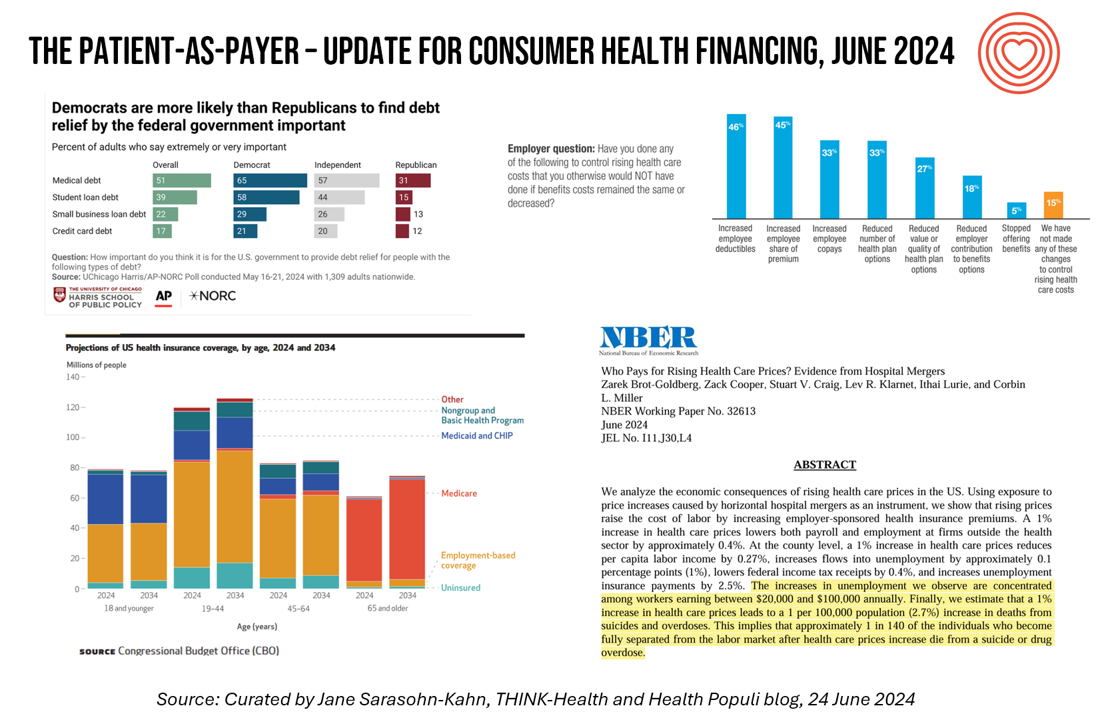

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

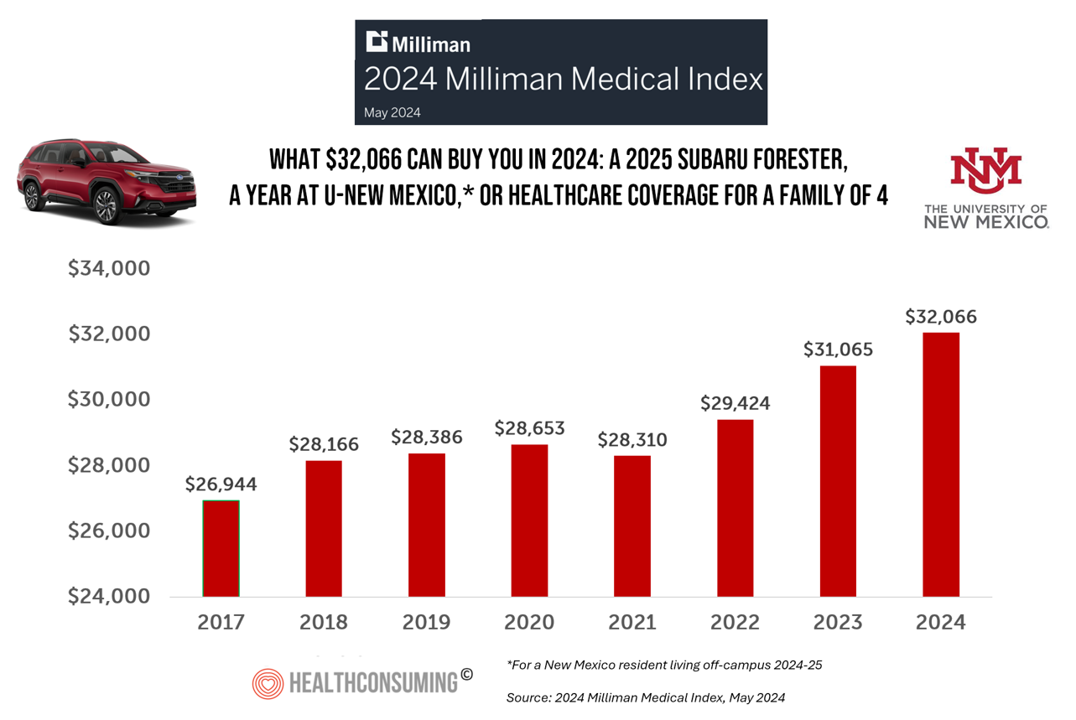

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

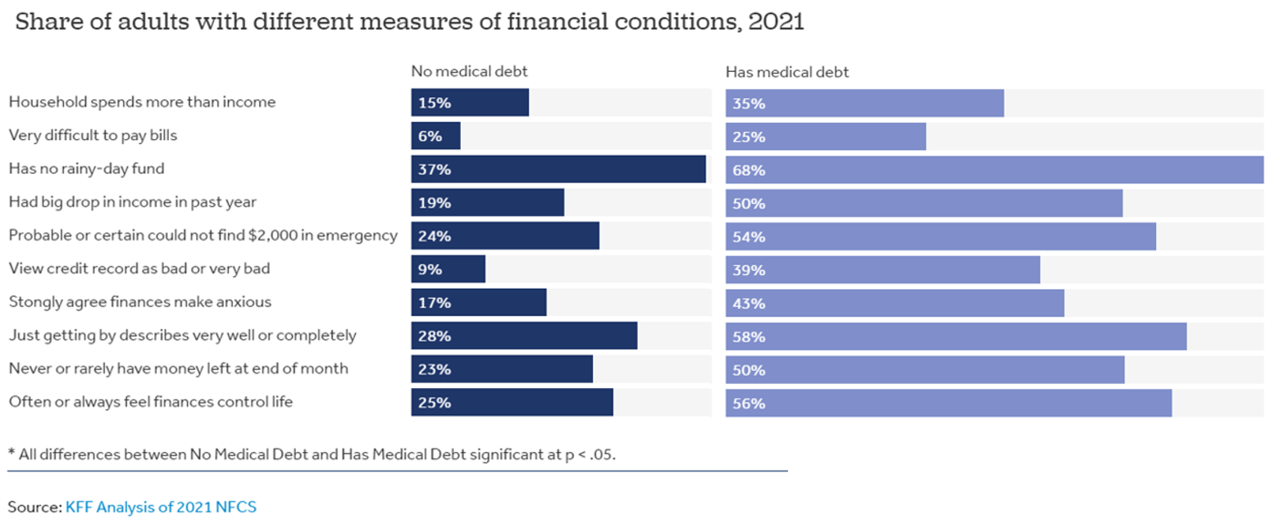

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

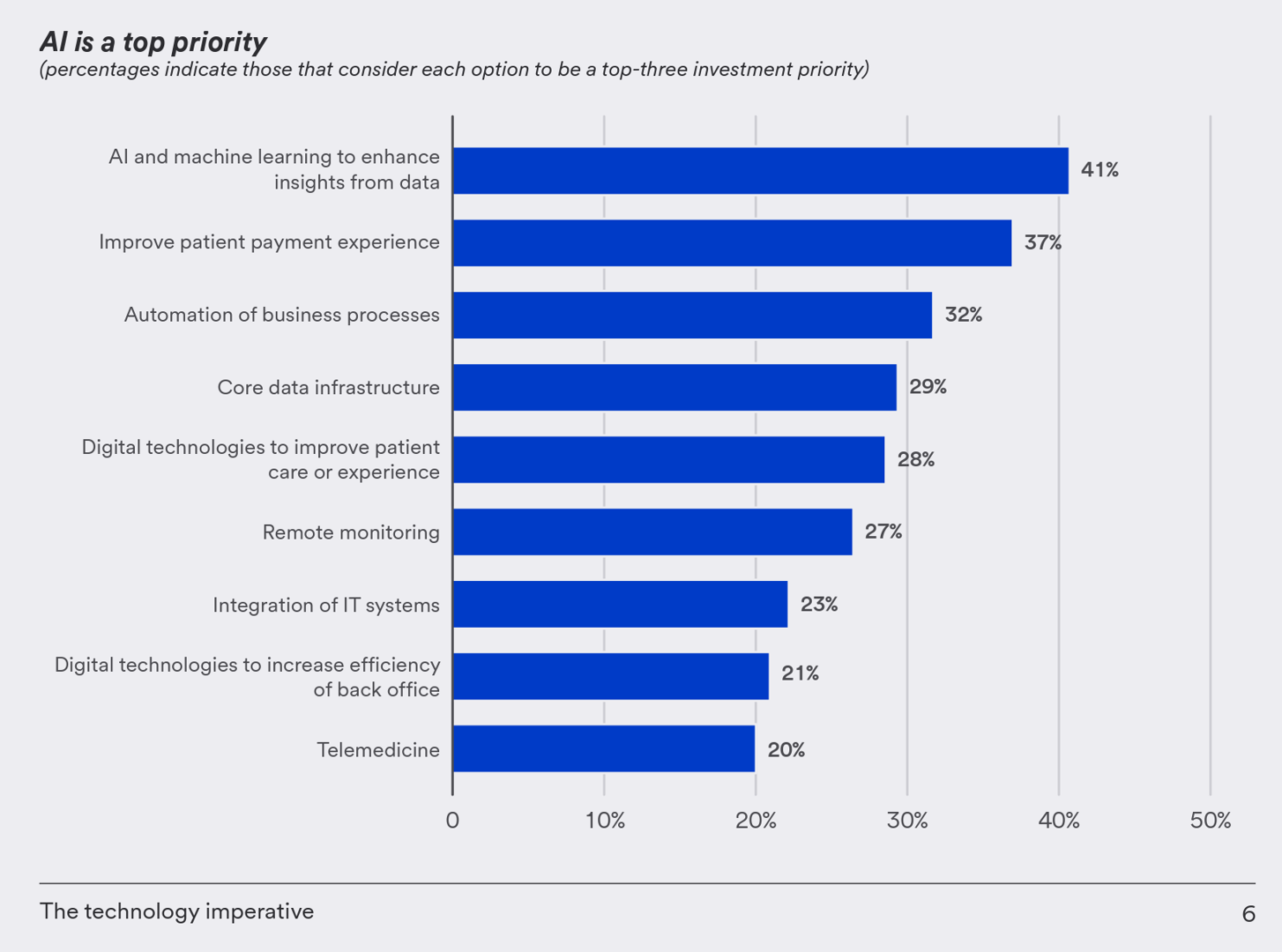

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

Integration is the New Innovation for Healthcare in 2023: Reflections on CES2023 and JPM2023

The peak of venture investment for digital health was in 2020 and 2021, precipitously declining later in 2022. And the outlook for 2023 is practical and Show-Me: that is, demonstrate clinical outcomes and return-on-investment before “I” (for investors) can take a leap of faith to spend a dollar, a Yen, a Euro, or British pound on a shiny new-new healthcare thing. If it’s January, then CES and JP Morgan convene their influential annual meetings which feature health technology for globally engaged health industry stakeholders — investors, surely, but also providers, innovators, analysts, and insurers. In my January

How Will the “New” Health Economy Fare in a Macro-Economic Downturn?

What happens to a health care ecosystem when the volume of patients and revenues they generate decline? Add to that scenario a growing consensus for a likely recession in 2023. How would that further impact the micro-economy of health care? A report from Trilliant on the 2022 Trends Shaping the Health Economy helps to inform our response to that question. Start with Sanjula Jain’s bottom-line: that every health care stakeholder will be impacted by reduced yield. That’s the fewer patients, less revenue prediction, based on Trilliant’s 13 trends re-shaping the U.S. health

The Direct Link Between Value-Based Health Care, Digital Transformation and Social Determinants – Insights from Innovaccer and Morning Consult

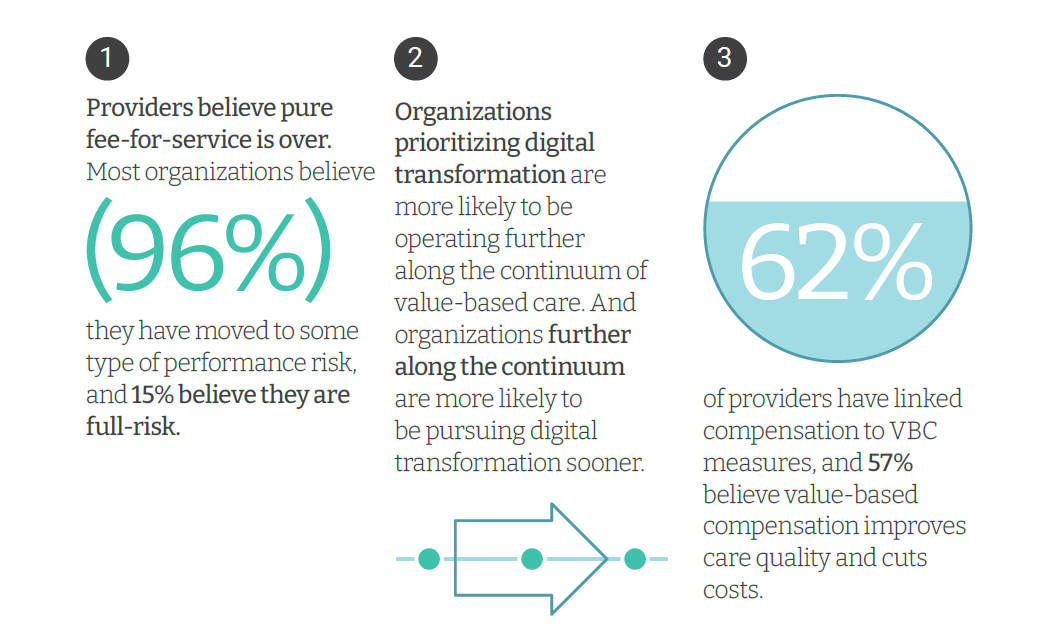

Only 4% of health care payments in the U.S. are pure fee-for-service (FFS) these days. “The end of pure FFS is near,” according to The State and Science of Value-Based Care, a report-out of survey research from Innovaccer and Morning Consult. Innovaccer, a health cloud/data analytics company, worked with Morning Consult to do deep-dive interviews with 75 senior health care executives; research was conducted in November and December 2021, so these perspectives represent those of health system leaders at the start of 2022. The full report is worth your read; my focus in this Health

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

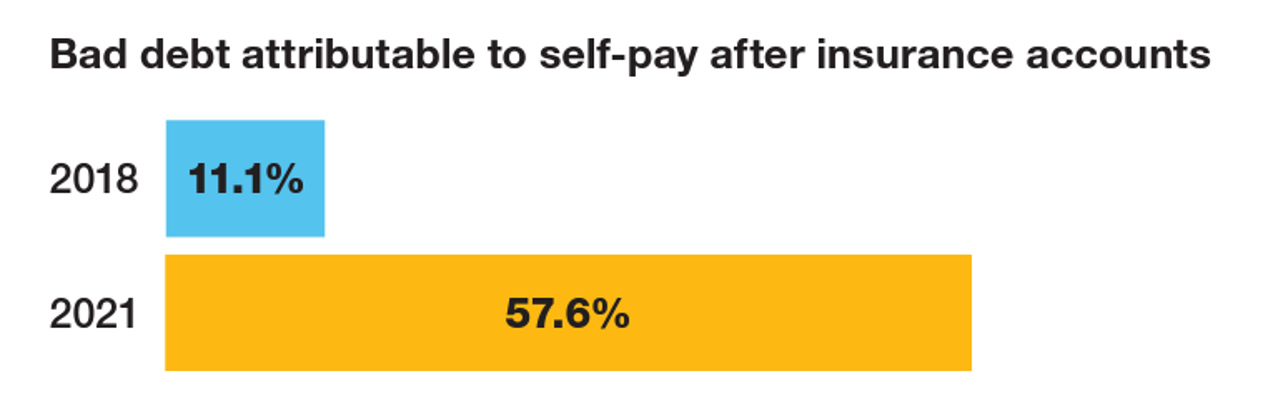

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

Medical Distancing Is Bad For Your Health

“Social distancing is great. Medical distancing? Not so much,” I observe in Medical Distancing in America: A Lingering Pandemic Side Effect., my essay published this week in Medecision’s Liberate Health blog. Since we learned to spell “coronavirus,” we also learned the meaning and risk-managing importance of physical distance early in the COVID-19 pandemic. But medical distancing became a corollary life-flow of the physical version, and for our collective health and well-being, it hasn’t been good for our health in ways beyond keeping our exposure to the virus at bay. For health care providers — physicians, hospitals, ambulatory clinics, diagnostic centers —

A Negative Outlook for US Hospital Margins Through 2021

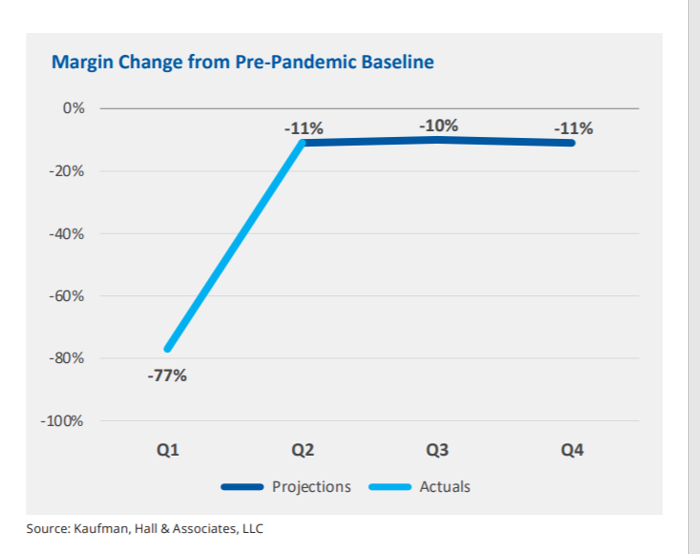

In the fourth quarter of 2021, U.S. hospital margins will still be lower than before the COVID-19 pandemic, Kaufman, Hall & Associates project in their latest read on hospital finances. Kaufman Hall has been monitoring hospitals’ financial health in the coronavirus era since March 2020, month-by-month. This new report looks into the Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021. This report was conducted on behalf of the American Hospital Association (AHA), who succinctly summarized the forecast saying, “COVID-19 [is] expected to drive continued hospital losses throughout 2021.” That projection is further couched in the concern that

New Primary Care, Retail and Tech Entrants Motivating Hospitals to Grow Consumer Chops

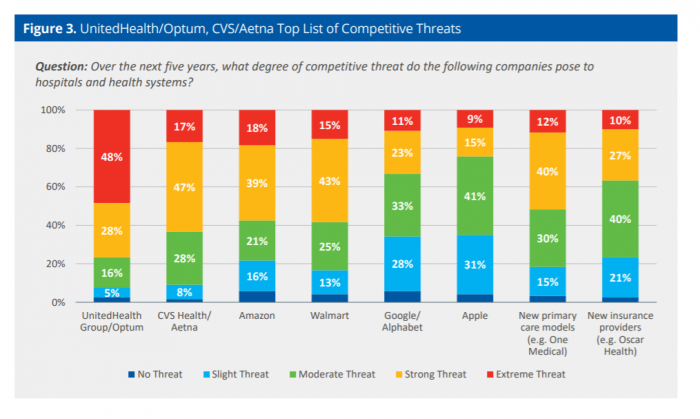

Rising costs, generational shifts, digital transformation, and fast-growing investments in new health care models and technologies are forcing change in the legacy health care, noted in the State of Consumerism in Healthcare 2021: Regaining Momentum, from Kaufman, Hall & Associates. As the title of Kaufman Hall’s sixth annual report suggests, health care consumers are evolving — even if the traditional healthcare system hasn’t uniformly responded in lock step with more demanding patients. Kaufman Hall analyzed 100 health care organizations in this year’s consumerism survey to assess their readiness to embrace consumer-centric strategies, understand how the industry prioritizes these approaches, evaluate

Emerging with A Stronger Healthcare System Post-COVID: NAM’s Lessons Learned

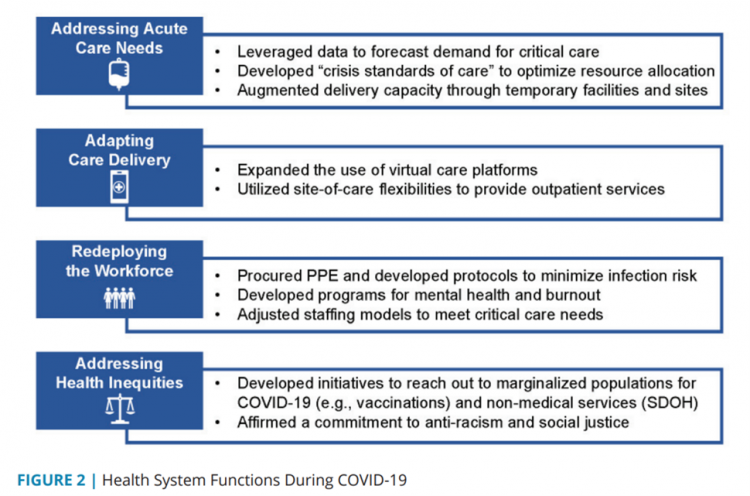

The coronavirus pandemic exposed weaknesses in the U.S. health care system that existed before the public health crisis. What lessons can be learned from the COVID-19 stress-test to build American health care back better? The National Academy of Medicine is publishing nine reports addressing health stakeholder segments impacted and re-shaped by COVID-19 — for public health, quality and safety, health care payers, clinicians, research, patients-families-communities, health product manufacturers, digital health, and care systems. The report on health care systems and providers was released this week: COVID-19 Impact Assessment: Lessons Learned and Compelling Needs was authored by experts on the front-line

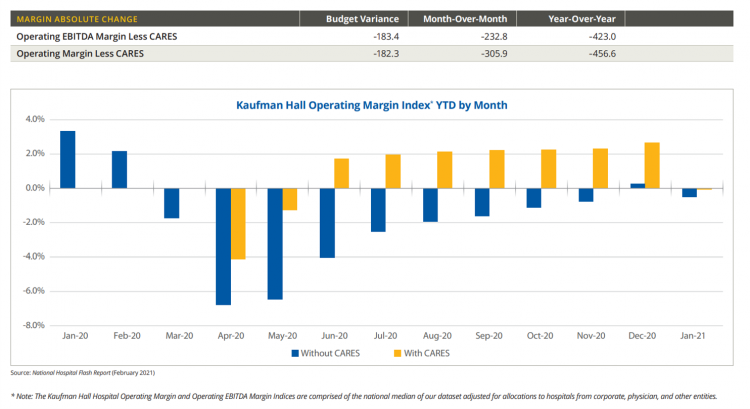

Hospitals Continue to Lose Money in Year 2 of the Pandemic

U.S. hospitals’ operating margins went negative in January 2021 after turning north for the first time in December 2020 since the start of the coronavirus pandemic, according to the February 2021 Hospital Flash Report from Kaufman Hall, commissioned by AHA, the American Hospitals Association. The first chart illustrates the importance of CARES Act funding to keep hospitals financially afloat during the public health crisis through most of last year. The start of 2021 was difficult for hospitals and health systems, Kaufman Hall explains, with falling outpatient revenues and increasing expenses resulting in that below-the-line blue bar for January 2021’s operating

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

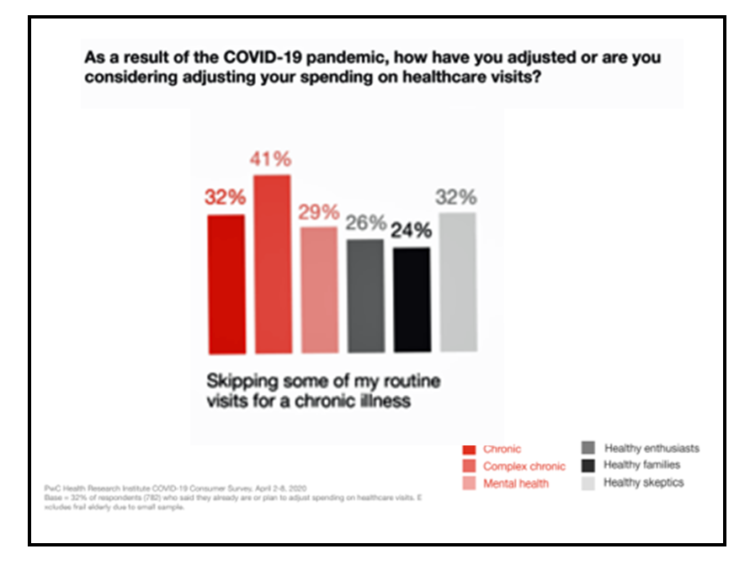

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

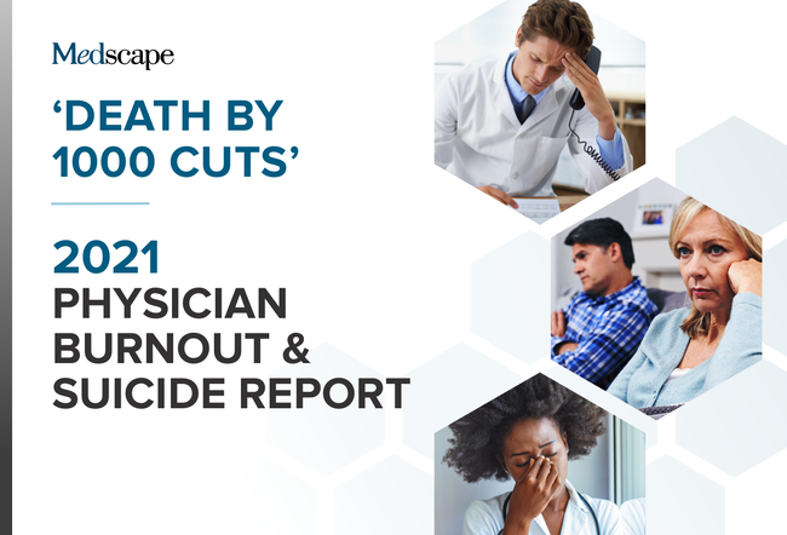

Dr. Burnout – The 2021 Medscape Physician Burnout & Suicide Report

Physicians in the U.S. are experiencing “death by 1,000 cuts,” according to the 2021 Medscape Physician Burnout & Suicide Report. Medscape polled 12,339 physicians representing over 29 specialties between late August and early November 2020 to gauge their feelings about work and life in the midst of the coronavirus pandemic. Medscape researched its first Physician Lifestyle Report in 2012. That research focused on physician “happiness” and work-life satisfaction. In 2013, the issue of burnout was called out on the cover of the report, shown here with the question, “does burnout affect lifestyle?” In 2015, the Physician Lifestyle Report was titled,

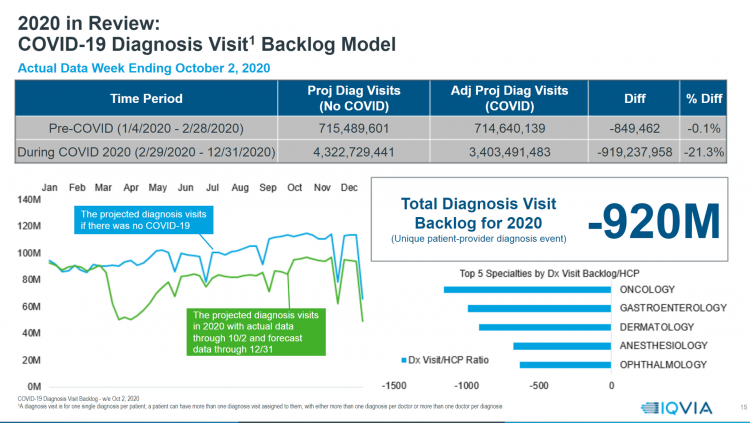

Will 2021 Be the Year of Sicker Americans? Pondering Late 2020 Data from IQVIA

Yesterday, IQVIA presented their end-of-year data based on medical claims in the U.S. health care system tracking the ups, downs, and ups of the coronavirus in America. IQVIA has been tracking COVID-19 medical trends globally from early 2020. The plotline of patient encounters for vaccines, prescribed medicines, foregone procedures and diagnostic visits to doctors begs the question: in 2021, will Americans be “sicker,” discovering later-stage cancer diagnoses, higher levels of pain due to delayed hip procedures, and eroded quality of life due to leaky guts? Here are a few snapshots that paint a picture for greater morbidity and potentially more “excess

Rebuilding Resilience, Trust, and Health – Deloitte’s Latest on Health Care and Sustainability

The COVID-19 pandemic has accelerated health care providers’ and plans’ investment in digital technologies while reducing capital spending on new physical assets, we learn in Building resilience during the COVID-19 pandemic and beyond from the Deloitte Center for Health Solutions. What must be built (or truly re-built), health care leaders believe, is first and foremost trust, followed by financial viability to ensure long-term resilience and sustainability — for the workforce, the organization, the community, and leaders themselves. For this report, Deloitte interviewed 60 health care chief financial officers to gauge their perspectives during the pandemic looking at the future of

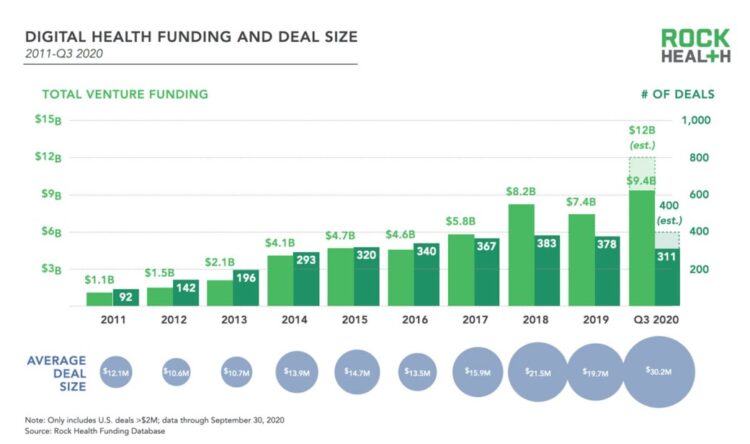

The Coronavirus Pandemic Turbocharged Digital Health Investment in 2020

2020 will be remembered for disruption and dislocation on many fronts; among the major blips in the year will be it remembered as the largest funding year for digital health recorded, according to Rock Health’s report on the 3Q2020 digital health funding. This funding record (“already” before year-end, tallied by the third quarter as Rock Health notes) was driven by “mega”-deals accelerated during the public health crisis of COVID-19. In the third quarter of 2020, some $4 billion was invested in U.S. based digital health start-ups adding up $9.4 billion in 2020….so far. This is $1.2 billion more than two

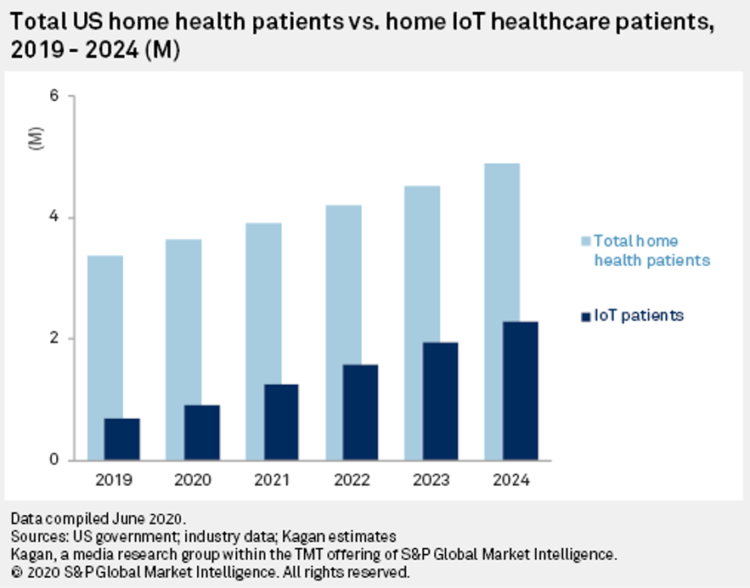

The Next Site for Hospital Care Is the Original One — Your Home

The coronavirus pandemic accelerated many trends and new workflows for patients and consumers, and health care providers, too. The convergence of basic needs like hygiene and safety, financial and health security, and living-working-learning-and-cooking-at-home has turbocharged a migration of more acute care delivered at home. I explore this growing concept in my latest essay on Medecision’s Liberation blog, How the Pandemic Is Accelerating the Hospital-At-Home Concept. The key points are that: Hospital-at-home services (H-a-H) combine home visits with virtual care and remote monitoring Think: advanced home care, enabled through virtual health technologies and wrap-around services both clinical and scaled social determinants

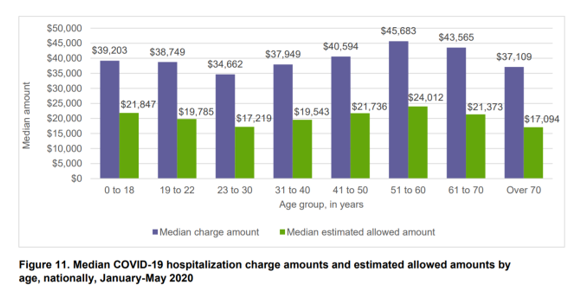

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

Beyond Care and Outcomes, Hospitals Must Deliver on Civics, Inclusivity, Equity, and Value – Lown Institute’s Best Hospitals

The core business of hospitals is patient care, often baked with teaching and research. But wait — there’s more, asserts the Lown Institute in their approach to ranking America’s Best Hospitals in 2020. The Institute’s methodology for assessing what’s “best” addresses ten pillars. Several of these are the “stick-to-the-knitting” components of the Webster Dictionary definition of hospital work: patient outcomes, clinical outcomes, avoiding overuse, patient safety, and a recent focus, patient satisfaction. Community benefit has been part of a hospital’s life, especially in the not-for-profit world where hospitals must demonstrate goodwill generated for and provided in the neighborhoods in which

U.S. Hospitals Will Lose $323 Billion in 2020 – Before Accounting for Growing COVID Cases

U.S. health systems are projected to lose $323 billion in 2020 due to declining inpatient and outpatient volumes caused by the COVID-19 pandemic’s impact on the “normal” hospital business. Hospitals racked up over $200 bn in losses between March and June 2020. according to the American Hospital Association’s report, Hospitals and Health Systems Continue to Face Unprecedented Financial Challenges Due to COVID-19. AHA suggests that the $323 bn loss figure may be underestimated, as growing coronavirus cases are emerging in certain states: as of this writing, Arizona, Arkansas, Florida, Louisiana, South Carolina, Texas, and Utah among those states heating up.

Health Care In the COVID-19 Era – PwC Finds Self-Rationing of Care and Meds Especially for Chronic Care

Patients in the U.S. are self-rationing care in the era of COVID-19 by cutting spending on health care visits and prescription drugs. The coronavirus pandemic’s impact on health consumers’ spending varies depending on whether the household is generally a healthy family unit, healthy “enthusiasts,” dealing with a simple or more complex chronic conditions, or managing mental health issues. PwC explored how COVID-19 is influencing consumers’ health care behaviors in survey research conducted in early April by the Health Research Institute. The findings were published in a May 2020 report, detailing study findings among 2,533 U.S. adults polled in early April

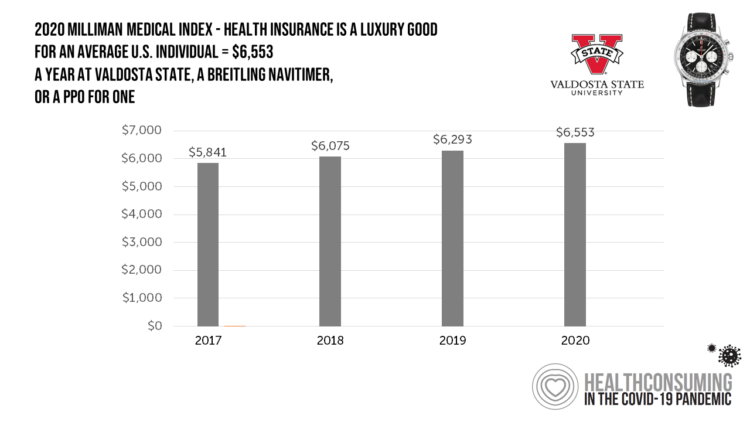

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

The Patient-as-Payor in the Coronavirus Pandemic

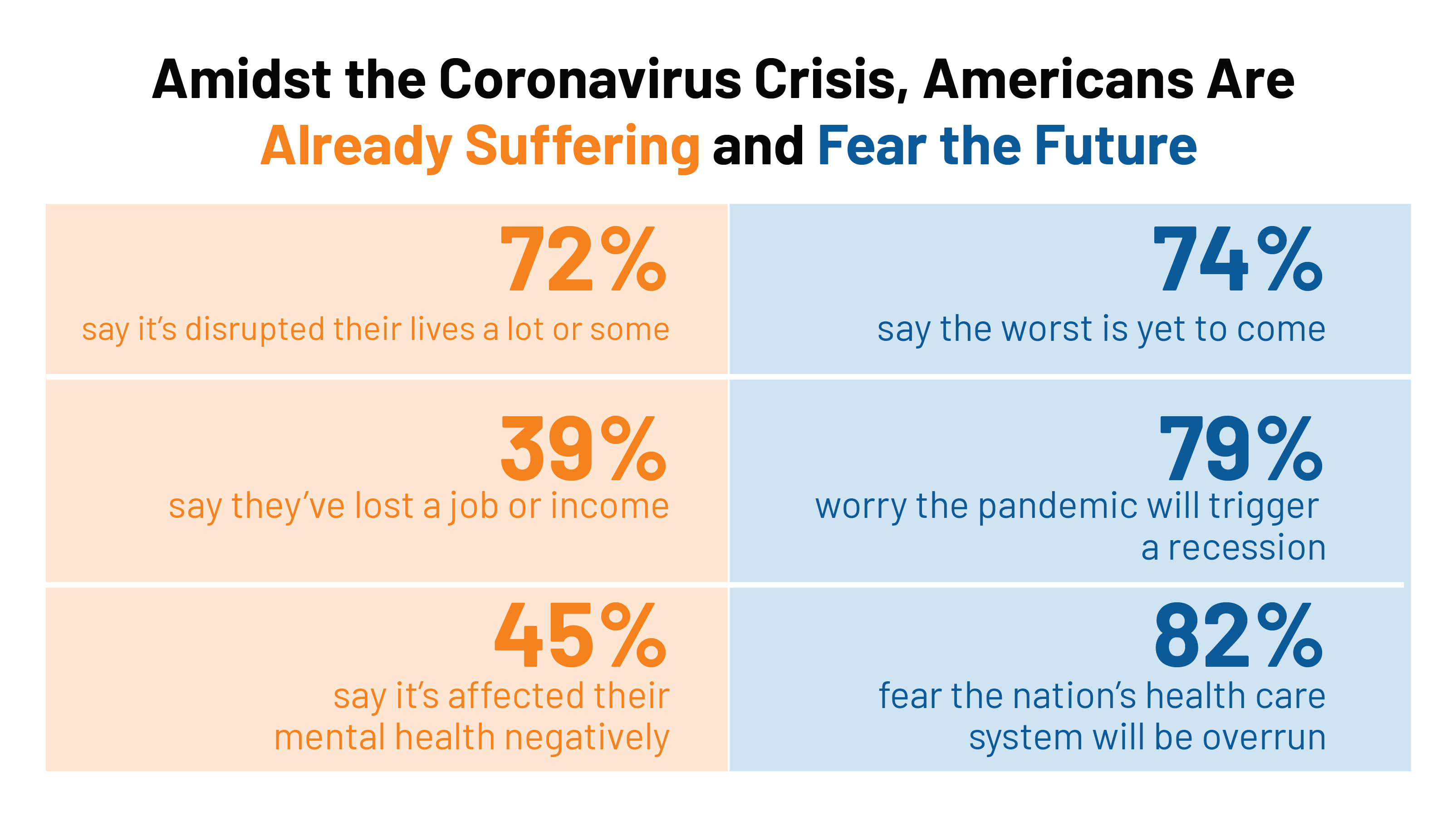

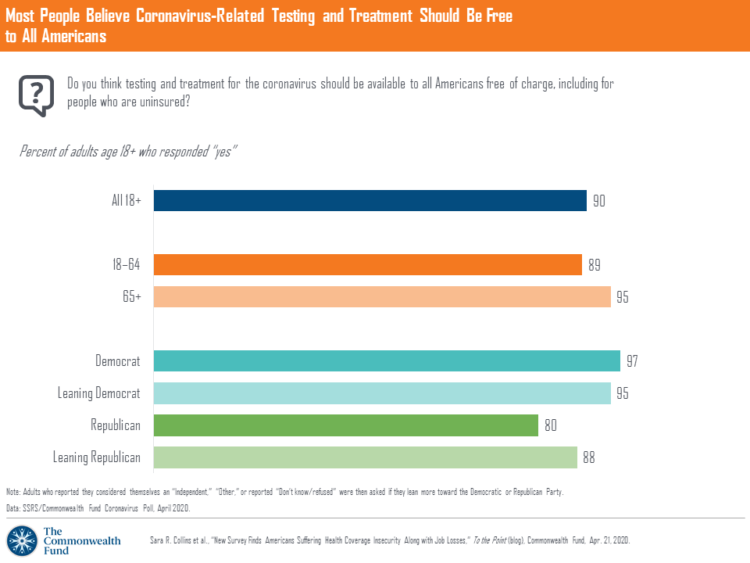

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

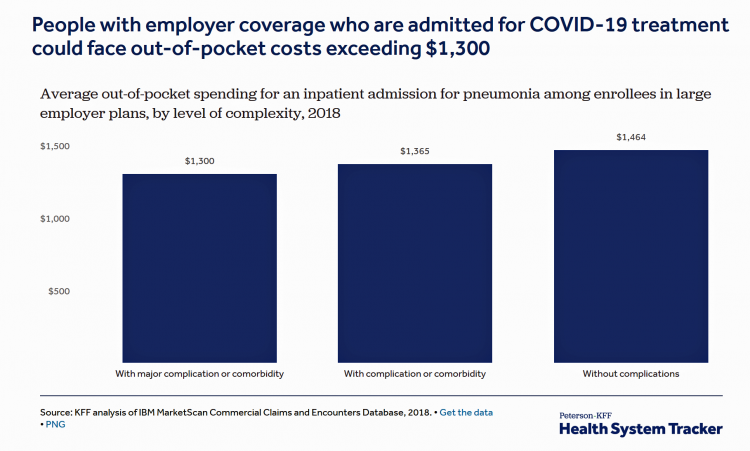

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Lockdown Economics for U.S. Health Consumers

The hashtag #StayHome was ushered onto Twitter by 15 U.S. national healthcare leaders in a USA Today editorial yesterday. The op-ed co-authors included Dr. Eric Topol, Dr. Leana Wen, Dr. Zeke Emanuel, Dr. Jordan Shlain, Dr. Vivek Murthy, Andy Slavitt, and other key healthcare opinion leaders. Some states and regions have already mandated that people stay home; at midnight last night, counties in the Bay Area in California instituted this, and there are tightening rules in my area of greater Philadelphia. UBS economist Paul Donovan talked about “Lockdown Economics” in his audio commentary today. Paul’s observations resonated with me as

Outpatient is the New Inpatient – The Future of Hospitals in America

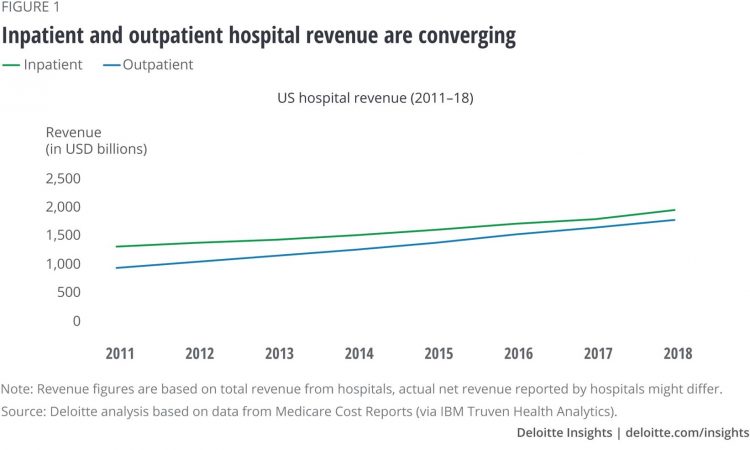

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

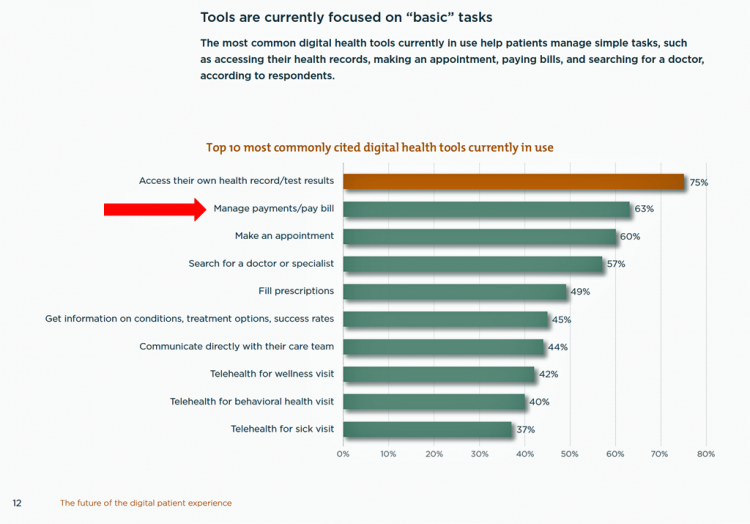

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

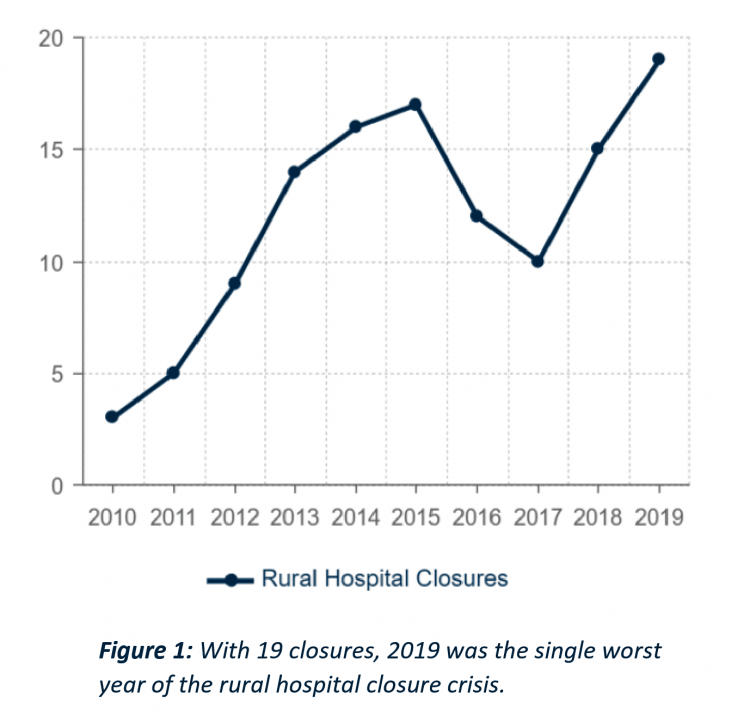

The Ill Health of Rural Hospitals in Four Charts

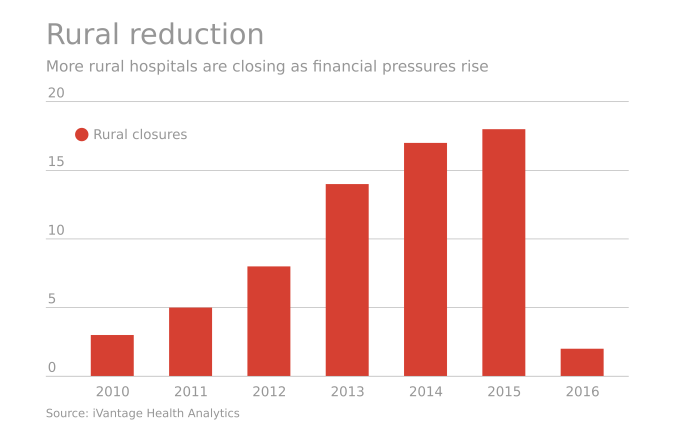

There are 1,844 rural hospitals operating in the U.S. That number is down by 19 in the 2019 calendar year, the worst year of rural hospital closings seen in the past decade. That hockey-stick growth of closures is shown in the first chart, where 34 rural hospitals shut down in the past 2 years. Rural U.S. hospitals are in poor fiscal health. “The accelerated rate at which rural hospitals are closing continues to unsettle the rural healthcare community and demands a more nuanced investigation into rural hospital performance,” threatening the stability of the rural health safety net, according to the

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

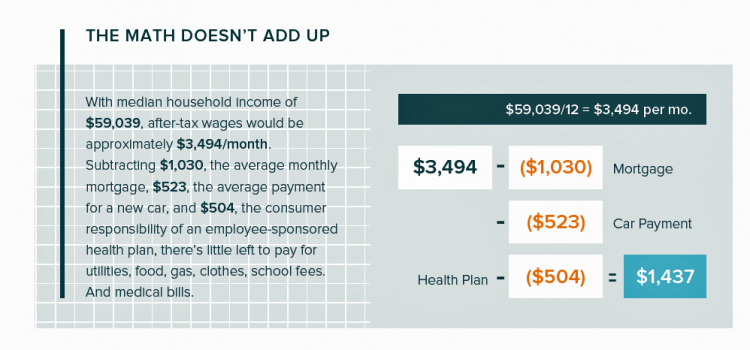

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

How MedModular Fits Into the New Lower-Cost, High-Quality, Consumer-Enchanted Healthcare World

In American health economics, there’s a demand side and a supply side. On the demand side, we’ve done a poor job trying to nudge patients and consumers toward rational economic decision making, lacking transparency, information symmetry, and basic health literacy. On the supply side, we’ve engaged in a medical arms race allocating capital resources to shinier and shinier new things, often without cost-benefit rationale or clinical evidence. On that supply side, though, I met up with an innovation that can help to bend the capital cost curve of how we envision and build new hospitals and clinics. This week, I

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

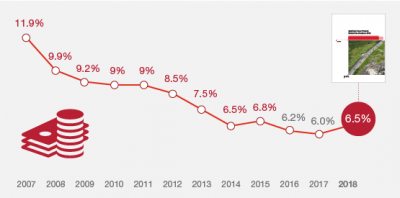

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

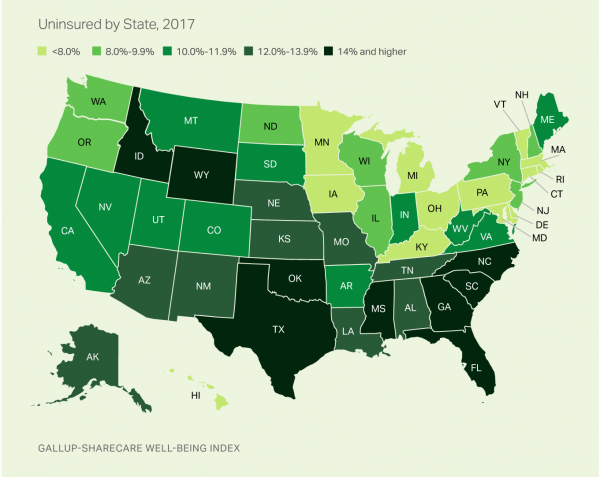

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

Will Getting Bigger Make Hospitals Get Better?

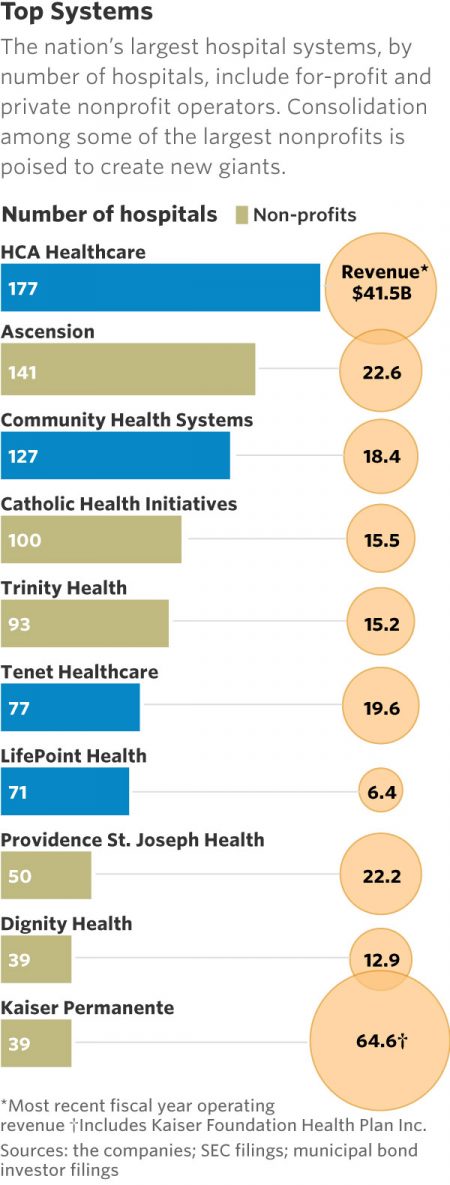

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health. In terms of size, the CHI and Dignity combination would create a larger company than McDonald’s or Macy’s in terms of projected $28 bn of revenue. (Use the chart of America’s top systems to do the math). For context, other hospital stories this week discuss in southern New Jersey. And this week, the New Jersey Hospital Association annual report called the hospital industry the “$23.4 billion economic bedrock” of the state. Add a third important item

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

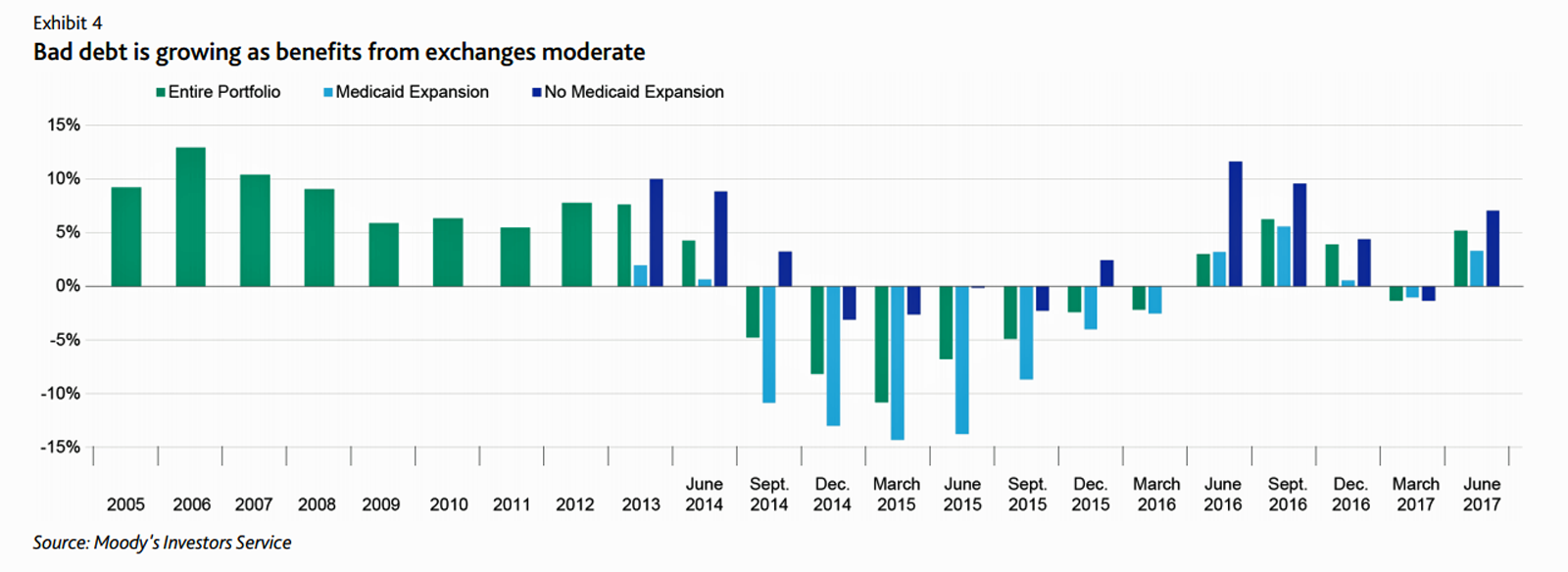

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

Patients Are Looking to Finance Healthcare Over Time

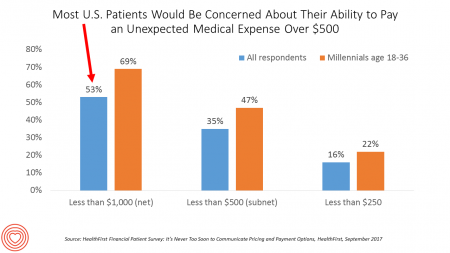

Most U.S. patients want healthcare providers to offer cost information before a procedure, and whether doctors offer financial options to help them extend payments over time. This is an automotive or home appliance procedure we’re talking about. It’s healthcare services, and American patients are now the third largest payors to providers in the nation. Thus, the title of a new report summarizing a consumer survey from HealthFirst notes, “It’s Never Too Soon to Communicate Pricing and Payment Options. The study found that two-thirds of U.S. consumers would like healthcare providers to discuss financing options; however, only 18 percent of providers have

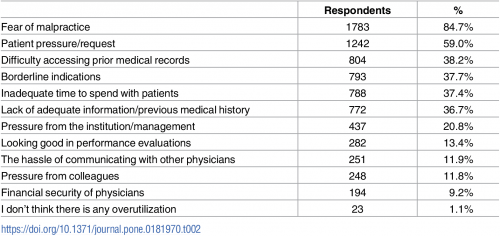

Healthcare Overtreatment in the U.S. – Risky and Costly

Overtreatment is a major contributor to waste and patient risk in America. Most U.S. physicians say it’s a common fact of life in American healthcare, gleaned through physician survey detailed in Overtreatment in the United States, published in PLOS One on September 6, 2017. The overwhelming majority (8 in 10 physicians) identified malpractice as the reason for overtreatment, followed by patient pressure/request (59%). Other reasons cited for overtreatment included: Difficulty accessing prior medical records Borderline indications Inadequate time to spend with patients, and Lack of adequate information or previous medical history. Overall, physicians judged 20% of healthcare to fall into

Patients’ Healthcare Payment Problems Are Providers’, Too

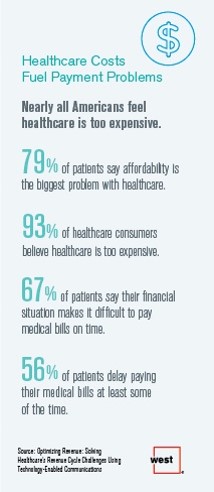

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

Consumer Experience Is An Integral Part of the Healthcare Experience

Patient satisfaction should be baked into healthcare provider service goals, according to Prioritizing the Patient Experience from West Corporation, the communications company. West is in the business of improving communications systems, and has a vested interest in expanding comms in health. This research polled patients and providers to assess how each healthcare stakeholder perceives various patient satisfaction issues, which when done well are grounded in sound communications strategy and technologies. Patient satisfaction is directly linked to the bottom lines of healthcare organizations, West contends, due to two key drivers: Evolving payment models are increasingly tying patient satisfaction to reimbursements; and,

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

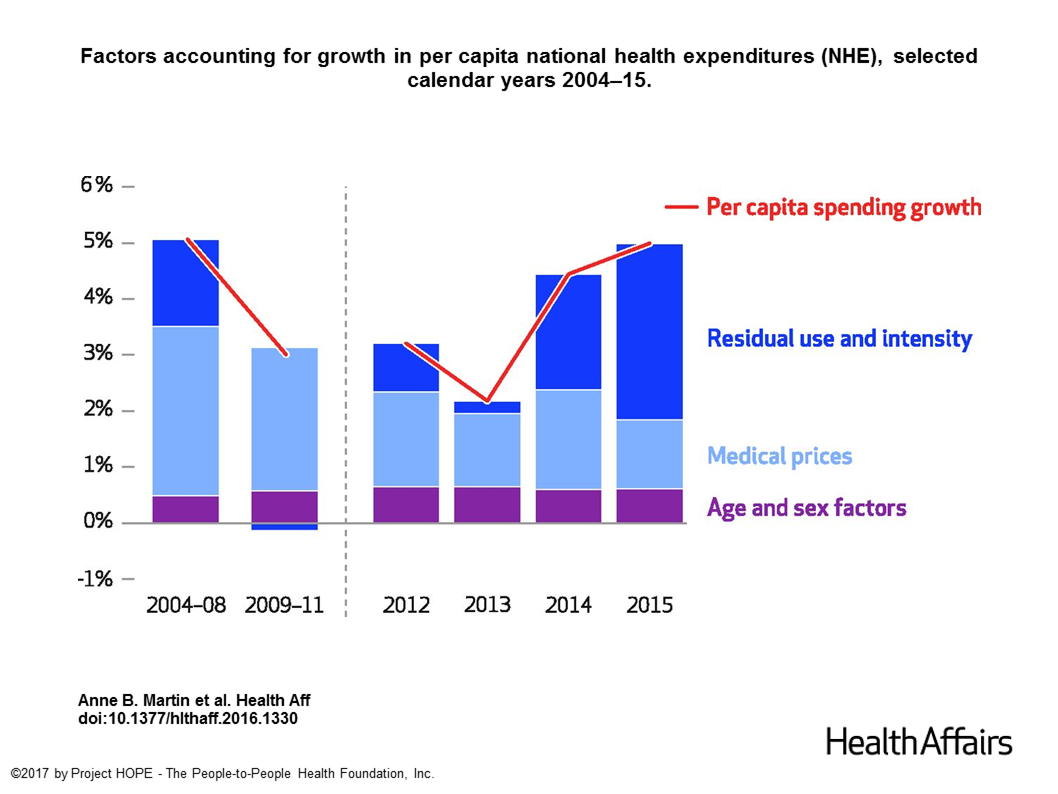

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

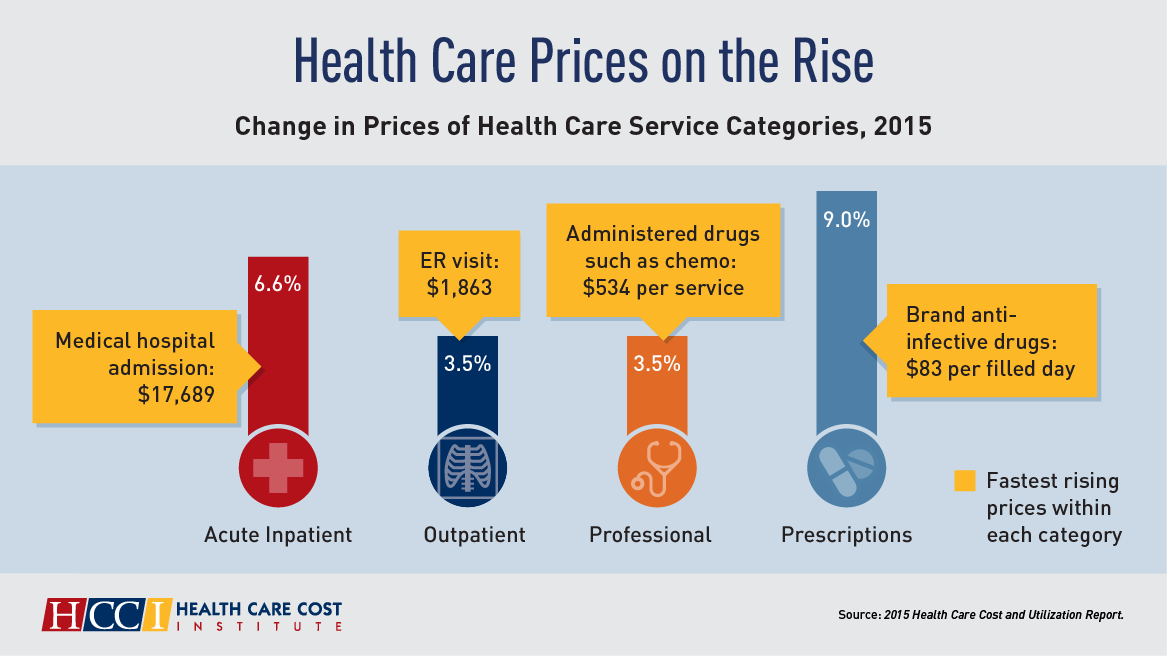

Both Healthcare Prices and Use of Services Driving Up Spending

Health care spending grew 4.6% in 2015, higher than the rise in either 2013 or 2014, according to the 2015 Health Care Cost and Utilization Report published by HCCI, the Health Care Cost Institute. The key contributors to health care spending by percentage were, first and foremost, prescription drugs which rose 9% in the year — notably, specialty medicines like anti-infective drugs (such as those for Hepatitis C and HIV) costing on average $83 per “filled day.” This cost doubled from $53 per person in 2012 to $101 per person in 2015. Hospital costs saw the second greatest percentage price increase

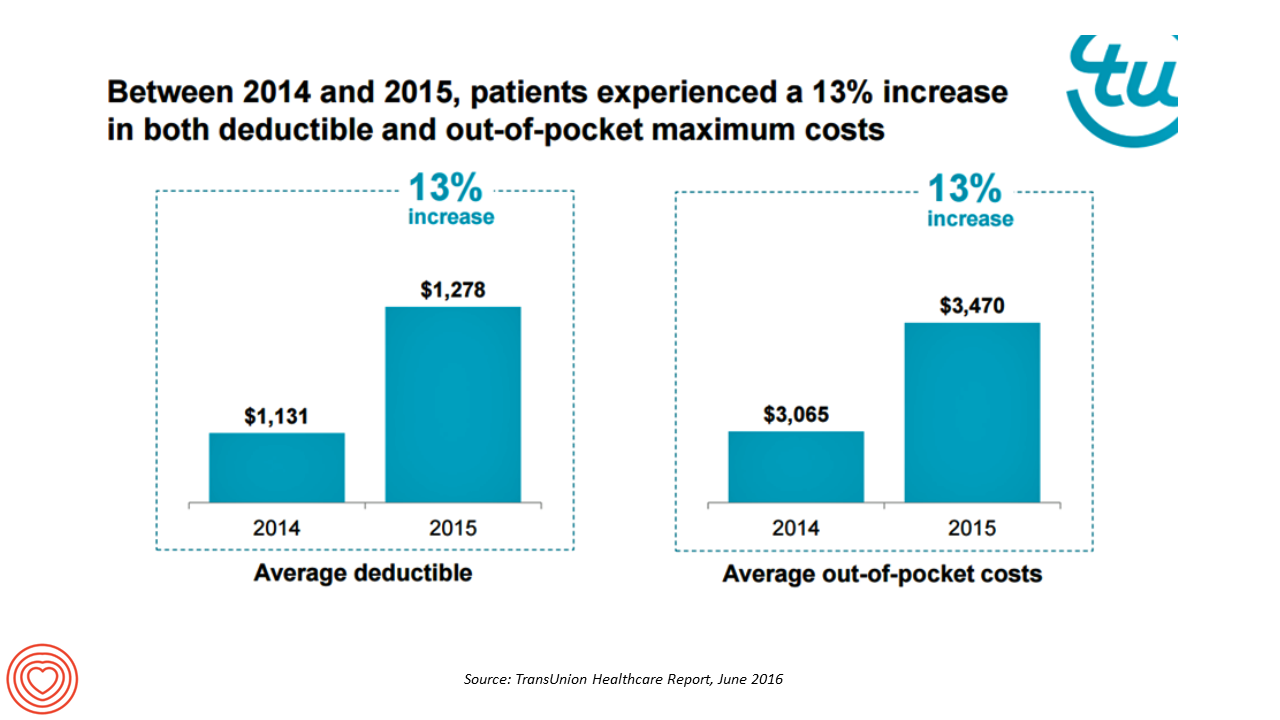

More Patients Morph Into Financially Burdened Health Consumers

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016. Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015. In

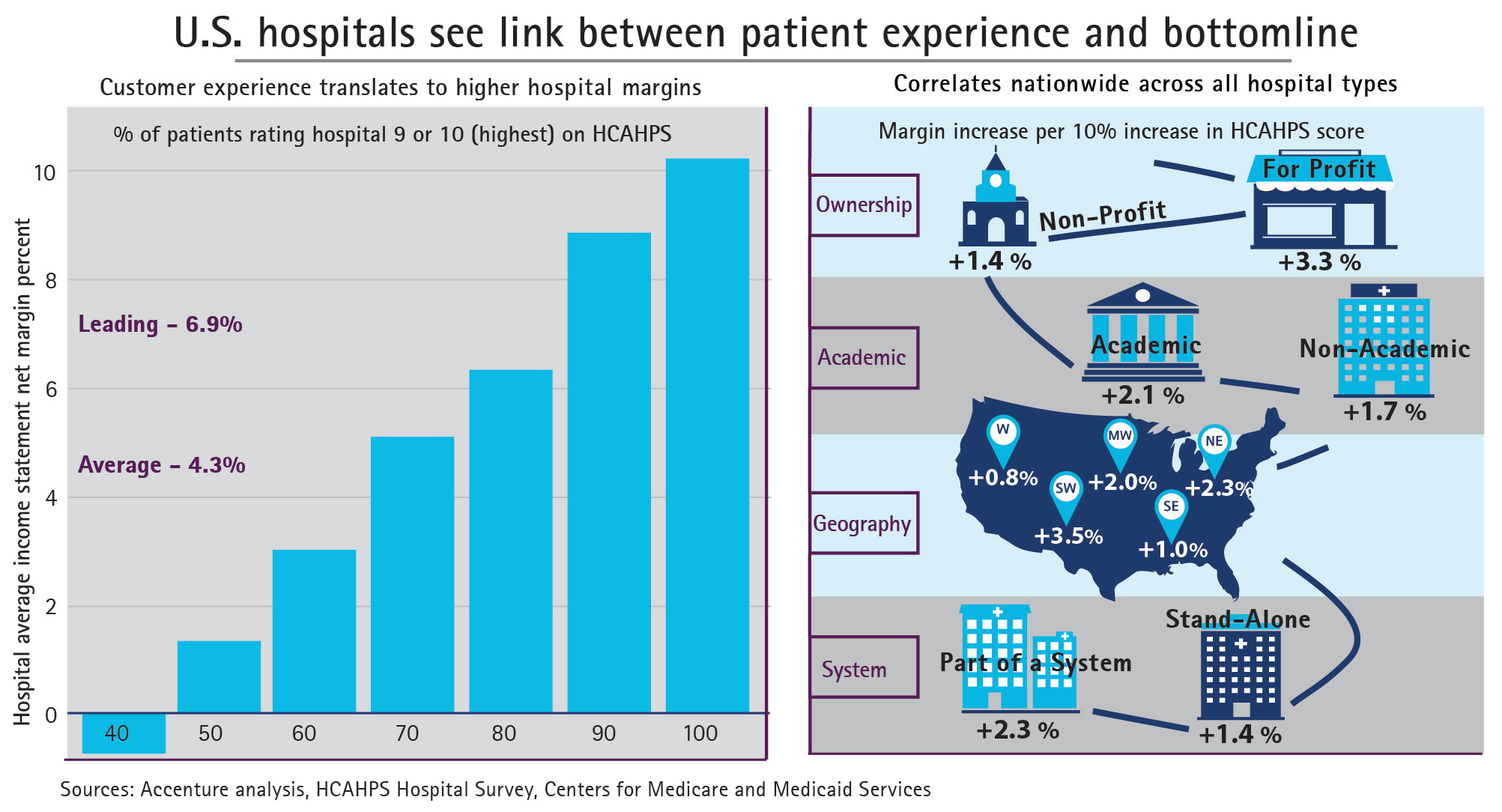

Happy Patients, Healthy Margins – the Hard ROI for Patient-Centered Care

Hospital margins can increase 50% if health providers offer patients a better customer experience, Accenture calculates in the paper, Insight Driven Health – Hospitals see link between patient experience and bottom line. Specifically, hospitals with HCAHPS scores of 9 or 10, the highest recommendations a patient can give in the survey, more likely enjoy higher margins (upwards of 8%). The Hospital Computer Assessment of Healthcare Providers and Systems (HCAHPS) survey is administered by the Centers for Medicare and Medicaid Services (CMS) and measures patients’ exeperiences in hospital post-discharge. The correlation, simply put, is “Happy Patients, Healthy Margins,” Accenture coined in

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

Rural Hospitals in America – Health Disparities, Hospital Disparities

Rural hospitals operating in the U.S. have a higher risk of mortality — closure — than other hospitals in America. The U.S. health care landscape is littered with examples of health disparities among the nation’s health citizens – for example, women’s lower access to heart-health care, Latinos’ higher rates of Type 2 Diabetes, and African-Americans’ greater risks of stroke, many cancers, maternal mortality, and many other causes of mortality and diminished health. A report from iVantage, Rural Relevance – Vulnerability to Value, documents the fiscally challenging environment for rural hospitals in America. There are at least 673 facilities at-risk of closure

Virtual Visits Would Conserve Primary Care Resources in US Healthcare

By shifting primary care visits by 5 minutes, moving some administrative tasks and self-care duties to patients, the U.S. could conserve billions of dollars which could extend primary care to underserved people and regions, hire more PCPs, and drive quality and patient satisfaction. Accenture’s report, Virtual Health: The Untapped Opportunity to Get the Most out of Healthcare, highlights the $10 bn opportunity which translates into conserving thousands of primary care providers. PCPs are in short supply, so virtual care represents a way to conserve precious primary care resources and re-deploy them to their highest-and-best-use. The analysis looks at three scenarios

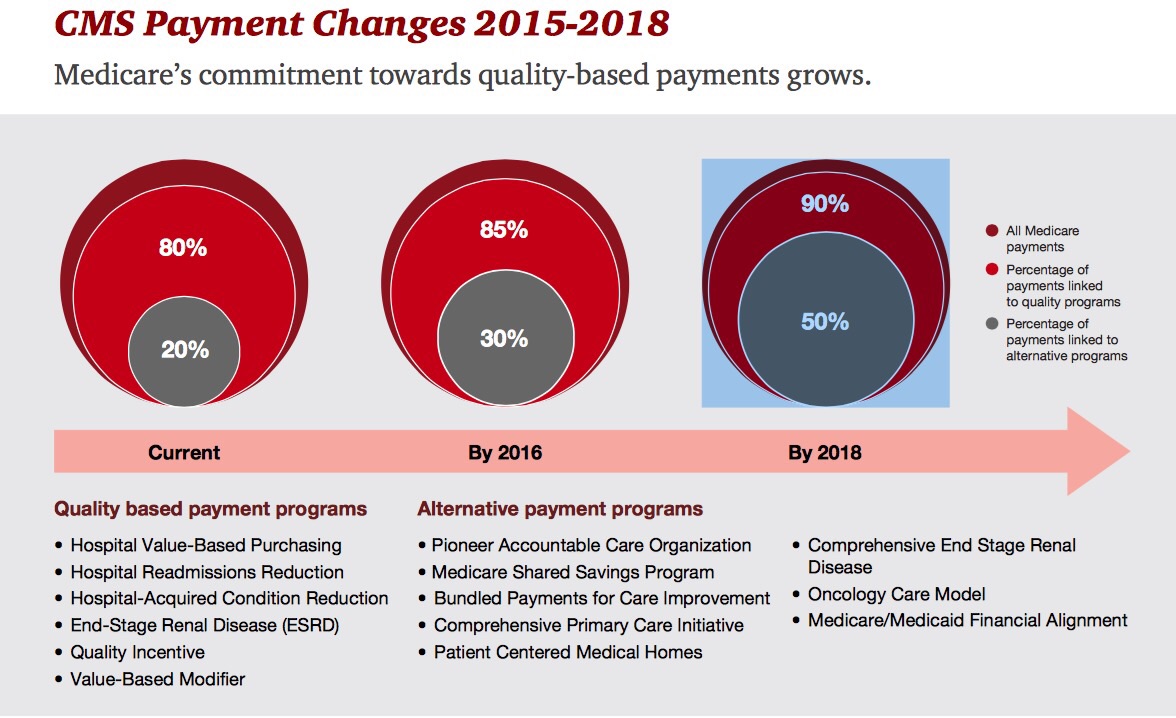

The Tricky Journey From Volume To Value In Health Care – Prelude To Health 2.0

By 2018, 90% of health care delivered to people enrolled in Medicare will be paid-for on the basis of quality, not on the amount of services delivered (that is, volume). But as providers must up their game in that new value-oriented health payment world, they are bound up in work flows and organizational structures built for fee-for-service reimbursement. This changing future is discussed in Healthcare’s alternative payment landscape, PwC’s Healthcare Research Institute report on the volume-to-value shift. PwC notes that health care providers’ ability to adapt to changing payment regimes vary and fall into four categories: traditional, lagging, vanguard and

Bridging a Commercialization and Design Chasm, StartUp Health Allies With Aurora Health Care

Startup Health, the health/care entrepreneur development company which has helped launch over 100 health/tech companies since “starting up” in 2011, announced a collaboration with Aurora Health Care today. This is one of the first ventures of its kind, linking up health/tech entrepreneurs with a health care provider organization as a living lab, or in the words of Unity Stoakes, Startup Health Co-Founder, a “collaboratory.” I spoke with Unity before the announcement went public, and learned that Startup Health sought a partner with shared values focused on getting innovations into patient care that could transform the healthcare delivery system. “Every single

Telehealth goes retail

In the past couple of weeks, a grocery store launched a telemedicine pilot, a pharmacy chain expanded telehealth to patients in 25 states, and several new virtual healthcare entrants received $millions in investments. On a parallel track, the AMA postponed dealing with medical ethics issues regarding telemedicine, the Texas Medical Association got stopped in its tracks in a case versus Teladoc, and the Centers for Medicare and Medicaid Services (CMS) issued a final rule for the Medicare Shared Savings Program that falls short of allowing Accountable Care Organizations (ACOs) to take full advantage of telehealth services. These events beg the

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

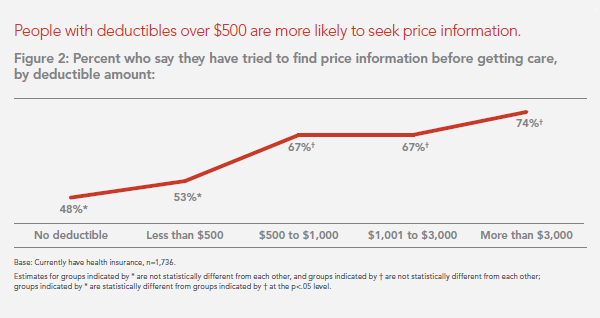

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

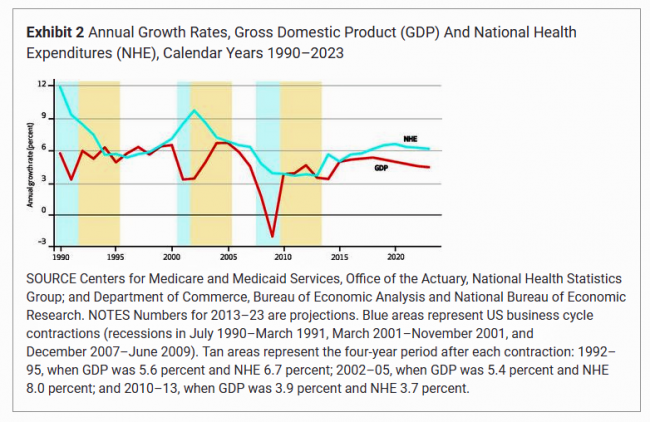

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Health costs up, credit down: health consumers face tightening credit markets in the face of rising medical costs

People who received health care in the U.S. between the second quarters of 2012 and 2013 faced 38% higher out-of-pocket costs, growing from $1,862 to $2,568 in just one year. These were payments for common procedures like joint replacements, Caesarean sections, and normal births. At the same time, consumers’ access to revolving credit lines fell by $1,000 over the twelve months. (Credit lines here include bank-issued credit cards, store credit cards, and home equity loans). The TransUnion Healthcare Report from TransUnion, the credit information company, paints a picture of tightening money for all consumers in the face of rising household

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

Innovating and thriving in value-based health – collaboration required

In health care, when money is tight, labor inputs like nurses and doctors stretched, and patients wanting to be treated like beloved Amazon consumers, what do you do? Why, innovate and thrive. This audacious Holy Grail was the topic for a panel II moderated today at the Connected Health Symposium, sponsored by Partners Heathcare, the Boston health system that includes Harvard’s hospitals and other blue chip health providers around the region. My panelists were 3 health ecosystem players who were not your typical discussants at this sort of meeting: none wore bow ties, and all were very entrepreneurial: Jeremy Delinsky

The new era of consumer health risk management: employers “migrate” risk

The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees. Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

For Medtech, Design is the New Plastics (advice to The Graduate)

Return on innovation in medical technology is on the decline. Med tech needed a GPS for its role in the health ecosystem, and lost its way as it focused on a few wrong priorities. In a $349 billion market, there has been much to lose…and will be to gain. The new world for medical technology and how the industry can turn around is the subject of P2C’s report, Medtech companies prepare for an innovation makeover, published in October 2013 by the PwC Health Research Institute (HRI). The problem has been an addiction to incremental improvements on existing products: think about the analog in

Taking vitamins can save money and impact the U.S. economy – and personal health

When certain people use certain dietary supplements, they can save money, according to a report from the Council for Responsible Nutrition and Frost and Sullivan, the analysts. The report is aptly titled, Smart Prevention – Health Care Cost Savings Resulting from the Targeted Use of Dietary Supplements. Its subtitle emphasizes the role of dietary supplements as a way to “combat unsustainable health care cost growth in the United States.” Specifically, the use of eight supplements in targeted individuals who can most benefit from them can save individuals and health systems billions of dollars. The eight money-saving supplements are: > Omega-3 > B

Consumers’ out-of-pocket health costs rising faster than wages – and a surprising hit from generic drug prices

U.S. health consumers faced greater out-of-pocket health care costs in 2012, especially for outpatient services (think: doctors’ visits) and generic drugs, as presented in The 2012 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI) published in September 2013. At the same time between 2011 and 2012, wages grew about 3%, remaining fairly flat over the past decade as health care costs continued to grow much faster. HCCI found that per capita (per person) out-of-pocket growth for outpatient visits amounted to an average of $118 between 2011 and 2012. But the biggest share of out-of-pocket costs for

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

Health consumers, meet the medical bank

Health consumers, meet a new player in your health care world: the bank. Financial services companies will play a growing role in U.S. health care as patients morph into health care consumers responsible for making more money-based decisions about their health care. This shift could make paying for health care just like paying other bills in the consumer retail market. And that’s a new role for health providers – doctors and hospitals – to fill. The Impact of Growing Patient Financial Responsibility on Healthcare Providers, prepared for Citi Enterprise Payments by Boundary Information Group, discusses what the impact of consumers’ payments in

The part-time medical home: retail health clinics

The number of retail health clinics will double between 2012 and 2015, according to a research brief from Accenture, Retail medical clinics: From Foe to Friend? published in June 2013. What are the driving market forces promoting the growth of retail clinics? Accenture points to a few key factors: Hospitals’ need to rationalize use of their emergency departments, which are often over-crowded and incorrectly utilized in cases of less-than-acute care. In addition, hospitals are now financially motivated under the Affordable Care Act (ACA, health reform) to reduce readmissions of patients into beds (particularly Medicare patients with acute myocardial infarction [heart attacks],

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Arianna and Lupe and Deepak and Sanjay – will the cool factor drive mobile health adoption?

Digital health is attracting the likes of Bill Clinton, Lupe Fiasco, Deepak Chopra, Dr. Sanjay Gupta, Arianna Huffington, and numerous famous athletes who rep a growing array of activity trackers, wearable sensors, and mobile health apps. Will this diverse cadre of popular celebs drive consumer adoption of mobile health? Can a “cool factor” motivate people to try out mobile health tools that, over time, help people sustain healthy behaviors? Mobile and digital health is a fast-growing, good-news segment in the U.S. macroeconomy. The industry attracted more venture capital in 2012 than other health sectors, based on Rock Health’s analysis of the year-in-review. Digital health

A health economics lesson from Jonathan Bush, at the helm of athenahealth

At HIMSS13 there are the equivalent of rock stars. Some of these are health system CIOs and health IT gurus who are driving significant and positive changes in their organizations, like Blackford Middleton, Keith Boone, Brian Ahier, and John Halamka. Others are C-level execs at health IT companies. In this latter group, many avoid the paparazzi (read: health trade reporters) and stay cocooned behind closed doors in two-story pieces of posh real estate on the exhibition floor. A few walk the floor, shake hands with folks, and take in the vibe of the event. We’ll call them open-source personalities. The

Digital health investment: greenhousing innovation and the accelerator

Traditional venture capital in health care is so 2010: welcome to The Greenhouse Effect: How Accelerators Are Seeding Digital Health Innovation, explained in a new report from California HealthCare Foundation written by Aaron Apodaca. Aaron clearly explains the growing interest in and influence of health accelerators, which grew out of the first era of the Internet (read: dot-com bust v 1.0) and the founding of the Y Combinator, an internet incubator that made relatively small investments in exchange for equity positions in start-ups. Health accelerators emerged around 2011, first with Rock Health in San Francisco, which was quickly followed by

Required reading: TIME Magazine’s Bitter Pill Cover Story

Today’s Health Populi is devoted to Steven Brill and his colleagues at TIME magazine whose special report, Bitter Pill: Why Medical Bills Are Killing Us, is required reading for every health citizen in the United States. Among many lightbulb moments for readers, key findings from the piece are: Local hospitals are beloved charities to people who live in their market – Brill calls these institutions “Non-Profit Profitmakers). They’re the single most politically powerful player in most Congressional districts The poor and less affluent more often pay the high chargemaster (“retail list”) price for health products and services vs. the wealthy

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Call them hidden, direct or discretionary, health care costs are a growing burden on U.S. consumers

Estimates on health spending in the U.S. are under-valued, according to The hidden costs of U.S. health care: Consumer discretionary health care spending, an analysis by Deloitte’s Center for Health Solutions. Health spending in the U.S. is aggregated in the National Health Expenditure Accounts (NHEA), assembled by the Department of Health and Human Services (DHHS) Centers for Medicare and Medicaid Services (CMS). In 2010, the NHEA calculated that $2.6 trillion were spent on health care based on the categories they “count” for health spending. These line items include: Hospital care Professional services (doctors, ambulatory care, lab services) Dental services Residential

The state of health informatics: positive ROI, but a shortage of talent and comprehensive data

While most players in health care see potential ROI through investing in health informatics, there’s a supply-side problem in the market in two ways: a labor shortage of health IT talent, and a dearth of clean and comprehensive data needed for specific objectives. Even with sufficient budgets, health care providers, plans, and pharma companies say, these two limiting factors prevent fully realizing the promise of health data. Deloitte and AMIA polled health providers, plans and life science companies on the state of informatics in health care, the results of which are summarized in The 2012 Deloitte-AMIA Health Informatics Industry Maturity Survey.

A health plan or a car: health insurance for a family of four exceeds $20K in 2012

The saying goes, “you pays your money and you makes your choice.” In 2012, if you have a bolus of $20,700 to spend, you can choose between a health plan for a family of four, or a sedan for the same family. That’s the calculation from the actuaries at Milliman, whose annual Milliman Medical Index is the go-to analysis on health care costs for a family of four covered by a preferred provider organization plan (PPO). While the 6.9% annual average cost increase is lower than the 7.3% in 2011, it is nonetheless, a record $1,335 real dollar increase at

It’s the prices and the technology, stupid: why U.S. health costs are higher than anywhere in the world

The price of physician services, proliferation of clinical technology and the cost of obesity are the key drivers of higher health spending in the U.S., according to The Commonwealth Fund‘s latest analysis in their Issues of International Health Policy titled, Explaining High Health Care Spending in the United States: An International Comparison of Supply, Utilization, Prices, and Quality, published in May 2012. The U.S. devotes 17.4% of the national economy to health spending, amounting to about $8,000 per person. The UK devotes about 10%, Germany 11.6%, France, 11.8%, Australia 8.7%, and Japan, 8.5%. On the physician pay front, primary care

More people in American have trouble paying medical bills: prognosis worse before better

1 in 3 U.S. health citizens had some problem paying for medical care in the first half of 2011, according to a survey from the Centers for Disease Control. In 2010, about 1 in 5 people had trouble paying for medical care. 26% of people were paying medical bills over time; 20% of people had problems paying medical bills in the past year; and, 11% had medical bills they were unable to pay at all. Not surprisingly, among people under 65, those who were poor and near-poor were most likely to be in families with medical bill problems. If you were

The state of health IT in America: thinking about the Bipartisan Policy Center report on health IT

There are few issue areas within the Beltway of Washington, DC, that have enjoyed more support across the political aisle than health care information technology. In 2004, George Bush asserted that every American would/should have an electronic medical record by 2014. Since then, Democrats and Republicans alike have supported the broad concept of wiring the U.S. health information infrastructure. With the injection of ARRA stimulus funds earmarked in the HITECH Act to promote health providers’ adoption of electronic health records, we’re now on the road to Americans getting access to their health information electronically. It won’t be all or even

From volume to value: how health execs see the future of health care

Transparency and authenticity, constant and clear communication, and a drive toward value underpin the future health system — for those health leaders who can commit to these pillars of transformational change. Leading Through Transformation: Top Healthcare CEOs’ Perspectives on the Future of Healthcare summarizes the interaction among 17 health execs who convened at the second CEO Forum held by Huron Healthcare Group. The report was released in January 2012. Health leaders concur that regardless of the politics of the Affordable Care Act and its prospects for whole or partial survival beyond November 2012, market pressures in the health sector are driving

We are all health illiterates: navigating the health system in a sea of paper and financial haze

“Older patients, caregivers, and family members face growing challenges in understanding and navigating the nation’s increasingly complex healthcare system,” begins a well-articulated column called Why Consumers Struggle to Understand Health Care, in U.S. News & World Report dated January 27, 2012. Health literacy isn’t just about understanding clinical directions for self-care, such as how to take medications prescribed by a doctor, or how to change a bandage and clean an infected area. Health literacy is also about how to effectively navigate one’s health system. The first graphic is a schematic published in the New Republic in 2009 which illustrates the arcane Trip-Tik

Get into the sunshine, church is out – the GAO report on health care price transparency

This morning during my still-dark-at-5:15 am walk, my iPod was motivating me to “get up offa that thing,” as James Brown was motivating me to “release the pressure.” Two minutes into the song, he urges, “Get into the sunshine, church is out.” This brought to mind a publication I’ve taken time to review from the General Accounting Office (GAO) report to the U.S. Congress, Health Care Price Transparency – Meaningful Price Information Is Difficult for Consumers to Obtain Prior to Receiving Care, published in September 2011. While employers and health plans want consumers to become more engaged in their health, a key barrier facing

Physicians won’t be celebrating Independence Day, at least when it comes to their practices

Doctors won’t be celebrating Independence Day on July 4th — at least when it comes to their professional practices. The days of the cottage industry physician are dwindling as more doctors are losing their independence, instead opting for employment. There are several reasons for physicians’ exodus from private practice: these include increasing administrative burdens, economies of scale for adopting information and communications technology, security in uncertain futures around reimbursement, and that all-important work-life balance. Accenture points out these trends in a summary report, Clinical Transformation: Dramatic Changes as Physician Employment Grows. Accenture sees benefits accruing to health systems acquiring physician

The average annual health costs for a U.S. family of four approach $20,000, with employees bearing 40%

Health care costs have doubled in less than nine years for the typical American family of four covered by a preferred provider health plan (PPO). In 2011, that health cost is nearly $20,000; in 2002, it was $9,235, as measured by the 2011 Milliman Medical Index (MMI). To put this in context, The 2011 poverty level for a family of 4 in the 48 contiguous U.S. states is $22,350 The car buyer could purchase a Mini-Cooper with $20,000 The investor could invest $20K to yield $265,353 at a 9% return-on-investment. The MMI increased 7.3% between 2010 and 2011, about the same

Self-service health: consumers want the same kinds of online services available to them in other aspects of their lives

Health consumers are at least as keen to access their medical history online as they are to manage other aspects of their personal lives. Intuit, the people who brought Quicken to the market to help consumers manage their personal financial lives, are keen to do the same for health care. And they’ve got the survey data in The Intuit Health Second Annual Health Care Check Up to make their case for the online personal health information management market. It is no surprise that the survey found that 70% of U.S. adults are concerned (very or somewhat) about managing their health

Don’t underestimate the costs of adopting health IT

Mature users of electronic health records bear many scars and learnings, having been through the first several rungs of the health information technology (HIT) adoption ladder. A few of these lessons for HIT adoption success… Implementing EMRs is a strategic and not just an IT-department initiative. HIT adoption requires top-down commitment and engagement. It takes longer and costs more than the planners of systems expect. During transition to an EMR, hospitals see an 80% “spike” (increase) in IT operating expenses — directly impacting the hospital’s overall operating budget as much as 200 basis points or more. There is evidence that those spikes

How to save $40 billion in health care: implement health IT in hospitals

Electronic health records (EHRs) broaden access to patient data and provide the platform for pushing evidence-based decision support to clinicians at the point-of-care. This promotes optimal care for patients, reduces medical errors, optimizes the use of labor, reduces duplication of tests, and by the way, improves patient outcomes. When done in aggregate across all health providers, a team from McKinsey estimates that $40 billion of costs could be saved in the U.S. health system. Reforming hospitals with IT investment in the McKinsey Quarterly talks about the American Reinvestment and Recovery Act’s (ARRA) $20+ billion worth of stimulus funding under the HITECH Act

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...