The Patient Is The Vector: Health 2.0 – Day 2 Learnings

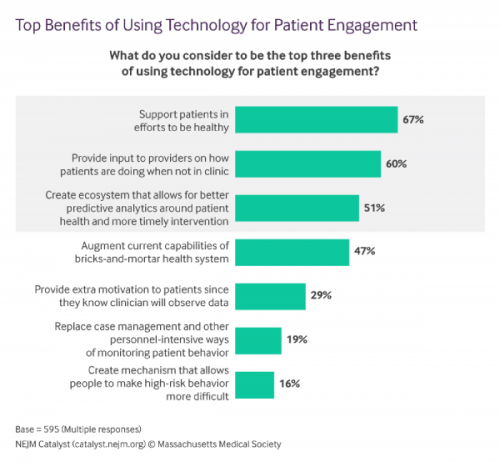

Question: “What is the opposite of ‘patient-centered care?'” asked a panelist on Day 1 of the 11th Annual Health 2.0 Conference. Answer: “‘Physician-centered care.'” Even physicians today see the merits of patient engagement, as this survey from New England Journal of Medicine found earlier this year. Since the launch of the first Health 2.0 Conference in 2007, the patient has played a growing role in session content and, increasingly, on the big stage and panel breakout sessions. A panel I attended on Day 2 convened five developers of patient engagement platforms and digital tools to help healthcare look and

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

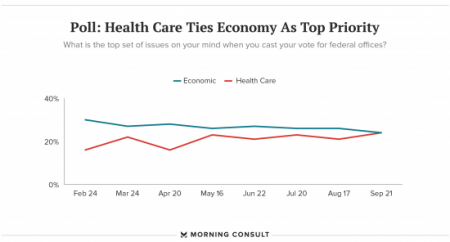

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

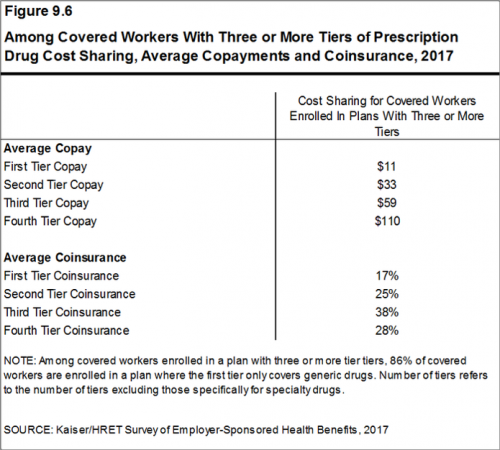

Prescription Drug Coverage at Work: Common, Complex, and Costly

Getting health insurance at work means also having prescription drug coverage; 99% of covered workers’ companies cover drugs, based on the 2017 Employer Health Benefits Survey released by the Kaiser Family Foundation (KFF). I covered the top-line of this important annual report in yesterday’s Health Populi post, which found that the health insurance premium for a family of four covered in the workplace has reached $18,764 — approaching the price of a new 2017 small car according to the Kelley Blue Book. The complexities of prescription drug plans have proliferated, since KFF began monitoring the drug portion of health benefits

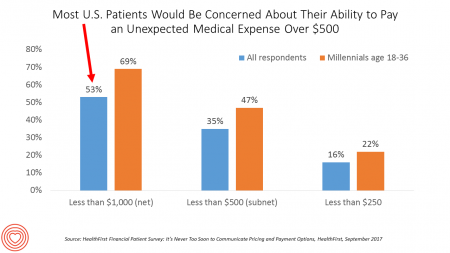

Patients Are Looking to Finance Healthcare Over Time

Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time. This is an automotive or home appliance procedure we’re talking about. It’s healthcare services, and American patients are now the third largest payors to providers in the nation. Thus, the title of a new report summarizing a consumer survey from HealthFirst notes, “It’s Never Too Soon to Communicate Pricing and Payment Options. The study found that two-thirds of U.S. consumers would like healthcare providers to discuss financing options; however, only 18 percent of providers have

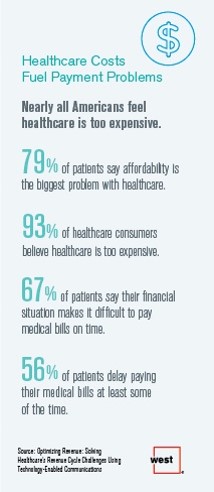

Patients’ Healthcare Payment Problems Are Providers’, Too

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

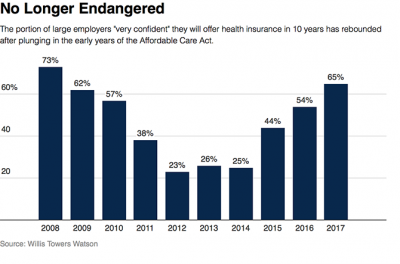

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

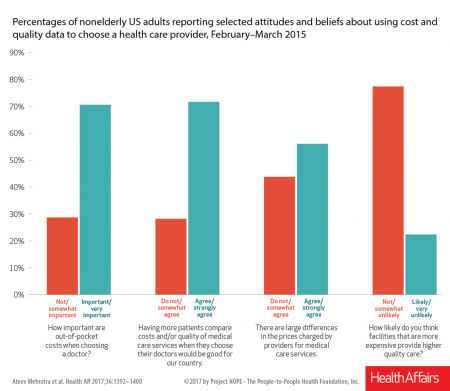

Price-Shopping for Healthcare Still A Heavy Lift for Consumers

Most U.S. consumers support the idea of price-shopping for healthcare, but don’t practice it. While patients “should” shop for health care and perceive differences in costs across providers, few seek information about their personal out-of-pocket costs before getting treatment. Few Americans shop around for health care, even when insured under a high-deductible health plan, conclude Ateev Mehrotra and colleagues in their research paper, Americans Support Price Shopping For Health Care, But Few Actually Seek Out Price Information. The article is published in Health Affairs‘ August 2017 issue. The bar chart shows some of the survey results, with the top-line finding

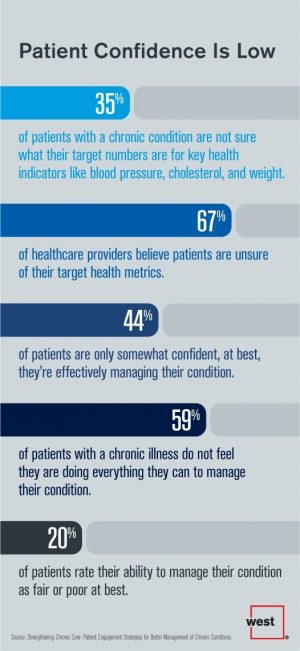

Strengthening Chronic Care Is Both Personal and Financial for the Patient

6 in 10 people diagnosed with a chronic condition do not feel they’re doing everything they can to manage their condition. At the same time, 67% of healthcare providers believe patients aren’t certain about their target health metrics. Three-quarters of physicians are only somewhat confident their patients are truly informed about their present state of health. Most people and their doctors are on the same page recognizing that patients lack confidence in managing their condition, but how to remedy this recognized challenge? The survey and report, Strengthening Chronic Care, offers some practical advice. This research was conducted by West

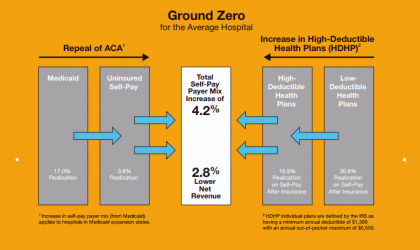

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

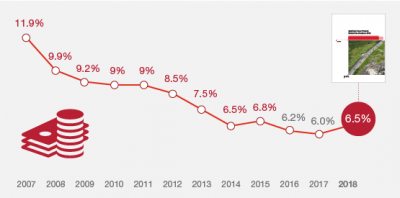

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

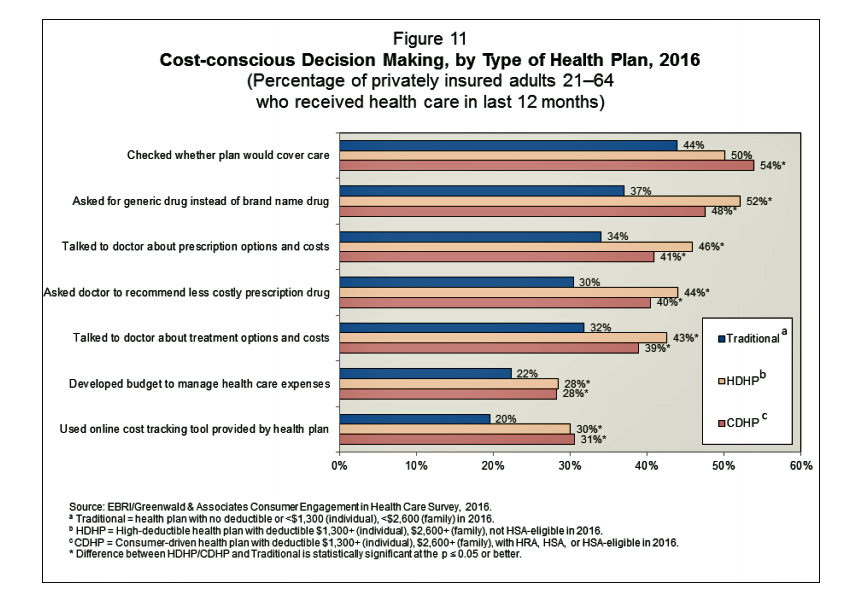

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

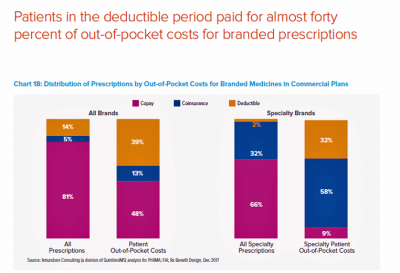

Medicines in America: The Half-Trillion Dollar Line Item

Prescription drug spending in the U.S. grew nearly 6% in 2016, reaching $450 billion, according to the QuintilesIMS Institute report, Medicines Use and Spending in the U.S., published today. U.S. drug spending is forecasted to grow by 30% over the next 5 years to 2021, amounting to $610 billion. In 2016, per capita (per person) spending on medicines for U.S. health citizens averaged $895. Specialty drugs made up $384 of that total, equal to 43% of personal drug spending, shown in the first chart. Spending on specialty drugs continues to increase as a proportion of total drug spending: traditional medicines’ share

Healthier Eating Is the Peoples’ Health Reform: the Gallup-Sharecare Well-Being Index

The top healthiest eating communities tend to circle the perimeter of the map of the lower 48 U.S. states. In these towns, more than 72% of health citizens report healthy eating. These areas are located in California, Florida, and Massachusetts, among others. Areas with the lowest rates of healthy eating are concentrated generally south of the Mason-Dixon Line, in places like Arkansas, Kentucky, and Mississippi, and other states. In these places, fewer than 57% of people eat healthy. Eating healthy foods in moderation is a mighty contributor to personal and public health, discussed in the report, State of American Well-Being

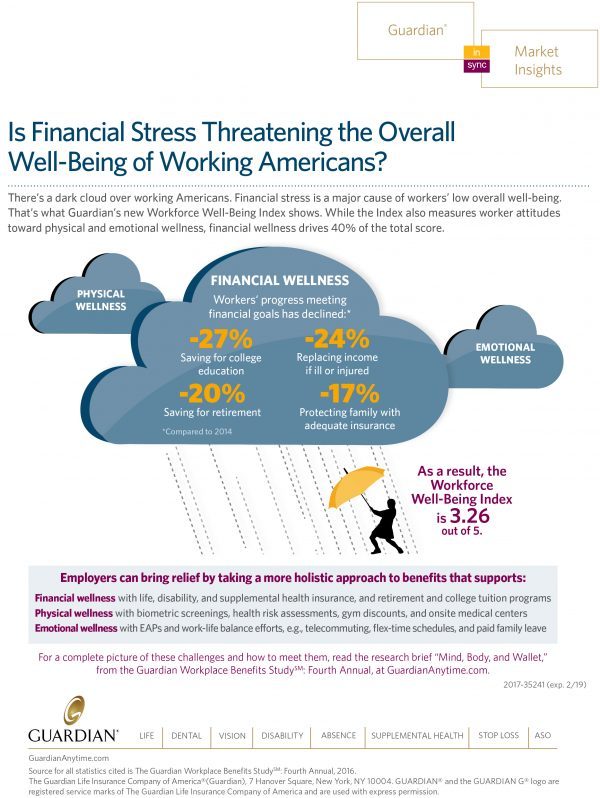

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

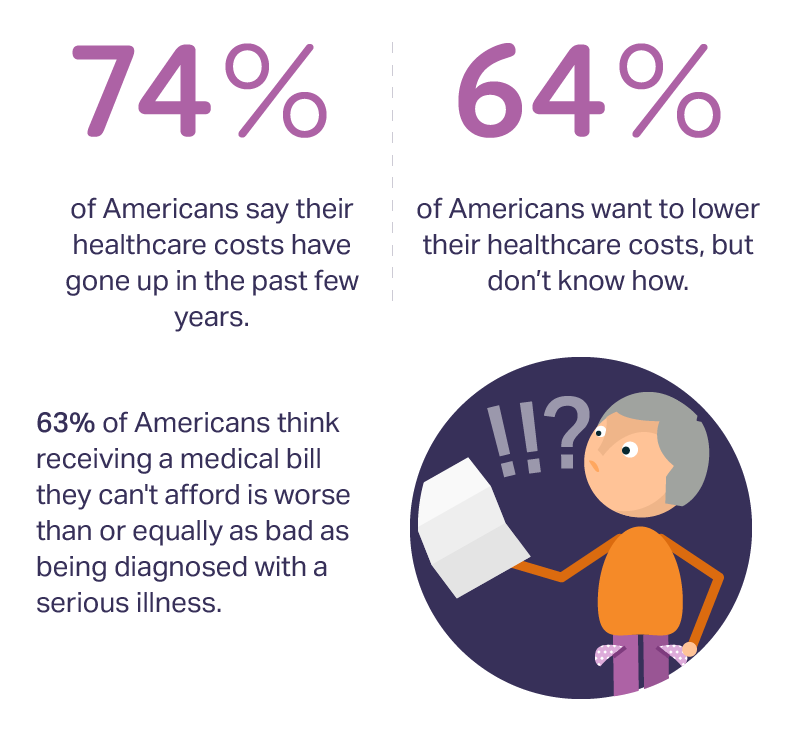

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

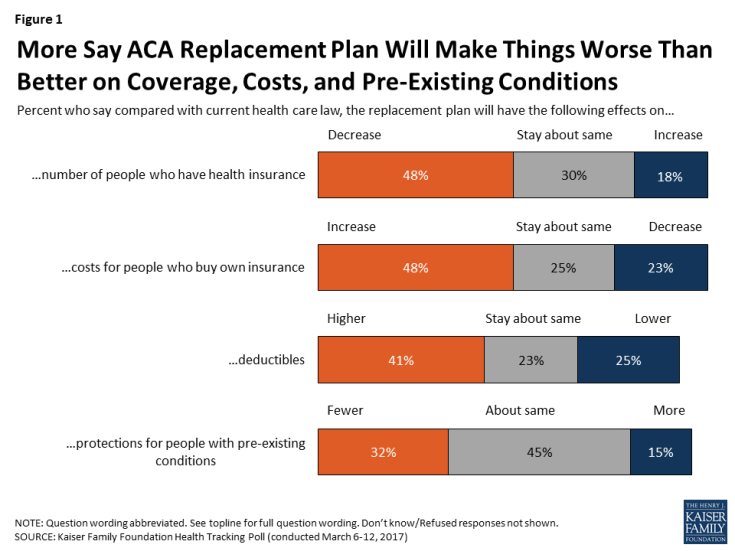

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

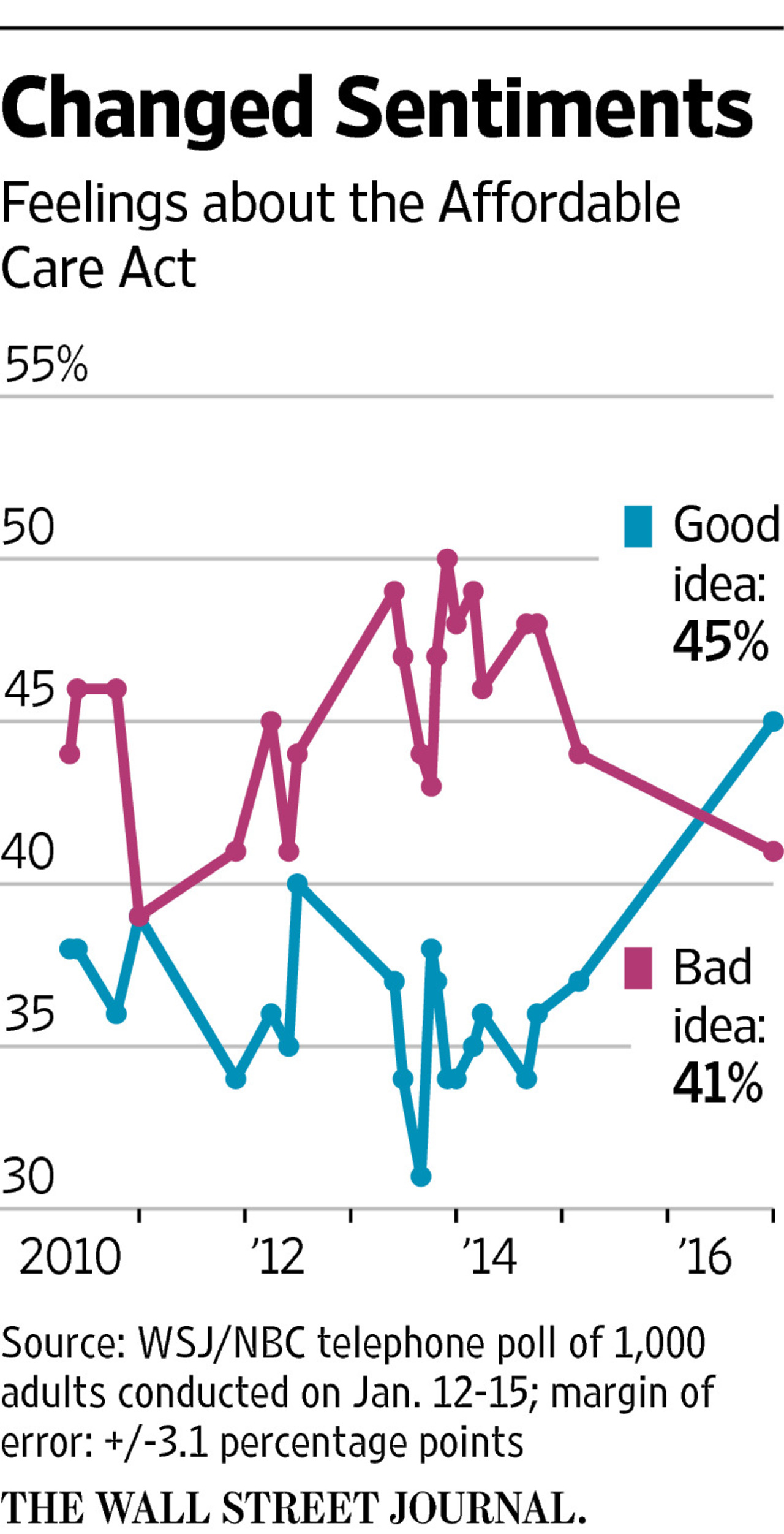

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

How Amazon Has Primed Healthcare Consumers

We are all Amazon Prime primed as consumers now. So it should not surprise healthcare providers, plans and suppliers that consumers expect just-in-time convenience for their healthcare, Accenture has found. Mind the gap: 8 in 10 U.S. patients would welcome some aspect of virtual healthcare, but only 1 in 5 providers is meeting that need. The consumer demand for virtual care is palpable for: Tracking biometrics, among 77% of consumers (say, for measuring blood pressure or blood glucose for people managing diabetes) Following up appointments, for 76% of people after seeing a doctor or being discharged from hospital Receiving reminders

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Patients Anxiously Prep to Be Healthcare Consumers, Alegeus Finds

Healthcare consumers are in a “state of denial,” according to research conducted for Alegeus, the consumer health benefits company. Overall, 3 in 4 consumers feel fear when it comes to their healthcare finances: most people worry about being hit with unexpected healthcare costs they can’t afford, and nearly half fear they won’t be able to afford their family’s healthcare needs. The wordle illustrates consumers’ mixed feelings about healthcare: while people feel frustrated, overwhelmed, powerless, confused and skeptical about healthcare in America, there are some emerging adjectives hinting at growing consumer health muscle-building: optimistic, hopeful, supported, engaged, accountable. Still, denial and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

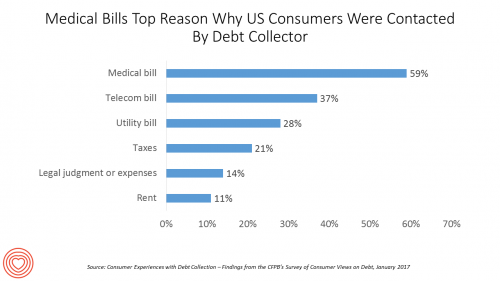

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

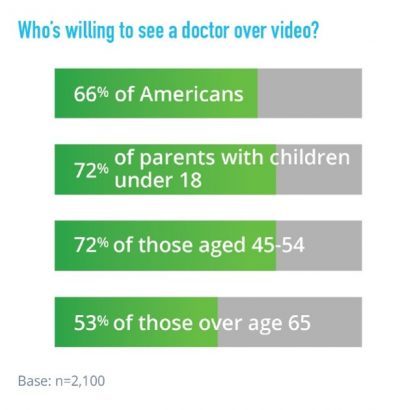

Most Consumers Willing to See Doctor Over Video in 2017

Two in three U.S. consumers are willing to see a doctor online. American health consumers welcome the opportunity to engage in virtual healthcare services via telehealth. American Well’s 2017 Telehealth Index surveyed 2,100 U.S. adults 18 and over in August and September 2016 to gauge consumers’ views on healthcare services, access, and receptivity to virtual care modes of delivery. Underneath the 66% of consumers open to telehealth are demographic differences: people with children are more likely to value virtual care, as well as people between 45 and 54, the survey found. Note, though, that a majority of older Americans over

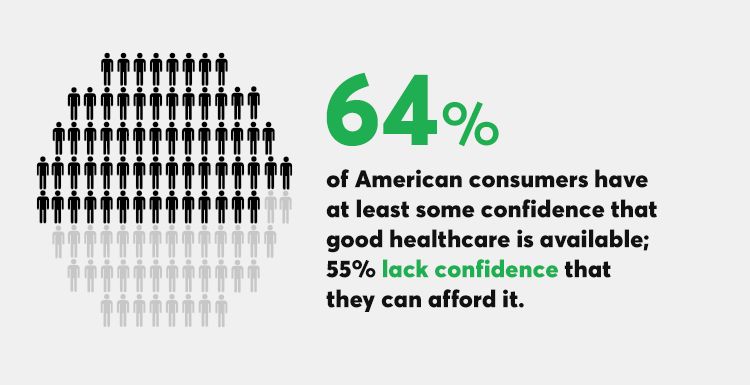

Health Care For All — Only Better, US Consumers Tell Consumer Reports

Availability of quality healthcare, followed by affordable care, are the top two issues concerning U.S. consumers surveyed just prior to Donald Trump’s inauguration as the 45th U.S. President. Welcome to Consumer Reports profile of Consumer Voices, As Trump Takes Office, What’s Top of Consumers’ Minds? “Healthcare for All, Only Better,” Consumer Reports summarizes as the top-line finding of the research. 64% of people are confident of having access to good healthcare, but 55% aren’t sure they can afford healthcare insurance to be able to access those services. Costs are too high, and choices in local markets can be spotty or non-existent.

You Don’t Know What You’ve Got ‘Til It’s Gone: More Americans Liking the ACA

It’s human nature to take what we have for granted. But it wasn’t all that long ago that millions of Americans were uninsured. Since the advent of the Affordable Care Act (ACA), American voters’ feelings about the plan were split roughly 50/50, with slightly more U.S. voters, at the margin, disliking Obamacare than liking it. “Don’t it always seem to go that you don’t know what you’ve got ’til it’s gone,” Joni Mitchell sang in her iconic song, “Big Yellow Taxi.” In the lyrics, Mitchell was referring back in 1970 to land development and eroding public green space. “You paved

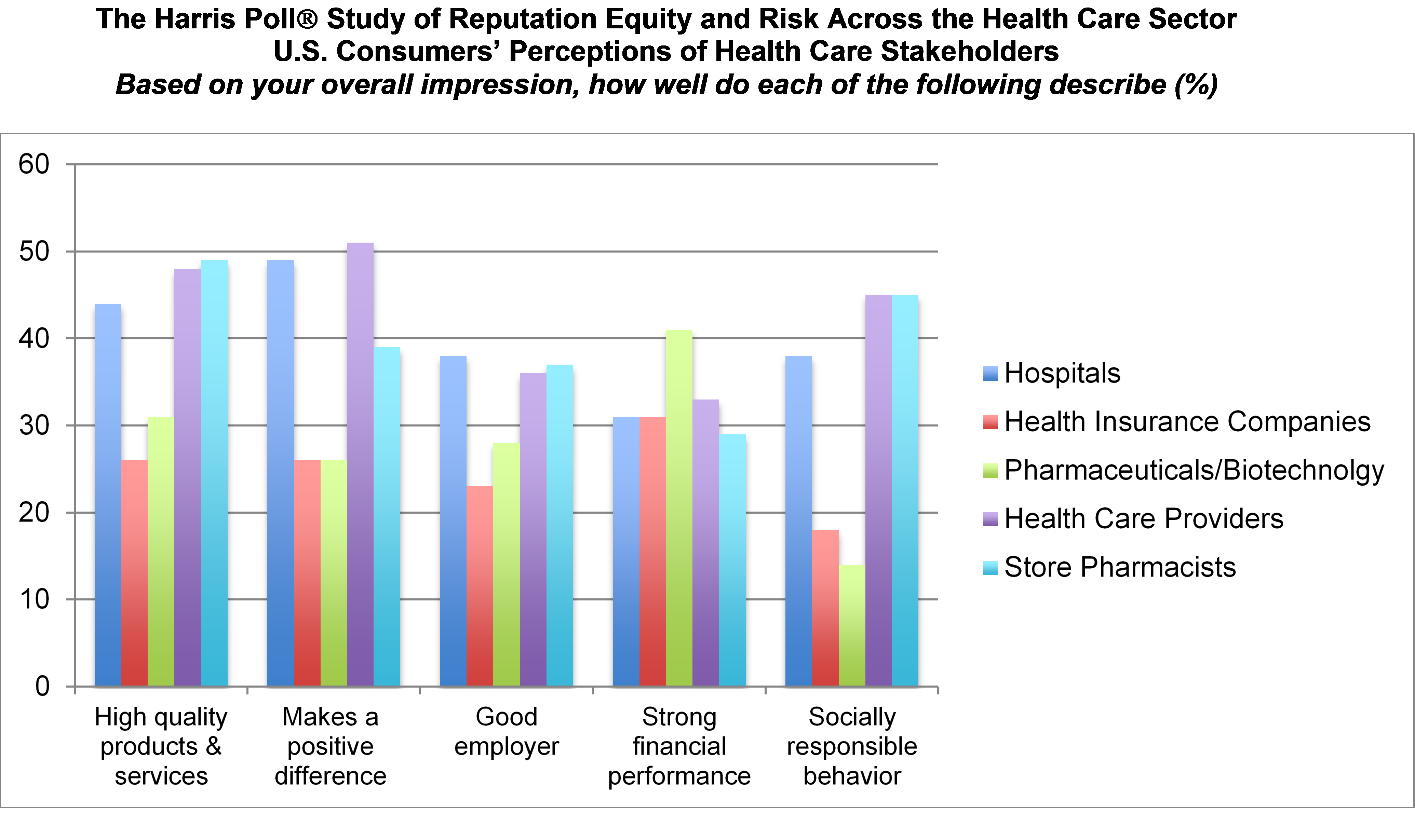

Pharma’s Branding Problem – Profits Over Patients

Nine in 10 U.S. consumers think pharma and biotech put profits above patient interests, according to the latest Harris Poll studying reputation equity across organizations serving health care. Notice the relatively low position of the green bars in the first chart (with the exception of the impression for “strong financial performance); these are the pharma/biotech consumer impressions. The health industry stakeholders consumers believe would more likely place them above making money are health care providers, like doctors and nurses, hospitals, and pharmacists. Health insurance companies fare somewhat better than pharma and biotech in this Poll, although rank low on social

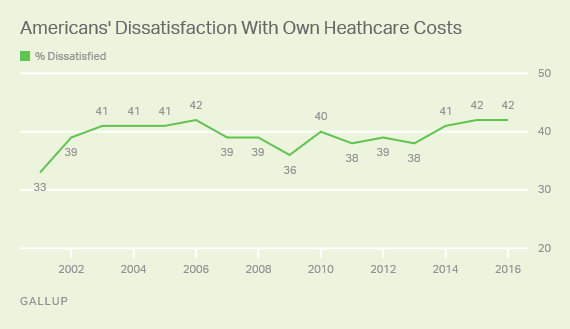

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

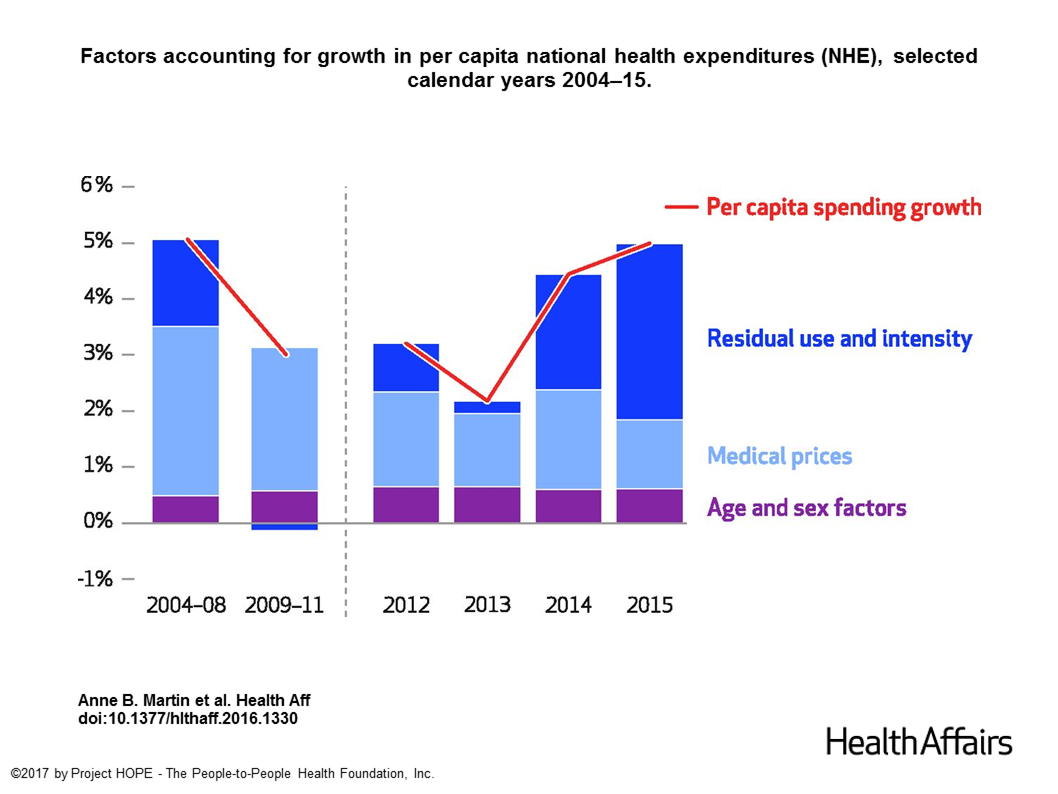

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

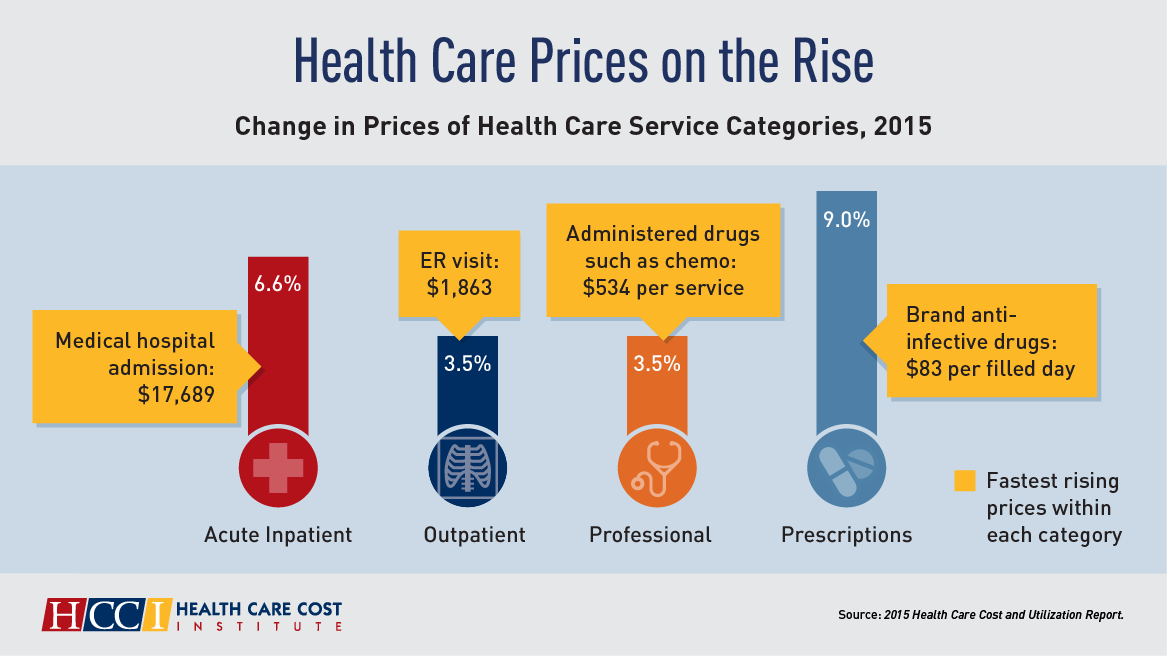

Both Healthcare Prices and Use of Services Driving Up Spending

Health care spending grew 4.6% in 2015, higher than the rise in either 2013 or 2014, according to the 2015 Health Care Cost and Utilization Report published by HCCI, the Health Care Cost Institute. The key contributors to health care spending by percentage were, first and foremost, prescription drugs which rose 9% in the year — notably, specialty medicines like anti-infective drugs (such as those for Hepatitis C and HIV) costing on average $83 per “filled day.” This cost doubled from $53 per person in 2012 to $101 per person in 2015. Hospital costs saw the second greatest percentage price increase

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care. As a proud Big Ten alum, I'm thrilled to be invited to meet with the OSU HSMP Alumni Society to share perspectives on health care innovation.

As a proud Big Ten alum, I'm thrilled to be invited to meet with the OSU HSMP Alumni Society to share perspectives on health care innovation.