Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Gaps in Health Equity in America Are Growing

There’s been a “clear lack of progress on health equity during the past 25 years in the United States,” asserts a data-rich analysis of trends conducted by two professors/researchers from UCLA’s School of Public Health. The study was published this week in JAMA Network Open. The research mashed up several measures of health equity covering the 25 years from 1993 through 2017. The data came out of the Centers for Disease Control and Prevention’s Behavioral Risk Factor Surveillance System looking at trends by race/ethnicity, sex and income across three categories for U.S. adults between 18 and 64 years of age.

Prescription Drugs Are Becoming A Luxury Good in America – Join the #HCLDR Chat Tonight

“Drugmakers Push Their Prices Higher” is the top story under the Business & Finance banner in today’s Wall Street Journal. That’s in terms of drugs’ list prices, which most patients don’t pay. But drug costs to patients are in the eye of the beholder, who in a high-deductible plan or Medicare Part D donut hole becomes the first-dollar payer. Patients continue to face rising drug costs, pushing them into what I’ve been thinking about as luxury-goods territory. The economic definition of a luxury good is a product for which demand increases more than proportionally as income rises, so that spending

Health Care and the Democratic Debates – Round 2 – Battle Royale for M4All vs Medicare for All Who Want It – What It Means for Industry

Looking at this photo of the 2020 Democratic Party Presidential candidate debater line-up might give you a déjà vu feeling, a repeat of the night-before debate. But this was Round 2 of the debate, with ten more White House aspirants sharing views — sometimes sparring — on issues of immigration, economic justice, climate change, and once again health care playing a starring role from the start of the two-hour event. The line-up from left to write included: Marianne Williamson. author and spiritual advisor John Hickenlooper, former Governor of Colorado Andrew Yang. tech company executive Pete Buttigieg, Mayor of South Bend,

Kroger Health Thinks Food is Medicine – Nutrition at the Grocery Store Via FMI’s Insights

In reading the July/August issue of Eating Well magazine this week, I came across this ad which I scanned for you to see yourself: “We believe in food as medicine.” Signed, Kroger Health. Here’s the introductory text in the full-page ad: “As Kroger Health, our vision is to help people live healthier lives. And now, more than ever, through our experts, innovation, and technology, we’re uniquely positioned to bring that vision to life,” the copy read. “We know food,” the text continued, as part of The Kroger Co. which is the largest grocery chain in the U.S. celebrating 135 years

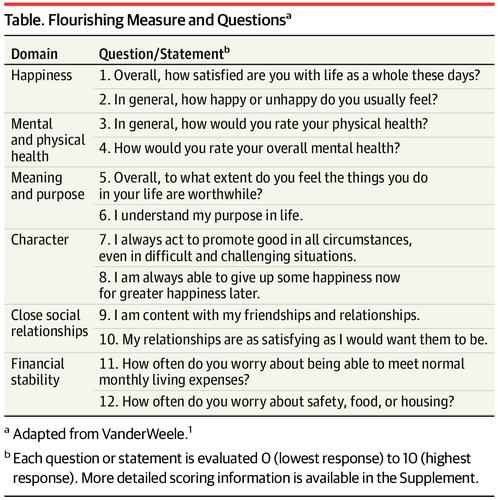

People Want to Flourish, Not Just Live – Speaking Health Politics to Real People

“How should we define ‘health?'” a 2011 BMJ article asked. The context for the question was that the 1948 World Health Organization definition of health — that health is, “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”– was not so useful in the 21st century. The authors, a global, multidisciplinary team from Europe, Canada and the U.S., asserted that by 2011, human health was marked less by infectious disease and more by non-communicable conditions that could be highly influenced, reversed and prevented through self-care by the individual and public health policy

How Consumers’ Belt-Tightening Could Impact Health/Care – Insights from Deloitte’s Retail Team

Over the ten years between 2007 and 2017, U.S. consumer spending for education, food and health care substantially grew, crowding out spending for other categories like transportation and housing. Furthermore, income disparity between wealthy Americans and people earning lower-incomes dramatically widened: between 2007-2017, income for high-income earners grew 1,305 percent more than lower-incomes. These two statistics set the kitchen table for spending in and beyond 2019, particularly for younger people living in America, considered in Deloitte’s report, The consumer is changing, but perhaps not how you think. The authors are part of Deloitte Consulting’s Retail team. The retail spending data

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

Will Health Consumers Morph Into Health Citizens? HealthConsuming Explains, Part 5

The last chapter (8) of HealthConsuming considers whether Americans can become “health citizens.” “Citizens” in this sense goes back to the Ancient Greeks: I return to Hippocrates, whose name is, of course, the root of The Hippocratic Oath that physicians take. Greece was the birthplace of Democracy with a capital “D.” Hippocrates’ book The Corpus is thought to be one of the first medical textbooks. The text covered social, physical, and nutritional influences, and the concept of “place” for health and well-being. Here, the discussion detailed the roles of air and water for health. The Hippocratic texts also coached doctors to

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

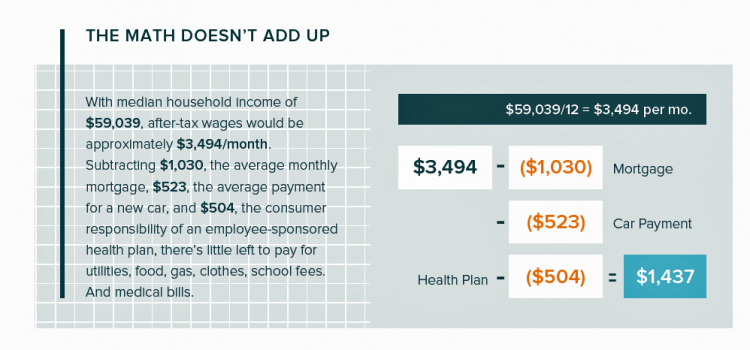

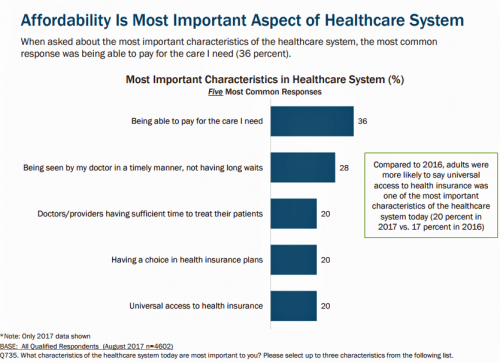

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

Money First, Then Kids: The State of the American Family in 2018

Most American families with children at home are concerned about paying bills on a monthly basis. One in two people have had at least one personal “economic crisis” in the past year, we learn in the American Family Survey 2018, released last week from Deseret News and The Brookings Institution. The project surveyed 3,000 U.S. adults across the general population, fielded online by YouGov. This poll, conducted since 2005, looks at the state of U.S. families through several issue lenses: the state of marriage and family, parents and teenagers, sexual harassment (with 2018 birthing the #MeToo movement), social capital and

The Ultimate Health Outcome, Mortality, Is Rising in America

How long can people living in the U.S. expect to live? 78.6 years of age, if you were born in 2017. That’s a decline of 0.1 year from 2016. This decline especially impacted baby boys: their life expectancy fell to 76.1 years, while baby girls’ life expectancy stayed even at 81.1 years. That’s the latest data on Mortality in the United States, 2017, soberly brought to you by the Centers for Disease Control and Prevention, part of the U.S. Department of Health and Human Services. Underneath these stark numbers are the specific causes of death: in 2017, more Americans died

Open Source Health Care Will Liberate Patients

Information is power in the hands of people. When it’s open in the sunshine, it empowers people — whether doctors, patients, researchers, Presidents, teachers, students, Everyday People. Welcome to the era of Open Source Healthcare, not only the “about time” for patients to own their health, but for the launch of a new publication that will support and continue to evolve the concept. It’s really a movement that’s already in process. Let’s go back to some definitions and healthcare basics to understand just why Open Source Healthcare is already a thing. When information access is uneven, it’s considered

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

How Emotions and “Nocebos” Get in the Way of Preventive Healthcare

There are health facts that are based on rigorous scientific evidence. And, there are people who, for a variety of reasons, make irrational healthcare decisions without regard to those health facts. An important new report discusses the all-too-human aspects of people-as-patients, who often make health decisions based more on emotions than on the cold, hard truths that could save their lives and protect the well-being of loved ones. Preventative care and behavioural science: The emotional drivers of healthcare decisions is that report, sponsored by Pfizer Vaccines and written by the Economist Intelligence Unit (EIU). The report analyzes the psychological factors that shape consumers’ health

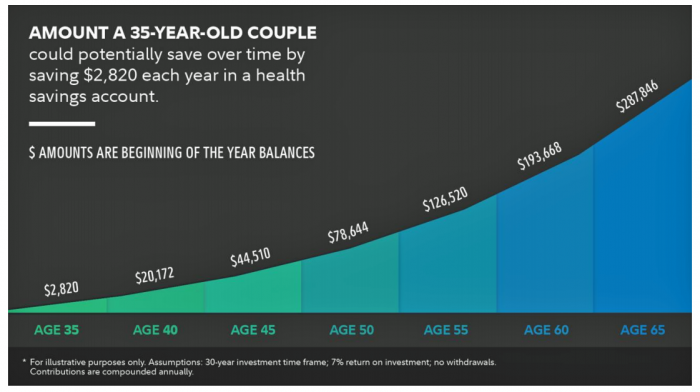

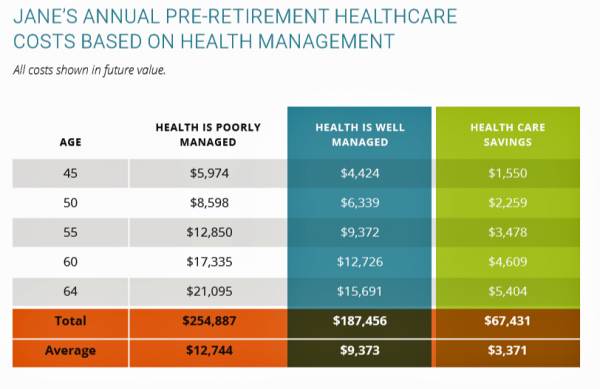

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

It Could Take Five Generations for a Low-Income US Family to Reach Average Income in America

Social mobility in America has a lot of friction: children of wealthier people tend to grow into affluence, and children of low-income parents tend to struggle to move up the income and education ladder, according to A Broken Social Elevator: How to Promote Social Mobility, a new report from the OECD. The Organization for Economic Cooperation and Development studied member nations’ economies, demographics, income and opportunities to gauge each country’s social mobility. Social mobility, the OECD explains, is multi-faceted. It can refer to inter-generational mobility between parents, children, and grandchildren. Alternatively, social mobility can look at intra-generational mobility, over the course

Pope Francis is a Public Health Advocate

“The world today is mostly deaf,” the Pontiff observes in Pope Francis: A Man of His Word, Wim Wenders’ documentary on this religious leader who likes to quote Dostoevsky, joke about mothers-in-law, and advocate for the sick, the poor, the disenfranchised, and Planet Earth. He is, I realized while watching this film and hearing this man of words, a public health advocate. Throughout the film, we see clips of Pope Francis washing the feet of prisoners in Philadelphia, comforting dying children in a pediatric clinic in central Africa, and speaking out to the U.S. Congress about the dangers of climate

Thinking About Kate and Anthony – Suicide and Depression Is US

Yesterday at 1 pm, we learned that the incidence of suicide is up in America in a report from the Centers for Disease Control (CDC), an agency in the U.S. Department of Health and Human Services. This morning, we awake to news that Anthony Bourdain, the witty and prolific travel and food expert, took his own life. Earlier this week, Kate Spade, fashion designer and creative force, took her own life. The loss of these two bright lights, gone from our lives to suicide within a few days of each other, gives me the sad compulsion to say something, again, about

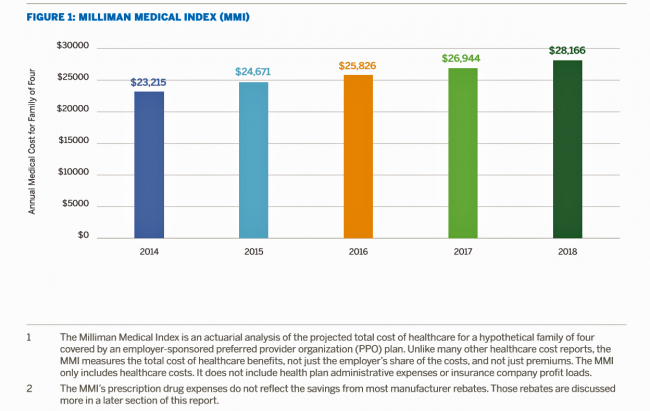

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

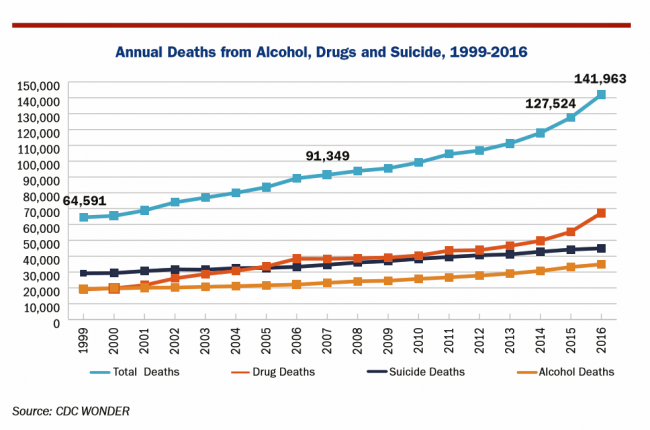

The U.S. is a Nation in Pain – America’s Life Expectancy Fell Again in 2016

American saw the greatest number of deaths from suicide and alcohol- and drug-induced fatalities was recorded in 2016. That statistic of nearly 142,000 equates to deaths from stroke and exceed the number of deaths among Americans who died in all U.S. wars since 1950, according to Pain in the Nation Update from the Well Being Trust and Trust for America’s Health. The line graph soberly illustrates the growing tragic public health epidemic of mortality due to preventable causes, those deaths of despair as Anne Case and Sir Angus Deaton have observed in their research into this uniquely all-American phenomenon. While this

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

Healthcare Access and Cost Top Americans’ Concerns in Latest Gallup Poll

Healthcare — availability and affordability — is a more intense worry for Americans in March 2018 than crime and violence, Federal spending, guns, drug use, and hunger and homelessness. The Gallup Poll, fielded in the first week of March 2018, found that peoples’ overall economic and employment concerns are on the decline since 2010, at the height of the Great Recession which began in 2008. While 70% of Americans were worried about economic matters in 2010, only 34% of people in the U.S. were worried about the economy, and 23% about unemployment, in March 2018. Gallup has asked this “worry”

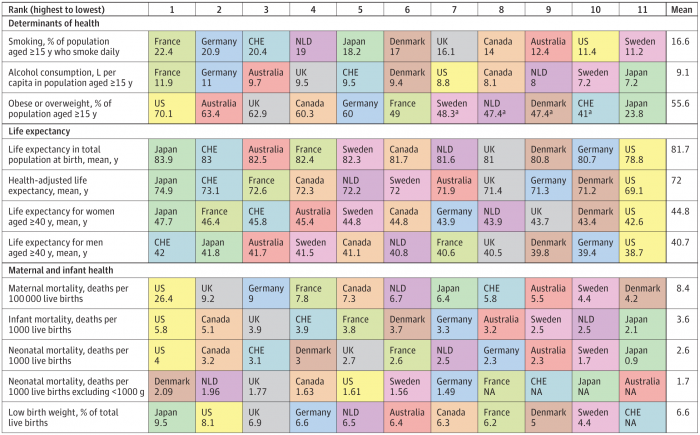

How We Spend Versus What We Get: America’s Healthcare Spending Makes for Poor Health

The U.S. spent nearly twice as much as other wealthy countries on healthcare, mostly due to higher prices for both labor and products (especially prescription drugs). And, America spends more on administrative costs compared to other high-income countries. What do U.S. taxpayers get in return for that spending? Lower life spans, higher maternal and infant mortality, and the highest level of obesity and overweight among our OECD peer nations. These sobering statistics were published in Health Care Spending in the United States and Other High-Income Countries this week in JAMA, the Journal of the American Medical Association. The study analyzes

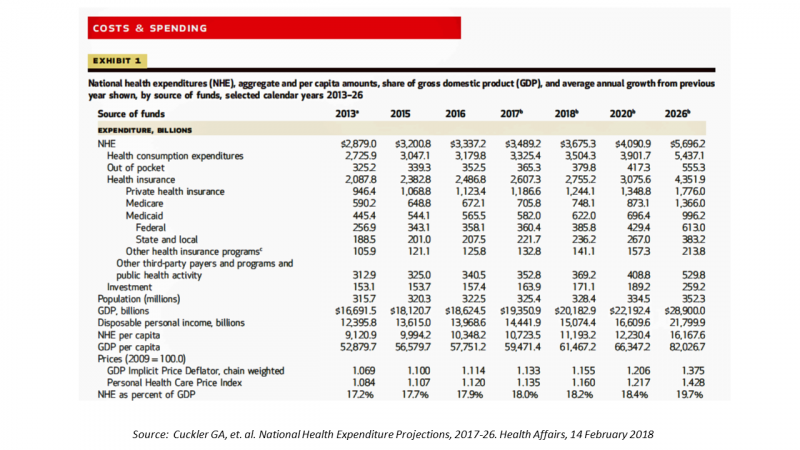

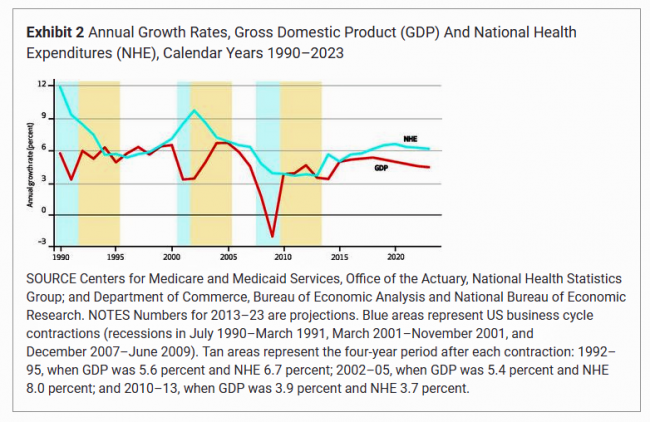

The $4 Trillion Health Economy of 2020

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

Getting Real About Social Determinants of Health

New research points out that real people live real lives, and our assumptions about social determinants of health (SDOH) may need to be better informed by those real lives. I read three reports in the past week sobering up my bullish #SDOH ethos dealing with food deserts, transportation, and health service access — three key social determinants of health. To remind you about the social determinants, here’s a graphic from Kaiser Family Foundation that summarizes the key pillars of SDOH. Assumption 1: Food deserts in and of themselves diminish peoples’ healthy nutrition lifestyles. Low-income households who are exposed to the same food-buying

What Healthcare Can Learn from A Pig and Piggy Bank via Santander Bank

When patients feel disrespected in a medical exam room, they will be less likely to follow instructions they receive from a doctor. Research from the Altarum Institute revealed this fundamental finding. The chart shows that feeling respected reduces a patient’s diabetes medication adherence by a factor of nearly 2x, and is a risk factor for poorly managed diabetes. Furthermore, consumers who feel disrespected by providers are three times more likely to not believe doctors are accurate sources of information than consumers who do feel respected. And, patients with diabetes who do not feel respected are one-third more likely to have poorly

Calling Out Health Disparities on Martin Luther King Day 2018

On this day appreciating the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group

Healthy Living in Digital Times at CES 2018

Connecting Life’s Dots, the organization Living in Digital Times partners with CES to deliver conference content during the show. At CES 2018, LIDT is connecting a lot of dots to help make health streamline into daily living. Robin Raskin, founder, kicked off LIDT’s press conference setting the context for how technology is changing lifestyles. Her Holy Grail is to help make tech fun for everybody, inclusive for everybody, and loved by everybody, she enthused. LIDT has been a presence at CES for many years, conceiving the contest the Last Gadget Standing, hosting tech-fashion shows with robots, and supporting a young innovators

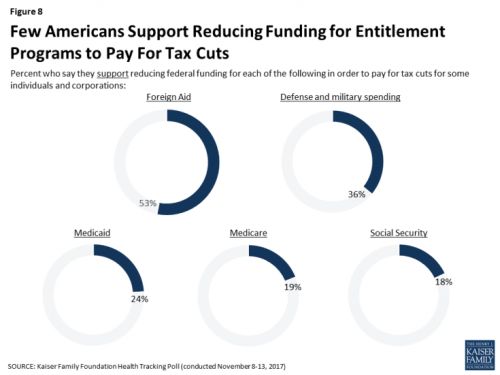

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

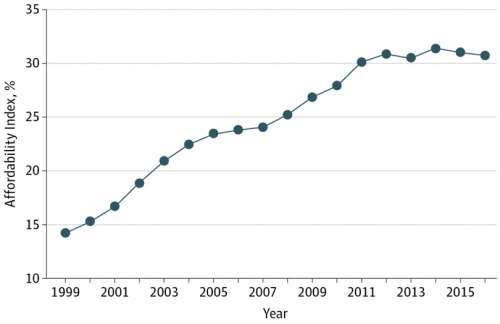

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

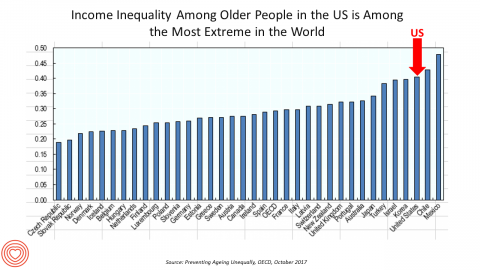

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

Most Americans Are Concerned About Healthcare Policy, and Costs Top the List of Concerns

4 in 5 Americans are aware of potential changes to healthcare policy brewing in Washington, DC. 92% of them are concerned about those changes, according to Healthcare Consumers in a Time of Uncertainty, the fifth annual survey from Transamerica Center for Health Studies. Peoples’ most-shared fears are losing their coverage for pre-existing conditions, out-of-pocket spending, and a ban on lifetime limits. That boils down to one thing: cost. That is, cost, for having to spend money on services not-covered by their health insurance plan; cost for out-of-pocket items under-insured, denied, or requiring coinsurance or co-payments; and, catastrophic costs that rise beyond

Transparency in Drug Prices, from OTC to Oncology

While on vacation in Bermuda, I found a box of private label ibuprofen for $2.45 for 20 – 200mg tablets, and one for Advil PM for $10.50 for the same number of pills, same strength. I’ve just returned from a lovely week’s holiday. When I travel, whether for work or vacation, it’s always a sort of Busman’s Holiday for me as I love to seek out health destinations wherever I go. So it was natural for me to spot the Dockyard Pharmacy at the port in Hamilton and wander in. I made my way back to the well-stocked pharmacy counter,

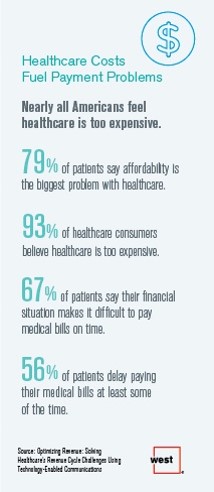

Patients’ Healthcare Payment Problems Are Providers’, Too

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

Health Equity Lessons from July 23, 1967, Detroit

On July 23, 1967, I was a little girl wearing a pretty dress, attending my cousin’s wedding at a swanky hotel in mid-town Detroit. Driving home with my parents and sisters after the wedding, the radio news channel warned us of the blazing fires that were burning in a part of the city not far from where we were on a highway leading out to the suburbs. Fifty years and five days later, I am addressing the subject of health equity at a speech over breakfast at the American Hospital Association 25th Annual Health Leadership Summit today. In my talk,

So Far, Food and Nutrition Aren’t Baked Into President Trump’s Health Policies

The FDA is delaying the public posting of calorie counts, a policy that President Obama’s administration had pioneered for public health and wellness. Menu labeling has applied to grocery stores, gas stations, convenience stores, movie theaters and sports stadiums that sell prepared food. “Health and Human Services Secretary Tom Price said the menu labeling requirements would be ‘unwise and unhelpful’ as currently written, and added that the FDA is looking for ways to make the rules ‘more flexible and less burdensome.'” Former FLOTUS Michelle Obama took on the issue of healthy food and fitness for America’s children. Except for keeping her White

Women and Children First? What the AHCA Holds for Vulnerable Populations

In accounting, there’s a rule with acronym “LIFO;” this stands for “last in, first out,” which requires taking account of the most recent cost of products being the first ones to be expensed on the ledger. I’m thinking about LIFO when it comes to the American Health Care Act (AHCA) which narrowly passed through Congress yesterday by 4 votes, with a final tally of 217 to 213. Why “LIFO?” Because long-uninsured folks who just recently received access to health insurance as an on-ramp to health care services could lose this benefit, just months after joining the ranks of the insured. Among

The Power of Joy in Health and Medicine – Learning From Dr. Regina Benjamin

Former Surgeon General Dr. Regina Benjamin was the first person who quoted to me, “Health isn’t in the doctor’s office. It’s where people live, work, play and pray,” imparting that transformational mantra to me in her 2011 interview with the Los Angeles Times. I wrote about that lightbulb moment here in Health Populi. Dr. Benjamin was the 18th Surgeon General, appointed by President Obama in 2009. As “America’s Doctor,” she served a four-year term, her mission focused on health disparities, prevention, rual health, and children’s health. Today, Dr. Benjamin wears many hats: she’s the Times Picayune/NOLA.com professor of medicine at

Your Zip Code Is Your Wellness Address

Geography is destiny, Napoleon is thought to have first said. More recently, the brilliant physician Dr. Abraham Verghese has spoken about “geography as destiny” in his speeches, such as “Two Souls Intertwined,” The Tanner Lecture he delivered at the University of Utah in 2012. Geography is destiny for all of us when it comes to our health and well-being, once again proven by Gallup-Healthways in The State of American Well-Being 2016 Community Well-Being Rankings. The darkest blue circles in the U.S. map indicate the metro areas in the highest-quintile of well-being. The index of well-being is based on five metrics, of consumer self-ranking

Stress Is A Social Determinant of Health – Money and Politics Top the List in 2017

The American Psychological Association reports that Americans are experiencing greater levels of stress in 2017 for the first time since initiating the Stress in America Survey ten years ago in 2007. This is a statistically significant finding, APA calculated. The member psychologists of the American Psychological Association (APA) began to report that patients were coming to appointments increasingly anxious about the 2016 Presidential election. So the APA polled U.S. adults on politics for the first time in ten years of conducting the Stress in America survey. Two-thirds of Americans are stressed and/or anxious about the future of the nation, and

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Health and Money: Americans’ New Year’s Resolutions for 2017

Health and money are the two issues about which Americans have set New Year’s resolutions, according to the Harris Poll, Americans Look to Get Their Bodies and Wallets in Shape with New Year’s Resolutions. The top goals U.S. consumers have set for 2017 are to: Eat healthier, 29% of all U.S. adults Save more money, 25% Lose weight, 24% Drink more water, 21% Pay down debt, 17% Spend more time with family and friends, 15% Get organized, 15% Travel more, 15% Read more, 14% Improve relationships, 14%. There are some marked differences between American men versus women across these resolutions;

Looking Beyond Tech for Health at CES 2017 – the Social Determinants

I’m at CES 2017 in Las Vegas all this week looking for signs of health in new technology announcements. While it’s no surprise there are hundreds of new and new-and-improved digital health innovations on the exhibition floor, you can look beyond those aisles to other companies who are new entrants in health. Arguably, these companies can bolster peoples’ health at least as much as activity tracking and calorie counting. Here are five examples I wrote about in my Huffington Post column yesterday, The Social Determinants of Health Live At CES 2017: Safety – Liberty Mutual Nutrition – Terraillon Healthy Sex

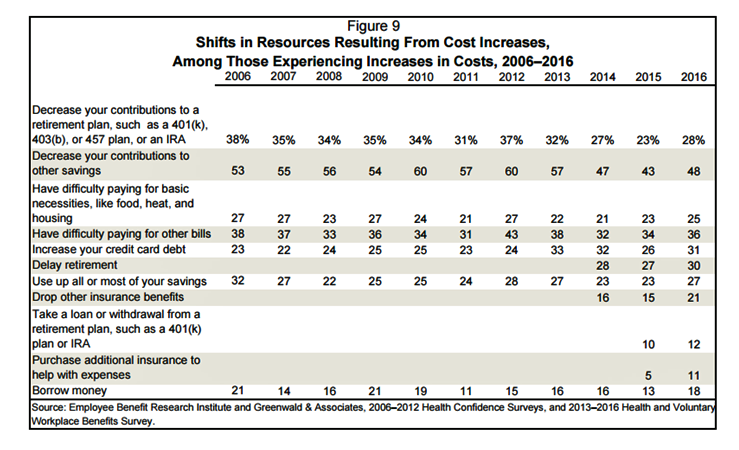

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

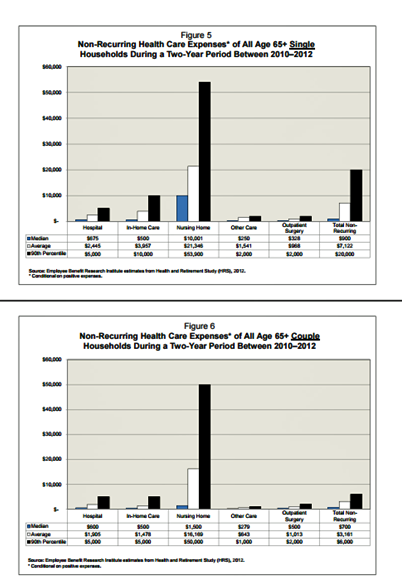

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

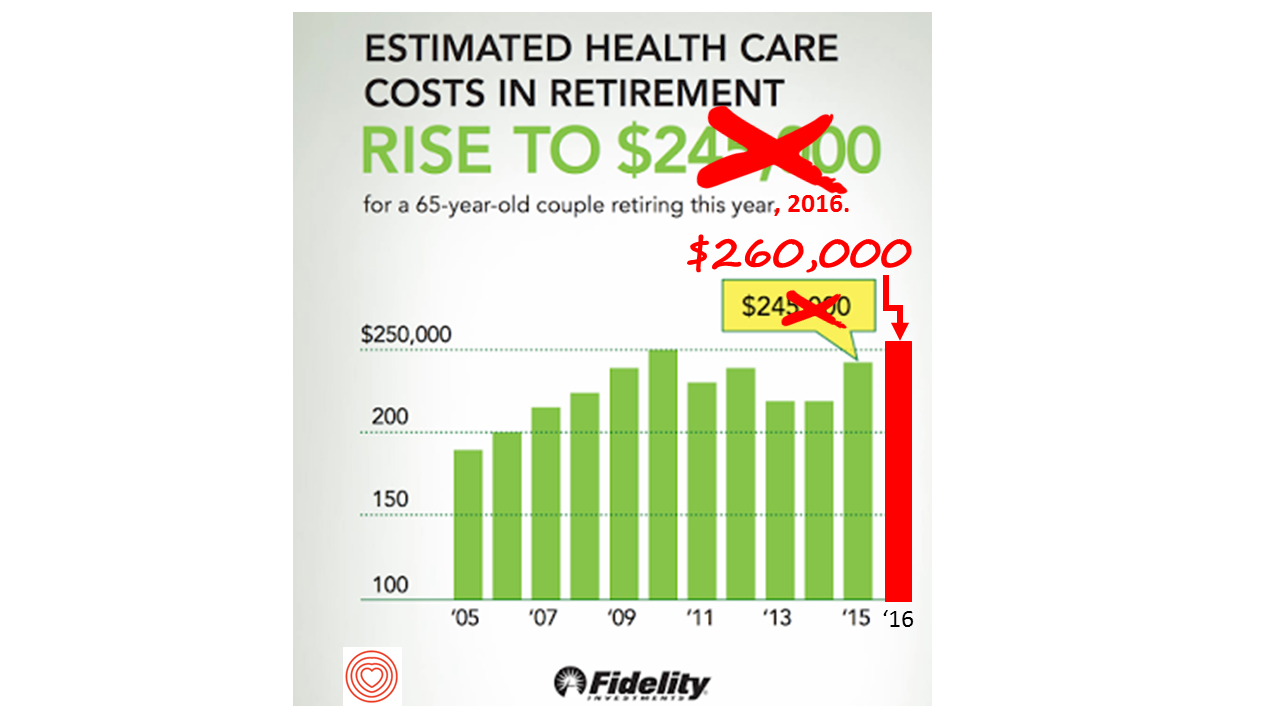

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

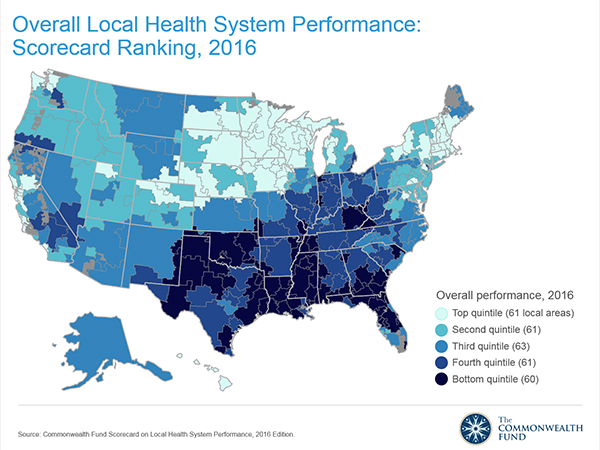

Health in America: Improving, But Disparities Need Policy Prescriptions

The bad news: mortality rates haven’t improved much and obesity rates rose in one-third of communities. The good news: public health gains can be made in resource-poor communities with the right health policies, based on research from The Commonwealth Fund, Rising to the Challenge, the Fund’s Scorecard on local health system performance for 2016. The top-line of this benchmark report is that health care in the U.S. has, overall, improved more than it’s declined. Among the big levers driving health care improvement in the past year have been the further expansion of health citizens covered with insurance through the Affordable

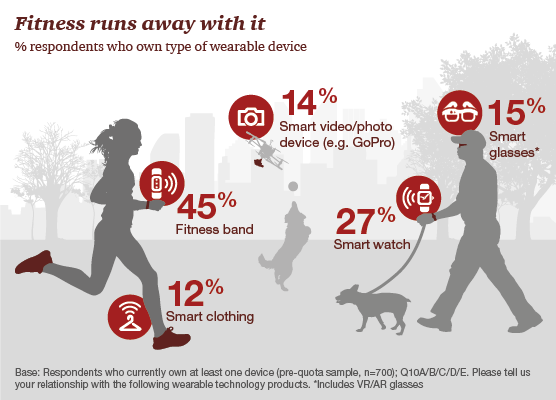

One in Two People Use Wearable Tech in 2016

Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC. Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing. Specifically, 45% of people own a fitness band, such as a Fitbit, the most popular device in this

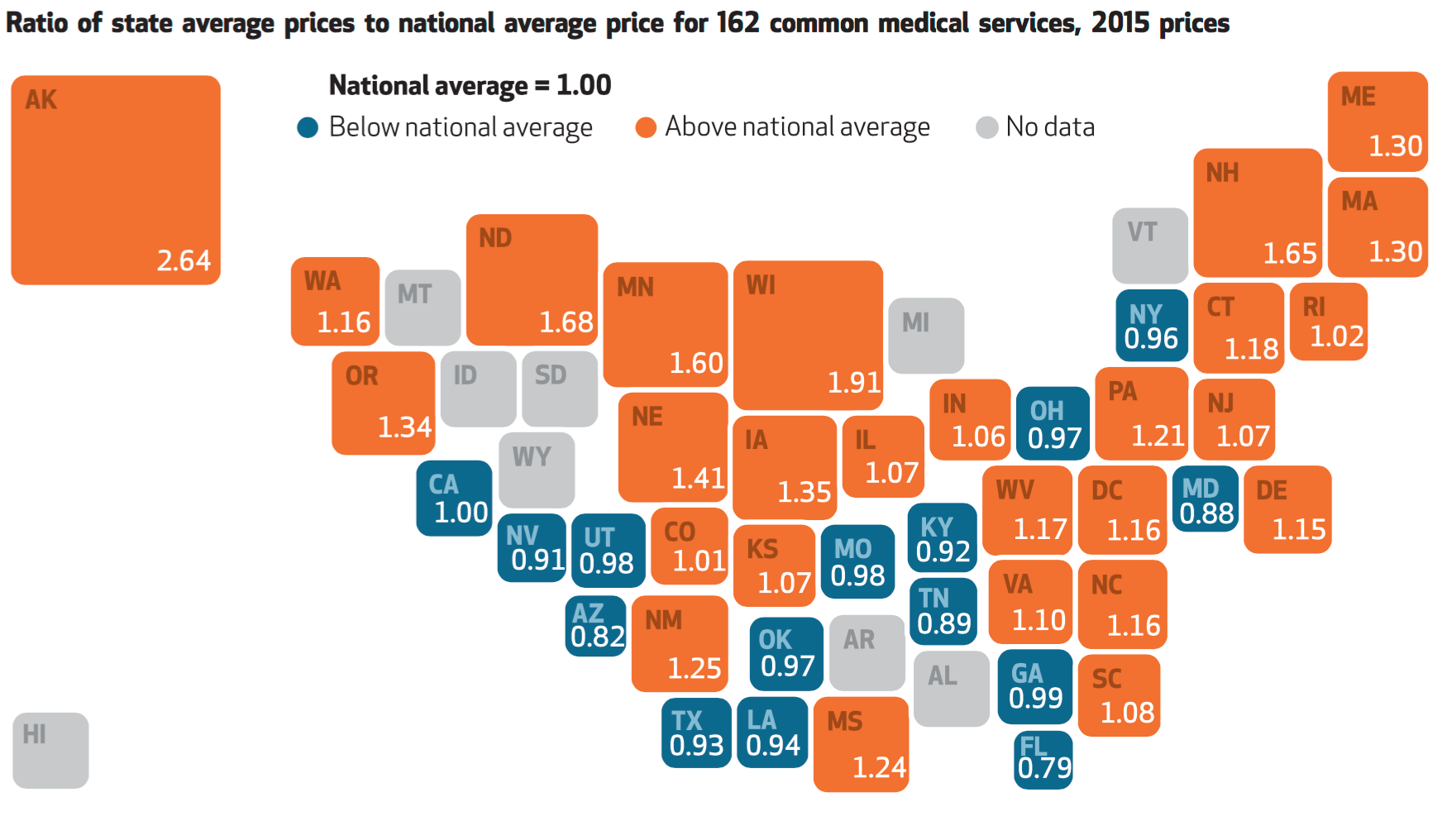

For Healthcare Costs, Geography is Destiny

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

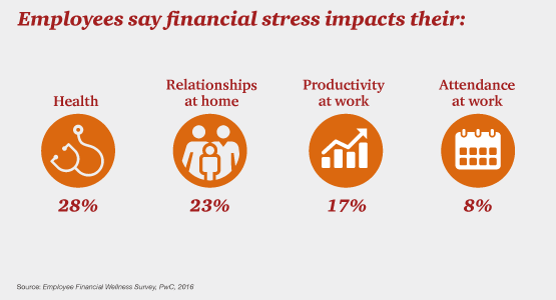

Money, Stress and Health: The American Worker’s Trifecta

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

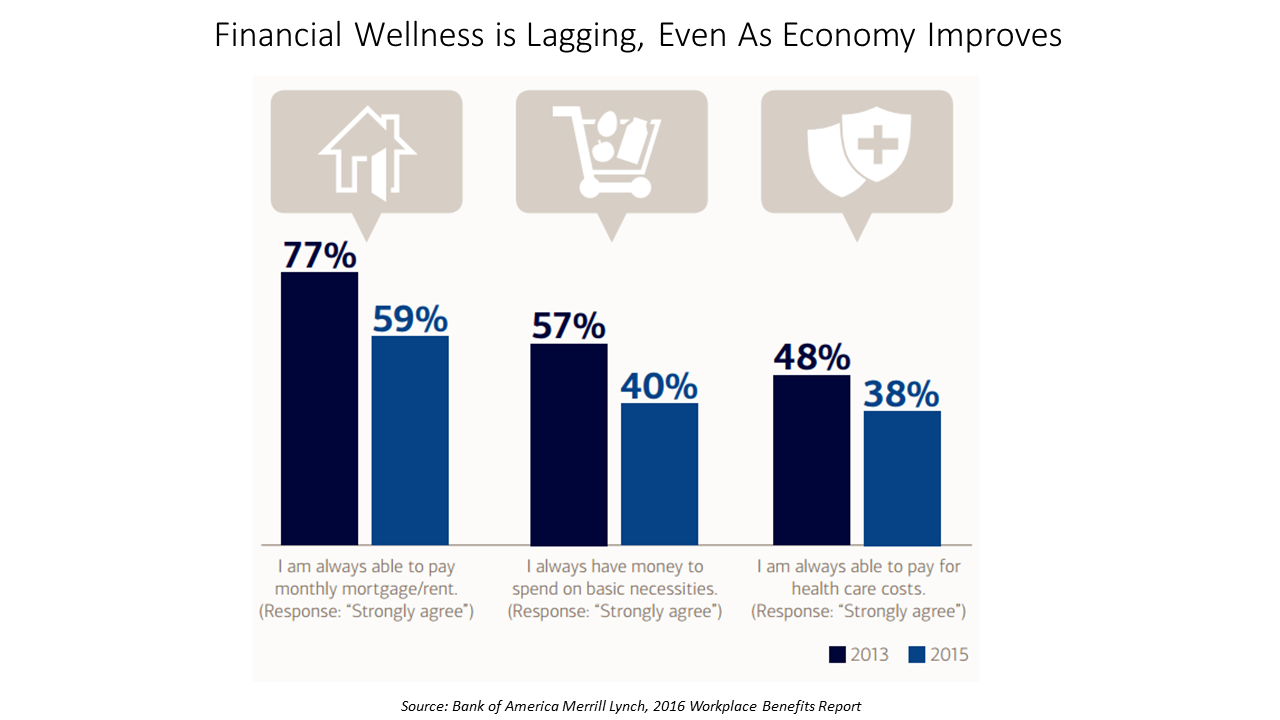

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

What Retail Financial Services Can Teach Healthcare

“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems. You could substitute “healthcare providers” for “banks and insurance companies,” because traditional health industry stakeholders are equally behind the consumer demand for digital convenience. This report has important insights relevant to health providers, health plans and suppliers (especially for

Being a Woman is a Social Determinant of Health – Happyish International Women’s Day

Today is International Women’s Day. Being a woman is a social determinant of health (for the worse). To mark the occasion of the Day, The International Labour Organization (ILO) published a report on women and work yesterday, finding that in the 178 countries studied, inequality between women and men persists across labor markets. And while there’s been progress in women’s education over the past twenty years, this hasn’t resulted in women advancing career paths and wage equality. It struck me this morning, reading both (paper versions of) the Wall Street Journal and the Financial Times that the latter had two FT-sponsored ads marking

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

Prescription Drug Costs Will Be In Health Benefits Bullseye in 2016

Prescription drug costs have become a front-and-center health benefits cost issue for U.S. employers in 2015, and in 2016 the challenge will be directly addressed through more aggressive utilization management (such as step therapy and prior authorization), tools to enable prescription intentions like DUR, and targeting fraud, waste and abuse. Consumers, too, will be more financially responsible for cost-sharing prescription drugs, in terms of deductibles and annual out-of-pocket limits, as described in the PBMI 2015-206 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda. The Pharmacy Benefit Management Institute has published this report for 15 years, which provides neutral, detailed survey

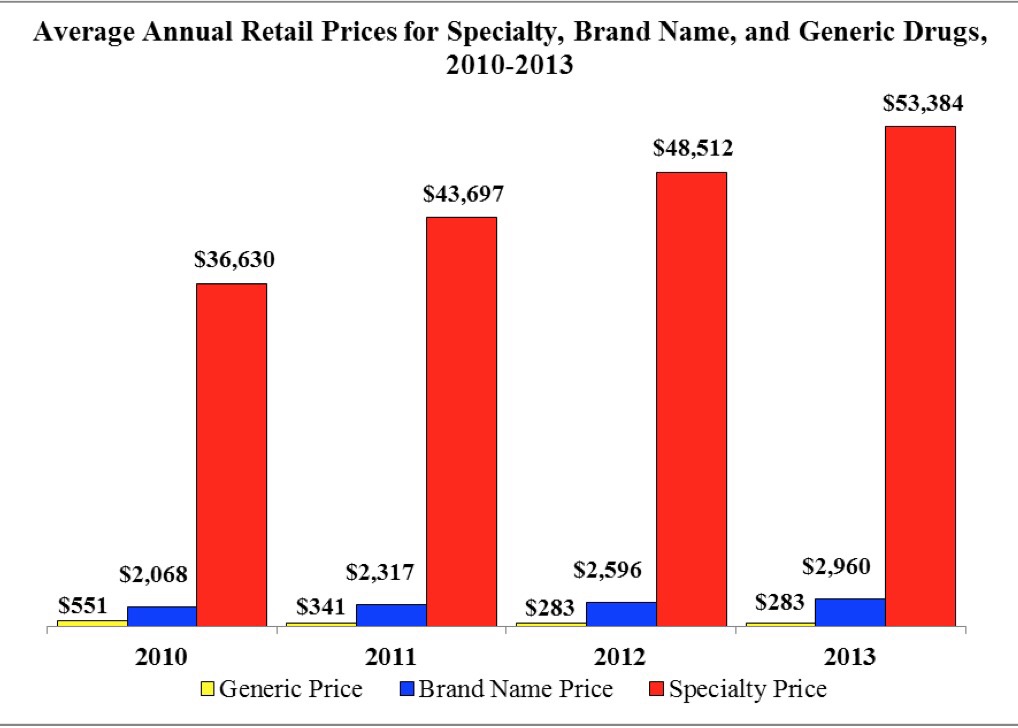

The Average Price of a New Specialty Drug Exceeds Median U.S. Annual Income; and a Tweet from Pam Anderson

The average price for a specialty drug was $53,384 in 2013; the average household income was $52,250. Thus, even allocating 100% of a family’s annual earnings to pay for a drug wouldn’t stretch far enough to cover it in 2013, nor would it do so today in 2015. This sober health economic artifact comes from the latest Rx Price Watch Report from the AARP, detailing cost trends for prescription drugs across all segments — generics, brands and specialty drugs. Contrast, as well, the $53K for the average specialty drug with the median 2013 Social Security benefit payout of $15,526 and median Medicare

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

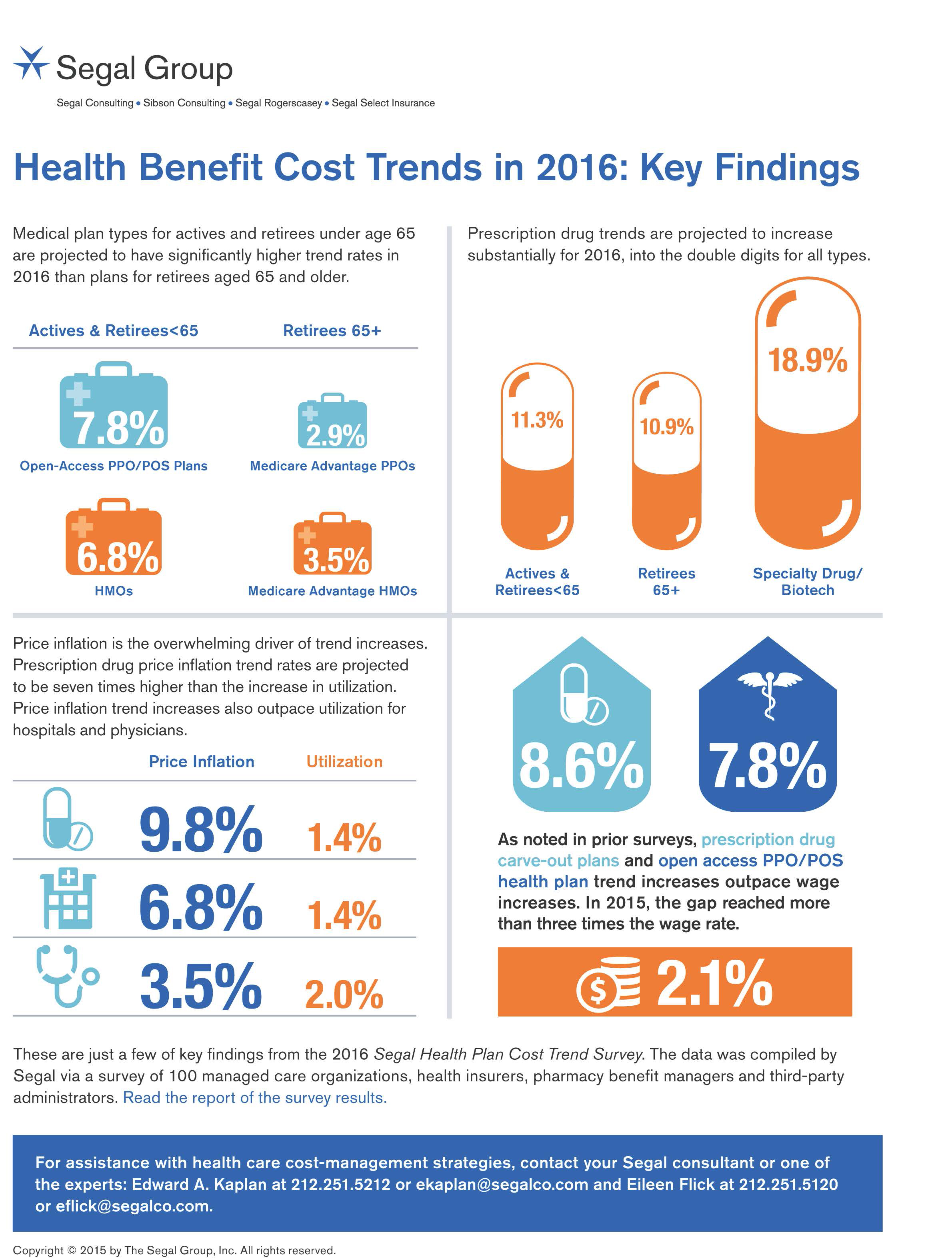

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

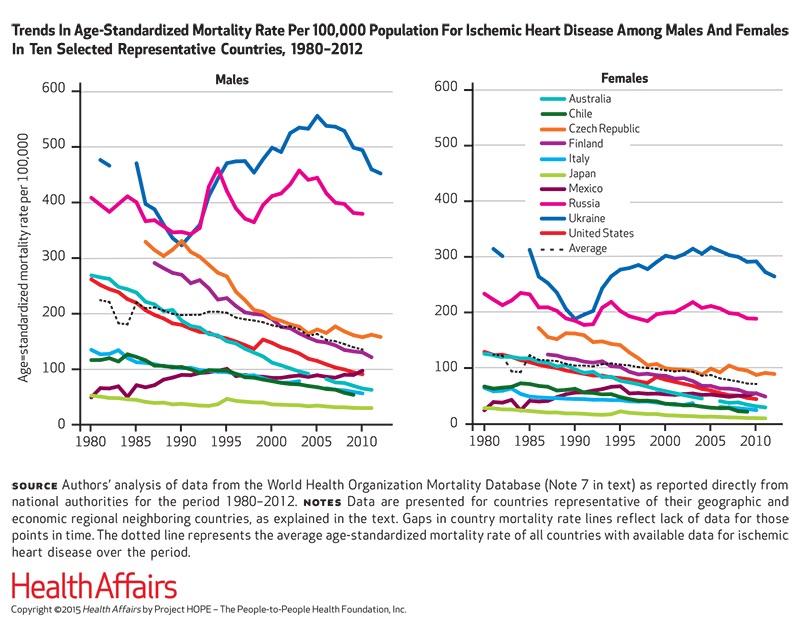

The rise and rise of noncommunicable diseases

Noncommunicable diseases (NCDs) are the #1 cause of death in the world. NCDs are the yin to the yang of infectious diseases. Mortality from infectious disease has fallen as national economies have developed, while NCDs such as heart disease, respiratory disease, cancer, diabetes, and other NCDs are a growing burden. Health Affairs devotes its September 2015 issue to The Growing Burden of Noncommunicable Diseases, featuring research focusing both on global trends and U.S.-specific challenges. In their look into the relationships between NCDs, unhealthy lifestyles and country wealth, Thomas Bollyky et. al. note that NCDs aren’t only the “diseases of affluence,”

Employers pushing consumerism for health benefits in 2016

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

Most Americans say drug prices are unreasonable and blame company profits

Three-quarters of U.S. adults say the cost of prescription drugs are unreasonable, and blame high medication prices set by profitable pharmaceutical companies according to the Kaiser Family Foundation Health Tracking Poll for June 2015. Profits made by drug companies are the #1 reason Americans cite among major factors that contribute to the price of prescription drugs (among 77% of people), followed by the cost of medical research (64%), the cost of marketing and advertising (54%), and the cost of lawsuits (49%). Regardless of the cost, 71% of people say that health insurance should “always” pay for high-cost drugs. At the same

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

Avoiding Wrinkles: A World Without Tobacco

May 31st is World No Tobacco Day, heralded by the World Health Organization, and celebrated by the advocacy group Action on Smoking and Health (with the very appropriate acronym ASH). Smoking is one of the most addictive (anti-)health behaviors around, so persuading people to quit the habit continues to challenge public health advocates. Enter ASH’s engaging campaign called “The Wrinkler,” with the introductory question, “Ever notice how some people who are 25 look 45?” The video continues to explain how we can “expedite the aging process….Ladies, wish you were half your age? Don’t wait for him to look younger; make yourself

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

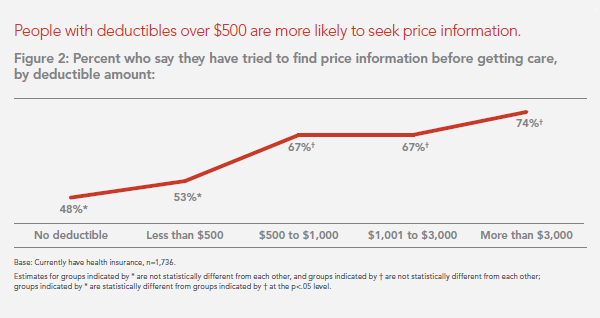

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

A health agenda comes to the 2015 Oscars

The 87th annual 2015 Oscars show (#Oscars15) feted more than the movie industry: the event celebrated health in both explicit and subtle ways. Julianne Moore took the golden statuette for Best Actress, playing the title role in Still Alice, the story a woman diagnosed with early-onset Alzheimer’s Disease. In accepting her award, Moore spoke of the need to recognize and “see” people with Alzheimer’s – so many people feel isolated and marginalized, Moore explained. Movies help us feel seen and not alone – and people with Alzheimer’s need to be seen so we can find a cure, she asserted. See Moore’s lovely

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Women are natural disruptors for health

“Disruption” is a well-used word these days in business and, in the past few years, in the health care business. That’s because there’s a general consensus that the U.S. health care system is broken. “System” is a word that I shouldn’t use as my friend J.D. Kleinke smartly argued that it’s that lack of system-ness that makes using the phrase “health care system” an Oxymoron. The fragmented health care environment creates innumerable pain points when accessing, receiving, and paying for services. And it’s women who feel so much of that pain. In that context, I’m gratified and humbled to be one

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

The new health economy, starring the consumer

“In the New Health Economy, ‘patients’ will be ‘consumers’ first, with both the freedom and responsibility that come with making more decisions and spending their own money.” This vision of the near-future is brought to you by the New Health Economy, a report from PwC’s Health Research Institute (HRI). The chart attests the fact that U.S. “consumers” are already spending nearly $3 trillion (with a capital “T”) on products and services that bolster personal health. This spending includes $94 billion on nutrition, $62 billion on weight loss, $59 billion on sporting goods and apparel, $45 billion on (so-called) organic and

Your health score: on beyond FICO

Over one dozen scores assessing our personal health are being mashed up, many using our digital data exhaust left on conversations scraped from Facebook and Twitter, via our digital tracking devices from Fitbit and Jawbone, retail shopping receipts, geo-location data created by our mobile phones, and publicly available data bases, along with any number of bits and pieces about ‘us’ we (passively) generate going about our days. Welcome to The Scoring of America: How Secret Consumer Scores Threaten Your Privacy and Your Future. Pam Dixon and Robert Gellman wrote this well-documented report, published April 2, 2014 by The World Privacy Forum.

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

The four futures of health care: simple, guru, ecosystem, self-care

In the not-too-distant future, will our health care be universally available to all, standardized with limited choices? Or, will we be in self-care mode, able to “buy up” if we can afford it like luxury goods? Will health care delivery be totally tech- and information-driven? Or, will care be driven by insurers’ health plans with artful designs that (almost) predetermine our choices? Welcome to four futures of health care, brought to us by PA Consulting whose report, How Can We Stop Healthcare From Bankrupting Our Children? speaks to scenarios based on 2 uncertainties, whether: Health care will be a personal

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.