Financial Strain Among Older People in America, and What Project 2025 Could Mean for Their Well-Being

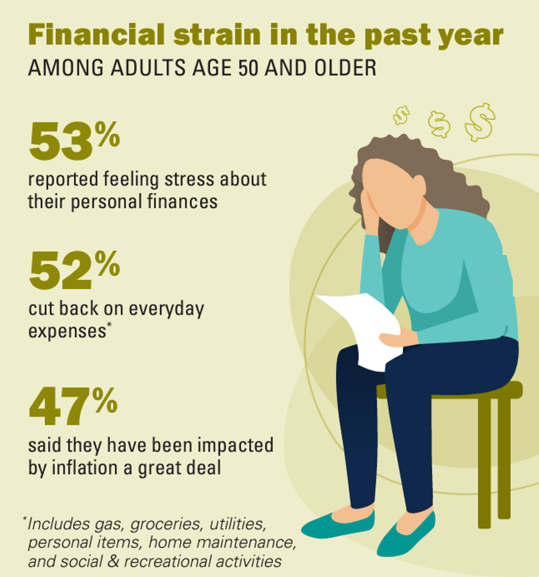

Over one-half of people 50 years of age and older in the U.S. have felt financial strain in the past year, resulting in 1 in 2 folks cutting back on everyday expenses like groceries and gas. We learn that nearly one-half of people 50 and over say they’ve been impacted by inflation “a great deal” in Making Ends Meet: Financial Strain and Well-Being Among Older Adults, the latest report from the Institute for Healthcare Policy and Innovation’s National Poll on Healthy Aging based at the University of Michigan (my alma mater). The poll was conducted by NORC at the University

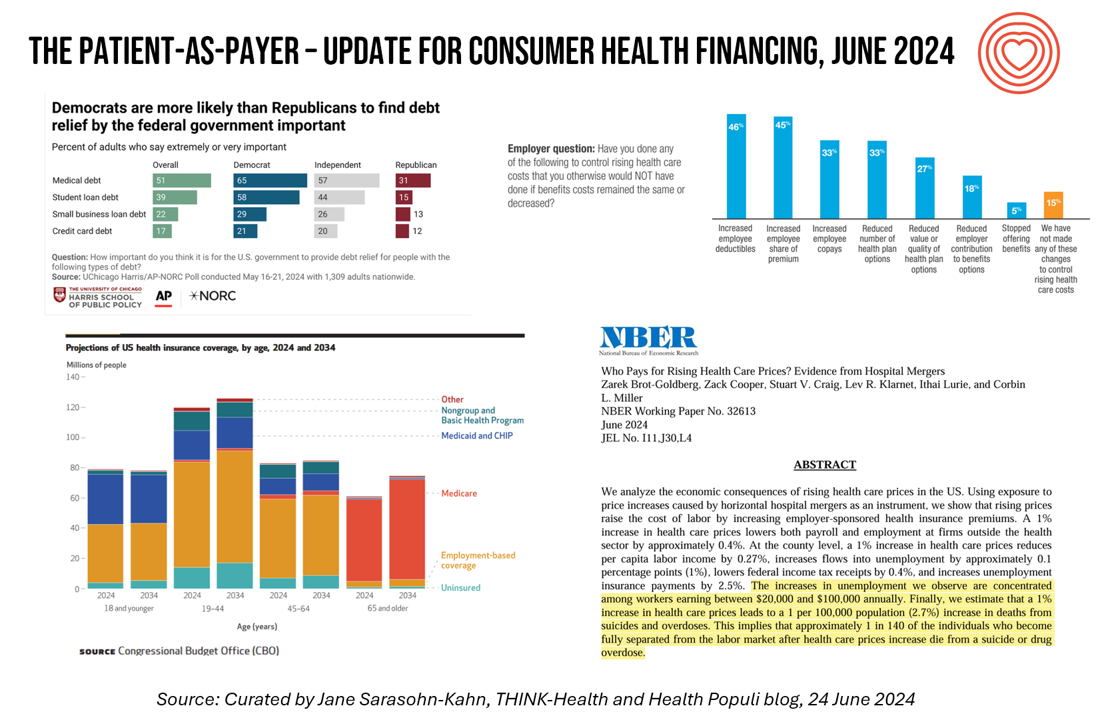

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

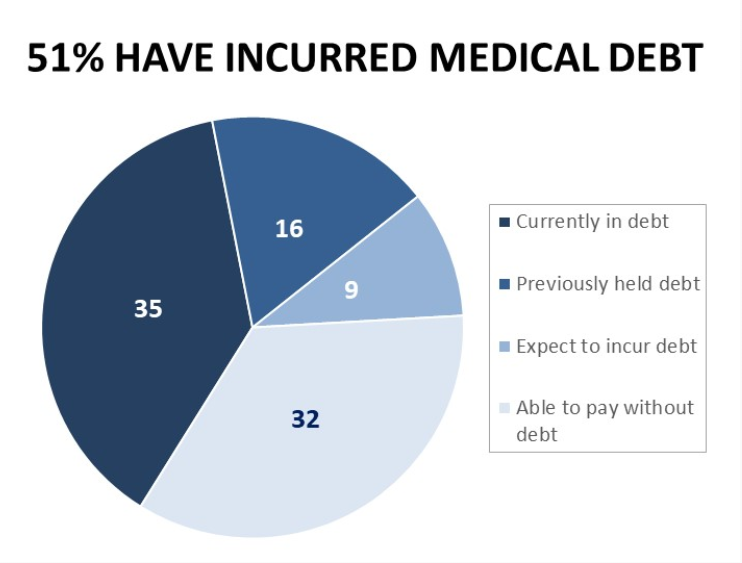

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

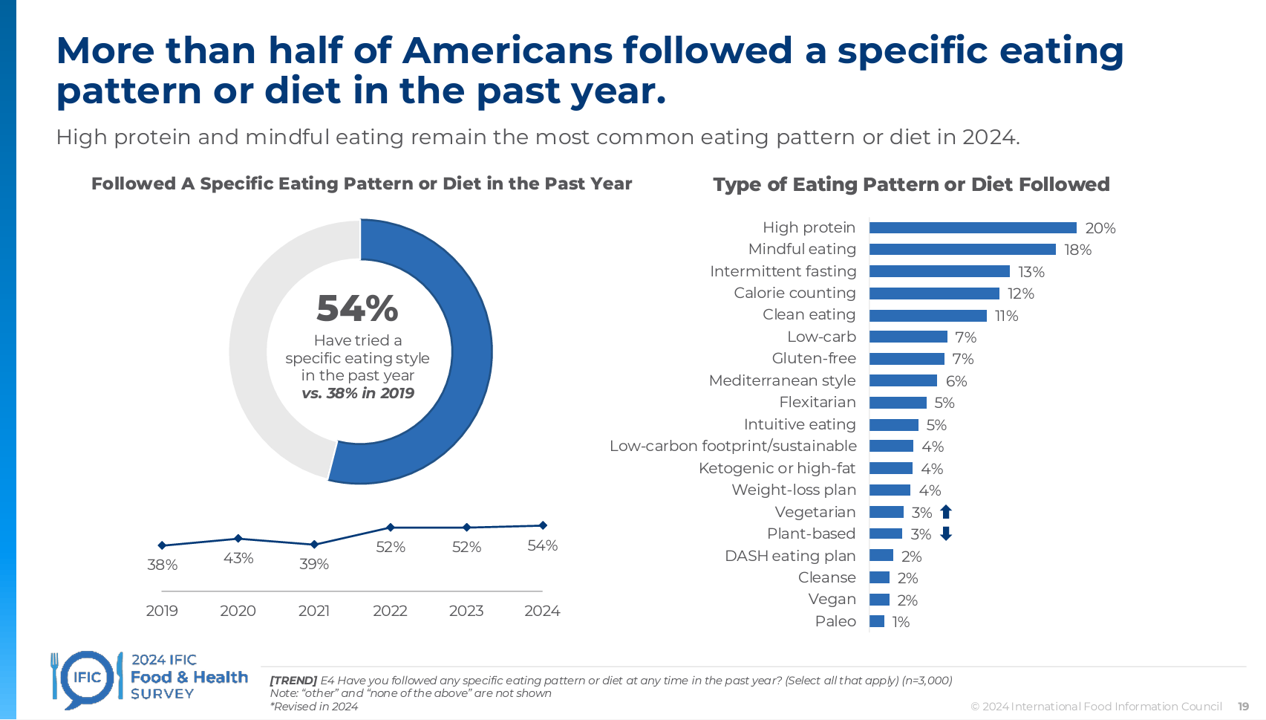

Most Americans Follow an Eating Pattern in Search of Energy, Protein, and Well-Being – With Growing Financial Stress: A Food as Medicine Update

Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned. In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

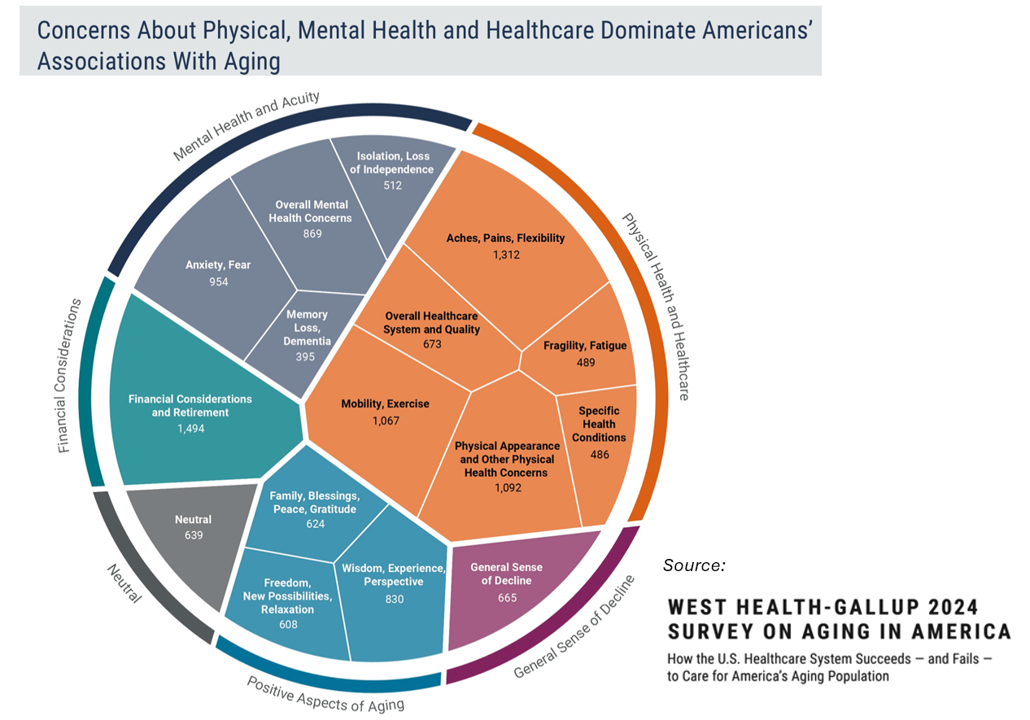

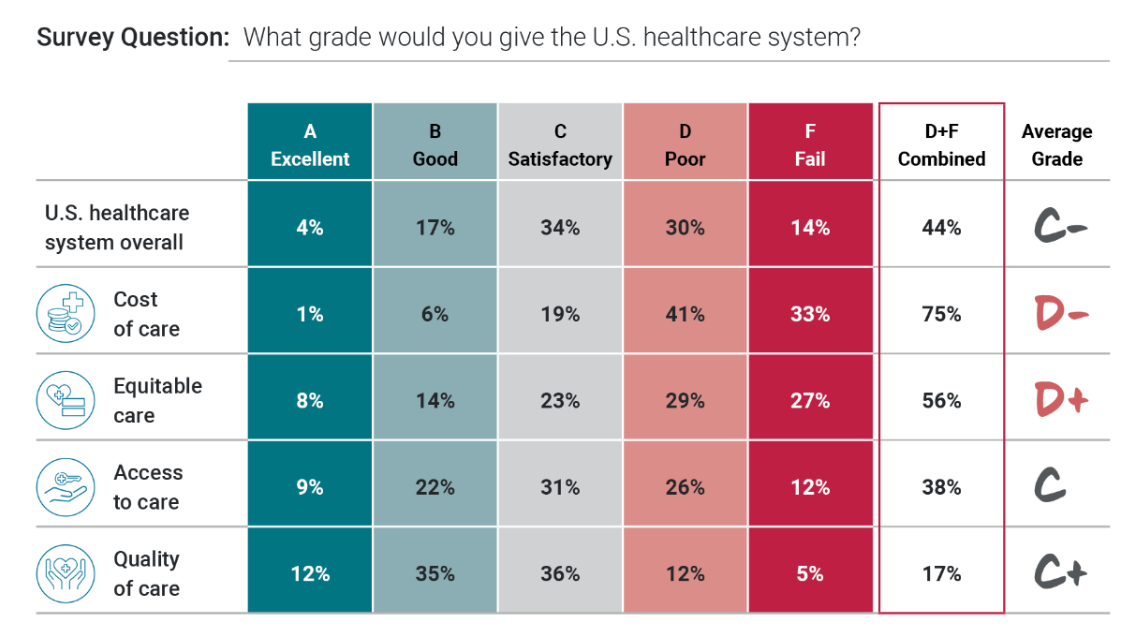

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

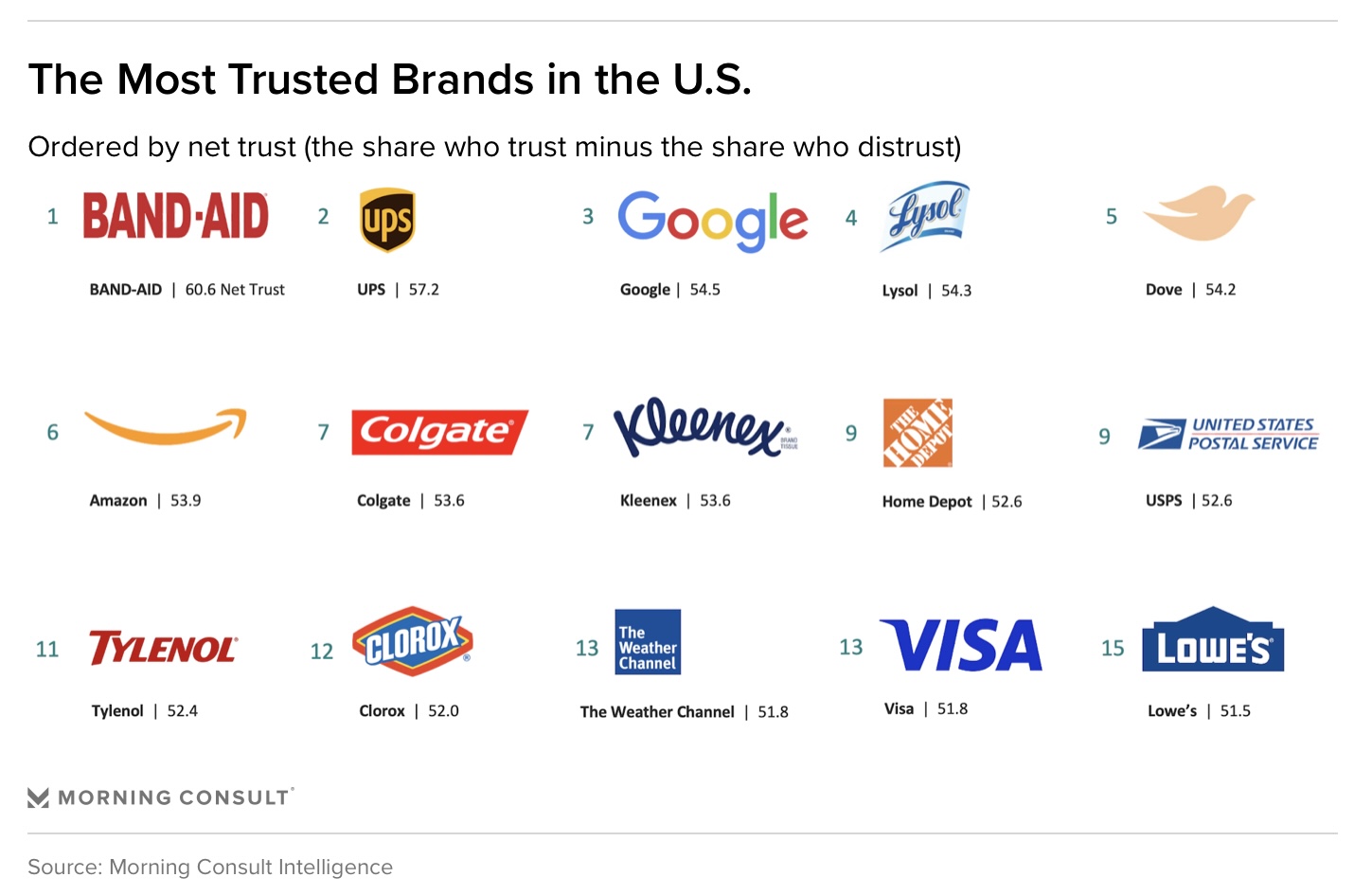

The Most Trusted Brands of 2024 Tell Us A Lot About Health Consumers

From bandages to home hygiene, OTC pain meds and DIY home projects, Morning Consult’s look into the most-trusted brands of 2024 give us insights into health consumers. I’ve been tracking this study since before the public health crisis of the coronavirus, and it always offers us a practical snapshot of the U.S. consumer’s current ethos on trusted companies helping people risk-manage daily living — and of course, find joy and satisfaction as well. In the top 15, we find self-care for health and well-being in many brands and products: we can call out Band-Aid, Dove, Colgate, Kleenex, and Tylenol. For

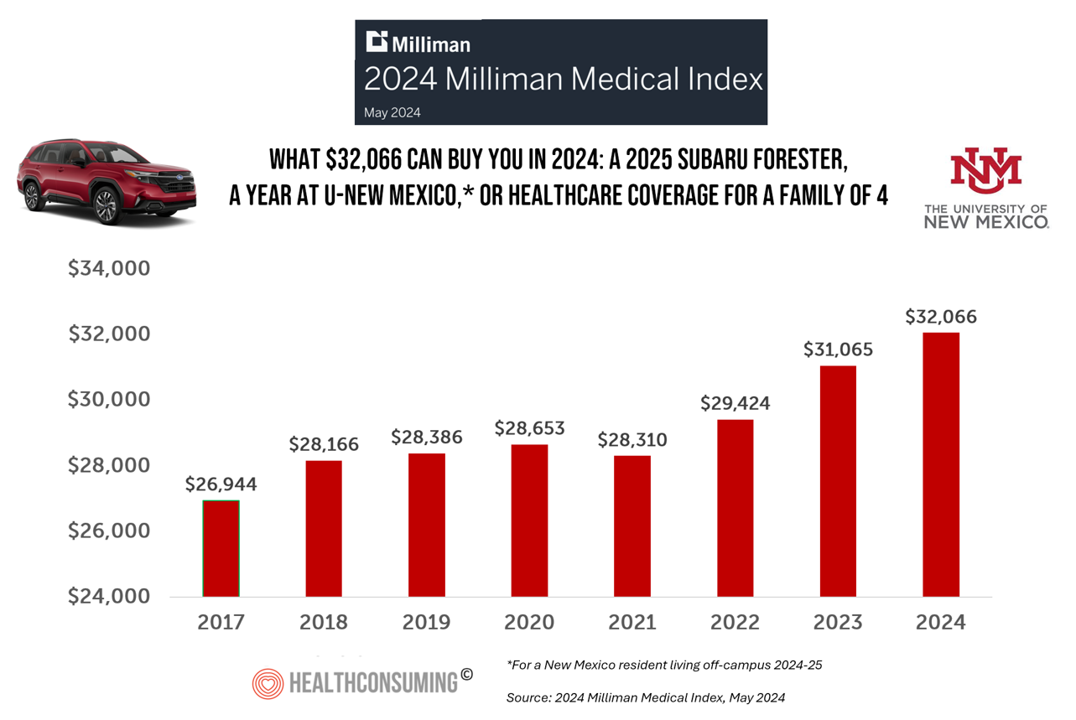

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

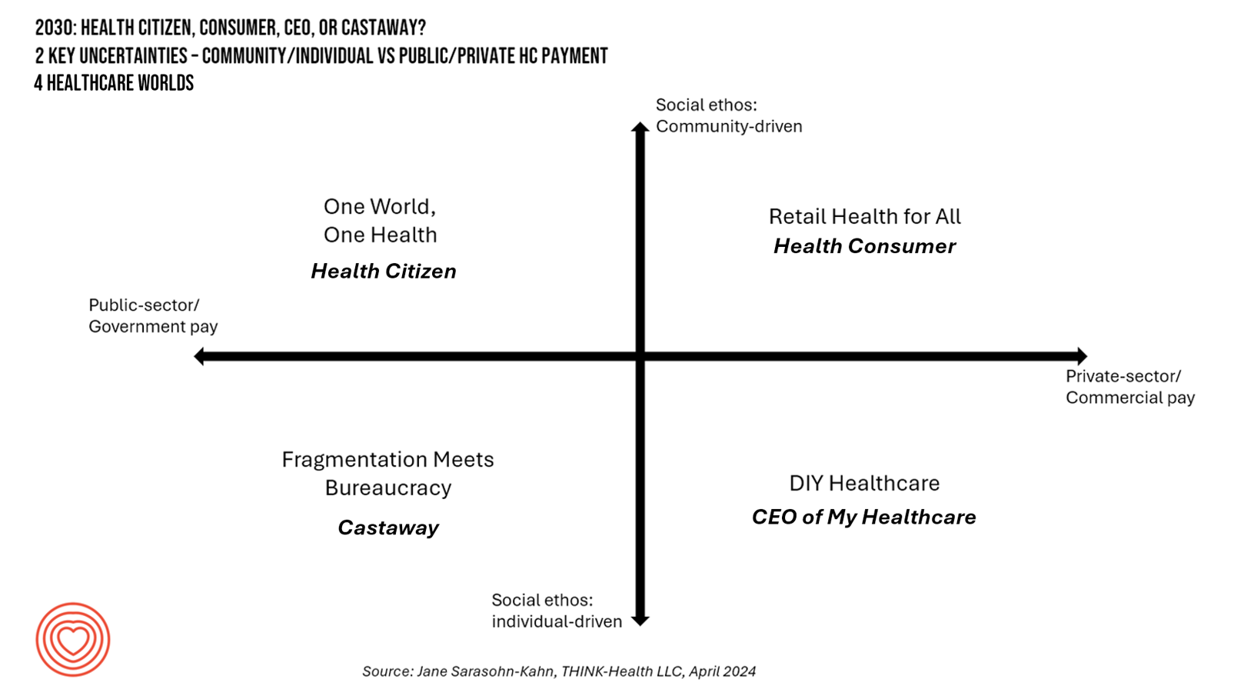

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

A Springtime Re-Set for Self-Care, From Fitness to Cozy Cardio: Peloton’s Latest Consumer Research

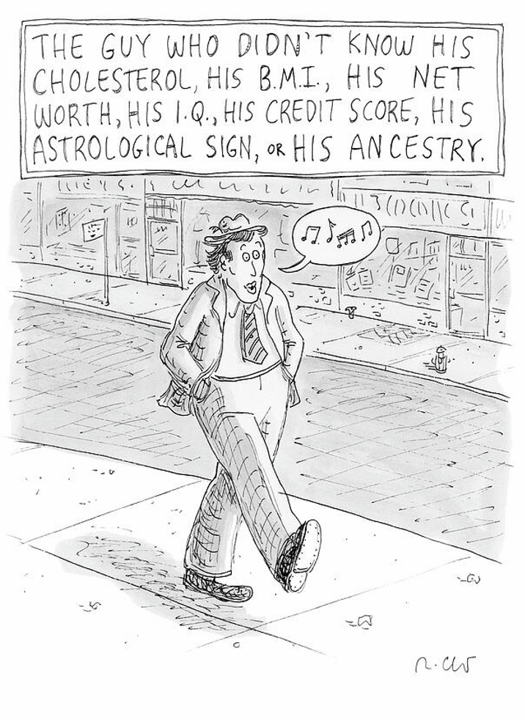

How many people do you know that don’t know their cholesterol or their BMI, their net worth or IQ, their credit score, astrological sign, or ancestry pie-chart? Chances are fewer and fewer as most people have gained access to medical records and lab test results on patient portals, calorie burns on smartwatches, credit scores via monthly credit card payments online, and completing spit tests from that popularly gifted Ancestry DNA test kits received during the holiday season. Meet “The Guy Who Didn’t Know His Cholesterol” conceived by Roz Chast,

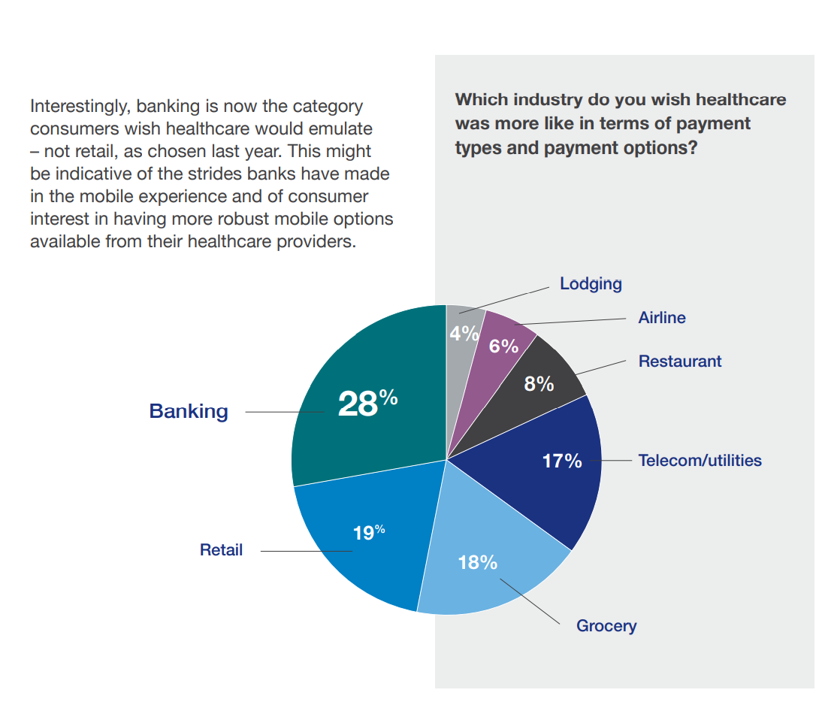

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

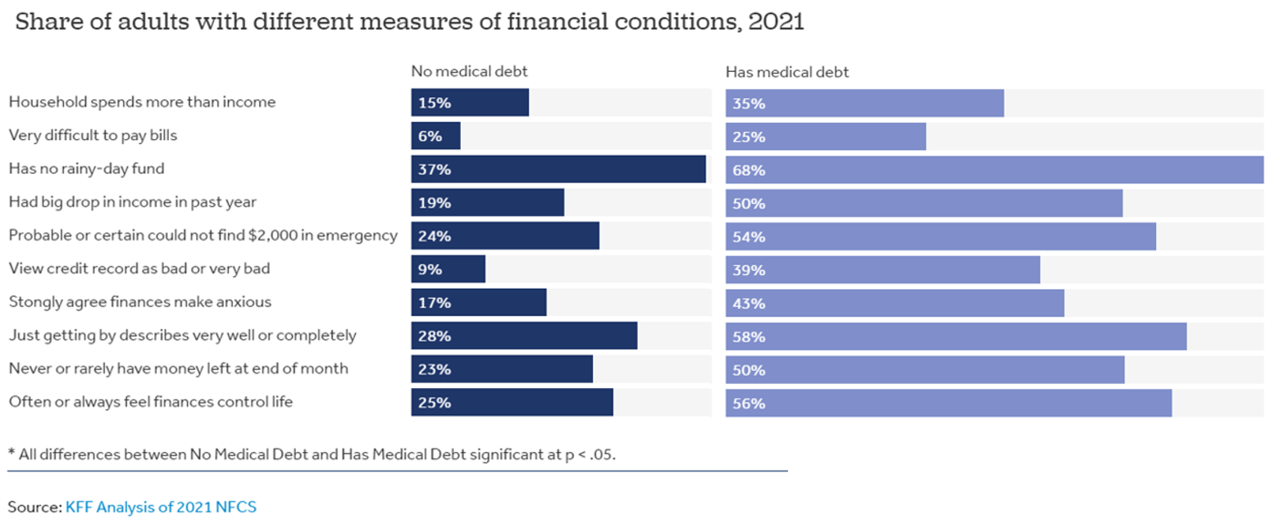

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

The Health Consumer in 2024 – The Health Populi TrendCast

At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen. As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household,

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

Inflation and the cost of health care top U.S. voters’ issues for 2024 elections

The cost of living ranks top in U.S. voters’ minds among many issues Americans are feeling and following in late 2023. A close second in line is affordability of health care, as consumers’ household budgets must make room for paying medical bills — with prescription drug costs also very important as a discussion topic for 2024 Presidential candidates, we learn from the latest KFF Health Tracking Poll published 1 December. The monthly study focused on U.S. voters’ top issues and perspectives on the health system and care approaching the new year of 2024. KFF fielded the study among 1,301 U.S.

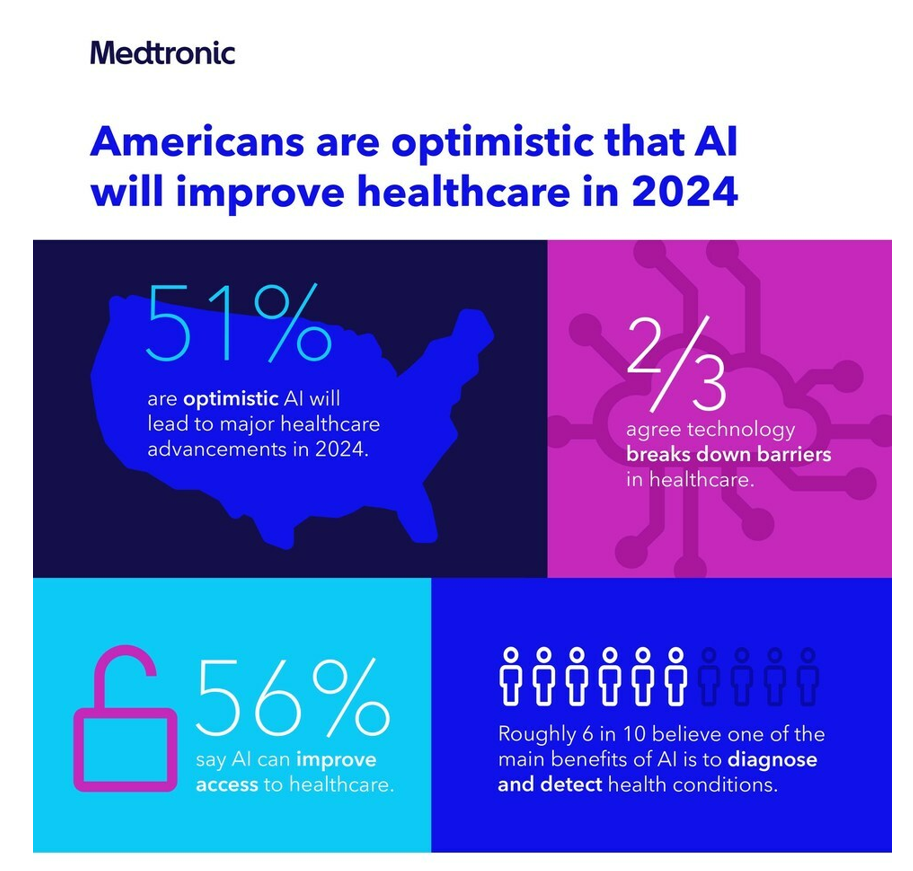

The Consumerization of AI in Healthcare – The Early Days of AI-Trust

Most people in the U.S. are bullish on the role AI will play in health care in 2024, especially to lower access barriers to care and to diagnose and detect health conditions. Two new studies point to the consumerization of AI in healthcare, from Medtronic and Deloitte. This post weaves their findings together and suggests some planning points for 2024. Medtronic collaborated with Morning Consult to poll 2,213 U.S. adults in late September 2023 to gauge peoples’ perspectives on AI and health care. With such optimism among health consumers comes some

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

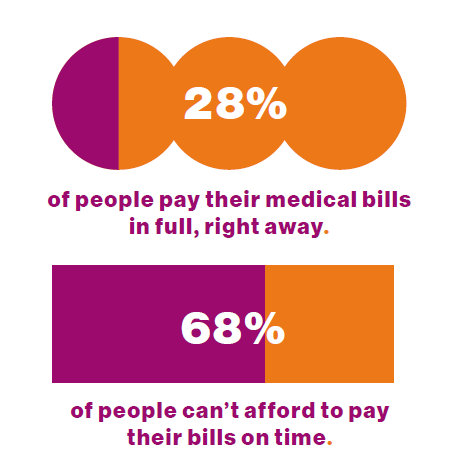

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

How Ahold-Delhaize Connects the Grocery, Climate Change, ESG and Consumers’ Health

In the food sector, “the opportunity for us and the role that we play is to connect climate and health,” Daniella Vega of Ahold Delhaize told Valerio Baselli during the Morningstar Sustainable Investing Summit 2023. In a conversation discussing the importance of non-financial metrics in companies’ ESG efforts, Vega connected the dots between climate change, retail grocery, and consumers’ health and well-being. Vega is the Global Senior Vice President, Health & Sustainability, with Ahold Delhaize— one of the largest food retail companies in the world. Based in the Netherlands, the company operates mainly in

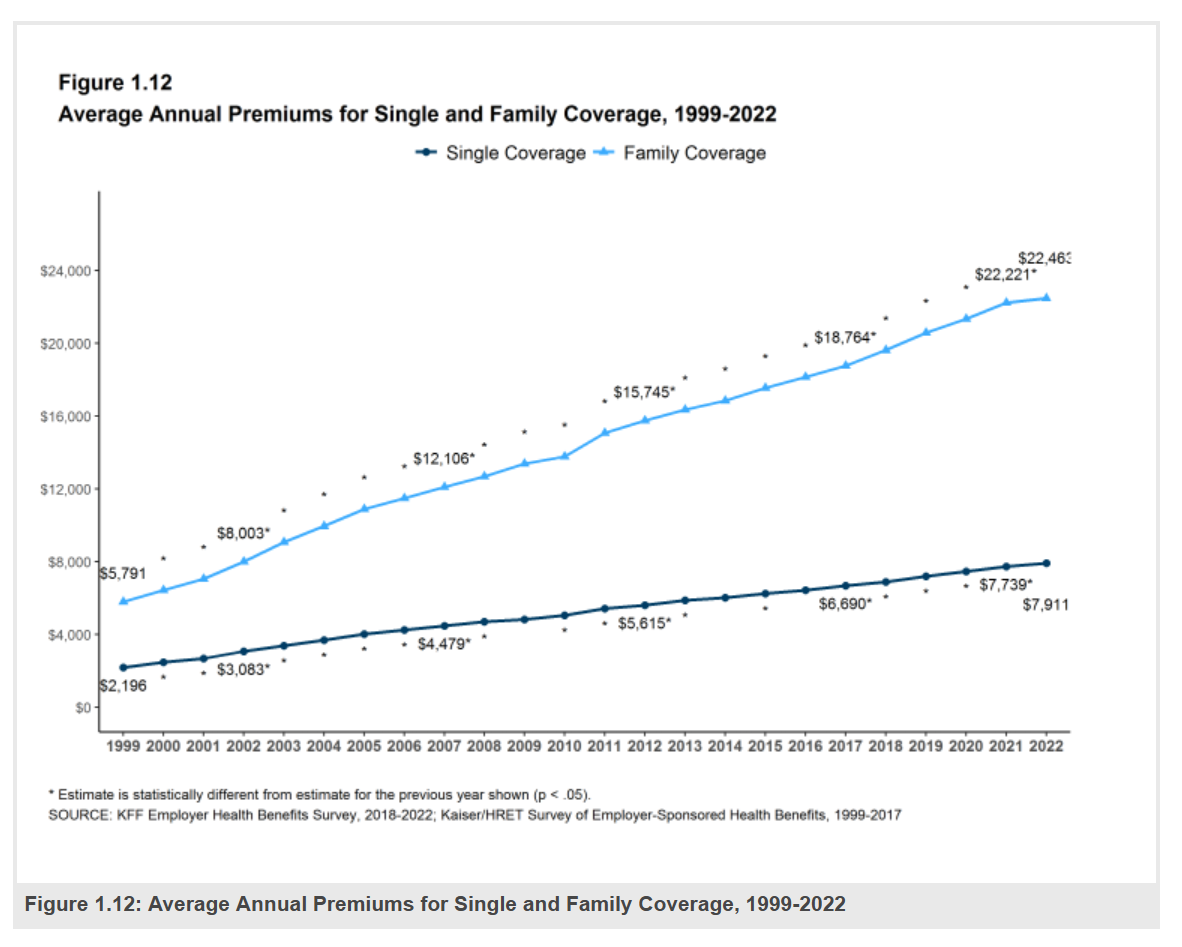

Money and Mental Health in the U.S. – How Difficulty Paying Medical Bills Can Hurt Healing and Well-Being

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network. Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023. That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that

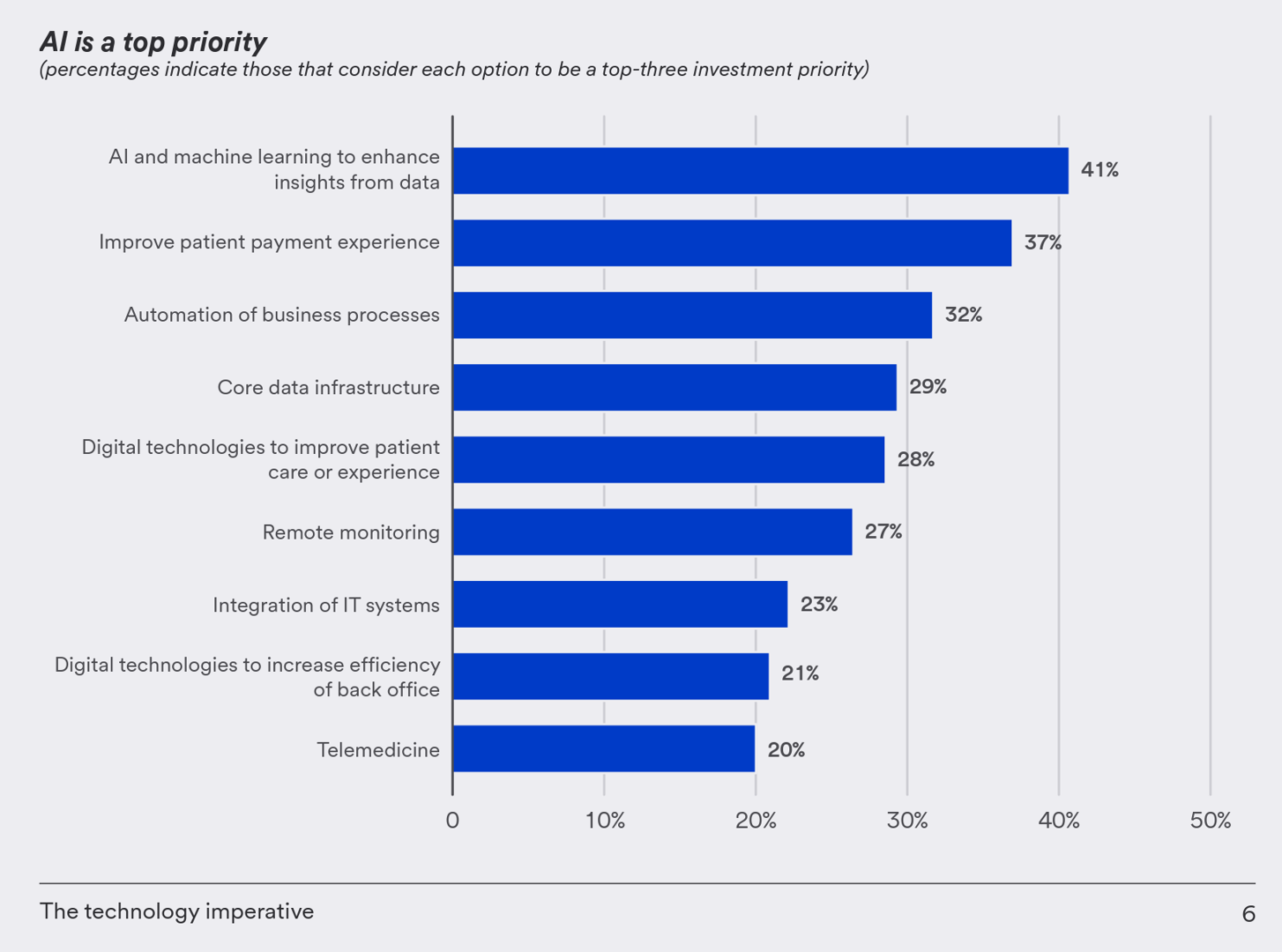

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

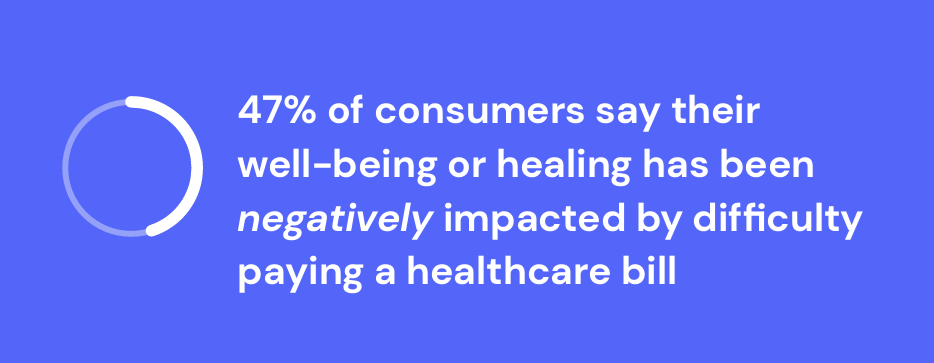

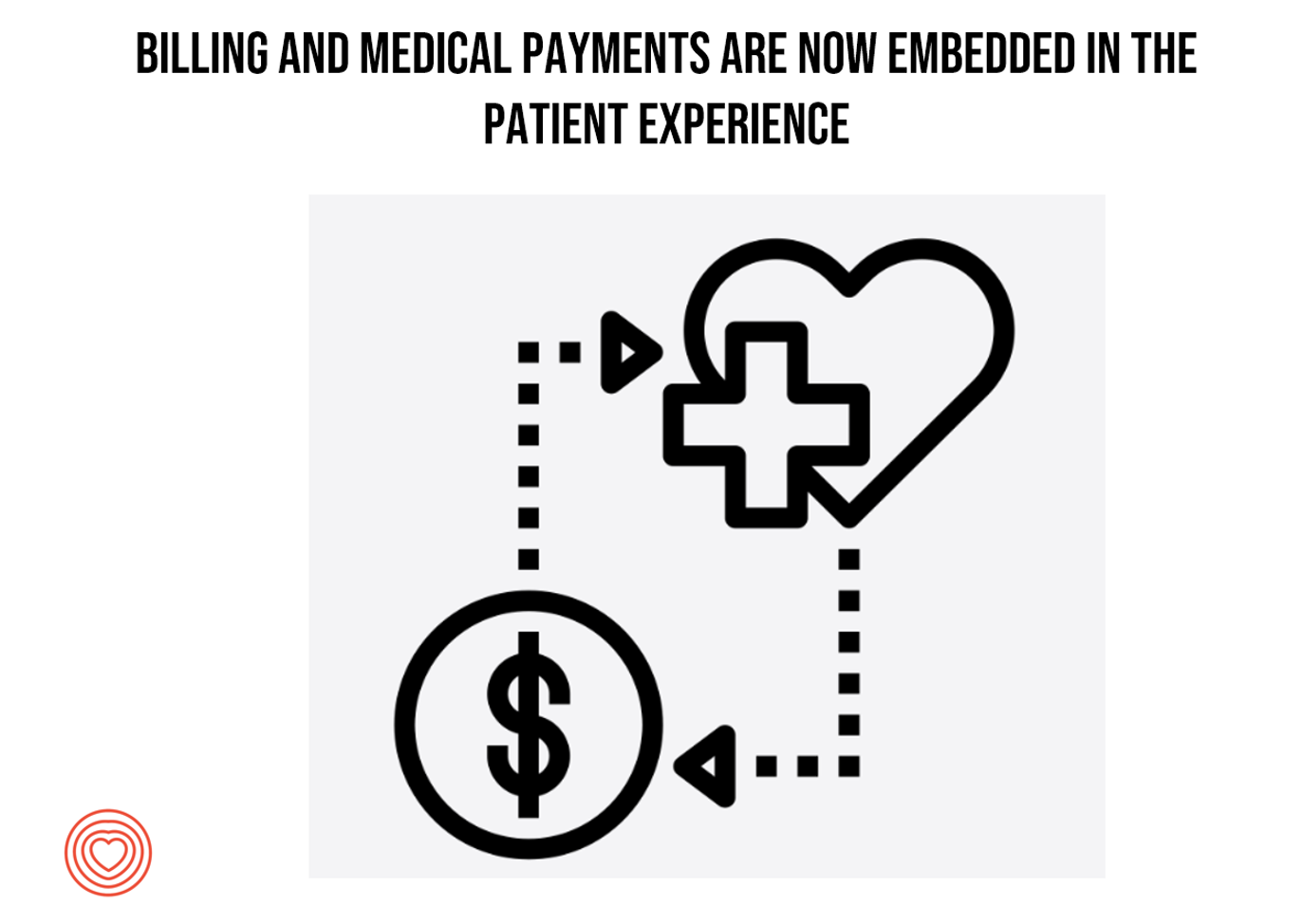

The Healthcare Financial Experience is a Stressful One: the Convergence of our Medical, Retail, and Financial Lives

One in two consumers in the U.S. feel their well-being or healing was negatively impacted by difficulty paying for their medical care. Welcome to the convergence of patients’ health care life with financial and retail lives, we learn from the 2024 Healthcare Financial Experience Study from Cedar. And that patient’s positive clinical experience can absolutely reverse the consumer’s perception of the provider, noted by this quote from OSU’s Chief Financial Officer Vincent Tammaro: “We’ve cured you of your ailment, but we’ve harmed you financially.” That’s a form of financial toxicity that

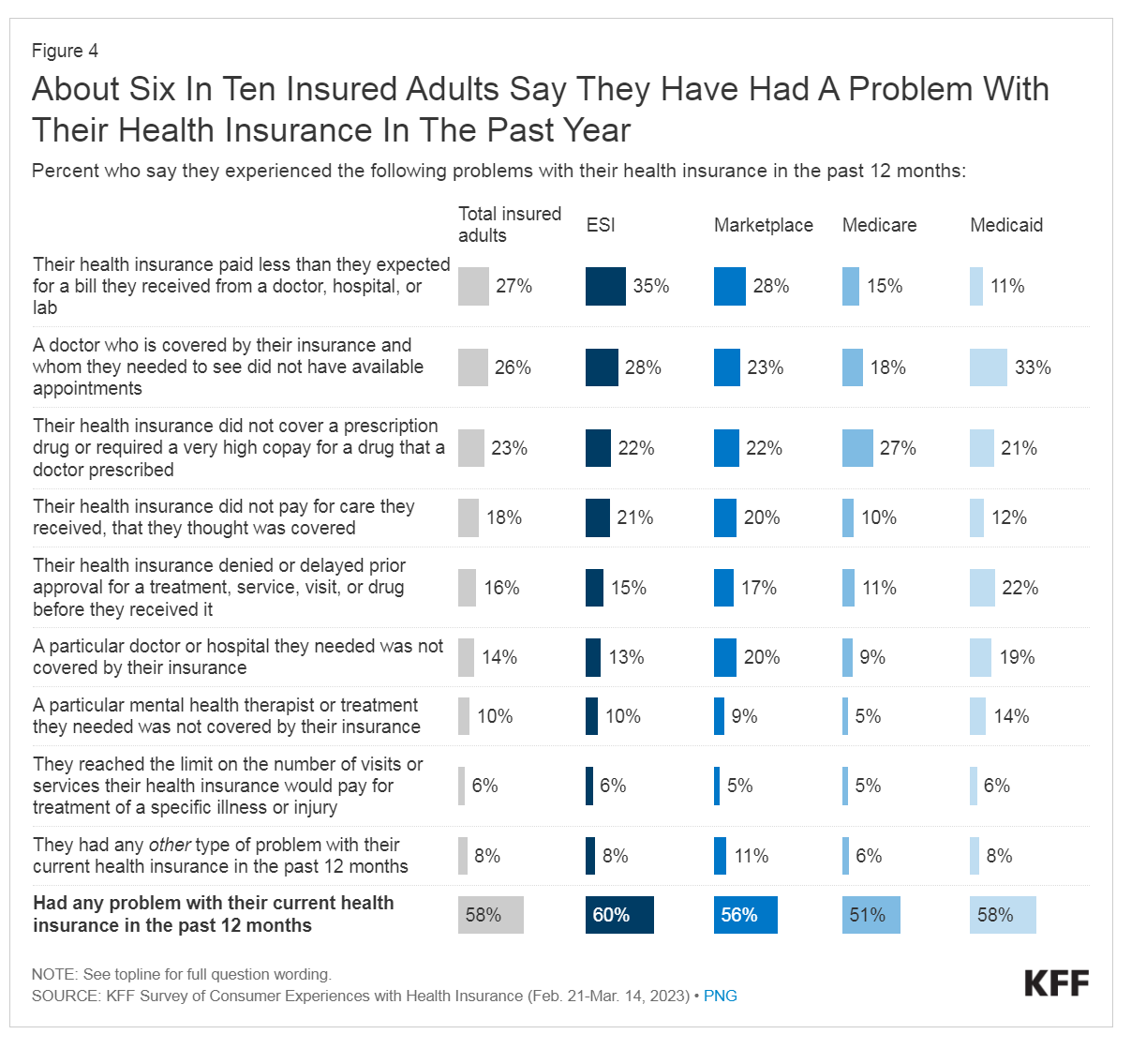

The Latest KFF Poll on Consumer Experiences with Health Insurance Speaks Volumes About Patients’ Administrative Burden

People love being health-insured, but their negative experiences with health plans create serious burdens on patients-as-consumers. And those burdens impact even more people who are unwell than healthier folks. The 2023 Kaiser Family Foundation Survey of Consumer Experiences with Health Insurance updates our understanding of and empathy for insured peoples’ Patient Administrative Burdens (PAB). For this study, KFF polled 3,605 U.S. adults 18 and over in February and March 2023 who had health insurance across different plan types. Over the past several years, I’ve come to appreciate the concept of PAB by listening to and learning from colleagues Dr, Grace

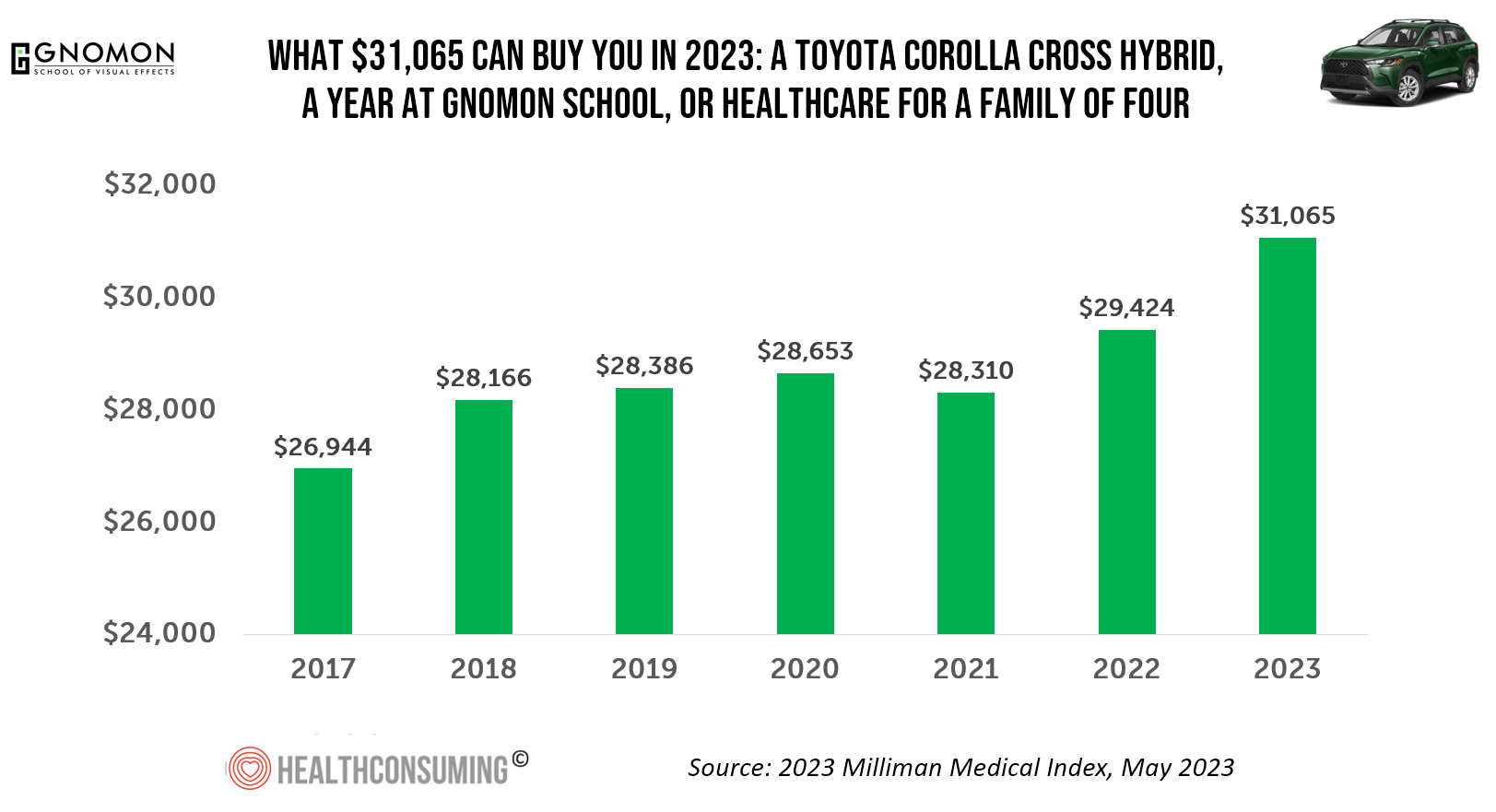

What $31,065 Can Buy You: a Toyota Corolla Cross Hybrid, a Year at Gnomon School, or Healthcare for a Family of 4 in America

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%. For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4. Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

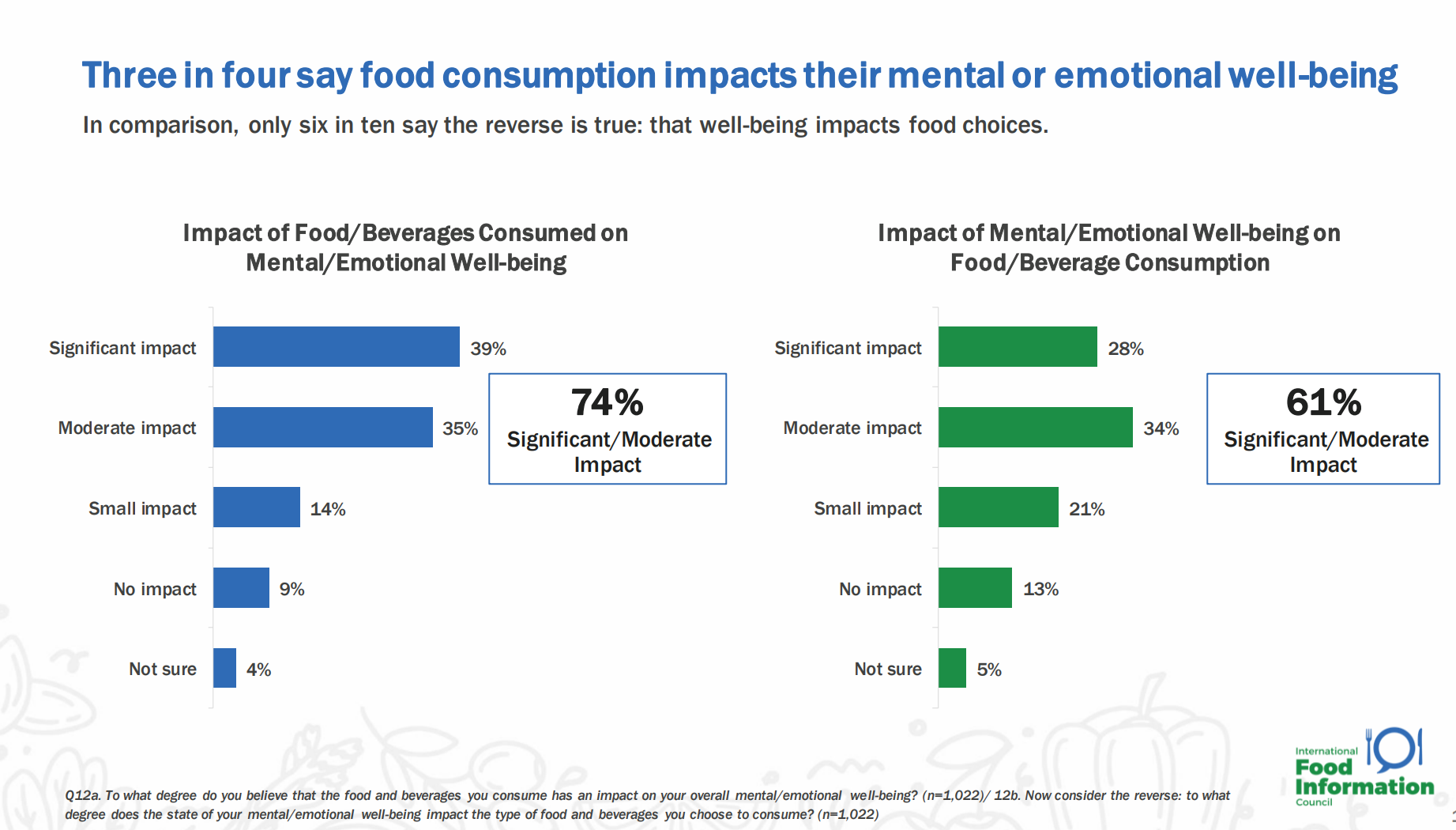

Our Mental and Emotional Health Are Interwoven With What We Eat and Drink – Chewing On the IFIC 2023 Food and Health Survey

As most Americans confess to feeling stressed over the past six months, peoples’ food and beverage choices have been intimately connected with their mental and emotional well-being, we learn from the 2023 Food & Health Survey from the International Food Information Council (IFIC). For this year’s study, IFIC commissioned Greenwald Research to conduct 1,022 interviews with adults between 18 and 80 years of age in April 2023. The research explored consumers’ perspectives on healthy food, the cost of food, approaches to self-care through food consumption, the growing role of social media in the food system, and the influence of sustainability

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

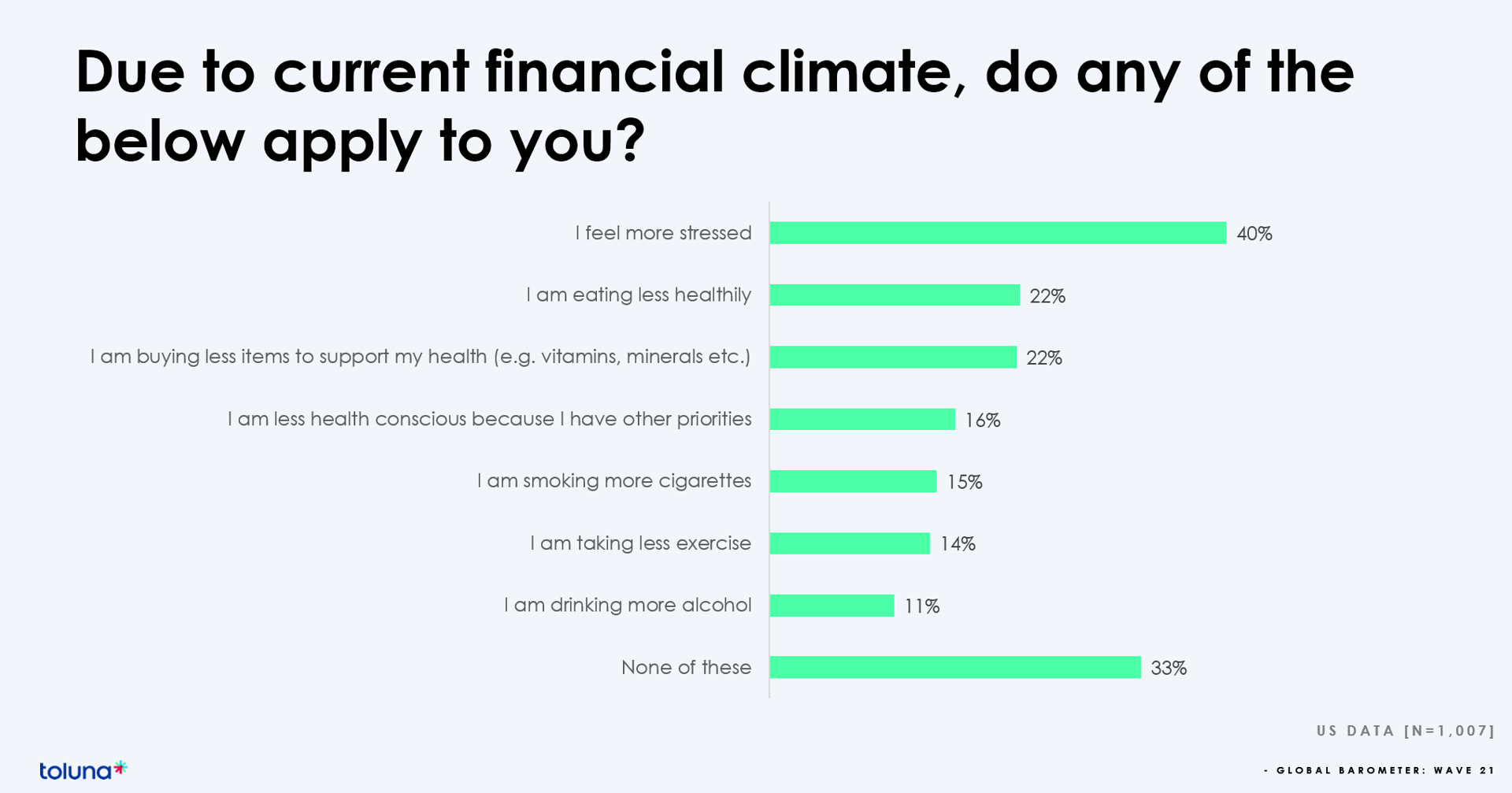

We Are All Health Consumers Now – Toluna’s Latest Look at Consumers’ Health & Well-Being

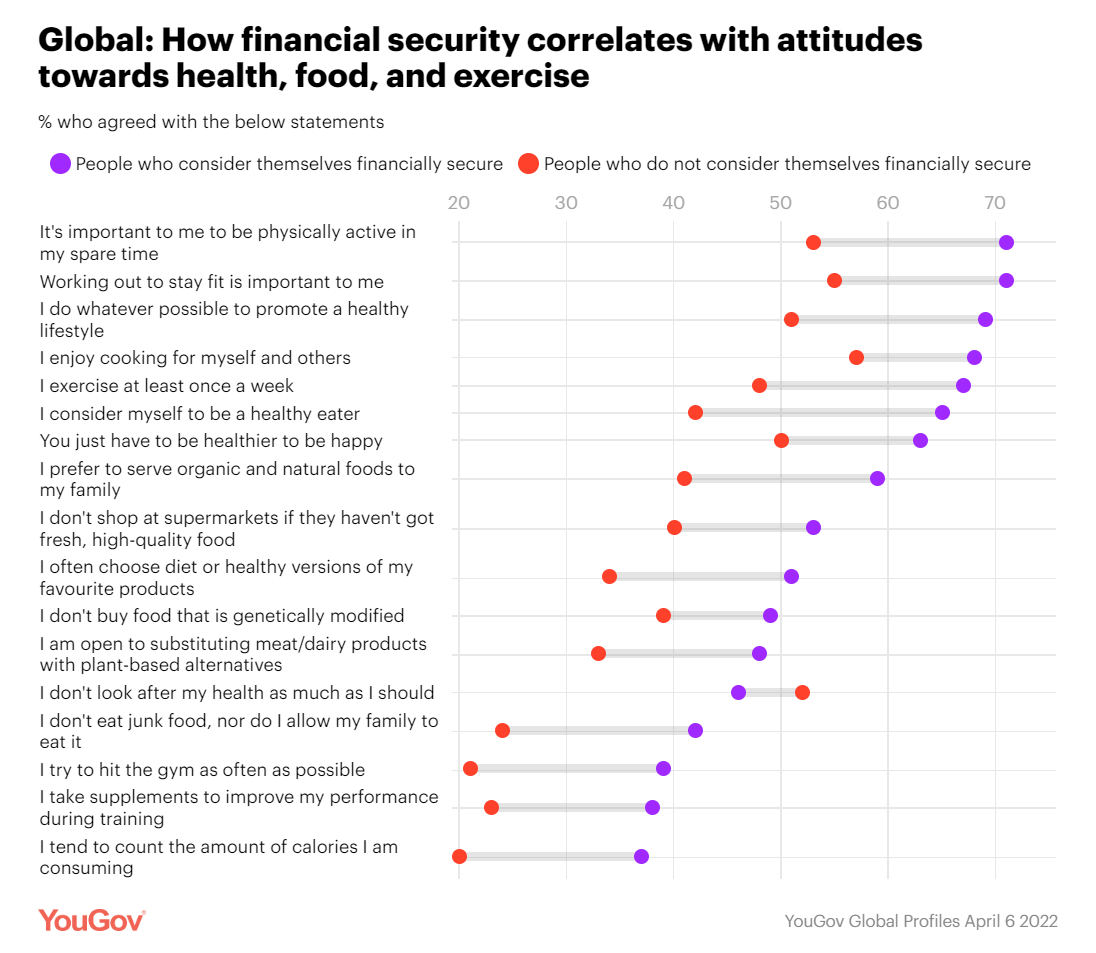

The challenging financial climate at the start of 2023 is impacting how people, globally, are perceiving, managing, and spending money on health and well-being, based on the latest (Wave 21) Global Consumer Barometer survey conducted by Toluna, a sister company of Harris Interactive. Globally, one-third of health citizens the world over are confronting greater stress levels due to the higher cost of living in their daily lives. One in two people say that rising cost of living is negatively impacting their health and well-being. On the positive side, one in three people believe

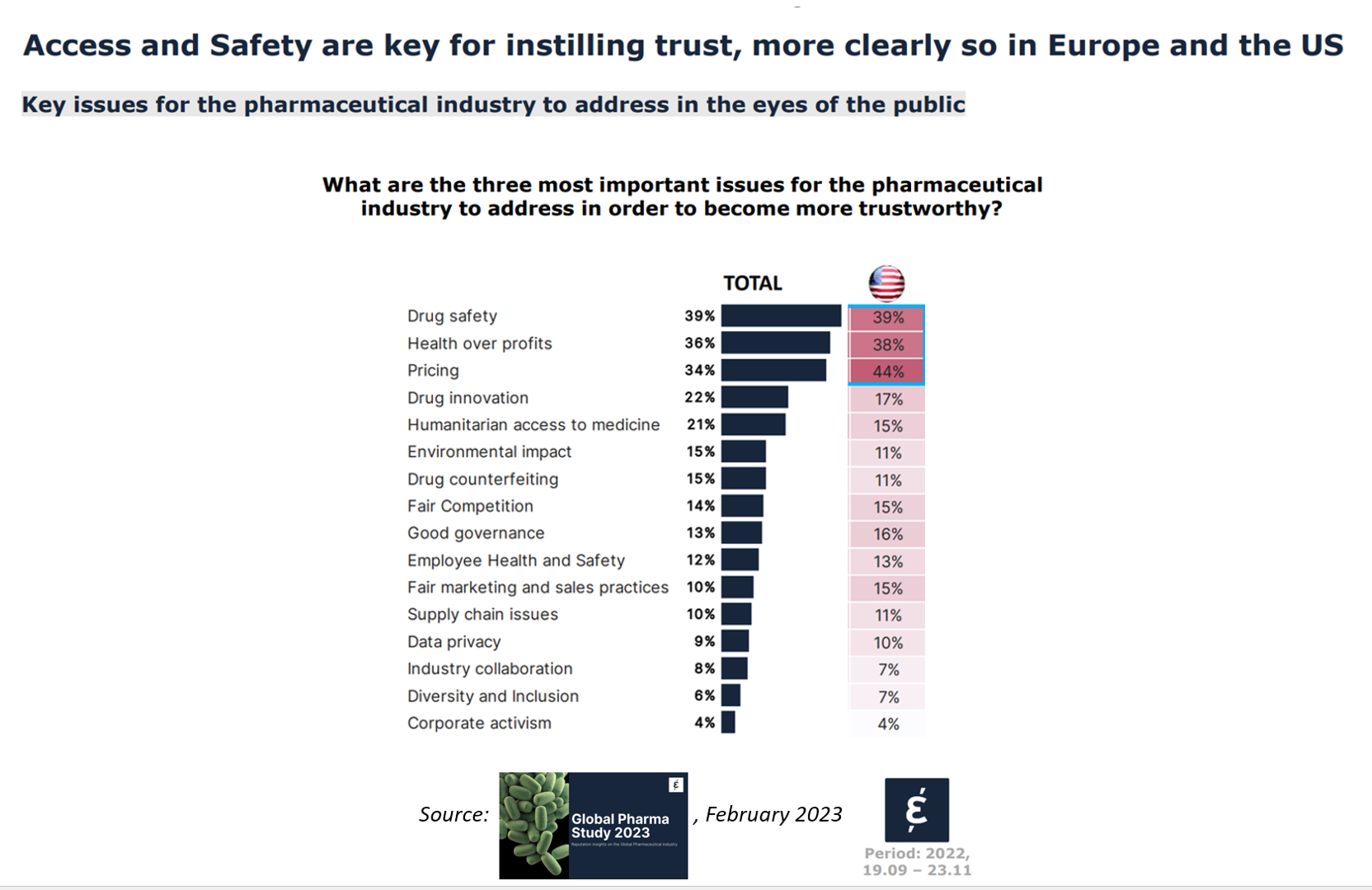

The Reputation of Pharma Among U.S. Consumers Is Tied More to Pricing Than to Innovation

In the U.S., price and the cost of medicines is tied to how people feel about the pharma industry, evidenced in the Global Pharma Study 2023 from Caliber. Caliber, a reputation and corporate strategy consultancy, fielded survey research among over 17,000 health consumers including U.S. adults between 18 and 75 years of age as well as health citizens living in Brazil, China, France, Germany, Japan, and the UK. Caliber assessed the reputation of 16 industries, globally, finding that pharma ranked 10th among the 16, just below automotive and just above chemicals (and well

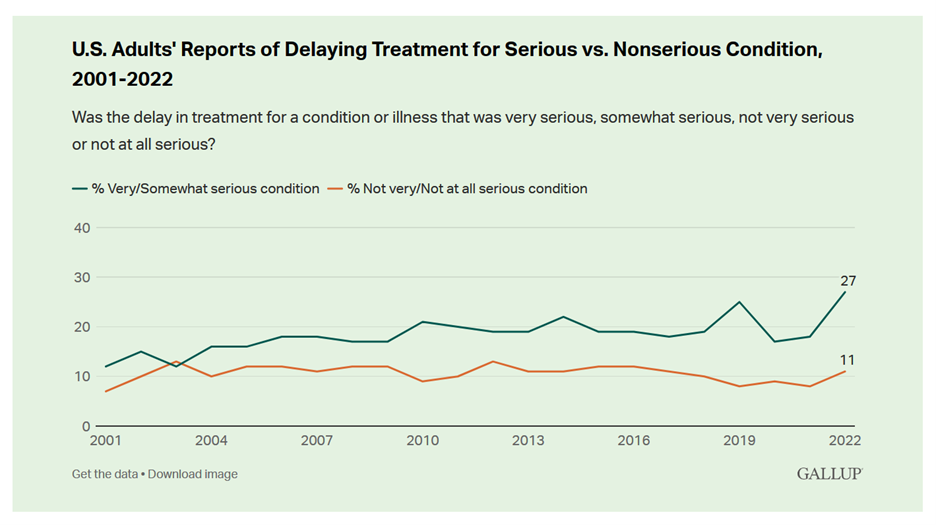

Record Numbers of People in the U.S. Putting Off Medical Care Due to Cost – A New “Pink Tax” on Women?

More people in the U.S. than ever have put off medical care due to cost, according to Gallup’s latest poll of patients in America. Gallup conducted the annual Health and Healthcare poll U.S. adults in November and December 2022. This was the highest level of self-rationing care due to cost the pollster has found since its inaugural study on the topic in 2001. This was also the most dramatic year-on-year increase of postponing treatment due to cost in the study’s history. Note the substantial difference in women avoiding

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

Dollar General & CHPA Collaborate to Bolster Health Consumers’ Literacy and Access for OTC Pain Meds and Self-Care

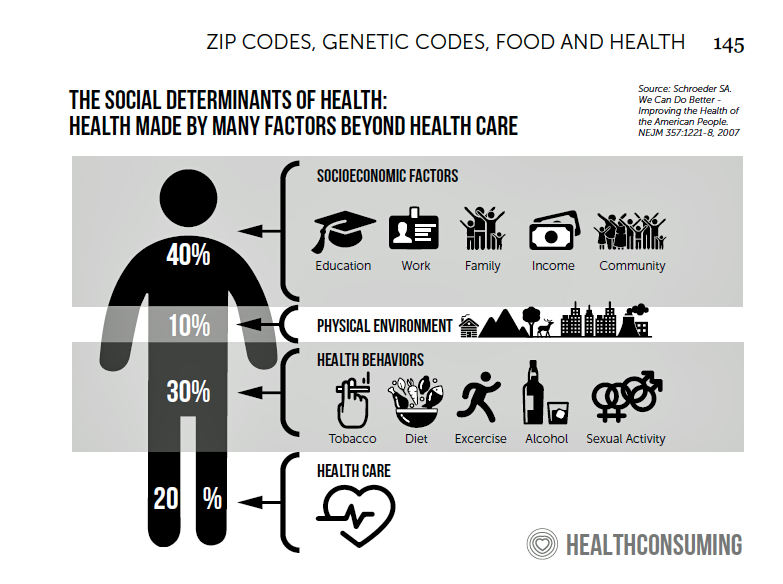

Health is “made” where we live, work, play, pray, learn….and shop. I spend a lot of time these days in the growing health/care ecosystem where retail health is broadening to address social determinants and drivers of health – namely food, transportation, broadband access, education, environment, and financial wellness – all opportunities for self-care and health engagement. For many years, I have followed the activities of CHPA, the Consumer Healthcare Products Association, and have participated in some of their conferences. Their recent announcement of a collaboration with Dollar General speaks to the growing role of self-care for all people.

The Food-Finance-Health Connection: Being Thankful, Giving Thanks

Food features central in any holiday season, in every one’s culture. For Thanksgiving in the United States, food plays a huge role in the history/legend of the holiday’s origins, along with the present-day celebration of the festival. At the same time, in and beyond the U.S., families’ finances will also be playing a central role in dinner-table conversations, shopping on the so-called “Black Friday” retail season (which has extended long before Friday 25th November), and in what’s actually served up on those tables. Let’s connect some dots today on food, finance and health as we enter the holiday season many

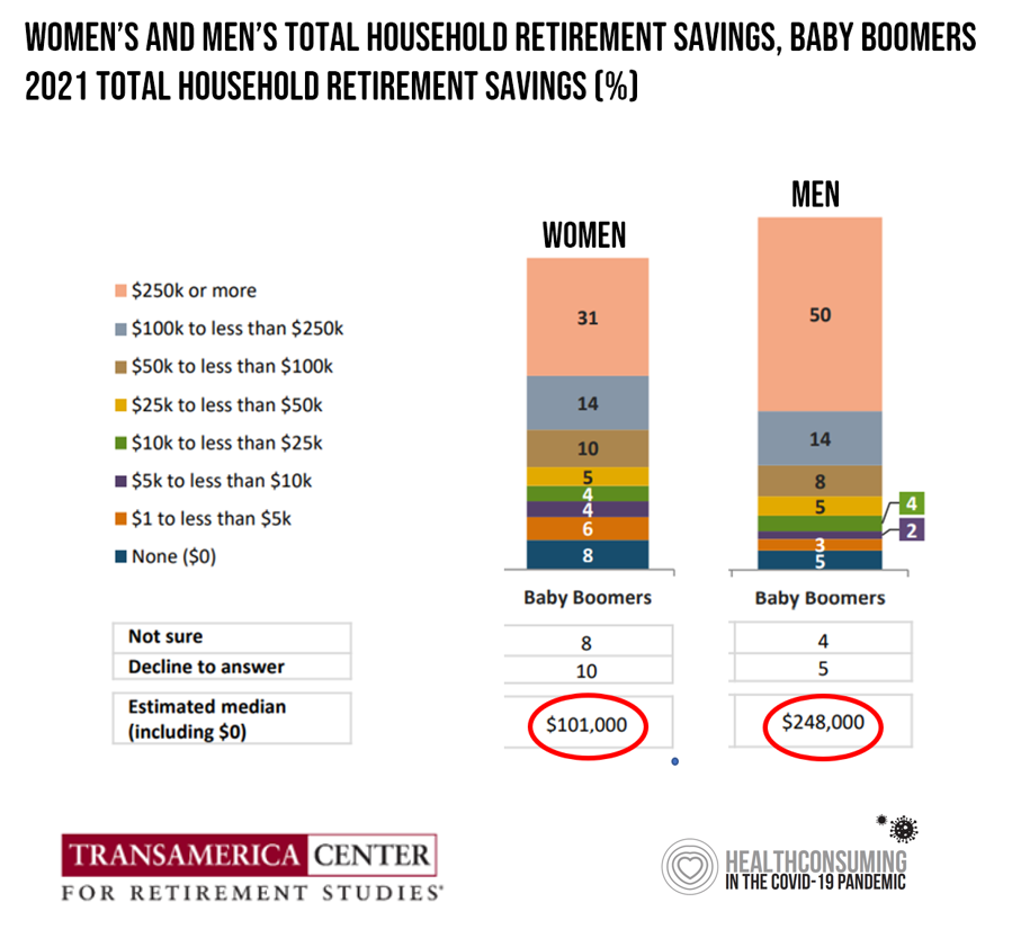

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Health Is Social, With More People Using Apps for Physical and Emotional Wellbeing

People who need people aren’t just the luckiest people in the world: they derive greater benefits through monitoring their health via apps that make it easier to make healthy choices. Channeling Barbra Streisand here to call out a key finding in new consumer research from Kantar on Connecting with the Health & Wellness Community. Kantar polled 10,000 online consumers in ten countries to gain perspectives on health citizens’ physical and emotional health and the role of technology to bolster (or diminish) well-being. The nations surveyed included Brazil, China, France, Germany, India, Singapore, South Africa, Spain,

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

Health Care Costs Are a Driver of Health Across All of America – Especially for Women

Three in four people in America grade health care costs a #fail, at grade “D” or lower. This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively. Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder

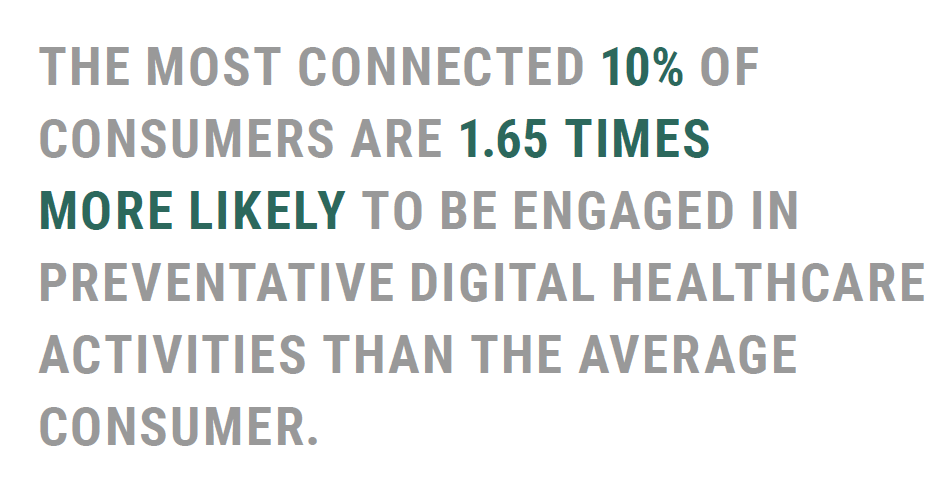

Connected Wellness Growing As Consumers Face Tighter Home Economics

“Consumers are using the Internet to take their health into their own hands,” at least for 1 in 2 U.S. consumers engaging in some sort of preventive health care activity online in mid-2022. The new report on Connected Wellness from PYMNTS and Care Credit profiles American health consumers’ use of digital tools for health care promotion and disease prevention. The bottom-line here is that the most connected 10% of consumers were 1.65 times more likely to be engaged in preventive digital health activities than the average person. Peoples’ engagement with digital health

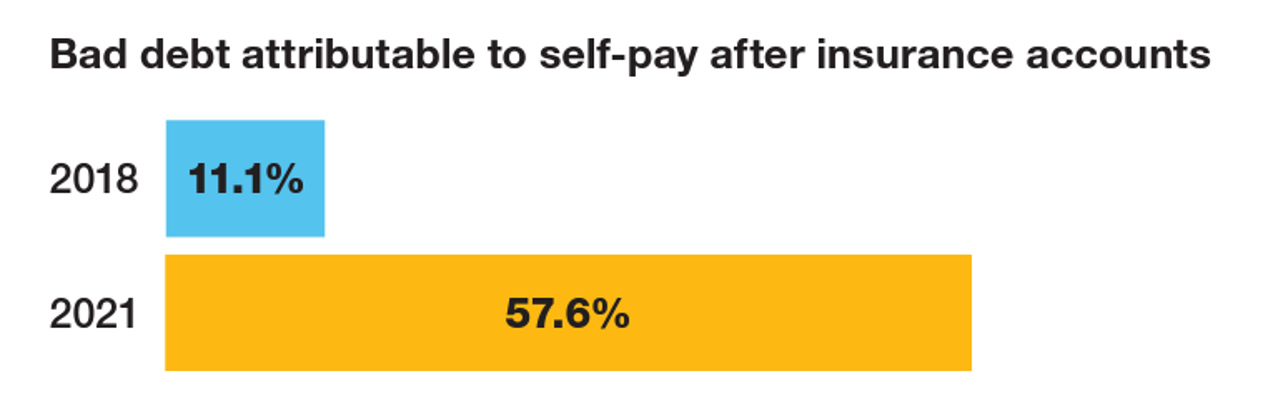

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

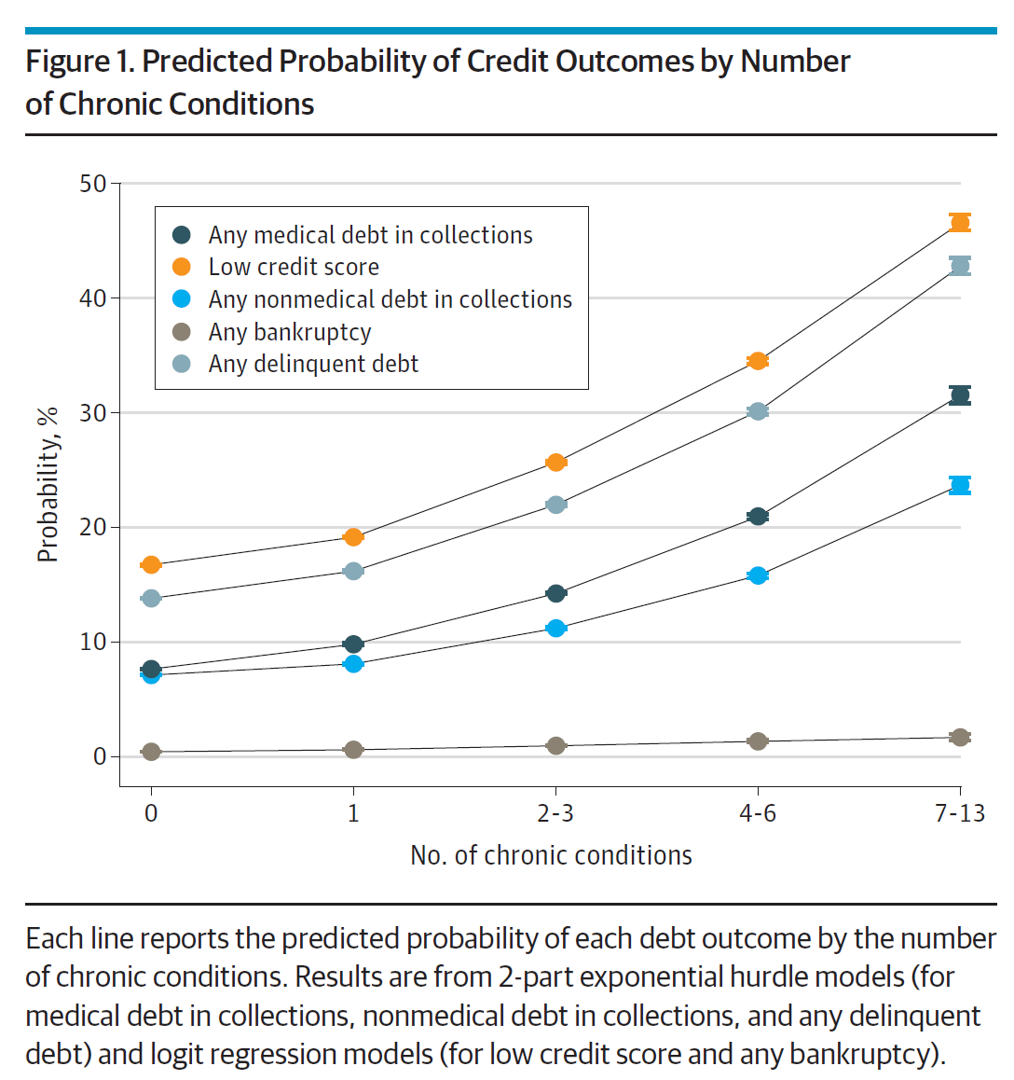

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

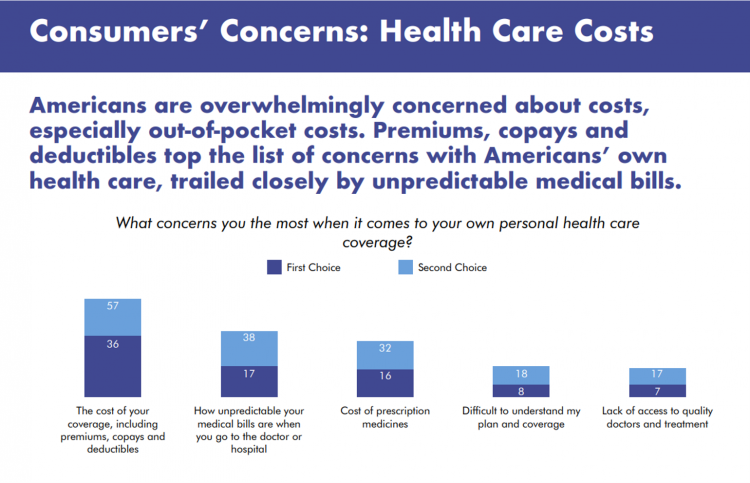

Americans Rationing Healthcare in the Inflationary Era; Out-of-Pocket Expenses Are the Concern

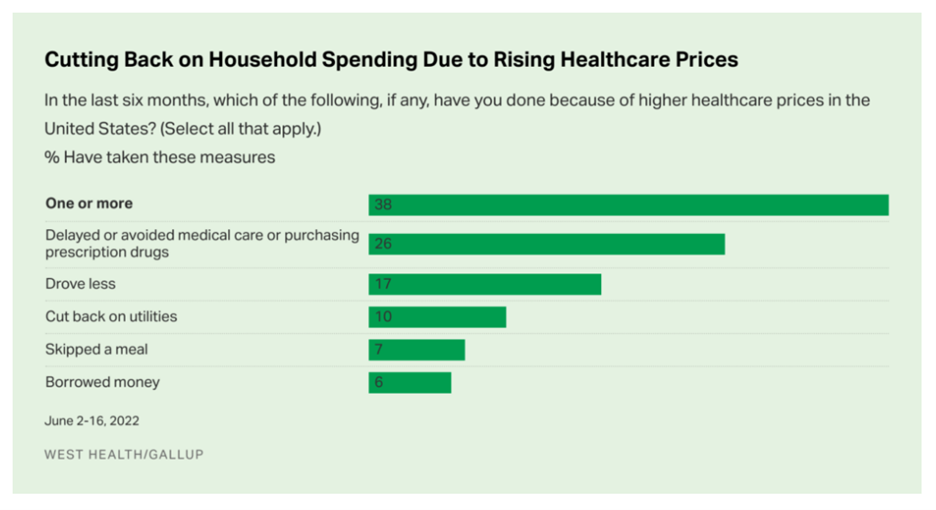

Nearly 100 million people in the U.S. cut back on healthcare due to costs in the first half of 2022, according to the latest poll on health care costs form Gallup and West Health, gauging Americans’ financial health in June 2022. That’s the month when inflation in the U.S. reached 9.1%, a 40-year high. Among Americans’ cuts to household spending was the most common medical self-rationing behavior, delaying or avoiding care or purchasing prescription drugs, the survey found. Nearly 4 in 5 people in the U.S. had delayed care or prescription meds between January

Health, Politics, Inflation and Women: Health Engagement at the Voting Booth

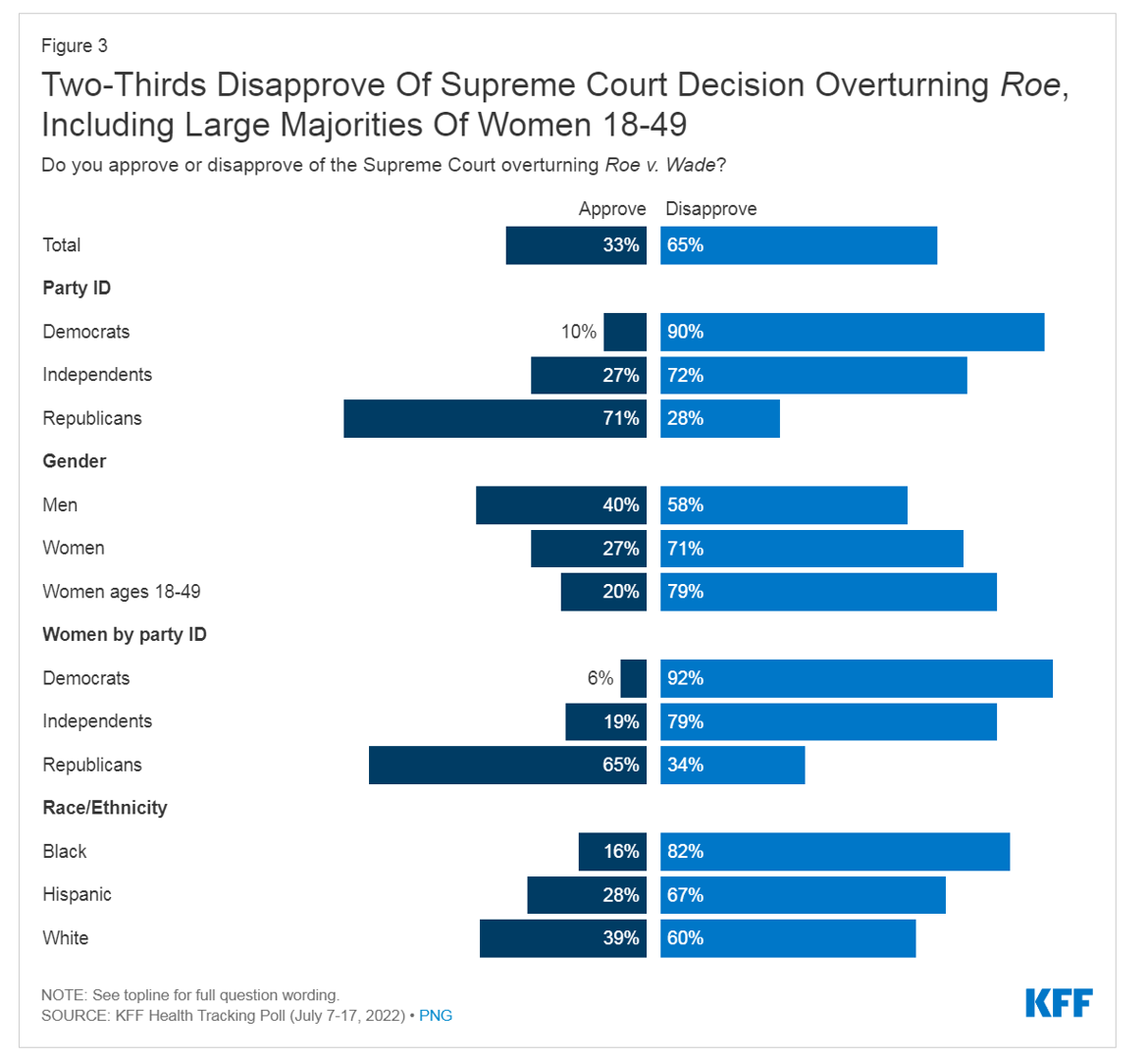

Two in three Americans disapproved of the Supreme Court’s decision to overturn the Roe v. Wade decision (aka the Dobbs case), the latest Kaiser Family Foundation Health Tracking Poll found. While inflation tops voters’ priorities, abortion access resonates for key voting blocs. KFF conducted this survey among 1,847 U.S. adults 18 and over between July 7 and 17, 2022. KFF published the study findings this week on August 2, a day of political primaries and ballot considerations in several U.S. states. Consider Kansas: a majority of Kansans voted on Tuesday to protect abortion rights

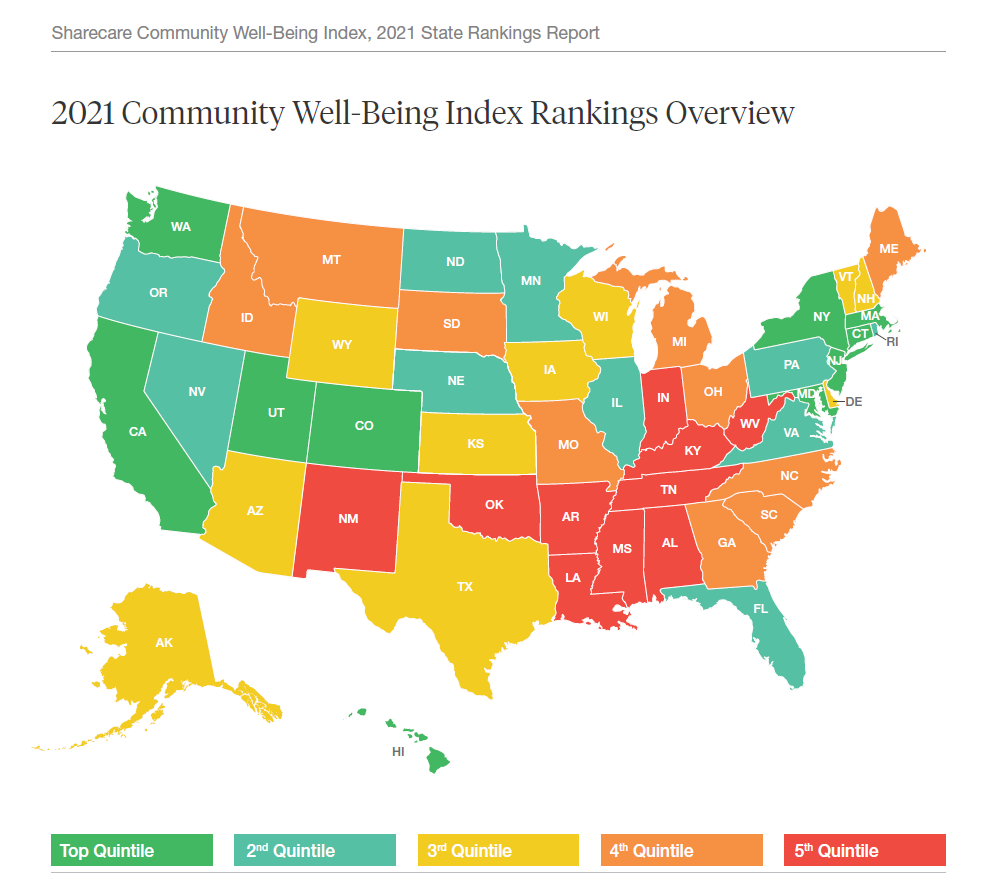

Your State as a Determinant of Health: Sharecare’s 2021 Community Well-Being Index

People whose sense of well-being shifted positively in the past two years are finding greater personal purpose and financial health, we see in Sharecare’s Community Well-Being Index – 2021 State Rankings Report. Sharecare has been annually tracking well-being across the 50 U.S. states since 2008. When the study launched, Well-Being Index evaluated five domains: physical, social, community, purpose, and financial. In 2020, Sharecare began a collaboration with the Boston University School of Public Health to expand the Index, including drivers of health such as, Healthcare access (like physician supply per 1,000

Money and Guns Are the Top Two Sources of Anxiety in America This Summer

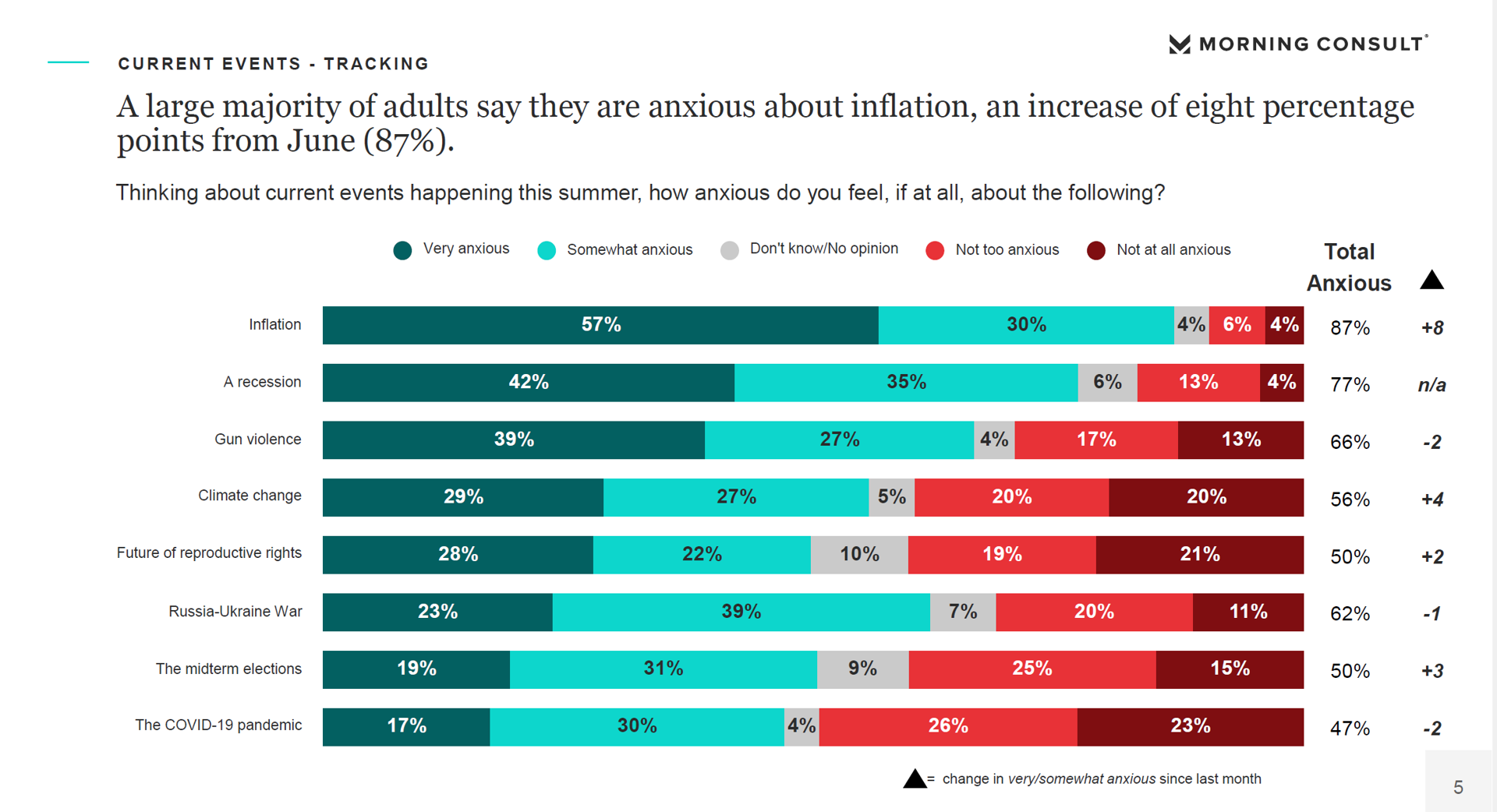

Inflation and the fear of economic recession were the top two causes of anxiety in America, followed by gun violence, in June 2022. Moms and Hispanic adults, in particular, were worried about losing income and of gun violence, discovered in the Healthy Minds Monthly Poll for July 2022 from the American Psychiatric Association (APA) and Morning Consult. For some context about these findings, note that this survey was fielded between June 18 and 20, 2022; that was, 24 days after the Robb Elementary School shooting in Uvalde, Texas Four days before the Supreme Court

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

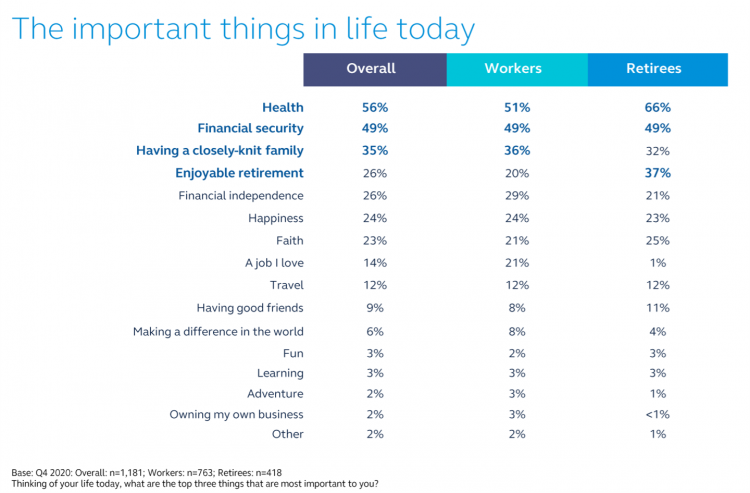

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

The Unbearable Heaviness of Inflation: Will Consumers’ Financial Stress Erode Their Health?

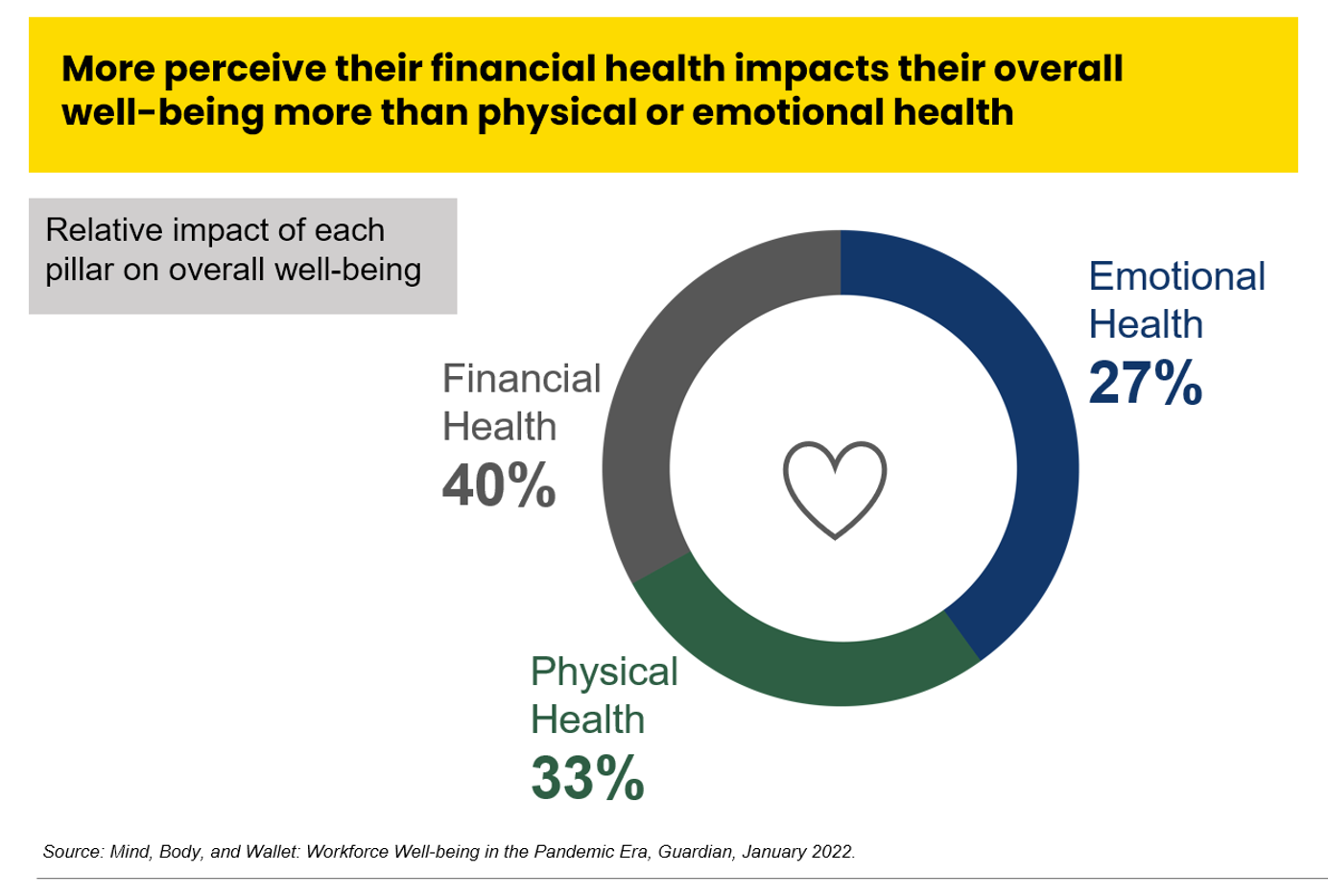

“Inflation is the big story,” the economics team at Morning Consult told us yesterday in a call on “How to Think Like An Economist.” While I already thought I did that, Team @MorningConsult updated us on the current state of consumers and what’s weighing most heavily on their minds…inflation being #1. An hour after the Morning Consult session, I brainstormed the topic of consumers-as-payers of medical bills and prescription drugs with GoodRx strategy leaders. In my data wonkiness, inflation certainly played a starring role in setting the stage for Mind, Body and Wallet — the title of one of the sources

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

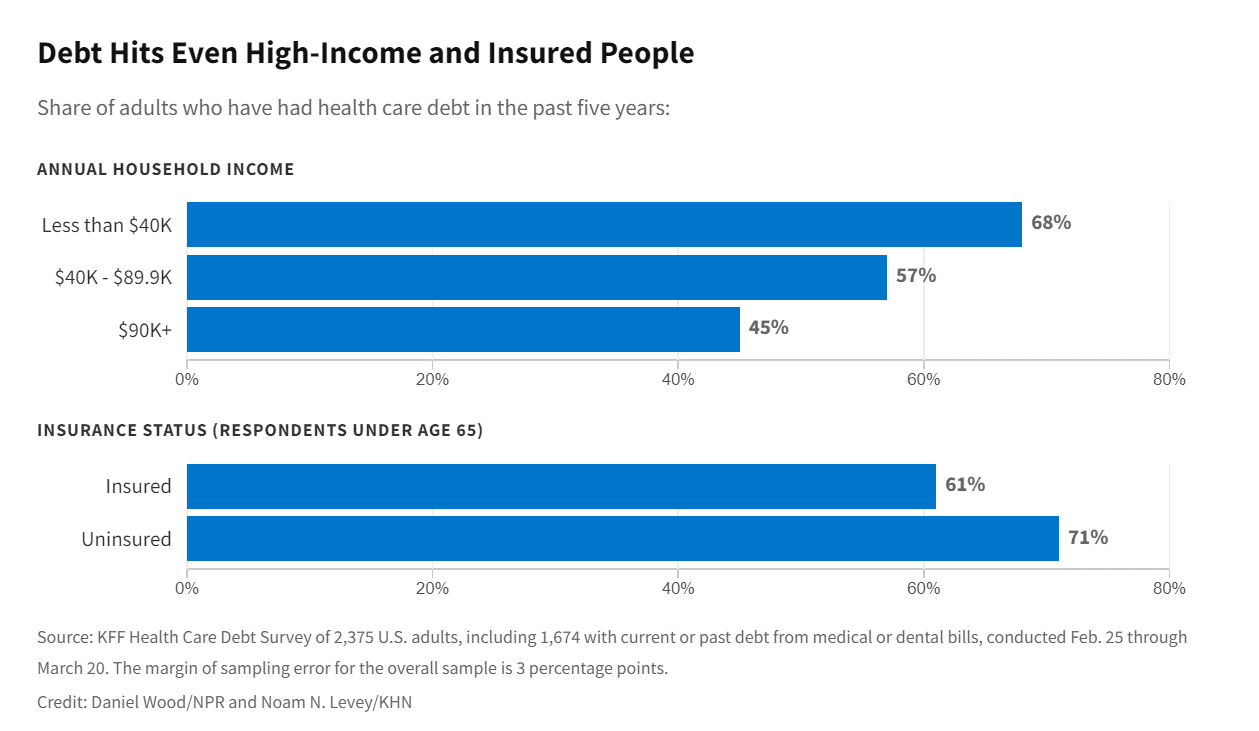

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

Jasper, Scaling a Human Touch for People Dealing with Cancer, Now With Walgreens

Each year, the first Sunday in June marks National Cancer Survivors Day. This year’s NCSD occurred two days ago on Sunday, 5th June. When you’re a cancer survivor, or happen to love one, every day is time to be grateful and celebrate that survival of someone who has come through a cancer journey. We all know (or are) people who have survived cancer. We know that the recipe for battling cancer goes beyond chemotherapy. We know of the resilience and grit required in the process: body, mind, and spirit. “Celebrate Life” is the mantra of NCSD, as this year’s campaign

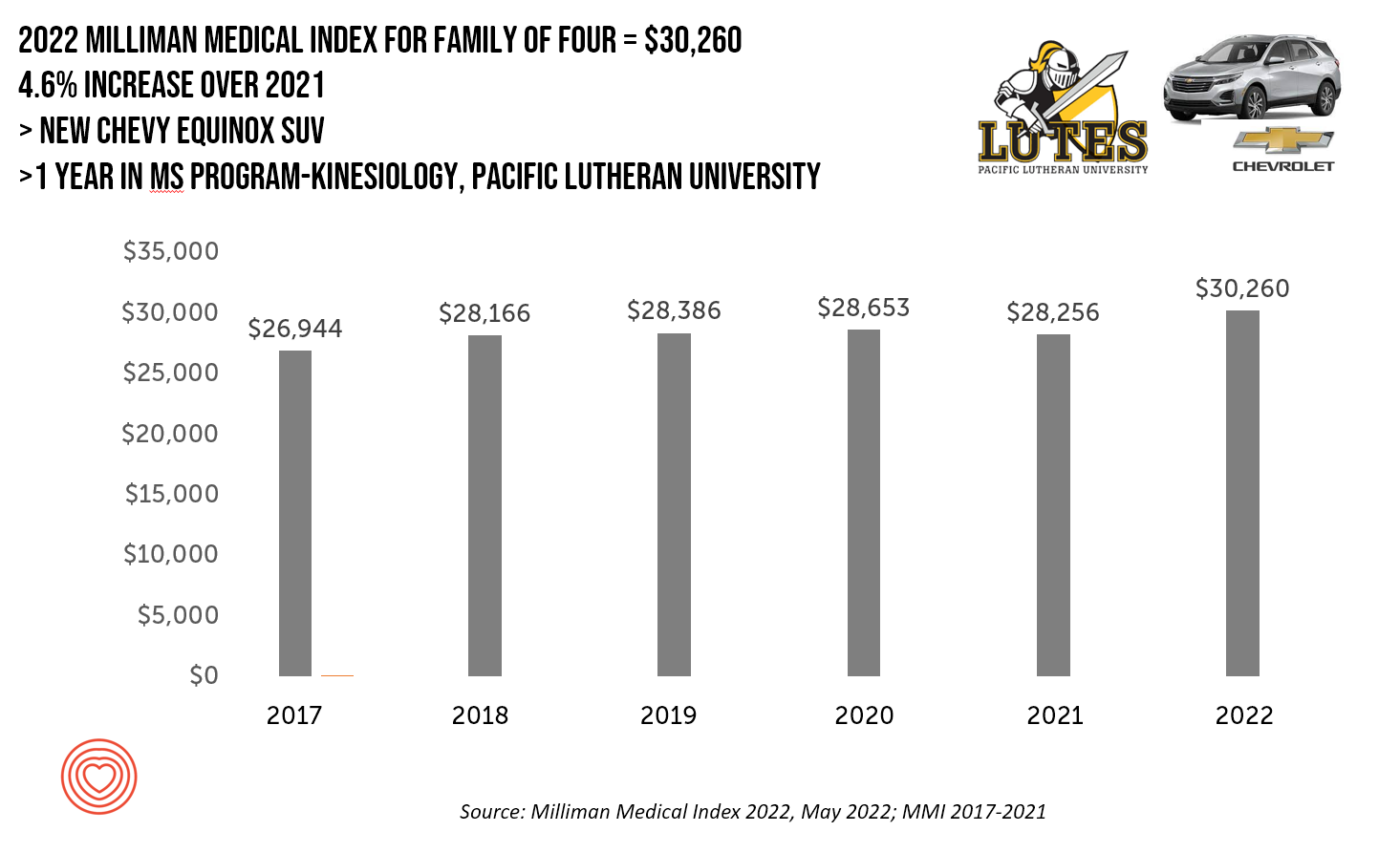

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

Social Determinants of Health Risks Challenge the Promise of Hospital-to-Home

In the wake of the pandemic and growing consumer preferences, the hospital-to-home movement is gaining traction among health systems. Amidst bullish forecasts for the promise of hospital-to-home discharges, the ability for many patients to make this migration would be a difficult bridge to cross. On the promising front, recent studies reviewed through a meta-analysis published in JAMA found that hospital-to-home programs can be clinically and cost-effective for inpatients discharged from hospital. Earlier this year, McKinsey addressed how “Care at Home” ecosystems can reshape the way health systems — and people — envision patient care. This

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

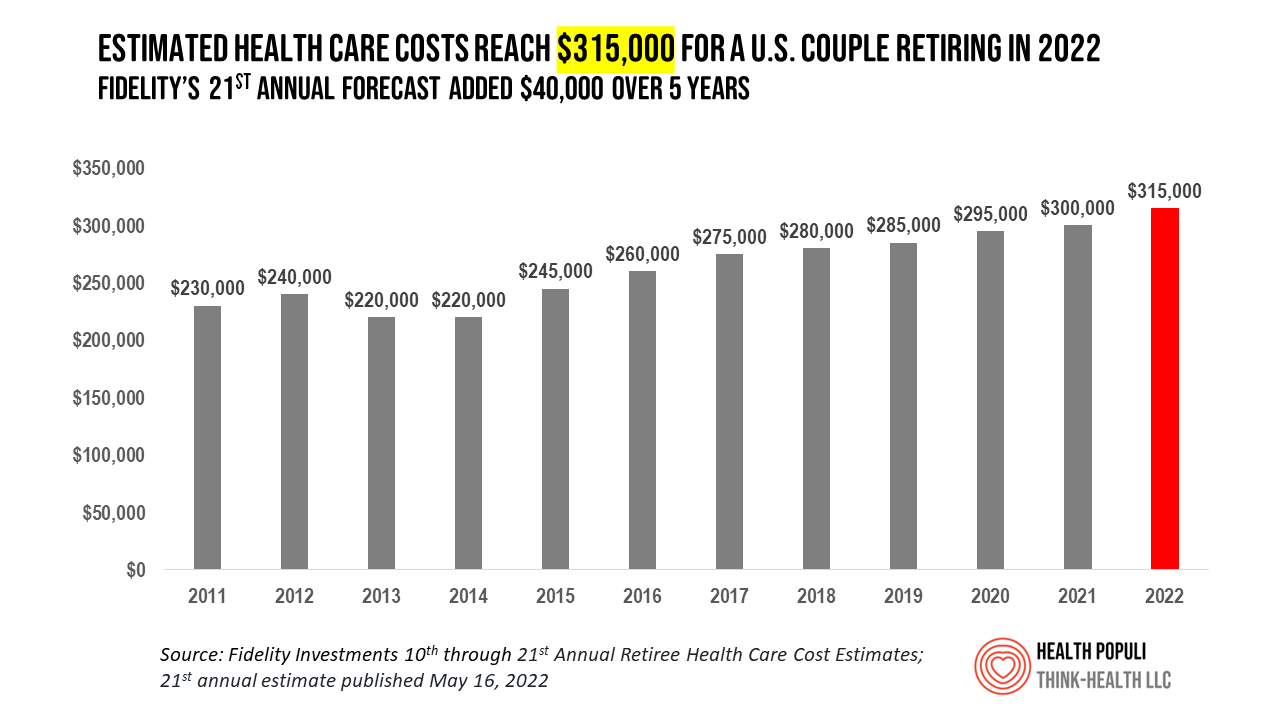

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

People Thinking More About the Value of Health Care, Beyond Cost

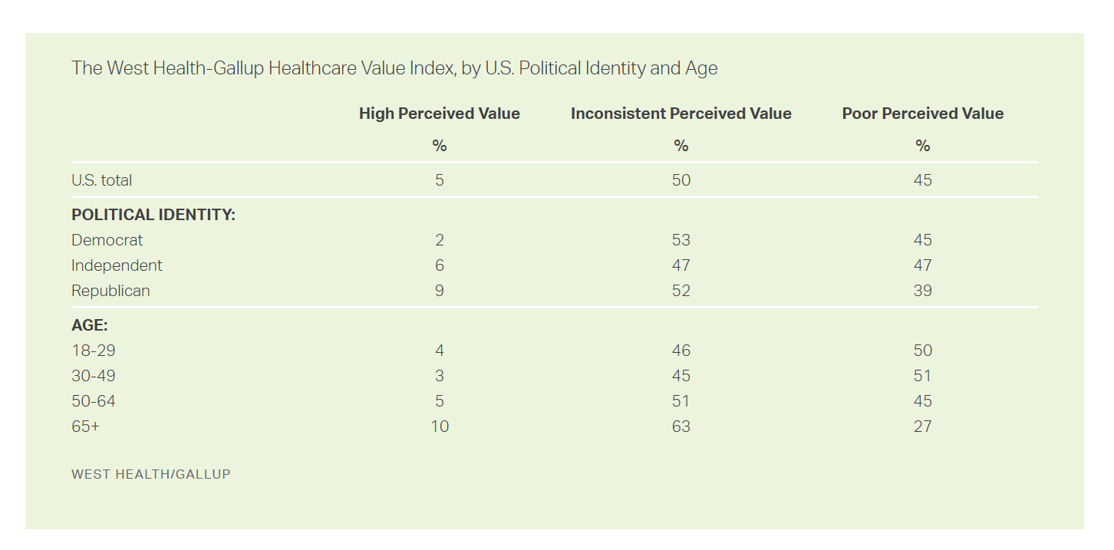

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

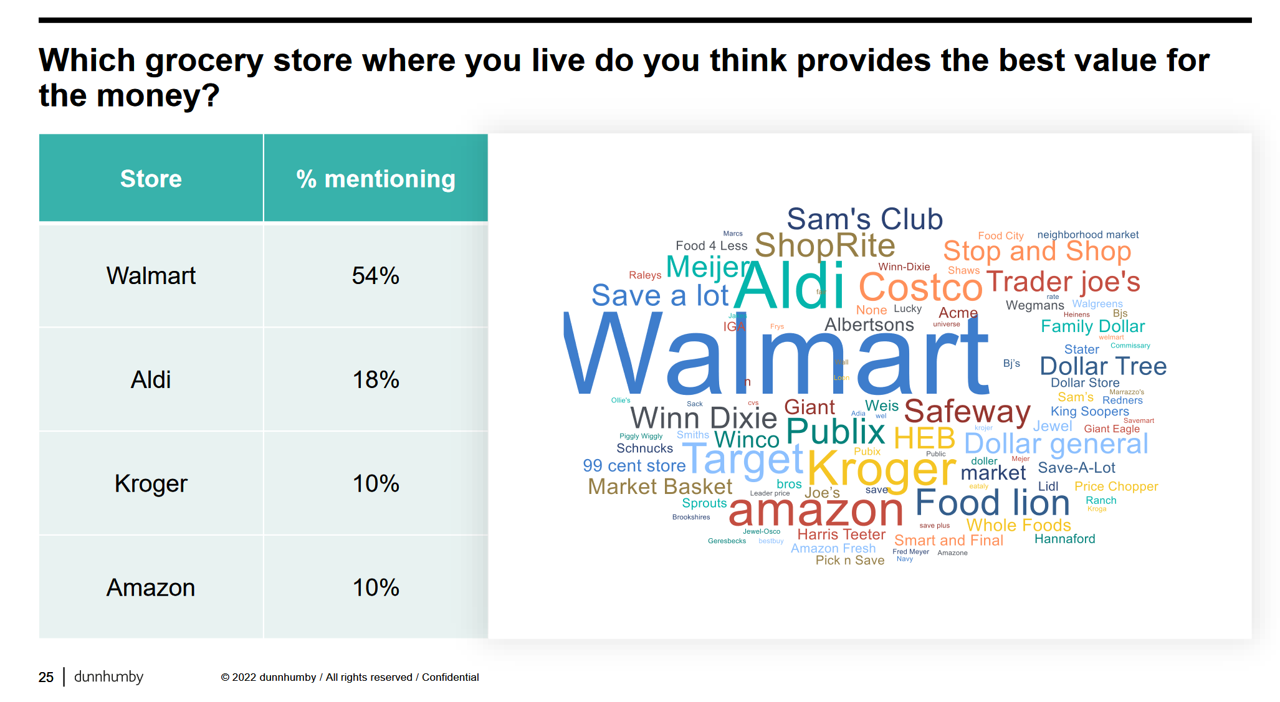

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

Go Local and Go Beyond Medical Care: What Hospitals, Health Plans, and Pharma Can Do to Rebuild Trust

Without trust, people do not engage with health care providers, health plans, or life science companies….nor do many people accept “science fact.” I explore the sad state of Trust and Health Care. published in the Medecision Liberate Health blog, with a positive and constructive call-to-action for health care industry stakeholders to consider in re-building this basic driver of well-being. That is, trust as a determinant of health. Edelman’s 2022 Trust Barometer came out in January 2022, coinciding as it annually does with the World Economic Forum’s meeting in Davos, Switzerland. Every year, WEF convenes the world’s biggest thinkers to wrestle with the

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

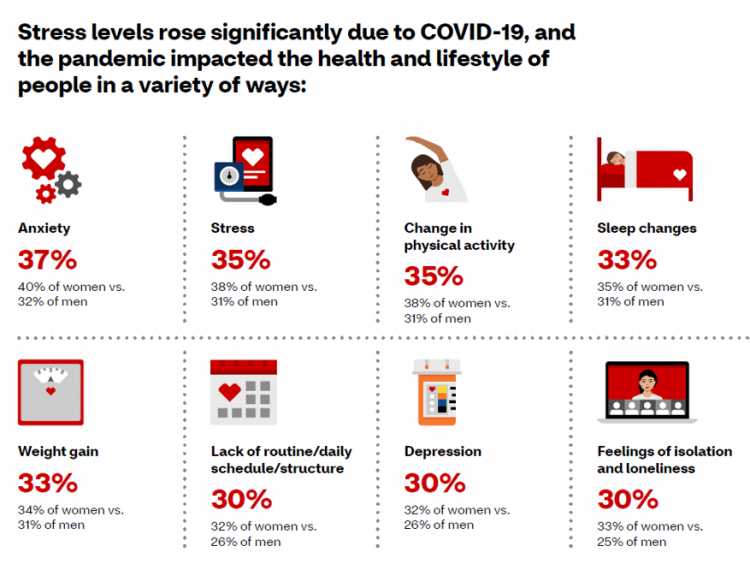

Stress in America on the Pandemic’s 2nd Anniversary: Money, Inflation, and War Add to Consumers’ Anxiety

As we mark the second anniversary of the COVID-19 pandemic, the key themes facing health citizens deal with money, inflation, and war — “piled on a nation stuck in COVID-19 survival mode,” according to the latest poll on Stress in America from the American Psychological Association. Financial health is embedded in peoples’ overall sense of well-being and whole health. Many national economies entered the coronavirus pandemic in early 2020 already marked by income inequality. The public health crisis exacerbated that, especially among women who were harder hit financially in the past two years than men were. That situation was even worse

Brand Relevance Has A Lot To Do with Health, Wellness, and Empowerment – Listening to (the) Prophet

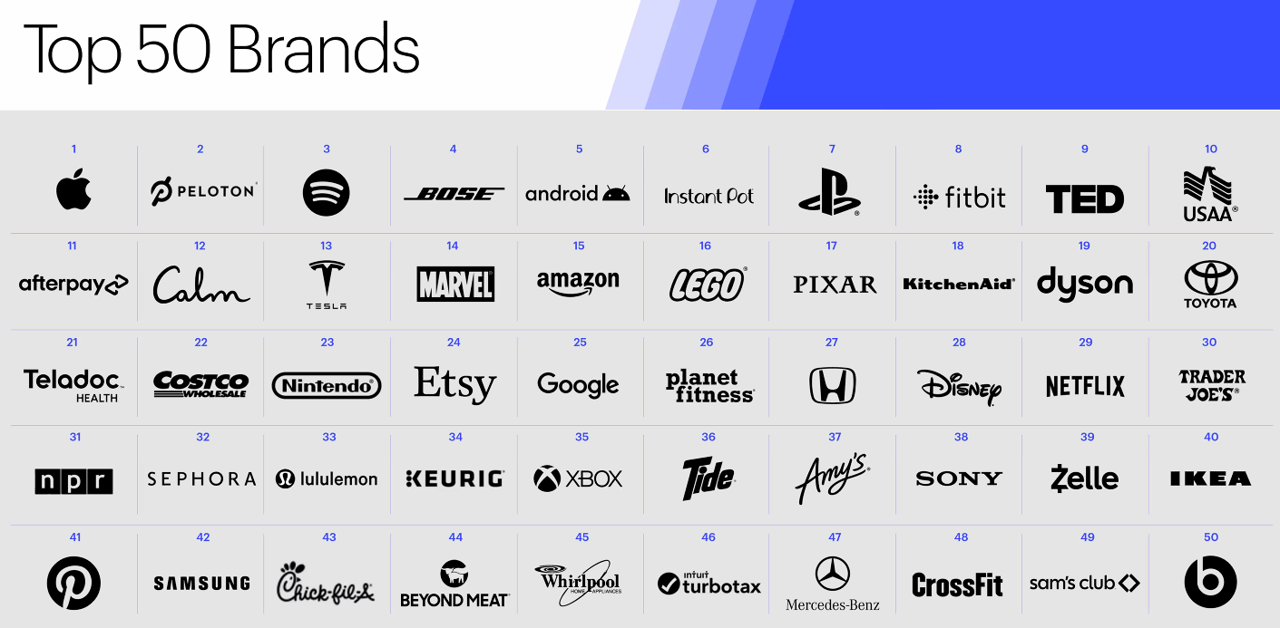

s in the seventh annual 2022 Brand Relevance Index from Prophet. The research developed a list of 50 companies representing what Prophet characterizes “the brands that people can’t live without in 2022.” For the 7th year in a row, Apple tops the study. Following Apple, the nine companies rounding out the top ten most relevant brands were Peloton, Spotify, Bose, Android, Instant Pot, Pixar, Fitbit, TED, and USAA. There are relative newbies in this list, representing consumers’ collective response to the COVID-19 pandemic and new life-flows. Put Calm and AfterPay in that category, along with Beyond Meat, and Zelle. The

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

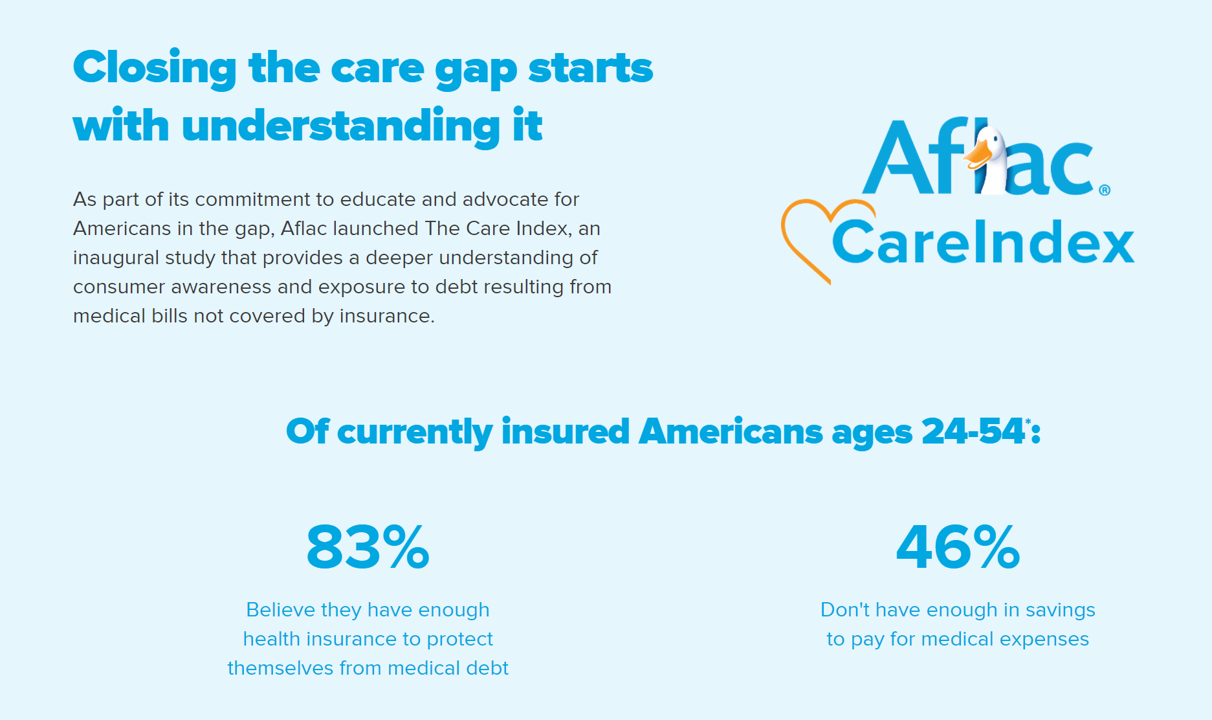

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

From Better for Me to Better for “We” — NielsenIQ’s New Consumer Hierarchy of Health

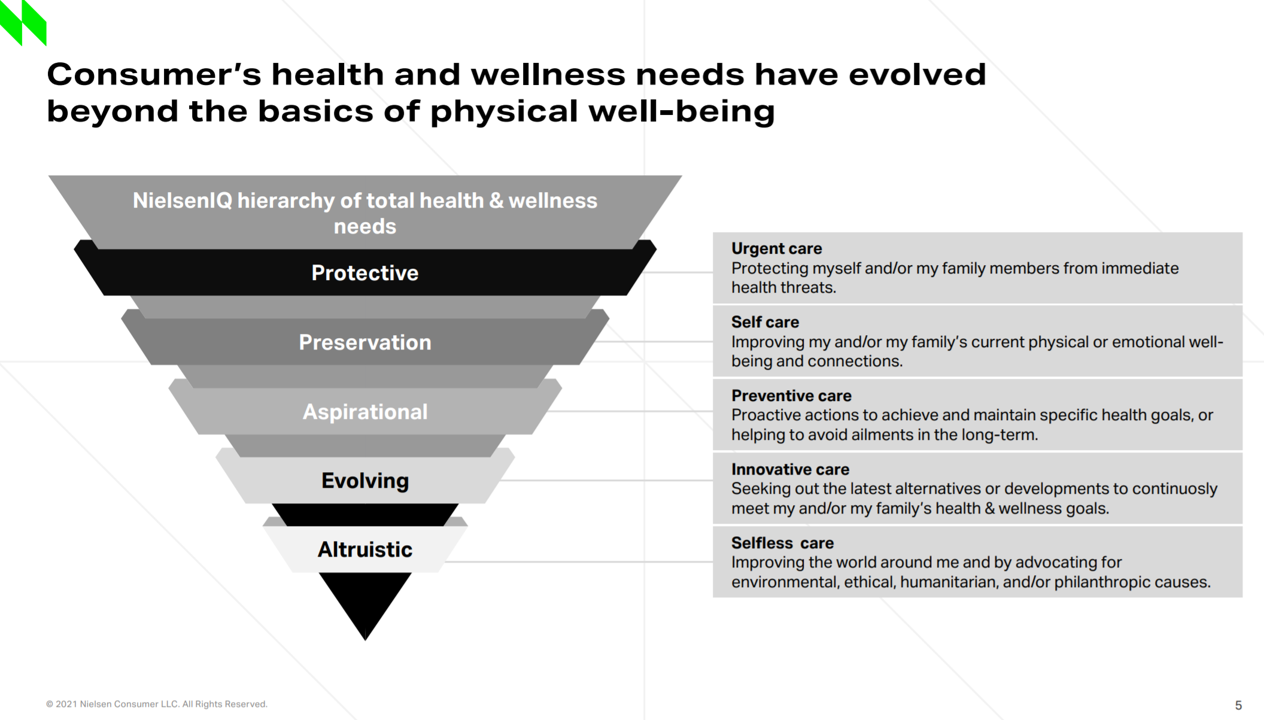

People around the world have made health a “proactive priority,” most important to live a longer, healthier life, to avoid preventable diseases, to protect against disease, and to look and feel healthier, according to NielsenIQ’s latest health and wellness report. As the triangle here illustrates, NielsenIQ has turned Maslow’s Hierarchy of Needs upside down, shifting protective and physical needs to the top rung and altruistic — the “me-to-we” ethos — at the base. Note the translations of these needs, on the ride, into the “care” flows — moving from urgent care down to self-care, preventive care, innovative care, and selfless

Health Care Planning for 2022 – Start with a Pandemic, Then Pivot to Health and Happiness

One of my favorite Dr. Seuss characters is the narrator featured in the book, I Had Trouble In Getting to Solla-Sollew. I frequently use this book when conducting futures and scenario planning sessions with clients in health/care. “The story opens with our happy-go-lucky narrator taking a stroll through the Valley of Vung where nothing went wrong,” the Seussblog explains. Then one day, our hero (shown here on the right side of the picture from the book) is not paying attention to where he is walking….thus admitting, “And I learned there are troubles of more than one kind, some come from

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

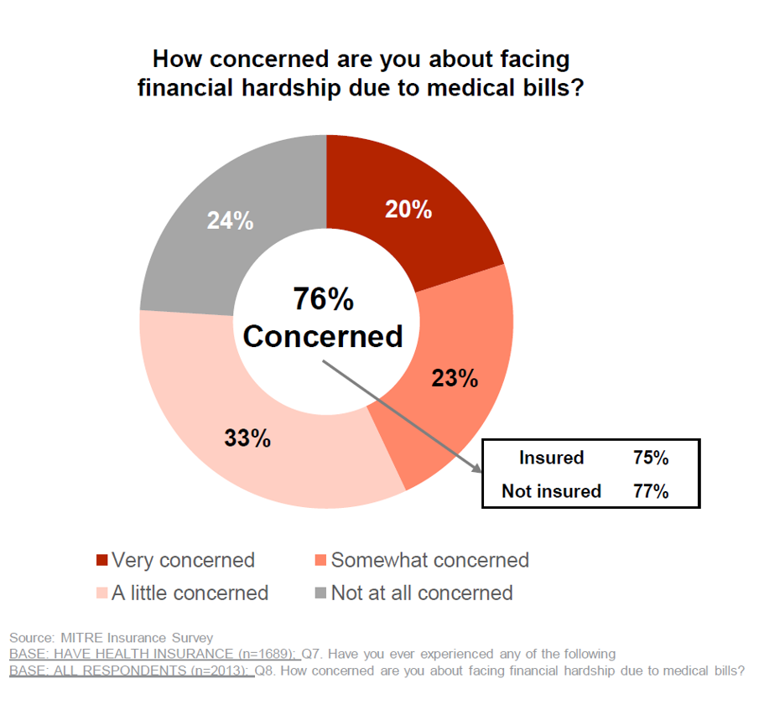

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

Aflac Finds Health Care and Financial Stress will “Dampen 2021 Holiday Magic” in U.S. Households

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey. Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America. Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with

Does Inequality Matter in the U.S.? Health and the Great Gatsby Curve

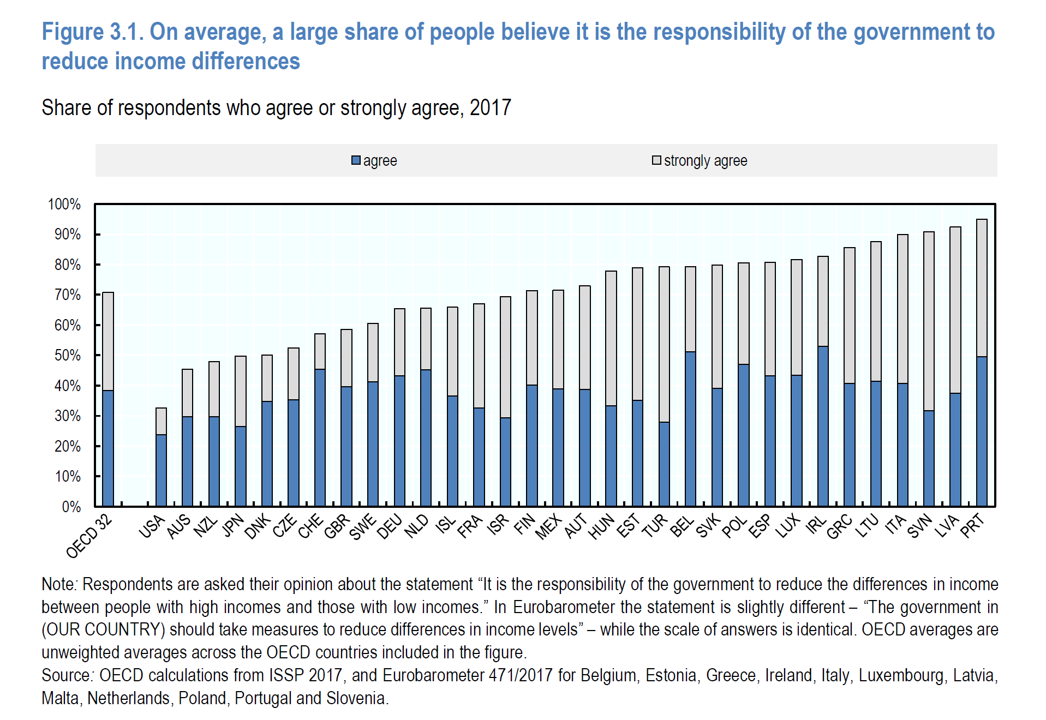

Compared with the rest of the developed world, people living in the U.S. may be concerned about income inequality, but their demand for income redistribution is the lowest among peer citizens living in 31 other OECD countries. In their latest report, Does Inequality Matter? the OECD examines how people perceive economic disparities and social mobility across the OECD 32 (the world’s developed countries from “A” Australia to “U,” the United Kingdom). Overall the OECD 32 average fraction of people who believe it is the government’s responsibility to reduce income differences among those who think disparities are too large is 80%

The Cost to Cover Health Insurance for a Family in America Is $22,221

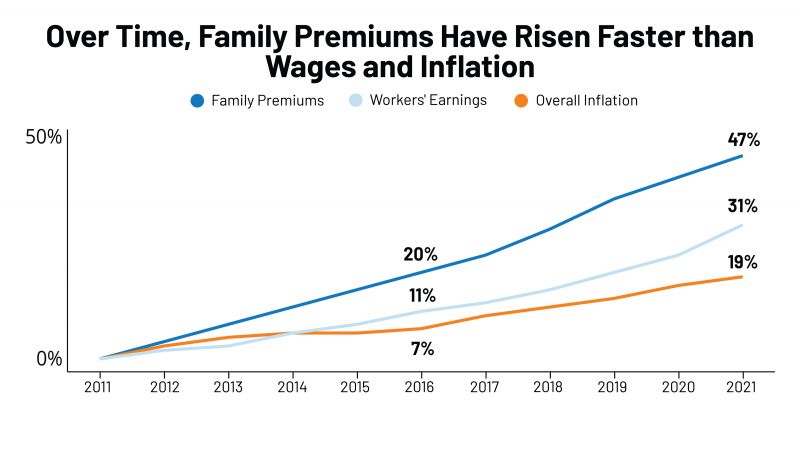

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

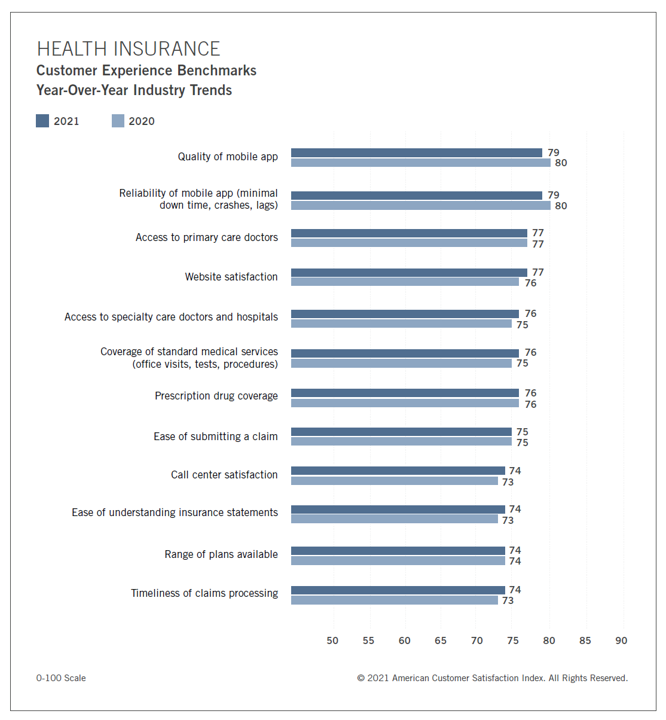

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

Health Disparities in America: JAMA Talks Structural Racism in U.S. Health Care

“Racial and ethnic inequities in the US health care system have been unremitting since the beginning of the country. In the 19th and 20th centuries, segregated black hospitals were emblematic of separate but unequal health care,” begins the editorial introducing an entire issue of JAMA dedicated to racial and ethnic disparities and inequities in medicine and health care, published August 17, 2021. This is not your typical edition of the Journal of the American Medical Association. The coronavirus pandemic has changed so many aspects of American health care for so many people, including doctors. Since the second quarter of 2020,

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

Healthy Living Trends Inspired by COVID-19: Retailers, Food, and Consumers’ Growing Self-Care Muscles

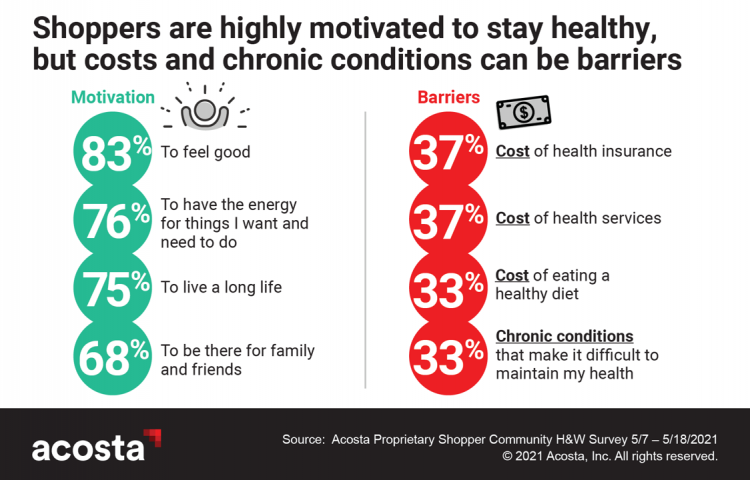

“Self-care” took on new meaning and personal work-flows for people living in and through the coronavirus pandemic in the U.S. Acosta, the retail market research pro’s, updated our understanding consumers evolving as COVID-19 Has Elevated the Health and Wellness Trends of the Recent Years, results of a survey conducted among in May 2021. In the U.S., consumers’ take on self-care has most to do with healthy eating and nutrition (for 1 in 2 people), getting regular medical checkups (for 42%), taking exercise, relaxing, using vitamins and supplements, and getting good sleep. Healthy relationships are an integral part of self-care for

Dollar General, the Latest Retail Health Destination?

“What if…healthcare happened where we live, work, play, pray and shop, delivering the highest levels of retail experience?” I asked and answered in my book HealthConsuming: From Health Consumer to Health Citizen. The chapter called “The new retail health” began with that “what if,” and much of the book responded with the explanation of patients evolving toward health consumers and, ultimately, health citizens empowered and owning their health and care. This week, Dollar General announced the hiring of its first Chief Medical Officer, Dr. Albert Wu. With that announcement, America’s largest dollar-store chain makes clear its ambitions to join a

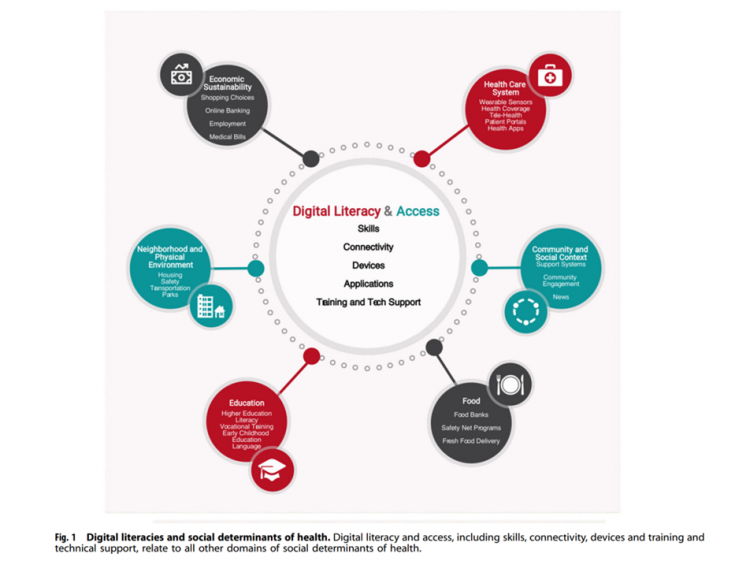

Digital Inclusion As Upstream Health Investment

Without access to connectivity during the pandemic, too many people could not work for their living, attend school and learn, connect with loved ones, or get health care. The COVID-19 era has shined a bright light on what some of us have been saying since the advent of the Internet’s emergence in health care: that digital literacies and connectivity are “super social determinants of health” because they underpin other social determinants of health, discussed in Digital inclusion as a social determinant of health, published in Nature’s npj Digital Medicine. On the downside, lack of access to digital tools and literacies

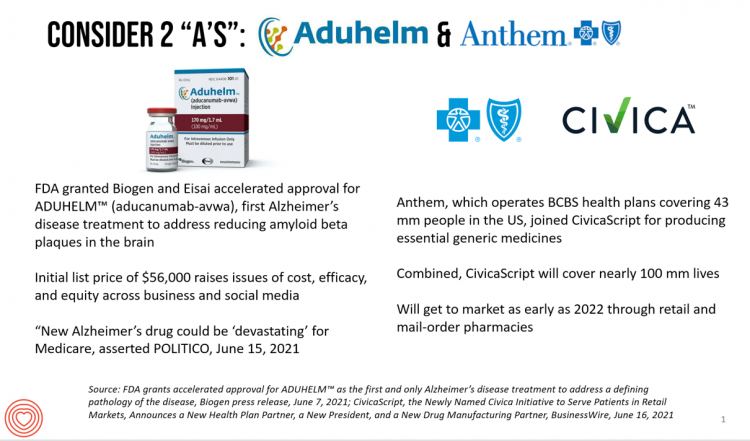

Aduhelm and Alzheimer’s Disease: A Potential Medicare Budget-Buster Puts A Blazing Light on Health Care Costs and Innovation

The FDA’s approval of the first therapy to treat Alzheimer’s Disease in over twenty years brought attention to a not-yet-convened debate of U.S. health care costs and spending, innovation, and return-on-the-investment (as well as “for whom” do the returns accrue). In my latest post for Medecision, I explore different angles on the Aduhelm and Alzheimer’s discussion, covering: The macro- and micro-economics of Alzheimer’s and the $56,000 list price for the drug The FDA regulatory process and aftermath U.S. consumers’ bipartisan support for drug price regulation through Medicare negotiation and private/commercial sector adoption Congressional legislation addressing the price of medicines in

The Healthiest Communities in the U.S. After the Pandemic – U.S. News & Aetna Foundation’s Post-COVID Lists

Some of America’s least-healthy communities are also those that index greater for vaccine hesitancy and other risks for well-being, found in U.S. News & World Report’s 2021 Healthiest Communities Rankings. U.S. News collaborated with the Aetna Foundation, CVS Health’s philanthropic arm, in this fourth annual list of the top geographies for well-being in the U.S. Six of the top ten healthiest towns in America are located in the state of Colorado. But #1 belongs to Los Alamos County, New Mexico, which also ranked first in ___. Beyond Colorado and New Mexico, we find that Virginia fared well for health in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

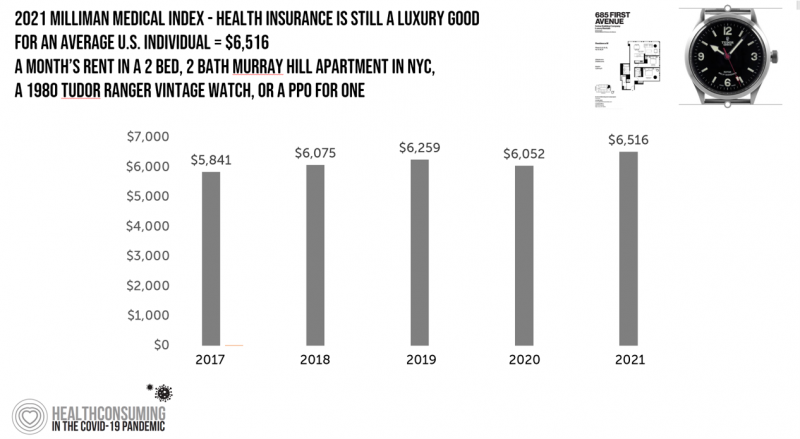

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

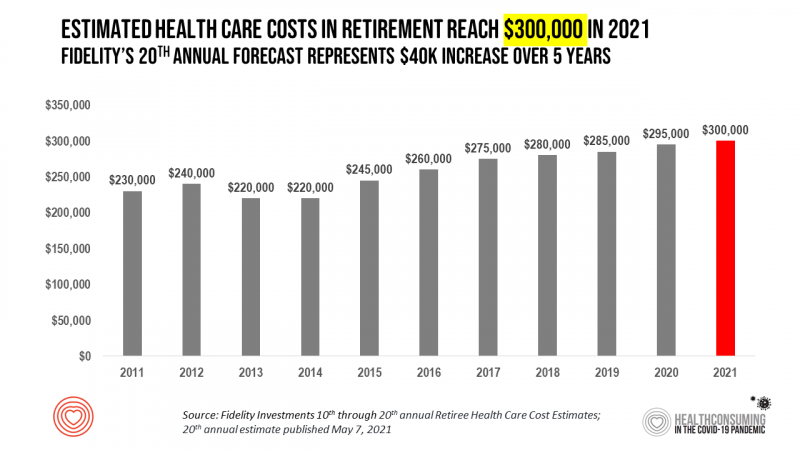

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

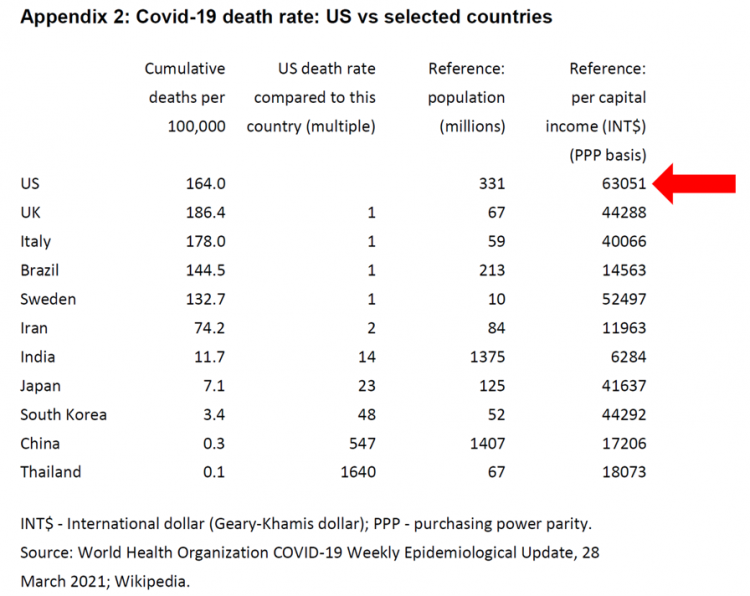

The Pandemic’s Death Rate in the U.S.: High Per Capita Income, High Mortality

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update. Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do. I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School. In reviewing

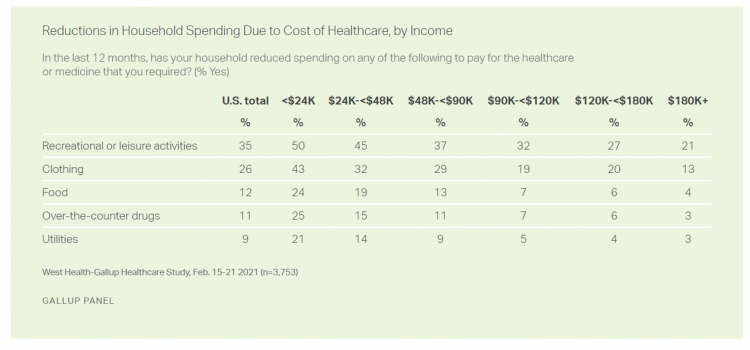

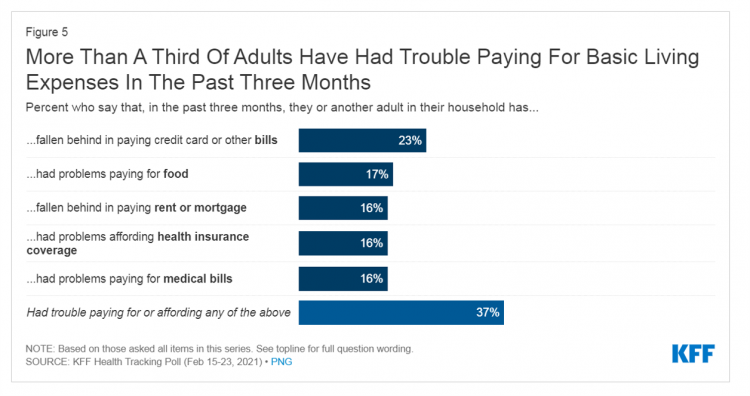

The Cost of Healthcare Can Drive Medical Rationing and Crowd Out Other Household Spending

One in five people in the U.S. cannot afford to pay for quality health care — an especially acute challenge for Black and Hispanic Americans, according to a West Health-Gallup poll conducted in March 2021, a year into the COVID-19 pandemic. “The cost of healthcare and its potential ramifications continues to serve as a burdensome part of day-to-day life for millions of Americans,” the study summary observed. Furthermore, “These realities can spill over into other health issues, such as delays in diagnoses of new cancer and associated treatments that are due to forgoing needed care,” the researchers expected. The first table

Housing as Prescription for Health/Care – in Medecision Liberation

COVID-19 ushered in the era of our homes as safe havens for work, shopping, education, fitness-awaking, bread-baking, and health-making. In my latest essay written for Medecision, I weave together new and important data and evidence supporting the basic social determinant of health — shelter, housing, home — and some innovations supporting housing-as-medicine from CVS Health, UnitedHealth Group, AHIP, Brookings Institution, the Urban Land Institute, and other stakeholders learning how housing underpins our health — physical, mental, financial. Read about a wonderful development from Communidad Partners, working with the Veritas Impact Partners group, channeling telehealth to housing programs serving residents with

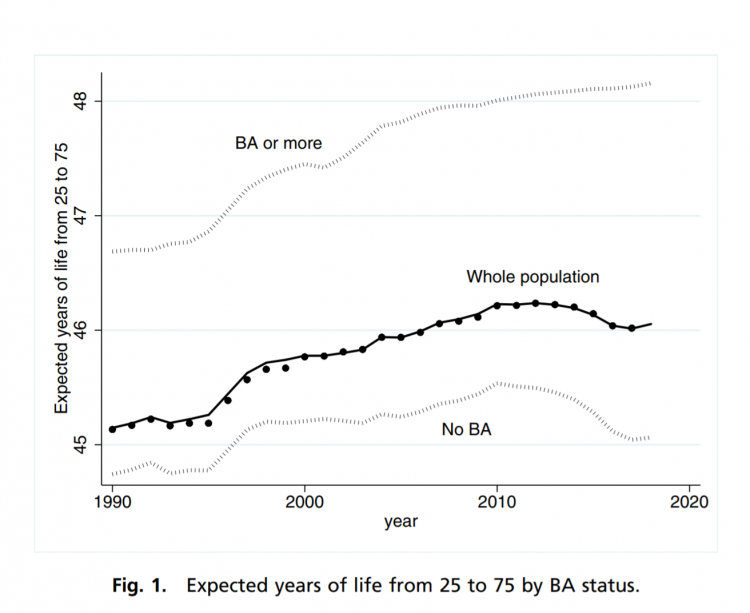

A BA Degree as Prescription for a Longer Life – Update on Deaths of Despair from Deaton and Case

“Without a four-year college diploma, it is increasingly difficult to build a meaningful and successful life in the United States,” according to an essay in PNAS, Life expectancy in adulthood is falling for those without a BA degree, but as educational gaps have widened, racial gaps have narrowed by Anne Case and Angus Deaton. Case and Deaton have done extensive research on the phenomenon of Deaths of Despair, the growing epidemic of mortality among people due to accidents, drug overdoses, and suicide. Case and Deaton wrote the book on Deaths of Despair (detailed here in Health Populi), Case and Deaton

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

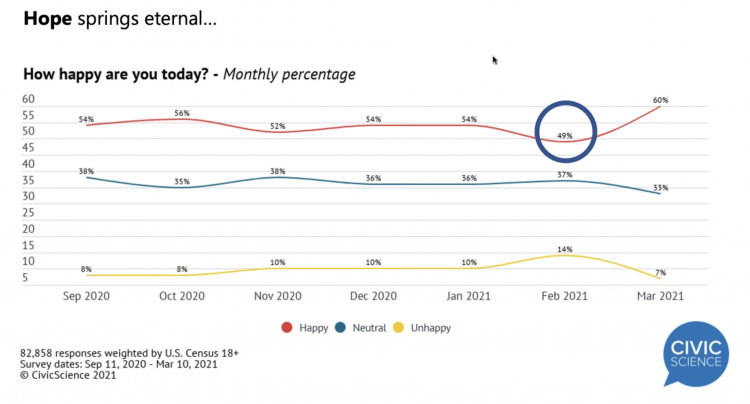

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

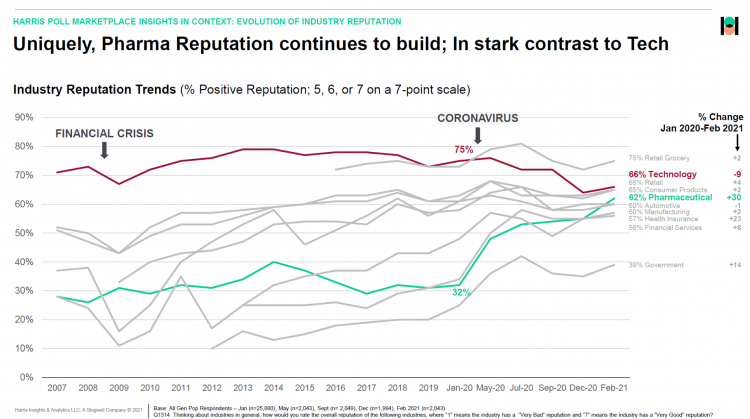

The Remarkable Rise of Pharma’s Reputation in the Pandemic

The reputation of the pharmaceutical industry gained a “whopping” 30 points between January 2020 and February 2021, based on the latest Harris Poll in their research into industries’ reputations. The study was written up by Beth Snyder Bulik in FiercePharma. Beth writes that, “a whopping two-thirds of Americans now offer a thumbs-up on pharma” as the title of her article, calling out the 30-point gain from 32% in January 2020 to 62% in February 2021. Thanks to Rob Jekielek, Managing Director of the Harris Poll, for sharing this graph with me for us to understand the details comparing pharma’s to

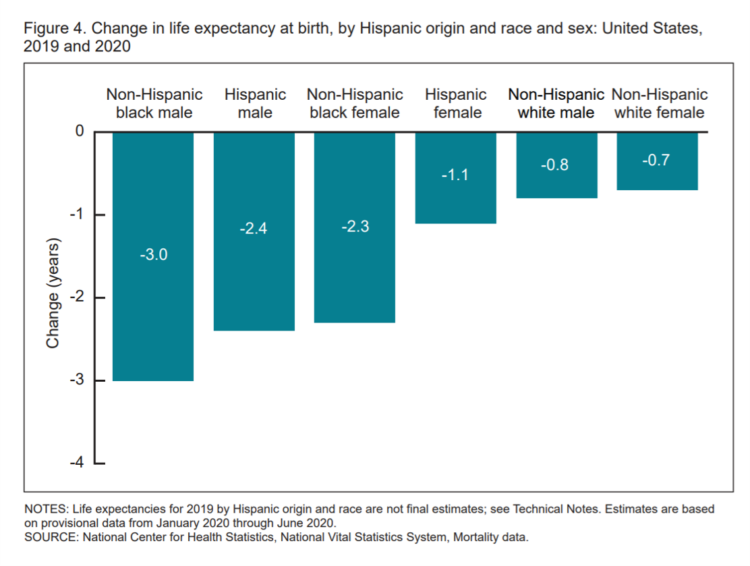

Americans Lost Future Life-Years in 2020: How Much Life Was Lost Depends on the Color of One’s Skin

Some people remark about 2020 being a “lost year” in the wake of the coronavirus pandemic. That happens to be a true statement, sadly not in jest: in the U.S., life expectancy at birth fell by one full year over the first half of 2020 compared with 2019, to 77.8 years. In 2019, life expectancy at birth was 78.8 years, according to data shared by the National Center for Health Statistics (NCHS), part of the Centers for Disease Control and Prevention (CDC). Life expectancy at birth declined for both females and males, shown in the first chart. The differences between

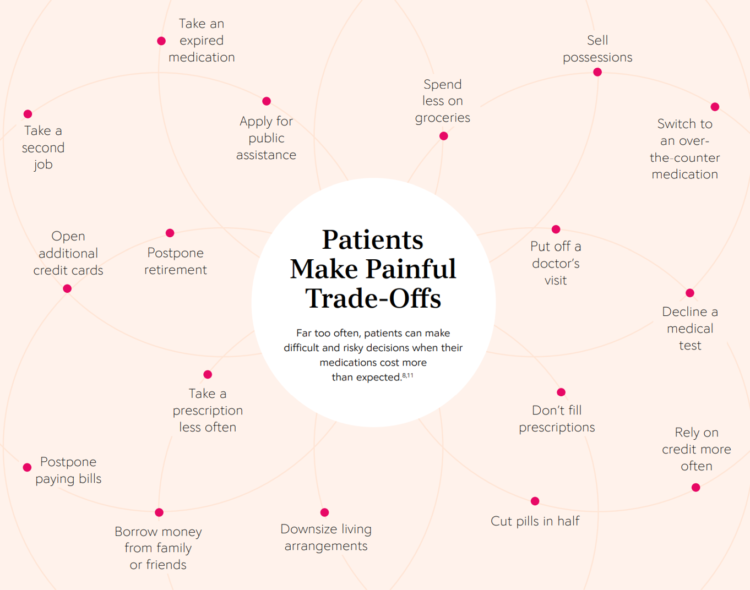

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

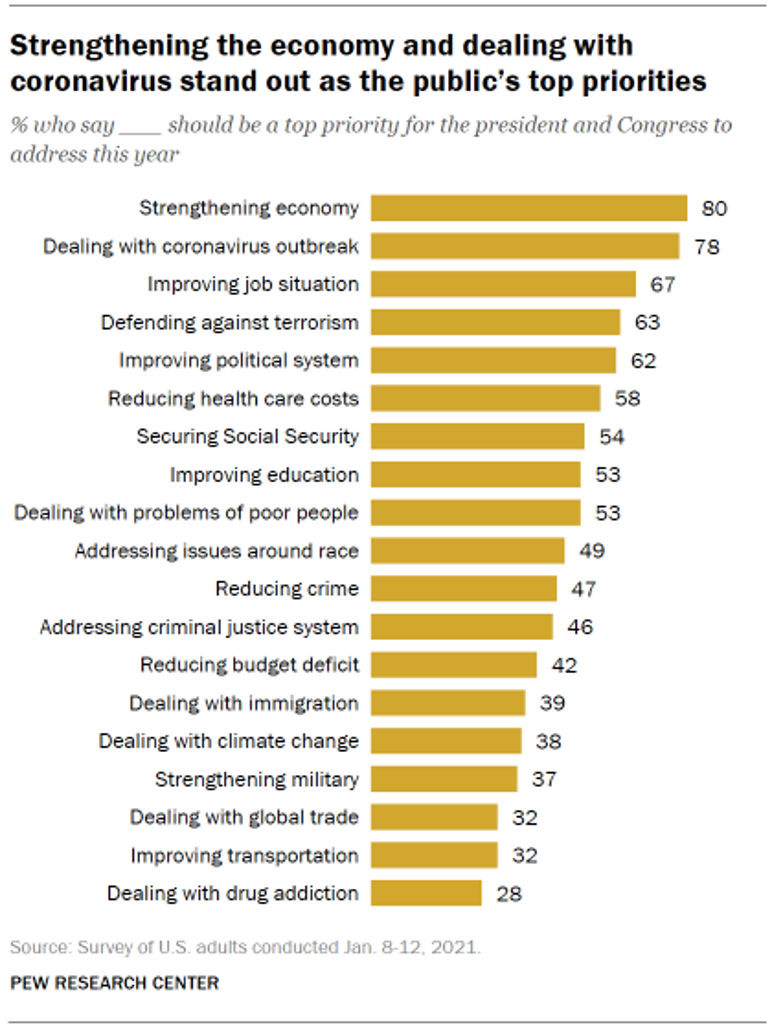

Americans A Year Into the Pandemic – A View from Pew

Nearly a year into the COVID-19 pandemic, the same percent of Americans say strengthening the U.S. economy and dealing with the coronavirus outbreak should be a top priority for President Biden and Congress to address this year, according to data from the Pew Research Center collected during the second week of January 2021. Two-thirds of people in the U.S. also want government leaders to prioritize improving the employment situation, defending against terrorism, and improving the political system, the study learned. At Americans’ low end of the priority list for the President and Congress are dealing with global trade, improving transportation,

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

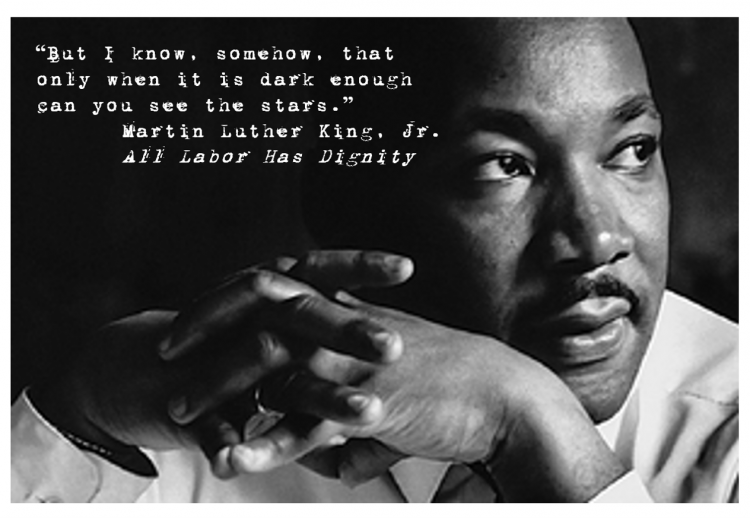

Preaching Health Equity in the Era of COVID on Martin Luther King, Jr. Day

Today as we appreciate the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group is

The Digital Consumer, Increasingly Connected to Health Devices; Parks Associates Kicking Off #CES2021

In 2020, the COVID-19 pandemic drove U.S. consumers to increase spending on electronics, notably laptops, smartphones, and desktop computers. But the coronavirus era also saw broadband households spending more on connecting health devices, with 42% of U.S. consumers owning digital health tech compared with 33% in 2015, according to research discussed in Supporting Today’s Connected Consumer from Parks Associates. developed for Sutherland, the digital transformation company. Consumer electronics purchase growth was, “likely driven by new social distancing guidelines brought on by COVID-19, which requires many individuals to work and attend school from home. Among the 26% of US broadband households

“The virus is the boss” — U.S. lives and livelihoods at the beginning of 2021

“The virus is the boss,” Austan Goolsbee, former Chair of the Council of Economic Advisers under President Obama, told Stephanie Ruhle this morning on MSNBC. Goolsbee and Jason Furman, former Chair of Obama’s Council of Economic Advisers, tag-teamed the U.S. economic outlook following today’s news that the U.S. economy lost 140,000 jobs — the greatest job loss since April 2020 in the second month of the pandemic. The 2020-21 economic recession is the first time in U.S. history that a downturn had nothing to do with the economy per se. As Uwe Reinhardt, health economist guru, is whispering in my

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...