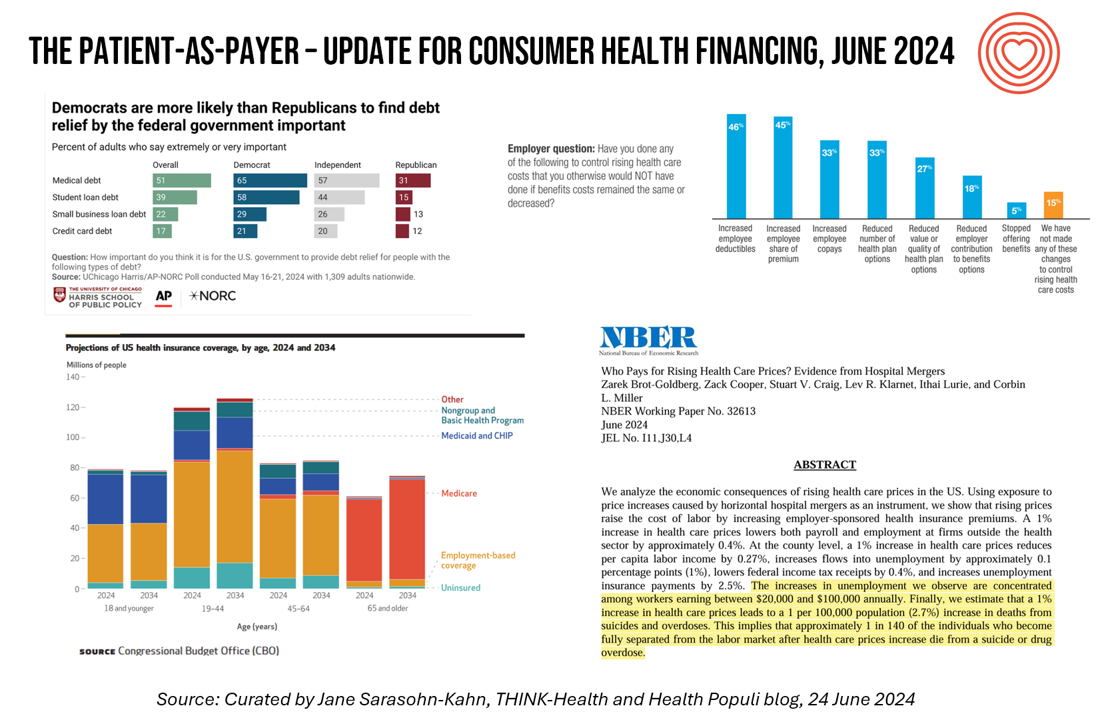

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

GNC Offers “Free Healthcare” — Telehealth, Generic Meds, and Loyalty in the Retail Health Ecosystem

The retail health landscape continues to grow, now with GNC Health offering a new program featuring telehealth and “curated set” of 40+ generic prescription drugs commonly used in urgent care settings. The services are available to members of GNC’s new-and-improved loyalty program, GNC PRO Access, which is priced at a fixed fee of $39.99 for one year’s membership. This is available to consumers 18 years of age and older. “As a trusted brand in the health and wellness space, we are thrilled to expand our efforts in helping our customers Live Well by offering

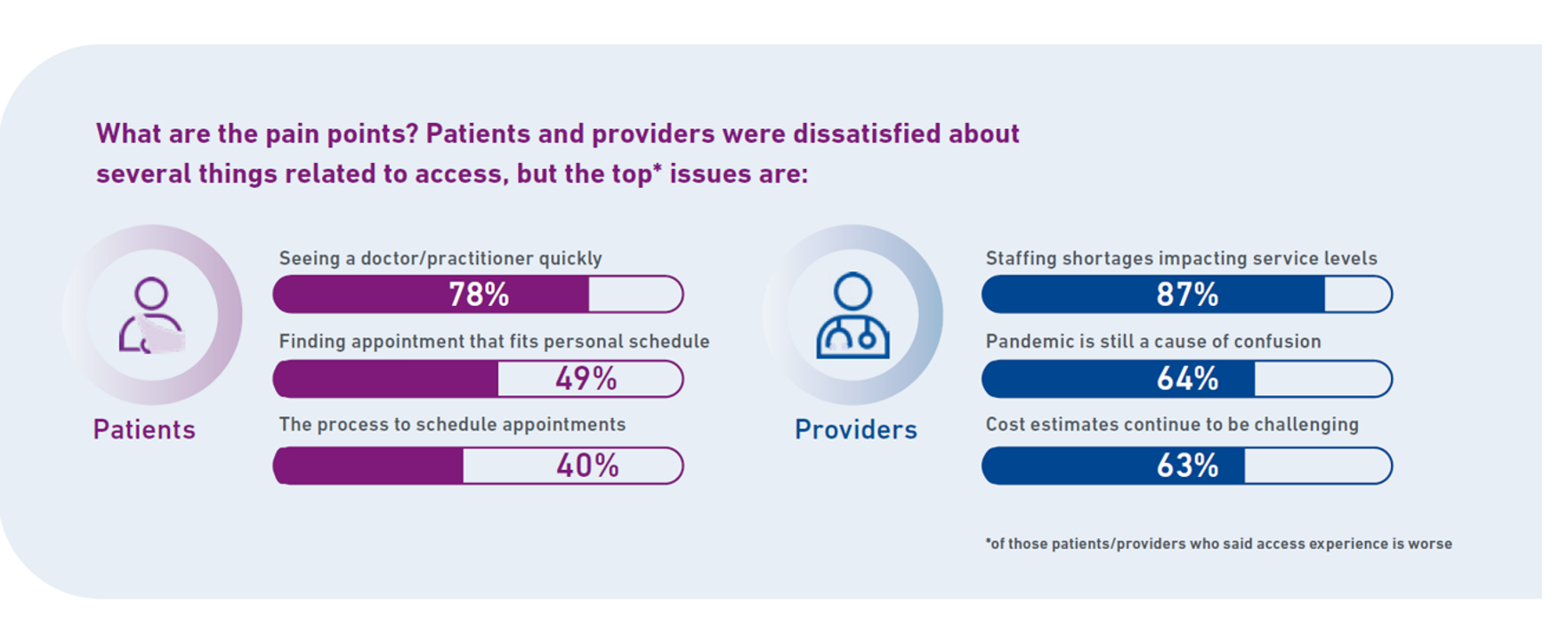

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

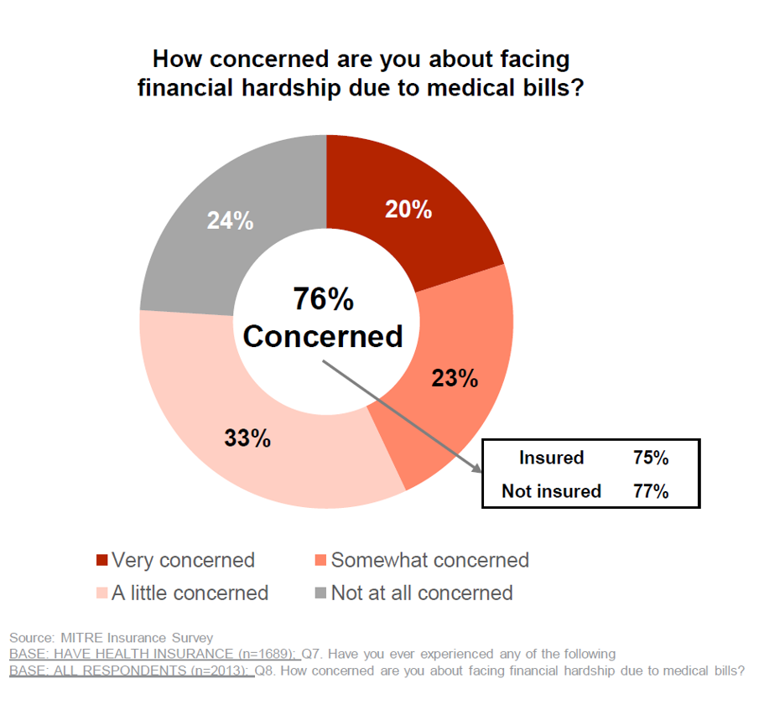

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

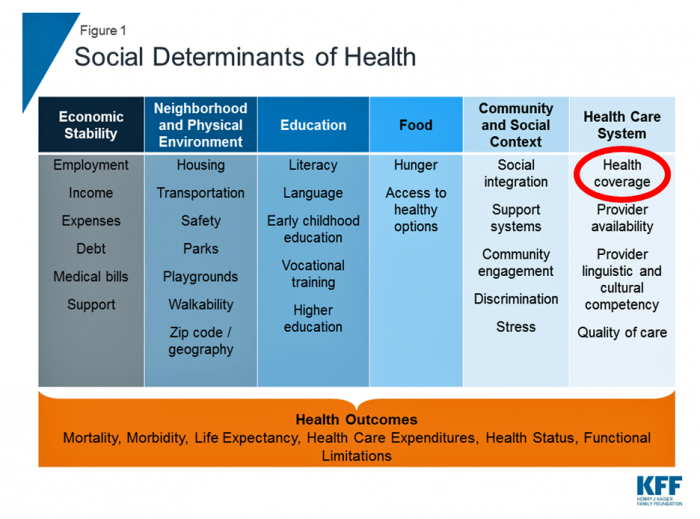

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

Effective Health Spending Is An Investment, Not a Cost: the Bottom-Line from OECD Health at a Glance 2021

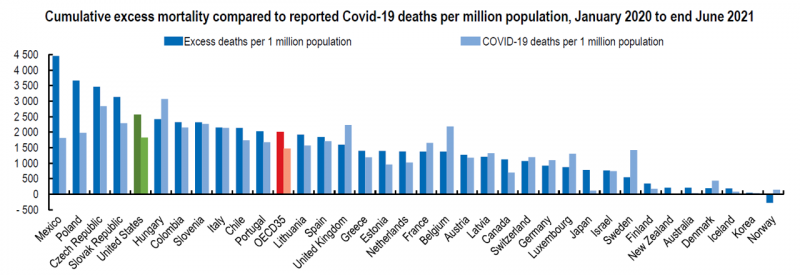

“The pandemic has shown that effective health spending is an investment, not a cost to be contained: stronger, more resilient health systems protect both populations and economies,” the OECD states in the first paragraph of the organization’s perennially-updated report, Health at a Glance 2021. This version of the global report incorporates public health data from the “OECD35,” 35 nations from “A” to “U” (Australia to United States) quantifying excess deaths experienced during the COVID-19 pandemic, the obesity epidemic, mental and behavioral health burdens, and health care spending, among many other metrics. The first chart illustrates that calculation of excess deaths,

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

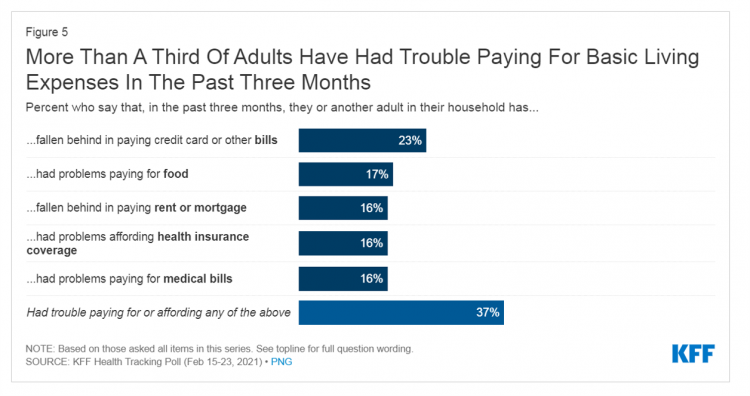

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

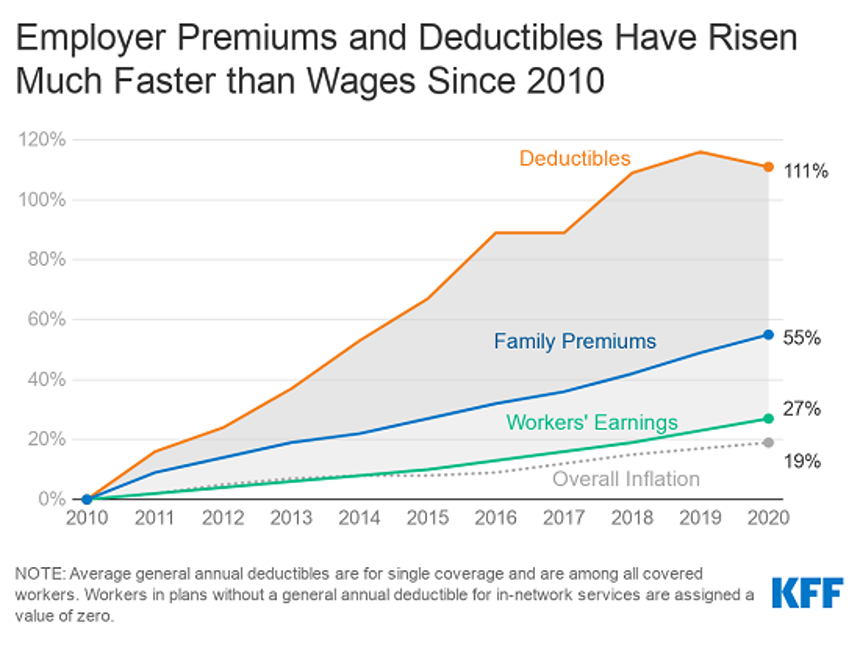

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

50 Days Before the U.S. Elections, Voters Say Health Care Costs and Access Top Their Health Concerns — More than COVID-19

The coronavirus pandemic has revealed deep cracks and inequities in U.S. health care in terms of exposure to COVID-19 and subsequent outcomes, with access to medical care and mortality rates negatively impacting people of color to a greater extent than White Americans. The pandemic has also led to economic decline that, seven weeks before the 2020 elections in America, is top-of-mind for health citizens with the virus-crisis itself receding to second place, according to the Kaiser Family Foundation September 2020 Health Tracking Poll. KFF polled 1,199 U.S. adults 18 years of age and older between August 28 and September 3,

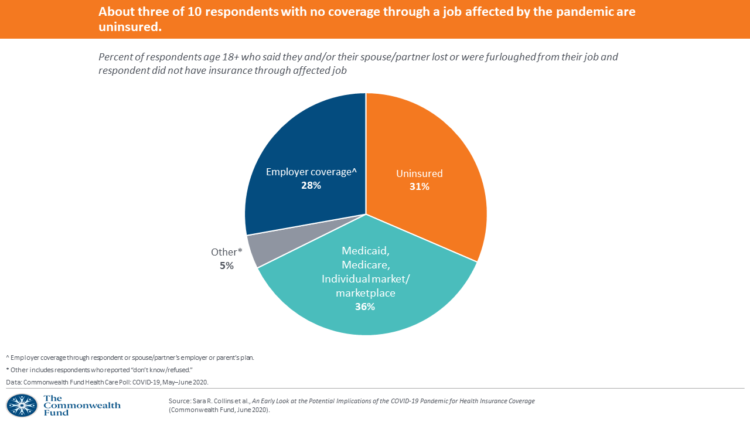

Health Insurance and Demand for Masking, Testing and Contact Tracing – New Data from The Commonwealth Fund

The coronavirus pandemic occasioned the Great Lockdown for people to shelter-at-home, tele-work if possible, and shut down large parts of the U.S. economy considered “non-essential.” As health insurance for working-age people is tied to employment, COVID-19 led to disproportionate loss of health plan coverage especially among people earning lower incomes, as well as non-white workers, explained in the Commonwealth Fund Health Care Poll: COVID-19, May-June 2020. The Commonwealth Fund commissioned interviews with 2,271 U.S. adults 18 and over between 13 May and 2nd June 2020 for this study. The survey has two lenses: first, on health insurance coverage among working

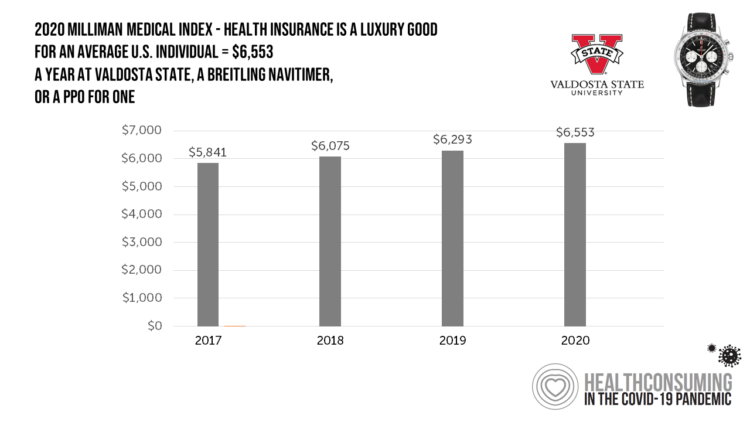

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

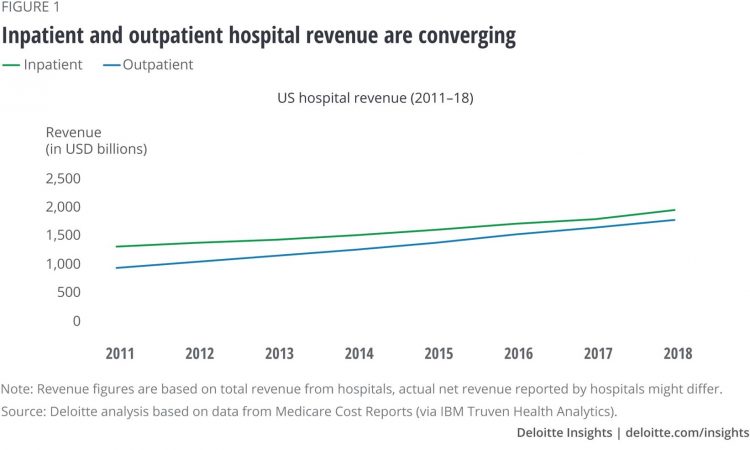

Outpatient is the New Inpatient – The Future of Hospitals in America

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

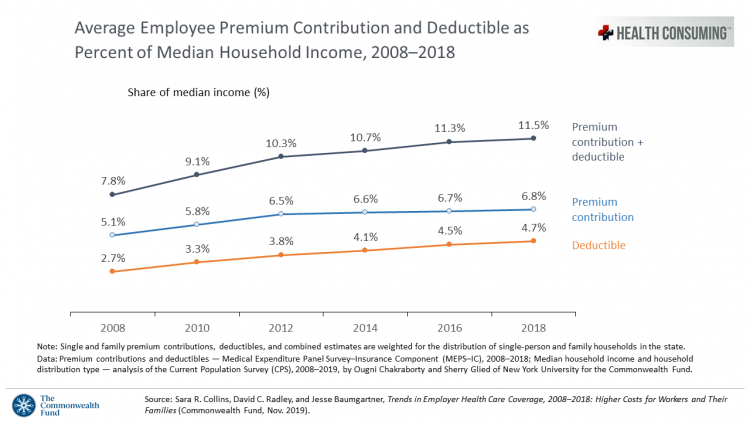

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Most U.S. Voters Support Building on the ACA, Not Medicare For All, As Fewer Americans Have Insurance Coverage

The vast majority of Americans favor lowering the cost of prescriptions, keeping the Affordable Care Act’s provisions to cover pre-existing conditions, lower overall medical costs, and protect people from surprise medical bills, according to the KFF Health Tracking Poll – September 2019: Health Care Policy In Congress And On The Campaign Trail. The big headline in this poll following last night’s third Democratic Presidential debate is that 55% of Democrats and Democrat-leaning Independent voters prefer a candidate that will build on the Affordable Care Act (ACA) versus a President that would replace the ACA with a Medicare For All plan (M4A).

Scaling the Social Determinants of Health – McKinsey and Kaiser’s Bold Move

People who are in poor health or use more health care services are more likely to report multiple unmet social needs, such as food insecurity, unsafe neighborhoods, lack of good housing, social isolation, and poor transportation access, found through a survey conducted by McKinsey. The results are summarized in Addressing the Social Determinants of Health. The growing recognition of the influence of social determinants reached a tipping point last week with the news that Kaiser-Permanente would work with Unite US to scale services to people who need them. The mainstreaming of SDoH speaks to the awareness that health is made

Assessing the GAO’s Report on Single-Payer Healthcare in America: Let’s Re-Imagine Workflow

Calls for universal health care, some under the banner of Medicare for All,” are growing among some policy makers and presidential candidates looking to run in 2020. As a response, the Chairman of the House Budget Committee in the U.S. Congress, Rep. John Yarmuth (D-Ky.), asked the Congressional Budget Office (CBO) to develop a report outlining definitions and concepts for a single-payer health care system in the U.S. The result of this ask is the report, Key Design Components and Considerations for Establishing a Single-Payer Health Care System, published on 1st May by the CBO. The report provides

Having Health Insurance Is A Social Determinant of Health

Health insurance was on the collective minds of American voters in the 2018 midterm elections. Health care, broadly defined, drove many people to the polls voting with feet and ballots to protect their access to a health plan covering a pre-existing condition or to protest the cost of expensive prescription drugs. These were the two top health care issues among voters in late 2018, a Kaiser Family Foundation poll at the time assessed. Yesterday, President Trump verbally re-branded the Republican Party as “the party of healthcare.” That Presidential pronouncement was tied to a letter written on U.S. Department of Justice

Calling Out Health Equity on Martin Luther King Day 2019

On this weekend as we appreciate the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other

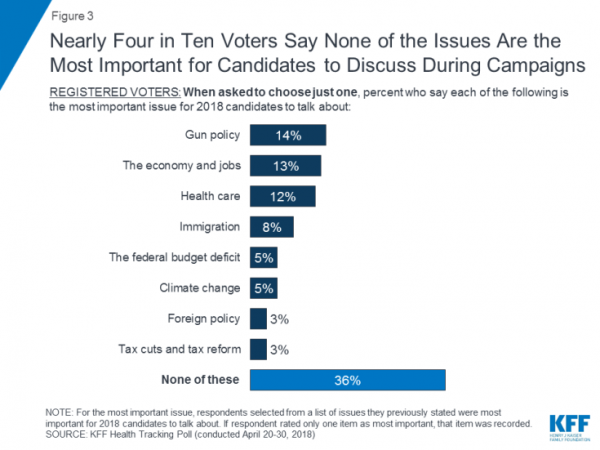

Guns, Jobs, or Health Care? In 2018, Voters Split as to Top Issue

It’s a fairly even split between voting first on gun policy, jobs, or healthcare for the 2018 mid-term elections, ac cording to the May 2018 Kaiser Family Foundation Health Tracking Poll. Arguably, gun policy can cut in two ways: in light of the Stoneman Douglas High School shootings and wake-up call for #NeverAgain among both students and the public-at-large, vis-a-vis Second Amendment issue voters. And, as a growing public health issue, “guns” could also be adjacent to health. “If it isn’t a health problem, then why are all these people dying from it?” rhetorically asked Dr. Garen Wintemute, professor of emergency

The United States of Care Launches to Promote Healthcare for All of US

Let’s change the conversation and put healthcare over politics. Sounds just right, doesn’t it? If you’re reading Health Populi, then you’re keen on health policy, health economics, most of all, patients: now playing starring roles as consumers, caregivers, and payors in their own care. Andy Slavitt, former Acting Administrator of the Centers for Medicare and Medicaid Services (CMS), has assembled a diverse group of health care leaders who care about those patients/people, too, appropriately named the United States of Care. Founders include Dr. Bill Frist, former Republican U.S. Senator from Tennessee, Dave Durenberger, former Republican U.S. Senator from Minnesota, and

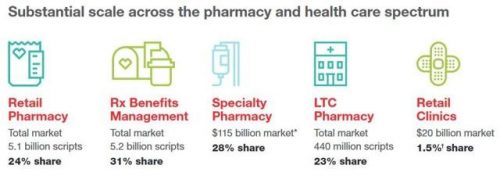

A Health Consumer Perspective on CVS+Aetna

A response to Amazon’s potential moves in healthcare and pharmacy…strategic positioning for the post-Trump healthcare landscape…vertical integration to better manage healthcare utilization and costs…these, and other rationale have been offered by industry analysts and observers of the discussions between CVS and Aetna, for the former to acquire the latter. “A pharmacy chain buying a health insurance company?” many have asked me over the past few days. These inquiring minds include people who work both inside and outside of health/care. I ask back: in 2017 and in the future, “What is a pharmacy? What is a health plan?” See the

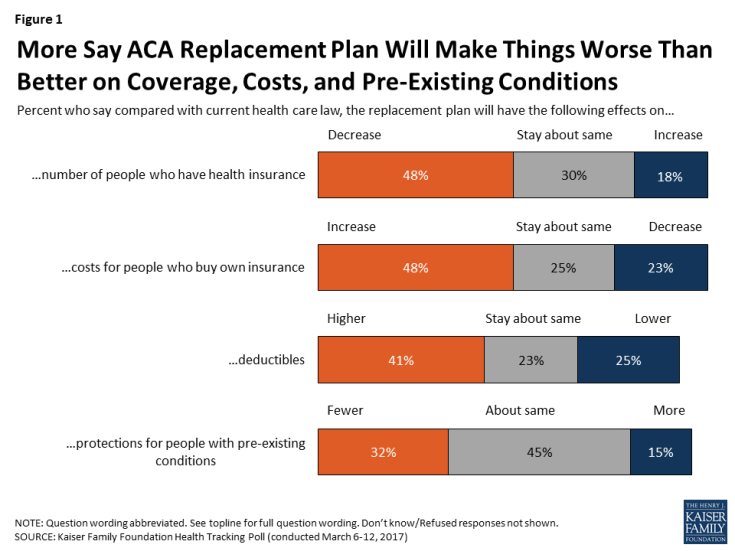

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

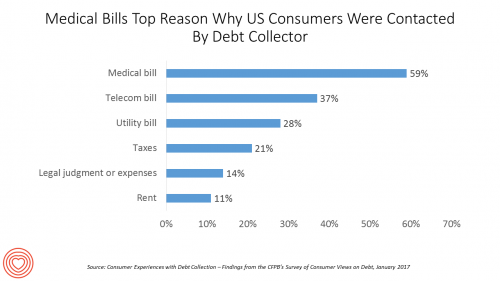

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

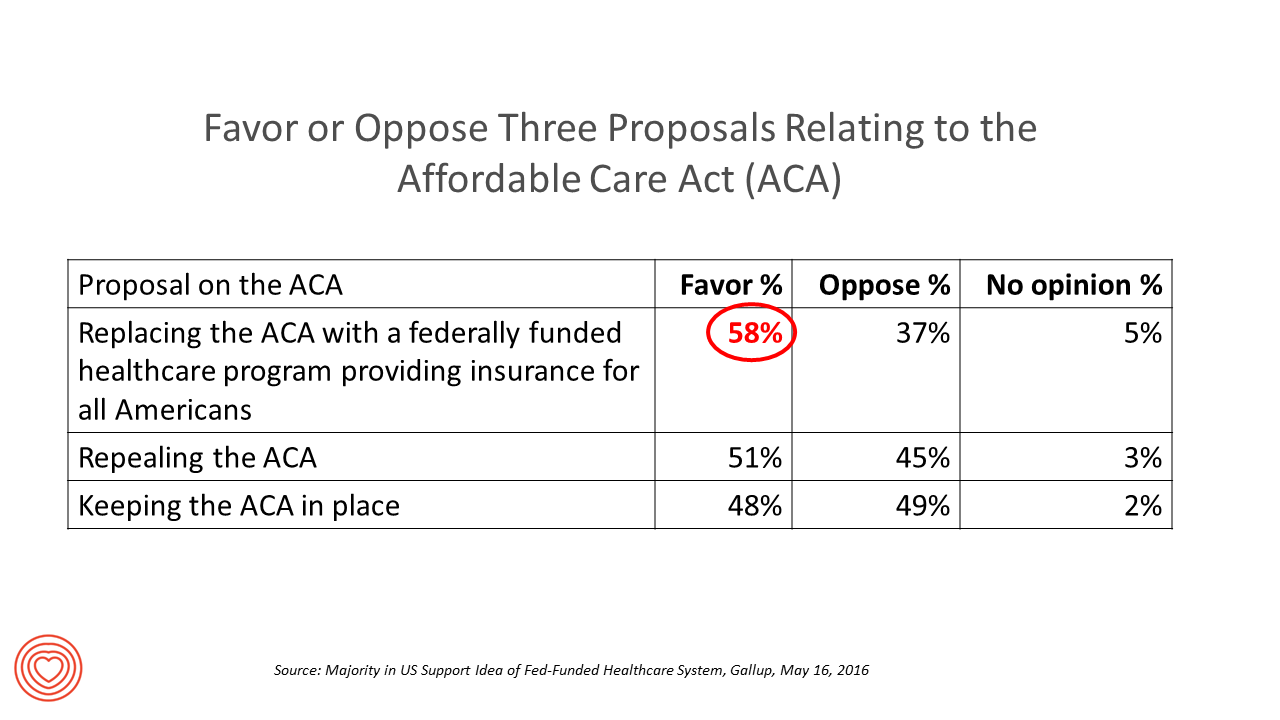

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

Diagnosis: Acute Health Care Angst In America

There’s an overall feeling of angst about healthcare in America among both health care consumers and the people who provide care — physicians and administrators. On one thing most healthcare consumers and providers (can agree: that the U.S. health care system is on the wrong track. Another area of commonality between consumers and providers regards privacy and security of health information: while healthcare providers will continue to increase investments in digital health tools and electronic health records systems, both providers and consumers are concerned about the security of personal health information. In How We View Healthcare in America: Consumer and Provider Perspectives,

Women are natural disruptors for health

“Disruption” is a well-used word these days in business and, in the past few years, in the health care business. That’s because there’s a general consensus that the U.S. health care system is broken. “System” is a word that I shouldn’t use as my friend J.D. Kleinke smartly argued that it’s that lack of system-ness that makes using the phrase “health care system” an Oxymoron. The fragmented health care environment creates innumerable pain points when accessing, receiving, and paying for services. And it’s women who feel so much of that pain. In that context, I’m gratified and humbled to be one

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

Health costs up, credit down: health consumers face tightening credit markets in the face of rising medical costs

People who received health care in the U.S. between the second quarters of 2012 and 2013 faced 38% higher out-of-pocket costs, growing from $1,862 to $2,568 in just one year. These were payments for common procedures like joint replacements, Caesarean sections, and normal births. At the same time, consumers’ access to revolving credit lines fell by $1,000 over the twelve months. (Credit lines here include bank-issued credit cards, store credit cards, and home equity loans). The TransUnion Healthcare Report from TransUnion, the credit information company, paints a picture of tightening money for all consumers in the face of rising household

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

A new medical side-effect: out-of-pocket health care costs

When we say the phrase “side effects,” what do we think of? The FDA says that “all medicines have benefits and risks. The risks of medicines are the chances that something unwanted or unexpected could happen to you when you use them. Risks could be less serious things, such as an upset stomach, or more serious things, such as liver damage.” There’s a new risk in town in health care, and it’s the equivalent of an upset stomach when it comes to a co-pay for a branded on-formulary drug, or liver damage if it involves a coinsurance percent of “retail”

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

U.S. Health Citizens Needed a Dummies Guide to the ACA

The Affordable Care Act (ACA) was signed in March 2010; that month, 57% of U.S. adults did something to self-ration health care, such as splitting prescription pills, postponing necessary health care, and putting off recommended medical tests, according to the Kaiser Family Foundation (KFF) Health Tracking Poll of March 2010. 57% of U.S. adults are still self-rationing health care in September 2013, according to KFF’s latest Health Tracking Poll, completed among 1,503 U.S. adults just two weeks before the launch of the Health Insurance Marketplaces on October 1, 2013. As of September 2013, only 19% of U.S. adults said they had heard

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Health care and survey taking at the Big Box Store

Where can you shop the health and beauty aisles, pick up some groceries and a prescription, get a flu vaccine, and weigh in on Obamacare and what digital health tools you like? Why, at one of several thousand retail stores where you can find a SoloHealth kiosk. As of yesterday afternoon, over 32 million encounters were recorded on SoloHealth kiosks, based on an app I saw on the company CEO Bart Foster’s smartphone. Kiosks are locatted around the United States in retailers including Walmart and Sam’s Clubs, along with major grocery chains like Schnuck’s and Publix, and the CVS pharmacy

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Health care costs for a family of 4 in 2013: a college education, a diamond or a 4-door sedan

If you have $22,030 in your wallet, you can buy: A princess-cut diamond A Ford Focus 4-door A year’s tuition at James Madison University (in-state, 2013-14) A health plan for a family of four. The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods. In 2013, the average family will

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

Dietitians provide a health bridge between food and pharmacy

The registered dietitian is an in-demand labor resource for grocery stores around the U.S. Advertising Age covered the phenomenon of the growing clout of dietitians in food chains (April 14, 2013). Let’s dig further into this phenomenon through the Health Populi lens on healthcareDIY and peoples’ ability to bend their personal health care cost curves. Stores such as Giant Eagle, Hy-Vee, Safeway and Wegmans are morphing into wellness destinations, with pharmacies and natural food aisles taking up valuable square footage to meet consumers’ growing demands for healthy choices. Some stores are formalizing their approach to food = health by formulating a

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Consumer health empowerment is compromised by complex information

The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care. While the banner of “consumerism” in health care has been flown

Health is wealth and wealth, health

It’s America Saves Week (February 25-March 2, 2013). Do you know what your savings rate is? If you’re in the center of the American savings bell curve, you probably don’t have a savings plan with specific goals and don’t know your net worth. Two-thirds of U.S. adults say they have sufficient emergency savings for unexpected expenses like a visit to a doctor. However, only one-half of non-retired people believe they’re saving enough for a retirement where they’ll have a “desirable standard of living.” This six annual survey by the Consumer Federation of America, the American Savings Education Council, and the

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Health reform, costs and the growing role of consumers: PwC’s tea leaves for 2013

PwC has seen the future of health care for the next year, and the crystal ball expects to see the following: Affordable Care Act implementation, with states playing lead roles The role of dual eligibles Employer’s role in health care benefits Consumers’ role in coverage Consumers’ ratings impact on health care Transforming health delivery Population health management Bring your own device Pharma’s changing value proposition The medical device industry & tax impact. In their report, Top health industry issues of 2013: picking up the pace on health reform, PwC summarizes these expectations as a “future [that] includes full implementation of

Health and consumer spending may be flat, but consumers hard hit due to wage stagnation & self-rationing

There’s good news on the macro-health economics front: the growth rate in national health spending in the U.S. fell in 2011, according to an analysis published in Health Affairs January 2013 issue. Furthermore, this study found that consumers’ spending on health has fallen to 27.7% of health spending, down from 32% in 2000, based on three spending categories: 1. Insurance premiums through the workplace or self-paid 2. Out-of-pocket deductibles and co-pays 3. Medicare payroll taxes. A key factor driving down health spending is the growth of generic drug substitution for more expensive Rx brands. Generics now comprise 80% of prescribed

Obama would get health-issue voters’ votes

Bob Blendon and his can-do team at the Harvard School of Public Health have done the heavy lifting for us by analyzing 36 telephone polls (that’s “polls,” not “poles”) looking at the role of health reform in the 2012 election cycle. I knew Bob Blendon when I was affiliated for a decade with Institute for the Future, and Blendon was affiliated as well as health politics consultant to the health team. He is the guru on this topic, so when I spotted his article, Understanding Health Care in the 2012 Election in this week’s New England Journal of Medicine, I dashed

Americans continue to self-ration health care in the economic recovery

Even though Inside-the-Beltway economists have said The Great Recession of 2007 is officially over, it doesn’t look that way when you ask consumers about health spending in 2012, based on results from a survey conducted on behalf of the American Osteopathic Association (AOA). One in 5 U.S. adults is trying to lower their personal health spending. One in four is seeking free or alternate sources of health care. Overall, 1 in 5 people says their health has been negatively impacted by the economy. The AOA discovered that people in the U.S. whose health has been negatively impacted by the economic downturn were

$12 water and $10 premium increases: how price elasticity is contextual in health and life

A $10 increase in a health plan premium drove up to 3% of retired University of Michigan employees to leave the plan, according to a study from U-M published in Health Economics, The Price Sensitivity of Medicare Beneficiaries. The U-M researchers analyzed the behaviors of 3,182 retirees over four years, to assess the impact of price on beneficiaries’ health plan choices. During the four years, the premium contribution for retirees increased significantly. The researchers conducted this study, in part, to anticipate how Americans will respond to health insurance exchanges in 2014 as they bring health plan information to the market

The ACA won’t undermine employer-based health insurance and could help the deficit, says CBO (again)

There’s intriguing fine print in the latest CBO analysis on the impact of the Affordable Care Act (ACA) on employer-sponsored health insurance in the U.S. CBO finds there will be 3 to 5 million working Americans without employer-sponsored health insurance due to the implementation of the ACA, according to the report, CBO and JCT’s Estimates of the Effects of the Affordable Care Act (ACA) on the Number of People Obtaining Employment-Based Health Insurance. Originally, the CBO and Joint Committee on Taxation (JCT) estimated that the number of people obtaining health insurance coverage through their employer would be 3 million people lower in 2019 under

Paying medical bills is a chronic problem for 1 in 3 uninsured, and 1 in 5 insured people under 65

Over 20% of U.S. families had problems paying medical bills in 2010 — about the same proportion as in 2007. The Center for Studying Health System Change found this datapoint “surprising,” given the Great Recession of 2008 that lingers into 2012. However, HSC points out that the leveling of medical bill problems may be a “byproduct” of reduced medical care utilization; in Health Populi-speak, self-rationing of health care. In the Tracking Report, Medical Bill Problems Steady for U.S. Families, 2007-2010, HSC analyzed data from the 2010 Health Tracking Household Survey and discovered that since 2003, the proportion of families facing problems with medical debt

Health insurance: employers still in the game, but what about patient health engagement?

U.S. employers’ health insurance-response to the nation’s economic downturn has been to shift health costs to employees. This has been especially true in smaller companies that pay lower wages. As employers look to the implementation of health reform in 2014, their responses will be based on local labor market and economic conditions. Thus, it’s important to understand the nuances of the paradigm, “all health care is local,” taking a page from Tip O’Neill’s old saw, “all politics is local.” The Center for Studying Health System Change (HSC) visited 12 communities to learn more about their local health systems and economies, publishing their

The average annual health costs for a U.S. family of four approach $20,000, with employees bearing 40%

Health care costs have doubled in less than nine years for the typical American family of four covered by a preferred provider health plan (PPO). In 2011, that health cost is nearly $20,000; in 2002, it was $9,235, as measured by the 2011 Milliman Medical Index (MMI). To put this in context, The 2011 poverty level for a family of 4 in the 48 contiguous U.S. states is $22,350 The car buyer could purchase a Mini-Cooper with $20,000 The investor could invest $20K to yield $265,353 at a 9% return-on-investment. The MMI increased 7.3% between 2010 and 2011, about the same

Even the most wealthy, healthy U.S. citizens worry about future health access and finance

It is no surprise that sicker, poorer people in the U.S. have concerns about how they’ll access and pay for health care in the future. What stands out in the latest Commonwealth Fund Survey of Public Views of the U.S. Health System, published in an April 11, 2011, Issue Brief, is that most U.S. health citizens in the healthiest, wealthiest demographic groups worry about accessing and paying for health care in the future. The chart highlights these findings: overall, 7 in 10 people worry about not getting high-quality care when they will need it, or that they won’t be able to pay

The Personal Health Economy for Americans in 2011

41% of Americans had problems getting a good paying job or raise in pay in the economic downturn in the U.S. 1 in 3 lost money in the stock market, had work hours cut or a pay cut. And, 31% had problems paying for gas and health care. 85% of uninsured people under 65 put off needed health care because of cost. In the past 12 months, families in the U.S. have faced multiple challenges with jobs, health, gas and food — challenges all bound up in the economic downturn in the U.S. 1 in 4 Americans report problems paying medical bills.

Only 1 in 10 unemployed people buy into COBRA

Because of high premiums, only 9 percent of unemployed workers have COBRA coverage. Maintaining Health Insurance During a Recession: Likely COBRA Eligibility, a study from The Commonwealth Fund (CMWF), clarifies how COBRA is actually used by unemployed people in the U.S. CMWF calculates that: – Two of three working adults are eligible to buy into COBRA under the 1985 Consolidated Omnibus Budget Reconciliation Act (COBRA) if they became unemployed. – Under COBRA, workers pay 4 to 6 times their current premium for health benefits. – Thus, only 9 percent of unemployed workers have COBRA coverage due to the high price

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...