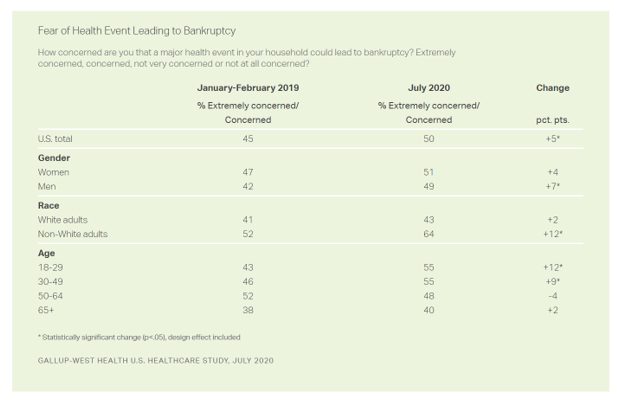

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

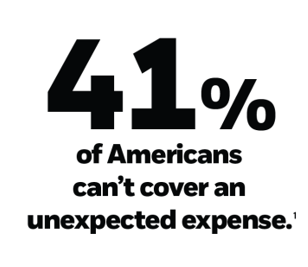

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

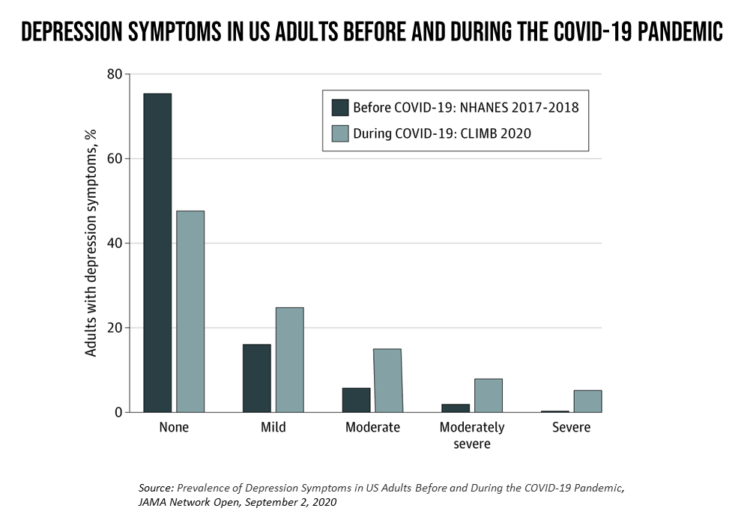

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

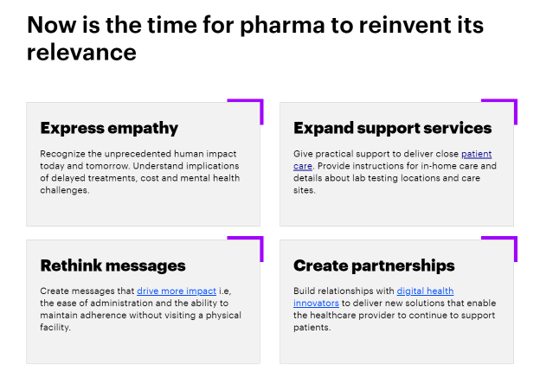

Pharma’s Future Relevance Depends on Empathy, Messaging, Partnering, and Supporting Patients and Providers

COVID-19 is re-shaping all industries, especially health care. And the pharma industry is challenged along with other health care sectors. In fact, the coronavirus crisis impacts on pharma are especially accelerated based on how the pandemic has affected health care providers, as seen through research from Accenture published in Reinventing Relevance: New Models for Pharma Engagement with Healthcare Providers in a COVID-19 World. For the study, Accenture surveyed 720 health care providers in general practice, oncology, immunology, and cardiology working in China, France, Japan, the United Kingdom, and the U.S., in May and June 2020. Top-line, Accenture points to four

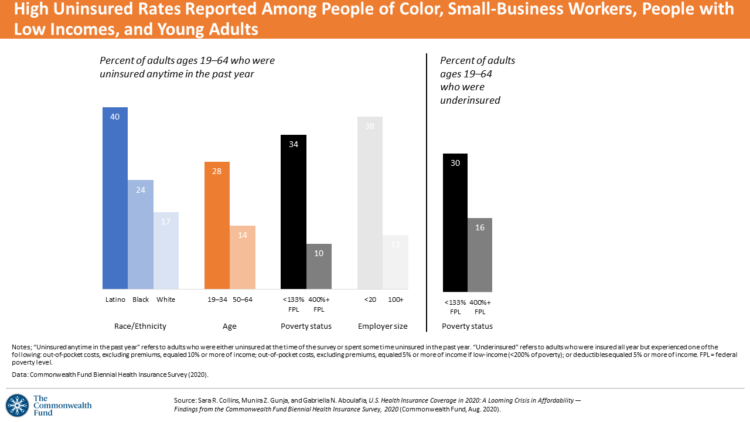

Health Insurance Affordability in the Time of the Coronavirus Pandemic

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

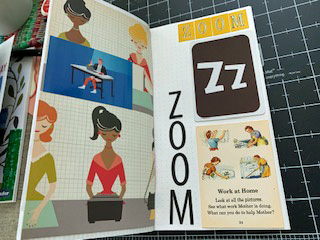

My ABCovid-19 Journal – Day 5 of 5, Letters “U” through “Z”

We’ve had a lovely week on Seneca Lake, re-setting our physical, mental, and emotional clocks in the #KahnCave. It’s been blissful. I’ve enjoyed receiving feedback on the past four days of ABCovid-19 journal shares on my LinkedIn page and Twitter feed @HealthyThinker. My #arttherapy is yours for the sharing and taking. We are all, truly, on this pandemic journey together. That’s public health, for you. Today, I bring you the fifth and last day of sharing my COVID-19 alphabet with you: the letters “U” through “Z.” Read on, and please let me know after seeing all 26 alpha’s which page(s)

My ABCovid-19 Journal – Day 1 of 5, “A” through “E”

My friends… It’s time in this pandemic journey that I take a full week to re-charge and bask in the midst of nature, a lake, farm-to-table food, wine-making, and the love of and therapeutic time with my wonderful husband. My gift to you all this week, 10th – 14th August, is to share with you pages from my “ABCovid-19 Journal” that I created/curated in the first weeks of the coronavirus pandemic. We all have our hacks for managing stress and discomfort, and in the first weeks of COVID-19, this was my life-saver. Journaling is one of my self-care strategies; think

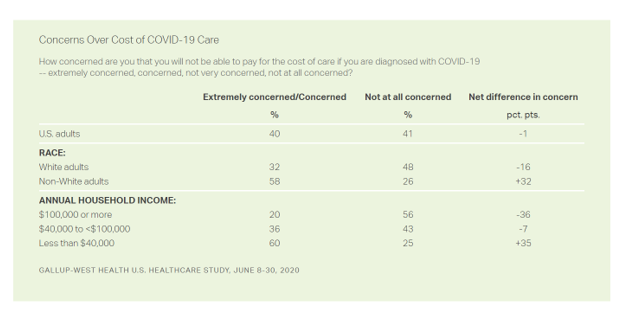

The Racial Divide Due to COVID-19 Also Applies to Healthcare and Pharma Costs

Into the sixth month of the coronavirus pandemic in the U.S., it’s clear that COVID-19 has wreaked a greater mortality and morbidity impact on people of color than on white adults. A new Gallup-West Health poll found that the coronavirus also concerns more non-white Americans than whites when it comes to the cost of health care and medicines to deal with the effects of COVID-19. Considering the cost of COVID-19 treatment, across all U.S. adults, 40% of people are concerned (extremely/concerned), and 41% are “not at all concerned.” Broken down by race, there is a stark difference in levels of

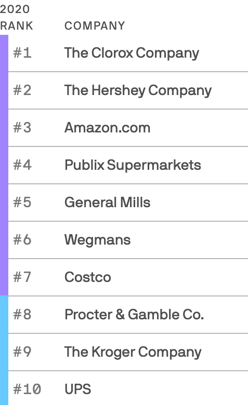

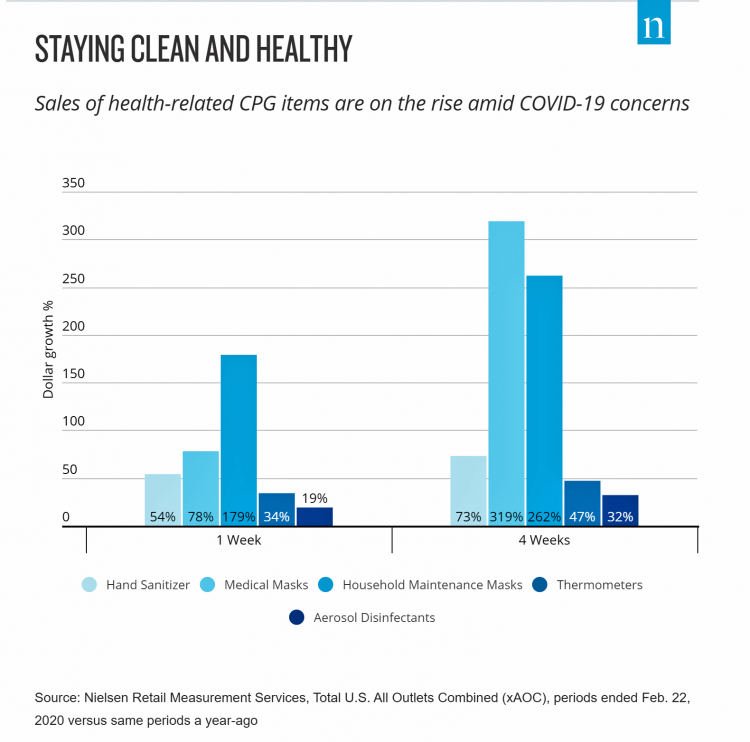

We Are All About Hygiene, Groceries, and Personal Care in the Midst of the Coronavirus Pandemic

Pass me the Clorox…tip the UPS driver…love thy grocer. These are our daily life-flows in the Age of COVID-19. Our basic needs are reflected in the new 2020 Axios-Harris Poll, released today. For the past several years, I’ve covered the Harris Poll of companies’ reputation rankings here in Health Populi. Last year, Wegmans, the grocer, ranked #1; Amazon, #2. In the wake of the COVID-19 pandemic, U.S. consumers’ basic needs are emerging as health and hygiene, food, and technology, based on the new Axios-Harris Poll on the top 100 companies. This year’s study was conducted in four waves, with the

Return-To-School Is Stressing Out U.S. Parents Across Income, Race and Political Party

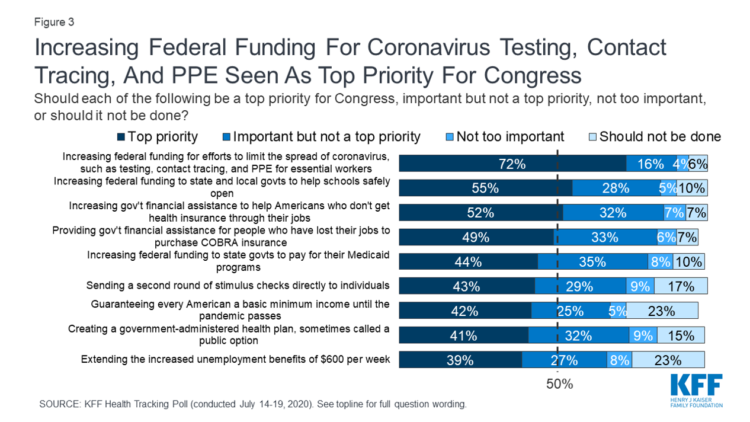

The worse of the coronavirus pandemic is yet to come, most Americans felt in July 2020. That foreboding feeling is shaping U.S. parents’ concerns about their children returning to school, with the calendar just weeks away from educators opening their classrooms to students, from kindergarten to the oldest cohort entering senior year of high school. The Kaiser Family Foundation’s July 2020 Health Tracking Poll focuses on the COVID-19 pandemic, return-to-school, and the governments’ response. KFF polled 1,313 U.S. adults 18 and older between July 14 to 19, 2020. The first line chart illustrates Americans’ growing concerns about the coronavirus, shifting

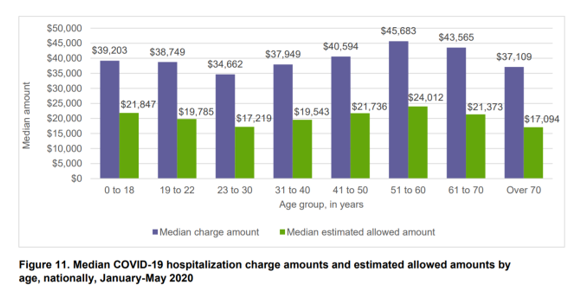

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

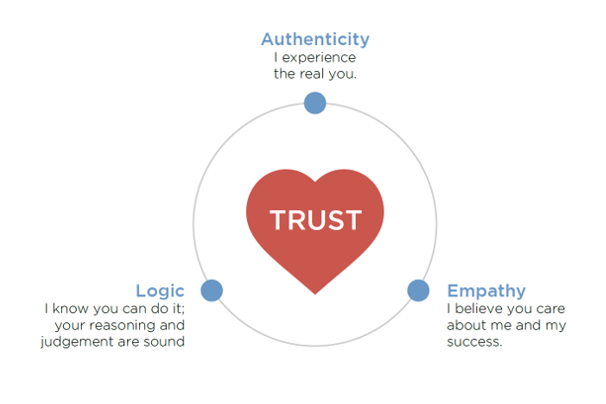

Trust Is a Key Social Currency for COVID-Embattled Consumers

The coronavirus pandemic has re-shaped patients into consumers, concerned about managing the risk of contracting the virus, millions of people experiencing months of sheltering, working, learning, and cooking at home. Combine these new life-flows with conflicting information about the nature, severity, and life-span of COVID-19: From three levels of government leaders: The President and the Executive Branch at the Federal Level, Governors of States, and Mayors of cities; Public health agencies, especially the U.S. Centers for Disease Control and the World Health Organization; Mass media; and, Social media. Re-entering life in the “next normal” requires a large dose of trust,

How Can Healthcare Bring Patients Back? A Preview of Our ATA Session, “Onward Together” in the COVID Era

Today kicks off the first all-virtual conference of the ATA, the American Telemedicine Association. ATA’s CEO Ann Mond Johnson and team turned on a dime over the past few months, migrating the already-planned live conference scheduled in early May to this week, all online. I’ll be midwifing a panel this afternoon at 440 pm Eastern time, initially focused on how health care can garner patient loyalty. That theme was given to us in the fourth quarter of 2019, when initial planning for ATA 2020 had begun. What a difference a few months make. Not only has ATA pivoted to an

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

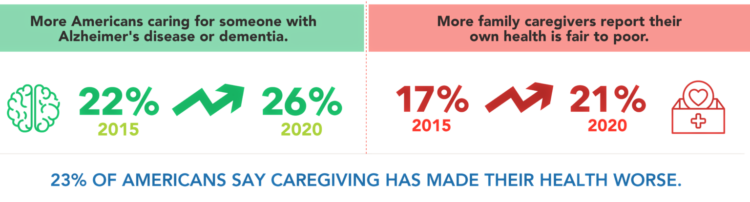

Big Hearts, High Tech – How Caregiving Has Changed in the U.S.

We are all caregivers now. The COVID-19 pandemic has touched and continues to re-shape our daily lives. One reality that the coronavirus era has revealed is that caregiving is a daily life-flow for everyone around the world. In the U.S., this has particularly acute impacts — physical, emotional, and financial. The 2020 AARP report on caregiving was published this month, and the survey research into caregivers uncovered fresh insights about caregivers’ demographics, financial stressors, and intensity of tasks both in volume and time. In addition, more caregivers are looking for and turning to technology to help them hack effort, time

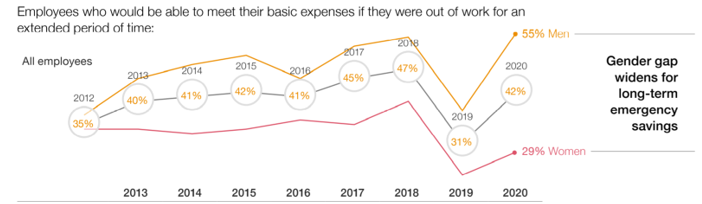

Financial Insecurity Among U.S. Workers Will Worsen in the Pandemic — Especially for Women

Millions of mainstream, Main Street Americans entered 2020 feeling income inequality and financial insecurity in the U.S. The coronavirus pandemic is exacerbating financial stress in America, hitting women especially hard, based on PwC’s 9th annual Employee Financial Wellness Survey COVID-19 Update. For this report, PwC polled 1,683 full-time employed adults between 18 and 75 years of age in January 2020. While the survey was conducted just as the pandemic began to emerge in the U.S., PwC believes, “the areas of concern back in January will only be more pronounced today,” reflecting, “the realities of the changing employee circumstances we are

Stress in America – COVID-19 Takes Toll on Finances, Education, Basic Needs and Parenting

“The COVID-19 pandemic has altered every aspect of American life, from health and work to education and exercise,” the new Stress in America 2020 study from the American Psychological Association begins. The APA summarizes the impact of these mass changes on the nation: “The negative mental health effects of the coronavirus may be as serious as the physical health implications,” with COVID-19 stressors hitting all health citizens in the U.S. in different ways. Beyond the risk of contracting the virus, the Great Lockdown of the U.S. economy has stressed the U.S. worker and the national economy, with 7 in 10

TransUnion Reveals the Home Economics and Social Determinants of COVID-19

Today, 7th May 2020, the U.S. Bureau of Labor Statistics announced that about 3.17 million jobs were lost in the nation in the last week. This calculated to an unemployment rate of 15.5%, an increase of 3.1% points from the previous week. Total jobs lost in the COVID-19 pandemic, starting from the utterance of the “P” word, has been ___ in the I.S. The virus’s global impact has led to what IMF called the Great Lockdown, resulting in economic inertia and contraction since Asia and Europe reported the first patients diagnosed with the coronavirus. The economic impact the world

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

The Patient-as-Payor in the Coronavirus Pandemic

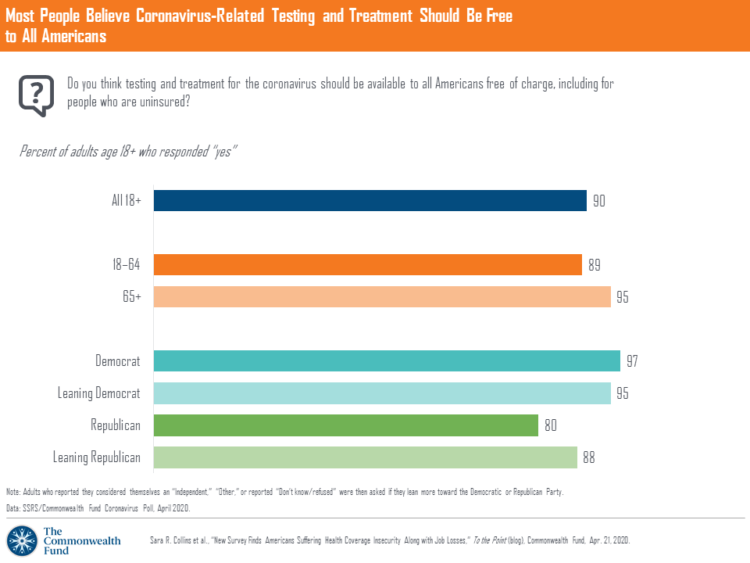

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

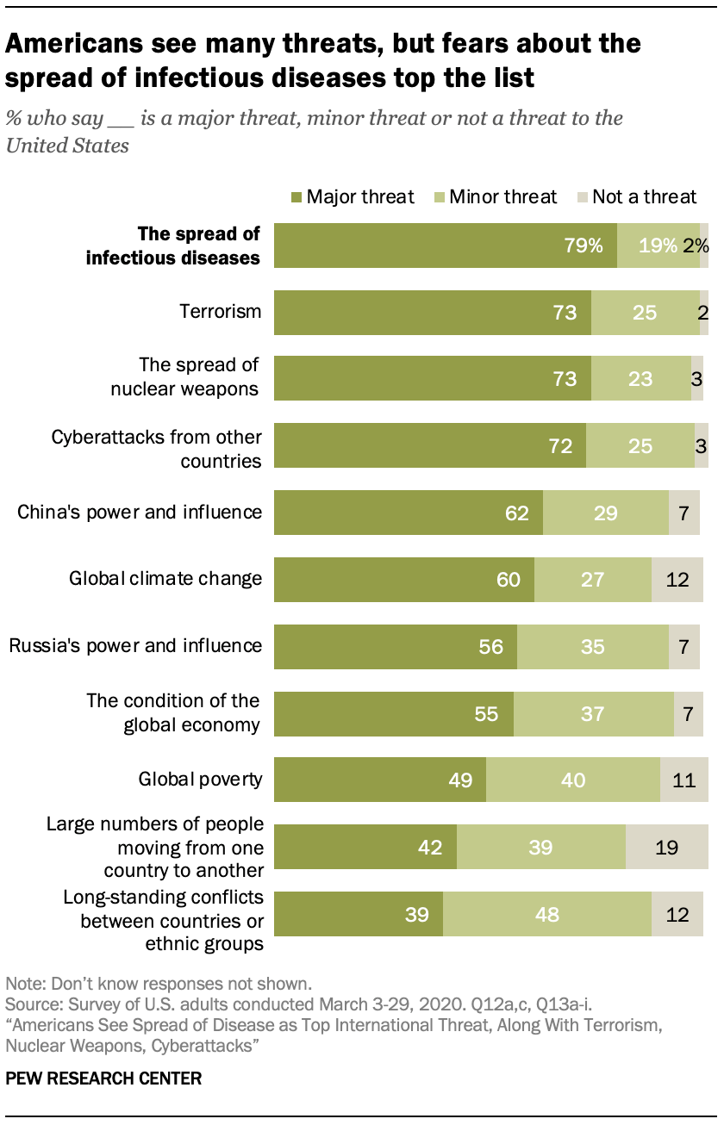

In the U.S., the Spread of Infectious Disease Now Seen As Bigger Threat Than Terrorism – Pew

The spread of infectious disease is the new terrorism in the eyes of Americans. The most significant major threat to the U.S. is infectious disease, four in five Americans said in March 2020, closely followed by terrorism (in general), the spread of nuclear weapons, and cyberattacks from other countries. For the study, the Pew Research Center commissioned a telephone survey conducted among 1,000 U.S. adults in March 2020. Large majorities of people are also highly concerned about China’s growing power and influence, global climate change, Russia’s power and influence, the condition of the global economy, and global poverty. The percent

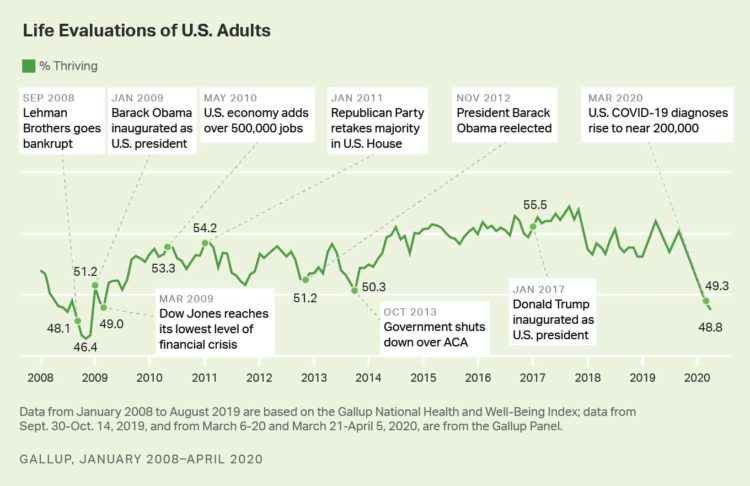

Americans’ Sense of Well-Being Falls to Great Recession Levels, Gallup Finds

It’s déjà vu all over again for Americans’ well-being: we haven’t felt this low since the advent of the Great Recession that hit our well-well-being hard in December 2008. As COVID-19 diagnoses reached 200,000 in the U.S. in April 2020, Gallup gauged that barely 1 in 2 people felt they were thriving. In the past 12 years, the percent of Americans feeling they were thriving hit a peak in 2018, as the life evaluations line graph illustrates. Gallup polled over 20,000 U.S. adults in late March into early April 2020 to explore Americans’ self-evaluations of their well-being. FYI, Gallup asks consumers

The Coronavirus Impact on American Life, Part 2 – Our Mental Health

As the coronavirus pandemic’s curve of infected Americans ratchets up in the U.S., people are seeking comfort from listening to Dolly Parton’s bedtime stories, crushing on Dr. Anthony Fauci’s science-wrapped-with-empathy, and streaming the Tiger King on Netflix. These and other self-care tactics are taking hold in the U.S. as most people are “social distancing” or sheltering in place, based on numbers from the early April 2020 Kaiser Family Foundation health tracking poll on the impact of the coronavirus on American life. While the collective practice of #StayHome to #FlattenTheCurve is the best-practice advice from the science leaders at CDC, the NIAID

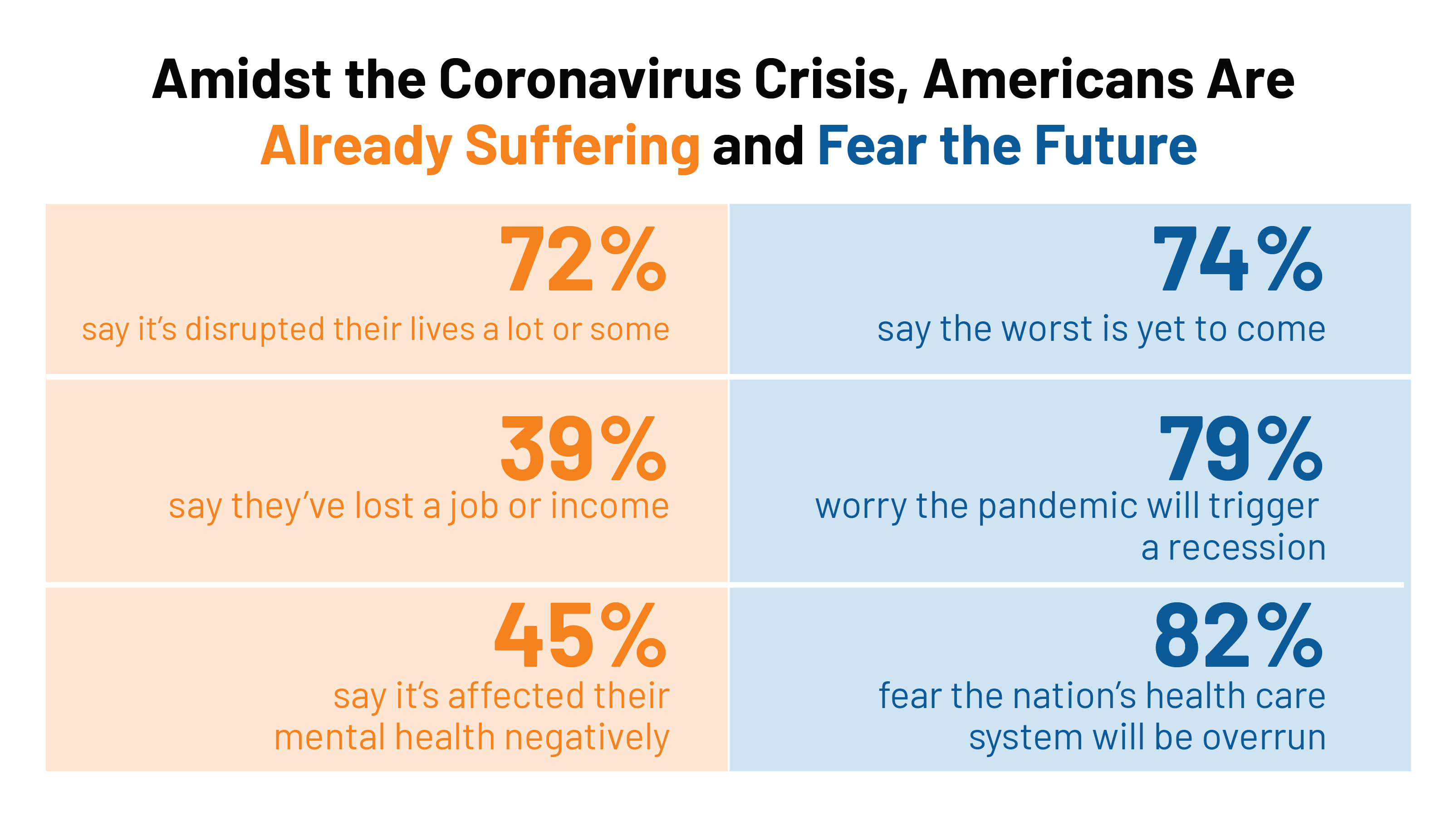

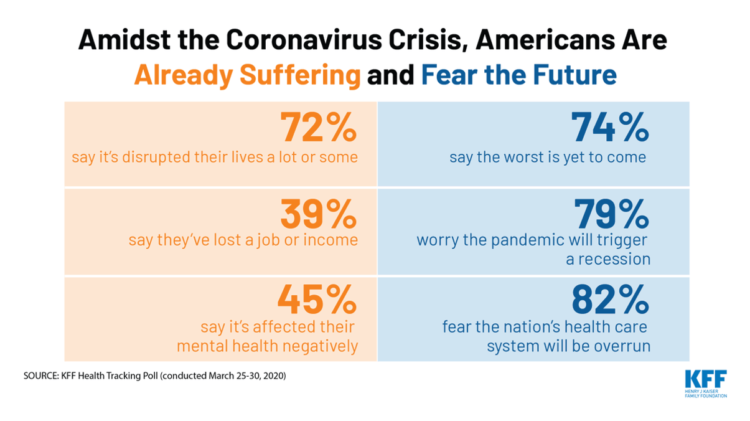

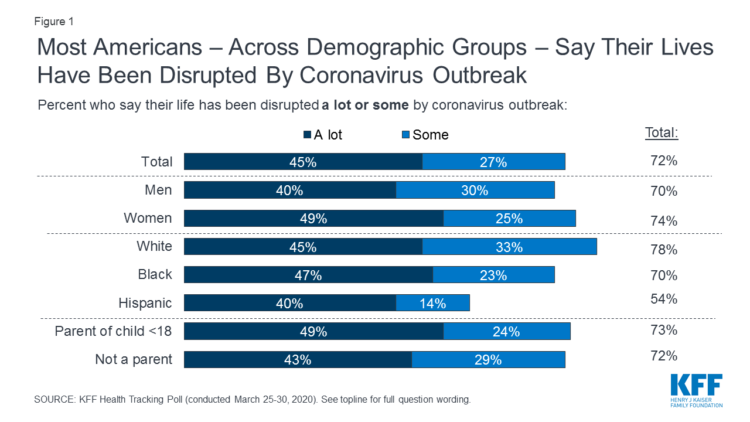

The Coronavirus Impact on American Life, Part 1 – Life Disrupted, and Money Concerns

Nearly 3 in 4 Americans see their lives disrupted by the coronavirus pandemic, according to the early April Kaiser Family Foundation Health Tracking Poll. This feeling holds true across most demographic factors: among both parents and people without children; men and women alike; white folks as well as people of color (although fewer people identifying as Hispanic, still a majority). There are partisan differences, however, in terms of who perceives a life-disruption due to COVID-19: 76% of Democrats believe this, 72% of Independents, and 70% of Republicans. Interestingly, only 30% of Republicans felt this way in March 2020, more than

In the US COVID-19 Pandemic, A Tension Between the Fiscal and the Physical

“Act fast and do whatever it takes,” insists the second half of the title of a new eBook with contributions from forty leading economists from around the world. The first half of the title is, Mitigating the COVID Economic Crisis. The book is discussed in a World Economic Forum essay discussing the economists’ consensus to “act fast.” As the U.S. curve adds new American patients testing positive for the coronavirus, the book and essay illustrate the tension between health consumer versus the health citizen in the U.S. For clinical context, as I write this post on 24th March 2020, today’s U.S.

The COVID19 Consumer: #AloneTogether and More Health Aware

The number of diagnoses of people testing positive with the coronavirus topped 14,000 today in the U.S., Johns Hopkins COVID-19 interactive map told us this morning. As tests have begun to come on stream from California on the west coast to New York state on the east, the U.S. COVID-19 positives will continue to ratchet up for weeks to come, based on the latest perspectives shared by the most-trusted expert in America, Dr. Anthony Fauci. This report from the U.S. Department of Health and Human Services on the nation’s response to the coronavirus pandemic, published March 13, 2020, forecasts a

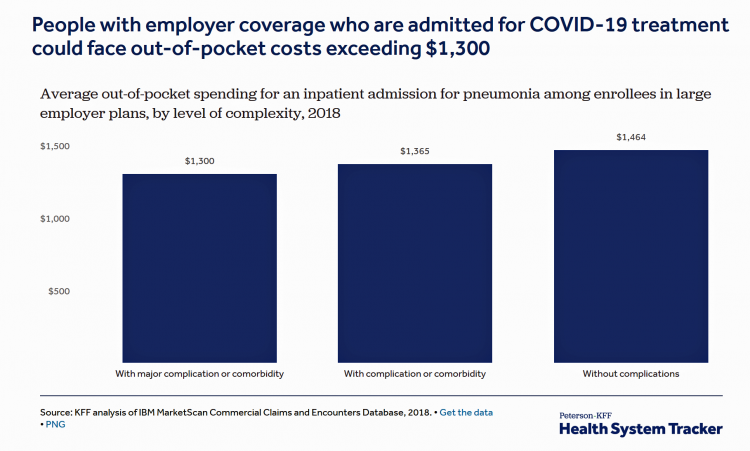

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Waking Up a Health Consumer in the COVID-19 Era

With President Trump’s somber speech from the Oval Office last night, we wake up on 12th March 2020 to a ban on most travel from Europe to the U.S., recommendations for hygiene, and call to come together in America. His remarks focused largely on an immigration and travel policy versus science, triaging, testing and treatment of the virus itself. Here is a link to the President’s full remarks from the White House website, presented at about 9 pm on 11 March 2020. Over the past week, I’ve culled several studies and resources to divine a profile of the U.S. consumer

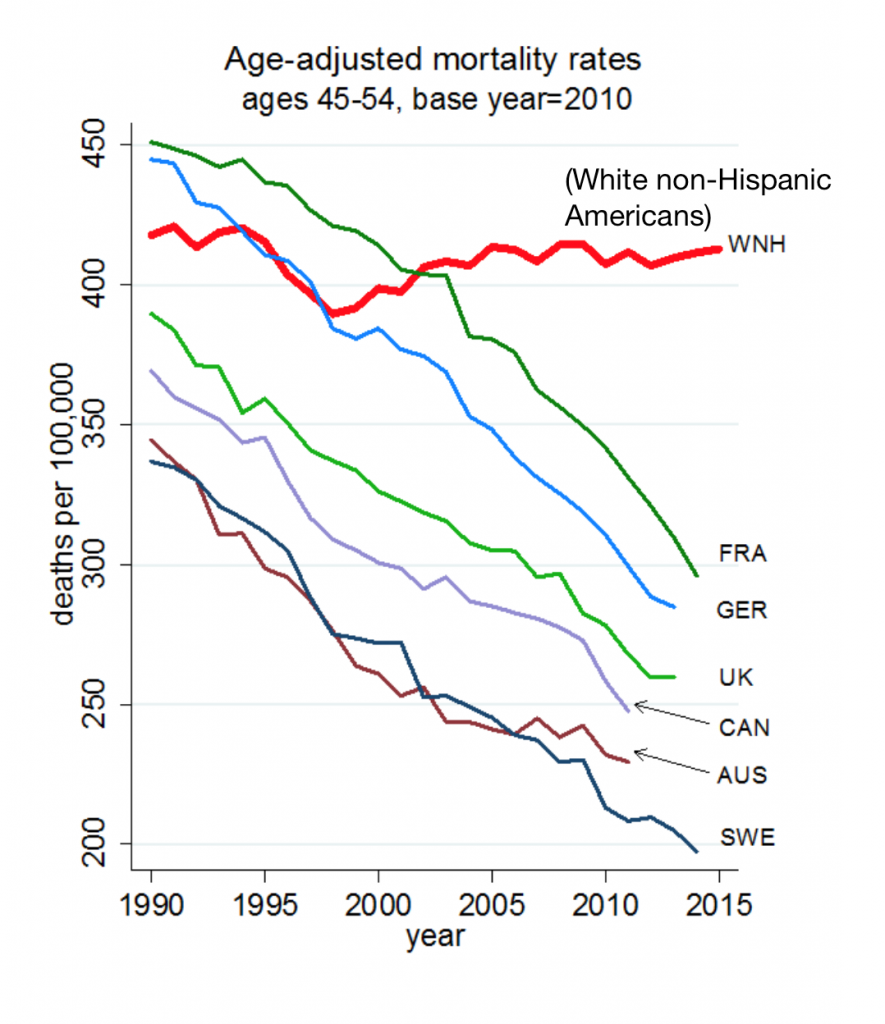

The Book on Deaths of Despair – Deaton & Case On Education, Pain, Work and the Future of Capitalism

Anne Case and Angus Deaton were working in a cabin in Montana the summer of 2014. Upon analyzing mortality data from the U.S. Centers for Disease Control, they noticed that death rates were rising among middle-aged white people. “We must have hit a wrong key,” they note in the introduction of their book, Deaths of Despair and the Future of Capitalism. This reversal of life span in America ran counter to a decades-long trend of lower mortality in the U.S., a 20th century accomplishment, Case and Deaton recount. In the 300 pages that follow, the researchers deeply dive into and

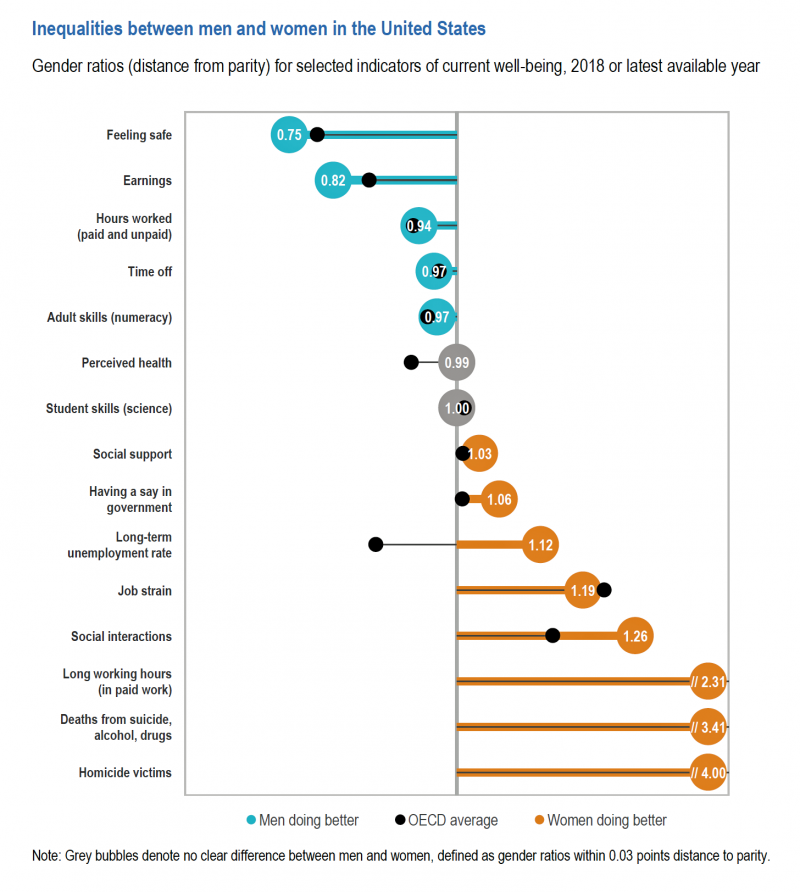

“How’s Life?” for American Women? The New OECD Report Reveals Financial Gaps on International Women’s Day 2020

March 8 is International Women’s Day. In the U.S., there remain significant disparities between men and women, in particular related to financial well-being. The first chart comes from the new OECD “How’s Life?” report published today (March 9th) measuring well-being around the country members of the OECD. This chart focuses on women versus men in the United States based on over a dozen key indicators. Top-line, many fewer women feel safe in America, and earnings in dollars and hours worked fall short of men’s incomes. This translates into lower socioeconomic status for women, which diminishes overall health and well-being for

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

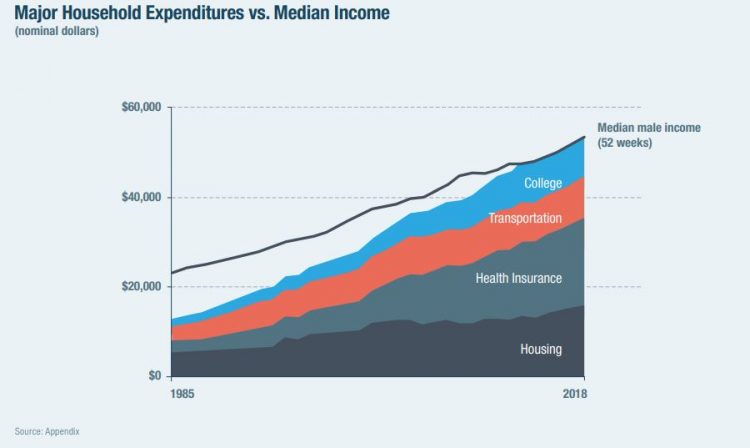

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

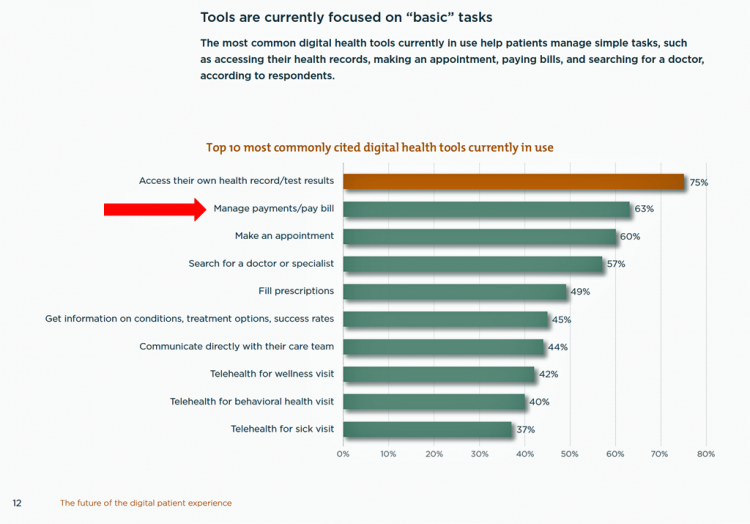

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

Will Trade Data for (Cheaper) Health Care – USC’s View of the Future

Patients are now front-line payors in the U.S. health care system. As such, American health consumers are wrestling with sticker shock from surgical procedures, surprise medical bills weeks after leaving the hospital, and the cost of prescription drugs — whether six-figure oncology therapies or essential medicines like insulin and EpiPens. To manage personal health finances, patients-as-payors are increasingly willing to face trade-offs and change personal behaviors to lower health care costs, based on research in The Future of Health Care Study from USC’s Center for the Digital Future. The Center analyzed the perspectives of 1,000 U.S. adults in August 2019 regarding

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

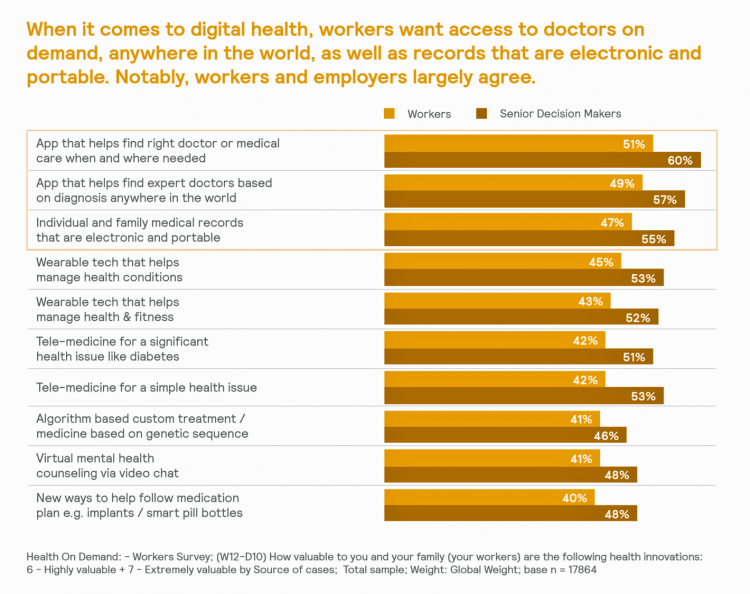

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

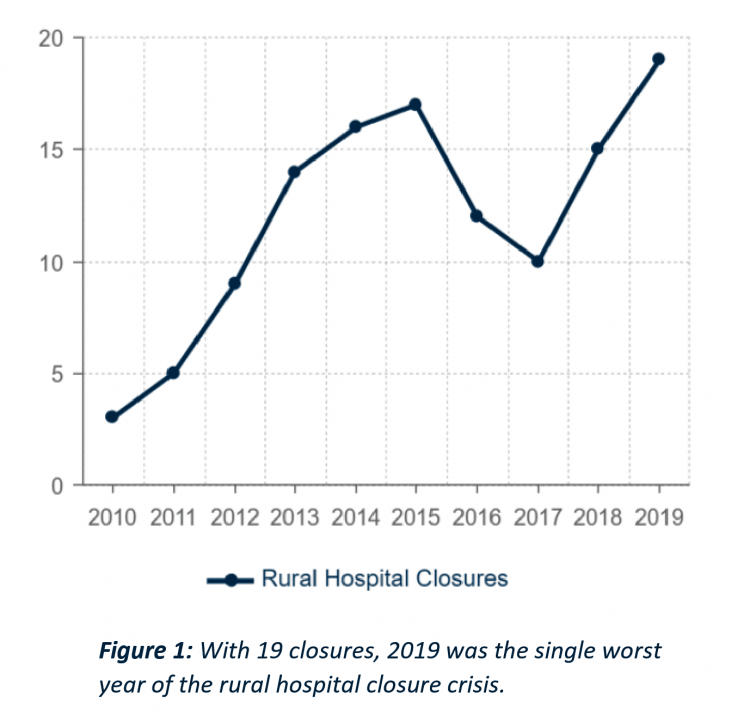

The Ill Health of Rural Hospitals in Four Charts

There are 1,844 rural hospitals operating in the U.S. That number is down by 19 in the 2019 calendar year, the worst year of rural hospital closings seen in the past decade. That hockey-stick growth of closures is shown in the first chart, where 34 rural hospitals shut down in the past 2 years. Rural U.S. hospitals are in poor fiscal health. “The accelerated rate at which rural hospitals are closing continues to unsettle the rural healthcare community and demands a more nuanced investigation into rural hospital performance,” threatening the stability of the rural health safety net, according to the

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

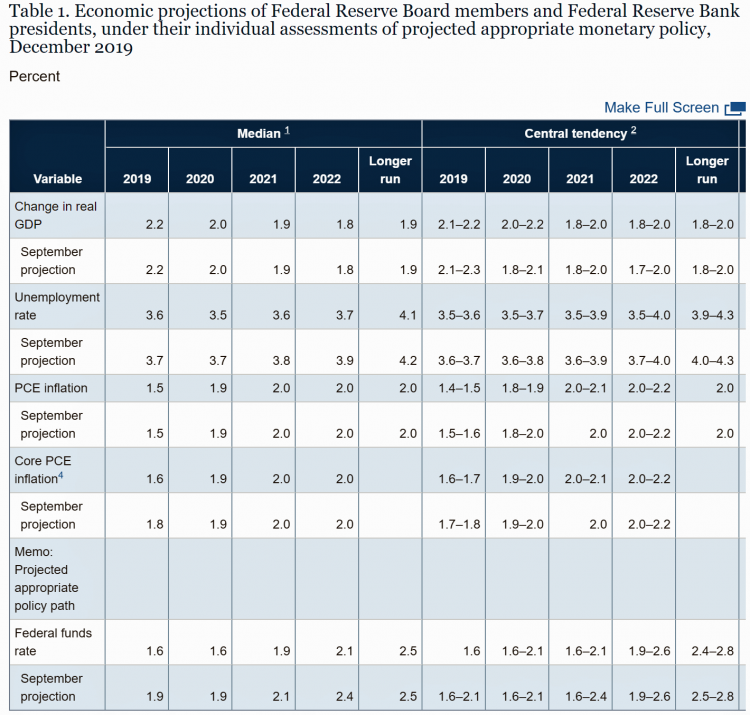

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

Health@Retail Update: Kroger and Hy-Vee Morph Grocery into Health, Walmart’s Health Center, CVS/housing and More

With our HealthConsuming “health is everywhere” ethos, this post updates some of the most impactful recent retail health developments shaping consumers’ health/care touchpoints beyond hospitals, physicians, and health plans. For inspiration and context, I’ll kick off with Roz Chast’s latest New Yorker cartoon from the February 3rd 2020 issue — Strangers in the Night, taking place in a Duane Reade pharmacy. Roz really channels the scene in front of the pharmacy counter, from Q-tips to vitamins and tea. And it’s hummable to the tune of, well, Strangers in the Night. Check out the 24-hour pharmacist under the pick-up sign. Now,

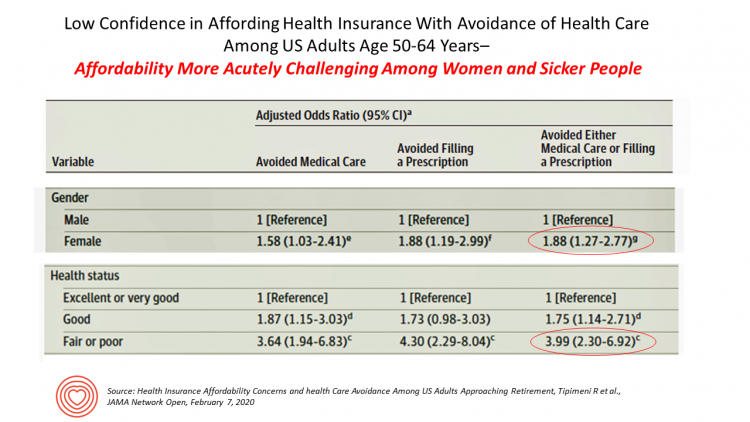

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

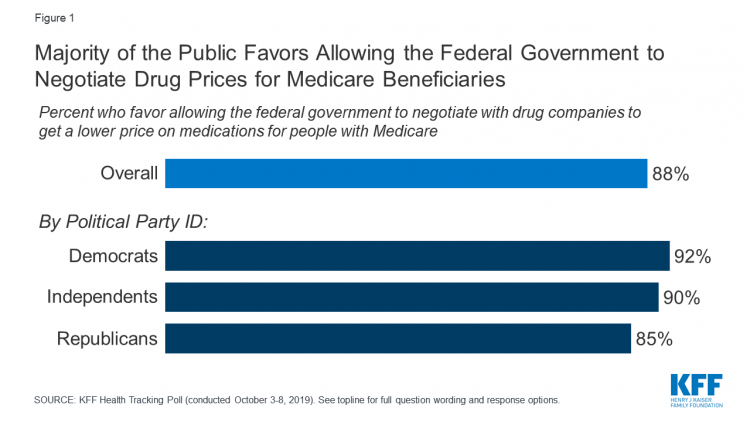

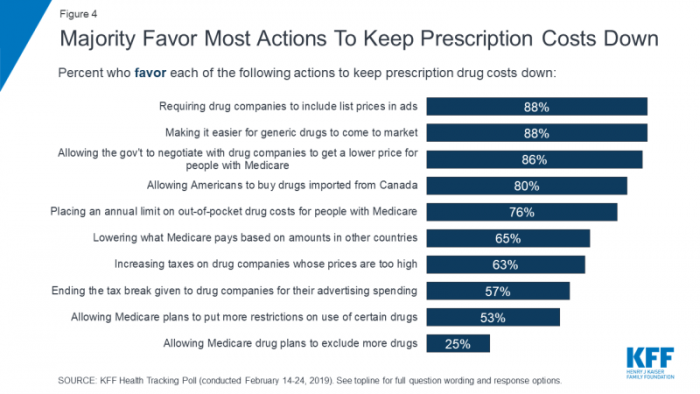

The State of the Union for Prescription Drug Prices

Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices. Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top

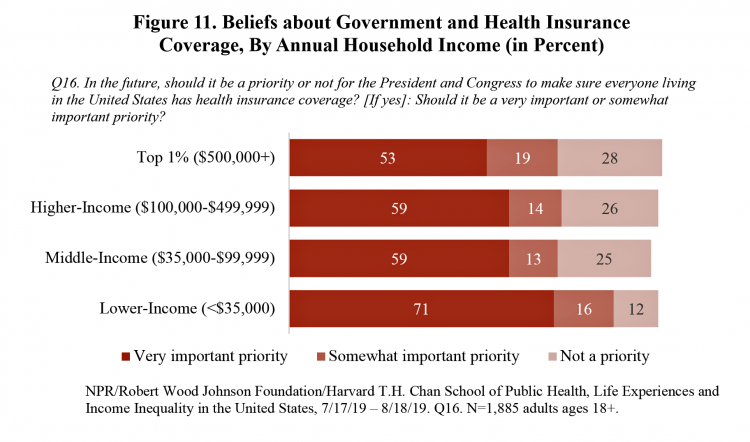

Most Americans Regardless of Income Say It’s Unfair for Wealthier People to Get Better Health Care

In America, earning lower or middle incomes is a risk factor for having trouble accessing health care and/or paying for it. But most Americans, rich or not, believe that it’s unfair for wealthier people to get better health care, according to a January 2020 poll from NPR, the Robert Wood Johnson Foundation and Harvard Chan School of Public Health, Life Experiences and Income Equality in the United States. The survey was conducted in July and August 2019 among 1,885 U.S. adults 18 or older. Throughout the study, note the four annual household income categories gauged in the research: Top 1%

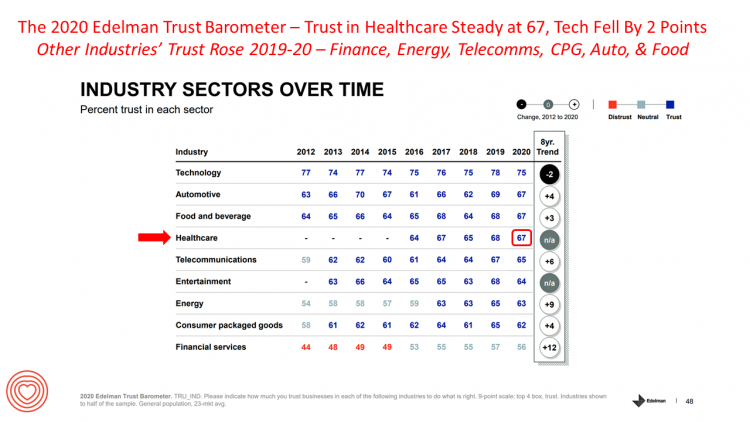

Income Inequality is Fostering Mis-Trust, the Edelman 2020 Trust Barometer Observes

Economic development has historically built trust among nations’ citizens. But in developed, wealthier parts of the world, like the U.S., “a record number of countries are experiencing an all-time high ‘mass-class’ trust divide,” according to the 2020 Edelman Trust Barometer. For 20 years, Edelman has released its annual Trust Barometer every year at the World Economic Forum in Davos, recognizing the importance of trust in the global economy and society. Last year, it was the employer who was the most-trusted touch-point in citizens’ lives the world over, I discussed in Health Populi one year ago. This year, even our employers can’t

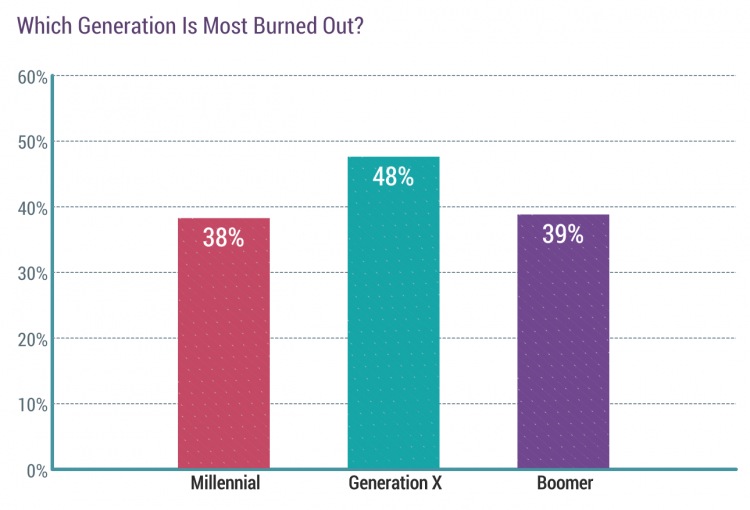

Physicians in America – Too Many Burned Out, Depressed, and Not Getting Support

Some one in three physicians is burned out, according to the Medscape’s National Physician Burnout & Suicide Report. The subtitle, “The Generational Divide,” tells a bit part of the subtext of this annual report that’s always jarring and impactful for both its raw numbers and implications for both patient care and the larger health care system in America. Nearly 1 in 2 physicians in Generation X, those people born between 1965 and 1979, feel burned out compared with roughly 4 in 10 doctors who are Millennials or Boomers. Furthermore, many more women than men physicians feel burned out: 48% of

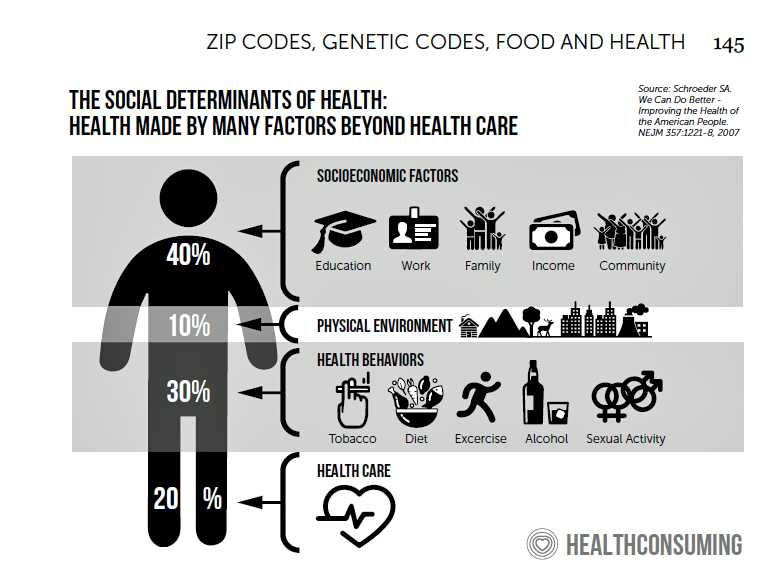

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

In 2020, PwC Expects Consumers to Grow DIY Healthcare Muscles As Medical Prices Increase

The new year will see a “looming tsunami” of high prices in healthcare, regulation trumping health reform, more business deals reshaping the health/care industry landscape, and patients growing do-it-yourself care muscles, according to Top health industry issues of 2020: Will digital start to show an ROI from the PwC Health Research Institute. I’ve looked forward to reviewing this annual report for the past few years, and always learn something new from PwC’s team of researchers who reach out to experts spanning the industry. In this 14th year of the publication, PwC polled executives from payers, providers, and pharma/life science organizations. Internally,

Medicare Members Are Health Consumers, Too – Our AHIP Talk About Aging, Digital Immigrants, and Personalizing Health/Care

As Boomers age, they’re adopting mobile and smart technology platforms that enable people to communicate with loved ones, manage retirement investment portfolios, ask Alexa to play Frank Sinatra’s greatest hits, and manage prescription refills from the local grocery store pharmacy. Last week, the Giant Eagle grocery chain was the first pharmacy retailer to offer a new medication management skill via Alexa. That program has the potential to change our Medicare members manage meds at home to ensure better adherence, supporting better health outcomes and personal feelings of efficacy and control. [As an aside, consumers really value pharmacies embedded in grocery

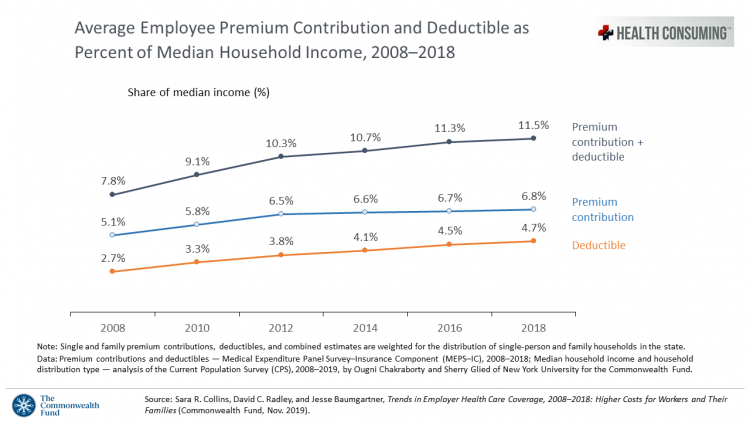

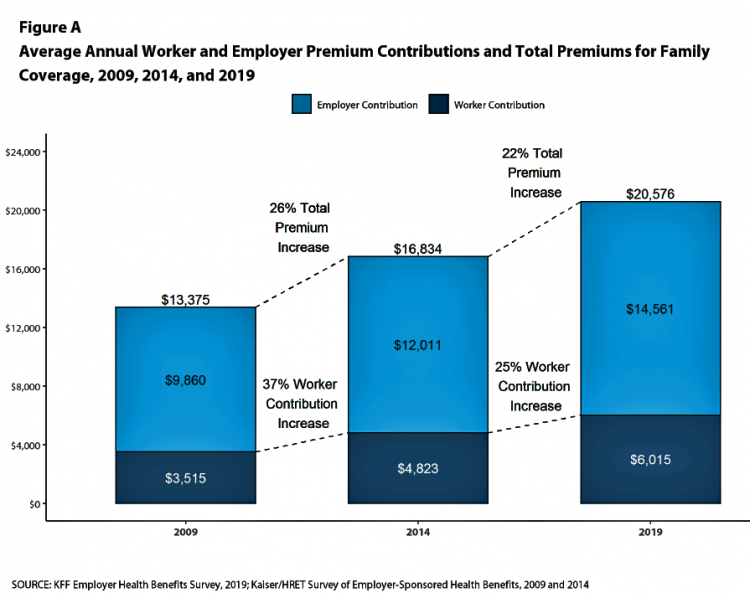

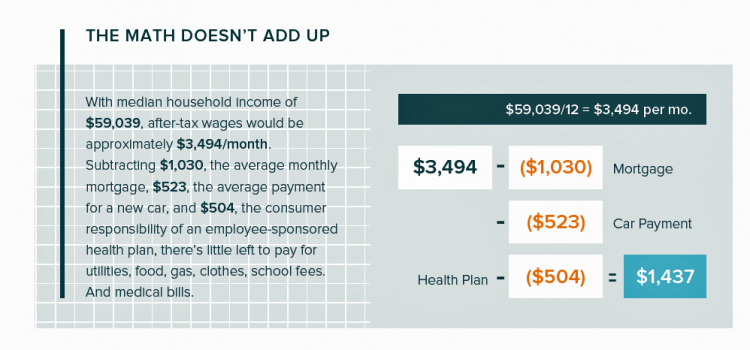

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Despite Greater Digital Health Engagement, Americans Have Worse Health and Financial Outcomes Than Other Nations’ Health Citizens

The idea of health care consumerism isn’t just an American discussion, Deloitte points out in its 2019 global survey of healthcare consumers report, A consumer-centered future of health. The driving forces shaping health and health care around the world are re-shaping health care financing and delivery around the world, and especially considering the growing role of patients in self-care — in terms of financing, clinical decision making and care-flows. With that said, Americans tend to be more healthcare-engaged than peer patients in Australia, Canada, Denmark, Germany, the Netherlands, Singapore, and the United Kingdom, Deloitte’s poll found. Some of the key behaviors

Hospitals Suffer Decline in Consumer Satisfaction

While customer satisfaction with health insurance plans slightly increased between 2018 and 2019, patient satisfaction with hospitals fell in all three settings where care is delivered — inpatient, outpatient, and the emergency room, according to the 2018-2019 ACSI Finance, Insurance and Health Care Report. ACSI polls about 300,000 U.S. consumers each year to gauge satisfaction with over 400 companies in 46 industries. For historic trends, you can check out my coverage of the 2014 version of this study here in Health Populi. The 2019 ACSI report bundles finance/banks, insurance (property/casualty, life and health) and hospitals together in one document. Health

Longevity Stalls Around the World And Wealth, More Concentrated

Two separate and new OECD reports, updating health and the global economic outlook, raise two issues that are inter-related: that gains in longevity are stalling, with chronic illnesses and mental ill health affecting more people; and, as wealth grows more concentrated among the wealthy, the economic outlook around most of the world is also slowing. First, we’ll mine the Health at a Glance 2019 annual report covering data on population health, health system performance, and medical spending across OECD countries. The first chart arrays the x-y data points of life expectancy versus health spending for each of the OECD countries

Social Determinants of Health – My Early Childhood Education and Recent Learnings, Shared at the HealthXL Global Gathering

My cousin Arlene got married in Detroit at the classic Book Cadillac Hotel on July 23, 1967, a Sunday afternoon wedding. When Daddy drove us back out to our suburban home about 30 minutes from the fancy hotel, the car radio was tuned to WWJ Newsradio 950, all news all the time. As soon as Daddy switched on the radio, we were shocked by the news of a riot breaking out in the city, fires and looting and gunshots and chaos in the Motor City. Two days later, my father, who did business with Mom-and-Pop retail store owners in the

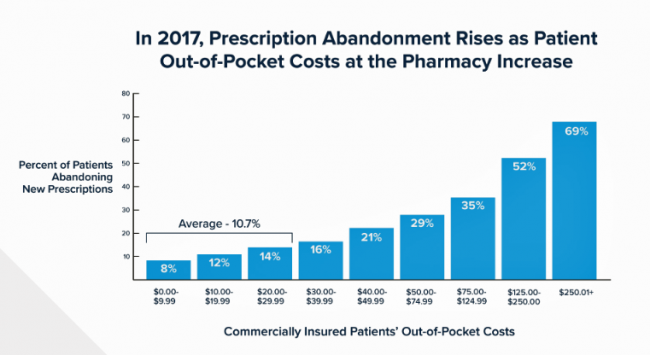

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

A Tale of Two Americas as Told by the 2019 OECD Report on Health

It was the best of times, It was the worst of times, It was the age of wisdom, it was the age of foolishness, It was the epoch of belief, it was the epoch of incredulity, … starts Dickens’ Tale of Two Cities. That’s what came to my mind when reading the latest global health report from the OECD, Health at a Glance 2019, which compares the United States to other nations’ health care outcomes, risk factors, access metrics, and spending. Some trends are consistent across the wealthiest countries of the world, many sobering, such as: Life expectancy rates fell in 19 of the

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

Great Expectations for Health Care: Patients Look for Consumer Experience and Trust in Salesforce’s Latest Research

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies. But as payors, health consumers face challenges in getting care, so great expectations are met with frustration and eroding trust with the system, according to the latest Connected Healthcare Consumer report from Salesforce published today as the company announced expansion of their health cloud capabilities. This is

While Costs Are A Top Concern Among Most U.S. Patients, So Are Challenges of Poverty, Food, and Housing

Rising health care costs continue to concern most Americans, with one in two people believing they’re one sickness away from getting into financial trouble, according to the 2019 Survey of America’s Patients conducted for The Physicians Foundation. In addition to paying for “my” medical bills, most people in the U.S. also say that income inequality and inadequate social services significantly contribute to high medical spending for every health citizen in the nation. The Physicians Foundation conducts this study into Americans’ views on the U.S. health care system every other year. This year’s poll was conducted in September 2019 and included input

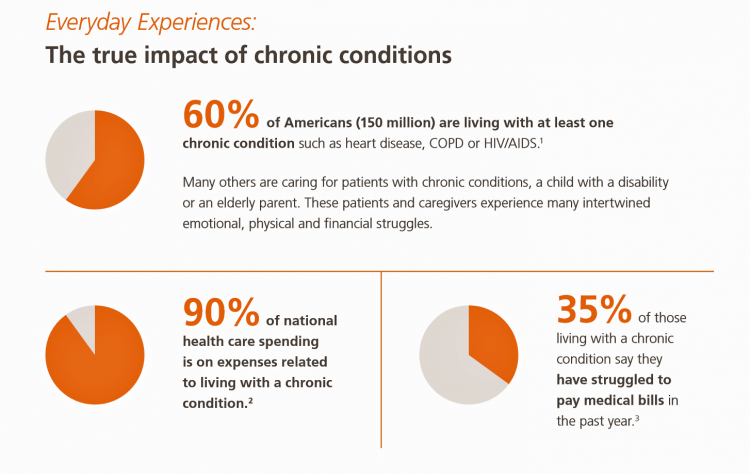

Making Health Care Better, from the N of 1 to the Public’s Health – Trend-Weaving Medecision Liberation 2019

Health and our health information are deeply personal. Changing health care and inspiring positive health behaviors is hard to do. But we must and we will, a group of inspiring and inspired people who work across the health/care ecosystem affirmed this week in Dallas at the conference of Medecision Liberation 2019. I was engaged at this conference to wear several hats — as a keynote speaker, a sort of “emcee,” and, finally, to trend-weave the many talks and discussions happening throughout the meeting. This post is my synthesis of the summary I delivered live at the end of the conference,

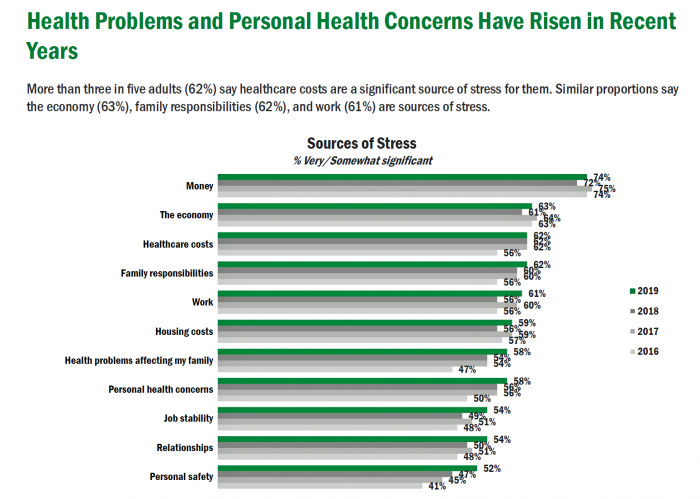

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

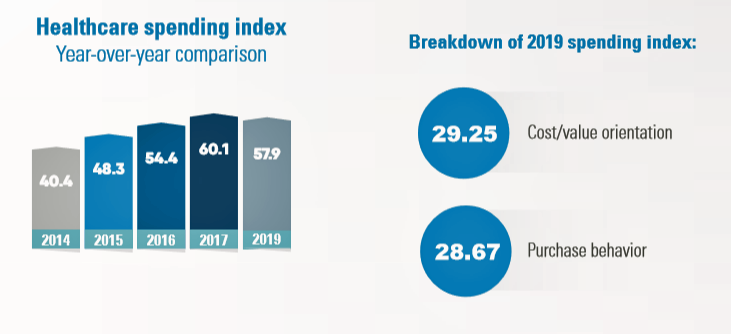

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

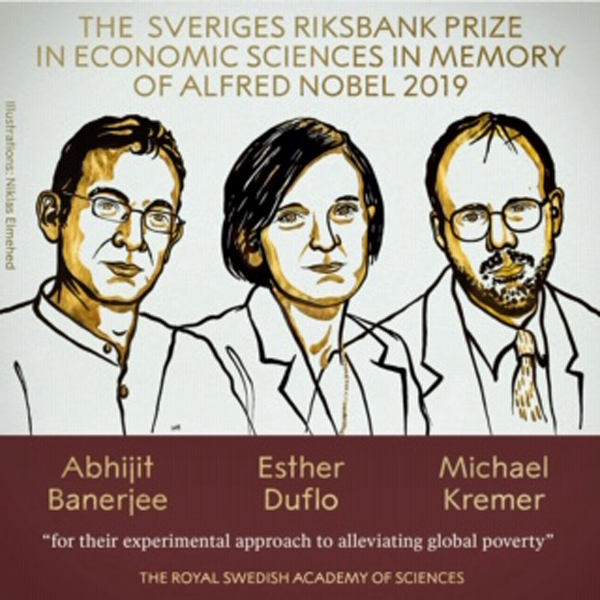

What the 2019 Nobel Prize Winners in Economics Teach Us About Health

The three winners of the 2019 Nobel Prize for Economics — Banerjee and Duflo (both of MIT) and Kremer (working at Harvard) — were recognized for their work on alleviating global poverty.” “Over 700 million people still subsist on extremely low incomes. Every year, five million children still die before their fifth birthday, often from diseases that could be prevented or cured with relatively cheap and simple treatments,” The Nobel Prize website notes. To respond to this audaciously huge challenge, Banerjee, Duflo and Kremer asked quite specific, granular questions that have since shaped the field of development economics — now

There Is No Health Without Mental Health – Today Is World Mental Health Day

There is no health without mental health. Every 40 seconds, someone loses their life to suicide. So #LetsTalk (the Twitter hashtag to share stories and research and support on the social feed). Today is October 10th, World Mental Health Day. As we go about our lives today and truly every day, we should be mindful that mental health is all about each of us individually, and all of us in our communities and in the world. First, let’s hear from Prince Harry and Ed Sheeran (who, video spoiler alert, decides to pivot his lyrics to a draft song titled “Gingers

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

“It’s the Deductible, Stupid” – Health Premiums Reach $20,576 in 2019 for a Family

Here’s the latest arithmetic on American workers’ financial trade-off of wages for health care insurance coverage: in the ten years since 2009, family premiums have risen 54% and workers’ contribution to health care spending grew 71%. Wages? They rose 26%, and general price inflation by 20%, according to the Kaiser Family Foundation survey on employer-sponsored benefits for 2019 released yesterday. Survey details for this 21st annual encyclopedia on employer-sponsored health care are published in Health Affairs October 2019 issue in a paper titled, Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy. Because this

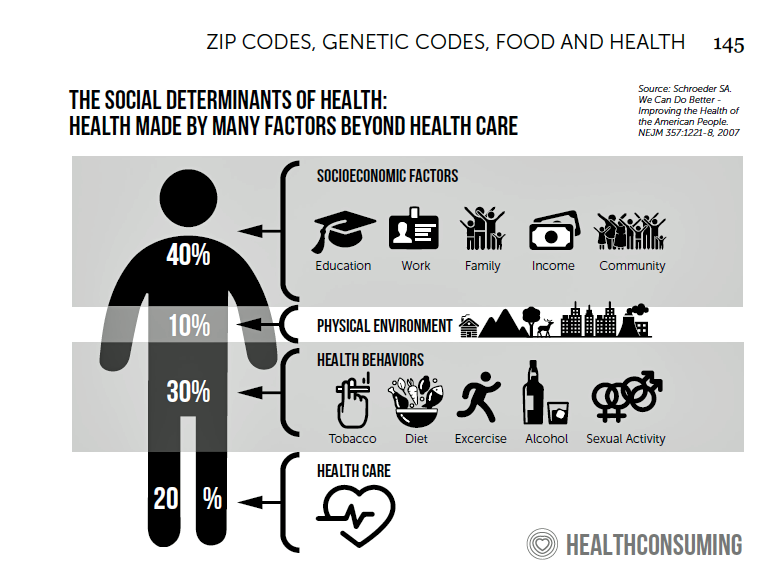

The Rise of Social Determinants of Health in Healthcare is Just Real Life Stuff for People, Patients, Consumers

Based on the influx of research studies and position papers on social determinants of health flowing into my email box and Google Alerts, I can say we’re past the inflection point where SDoH is embraced by hospitals, professional societies, health plans and even a couple of pioneering pharma companies. PwC published a well-researched global-reaching report this week appropriately titled, Action required: The urgency of addressing social determinants of health. The “wheel of determinants” illustrates potential partners for collaborating in communities to address SDoH factors. The collaborators include governments, health care providers, payors, life science and pharma, tech and telecomms, policy

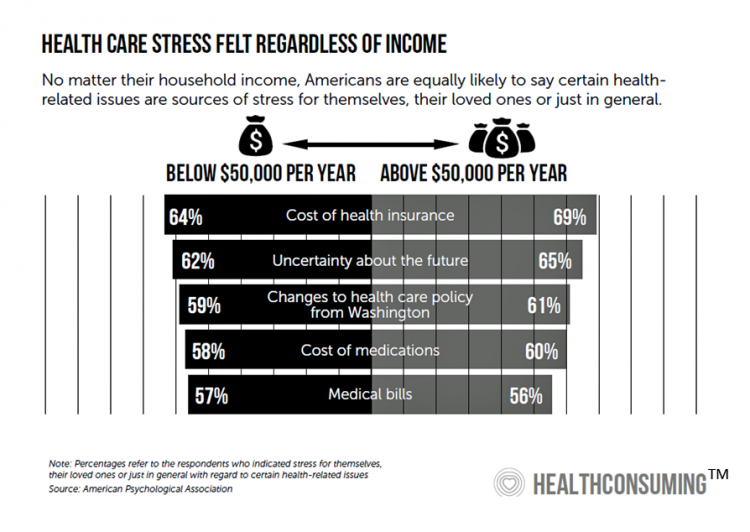

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

Worrying About Possible Recession Compels Health Consumers to Seek Less Care

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space. Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care. Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll. The other side of this personal health

Celebrating “Labor Day” Welcoming Natalist to Our Health Ecosystem

There are many definitions of the word, “labor.” Oxford Dictionary provides context for the definition as follows: To work, as in especially hard physical work To make great effort (as in, “laboring from dawn to dusk”) To have difficulty in doing something despite working hard. For this third point, Oxford offers these synonyms: “strive, struggle, endeavor, try hard, do one’s best, do all one can, go all out, fight, push, be at pains, put oneself out.” And finally, one fourth contextual point: “A labor of love.” That is indeed the perfect framing this Labor Day week for my welcome to

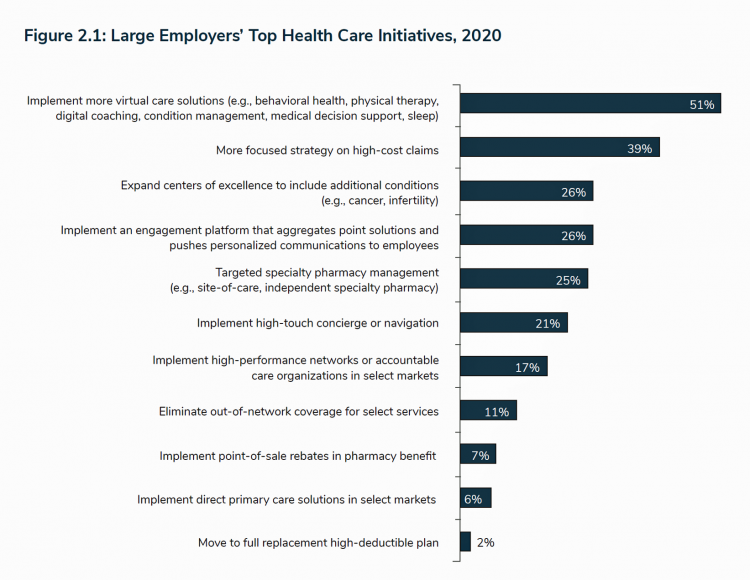

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

Health Care Bills’ Financial Toxicity – Remembering the Jones’ of Whatcom County, WA

“In an extreme example of angst over expensive medical bills, an elderly Washington couple who lived near the U.S.-Canadian border died in a murder-suicide this week after leaving notes that detailed concerns about paying for medical care,” USA Today reported on August 10, 2019. Five years ago, financial toxicity as a side-effect was noted by two Sloan Kettering Medical Center in a landmark report on 60 Minutes in October 2014. Epidemiologist Peter Bach and oncologist Leonard Saltz told CBS’s Lesley Stahl, “A cancer diagnosis is one of the leading causes of personal bankruptcy…We need to take into account the financial

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

Gaps in Health Equity in America Are Growing

There’s been a “clear lack of progress on health equity during the past 25 years in the United States,” asserts a data-rich analysis of trends conducted by two professors/researchers from UCLA’s School of Public Health. The study was published this week in JAMA Network Open. The research mashed up several measures of health equity covering the 25 years from 1993 through 2017. The data came out of the Centers for Disease Control and Prevention’s Behavioral Risk Factor Surveillance System looking at trends by race/ethnicity, sex and income across three categories for U.S. adults between 18 and 64 years of age.

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

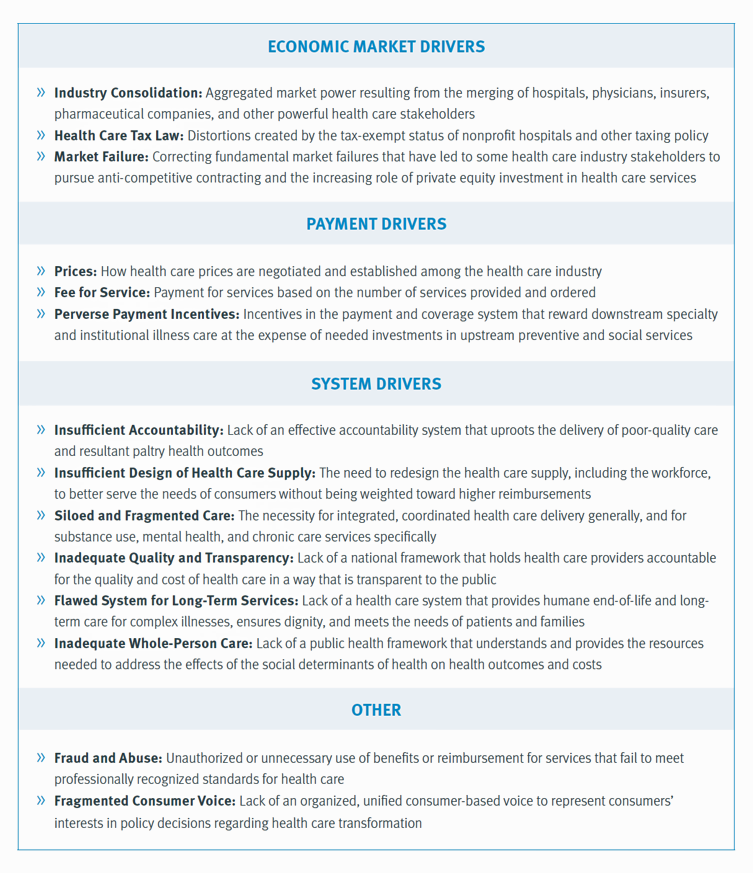

Americans Could Foster a Health Consumer Movement, Families USA Envisions

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

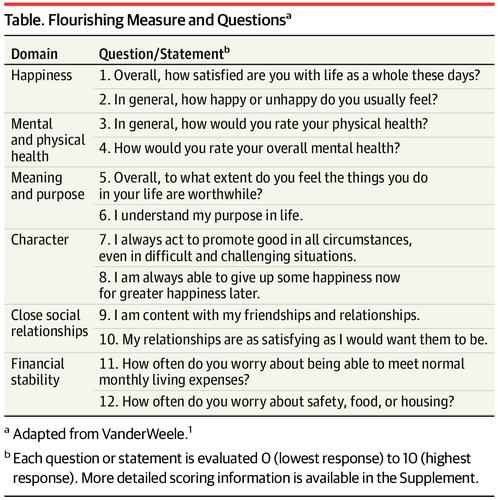

People Want to Flourish, Not Just Live – Speaking Health Politics to Real People

“How should we define ‘health?'” a 2011 BMJ article asked. The context for the question was that the 1948 World Health Organization definition of health — that health is, “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”– was not so useful in the 21st century. The authors, a global, multidisciplinary team from Europe, Canada and the U.S., asserted that by 2011, human health was marked less by infectious disease and more by non-communicable conditions that could be highly influenced, reversed and prevented through self-care by the individual and public health policy

How Consumers’ Belt-Tightening Could Impact Health/Care – Insights from Deloitte’s Retail Team

Over the ten years between 2007 and 2017, U.S. consumer spending for education, food and health care substantially grew, crowding out spending for other categories like transportation and housing. Furthermore, income disparity between wealthy Americans and people earning lower-incomes dramatically widened: between 2007-2017, income for high-income earners grew 1,305 percent more than lower-incomes. These two statistics set the kitchen table for spending in and beyond 2019, particularly for younger people living in America, considered in Deloitte’s report, The consumer is changing, but perhaps not how you think. The authors are part of Deloitte Consulting’s Retail team. The retail spending data

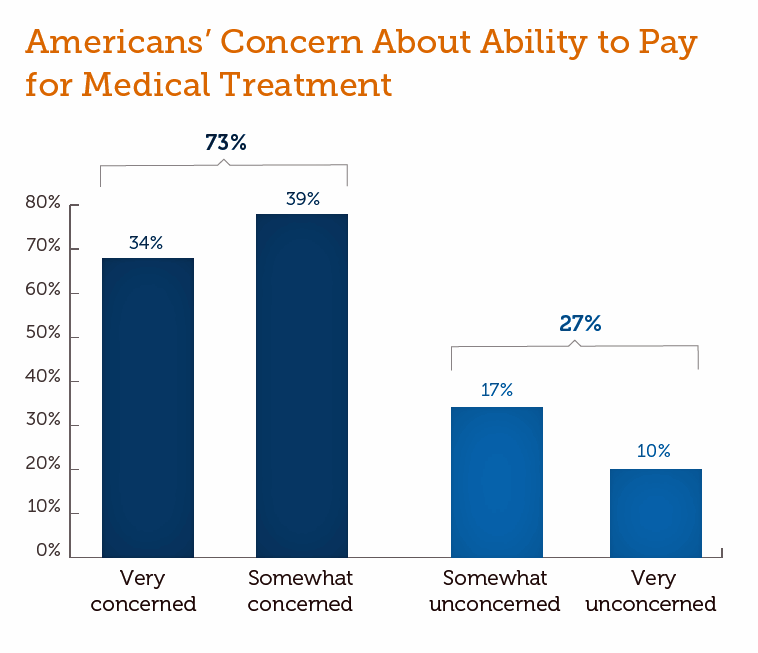

Health Care Costs Still Americans’ Top Financial Worry Among All Money Concerns

Health care costs rank ahead of Americans’ money-worries about low wages and availability of cash, paying for college, house payments, taxes, and debt, according to the latest Gallup poll on peoples’ most important family financial problems in 2019. Medical costs have, in fact, ranked at the top of this list for three years in a row, with a five percentage point rise between 2018 and 2019. No other financial concern had that growth in increase-of-money-worries in the past year. Health care costs rank the top financial problem for people across all income levels. One in five families (19%) earning under

Patients’ Expectations for Health Beyond Care: Think Food, Exercise, Emotions, Sleep and Finance

People want to make health with their health care providers, and they want more than care from them: most patients are looking for support with healthy eating, exercise, emotional support, sleep, stress management, social relationships, and financial health. And in case physicians, nurses and pharmacists aren’t sufficiently business with that punch-list for health, two in three U.S. patients would also like to receive help in finding a higher purpose. This is the health consumer’s mass call-out for holistic health, Welltok discovered in a survey conducted among over 1,600 U.S. adults in March 2019. The results are detailed in the assertively

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

Scaling the Social Determinants of Health – McKinsey and Kaiser’s Bold Move

People who are in poor health or use more health care services are more likely to report multiple unmet social needs, such as food insecurity, unsafe neighborhoods, lack of good housing, social isolation, and poor transportation access, found through a survey conducted by McKinsey. The results are summarized in Addressing the Social Determinants of Health. The growing recognition of the influence of social determinants reached a tipping point last week with the news that Kaiser-Permanente would work with Unite US to scale services to people who need them. The mainstreaming of SDoH speaks to the awareness that health is made

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

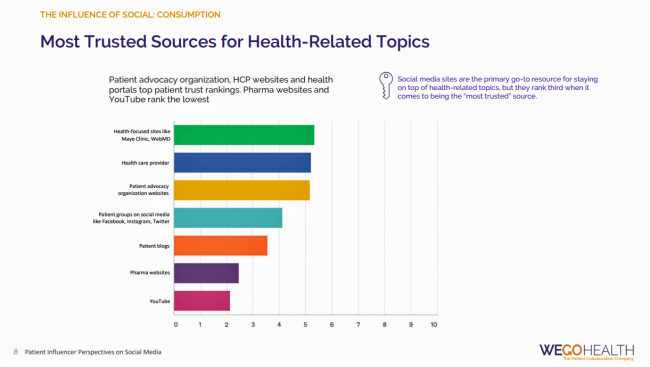

Listen Up, Healthcare: Hear The Patient’s Voice!

Consider the voice of a patient before the advent of the Internet in the digital 1.0 world, and then the proliferation of social networks in v 2.0. One patient could talk with another over their proverbial neighborhood fence, a concerned parent at the PTA meeting with others dealing with a children’s health issue, or a recovering alcoholic testifying in person at an AA session. Today, the voice of the patient is magnified one-to-many, omnichannel and multi-platform — via video, blogs, podcasts, social networks, listservs….and, yes, still in live forums like AA meetings, church basements, Y-spaces, and the Frazzled Cafe meet-ups

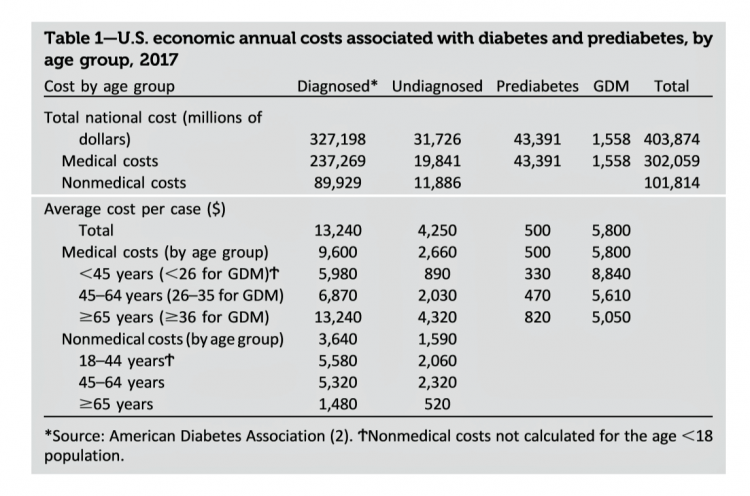

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

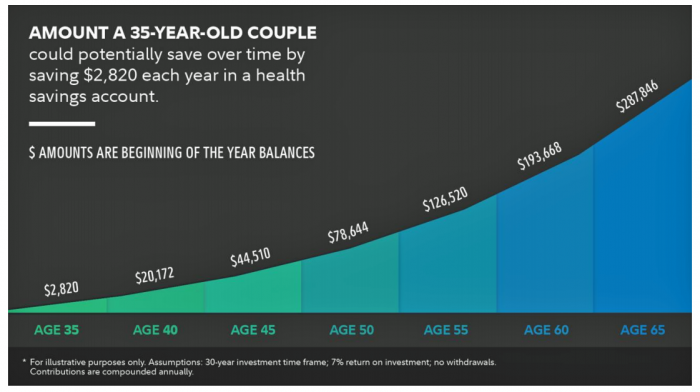

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

World Health Day 2019: Let’s Celebrate Food, Climate, Insurance Coverage and Connectivity

Today, 7 April, is World Health Day. With that in mind, I devote this post to three key social determinants of health (SDOH) that are top-of-mind for me these days: food for health, climate change, and universal health coverage. UHC happens to be WHO’s focus for World Health Day 2019. [As a bonus, I’ll add in a fourth SDOH in the Hot Points for good measure and health-making]. Why a World Health Day? you may be asking. WHO says it’s, “a chance to celebrate health and remind world leaders that everyone should be able to access the health care they need,

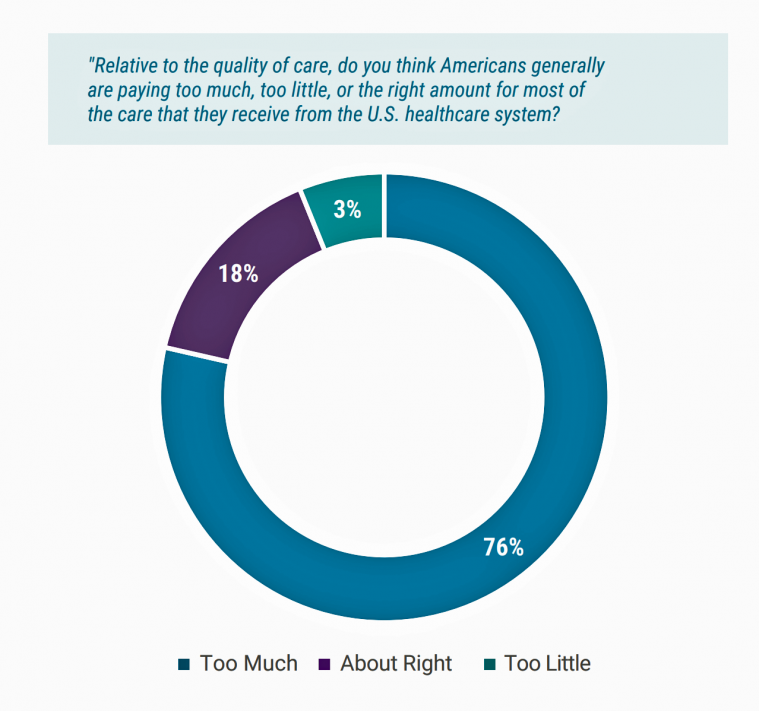

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

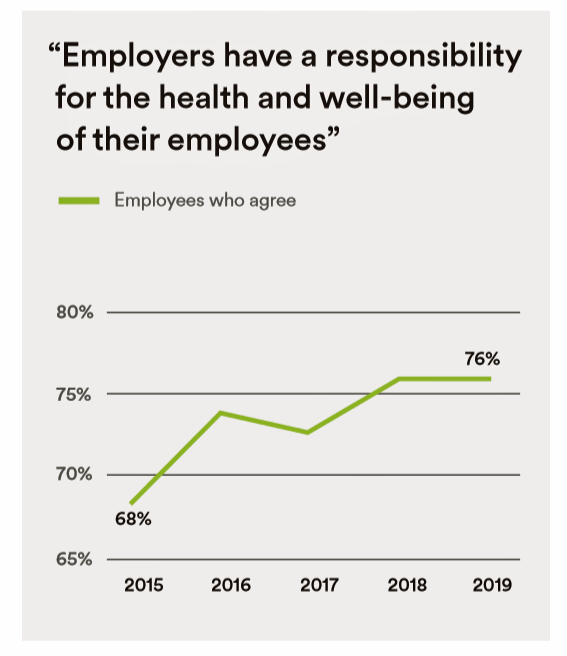

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

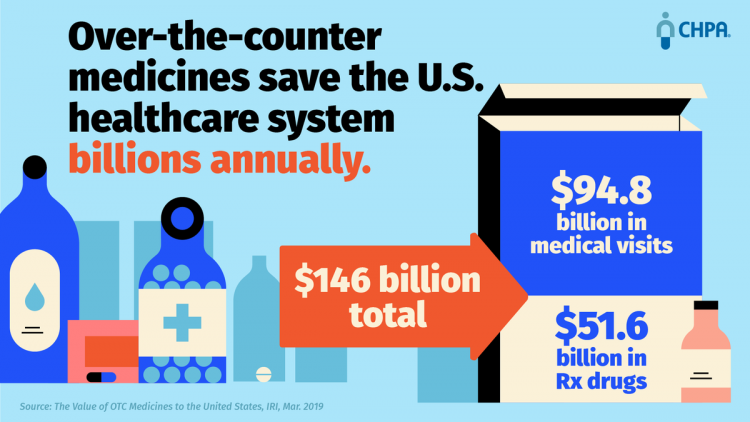

The Evolution of Self-Care for Consumers – Learning and Sharing at CHPA

Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts. The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look

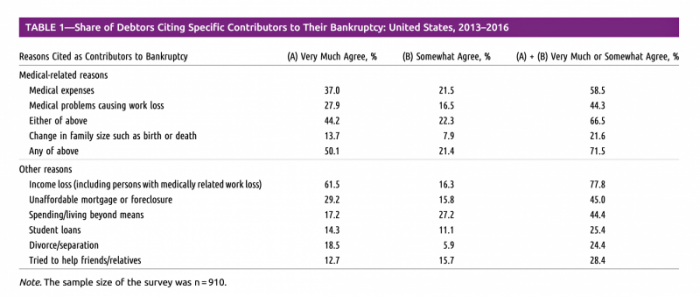

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

Most Americans Across Party ID Favor U.S. Government Negotiation to Lower Rx Drug Costs

There’s little Americans, by political party, agree upon in 2019. One of the only issues bringing people together in the U.S. is prescription drug prices — that they’re too high, that the Federal government should negotiate to lower costs for Medicare enrollees, and that out-of-pocket costs for drugs should be limited. The Kaiser Family Foundation has been tracking this topic for a few years, and this month, their March 2019 Health Tracking Poll shows vast majorities of Democrats, Independents and Republicans all share these sentiments. It’s not that patients who take prescription drugs don’t appreciate them – most (58%) say medicines

The Cost of Prescription Drugs, Doctors and Patient Access – A View from HIMSS19

Most patient visits to doctors result in a prescription written for a medicine that people retrieve from a pharmacy, whether retail in the local community or via mail order for a maintenance drug. This one transaction generates a lot of data points, which individually have a lot of importance for the individual patient. Mashed with other patients’, prescription drug utilization data can combine with more data to be used for population health, cost-effectiveness, and other constructive research pursuits. At HIMSS19, there’s an entire day devoted to a Pharma Forum on Tuesday 12 February, focusing on pharma-provider-payor collaborations. Allocating a full

Care Gets Personal at Philips for Parents and Babies

Our homes should nurture our health. In addition to nutrition and good food, positive relationships, clean air and water, and the basic needs that bolster whole health, technology is playing a growing role to help us manage health at home. At CES 2019, I spent time with Roy Jakobs, Chief Business Leader of Personal Health with Philips, to discuss the company’s evolving portfolio of products that help fulfill the mission to support people across their own continuum of health. Following CES, I wanted to further dive into one part of the portfolio very important to family health at home: the

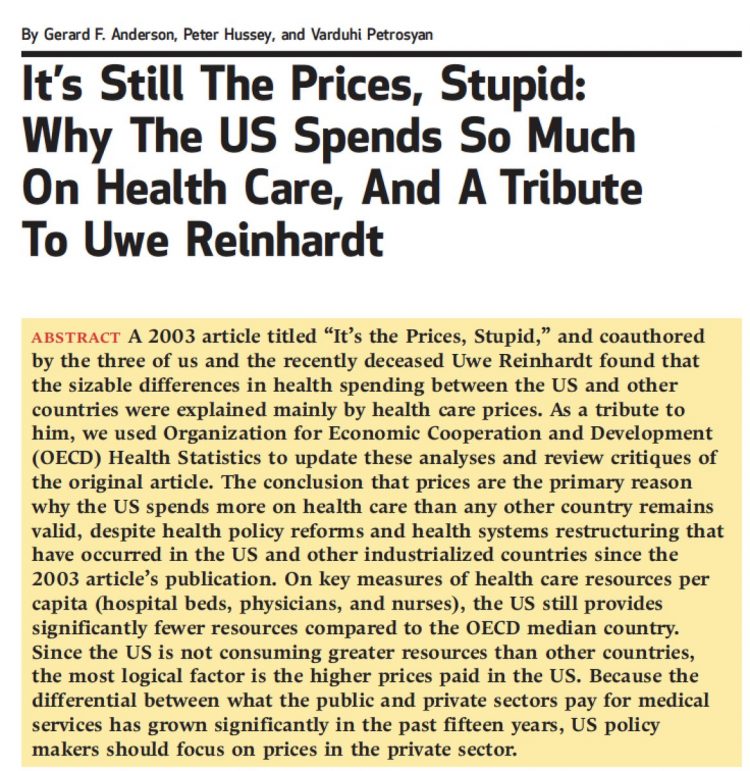

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

Hackathons are intense, fast-paced events where interdisciplinary teams come together to solve complex problems. In this SEE YOU NOW Insight from

Hackathons are intense, fast-paced events where interdisciplinary teams come together to solve complex problems. In this SEE YOU NOW Insight from  I'm once again pretty gobsmackingly happy to have been named a judge for

I'm once again pretty gobsmackingly happy to have been named a judge for  Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during

Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during