U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

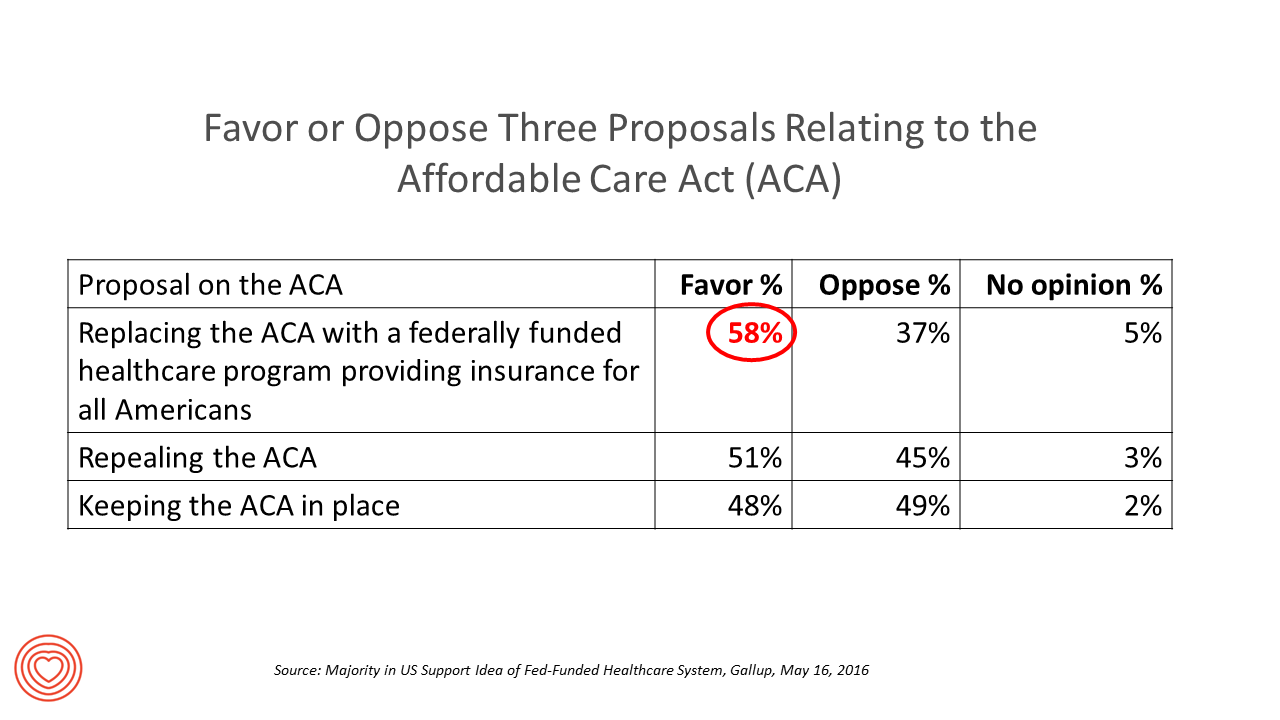

Growing Sentiment for a Single Payer Healthcare System in the U.S.

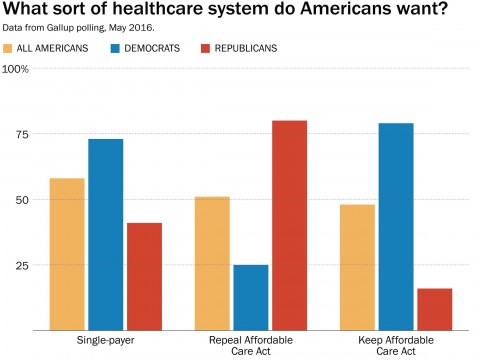

There is growing support for a single payer healthcare system in America, found in the latest Gallup Poll and a survey the organization conducted earlier this year in May 2016. A slight majority of Americans favor a single payer system, shown in the first chart. By political party, that splits into 3 in 4 Democrats pro-single payer, and 4 in 10 Republicans (41%). Note that the 41% of Republicans who favor single payer is a much higher number than the 16% who favor keeping the Affordable Care Act in place. Gallup writes, “The general idea of a single payer system seems to

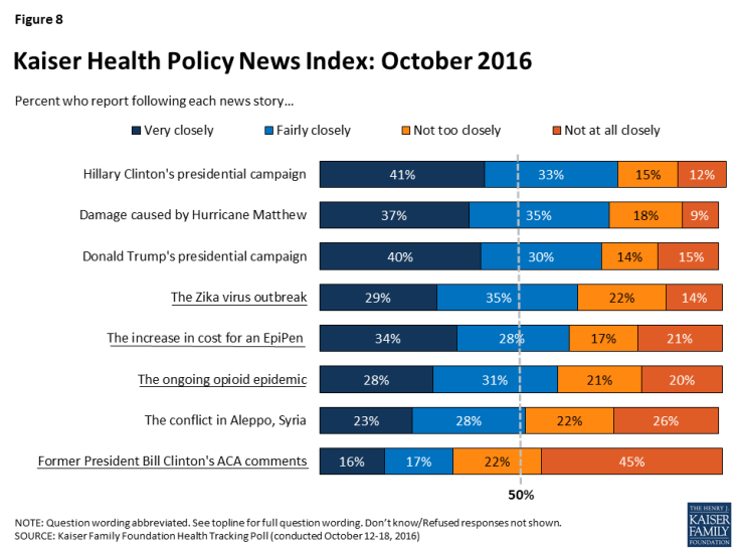

In #Election2016, Americans Care More About the Cost of Prescription Drugs Than the ACA

“When thinking about health care priorities for the next president and Congress to address, dealing with the high price of prescription drugs tops the public’s list while issues specific to the Affordable Care Act (ACA), such as repealing provisions of the law or repealing the law entirely, are viewed as top priorities by fewer Americans,” according to the Kaiser Health Tracking Poll for October 2016 – the last such survey to be taken before the 2016 Presidential election. The poster child snapshot image representing the high cost of prescription drugs is the increase in cost for an EpiPen, which among

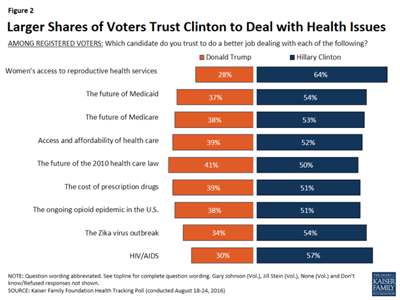

More Americans See Hillary Clinton As the 2016 Presidential Health Care Candidate

When it comes to health care, more American voters trust Hillary Clinton to deal with health issues than Donald Trump, according to the Kaiser Health Tracking Poll: August 2016 from the Kaiser Family Foundation (KFF). The poll covered the Presidential election, the Zika virus, and consumers’ views on the value of and access to personal health information via electronic health records. Today’s Health Populi post will cover the political dimensions of the August 2016 KFF poll; in tomorrow’s post, I will address the health information issues. First, let’s address the political lens of the poll. More voters trust Hillary Clinton to do

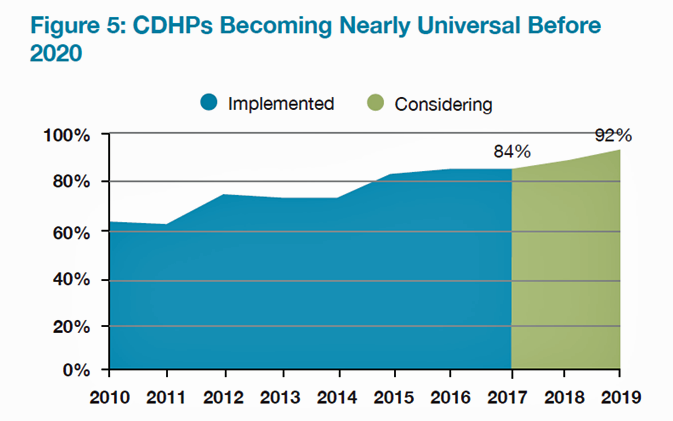

Employers Changing Health Care Delivery – Health Reform At Work

Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH). Health care cost increases will average 5% in 2017 based on planned design changes, according to the top-line of the study. The major cost drivers, illustrated in the wordle, will be specialty pharmacy (discussed in yesterday’s Health Populi), high cost patient claims, specific conditions (such as musculoskeletal/back pain), medical inflation, and inpatient care. To temper these medical trend increases,

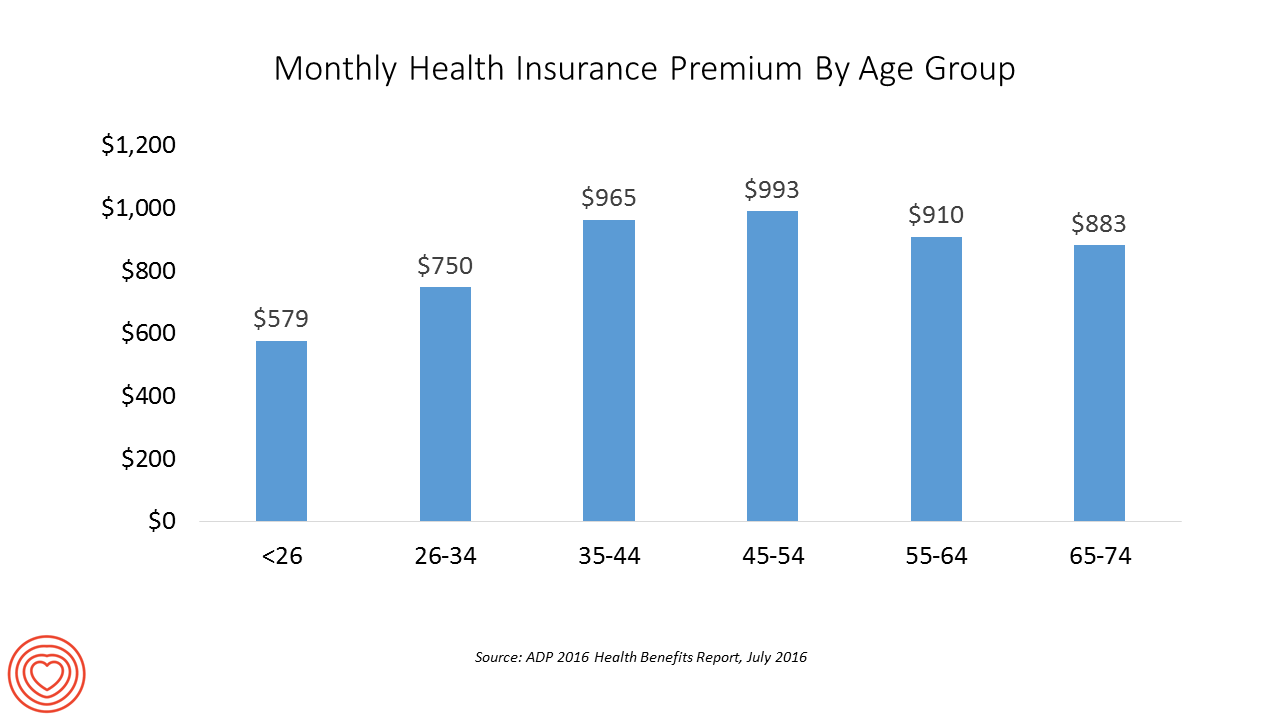

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

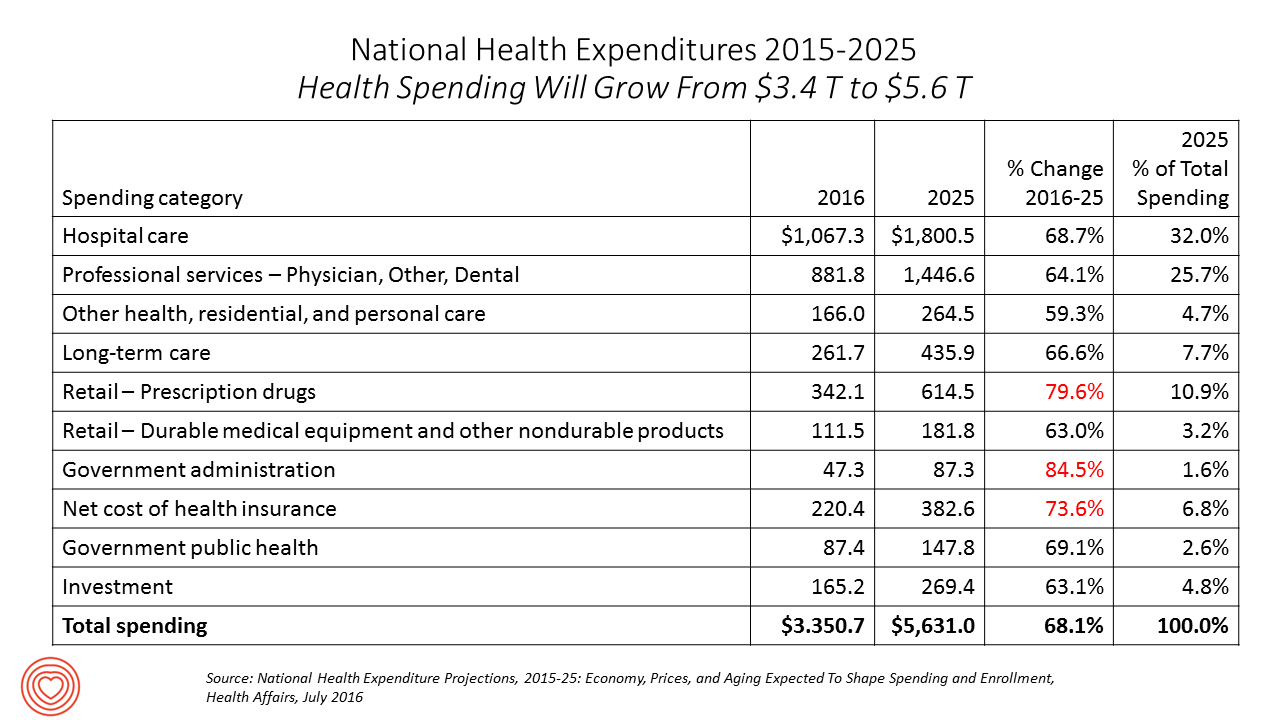

U.S. Health Spending Will Comprise 20% of GDP in 2025

Spending on health care in America will comprise $1 in every $5 of gross domestic product in 2025, according to National Health Expenditure Projections, 2015-25: Economy, Prices, And Aging Expected to Shape Spending and Enrollment, featured in the Health Affairs July 2016 issue. Details on national health spending are shown by line item in the table, excerpted from the article. Health spending will grow by 5.8% per year, on average, between 2015 and 2025, based on the calculations by the actuarial team from the Centers for Medicare and Medicaid Services (CMS), authors of the study. The team noted that the Affordable Care

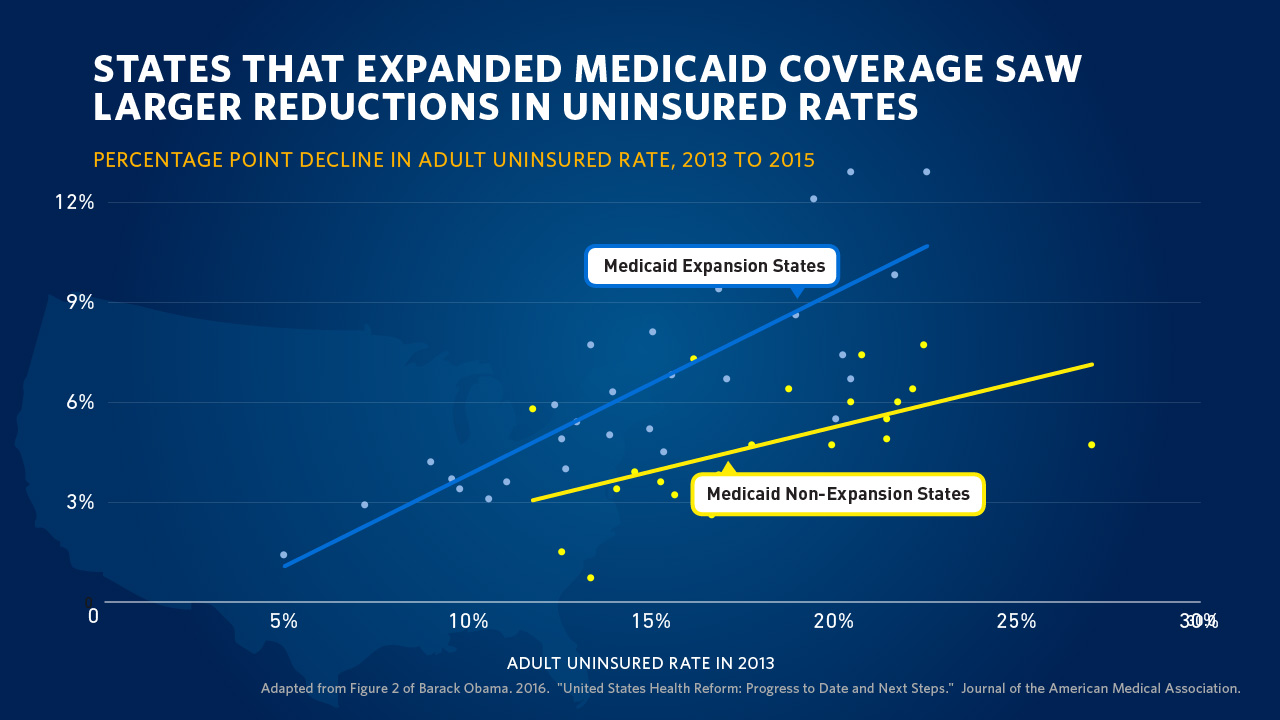

Health Care Reform: President Obama Pens Progress in JAMA

“Take Governor John Kasich’s explanation for expanding Medicaid: ‘For those that live in the shadows of life, those who are the least among us, I will not accept the fact that the most vulnerable in our state should be ignored. We can help them.’” So quotes President Barack Obama in the Journal of the American Medical Association, JAMA, in today’s online issue. #POTUS penned, United States Health Care Reform: Progress to Date and Next Steps. The author is named as “Barack Obama, JD,” a nod to the President’s legal credentials. Governor Kasich, a Republican, was one of 31 Governors who

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

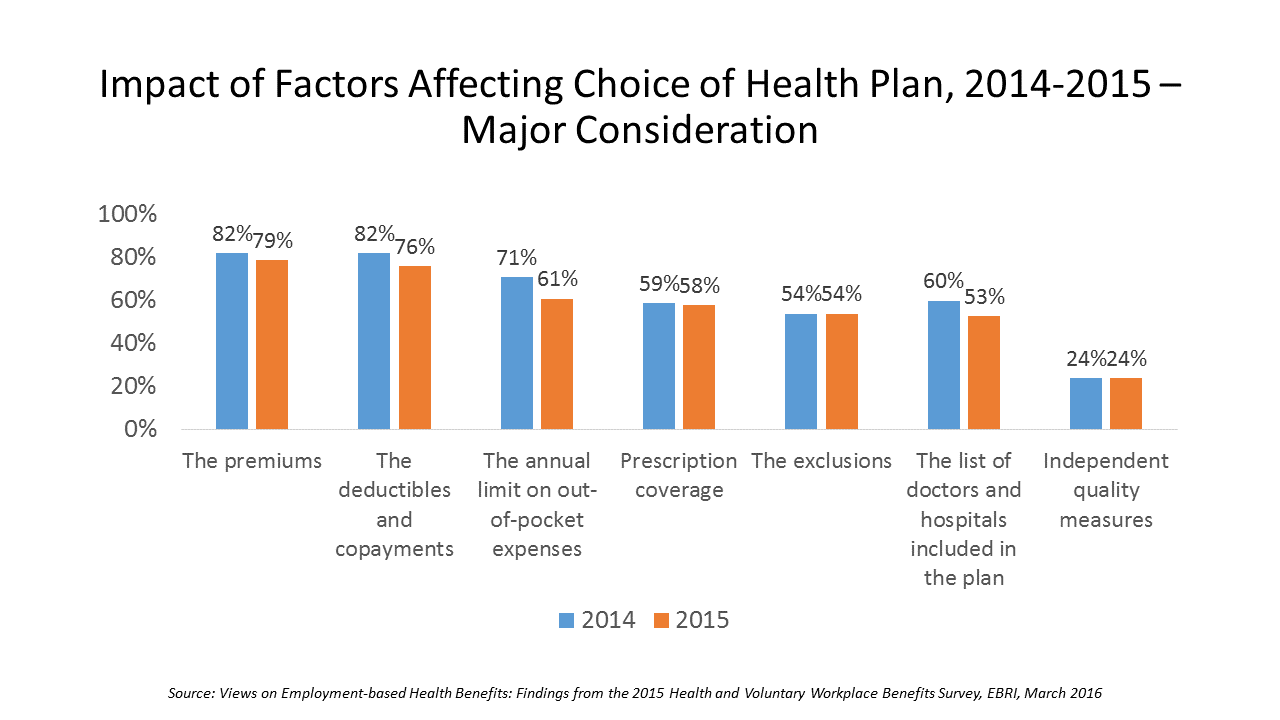

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

Diagnosis: Acute Health Care Angst In America

There’s an overall feeling of angst about healthcare in America among both health care consumers and the people who provide care — physicians and administrators. On one thing most healthcare consumers and providers (can agree: that the U.S. health care system is on the wrong track. Another area of commonality between consumers and providers regards privacy and security of health information: while healthcare providers will continue to increase investments in digital health tools and electronic health records systems, both providers and consumers are concerned about the security of personal health information. In How We View Healthcare in America: Consumer and Provider Perspectives,

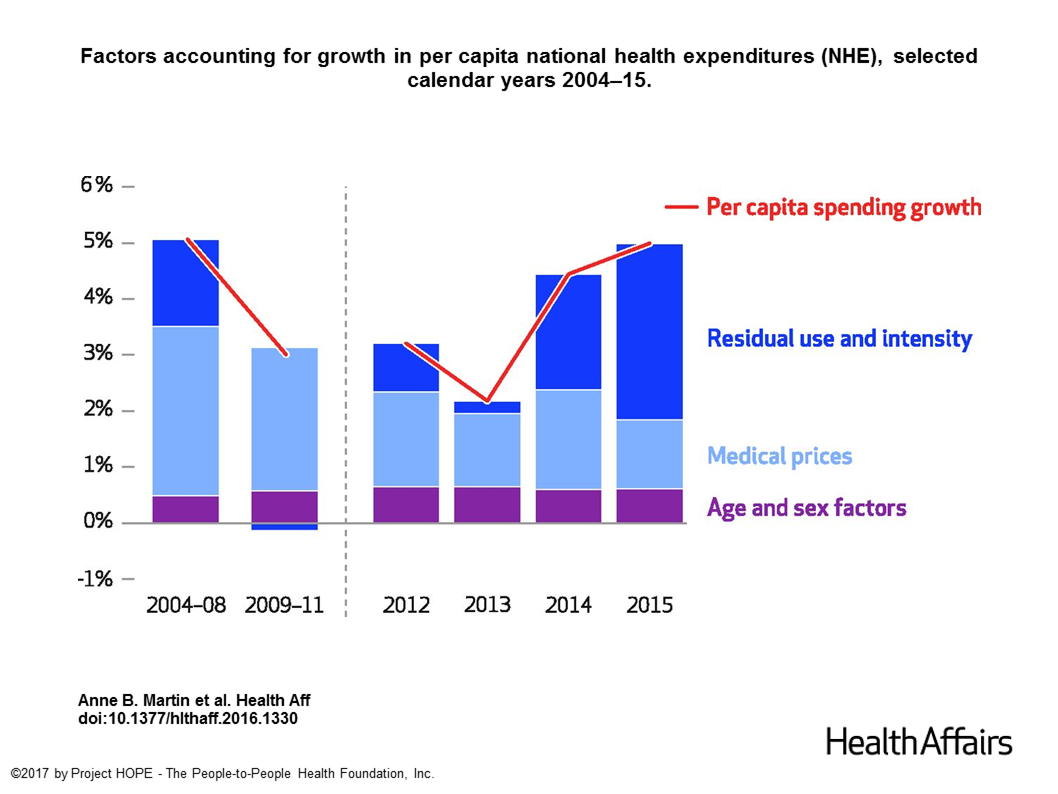

U.S. National Health Spending Up Due to More People Covered and Higher Drug Costs

National health spending in American grew by 5.3% in 2014, hitting the $3 trillion mark. This represented an up-tick nearly twice the growth rate of 2.9% in 2013, the slowest rate of growth in 55 years, according to the latest analysis of the U.S. health economy published by Health Affairs. The first chart illustrates the factors that contribute to that 5.3% growth in health spending. The two largest factors were medical prices and so-called “residual use and intensity.” The medical price increase portion was 1.8% in 2014, up from 1.3% in 2013. The use and intensity component was attributable to

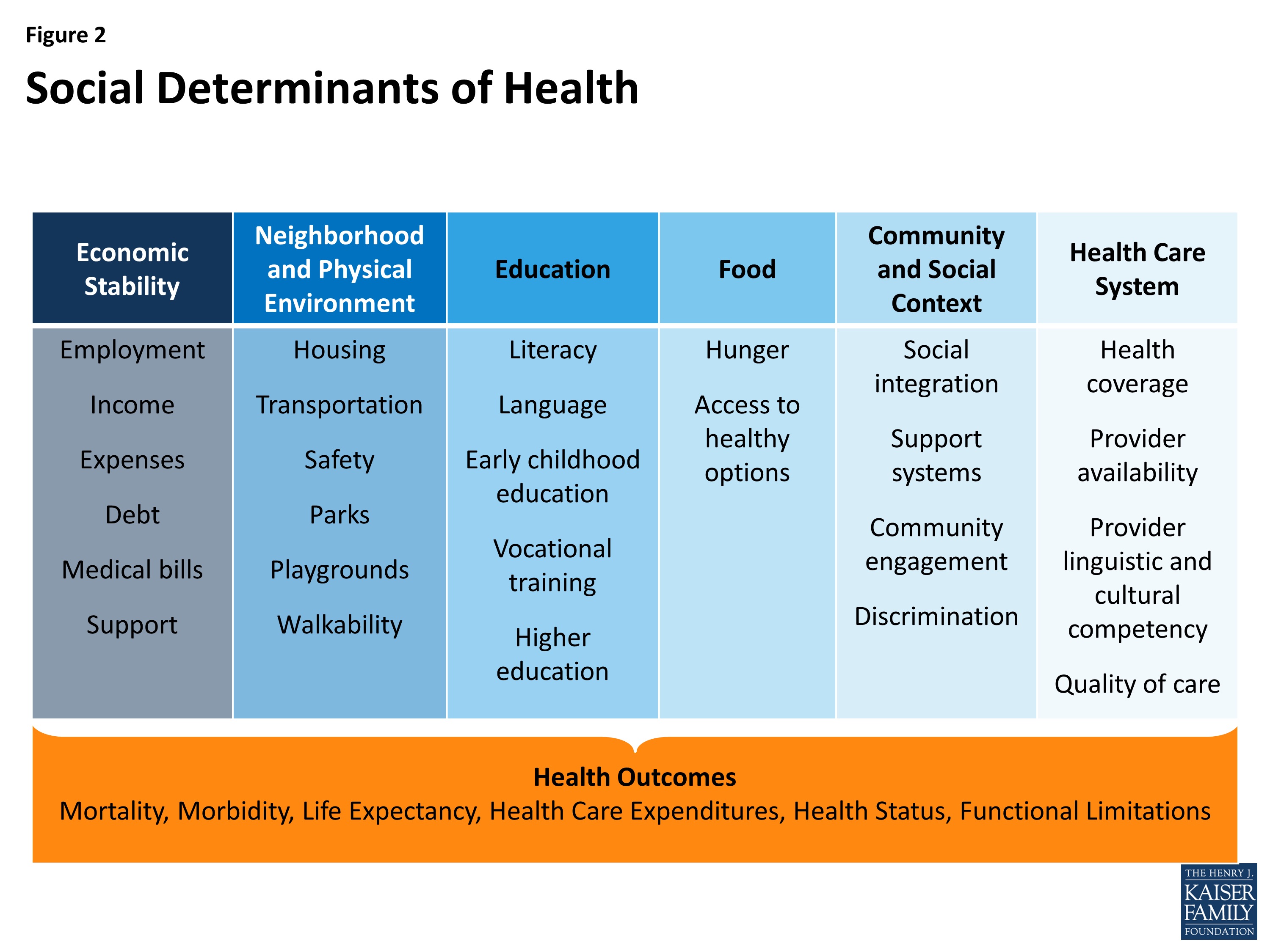

Social Determinants Impact Health More Than Health Care

The factors of where people are born, live, work and age — social determinants — shape human health more than health care. Yet in the U.S. much more resource per capita is funneled into healthcare services than into social ones. Beyond Health Care: The Role of Social Determinants in Promoting Health and Health Equity was published by The Kaiser Commission on Medicaid and the Uninsured in November 2015, calling attention to the opportunity and wisdom of baking health into all public policy. The social determinants of health (SDOH) include economic stability, the physical environment and neighborhood, education, food, community and

Pocketbook Health Economics In One Chart

Covering the uninsured changes pocketbook problems, this chart demonstrates. The Kaiser Family Foundation (KFF) surveyed Californians between February and May 2015, and found that people newly enrolling in health insurance had less financial stress, and more health needs met. KFF asked previously uninsured Californians to rank five household “pocketbook” spending categories which they said were difficult to afford: health care, housing (rent/mortgage), gasoline, utilities, and food. Among the five, people gaining insurance worried much less about health care costs (49%, slipping to fourth place), and more about paying for shelter (58%), utility bills (54%), and gas (53%), shown in the

Medicare Makes the Case for Outcomes, As Increasing Costs Loom

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential. Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Health Care in the 2014 Mid-Term Election

In the November 2014 mid-term elections, Democrats tend to favor continuing the Affordable Care Act (ACA) as-is, and Republicans favor scrapping it, scaling it back, or fully replacing the law with something yet to be defined. But it’s hard to read just where the ACA will end up after tomorrow’s election, because many key battleground states are too close to call…and the two major parties have such polar views on health reform. What’s most significant this year is that those most likely to vote are less likely to vote for a congressional candidate who supports the ACA (40%) than would

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

Online is to go-to place for health insurance info, but lots of uninsured people live offline

A vast majority of people shopping for a health plan on a Health Insurance Exchange for coverage in 2014 obtained information online via websites. One-half of these shoppers used only online information, and 29% combined both websites and other sources like direct assistance, informal assistance, and via (offline) media. In the Health Reform Monitoring Survey from the Urban Institute Health Policy Center, a research team, funded by the Robert Wood Johnson Foundation and the Ford Foundation, looked into data collected from the Health Reform Monitoring Survey in March 2014 at the end of the 2014 open enrollment period for the

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

Hillary Clinton wows the HIMSS14 crowd

At last year’s annual HIMSS conference, I had the pleasure of experiencing Bill Clinton’s keynote speech in New Orleans, which I wrote about here. As a long-time member of HIMSS, this was a great moment in my many years attending HIMSS conferences. Another special moment in HIMSS conference history happened today, as, I had the honor of attending Hillary Clinton’s keynote speech at HIMSS 2014 in Orlando today. I am blessed with fast-typing fingers thanks to my mother’s genes, and took constant notes during Hillary’s talk. My favorite paragraphs are quoted below, indicating “Applause” pauses where Hillary was lauded.

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

What, We Worry? Thinking About Healthcare (Costs) Is Stressing Us Out

Three-quarters of us are concerned about health care, a fraction fewer than those of us worried about the economy. Underneath stress about healthcare, people are worried about costs and the impact of the Affordable Care Act (ACA). Say hello to the Healthcare Worry Scale, developed by Chase Communications, a firm focused on marketing and media, largely in the health industry. Chase found that: – 93% believe that their health care costs will continue to increase – 49% say the ACA’s impact is a “major” worry – 43% say getting a disease, medical condition, or injury that health insurance doesn’t fully

Health Care Everywhere at the 2014 Consumer Electronics Show

When the head of the Consumer Electronics Association gives a shout-out to the growth of health products in his annual mega-show, attention must be paid. The #2014CES featured over 300 companies devoted to “digital health” as the CEA defines the term. But if you believe that health is where we live, work, play, and pray, then you can see health is almost everywhere at the CES, from connected home tech and smart refrigerators to autos that sense ‘sick’ air and headphones that amplify phone messages for people with hearing aids, along with pet activity tracking devices like the Petbit. If

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Health care and costs on front-burner for people in America (again)

This week in America, the concept of “health care consumer” is in a tug-of-war, and those of us trying to behave as such feel bloodied in the skirmish. One side of the tug-of-war is the obvious, post October 1st reality of the sad state of the Health Insurance Exchanges. This has been well covered in mass media, right, left and center. And Americans polled by Gallup last week express their knowledge of that fact — even if they didn’t know what Healthcare.gov was on the 1st of October. The first chart shows that health care is now a front-burner issue

America’s health care is better due to Todd Park – detractors, be careful what you wish for

In the aftermath of the snafu that was/is the failed launch of the Affordable Care Act’s Health Insurance Exchange comes, today via Reuters, an article called Obama’s tech expert becomes target over healthcare website woes. The piece, by Roberta Rampton and Sarah McBride, states that Todd Park, Chief Technology Officer at The White House, “now finds himself among a handful of officials with targets on their backs as Republicans try to root out who is responsible for this month’s glitch-ridden rollout of Healthcare.gov,” going on to say that “The White House trotted him out in July to talk up the new version”

U.S. Health Citizens Needed a Dummies Guide to the ACA

The Affordable Care Act (ACA) was signed in March 2010; that month, 57% of U.S. adults did something to self-ration health care, such as splitting prescription pills, postponing necessary health care, and putting off recommended medical tests, according to the Kaiser Family Foundation (KFF) Health Tracking Poll of March 2010. 57% of U.S. adults are still self-rationing health care in September 2013, according to KFF’s latest Health Tracking Poll, completed among 1,503 U.S. adults just two weeks before the launch of the Health Insurance Marketplaces on October 1, 2013. As of September 2013, only 19% of U.S. adults said they had heard

Health information search online, an hour a week. Time with a doctor? An hour a year.

In game-scoring unit terms, 52 is the number of hours an average American spends seeking health information online each year. The 1 (hour) is roughly equivalent to the approximate total time a patient spends with a physician (an average of 3 visits, with an average time per vision of 20 minutes). Thus, 52:1. This means that the average U.S. health consumer spends much more time DIYing her health using digital information resources than speaking face-to-face with their physician in the doctor’s office. Still, the physician continues to be a go-to source for health information, according to Makovsky, a health communications

People with doctors interested in EMRs, but where’s the easy button?

1 in two people who are insured and have a regular doctor are interested in trying out an electronic medical record. But they need a doctor or nurse to suggest this, and they need it to be easy to use. The EMR Impact survey was conducted by Aeffect and 88 Brand Partners to assess 1,000 U.S. online consumers’ views on electronic medical records (EMRs): specifically, how do insured American adults (age 25 to 55 who have seen their regular physician in the past 3 years) view accessing their personal health information via EMRs? Among this population segment, 1 in 4 people (24%)

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The part-time medical home: retail health clinics

The number of retail health clinics will double between 2012 and 2015, according to a research brief from Accenture, Retail medical clinics: From Foe to Friend? published in June 2013. What are the driving market forces promoting the growth of retail clinics? Accenture points to a few key factors: Hospitals’ need to rationalize use of their emergency departments, which are often over-crowded and incorrectly utilized in cases of less-than-acute care. In addition, hospitals are now financially motivated under the Affordable Care Act (ACA, health reform) to reduce readmissions of patients into beds (particularly Medicare patients with acute myocardial infarction [heart attacks],

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Health care costs for a family of 4 in 2013: a college education, a diamond or a 4-door sedan

If you have $22,030 in your wallet, you can buy: A princess-cut diamond A Ford Focus 4-door A year’s tuition at James Madison University (in-state, 2013-14) A health plan for a family of four. The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods. In 2013, the average family will

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Un-directed Americans in a consumer-directed healthcare world

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans. It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013. While you might know the Aflac Duck, you may not be aware that Aflac is the

Bending the cost-curve: a proposal from some Old School bipartisans

Strange political bedfellows have come together to draft a formula for dealing with spiraling health care costs in the U.S. iin A Bipartisan Rx for Patient-Centered Care and System-Wide Cost Containment from the Bipartisan Policy Center (BPC). The BPC was founded by Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole, and George Mitchell. This report also involved Bill Frist, Pete Domenici, and former White House and Congressional Budget Office Director Dr. Alice Rivlin who together work with the Health Care Cost Containment Initiative at the BPC. The essence of the 132-page report is that the U.S. health system is

US Health Executives Predict the ACA Will Increase Health Insurance Premiums

As a result of implementing the Affordable Care Act (health reform), most U.S. health executives crystal balls foresee health care insurance premiums will increase over 10% in the next three years. 4 in 10 predict premiums will grow over 25% over the next 3 years. This sobering forecast comes out of a Munich RE Health survey conducted among 326 health industry executives in March 2013. Those polled included representatives from health plans, managed care, disease management firms, and health insurance brokers and agents. How do health execs expect employers would deal with such fast-rising health premium costs? Why shift more

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Most consumers will look to health insurance exchanges to buy individual plans in 2013

As the Affordable Care Act, health reform, aka Obamacare, rolls out in 2013, American health insurance shoppers will look for sources of information they can trust on health plan quality and customer service satisfaction — as they do for automobiles, mobile phone plans, and washing machines. For many years, one of a handful of trusted sources for such insights has been J.D. Power and Associates. J.D. Power released its 2013 Member Health Plan Study (the seventh annual survey) and found that most consumers currently enrolled in a health plan have had a choice of only “one” at the time

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

A health economics lesson from Jonathan Bush, at the helm of athenahealth

At HIMSS13 there are the equivalent of rock stars. Some of these are health system CIOs and health IT gurus who are driving significant and positive changes in their organizations, like Blackford Middleton, Keith Boone, Brian Ahier, and John Halamka. Others are C-level execs at health IT companies. In this latter group, many avoid the paparazzi (read: health trade reporters) and stay cocooned behind closed doors in two-story pieces of posh real estate on the exhibition floor. A few walk the floor, shake hands with folks, and take in the vibe of the event. We’ll call them open-source personalities. The

Consumer health empowerment is compromised by complex information

The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care. While the banner of “consumerism” in health care has been flown

Health cost transparency on the W-2: sticker shock at the point-of-paystub

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage. This new piece of data, shown in Box 12, DD information, comes as part of health reform, The Affordable Care Act, which requires employers with over 250 workers to show how much they spend on employer-sponsored health benefits in total. This is the employer’s premium cost, and does not include the covered worker’s out-of-pocket spending (e.g., copays, coinsurance and deductibles). It is being furnished on W-2’s “for informational

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Health and consumer spending may be flat, but consumers hard hit due to wage stagnation & self-rationing

There’s good news on the macro-health economics front: the growth rate in national health spending in the U.S. fell in 2011, according to an analysis published in Health Affairs January 2013 issue. Furthermore, this study found that consumers’ spending on health has fallen to 27.7% of health spending, down from 32% in 2000, based on three spending categories: 1. Insurance premiums through the workplace or self-paid 2. Out-of-pocket deductibles and co-pays 3. Medicare payroll taxes. A key factor driving down health spending is the growth of generic drug substitution for more expensive Rx brands. Generics now comprise 80% of prescribed

Americans #1 health care priority for the President: reduce costs

Reducing health care costs far outranks improving quality and safety, improving the public’s health, and upping the customer experience as Americans’ top priority for President Obama’s health care agenda, according to a post-election poll conducted by PwC’s Health Research Institute. In Warning signs for health industry, PwC’s analysis of the survey results, found that 7 in 10 Americans point to the high costs of health care as their top concern in President Obama’s second term for addressing health care issues. Where would cost savings come from if U.S. voters wielded the accountant’s scalpel? The voters have spoken, saying, Reduce payments

Employers slow health cost increases for 2013 by growing consumer-directed plans

Health benefit costs grew a relatively low 4.1% in 2012 (5.4% for large employers), largely due to companies moving workers into lower-cost consumer-directed health plans. Last year, benefit costs grew at an annual rate of 6.1%, representing about a 30% fall in year-on-year cost growth for companies. And, coverage is up to 59% of employees having ticked down to 55% for the past couple of years. Employers expect about a 5% increase for 2013. Mercer’s National Survey of Employer-Sponsored Health Plans analysis finds that U.S. employers are looking toward 2014, when they’ll be covering more uninsured workers, and using this advance

Health as long-term deficit driver – the CBO points out tough choices

There are many forks in the road facing us in the U.S. for deficit reduction, as the picture shows. This is the cover graphic for Choices for Deficit Reduction, a report from the Congressional Budget Office (CBO) published November 2012. Those roads could be labeled “Medicare” and “Medicaid,” as health is the #1 deficit driver for the American economy — most notably, Medicare and long-term care services financed via Medicaid. The CBO expects that per capita spending on health care, already at 18% of the national economy in 2012, will continue to grow faster than spending on other goods and

Obama would get health-issue voters’ votes

Bob Blendon and his can-do team at the Harvard School of Public Health have done the heavy lifting for us by analyzing 36 telephone polls (that’s “polls,” not “poles”) looking at the role of health reform in the 2012 election cycle. I knew Bob Blendon when I was affiliated for a decade with Institute for the Future, and Blendon was affiliated as well as health politics consultant to the health team. He is the guru on this topic, so when I spotted his article, Understanding Health Care in the 2012 Election in this week’s New England Journal of Medicine, I dashed

U.S. health insurance updates from Kaiser, EBRI and the Census Bureau; uninsurance related to poor health

The average annual premiums for employer-sponsored health insurance in 2012 are double what they were a decade ago in terms of both total premium and worker contribution increases. The picture shows the story, according to the 2012 Employer Health Benefits Survey from the Kaiser Family Foundation (KFF). This annual survey polls small, mid-size and large employers to assess their updates for providing health insurance and prescription drug coverage to active and retired employees. The percentage growth of health costs in the past year were a “modest” 4%, according to KFF. Modest is a relative term: this single digit increase is indeed much

Pharmacists are a valuable member of the primary care team

It’s American Pharmacist Month, so let’s celebrate that key member of the health care team. Most Americans live quite close to a pharmacy, compared with peoples’ proximity to doctors, hospitals and emergency rooms. The pharmacist is not only a trusted health professional in the eyes of consumers: he/she is a key influencer on peoples’ health. And seeing as the #1 barrier to people taking prescription drugs is cost, the community-based pharmacist is in a prime position to educate, influence and motivate people to become more informed and activated health consumers. CVS Caremark’s survey of pharmacists is discussed in the company’s

A handful of health plans adopts HIT to get closer to consumers

Health payers and plans are realigning their business operations to get closer to consumers. Anticipating the impact of the Affordable Care Act (ACA), coupled with the continuing trend toward consumer-driven health plans, Chilmark Research published the 2012 Benchmark Report: Payer Adoption of Emerging Consumer Tech in August 2012. John Moore, industry analyst and founder of Chilmark, and I had an email exchange to discuss the report. JSK: Why is this topic so timely now? JM: Payers have been trying for years to engage their members with less than stellar results. The advent of new consumer technologies such as social media, mobile,

The rise and rise of retail clinics: a growing site for primary care, everywhere

There were nearly 6 million patient visits to retail health clinics in 2009. Such visits to retail clinics rose four-fold between 2007 and 2009, according to a RAND study published in the September 2012 issue of Health Affairs. Visits for prevention versus acute care in 2009 were roughly evenly split, with 47.5% and 51.4% of people over 18 seeking prevention vs. acute care from retail clinics, respectively. The most common acute care complaints in the retail setting were upper respiratory infections, pharyngitis, otitis externa, conjunctivitis, urinary tract infections, and allergies. What’s underneath the impressive rise is important to parse out

Physicians not doing so well – financially, socially, physically – and what it means for health reform

Physicians’ wellbeing dropped in July: while providers’ mental health stayed sound since June, it’s financial, physical and social health that’s dragging providers’ overall wellness down. QuantiaMD, the social network exclusively for doctors, launched the Physician Wellbeing Index in January 2012. The Index measures four aspects of physician-reported wellbeing: physical, mental, financial, and social health. QuantiaMD says it’s the world’s only measure of “how physicians are doing as people.” Based on the Index, QuantiaMD tailors content to meet the needs of the physicians in the social network. In July, the chart illustrates that doctors’ wellbeing slipped in 3 of the 4

Why we now need primary care, everywhere

With the stunning Supreme Court 5-4 majority decision to uphold the Patient Protection and Affordable Care Act (ACA), there’s a Roberts’ Rules of (Health Reform) Order that calls for liberating primary care beyond the doctors’ office. That’s because a strategic underpinning of the ACA is akin to President Herbert Hoover’s proverbial “chicken in every pot:” for President Obama, the pronouncement is something like, “a medical home for every American.” But insurance for all doesn’t equate to access: because 32-some million U.S. health citizens buy into health insurance plans doesn’t guarantee every one of them access to a doctor. There’s a

The selling of a health plan, part two

Calling Don Draper, Donny Deutsch, and the spirit of David Ogilvy: the President needs you. The President must sell the Affordable Care Act to the American people now that Justice Roberts wrote the Supreme Court’s historic 5-4 majority opinion supporting the Act, and especially the individual mandate. He argued for the majority that while the mandate is unconstitutional under the Commerce Clause which would “command people to buy insurance,” he said that the mandate is a de facto tax, as people who would choose to opt out of insurance would have an alternative of paying an IRS fine. Senator Eric

The gender gap in U.S. health economics

50% more women than men are worried about health care affordability and access in the U.S., revealed in a new Kaiser Opinion Poll, the Health Security Watch, based on interviews from May 2012. Overall, about the same proportion of men and women had problems paying medical bills in the past year — 26% vs. 27%, respectively. However, when it comes to self-rationing health care — delaying or skipping treatment due to cost — gender gap shows, with 52% of men and 64% of women delaying or skipping health care. Underneath these numbers are even greater gaps between men and women.

58% of Americans self-rationing health care due to cost

Since the advent of the Great Recession of 2008, more Americans have been splitting pills, postponing needed visits to doctors, skipping dental care, and avoiding recommended medical tests due to the cost of those health care services. Call it health care self-rationing: the Kaiser Family Foundation (KFF) has been tracking this trend for the past several years, and the proportion of American adults rationing health demand is up to 58%. This KFF Health Tracking Poll interviewed 1,218 U.S. adults age 18 and older via landline and cell phone in May 2012. As the chart illustrates, 38% of people are “DIYing” health care

The pharmaceutical landscape for 2012 and beyond: balancing cost with care, and incentives for health behaviors

Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui. Express-Scripts Medco’s report on 9 Leading Trends in Rx Plan Management presents findings from a survey of 318 pharmacy benefit decision makers in public and private sector organizations. About one-half of the respondents represented smaller organizations with fewer than 5,000 employees; about 20% represented jumbo companies with over 25,000 workers. The survey was conducted in the

A health plan or a car: health insurance for a family of four exceeds $20K in 2012

The saying goes, “you pays your money and you makes your choice.” In 2012, if you have a bolus of $20,700 to spend, you can choose between a health plan for a family of four, or a sedan for the same family. That’s the calculation from the actuaries at Milliman, whose annual Milliman Medical Index is the go-to analysis on health care costs for a family of four covered by a preferred provider organization plan (PPO). While the 6.9% annual average cost increase is lower than the 7.3% in 2011, it is nonetheless, a record $1,335 real dollar increase at

Patient engagement and medical homes – core drivers of a high-performing health system

It was Dr. Charles Safran who said, “Patients are the most under-utilized resource in the U.S. health system,” which he testified to Congress in 2004. Seven years later, patients are still under-utilized, not just in the U.S. but around the world. Yet, “when patients have an active role in their own health care, the quality of their care, and of their care experience improves,” assert researchers from The Commonwealth Fund in their analysis of 2011 global health consumer survey data published in the April/June 2010 issue of the Journal of Ambulatory Care Management. This analysis is summarized in International Perspectives on

The ACA won’t undermine employer-based health insurance and could help the deficit, says CBO (again)

There’s intriguing fine print in the latest CBO analysis on the impact of the Affordable Care Act (ACA) on employer-sponsored health insurance in the U.S. CBO finds there will be 3 to 5 million working Americans without employer-sponsored health insurance due to the implementation of the ACA, according to the report, CBO and JCT’s Estimates of the Effects of the Affordable Care Act (ACA) on the Number of People Obtaining Employment-Based Health Insurance. Originally, the CBO and Joint Committee on Taxation (JCT) estimated that the number of people obtaining health insurance coverage through their employer would be 3 million people lower in 2019 under

Employers shopping for value in health – Towers Watson/NBGH 2012 survey results

Employers expect total health costs to reach $11,664 per active employee this year, over $700 more than in 2011. Employees’ share of that will be nearly $3,000, the highest contribution by workers in history. In 2012, workers are contributing 34% more to health costs than they did 5 years ago. The metric is that for every $1,000 employers will spend on health care in 2012, workers will pay $344 for premium and out-of-pocket costs. Still, health care cost increases are expected to level off to about 6% in 2012, that’s still twice as great as general consumer price inflation. with

Job #1 in data analytics for health care: get the data, and make sure you can trust it

The ability to get the data is the #1 obstacle that will slow the adoption of data analytics in health care, according to IBM’s report, The value of analytics in healthcare: from insights to outcomes. Healthcare “high performers,” as IBM calls them, use data analytics for guiding future strategy, product research and development, and sales and marketing functions. 90% of healthcare CIOs told IBM that developing “insight and intelligence” were key focuses of their organizations over the next 3 to 5 years. Underneath this macro objective are 3 business goals that data analytics addresses in healthcare: to improve clinical effectiveness

Addressing chronic illness can help cure the U.S. budget deficit

Chronic illness represents $3 of every $4 of annual health spending in the U.S. That’s about $1.5 trillion. Living Well With Chronic Illness, a report from The Institute of Medicine (IOM), issues a “call for public health action” to address chronic illness through: – Adopting evidence-based interventions for disease prevention – Developing new public policies to promote better living with chronic disease – Building a comprehensive surveillance system that integrates quality of life measures, and – Enhancing collaboration among health ecosystem stakeholders: health care, health, and community non-healthcare services. The IOM recognizes the social determinants that shape peoples’ health status

The state of health IT in America: thinking about the Bipartisan Policy Center report on health IT

There are few issue areas within the Beltway of Washington, DC, that have enjoyed more support across the political aisle than health care information technology. In 2004, George Bush asserted that every American would/should have an electronic medical record by 2014. Since then, Democrats and Republicans alike have supported the broad concept of wiring the U.S. health information infrastructure. With the injection of ARRA stimulus funds earmarked in the HITECH Act to promote health providers’ adoption of electronic health records, we’re now on the road to Americans getting access to their health information electronically. It won’t be all or even

The Trust Deficit – what does it mean for health care?

Technology, autos, food and consumer products — two-thirds of people around the globe trust these four industries the most. The least trusted sectors are media, banks and financial services. Welcome to the twelfth annual poll of the 2012 Edelman Trust Barometer, gauging global citizens’ perspectives on institutions and their trustworthiness. This survey marks the largest decline in trust in government in the 12 years the Barometer has polled peoples’ views. Interestingly, trust in government among US citizens stayed stable. The top-line finds a huge drop in global citizens’ trust in government, with a smaller decline for business. There’s an interplay

US doctors less sanguine about the benefits of health IT

To doctors working in eight countries around the globe, the biggest benefit of health IT is better access to quality data for clinical access, followed by reducing medical errors, improving coordination of care across care settings, and improving cross-organizational workflow. However, except for the issue of health IT’s potential to improve cross-organizational working processes, American doctors have lower expectations about these benefits than their peers who work in the 7 other nations polled in a global study from Accenture‘s Eight-Country Survey of Doctors Shows Agreement on Top Healthcare Information Technology Benefits, But a Generational Divide Exists. Accenture polled over 3,700 doctors working in

Paying medical bills is a chronic problem for 1 in 3 uninsured, and 1 in 5 insured people under 65

Over 20% of U.S. families had problems paying medical bills in 2010 — about the same proportion as in 2007. The Center for Studying Health System Change found this datapoint “surprising,” given the Great Recession of 2008 that lingers into 2012. However, HSC points out that the leveling of medical bill problems may be a “byproduct” of reduced medical care utilization; in Health Populi-speak, self-rationing of health care. In the Tracking Report, Medical Bill Problems Steady for U.S. Families, 2007-2010, HSC analyzed data from the 2010 Health Tracking Household Survey and discovered that since 2003, the proportion of families facing problems with medical debt

What’s baked into the Affordable Care Act? Half of Americans still don’t realize there’s no-cost preventive care

The U.S. public’s views on health reform — the Affordable Care Act (ACT) – remain fairly negative, although the percent of people feeling favorably toward it increased from 34% to 37% between October and November. Still, that represents a low from the 50% who favored the law back in July 2010. It’s quite possible that American health citizens’ views on health reform are largely reflective of their more general feelings about the direction of the country and what’s going on in Washington right now, versus what’s specifically embodied in the health care law, according to the November 2011 Kaiser Health

Workplace wellness: the cost of unhealthy behaviors in the American workforce is $623 per worker

The health status of the American workforce is declining. Every year, unhealthy behaviors of the U.S. workforce cost employers $623 per employee annually, according to the Thomson Reuters Workforce Wellness Index. People point to smoking, obesity and stress as the 3 most important factors impacting health costs. Thomson Reuters and NPR polled over 3,000 Americans on their health behaviors, utilization and costs of health care, publishing their results in a summary, Paying for Unhealthy Behaviors in October 2011. 4 in 5 overall — and 9 in 10 of those with over $50,000 annual income — believe that people with healthy behaviors should receive a

Primary care, everywhere: how the shortage of PCPs is driving innovation – especially for patient participation in their own care

The signs of the primary care crisis in America are visible: A growing number of visits to the emergency room for treating commonplace ailments Waiting lists for signing up with and queuing lines to see primary care doctors Fewer med students entering primary care disciplines Maldistribution of primary care practitioners (PCPs) in underserved areas, rural, exurban and urban. The implementation of the Affordable Care Act will (try to) enroll at least 30 million newly-insured health citizens into the U.S. health system. That’s the objective: whether being insured will actually provide people access to needed primary care is a big question given the current supply of

Health insurance: employers still in the game, but what about patient health engagement?

U.S. employers’ health insurance-response to the nation’s economic downturn has been to shift health costs to employees. This has been especially true in smaller companies that pay lower wages. As employers look to the implementation of health reform in 2014, their responses will be based on local labor market and economic conditions. Thus, it’s important to understand the nuances of the paradigm, “all health care is local,” taking a page from Tip O’Neill’s old saw, “all politics is local.” The Center for Studying Health System Change (HSC) visited 12 communities to learn more about their local health systems and economies, publishing their

Walmart’s rollback of health insurance for employees: just another employer facing higher health care costs?

Walmart is increasing premium sharing costs for employees subscribing to health insurance, and cutting the benefit for part-timers. Quoted in the New York Times, a company rep said, “over the last few years, we’ve all seen our health care rates increase and it’s probably not a surprise that this year will be no different. We made the difficult decision to raise rates that will affect our associates’ medical costs.” In so doing, Walmart told the Times that they will, “strike a balance between managing costs and providing quality care and coverage.” MarketWatch wrote that Walmart will increase health care premium costs

Telemedicine is an enabler of health reform

Globally, in developed economies, the challenges of increasing health care costs, access to quality health care, aging citizens and the supply of clinicians are universal. CSC says telemedicine can address these challenges as part of reforming health care delivery and financing throughout the world. In Telemedicine: An Essential Technology for Reformed Healthcare, CSC sees telemedicine as an enabler for health reforms’ goals the world over. In the U.S., telemedicine is explicitly mentioned in the Affordable Care Act. In April 2011, the Federal Register included language about health financing reform that said, “The ACO shall define processes to promote evidence-based medicine and patient engagement, report

Employers continue to worry about health costs in 2011, and expect to expand defined benefit plans

With health reform uncertainties, growing health regulations, and ever-increasing costs, employers who sponsor health plans for their workforce will continue to cover active employees. That is, at least until 2017, according to the crystal ball used by Mercer, explained in the Health & Benefits Perspective called Emerging challenges…and opportunities…in the new health care world, published in May 2011. Note that it’s “active” employees who Mercer expects will retain access to health benefits. For retirees, however, it’s another story. They need to be ready to take on more responsibility, financially and perhaps going-to-market to select coverage, while employers may continue some level

The average annual health costs for a U.S. family of four approach $20,000, with employees bearing 40%

Health care costs have doubled in less than nine years for the typical American family of four covered by a preferred provider health plan (PPO). In 2011, that health cost is nearly $20,000; in 2002, it was $9,235, as measured by the 2011 Milliman Medical Index (MMI). To put this in context, The 2011 poverty level for a family of 4 in the 48 contiguous U.S. states is $22,350 The car buyer could purchase a Mini-Cooper with $20,000 The investor could invest $20K to yield $265,353 at a 9% return-on-investment. The MMI increased 7.3% between 2010 and 2011, about the same

Retail health options expand with American Well and Activ Doctors going direct

The traditional venues for retail health are found in pharmacies, grocery chains, and on the ground floor storefronts in hospitals. Joining these bricks-based models are digital, online health ventures that are expanding the definition and space of retail health. This week, two announcements illustrate this phenomenon, from American Well and Active Doctors. American Well, which launched in 2008, is an online physician consultation service in the U.S. that has successfully worked with health plans to channel consults to patients in Hawaii, Minnesota, and New York, among other local programs. Last year, American Well went live with the Rite Aid pharmacy chain in Pennsylvania. This week, American

The online digital health divide persists for African Americans and Hispanics; implications for health reform

Differences in race, ethnicity and income drive online health disparities, according to a poll from The Washington Post/Kaiser Family Foundation (KFF)/Harvard University Race and Recession Survey, based on data from early 2011. The underlying issue here is the online digital divide, which still persists for African Americans and Hispanics of lower socioeconomic status. Overall, 84% of U.S. adults use the Internet or email at least occasionally. However, only 69% of African Americans and 64% of Hispanics with less than $40,000 annual income use the Internet or email. However, income flattens Internet/email use: for people who earn over $40K a year, 95% of whites, 94% of African

Even the most wealthy, healthy U.S. citizens worry about future health access and finance

It is no surprise that sicker, poorer people in the U.S. have concerns about how they’ll access and pay for health care in the future. What stands out in the latest Commonwealth Fund Survey of Public Views of the U.S. Health System, published in an April 11, 2011, Issue Brief, is that most U.S. health citizens in the healthiest, wealthiest demographic groups worry about accessing and paying for health care in the future. The chart highlights these findings: overall, 7 in 10 people worry about not getting high-quality care when they will need it, or that they won’t be able to pay

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.