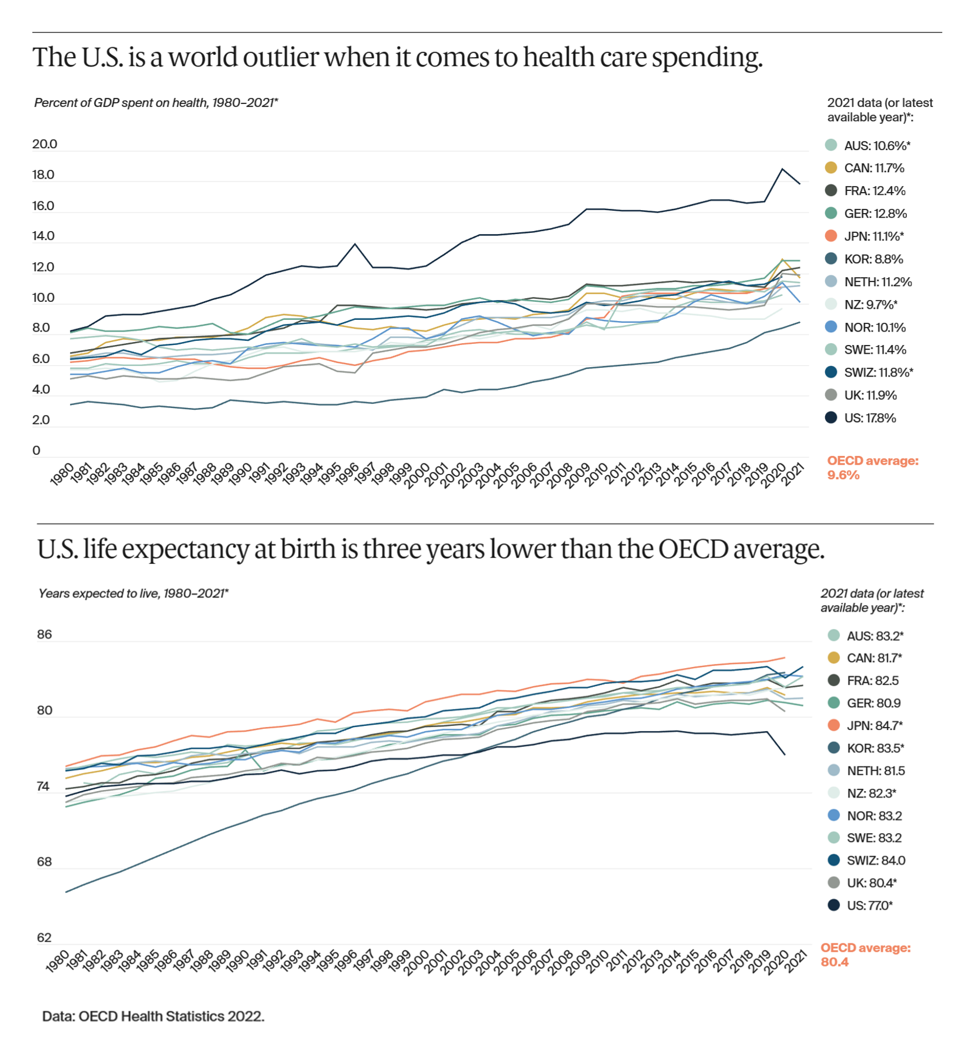

The US Healthcare System Outspends and Underperforms While Most People Live Paycheck to Paycheck

The U.S. is an outlier in the world for high health care spending, as well as in low achievement for life expectancy at birth — 3 years less than that in peer OECD countries — discussed in U.S. Health Care from a Global Perspective, 2022: Accelerating Spending, Worsening Outcomes, the latest look into American health system performance in a global context from The Commonwealth Fund. Another study published in JAMA this week talks about the Organization and Performance of US Health Systems, calling out the fact that, “Small quality differentials combined with large price differentials suggests that health systems have

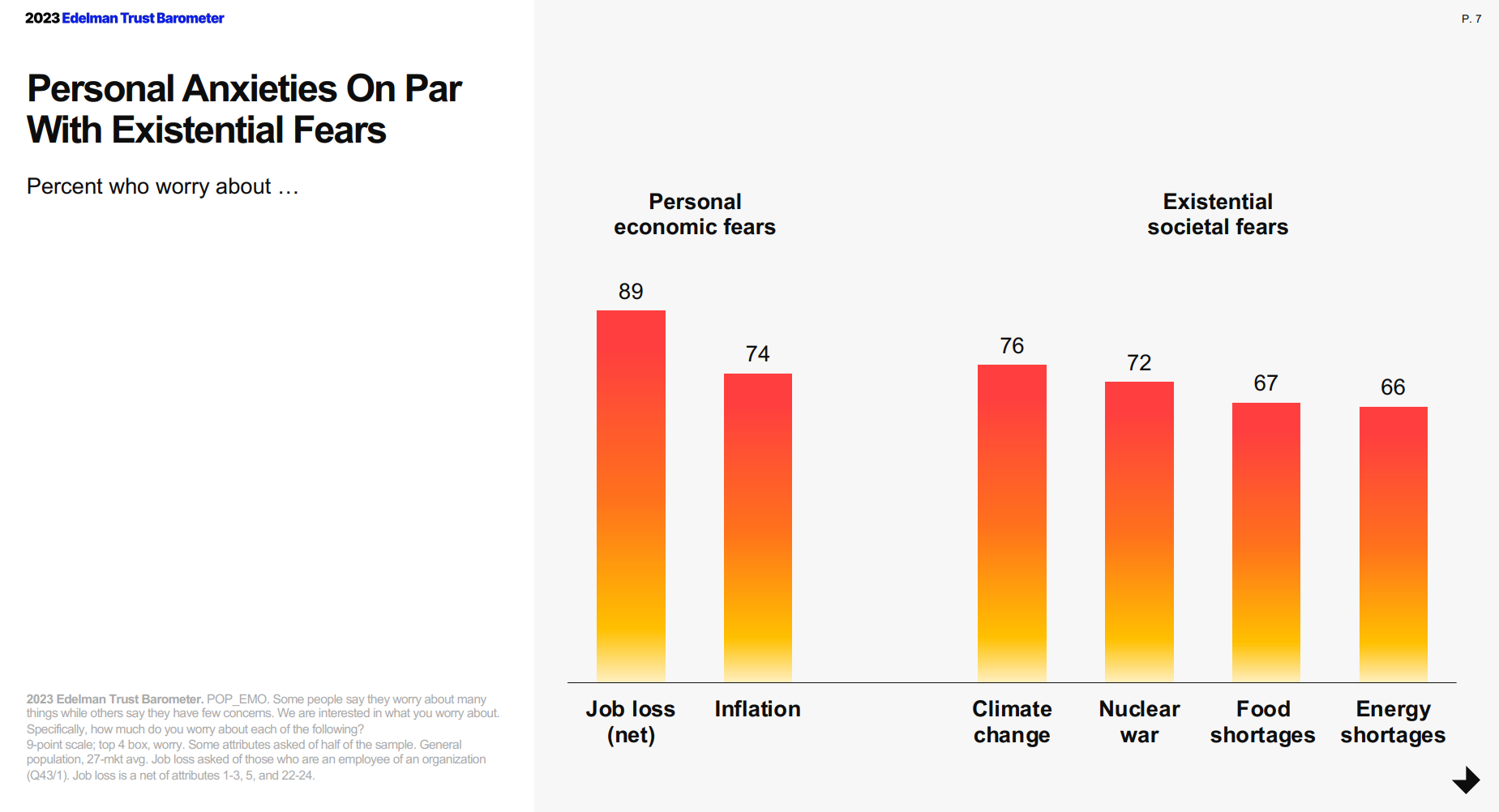

The Polarization of Trust in 2023 – What It Means for Health, via Edelman at Davos WEF 23

For the third year in a row, citizens in most of the world see business as the most-trusted institution, above government, media, and NGOs, found in the 2023 Edelman Trust Barometer, unveiled this week at the annual World Economic Forum in Davos, Switzerland. The Edelman team conducted this 23rd annual study in November 2022 in 28 countries, among over 32,000 people — some 1,150 residents per country polled. (Note that Russia, studied in the surveys between 2007 and 2022, was not included in the 2023 research). The first chart arrays

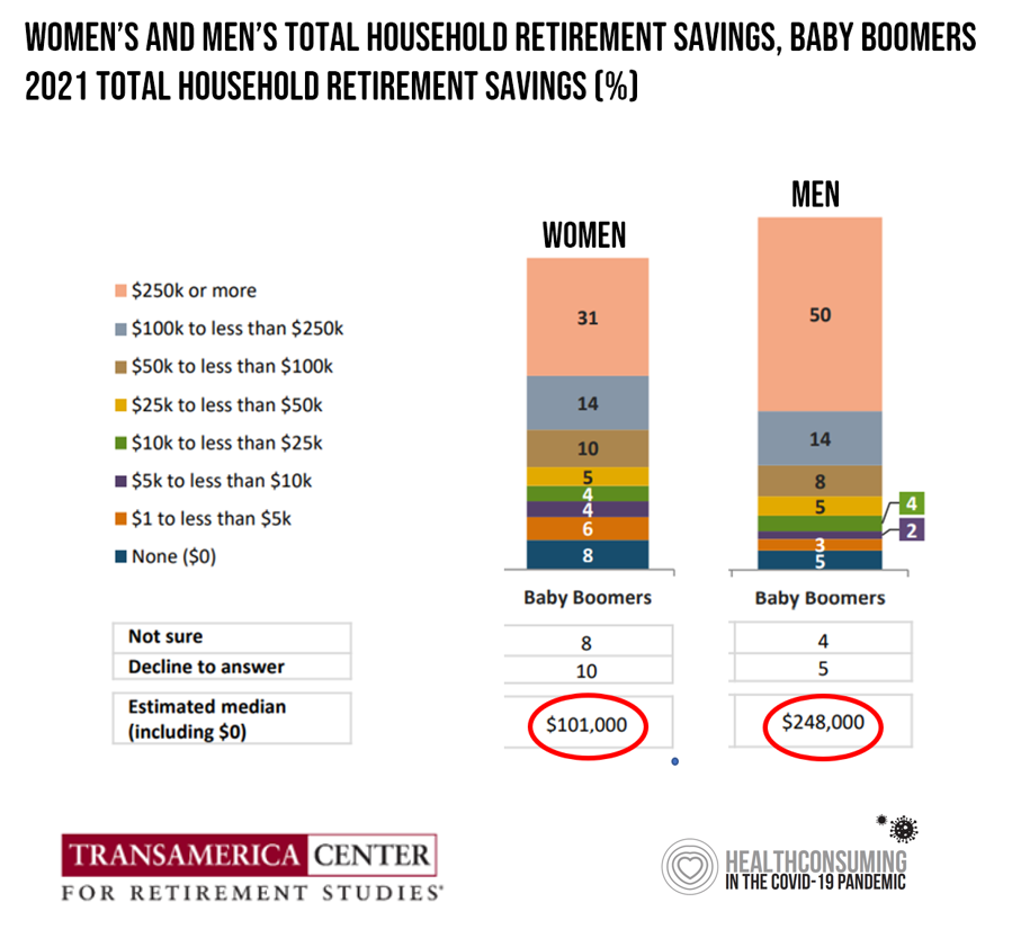

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Irrational Exuberance for Hospital-To-Home? Care About the Caregivers, the House, the Fridge.

Home, Sweet Hospital-At-Home? It depends, I hedge in my latest essay for Medecision. In our bullish and, on its face, compassionate and cost-rational embrace of the migration of acute care from hospital beds to peoples’ living and bedrooms, there are several guardrails to consider beyond sheer payment and reimbursement calculations. Consider, The caregivers for the folks heading home from hospital The state of the physical home — for safety, comfort, environmental health, and emotional security, and, Food security and nutritional access. On caregiving: I spend extra time detailing research in which Alexandra Drane, founder of

Health Care Costs Are a Driver of Health Across All of America – Especially for Women

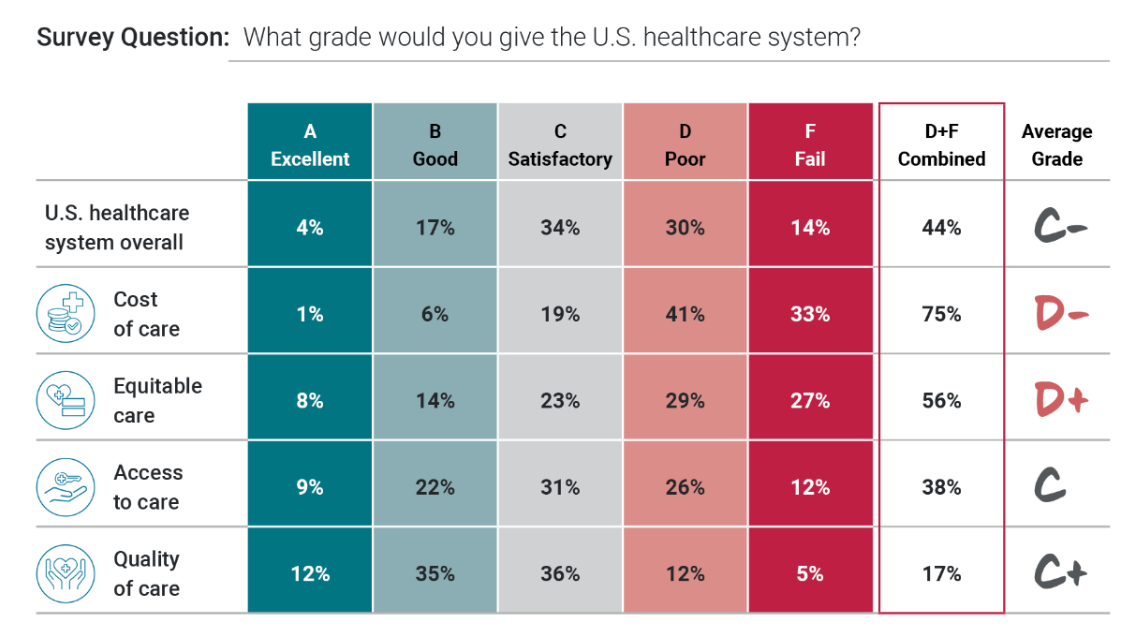

Three in four people in America grade health care costs a #fail, at grade “D” or lower. This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively. Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

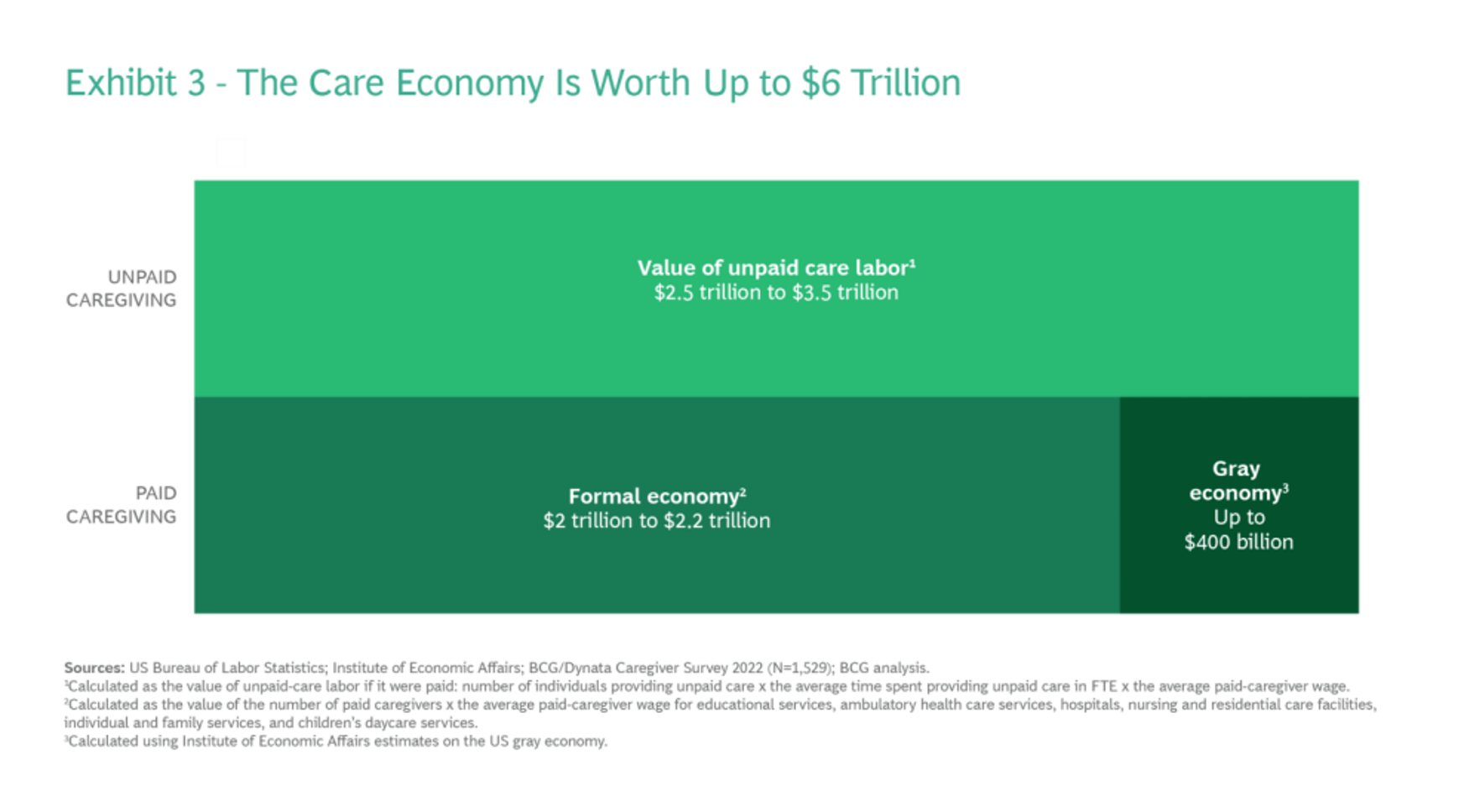

The Care Crisis – Robots Won’t Save Us

Among the many lessons we should and must take emerging out of the COVID-19 pandemic, understanding and addressing the caregiver shortage-cum-crisis will be crucial to building back a stronger national economy and financially viable households across the U.S. And if you thought robots, AI and the platforming of health care would solve the shortage of caregivers, forget it. Get smarter on the caregiver crisis by reading a new report, To Fix the Labor Shortage, Solve the Care Crisis, from BCG. You’ll learn that 9 of 10 new care-sector jobs will be in-person for

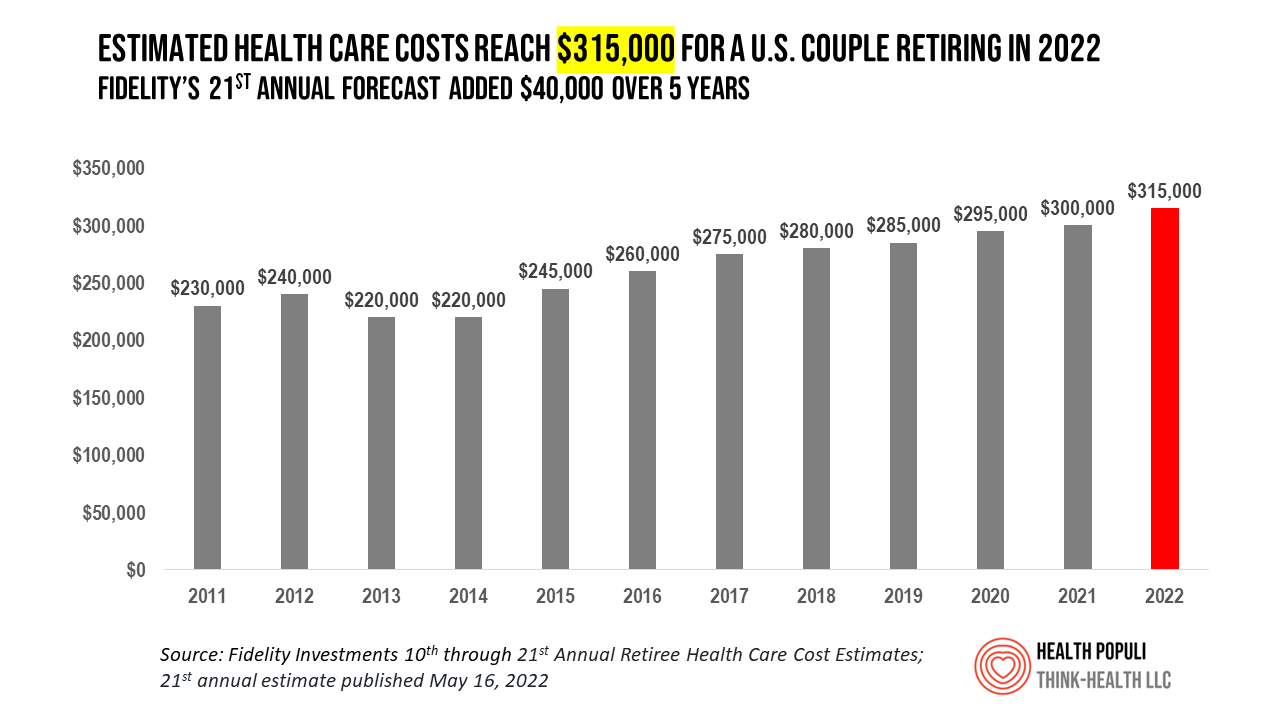

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

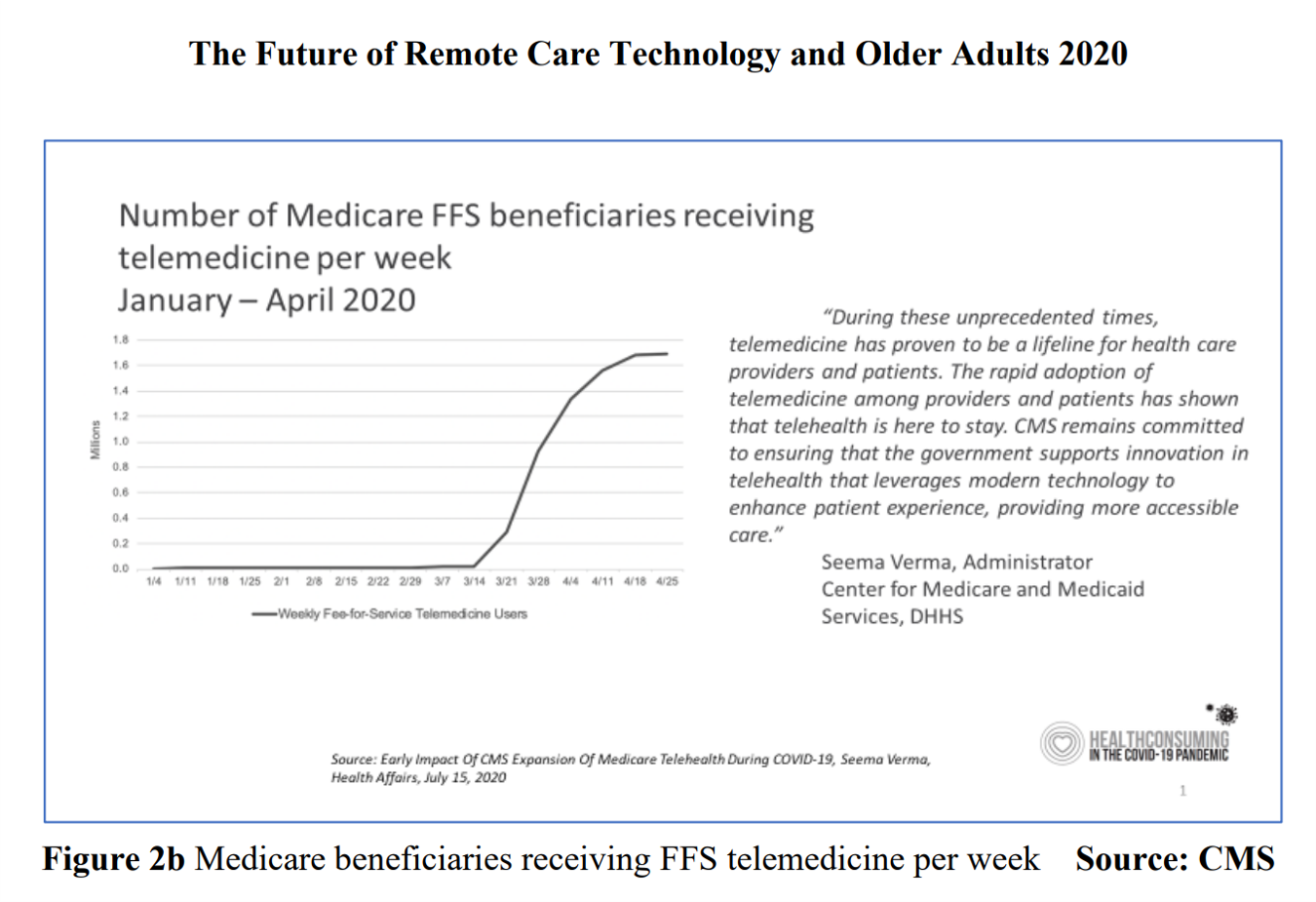

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

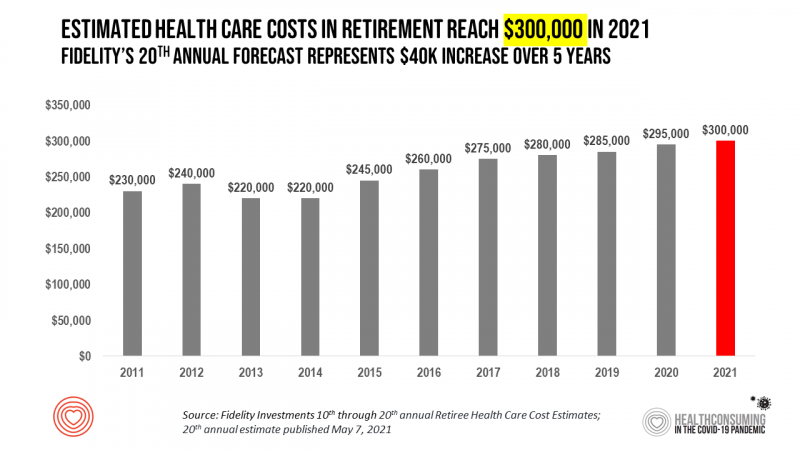

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

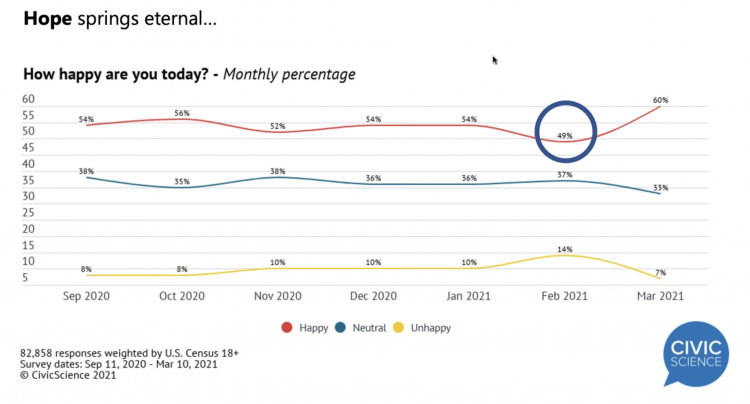

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

A New Health Literacy Pillar: Personal Data Stewardship

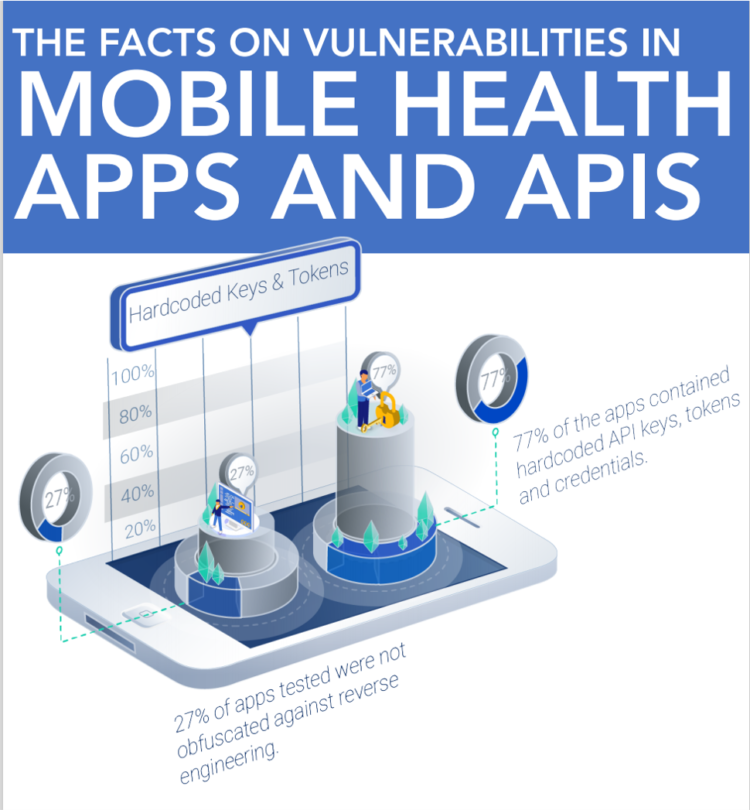

The growing use of APIs in health information technology innovation for patient care has been a boon to speeding development placed in the hands of providers and patients. Using APIs can help drive interoperability and make data “liquid” and useable. APIs can enable “Data liberación,” a concept proposed by Todd Park when he worked in the Obama administration. Without securing patients’ personal health data leveraging APIs, those intimate details are highly hackable explained in All That we Let In, a report from Knight Ink and Appr0ov. It is likely that behind growing health data hacks is the marginally greater financial

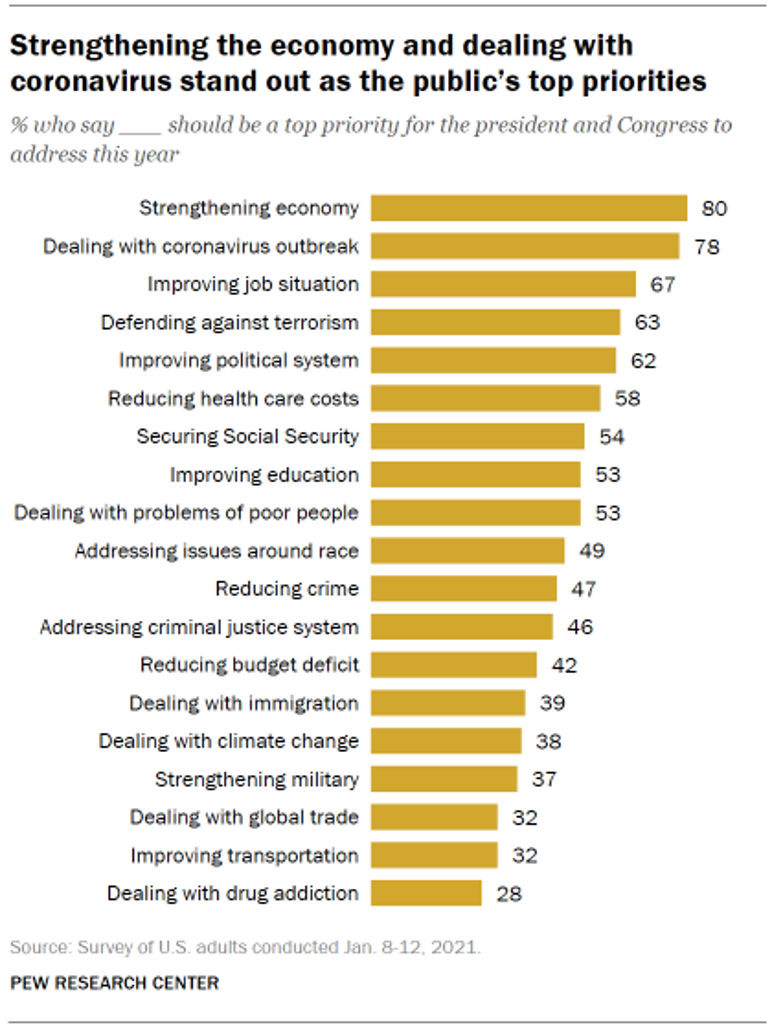

Americans A Year Into the Pandemic – A View from Pew

Nearly a year into the COVID-19 pandemic, the same percent of Americans say strengthening the U.S. economy and dealing with the coronavirus outbreak should be a top priority for President Biden and Congress to address this year, according to data from the Pew Research Center collected during the second week of January 2021. Two-thirds of people in the U.S. also want government leaders to prioritize improving the employment situation, defending against terrorism, and improving the political system, the study learned. At Americans’ low end of the priority list for the President and Congress are dealing with global trade, improving transportation,

Food Trends and Hunger in the Pandemic – the Importance of Food Security in Health and Economic Security

In 2020, the COVID-19 pandemic changed all kinds of aspects of our daily lives, not the least of which were our food habits — how we shopped for food, how we bought food, how we cooked and baked from scratch, and how our tastes and nutritional choices changed with our #StayHome and #WorkFromHome lifestyles. People who could keep their jobs and work from home connected by broadband learned how to build up pandemic pantries, shop online, and stay well-fed. But for people in the U.S. who lost employment, had hours cut, or were compelled to stay home to teach kids

The Biden Administration’s Whole-of-Government Approach to Equity – in Health and Beyond

In the U.S., the COVID-19 pandemic has revealed disparities in housing, food, and job security, and the role that one’s ZIP code and social determinants play in health outcomes. Overall, America has done poorly in light of being 4% of the world’s population but having one-fifth of the planet’s deaths due to the coronavirus. But these have disproportionately hit non-white people, who are nearly three times as likely to die from COVID-19 than white Americans. I’ve been head-down reviewing the first two days of President Biden’s signing Executive Orders, reading the National Strategy for COVID-19 Response, and inventorying line items

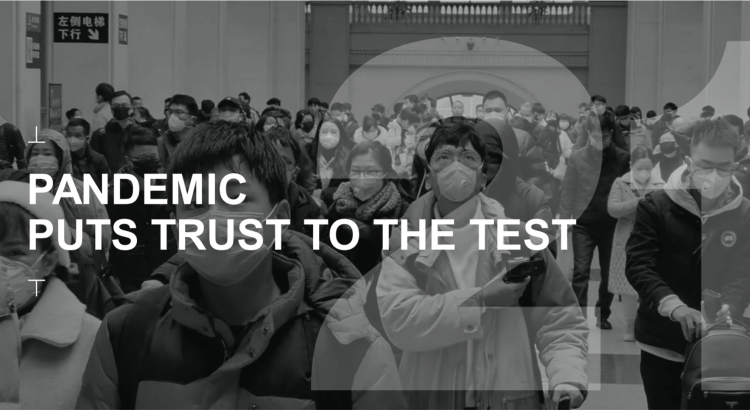

Trust Plummets Around the World: The 2021 Edelman Trust Barometer in #CES2021 and Microsoft Context

Citizens around the world unite around the concept that Trust is Dead. This is no truer than in the U.S., where trust in every type of organization and expert has plummeted in the wake of the COVID-19 pandemic, political and social strife, and an economic downturn. Welcome to the sobering 2021 Edelman Trust Barometer, released this week as the world’s technology innovators and analysts are convening at CES 2021, and the annual JP Morgan Healthcare meetup virtually convened. As the World Economic Forum succinctly put the situation, “2020 was the year of two equally destructive viruses: the pandemic and the

Home Is the Health Hub for Older People – Learning from Laurie Orlov

By April 2020, over one million Medicare members were receiving health care via telemedicine. The graph here shows you the hockey-stick growth for virtual care use by older Americans into the second month of the coronavirus pandemic. The COVID-19 public health crisis up-ended all aspects of daily living in America for people of all ages. For older Americans, avoiding the risk of contracting the tricky virus in public, and especially, in health care settings, became Job 1. The pandemic thus nudged older people toward adopting digital lifestyles for daily life, for shopping, for praying, and indeed, for health care. Laurie

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

50 Days Before the U.S. Elections, Voters Say Health Care Costs and Access Top Their Health Concerns — More than COVID-19

The coronavirus pandemic has revealed deep cracks and inequities in U.S. health care in terms of exposure to COVID-19 and subsequent outcomes, with access to medical care and mortality rates negatively impacting people of color to a greater extent than White Americans. The pandemic has also led to economic decline that, seven weeks before the 2020 elections in America, is top-of-mind for health citizens with the virus-crisis itself receding to second place, according to the Kaiser Family Foundation September 2020 Health Tracking Poll. KFF polled 1,199 U.S. adults 18 years of age and older between August 28 and September 3,

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

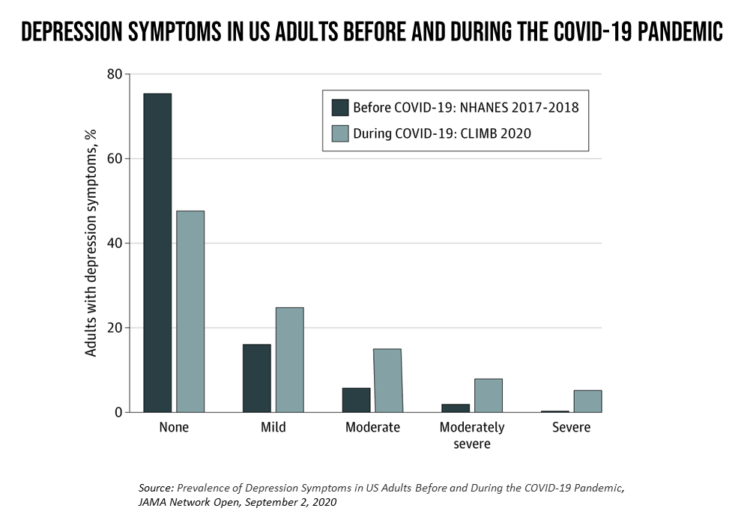

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...