Financial Strain Among Older People in America, and What Project 2025 Could Mean for Their Well-Being

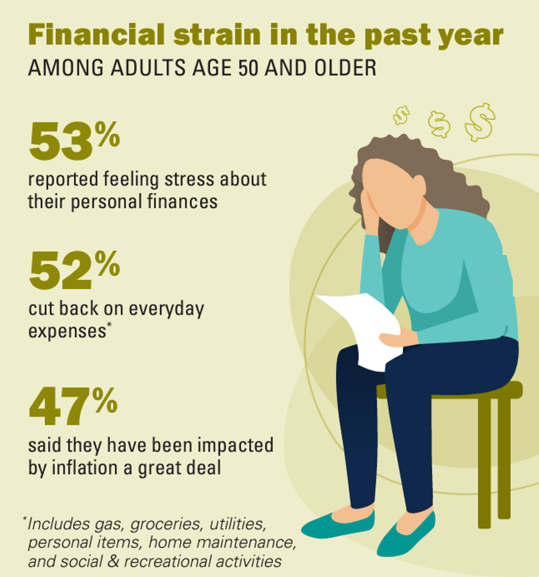

Over one-half of people 50 years of age and older in the U.S. have felt financial strain in the past year, resulting in 1 in 2 folks cutting back on everyday expenses like groceries and gas. We learn that nearly one-half of people 50 and over say they’ve been impacted by inflation “a great deal” in Making Ends Meet: Financial Strain and Well-Being Among Older Adults, the latest report from the Institute for Healthcare Policy and Innovation’s National Poll on Healthy Aging based at the University of Michigan (my alma mater). The poll was conducted by NORC at the University

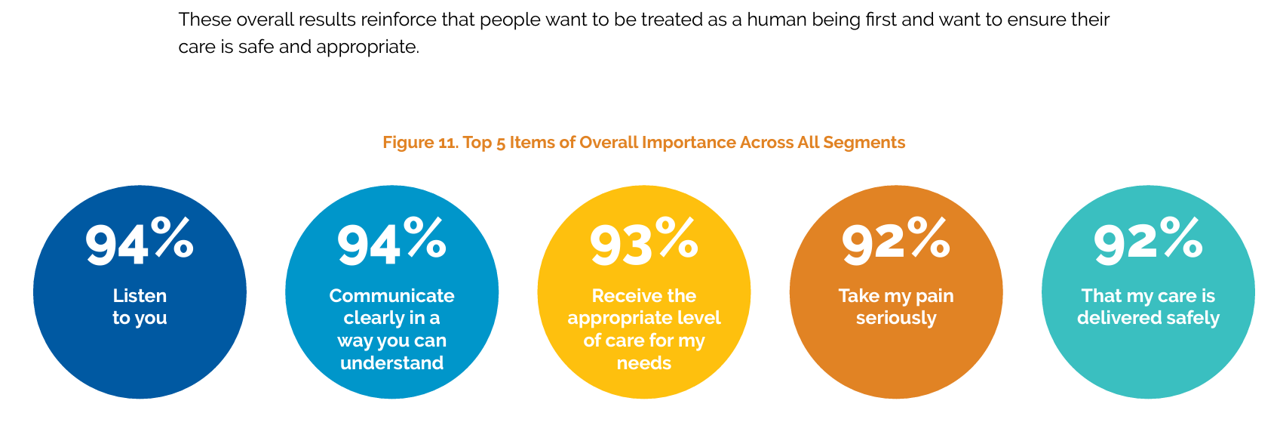

“Listen to Me:” Personalization in Health Care Starts With Taking Patients’ Voices Seriously – the 15th Beryl Institute-Ipsos PX Pulse Survey

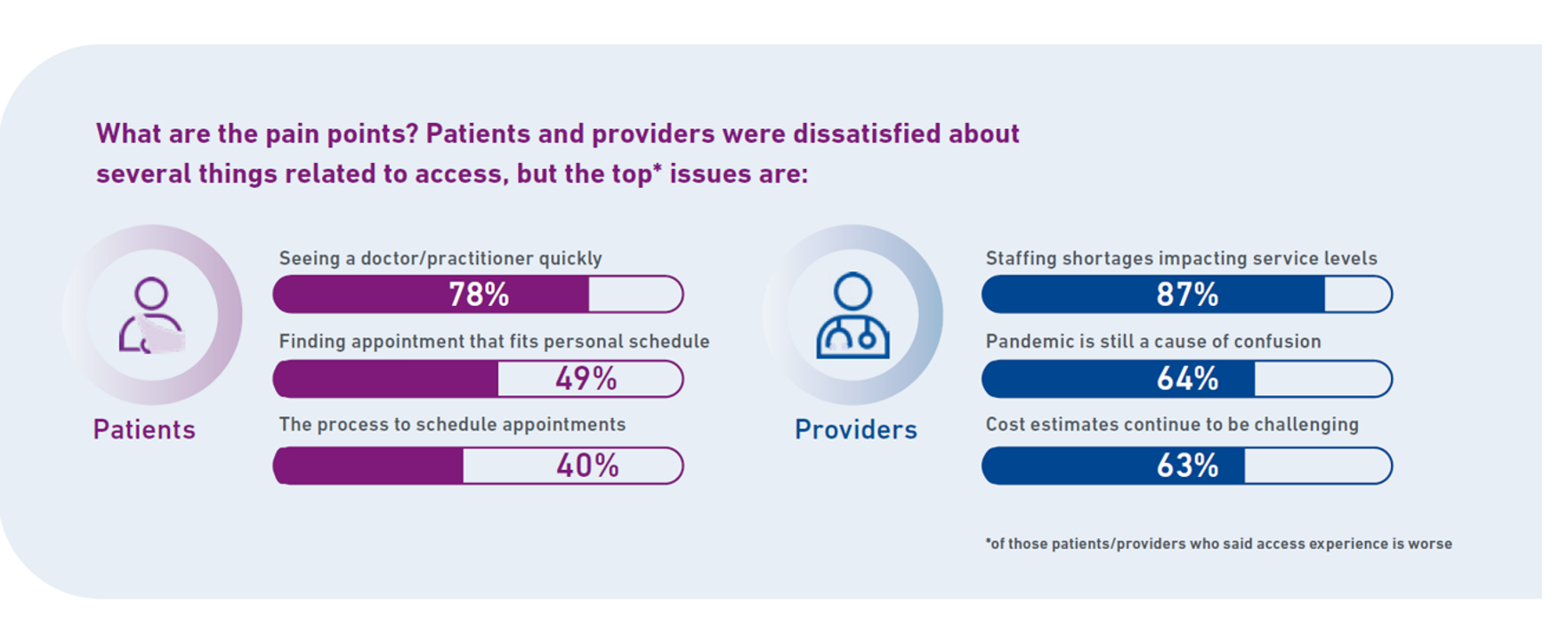

Patients’ experience with health care in the U.S. dropped to its lowest point over the past year, explained in the 15th release of The Beryl Institute – Ipsos PX Pulse survey. The study into U.S. adult consumers’ perspectives defined “patient experience” (PX) as, “The sum of all interactions, shaped by an organization’s culture, that influence patient perceptions across the continuum of care.” The survey was fielded by Ipsos among 1,018 U.S. adults in March 2024. Health care providers (and other industry stakeholders that go B2B or B2B2C (or P) are all thinking

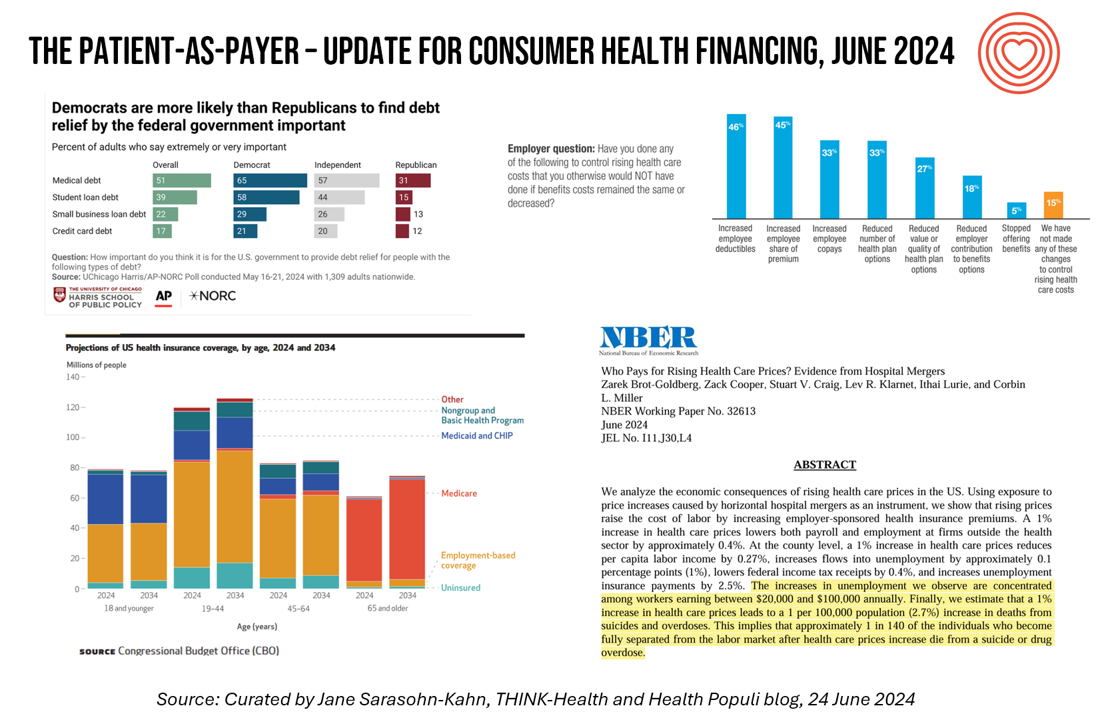

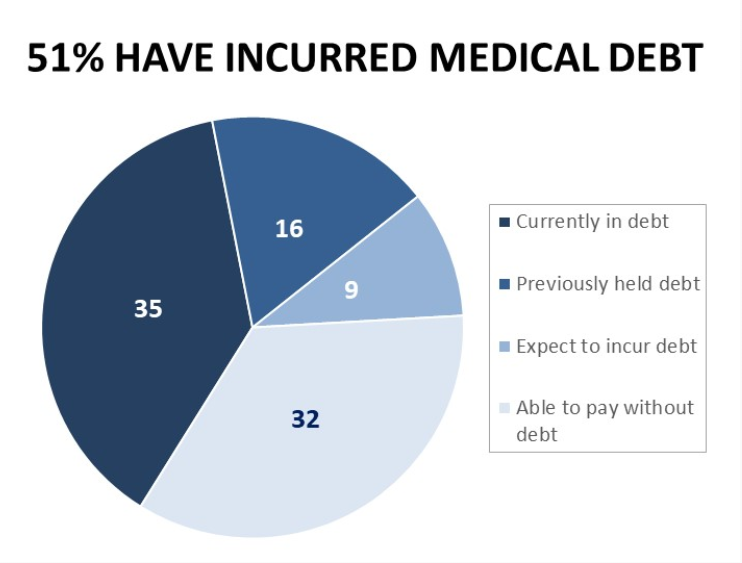

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

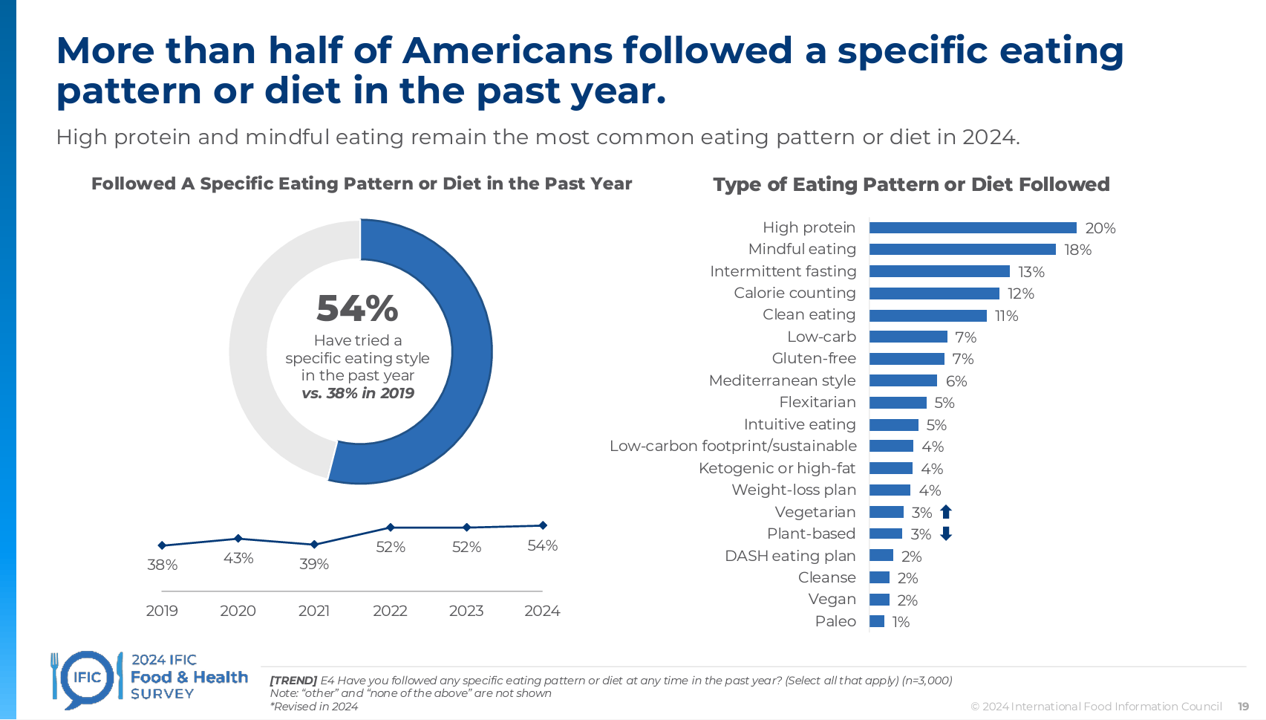

Most Americans Follow an Eating Pattern in Search of Energy, Protein, and Well-Being – With Growing Financial Stress: A Food as Medicine Update

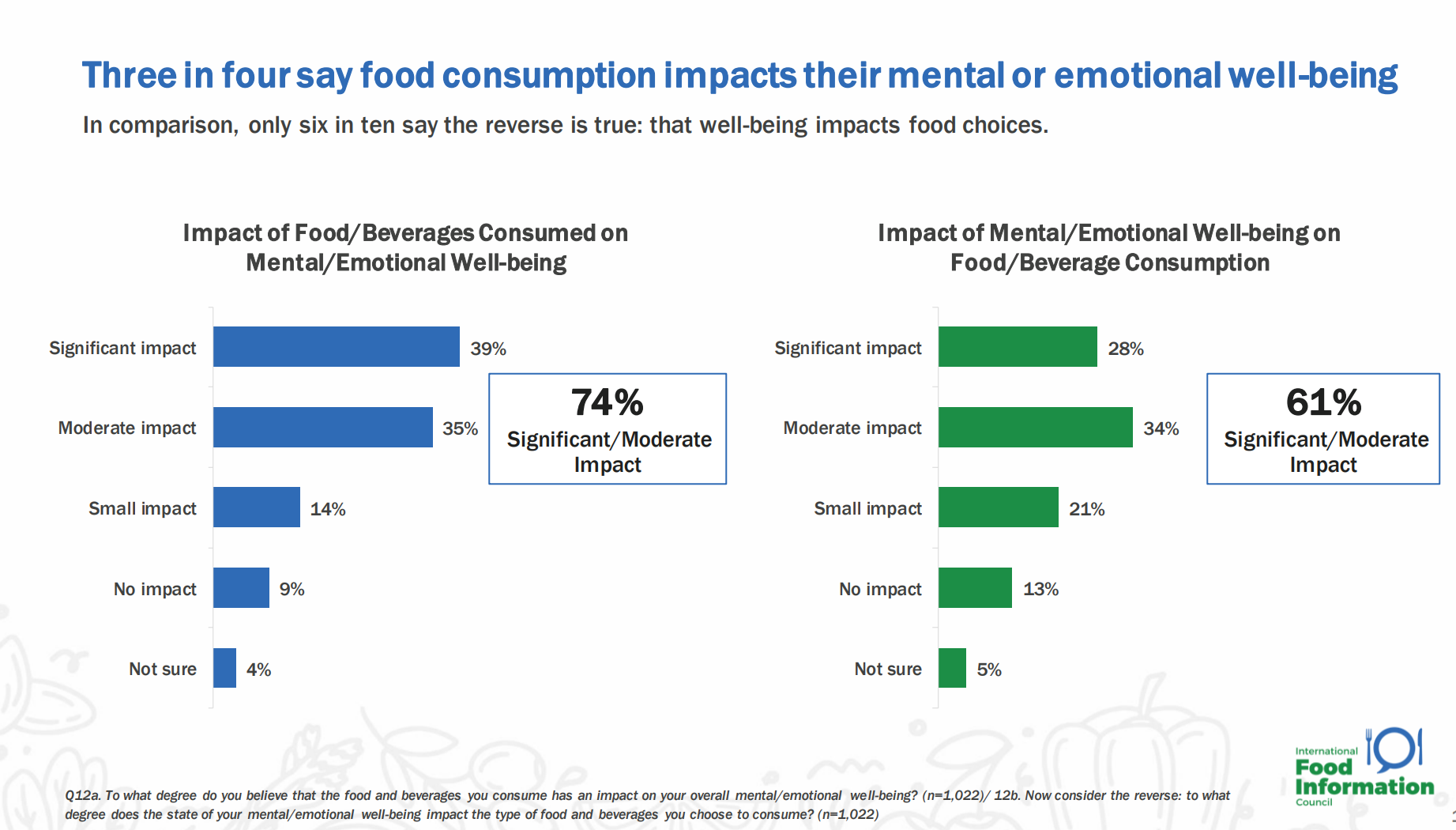

Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned. In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

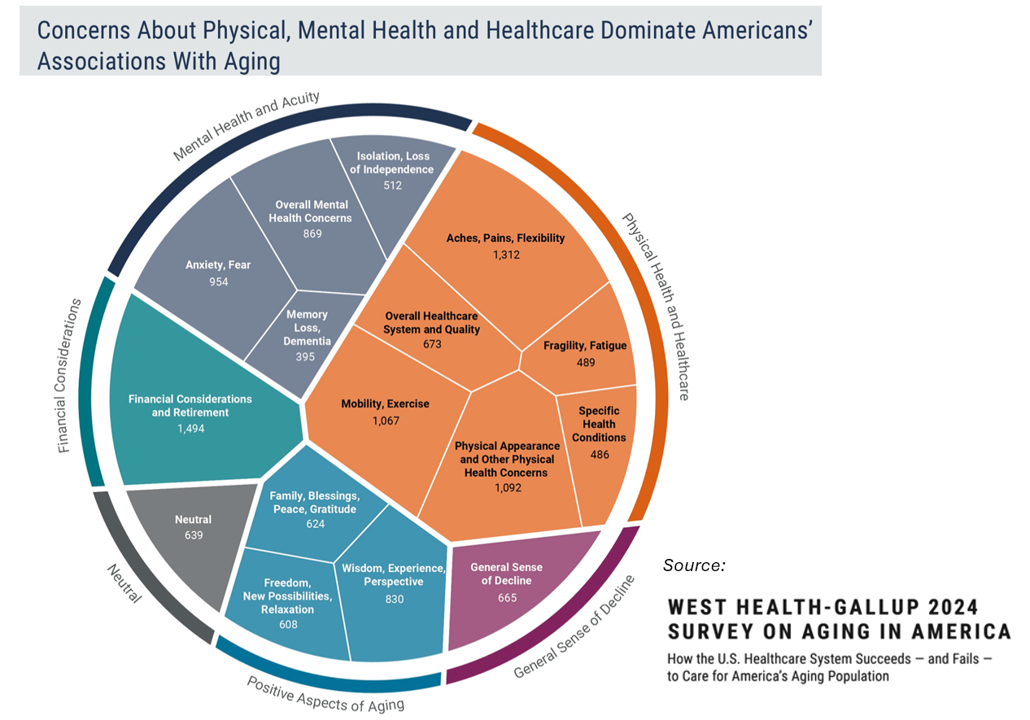

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

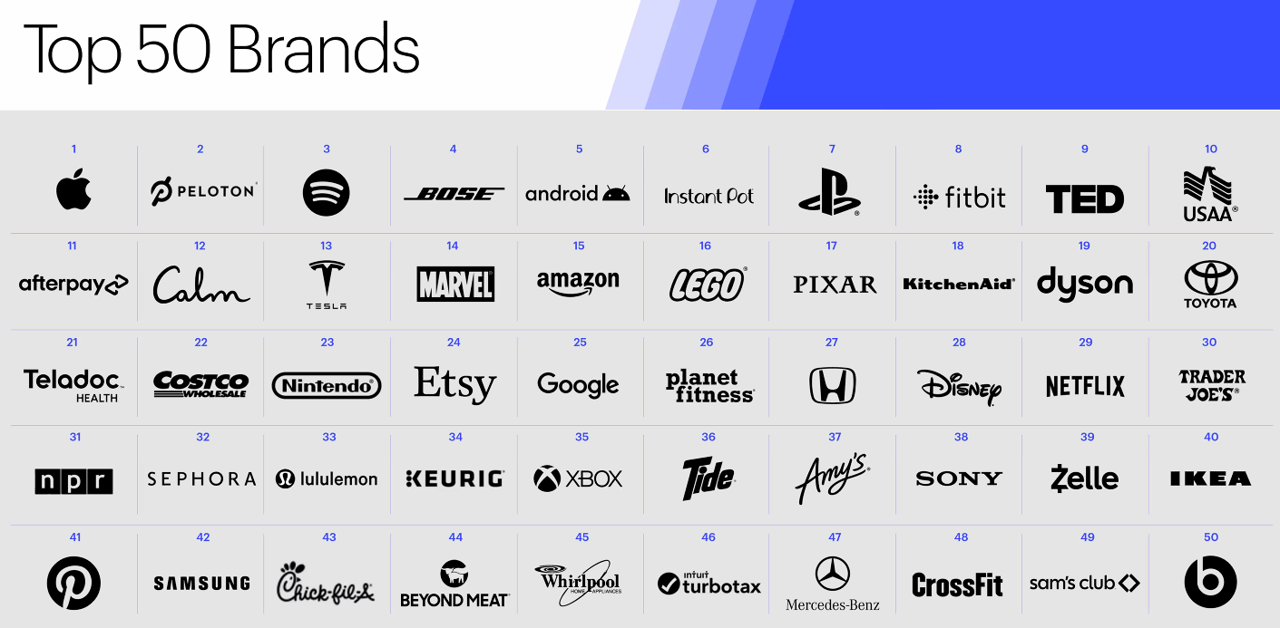

The Most Trusted Brands of 2024 Tell Us A Lot About Health Consumers

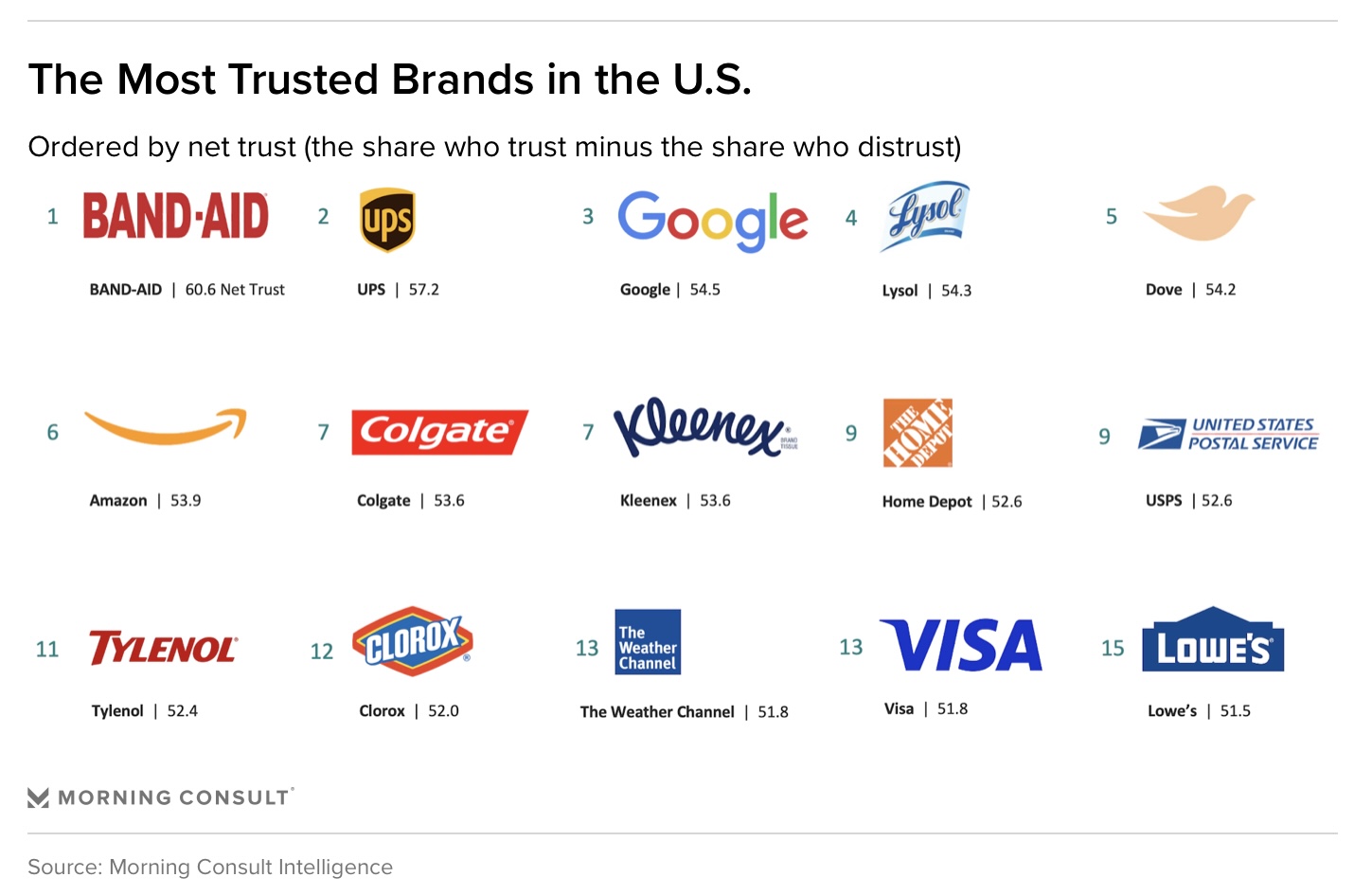

From bandages to home hygiene, OTC pain meds and DIY home projects, Morning Consult’s look into the most-trusted brands of 2024 give us insights into health consumers. I’ve been tracking this study since before the public health crisis of the coronavirus, and it always offers us a practical snapshot of the U.S. consumer’s current ethos on trusted companies helping people risk-manage daily living — and of course, find joy and satisfaction as well. In the top 15, we find self-care for health and well-being in many brands and products: we can call out Band-Aid, Dove, Colgate, Kleenex, and Tylenol. For

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

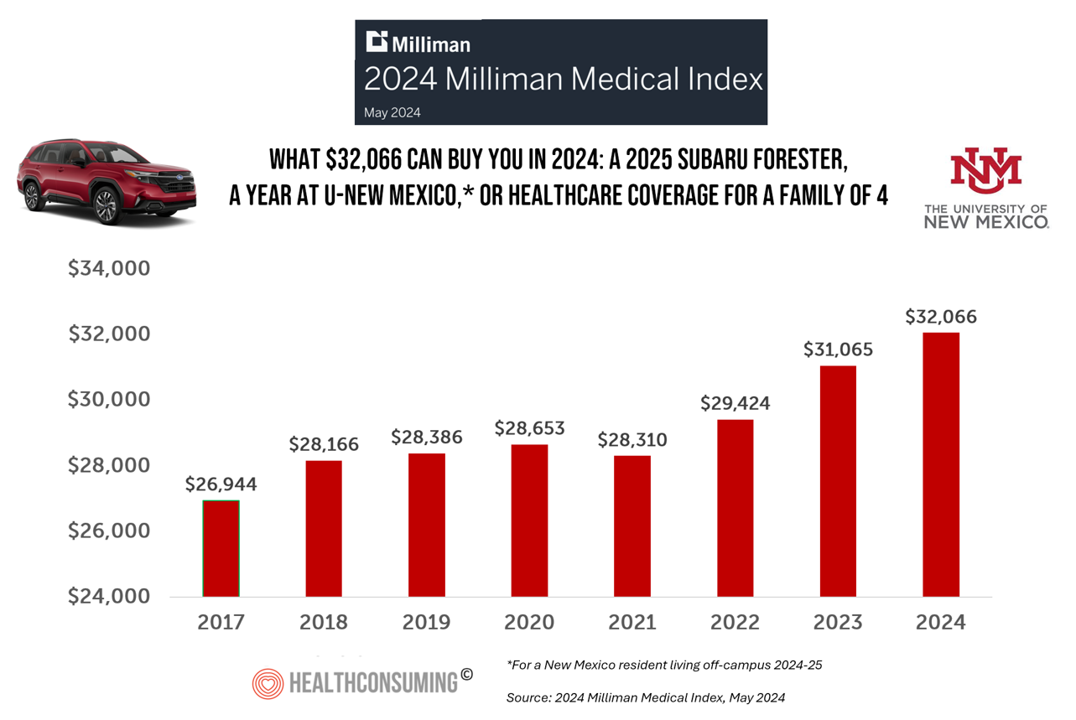

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

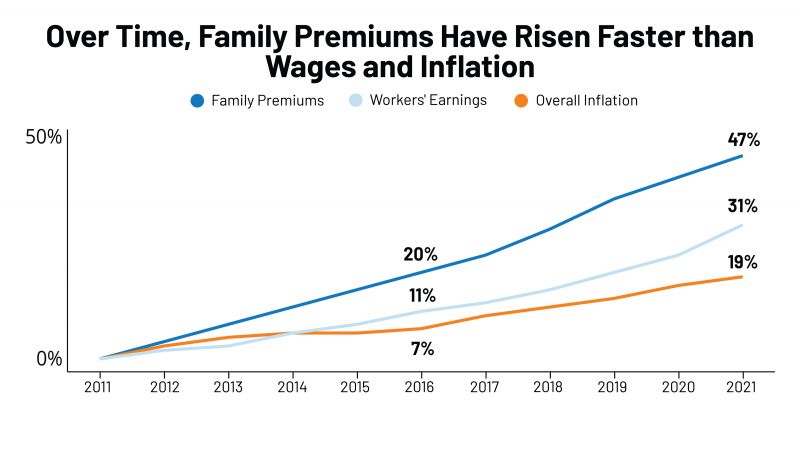

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

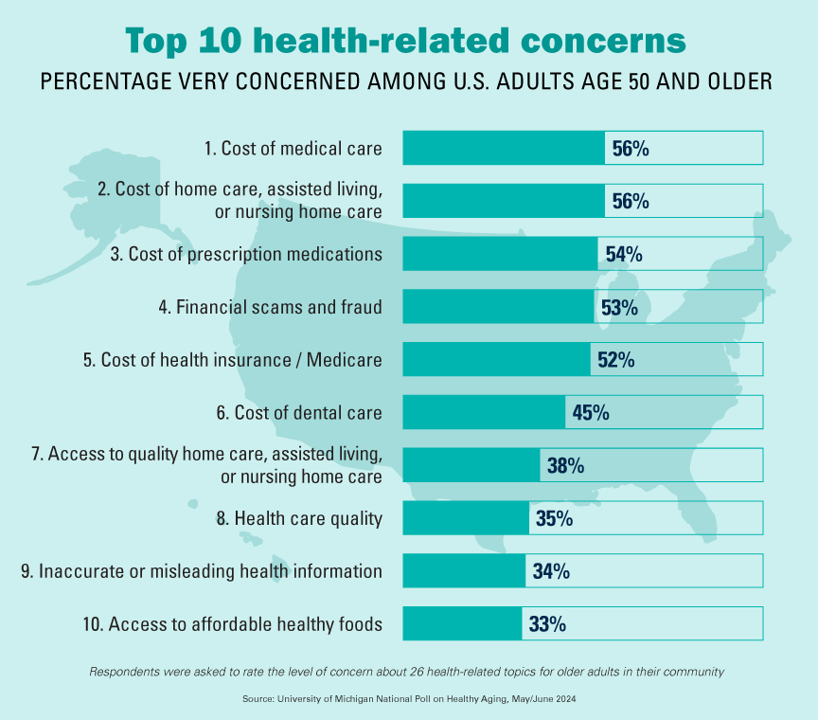

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

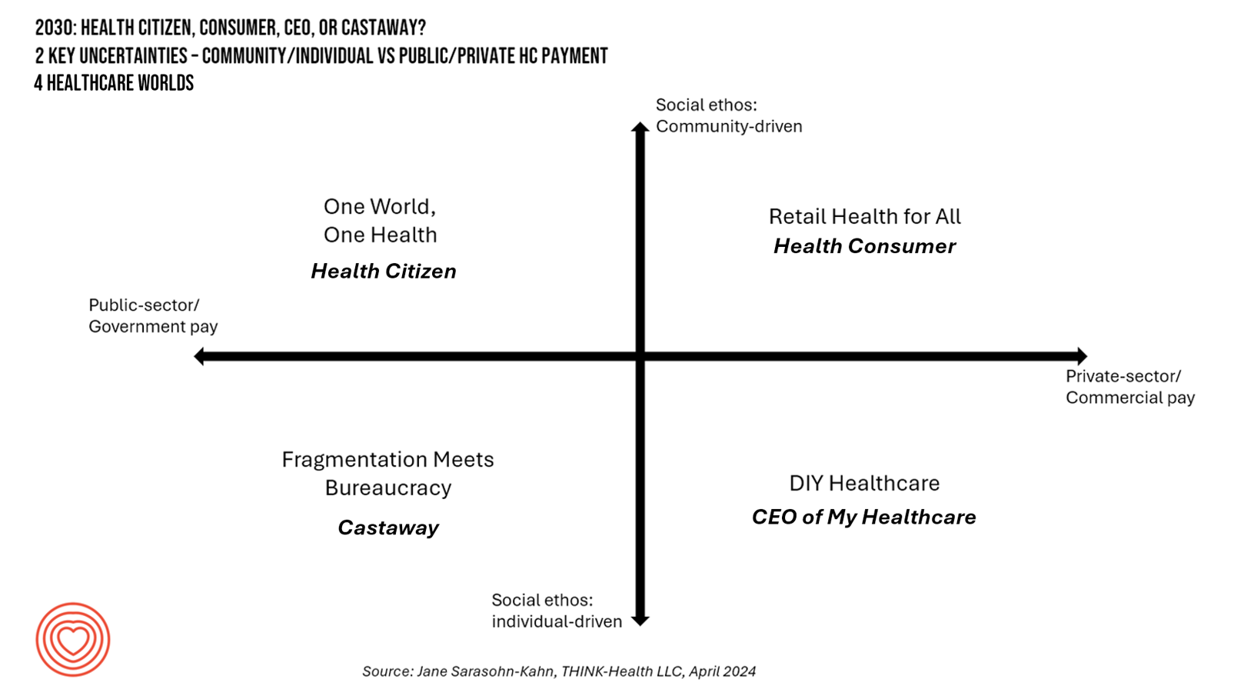

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

A Springtime Re-Set for Self-Care, From Fitness to Cozy Cardio: Peloton’s Latest Consumer Research

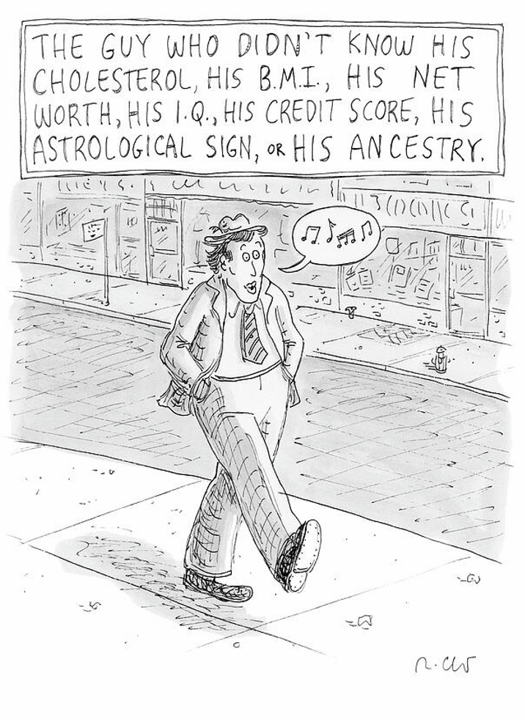

How many people do you know that don’t know their cholesterol or their BMI, their net worth or IQ, their credit score, astrological sign, or ancestry pie-chart? Chances are fewer and fewer as most people have gained access to medical records and lab test results on patient portals, calorie burns on smartwatches, credit scores via monthly credit card payments online, and completing spit tests from that popularly gifted Ancestry DNA test kits received during the holiday season. Meet “The Guy Who Didn’t Know His Cholesterol” conceived by Roz Chast,

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

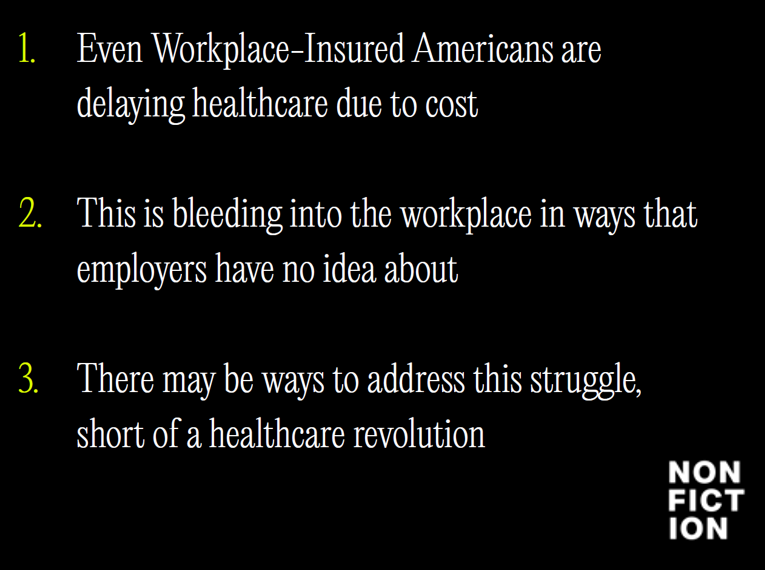

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

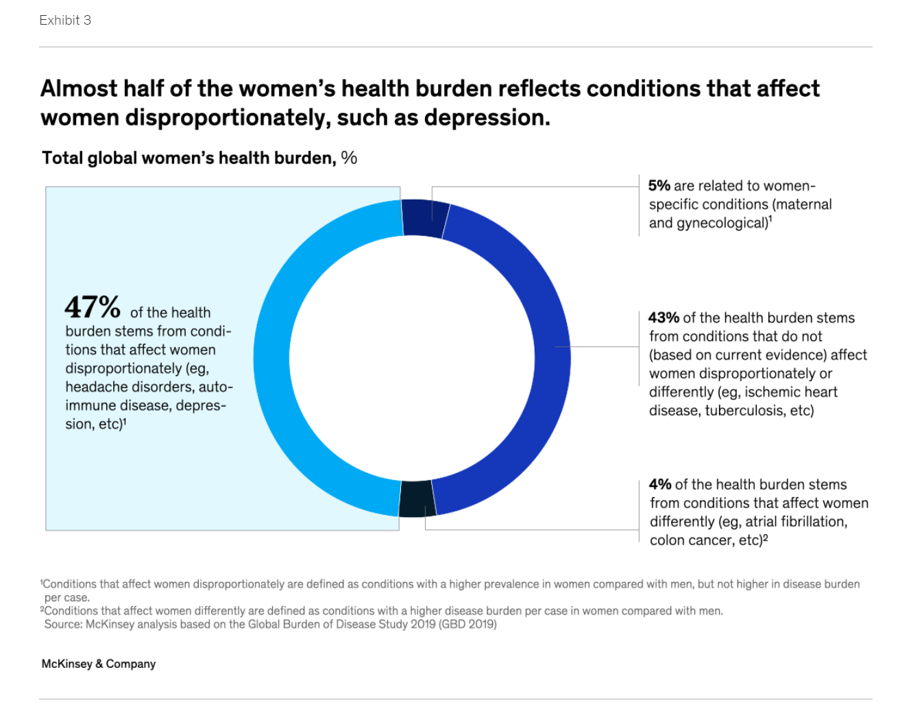

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

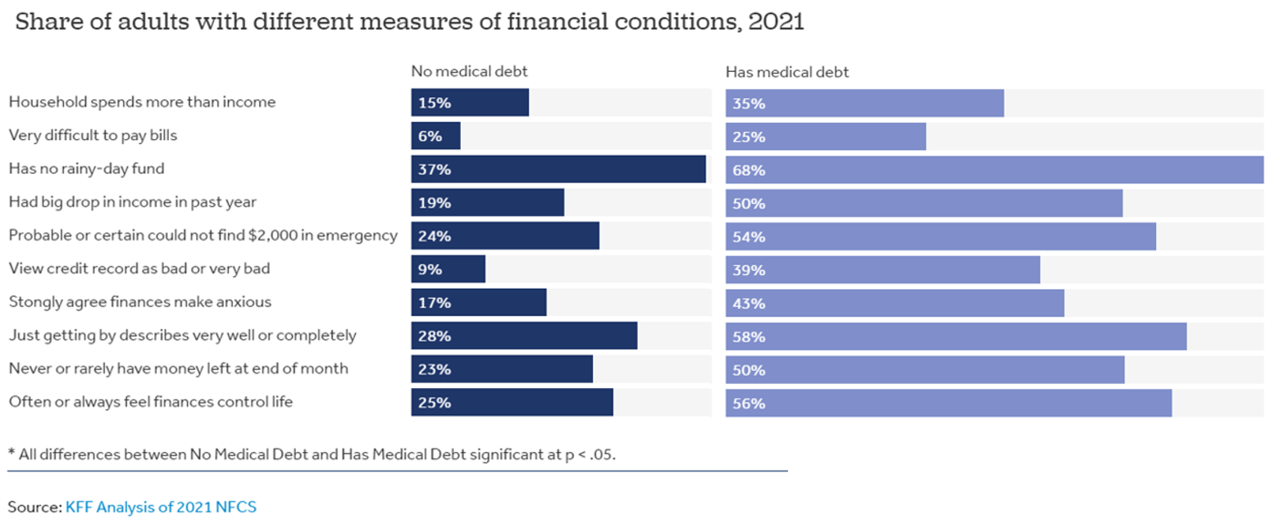

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

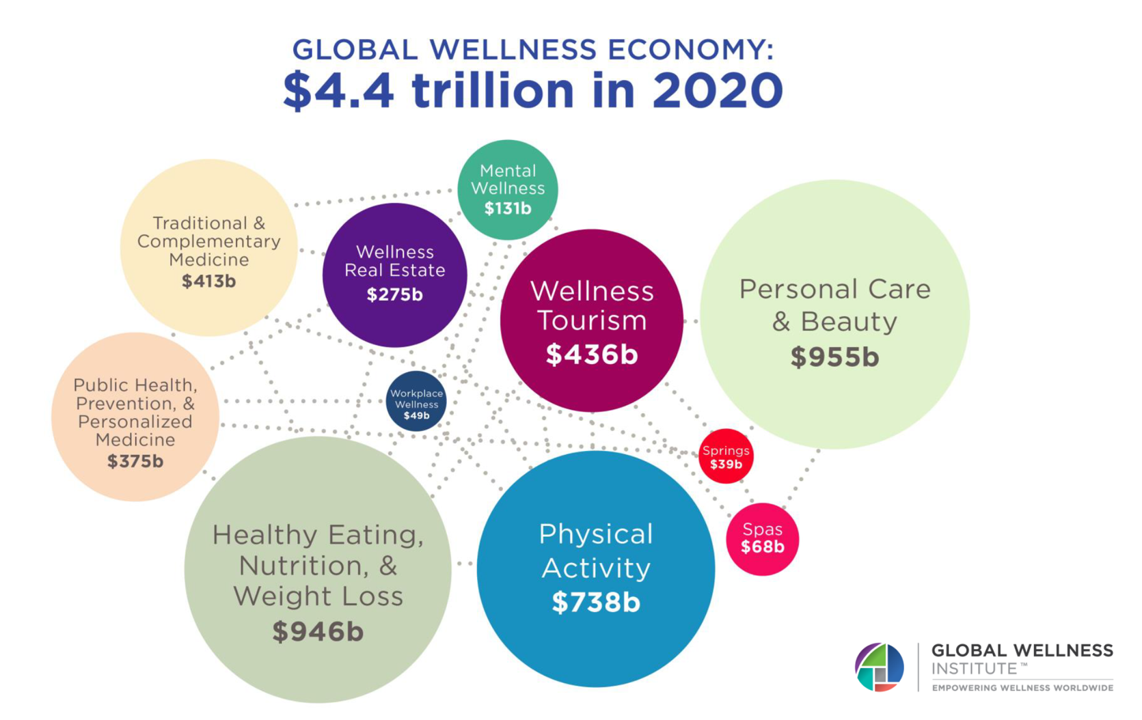

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

The Health Consumer in 2024 – The Health Populi TrendCast

At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen. As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household,

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

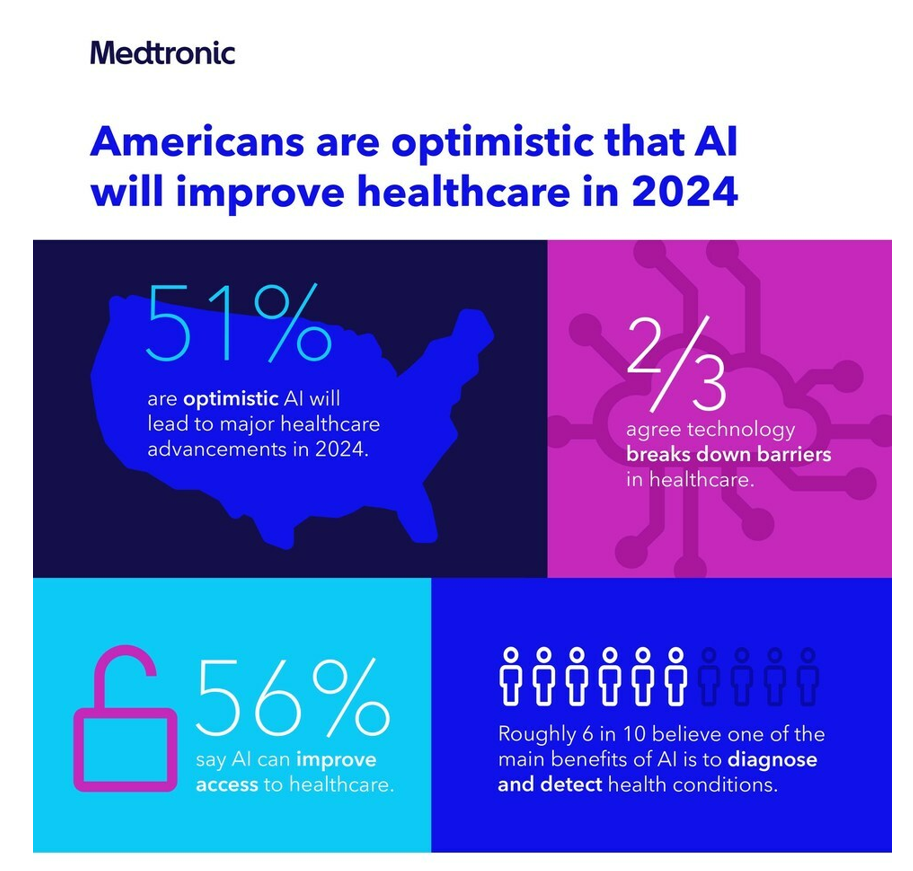

The Consumerization of AI in Healthcare – The Early Days of AI-Trust

Most people in the U.S. are bullish on the role AI will play in health care in 2024, especially to lower access barriers to care and to diagnose and detect health conditions. Two new studies point to the consumerization of AI in healthcare, from Medtronic and Deloitte. This post weaves their findings together and suggests some planning points for 2024. Medtronic collaborated with Morning Consult to poll 2,213 U.S. adults in late September 2023 to gauge peoples’ perspectives on AI and health care. With such optimism among health consumers comes some

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

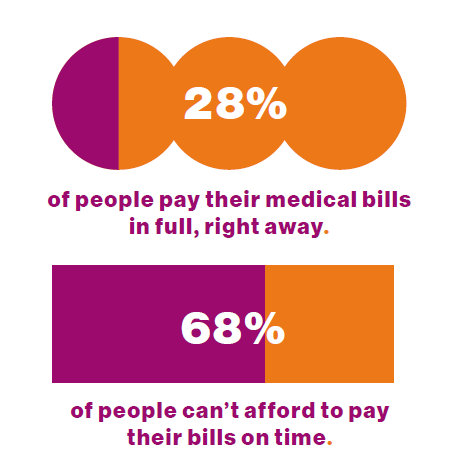

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

How Ahold-Delhaize Connects the Grocery, Climate Change, ESG and Consumers’ Health

In the food sector, “the opportunity for us and the role that we play is to connect climate and health,” Daniella Vega of Ahold Delhaize told Valerio Baselli during the Morningstar Sustainable Investing Summit 2023. In a conversation discussing the importance of non-financial metrics in companies’ ESG efforts, Vega connected the dots between climate change, retail grocery, and consumers’ health and well-being. Vega is the Global Senior Vice President, Health & Sustainability, with Ahold Delhaize— one of the largest food retail companies in the world. Based in the Netherlands, the company operates mainly in

Money and Mental Health in the U.S. – How Difficulty Paying Medical Bills Can Hurt Healing and Well-Being

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network. Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023. That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that

The Healthcare Financial Experience is a Stressful One: the Convergence of our Medical, Retail, and Financial Lives

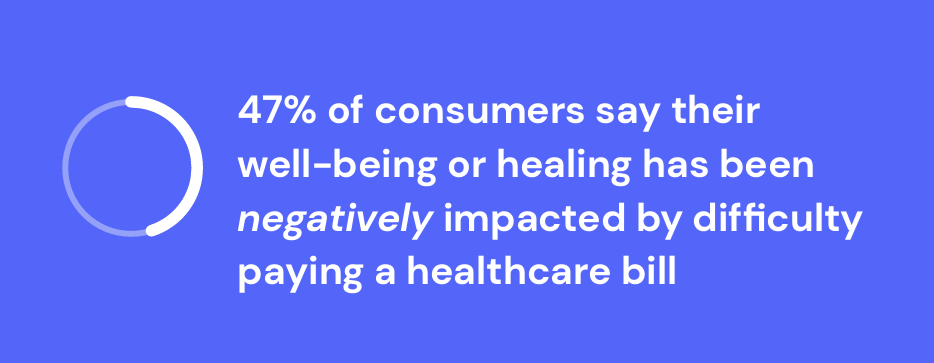

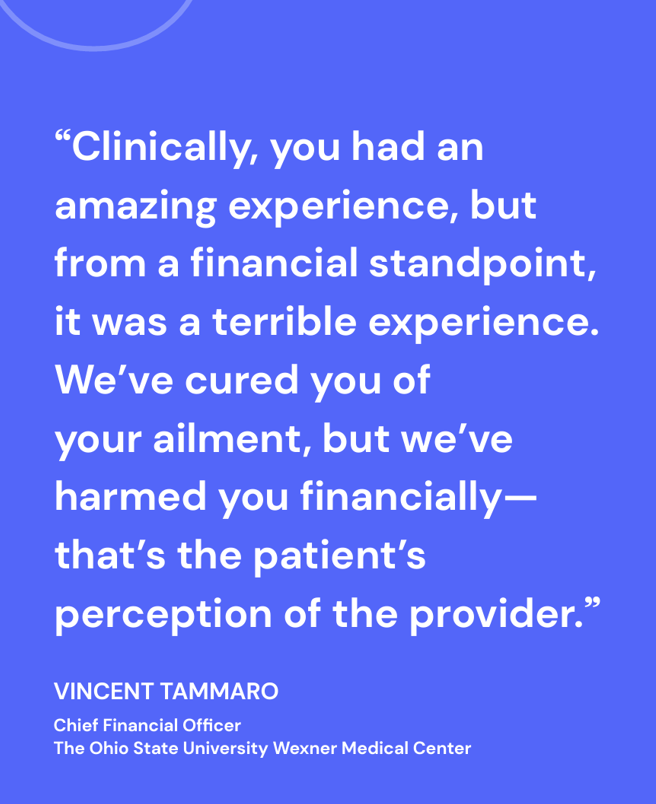

One in two consumers in the U.S. feel their well-being or healing was negatively impacted by difficulty paying for their medical care. Welcome to the convergence of patients’ health care life with financial and retail lives, we learn from the 2024 Healthcare Financial Experience Study from Cedar. And that patient’s positive clinical experience can absolutely reverse the consumer’s perception of the provider, noted by this quote from OSU’s Chief Financial Officer Vincent Tammaro: “We’ve cured you of your ailment, but we’ve harmed you financially.” That’s a form of financial toxicity that

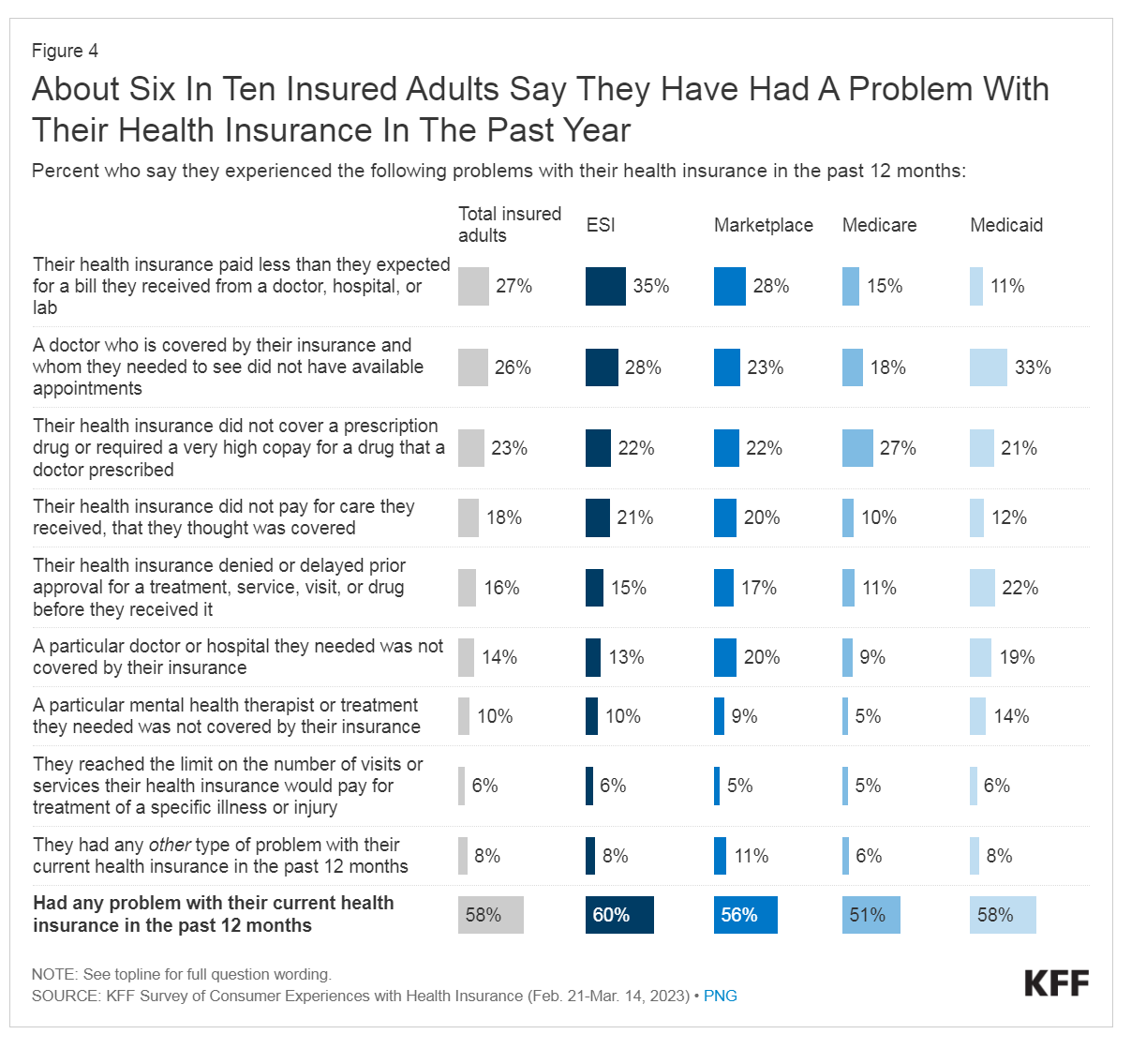

The Latest KFF Poll on Consumer Experiences with Health Insurance Speaks Volumes About Patients’ Administrative Burden

People love being health-insured, but their negative experiences with health plans create serious burdens on patients-as-consumers. And those burdens impact even more people who are unwell than healthier folks. The 2023 Kaiser Family Foundation Survey of Consumer Experiences with Health Insurance updates our understanding of and empathy for insured peoples’ Patient Administrative Burdens (PAB). For this study, KFF polled 3,605 U.S. adults 18 and over in February and March 2023 who had health insurance across different plan types. Over the past several years, I’ve come to appreciate the concept of PAB by listening to and learning from colleagues Dr, Grace

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

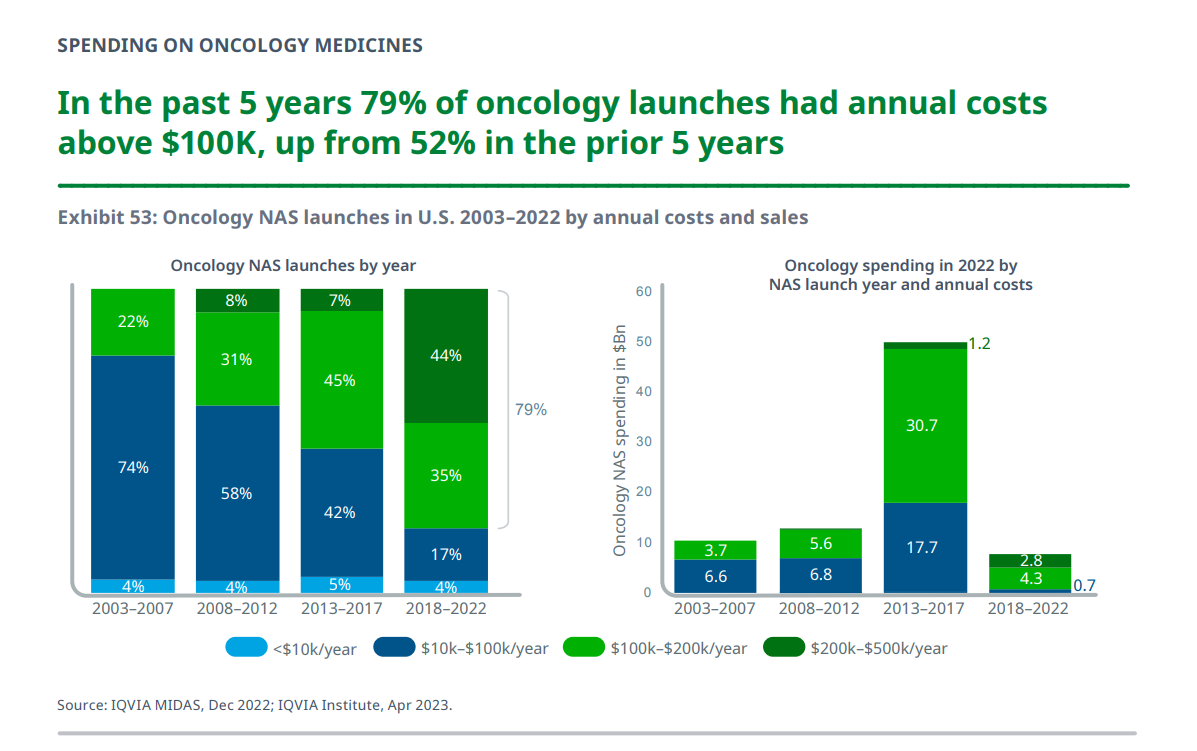

Consumers and Cancer: 3 Patient-Focused Charts From IQVIA on the State of the Oncology in 2023 – and Introducing CancerX

It’s time for the annual ASCO conference, currently convening the American Society for Clinical Oncology in Chicago. Starting 2nd June, there have been dozens of positive announcements updating research and therapies bringing hope to the 2 million new patients who will be diagnosed with cancer in the U.S. in 2023, and millions of more people worldwide. Just in time for #ASCO2023, the IQVIA Institute published their annual report on Global Oncology Trends 2023 – Outlook to 2027, an update featuring pipelines, therapy approvals, research updates, costs of oncology products, and patients.

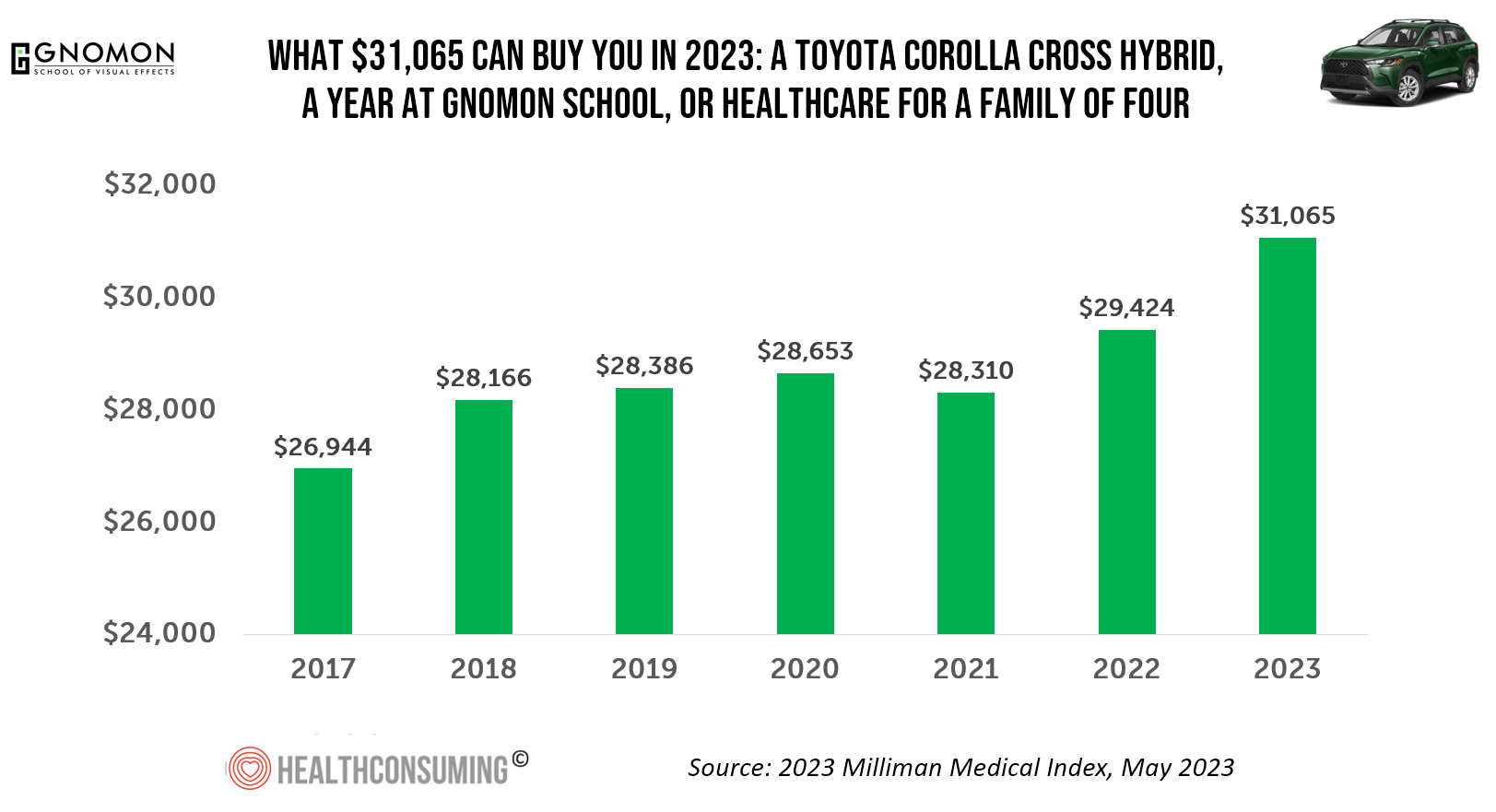

What $31,065 Can Buy You: a Toyota Corolla Cross Hybrid, a Year at Gnomon School, or Healthcare for a Family of 4 in America

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%. For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4. Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

The Growing Pet Economy – What It Means for Human Health, Well-Being, and Healthcare Costs

Our pets can be personal and family drivers of health and health care cost savings, according to a new study from according to a new report from researchers at George Mason University published in their paper, Health Care Cost Savings of Pet Ownership. Reviewing this new paper inspired me to explore the current state of the pet/health market and implications for their human families, my weaving of various stories explored in this Health Populi blog post. Some of the key signposts we’ll cover are: The report on pet ownership driving owners’ health care cost savings A new market analysis of

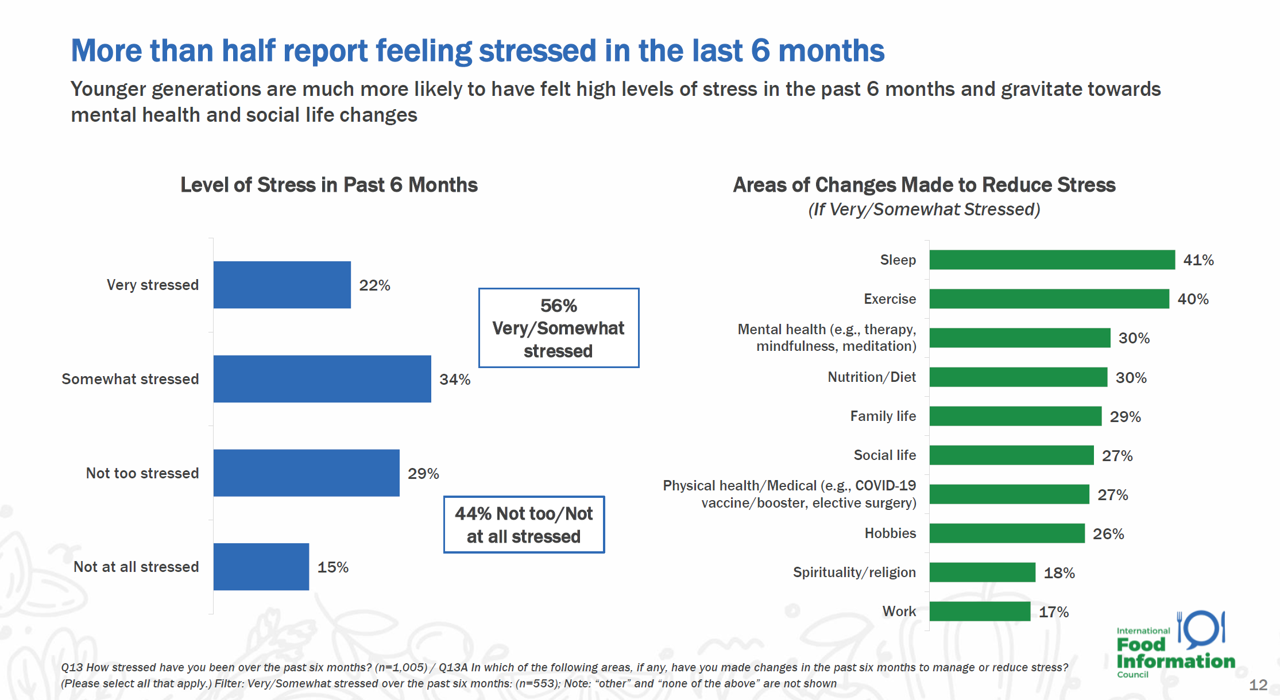

Our Mental and Emotional Health Are Interwoven With What We Eat and Drink – Chewing On the IFIC 2023 Food and Health Survey

As most Americans confess to feeling stressed over the past six months, peoples’ food and beverage choices have been intimately connected with their mental and emotional well-being, we learn from the 2023 Food & Health Survey from the International Food Information Council (IFIC). For this year’s study, IFIC commissioned Greenwald Research to conduct 1,022 interviews with adults between 18 and 80 years of age in April 2023. The research explored consumers’ perspectives on healthy food, the cost of food, approaches to self-care through food consumption, the growing role of social media in the food system, and the influence of sustainability

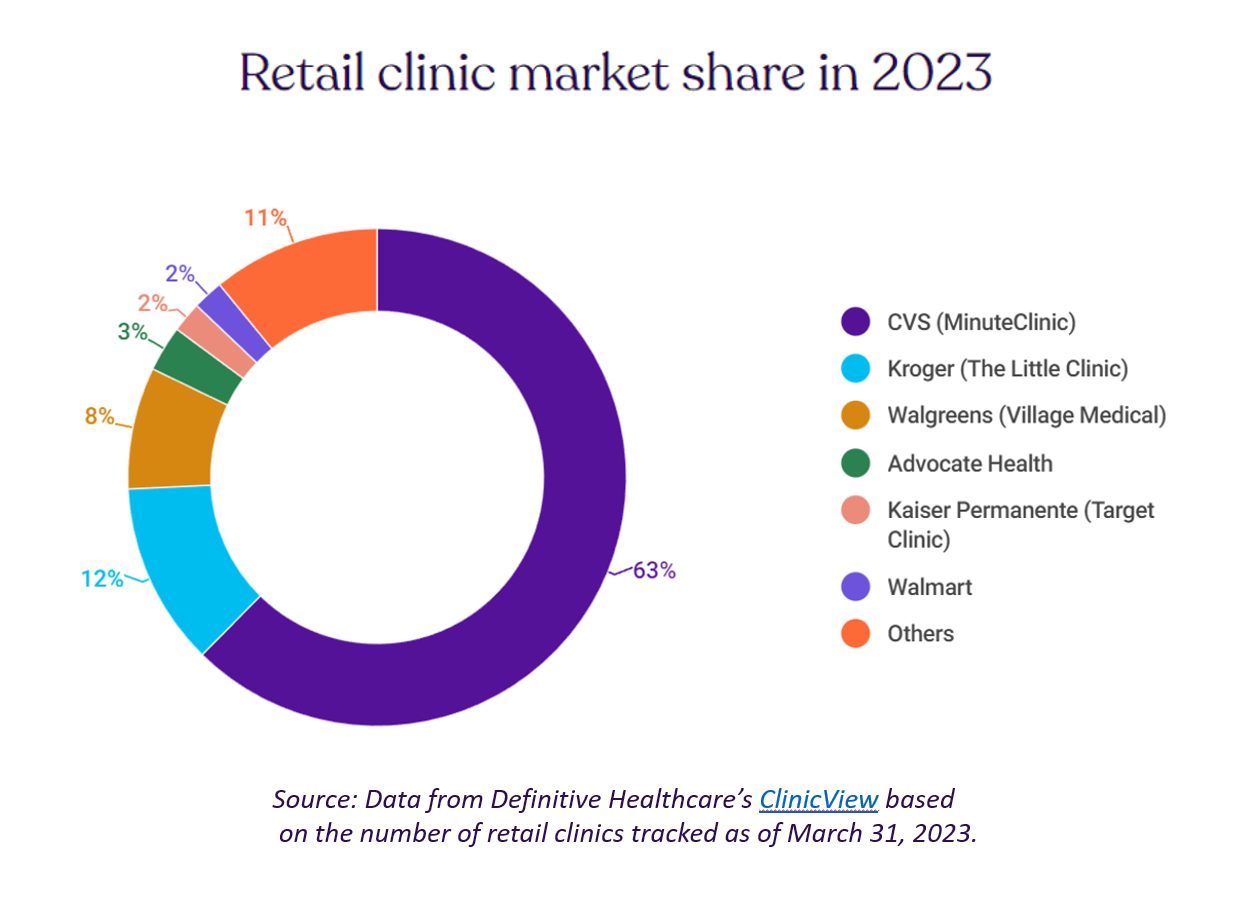

Retail Clinics’ Growing Role in Health Care and Prescription Drug Sales

“It seemed like an odd pairing: shampoo and a throat swab,” observes a new report on the growth of retail health from Definitive Healthcare. But retail clinics are no longer, as the paper explains, “an experiment of a few grocery stores….they’re becoming a major force in the U.S. healthcare system,” asserts the thesis of Retailers in healthcare: A catalyst for provider evolution. While the use of emergency departments fell by 1% in the past five years, the use of retail clinics expanded by 70%, Definitive Healthcare calculated. Most retail clinics are owned by

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

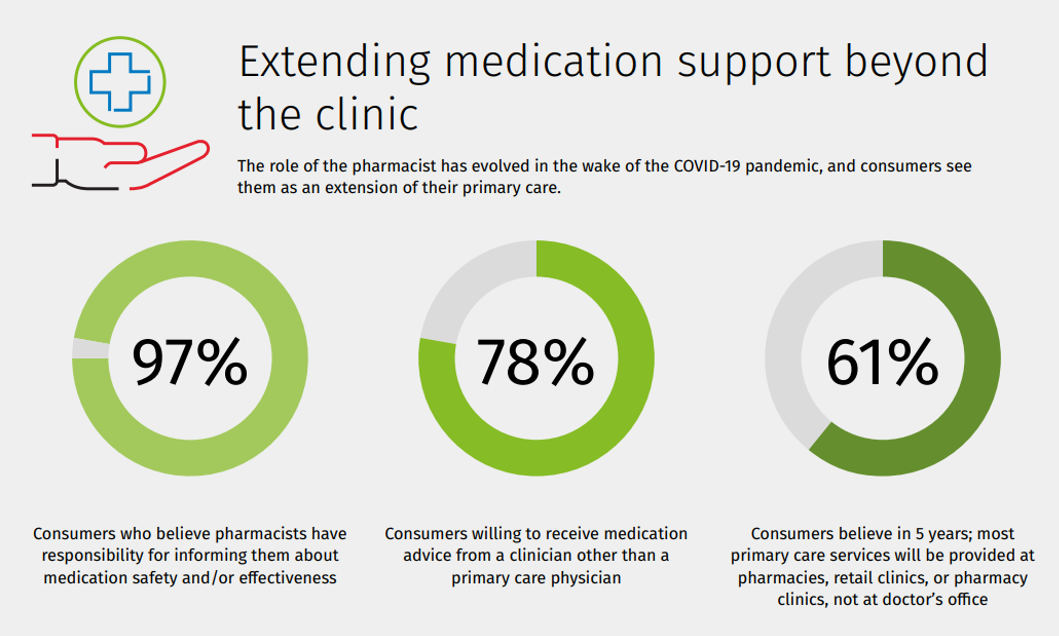

Getting Health Care at a Retail Pharmacy vs a Retail Store: Consumers May Be Favoring the Pharmacist Versus the Retailer

Not all “retail health” sites are created equal, U.S. consumers seem to be saying in a new study from Wolters Kluwer Health, the company’s second Pharmacy Next: Consumer Care and Cost Trends survey. Specifically, consumers have begun to differentiate between health care delivered at a retail pharmacy versus care offered at a retail store — such as Target or Walmart (both named as sites that offer “health clinics in department stores” in the study press release). While 58% of Americans were likely to visit a local pharmacy as a “first step” when faced with a non-emergency medical situation and 79%

Women’s Health on Her Own Terms – “She Knows” What She Needs

Despite some improvement in the representation of women by cinema, TV shows, and brands, distortions in media remain that are risks to women receiving appropriate health care. Breaking through taboos of weight, reproductive services, and mental health are the top 3 factors preventing women from getting proper care, according to Health On Her Terms, a research study from WPP and Ogilvy partnering with SeeHer, an organization of collaborations from media, technology, business, education, and other sectors (including over 7,000 brands) focused on the accurate portrayal of women and girls in society. Taglined as “The Marketer’s Hippocratic Oath to Women, the

Consumers Expect Every Company to Play a Meaningful Role in “My Health” – New Insights from the 2023 Edelman Trust Barometer

People have expanded their definitions of health in 2023, with mental health supplanting physical health for the top-ranked factor in feeling healthy. Welcome to the Edelman Trust Barometer Special Report: Trust and Health, released this week, with striking findings about how the economic, post-pandemic life, pollution and climate change all feed mis-trust among citizens living in 13 countries — and their eroding trust for health care systems. While these factors vary by country in terms of relative contribution to citizen trust, note that in the U.S., social polarization plays an outsized role in factors that “make us

We Are All Health Consumers Now – Toluna’s Latest Look at Consumers’ Health & Well-Being

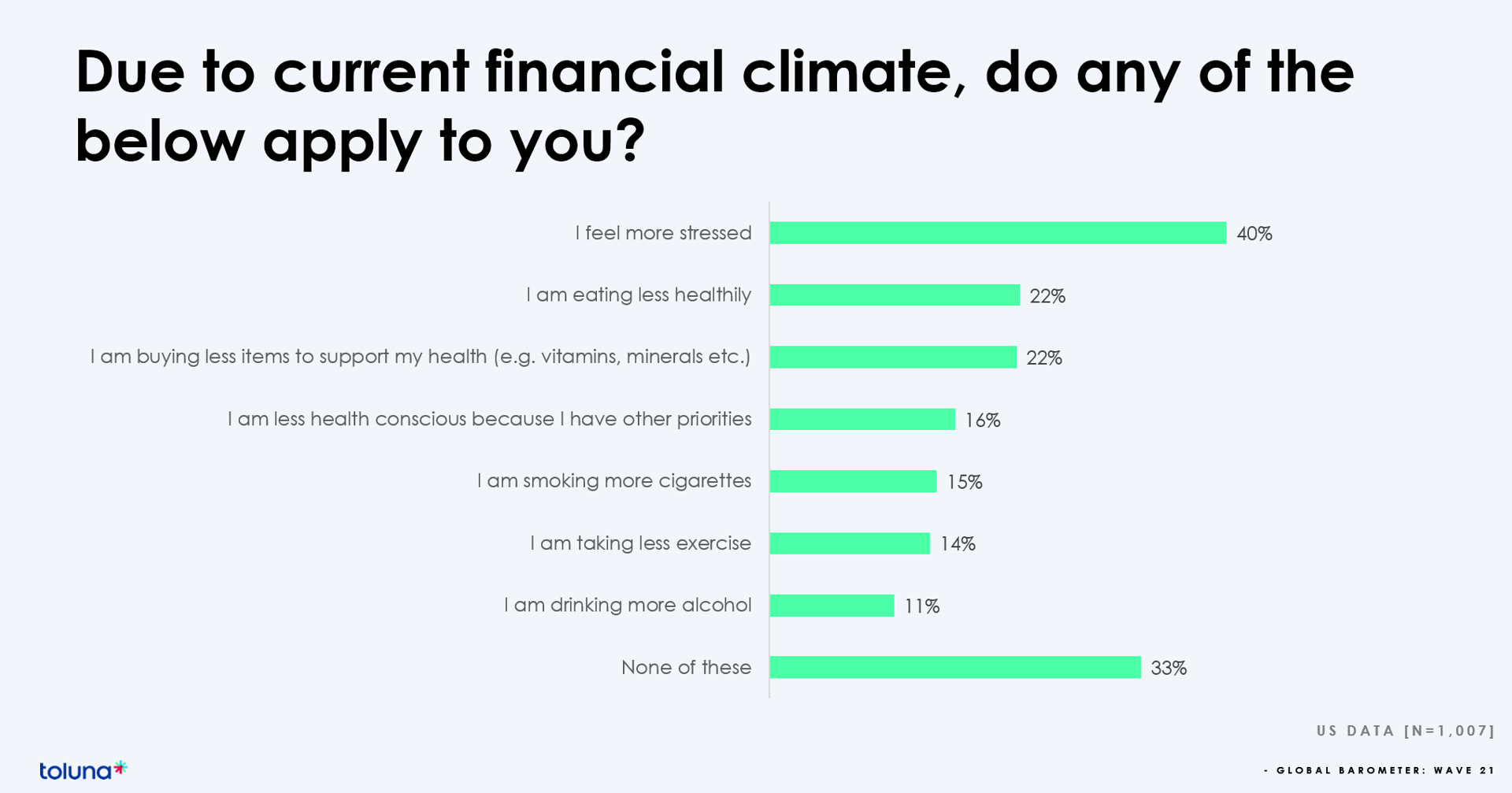

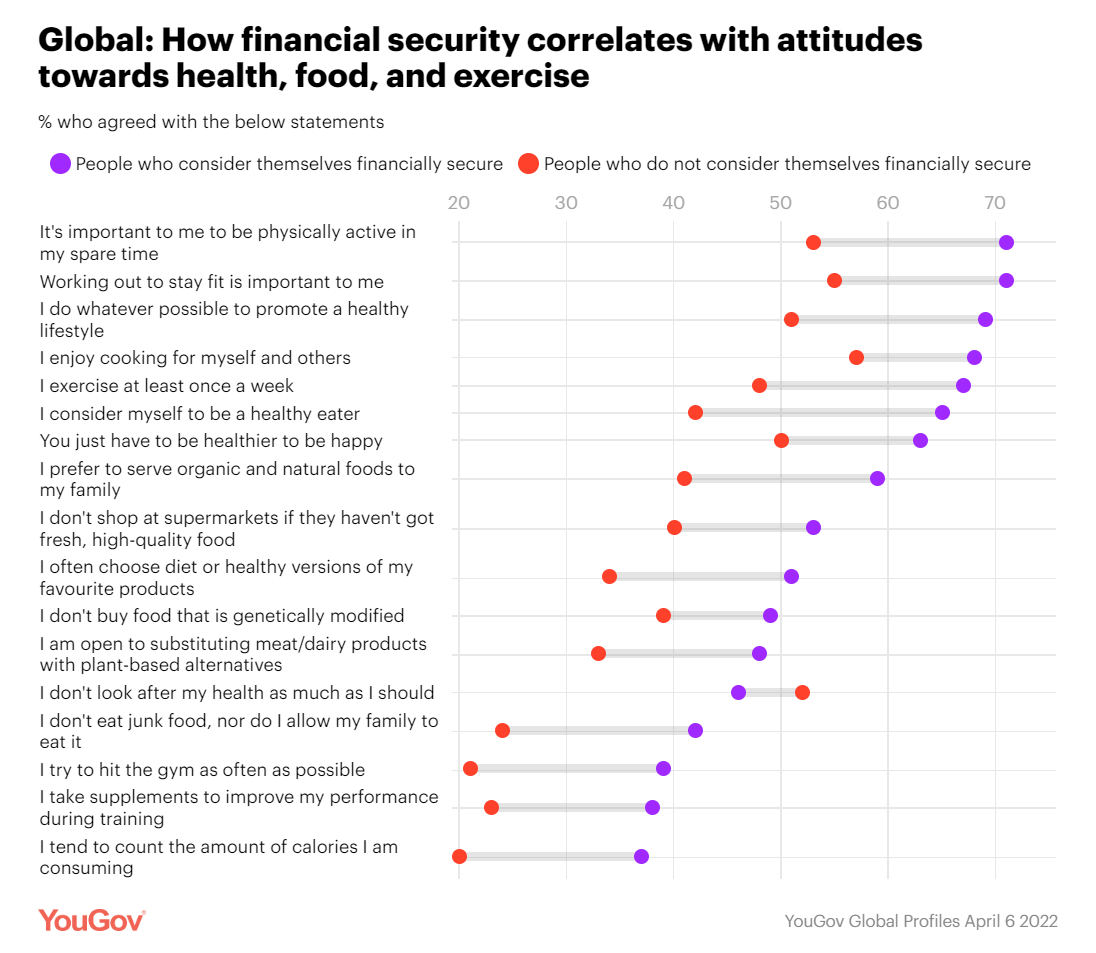

The challenging financial climate at the start of 2023 is impacting how people, globally, are perceiving, managing, and spending money on health and well-being, based on the latest (Wave 21) Global Consumer Barometer survey conducted by Toluna, a sister company of Harris Interactive. Globally, one-third of health citizens the world over are confronting greater stress levels due to the higher cost of living in their daily lives. One in two people say that rising cost of living is negatively impacting their health and well-being. On the positive side, one in three people believe

The Future of Love and How It Could Shape Health, Well-Being, and Daily Living

“The future of love is bound to the institutions that have historically shaped and defined it,” Ipsos’s What the Future: Love report begins. Consider: religion, government, financial institutions….and the health care ecosystem, as well. On this Valentine’s Day 14th February 2023, it is a good time to consider this convergence as health politics, financial well-being, and emerging technologies will be re-shaping institutions and consumers in the coming months and near-term. The Ipsos researchers have been assessing the future of many aspects of our lives over the past couple of years, such as the future of wellness,

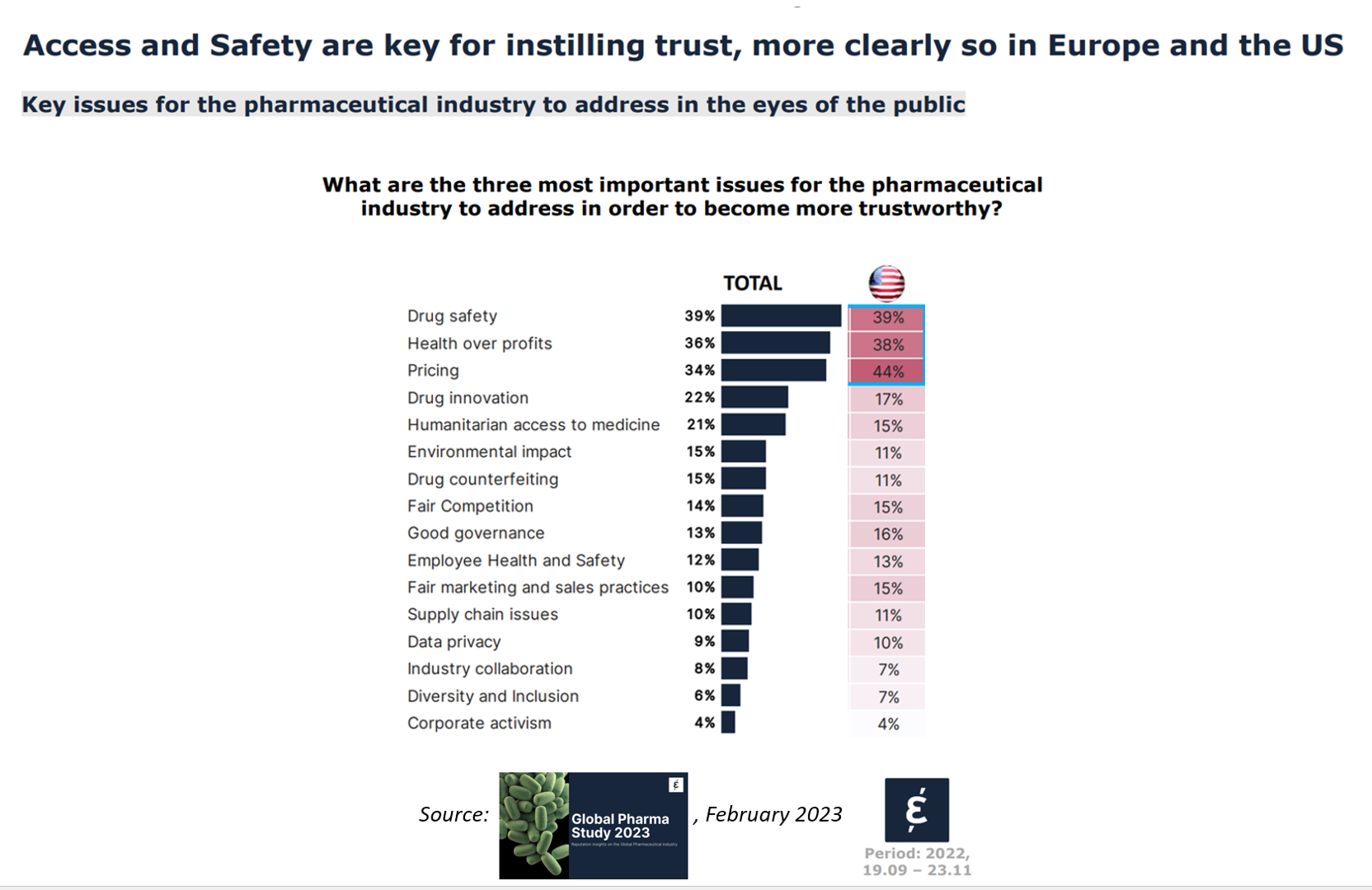

The Reputation of Pharma Among U.S. Consumers Is Tied More to Pricing Than to Innovation

In the U.S., price and the cost of medicines is tied to how people feel about the pharma industry, evidenced in the Global Pharma Study 2023 from Caliber. Caliber, a reputation and corporate strategy consultancy, fielded survey research among over 17,000 health consumers including U.S. adults between 18 and 75 years of age as well as health citizens living in Brazil, China, France, Germany, Japan, and the UK. Caliber assessed the reputation of 16 industries, globally, finding that pharma ranked 10th among the 16, just below automotive and just above chemicals (and well

Wellness in 2023 Is About Connections, Mental Health and Science – Global Wellness Summit’s 2023 Trends

Consumers’ wellness life-flows and demands in 2023 will go well beyond exercise resolutions, eating more greens, and intermittent fasting as a foodstyle. It’s time for us to get the annual update on health consumers from the multi-faceted team who curated the Global Wellness Summit’s annual report on The Future of Wellness 2023 Trends. In this year’s look into wellness for the next few years, we see that health-oriented consumers are seeking solutions for dealing with loneliness and mental health, weight and hydration, travel-as-medicine as health destinations, and — not surprisingly —

Quick, Accessible, Inexpensive Health Care – A Retail Health Update from Amazon and Dollar General

Two announcements this week add important initiatives to patients’ growing choices that speak to their consumer-sides’ sense of value and personal healthcare cost-containment: Amazon launched RxPass, a generic medicines subscription service; and, Dollar General promoted its mobile health service powered by DocGo on demand for health visits, “right outside the store.” These two programs come from outside of the legacy health care system of so-called incumbents — hospitals, health systems, health insurance — leveraging two brand-names beloved to many consumers for convenience, price transparency, and sheer cost. First, check out Amazon Pharmacy’s RxPass. Amazon

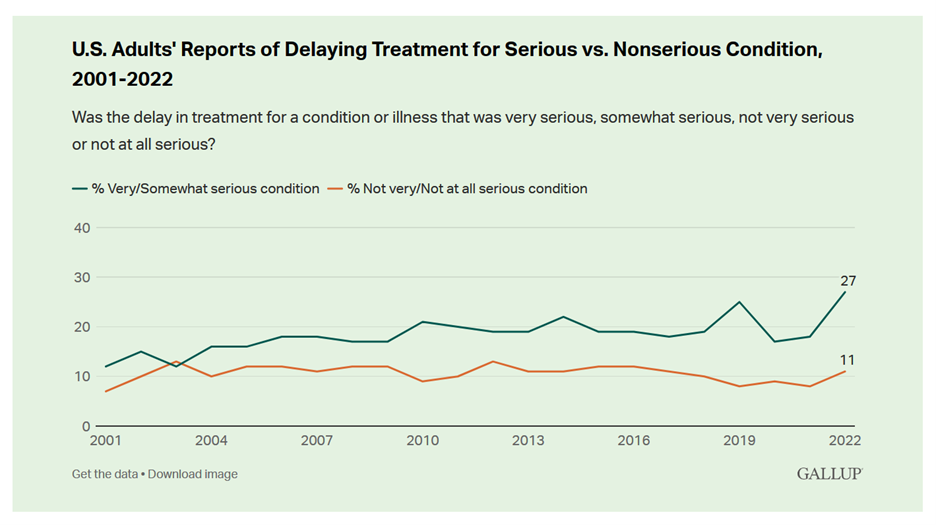

Record Numbers of People in the U.S. Putting Off Medical Care Due to Cost – A New “Pink Tax” on Women?

More people in the U.S. than ever have put off medical care due to cost, according to Gallup’s latest poll of patients in America. Gallup conducted the annual Health and Healthcare poll U.S. adults in November and December 2022. This was the highest level of self-rationing care due to cost the pollster has found since its inaugural study on the topic in 2001. This was also the most dramatic year-on-year increase of postponing treatment due to cost in the study’s history. Note the substantial difference in women avoiding

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

Dollar General & CHPA Collaborate to Bolster Health Consumers’ Literacy and Access for OTC Pain Meds and Self-Care

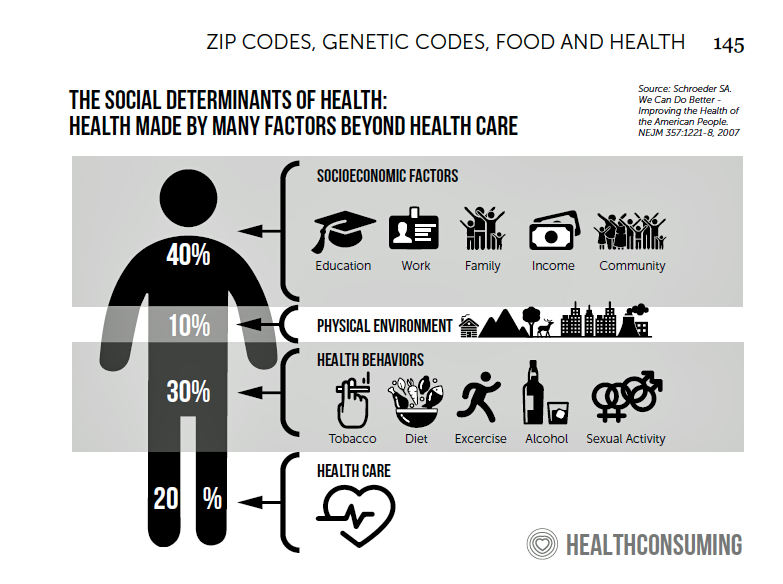

Health is “made” where we live, work, play, pray, learn….and shop. I spend a lot of time these days in the growing health/care ecosystem where retail health is broadening to address social determinants and drivers of health – namely food, transportation, broadband access, education, environment, and financial wellness – all opportunities for self-care and health engagement. For many years, I have followed the activities of CHPA, the Consumer Healthcare Products Association, and have participated in some of their conferences. Their recent announcement of a collaboration with Dollar General speaks to the growing role of self-care for all people.

The Food-Finance-Health Connection: Being Thankful, Giving Thanks

Food features central in any holiday season, in every one’s culture. For Thanksgiving in the United States, food plays a huge role in the history/legend of the holiday’s origins, along with the present-day celebration of the festival. At the same time, in and beyond the U.S., families’ finances will also be playing a central role in dinner-table conversations, shopping on the so-called “Black Friday” retail season (which has extended long before Friday 25th November), and in what’s actually served up on those tables. Let’s connect some dots today on food, finance and health as we enter the holiday season many

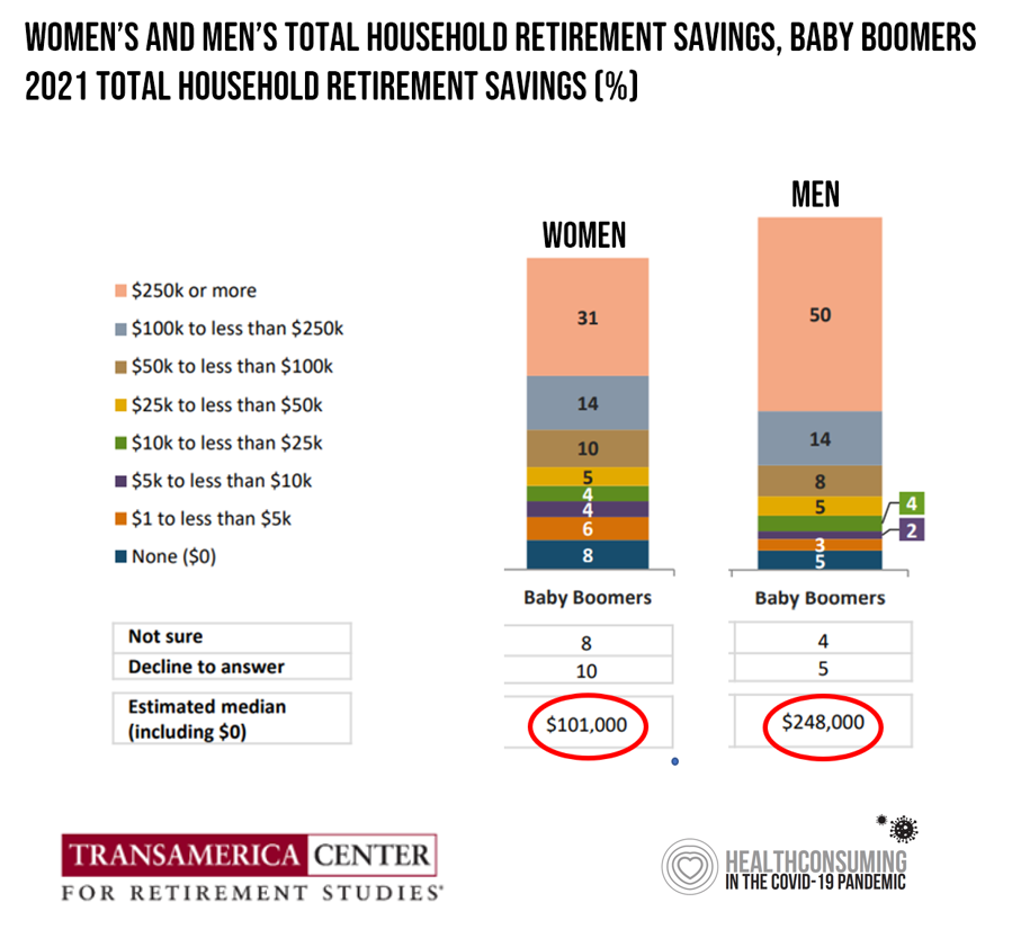

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

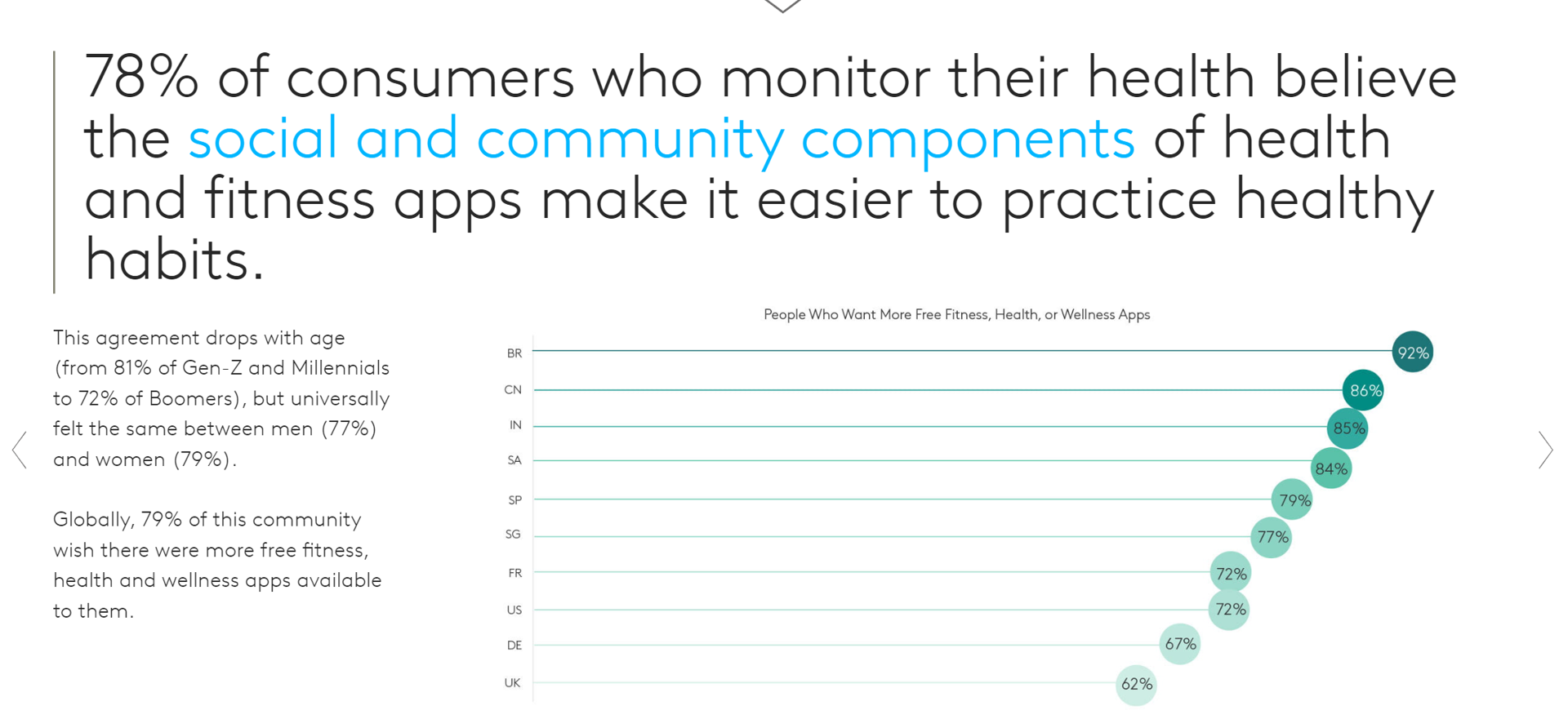

Health Is Social, With More People Using Apps for Physical and Emotional Wellbeing

People who need people aren’t just the luckiest people in the world: they derive greater benefits through monitoring their health via apps that make it easier to make healthy choices. Channeling Barbra Streisand here to call out a key finding in new consumer research from Kantar on Connecting with the Health & Wellness Community. Kantar polled 10,000 online consumers in ten countries to gain perspectives on health citizens’ physical and emotional health and the role of technology to bolster (or diminish) well-being. The nations surveyed included Brazil, China, France, Germany, India, Singapore, South Africa, Spain,

How Will the “New” Health Economy Fare in a Macro-Economic Downturn?

What happens to a health care ecosystem when the volume of patients and revenues they generate decline? Add to that scenario a growing consensus for a likely recession in 2023. How would that further impact the micro-economy of health care? A report from Trilliant on the 2022 Trends Shaping the Health Economy helps to inform our response to that question. Start with Sanjula Jain’s bottom-line: that every health care stakeholder will be impacted by reduced yield. That’s the fewer patients, less revenue prediction, based on Trilliant’s 13 trends re-shaping the U.S. health

The Patient as Prescription Drug Payer – The GoodRx Playbook

Patients have more financial skin-in-their-healthcare-games facing high-deductibles and direct out-of-pocket costs for medical bills…including prescription drugs. I collaborated with GoodRx on a “yellow paper” discussing The Health Consumers as Payer, with implications and calls-to-action for pharma and life science companies. You can download the paper at this link. The report is intended to be a playbook for understanding patients’ growing role as consumers and health care payers, providing insights into peoples’ home economic mindsets and how these impact a patient’s adherence to medication based on cost and perceived value. With inflation facing household

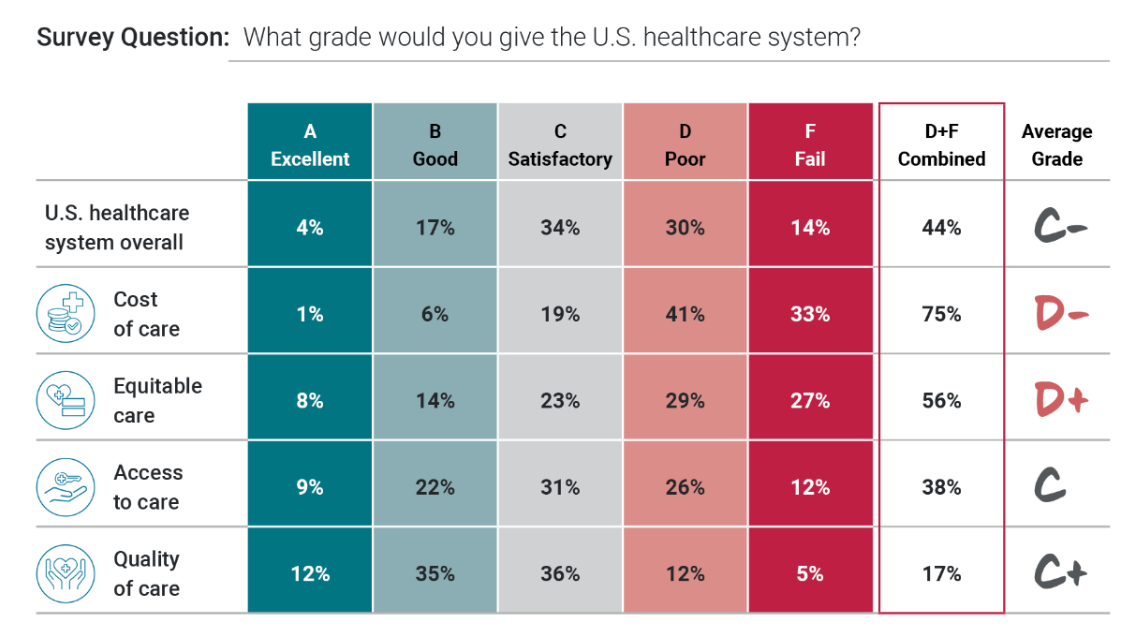

Health Care Costs Are a Driver of Health Across All of America – Especially for Women

Three in four people in America grade health care costs a #fail, at grade “D” or lower. This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively. Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder

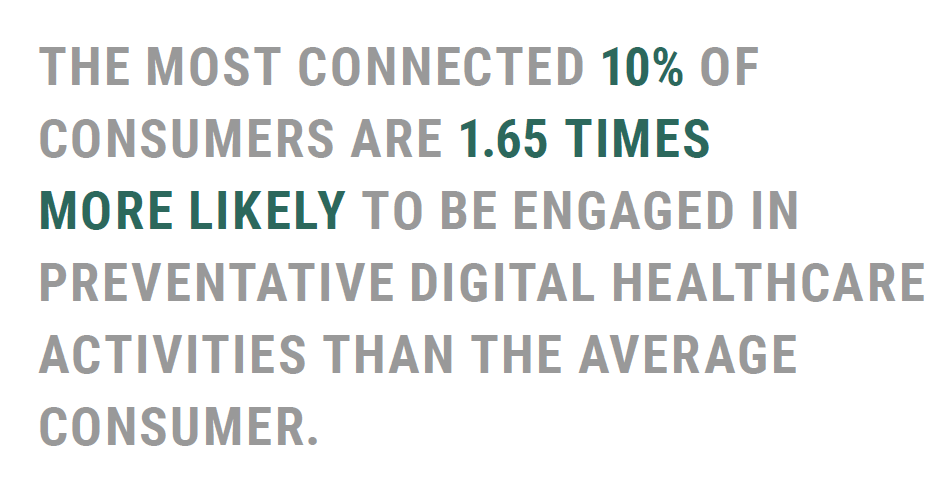

Connected Wellness Growing As Consumers Face Tighter Home Economics

“Consumers are using the Internet to take their health into their own hands,” at least for 1 in 2 U.S. consumers engaging in some sort of preventive health care activity online in mid-2022. The new report on Connected Wellness from PYMNTS and Care Credit profiles American health consumers’ use of digital tools for health care promotion and disease prevention. The bottom-line here is that the most connected 10% of consumers were 1.65 times more likely to be engaged in preventive digital health activities than the average person. Peoples’ engagement with digital health

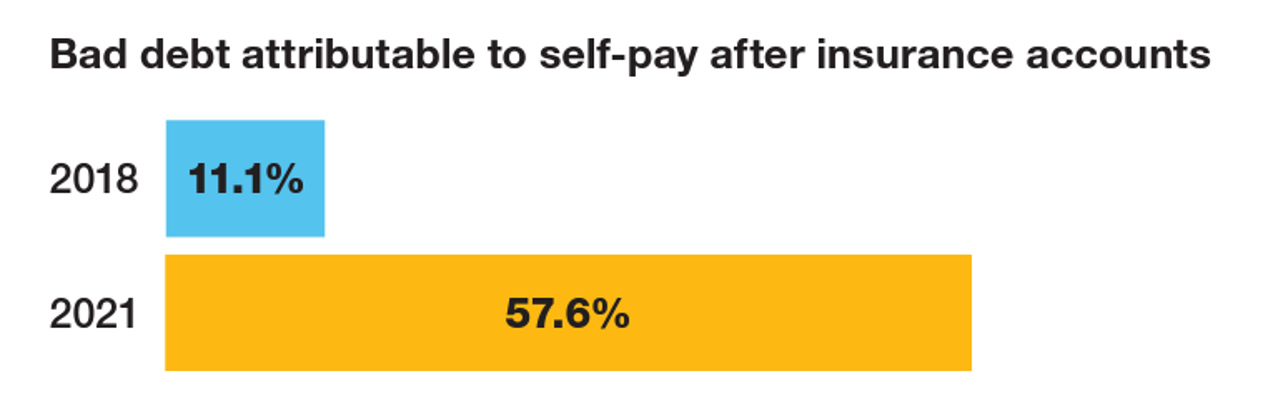

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

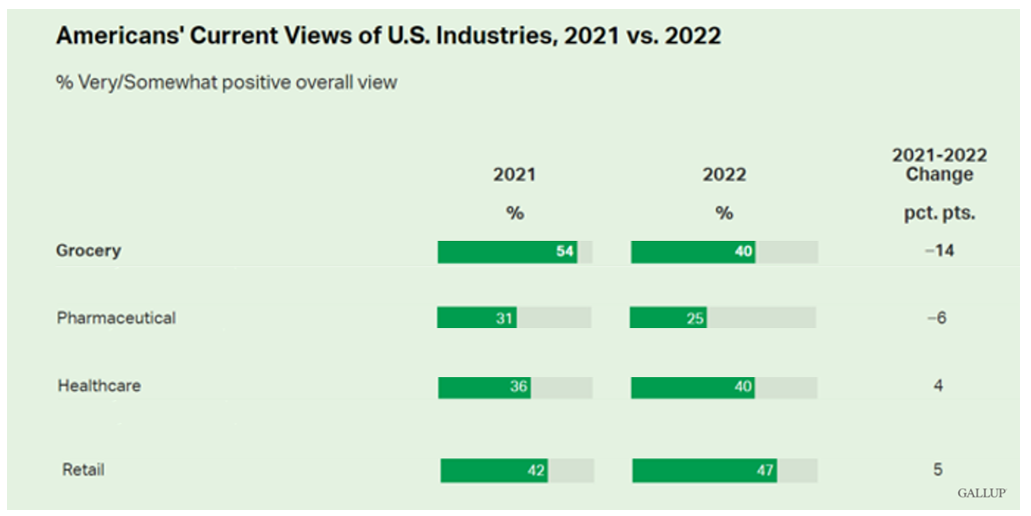

Gallup Reveals Americans’ Views on Industry Are the Lowest Since 2008 – Implications for Healthcare and Pharma

Americans’ positive views of 25 industries in the U.S. have declined in the past year. In their latest look into consumers’ views on business in America, Gallup found that peoples’ ratings on business fell to their lowest ratings overall since 2008. Peoples’ highest ratings of industry in American occurred in 2017 when nearly 50% of people gave business a very or somewhat positive grade. The year-on-year decline from 2021 find oil and gas at the lowest level of positivity, advertising/PR, legal, the Federal government, and pharma at the bottom of the ratings.

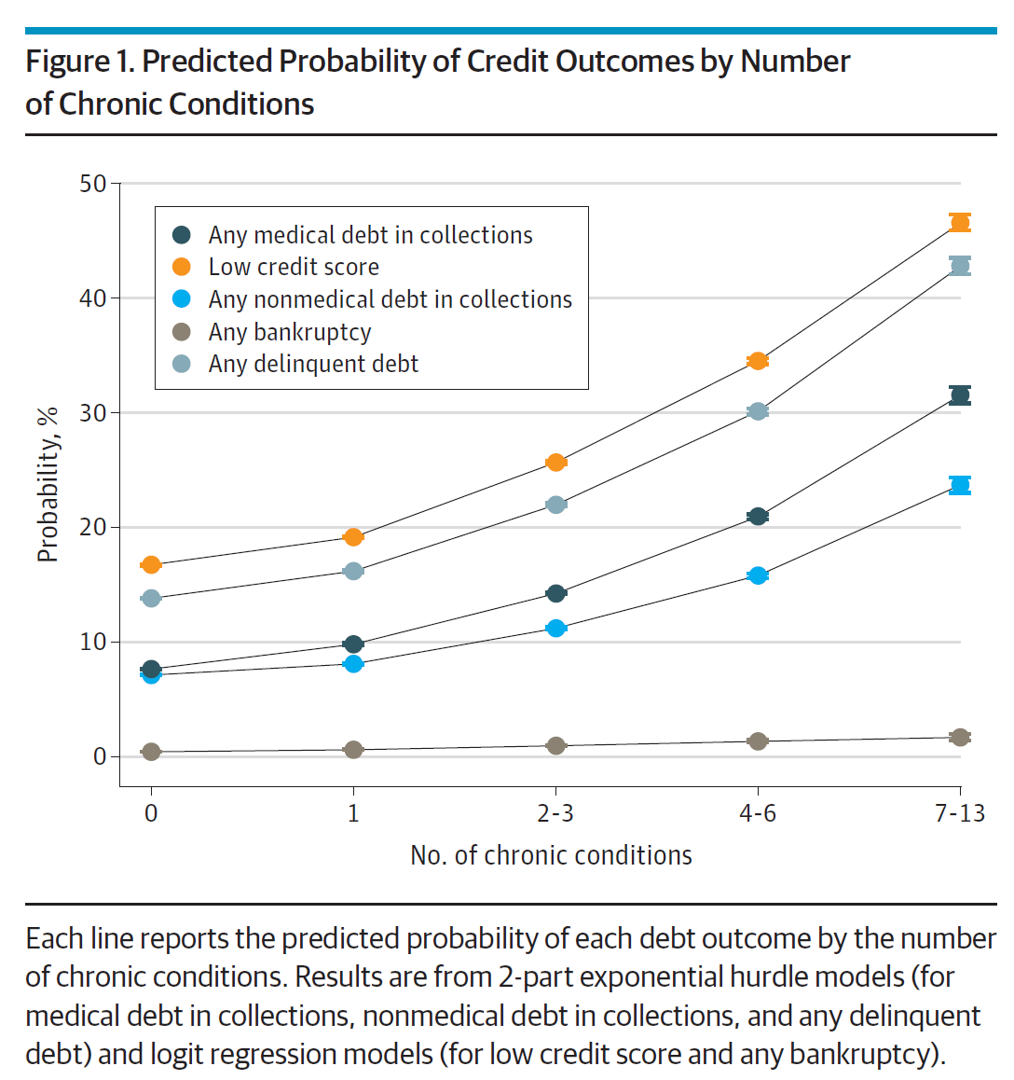

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

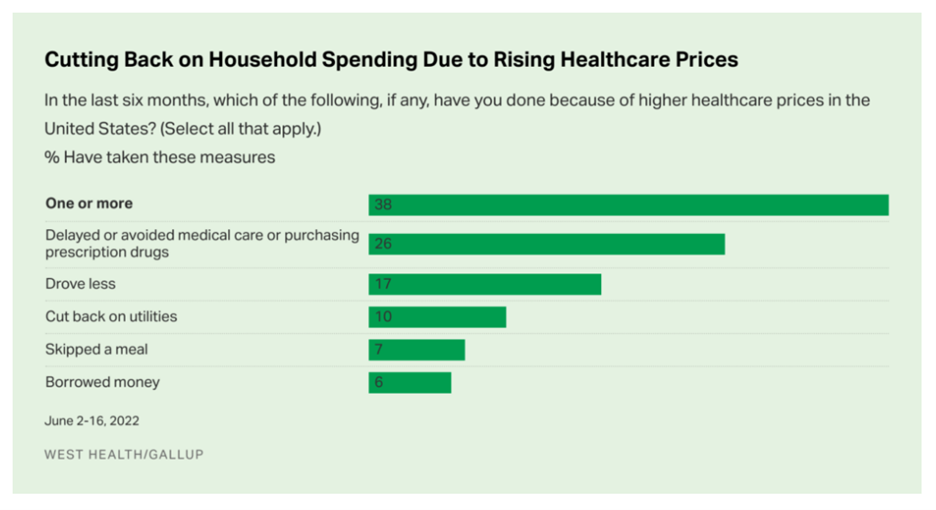

Americans Rationing Healthcare in the Inflationary Era; Out-of-Pocket Expenses Are the Concern

Nearly 100 million people in the U.S. cut back on healthcare due to costs in the first half of 2022, according to the latest poll on health care costs form Gallup and West Health, gauging Americans’ financial health in June 2022. That’s the month when inflation in the U.S. reached 9.1%, a 40-year high. Among Americans’ cuts to household spending was the most common medical self-rationing behavior, delaying or avoiding care or purchasing prescription drugs, the survey found. Nearly 4 in 5 people in the U.S. had delayed care or prescription meds between January

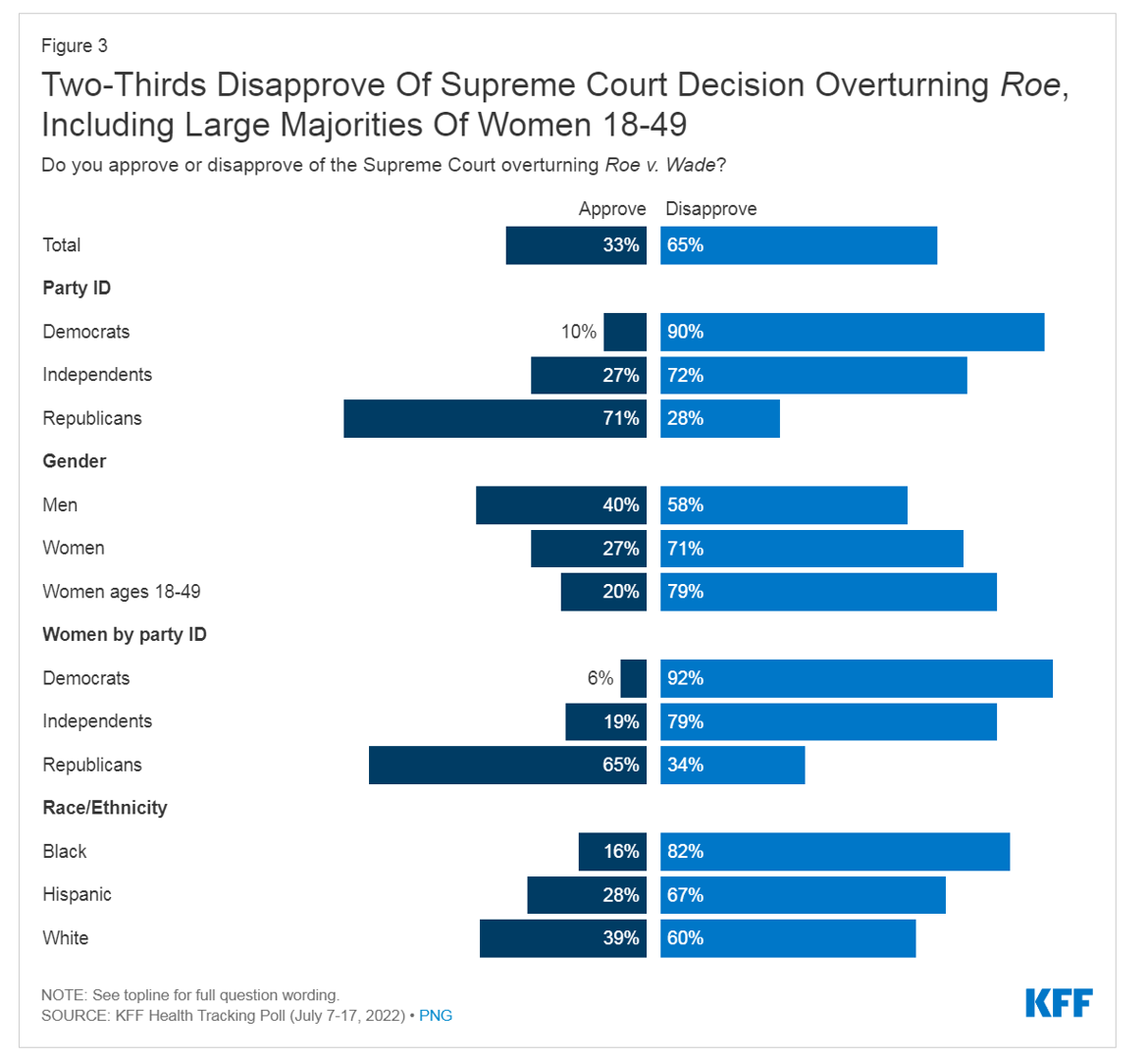

Health, Politics, Inflation and Women: Health Engagement at the Voting Booth

Two in three Americans disapproved of the Supreme Court’s decision to overturn the Roe v. Wade decision (aka the Dobbs case), the latest Kaiser Family Foundation Health Tracking Poll found. While inflation tops voters’ priorities, abortion access resonates for key voting blocs. KFF conducted this survey among 1,847 U.S. adults 18 and over between July 7 and 17, 2022. KFF published the study findings this week on August 2, a day of political primaries and ballot considerations in several U.S. states. Consider Kansas: a majority of Kansans voted on Tuesday to protect abortion rights

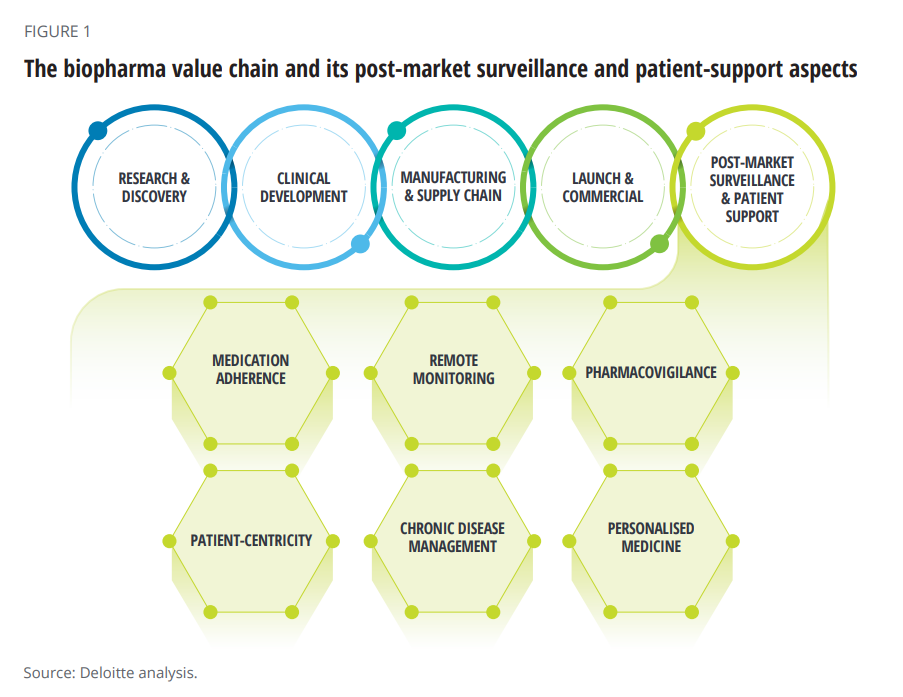

Patient Support Isn’t Just About the Price of Therapy: It’s About Safety, Really Rich Data and Trust

When I talk about patient support programs (PSPs), I’m most often focused on supporting peoples’ access to medicines due to costs, bolstering health literacy, and addressing health citizens’ risks of drivers of health that can be obstacles to optimal health outcomes (those challenging social determinants of health). A new report from Deloitte on Intelligent post-launch patient support speaks to another crucial definition of patient support: post-market surveillance and patient safety. The paper’s central thesis is that improving patient support is a critical step in the biopharma value chain, illustrated in the first diagram

The Retail Health Battle Royale in the U.S. – A Week-Long Brainstorm, Day 1 of 5

I’ve returned to the U.S. for a couple of months, having lived in and worked from Brussels, Belgium, since October 2021 (save for about ten days in March 2022). Work and life slow down in Europe in July and August, giving us the opportunity to return to our U.S. home base, reunite with friends and family, and re-join life and living this side of the Atlantic. The timing of my return to the U.S. coincides with a retail health hurricane of big announcements shaking up the health/care ecosystem. Among these events are Amazon’s plan to acquire One Medical, Apple’s publication of

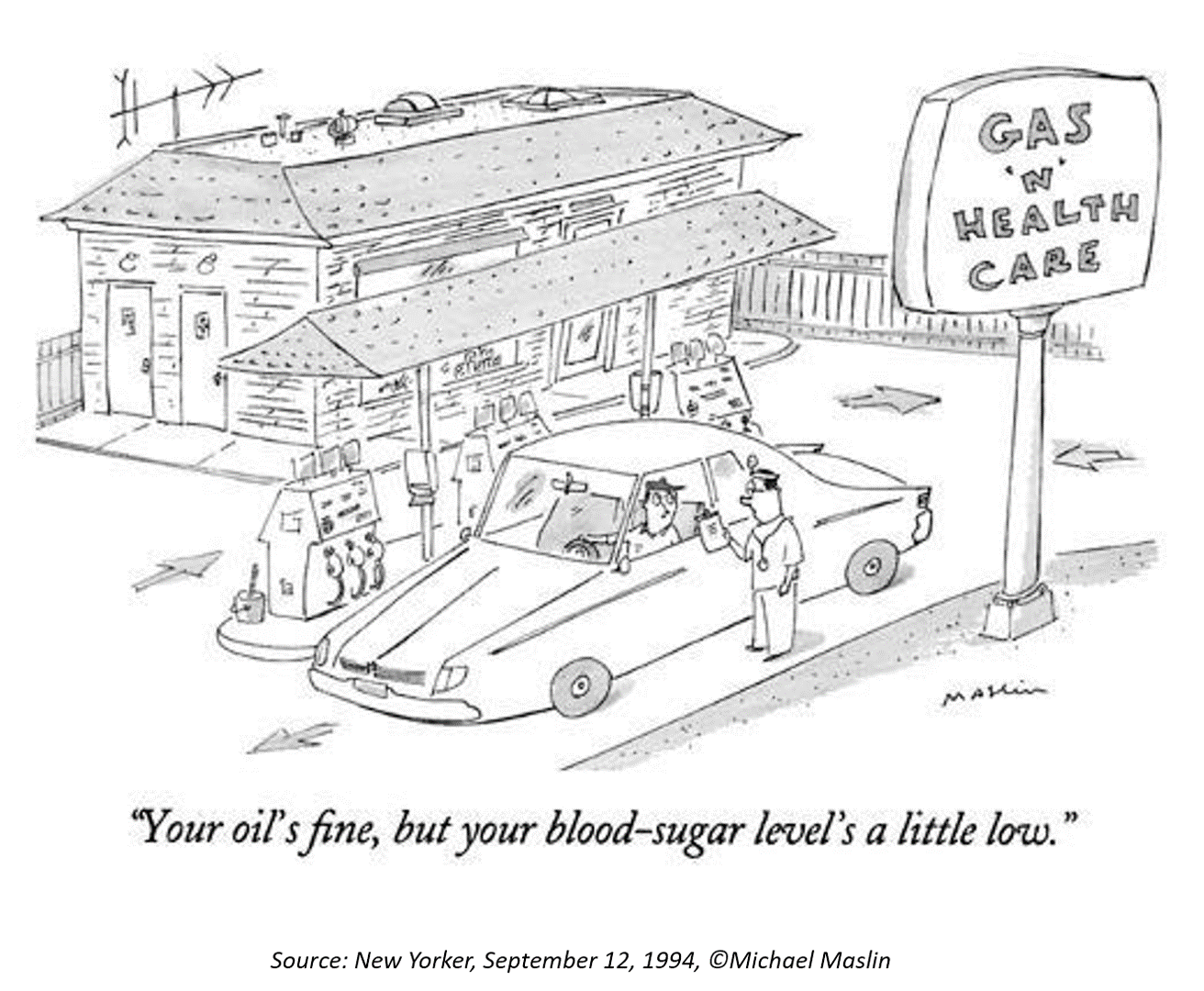

Gas ‘N Healthcare – How Transportation Links to Health Care Access and Financial Health

Some patients dealing with cancer at Mercy Health’s Lourdes Hospital have been supplied with gas cards. This gesture is enabling families to get to medical appointments around Paducah, Kentucky where, this week, car drivers faced regular gas priced at an average of $4.16 a gallon compared with $2.92 one year ago. Here’s the Hospital’s Facebook page featuring their gratitude to FiveStar Food Mart, the American Cancer Society, and the Mercy Health Foundation. “By providing cancer patients with gas cards, the cancer care team at Mercy Health Lourdes Hospital in Paducah hopes to mitigate financial challenges

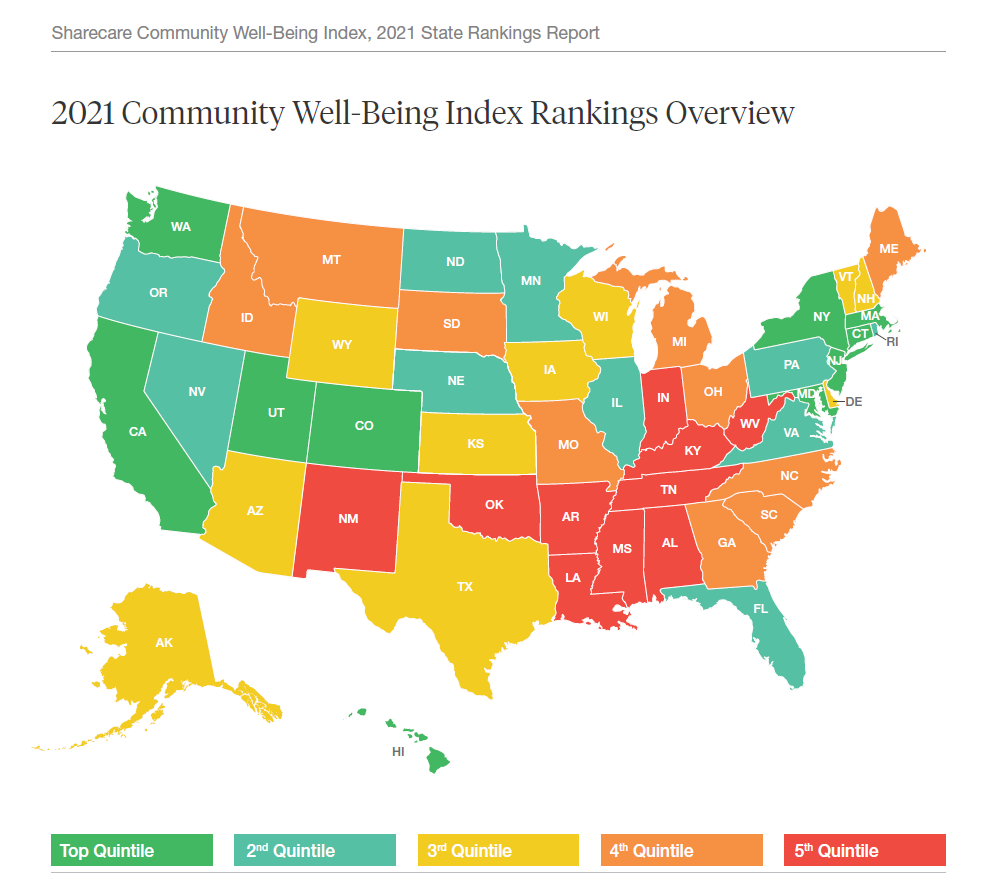

Your State as a Determinant of Health: Sharecare’s 2021 Community Well-Being Index

People whose sense of well-being shifted positively in the past two years are finding greater personal purpose and financial health, we see in Sharecare’s Community Well-Being Index – 2021 State Rankings Report. Sharecare has been annually tracking well-being across the 50 U.S. states since 2008. When the study launched, Well-Being Index evaluated five domains: physical, social, community, purpose, and financial. In 2020, Sharecare began a collaboration with the Boston University School of Public Health to expand the Index, including drivers of health such as, Healthcare access (like physician supply per 1,000

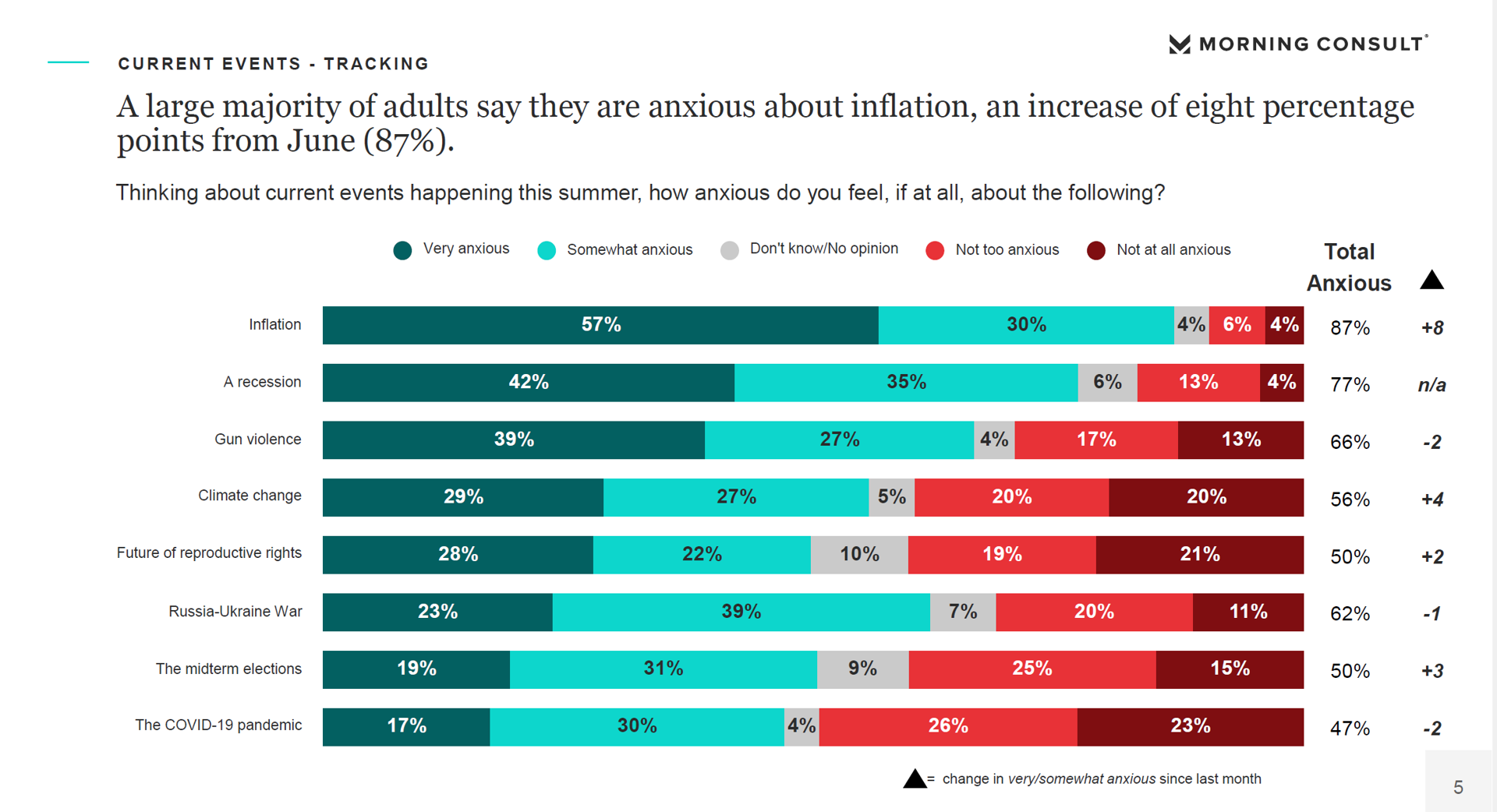

Money and Guns Are the Top Two Sources of Anxiety in America This Summer

Inflation and the fear of economic recession were the top two causes of anxiety in America, followed by gun violence, in June 2022. Moms and Hispanic adults, in particular, were worried about losing income and of gun violence, discovered in the Healthy Minds Monthly Poll for July 2022 from the American Psychiatric Association (APA) and Morning Consult. For some context about these findings, note that this survey was fielded between June 18 and 20, 2022; that was, 24 days after the Robb Elementary School shooting in Uvalde, Texas Four days before the Supreme Court

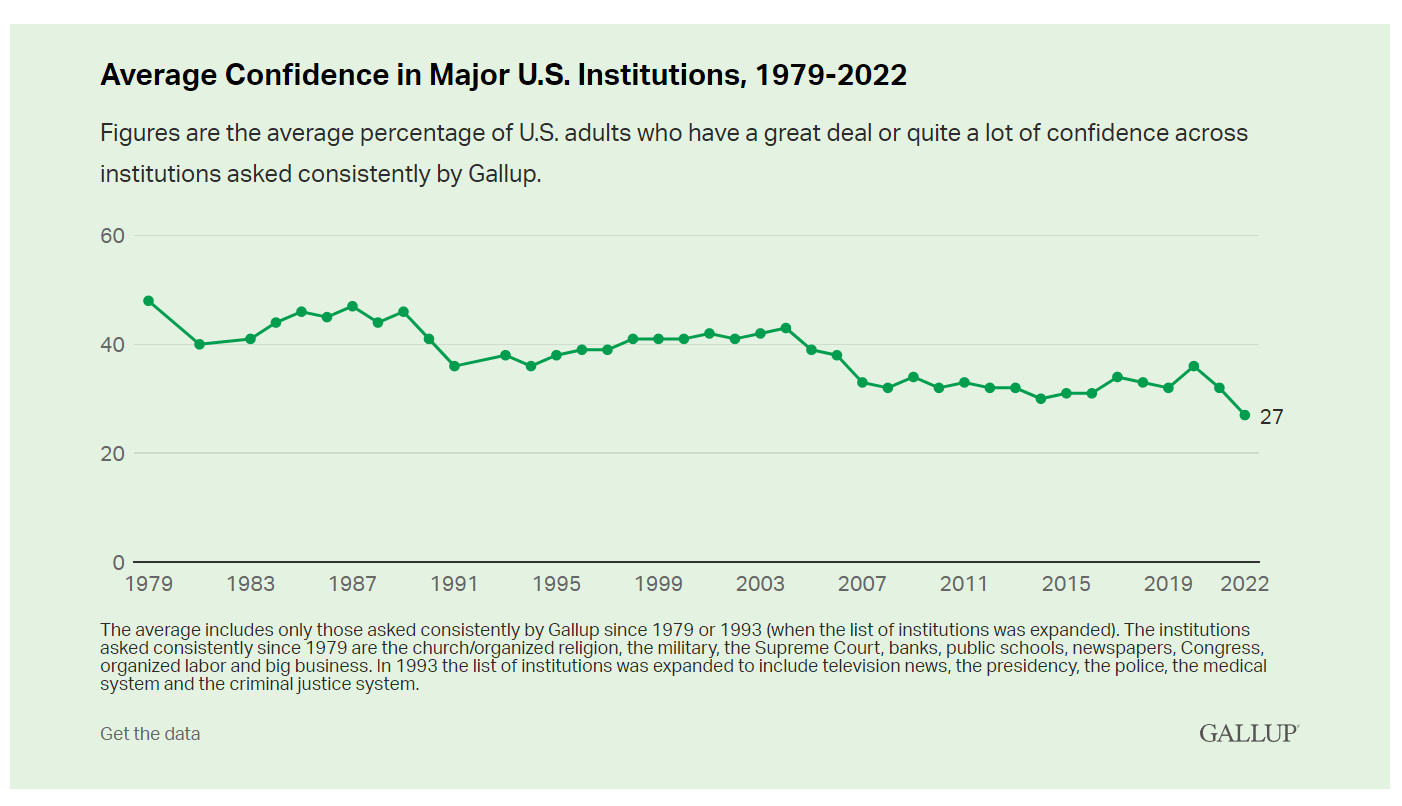

More Americans Trust Small Biz and the Military than the Medical System, Gallup Finds

The most trusted institutions in the U.S. are small business and the military, the only two sectors in which a majority of Americans have confidence. Americans’ trust in institutions hit new historic lows in 2022, Gallup found in its latest poll of U.S. sentiment across all major sectors. Today, more Americans have faith in the police than in the medical system, according to a Gallup poll finding that Confidence in U.S. Institutions Down; Average at New Low. published this week of Independence Day 2022. Confidence runs from a higher of 68% for

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

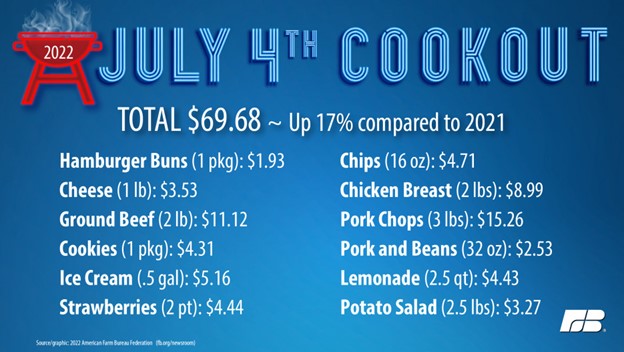

The Higher Cost of Cookouts – Happy, Healthy Independence Day 2022

On this July 4th holiday, Americans aren’t feeling quite so financially independent on Independence Day 2022. The cost of a cookout for your family and friend group of 10 rose over $10 this year, 17% higher than in 2021, based on the American Farm Bureau Federation’s annual assessment of BBQing Economics on the Fourth of July. This estimate is based on a market-basket menu that includes cheeseburgers, pork chops, chicken breasts, homemade potato salad, strawberries and ice cream. Key factors driving up the cost of an All-American cookout include supply chain disruptions (a hangover

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

The Unbearable Heaviness of Inflation: Will Consumers’ Financial Stress Erode Their Health?

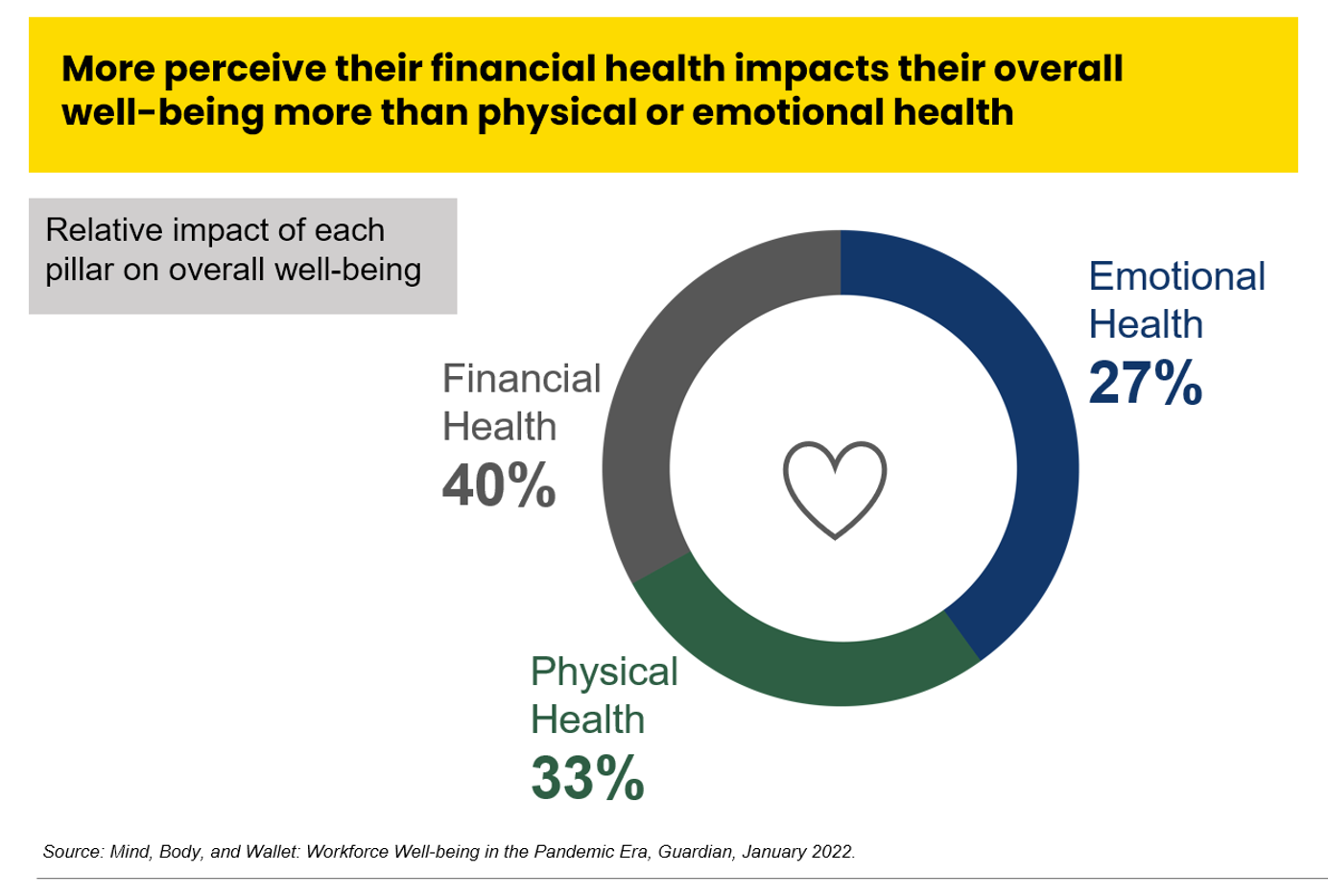

“Inflation is the big story,” the economics team at Morning Consult told us yesterday in a call on “How to Think Like An Economist.” While I already thought I did that, Team @MorningConsult updated us on the current state of consumers and what’s weighing most heavily on their minds…inflation being #1. An hour after the Morning Consult session, I brainstormed the topic of consumers-as-payers of medical bills and prescription drugs with GoodRx strategy leaders. In my data wonkiness, inflation certainly played a starring role in setting the stage for Mind, Body and Wallet — the title of one of the sources

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

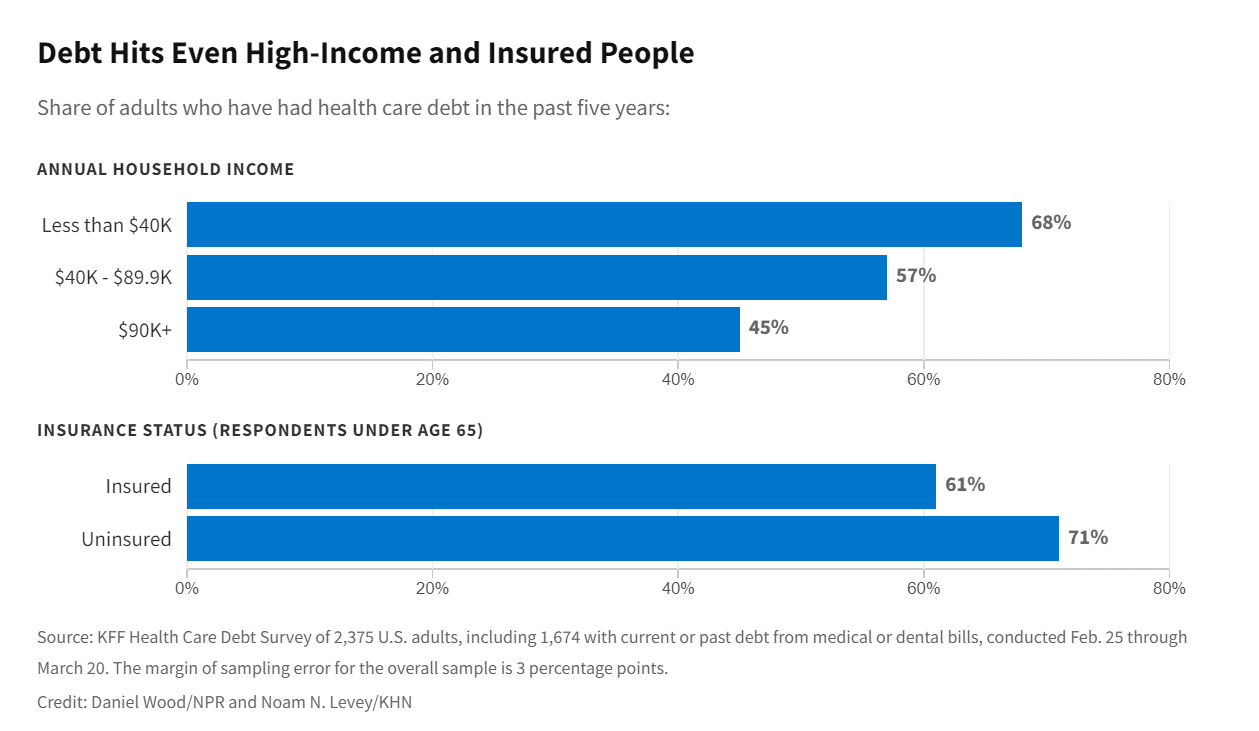

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

Consumers Intend to Invest in Technology — With Budget and Value in Mind

Consumers continued to invest in and use several technologies that supported self-care at home in 2021, with plans to purchase connected health devices, sports and fitness equipment in the next year. But these purchases will be made with greater attention to budget and value consumer mindsets firmly focused on (and stressed by) inflation. The 24th Annual Technology Ownership & Market Potential Study from the Consumer Technology Association (CTA) tells us that Americans in 2022 will have to manage challenging economic headwinds, shopping for technology is preparing people for their new normal —

Jasper, Scaling a Human Touch for People Dealing with Cancer, Now With Walgreens

Each year, the first Sunday in June marks National Cancer Survivors Day. This year’s NCSD occurred two days ago on Sunday, 5th June. When you’re a cancer survivor, or happen to love one, every day is time to be grateful and celebrate that survival of someone who has come through a cancer journey. We all know (or are) people who have survived cancer. We know that the recipe for battling cancer goes beyond chemotherapy. We know of the resilience and grit required in the process: body, mind, and spirit. “Celebrate Life” is the mantra of NCSD, as this year’s campaign

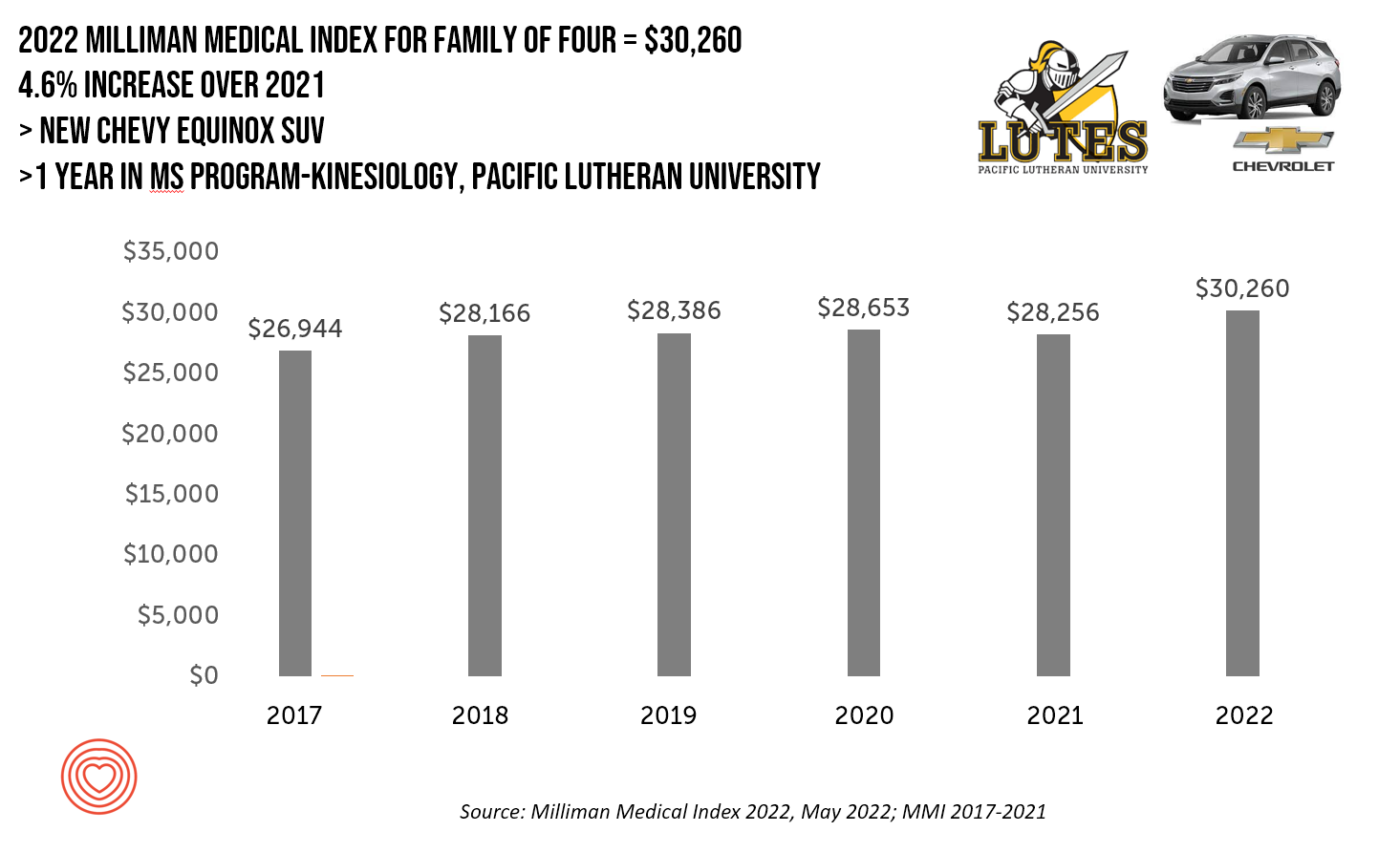

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

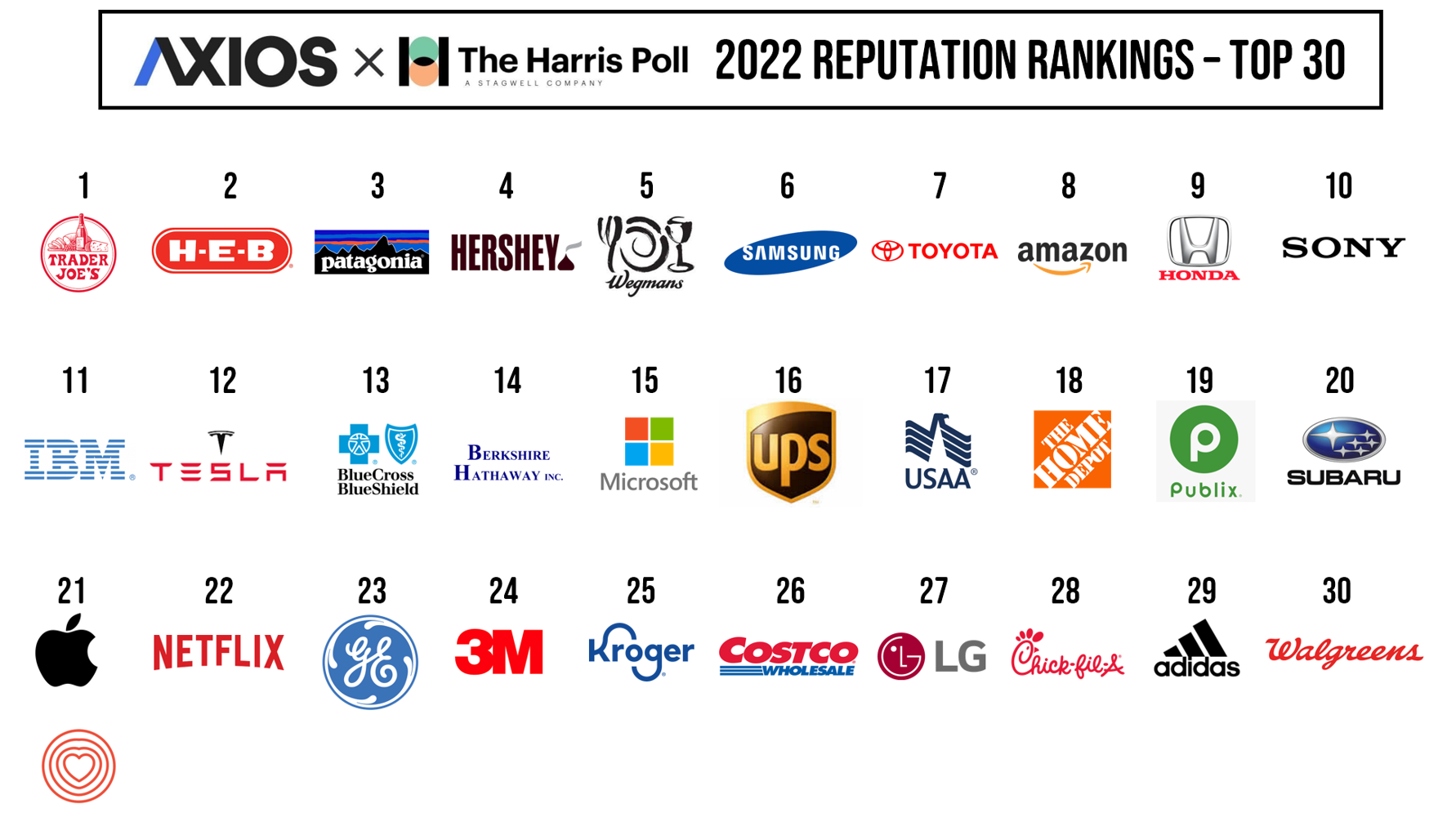

Food, Cars, and Tech: Here’s How U.S. Consumers Rank Companies’ Reputations – the 2022 Axios-Harris Poll

We’re all about food and cars and our technology, looking at the 2022 Axios Harris Poll 2022 Reputation Rankings published this week. I’ve curated the logos of the top 30 companies based on the Poll’s survey of 33,096 U.S. adults conducted in March and April 2022. The survey assessed peoples’ awareness of companies that either “excel or falter in society,” according to the study methodology. Here you see the top 30. The COVID-19 pandemic bolstered consumers’ awareness and call-to-action for peoples’ basic needs: food, working-from-home (thus, tech as a determinant of health and wellbeing),

How Trust and Geopolitics Will Impact Health and Business – Edelman 2022 Trust Barometer at the World Economic Forum in Davos

When we think about the state of Trust in in mid-2022, there is some good news: Trust is rising (at least in democratic countries, while falling in autocratic ones). The bad news: the gap in Trust has dramatically widened between higher-income people compared with those earning lower-incomes, globally. And that gap is “tinder” that can be quickly sparked into a socio-political fire in countries around the world, Richard Edelman cautioned today when introducing the latest look at the 2022 Edelman Trust Barometer, focusing on geopolitics and business. We have never seen numbers like this

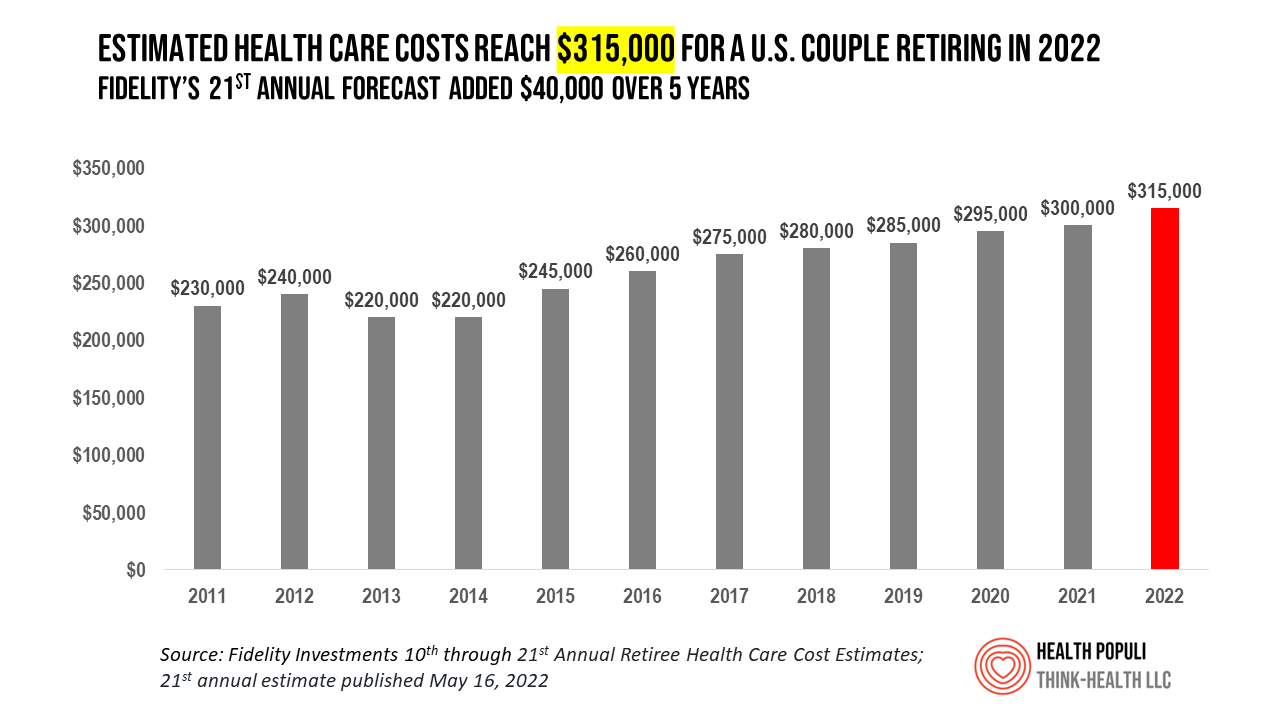

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

Stress Is Playing A Big Role in Consumers’ Food Habits: Food-As-Medicine Update from IFIC

The COVID-19 pandemic accelerated consumers, globally, to take on more DIY roles as well as self-care for health and well-being. In addition, anxiety and stress are mainstream across demographics and have impacted the way people select and consume food, based on findings in the 2022 Food and Health Survey from the International Food Information Council (IFIC). In this 17th annual consumer survey, IFIC points to two underlying macro trends that are re-shaping peoples’ relationship with food and health: the pandemic’s impact, and “significant” generational shifts in taste, consumption, and values about nutrition and sustainability.

Reimagining Health Care Without Walls – Deloitte’s Vision

Delivering health care during the heights of the COVID-19 pandemic proved to both patients and their clinicians that virtual care was not only a viable channel for care, but very often a preferable “place” to collaborate for treatment. Even before the coronavirus pandemic emerged in early 2020, telehealth and the hospital-to-home movement were beginning to become part of a portfolio of delivery modes across the continuum of care. Deloitte spells out the current and future prospects for the Hospital in the future “without” walls in a new report that spells out driving forces, future scenarios, and impacts on a business long

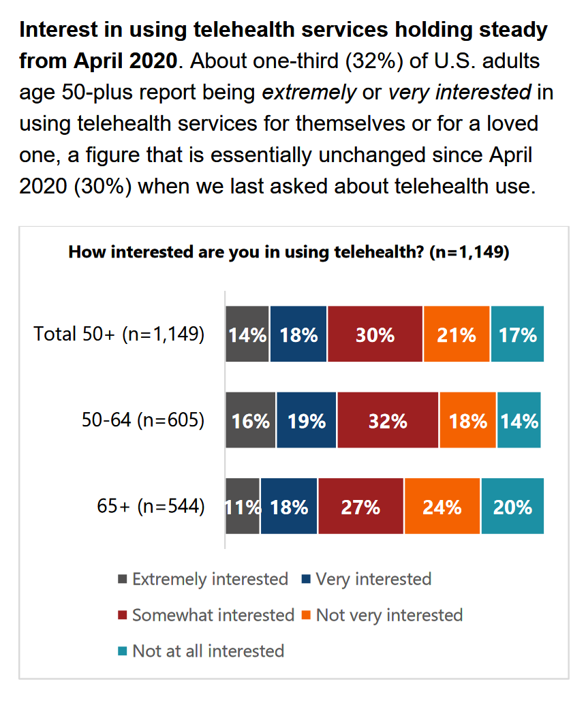

Three in Five People 50+ in the US Will Likely Use Telehealth In the Future – An Update from AARP

“Telehealth certainly appears to be here to stay,” the AARP forecasts in An Updated Look at Telehealth Use Among U.S. Adults 50-Plus from AARP. Two years after the emergence of the COVID-19 pandemic, one-half of U.S. adults over 50 said they or someone in their family had used telehealth. In early 2022, over half of those over 50 (the AARP core membership base) told the Association they would likely use telehealth in the future. This future expectation varies by race, the implications of which I discuss below in

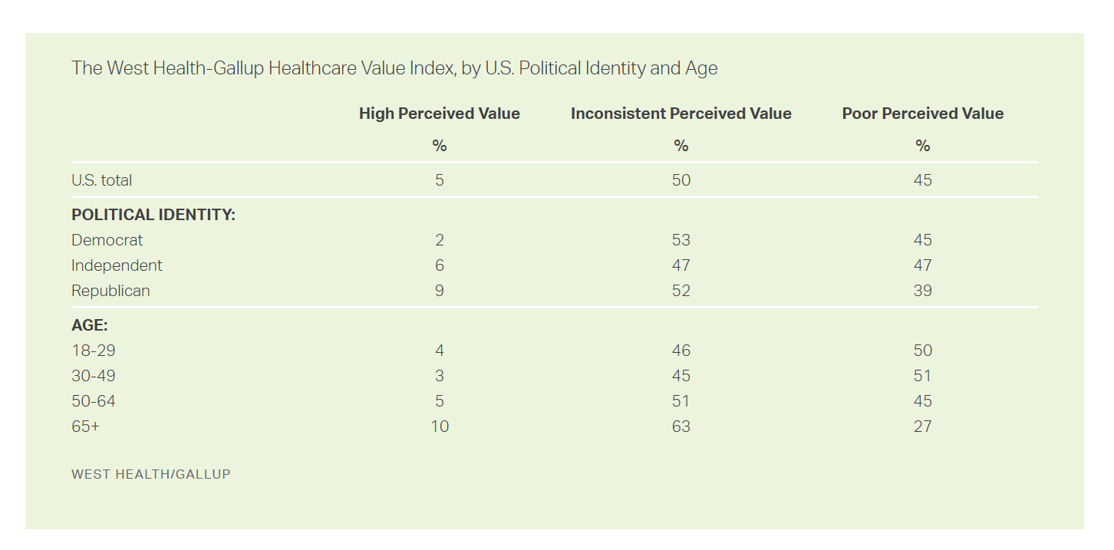

People Thinking More About the Value of Health Care, Beyond Cost

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

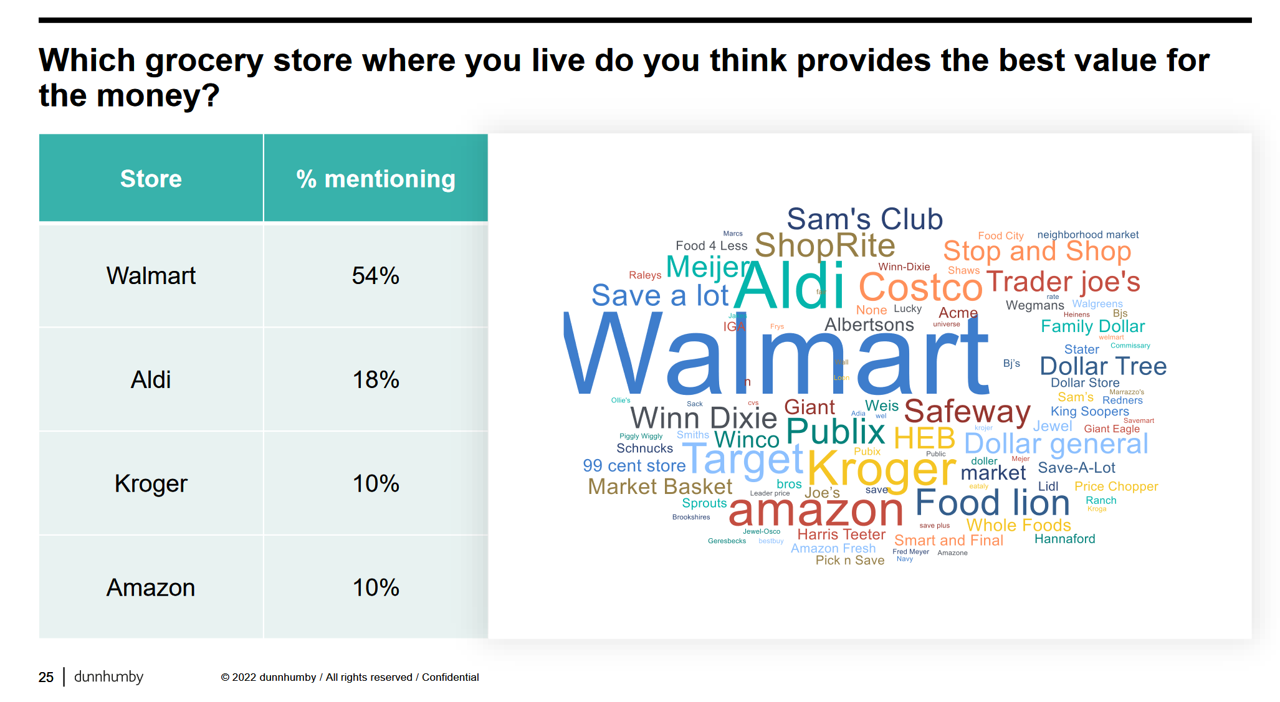

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

Stress in America on the Pandemic’s 2nd Anniversary: Money, Inflation, and War Add to Consumers’ Anxiety

As we mark the second anniversary of the COVID-19 pandemic, the key themes facing health citizens deal with money, inflation, and war — “piled on a nation stuck in COVID-19 survival mode,” according to the latest poll on Stress in America from the American Psychological Association. Financial health is embedded in peoples’ overall sense of well-being and whole health. Many national economies entered the coronavirus pandemic in early 2020 already marked by income inequality. The public health crisis exacerbated that, especially among women who were harder hit financially in the past two years than men were. That situation was even worse

Brand Relevance Has A Lot To Do with Health, Wellness, and Empowerment – Listening to (the) Prophet

s in the seventh annual 2022 Brand Relevance Index from Prophet. The research developed a list of 50 companies representing what Prophet characterizes “the brands that people can’t live without in 2022.” For the 7th year in a row, Apple tops the study. Following Apple, the nine companies rounding out the top ten most relevant brands were Peloton, Spotify, Bose, Android, Instant Pot, Pixar, Fitbit, TED, and USAA. There are relative newbies in this list, representing consumers’ collective response to the COVID-19 pandemic and new life-flows. Put Calm and AfterPay in that category, along with Beyond Meat, and Zelle. The

Food Insecurity, Energy Prices, and Medical Debt Spike in February 2022

There’s a trifecta cost challenge hitting U.S. household budgets in February 2022, highlighted in a poll from Morning Consult: inflationary spikes for housing, food, and energy, and the COVID-19 Omicron variant forcing health care costs up for some consumers driving medical debt up. This further underscores the reality that medical spending in the U.S. is taking shape as a consumer service or good, competing with — potentially crowding out — other household line items like food and increasingly costly petrol to fill gas tanks. Or taken the other way, gas and food crowding out health care spending, leading to either

Medical Distancing Is Bad For Your Health

“Social distancing is great. Medical distancing? Not so much,” I observe in Medical Distancing in America: A Lingering Pandemic Side Effect., my essay published this week in Medecision’s Liberate Health blog. Since we learned to spell “coronavirus,” we also learned the meaning and risk-managing importance of physical distance early in the COVID-19 pandemic. But medical distancing became a corollary life-flow of the physical version, and for our collective health and well-being, it hasn’t been good for our health in ways beyond keeping our exposure to the virus at bay. For health care providers — physicians, hospitals, ambulatory clinics, diagnostic centers —

The Wellness Economy in 2022 Finds Health Consumers Moving from Feel-Good Luxury to Personal Survival Tactics

The Future of Wellness in 2022 is, “shifting from a ‘feel-good’ luxury to survivalism as people seek resilience,” based on the Global Wellness Institute’s forecast on this year’s look into self-care and consumer’s spending on health beyond medical care — looking beyond COVID-19. GWI published two research papers this week on The Future of Wellness and The Global Wellness Economy‘s country rankings as of February 2021. I welcomed the opportunity to spend time for a deep dive into the trends and findings with the GWI community yesterday exploring all of the data, listening through my health economics-consumer-technology lens. First, consider

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

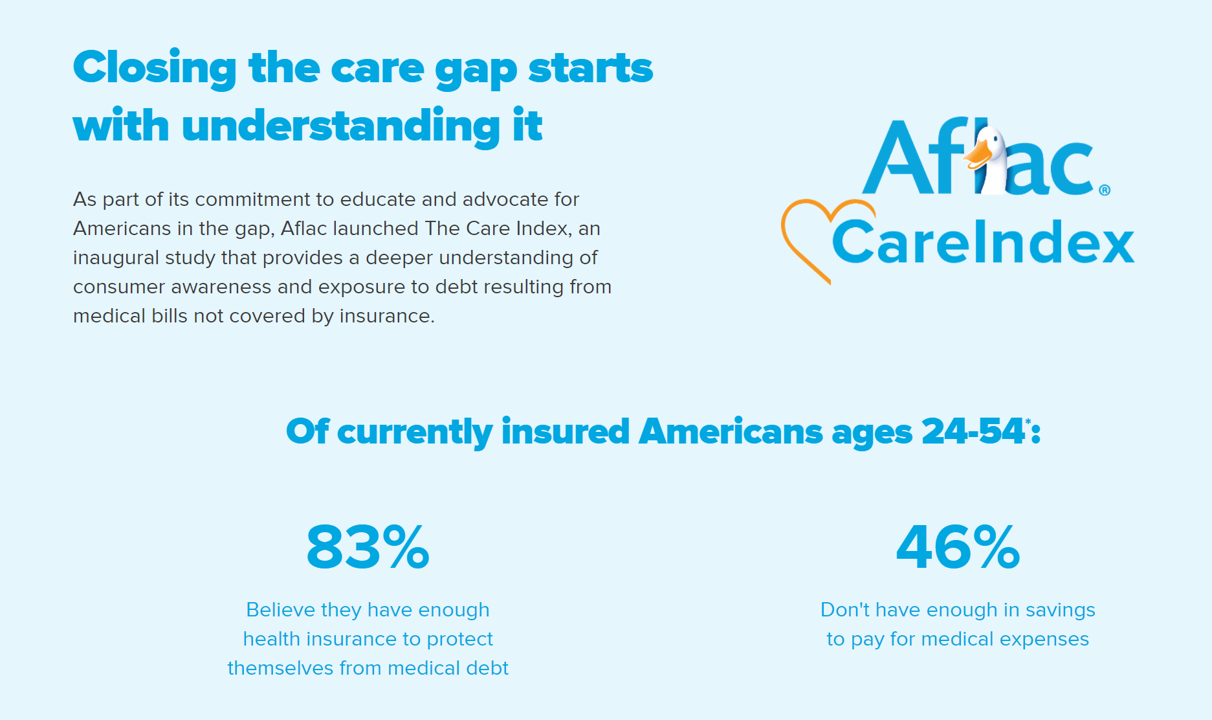

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

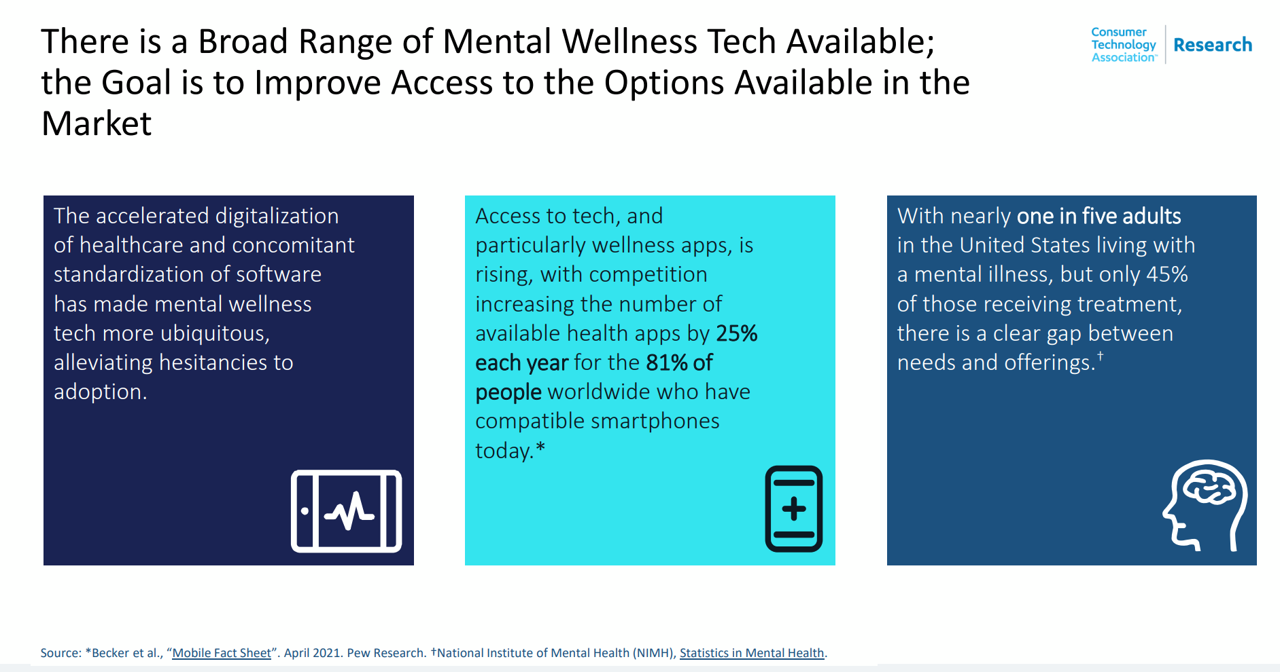

Mental Health at CES 2022 – The Consumer’s Context for Wellbeing in the New Year

As we enter COVID-19’s “junior year,” one unifying experience shared by most humans are feelings of pandemic fatigue: anxiety, grief, burnout, which together diminish our mental health. There are many signposts pointing to the various flavors of mental and behavioral health challenges, from younger peoples’ greater risk of depression and suicide ideation to increased deaths of despair due to overdose among middle-aged people. And about one-in-three Americans has made a 2022 New Year’s resolution involving some aspect of mental health, the American Psychiatric Association noted approaching the 2021 winter holiday season. Underneath this overall statistic are important differences across various

Health Care Planning for 2022 – Start with a Pandemic, Then Pivot to Health and Happiness

One of my favorite Dr. Seuss characters is the narrator featured in the book, I Had Trouble In Getting to Solla-Sollew. I frequently use this book when conducting futures and scenario planning sessions with clients in health/care. “The story opens with our happy-go-lucky narrator taking a stroll through the Valley of Vung where nothing went wrong,” the Seussblog explains. Then one day, our hero (shown here on the right side of the picture from the book) is not paying attention to where he is walking….thus admitting, “And I learned there are troubles of more than one kind, some come from

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

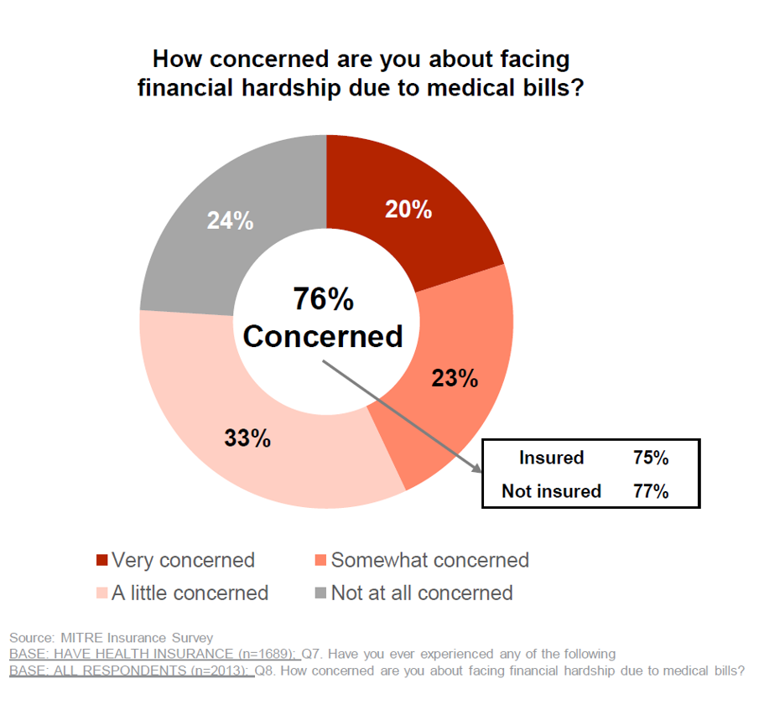

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

Aflac Finds Health Care and Financial Stress will “Dampen 2021 Holiday Magic” in U.S. Households

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey. Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America. Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with

Fastest-Growing Brands for 2021 Are About Digital Money, Social Connections and Boomers’ Best Lives

Two pharmaceutical companies bubble up among the 20 fastest-growing brands for 2021 in Morning Consult’s report on the Fastest-Growing Brands of 2021. But the surprise in this year’s top 20 brand rankings was that five of them addressed consumers’ financial flows: Coinbase, AfterPay. Cash App, Mastercard, Chime, and Bitcoin. One year ago when I covered this study, I found that the fastest-growing brands of 2020 had everything to do with the pandemic. They dealt with home entertainment, digital connectivity, hygiene, and indeed, health (with Pfizer and AstraZeneca the two pharma brands top-of-mind for consumers). In this year’s update, exploring consumers’

Best Buy Buys Current Health As Our Homes Morph Into Health Spaces

Best Buy continues to grow its health/care market footprint and service portfolio through remote health monitoring, first announced in the press release, Best Buy to acquire Current Health to help make home the center of health. The financial deal was disclosed yesterday at £300 million, about $400 million US dollars (FYI, Current Health is based in Scotland, thus value given in pounds sterling, with a particularly strong US $ exchange right now at 1.34). Remote monitoring has been part of Best Buy Health’s vision from the time the company explained its big audacious goals for the health ecosystem in 2018

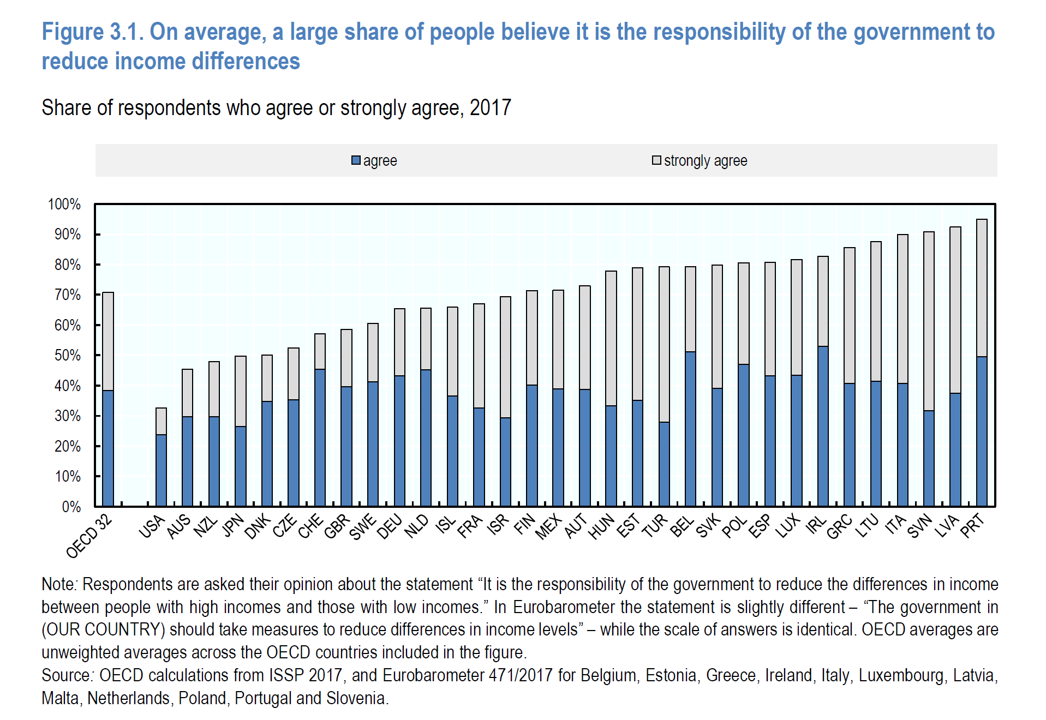

Does Inequality Matter in the U.S.? Health and the Great Gatsby Curve

Compared with the rest of the developed world, people living in the U.S. may be concerned about income inequality, but their demand for income redistribution is the lowest among peer citizens living in 31 other OECD countries. In their latest report, Does Inequality Matter? the OECD examines how people perceive economic disparities and social mobility across the OECD 32 (the world’s developed countries from “A” Australia to “U,” the United Kingdom). Overall the OECD 32 average fraction of people who believe it is the government’s responsibility to reduce income differences among those who think disparities are too large is 80%

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

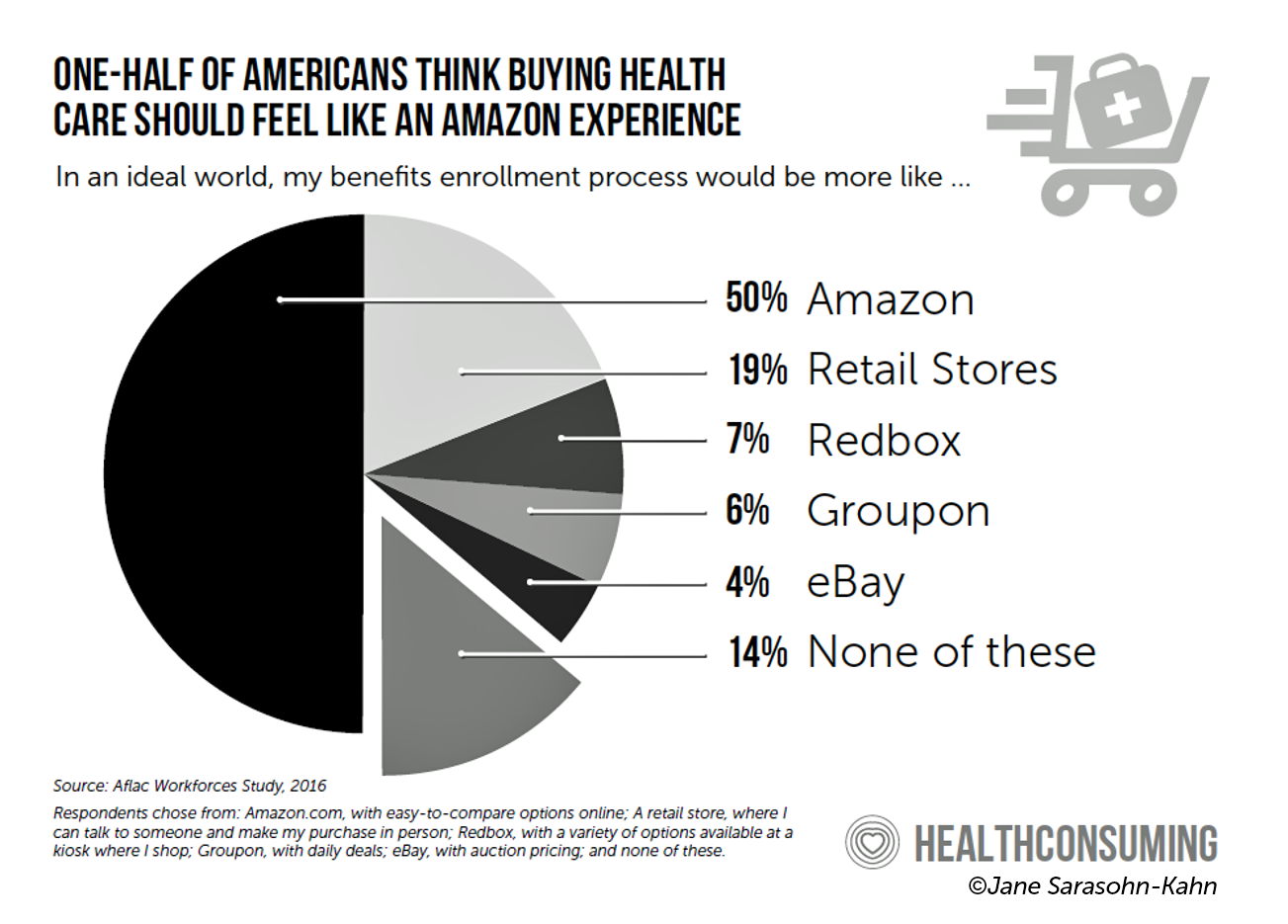

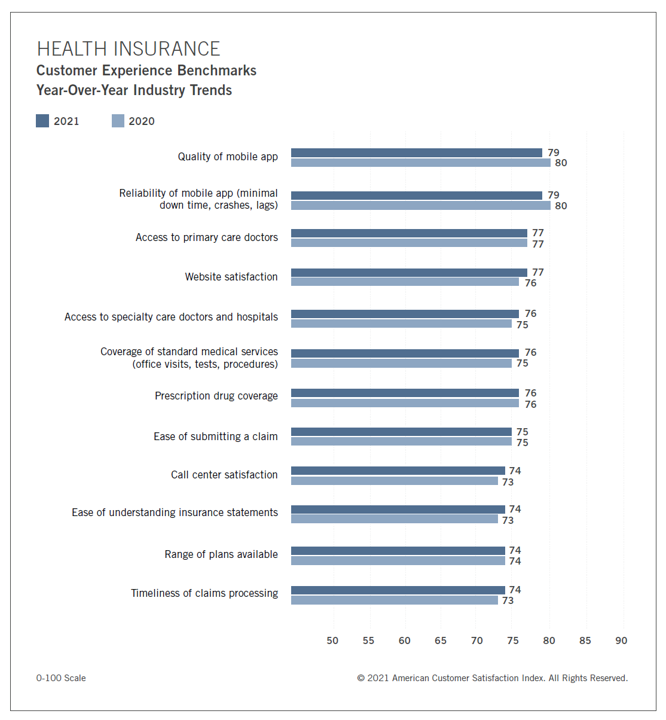

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

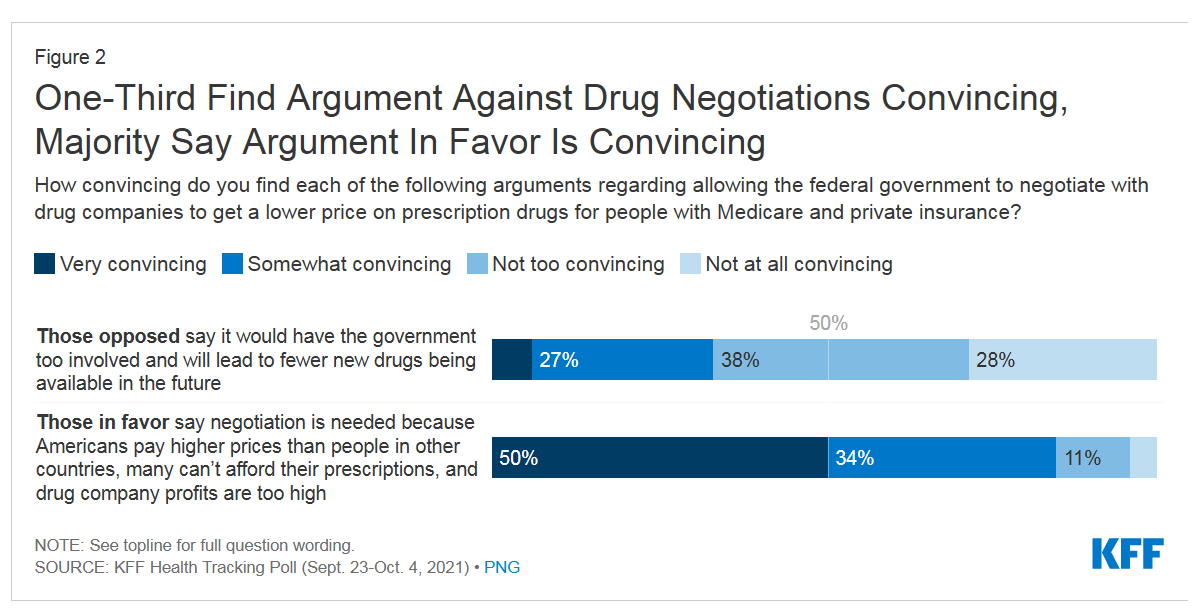

Support for Drug Price Negotiation Brings Partisans Together in the U.S.

Most U.S. adults across political parties favor allowing the Federal government authority to negotiate for drug prices — even after hearing the arguments against the health policy. Drug price negotiation, say by the Medicare program, is a unifying public policy in the current era of political schisms in America, based on the findings in a special Kaiser Family Foundation (KFF) Health Tracking Poll conducted in late September-early October 2021. Overall, 4 in 5 Americans favor allowing the Federal government negotiating power for prescription drug prices, shown in the first chart from the KFF report. By party, nearly all Democrats agree

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...