While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

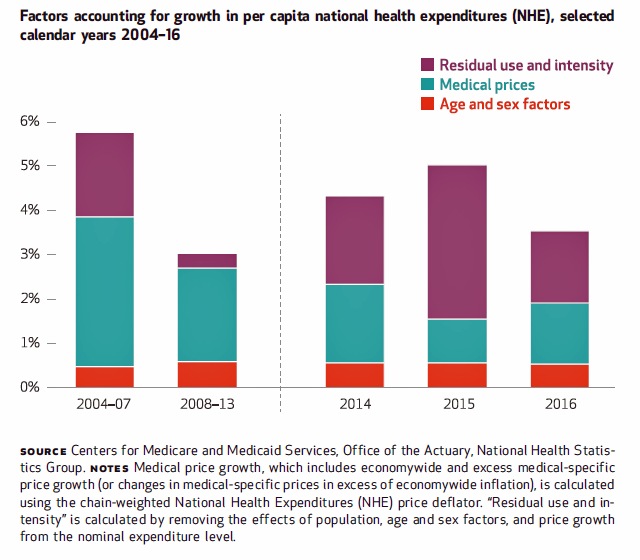

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

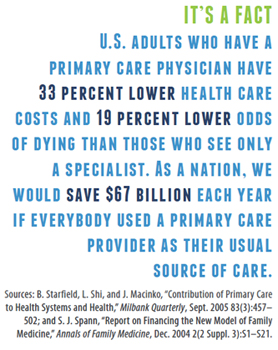

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

Money First, Then Kids: The State of the American Family in 2018

Most American families with children at home are concerned about paying bills on a monthly basis. One in two people have had at least one personal “economic crisis” in the past year, we learn in the American Family Survey 2018, released last week from Deseret News and The Brookings Institution. The project surveyed 3,000 U.S. adults across the general population, fielded online by YouGov. This poll, conducted since 2005, looks at the state of U.S. families through several issue lenses: the state of marriage and family, parents and teenagers, sexual harassment (with 2018 birthing the #MeToo movement), social capital and

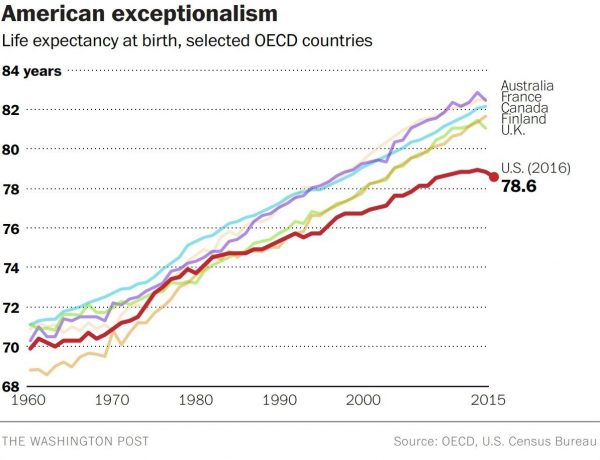

The Ultimate Health Outcome, Mortality, Is Rising in America

How long can people living in the U.S. expect to live? 78.6 years of age, if you were born in 2017. That’s a decline of 0.1 year from 2016. This decline especially impacted baby boys: their life expectancy fell to 76.1 years, while baby girls’ life expectancy stayed even at 81.1 years. That’s the latest data on Mortality in the United States, 2017, soberly brought to you by the Centers for Disease Control and Prevention, part of the U.S. Department of Health and Human Services. Underneath these stark numbers are the specific causes of death: in 2017, more Americans died

Consumers Want Help With Health: Can Healthcare Providers Supply That Demand?

Among people who have health insurance, managing the costs of their medical care doesn’t rank as a top frustration. Instead, attending to health and wellbeing, staying true to an exercise regime, maintaining good nutrition, and managing stress top U.S. consumers’ frustrations — above managing the costs of care not covered by insurance. And maintaining good mental health and staying on-track with health goals come close to managing uncovered costs, Oliver Wyman’s 2018 consumer survey learned. These and other important health consumer insights are revealed in the firm’s latest report, Waiting for Consumers – The Oliver Wyman 2018 Consumer Survey of US

Financial Stress Is An Epidemic In America, Everyday Health Finds

One in three working-age people in the U.S. have seen a doctor about something stress-related. Stress is a way of American life, based on the findings in The United States of Stress, a survey from Everyday Health. Everyday Health polled 6,700 U.S. adults between 18 and 64 years of age about their perspectives on stress, anxiety, panic, and mental and behavioral health. Among all sources of stress, personal finances rank as the top stressor in the U.S. Over one-half of consumers say financial issues regularly stress them out. Finances, followed by jobs and work issues, worries about the future, and relationships cause

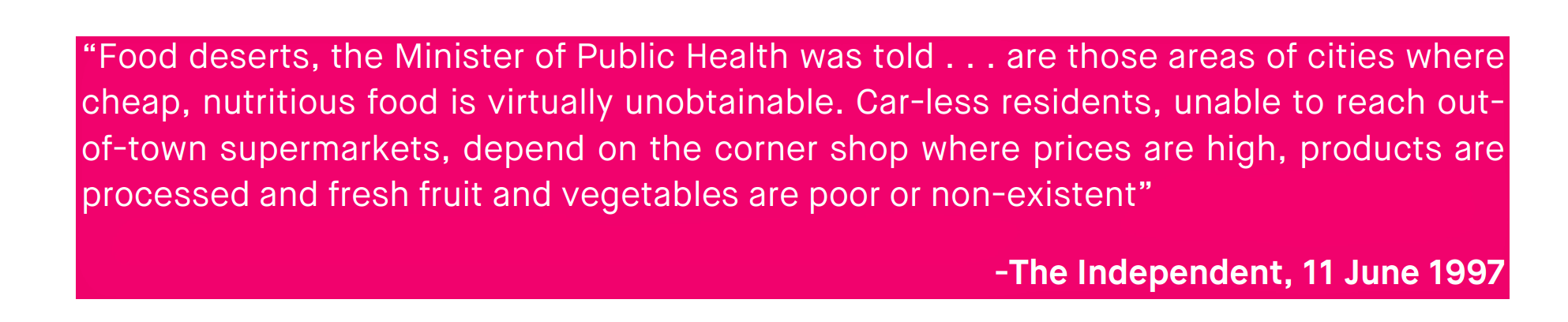

Food and Cooking for Health: a UK Perspective from Hammersmith & Fulham

Food deserts aren’t just a U.S. phenomenon. They’re found all around the world. This week as I explore social determinants of health and technology solutions in several parts of Europe, I’ve learned more about food access challenges in the UK. These are discussed in a report published this month by the Social Market Foundation asking, What are the barriers to eating healthily in the UK? The research was supported by Kellogg’s, the food manufacturer. The first table comes from the report, and the topline shows that about 4 in 10 Britons shopped at a cheaper food store in response to high

Loneliness, Public Policy and AI – Lessons From the UK For the US

There’s a shortage of medical providers in the United Kingdom, a nation where healthcare is guaranteed to all Britons via the most beloved institution in the nation: The National Health Service. The NHS celebrated its 70th anniversary in July this year. The NHS “supply shortage” is a result of financial cuts to both social care and public health. These have negatively impacted older people and care for people at home in Great Britain. This article in the BMJ published earlier this year called for increasing these investments to ensure further erosion of population and public health outcomes, and to prevent

Open Source Health Care Will Liberate Patients

Information is power in the hands of people. When it’s open in the sunshine, it empowers people — whether doctors, patients, researchers, Presidents, teachers, students, Everyday People. Welcome to the era of Open Source Healthcare, not only the “about time” for patients to own their health, but for the launch of a new publication that will support and continue to evolve the concept. It’s really a movement that’s already in process. Let’s go back to some definitions and healthcare basics to understand just why Open Source Healthcare is already a thing. When information access is uneven, it’s considered

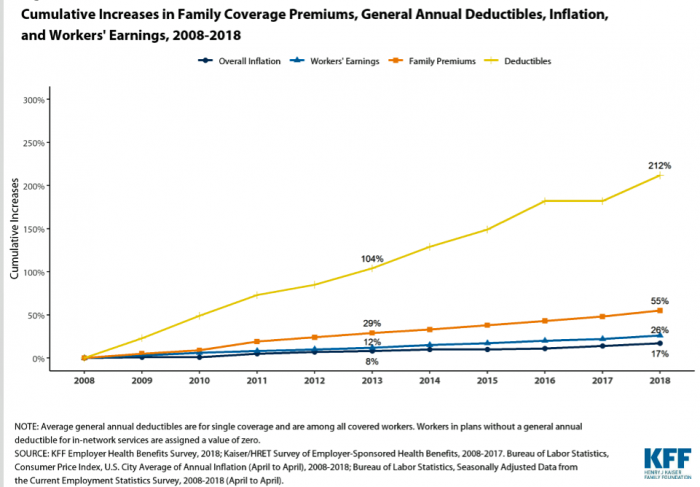

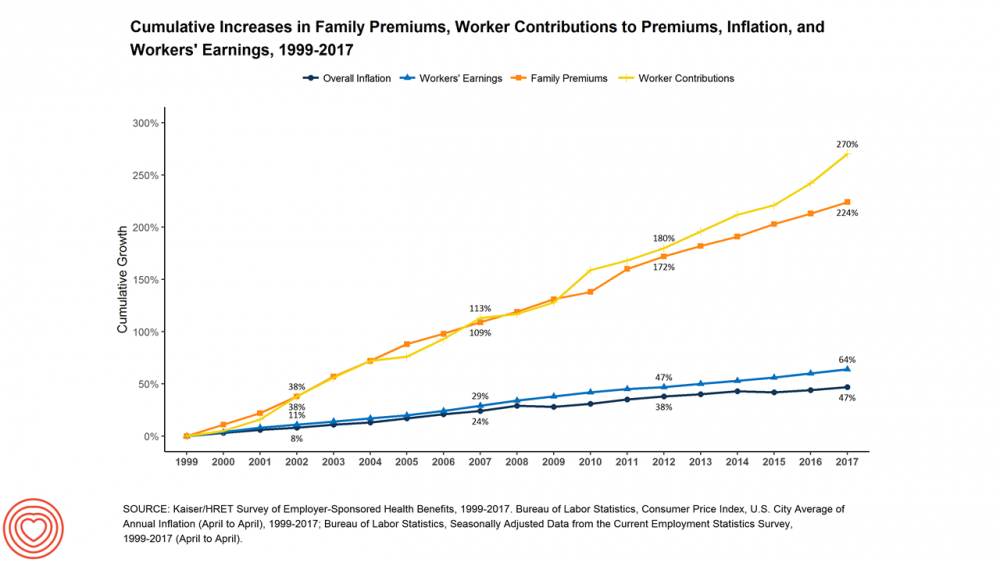

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Consumers Don’t Know What They Don’t Know About Healthcare Costs

The saving rate in the U.S. ranks among the lowest in the world, in a country that rates among the richest nations. So imagine how well Americans save for healthcare? “Consumers are not disciplined about saving in general,” with saving for healthcare lagging behind other types of savings, Alegeus observes in the 2018 Alegeus Consumer Health & Financial Fluency Report. Alegeus surveyed 1,400 U.S. healthcare consumers in September 2017 to gauge peoples’ views on healthcare finances, insurance, and levels of fluency. As patients continue to take on more financial responsibility for healthcare spending in the U.S., they are struggling with finances and

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations. Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives. The first chart summarizes the study’s findings, including the facts that: One-third of people have less than three months of income in the bank for emergency Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved People who are highly stressed tend not to

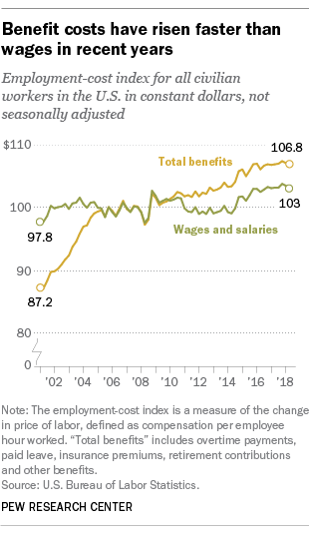

Benefit Cost Increases Overwhelm Flat Wages for Most in US: Pew

Today’s financial news reports and the bullish stock market generate headlines saying that the U.S. economy is riding high. President Trump forecasted in late July, “we are now on track to hit an average GDP annual growth of over 3% and it could be substantially over 3%,” Trump said. “Each point, by the way, means approximately $3 trillion and 10 million jobs. Think of that.” Indeed, unemployment is at its lowest rate in decades at 4%. Today, NASDAQ reported that, “the U.S. economy stays strong as the Fed holds steady.” For mainstream working people, though, even with a job in a high employment

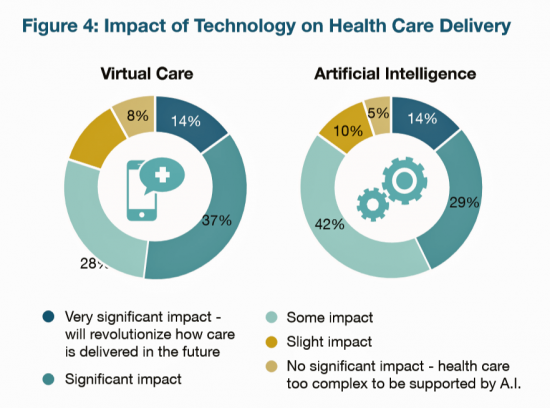

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

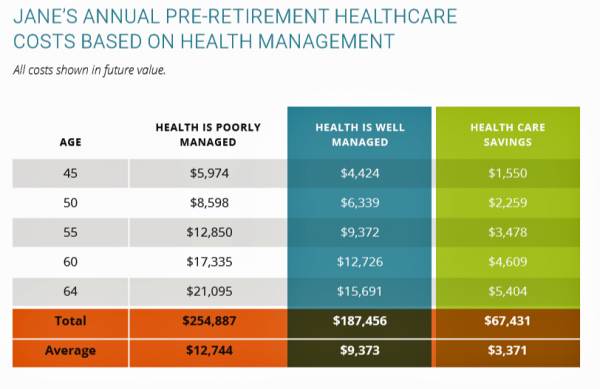

How Taking Care of Your Health Boosts Savings Accounts

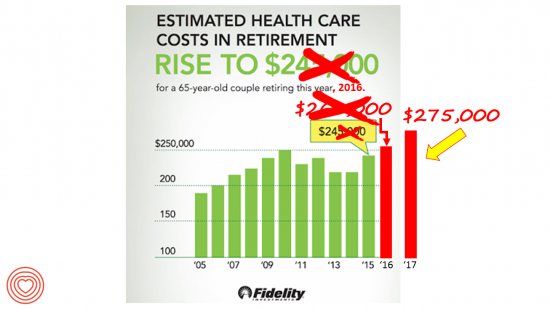

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

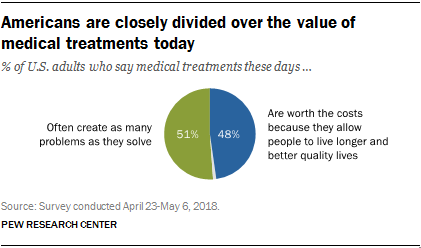

Consumers Consider Cost When They Think About Medical Innovation

While the vast majority of Americans say that science has made life easier for most people, and especially for health care, people are split in questioning the financial cost and value of medical treatments, the Pew Research Center has found. The first chart illustrates the percent of Americans identifying various aspects of medical treatments as “big problems.” If you add in people who see these as “small problems,” 9 in 10 Americans say that all of these line items are “problems.” In the sample, two-thirds of respondents had seen a health care provider for an illness or medical condition in

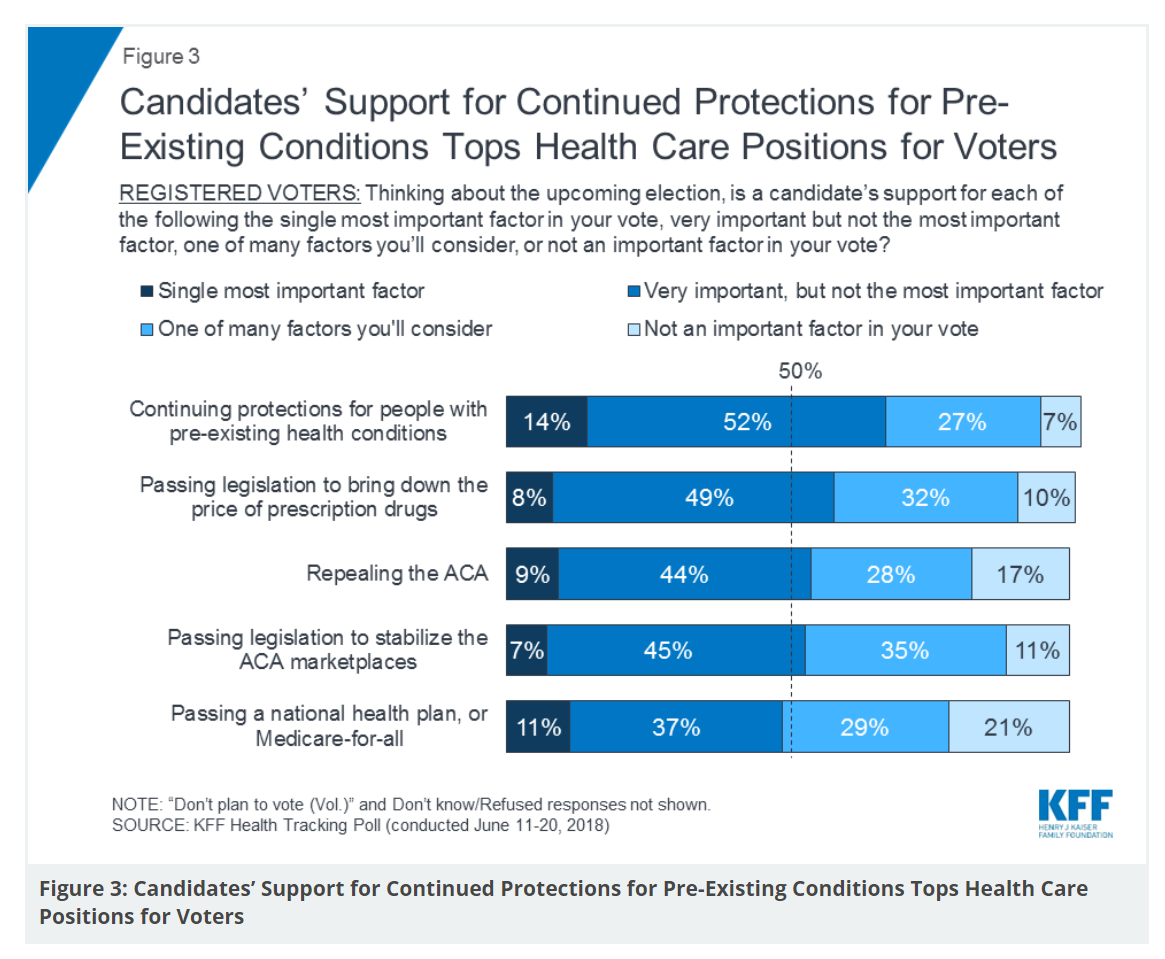

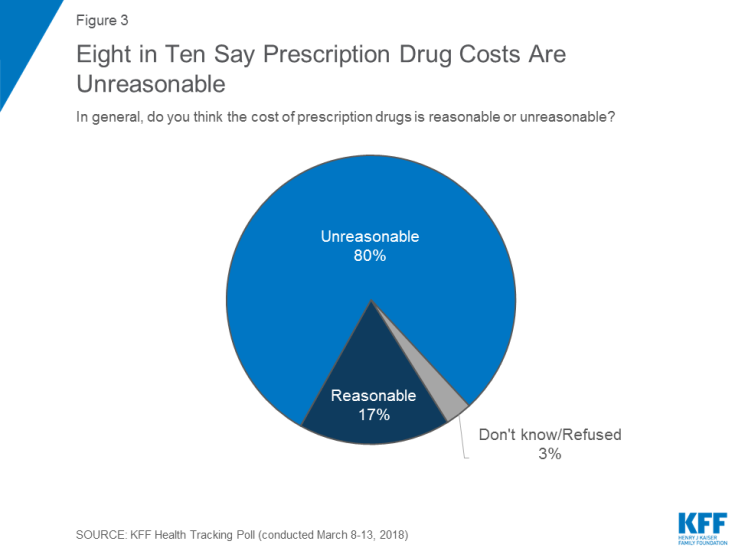

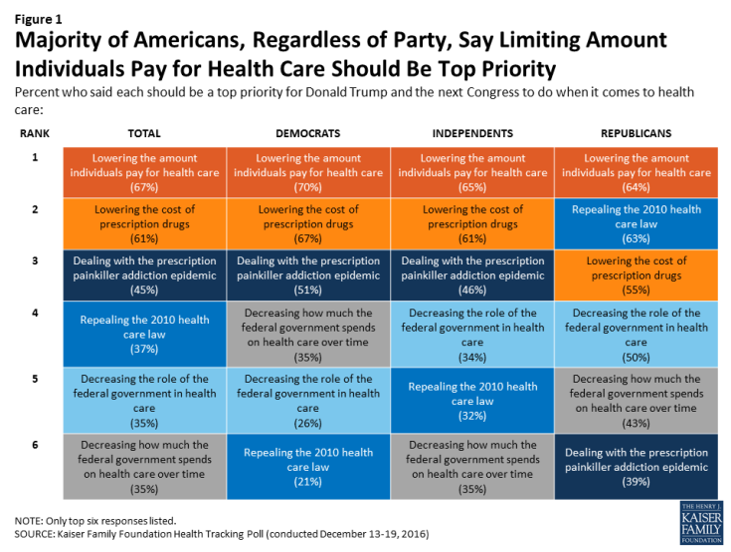

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

Good Coffee + Engaging Design + Banking = Financial Health

As I walked by windows with Marvel-inspired superhero characters, I stopped to read their talk-bubbles: “strengthen your savings, power your financial quest, be the hero of your money, be one with your budget.” The top-line message here is that you can be your own fiscal superhero. The sign read, Capital One Cafe with Peet’s Coffee. But was it a bank branch or a cafe? I asked myself, passing by this sign yesterday morning at the corner of Walnut and 18th Streets in center city Philadelphia. It’s both, as it turned out, and when I entered I found a welcoming, beautifully

It Could Take Five Generations for a Low-Income US Family to Reach Average Income in America

Social mobility in America has a lot of friction: children of wealthier people tend to grow into affluence, and children of low-income parents tend to struggle to move up the income and education ladder, according to A Broken Social Elevator: How to Promote Social Mobility, a new report from the OECD. The Organization for Economic Cooperation and Development studied member nations’ economies, demographics, income and opportunities to gauge each country’s social mobility. Social mobility, the OECD explains, is multi-faceted. It can refer to inter-generational mobility between parents, children, and grandchildren. Alternatively, social mobility can look at intra-generational mobility, over the course

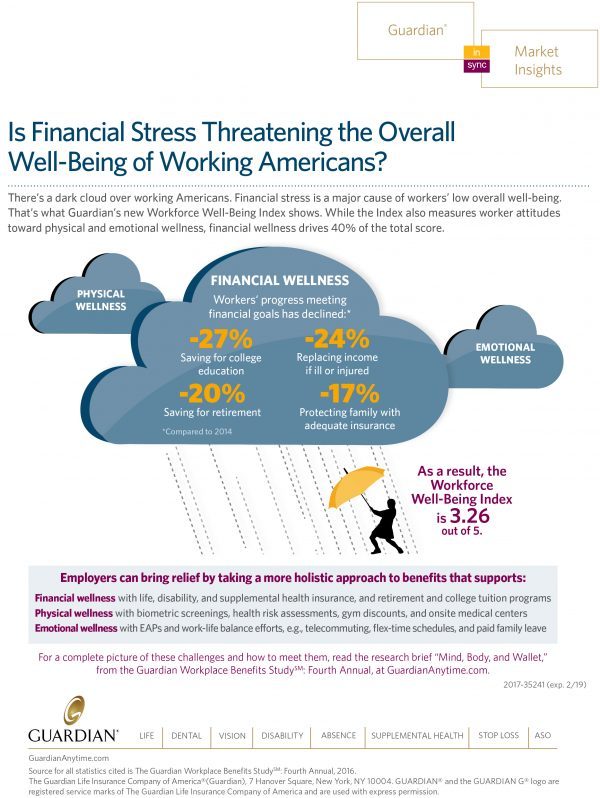

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

Doing Less Can Be Doing More for Healthcare – the Biggest Takeaway From ASCO 2018

Less can lead to more for so many things: eating smaller portions, lowering sugar consumption, and driving less in favor of walking or cycling come to mind. When it comes to healthcare utilization, doing less can also result in equal or even better outcomes. Groundbreaking research presented at this week’s ASCO meeting found that some women diagnosed with certain forms of cancer do not benefit from undergoing chemotherapy. The American Society of Clinical Oncology (ASCO) is one of the largest medical meetings annually, and at this huge meeting these research results for the TAILORx trial were huge news with big

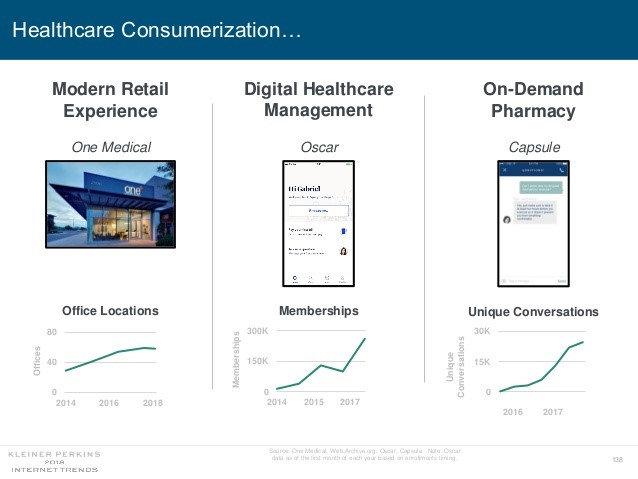

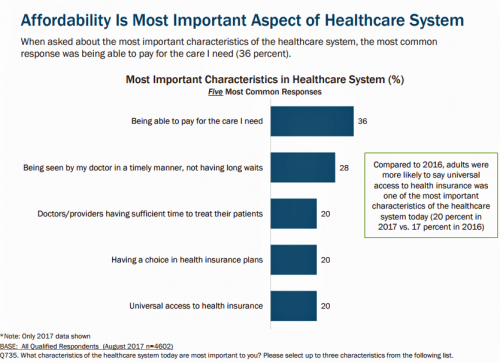

Mary Meeker on Healthcare in 2018: Connectivity, Consumerization, and Costs

Health care features prominently in the nearly-300 slides curated by Mary Meeker in her always- informative report on Internet Trends 2018. Meeker, of Kleiner Perkins, released the report as usual at the Code Conference, held this year on 30 May 2018 in Silicon Valley. I’ve mined Meeker’s report for several years here on Health Populi: 2017 – Digital healthcare at the inflection point, via Mary Meeker 2015 – Musings with Mary Meeker on the digital/health nexus 2014 – Healthcare at an inflection point: digital trends via Mary Meeker 2013 – The role of internet technologies in reducing healthcare costs – Meeker

The US Covered Nearly 50% of Global Oncology Medicine Spending in 2017 – a market update from IQVIA

“We are at a remarkable point of cancer treatment,” noted Murray Aitken, Executive Director, IQVIA Institute for Human Data Science, in a call with media this week. 2017 was a banner year of innovative drug launches in oncology, Aitken coined, with more drugs used more extensively, driving improved patient for people dealing with cancer. This upbeat market description comes out of a report on Global Oncology Trends 2018 from the IQVIA Institute for Human Data Science. The subtitle of the report, “Innovation, Expansion and Disruption,” is appropriately put. The report covers these three themes across four sections: advances in therapies,

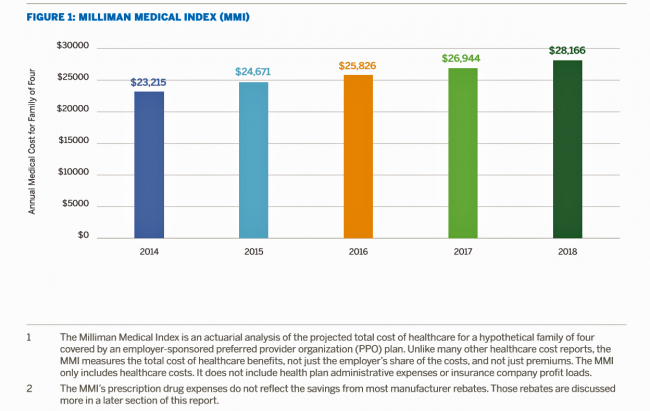

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

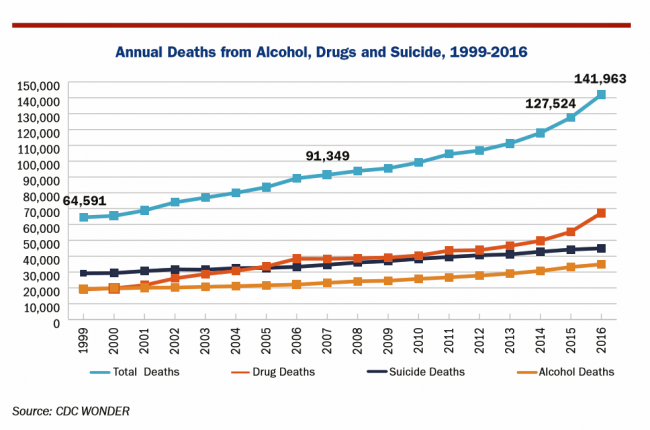

The U.S. is a Nation in Pain – America’s Life Expectancy Fell Again in 2016

American saw the greatest number of deaths from suicide and alcohol- and drug-induced fatalities was recorded in 2016. That statistic of nearly 142,000 equates to deaths from stroke and exceed the number of deaths among Americans who died in all U.S. wars since 1950, according to Pain in the Nation Update from the Well Being Trust and Trust for America’s Health. The line graph soberly illustrates the growing tragic public health epidemic of mortality due to preventable causes, those deaths of despair as Anne Case and Sir Angus Deaton have observed in their research into this uniquely all-American phenomenon. While this

The Gap Between the Trump Administration’s Promise of Reducing Rx Costs for Consumers and What People Really Want

This is what happened to pharma stock prices on Friday after President Trump and Secretary of Health and Human Services Alex Azar outlined their new policies focusing on prescription drug prices. The graph is the Nasdaq U.S. Smart Pharmaceuticals Index (NQSSPH) from May 11, 2018, the date when POTUS and Secretary Azar made their announcement. What this upward driving curve indicates, from the start of stock trading in the morning until the ring of the closing bell, is that the pharma industry players, both manufacturers and PBMs, were quite delighted with what they heard. The blueprint for restructuring the prescription drug industry,

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

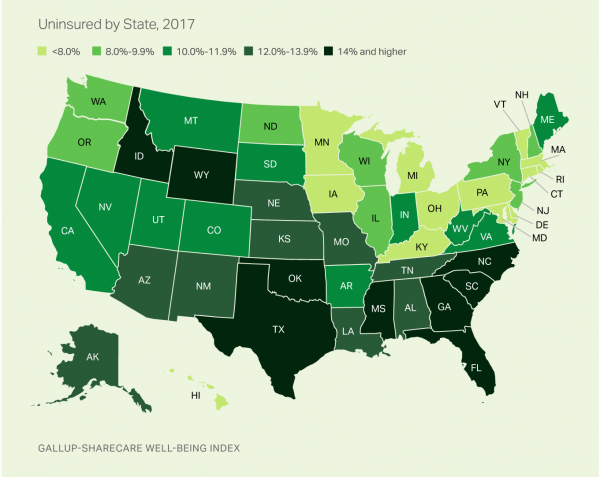

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

How Walmart Could Bolster Healthcare in the Community

Walmart has been a health/care destination for many years. The company that defined Big Box stores in their infancy grew in healthcare, health and wellness over the past two decades, pioneering the $4 generic prescription back in 2006. Today, that low-cost generic Rx is ubiquitous in the retail pharmacy. A decade later, can Walmart re-imagine primary care the way the company did low-cost medicines? Walmart is enhancing about 500 of 3500 stores, and health will be part of the interior redecorating. Walmart has had ambitious plans in healthcare since those $4 Rx’s were introduced. Here’s a New York Times article from

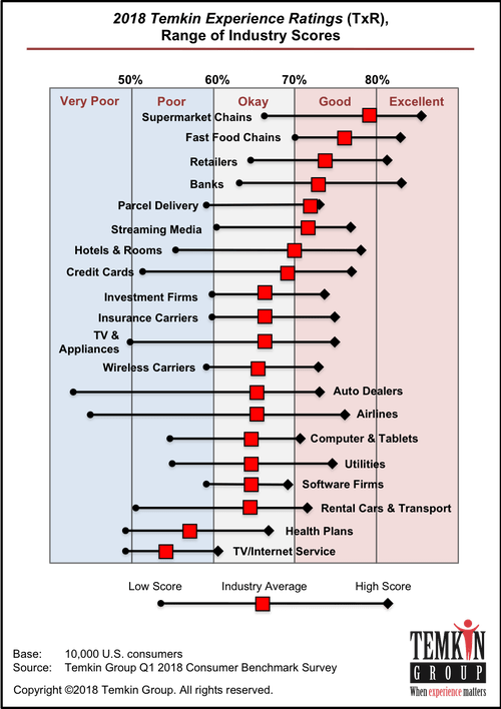

What Would Healthcare Feel Like If It Acted Like Supermarkets – the 2018 Temkin Experience Ratings

U.S. consumers rank supermarkets, fast food chains, retailers, and banks as their top performing industries for experience according to the 2018 Temkin Experience Ratings. Peoples’ experience with health plans rank at the bottom of the roster, on par with rental cars and TV/Internet service providers. If there is any good news for health plans in this year’s Temkin Experience Ratings compared to the 2017 results, it’s at the margin of “very poor” performance: last year, health plans has the worst performance of any industry (with the bar to the furthest point on the left as “low scoring”). This year, it

Sounds Like A John Denver Song: Virginia and Colorado Towns Rank High As Healthy Communities

If it’s true that “your ZIP code is more important than your genetic code,” you’d look for a job in 22046, buy a house there, and plant your roots. You’d find yourself in Falls Church, Virginia, named number one in the Healthiest Communities rankings of 500 U.S. towns. You can see a list of all of the communities here. The project is a collaboration between the Aetna Foundation and U.S. News & World Report, with help from the University of Missouri Center for Applied Research and Engagement Systems (CARES) and a team from the National Committee on Vital and Health

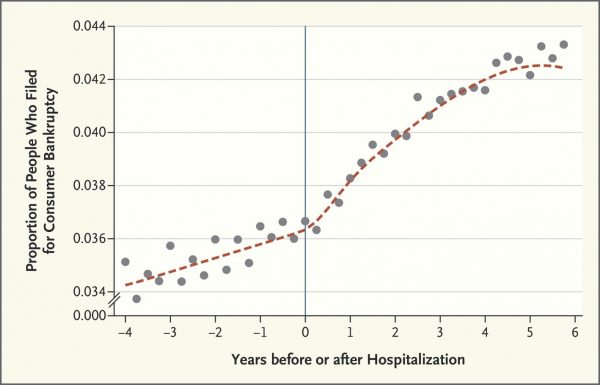

The New Financial Toxicity in Health Care: The Cost of Hospitalization

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

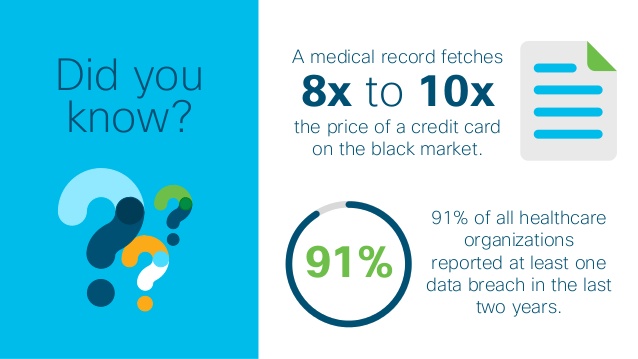

Patient Privacy And Cyber In-Security at HIMSS 2018

Nearly one-half of Americans experienced a personal data breach in the past three years, the third annual national cybersecurity survey found. Ensuring privacy and cybersecurity should become integrated into the healthcare industry’s consideration of a patient’s consumer experience. This makes sense, given that privacy and cybersecurity ranked the second highest priority to hospitals and healthcare providers polled in HIMSS 2018 Healthcare Leadership Survey. Providers put patient safety as #1. Appropriately, privacy and security were hot topics at HIMSS Annual Conference this year, in respond to providers’ demands for more education and concerns around the challenges. Let’s put these concerns in

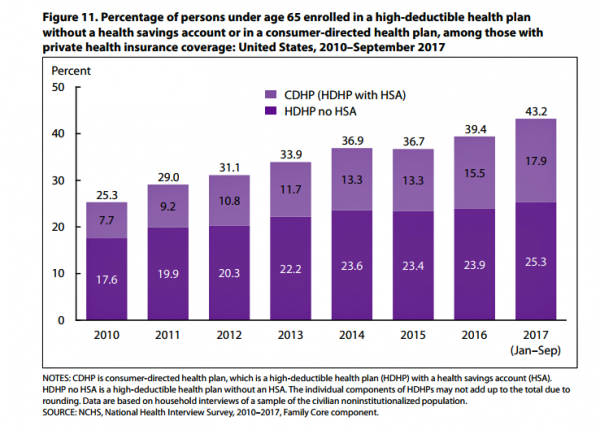

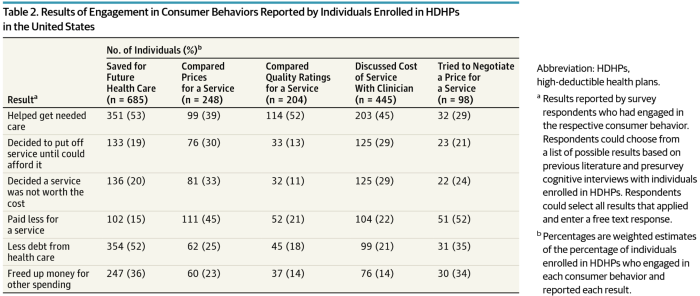

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

Consumer Health and Patient Engagement – Are We There Yet?

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

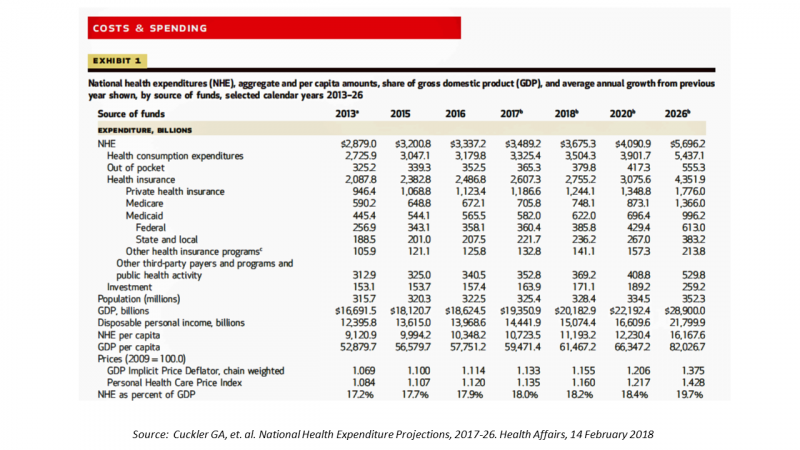

The $4 Trillion Health Economy of 2020

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

When Buying a Pair of Jeans Competes With Filling a Prescription at CVS in Target

Stories about three fashion brands have me thinking about women and their health economics. Stay with me. Target unveiled its new line of clothing, Universal Thread, which features pieces that are accessible to women who may be dealing with physical limitations or sensory challenges. I first read about Universal Thread on The Mighty website, which is a community of over 1 million people interested in connecting on health and disabilities. As The Mighty described, the brand Universal Thread, “is centered around denim since it is a staple in many women’s wardrobes, but denim can be uncomfortable for many people with disabilities

Getting Real About Social Determinants of Health

New research points out that real people live real lives, and our assumptions about social determinants of health (SDOH) may need to be better informed by those real lives. I read three reports in the past week sobering up my bullish #SDOH ethos dealing with food deserts, transportation, and health service access — three key social determinants of health. To remind you about the social determinants, here’s a graphic from Kaiser Family Foundation that summarizes the key pillars of SDOH. Assumption 1: Food deserts in and of themselves diminish peoples’ healthy nutrition lifestyles. Low-income households who are exposed to the same food-buying

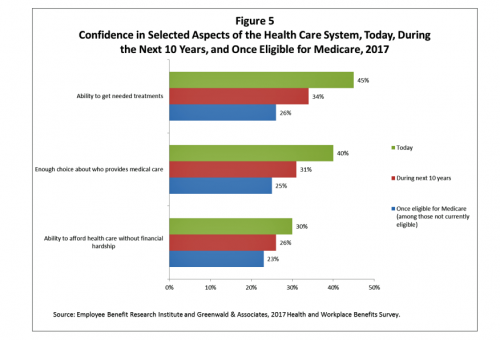

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

What Healthcare Can Learn from A Pig and Piggy Bank via Santander Bank

When patients feel disrespected in a medical exam room, they will be less likely to follow instructions they receive from a doctor. Research from the Altarum Institute revealed this fundamental finding. The chart shows that feeling respected reduces a patient’s diabetes medication adherence by a factor of nearly 2x, and is a risk factor for poorly managed diabetes. Furthermore, consumers who feel disrespected by providers are three times more likely to not believe doctors are accurate sources of information than consumers who do feel respected. And, patients with diabetes who do not feel respected are one-third more likely to have poorly

Calling Out Health Disparities on Martin Luther King Day 2018

On this day appreciating the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group

Most Americans Say Healthcare is #1 Policy Issue Entering 2018

Concerns about health care are, by a large margin, the top domestic policy issue U.S. voters identified as they enter 2018. The proportion of Americans citing healthcare as the top public agenda priority grew by 50% since 2016, from 31% two years ago to 48%. Taxes rank #2 this year, garnering 31% of Americans’ concerned, followed by immigration, which has remained flat cited by about one-in-four Americans. The Associated Press (AP)-NORC Center for Public Affairs Research polled 1,444 U.S. adults 18 and over between November 30 and December 4, 2017 for this survey. While one-half of Americans would like the

Let’s Increase Life Expectancy in America in 2018 – A New Year for Opioids, Social Determinants, and Financial Health

For this end-of-year post leading into 2018, I choose to address the big topic of how long we live in America, and what underpins the sobering fact that life expectancy is falling. Life expectancy in the United States declined to 78.6 years in 2016, placing America at number 37 on the list of 137 countries the World Economic Forum (WEF) has ranked in their annual Global Competitiveness Report 2017-2018. The first chart shows the declining years for Americans compared with health citizens of Australia, France, Canada, Finland, and the UK. While Australians’ and Britons’ life expectancies declined from 2015-16, their

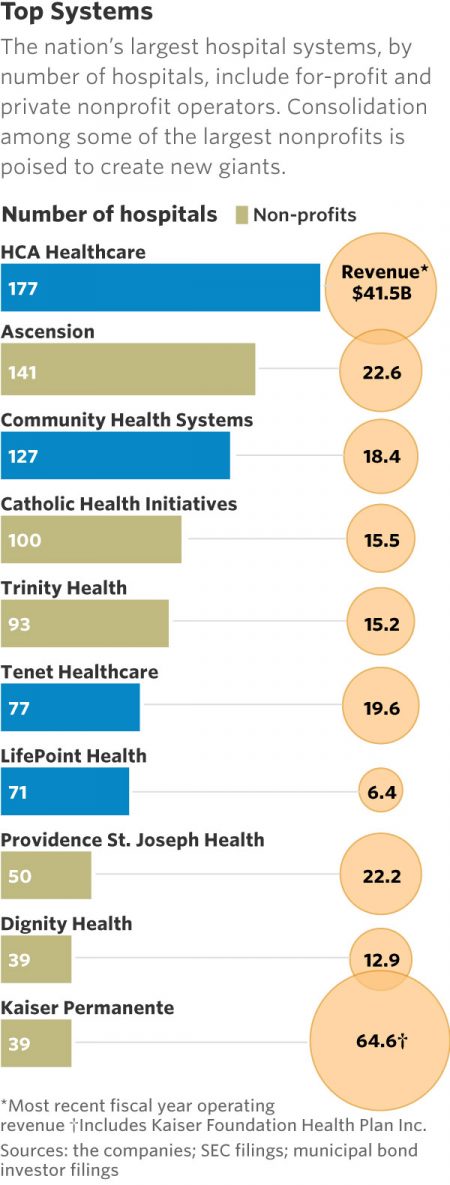

Will Getting Bigger Make Hospitals Get Better?

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health. In terms of size, the CHI and Dignity combination would create a larger company than McDonald’s or Macy’s in terms of projected $28 bn of revenue. (Use the chart of America’s top systems to do the math). For context, other hospital stories this week discuss in southern New Jersey. And this week, the New Jersey Hospital Association annual report called the hospital industry the “$23.4 billion economic bedrock” of the state. Add a third important item

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

The State of Financial Wellness and Health in America – Suffering Across the Ages

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health. Welcome to The uncomfortable reality of financial wellbeing, a report on the 2017 Financial Mindset Study Highlights from Alight Solutions, an HR services company. The first chart arrays the well-being rankings across the five factors, showing that just over one-half of Americans have more positive views on their emotional

High-Deductibles Do Not Automatically Inspire Healthcare Consumerism

It takes more than enrolling in a high-deductible health plan (HDHP) for someone to immediately morph into an effective health care “consumer.” Research from Dr. Jeffrey Kullgren and his team from the University of Michigan found that enrollees in HDHPs could garner more benefits from these plans were people better informed about how to use them, including how to save for them and spend money once enrolled in them. The team’s research letter was published in JAMA Internal Medicine on 27 November 2017. The discussion details results of a survey conducted among 1,637 people 18 to 64 years of age

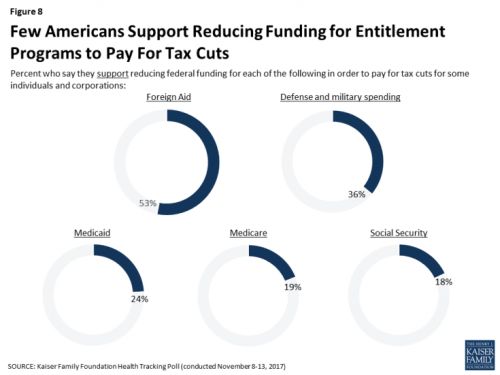

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

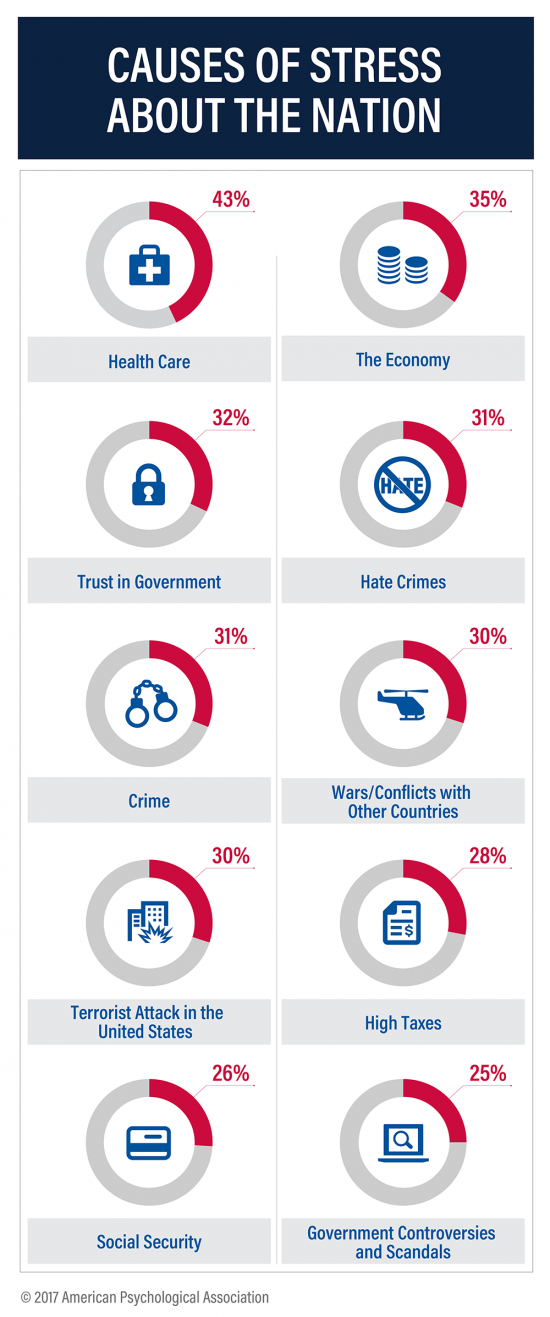

Stress is US: Health Care Is the #1 Stressor in America

Above the economy, trust in government, crime, war, terrorism, and taxes, health care is the top cause of stress in America. For ten years, the American Psychological Association has gauged Americans’ collective mood in their ongoing study, Stress in America. The latest report is The State of Our Nation, published this month, finding that we’re at the “lowest point in our nation’s history” according to 59% of Americans. The 2016 national election in the U.S. raised the stress-stakes, when APA released a stress study we discussed here in Health Populi. The election season was a source of stress for 52%

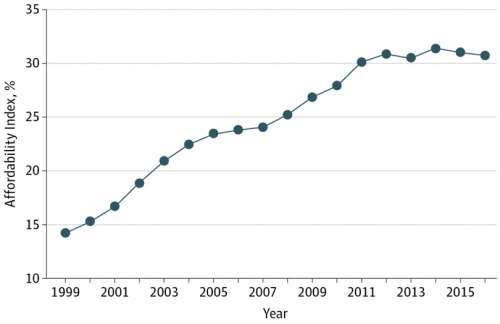

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

In the Post-Weinstein Era, How to Market Health to Women: Philips, Kalenji, and Libresse Getting It Right

“With Mad Men still in charge, ad campaigns miss the mark,” an editorial published this week in the Financial Times asserts. Leave it to a fiscally conservative British publication to be spot-on about a particularly, but not uniquely, American challenge, in this post-Weinstein (Miramax), -Price (Amazon), and today, -Halperin (MSNBC) moment of sexual harassment revelations. In health/care, women are key consumers, buyers and influencers, yet under-represented in the Mad Men demographic of senior advertising executives, as the data-driven FT essay points out. So it’s especially heartening to find this month a few examples of empowering, inspiring ad campaigns getting health/care marketing

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

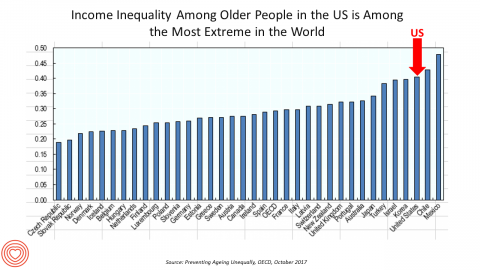

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

Most Americans Are Concerned About Healthcare Policy, and Costs Top the List of Concerns

4 in 5 Americans are aware of potential changes to healthcare policy brewing in Washington, DC. 92% of them are concerned about those changes, according to Healthcare Consumers in a Time of Uncertainty, the fifth annual survey from Transamerica Center for Health Studies. Peoples’ most-shared fears are losing their coverage for pre-existing conditions, out-of-pocket spending, and a ban on lifetime limits. That boils down to one thing: cost. That is, cost, for having to spend money on services not-covered by their health insurance plan; cost for out-of-pocket items under-insured, denied, or requiring coinsurance or co-payments; and, catastrophic costs that rise beyond

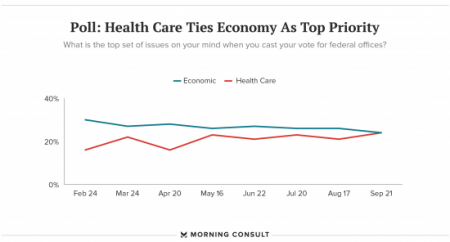

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

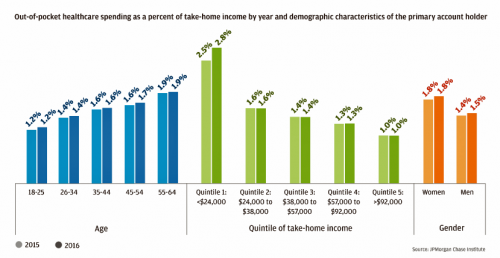

Out-Of-Pocket Healthcare Costs Grow in the Family Budget

For each dollar spent on healthcare in the United States, families paid 28 cents, according to the U.S. National Health Expenditure Accounts for 2015. Welcome to the new era of Americans and medical banking, with new insights provided by the largest of banks, JP Morgan Chase, in Paying Out-of-Pocket: The Healthcare Spending of 2 Million U.S. Families, from JP Morgan Chase. Chase is the largest bank in America based on its assets. They’ve mined 2.3 million de-identified records of Chase consumers in their banking network to learn about customers’ healthcare spending. These data represent spending between 2013 and 2016, detailed

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

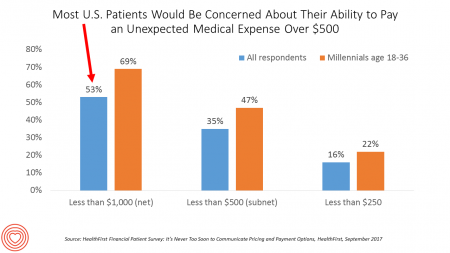

Patients Are Looking to Finance Healthcare Over Time

Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time. This is an automotive or home appliance procedure we’re talking about. It’s healthcare services, and American patients are now the third largest payors to providers in the nation. Thus, the title of a new report summarizing a consumer survey from HealthFirst notes, “It’s Never Too Soon to Communicate Pricing and Payment Options. The study found that two-thirds of U.S. consumers would like healthcare providers to discuss financing options; however, only 18 percent of providers have

Celebrating 10 Years of Health Populi, 10 Healthcare Milestones and Learnings

Happy anniversary to me…well, to the Health Populi blog! It’s ten years this week since I launched this site, to share my (then) 20 years of experience advising health care stakeholders in the U.S. and Europe at the convergence of health, economics, technology, and people. To celebrate the decade’s worth of 1,791 posts here on Health Populi (all written by me in my independent voice), I’ll offer ten health/care milestones that represent key themes covered from early September 2007 through to today… 1. Healthcare is one-fifth of the national U.S. economy, and the top worrisome line item in the American

Transparency in Drug Prices, from OTC to Oncology

While on vacation in Bermuda, I found a box of private label ibuprofen for $2.45 for 20 – 200mg tablets, and one for Advil PM for $10.50 for the same number of pills, same strength. I’ve just returned from a lovely week’s holiday. When I travel, whether for work or vacation, it’s always a sort of Busman’s Holiday for me as I love to seek out health destinations wherever I go. So it was natural for me to spot the Dockyard Pharmacy at the port in Hamilton and wander in. I made my way back to the well-stocked pharmacy counter,

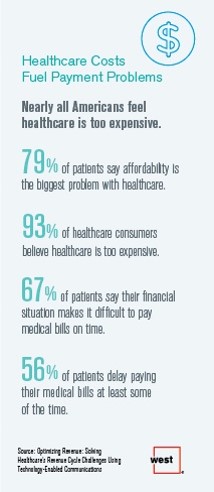

Patients’ Healthcare Payment Problems Are Providers’, Too

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

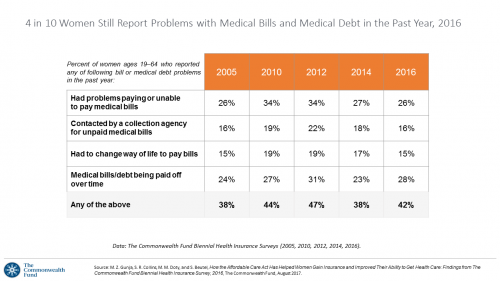

Women’s Access to Health Care Improved Under the Affordable Care Act

The Affordable Care Act (ACT) was implemented in 2010. Since the inception of the ACA, the proportion of uninsured women in the U.S. fell by nearly one-half, from 19 million in 2010 to 11 million in 2016. The Commonwealth Fund has documented the healthcare gains that American women made since the ACA launch in their issue brief, How the Affordable Care Act Has Helped Women Gain Insurance and Improved Their Ability to Get Health Care, published earlier this month. The first chart talks about insurance: health care plan coverage, which is the prime raison d’être of the ACA. It’s

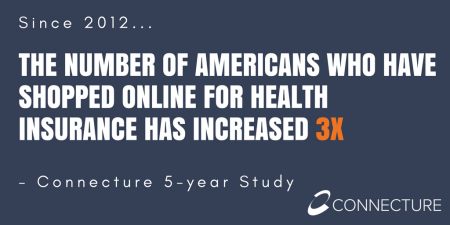

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

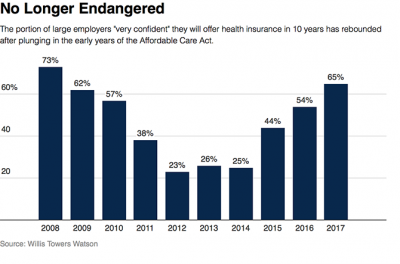

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

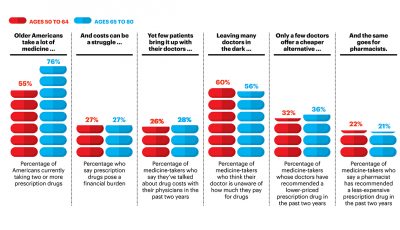

Patients Want Doctors To Know How Much Their Drugs Cost

Patients want their doctors to know what their personal costs for medicines are; 42% of patients also believe their doctor is aware of how much they spend on prescription drugs. However, 61% of these people have not talked with doctors about drug prices. Nor do most doctors have access to this kind of information at the individual patient level. One important tactic to addressing overall healthcare costs, and managing the prescription drug line item in those costs, is discussed in Doctors and Pharmacists: An Underused Resource to Manage Drug Costs for Older Adults, a report on a survey sponsored

Learning From Adam Niskar – Living Beyond The Wheelchair

After diving into Walnut Lake in suburban Detroit, Adam Niskar sustained a spinal injury that would paralyze much of his body for the rest of his life. The trauma didn’t paralyze his life and living, though. But today, my family will celebrate that life at Adam’s memorial service. Adam was my cousin. He was one of the best-loved people on the planet, and that was part of a therapeutic recipe that sustained him from the traumatic accident in 1999 until Monday, July 31st, 2017, when Adam passed away from complications due to an infection that, this time around, his body

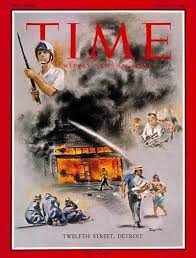

Health Equity Lessons from July 23, 1967, Detroit

On July 23, 1967, I was a little girl wearing a pretty dress, attending my cousin’s wedding at a swanky hotel in mid-town Detroit. Driving home with my parents and sisters after the wedding, the radio news channel warned us of the blazing fires that were burning in a part of the city not far from where we were on a highway leading out to the suburbs. Fifty years and five days later, I am addressing the subject of health equity at a speech over breakfast at the American Hospital Association 25th Annual Health Leadership Summit today. In my talk,

Note to Mooch: The ER is Not Universal Health Care

I quote directly from the Twitter feed of Anthony Scaramucci, @scaramucci: “@dhank2525 agree. We already have Univ Health Care, we made decision long ago to treat everyone that enters an emergency room.” Mr. Scaramucci is President Trump’s Communications Chief, replacing Sean Spicer. Mr. Scaramucci is neither veteran journalist nor healthcare policy wonk. He’s a successful businessman, which I respect for his savvy and ability to build a fund, attract investors, and create a media persona which he has telegenically broadcast on CNBC and elsewhere over the past decade. He’s got a engaging public personality, and goes by the moniker, “Mooch.” But

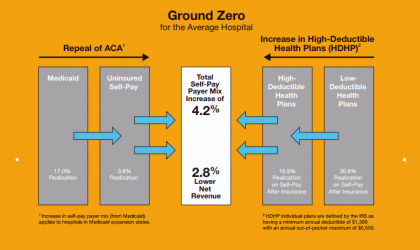

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

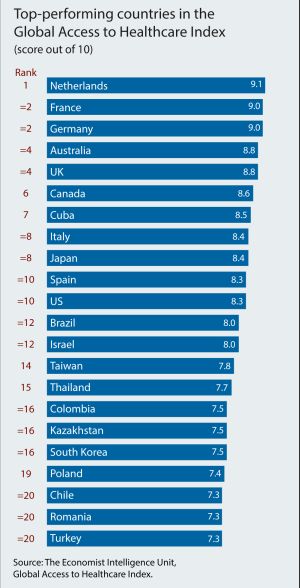

Is There Political Will for Healthcare Access in the US?

The Netherlands, France and Germany are the best places to be a patient, based on the Global Access to Healthcare Index, developed by the Economist Intelligence Unit (EIU). Throughout the world, nations wrestle with how to provide healthcare to health citizens, in the context of stretched government budgets and demand for innovative and accessible services. The Global Access to Healthcare Index gauges countries’ healthcare systems in light of peoples’ ability to access services, detailed in Global Access to Healthcare: Building Sustainable Health Systems. The United States comes up 10th in line (tied with Spain) in this analysis. Countries that score the

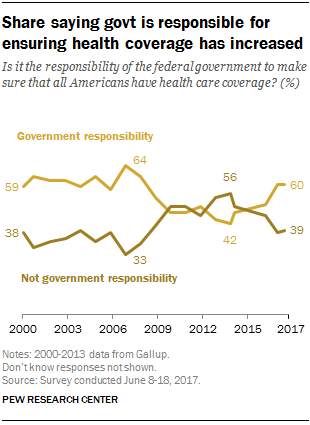

Costs of Healthcare Top Americans’ Financial Concerns: It’s Financial Health Matters Day

Americans are most worried about healthcare costs among all financial concerns; most people in the U.S. also believe the Federal government should ensure that all people have health coverage. Two polls published in the past week point to the fact that most U.S. health citizens are concerned about health care for themselves and their families, driving a growing proportion of people to favor a single-payer health system. The first line chart illustrates a dramatic trajectory up of the number of American identifying healthcare costs as their #1 financial problem, rising from 10% of people in 2013 to 17% in 2017.

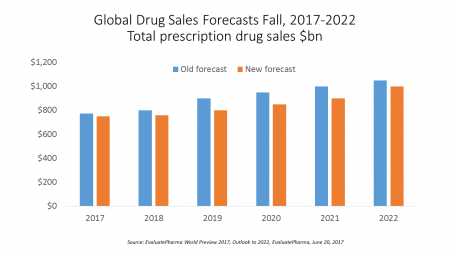

Global Drug Sales Forecasts Fall For Next Five Years

Total prescription drug sales have been trimmed, based on calculations of EvaluatePharma which forecasts a $390 bn drop in revenues between 2017 and 2022. “Political and public scrutiny over pricing of both new and old drugs is not going to go away,” EvaluatePharma called out in its report. The intense scrutiny on pharma industry pricing was fostered by Martin Shkreli in his pricing of Daraprim (taking a $13.50 product raising the price to $750), Harvoni and Sovaldi pricing for Hepatitis C therapies, and last year’s EpiPen pricing uproar. A May 2017 analysis of prescription drug costs by AARP judges that, “Nothing

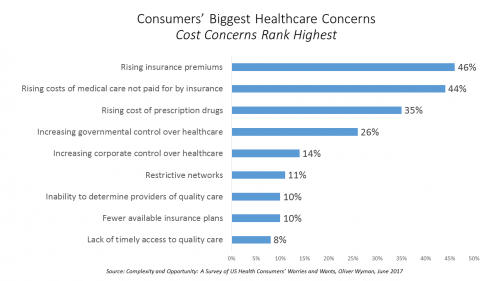

Healthcare Cost Concerns Trump All Others Across the Generations

Patients, evolving into health consumers, seek a better healthcare experience. While most people are pretty satisfied with their medical care, cost and confusion reign. This is the topline finding of a study from Oliver Wyman appropriately titled, Complexity and Opportunity, a survey of U.S. health consumers’ worries and wants. Oliver Wyman collaborated on the research with the FORTUNE Knowledge Group. Consumers’ biggest healthcare concerns deal with costs: rising insurance premiums; greater out-of-pocket costs for care not covered by insurance; and, the growing costs of prescription drugs together rank as the top 3 healthcare concerns in this study. After costs, consumers cite government

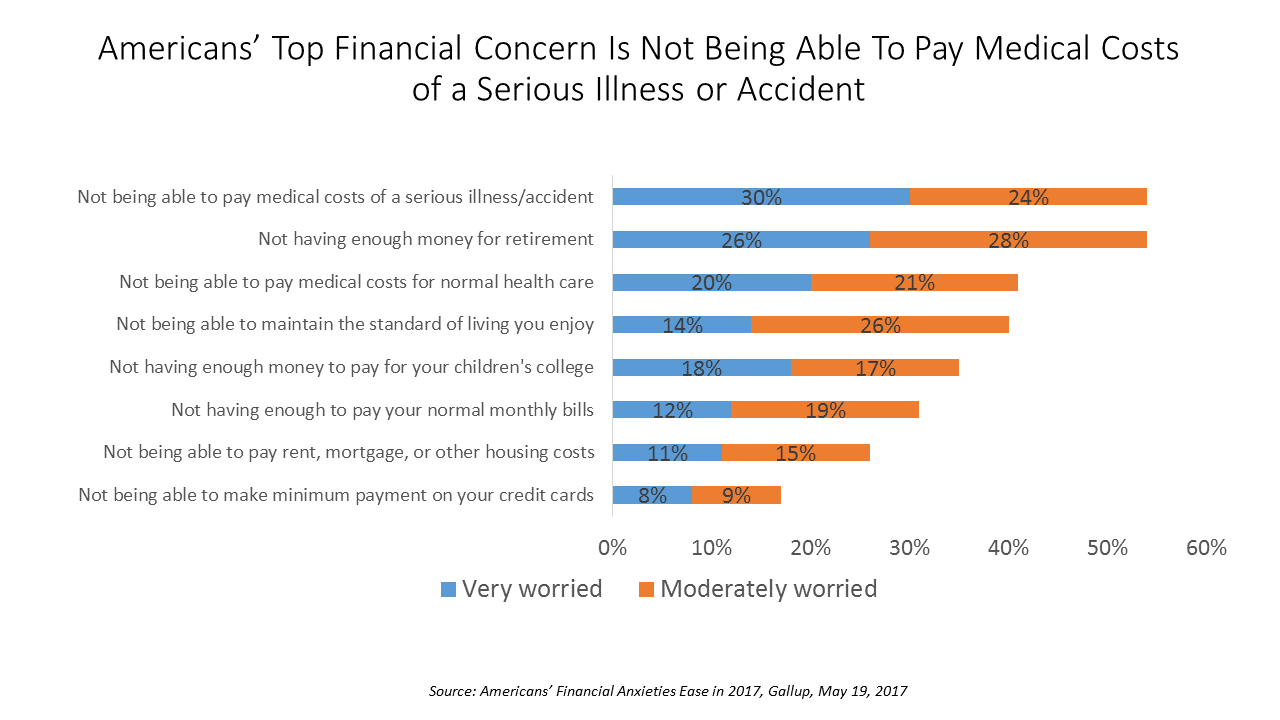

How To Pay For A Serious Medical Illness Tops Americans’ Fiscal Fears

While Americans’ financial worries are softening in 2017, one issue tops the list of fiscal fears: not having enough money to pay the costs involved in a serious illness or accident, Gallup found in a consumer poll fielded in early April 2017. 54% of Americans fear an inability to cover healthcare costs in the event of an accident or serious illness. This percentage was 60% in 2016, and 55% in 2015. This year’s data point ties with Americans financial worry about not having enough money for retirement, but healthcare cost concerns rank higher in terms of being “very worried” versus

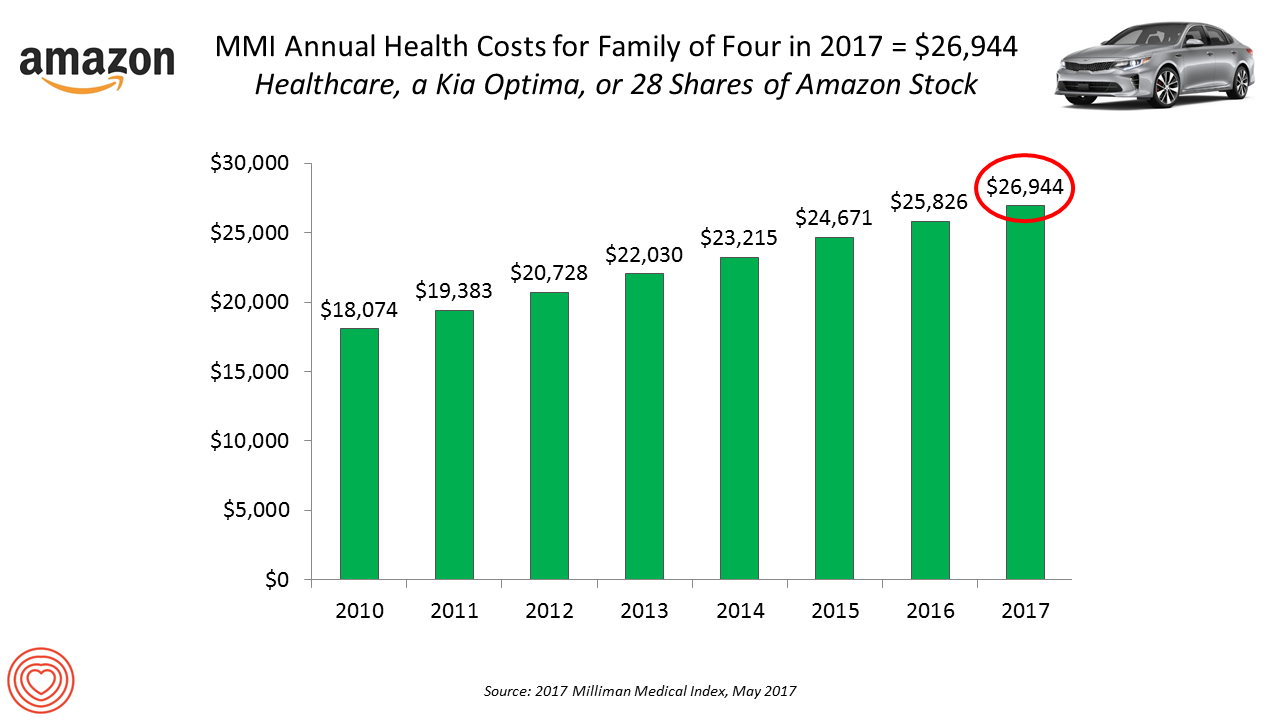

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

The Power of Joy in Health and Medicine – Learning From Dr. Regina Benjamin

Former Surgeon General Dr. Regina Benjamin was the first person who quoted to me, “Health isn’t in the doctor’s office. It’s where people live, work, play and pray,” imparting that transformational mantra to me in her 2011 interview with the Los Angeles Times. I wrote about that lightbulb moment here in Health Populi. Dr. Benjamin was the 18th Surgeon General, appointed by President Obama in 2009. As “America’s Doctor,” she served a four-year term, her mission focused on health disparities, prevention, rual health, and children’s health. Today, Dr. Benjamin wears many hats: she’s the Times Picayune/NOLA.com professor of medicine at

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

Health Care Costs Are A Top Worry for Americans Across Political Parties

Health care costs are out-of-reach for more Americans, among both people who have insurance through the workplace or via health insurance exchanges. The first chart illustrates the growing healthcare affordability challenge for American health consumers, discussed in a data note to the Kaiser Family Foundation Health Tracking Poll in March 2017. In 2017, 43% of consumers found it difficult to meet the health care deductible before insurance would kick in 37% of consumers found it difficult to pay for the cost of health insurance each month 31% said it was difficult to pay for copayments for doctor visits and prescription drugs.

Finding Health in Consumer Goods

People want to live healthier lives, and consumer good companies are responding to these demands to keep and gain market share and profit margins. Consumer product firms reformulated over 180,000 consumer products in 2016 for in response to consumers’ health and wellness wishes, based on data collected by Deloitte for The Consumer Goods Forum project (CGF) and published in The CGF Health & Wellness Progress Report. The CGF is an industry network of some 400 consumer goods, retail, and service companies supporting the global adoption of standards and practices. This Report focused on the CGF members’ progress toward health and wellness

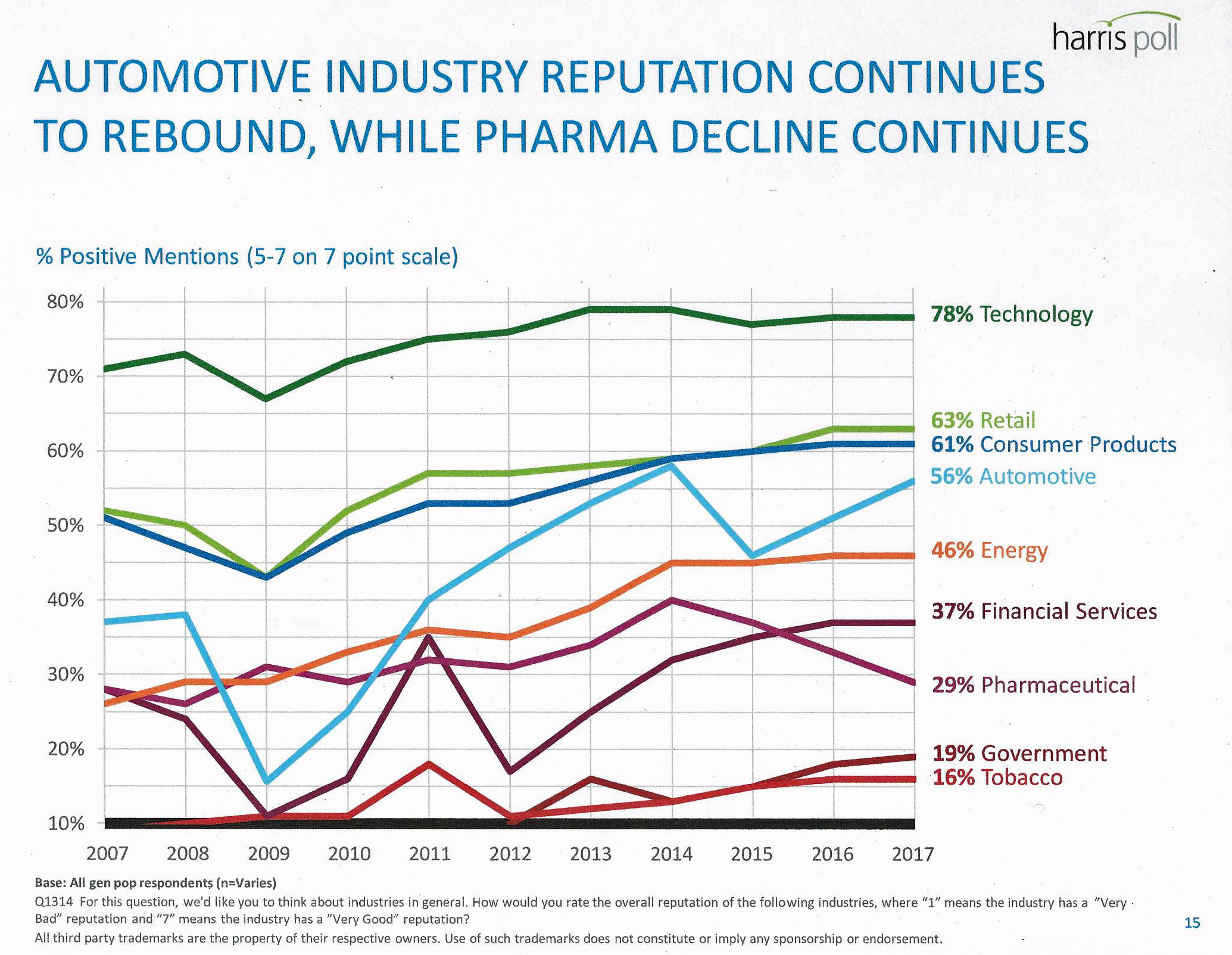

Pharma Industry Reputation Declines Second Year In A Row

U.S. consumers love technology, retail, and consumer products; automotive company reputations are improving, even with Volkswagen’s emission scandal potentially tarnishing the industry segment. The only corporate sector whose reputation fell in 2016 was the pharmaceutical industry’s, according to the Harris Poll’s 2017 Reputation Quotient report. The line chart illustrates the decline of pharma’s reputation, which puts it on par with its consumer perceptions in 2010 — just before Medicare Part D was legislated and implemented, which improved pharma’s image among American health citizens (especially older patients who tend to be more frequent consumers of prescription drugs). Pharma’s reputation quotient is back

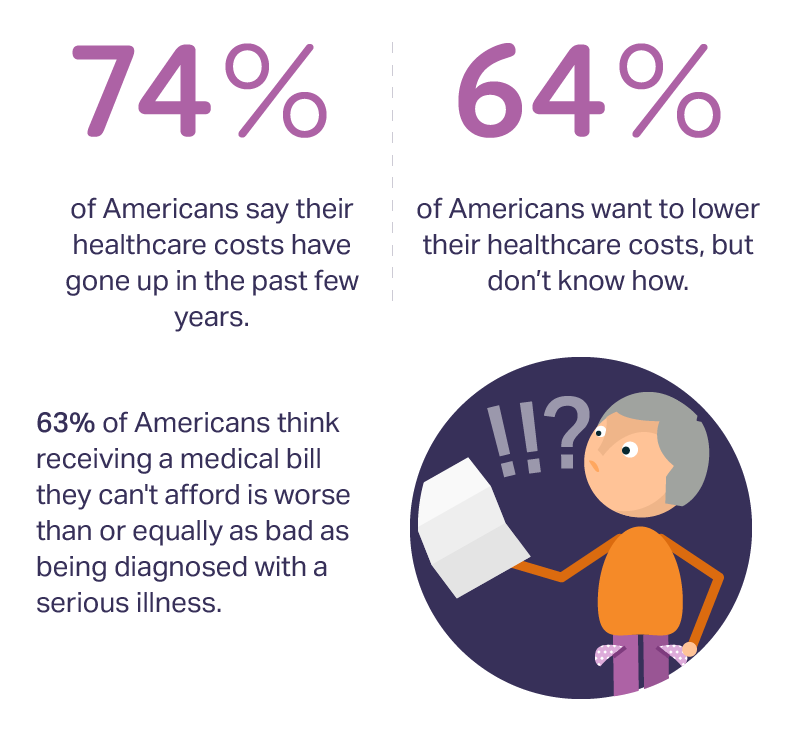

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

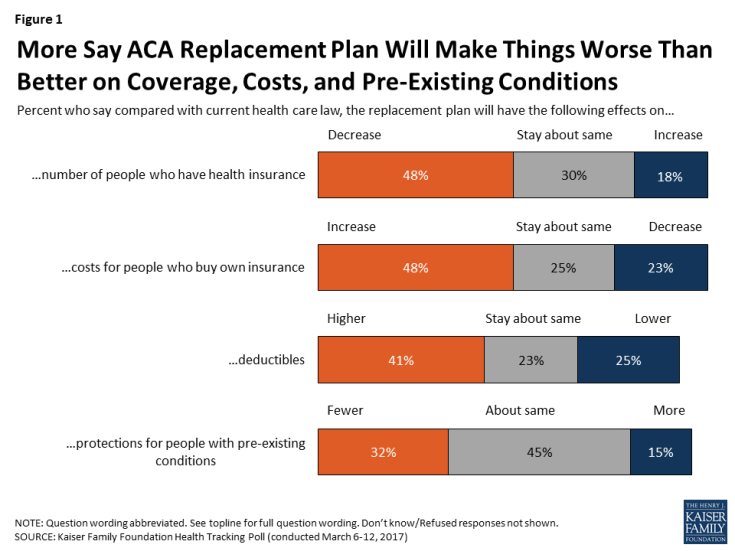

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

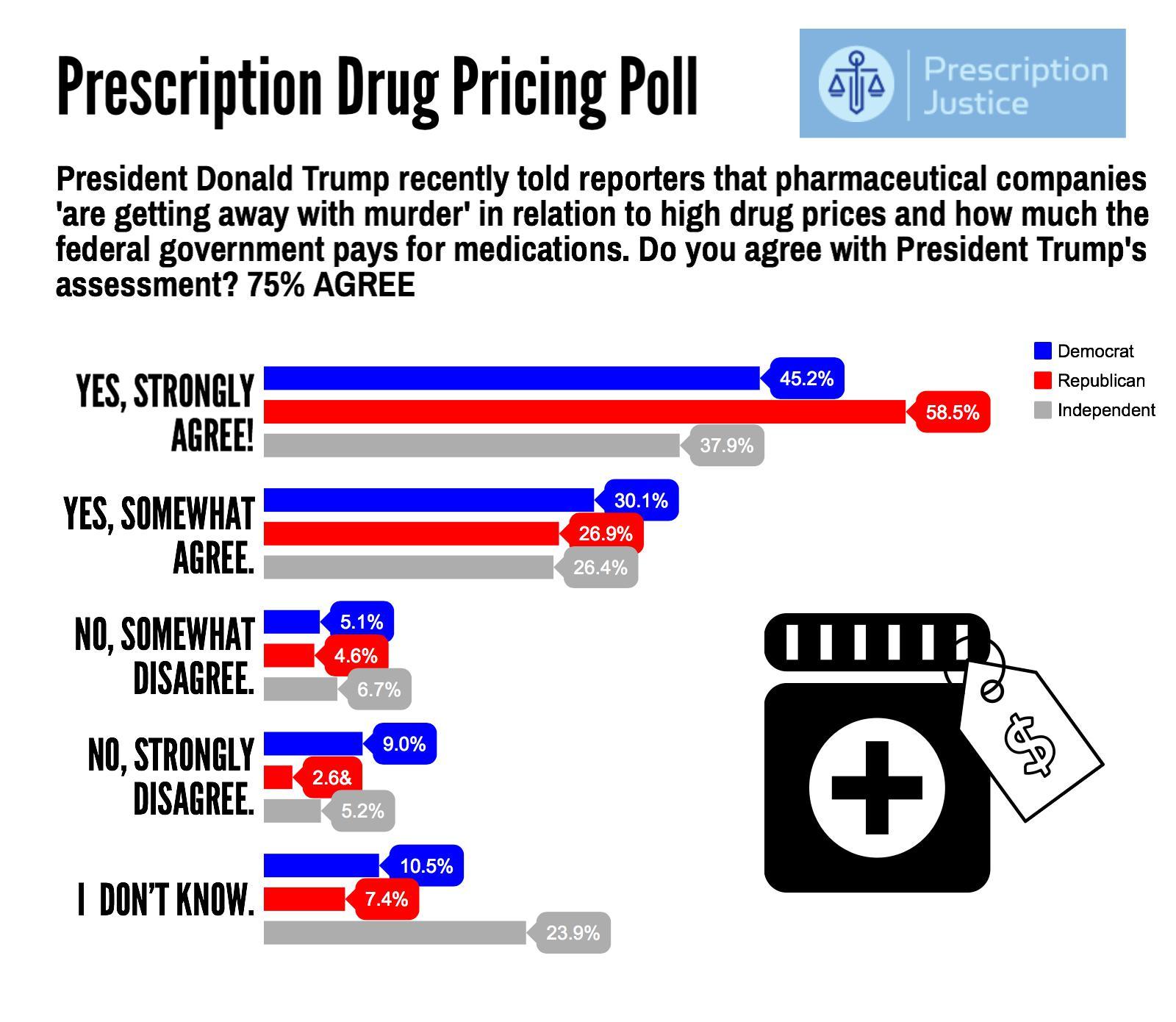

The Healthcare Reform Issue Americans Agree On: Lowering Rx Costs

Yesterday, the Tweeter-in-Chief President Donald Trump tweeted, “I am working on a new system where there will be competition in the Drug Industry. Pricing for the American people will come way down!” Those 140 characters sent pharma stocks tumbling, as illustrated by the chart for Mylan shares dated 7 March 2017. This is one issue that Americans across the political spectrum agree on with the POTUS. The latest Zogby poll into this issue, conducted for Prescription Justice, found 3 in 4 Americans agree that pharmaceutical companies are “getting away with murder,” as President Trump said in a TIME magazine interview

Your Zip Code Is Your Wellness Address

Geography is destiny, Napoleon is thought to have first said. More recently, the brilliant physician Dr. Abraham Verghese has spoken about “geography as destiny” in his speeches, such as “Two Souls Intertwined,” The Tanner Lecture he delivered at the University of Utah in 2012. Geography is destiny for all of us when it comes to our health and well-being, once again proven by Gallup-Healthways in The State of American Well-Being 2016 Community Well-Being Rankings. The darkest blue circles in the U.S. map indicate the metro areas in the highest-quintile of well-being. The index of well-being is based on five metrics, of consumer self-ranking

Stress Is A Social Determinant of Health – Money and Politics Top the List in 2017

The American Psychological Association reports that Americans are experiencing greater levels of stress in 2017 for the first time since initiating the Stress in America Survey ten years ago in 2007. This is a statistically significant finding, APA calculated. The member psychologists of the American Psychological Association (APA) began to report that patients were coming to appointments increasingly anxious about the 2016 Presidential election. So the APA polled U.S. adults on politics for the first time in ten years of conducting the Stress in America survey. Two-thirds of Americans are stressed and/or anxious about the future of the nation, and

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

Marketing Medicines: Going Boldly and Accessibly for Rx

Over the past two weeks, we see two marketing campaigns emerge to market medicines: first, from the branded pharmaceutical association PhRMA, the #GoBoldly initiative with a theme of innovation and personalized medicine. Second, there’s a campaign from the Generic Pharmaceutical Association (GPhA), rebranding the organization as the Association for Accessible Medicines with the tagline, “keep medicines in reach.” What’s this all about? To put these marketing initiatives in context, let’s start with the publication of Express Scripts 2016 Drug Trend Report. “Drug trend” is short-hand for growth in prescription drug spending, year on year. The first graph illustrates the price index

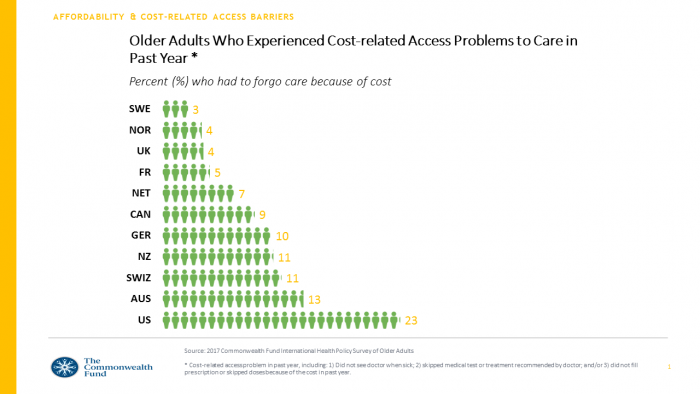

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Patients Anxiously Prep to Be Healthcare Consumers, Alegeus Finds

Healthcare consumers are in a “state of denial,” according to research conducted for Alegeus, the consumer health benefits company. Overall, 3 in 4 consumers feel fear when it comes to their healthcare finances: most people worry about being hit with unexpected healthcare costs they can’t afford, and nearly half fear they won’t be able to afford their family’s healthcare needs. The wordle illustrates consumers’ mixed feelings about healthcare: while people feel frustrated, overwhelmed, powerless, confused and skeptical about healthcare in America, there are some emerging adjectives hinting at growing consumer health muscle-building: optimistic, hopeful, supported, engaged, accountable. Still, denial and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Thanks to Feedspot for identifying

Thanks to Feedspot for identifying  Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.