Employee Health Benefits: Wellness Up, Rx Down

As the recession continues to negatively impact U.S. business, employers are tightly managing benefits across-the-line, from health to housing and travel categories. Benefits overall are experiencing a downward trend versus 5 years ago. In the health arena, benefits that show staying power include wellness resources (covered by 75% of employers), on-site flu vaccinations (68%), wellness programs (59%), and 24-hour nurse lines (59%). On the downside, benefit programs that are expected to erode in the next 12 months are prescription drug coverage, dental insurance mail-order drug programs, and chiropractic coverage, among others shown in the chart. The Society for Human Resource

Health plans are in a service business: it’s not only about costs and benefit design for employers

J.D. Power, an expert in understanding satisfaction across industries, has looked under the hood of employers and their satisfaction with health plans. In summary: it’s not only about the benefits and costs when it comes to health plan satisfaction. For employers, satisfaction is also based on near-equal parts of “service” in 3 guises: account servicing from the employer’s point of view (where more communication from the plan is seen as better than less); employee plan service experiences; and problem resolution. For the 4 in 5 employers who have had problems with health plans (that’s 79% of employers), it’s less about costs and

Health insurance DIY – most unable to pay

61% of American health citizens have difficulty paying for health insurance when they go out on the open market to purchase it as individual customers. A survey from the Kaiser Family Foundation (KFF) finds that most people in the U.S. who go for health insurance on their own have trouble paying for it. 14 million people in the U.S. aren’t covered by employers and seek so-called non-group or individual health insurance policies. Premium increases for these policies averaged 20% in early 2010. Nearly 1/2 of these people are self-employed or work in small business. The average out-of-pocket health spending for

Health consumers don’t understand their patient-power…yet

Most health consumers define the value of drugs in terms of safety and efficacy first, then quality of life and cost second. These priorities are similarly shared by both biopharma executives and managed care management. Where consumers diverge with the two health industry stakeholders, though, is with respect to their power: while about 1 in 3 biopharma and managed care execs believe that patients will be influential in the success or failure of new therapies over the next five years, only 11% of patients say that “people like me” will be influential over what new drugs will be available in the

More out-of-pocket, more wellness in 2011? A look into PwC's Behind the numbers

Medical costs will increase by 9% in 2011, a mere 0.5% less than 2010 cost growth. The fastest-growing components will be inpatient and outpatient costs, shown in the pie chart. 81% of premium costs are bound up in provider costs for hospitals and physicians — the two most significant factors of medical inflation. And Americans will bear even more medical costs, out-of-pocket (OOP), in 2011 in the form of greater coinsurance and deductibles. Behind the numbers: Medical cost trends to 2011 looks into employers’ crystal balls on health benefits for 2011. PricewaterhouseCoopers’ Health Research Institute surveyed 700 U.S.-based companies, small through jumbo sized, to

After health reform, employers will play, not pay – but employees will

Employers are worried about health reform

$18,074 is the medical cost for a typical family four in the U.S. in 2010

Today, $18,074 could cover… A new 2010 Honda Civic A year of college at Hampton University in Virginia The per capita income in Waterloo, NY. Or, you could cover health insurance for a typical family of four in America. In the past year, the average cost of health care for a family of four in the U.S. has increased by $1,303, the large single dollar increase seen in the past 10 years since the start of the Milliman Medical Index (MMI). The total medical cost for a family of four is $18,074 in 2010. Employers will pay, on average, 59% of the

Half of employers will offer consumer-directed health plans in 2015

The growth of consumer-directed health plans (CDHPs) continues as employers look for ways to rationalize their health spending in the midst of annual double-digit health cost increases. By 2015, 61% of large employers will off CDHPs. Overall, 45% of employers think they’ll be offering CDHPs in five years. These data were found through the Mercer National Survey of Employer-Sponsored Health Plans, sponsored by the American Association of Preferred Provider Organizations (AAPPO), published in April 2010. In 2009, 15% of all employers offered a CDHP: this grew from 10% in 2008. 18% of employers are likely to offer a CDHP this

Employers seek to maintain benefits while reducing costs, in MetLife survey

When it comes to health plans sponsored by U.S. employers, there are two realities facing benefits managers: on one side of the coin, most U.S. employers held the line on employee benefits in the recession. The other reality: controlling costs is the most important objective for employee benefits, according to most U.S. employers polled in MetLife’s 8th Annual Study of Employee Benefits Trends. Under the cost-control priority, though, is a novel finding in the MetLife study. That is that employers see a link between benefits and employee productivity and loyalty. Thus, when productivity is viewed as a benefits objective, employers can connect the dots

Health costs for smaller companies grew twice as fast as for larger firms in 2009

Inflation in the U.S. fell by 0.4% in 2009, the first such annual decline in the Consumer Price Index since 1955. At the same time, health care costs for American employers grew 7.3% per capita in 2009. As the chart health spending increased nearly 5%, with employers’ costs increasing even more quickly over the year. This was especially twice-as-onerous for small and mid-sized companies whose costs grew much faster than for larger companies, whose rate of increase actually fell in the year. These sobering statistics were calculated by Thomson Reuters and published in Helathcare Costs Rise More Than 7 Percent

The #1 focus for employees: physical health, fiscal health

While Congress and the President arm-wrestled through the Health Summit, the private sector doesn’t sit still waiting in a frozen state for the result of inside-Beltway-health-baseball. Employees/consumers and employers have aligning in mutual self-interest when it comes to health care benefits, costs, and disease management, according to a survey sponsored jointly by Deloitte and the International Society of Certified Employee Benefit Specialists, 2010 Top Five Total Rewards Priorities Survey. This latest recession has focused the minds of companies and their workers and driven the collective priority of managing health costs while maintaining job and retirement security. In this 16th annual

Employers say health engagement is low, but tactics seem more actuarial than action-oriented

While the stock market and companies’ profitability improves, much of that has been done on the backs of employees: through reductions in force and job cuts, and re-working of benefits. Health benefits are a prime target for cost management as companies try to survive through the long recovery. Combined with insurance companies’ cost increases (most notably and recently Anthem’s announcement of up-to-39% increases in premium costs), employers who choose to continue to provide health insurance to employers are in a bind. According to the 15th annual survey from National Business Group on Health/Towers Watson, employers faced cost increases of 7%

DIY health care comes to the workplace: employers get into cold/flu prevention

While coughs, colds and seasonal allergies have always been a retail health category, this recession has bolstered the workplace channel for messaging and products. BigResearch‘s Workplace Media group has found that 85% of working consumers are concerned about this year’s flue and cold season. Two-thirds of workers planned to get a flu shot. And, 9 in 10 workers would likely welcome and use an offer for flu/cold products delivered through the workplace. The H1N1 virus drives most working consumers to take extra precautions this cold/flu season. Other key findings are that: 3/4 of employers will offer flu prevention tips to

Health cost increases will hit double-digits in 2010 – another reason for real health reform

So much for America’s ability to manage health care costs without health reform: health costs will increase in the double-digits this year, according to Buck Consultants‘ 21st National Health Care Trend Survey. This annual survey monitors medical trend — the factors that drive cost increases. These include inflation, service utilization, technology, adding new programs, changes in service mix, and benefit mandates. The chart illustrates that medical trend varies across plans — but not my much. High-deductible consumer-driven health plans expect growth of 10.4%: hardly a significantly lower rate of growth than for the most open, rich plans (PPO, POS). Buck

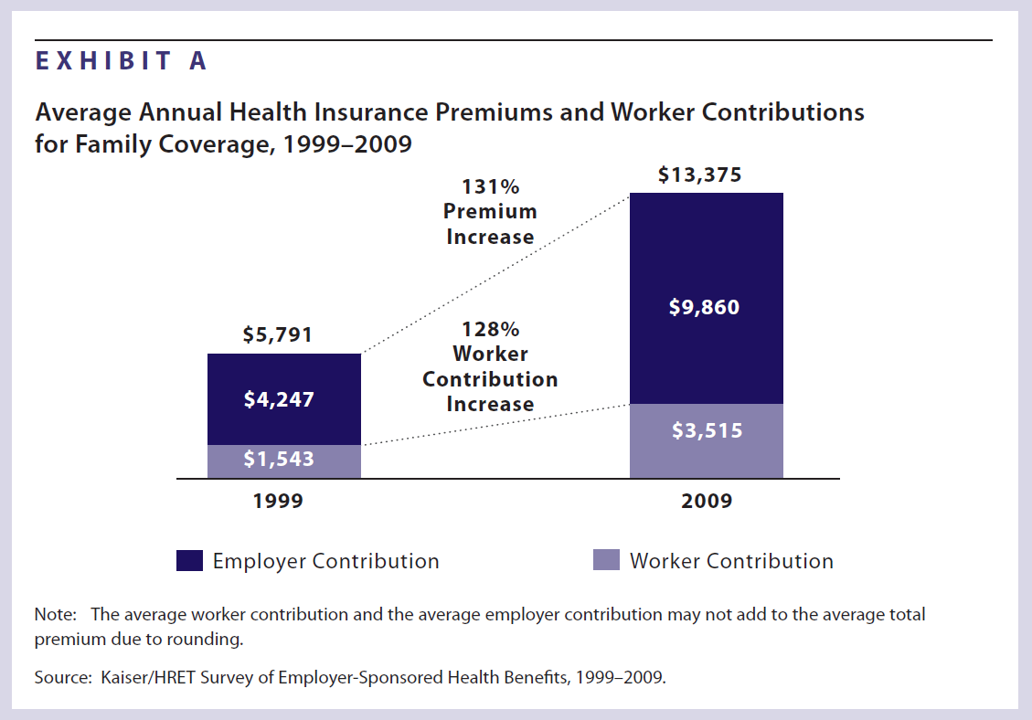

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

Eroding and unaffordable: health care for workers in America

Rosie the Riveter reminds us to Honor Labor. In that vein, with the Labor Day holiday upon us, this post assembles data to paint the latest picture of health insurance and the American worker in 2009… Workscape’s Annual Benefits Study for 2009 found that employees have a heightened appreciation of benefits. The declining economy clearly has increased awareness and appreciation of workplace benefits. Trends In Underinsurance And The Affordability Of Employer Coverage, 2004-2007, in Health Affairs online, found eroding health insurance coverage among employers who continued to provide insurance, and further moves for employees to have more financial “skin in

$16,771 is the cost of health care for a family of four in 2009

$16,771 is roughly the cost of health care for an American family of four in 2009, according to the Milliman Medical Index. If the median family income in 2008 was about $67,000, then health care costs represent about 25% of the annual household paycheck (remember, that’s gross, not net, income). As the chart illustrates, 1 in 3 health care dollars goes to physicians, with another third paid to inpatient services. Outpatient services and prescription drugs consume 15-17 cents on the health dollar in 2009. The greatest increase in cost trends in 2008-9 is with hospital outpatient services, which grew more

Generics are real, and really impacting household and employer economies

Every 1 additional prescription per 100 that is filled with a generic Rx in the Rochester NY region yields $82 million in annual cost savings to the community: specifically, to employers, consumers and health plans. The Blue Cross Blue Shield Association presented findings from a survey and featured best practices from member plans in a webinar, “Generic Drugs Can Be Good for Your Health and Your Wallet.” Blues Plans believe that implementing generic drug programs can help Americans access drugs at an affordable cost. In BCBSA’s health reform recommendations, Pathway to Covering America, there are 5 key points: four are

Wal-Mart’s wearing a new hat: health care advocate

Nearly 100% of Wal-Mart’s staff is covered by health insurance, either through the company itself or through another source. Covered “associates” reached a total of 94.5% this month, compared with 92.7% last year. The total proportion of Wal-Mart employees covered by Wal-Mart’s plans at the end of open enrollment was 51.8%. Uninsured Wal-Mart employees fell to 5.5%, a 40% drop from 2007 to 2009. The most recently gauged national uninsured rate for employed Americans was 16.8%. Wal-Mart’s role in health care is growing both in terms of its approach to employee health benefits within the company, and

Only 1 in 10 unemployed people buy into COBRA

Because of high premiums, only 9 percent of unemployed workers have COBRA coverage. Maintaining Health Insurance During a Recession: Likely COBRA Eligibility, a study from The Commonwealth Fund (CMWF), clarifies how COBRA is actually used by unemployed people in the U.S. CMWF calculates that: – Two of three working adults are eligible to buy into COBRA under the 1985 Consolidated Omnibus Budget Reconciliation Act (COBRA) if they became unemployed. – Under COBRA, workers pay 4 to 6 times their current premium for health benefits. – Thus, only 9 percent of unemployed workers have COBRA coverage due to the high price

The average health insurance premium costs 84% of average unemployment benefits

The average unemployment benefit across the U.S. is $1,278; COBRA monthly premiums for family coverage are $1,069. In 9 of the 50 states, COBRA equals or is greater than the monthly unemployment benefit. Those states are Alaska, Arkansas, Arizona, Delaware, Florida, Louisiana, Mississippi, South Carolina, and West Virginia. These metrics are shown in the table above. Families USA has appropriately titled its report on this situation, Squeezed: Caught Between Unemployment Benefits and Health Care Costs. COBRA, the Consolidated Omnibus Budget Reconciliation Act, is the mechanism that allows laid-off workers to buy into their employer’s health plans when

A majority of employers who don’t sponsor health would be unwilling to contribute over $50 per employee per month for coverage

The U.S. employer sponsored health system is experiencing some bipolar behavior: there is a cadre of large employers who want to continue sponsoring health benefits as part of overall compensation. But, for at least one in 3 employers, most would not be willing to pay $50 per member per month to cover health for an employee. According to Mercer‘s survey of employers released October 21st, 2008, What Price Universal Health Coverage?, the rejoinder is: any price is too high. 4 in 10 employers say the main reason they do not offer health coverage is simply that they cannot

Employers’ wellness programs in a Health 2.0 era

Employee wellness is a growth business: 57% of large employers provide wellness programs to employees, increasing from 49% of large employers in 2006. According MetLife’s Sixth Annual Employee Benefits Trends Study, nine of ten companies that offer wellness believe these programs are effective in reducing medical costs. For the average employer, MetLife found, 58% of the total benefits spend goes to medical coverage — an even higher percentage for smaller employers. The most popular wellness programs include smoking cessation, weight management, an exercise regimen and cancer screening among others. While 4 in 5 employers provide incentives to “nudge” people into

Employee health and productivity — a growth segment

If employers got their collective hands on Aladdin’s lamp, they’d wish for: Increased employee accountability Reduced health risks Tailored health management programs that account for risk Health data and measurement tools that feed into analytics and outcomes measures, and Integrated and well-managed benefits and programs. These wishes are brought to you by Hewitt Associates’ 2008 survey, The Road Ahead: Driving Productivity by Investing in Health. 38% of employers plan to develop strategies for employee health and productivity in the next 1 to 2 years; 21% plan to do so within 3 to 5 years. 1 in 5 (19%) aren’t

Small business and health care costs – 25 years of hurt

The cost of health insurance is the #1 problem cited by small business owners. Health costs beat gas prices, the #2 most severe problem cited by small business, as of March 2008 (when the survey was conducted). This week, small business leaders convened at the annual National Small Business Summit conference of the National Federation of Independent Business (NFIB). The report notes the downturn in the economy during the second half of 2007 when the NFIB Small Business Optimism Index dropped to 94.6 in December, the lowest since 2001. Health care costs rank first in small business problems regardless of

Medical costs for a family of four = $15,609

$15,609 could cover a lot of household needs for the average American family in the course of a year: utilities, mortgage, gas tank fills. It’s also the cost of health care to cover a family of four in 2008. Milliman notes that the average annual medical cost for a family of four increased by 7.6% from 2007 to 2008. This rate of increase is lower than the 8.4% average annual increase between 2003-2007; however, the burden of overall expense is “steadily shifting to employees,” Milliman attests. Health spending splits into five components, as the Milliman Medical Index

Health Plan Illiteracy, or how not to benefit from the Benefit

Health plan illiteracy is alive and well, according to J.D. Power and Associates. The consumer market research firm’s 2008 National Health Insurance Plan Study finds that 1 in two plan members don’t understand their plan. In this second year of the survey, J.D. Power notes that, as consumers understand the benefits of their Benefit, their satisfaction with the plan increases. Thus, there is a virtuous cycle that happens between a plan and an enrollee when communication is clear and understood. J.D. Power looked at member satisfaction in 107 health plans throughout the U.S. in terms of 7 key metrics:

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Health Populi’s Tea Leaves for 2008

I “leave” you for the year with some great, good, and less-than-sanguine expectations for health care in 2008. These are views filtered through my lens on the health care world: the new consumer, health information technology, globalization, politics, and health economics. Health politics shares the stage with Iraq. Health care is second only to Iraq as the issue that Americans most want the 2008 presidential candidates to talk about, according to the latest Kaiser Health Tracking Poll. Several candidates have responded to the public’s interest with significant health care reform proposals. But major health reform – such as universal access

Steel, Coffee Beans and Health Care

The UAW and GM have been debating health care as Friday’s deadline for their national contract approaches. This round of negotiation is about survival. Yesterday, I covered the rising costs of employer-sponsored health insurance. Today, let’s visit the intimately-related topic of retiree health benefits. These are eroding even faster than health benefits for employed workers. Many employers have significantly scaled back health benefits for retirees. Currently, one in three large employers offers retire benefits, compared with two in three in the late 1980s. Consider the predicament of the company ranked #3 on the 2006 Fortune 500 list, General Motors. Retirees

Hackathons are intense, fast-paced events where interdisciplinary teams come together to solve complex problems. In this SEE YOU NOW Insight from

Hackathons are intense, fast-paced events where interdisciplinary teams come together to solve complex problems. In this SEE YOU NOW Insight from  I'm once again pretty gobsmackingly happy to have been named a judge for

I'm once again pretty gobsmackingly happy to have been named a judge for  Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during

Stay tuned to Health Populi in early January as I'll be attending Media Days and meeting with innovators in digital health, longevity, and the home-for-health during