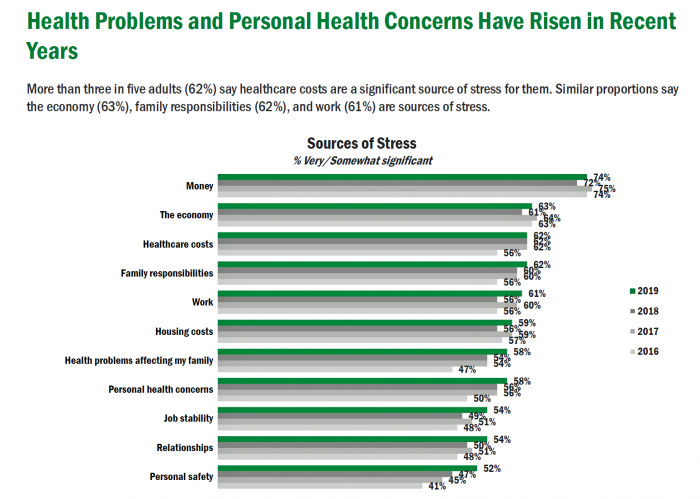

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

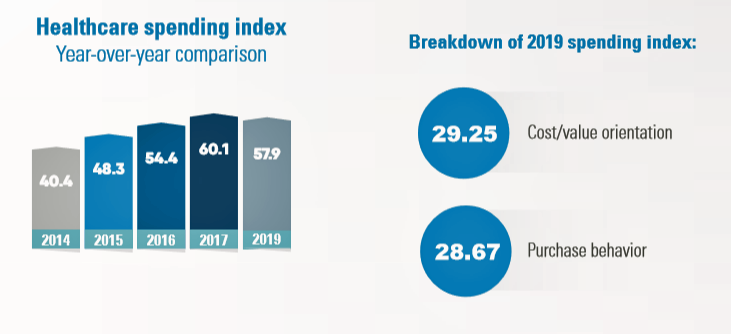

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

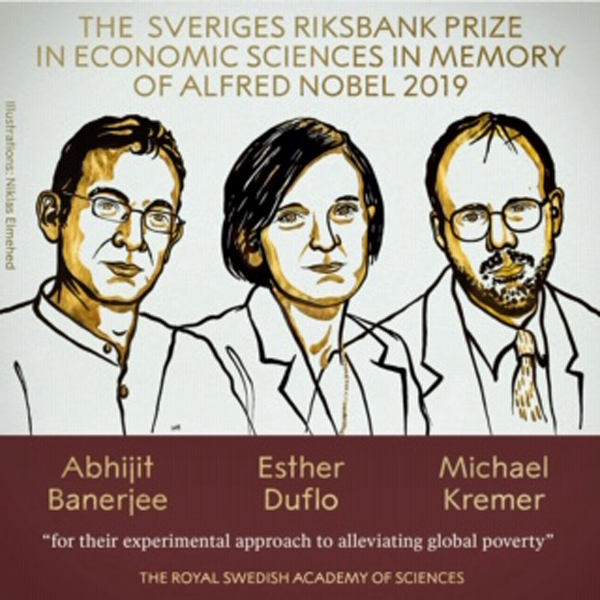

What the 2019 Nobel Prize Winners in Economics Teach Us About Health

The three winners of the 2019 Nobel Prize for Economics — Banerjee and Duflo (both of MIT) and Kremer (working at Harvard) — were recognized for their work on alleviating global poverty.” “Over 700 million people still subsist on extremely low incomes. Every year, five million children still die before their fifth birthday, often from diseases that could be prevented or cured with relatively cheap and simple treatments,” The Nobel Prize website notes. To respond to this audaciously huge challenge, Banerjee, Duflo and Kremer asked quite specific, granular questions that have since shaped the field of development economics — now

There Is No Health Without Mental Health – Today Is World Mental Health Day

There is no health without mental health. Every 40 seconds, someone loses their life to suicide. So #LetsTalk (the Twitter hashtag to share stories and research and support on the social feed). Today is October 10th, World Mental Health Day. As we go about our lives today and truly every day, we should be mindful that mental health is all about each of us individually, and all of us in our communities and in the world. First, let’s hear from Prince Harry and Ed Sheeran (who, video spoiler alert, decides to pivot his lyrics to a draft song titled “Gingers

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

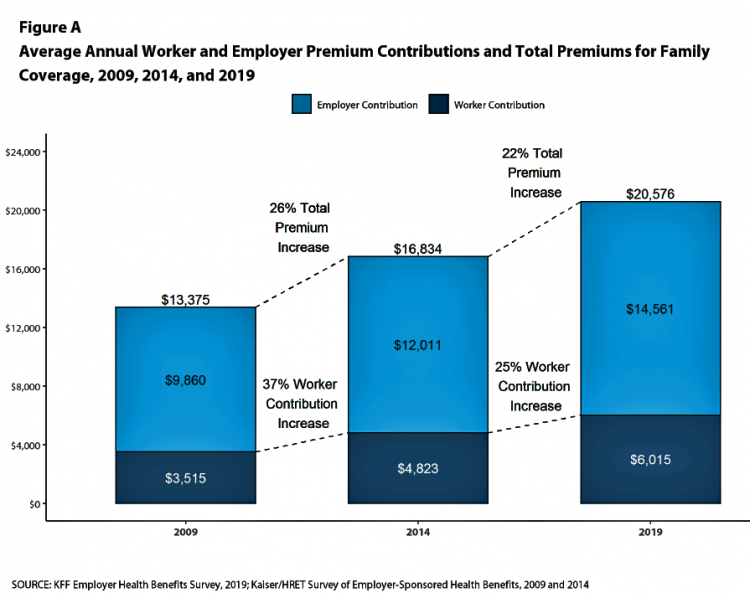

“It’s the Deductible, Stupid” – Health Premiums Reach $20,576 in 2019 for a Family

Here’s the latest arithmetic on American workers’ financial trade-off of wages for health care insurance coverage: in the ten years since 2009, family premiums have risen 54% and workers’ contribution to health care spending grew 71%. Wages? They rose 26%, and general price inflation by 20%, according to the Kaiser Family Foundation survey on employer-sponsored benefits for 2019 released yesterday. Survey details for this 21st annual encyclopedia on employer-sponsored health care are published in Health Affairs October 2019 issue in a paper titled, Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy. Because this

The Rise of Social Determinants of Health in Healthcare is Just Real Life Stuff for People, Patients, Consumers

Based on the influx of research studies and position papers on social determinants of health flowing into my email box and Google Alerts, I can say we’re past the inflection point where SDoH is embraced by hospitals, professional societies, health plans and even a couple of pioneering pharma companies. PwC published a well-researched global-reaching report this week appropriately titled, Action required: The urgency of addressing social determinants of health. The “wheel of determinants” illustrates potential partners for collaborating in communities to address SDoH factors. The collaborators include governments, health care providers, payors, life science and pharma, tech and telecomms, policy

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

Worrying About Possible Recession Compels Health Consumers to Seek Less Care

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space. Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care. Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll. The other side of this personal health

Celebrating “Labor Day” Welcoming Natalist to Our Health Ecosystem

There are many definitions of the word, “labor.” Oxford Dictionary provides context for the definition as follows: To work, as in especially hard physical work To make great effort (as in, “laboring from dawn to dusk”) To have difficulty in doing something despite working hard. For this third point, Oxford offers these synonyms: “strive, struggle, endeavor, try hard, do one’s best, do all one can, go all out, fight, push, be at pains, put oneself out.” And finally, one fourth contextual point: “A labor of love.” That is indeed the perfect framing this Labor Day week for my welcome to

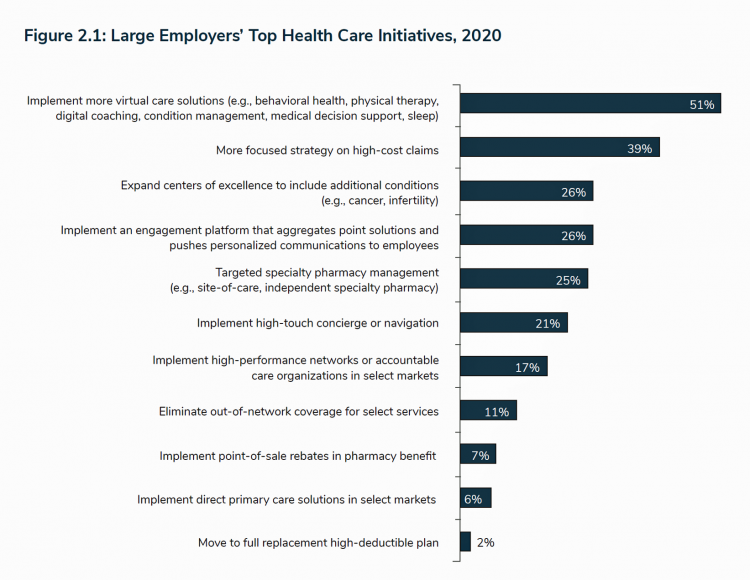

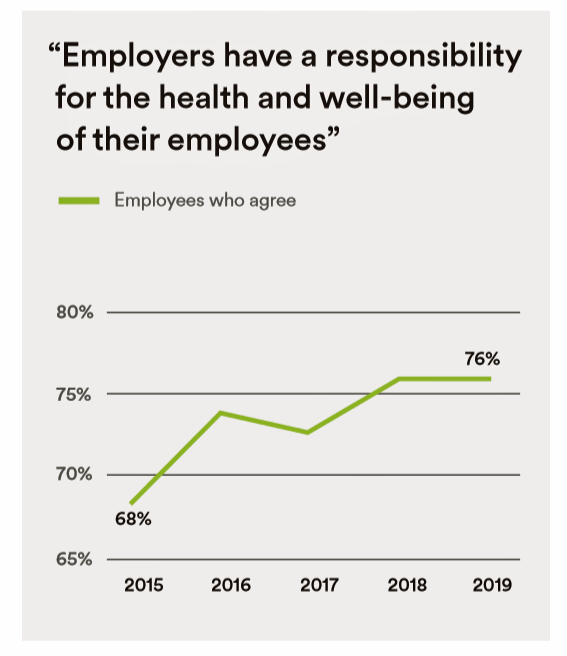

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

Health Care Bills’ Financial Toxicity – Remembering the Jones’ of Whatcom County, WA

“In an extreme example of angst over expensive medical bills, an elderly Washington couple who lived near the U.S.-Canadian border died in a murder-suicide this week after leaving notes that detailed concerns about paying for medical care,” USA Today reported on August 10, 2019. Five years ago, financial toxicity as a side-effect was noted by two Sloan Kettering Medical Center in a landmark report on 60 Minutes in October 2014. Epidemiologist Peter Bach and oncologist Leonard Saltz told CBS’s Lesley Stahl, “A cancer diagnosis is one of the leading causes of personal bankruptcy…We need to take into account the financial

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

Gaps in Health Equity in America Are Growing

There’s been a “clear lack of progress on health equity during the past 25 years in the United States,” asserts a data-rich analysis of trends conducted by two professors/researchers from UCLA’s School of Public Health. The study was published this week in JAMA Network Open. The research mashed up several measures of health equity covering the 25 years from 1993 through 2017. The data came out of the Centers for Disease Control and Prevention’s Behavioral Risk Factor Surveillance System looking at trends by race/ethnicity, sex and income across three categories for U.S. adults between 18 and 64 years of age.

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

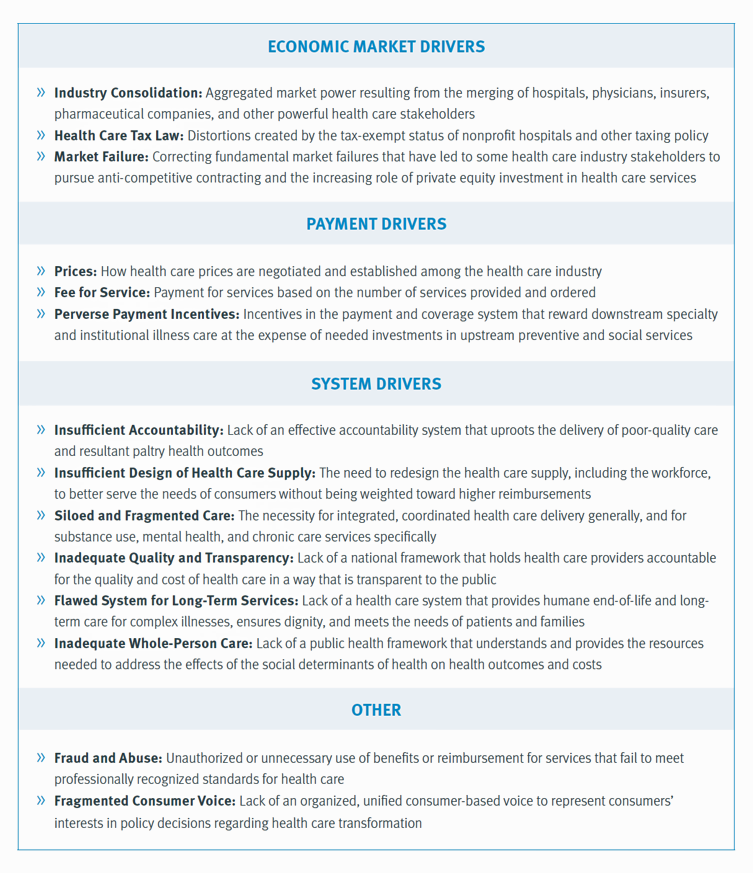

Americans Could Foster a Health Consumer Movement, Families USA Envisions

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

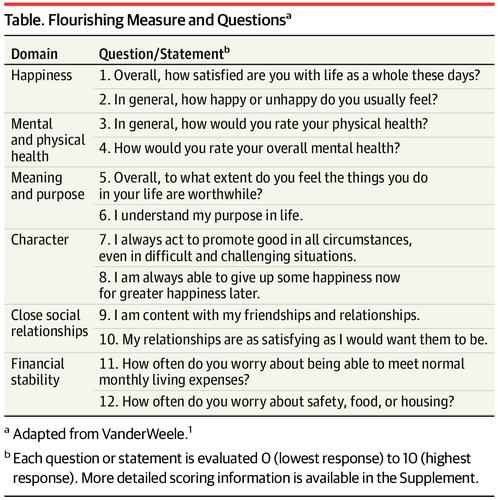

People Want to Flourish, Not Just Live – Speaking Health Politics to Real People

“How should we define ‘health?'” a 2011 BMJ article asked. The context for the question was that the 1948 World Health Organization definition of health — that health is, “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”– was not so useful in the 21st century. The authors, a global, multidisciplinary team from Europe, Canada and the U.S., asserted that by 2011, human health was marked less by infectious disease and more by non-communicable conditions that could be highly influenced, reversed and prevented through self-care by the individual and public health policy

How Consumers’ Belt-Tightening Could Impact Health/Care – Insights from Deloitte’s Retail Team

Over the ten years between 2007 and 2017, U.S. consumer spending for education, food and health care substantially grew, crowding out spending for other categories like transportation and housing. Furthermore, income disparity between wealthy Americans and people earning lower-incomes dramatically widened: between 2007-2017, income for high-income earners grew 1,305 percent more than lower-incomes. These two statistics set the kitchen table for spending in and beyond 2019, particularly for younger people living in America, considered in Deloitte’s report, The consumer is changing, but perhaps not how you think. The authors are part of Deloitte Consulting’s Retail team. The retail spending data

Health Care Costs Still Americans’ Top Financial Worry Among All Money Concerns

Health care costs rank ahead of Americans’ money-worries about low wages and availability of cash, paying for college, house payments, taxes, and debt, according to the latest Gallup poll on peoples’ most important family financial problems in 2019. Medical costs have, in fact, ranked at the top of this list for three years in a row, with a five percentage point rise between 2018 and 2019. No other financial concern had that growth in increase-of-money-worries in the past year. Health care costs rank the top financial problem for people across all income levels. One in five families (19%) earning under

Patients’ Expectations for Health Beyond Care: Think Food, Exercise, Emotions, Sleep and Finance

People want to make health with their health care providers, and they want more than care from them: most patients are looking for support with healthy eating, exercise, emotional support, sleep, stress management, social relationships, and financial health. And in case physicians, nurses and pharmacists aren’t sufficiently business with that punch-list for health, two in three U.S. patients would also like to receive help in finding a higher purpose. This is the health consumer’s mass call-out for holistic health, Welltok discovered in a survey conducted among over 1,600 U.S. adults in March 2019. The results are detailed in the assertively

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

Scaling the Social Determinants of Health – McKinsey and Kaiser’s Bold Move

People who are in poor health or use more health care services are more likely to report multiple unmet social needs, such as food insecurity, unsafe neighborhoods, lack of good housing, social isolation, and poor transportation access, found through a survey conducted by McKinsey. The results are summarized in Addressing the Social Determinants of Health. The growing recognition of the influence of social determinants reached a tipping point last week with the news that Kaiser-Permanente would work with Unite US to scale services to people who need them. The mainstreaming of SDoH speaks to the awareness that health is made

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

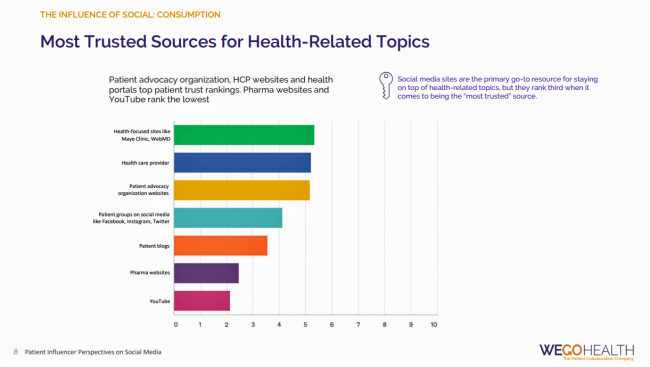

Listen Up, Healthcare: Hear The Patient’s Voice!

Consider the voice of a patient before the advent of the Internet in the digital 1.0 world, and then the proliferation of social networks in v 2.0. One patient could talk with another over their proverbial neighborhood fence, a concerned parent at the PTA meeting with others dealing with a children’s health issue, or a recovering alcoholic testifying in person at an AA session. Today, the voice of the patient is magnified one-to-many, omnichannel and multi-platform — via video, blogs, podcasts, social networks, listservs….and, yes, still in live forums like AA meetings, church basements, Y-spaces, and the Frazzled Cafe meet-ups

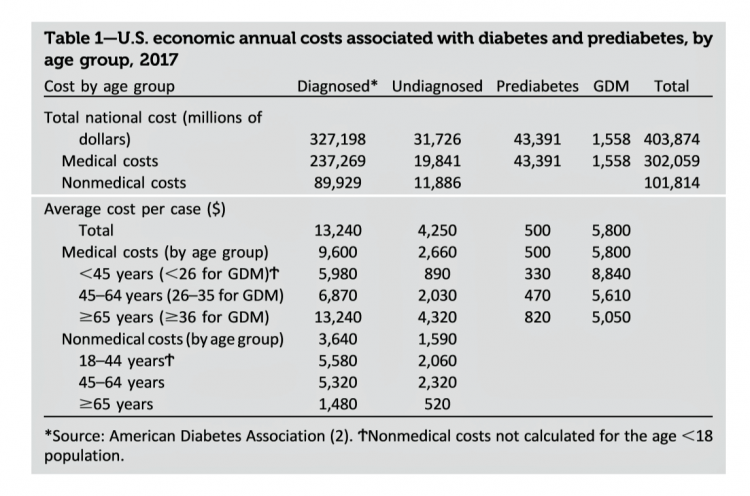

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

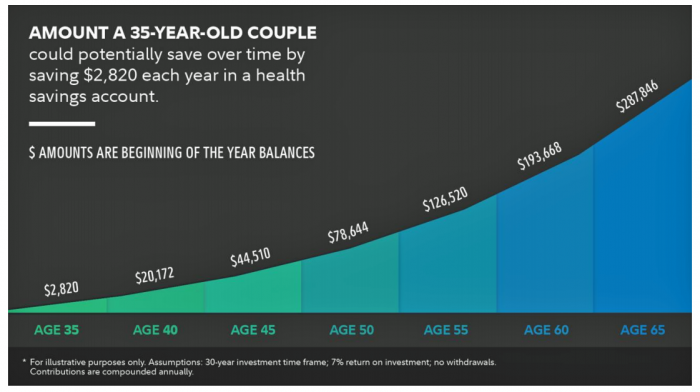

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

World Health Day 2019: Let’s Celebrate Food, Climate, Insurance Coverage and Connectivity

Today, 7 April, is World Health Day. With that in mind, I devote this post to three key social determinants of health (SDOH) that are top-of-mind for me these days: food for health, climate change, and universal health coverage. UHC happens to be WHO’s focus for World Health Day 2019. [As a bonus, I’ll add in a fourth SDOH in the Hot Points for good measure and health-making]. Why a World Health Day? you may be asking. WHO says it’s, “a chance to celebrate health and remind world leaders that everyone should be able to access the health care they need,

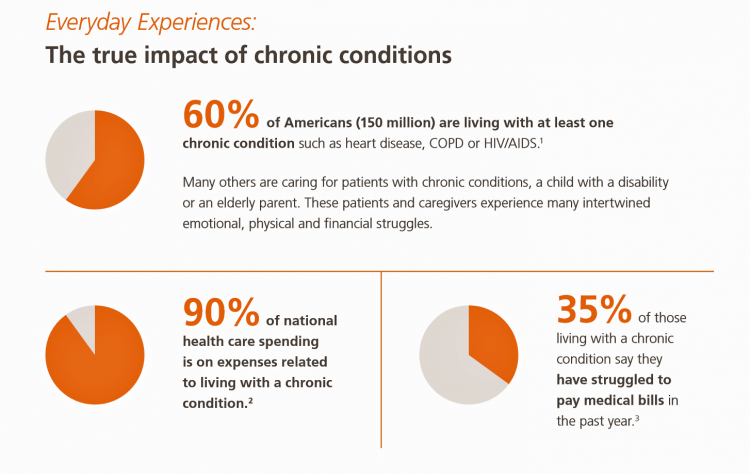

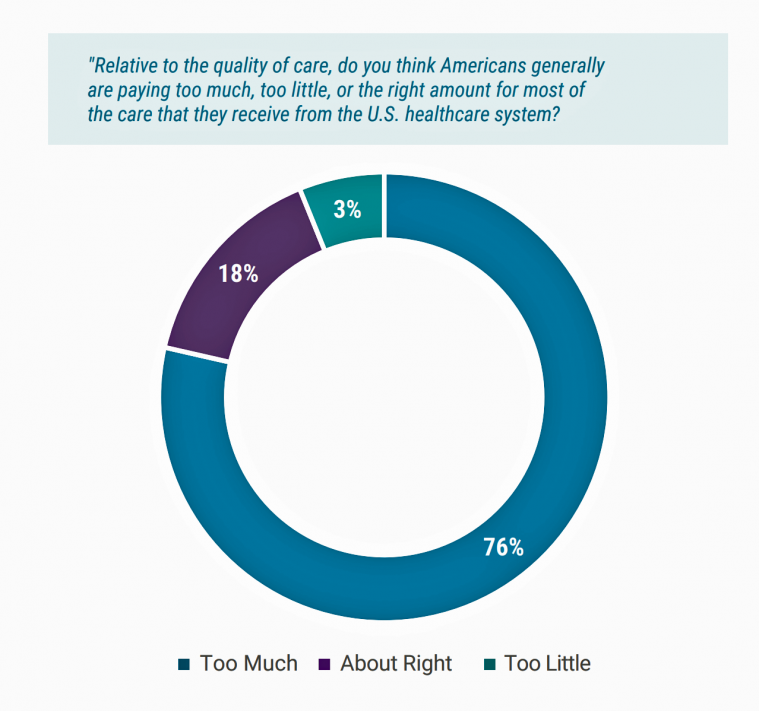

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

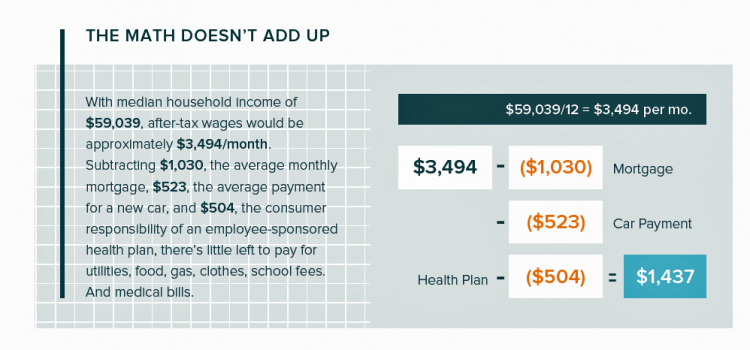

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

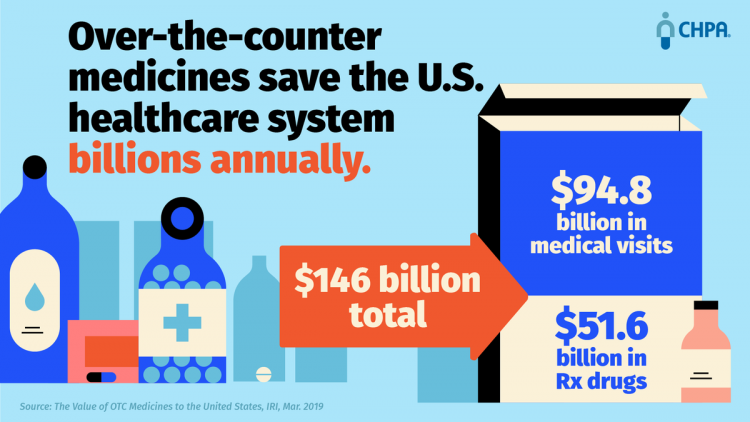

The Evolution of Self-Care for Consumers – Learning and Sharing at CHPA

Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts. The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

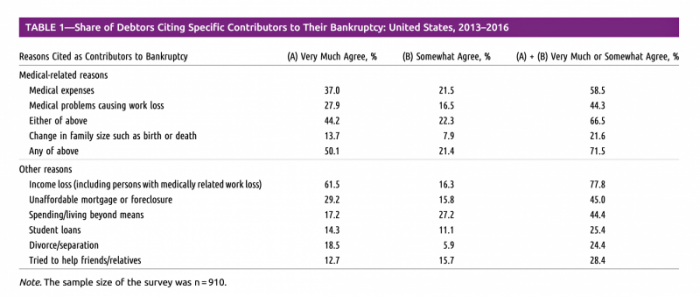

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

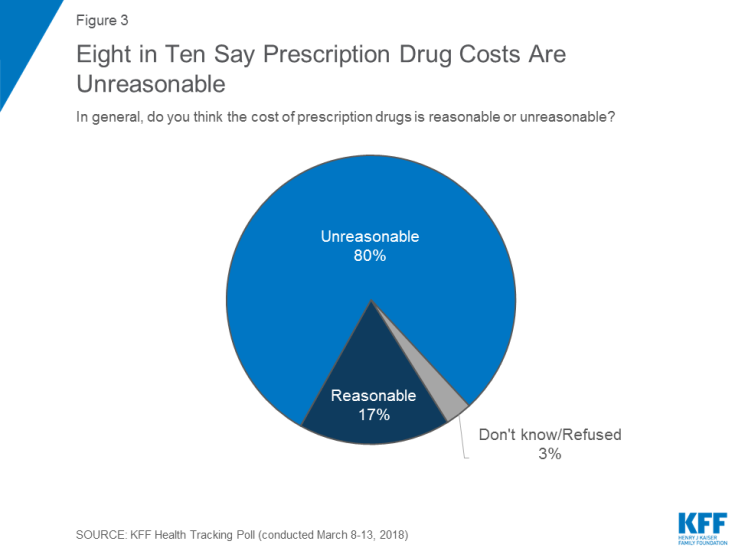

Most Americans Across Party ID Favor U.S. Government Negotiation to Lower Rx Drug Costs

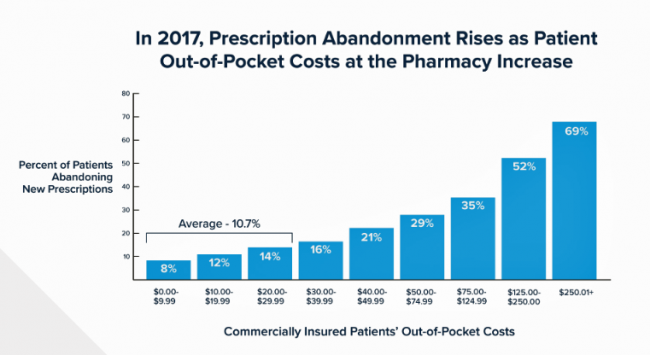

There’s little Americans, by political party, agree upon in 2019. One of the only issues bringing people together in the U.S. is prescription drug prices — that they’re too high, that the Federal government should negotiate to lower costs for Medicare enrollees, and that out-of-pocket costs for drugs should be limited. The Kaiser Family Foundation has been tracking this topic for a few years, and this month, their March 2019 Health Tracking Poll shows vast majorities of Democrats, Independents and Republicans all share these sentiments. It’s not that patients who take prescription drugs don’t appreciate them – most (58%) say medicines

The Cost of Prescription Drugs, Doctors and Patient Access – A View from HIMSS19

Most patient visits to doctors result in a prescription written for a medicine that people retrieve from a pharmacy, whether retail in the local community or via mail order for a maintenance drug. This one transaction generates a lot of data points, which individually have a lot of importance for the individual patient. Mashed with other patients’, prescription drug utilization data can combine with more data to be used for population health, cost-effectiveness, and other constructive research pursuits. At HIMSS19, there’s an entire day devoted to a Pharma Forum on Tuesday 12 February, focusing on pharma-provider-payor collaborations. Allocating a full

Care Gets Personal at Philips for Parents and Babies

Our homes should nurture our health. In addition to nutrition and good food, positive relationships, clean air and water, and the basic needs that bolster whole health, technology is playing a growing role to help us manage health at home. At CES 2019, I spent time with Roy Jakobs, Chief Business Leader of Personal Health with Philips, to discuss the company’s evolving portfolio of products that help fulfill the mission to support people across their own continuum of health. Following CES, I wanted to further dive into one part of the portfolio very important to family health at home: the

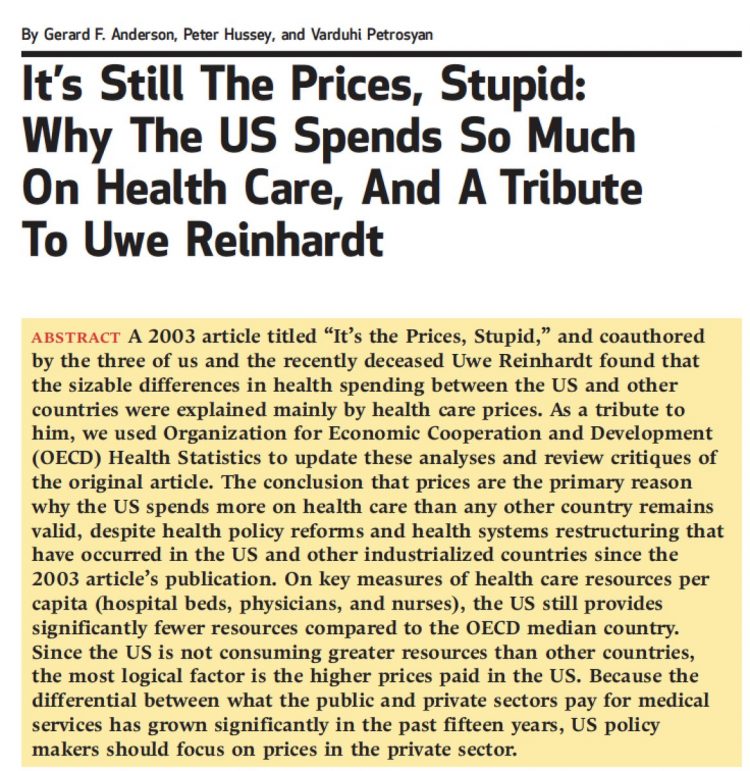

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

The Caveats for Health/Care at CES 2019

According to the Cambridge Dictionary, a “caveat” is, “a warning to consider something before doing anything more.” It is fitting that CES is held in Las Vegas, land of high risk and, with a lot of luck, reward. With that theme in mind, I depart LAS airport tonight on an aptly-named red-eye flight back home after spending an entire week here. I’m pondering not what I saw — some of which I covered daily over the past week — but what I didn’t see. Consider these the caveats for health/care at #CES2019. In no particular order… Where was the Chairman of

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

Rationing Care in America: Cost Implications Getting to Universal Health Coverage

It would not be surprising to know that when the Great Recession hit the U.S. in 2008, one in three Americans delayed medical treatment due to costs. Ten years later, as media headlines and the President boast an improved American economy, the same proportion of people are self-rationing healthcare due to cost. That percentage of people who delay medical cost based on the expense has remained stable since 2006: between 29 and 31 percent of Americans have self-rationed care due to cost for over a decade. And, 19% of U.S. adults, roughly one-in-five people who are sick and dealing with

Americans End 2018 Worried About Healthcare Costs

Nearly one-half of Americans are quite concerned they won’t have enough money to pay for medical care, according to the latest Gallup poll. Health insurance in-security is mainstream as of November 2018, when Gallup polled U.S. adults about views on healthcare costs. It’s a major concern among six in ten people that their health plan would require they pay higher premiums or a bigger portion of their healthcare expenses. It’s also a big concern for four in ten people that someone in their family would be denied health insurance covering for a pre-existing condition, or that they might have to

While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

Money First, Then Kids: The State of the American Family in 2018

Most American families with children at home are concerned about paying bills on a monthly basis. One in two people have had at least one personal “economic crisis” in the past year, we learn in the American Family Survey 2018, released last week from Deseret News and The Brookings Institution. The project surveyed 3,000 U.S. adults across the general population, fielded online by YouGov. This poll, conducted since 2005, looks at the state of U.S. families through several issue lenses: the state of marriage and family, parents and teenagers, sexual harassment (with 2018 birthing the #MeToo movement), social capital and

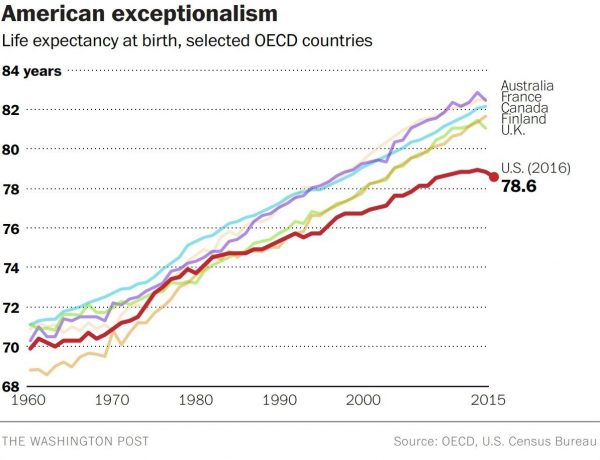

The Ultimate Health Outcome, Mortality, Is Rising in America

How long can people living in the U.S. expect to live? 78.6 years of age, if you were born in 2017. That’s a decline of 0.1 year from 2016. This decline especially impacted baby boys: their life expectancy fell to 76.1 years, while baby girls’ life expectancy stayed even at 81.1 years. That’s the latest data on Mortality in the United States, 2017, soberly brought to you by the Centers for Disease Control and Prevention, part of the U.S. Department of Health and Human Services. Underneath these stark numbers are the specific causes of death: in 2017, more Americans died

Consumers Want Help With Health: Can Healthcare Providers Supply That Demand?

Among people who have health insurance, managing the costs of their medical care doesn’t rank as a top frustration. Instead, attending to health and wellbeing, staying true to an exercise regime, maintaining good nutrition, and managing stress top U.S. consumers’ frustrations — above managing the costs of care not covered by insurance. And maintaining good mental health and staying on-track with health goals come close to managing uncovered costs, Oliver Wyman’s 2018 consumer survey learned. These and other important health consumer insights are revealed in the firm’s latest report, Waiting for Consumers – The Oliver Wyman 2018 Consumer Survey of US

Financial Stress Is An Epidemic In America, Everyday Health Finds

One in three working-age people in the U.S. have seen a doctor about something stress-related. Stress is a way of American life, based on the findings in The United States of Stress, a survey from Everyday Health. Everyday Health polled 6,700 U.S. adults between 18 and 64 years of age about their perspectives on stress, anxiety, panic, and mental and behavioral health. Among all sources of stress, personal finances rank as the top stressor in the U.S. Over one-half of consumers say financial issues regularly stress them out. Finances, followed by jobs and work issues, worries about the future, and relationships cause

Food and Cooking for Health: a UK Perspective from Hammersmith & Fulham

Food deserts aren’t just a U.S. phenomenon. They’re found all around the world. This week as I explore social determinants of health and technology solutions in several parts of Europe, I’ve learned more about food access challenges in the UK. These are discussed in a report published this month by the Social Market Foundation asking, What are the barriers to eating healthily in the UK? The research was supported by Kellogg’s, the food manufacturer. The first table comes from the report, and the topline shows that about 4 in 10 Britons shopped at a cheaper food store in response to high

Open Source Health Care Will Liberate Patients

Information is power in the hands of people. When it’s open in the sunshine, it empowers people — whether doctors, patients, researchers, Presidents, teachers, students, Everyday People. Welcome to the era of Open Source Healthcare, not only the “about time” for patients to own their health, but for the launch of a new publication that will support and continue to evolve the concept. It’s really a movement that’s already in process. Let’s go back to some definitions and healthcare basics to understand just why Open Source Healthcare is already a thing. When information access is uneven, it’s considered

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Consumers Don’t Know What They Don’t Know About Healthcare Costs

The saving rate in the U.S. ranks among the lowest in the world, in a country that rates among the richest nations. So imagine how well Americans save for healthcare? “Consumers are not disciplined about saving in general,” with saving for healthcare lagging behind other types of savings, Alegeus observes in the 2018 Alegeus Consumer Health & Financial Fluency Report. Alegeus surveyed 1,400 U.S. healthcare consumers in September 2017 to gauge peoples’ views on healthcare finances, insurance, and levels of fluency. As patients continue to take on more financial responsibility for healthcare spending in the U.S., they are struggling with finances and

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations. Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives. The first chart summarizes the study’s findings, including the facts that: One-third of people have less than three months of income in the bank for emergency Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved People who are highly stressed tend not to

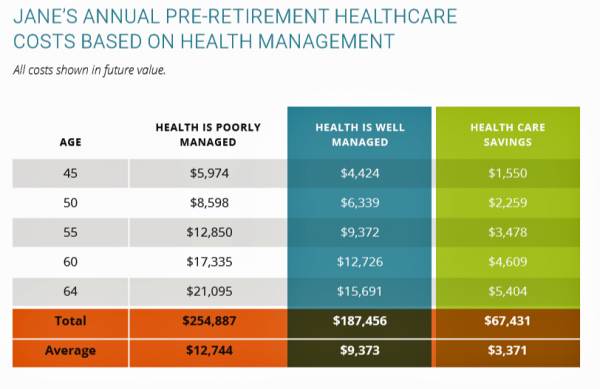

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

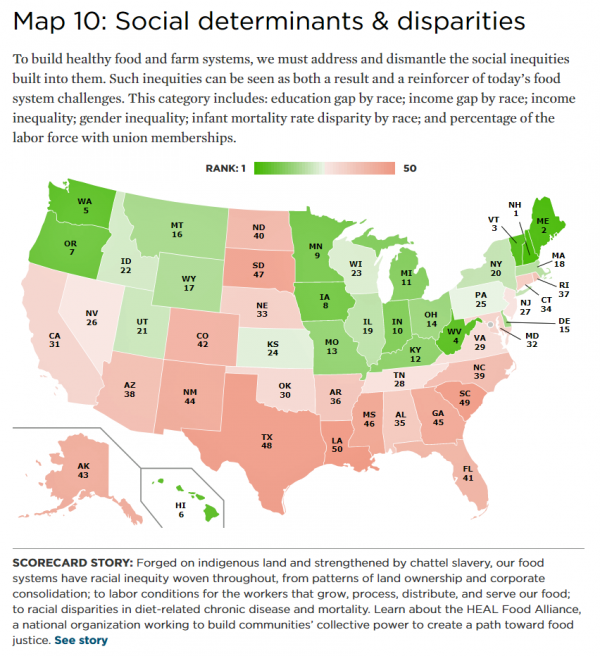

The Social Determinants of Food for Health, Farms, and the Economy

America’s agricultural roots go deep, from the native Patuxet tribe that shared maize with Mayflower settling Pilgrims in southern New England, to biodynamic and organic winemakers in Sonoma County, California, operating today. In 2016, 21.4 million full- and part-time jobs were related to agriculture and food sectors, about 11% of total U.S. employment. Farming is an integral part of a nation’s food system, so the Union of Concerned Scientists developed the 50-State Food System Scorecard to gauge the state of farming and food in the U.S. on several dimensions: diet and health outcomes, farming as an industry and economic engine,

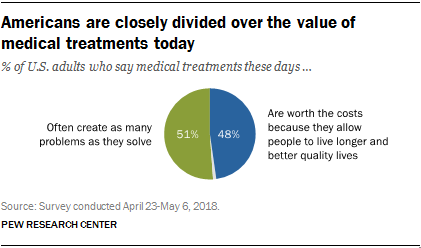

Consumers Consider Cost When They Think About Medical Innovation

While the vast majority of Americans say that science has made life easier for most people, and especially for health care, people are split in questioning the financial cost and value of medical treatments, the Pew Research Center has found. The first chart illustrates the percent of Americans identifying various aspects of medical treatments as “big problems.” If you add in people who see these as “small problems,” 9 in 10 Americans say that all of these line items are “problems.” In the sample, two-thirds of respondents had seen a health care provider for an illness or medical condition in

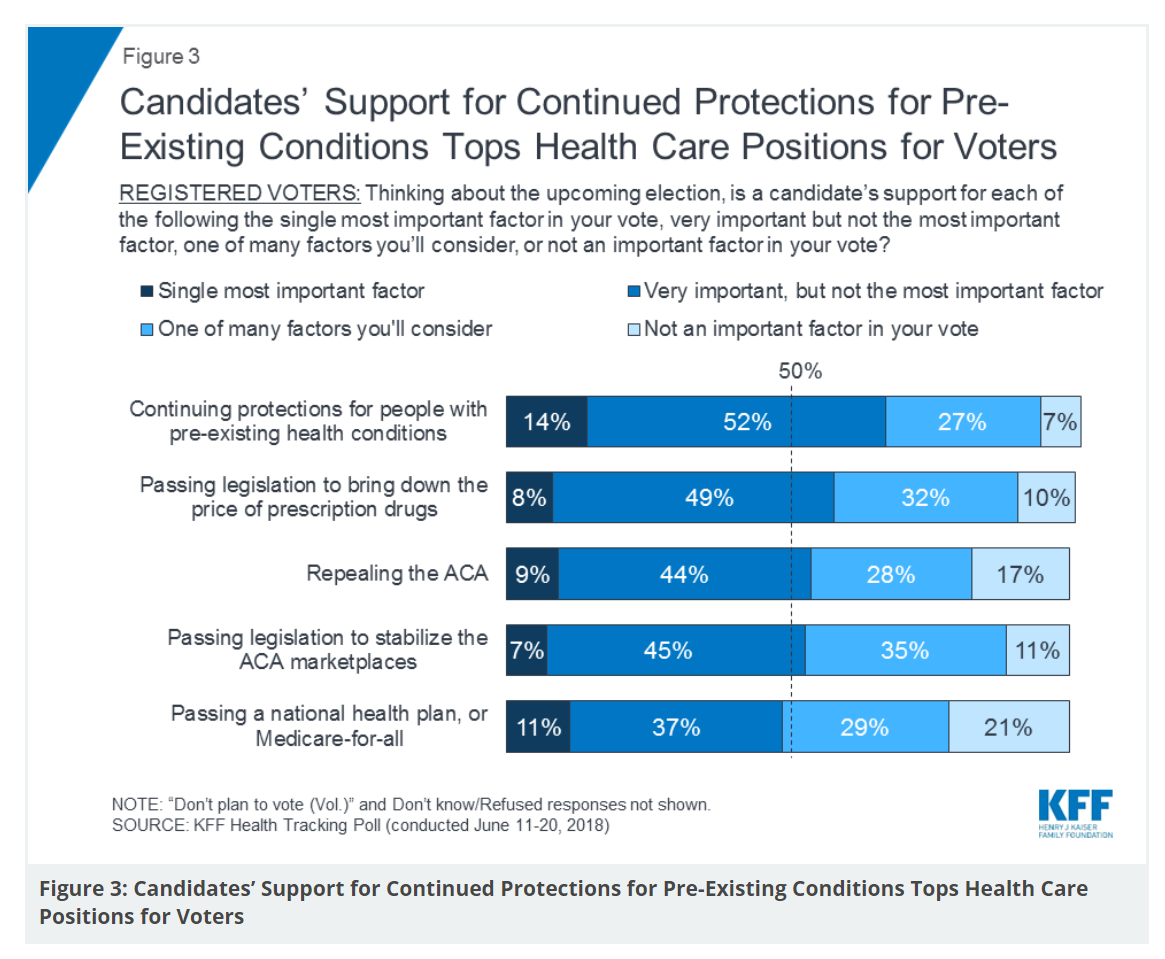

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

Good Coffee + Engaging Design + Banking = Financial Health

As I walked by windows with Marvel-inspired superhero characters, I stopped to read their talk-bubbles: “strengthen your savings, power your financial quest, be the hero of your money, be one with your budget.” The top-line message here is that you can be your own fiscal superhero. The sign read, Capital One Cafe with Peet’s Coffee. But was it a bank branch or a cafe? I asked myself, passing by this sign yesterday morning at the corner of Walnut and 18th Streets in center city Philadelphia. It’s both, as it turned out, and when I entered I found a welcoming, beautifully

It Could Take Five Generations for a Low-Income US Family to Reach Average Income in America

Social mobility in America has a lot of friction: children of wealthier people tend to grow into affluence, and children of low-income parents tend to struggle to move up the income and education ladder, according to A Broken Social Elevator: How to Promote Social Mobility, a new report from the OECD. The Organization for Economic Cooperation and Development studied member nations’ economies, demographics, income and opportunities to gauge each country’s social mobility. Social mobility, the OECD explains, is multi-faceted. It can refer to inter-generational mobility between parents, children, and grandchildren. Alternatively, social mobility can look at intra-generational mobility, over the course

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

Technology, Aging and Obesity Drive Healthcare Spending, BEA Finds

The U.S. Department of Commerce Bureau of Economic Analysis (BEA) released, for the first time, data that quantifies Americans’ spending to treat 261 medical conditions, from “A” diseases like acute myocardial infarction, acute renal failure, ADHD, allergic reactions, anxiety disorders, appendicitis and asthma, to dozens of other conditions from the rest of the alphabet. High Spending Growth Rates For Key Diseases In 2000-14 Were Driven By Technology And Demographic Factors, a June 2018 Health Affairs article, analyzed this data. This granular information comes from the BEA’s satellite account, using data from the Medical Expenditure Panel Survey which nationally examines expenditures by disease;

Doing Less Can Be Doing More for Healthcare – the Biggest Takeaway From ASCO 2018

Less can lead to more for so many things: eating smaller portions, lowering sugar consumption, and driving less in favor of walking or cycling come to mind. When it comes to healthcare utilization, doing less can also result in equal or even better outcomes. Groundbreaking research presented at this week’s ASCO meeting found that some women diagnosed with certain forms of cancer do not benefit from undergoing chemotherapy. The American Society of Clinical Oncology (ASCO) is one of the largest medical meetings annually, and at this huge meeting these research results for the TAILORx trial were huge news with big

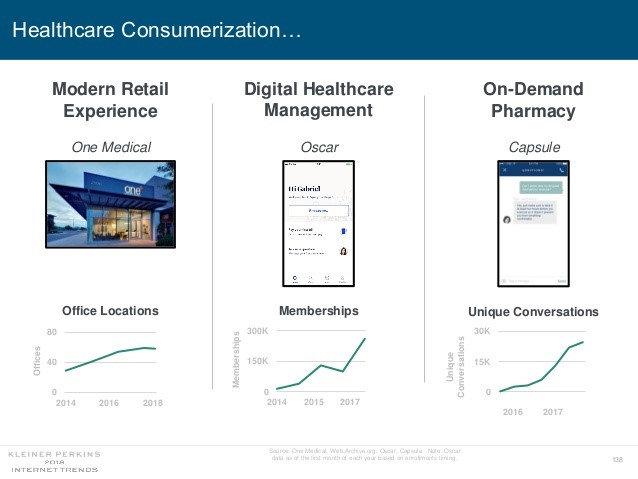

Mary Meeker on Healthcare in 2018: Connectivity, Consumerization, and Costs

Health care features prominently in the nearly-300 slides curated by Mary Meeker in her always- informative report on Internet Trends 2018. Meeker, of Kleiner Perkins, released the report as usual at the Code Conference, held this year on 30 May 2018 in Silicon Valley. I’ve mined Meeker’s report for several years here on Health Populi: 2017 – Digital healthcare at the inflection point, via Mary Meeker 2015 – Musings with Mary Meeker on the digital/health nexus 2014 – Healthcare at an inflection point: digital trends via Mary Meeker 2013 – The role of internet technologies in reducing healthcare costs – Meeker

The Healthiest Communities Are Built on Education, Good Food, Mindfulness, and the Power of Love

Be the change you wish to see in the world, Gandhi has been attributed as saying. This sentiment was echoed by Lauren Singer as we brainstormed the social determinants of health and the factors that underpin healthy communities. Our Facebook Live session was convened by the Aetna Foundation, which sponsored research on the Healthiest Communities in 2018. In addition to Lauren, founder of Trash Is For Tossers, Dr. Garth Graham, President of the Aetna Foundation, Dr. Pedro Noguera, Distinguished Professor of Education at UCLA, and I joined the quartet, moderated with panache and sensitivity by Mark J. Ellwood, journalist. Each

The US Covered Nearly 50% of Global Oncology Medicine Spending in 2017 – a market update from IQVIA

“We are at a remarkable point of cancer treatment,” noted Murray Aitken, Executive Director, IQVIA Institute for Human Data Science, in a call with media this week. 2017 was a banner year of innovative drug launches in oncology, Aitken coined, with more drugs used more extensively, driving improved patient for people dealing with cancer. This upbeat market description comes out of a report on Global Oncology Trends 2018 from the IQVIA Institute for Human Data Science. The subtitle of the report, “Innovation, Expansion and Disruption,” is appropriately put. The report covers these three themes across four sections: advances in therapies,

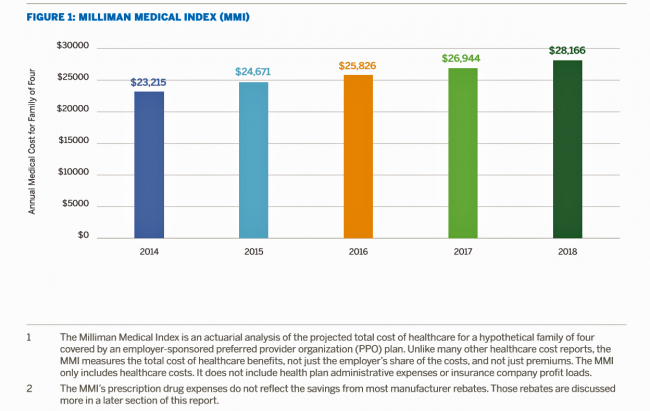

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

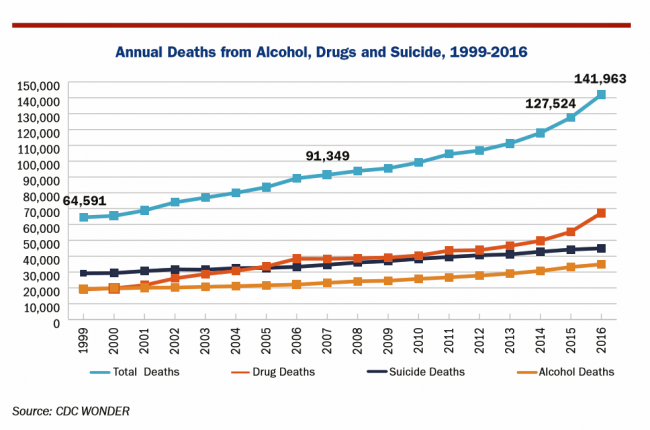

The U.S. is a Nation in Pain – America’s Life Expectancy Fell Again in 2016

American saw the greatest number of deaths from suicide and alcohol- and drug-induced fatalities was recorded in 2016. That statistic of nearly 142,000 equates to deaths from stroke and exceed the number of deaths among Americans who died in all U.S. wars since 1950, according to Pain in the Nation Update from the Well Being Trust and Trust for America’s Health. The line graph soberly illustrates the growing tragic public health epidemic of mortality due to preventable causes, those deaths of despair as Anne Case and Sir Angus Deaton have observed in their research into this uniquely all-American phenomenon. While this

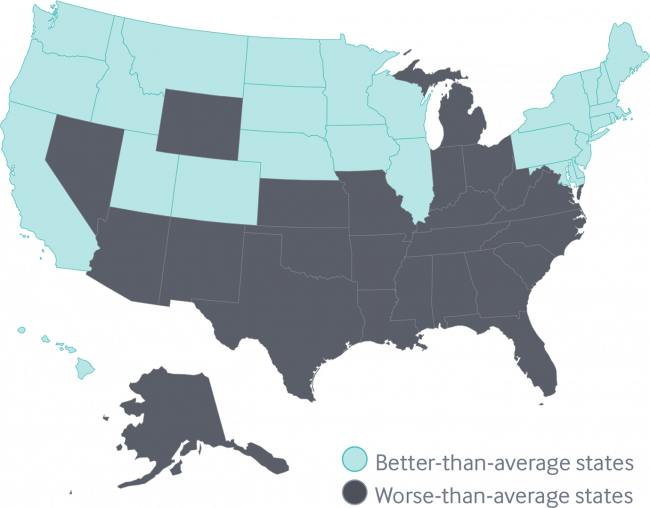

A Tale of Two America’s for Health

Disparities in Americans’ health vary among people living in each of the 50 states. These differences in health status generally fall into two regions: north and south, found in the Commonwealth Fund’s 2018 Scorecard on State Health System Performance. The map shows this stark geography-is-health-destiny reality: the worse-than-average states, the Fund found, run from Nevada southeast to Arizona, through New Mexico and Texas all the way to Atlantic Ocean and the Carolinas, then north west all the way up through the industrial Midwest states through Michigan to the north. Wyoming is the only non-contiguous state in the worse-performing U.S. state

The Gap Between the Trump Administration’s Promise of Reducing Rx Costs for Consumers and What People Really Want

This is what happened to pharma stock prices on Friday after President Trump and Secretary of Health and Human Services Alex Azar outlined their new policies focusing on prescription drug prices. The graph is the Nasdaq U.S. Smart Pharmaceuticals Index (NQSSPH) from May 11, 2018, the date when POTUS and Secretary Azar made their announcement. What this upward driving curve indicates, from the start of stock trading in the morning until the ring of the closing bell, is that the pharma industry players, both manufacturers and PBMs, were quite delighted with what they heard. The blueprint for restructuring the prescription drug industry,

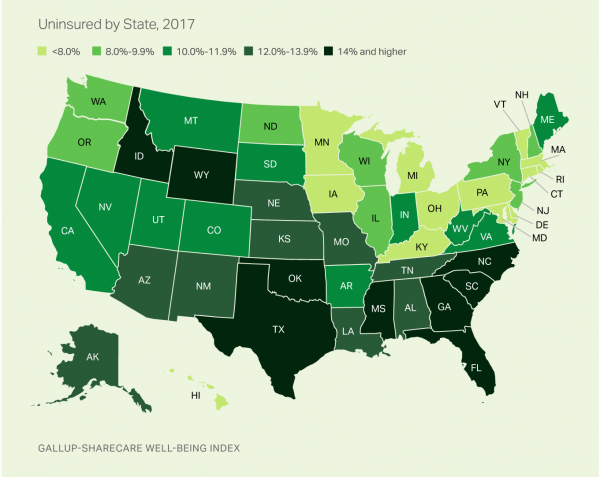

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

How Walmart Could Bolster Healthcare in the Community

Walmart has been a health/care destination for many years. The company that defined Big Box stores in their infancy grew in healthcare, health and wellness over the past two decades, pioneering the $4 generic prescription back in 2006. Today, that low-cost generic Rx is ubiquitous in the retail pharmacy. A decade later, can Walmart re-imagine primary care the way the company did low-cost medicines? Walmart is enhancing about 500 of 3500 stores, and health will be part of the interior redecorating. Walmart has had ambitious plans in healthcare since those $4 Rx’s were introduced. Here’s a New York Times article from

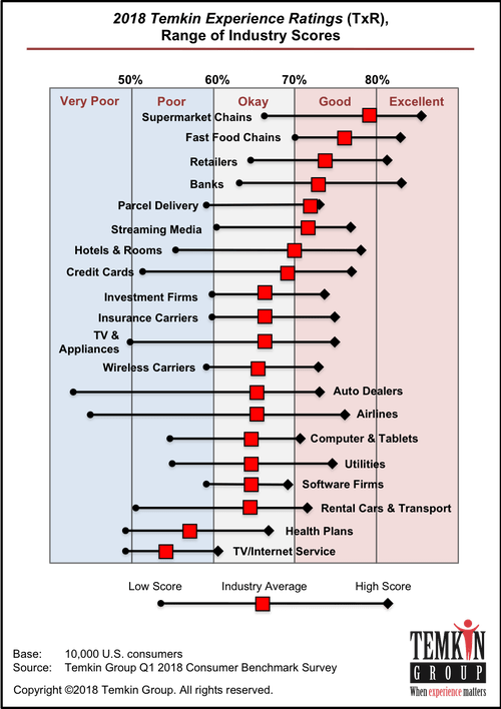

What Would Healthcare Feel Like If It Acted Like Supermarkets – the 2018 Temkin Experience Ratings

U.S. consumers rank supermarkets, fast food chains, retailers, and banks as their top performing industries for experience according to the 2018 Temkin Experience Ratings. Peoples’ experience with health plans rank at the bottom of the roster, on par with rental cars and TV/Internet service providers. If there is any good news for health plans in this year’s Temkin Experience Ratings compared to the 2017 results, it’s at the margin of “very poor” performance: last year, health plans has the worst performance of any industry (with the bar to the furthest point on the left as “low scoring”). This year, it

Healthcare Access and Cost Top Americans’ Concerns in Latest Gallup Poll

Healthcare — availability and affordability — is a more intense worry for Americans in March 2018 than crime and violence, Federal spending, guns, drug use, and hunger and homelessness. The Gallup Poll, fielded in the first week of March 2018, found that peoples’ overall economic and employment concerns are on the decline since 2010, at the height of the Great Recession which began in 2008. While 70% of Americans were worried about economic matters in 2010, only 34% of people in the U.S. were worried about the economy, and 23% about unemployment, in March 2018. Gallup has asked this “worry”

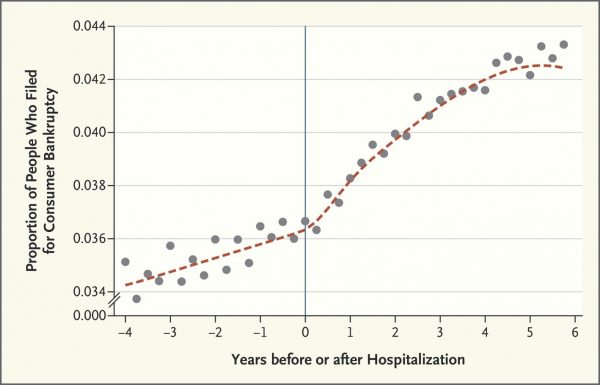

The New Financial Toxicity in Health Care: The Cost of Hospitalization

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

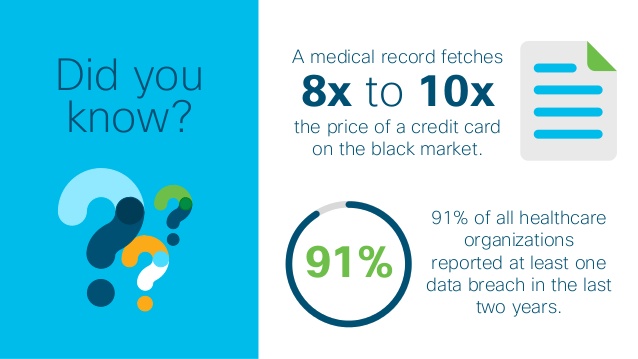

Patient Privacy And Cyber In-Security at HIMSS 2018

Nearly one-half of Americans experienced a personal data breach in the past three years, the third annual national cybersecurity survey found. Ensuring privacy and cybersecurity should become integrated into the healthcare industry’s consideration of a patient’s consumer experience. This makes sense, given that privacy and cybersecurity ranked the second highest priority to hospitals and healthcare providers polled in HIMSS 2018 Healthcare Leadership Survey. Providers put patient safety as #1. Appropriately, privacy and security were hot topics at HIMSS Annual Conference this year, in respond to providers’ demands for more education and concerns around the challenges. Let’s put these concerns in

Tweets at Lunch with Paul Krugman – Health IT Meets Economics

I greatly appreciated the opportunity today to attend a luncheon at the HX360 meeting which convened as part of the 2018 HIMSS Conference. The speaker at this event was Paul Krugman, who won the Nobel Prize for Economics 10 years ago and today is an iconic op-ed columnist at the New York Times And Distinguished Professor of Economics at the City University of New York (CUNY). I admit to being a bit of a groupie for Paul Krugman’s work. It tickles me to look at Rise Global’s list of the Top 100 Influential Economists:

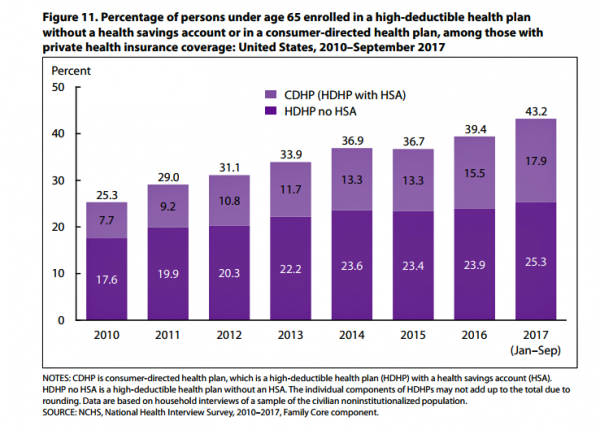

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

Consumer Health and Patient Engagement – Are We There Yet?

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

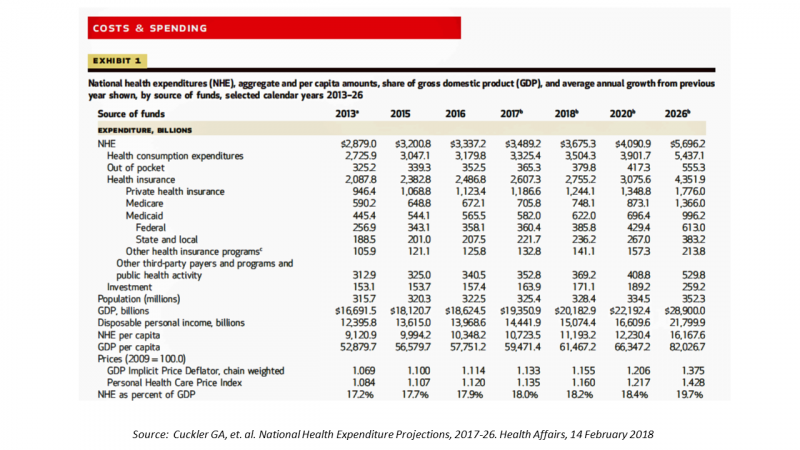

The $4 Trillion Health Economy of 2020

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

When Buying a Pair of Jeans Competes With Filling a Prescription at CVS in Target

Stories about three fashion brands have me thinking about women and their health economics. Stay with me. Target unveiled its new line of clothing, Universal Thread, which features pieces that are accessible to women who may be dealing with physical limitations or sensory challenges. I first read about Universal Thread on The Mighty website, which is a community of over 1 million people interested in connecting on health and disabilities. As The Mighty described, the brand Universal Thread, “is centered around denim since it is a staple in many women’s wardrobes, but denim can be uncomfortable for many people with disabilities

Getting Real About Social Determinants of Health

New research points out that real people live real lives, and our assumptions about social determinants of health (SDOH) may need to be better informed by those real lives. I read three reports in the past week sobering up my bullish #SDOH ethos dealing with food deserts, transportation, and health service access — three key social determinants of health. To remind you about the social determinants, here’s a graphic from Kaiser Family Foundation that summarizes the key pillars of SDOH. Assumption 1: Food deserts in and of themselves diminish peoples’ healthy nutrition lifestyles. Low-income households who are exposed to the same food-buying

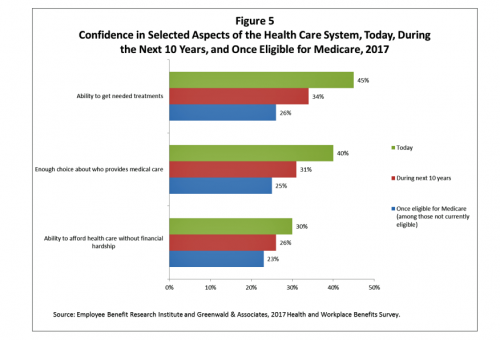

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

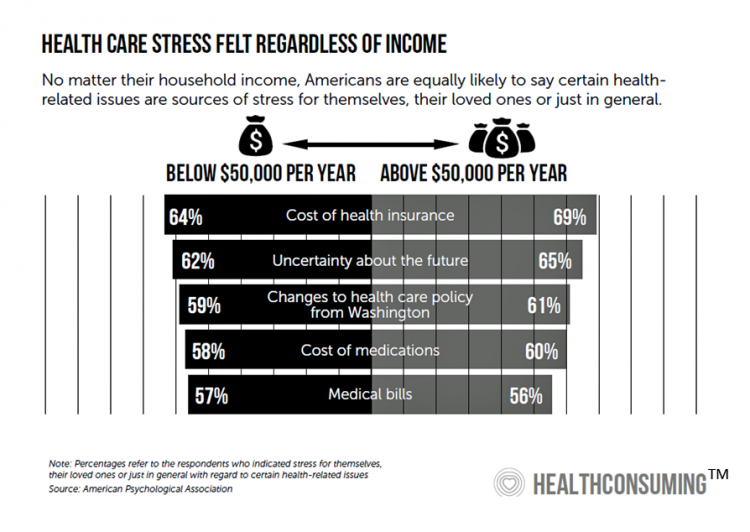

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

What Healthcare Can Learn from A Pig and Piggy Bank via Santander Bank

When patients feel disrespected in a medical exam room, they will be less likely to follow instructions they receive from a doctor. Research from the Altarum Institute revealed this fundamental finding. The chart shows that feeling respected reduces a patient’s diabetes medication adherence by a factor of nearly 2x, and is a risk factor for poorly managed diabetes. Furthermore, consumers who feel disrespected by providers are three times more likely to not believe doctors are accurate sources of information than consumers who do feel respected. And, patients with diabetes who do not feel respected are one-third more likely to have poorly

Calling Out Health Disparities on Martin Luther King Day 2018

On this day appreciating the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group

Most Americans Say Healthcare is #1 Policy Issue Entering 2018

Concerns about health care are, by a large margin, the top domestic policy issue U.S. voters identified as they enter 2018. The proportion of Americans citing healthcare as the top public agenda priority grew by 50% since 2016, from 31% two years ago to 48%. Taxes rank #2 this year, garnering 31% of Americans’ concerned, followed by immigration, which has remained flat cited by about one-in-four Americans. The Associated Press (AP)-NORC Center for Public Affairs Research polled 1,444 U.S. adults 18 and over between November 30 and December 4, 2017 for this survey. While one-half of Americans would like the

Let’s Increase Life Expectancy in America in 2018 – A New Year for Opioids, Social Determinants, and Financial Health

For this end-of-year post leading into 2018, I choose to address the big topic of how long we live in America, and what underpins the sobering fact that life expectancy is falling. Life expectancy in the United States declined to 78.6 years in 2016, placing America at number 37 on the list of 137 countries the World Economic Forum (WEF) has ranked in their annual Global Competitiveness Report 2017-2018. The first chart shows the declining years for Americans compared with health citizens of Australia, France, Canada, Finland, and the UK. While Australians’ and Britons’ life expectancies declined from 2015-16, their

Health Consumers Face the New Year Concerned About Costs, Security and Caring – Health Populi’s 2018 Forecast

As 2018 approaches, consumers will gather healthy New Year’s Resolutions together. Entering the New Year, most Americans are also dealing with concerns about healthcare costs, cybersecurity, and caring – for physical health, mental stress, and the nation. Healthcare costs continue to be top-of-mind for consumer pocketbook issues. Entrenched frugality is the new consumer ethos. While the economy might be statistically improving, American consumers’ haven’t regained confidence. In 2018, frugality will impact how people look at healthcare costs. 88% of US consumers are likely to consider cost when selecting a healthcare provider, a Conduent survey found. Physicians know this: 81% of

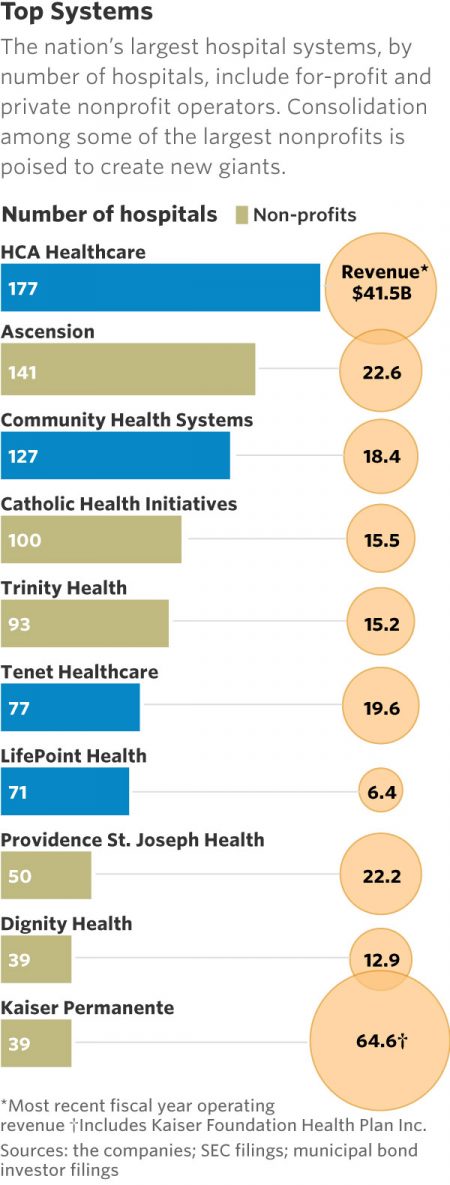

Will Getting Bigger Make Hospitals Get Better?

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health. In terms of size, the CHI and Dignity combination would create a larger company than McDonald’s or Macy’s in terms of projected $28 bn of revenue. (Use the chart of America’s top systems to do the math). For context, other hospital stories this week discuss in southern New Jersey. And this week, the New Jersey Hospital Association annual report called the hospital industry the “$23.4 billion economic bedrock” of the state. Add a third important item

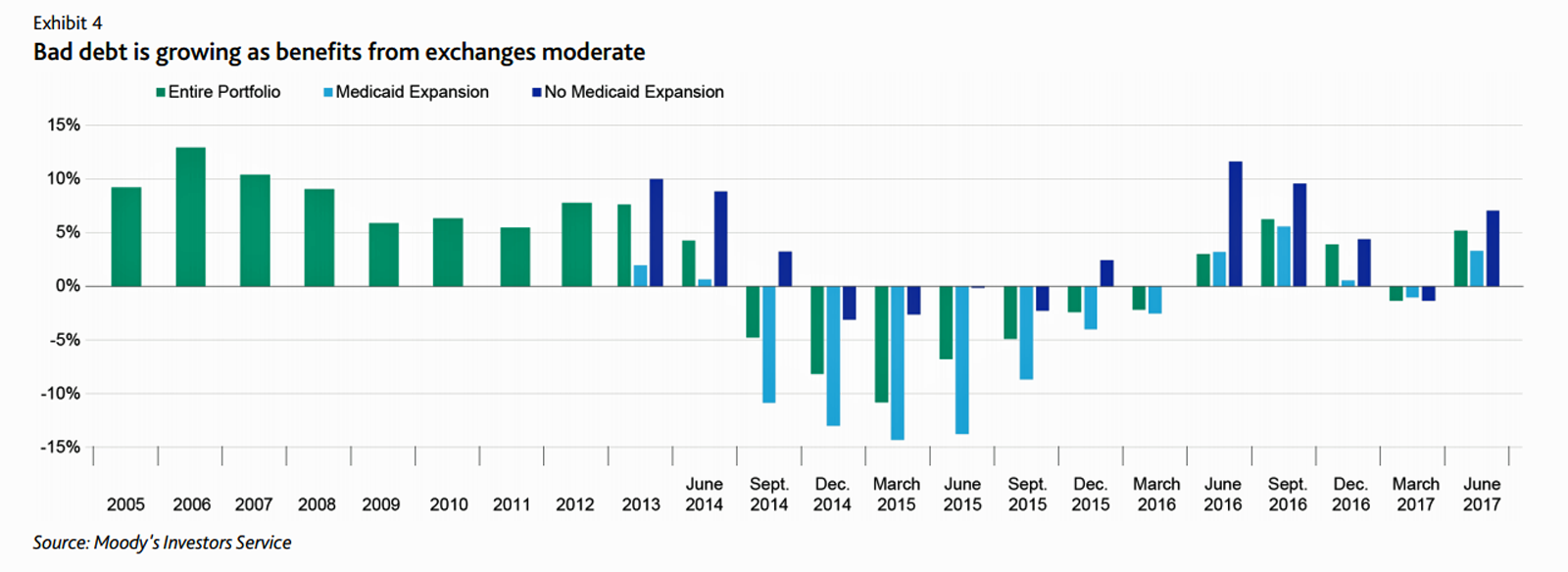

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.