Americans Want More Health Care Issues Baked into the 2024 Elections – Gallup

Beyond women’s health and abortion politics, most Americans are looking for more health care baked into the 2024 Elections, based on a new poll from Gallup in collaboration with West Health. Two in three U.S. adults thought health care was not receiving enough attention during the 2024 Presidential campaign as of September 2024. This is a majority shared opinion for voters across the three party IDs in the U.S., shown in the first bar graph. The research polled 3,660 U.S. adults in September, about two-thirds before the presidential debate held September 10, and about one-third

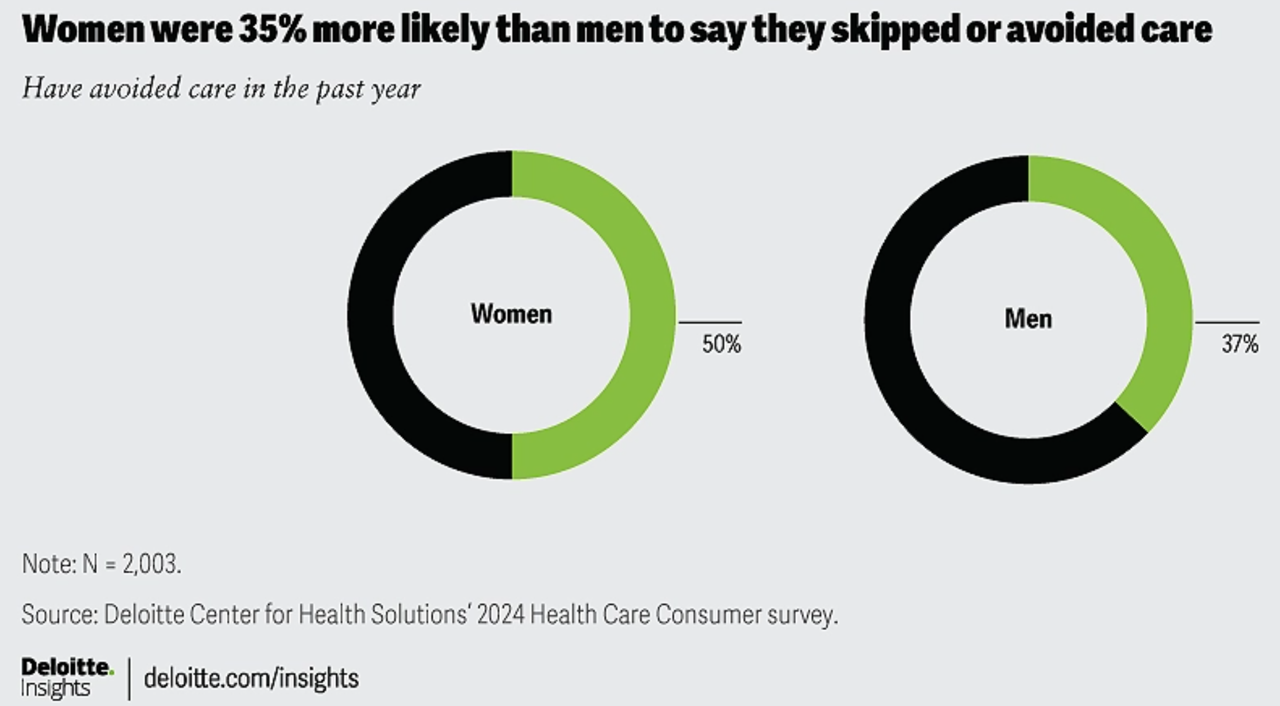

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

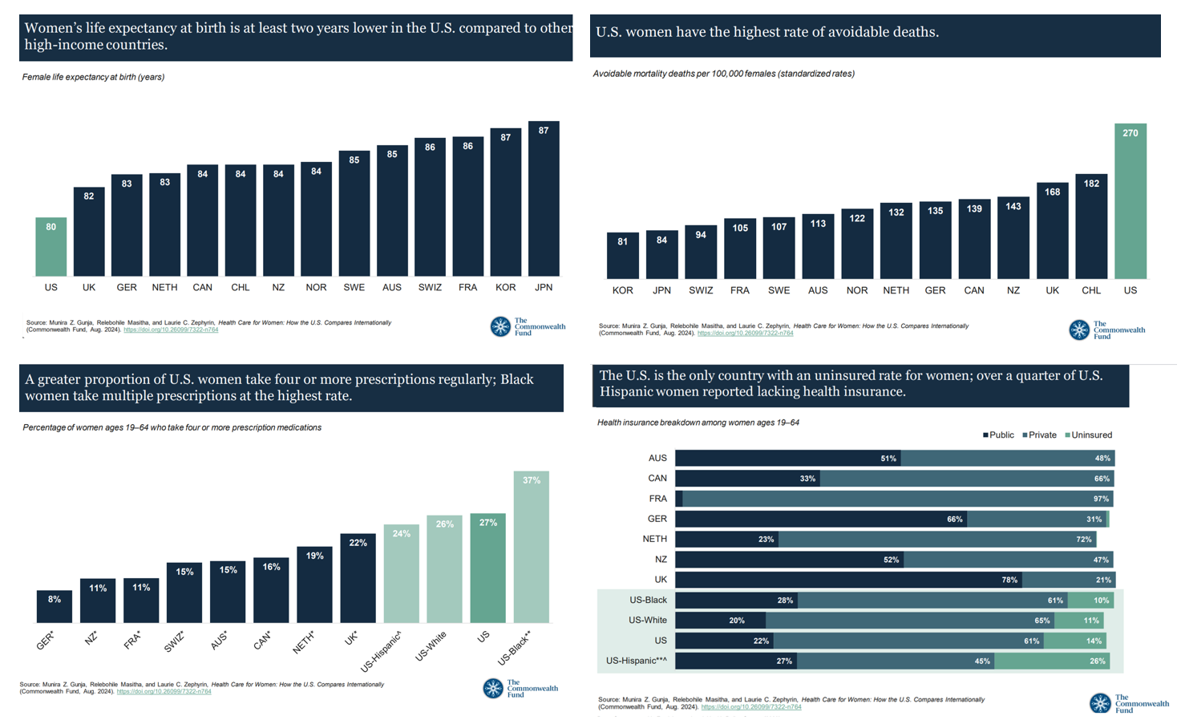

Women’s Health Outcomes in the U.S.: Spending More, Getting (Way) Less – 4 Charts from The Commonwealth Fund

Women in the U.S. have lower life expectancy, greater risks of heart disease, and more likely to face medical bills and self-rationing due to costs, we learn in the latest look into Health Care for Women: How the U.S. Compares Internationally from The Commonwealth Fund. The Fund identified four key conclusions in this global study: Mortality, shown in the first chart which illustrates women in the U.S. having the lowest life expectancy of 80 years versus women in other high-income countries; Health status, with women in the U.S. more likely to consume multiple prescription

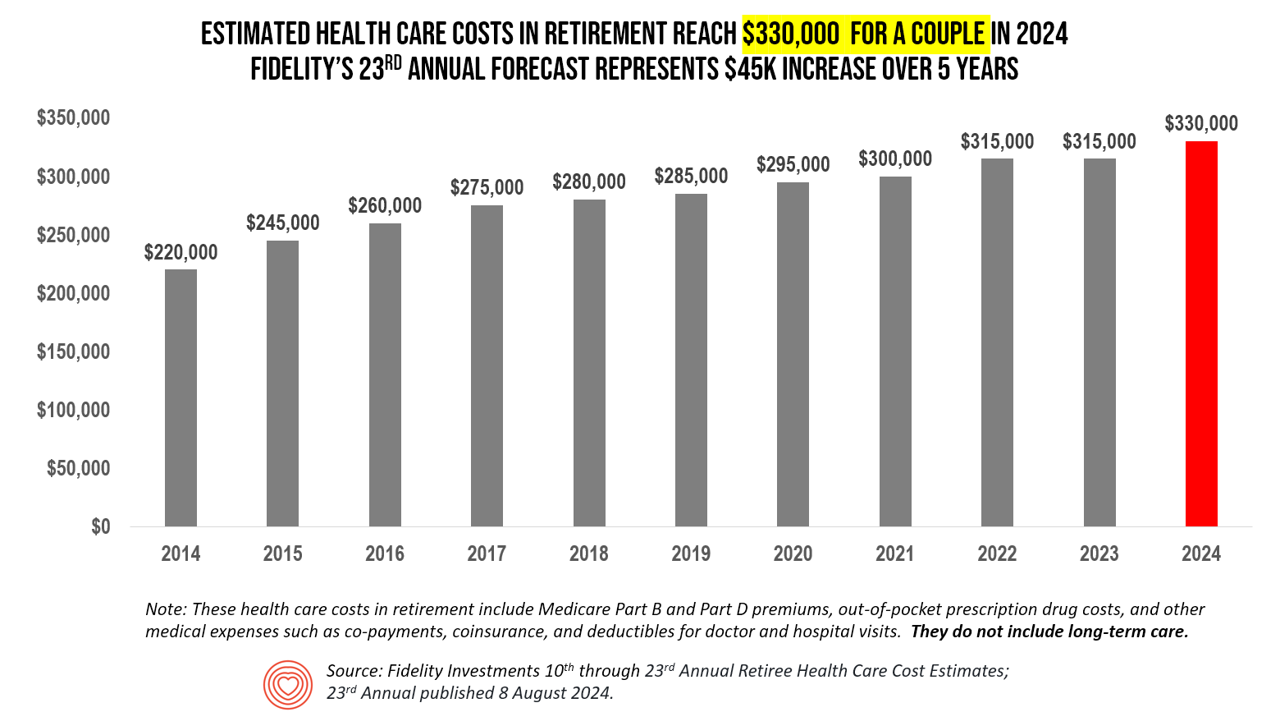

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

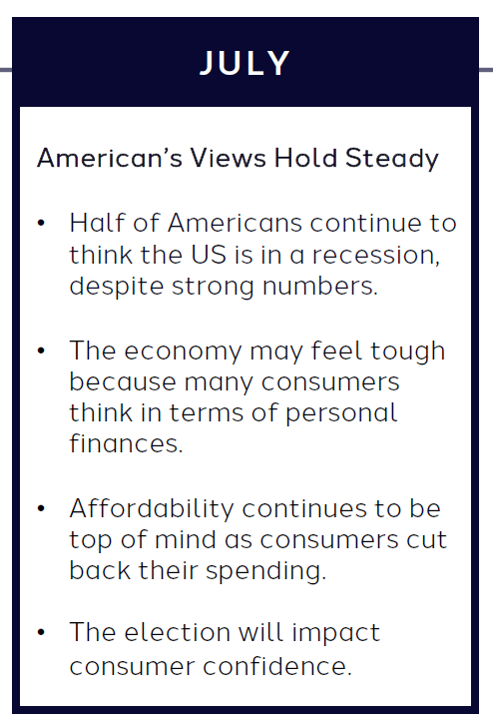

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

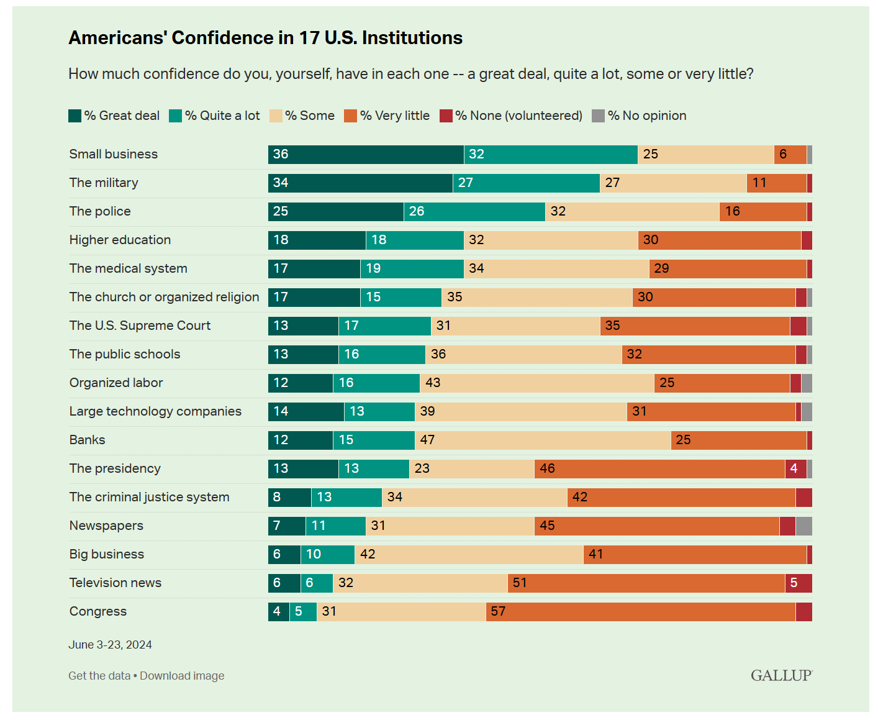

Trust in Institutions Among Americans: Small Biz, the Military and Police More than the Medical System

Two-thirds of Americans have a lot of confidence in small business in the U.S. In second place, 61% of people in the U.S. have confidence in the military, followed by 51% with the police. The Gallup Poll on Americans’ confidence in 17 U.S. institutions is out today, reflecting a snapshot of U.S. adults’ views on the organizations that touch their daily lives. And health care doesn’t fare too well in this latest read. Only 36% of Americans have confidence in the U.S. medical system, tied with peoples’ feelings of lack of confidence

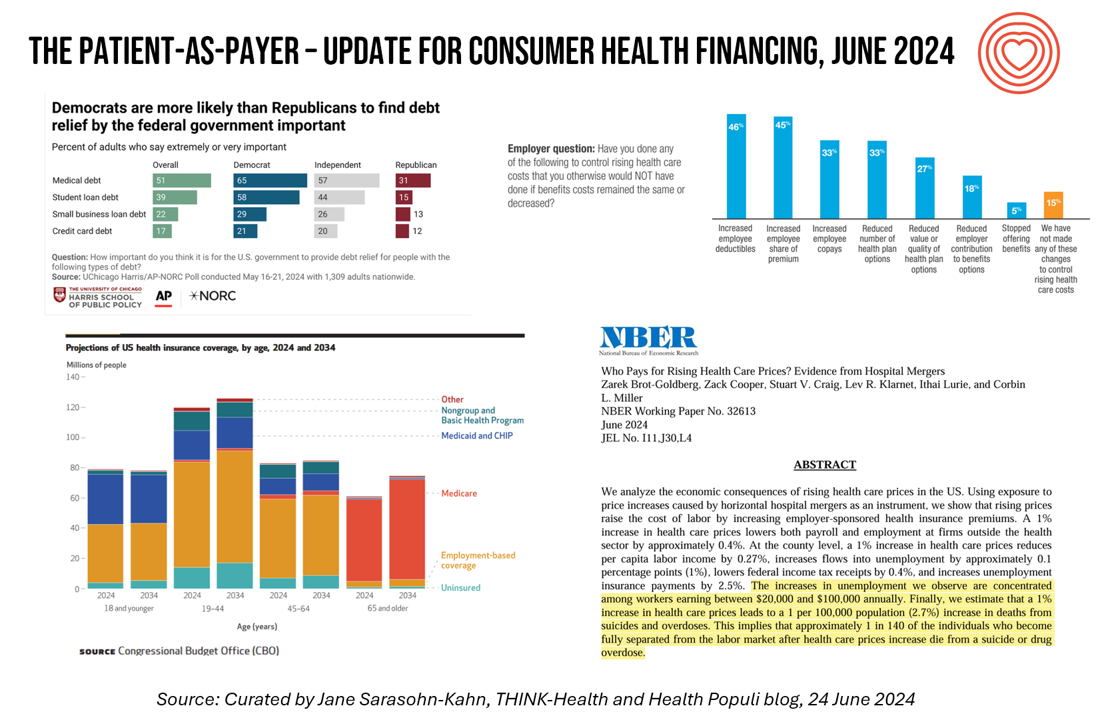

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

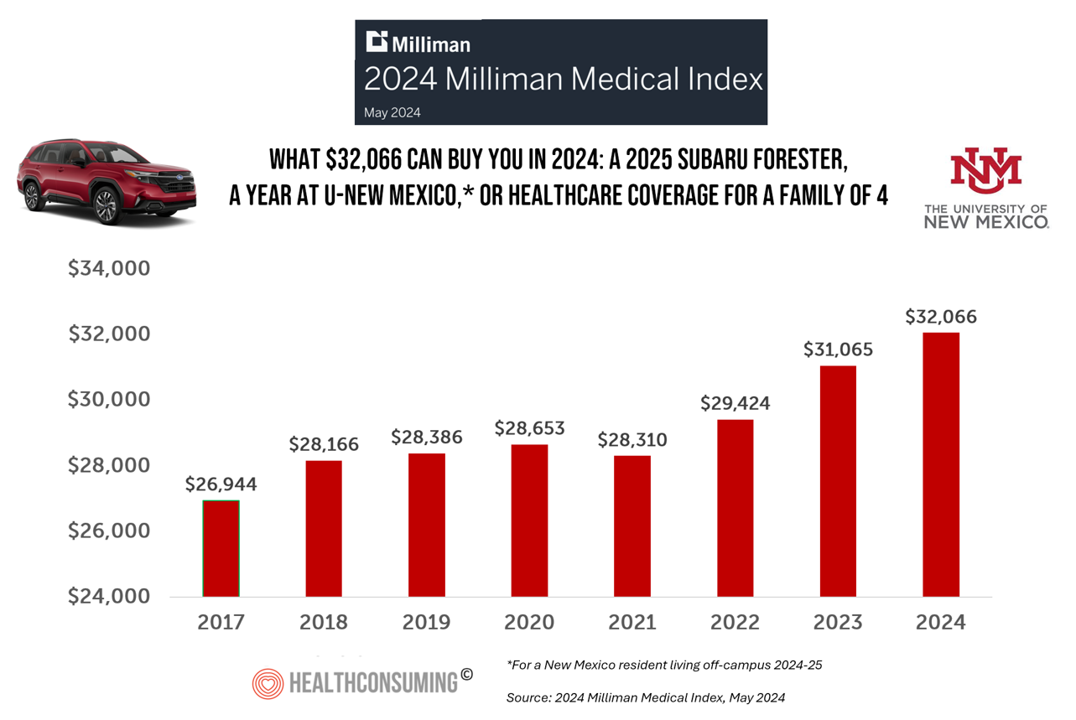

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

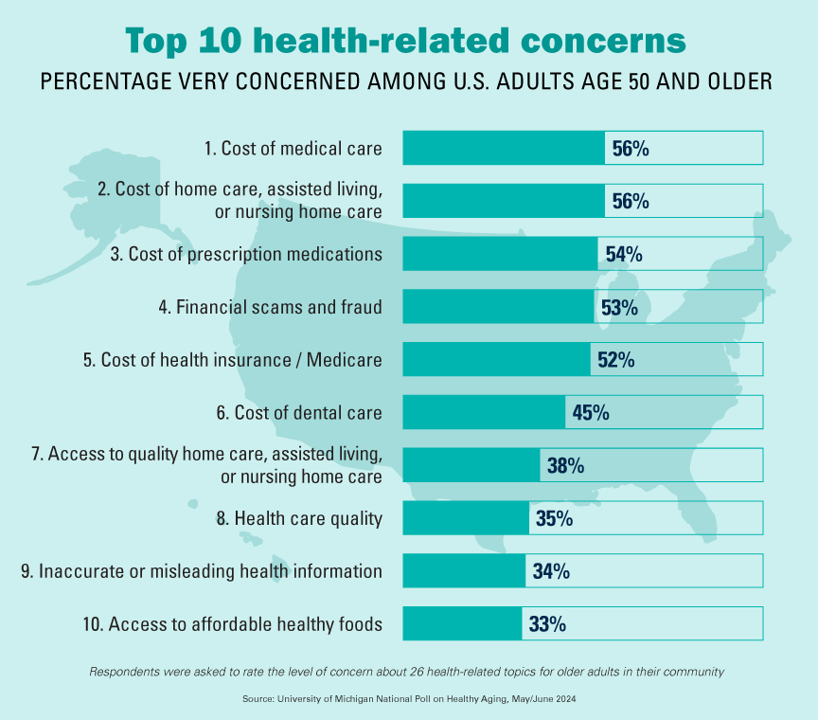

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

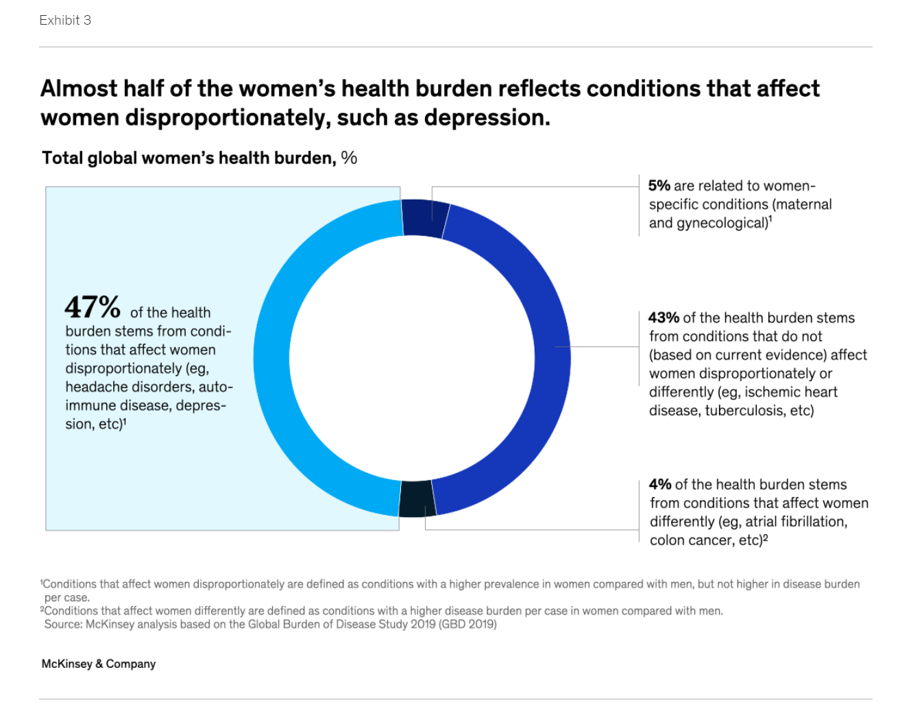

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

A Health Consumer Bill of Rights: Assuring Affordability, Access, Autonomy, and Equity

Let’s put “health” back into the U.S. health care system. That’s the mantra coming out of this week’s annual Capitol Conference convened by the National Association of Benefits and Insurance Professionals (NABIP). (FYI you might know of NABIP by its former acronym, NAHU, the National Association of Health Underwriters). NABIP, whose members represent professionals in the health insurance benefits industry, drafted and adopted a new American Healthcare Consumer Bill of Rights launched at the meeting. While the digital health stakeholder community is convening this week at VIVE in Los Angeles to share innovations in health tech, NABIP

Americans Come Together in Worries About Medical Bills, the Cost of Health Care, and Prescription Drug Costs

In the U.S., national news media, Federal statistics, dozens of business leaders and the Federal Reserve Bank have been talking about an historically positive American economy on a macro level. But among individual residents of the U.S., there is still a negative feeling about the economy in a personal context, revealed in the Kaiser Family Foundation Health Tracking Poll for February 2024. I’ve selected three figures of data from the KFF’s Poll which make the point that in peoples’ negative feelings about the national economy, their personal feelings about medical costs rank high

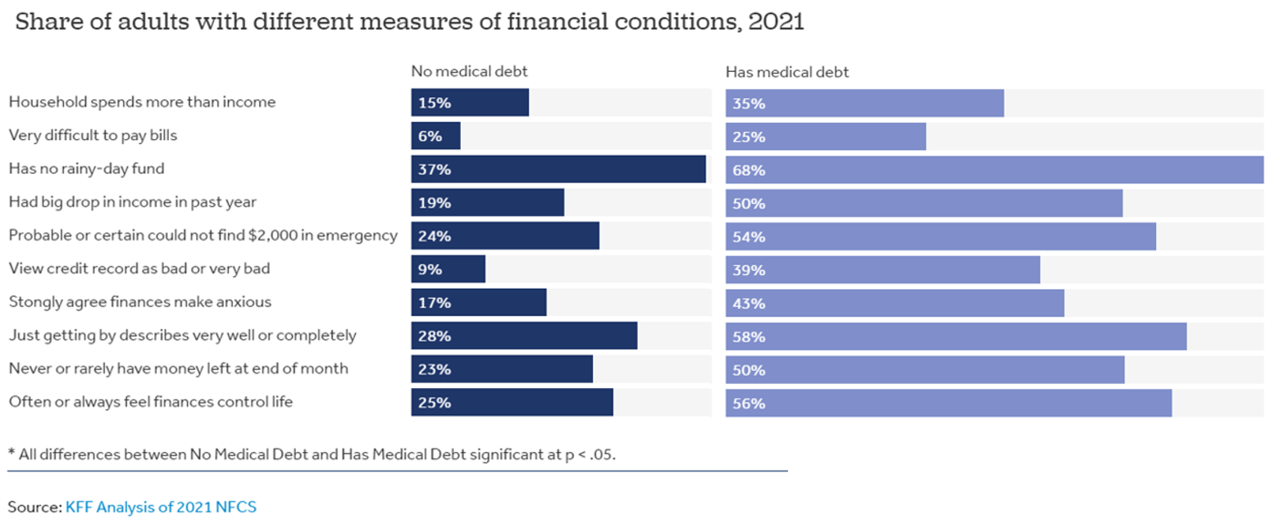

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

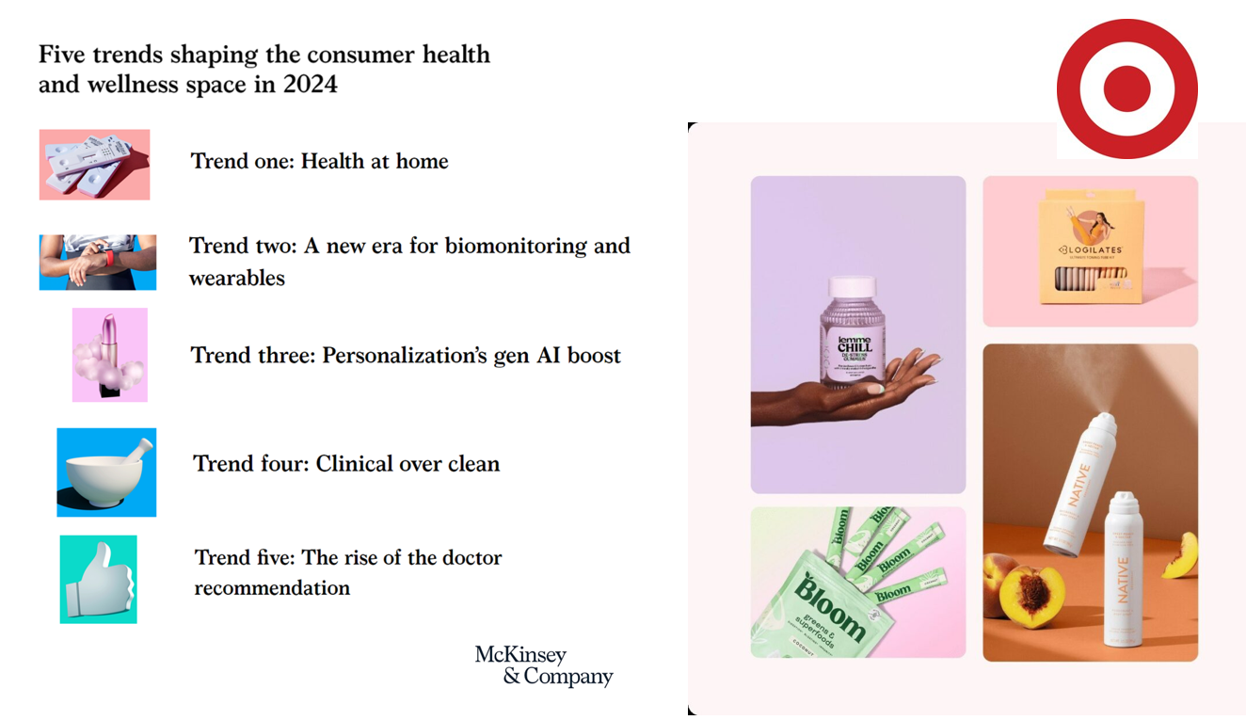

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

Thank you,

Thank you,  As a proud Big Ten alum, I'm thrilled to be invited to meet with the OSU HSMP Alumni Society to share perspectives on health care innovation.

As a proud Big Ten alum, I'm thrilled to be invited to meet with the OSU HSMP Alumni Society to share perspectives on health care innovation. I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!

I was invited to be a Judge for the upcoming CES 2025 Innovation Awards in the category of digital health and connected fitness. So grateful to be part of this annual effort to identify the best in consumer-facing health solutions for self-care, condition management, and family well-being. Thank you, CTA!