“Listen to Me:” Personalization in Health Care Starts With Taking Patients’ Voices Seriously – the 15th Beryl Institute-Ipsos PX Pulse Survey

Patients’ experience with health care in the U.S. dropped to its lowest point over the past year, explained in the 15th release of The Beryl Institute – Ipsos PX Pulse survey. The study into U.S. adult consumers’ perspectives defined “patient experience” (PX) as, “The sum of all interactions, shaped by an organization’s culture, that influence patient perceptions across the continuum of care.” The survey was fielded by Ipsos among 1,018 U.S. adults in March 2024. Health care providers (and other industry stakeholders that go B2B or B2B2C (or P) are all thinking

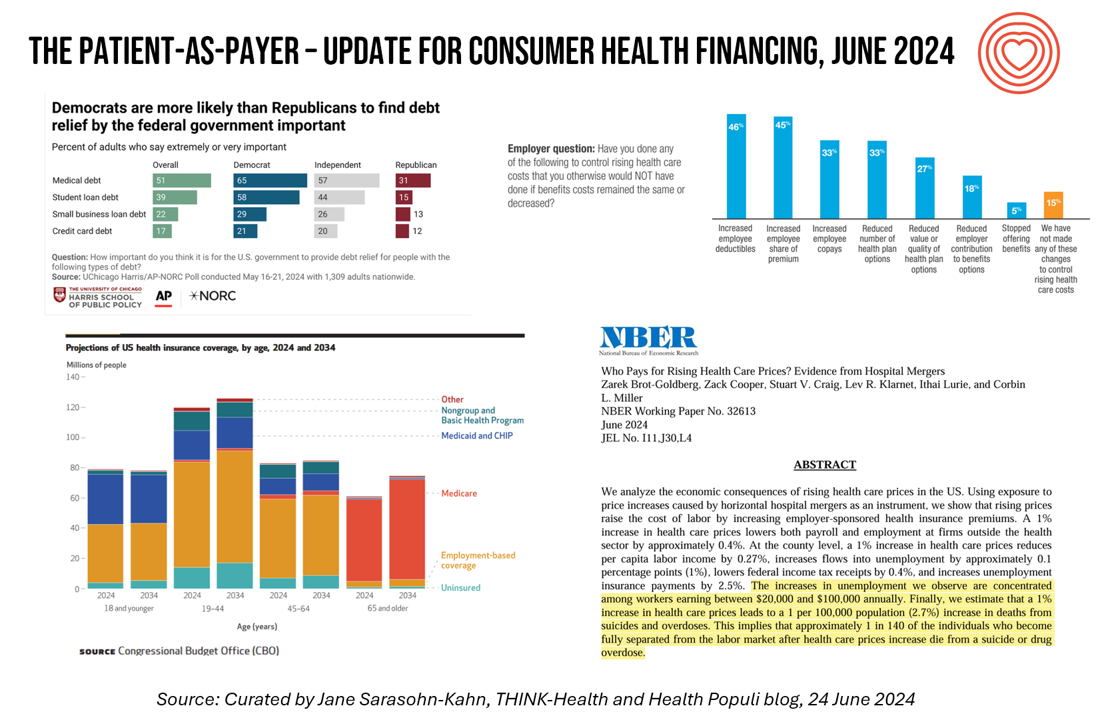

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

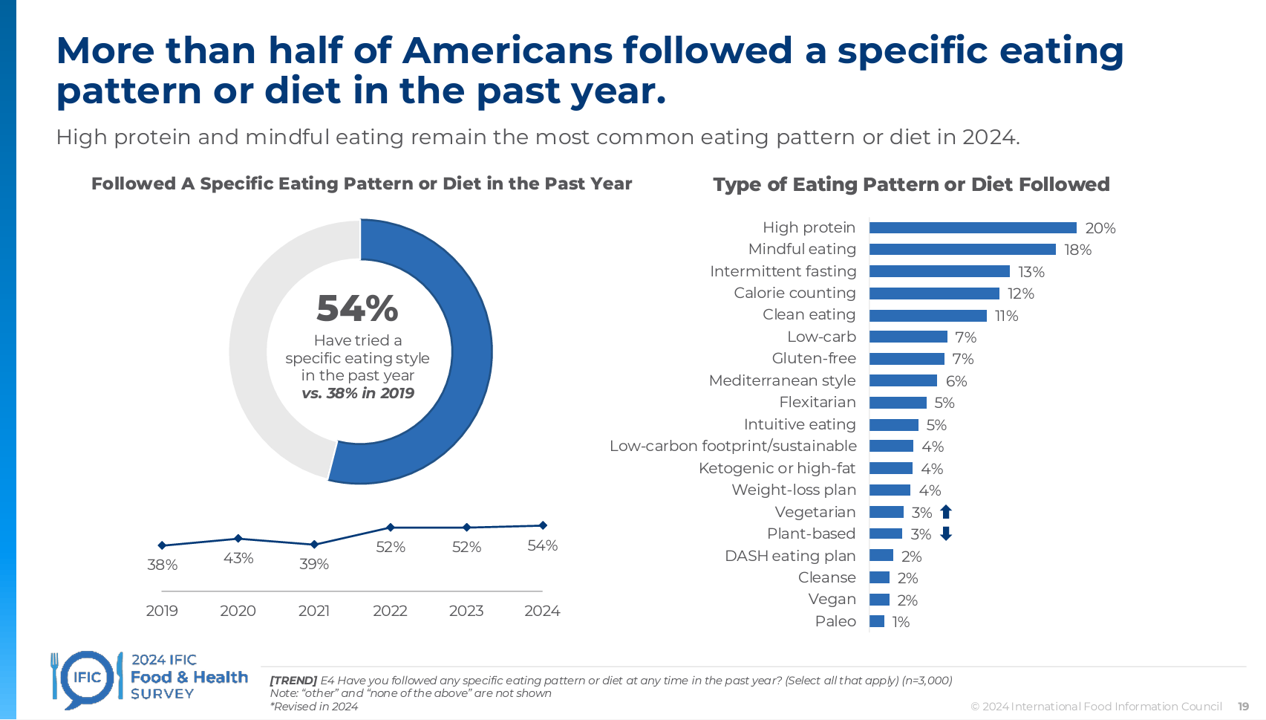

Most Americans Follow an Eating Pattern in Search of Energy, Protein, and Well-Being – With Growing Financial Stress: A Food as Medicine Update

Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned. In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense

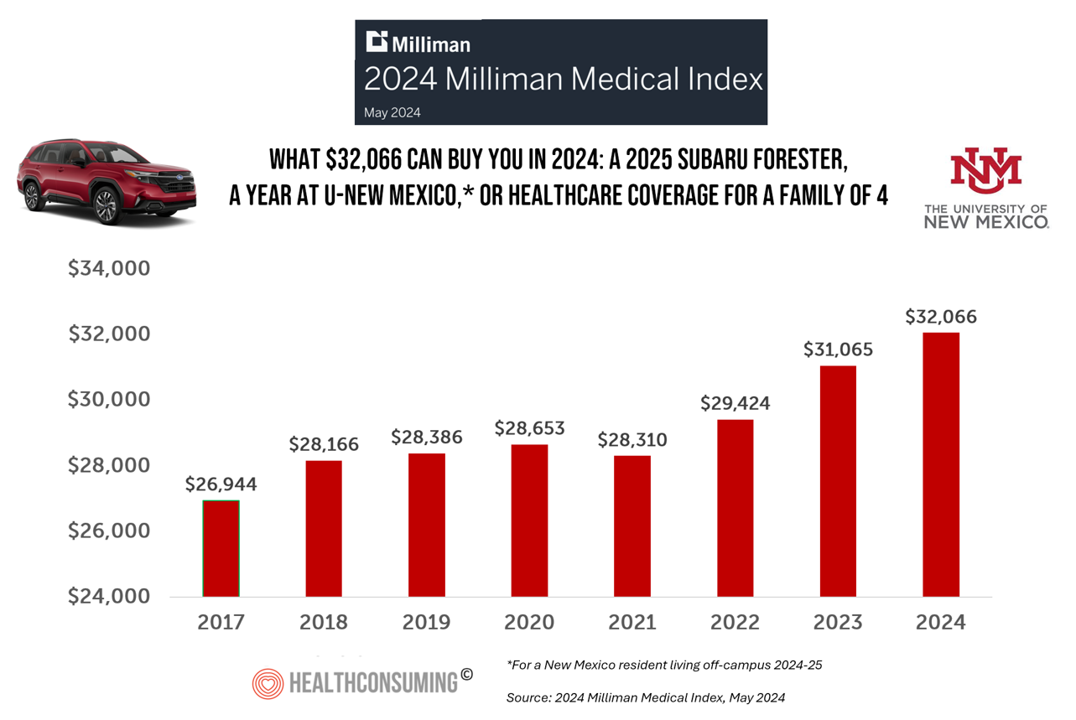

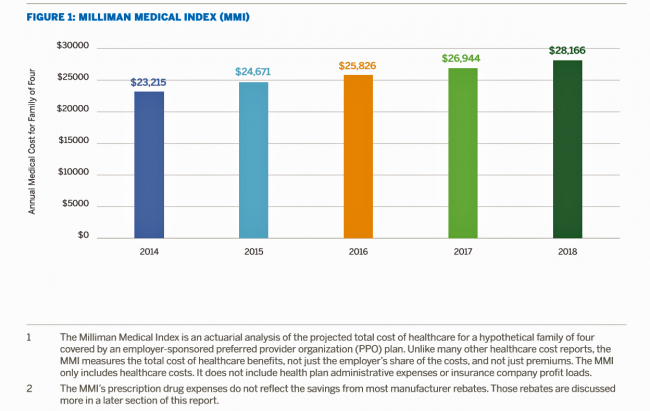

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

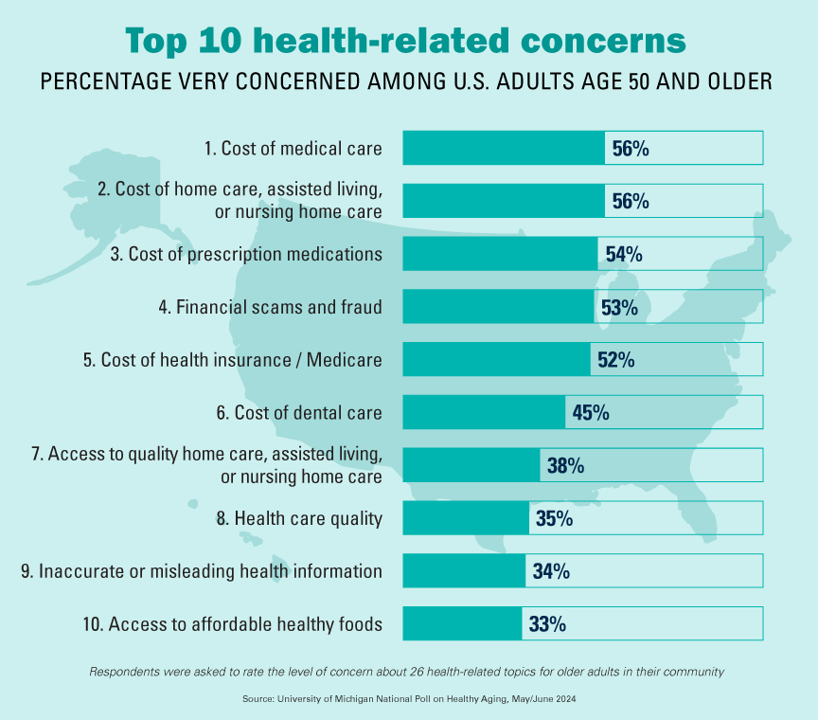

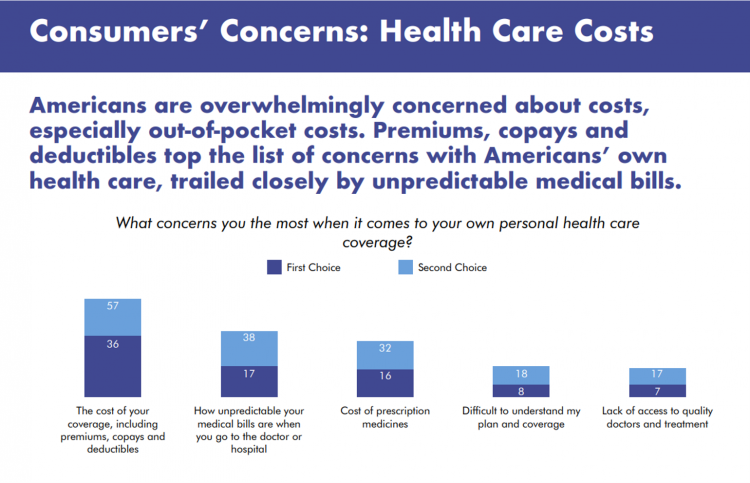

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

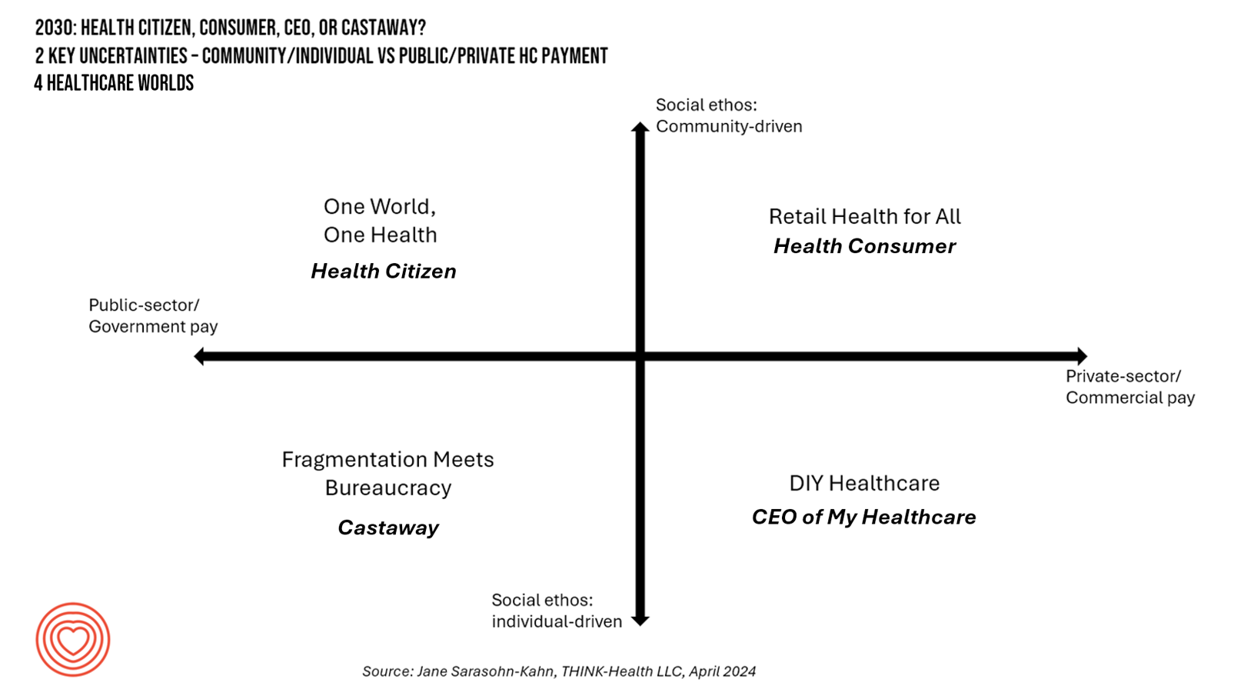

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

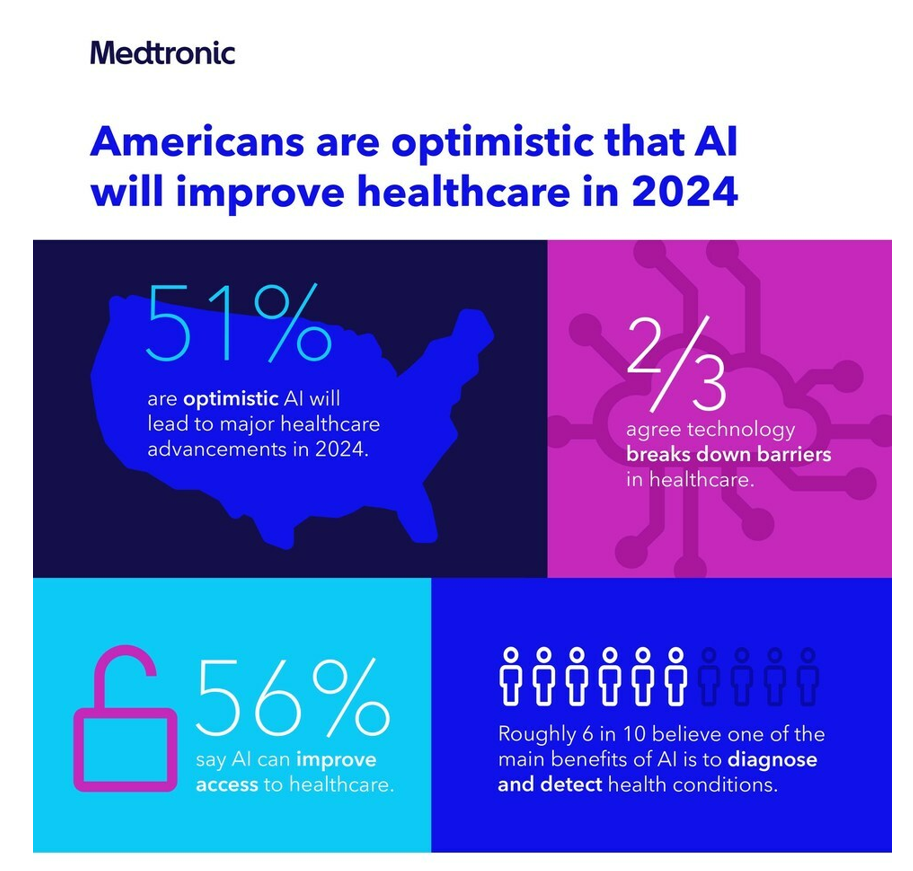

The Consumerization of AI in Healthcare – The Early Days of AI-Trust

Most people in the U.S. are bullish on the role AI will play in health care in 2024, especially to lower access barriers to care and to diagnose and detect health conditions. Two new studies point to the consumerization of AI in healthcare, from Medtronic and Deloitte. This post weaves their findings together and suggests some planning points for 2024. Medtronic collaborated with Morning Consult to poll 2,213 U.S. adults in late September 2023 to gauge peoples’ perspectives on AI and health care. With such optimism among health consumers comes some

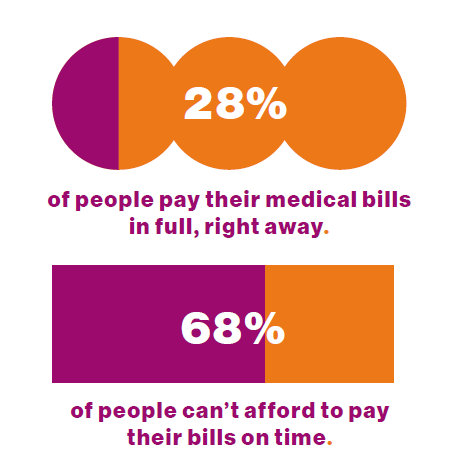

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

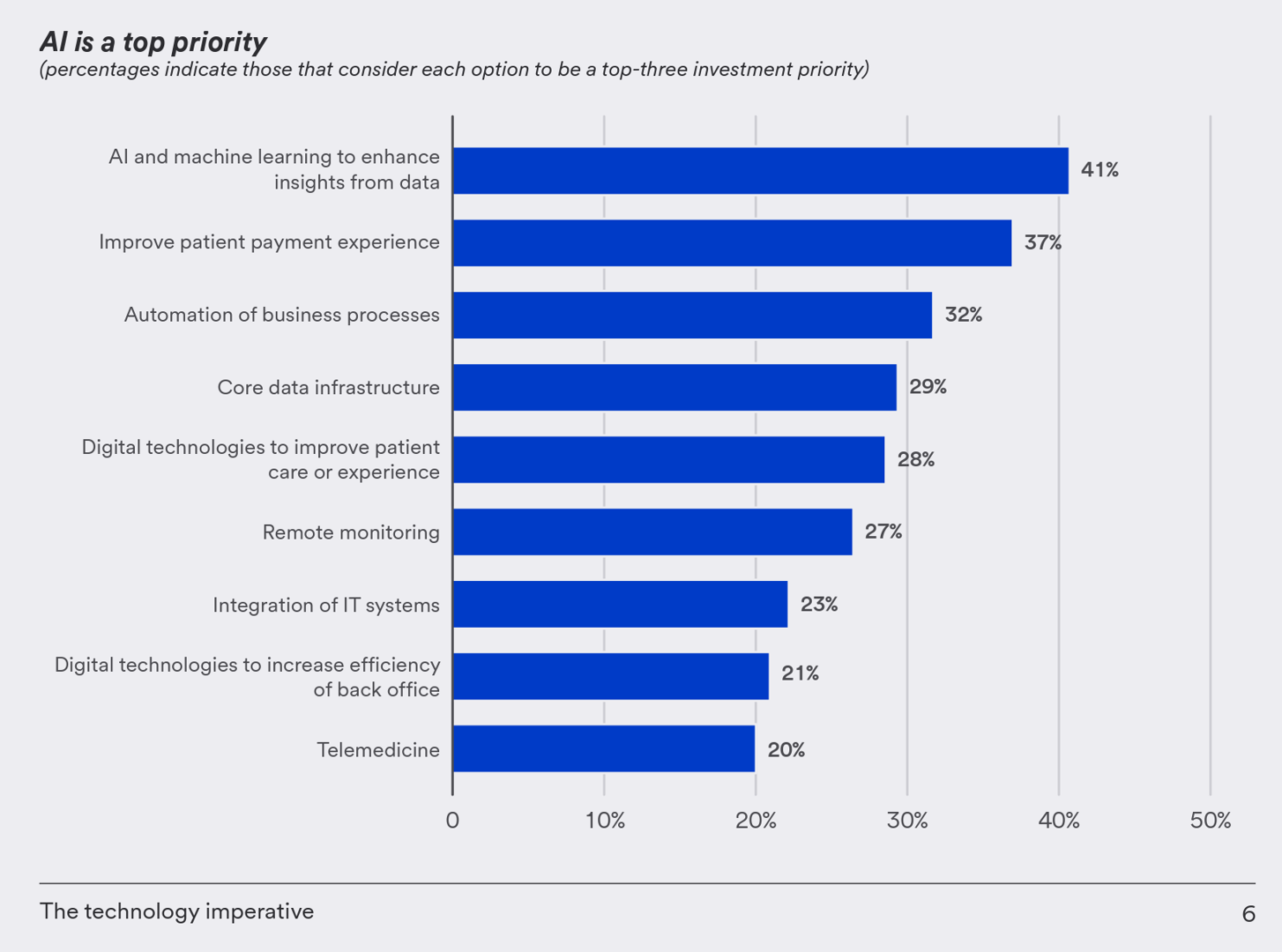

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

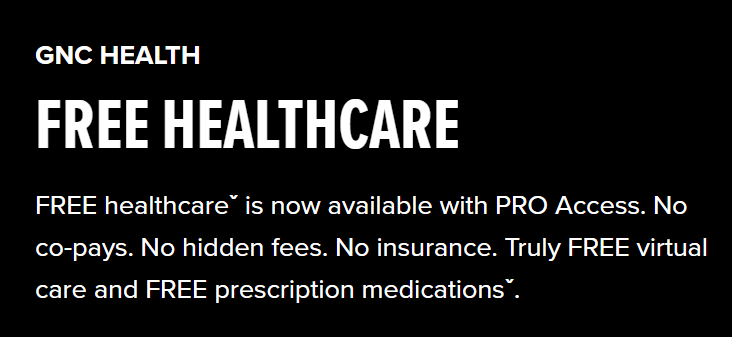

GNC Offers “Free Healthcare” — Telehealth, Generic Meds, and Loyalty in the Retail Health Ecosystem

The retail health landscape continues to grow, now with GNC Health offering a new program featuring telehealth and “curated set” of 40+ generic prescription drugs commonly used in urgent care settings. The services are available to members of GNC’s new-and-improved loyalty program, GNC PRO Access, which is priced at a fixed fee of $39.99 for one year’s membership. This is available to consumers 18 years of age and older. “As a trusted brand in the health and wellness space, we are thrilled to expand our efforts in helping our customers Live Well by offering

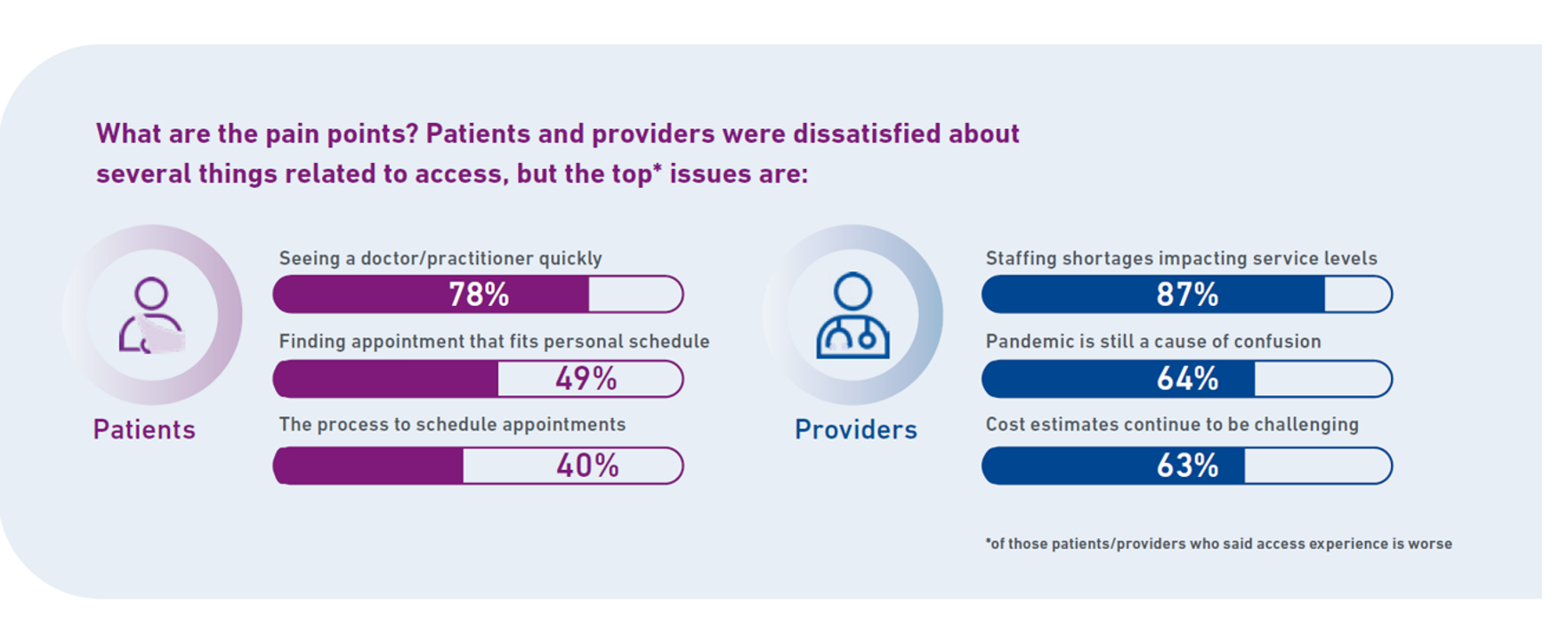

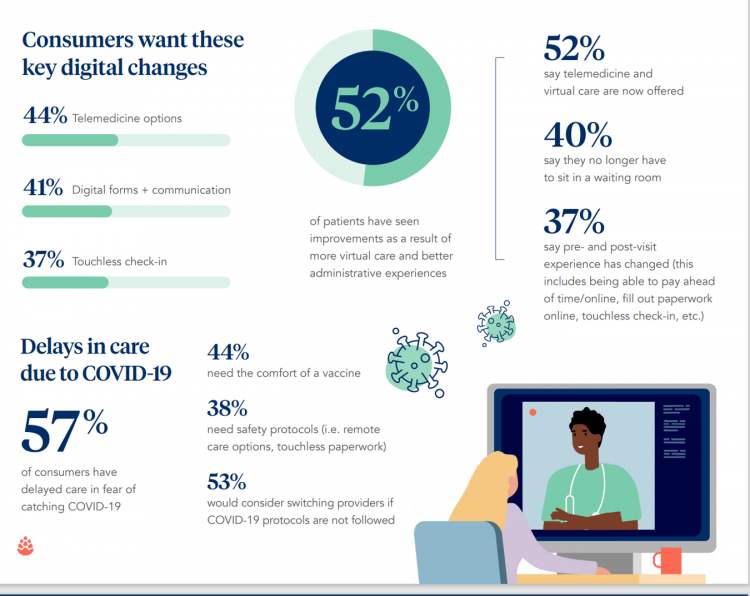

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

Women’s Health on Her Own Terms – “She Knows” What She Needs

Despite some improvement in the representation of women by cinema, TV shows, and brands, distortions in media remain that are risks to women receiving appropriate health care. Breaking through taboos of weight, reproductive services, and mental health are the top 3 factors preventing women from getting proper care, according to Health On Her Terms, a research study from WPP and Ogilvy partnering with SeeHer, an organization of collaborations from media, technology, business, education, and other sectors (including over 7,000 brands) focused on the accurate portrayal of women and girls in society. Taglined as “The Marketer’s Hippocratic Oath to Women, the

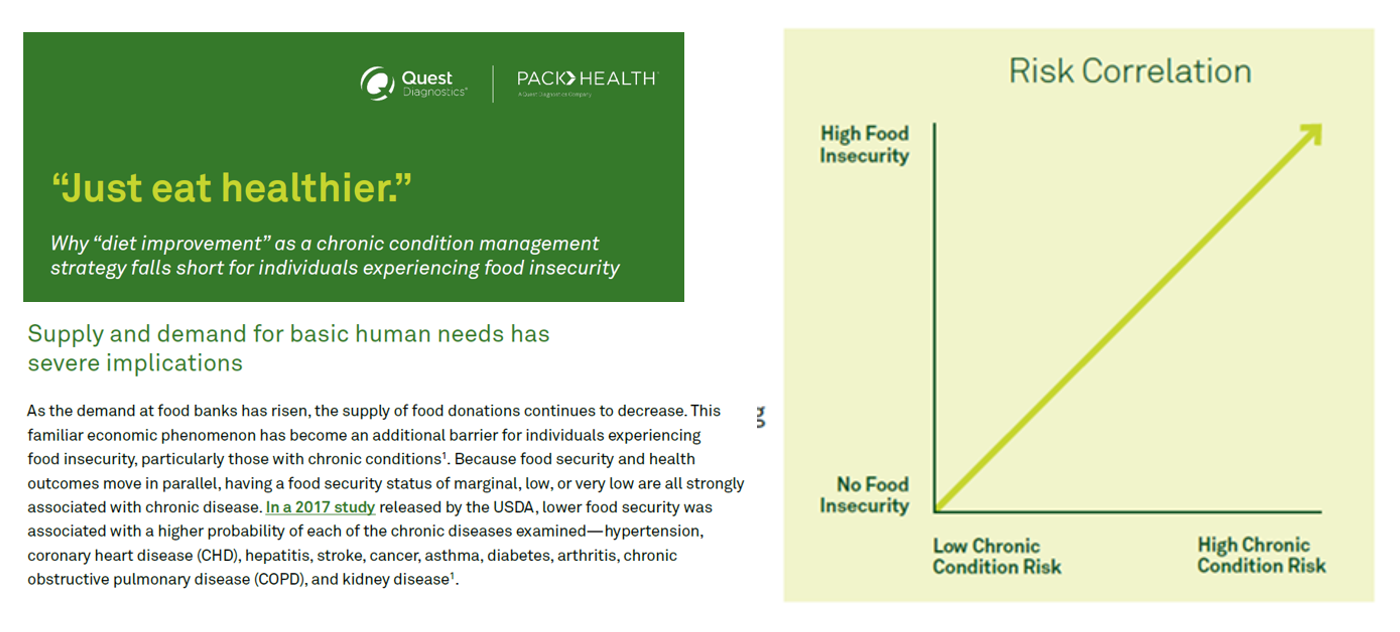

Food-as-Medicine Update: How SNAP Members Face Greater Chronic Illness and a “Hunger Cliff”

The pandemic worsened food insecurity for many people in the U.S., putting more people at risk for not only hunger but for chronic diseases that can be managed with access to nutritious, fresh food. In Helping SNAP Consumers During Economic Headwinds from Numerator, we get a current read on food security, the SNAP program, and the challenges of chronic health management that are intimately tied. To set some context on this current challenge to peoples’ health, the U.S. is facing the official end of the pandemic emergency on May 11, 2023. At that point, support for government-sponsored programs that have supported

We Are All Health Consumers Now – Toluna’s Latest Look at Consumers’ Health & Well-Being

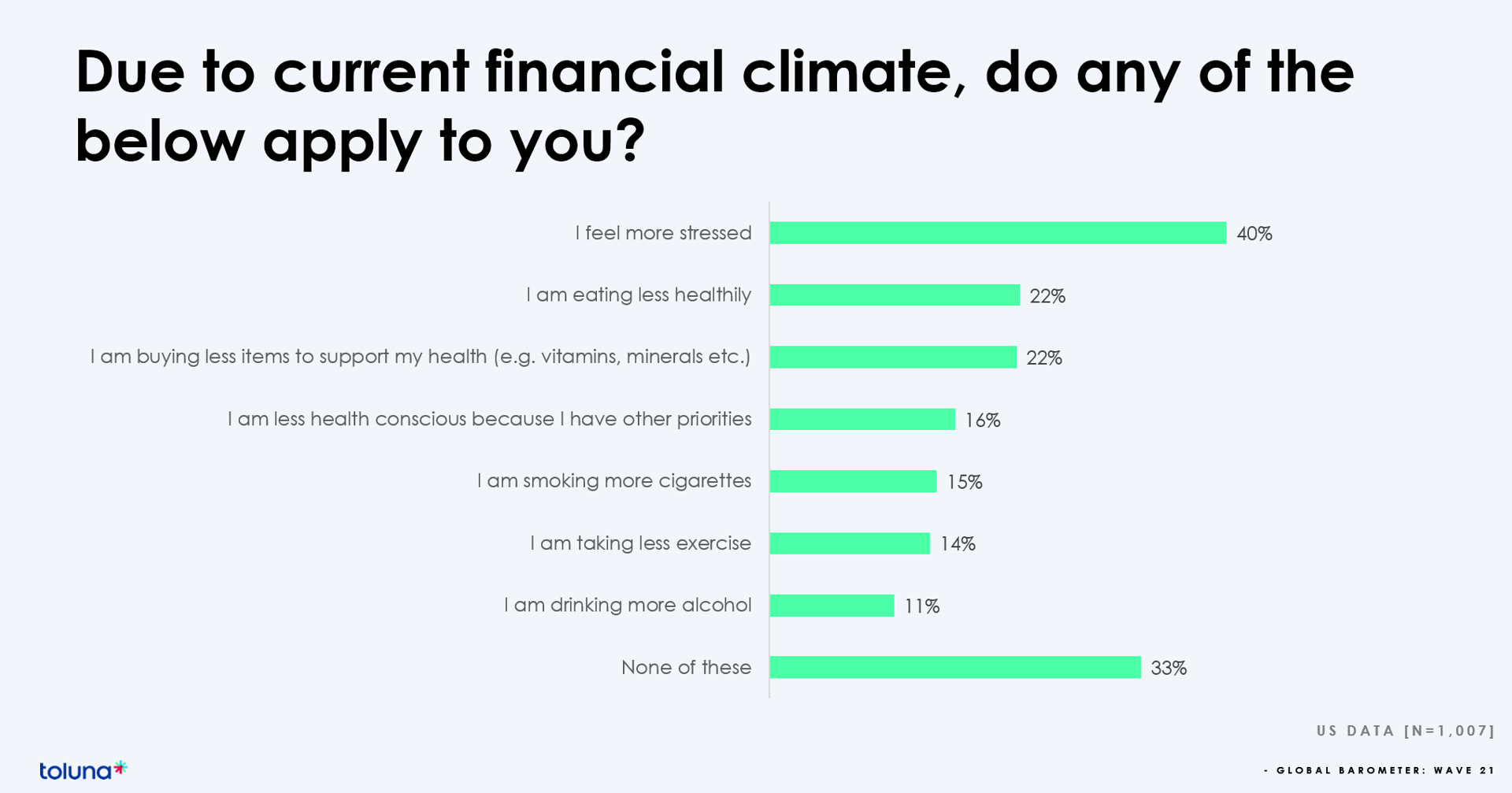

The challenging financial climate at the start of 2023 is impacting how people, globally, are perceiving, managing, and spending money on health and well-being, based on the latest (Wave 21) Global Consumer Barometer survey conducted by Toluna, a sister company of Harris Interactive. Globally, one-third of health citizens the world over are confronting greater stress levels due to the higher cost of living in their daily lives. One in two people say that rising cost of living is negatively impacting their health and well-being. On the positive side, one in three people believe

The American Hospital Association Looks at Retail and Tech Health Care Disruptors

Ever since Clayton Christensen explained the concept of disruptive innovation in 1995, health care became one of the poster children emblematic of an industry ripe for disruption. Nearly 30 years later, disrupting health care continues to be a theme which, in 2023, seems open for those slow-moving tectonic driving forces to finally re-form and re-imagine health care delivery. So in today’s Health Populi we turn to a new report, Health Care Disruption 2023 Outlook, part of AHA’s “The Buzz” market scan initiative. The American Hospital Association is taking disruption seriously right here, right now, as the U.S. hospital sector is

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

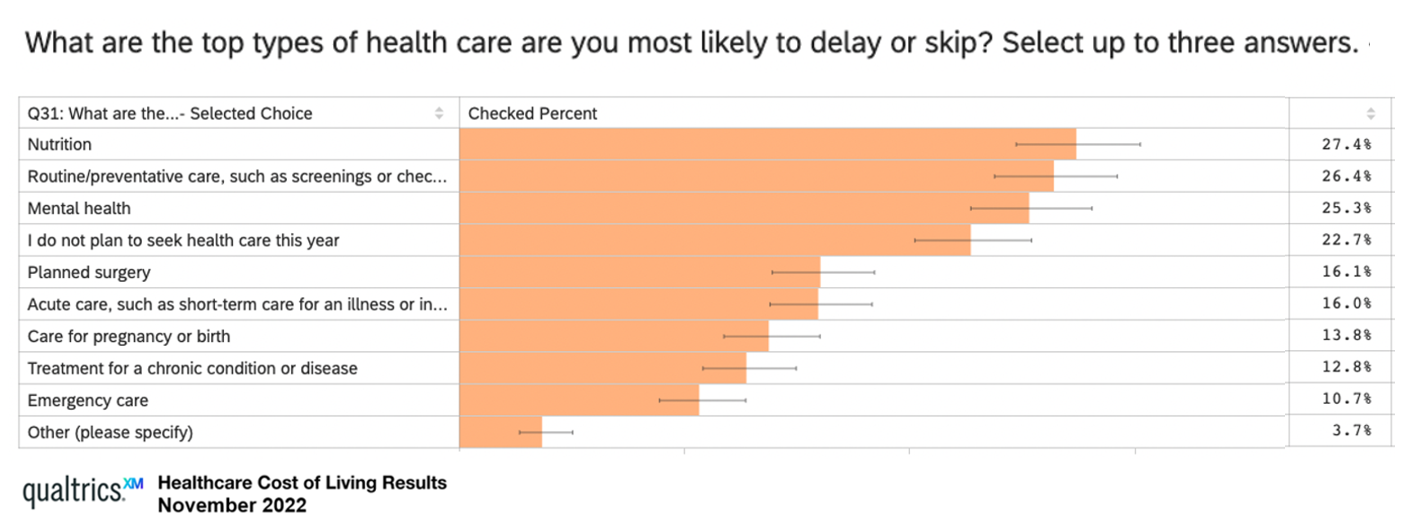

Consumers Are Feeling Their Healthcare Cost of Living – Research from Qualtrics

Rising costs are the #1 reason U.S. health consumers are avoiding or delaying health care, replacing concerns about COVID-19, based on survey research from Qualtrics. The company’s Healthcare Cost of Living survey research learned that 48% of U.S. adults chose to defer health care in 2022, split by 31% of consumers skipping care due to cost concerns, and, 17% of people delaying care who had concerns about the coronavirus. Note the types of care delayed or skipped: Over 27% of people delayed care related to nutrition 26% delayed routine or preventive care, such as screenings or

Connected Wellness Growing As Consumers Face Tighter Home Economics

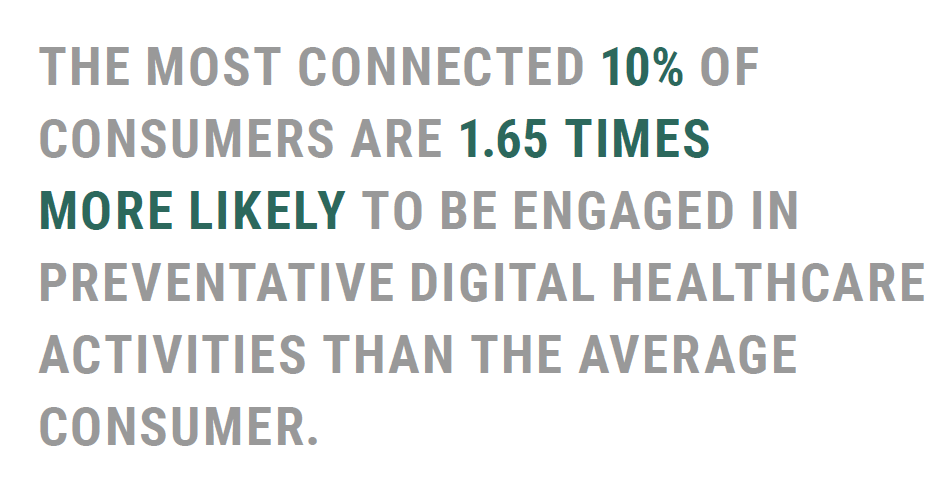

“Consumers are using the Internet to take their health into their own hands,” at least for 1 in 2 U.S. consumers engaging in some sort of preventive health care activity online in mid-2022. The new report on Connected Wellness from PYMNTS and Care Credit profiles American health consumers’ use of digital tools for health care promotion and disease prevention. The bottom-line here is that the most connected 10% of consumers were 1.65 times more likely to be engaged in preventive digital health activities than the average person. Peoples’ engagement with digital health

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

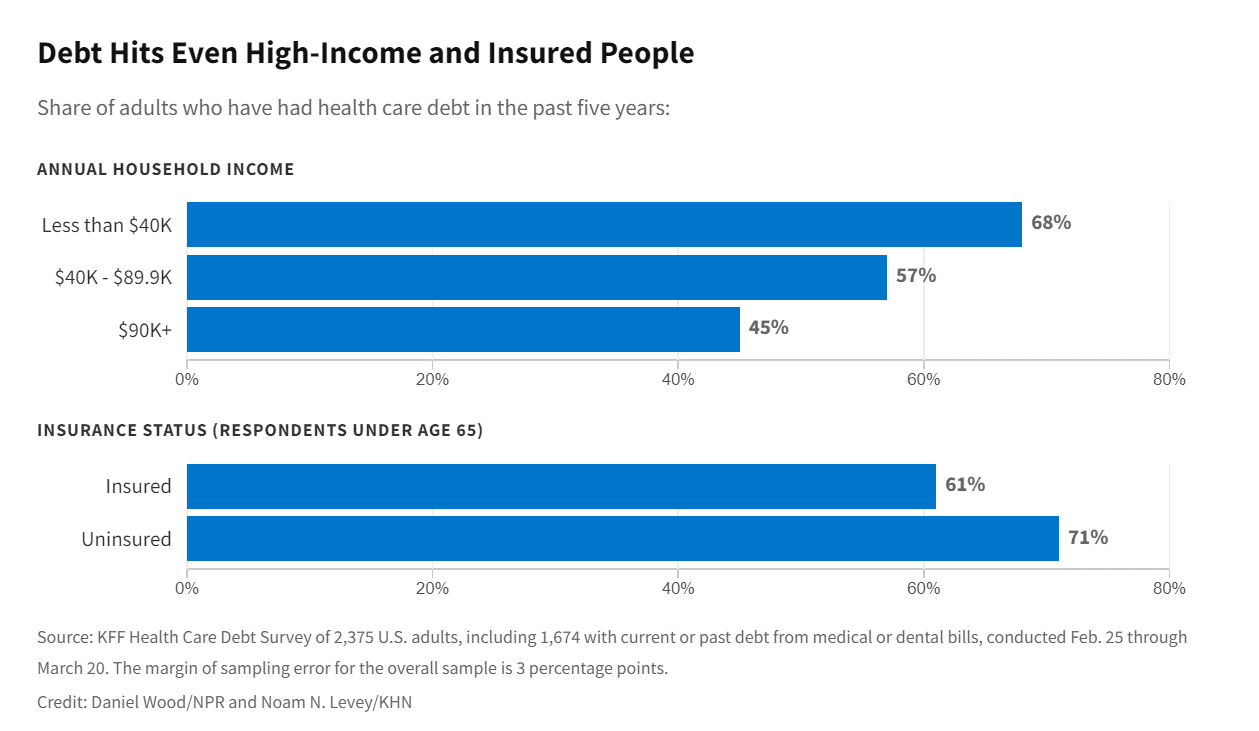

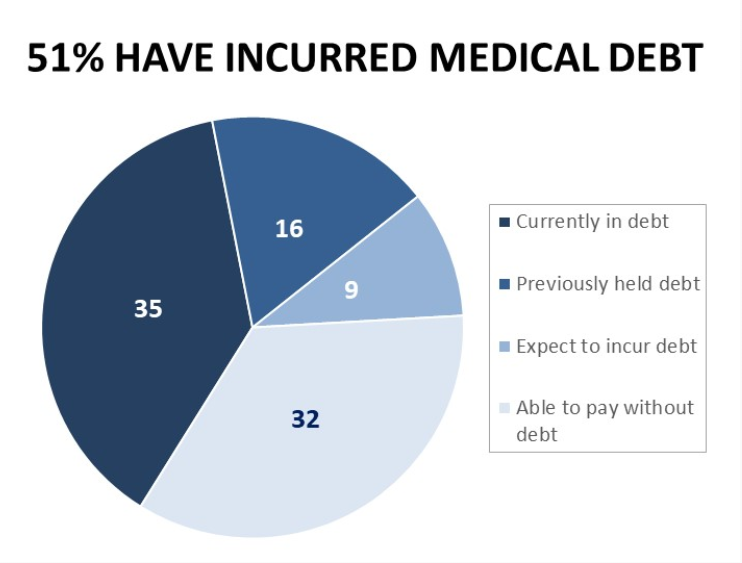

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

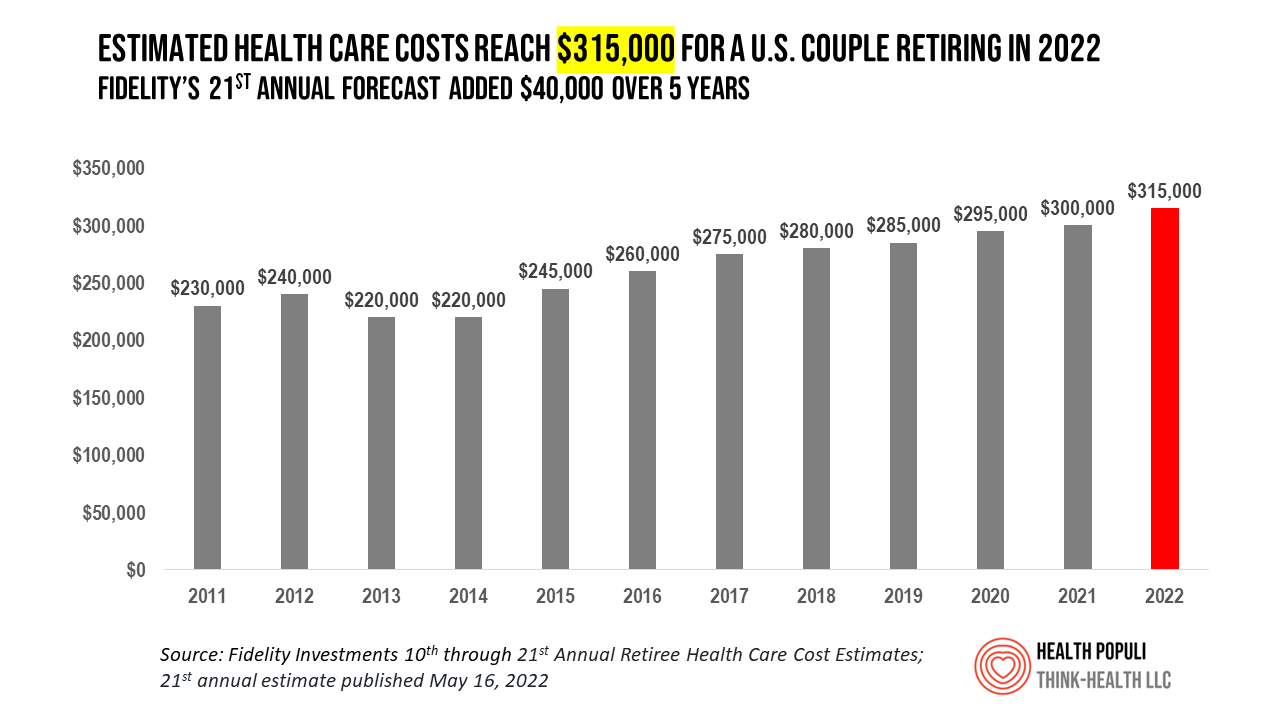

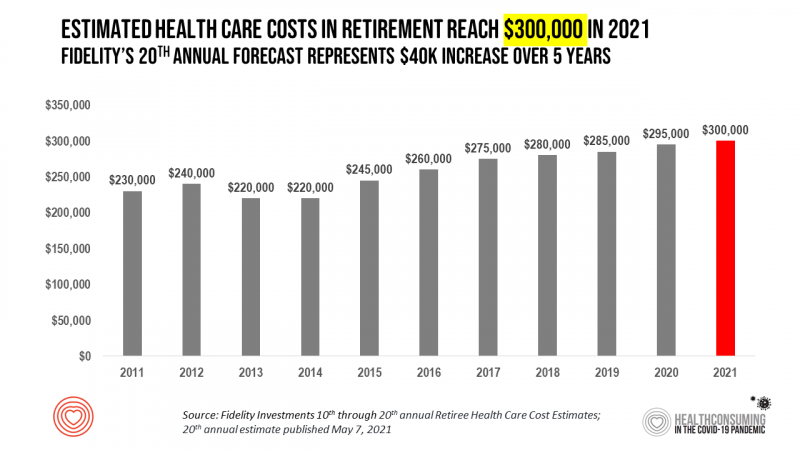

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

People Thinking More About the Value of Health Care, Beyond Cost

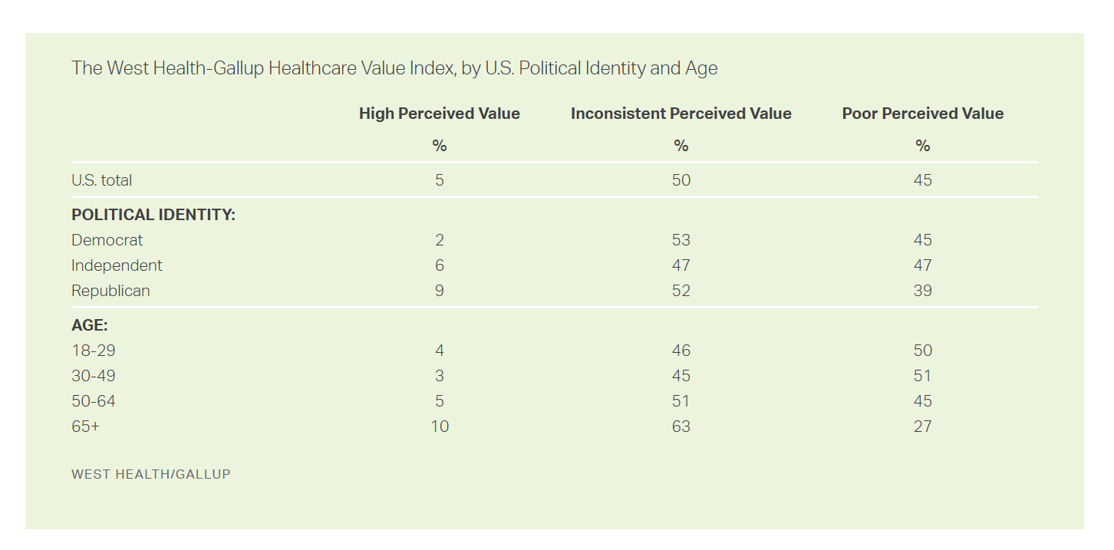

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

The Demand for Self-Care At-Home Will Grow Post-Pandemic – Insights from IRI

The coronavirus pandemic has re-shaped consumers across many life- and work-flows. When it comes to peoples’ relationship to consumer packaged goods (CPG), the public health crisis has indeed impacted consumers’ purchasing behaviors and definition of “value,” based on IRI’s latest analysis of CPG shifts in 2022 and 2023. IRI has been tracking COVID-19’s impact on CPG and retail since the emergence of the coronavirus. In this Health Populi post, I’ll discuss the research group’s assessment of CPG shifts of consumer packaged goods through my lens on health/care, everywhere — especially, in this case, the home.

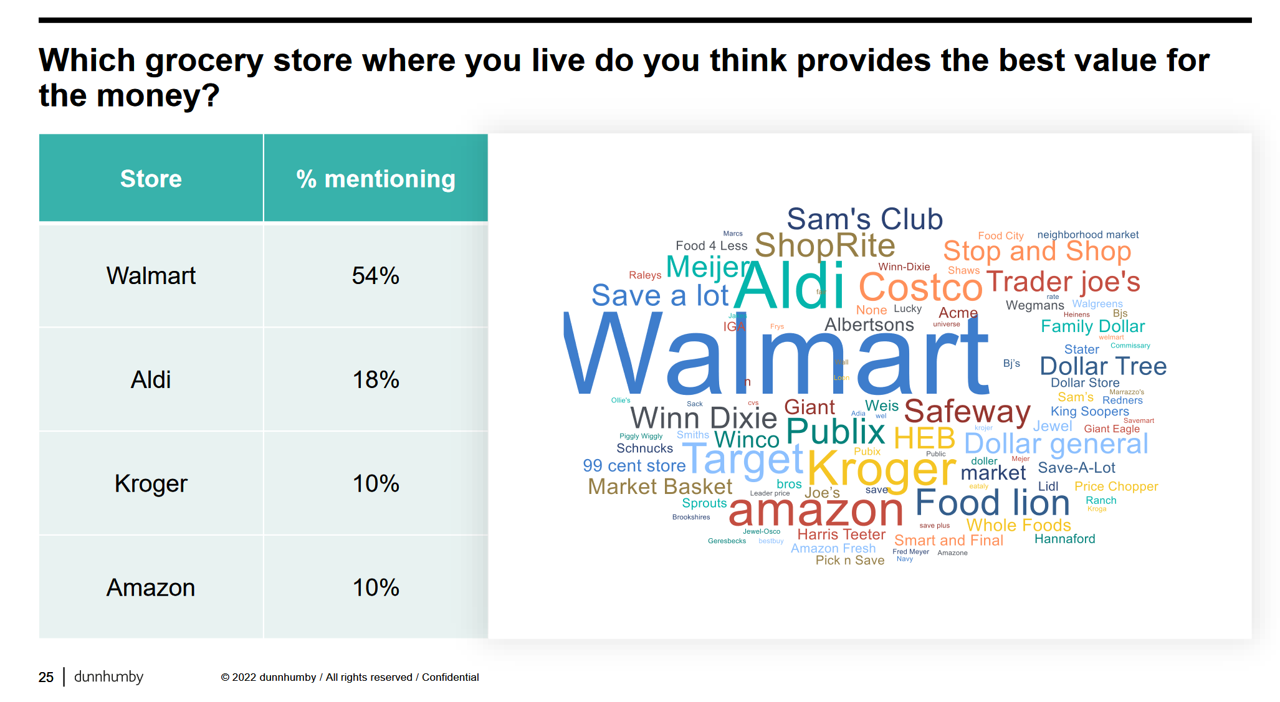

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

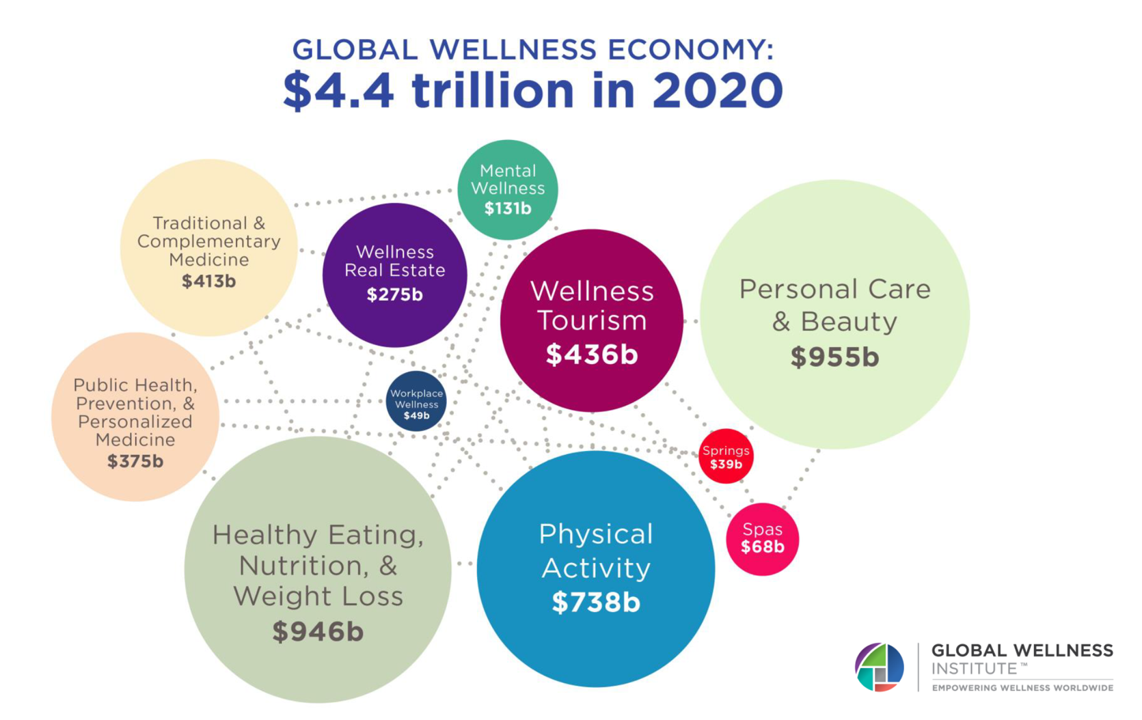

The Wellness Economy in 2022 Finds Health Consumers Moving from Feel-Good Luxury to Personal Survival Tactics

The Future of Wellness in 2022 is, “shifting from a ‘feel-good’ luxury to survivalism as people seek resilience,” based on the Global Wellness Institute’s forecast on this year’s look into self-care and consumer’s spending on health beyond medical care — looking beyond COVID-19. GWI published two research papers this week on The Future of Wellness and The Global Wellness Economy‘s country rankings as of February 2021. I welcomed the opportunity to spend time for a deep dive into the trends and findings with the GWI community yesterday exploring all of the data, listening through my health economics-consumer-technology lens. First, consider

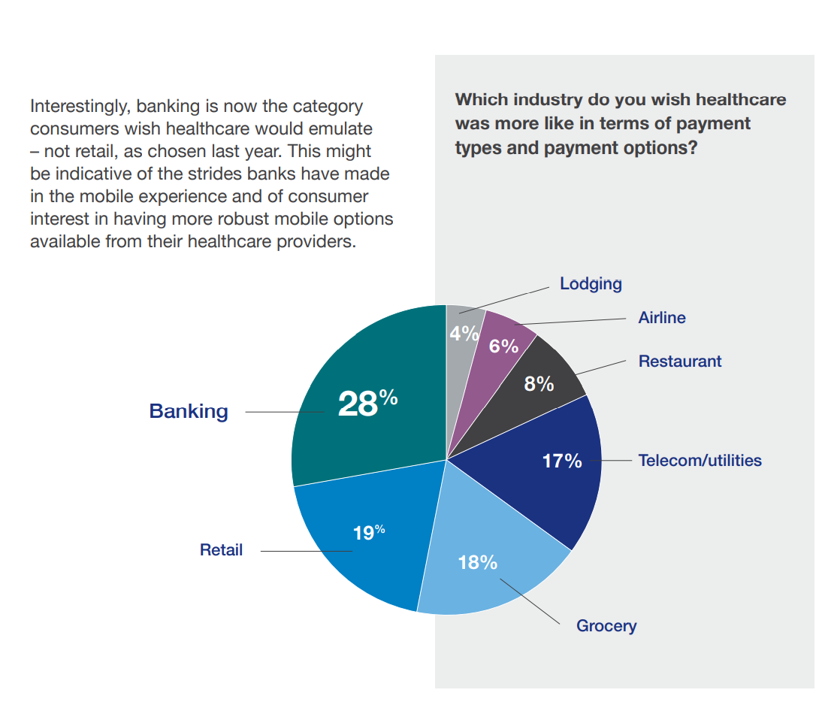

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

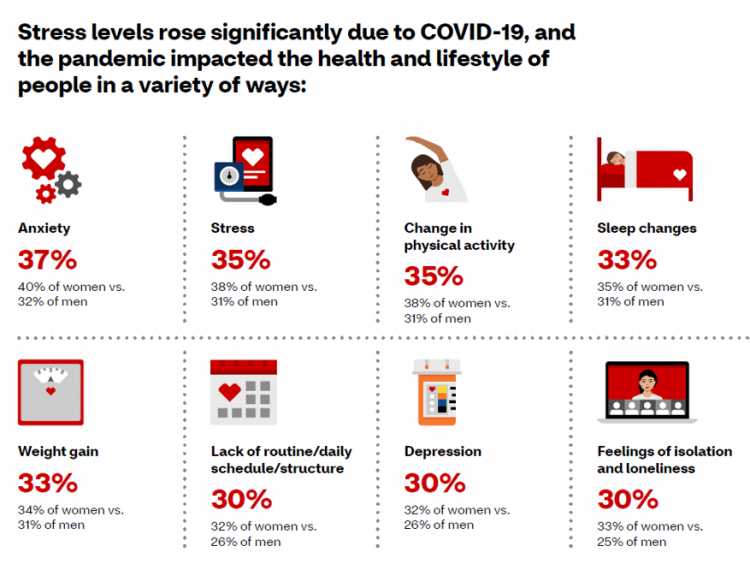

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

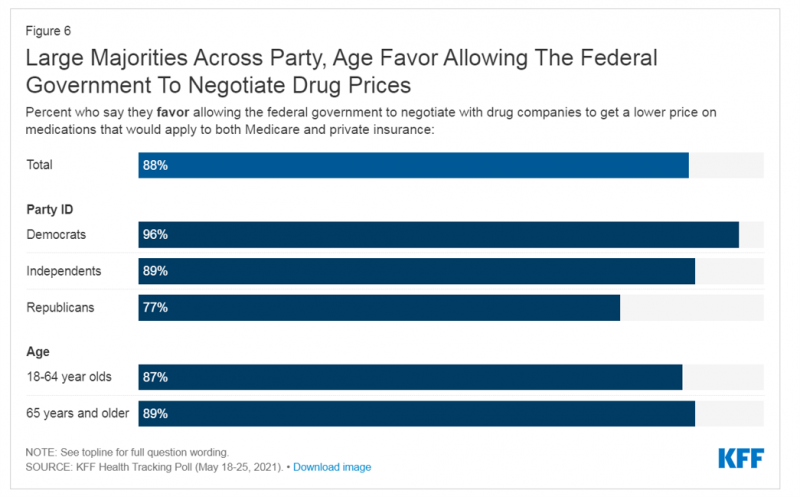

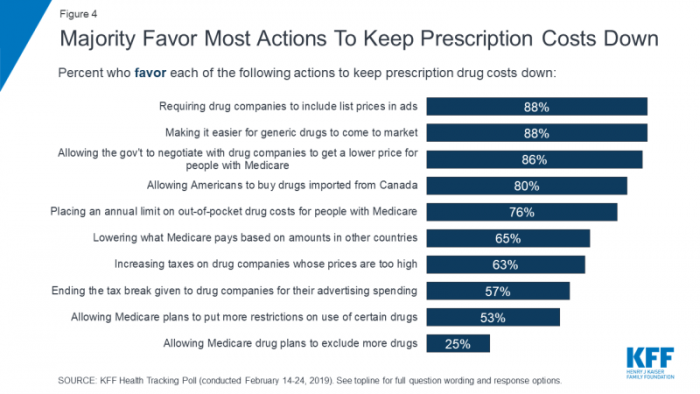

What Do Democrats and Republicans Agree On? Allowing Negotiations to Lower Rx Prices

People living in the U.S. have weathered over fifteen months of life-shifts for work, school, prayer, fitness, and social lives. So you might think that the most important public priority for Congress might have something to do with COVID-19, vaccines, or health insurance coverage. But across all priorities, it turns out that prescription drug costs rank higher in Americans’ minds than any other issue in the Kaiser Family Foundation Health Tracking Poll for May 2021. Two-thirds of U.S. adults said that allowing the federal government and private insurance plans to negotiate for lower prices on Rx drugs was their top

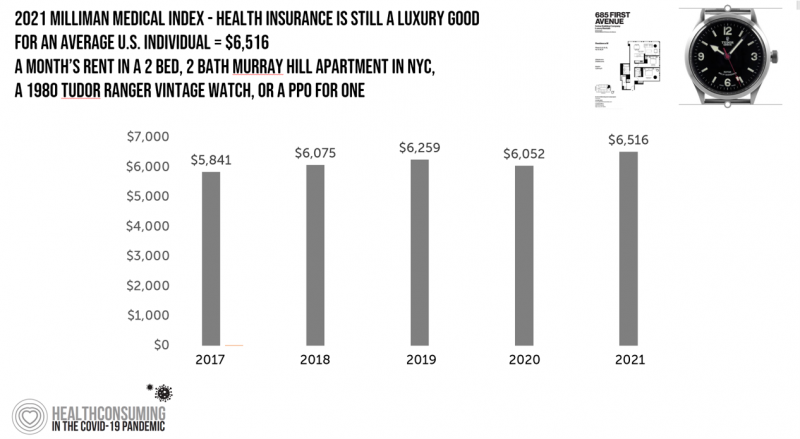

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

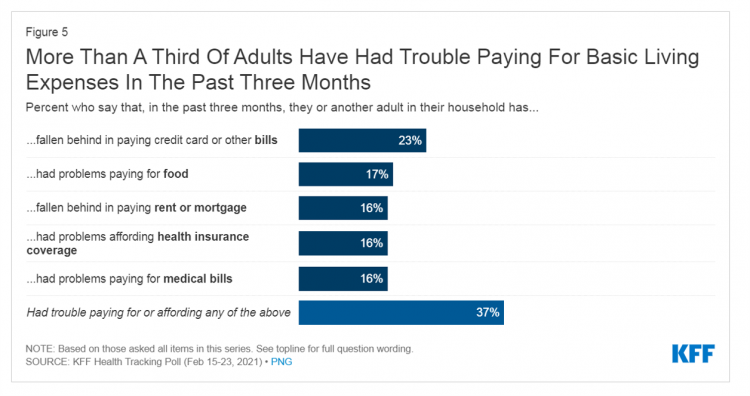

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

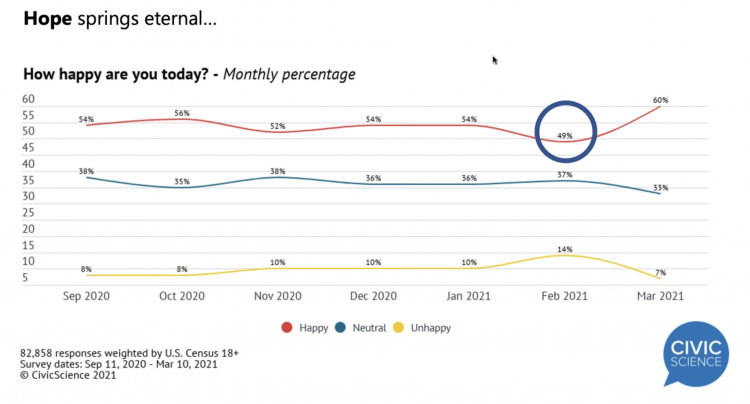

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

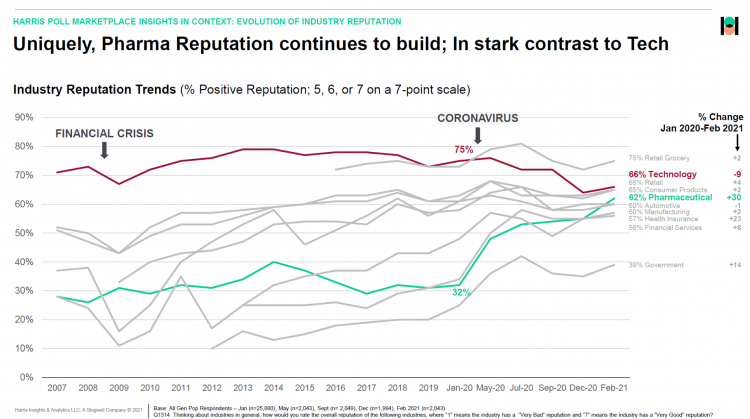

The Remarkable Rise of Pharma’s Reputation in the Pandemic

The reputation of the pharmaceutical industry gained a “whopping” 30 points between January 2020 and February 2021, based on the latest Harris Poll in their research into industries’ reputations. The study was written up by Beth Snyder Bulik in FiercePharma. Beth writes that, “a whopping two-thirds of Americans now offer a thumbs-up on pharma” as the title of her article, calling out the 30-point gain from 32% in January 2020 to 62% in February 2021. Thanks to Rob Jekielek, Managing Director of the Harris Poll, for sharing this graph with me for us to understand the details comparing pharma’s to

Consumers Demand Digital Transformation Across Their Health Care Experiences

From appointment scheduling to checking in, payment and clinical encounter follow-up, patients now expect digital experiences across the health care continuum….and really great ones, like they get from Amazon and other platforms that earn high net promoter scores. That is the big message from the 2020 Healthcare Consumer Experience Study published by Cedar, based on the input of 1,502 U.S. adults who paid a medical bill between October 2019 and October 2020. The timing of this study coincided with the start of the COVID-19 pandemic in the U.S. through at least seven months of American patients’ experiences in 2020. Two-thirds

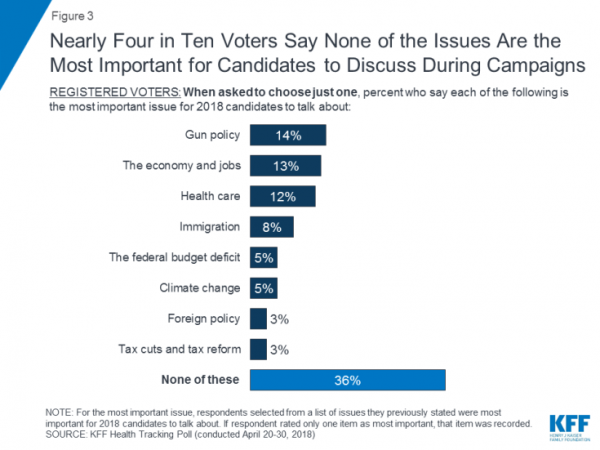

Voting for Health in 2020

In the 2018 mid-term elections, U.S. voters were driven to polls with health care on their minds. The key issues for health care voters were costs (for care and prescription drugs) and access (read: protecting pre-existing conditions and expanding Medicaid). Issue #2 for 2018 voters was the economy. In 2020, as voting commences in-person tomorrow on 3rd November, U.S. voters have lives and livelihoods on their minds. It’s the pandemic – our physical lives looming largest in the polls – coupled with our fiscal and financial lives. Health is translating across all definitions for U.S. voters in November 2020: for

Return-To-School Is Stressing Out U.S. Parents Across Income, Race and Political Party

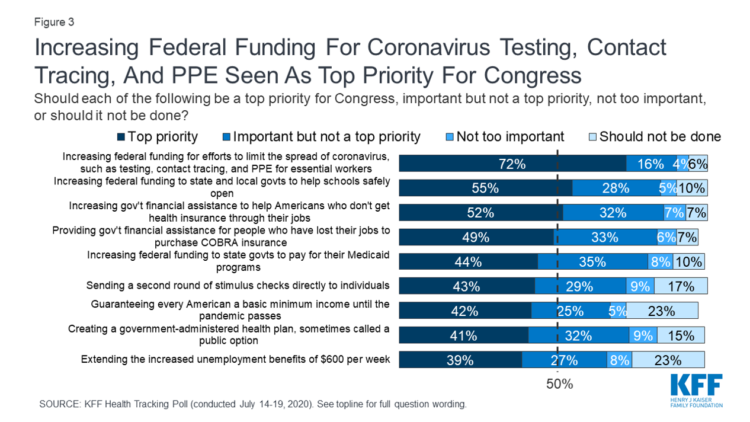

The worse of the coronavirus pandemic is yet to come, most Americans felt in July 2020. That foreboding feeling is shaping U.S. parents’ concerns about their children returning to school, with the calendar just weeks away from educators opening their classrooms to students, from kindergarten to the oldest cohort entering senior year of high school. The Kaiser Family Foundation’s July 2020 Health Tracking Poll focuses on the COVID-19 pandemic, return-to-school, and the governments’ response. KFF polled 1,313 U.S. adults 18 and older between July 14 to 19, 2020. The first line chart illustrates Americans’ growing concerns about the coronavirus, shifting

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

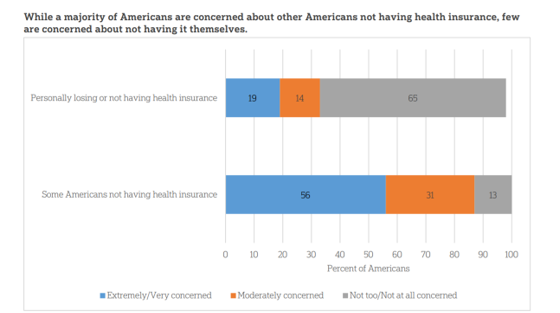

Americans’ Concerns About the US Healthcare System Loom Larger Than Worries About Their Own Care

The coronavirus pandemic has further opened the kimono of the U.S. healthcare system to Americans: four months into the COVID-19 outbreak, most consumers (62%) of people in the U.S. are more concerned about other people not having access to high quality health care versus themselves. This is a 16 point increase in concern in May 2020 compared with the response to the same question asked in February in a poll conducted by the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research (the AP-NORC Center). The AP-NORC Poll found more of this

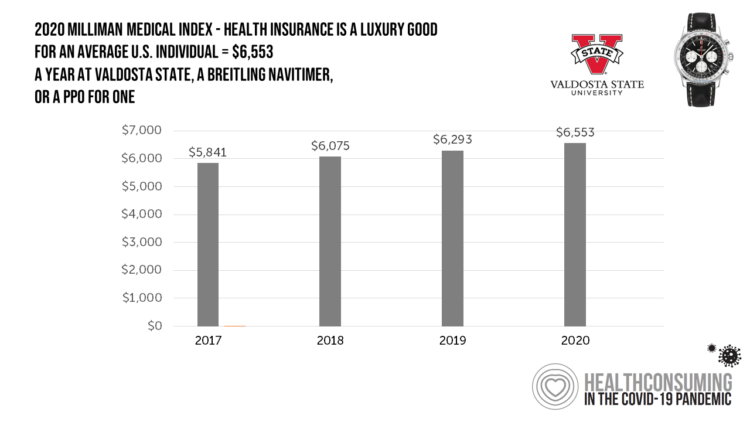

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

The Coronavirus Impact on American Life, Part 1 – Life Disrupted, and Money Concerns

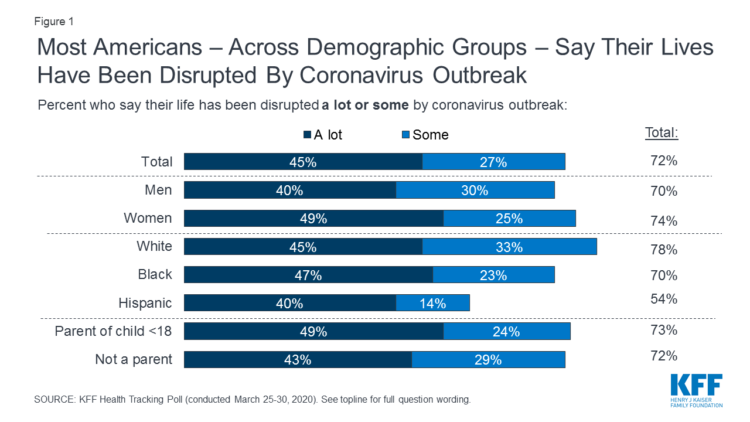

Nearly 3 in 4 Americans see their lives disrupted by the coronavirus pandemic, according to the early April Kaiser Family Foundation Health Tracking Poll. This feeling holds true across most demographic factors: among both parents and people without children; men and women alike; white folks as well as people of color (although fewer people identifying as Hispanic, still a majority). There are partisan differences, however, in terms of who perceives a life-disruption due to COVID-19: 76% of Democrats believe this, 72% of Independents, and 70% of Republicans. Interestingly, only 30% of Republicans felt this way in March 2020, more than

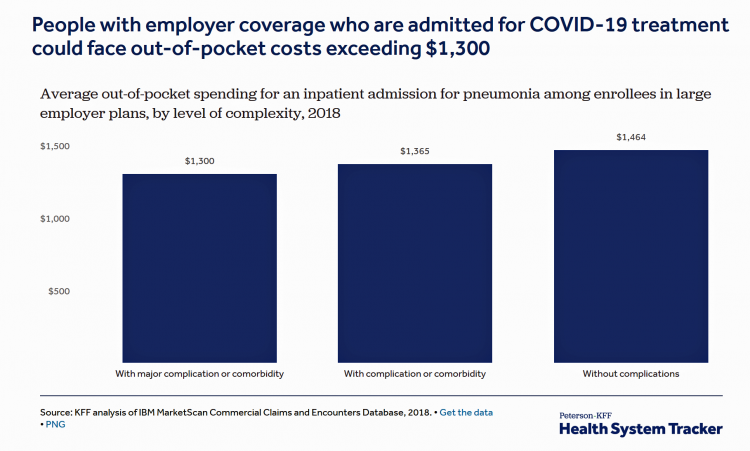

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Lockdown Economics for U.S. Health Consumers

The hashtag #StayHome was ushered onto Twitter by 15 U.S. national healthcare leaders in a USA Today editorial yesterday. The op-ed co-authors included Dr. Eric Topol, Dr. Leana Wen, Dr. Zeke Emanuel, Dr. Jordan Shlain, Dr. Vivek Murthy, Andy Slavitt, and other key healthcare opinion leaders. Some states and regions have already mandated that people stay home; at midnight last night, counties in the Bay Area in California instituted this, and there are tightening rules in my area of greater Philadelphia. UBS economist Paul Donovan talked about “Lockdown Economics” in his audio commentary today. Paul’s observations resonated with me as

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

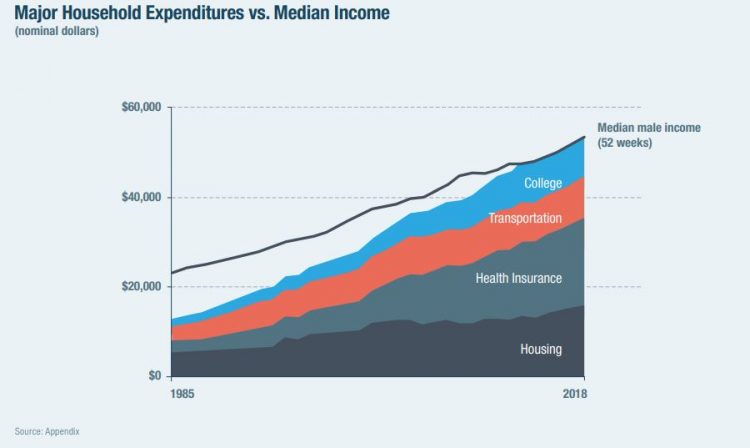

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

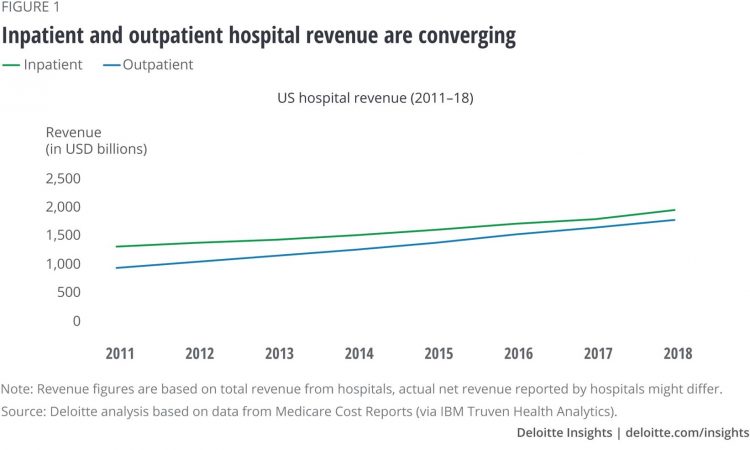

Outpatient is the New Inpatient – The Future of Hospitals in America

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

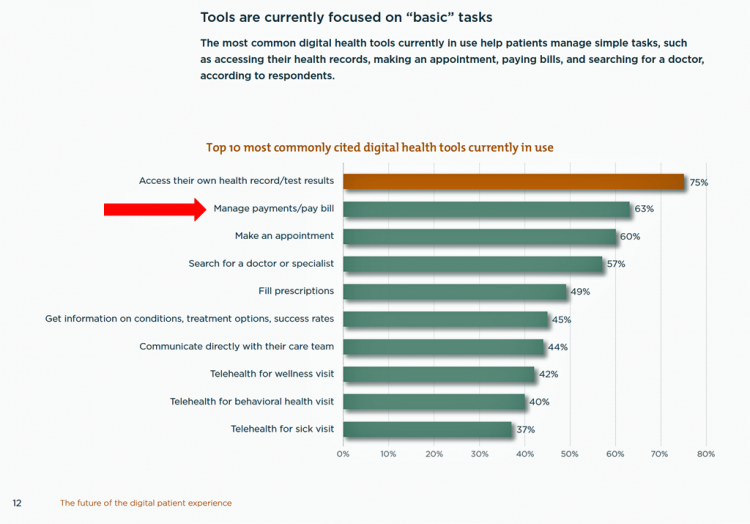

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

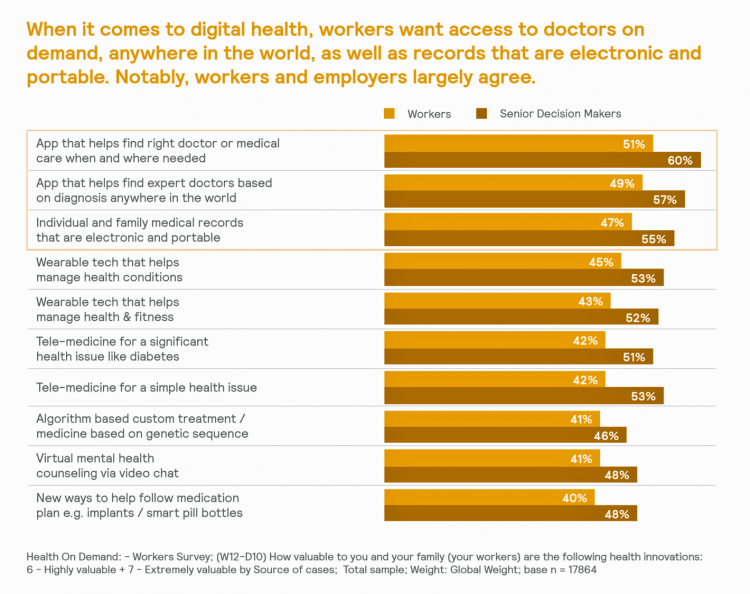

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

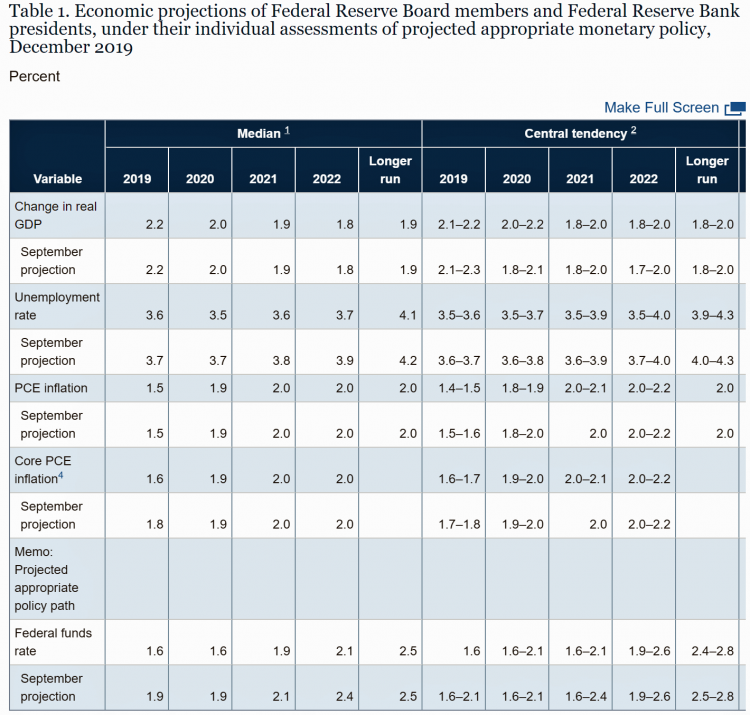

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

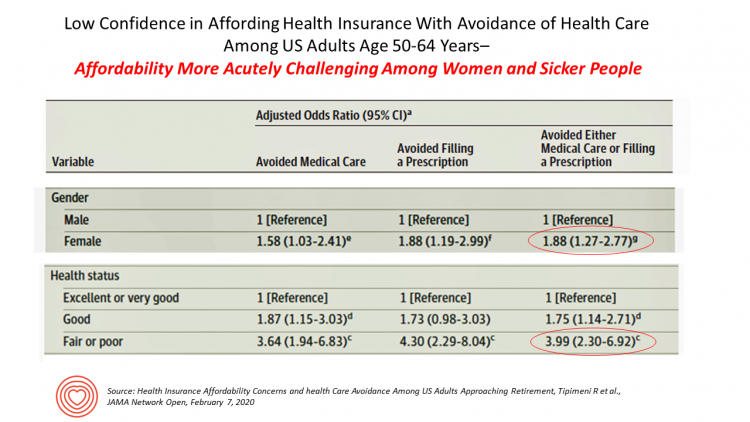

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

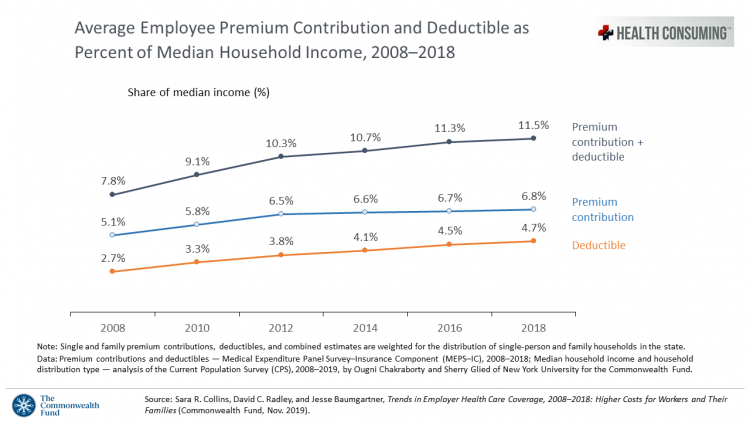

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Hospitals Suffer Decline in Consumer Satisfaction

While customer satisfaction with health insurance plans slightly increased between 2018 and 2019, patient satisfaction with hospitals fell in all three settings where care is delivered — inpatient, outpatient, and the emergency room, according to the 2018-2019 ACSI Finance, Insurance and Health Care Report. ACSI polls about 300,000 U.S. consumers each year to gauge satisfaction with over 400 companies in 46 industries. For historic trends, you can check out my coverage of the 2014 version of this study here in Health Populi. The 2019 ACSI report bundles finance/banks, insurance (property/casualty, life and health) and hospitals together in one document. Health

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

Great Expectations for Health Care: Patients Look for Consumer Experience and Trust in Salesforce’s Latest Research

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies. But as payors, health consumers face challenges in getting care, so great expectations are met with frustration and eroding trust with the system, according to the latest Connected Healthcare Consumer report from Salesforce published today as the company announced expansion of their health cloud capabilities. This is

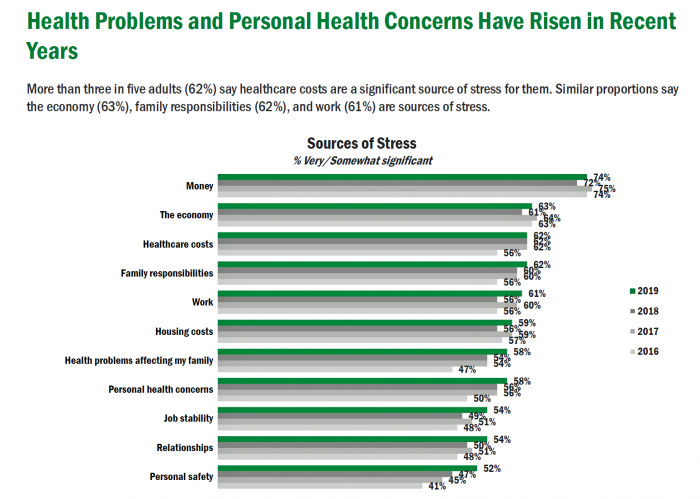

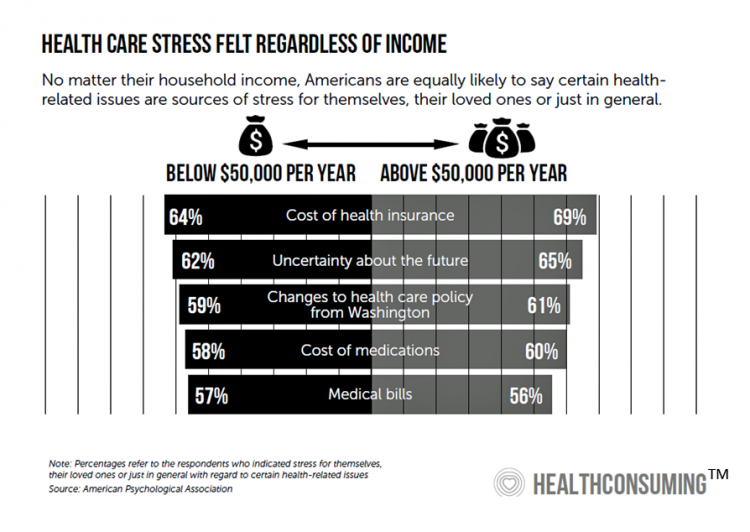

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

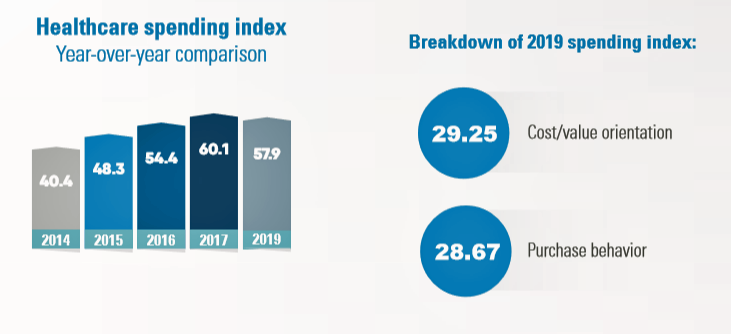

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

Worrying About Possible Recession Compels Health Consumers to Seek Less Care

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space. Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care. Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll. The other side of this personal health

A Portrait of the Health Consumer as Confused, Cost-Challenged, and Out of Control

Patients in the U.S. are confused, cost-challenged and lacking control, according to The Consumer Healthcare Paradox from Maestro Health, an employee health and benefits company. Data illustrating that “paradox” is shown in the second chart: while 78% percent of patients told Maestro Health their health care experience is positive, 69% feel they lack control over their patient journey. Quality health care in America is too expensive, 79% of consumers said. Furthermore, one in two U.S. patients had received a medical bill that was higher than they anticipated it would be. Finally, one in two U.S. patients said the quality of

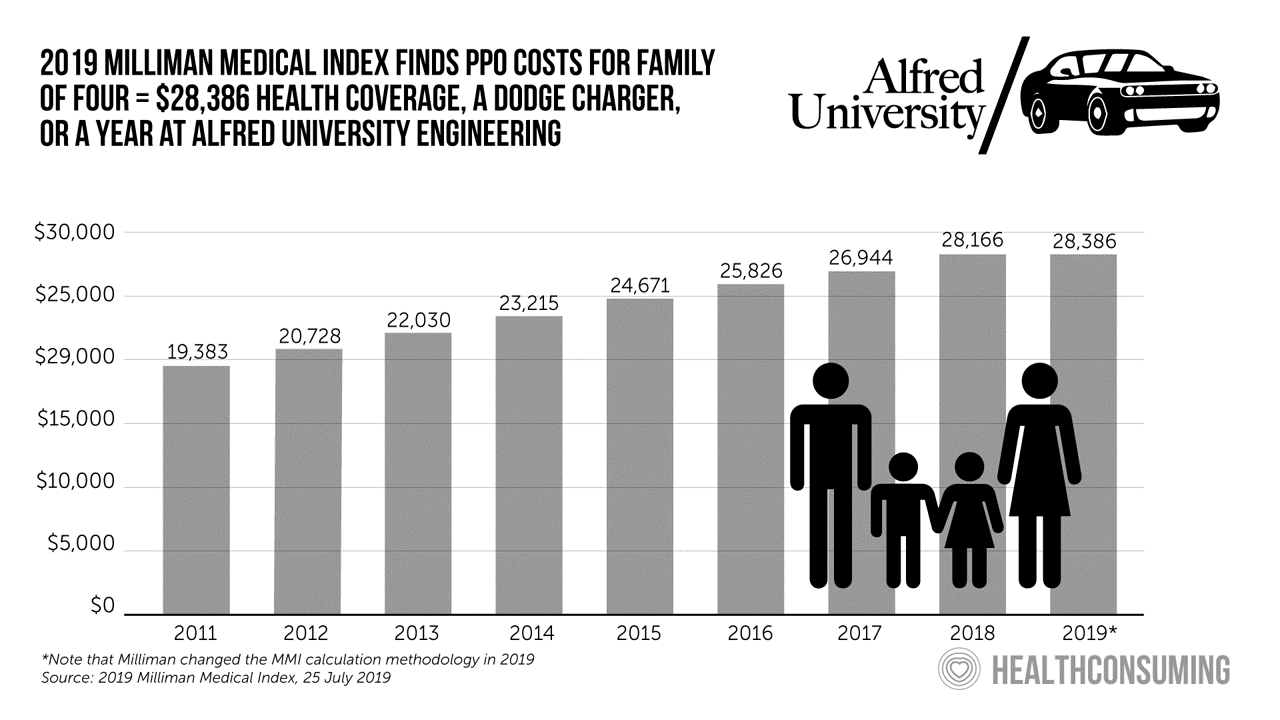

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Americans Could Foster a Health Consumer Movement, Families USA Envisions

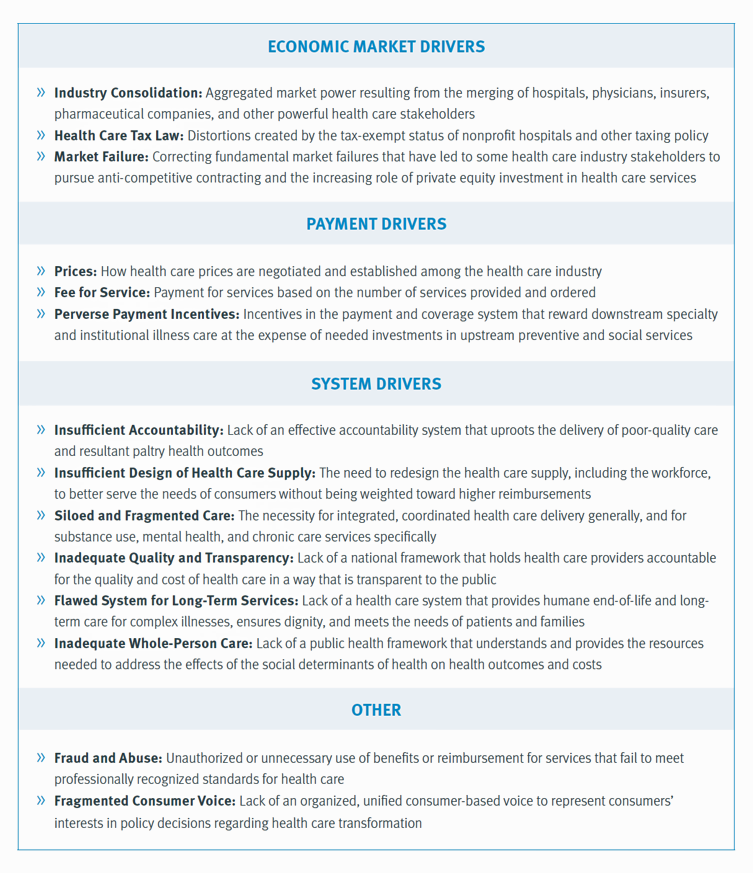

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

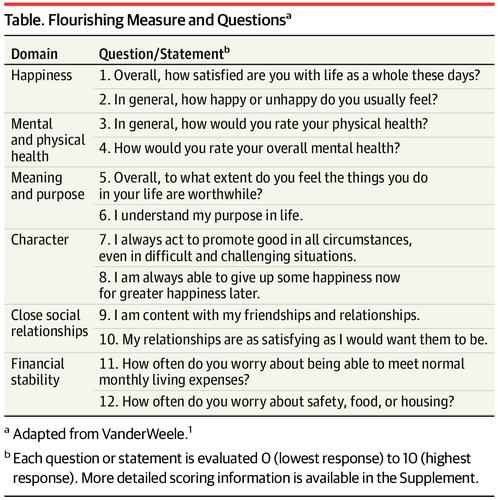

People Want to Flourish, Not Just Live – Speaking Health Politics to Real People

“How should we define ‘health?'” a 2011 BMJ article asked. The context for the question was that the 1948 World Health Organization definition of health — that health is, “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”– was not so useful in the 21st century. The authors, a global, multidisciplinary team from Europe, Canada and the U.S., asserted that by 2011, human health was marked less by infectious disease and more by non-communicable conditions that could be highly influenced, reversed and prevented through self-care by the individual and public health policy

How Consumers’ Belt-Tightening Could Impact Health/Care – Insights from Deloitte’s Retail Team

Over the ten years between 2007 and 2017, U.S. consumer spending for education, food and health care substantially grew, crowding out spending for other categories like transportation and housing. Furthermore, income disparity between wealthy Americans and people earning lower-incomes dramatically widened: between 2007-2017, income for high-income earners grew 1,305 percent more than lower-incomes. These two statistics set the kitchen table for spending in and beyond 2019, particularly for younger people living in America, considered in Deloitte’s report, The consumer is changing, but perhaps not how you think. The authors are part of Deloitte Consulting’s Retail team. The retail spending data

When Will Self-Service Come to Health Care?

At least one in three people who have tried out virtual health care have done so because they use technology in all aspects of life and want to do the same with their healthcare. This data point has informed my vision for self-care and the home as our health hub, bolstered in part through the research of Accenture from which this first graphic comes. A common theme at health care meetings these days is how and when health care will meet its Amazon, Apple, or Uber moment? Lately, one of my speaking topics is the “Amazon Prime-ing” of health consumers,

Prescription Drug Costs In America Through the Patient Lens, via IQVIA, GoodRx and a New $2 Million Therapy

Americans consumed 17.6 prescriptions per person in 2018, two in three of which treated chronic conditions. Welcome to Medicine Use and Spending in the U.S. , the annual review of prescription drug supply, demand and Rx pricing dynamics from the IQVIA Institute for Human Data Science. In a call with analysts this week in which I participated, the Institute’s Executive Director Murray Aitken discussed the report which looks back at 2018 and forward to 2023 with scenarios about what the U.S. prescription drug market might look like five years from now. The report is organized into four sections: medical use

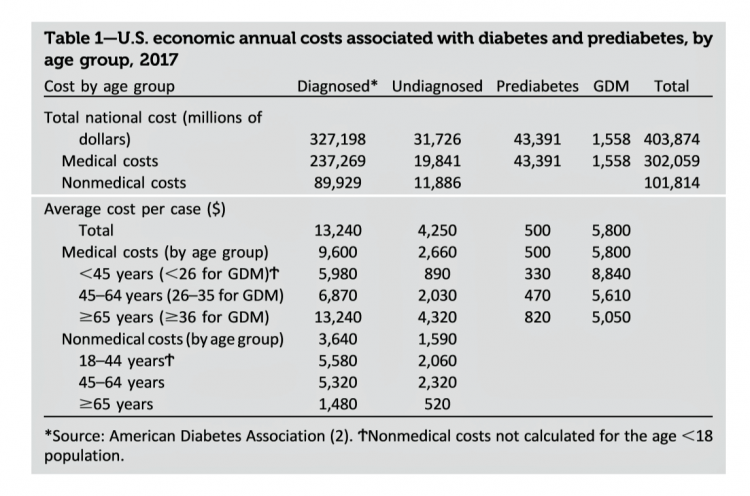

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

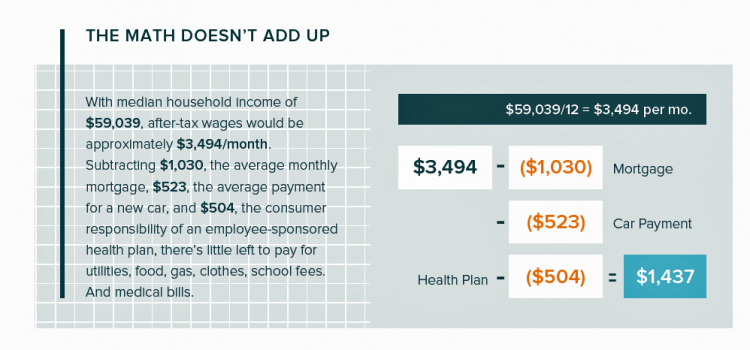

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

Most Americans Across Party ID Favor U.S. Government Negotiation to Lower Rx Drug Costs

There’s little Americans, by political party, agree upon in 2019. One of the only issues bringing people together in the U.S. is prescription drug prices — that they’re too high, that the Federal government should negotiate to lower costs for Medicare enrollees, and that out-of-pocket costs for drugs should be limited. The Kaiser Family Foundation has been tracking this topic for a few years, and this month, their March 2019 Health Tracking Poll shows vast majorities of Democrats, Independents and Republicans all share these sentiments. It’s not that patients who take prescription drugs don’t appreciate them – most (58%) say medicines

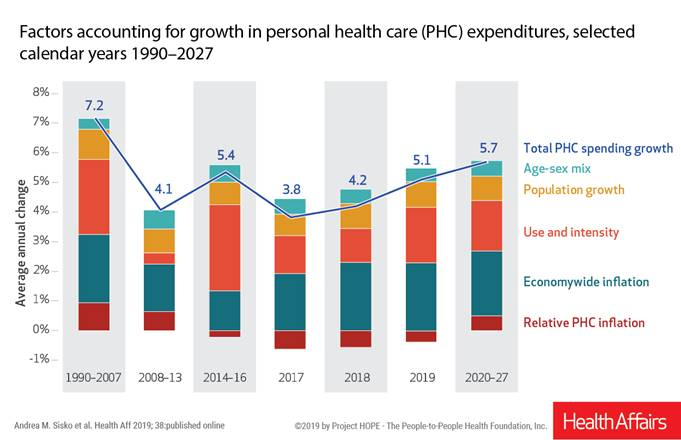

National Health Spending Will Reach Nearly 20% of U.S. GDP By 2027

National health spending in the U.S. is expected to grow by 5.7% every year from 2020 to 2027, the actuaries at the Centers for Medicare and Medicaid Services forecast in their report, National Health Expenditure Projections, 2018-2927: Economic And Demographic Trends Drive Spending And Enrollment Growth, published yesterday by Health Affairs. For context, note that general price inflation in the U.S. was 1.6% for the 12 months ending January 2019 according to the U.S. Bureau of Labor Statistics. This growth rate for health care costs exceeds every period measured since the high of 7.2% recorded in 1990-2007. The bar chart illustrates the

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

The Caveats for Health/Care at CES 2019

According to the Cambridge Dictionary, a “caveat” is, “a warning to consider something before doing anything more.” It is fitting that CES is held in Las Vegas, land of high risk and, with a lot of luck, reward. With that theme in mind, I depart LAS airport tonight on an aptly-named red-eye flight back home after spending an entire week here. I’m pondering not what I saw — some of which I covered daily over the past week — but what I didn’t see. Consider these the caveats for health/care at #CES2019. In no particular order… Where was the Chairman of

The Consumer as Payor – Retail Health at CES 2019

All health/care is retail now in America. I say this as most people in the U.S. who have health insurance must take on a deductible of some amount, which compels that insured individual to spend the first dollar on medical services up until they meet their financial commitment. At that point, health insurance kicks in, and then the insured may have to spend additional funds on co-payments for general medicines and services, and coinsurance for specialty drugs like injectables and high-cost new therapies. The patient is a consumer is a payor, I asserted today during my talk on the expanding

Open Source Health Care Will Liberate Patients

Information is power in the hands of people. When it’s open in the sunshine, it empowers people — whether doctors, patients, researchers, Presidents, teachers, students, Everyday People. Welcome to the era of Open Source Healthcare, not only the “about time” for patients to own their health, but for the launch of a new publication that will support and continue to evolve the concept. It’s really a movement that’s already in process. Let’s go back to some definitions and healthcare basics to understand just why Open Source Healthcare is already a thing. When information access is uneven, it’s considered

Sicker Consumers Are More Willing to Share Health Data

People dealing with chronic conditions are keener to share personally-generated data than people that don’t have a chronic disease, Deloitte’s 2018 Survey of U.S> Health Care Consumers learned. This and other insights about the patient journey are published in Inside the patient journey, a report from Deloitte that assesses three key touch points for consumer health engagement. These three patient journey milestones are searching for care, using new channels of care, and tracking and sharing health data, Deloitte maps. What drives people to engage on their patient journeys has a lot more to do with practical matters of care like convenience,

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Consumers Don’t Know What They Don’t Know About Healthcare Costs

The saving rate in the U.S. ranks among the lowest in the world, in a country that rates among the richest nations. So imagine how well Americans save for healthcare? “Consumers are not disciplined about saving in general,” with saving for healthcare lagging behind other types of savings, Alegeus observes in the 2018 Alegeus Consumer Health & Financial Fluency Report. Alegeus surveyed 1,400 U.S. healthcare consumers in September 2017 to gauge peoples’ views on healthcare finances, insurance, and levels of fluency. As patients continue to take on more financial responsibility for healthcare spending in the U.S., they are struggling with finances and

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

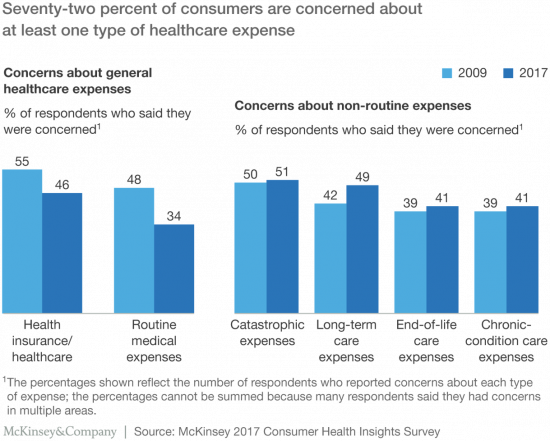

Americans Growing Health Consumer Muscles and Knowledge: McKinsey

Most Americans are healthcare cost-conscious, concerned about various kinds of healthcare expenses, data from McKinsey’s research has found presented in Healthcare consumerism 2018: An update on the journey. McKinsey’s consumer research identified four themes: affordability as a pressing consumer concern; lack of continuity of care for many consumers; growing demand for digital convenience and access; and, greater willingness to partake in health care programs that lower costs, if made available. Personal and household concerns about healthcare costs is top-of-mind for U.S. consumers, as I’ve pointed out in previous studies such as Kaiser Family Foundation’s look at top “pocketbook issues,” here on

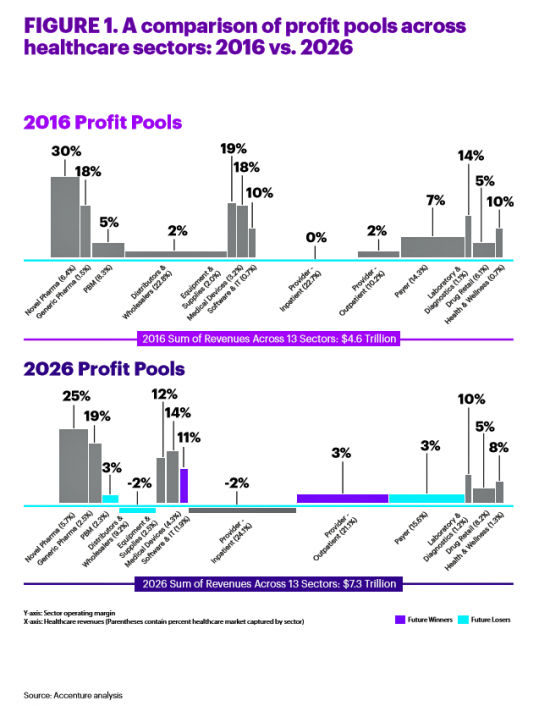

Healthcare’s Profits Will Be Dramatically Redistributed as Care Shifts to Consumers: Accenture

All sectors who are stakeholders in the healthcare ecosystem aren’t created equal, Accenture explains in their report, Healthcare’s future winners and losers. Observing the influx of new flavors of entrants like Amazon and Google, start-ups like Iora Health, Oscar and FetchMD, begs the question: how will legacy healthcare system players fare? Who will survive, and what will be the success factors that bolster long-term viability? To answer that question, Accenture points to three market trends that set “new rules” in healthcare: Blurred lines, which are the grey areas and adjacencies between technology, service, finance, and retail The middle of nowhere,

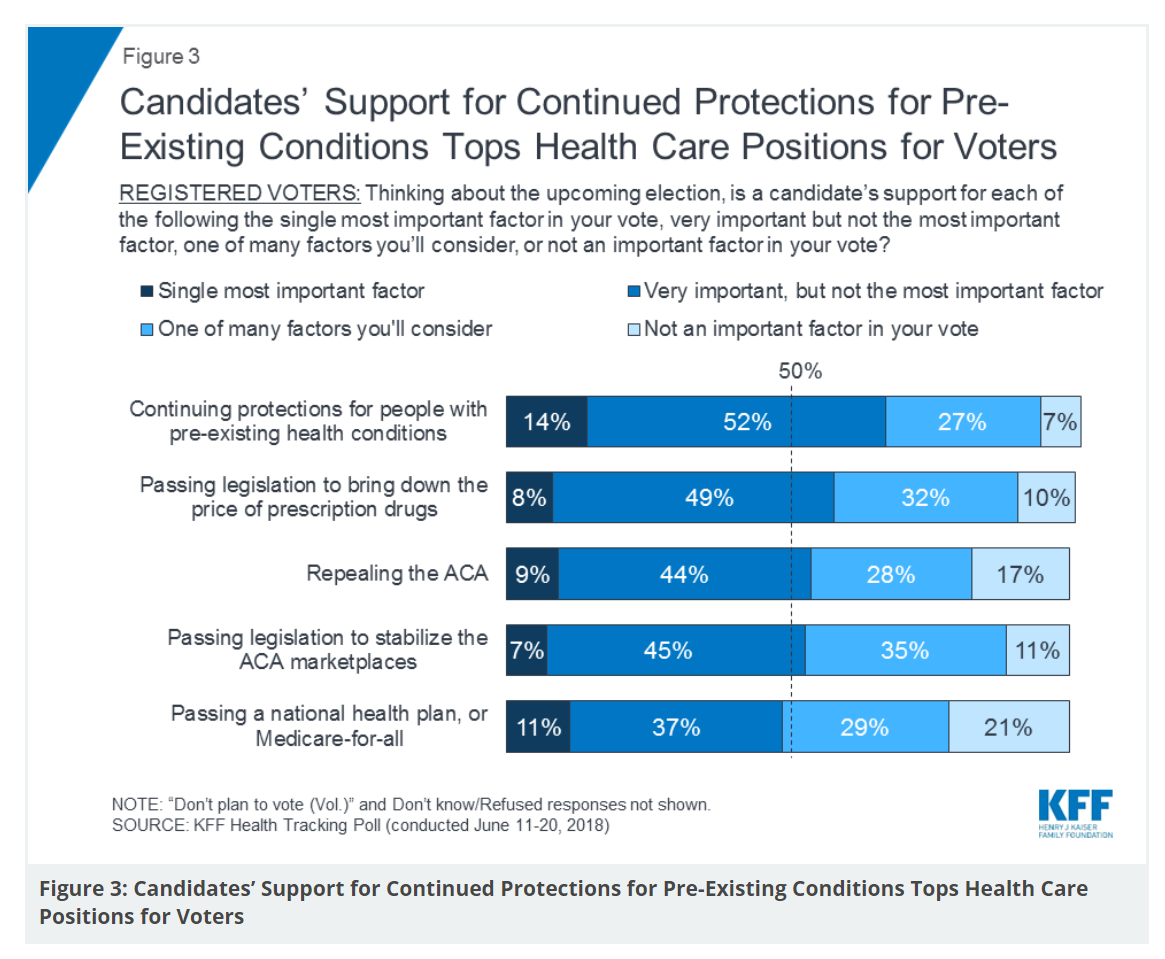

Healthcare, and Especially Covering Pre-Existing Conditions, Ranks High for Voters in 2018

President Trump and his administrative have been trying to make the ACA fail, claim most U.S. adults. Thus, the public holds the POTUS and the Republican party responsible for moving the Affordable Care Act forward….or not, according to the July 2018 Kaiser Health Tracking Poll conducted by the Kaiser Family Foundation (KFF). Health care will be a key issue in the 2018 mid-term elections that will be held in November. Among U.S. voters’ key health care concerns in 2018, one ranks “most” or “very important” for two-thirds of Americans: that is continuing to protect people with pre-existing health conditions. Other issues

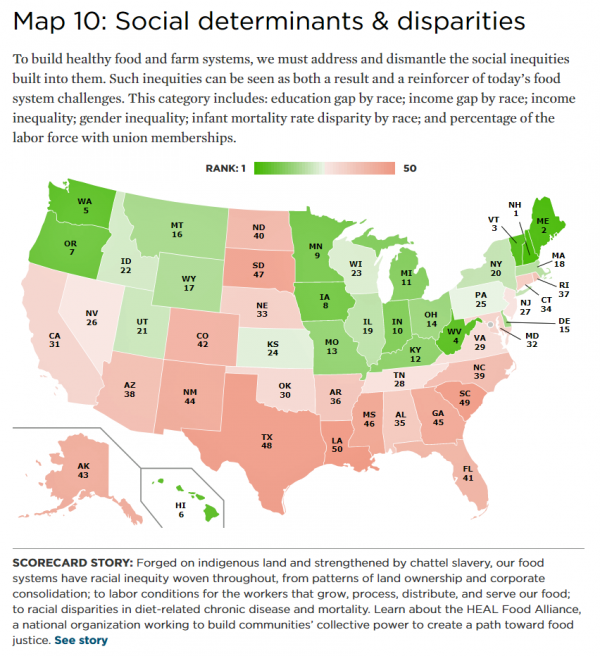

The Social Determinants of Food for Health, Farms, and the Economy

America’s agricultural roots go deep, from the native Patuxet tribe that shared maize with Mayflower settling Pilgrims in southern New England, to biodynamic and organic winemakers in Sonoma County, California, operating today. In 2016, 21.4 million full- and part-time jobs were related to agriculture and food sectors, about 11% of total U.S. employment. Farming is an integral part of a nation’s food system, so the Union of Concerned Scientists developed the 50-State Food System Scorecard to gauge the state of farming and food in the U.S. on several dimensions: diet and health outcomes, farming as an industry and economic engine,

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

Technology, Aging and Obesity Drive Healthcare Spending, BEA Finds

The U.S. Department of Commerce Bureau of Economic Analysis (BEA) released, for the first time, data that quantifies Americans’ spending to treat 261 medical conditions, from “A” diseases like acute myocardial infarction, acute renal failure, ADHD, allergic reactions, anxiety disorders, appendicitis and asthma, to dozens of other conditions from the rest of the alphabet. High Spending Growth Rates For Key Diseases In 2000-14 Were Driven By Technology And Demographic Factors, a June 2018 Health Affairs article, analyzed this data. This granular information comes from the BEA’s satellite account, using data from the Medical Expenditure Panel Survey which nationally examines expenditures by disease;

Doing Less Can Be Doing More for Healthcare – the Biggest Takeaway From ASCO 2018

Less can lead to more for so many things: eating smaller portions, lowering sugar consumption, and driving less in favor of walking or cycling come to mind. When it comes to healthcare utilization, doing less can also result in equal or even better outcomes. Groundbreaking research presented at this week’s ASCO meeting found that some women diagnosed with certain forms of cancer do not benefit from undergoing chemotherapy. The American Society of Clinical Oncology (ASCO) is one of the largest medical meetings annually, and at this huge meeting these research results for the TAILORx trial were huge news with big

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

Guns, Jobs, or Health Care? In 2018, Voters Split as to Top Issue

It’s a fairly even split between voting first on gun policy, jobs, or healthcare for the 2018 mid-term elections, ac cording to the May 2018 Kaiser Family Foundation Health Tracking Poll. Arguably, gun policy can cut in two ways: in light of the Stoneman Douglas High School shootings and wake-up call for #NeverAgain among both students and the public-at-large, vis-a-vis Second Amendment issue voters. And, as a growing public health issue, “guns” could also be adjacent to health. “If it isn’t a health problem, then why are all these people dying from it?” rhetorically asked Dr. Garen Wintemute, professor of emergency

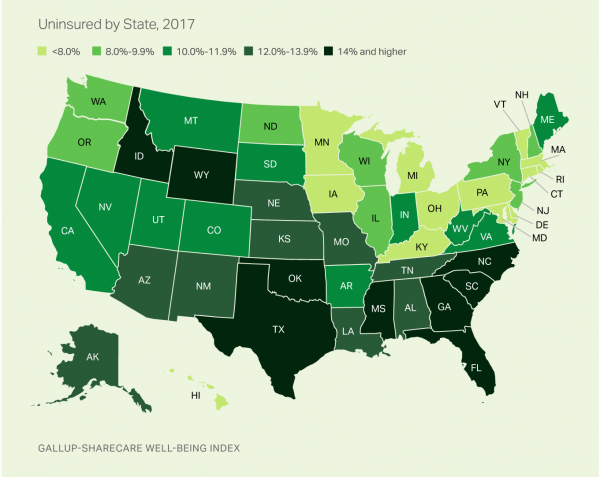

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...