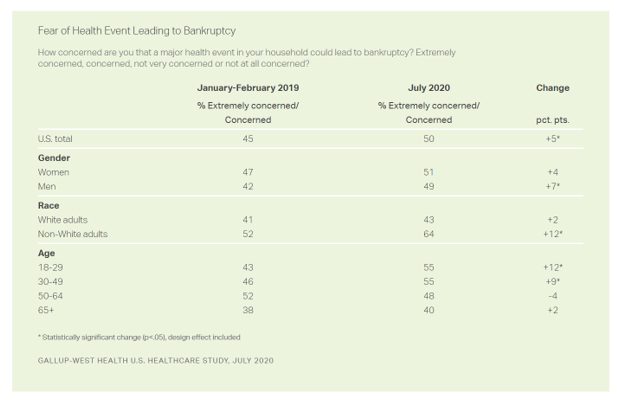

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

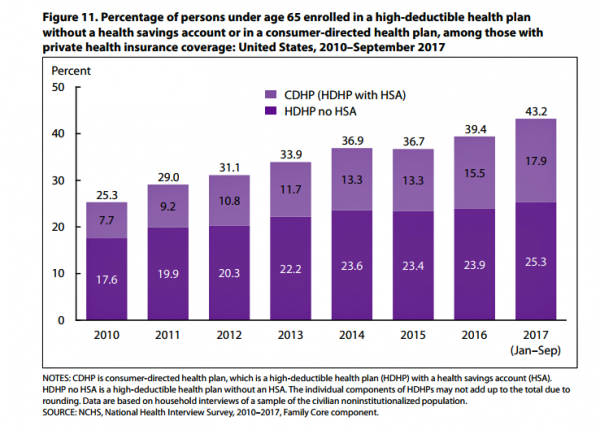

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

The State of Financial Wellness and Health in America – Suffering Across the Ages

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health. Welcome to The uncomfortable reality of financial wellbeing, a report on the 2017 Financial Mindset Study Highlights from Alight Solutions, an HR services company. The first chart arrays the well-being rankings across the five factors, showing that just over one-half of Americans have more positive views on their emotional

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

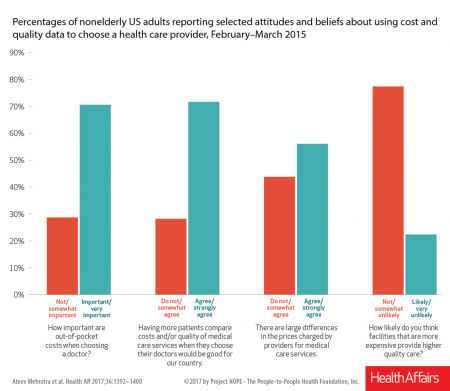

Price-Shopping for Healthcare Still A Heavy Lift for Consumers

Most U.S. consumers support the idea of price-shopping for healthcare, but don’t practice it. While patients “should” shop for health care and perceive differences in costs across providers, few seek information about their personal out-of-pocket costs before getting treatment. Few Americans shop around for health care, even when insured under a high-deductible health plan, conclude Ateev Mehrotra and colleagues in their research paper, Americans Support Price Shopping For Health Care, But Few Actually Seek Out Price Information. The article is published in Health Affairs‘ August 2017 issue. The bar chart shows some of the survey results, with the top-line finding

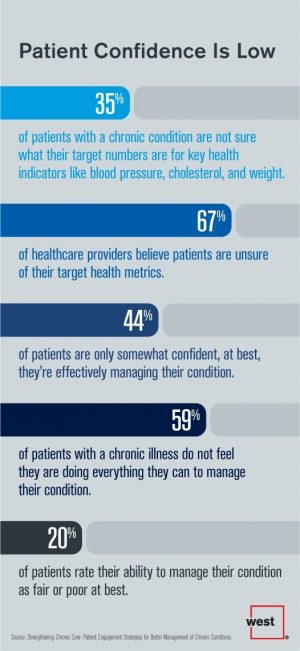

Strengthening Chronic Care Is Both Personal and Financial for the Patient

6 in 10 people diagnosed with a chronic condition do not feel they’re doing everything they can to manage their condition. At the same time, 67% of healthcare providers believe patients aren’t certain about their target health metrics. Three-quarters of physicians are only somewhat confident their patients are truly informed about their present state of health. Most people and their doctors are on the same page recognizing that patients lack confidence in managing their condition, but how to remedy this recognized challenge? The survey and report, Strengthening Chronic Care, offers some practical advice. This research was conducted by West

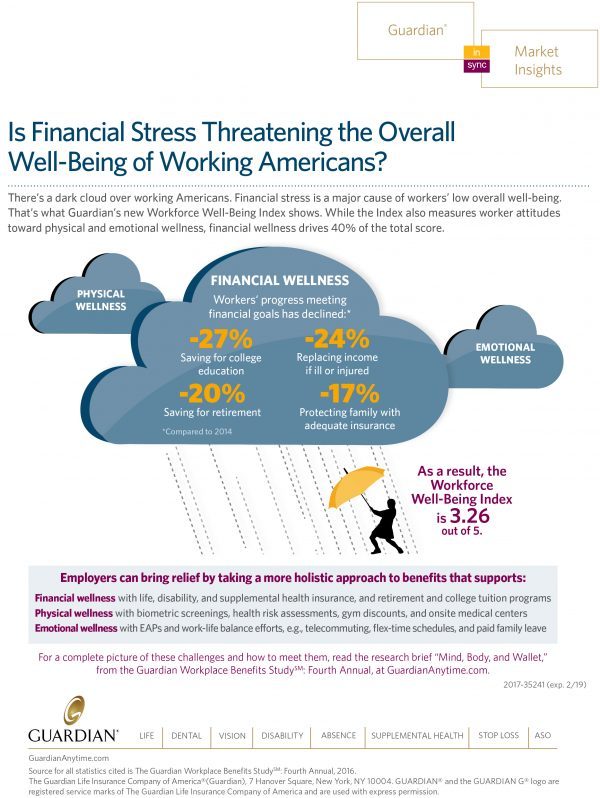

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

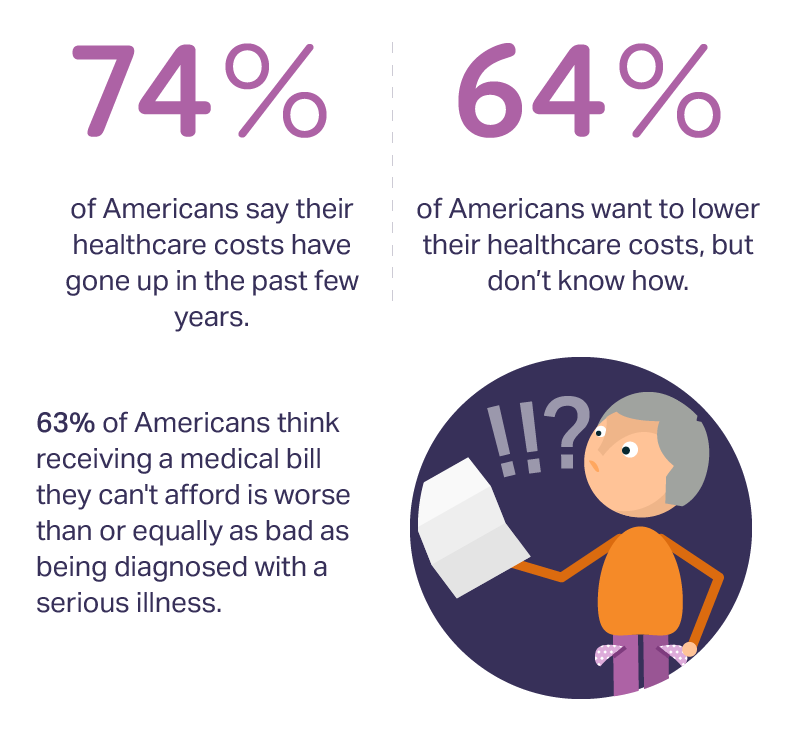

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

How Amazon Has Primed Healthcare Consumers

We are all Amazon Prime primed as consumers now. So it should not surprise healthcare providers, plans and suppliers that consumers expect just-in-time convenience for their healthcare, Accenture has found. Mind the gap: 8 in 10 U.S. patients would welcome some aspect of virtual healthcare, but only 1 in 5 providers is meeting that need. The consumer demand for virtual care is palpable for: Tracking biometrics, among 77% of consumers (say, for measuring blood pressure or blood glucose for people managing diabetes) Following up appointments, for 76% of people after seeing a doctor or being discharged from hospital Receiving reminders

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

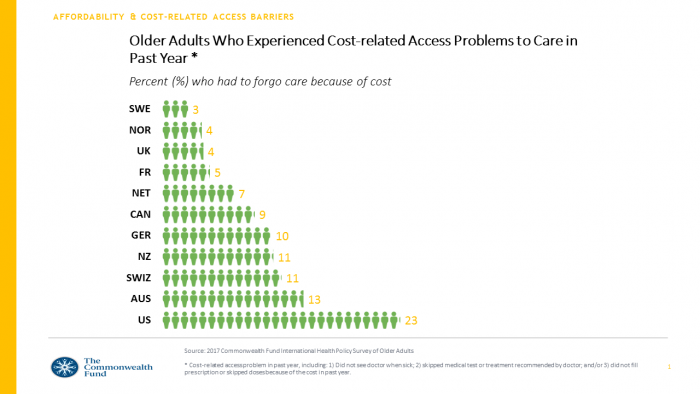

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

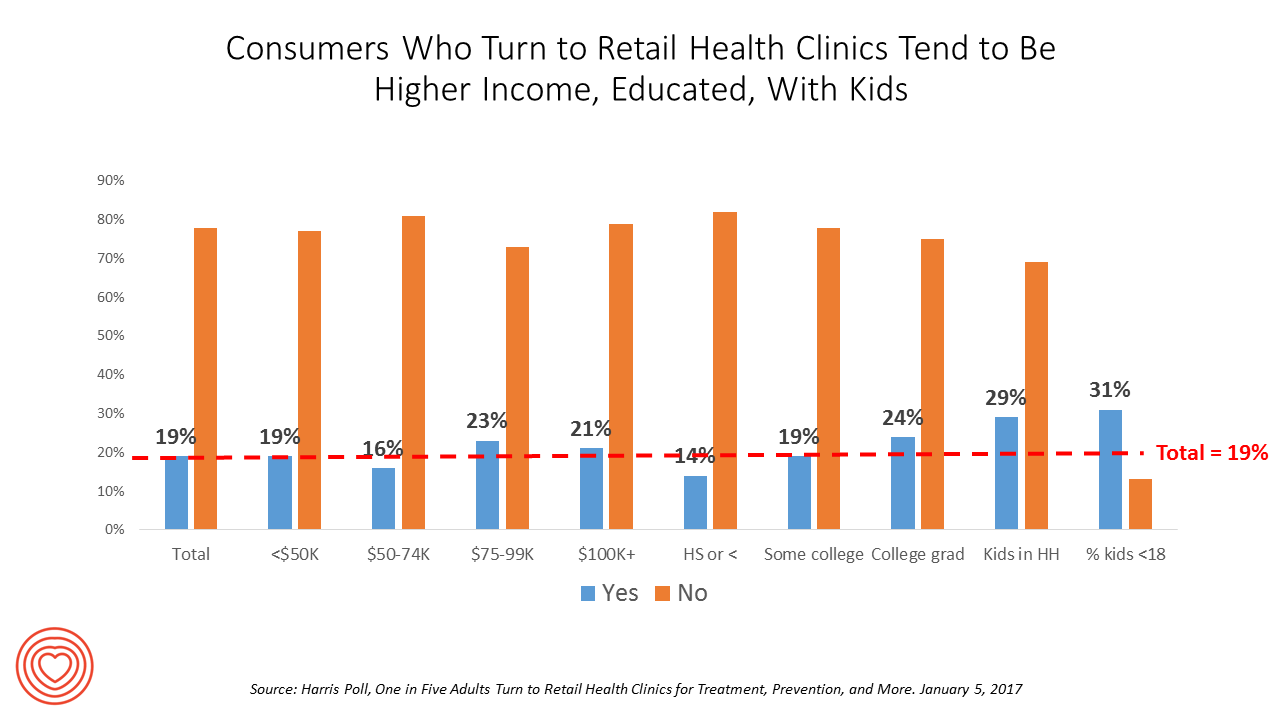

More Consumers Use Retail Health Clinics for Healthcare Management, Harris Finds

1 in 5 U.S. adults used a retail clinic in 2016. Increasingly, health consumers seek care from retail clinics for more complex healthcare services beyond flu shots and pre-school exams, according to the Harris Poll’s survey, One in Five Adults Turn to Retail Health Clinics for Treatment, Prevention, and More, published January 5, 2017. Additional points the poll revealed are worth attention for public health policy purposes: Twice as many people who identify as LGBT turn to retail clinics than others (35% vs. 18%) Older people frequent retail clinics for flu vaccines more than younger people do More younger men

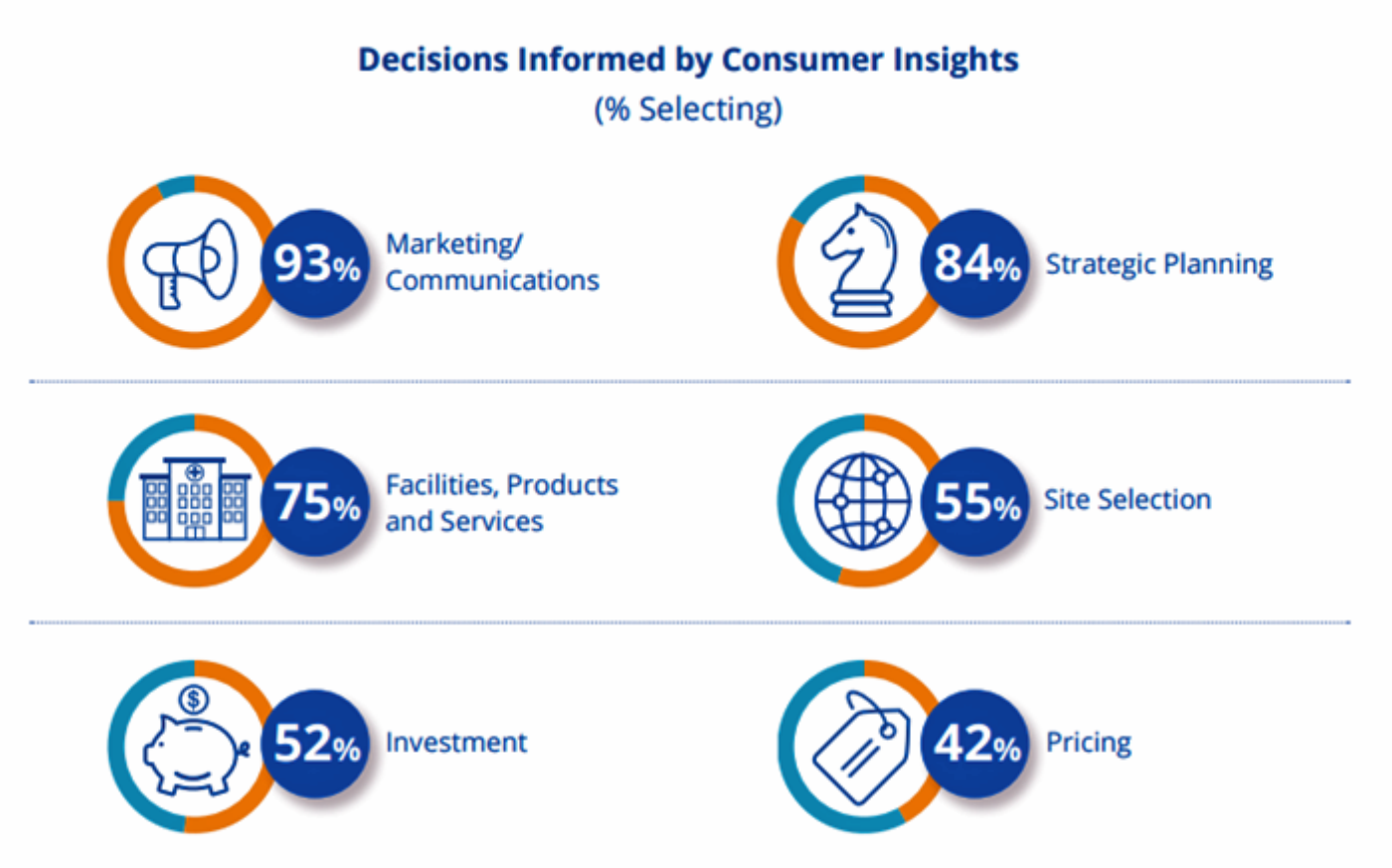

Hospitals Need to Cross the Health Consumer Chasm

Most U.S. hospitals have not put consumerism into action, a new report from KaufmanHall and Caden’s Consulting asserts from the second paragraph. Patient experience is the highest priority, but has the biggest capability gap for hospitals, the report calls out. KaufmanHall surveyed 1,000 hospital and health system executives in 100 organizations to gauge their perspectives on health consumers and the hospital’s business. KaufmanHall points out several barriers for hospitals working to be consumer-centered: Internal/institutional resistance to change Lack of urgency Competing priorities Skepticism Lack of clarity (vis-a-vis strategic plan) Lack of data and analytics. The key areas identified for consumer centricity

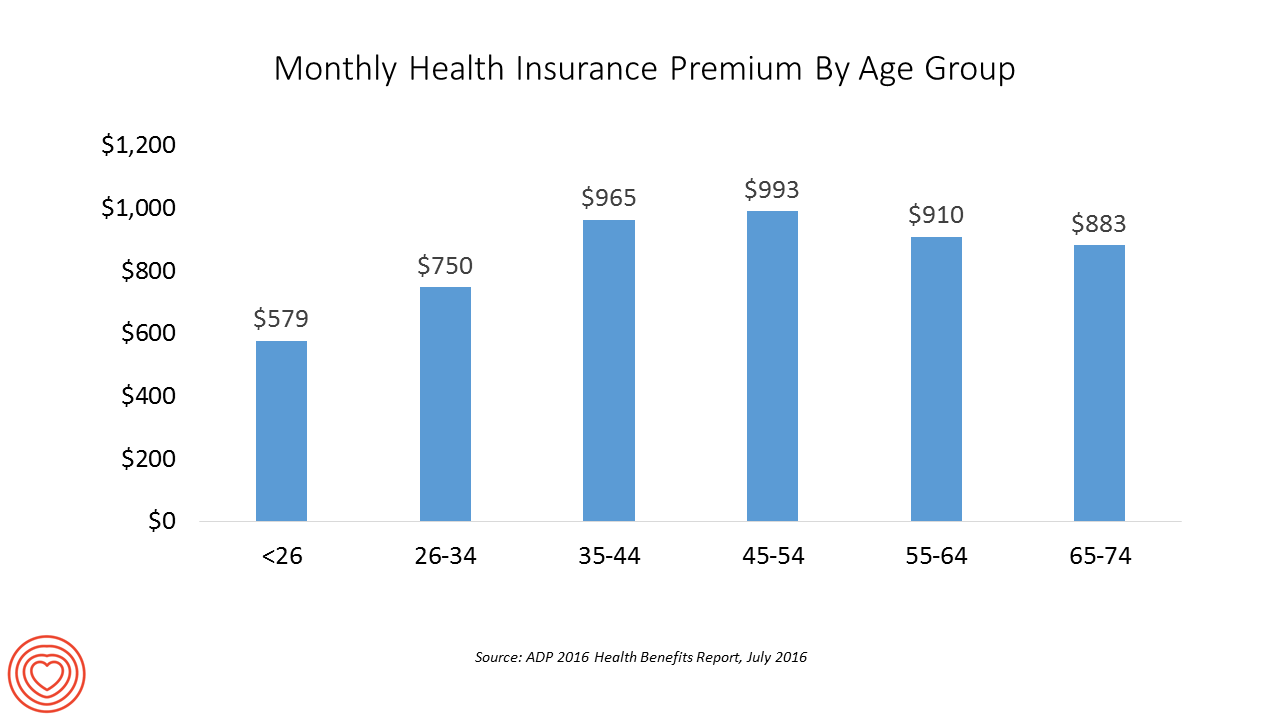

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

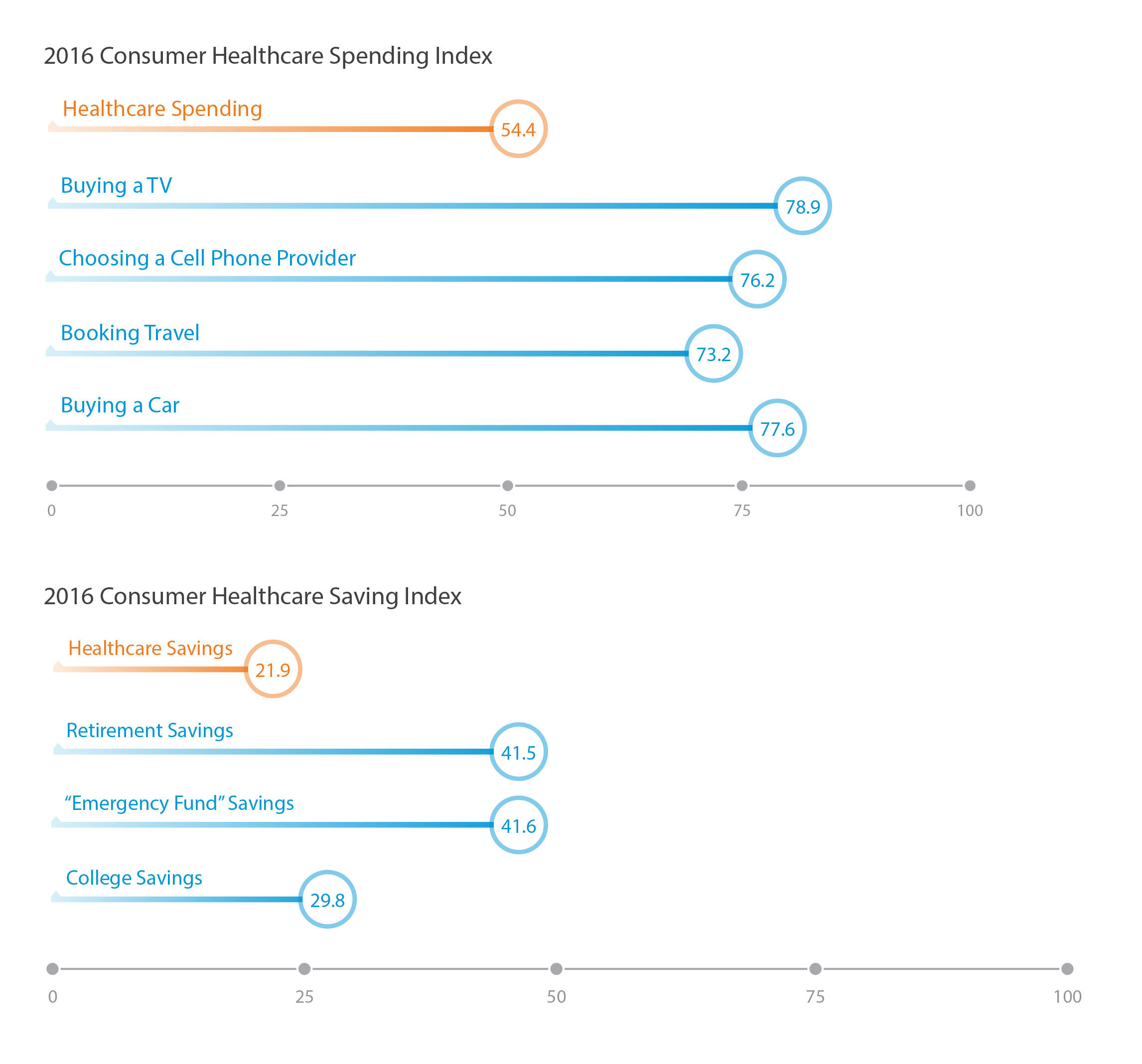

Healthcare Consumerism? Not So Fast, Alegeus Finds

Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans? Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016. Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...