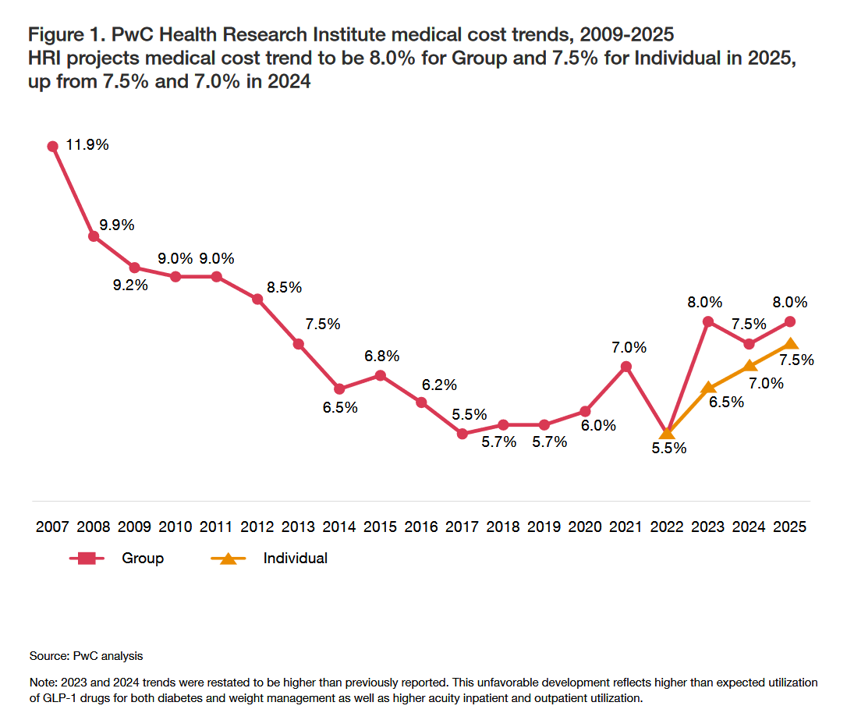

What’s Expected to Drive Up Health Plan Costs in 2025: GLP-1s, Behavioral Health, and Inflationary Pressures for Hospitals and Doctors – PwC’s Behind the Numbers 2025

The U.S. Bureau of Labor Statistics had good news for American consumers long-facing inflation for household spending over the past couple of years, announcing on July 11, 2024, that the general consumer price index (CPI) fell, lowering real prices for people buying airline tickets, used cars and trucks, communication, and petrol to fill auto tanks. That positive economic news did not extend to medical care and personal care, the BLS reported, whose costs increased by 3.3% and 3.2%, respectively. (Motor vehicle insurance costs grew a whopping 19.5% in the report, FYI). Following the

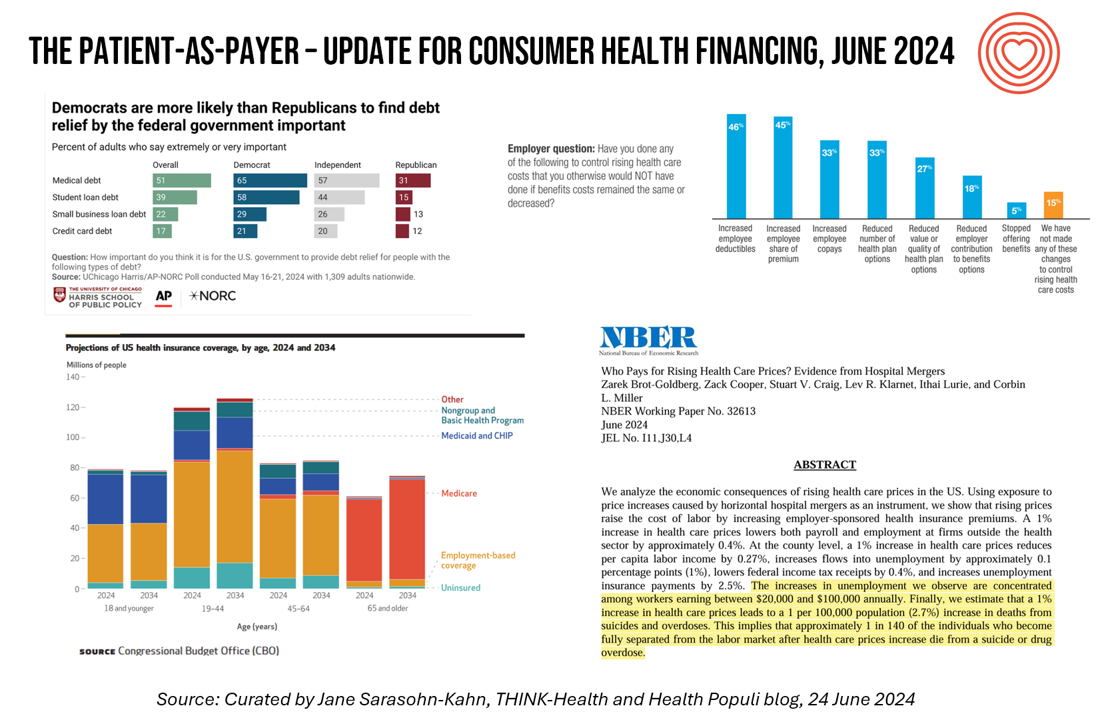

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

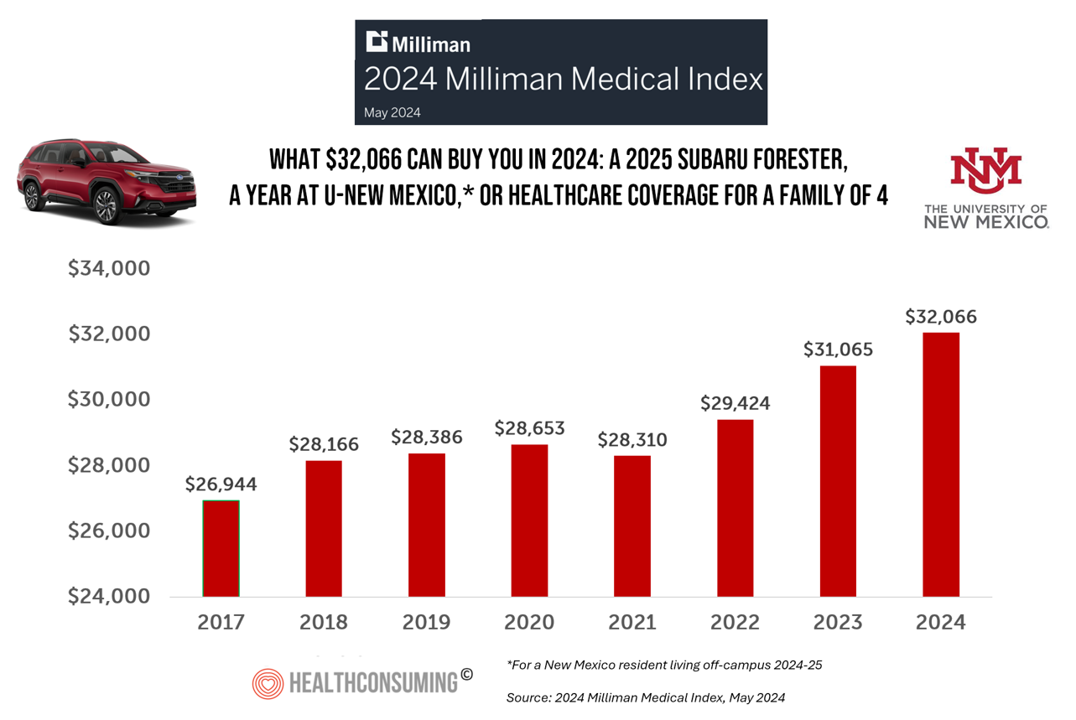

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

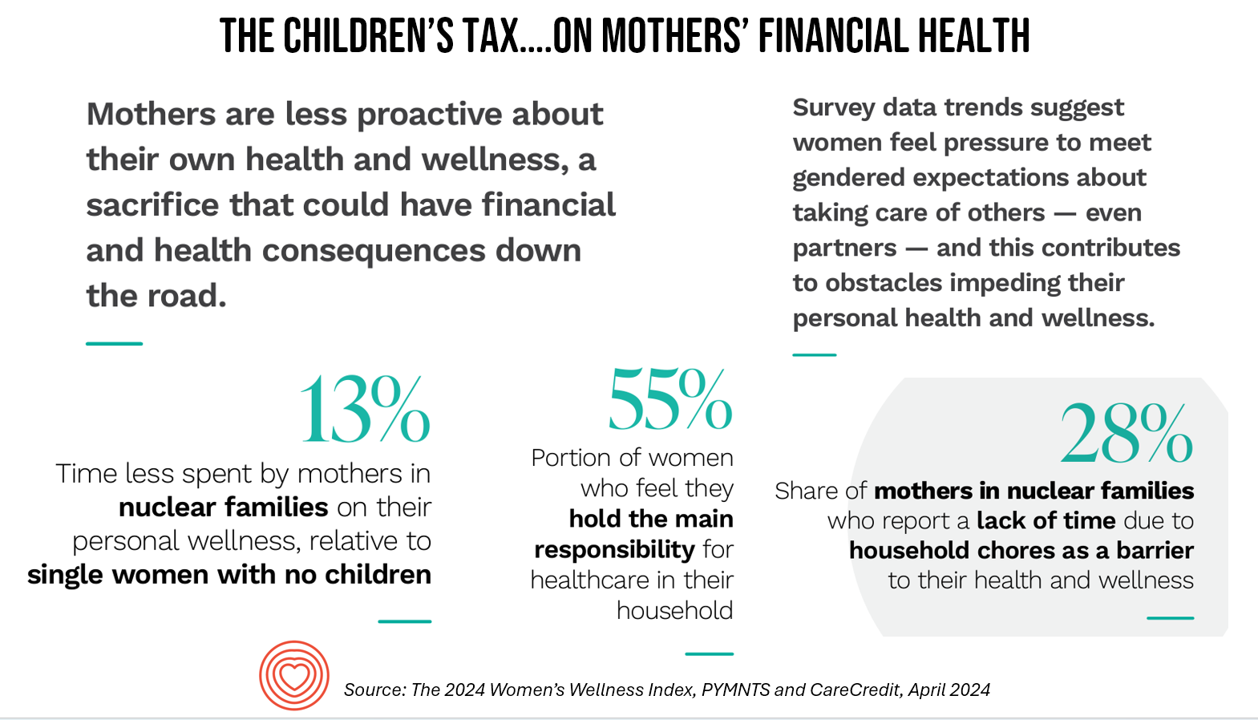

A Tax on Moms’ Financial and Physical Health – The 2024 Women’s Wellness Index

“Motherhood is the exquisite inconvenience of being another person’s everything” is a quote I turn to when I think about my own Mom and the remarkable women in my life raising children. With Mother’s Day soon approaching, the 2024 Women’s Wellness Index reminds us that the act of “being another person’s everything” has its cost. The Index, sponsored by PYMNTS in collaboration with CareCredit, was built on survey responses from 10,045 U.S. consumers fielded in November-December 2023. The study gauged women’s perspectives on finances, family, social life impacts on health and well-being. My key takeaway from

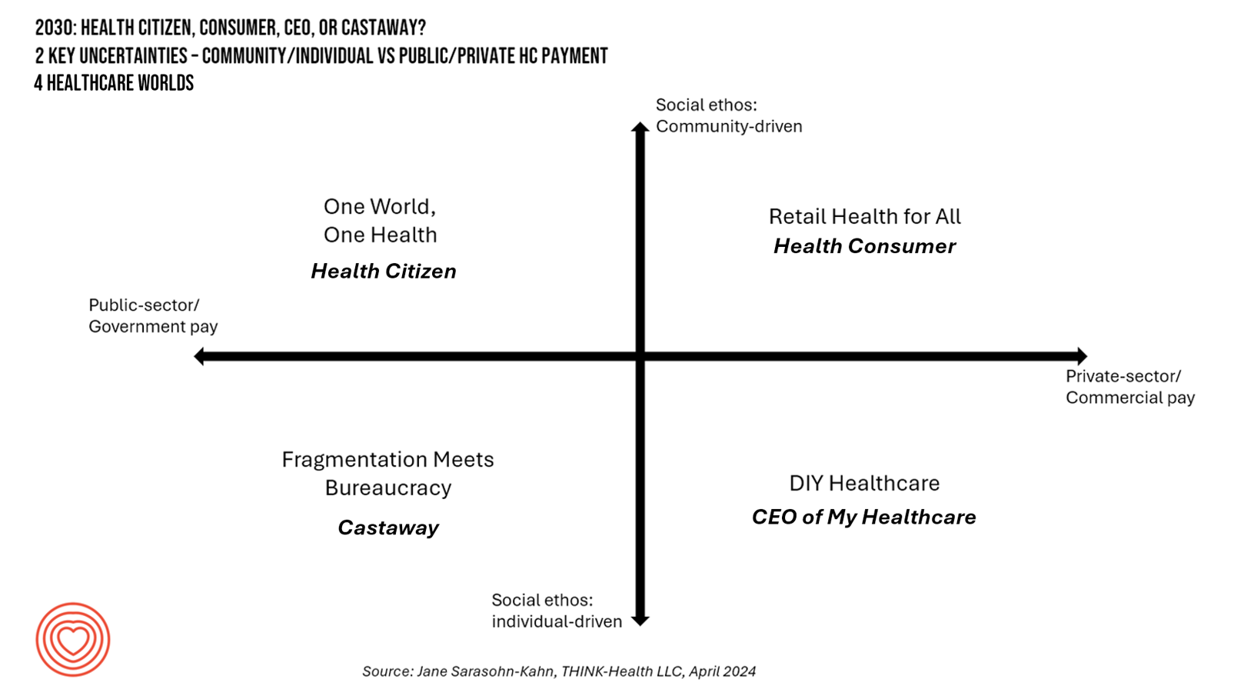

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

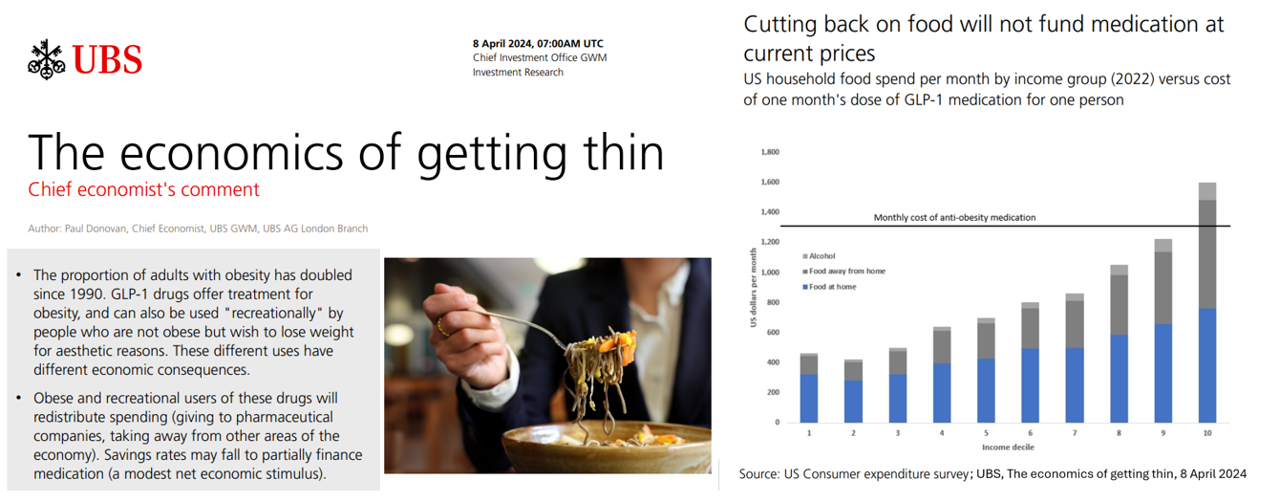

Considering Equity and Consumer Impacts of GLP-1 Drugs – A UBS Economist Weighs In

Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland). Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog. “These different uses have different economic consequences,” Donovan explains: Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work. While so-called recreational GLP-1 consumers may experience these

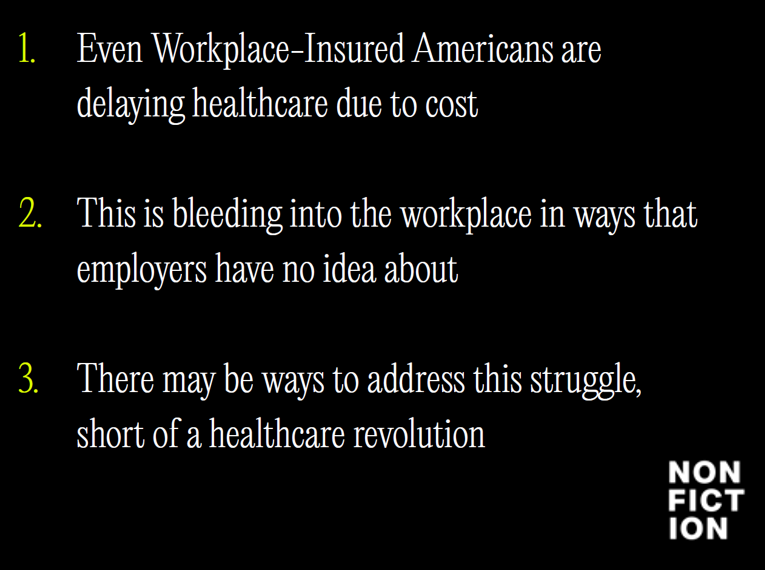

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

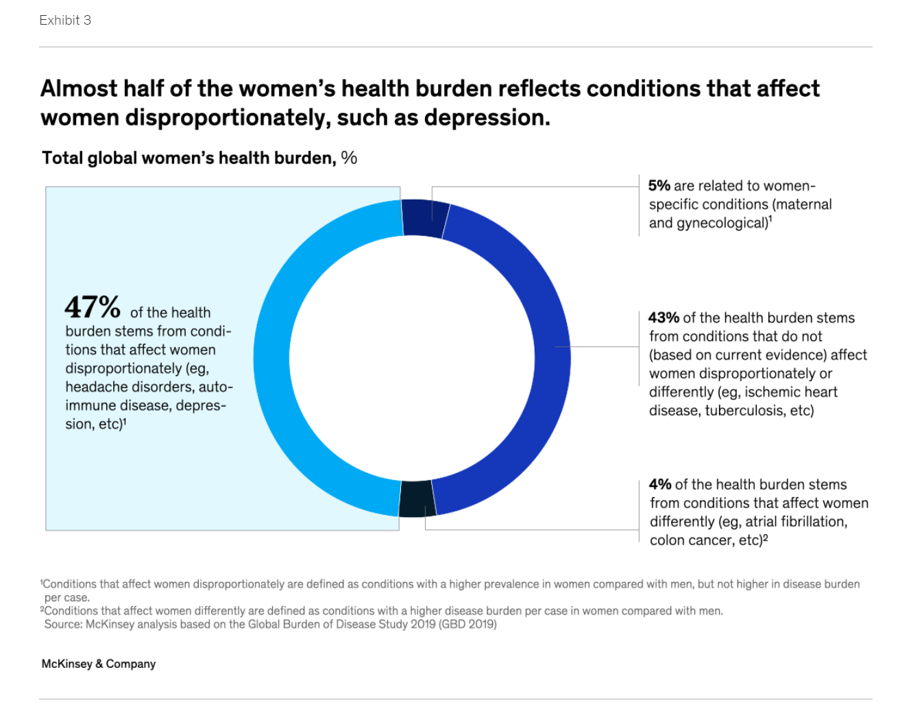

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

From Evolution to Innovation, from Health Care to Health: How Health Plans With Collaborators Are Re-Defining the Industry

As a constant observer and advisor across the health/care ecosystem, for me the concept of a “health plan” in the U.S. is getting fuzzier by the day. Furthermore, health plan members now see themselves as medical bill payers, seeking value and consumer-level services for their health insurance premium investment. Weaving these ideas together is my mission in preparing a session to deliver at the upcoming AHIP 2024 conference in June, I’m thinking a lot about the evolving nature of health insurance, plans, and the organizations that provide them. To help me define first principles, I turned to the American father

The Health Consumer in 2024 – The Health Populi TrendCast

At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen. As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household,

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

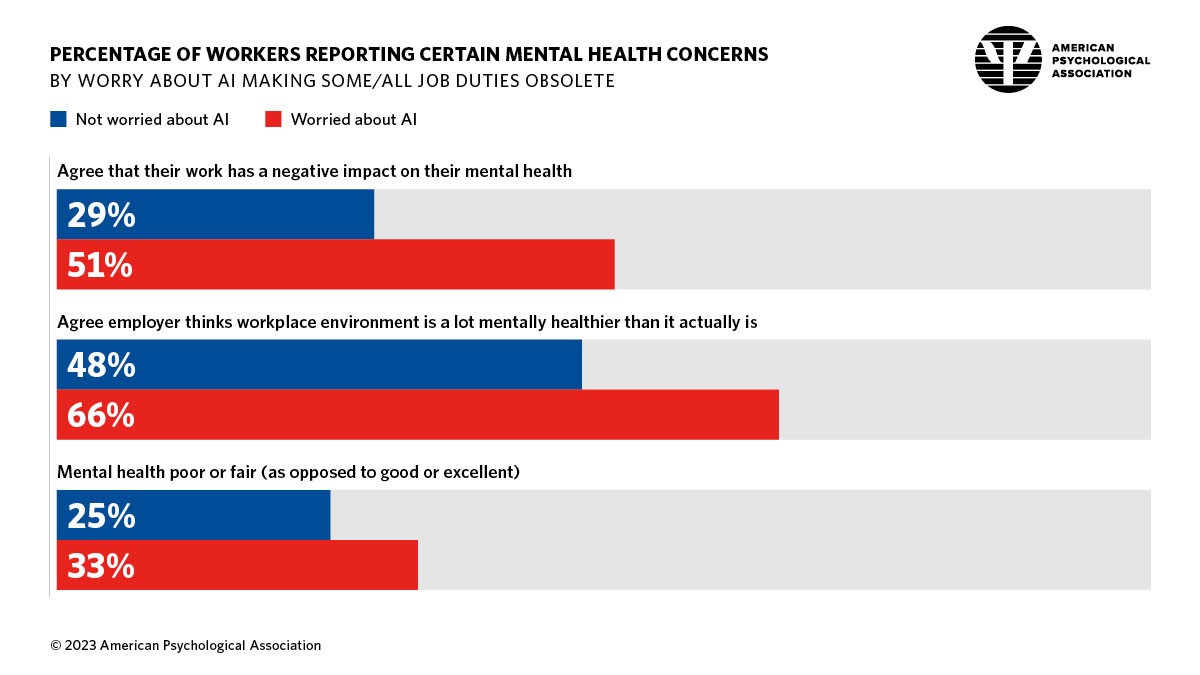

Working in America: AI Is the Next Major Job Stressor

Workers in America are worried about the potential impacts that artificial intelligence (AI) could have on the workplace and jobs, according to Work in America: Artificial Intelligence, Monitoring Technology and Psychological Well-Being, a study from the American Psychological Association (APA). For many years, we’ve been tracking APA’s Stress in America studies gauging Americans’ mental health before the pandemic and during the pandemic. To social and political stress, we must now add in another stressor to peoples’ daily lives: concerns about AI and the potential for it to make one’s job obsolete, with the subsequent

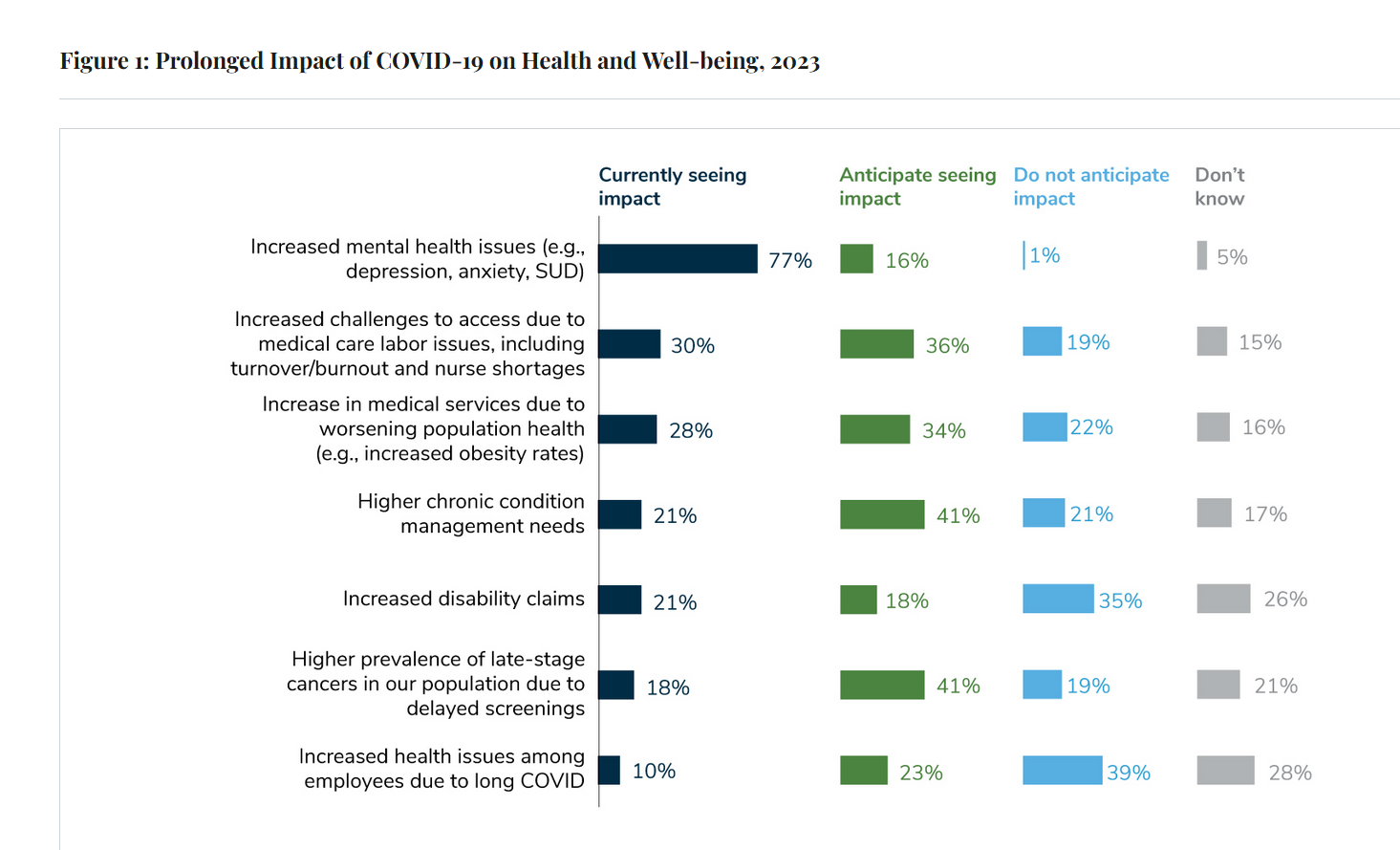

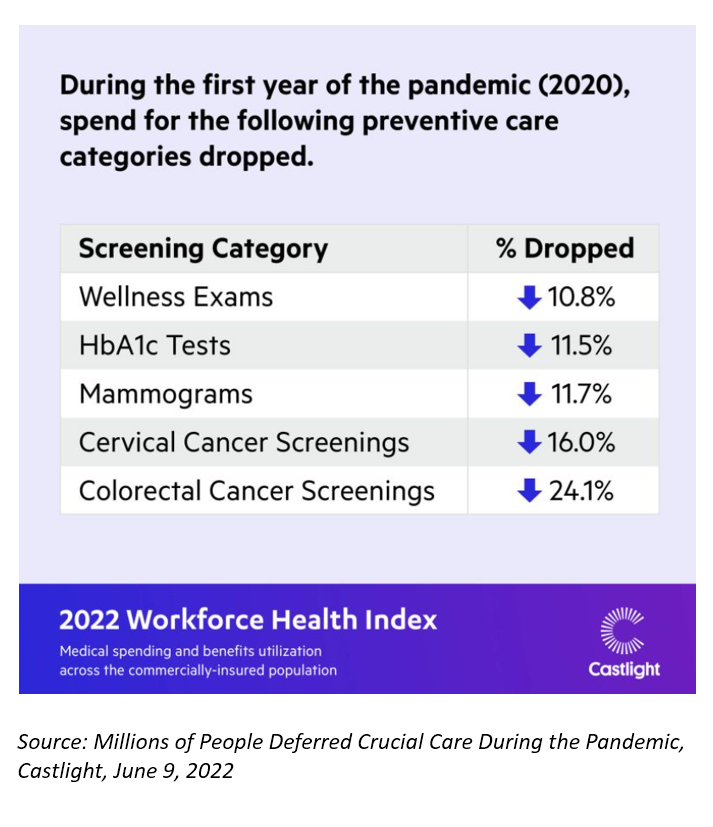

Large Employers Expect More Employees Will Experience Prolonged Health Impacts Due to COVID-19. and a Note About Telehealth Engagement

Due to their delayed return to medical services and diagnostic testing in the COVID-19 pandemic era, U.S. employees are expected to sustain serious health impacts that will drive employers’ health care costs, envisioned in the 2024 Large Employer Health Care Strategy Survey from the Business Group on Health (BGH). Dealing with mental health issues is the top health and well-being impact workers in large companies are addressing in 2023. Looking forward, large employers foresee their workers will be seeking care for chronic conditions and later-stage cancers that are diagnosed due to delayed screenings.

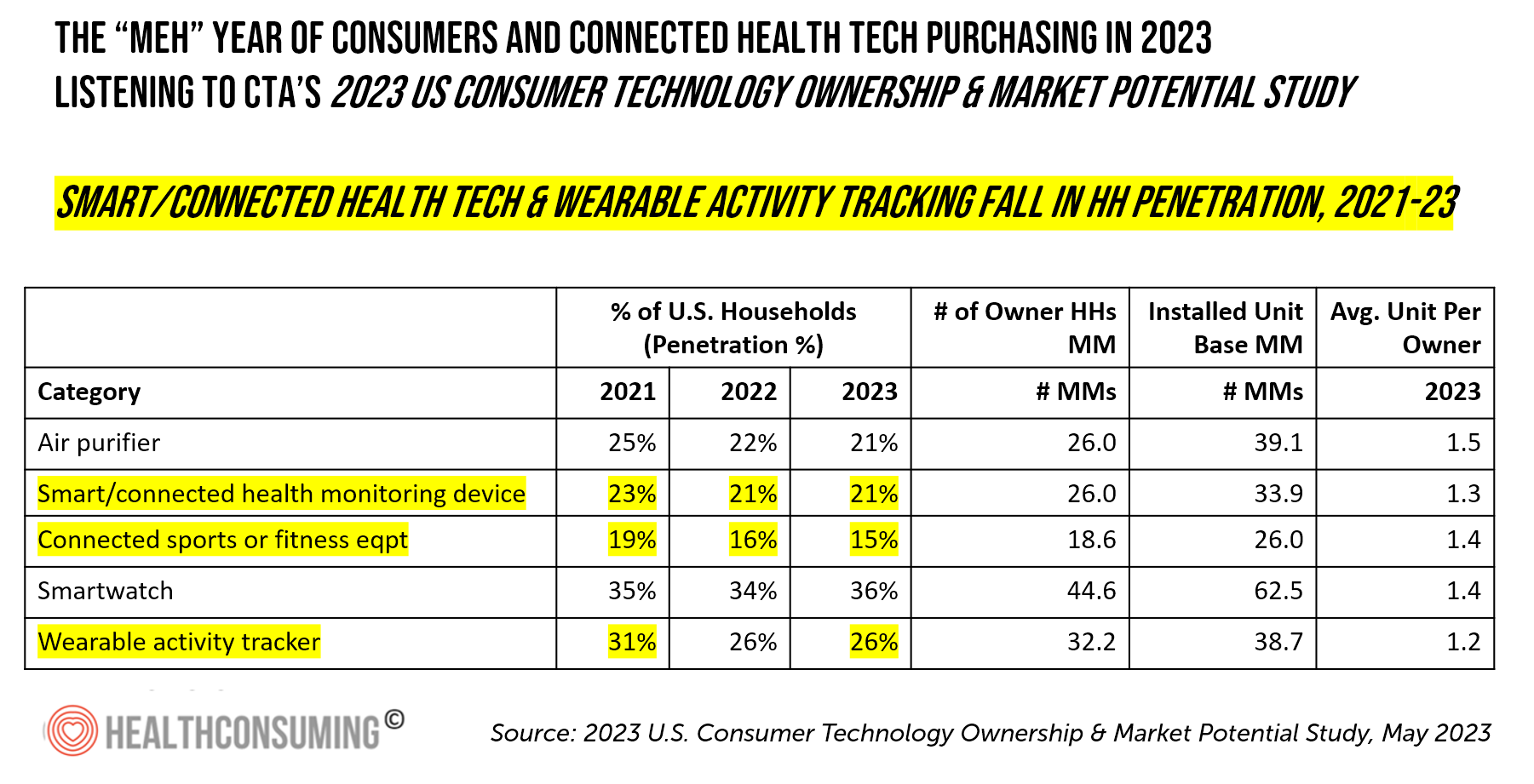

It Will Be a “Meh” Year for Consumers Buying Connected Health Devices, Based on CTA’s 2023 Forecast

In 2023, U.S. consumers’ purchases of technology in their households will contract this year. Consumer-facing health-tech categories won’t be spared, we learn in the 2023 U.S. Consumer Technology Ownership & Market Potential Study, an annual update from the Consumer Technology Association (CTA). On the upside, smartwatch market penetration held steady in 2023, as this favorite form of wearable technology is “providing consumers a personalized digital health and fitness dashboard at their fingertips.” Many of these new smartwatch purchases will be cellular-enabled, blurring the space between smartphones and watches. One in five households intends to purchase

The Growing Pet Economy – What It Means for Human Health, Well-Being, and Healthcare Costs

Our pets can be personal and family drivers of health and health care cost savings, according to a new study from according to a new report from researchers at George Mason University published in their paper, Health Care Cost Savings of Pet Ownership. Reviewing this new paper inspired me to explore the current state of the pet/health market and implications for their human families, my weaving of various stories explored in this Health Populi blog post. Some of the key signposts we’ll cover are: The report on pet ownership driving owners’ health care cost savings A new market analysis of

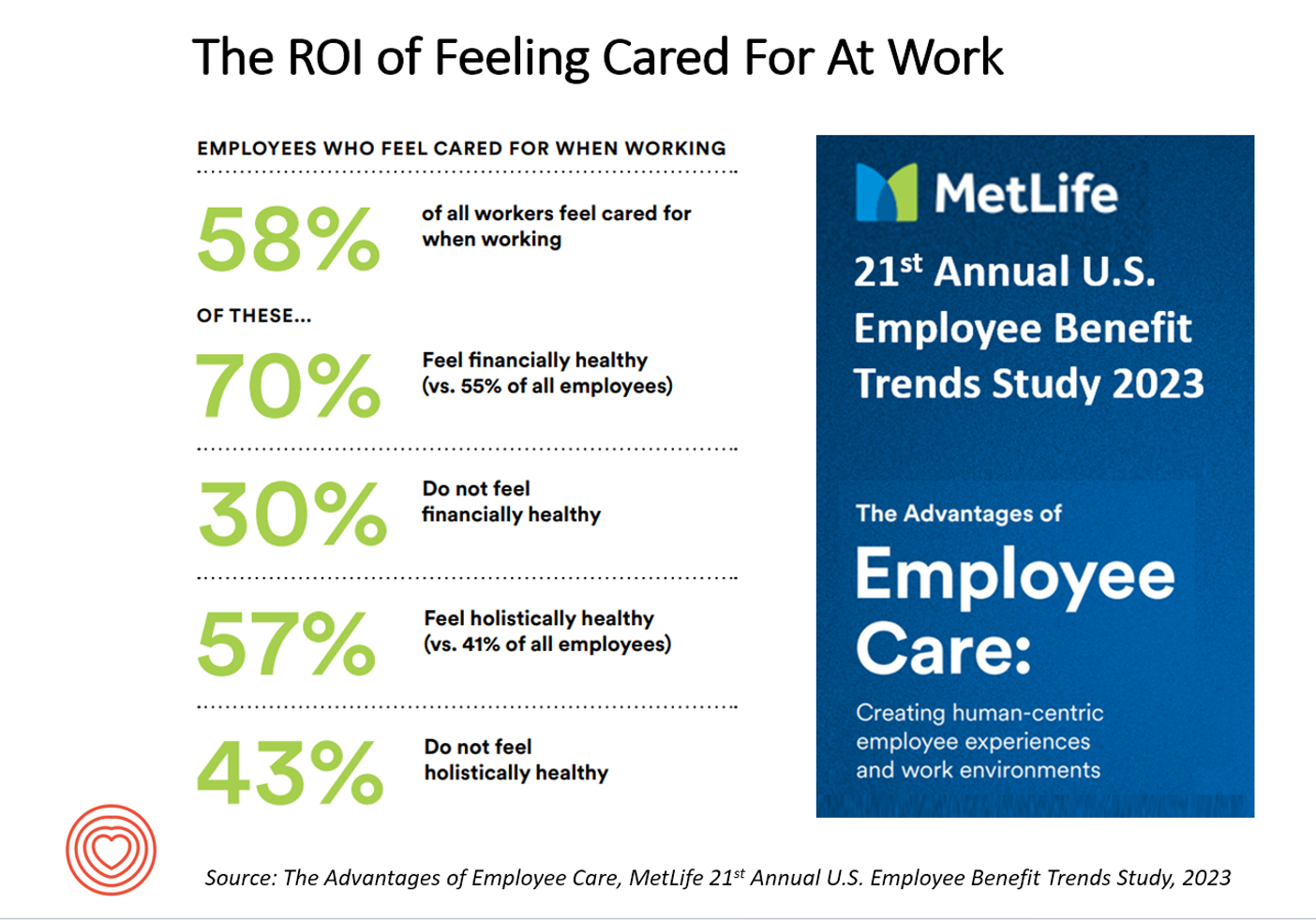

The ROI on Feeling Cared-For At Work – Employer Trust, Love, and Building the Joyconomy

“Can employers afford not to care?” MetLife’s 21st annual U.S. Employee Benefit Trends Study asks and answers that question, with a resounding and evidence-based “NO.” I’m in Salt Lake City today discussing the drivers of health, “yesterday, today, and tomorrow” at the Virgin Pulse Thrive Summit, celebrating the ten-year anniversary of the company. As you would expect from an organization that is part of Richard Branson’s business ecosystem, the meeting will be energetically produced, delivering insights wrapped in info-taining ways. One of those features will be my being invited to create a

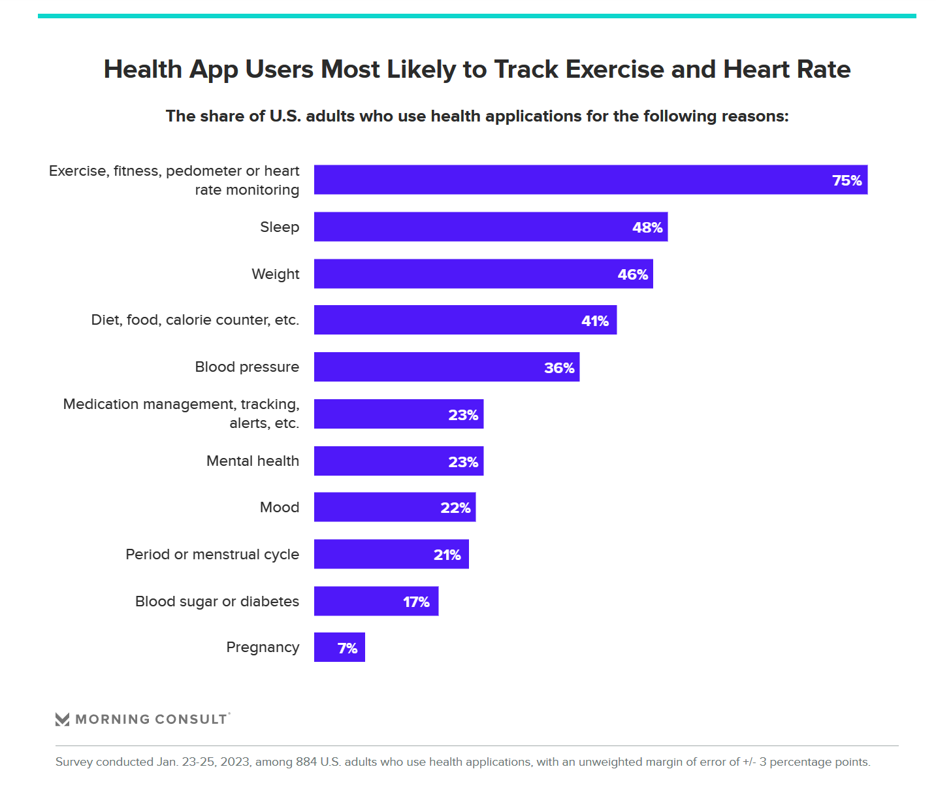

People Using Health Apps and Wearable Tech Most Likely Track Exercise and Heart Rate, Sleep and Weight – But Cost Is Still A Barrier

Over one in three U.S. consumers use a health app or wearable technology device to track some aspect of their health. “The public’s use of health apps and wearables has increased in recent years but digital health still has room to grow,” a new poll from Morning Consult asserts, published today. Among digital health tech users, most check into them at least once every day in the past month. One in four use these tech’s multiple times a day, the first pie chart illustrates. Eighteen percent of people use their digital

Wellness in 2023 Is About Connections, Mental Health and Science – Global Wellness Summit’s 2023 Trends

Consumers’ wellness life-flows and demands in 2023 will go well beyond exercise resolutions, eating more greens, and intermittent fasting as a foodstyle. It’s time for us to get the annual update on health consumers from the multi-faceted team who curated the Global Wellness Summit’s annual report on The Future of Wellness 2023 Trends. In this year’s look into wellness for the next few years, we see that health-oriented consumers are seeking solutions for dealing with loneliness and mental health, weight and hydration, travel-as-medicine as health destinations, and — not surprisingly —

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

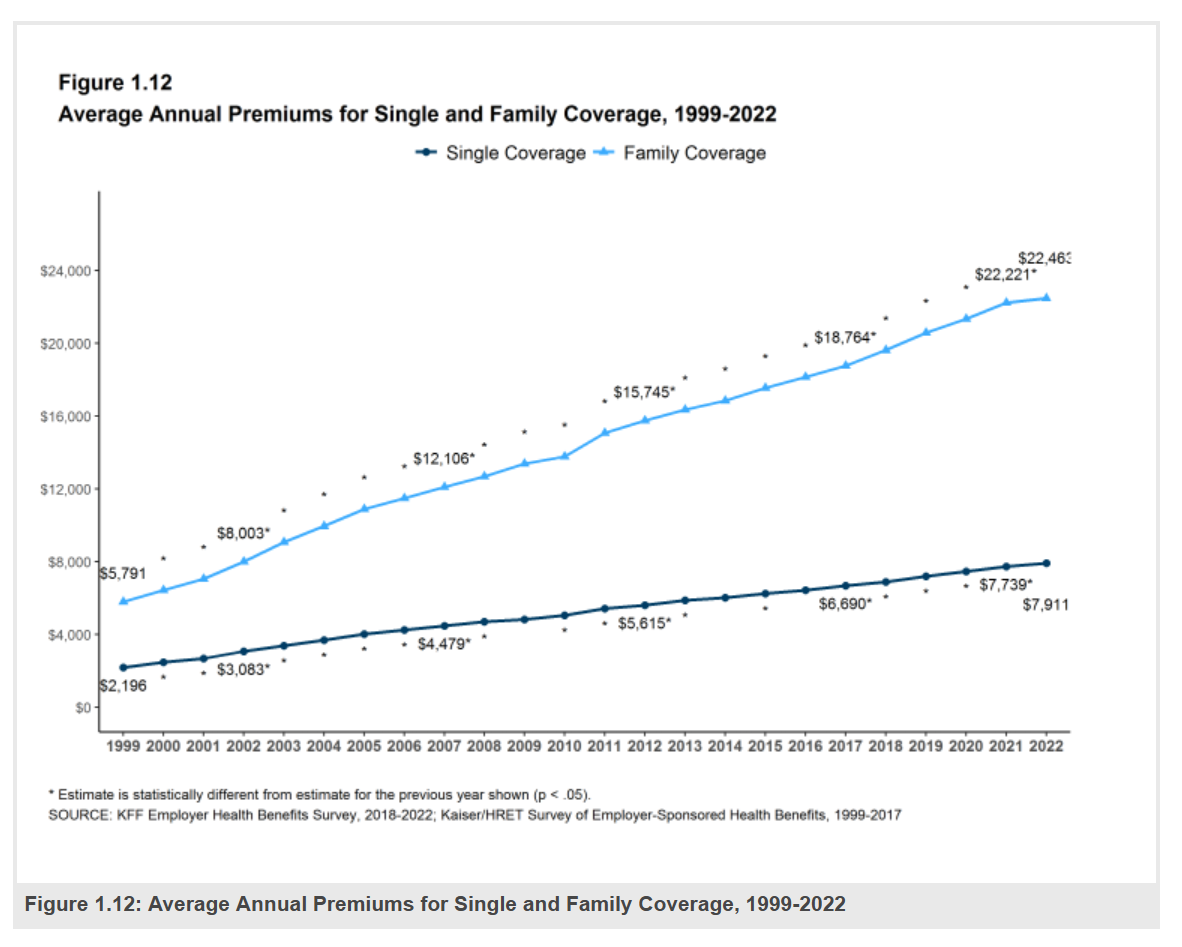

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

Vaccinations, Art and Labor Day: Learning from Diego Rivera and Edsel Ford

For Labor Day 2022, I’m thinking about health, vaccines, work (especially returning-to-work), and art. Let’s start with the vaccine news. Called the “first updated COVID-19 booster,” on September 1st the CDC announced the availability and approval for health citizens to get new vaccines which have added Omicron BA.4 and BA.5 spike protein components to the original vaccine formulation. The booster shots will be administered using vaccines from Pfizer-BioNTech for people ages 12 years and older, and from Moderna for people ages 18 years and older. Walgreens announced appointment scheduling for the boosters, and CVS Health discussed the plans for the

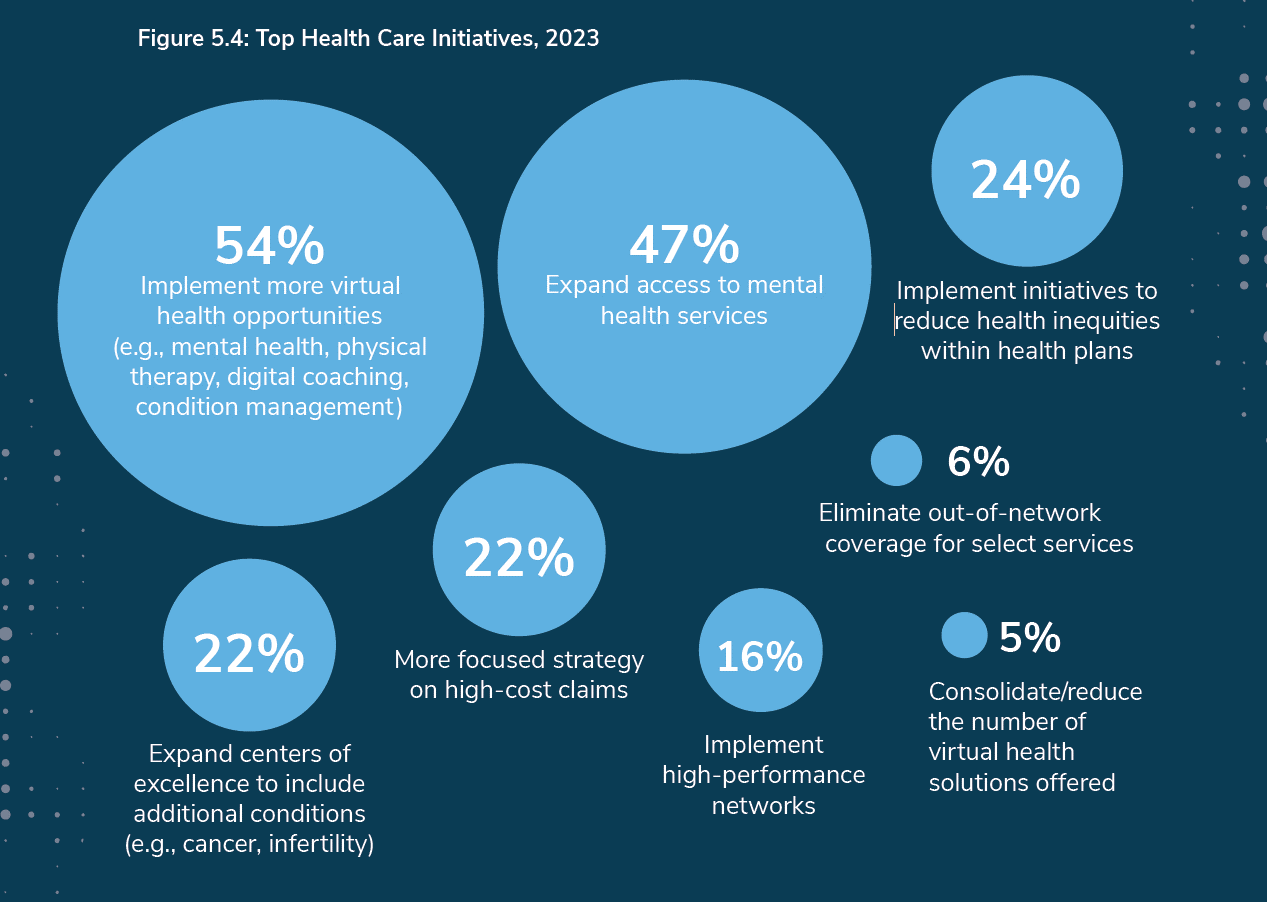

Virtual Care and Mental Health Top of Mind for Employers’ Workplaces in 2023

The concept that all companies are “health care companies” takes on greater import in the wake of the pandemic. The 2023 Large Employers’ Health Care Strategy and Plan Design Survey from the Business Group on Health (BGH) found that two in three large employers see their health and well-being strategy as an integral part of their overall workforce strategy. This is our annual go-to study guiding us on the private sector’s big thinking about health care plans and investments on workers’ behalf. The first line chart illustrates how this phenomenon shot up in importance for

The Retail Health Battle Royale in the U.S. – A Week-Long Brainstorm, Day 2 of 5 – Amazon and One Medical

Today we review the various viewpoints on Amazon’s announced acquisition of One Medical (ONEM, aka 1life Healthcare) which has been a huge story in both health care trade publications, business news, and mainstream media outlets. Welcome to Day 2 of The Retail Health Battle Royale in the U.S., my week-long update of the American retail health/care ecosystem weaving the latest updates from the market and implications and import for health care consumers. The deal was announced on 21 July, with Amazon striking the price at about $3.9 billion. Goldman Sachs and Morgan Stanley put the deal together,

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

Use of Preventive Health Services Declined Among Commercially Insured People – With Big Differences in Telehealth for Non-White People, Castlight Finds

Declines in preventive care services like cancer screenings and blood glucose testing concern employers, whose continued to cover health insurance for employees during the pandemic. “As we enter the third year of the COVID-19 pandemic, employers continue to battle escalating clinical issues, including delayed care for chronic conditions, postponed preventive screenings, and the exponential increase in demand for behavioral health services,” the Chief Medical Officer for Castlight Health notes in an analysis of medical claims titled Millions of People Deferred Crucial Care During the Pandemic, published in June. The

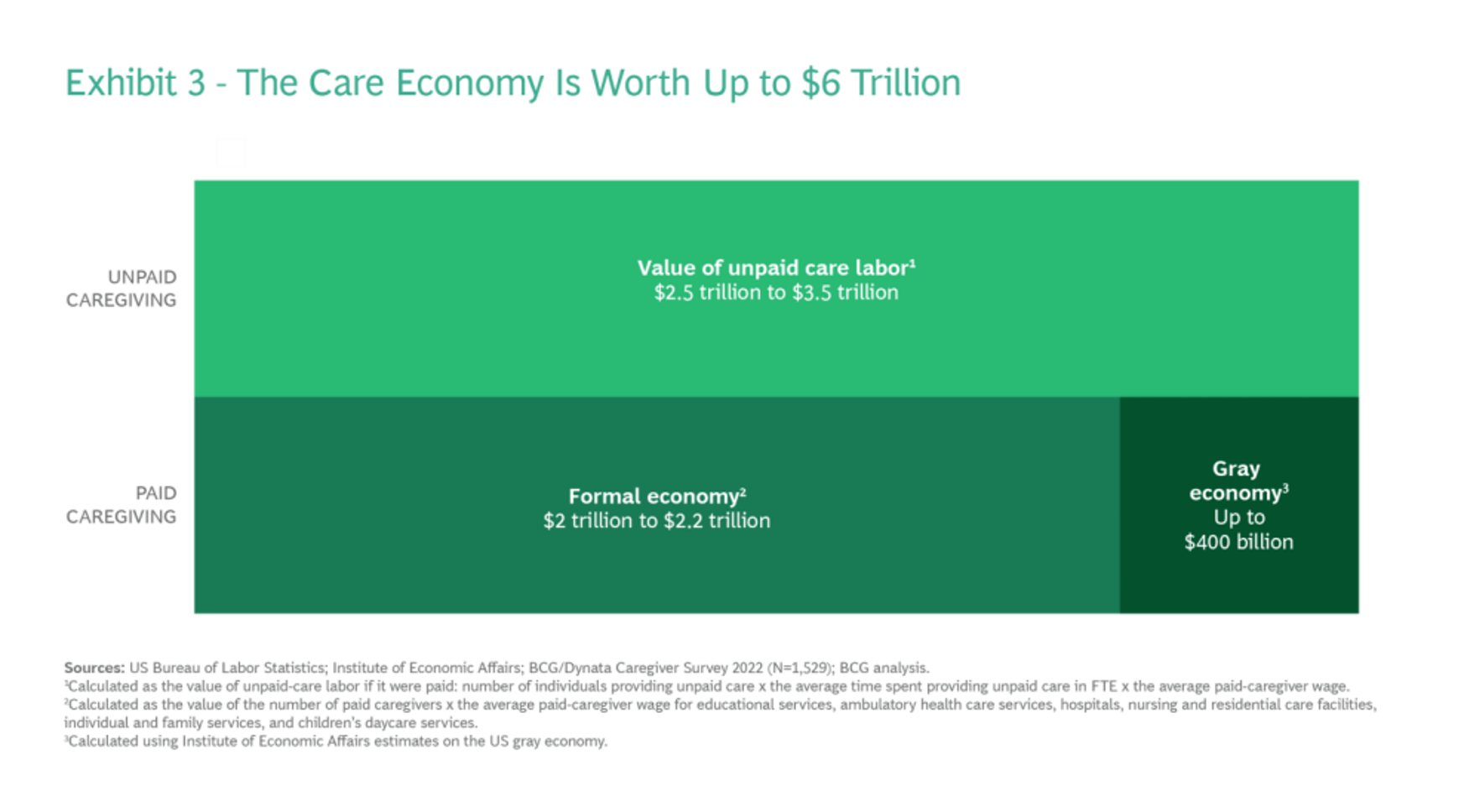

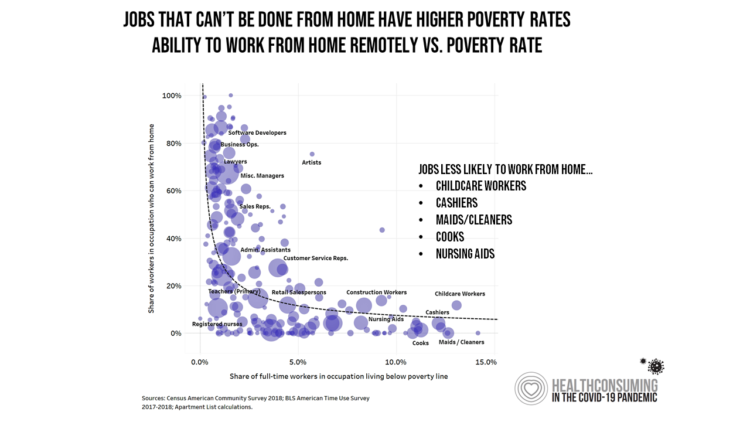

The Care Crisis – Robots Won’t Save Us

Among the many lessons we should and must take emerging out of the COVID-19 pandemic, understanding and addressing the caregiver shortage-cum-crisis will be crucial to building back a stronger national economy and financially viable households across the U.S. And if you thought robots, AI and the platforming of health care would solve the shortage of caregivers, forget it. Get smarter on the caregiver crisis by reading a new report, To Fix the Labor Shortage, Solve the Care Crisis, from BCG. You’ll learn that 9 of 10 new care-sector jobs will be in-person for

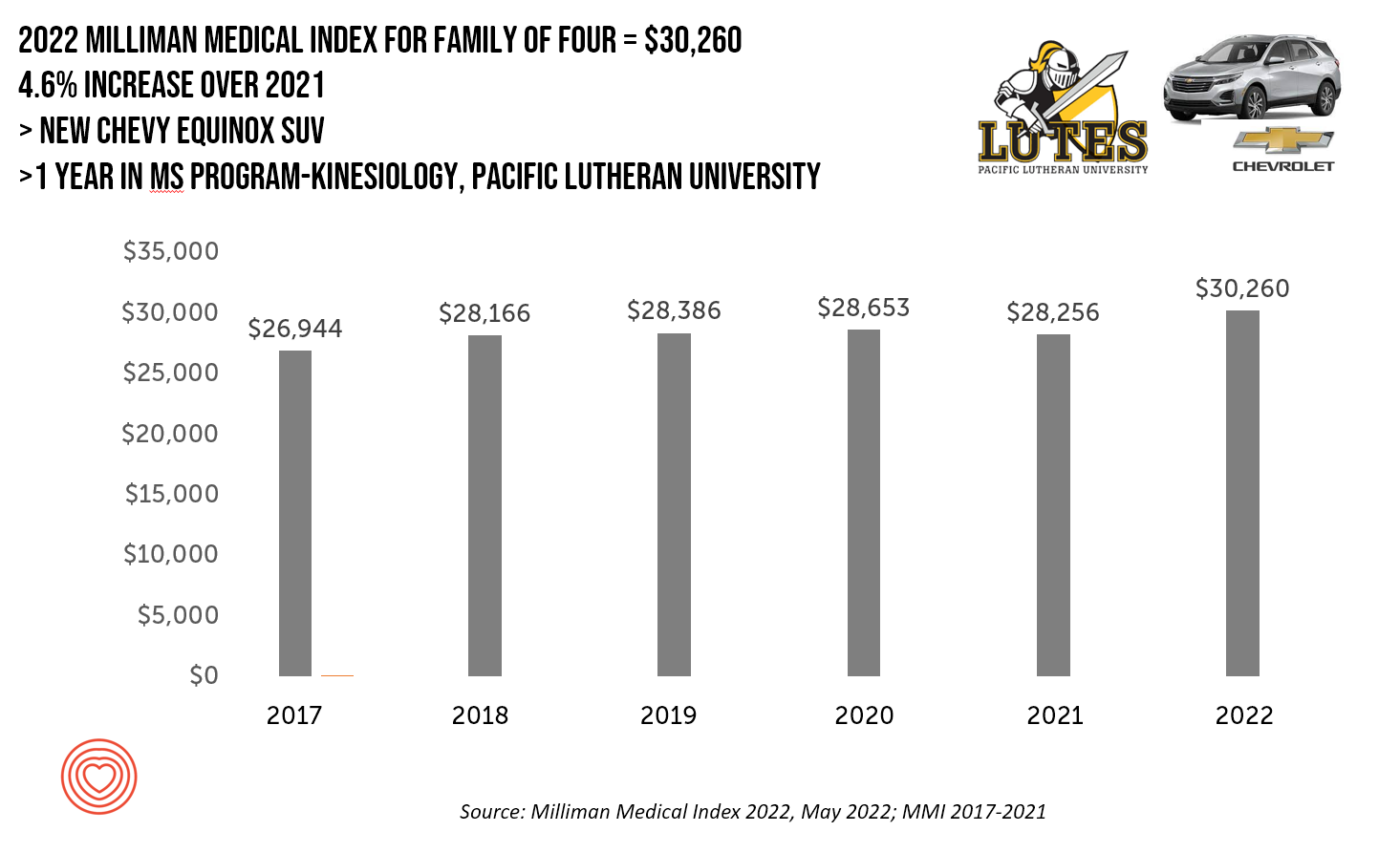

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

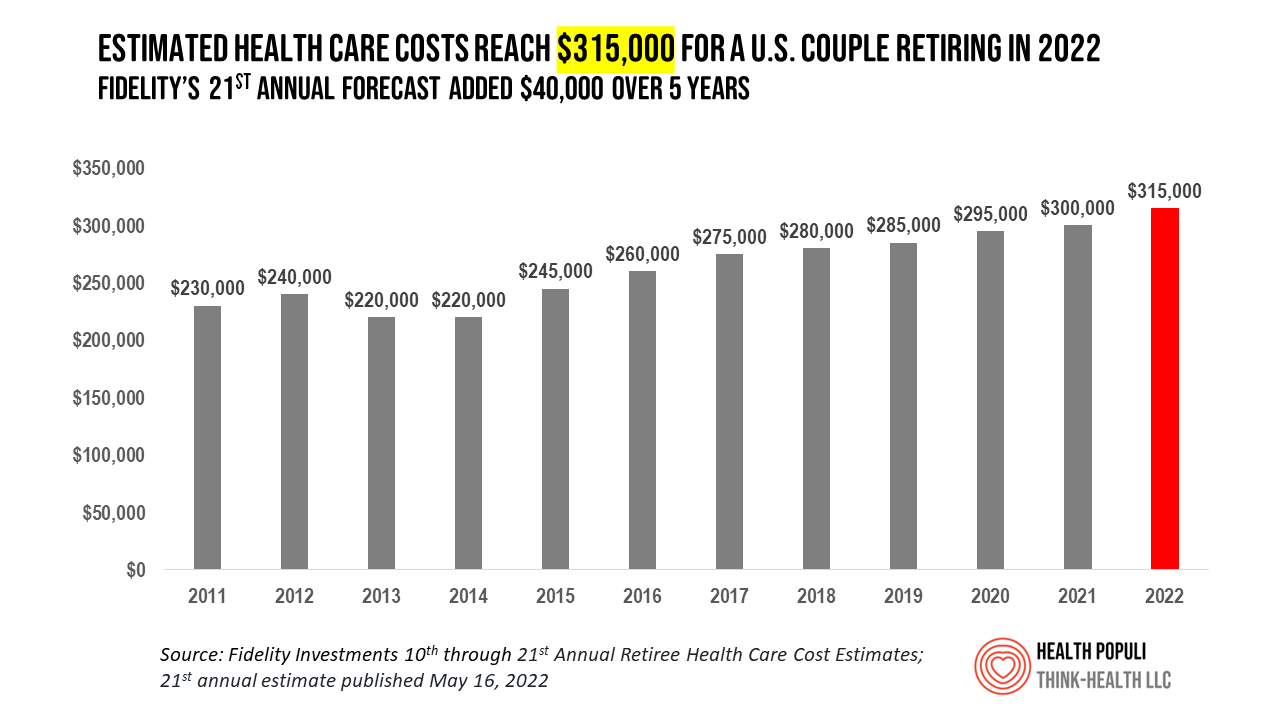

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

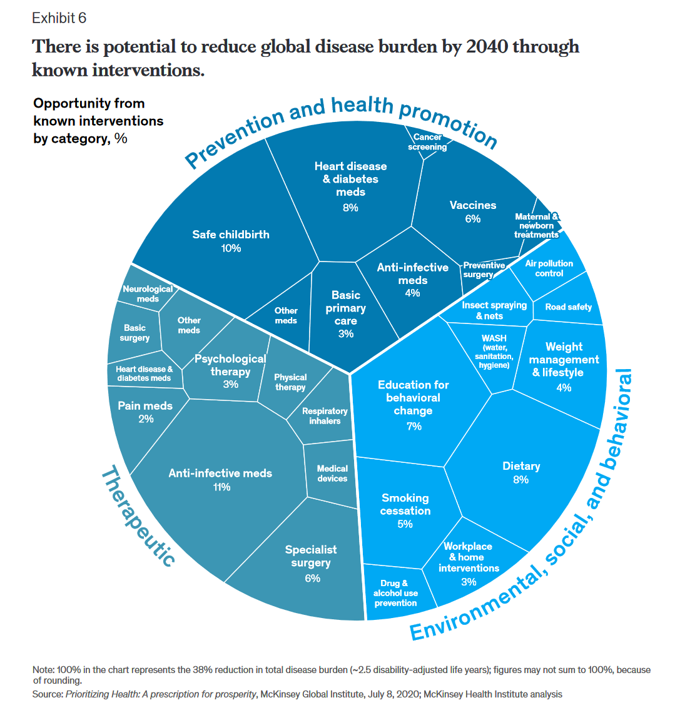

McKinsey’s Six Shifts To Add Life to Years — and One More to Consider

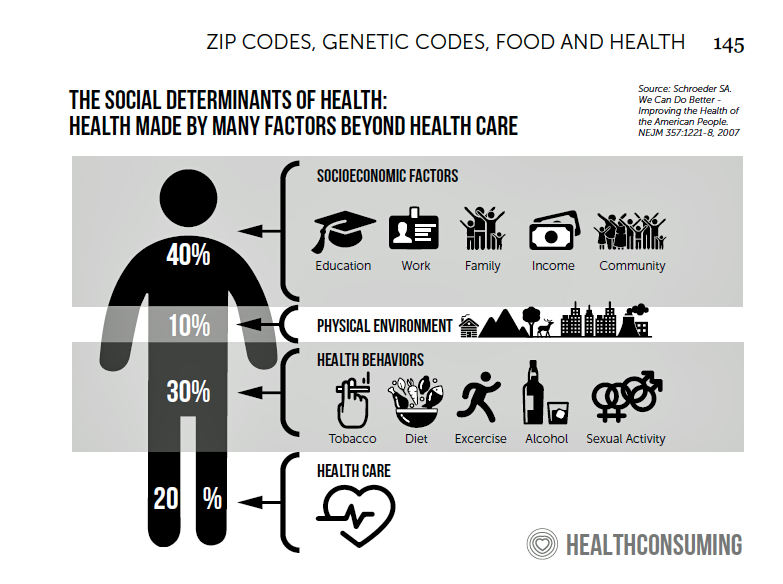

People spend one-half of their lives in “less-than-good health,” we learn early in the paper, Adding years to life and life to years from the McKinsey Health Institute. In this data-rich essay, the McKinsey team at MHI sets out an agenda that could help us add 45 billion extra years of higher-quality life equal to an average of six years per person (depending on your country and population demographics). The first graphic from the report illustrates four dimensions of health and the factors underneath each of them that can bolster or diminish our well-being: personal behaviors (such as sleep and diet),

Stress in America on the Pandemic’s 2nd Anniversary: Money, Inflation, and War Add to Consumers’ Anxiety

As we mark the second anniversary of the COVID-19 pandemic, the key themes facing health citizens deal with money, inflation, and war — “piled on a nation stuck in COVID-19 survival mode,” according to the latest poll on Stress in America from the American Psychological Association. Financial health is embedded in peoples’ overall sense of well-being and whole health. Many national economies entered the coronavirus pandemic in early 2020 already marked by income inequality. The public health crisis exacerbated that, especially among women who were harder hit financially in the past two years than men were. That situation was even worse

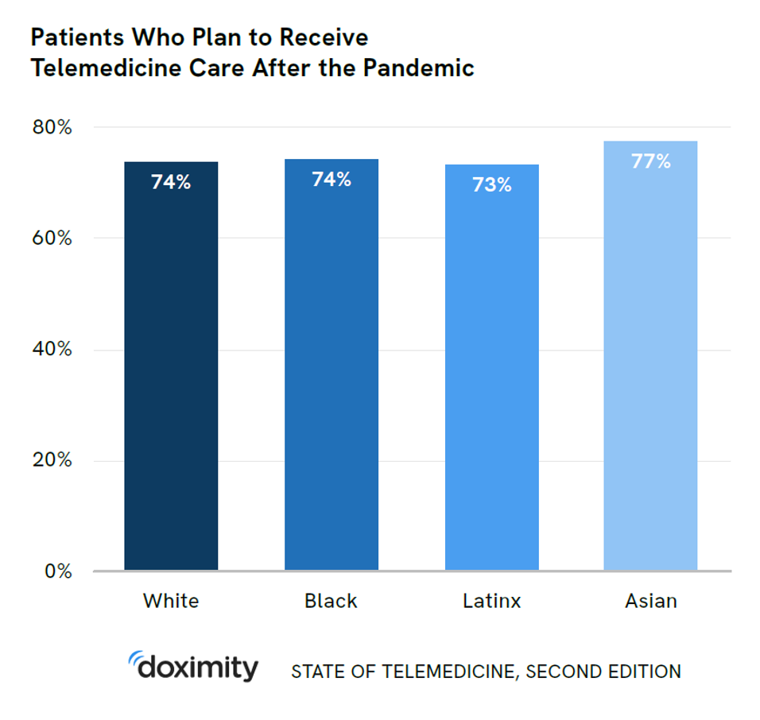

Doximity Study Finds Telehealth Is Health for Every Day Care

There’s more evidence that doctors and patients, both, want to use telehealth after the COVID-19 pandemic fades. Doximity’s second report on telemedicine explores both physicians’ and patients’ views on virtual care, finding most doctors and health consumers on the same page of virtual care adoption. For the physicians’ profile, Doximity examined 180,000 doctors’ who billed Medicare for telemedicine claims between January 2020 and June 2021. Telemedicine use did not vary much across physician age groups. Doctors in specialties that manage chronic illnesses were more likely to use telehealth: endocrinology (think: diabetes), gastroenterology, rheumatology, urology, nephrology, cardiology, ENT, neurology, allergy, and

Diagnosis: Stress, Anxiety and Anger – the 2022 Medscape Physician Burnout & Depression Report

As physicians deal on the frontlines in Year 3 of the COVID-19 pandemic, they’re stressed, anxious, and angry concludes the Medscape 2022 Physician Burnout & Depression Report. This year, the tagline focuses on stress, anxiety and anger. [Over the past couple of years, the study has used the word “suicide” in the title of the report, FYI]. Those reporting burnout are more likely women physicians than males (56% vs. 41%), work in the ER or critical care departments, and deal with too many bureaucratic tasks like charting and paperwork. For this annual look into the state of U.S. physicians mindsets

The Trust Deficit Is Bad for Health: A Health/Care Lens on the 2022 Edelman Trust Barometer

“Health is the cornerstone to our core needs, thereby the cornerstone to trust.” So wrote Kirsty Graham, Global Leader of Sectors and Global Chair of Health at Edelman, in an essay explaining the 2022 Edelman Trust Barometer. If it’s January, it must be time for the World Economic Forum in Davos, the annual setting for Edelman’s launch of the company’s Trust Barometer. While WEF is mostly virtual this year due to the pandemic, Edelman has released the survey of global citizens’ views on trust in institutions right on-time and in full and sobering detail. I welcome and dig into the

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

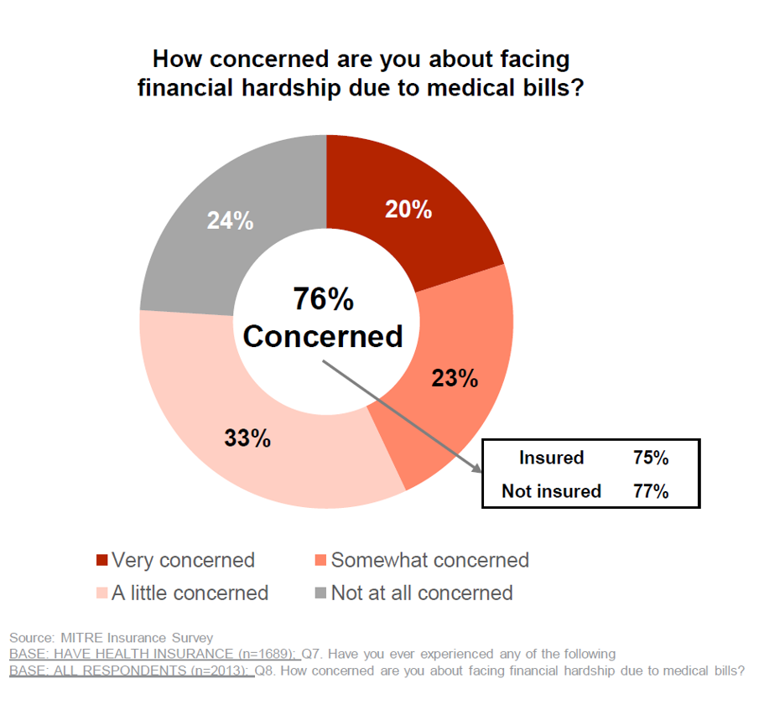

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

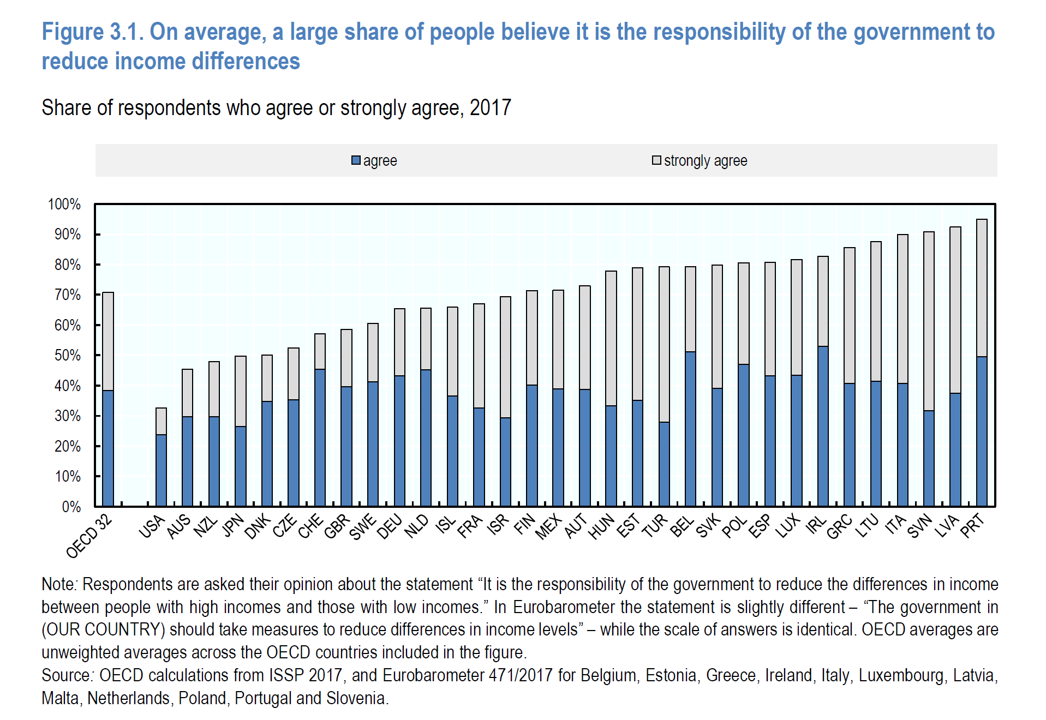

Does Inequality Matter in the U.S.? Health and the Great Gatsby Curve

Compared with the rest of the developed world, people living in the U.S. may be concerned about income inequality, but their demand for income redistribution is the lowest among peer citizens living in 31 other OECD countries. In their latest report, Does Inequality Matter? the OECD examines how people perceive economic disparities and social mobility across the OECD 32 (the world’s developed countries from “A” Australia to “U,” the United Kingdom). Overall the OECD 32 average fraction of people who believe it is the government’s responsibility to reduce income differences among those who think disparities are too large is 80%

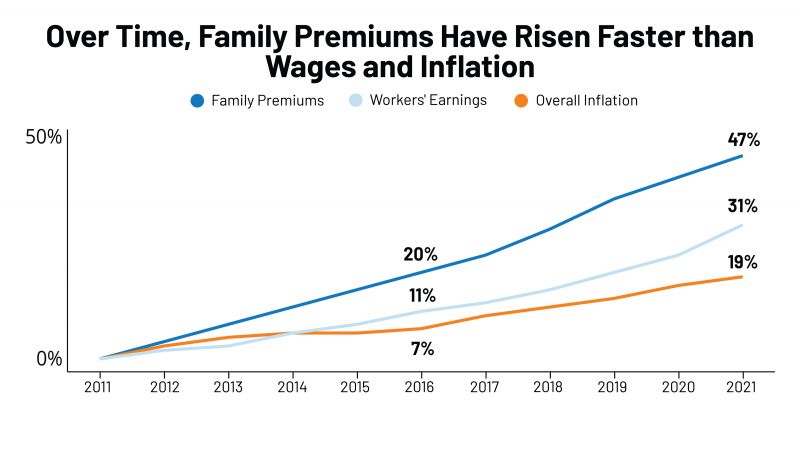

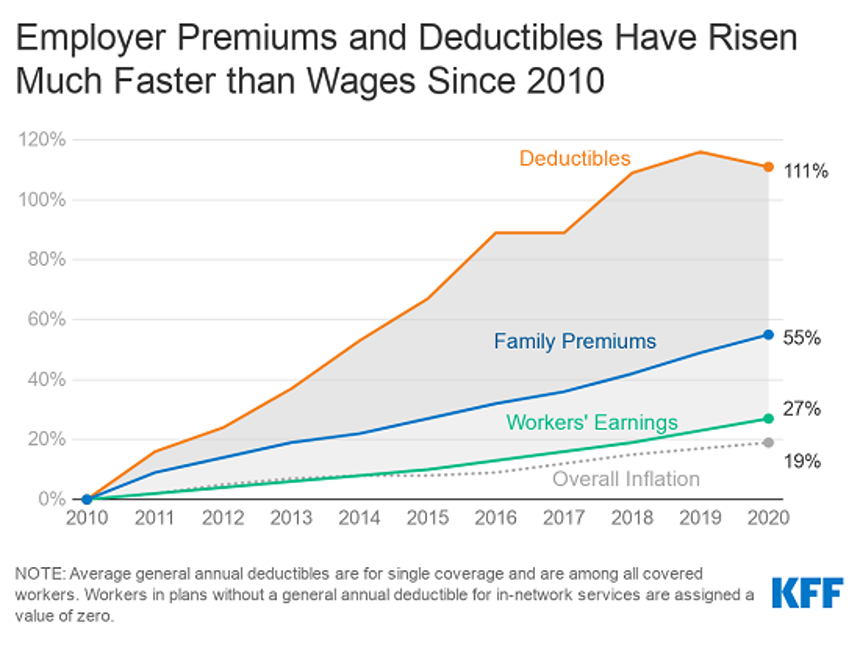

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

Genentech’s Look Into the Mirror of Health Inequities

In 2020, Genentech launched its first study into health inequities. The company spelled out their rationale to undertake this research very clearly: “Through our work pursuing groundbreaking science and developing medicines for people with life-threatening diseases, we consistently witness an underrepresentation of non-white patients in clinical research. We have understood inequities and disproportionate enrollment in clinical trials existed, but nowhere could we find if patients of color had been directly asked: ‘why?’ So, we undertook a landmark study to elevate the perspectives of these medically disenfranchised individuals and reveal how this long-standing inequity impacts their relationships with the healthcare system

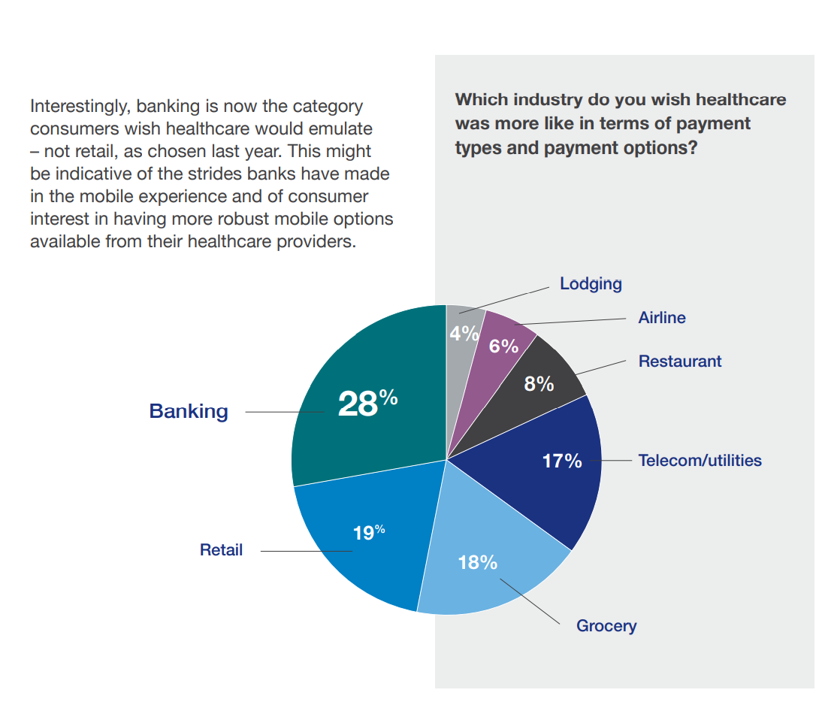

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

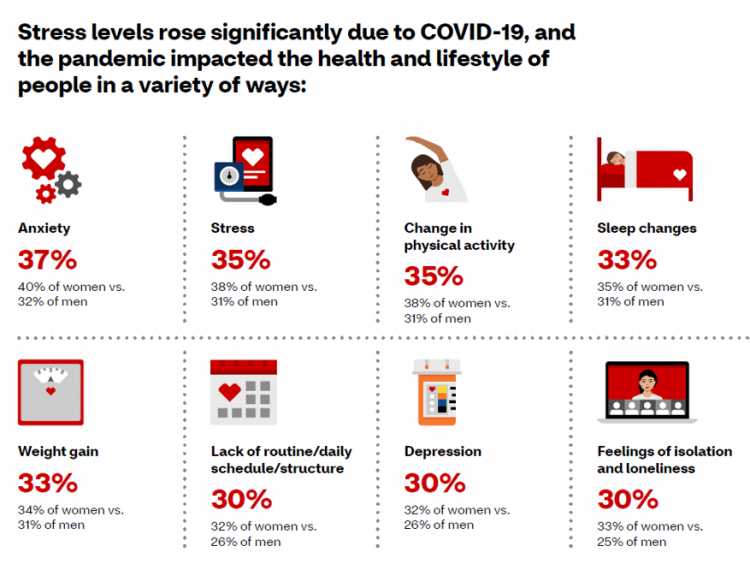

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

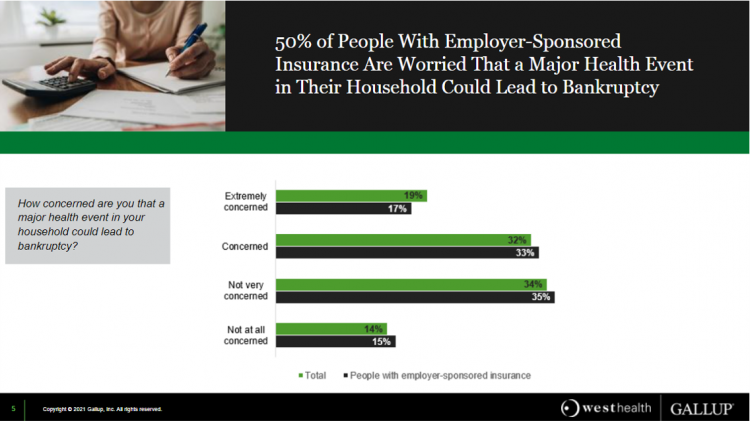

One in Two Americans with Work-Based Insurance Worries That Healthcare Costs Could Lead to Bankruptcy

One in two people in the U.S. with employer-sponsored health insurance worry that a major health event in their household could lead to bankruptcy, according to research gathered by West Health and Gallup in Business Speaks: The Future of Employer-Sponsored Insurance. Gallup and West Health presented their study in a webinar earlier this week; in today’s post, I feature a few key data points that particularly resonate as I celebrate/appreciate yesterday’s U.S. Supreme Court’s ruling on the Affordable Care Act (i.e., California v. Texas) combined with a new study published in JAMA Network Open, discussed below the digital fold in

The Stress of the Caregiver: The Most Over-Utilized, Unpaid Stakeholder in U.S. Healthcare

We’ve long know that “the patient” has been an under-utilized resource in the U.S. healthcare system since Dr. Charles Safran testified with that statement to Congress way back in 2004…an era where bipartisanship for health IT was a real thing. Today, with the insights of Alexandra Drane (Founder of ARCHANGELS) and Dr. Nirav Shah (of Stanford University), we know that caregivers are among the most over-utilized resources in the U.S. healthcare system — overused, over-stressed, under-paid, detailed n How Health Systems Can Care for Caregivers, published in the NEJM Catalyst July 2021 issue. In this study, Drane and Shah analyze

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

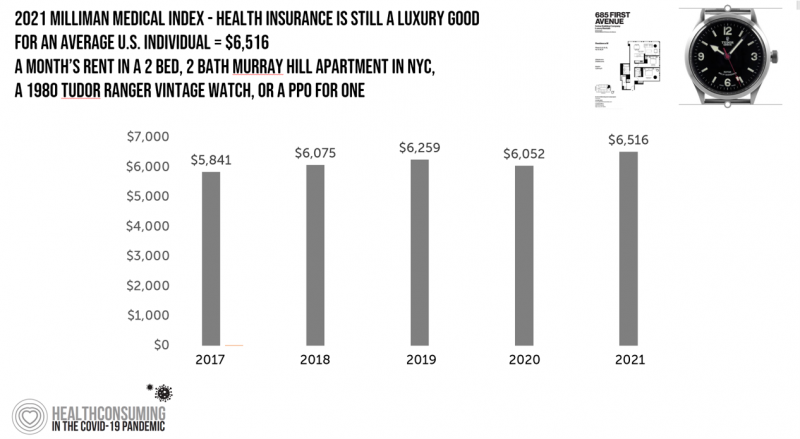

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

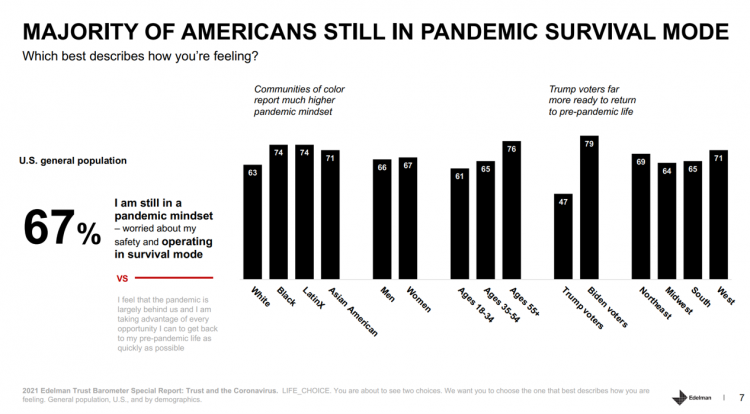

The Continued Erosion of Trust in the Age of COVID

A year into the COVID-19 pandemic, most Americans are still in “survival mode,” according to an update of the 2021 Edelman Trust Barometer, Trust and the Coronavirus in the U.S. Updating the company’s annual Trust Barometer, Edelman conducted a new round of interviews in the U.S. among 2,500 people in early March. [For context, you can read my take on the 2021 Edelman Trust Barometer published during the World Economic Forum in January 2021 here in Health Populi]. The first chart shows that two in three people in the U.S. are still in a pandemic mindset, worried about safety and

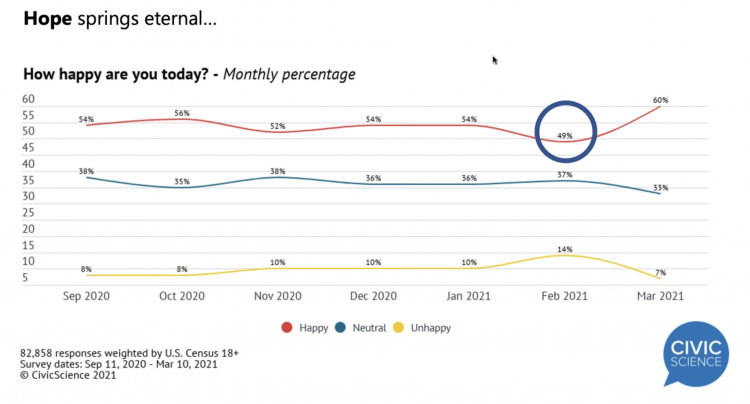

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

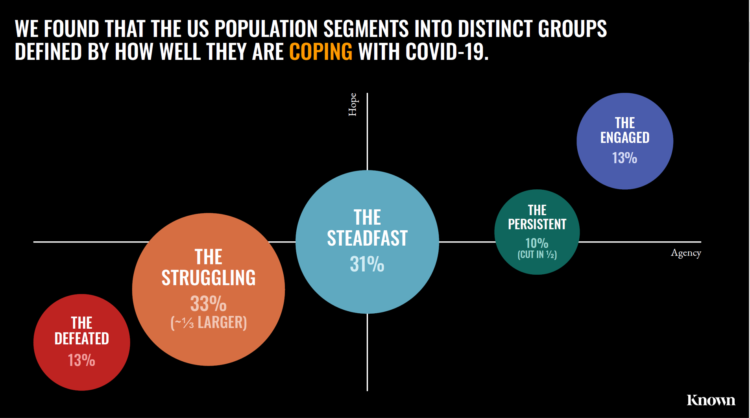

The Pandemic Has Been a Shock to Our System – Learning from Known

The coronavirus pandemic has been a shock to people across all aspects of everyday living, for older and younger people, for work and school, for entertainment and travel — all impacting our hearts, minds, and wallets. “As the bedrock of daily life was shaken, uncertainty predictably emerged as the prevailing emotion of our time but this universal problem was eliciting a highly differentiated reaction in different people,” Kern Schireson, CEO of Known, observed. His company has conducted a large quantitative and qualitative research program culminating in a first report, The Human Condition 2020: A Shock To The System. Known’s team of

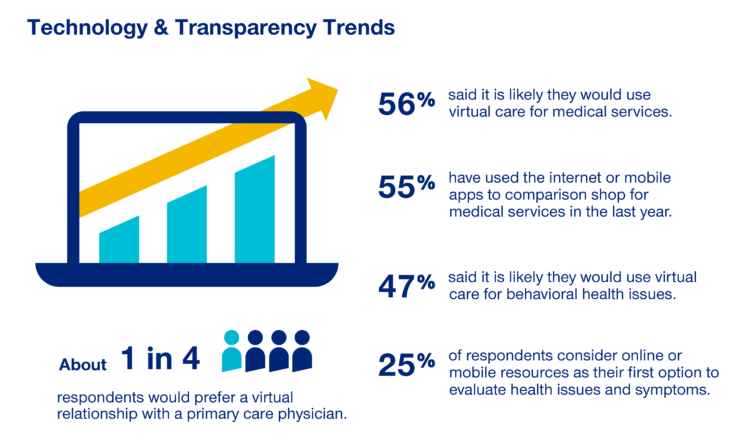

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

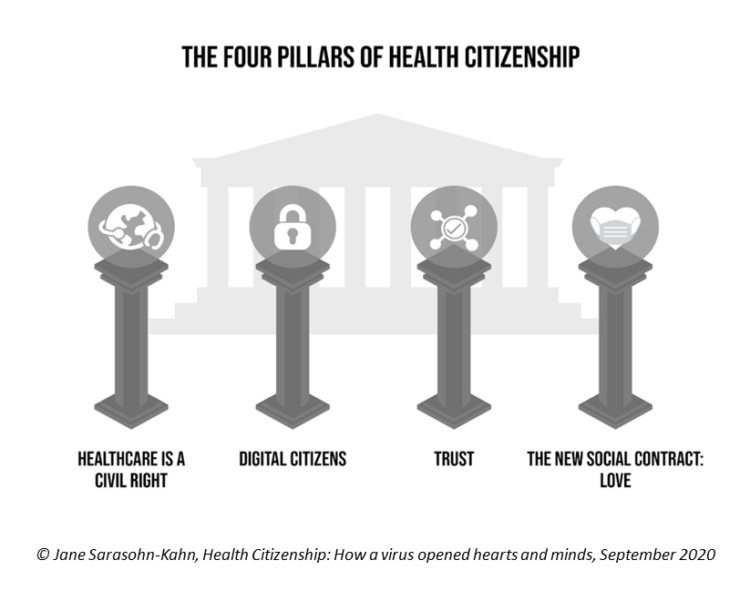

Health Citizenship in America. If Not Now, When?

On February 4th, 2020, in a hospital in northern California, the first known inpatient diagnosed with COVID-19 died. On March 11th, the World Health Organization called the growing prevalence of the coronavirus a “pandemic.” On May 25th, George Floyd, a 46-year-old Black man, died at the hands of police in Minneapolis. This summer, the Dixie Chicks dropped the “Dixie” from their name, and NASCAR cancelled the confederate flag from their tracks. Today, nearly 200,000 Americans have died due to the novel coronavirus. My new book, Health Citizenship: How a virus opened hearts and minds, launched this week. In it, I

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

50 Days Before the U.S. Elections, Voters Say Health Care Costs and Access Top Their Health Concerns — More than COVID-19

The coronavirus pandemic has revealed deep cracks and inequities in U.S. health care in terms of exposure to COVID-19 and subsequent outcomes, with access to medical care and mortality rates negatively impacting people of color to a greater extent than White Americans. The pandemic has also led to economic decline that, seven weeks before the 2020 elections in America, is top-of-mind for health citizens with the virus-crisis itself receding to second place, according to the Kaiser Family Foundation September 2020 Health Tracking Poll. KFF polled 1,199 U.S. adults 18 years of age and older between August 28 and September 3,

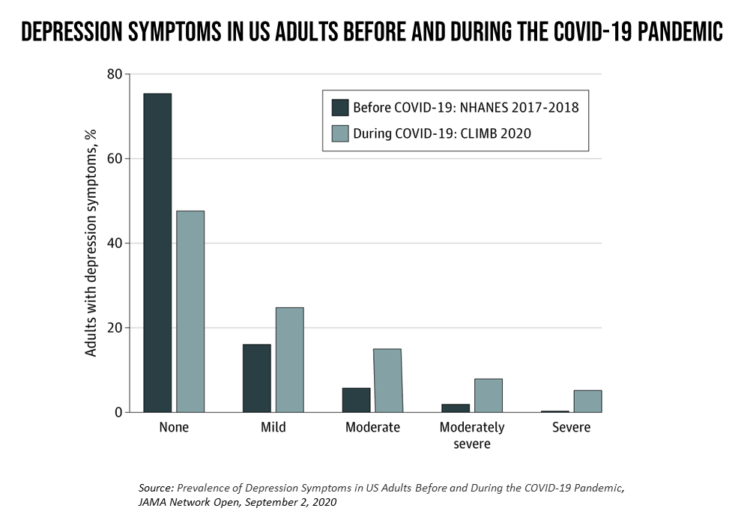

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

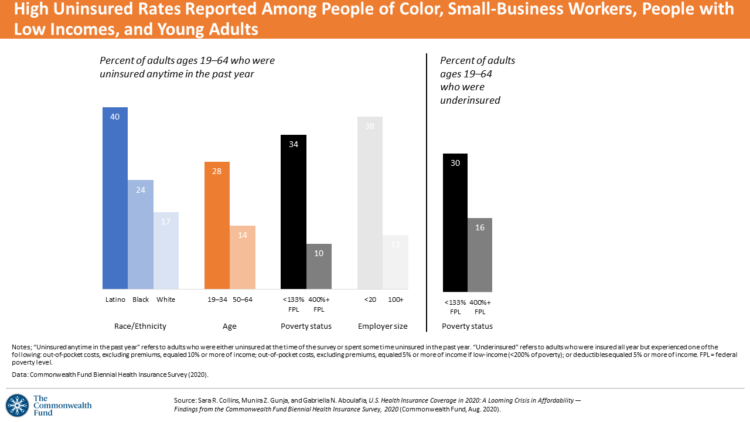

Health Insurance Affordability in the Time of the Coronavirus Pandemic

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

The She-Cession – a Financially Toxic Side-Effect of the Coronavirus Pandemic

Along with the life-threatening impact of the coronavirus on physical health, and the accompanying mental health distress activated by self-distancing comes a third unintended consequence with the pandemic: a hard hit on women’s personal economies. The recession of the pandemic is considered by many economists as a “She-Cession,” a downturn in the economy that’s negatively impacting women more acutely than men. This is markedly different than the Great Recession of 2008, the last major financial crisis: that financial decline was coined a “ManCession,” taking a more significant toll out of more typically men’s jobs like construction and manufacturing where fewer

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

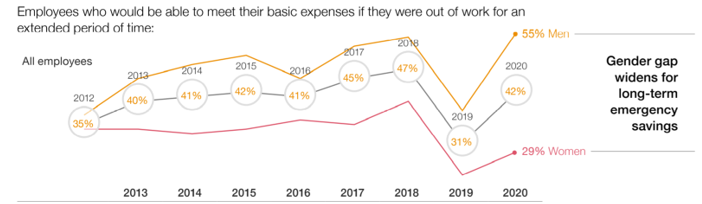

Financial Insecurity Among U.S. Workers Will Worsen in the Pandemic — Especially for Women

Millions of mainstream, Main Street Americans entered 2020 feeling income inequality and financial insecurity in the U.S. The coronavirus pandemic is exacerbating financial stress in America, hitting women especially hard, based on PwC’s 9th annual Employee Financial Wellness Survey COVID-19 Update. For this report, PwC polled 1,683 full-time employed adults between 18 and 75 years of age in January 2020. While the survey was conducted just as the pandemic began to emerge in the U.S., PwC believes, “the areas of concern back in January will only be more pronounced today,” reflecting, “the realities of the changing employee circumstances we are

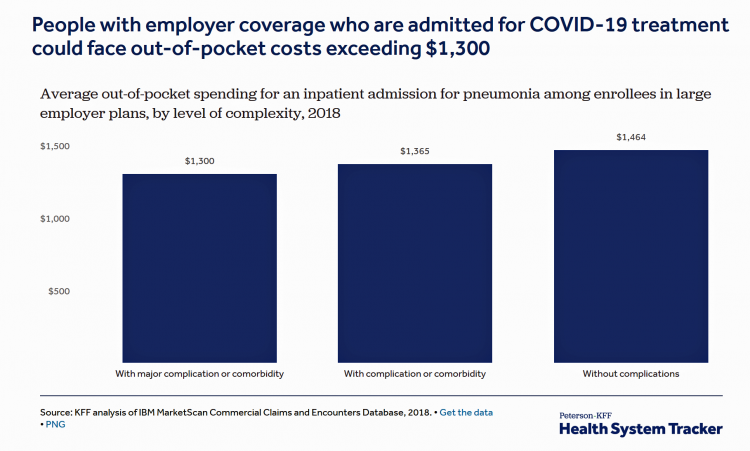

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

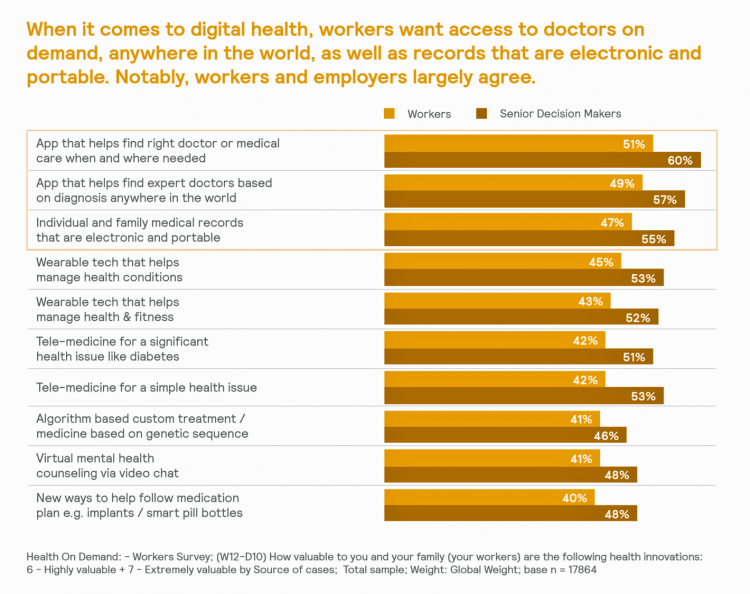

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

“Digital Health Is An Ecosystem of Ecosystems” – CTA’s 2020 Trends to Watch Into the Data Age

In CTA’s 2020 Consumer Tech Forecast launched yesterday at Media Day 1 at CES, Steve Koenig VP of Research, said that, “digital health is an ecosystem of ecosystems.” Health, medical and wellness trends featured large in the forecast, which brought together key trends for 5G, robotics, voice tech, AR/VR/XR, and the next iteration of IoT — which Steve said will still be called “IoT,” but in this phase will morph into the “Intelligence of Things.” That speaks to Steve’s phrase, “ecosystem of ecosystems,” because that’s not just “digital” health — that’s now the true nature of health/care, and what is

In 2020, PwC Expects Consumers to Grow DIY Healthcare Muscles As Medical Prices Increase

The new year will see a “looming tsunami” of high prices in healthcare, regulation trumping health reform, more business deals reshaping the health/care industry landscape, and patients growing do-it-yourself care muscles, according to Top health industry issues of 2020: Will digital start to show an ROI from the PwC Health Research Institute. I’ve looked forward to reviewing this annual report for the past few years, and always learn something new from PwC’s team of researchers who reach out to experts spanning the industry. In this 14th year of the publication, PwC polled executives from payers, providers, and pharma/life science organizations. Internally,

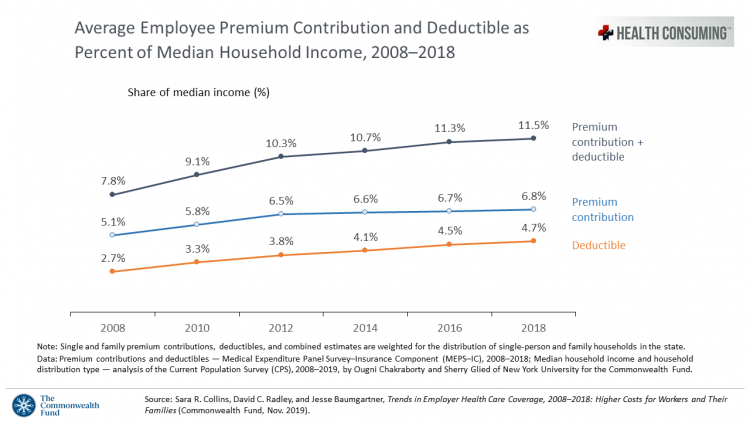

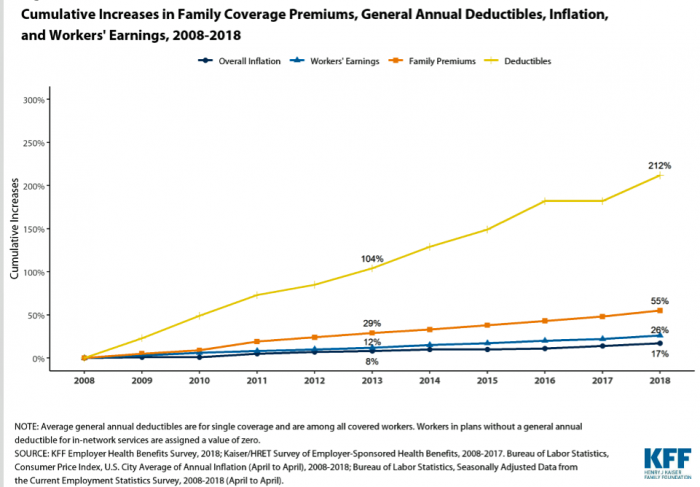

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

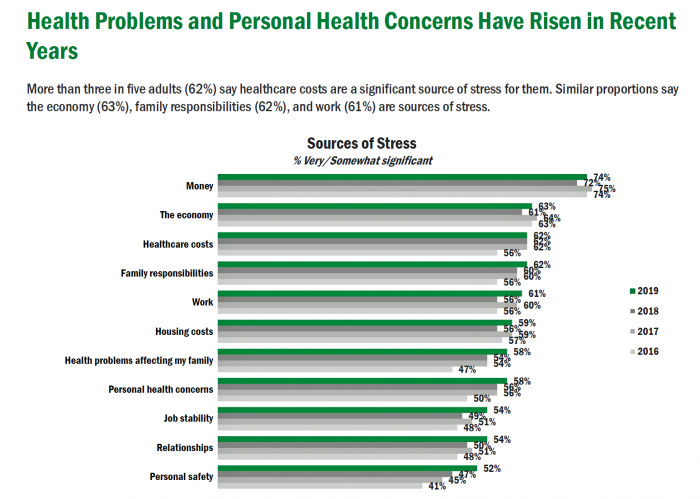

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

A Portrait of the Health Consumer as Confused, Cost-Challenged, and Out of Control

Patients in the U.S. are confused, cost-challenged and lacking control, according to The Consumer Healthcare Paradox from Maestro Health, an employee health and benefits company. Data illustrating that “paradox” is shown in the second chart: while 78% percent of patients told Maestro Health their health care experience is positive, 69% feel they lack control over their patient journey. Quality health care in America is too expensive, 79% of consumers said. Furthermore, one in two U.S. patients had received a medical bill that was higher than they anticipated it would be. Finally, one in two U.S. patients said the quality of

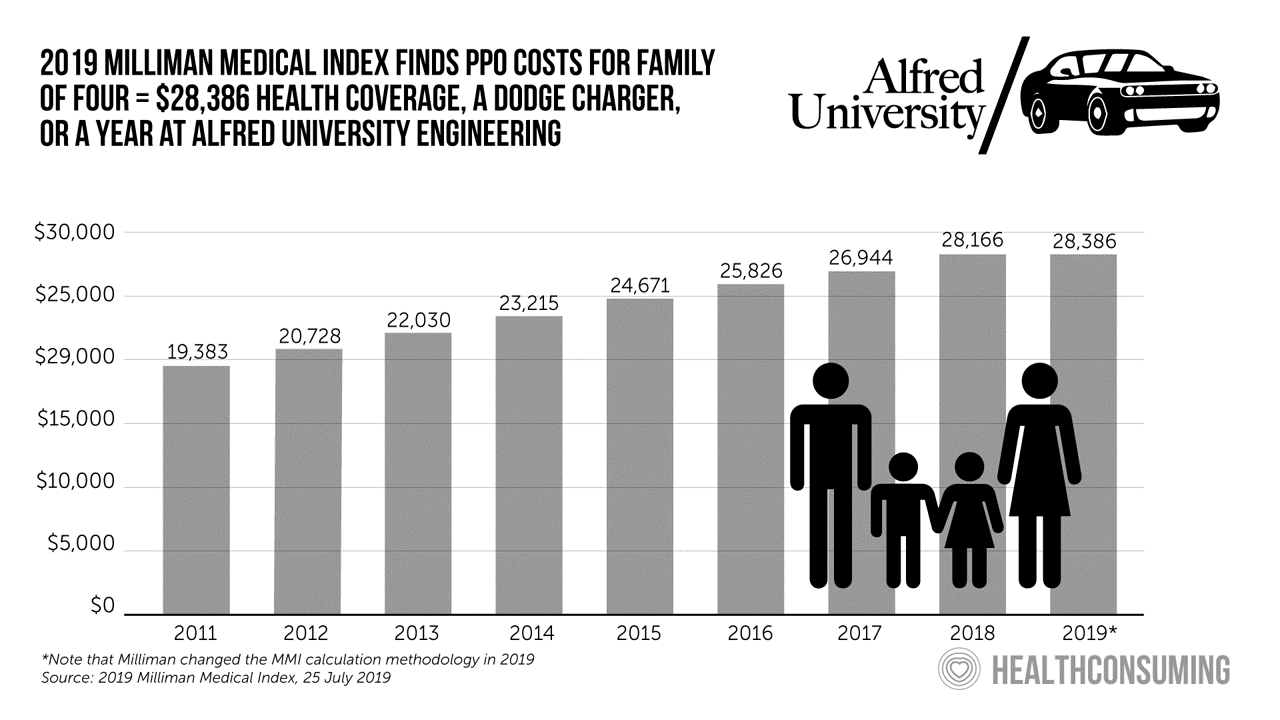

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

Health/Care Everywhere – Re-Imagining Healthcare at ATA 2019

“ATA” is the new three-letter acronym for the American Telemedicine Association, meeting today through Tuesday at the Convention Center in New Orleans. Ann Mond Johnson assumed the helm of CEO of ATA in 2018, and she’s issued a call-to-action across the health/care ecosystem for a delivery system upgrade. Her interview here in HealthLeaders speaks to her vision, recognizing, “It’s just stunning that there’s such a lag between what is possible in telehealth and what is actually happening.” I’m so keen on telehealth, I’m personally participating in three sessions at #ATA19. On Monday 15th April (US Tax Day, which is relevant

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

“Telehealth is a digital distribution channel for health care” – catching up with Roy Schoenberg, President and CEO of American Well

Ten years ago, two brothers, physicians both, started up a telemedicine company called American Well. They launched their service first in Hawaii, where long distances and remote island living challenged the supply and demand sides of health care providers and patients alike. A decade later, I sat down for a “what’s new?” chat with Roy Schoenberg, American Well President and CEO. In full transparency, I enjoy and appreciate the opportunity to meet with Roy (or very occasionally Ido, the co-founding brother-other-half) every year at HIMSS and sometimes at CES. In our face-to-face brainstorm this week, we covered a wide range

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

Consumers Want Help With Health: Can Healthcare Providers Supply That Demand?

Among people who have health insurance, managing the costs of their medical care doesn’t rank as a top frustration. Instead, attending to health and wellbeing, staying true to an exercise regime, maintaining good nutrition, and managing stress top U.S. consumers’ frustrations — above managing the costs of care not covered by insurance. And maintaining good mental health and staying on-track with health goals come close to managing uncovered costs, Oliver Wyman’s 2018 consumer survey learned. These and other important health consumer insights are revealed in the firm’s latest report, Waiting for Consumers – The Oliver Wyman 2018 Consumer Survey of US

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

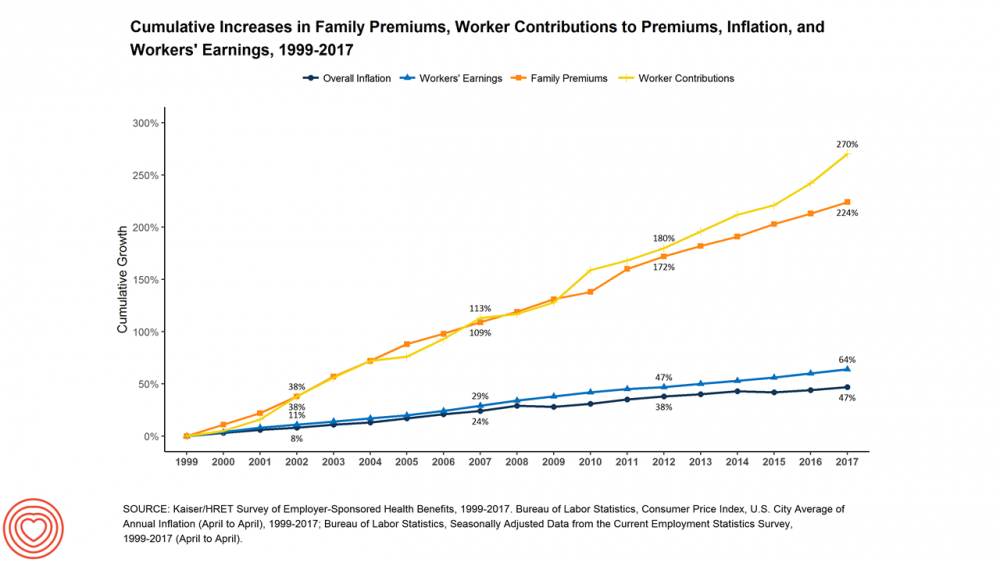

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

More U.S. Companies Offering Health Insurance After 8 Years of Decline

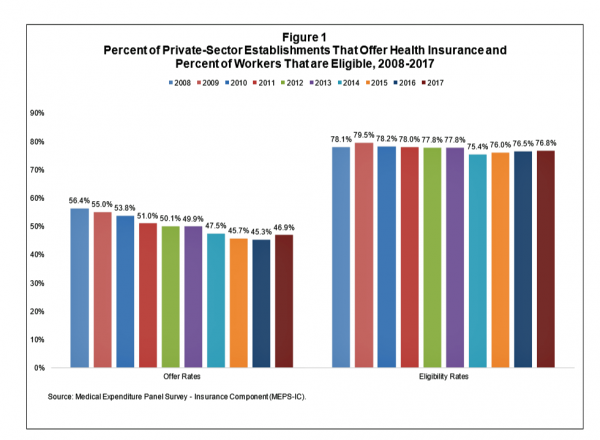

After eight years of decline, more U.S. employers offered health insurance to workers in 2017, EBRI reports in its latest Issue Brief. In 2017, 46.9% of U.S. companies offered health insurance to their employees, up by 1.6 percentage points from a low of 45.3% in 2016. For perspective, ten years earlier in 2008, 56.4% of employers offered health insurance, shown in the first bar chart (Figure 1 from the EBRI report). The largest percentage point increase in health plan offer-rates came from the smallest companies, those with less than 10 employees: while 21.7% of those companies offered health insurance in

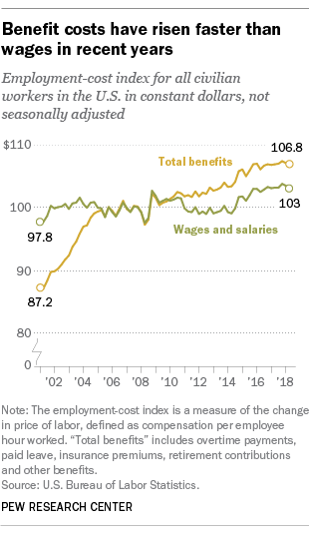

Benefit Cost Increases Overwhelm Flat Wages for Most in US: Pew

Today’s financial news reports and the bullish stock market generate headlines saying that the U.S. economy is riding high. President Trump forecasted in late July, “we are now on track to hit an average GDP annual growth of over 3% and it could be substantially over 3%,” Trump said. “Each point, by the way, means approximately $3 trillion and 10 million jobs. Think of that.” Indeed, unemployment is at its lowest rate in decades at 4%. Today, NASDAQ reported that, “the U.S. economy stays strong as the Fed holds steady.” For mainstream working people, though, even with a job in a high employment

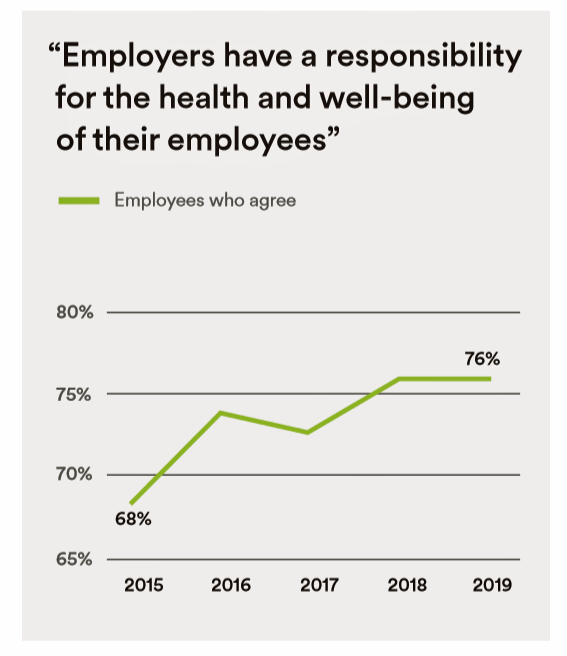

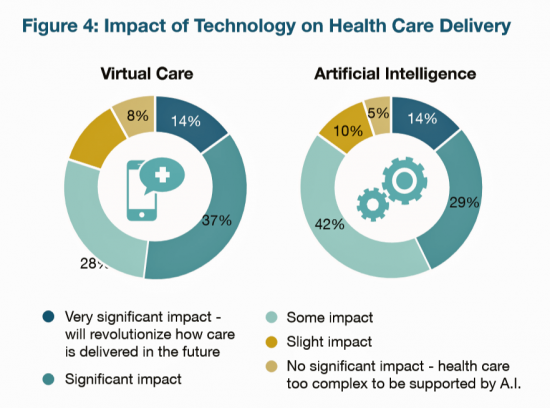

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

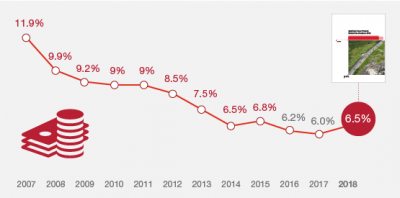

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

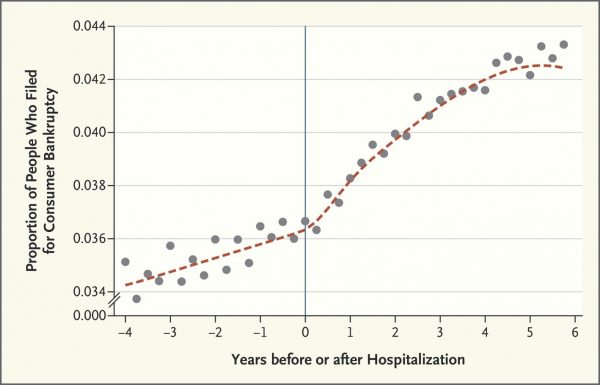

The New Financial Toxicity in Health Care: The Cost of Hospitalization

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

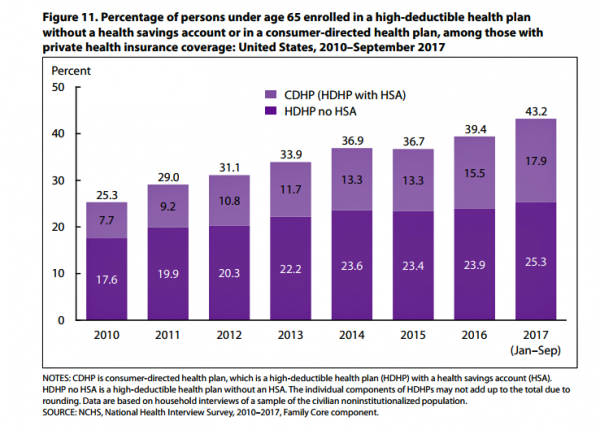

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

Healthcare EveryWhere: Philips and American Well Streamline Telehealth

Two mature companies in their respective healthcare spaces came together earlier this month to extend healthcare services where patients live and doctors work, via telehealth services. Philips, celebrating 127 years in business this year, has gone all-in on digital health across the continuum of care, from prevention and healthy living to the ICU and hospital emergency department. American Well is among the longest operating telehealth companies, founded in 2006. Together, these two established organizations will transcend physician offices and ERs and deliver virtual care in and beyond the U.S. I had the opportunity to sit down with Ido Schoenberg, MD,

Hug Your Physician: S/He Needs It – Listening to the 2018 Medscape National Physician Burnout & Depression Report

Two in five U.S. physicians feels burned out, according to the Medscape National Physician Burnout & Depression Report for 2018. This year, Medscape explicitly adds the condition of “depression” to its important study, and its title. In 2017, the Medscape report was about bias and burnout. Physicians involved in primary care specialties and critical care are especially at-risk for burnout, the study found. One in five OBGYNs experience both burnout and depression. Furthermore, there’s a big gender disparity when it comes to feeling burned out: nearly one-half of female physicians feel burnout compared with 38% of male doctors. Being employed by

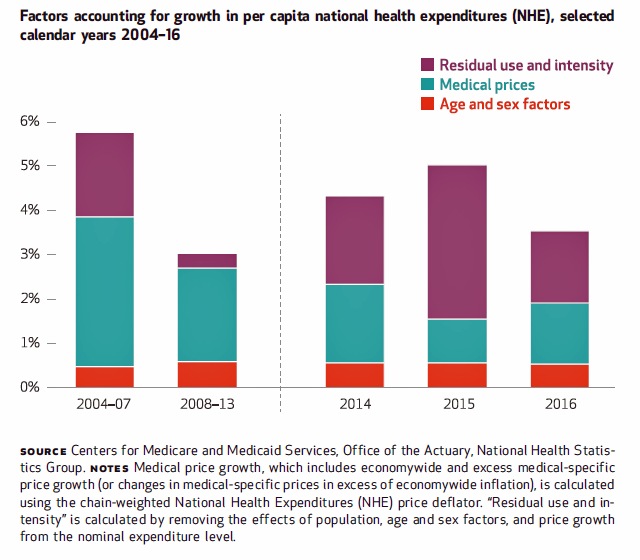

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

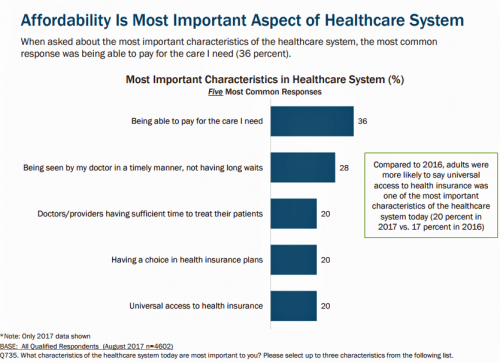

Most Americans Are Concerned About Healthcare Policy, and Costs Top the List of Concerns

4 in 5 Americans are aware of potential changes to healthcare policy brewing in Washington, DC. 92% of them are concerned about those changes, according to Healthcare Consumers in a Time of Uncertainty, the fifth annual survey from Transamerica Center for Health Studies. Peoples’ most-shared fears are losing their coverage for pre-existing conditions, out-of-pocket spending, and a ban on lifetime limits. That boils down to one thing: cost. That is, cost, for having to spend money on services not-covered by their health insurance plan; cost for out-of-pocket items under-insured, denied, or requiring coinsurance or co-payments; and, catastrophic costs that rise beyond

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

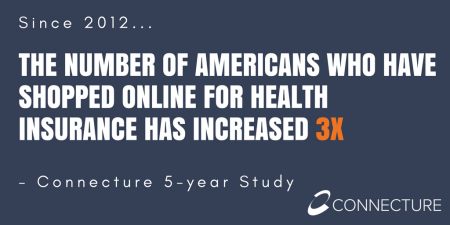

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

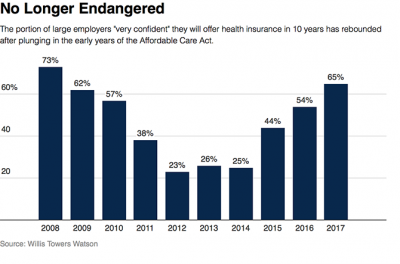

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

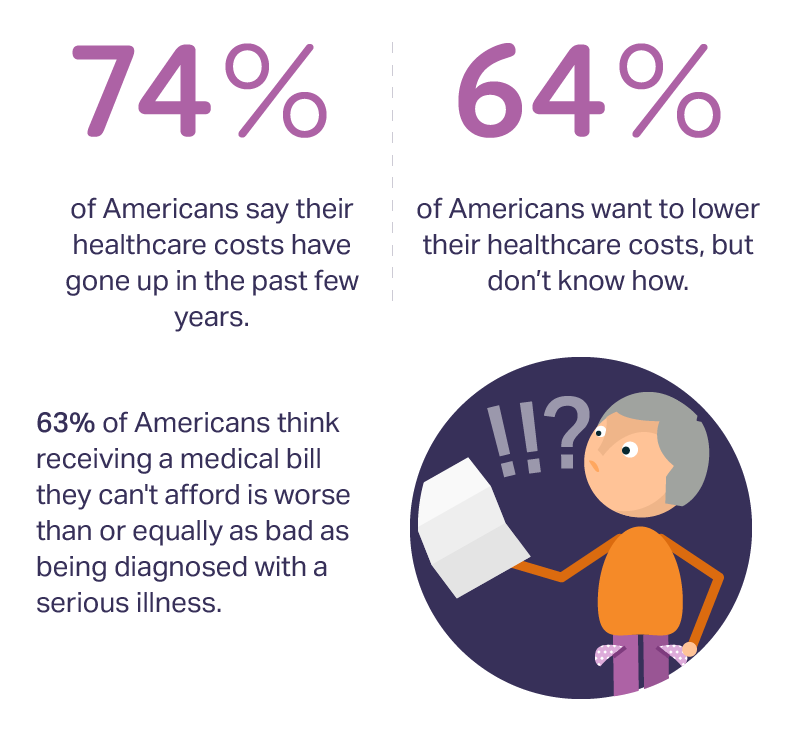

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

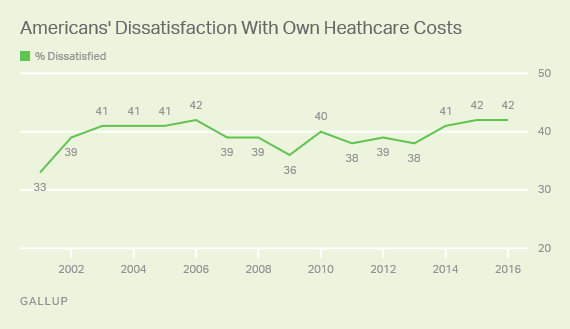

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

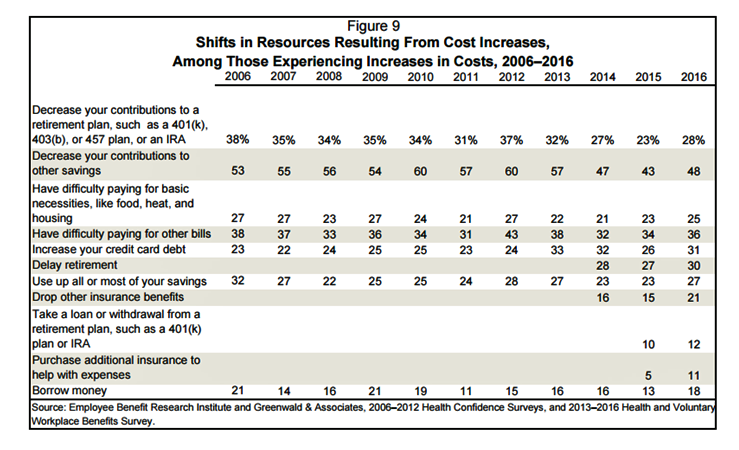

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...