Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

The future of sensors in health care – passive, designed, integrated

Here’s Ann R., who is a patient in the not-too-distance-future, when passive sensors will be embedded in her everyday life. The infographic illustrates a disruption in health care for people, where data are collected on us (with our permission) that can help us improve our own self-care, and help our clinicians know more about us outside of their offices, exam rooms and institutions. In Making Sense of Sensors: How New Technologies Can Change Patient Care, my paper for the California HealthCare Foundation, I set out to organize the many types of sensors proliferating the health care landscape, and identify key

The Accountable Care Community opportunity

“ACOs most assuredly will not…deliver the disruptive innovation that the U.S. health-care system urgently needs,” wrote Clay Christensen, godfather of disruptive innovation, et. al., in an op-ed in the Wall Street Journal of February18, 2013. In the opinion piece, Christensen and colleagues make the argument that Accountable Care Organizations (ACOs) as initially conceived won’t address several key underlying forces that keep the U.S. health care industry in stasis: Physicians’ behavior will have to change to drive cost-reduction. Clinicians will need “re-education,” the authors say, adopting evidence-based medicine and operating in lower-cost milieus. Patients’ behavior will have to change. This requires

Health cost transparency on the W-2: sticker shock at the point-of-paystub

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage. This new piece of data, shown in Box 12, DD information, comes as part of health reform, The Affordable Care Act, which requires employers with over 250 workers to show how much they spend on employer-sponsored health benefits in total. This is the employer’s premium cost, and does not include the covered worker’s out-of-pocket spending (e.g., copays, coinsurance and deductibles). It is being furnished on W-2’s “for informational

The flu shot economy

4 in 10 Americans got flu shots in this epidemic season, and most of these didn’t receive their immunization in their doctor’s office. The Flu Vaccination Survey from Ipsos Public Affairs, conducted in January 2013, paints a picture of U.S. health consumers who are project managing their personal approaches to preventing the flu in this historically hard-hitting flu season. The most expressed demand for flu shots has been among people 55 and over, one-half of whom have received vaccinations, with the lowest use been in the 25-35 year age group. Geographically, the most covered health citizens live in New England

Health reform, costs and the growing role of consumers: PwC’s tea leaves for 2013

PwC has seen the future of health care for the next year, and the crystal ball expects to see the following: Affordable Care Act implementation, with states playing lead roles The role of dual eligibles Employer’s role in health care benefits Consumers’ role in coverage Consumers’ ratings impact on health care Transforming health delivery Population health management Bring your own device Pharma’s changing value proposition The medical device industry & tax impact. In their report, Top health industry issues of 2013: picking up the pace on health reform, PwC summarizes these expectations as a “future [that] includes full implementation of

Retail and work-site clinics – medical homes for younger adults?

The use of retail and work-site health clinics is up, and their consumers skew young. Overall, 27% of all U.S. adults have stepped into a walk-in clinic in the past two years. But only 15% of people 65 and over have used such a clinic. This begs the question: are retail and on-site clinics at the workplace filling the role of medical homes for younger adult Americans? The Harris Interactive/HealthDay poll published in January 2013 discovered that use of retail clinics grew from 7% in 2008 to 27% in 2012. The largest age cohort using walk-in clinics is people between

We are all health deputies in the #digitalhealth era: live from the 2013 Consumer Electronic Show

Reed Tuckson of UnitedHealthGroup was the first panelist to speak at the kickoff of the Digital Health Summit, the fastest-growing aspct of the 2013 Consumer Electronics Show (#2013CES). Tuckson implored the spillover audience to all, “self-deputize as national service agents in health,” recognizing that technology developers in the room at this show that’s focused on developers building Shiny New Digital Things have much to bring to health. As Andrew Thompson of Proteus Medical (the “invisible pill” company) said, “we can’t bend the health care cost curve; we have to break it.” This pioneering panel was all about offering new-new technologies

Cost-conscious health consumers are adopting personal health IT

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012. The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled

Employers slow health cost increases for 2013 by growing consumer-directed plans

Health benefit costs grew a relatively low 4.1% in 2012 (5.4% for large employers), largely due to companies moving workers into lower-cost consumer-directed health plans. Last year, benefit costs grew at an annual rate of 6.1%, representing about a 30% fall in year-on-year cost growth for companies. And, coverage is up to 59% of employees having ticked down to 55% for the past couple of years. Employers expect about a 5% increase for 2013. Mercer’s National Survey of Employer-Sponsored Health Plans analysis finds that U.S. employers are looking toward 2014, when they’ll be covering more uninsured workers, and using this advance

Another call for transparency in health care from employers and unions for consumers

In the wake of Hurricane Sandy, there are strange bedfellows coming together this week. First strange bedfellow moment for me this week was the video of Governor Chris Christie and President Barak Obama embracing and working together in storm-turn New Jersey yesterday. Saints be praised! to see a Republican and Democrat coming together, working together, consoling citizens together. In health care this week, another welcome strange bedfellow event is the statement issued by Catalyst for Payment Reform (CPR), an advocacy group of business, labor unions (notably, the AFL-CIO), and consumer advocates promoting broadly available information for consumers about the price and quality

Small business says stress is the #1 wellness need for employees

Nearly 50% of business start-ups view health and wellness as crucial to employee recruitment and retention. 31% of start-ups under 10 years of age have adopted wellness programs. Furthermore, 3 in 4 small companies that offer wellness programs say they positively impact the businesses’ bottom-lines. Nonetheless, more than one-half of small business — companies with fewer than 100 employees — say that there isn’t enough information available that focuses squarely on wellness in small business. These findings come from Workplace Wellness Programs in Small Business: Impacting the Bottom Line, a report from the National Small Business Association (NSBA) and Humana, details findings

In sickness and in health: consumers expect doctors to be wellness coaches, too

4 in 5 health consumers expect doctors not only to treat them when they’re sick, but to keep them healthy. “In sickness and in health” now morphs over to the doctor-patient relationship, beyond the marriage vow. Better Health through Better Patient Communications, a survey from Varolii, finds that people are looking for health, beyond health care, from their physicians. Varolii is a customer interaction company that claims to have interacted with 1 in 3 Americans through some sort of company communication: they work with major Fortune 1000 companies, including banks, airlines, retail, and, yes, health care. They recently attracted a

Employers grow onsite health clinics, and employer-sponsored telemedicine will grow

With “Zero” large employers expecting to drop health insurance, as reported in the Washington Post, companies are getting creative and innovative about how to manage workers’ health and wellness, while addressing ever-growing costs. One strategy that’s getting more traction is the re-invention of the onsite health center. Towers Watson‘s 2012 Onsite Health Center survey report, finds that one-half of employers view establishing an onsite health center as a linchpin to enhancing productivity and health in the workplace. Following close behind productivity is the onsite health center’s promise of reducing medical costs, improving access to care, and the traditional reason for providing onsite

Wellness takes hold among large employers – and more sticks nudge workers toward health

Employee benefits make up one-third of employers’ investments in workers, and companies are looking for positive ROI on that spend. Health benefits are the largest component of that spending, and are a major cost-management focus. In 2012 and beyond, wellness is taking center stage as part of employers’ total benefits strategies. In the 2012 Wellness & Benefits Administration Benchmarking study, a new report from bswift, a benefits administration company, the vast majority of large employers (defined as those with over 500 workers) are sponsoring wellness programs, extending them to dependents as well as active workers. Increasingly, sticks accompany carrots for

Employees will bear more health costs to 2017 – certainty in an uncertain future

Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making. The 2012 Deloitte Survey of U.S. Employers finds them, mostly, planning to subsidize health benefits for workers over the next few years, while placing greater financial and clinical burdens on the insured and moving more quickly toward high-deductible health plans and consumer-directed plans. In addition, wellness, prevention and targeted population health programs will be adopted by most employers staying in the health care game, shown in

Why we now need primary care, everywhere

With the stunning Supreme Court 5-4 majority decision to uphold the Patient Protection and Affordable Care Act (ACA), there’s a Roberts’ Rules of (Health Reform) Order that calls for liberating primary care beyond the doctors’ office. That’s because a strategic underpinning of the ACA is akin to President Herbert Hoover’s proverbial “chicken in every pot:” for President Obama, the pronouncement is something like, “a medical home for every American.” But insurance for all doesn’t equate to access: because 32-some million U.S. health citizens buy into health insurance plans doesn’t guarantee every one of them access to a doctor. There’s a

58% of Americans self-rationing health care due to cost

Since the advent of the Great Recession of 2008, more Americans have been splitting pills, postponing needed visits to doctors, skipping dental care, and avoiding recommended medical tests due to the cost of those health care services. Call it health care self-rationing: the Kaiser Family Foundation (KFF) has been tracking this trend for the past several years, and the proportion of American adults rationing health demand is up to 58%. This KFF Health Tracking Poll interviewed 1,218 U.S. adults age 18 and older via landline and cell phone in May 2012. As the chart illustrates, 38% of people are “DIYing” health care

The Online Couch: how “safe Skyping” is changing the relationship for patients and therapists

Skype and videoconferencing have surpassed the tipping point of consumer adoption. Grandparents Skype with grandchildren living far, far away. Soldiers converse daily with families from Afghanistan and Iraq war theatres. Workers streamline telecommuting by videoconferencing with colleagues in geographically distributed offices. In the era of DIY’ing all aspects of life, more health citizens are taking to DIY’ing health — and, increasingly, looking beyond physical health for convenient access to mental and behavioral health services. The Online Couch: Mental Health Care on the Web is my latest paper for the California HealthCare Foundation. Among a range of emerging tech-enabled mental health

The Age of Value in Health Care

The idea of value-based purchasing in health care has been around since the 1990s, when 3 researchers named Meyer, Rybowski and Eichler wrote, “The concept of value-based health care purchasing is that buyers should hold providers of health care accountable for both cost and quality of care. Value-based purchasing brings together information on the quality of health care, including patient outcomes and health status, with data on the dollar outlays going towards health. It focuses on managing the use of the health care system to reduce inappropriate care and to identify and reward the best-performing providers. This strategy can be

Investments in wellness will grow in 2013, but social health still a novelty for employers

One-third of employers will increase investments in wellness programs in 2013. Employers look to these programs to reduce health care costs, to create a culture of health, to improve workforce productivity, and to enhance employee engagement. Workers say wellness programs are important in their choice of employer. But while employers and employee chasm agree on that point, there’s a gap between how employers see the programs’ benefits, and how aware (or unaware) employees are. Call this a Wellness Literacy Gap, akin to health literacy and health plan literacy. Over one-half of employers believe employees understand the programs they offer,

Health costs will increase in 2013, and employees will bear more: can wellness programs help stem the rise?

Health spending will increase by 7.5% in 2013, with employees’ contributions rising for in-network deductibles, prescription drugs and emergency room visits. 3 in 4 employers, seeking to control rising health expenses, will offer wellness programs, even though a vast majority can’t yet measure an ROI on them. The Health and Well-Being: Touchstone Survey Results from PriceWaterhouseCoopers (PwC). PwC points out that the 7.5% medical cost increase is historically lower than in recent years, as a result of structural changes in the health care market including: A sluggish economy Growing focus on cost containment Lower utilization of health services by patients Employers’ efforts

The pharmaceutical landscape for 2012 and beyond: balancing cost with care, and incentives for health behaviors

Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui. Express-Scripts Medco’s report on 9 Leading Trends in Rx Plan Management presents findings from a survey of 318 pharmacy benefit decision makers in public and private sector organizations. About one-half of the respondents represented smaller organizations with fewer than 5,000 employees; about 20% represented jumbo companies with over 25,000 workers. The survey was conducted in the

Employers who offer more flexibility yield healthier workforces

The most flexible workplaces are good for worker’s health: they yield the most engaged workforces, greater job satisfaction, increased commitment to the firm, better mental health and lower indicators of depression. But not all firms are all that flexible, which is the top line of the Family and Work Institute‘s 2012 National Study of Employers (NSE), funded by The Alfred P. Sloan Foundation. What makes this survey different from others polling employers is that the NSE looks at the comprehensive array of total benefits offered to employees and their changing needs in terms of family, finance, and social lives. In the past seven years,

Your doctor’s appointment on your phone: out of beta and into your pocket

You can now carry a doctor with you in your pocket. Two top telehealth companies that support online physician-patient visits have gone mobile. This upgrade was announced this week at the 2012 American Telemedicine Association conference, being held in San Jose, CA. In enabling mobile physician visits, American Well and Consult A Doctor join Myca, which has offered mobile phone-based visits for clients for at least two years to employer clinic customers. In April 2010, my report, How Smartphones Are Changing Healthcare for Consumers and Providers, talked about Myca’s work with Qualcomm: the telecomms company armed traveling employees with mobile phones that could connect

The decline and potential renaissance of employer-sponsored health benefits: EBRI and MetLife reports tell the story

Two reports this week suggest countervailing trends for employer-sponsored health benefits: the erosion of the health benefit among companies, and opportunities for those progressive employers who choose to stay in the health benefit game. In 2010, nearly 50% of workers under 65 years of age worked for firms that did not offer health benefits. The uber-trend, first, is that the percentage of workers covered by employer-sponsored health insurance has declined since 2002. Workers offered the option of buying into a health benefit, as well as the percent covered by a health plan, have both fallen, according to the Employee Benefits Research Institute (EBRI), an organization that

Wellness Ignited! Edelman panel talks about how to build a health culture in the U.S.

Dr. Andrew Weil, the iconic guru of all-things-health, was joined by a panel of health stakeholders at this morning’s Edelman salon discussing Wellness Ignited – Now and Next. Representatives from the American Heart Association, Columbia University, Walgreens, Google, Harvard Business School, and urban media mavens Quincy Jones III and Shawn Ullman, who lead Feel Rich, a health media organization, were joined by Nancy Turett, Edelman’s Chief Strategist of Health & Society, in the mix. Each participant offered a statement about what they do related to health and wellness, encapsulating a trend identified by Jennifer Pfahler, EVP of Edelman. Trend 1: Integrative

Public health is valued by Americans, but health citizens balance personal responsibility with a Nanny State

While most Americans largely believe in motorcycle helmet laws, seatbelt-wearing mandates, and regulations to reduce sale in packaged foods, most are also concerned about the nation turning into the United States of Nanny. The Harris Interactive/Health Day poll of March 20, 2012, finds a health citizenry “pro” most public and safety regulations, from banning texting while driving to requiring the HPV vaccination (e.g., Gardasil). Specifically, as the chart shows, – 91% of U.S. adults are for banning texting while driving – 86% are for requiring vaccination of young children against mumps, measles, and other diseases – 86% also like to

The ACA won’t undermine employer-based health insurance and could help the deficit, says CBO (again)

There’s intriguing fine print in the latest CBO analysis on the impact of the Affordable Care Act (ACA) on employer-sponsored health insurance in the U.S. CBO finds there will be 3 to 5 million working Americans without employer-sponsored health insurance due to the implementation of the ACA, according to the report, CBO and JCT’s Estimates of the Effects of the Affordable Care Act (ACA) on the Number of People Obtaining Employment-Based Health Insurance. Originally, the CBO and Joint Committee on Taxation (JCT) estimated that the number of people obtaining health insurance coverage through their employer would be 3 million people lower in 2019 under

Employers shopping for value in health – Towers Watson/NBGH 2012 survey results

Employers expect total health costs to reach $11,664 per active employee this year, over $700 more than in 2011. Employees’ share of that will be nearly $3,000, the highest contribution by workers in history. In 2012, workers are contributing 34% more to health costs than they did 5 years ago. The metric is that for every $1,000 employers will spend on health care in 2012, workers will pay $344 for premium and out-of-pocket costs. Still, health care cost increases are expected to level off to about 6% in 2012, that’s still twice as great as general consumer price inflation. with

HealthcareDIY – from employee wellness incentives to #retailhealth, #pharmacy, & #CDHP

Most U.S. companies will increase the dollar value of health incentives offered to workers in 2012, based on the annual survey from Fidelity Investments and the National Business Group on Health addressing employers’ plans for health benefits. 3 in 4 employers used incentives in 2011 to engage employees in wellness programs, with an average incentive value of $460. This number was $260 in 2009. The poll found that employers expect employees to improve their personal health, and will increasingly ration access to benefits based on employees’ engagement with health criteria. Employers’ approaches to incentives have begun to adopt value-based benefit design strategies that

On the road to retail health: healthcareDIY and primary care, everywhere

At the ConvUrgent Care Symposium in Orlando, attendees from the worlds of clinics, ambulatory care, hospital beds, pharmacies, medical devices, life sciences, health information, health IT, health plans, academic medical centers and professional medical societies came together to share and learn about the morphing landscape of retail health. The topline message: primary care is everywhere, and based on the response to my keynote talk this morning, every stakeholder segment gets it. My mantra, courtesy of the U.S. Surgeon General Regina Benjamin: don’t look at health in isolation, that is, where the doctor and hospital are. Health happens wherever the person

Paying medical bills is a chronic problem for 1 in 3 uninsured, and 1 in 5 insured people under 65

Over 20% of U.S. families had problems paying medical bills in 2010 — about the same proportion as in 2007. The Center for Studying Health System Change found this datapoint “surprising,” given the Great Recession of 2008 that lingers into 2012. However, HSC points out that the leveling of medical bill problems may be a “byproduct” of reduced medical care utilization; in Health Populi-speak, self-rationing of health care. In the Tracking Report, Medical Bill Problems Steady for U.S. Families, 2007-2010, HSC analyzed data from the 2010 Health Tracking Household Survey and discovered that since 2003, the proportion of families facing problems with medical debt

Employees predict reduced benefits in 2012; one-half expect layoffs

On the face of the raw data, tbe good news from the U.S. Bureau of Labor Statistics on the nation’s employment picture was an additional 120,000 jobs in November. This drove the unemployment rate down to 8.6%. Underneath that number, though, remains what is still a shaky economy for both workers and those seeking full employment to match what they might have lost as a result of their layoffs. First and foremost, most people who are fortunate to still have their jobs see 2012 as a year where the benefits they receive through their employers will fall, according to the Randstad Employee Attachment Index,

Employers aren’t engaging with patient/health engagement

The vast majority of employers who sponsor health benefits look at those benefits as part of a larger organization culture of health. While one-third are adopting value-based health plan strategies — doubling from 16% in 2010 to 37% in 2011 — only 3% of employers are taking an integrated view of value-based benefits and corporate wellness. This is the second year for the International Foundation of Employee Benefit Plans (IFEBP) and Pfizer to examine employers’ approaches to value-based health care (VBHC). As explained by Michael Porter, the guru on health value chains, value in health care focuses on the patient at

Workplace wellness: the cost of unhealthy behaviors in the American workforce is $623 per worker

The health status of the American workforce is declining. Every year, unhealthy behaviors of the U.S. workforce cost employers $623 per employee annually, according to the Thomson Reuters Workforce Wellness Index. People point to smoking, obesity and stress as the 3 most important factors impacting health costs. Thomson Reuters and NPR polled over 3,000 Americans on their health behaviors, utilization and costs of health care, publishing their results in a summary, Paying for Unhealthy Behaviors in October 2011. 4 in 5 overall — and 9 in 10 of those with over $50,000 annual income — believe that people with healthy behaviors should receive a

Primary care, everywhere: how the shortage of PCPs is driving innovation – especially for patient participation in their own care

The signs of the primary care crisis in America are visible: A growing number of visits to the emergency room for treating commonplace ailments Waiting lists for signing up with and queuing lines to see primary care doctors Fewer med students entering primary care disciplines Maldistribution of primary care practitioners (PCPs) in underserved areas, rural, exurban and urban. The implementation of the Affordable Care Act will (try to) enroll at least 30 million newly-insured health citizens into the U.S. health system. That’s the objective: whether being insured will actually provide people access to needed primary care is a big question given the current supply of

Health insurance: employers still in the game, but what about patient health engagement?

U.S. employers’ health insurance-response to the nation’s economic downturn has been to shift health costs to employees. This has been especially true in smaller companies that pay lower wages. As employers look to the implementation of health reform in 2014, their responses will be based on local labor market and economic conditions. Thus, it’s important to understand the nuances of the paradigm, “all health care is local,” taking a page from Tip O’Neill’s old saw, “all politics is local.” The Center for Studying Health System Change (HSC) visited 12 communities to learn more about their local health systems and economies, publishing their

Walmart’s rollback of health insurance for employees: just another employer facing higher health care costs?

Walmart is increasing premium sharing costs for employees subscribing to health insurance, and cutting the benefit for part-timers. Quoted in the New York Times, a company rep said, “over the last few years, we’ve all seen our health care rates increase and it’s probably not a surprise that this year will be no different. We made the difficult decision to raise rates that will affect our associates’ medical costs.” In so doing, Walmart told the Times that they will, “strike a balance between managing costs and providing quality care and coverage.” MarketWatch wrote that Walmart will increase health care premium costs

Employers’ health plans look to behavior change, while accelerating the premium cost shift to employees

The new mantra for employers who sponsor health benefits is: “a healthy workplace leads to a healthy workforce.” Employers that sponsor health plans are now in the behavior change business, according to Aon’s 2011 Health Care Survey. Health plans are tightly focusing on wellness, motivating and sustaining positive personal health changes, with carefully designed incentives (carrots and sticks) informed by behavioral economics. The paradigm is value-based insurance design (VBID) that removes barriers to essential, high-value health services to bolster treatment adherence, improve productivity, and reduce overall medical costs. The top five priority tactics for employers in health are: To offer incentives

Employers continue to worry about health costs in 2011, and expect to expand defined benefit plans

With health reform uncertainties, growing health regulations, and ever-increasing costs, employers who sponsor health plans for their workforce will continue to cover active employees. That is, at least until 2017, according to the crystal ball used by Mercer, explained in the Health & Benefits Perspective called Emerging challenges…and opportunities…in the new health care world, published in May 2011. Note that it’s “active” employees who Mercer expects will retain access to health benefits. For retirees, however, it’s another story. They need to be ready to take on more responsibility, financially and perhaps going-to-market to select coverage, while employers may continue some level

Working past 70 is the new retirement

American workers are worried about outliving their savings and not being able to meet the financial needs of their families, according to The 12th Annual Retirement Survey from the Transamerica Center for Retirement Studies. The study paints a picture of 4,080 U.S. workers who forecast insecure financial futures. Their personal portraits find them working into older ages than they had previously expected to — before the recession. 54% of workers plan to work in retirement. 39% of workers will retire after age 70, or not at all. It’s not only Baby Boomers who expect to work past 65. Two-thirds of workers in their

The average annual health costs for a U.S. family of four approach $20,000, with employees bearing 40%

Health care costs have doubled in less than nine years for the typical American family of four covered by a preferred provider health plan (PPO). In 2011, that health cost is nearly $20,000; in 2002, it was $9,235, as measured by the 2011 Milliman Medical Index (MMI). To put this in context, The 2011 poverty level for a family of 4 in the 48 contiguous U.S. states is $22,350 The car buyer could purchase a Mini-Cooper with $20,000 The investor could invest $20K to yield $265,353 at a 9% return-on-investment. The MMI increased 7.3% between 2010 and 2011, about the same

American health consumers still health rationing in 2011

The top 4 personal consumer worries are incomes not keeping up with rising prices; having to pay more for health care and health insurance; not having enough money for retirement; and. not being able to afford health care services we think we need. The April 2011 Kaiser Public Opinion poll from the Kaiser Family Foundation paints a picture of an American populus that’s putting health economic worries at the top of their list of personal concerns. The survey was fielded in March 2011. 1 in 2 U.S. adults has skipped some aspect of health care due to cost in the

Retail health options expand with American Well and Activ Doctors going direct

The traditional venues for retail health are found in pharmacies, grocery chains, and on the ground floor storefronts in hospitals. Joining these bricks-based models are digital, online health ventures that are expanding the definition and space of retail health. This week, two announcements illustrate this phenomenon, from American Well and Active Doctors. American Well, which launched in 2008, is an online physician consultation service in the U.S. that has successfully worked with health plans to channel consults to patients in Hawaii, Minnesota, and New York, among other local programs. Last year, American Well went live with the Rite Aid pharmacy chain in Pennsylvania. This week, American

Wellness is the new health benefit (a double entendre)

Wellness and disease prevention were the meta-themes at Health 2.0’s Spring Fling held earlier this week in San Diego. where the discussions, technology demonstrations, and keynote speakers were all-health (as opposed to health care), all-the-time. Dr. Dean Ornish told the attendees in the standing-room-only ballroom space that the joy of living is a greater motivator than the fear of death. And the 1.0 version of managing health risks has been more the latter than the former. As a result, Ornish’s two decades of research have shown that health is more a function of lifestyle choices than it is drugs and surgery. In fact, people have

The Post-Health Plan Health Plan: Humana

“If nothing else, the health reform bill has signaled the beginning of the end of the health plan as we know and love it,” David Brailer, once health IT czar under President GW Bush and now venture capitalist, is quoted in Reuters on Hot Healthcare Investing Trends for 2011. One health plan Brailer called out that could be relevant in the post-reform, post-recessionary US health world is Humana. I had the opportunity to spend time with Paul Kusserow, Chief Strategy Officer for Humana, during the HIMSS11 meeting. Our conversation began with me asking why the chief strategist for Humana would

Lost costs: lost productivity represents one-half of health costs for U.S. employers

51% of total health costs are attributed to lost productivity at work in terms of on-the-job performance and absence. The other 49% is made up of direct medical costs (27%) and wage replacements (22%). Thus, most health care ‘costs’ to employers aren’t in the medical care or insurance line item at all — they’re in productivity. “The ultimate ‘good’ to be purchased from our health care ‘system’ is the overall health of Americans,” asserts a new report, Synergies at Work: Realizing the Full Value of Health Investments, from researchers at the Center for Value-Based Insurance Design at the University of Michigan (my

As health care demand is constrained, who will pay for medical innovations? Reflections on Moody’s analysis

“Employers and health insurers, through benefit design and medical management, are now playing a larger role in curbing use of healthcare services….spurring a more permanent cultural shift in consumer behavior,” Moody’s writes in a special comment dated February 16, 2011. “This will continue to constrain healthcare demand even as the economy recovers.” The chart illustrates one of the main reasons for the so-called “constrained healthcare demand:” increasing costs on health consumers. Look at the slope of the line on average out-of-pocket maximum costs for an employee receiving health insurance at work: the raw number grew from $2,742 in 2008 to

Employees look to their employers for health information – new findings from NBGH

Employers spend about $10,000 each year per active employee for health care. In return, they’re looking for value for their money in the form of cost-effective, efficient health care that yields optimal outcomes for insured workers and their families. The ROI isn’t as great as employers as investors in worker health would like to see. As a result, companies are looking to comparative effectiveness research as a tool to help make better health spending decisions — for the companies themselves and for employees. The National Business Group on Health (NBGH) surveyed 1,538 employees at large employers to ascertain workers’ views on health

Affluent boomers worry about health costs in retirement

Affluent Baby Boomers in the U.S. foresee a retirement with a more active lifestyle, with a better standard of living and engagement in work. 1 in 4 see continuing their education or learning a new trade, and 1 in 5 anticipate starting or furthering their business. These aspirations are tempered with many financial concerns — top among them being rising health care costs and expenses (a concern for 2 in 3 affluent Boomers), and ensuring that retirement assets will last throughout their lifetime (a worry among 1 in 2 Boomers). Merrill Lynch surveyed affluent U.S. adults on their retirement concerns

The Myth of Consumer-Directed Health Care

The theory behind “consumer-driven health care” is that when the health care user has more financial ‘skin in the game,’ they’ll become more informed and effective purchasers of health care for themselves and their families. That theory hasn’t translated into practice, based on data from the Employee Benefits Research Institute’s (EBRI) latest Consumer Engagement in Health Care Survey. Health Reimbursement Accounts (HRAs) began appearing in employer benefit packages around 2001, with Health Savings Accounts emerging in 2004. 20% of large employers (with >500 employees) offered either an HRA or HSA plan in 2010, covering 21 million people or 12% of

U.S. employers put health care cost containment at the top of reform priorities

1 in 5 among all U.S. employers (22%) would likely drop health insurance coverage and let workers buy a plan through a health insurance exchange. However, most employers would expand wellness programs driven by incentives in health reform. Employers’ perspectives on the Affordable Care Act/health reform are mixed, according to a survey conducted by the Midwest Business Group on Health, co-sponsored by the National Business Coalition on Health, Business Insurance and Workforce Management. Not surprisingly, these views vary by whether the firm is large (>500 employees) or small. More large employers support the creation of Health Insurance Exchanges and would expand wellness services;

1 in 2 employers will continue to offer health insurance even if HIEs are competitive in 2014

Just over one-half of U.S. employers plan to maintain their health plans in 2014 even if health insurance exchanges (HIEs) offer competitive priced health plans for individual employee health coverage, according to a survey of 1,400 employers by Willis and Diamond Management & Technology Consultants. 1 in 3 employers is not sure whether they’ll maintain their own health plan or shift employees toward an HIE. The Health Care Reform Survey 2010 measured U.S. employers’ knowledge of the Affordable Care Act (ACA) and its expected impact on employers’ benefits. 9 in 10 employers (88%) believe that ACA will increase the costs of the health plans with

People with chronic conditions self-ration health care more than healthy people

3 in 4 American workers who receive health insurance at the workplace have been impacted by increasing health care costs. As a result, more are self-rationing health care; this is taking many forms, including delaying visits to the doctor, skipping a recommended visit, and not filling prescriptions written by the doctor. Most concerning is that the 14% drop in the percent of employees trying to take better care of themselves in the past year, according to Employee Perspectives on Health Care: The Affordability Gap, from Towers Watson. As health costs rise, employee satisfaction is falling — this is particularly true

Using collaborative online tools for collaborative health care reduce costs

“Freeing health data from silos” and fostering collaboration between patients and providers can save costs and improve health quality for employers who sponsor health benefits. The bottom line: employers can benefit from using social media tools for employee health management, according to a report from Healthcare Performance Management in the Era of “Twitter” from the HPM Institute. As employer health care costs continue to annually escalate in the high single or low double digits, benefits managers have focused on tinkering with health plan design: looking into 2011 health plan strategies, employers are planning to implement Another prescription for dealing with runaway

Benefits and costs: the growing burden of health insurance on American families

Since 2000, American workers’ contributions to health insurance premiums more than doubled, to nearly $4,000 a year from $1,619 ten years earlier. The total premium going to health insurance per worker for family coverage is $13,770 in 2010, with nearly $10,000 being borne by the employer. Workers’ share of premium increased 147%, and employers’ grew 114%. The Kaiser Family Foundation/Health Research & Educational Trust’s (KFF/HRET) annual 2010 Employer Health Benefits survey tells the story of health insurance costs that continue to grow, the rates of which depend on the type of health insurance purchased. For example, workers in high-deductible health plans saw

More employers will offer health insurance, RAND forecasts

What will employers do with their health insurance sponsorship once health reform kicks into full-implementation in 2014? Will they drop coverage? There’s been some speculation that more employers would exit covering employees, but researchers at RAND see quite the opposite scenario. An additional 13.6 million workers will be offered health insurance coverage in a post-ACA America, based on a forecasting model the RAND team constructed. This increases the percentage of employers offering workers health insurance from 84.6% of workers to 94.6% of workers post-reform. The increase is driven, the model predicts, by two key factors: More demand for coverage by workers due

As employers’ health costs increase 8.9% in 2011, employees will have more skin in the game

Large employers expect health care costs to increase by 8.9% in 2011, up from 7.0% in 2011. To stem cost increases, employers will adopt an array of tactics, most prominently offering consumer-directed health plans (CDHPs) and expanding wellness programs that encourage incentives to healthy lifestyles. These expectations come from Large Employers’ 2011 Health Plan Design Changes, a survey report from the National Business Group on Health poll of large employers. 1 in 5 employers say CDHPs are the most effective approach for managing health care cost growth, as shown in the chart. 61% of employers will off CDHPs in 2011, 20% of whom will

Running out money in retirement: the role of health costs

1 in 2 Baby Boomers born between 1948 and 1954 planning to retire in the first wave of Boomer retirements is at-risk of running out of money in retirement, according to the EBRI Retirement Readiness Rating. The Rating gauges just how prepared retirees are to finance their lives when they retire. This is defined as the percentage of pre-retirement households at-risk of not having enough money in retirement to pay for basic expenses such as housing, food, shelter, and uninsured health expenses. The net risk is determined as a function of retirement savings such as Social Security, IRAs, pensions, housing equity

Employee Health Benefits: Wellness Up, Rx Down

As the recession continues to negatively impact U.S. business, employers are tightly managing benefits across-the-line, from health to housing and travel categories. Benefits overall are experiencing a downward trend versus 5 years ago. In the health arena, benefits that show staying power include wellness resources (covered by 75% of employers), on-site flu vaccinations (68%), wellness programs (59%), and 24-hour nurse lines (59%). On the downside, benefit programs that are expected to erode in the next 12 months are prescription drug coverage, dental insurance mail-order drug programs, and chiropractic coverage, among others shown in the chart. The Society for Human Resource

Health plans are in a service business: it’s not only about costs and benefit design for employers

J.D. Power, an expert in understanding satisfaction across industries, has looked under the hood of employers and their satisfaction with health plans. In summary: it’s not only about the benefits and costs when it comes to health plan satisfaction. For employers, satisfaction is also based on near-equal parts of “service” in 3 guises: account servicing from the employer’s point of view (where more communication from the plan is seen as better than less); employee plan service experiences; and problem resolution. For the 4 in 5 employers who have had problems with health plans (that’s 79% of employers), it’s less about costs and

Health insurance DIY – most unable to pay

61% of American health citizens have difficulty paying for health insurance when they go out on the open market to purchase it as individual customers. A survey from the Kaiser Family Foundation (KFF) finds that most people in the U.S. who go for health insurance on their own have trouble paying for it. 14 million people in the U.S. aren’t covered by employers and seek so-called non-group or individual health insurance policies. Premium increases for these policies averaged 20% in early 2010. Nearly 1/2 of these people are self-employed or work in small business. The average out-of-pocket health spending for

Health consumers don’t understand their patient-power…yet

Most health consumers define the value of drugs in terms of safety and efficacy first, then quality of life and cost second. These priorities are similarly shared by both biopharma executives and managed care management. Where consumers diverge with the two health industry stakeholders, though, is with respect to their power: while about 1 in 3 biopharma and managed care execs believe that patients will be influential in the success or failure of new therapies over the next five years, only 11% of patients say that “people like me” will be influential over what new drugs will be available in the

More out-of-pocket, more wellness in 2011? A look into PwC's Behind the numbers

Medical costs will increase by 9% in 2011, a mere 0.5% less than 2010 cost growth. The fastest-growing components will be inpatient and outpatient costs, shown in the pie chart. 81% of premium costs are bound up in provider costs for hospitals and physicians — the two most significant factors of medical inflation. And Americans will bear even more medical costs, out-of-pocket (OOP), in 2011 in the form of greater coinsurance and deductibles. Behind the numbers: Medical cost trends to 2011 looks into employers’ crystal balls on health benefits for 2011. PricewaterhouseCoopers’ Health Research Institute surveyed 700 U.S.-based companies, small through jumbo sized, to

After health reform, employers will play, not pay – but employees will

Employers are worried about health reform

$18,074 is the medical cost for a typical family four in the U.S. in 2010

Today, $18,074 could cover… A new 2010 Honda Civic A year of college at Hampton University in Virginia The per capita income in Waterloo, NY. Or, you could cover health insurance for a typical family of four in America. In the past year, the average cost of health care for a family of four in the U.S. has increased by $1,303, the large single dollar increase seen in the past 10 years since the start of the Milliman Medical Index (MMI). The total medical cost for a family of four is $18,074 in 2010. Employers will pay, on average, 59% of the

Half of employers will offer consumer-directed health plans in 2015

The growth of consumer-directed health plans (CDHPs) continues as employers look for ways to rationalize their health spending in the midst of annual double-digit health cost increases. By 2015, 61% of large employers will off CDHPs. Overall, 45% of employers think they’ll be offering CDHPs in five years. These data were found through the Mercer National Survey of Employer-Sponsored Health Plans, sponsored by the American Association of Preferred Provider Organizations (AAPPO), published in April 2010. In 2009, 15% of all employers offered a CDHP: this grew from 10% in 2008. 18% of employers are likely to offer a CDHP this

Employers seek to maintain benefits while reducing costs, in MetLife survey

When it comes to health plans sponsored by U.S. employers, there are two realities facing benefits managers: on one side of the coin, most U.S. employers held the line on employee benefits in the recession. The other reality: controlling costs is the most important objective for employee benefits, according to most U.S. employers polled in MetLife’s 8th Annual Study of Employee Benefits Trends. Under the cost-control priority, though, is a novel finding in the MetLife study. That is that employers see a link between benefits and employee productivity and loyalty. Thus, when productivity is viewed as a benefits objective, employers can connect the dots

Health costs for smaller companies grew twice as fast as for larger firms in 2009

Inflation in the U.S. fell by 0.4% in 2009, the first such annual decline in the Consumer Price Index since 1955. At the same time, health care costs for American employers grew 7.3% per capita in 2009. As the chart health spending increased nearly 5%, with employers’ costs increasing even more quickly over the year. This was especially twice-as-onerous for small and mid-sized companies whose costs grew much faster than for larger companies, whose rate of increase actually fell in the year. These sobering statistics were calculated by Thomson Reuters and published in Helathcare Costs Rise More Than 7 Percent

The #1 focus for employees: physical health, fiscal health

While Congress and the President arm-wrestled through the Health Summit, the private sector doesn’t sit still waiting in a frozen state for the result of inside-Beltway-health-baseball. Employees/consumers and employers have aligning in mutual self-interest when it comes to health care benefits, costs, and disease management, according to a survey sponsored jointly by Deloitte and the International Society of Certified Employee Benefit Specialists, 2010 Top Five Total Rewards Priorities Survey. This latest recession has focused the minds of companies and their workers and driven the collective priority of managing health costs while maintaining job and retirement security. In this 16th annual

Employers say health engagement is low, but tactics seem more actuarial than action-oriented

While the stock market and companies’ profitability improves, much of that has been done on the backs of employees: through reductions in force and job cuts, and re-working of benefits. Health benefits are a prime target for cost management as companies try to survive through the long recovery. Combined with insurance companies’ cost increases (most notably and recently Anthem’s announcement of up-to-39% increases in premium costs), employers who choose to continue to provide health insurance to employers are in a bind. According to the 15th annual survey from National Business Group on Health/Towers Watson, employers faced cost increases of 7%

DIY health care comes to the workplace: employers get into cold/flu prevention

While coughs, colds and seasonal allergies have always been a retail health category, this recession has bolstered the workplace channel for messaging and products. BigResearch‘s Workplace Media group has found that 85% of working consumers are concerned about this year’s flue and cold season. Two-thirds of workers planned to get a flu shot. And, 9 in 10 workers would likely welcome and use an offer for flu/cold products delivered through the workplace. The H1N1 virus drives most working consumers to take extra precautions this cold/flu season. Other key findings are that: 3/4 of employers will offer flu prevention tips to

Health cost increases will hit double-digits in 2010 – another reason for real health reform

So much for America’s ability to manage health care costs without health reform: health costs will increase in the double-digits this year, according to Buck Consultants‘ 21st National Health Care Trend Survey. This annual survey monitors medical trend — the factors that drive cost increases. These include inflation, service utilization, technology, adding new programs, changes in service mix, and benefit mandates. The chart illustrates that medical trend varies across plans — but not my much. High-deductible consumer-driven health plans expect growth of 10.4%: hardly a significantly lower rate of growth than for the most open, rich plans (PPO, POS). Buck

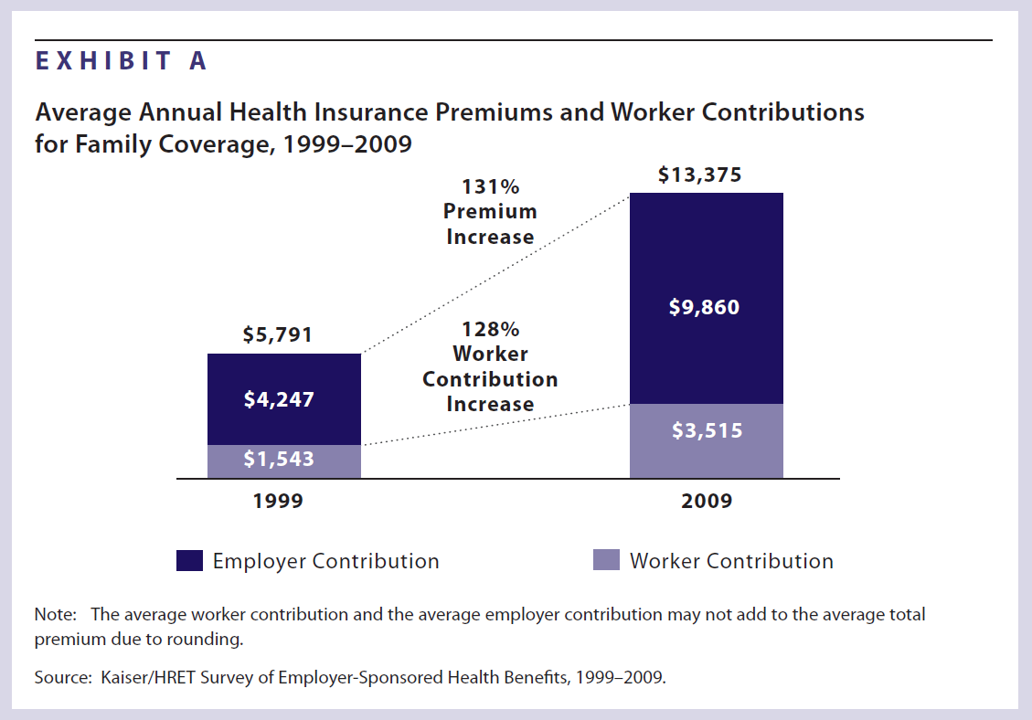

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

Eroding and unaffordable: health care for workers in America

Rosie the Riveter reminds us to Honor Labor. In that vein, with the Labor Day holiday upon us, this post assembles data to paint the latest picture of health insurance and the American worker in 2009… Workscape’s Annual Benefits Study for 2009 found that employees have a heightened appreciation of benefits. The declining economy clearly has increased awareness and appreciation of workplace benefits. Trends In Underinsurance And The Affordability Of Employer Coverage, 2004-2007, in Health Affairs online, found eroding health insurance coverage among employers who continued to provide insurance, and further moves for employees to have more financial “skin in

$16,771 is the cost of health care for a family of four in 2009

$16,771 is roughly the cost of health care for an American family of four in 2009, according to the Milliman Medical Index. If the median family income in 2008 was about $67,000, then health care costs represent about 25% of the annual household paycheck (remember, that’s gross, not net, income). As the chart illustrates, 1 in 3 health care dollars goes to physicians, with another third paid to inpatient services. Outpatient services and prescription drugs consume 15-17 cents on the health dollar in 2009. The greatest increase in cost trends in 2008-9 is with hospital outpatient services, which grew more

Generics are real, and really impacting household and employer economies

Every 1 additional prescription per 100 that is filled with a generic Rx in the Rochester NY region yields $82 million in annual cost savings to the community: specifically, to employers, consumers and health plans. The Blue Cross Blue Shield Association presented findings from a survey and featured best practices from member plans in a webinar, “Generic Drugs Can Be Good for Your Health and Your Wallet.” Blues Plans believe that implementing generic drug programs can help Americans access drugs at an affordable cost. In BCBSA’s health reform recommendations, Pathway to Covering America, there are 5 key points: four are

Wal-Mart’s wearing a new hat: health care advocate

Nearly 100% of Wal-Mart’s staff is covered by health insurance, either through the company itself or through another source. Covered “associates” reached a total of 94.5% this month, compared with 92.7% last year. The total proportion of Wal-Mart employees covered by Wal-Mart’s plans at the end of open enrollment was 51.8%. Uninsured Wal-Mart employees fell to 5.5%, a 40% drop from 2007 to 2009. The most recently gauged national uninsured rate for employed Americans was 16.8%. Wal-Mart’s role in health care is growing both in terms of its approach to employee health benefits within the company, and

Only 1 in 10 unemployed people buy into COBRA

Because of high premiums, only 9 percent of unemployed workers have COBRA coverage. Maintaining Health Insurance During a Recession: Likely COBRA Eligibility, a study from The Commonwealth Fund (CMWF), clarifies how COBRA is actually used by unemployed people in the U.S. CMWF calculates that: – Two of three working adults are eligible to buy into COBRA under the 1985 Consolidated Omnibus Budget Reconciliation Act (COBRA) if they became unemployed. – Under COBRA, workers pay 4 to 6 times their current premium for health benefits. – Thus, only 9 percent of unemployed workers have COBRA coverage due to the high price

The average health insurance premium costs 84% of average unemployment benefits

The average unemployment benefit across the U.S. is $1,278; COBRA monthly premiums for family coverage are $1,069. In 9 of the 50 states, COBRA equals or is greater than the monthly unemployment benefit. Those states are Alaska, Arkansas, Arizona, Delaware, Florida, Louisiana, Mississippi, South Carolina, and West Virginia. These metrics are shown in the table above. Families USA has appropriately titled its report on this situation, Squeezed: Caught Between Unemployment Benefits and Health Care Costs. COBRA, the Consolidated Omnibus Budget Reconciliation Act, is the mechanism that allows laid-off workers to buy into their employer’s health plans when

A majority of employers who don’t sponsor health would be unwilling to contribute over $50 per employee per month for coverage

The U.S. employer sponsored health system is experiencing some bipolar behavior: there is a cadre of large employers who want to continue sponsoring health benefits as part of overall compensation. But, for at least one in 3 employers, most would not be willing to pay $50 per member per month to cover health for an employee. According to Mercer‘s survey of employers released October 21st, 2008, What Price Universal Health Coverage?, the rejoinder is: any price is too high. 4 in 10 employers say the main reason they do not offer health coverage is simply that they cannot

Employers’ wellness programs in a Health 2.0 era

Employee wellness is a growth business: 57% of large employers provide wellness programs to employees, increasing from 49% of large employers in 2006. According MetLife’s Sixth Annual Employee Benefits Trends Study, nine of ten companies that offer wellness believe these programs are effective in reducing medical costs. For the average employer, MetLife found, 58% of the total benefits spend goes to medical coverage — an even higher percentage for smaller employers. The most popular wellness programs include smoking cessation, weight management, an exercise regimen and cancer screening among others. While 4 in 5 employers provide incentives to “nudge” people into

Employee health and productivity — a growth segment

If employers got their collective hands on Aladdin’s lamp, they’d wish for: Increased employee accountability Reduced health risks Tailored health management programs that account for risk Health data and measurement tools that feed into analytics and outcomes measures, and Integrated and well-managed benefits and programs. These wishes are brought to you by Hewitt Associates’ 2008 survey, The Road Ahead: Driving Productivity by Investing in Health. 38% of employers plan to develop strategies for employee health and productivity in the next 1 to 2 years; 21% plan to do so within 3 to 5 years. 1 in 5 (19%) aren’t

Small business and health care costs – 25 years of hurt

The cost of health insurance is the #1 problem cited by small business owners. Health costs beat gas prices, the #2 most severe problem cited by small business, as of March 2008 (when the survey was conducted). This week, small business leaders convened at the annual National Small Business Summit conference of the National Federation of Independent Business (NFIB). The report notes the downturn in the economy during the second half of 2007 when the NFIB Small Business Optimism Index dropped to 94.6 in December, the lowest since 2001. Health care costs rank first in small business problems regardless of

Medical costs for a family of four = $15,609

$15,609 could cover a lot of household needs for the average American family in the course of a year: utilities, mortgage, gas tank fills. It’s also the cost of health care to cover a family of four in 2008. Milliman notes that the average annual medical cost for a family of four increased by 7.6% from 2007 to 2008. This rate of increase is lower than the 8.4% average annual increase between 2003-2007; however, the burden of overall expense is “steadily shifting to employees,” Milliman attests. Health spending splits into five components, as the Milliman Medical Index

Health Plan Illiteracy, or how not to benefit from the Benefit

Health plan illiteracy is alive and well, according to J.D. Power and Associates. The consumer market research firm’s 2008 National Health Insurance Plan Study finds that 1 in two plan members don’t understand their plan. In this second year of the survey, J.D. Power notes that, as consumers understand the benefits of their Benefit, their satisfaction with the plan increases. Thus, there is a virtuous cycle that happens between a plan and an enrollee when communication is clear and understood. J.D. Power looked at member satisfaction in 107 health plans throughout the U.S. in terms of 7 key metrics:

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Health Populi’s Tea Leaves for 2008

I “leave” you for the year with some great, good, and less-than-sanguine expectations for health care in 2008. These are views filtered through my lens on the health care world: the new consumer, health information technology, globalization, politics, and health economics. Health politics shares the stage with Iraq. Health care is second only to Iraq as the issue that Americans most want the 2008 presidential candidates to talk about, according to the latest Kaiser Health Tracking Poll. Several candidates have responded to the public’s interest with significant health care reform proposals. But major health reform – such as universal access

Steel, Coffee Beans and Health Care

The UAW and GM have been debating health care as Friday’s deadline for their national contract approaches. This round of negotiation is about survival. Yesterday, I covered the rising costs of employer-sponsored health insurance. Today, let’s visit the intimately-related topic of retiree health benefits. These are eroding even faster than health benefits for employed workers. Many employers have significantly scaled back health benefits for retirees. Currently, one in three large employers offers retire benefits, compared with two in three in the late 1980s. Consider the predicament of the company ranked #3 on the 2006 Fortune 500 list, General Motors. Retirees

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.