Leveraging Trust, Showing Humility: How Health Care Organizations Can Serve Consumers – A New Read from McKinsey

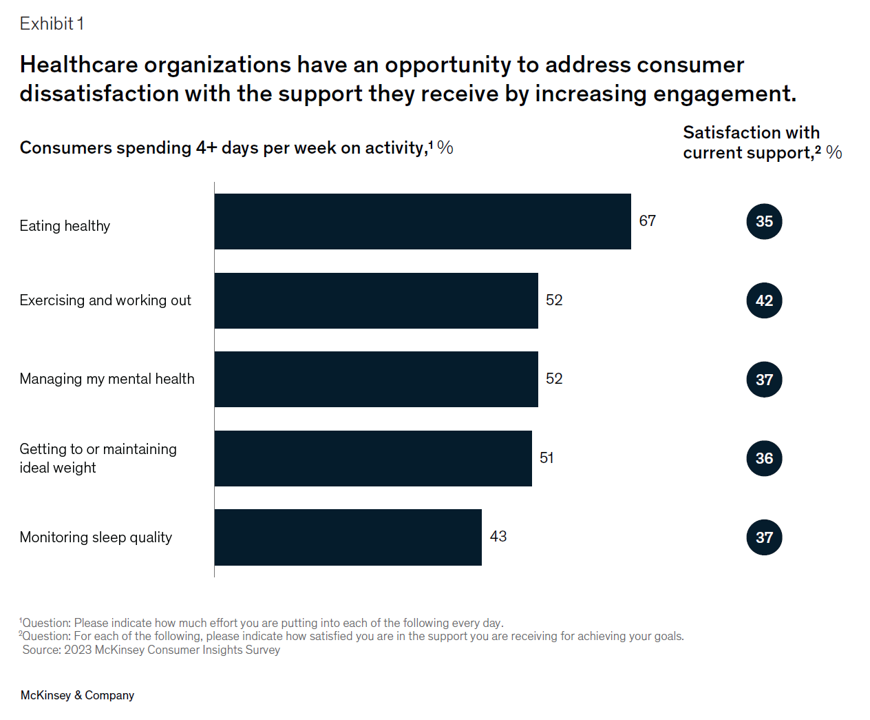

Three trends underpin health consumers’ evolving demands for service: spending more but getting less satisfaction and innovation; trusting health care with data but underwhelmed by the use of that personal information; and, growing “shopping” behavior seeking quality, availability, proximity, cost, and options across channels for health care. That’s the current read from McKinsey & Company’s team noting that Consumers rule: Driving healthcare growth with a consumer-led strategy. In this health consumer update, McKinsey spoke with three consumer marketing experts from other industries to learn best practices on how best to “be there”

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

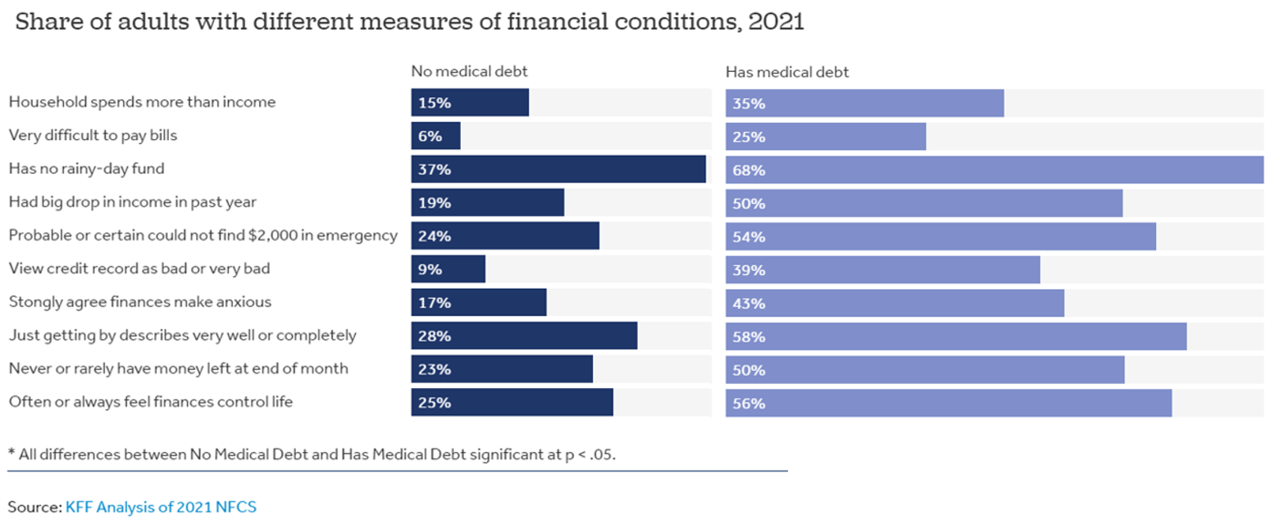

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

The Future of Love and How It Could Shape Health, Well-Being, and Daily Living

“The future of love is bound to the institutions that have historically shaped and defined it,” Ipsos’s What the Future: Love report begins. Consider: religion, government, financial institutions….and the health care ecosystem, as well. On this Valentine’s Day 14th February 2023, it is a good time to consider this convergence as health politics, financial well-being, and emerging technologies will be re-shaping institutions and consumers in the coming months and near-term. The Ipsos researchers have been assessing the future of many aspects of our lives over the past couple of years, such as the future of wellness,

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

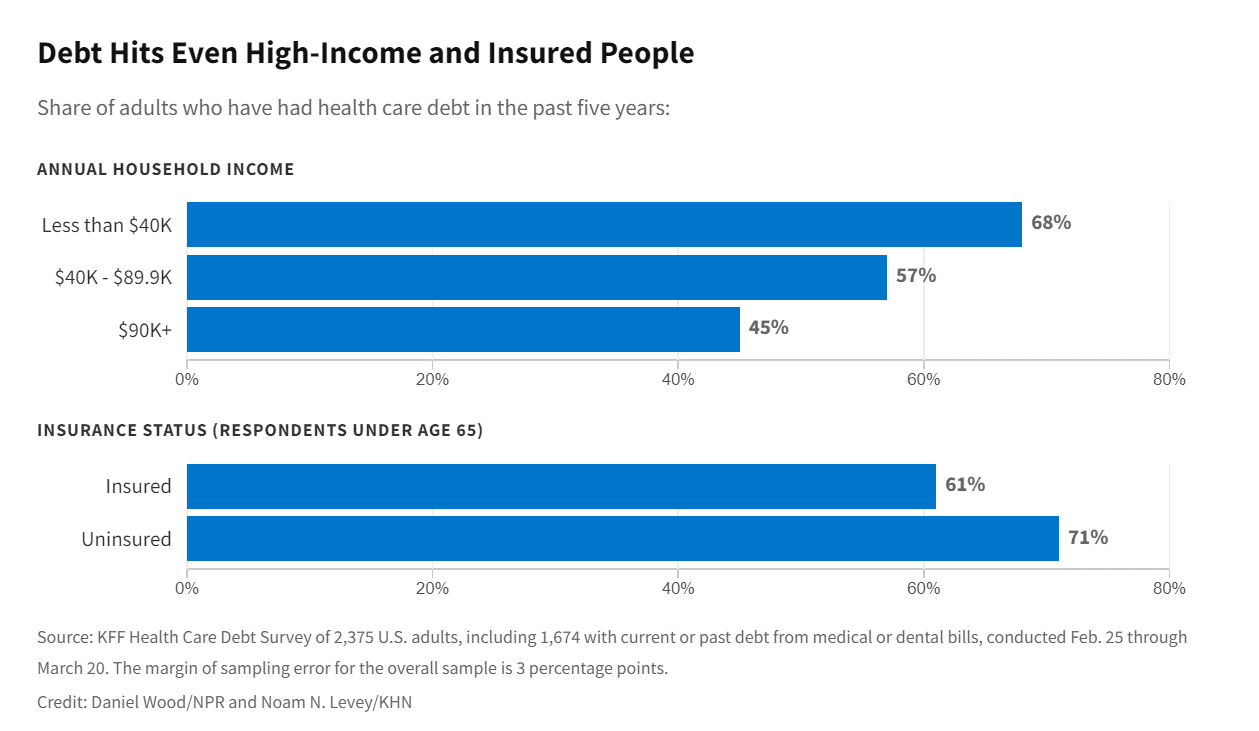

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

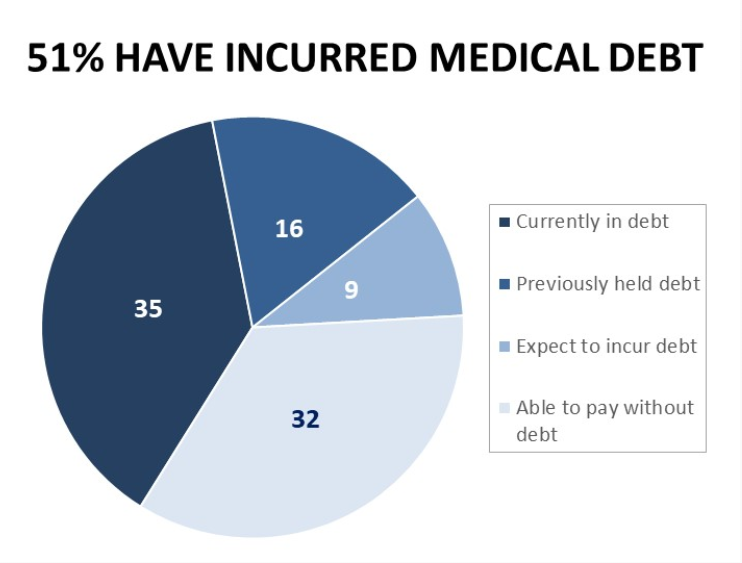

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

Fastest-Growing Brands for 2021 Are About Digital Money, Social Connections and Boomers’ Best Lives

Two pharmaceutical companies bubble up among the 20 fastest-growing brands for 2021 in Morning Consult’s report on the Fastest-Growing Brands of 2021. But the surprise in this year’s top 20 brand rankings was that five of them addressed consumers’ financial flows: Coinbase, AfterPay. Cash App, Mastercard, Chime, and Bitcoin. One year ago when I covered this study, I found that the fastest-growing brands of 2020 had everything to do with the pandemic. They dealt with home entertainment, digital connectivity, hygiene, and indeed, health (with Pfizer and AstraZeneca the two pharma brands top-of-mind for consumers). In this year’s update, exploring consumers’

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

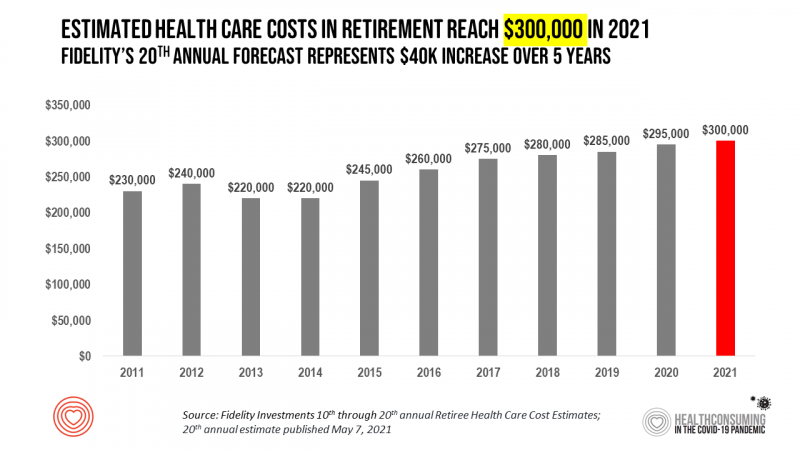

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

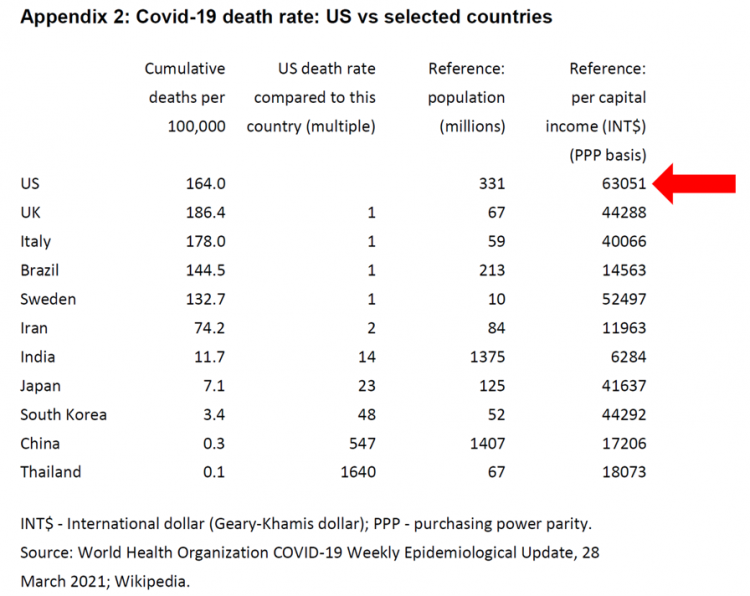

The Pandemic’s Death Rate in the U.S.: High Per Capita Income, High Mortality

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update. Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do. I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School. In reviewing

Housing as Prescription for Health/Care – in Medecision Liberation

COVID-19 ushered in the era of our homes as safe havens for work, shopping, education, fitness-awaking, bread-baking, and health-making. In my latest essay written for Medecision, I weave together new and important data and evidence supporting the basic social determinant of health — shelter, housing, home — and some innovations supporting housing-as-medicine from CVS Health, UnitedHealth Group, AHIP, Brookings Institution, the Urban Land Institute, and other stakeholders learning how housing underpins our health — physical, mental, financial. Read about a wonderful development from Communidad Partners, working with the Veritas Impact Partners group, channeling telehealth to housing programs serving residents with

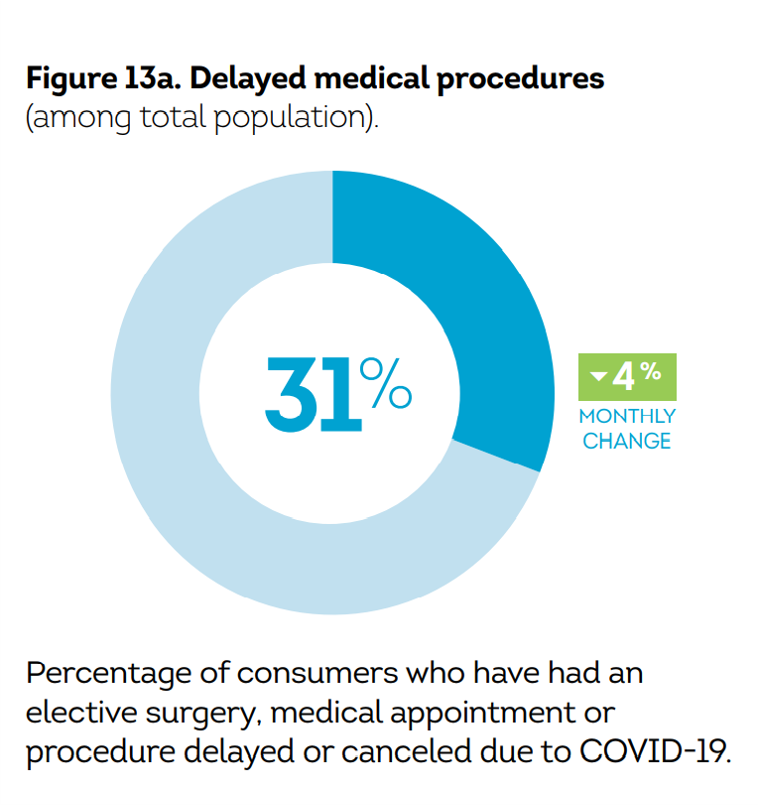

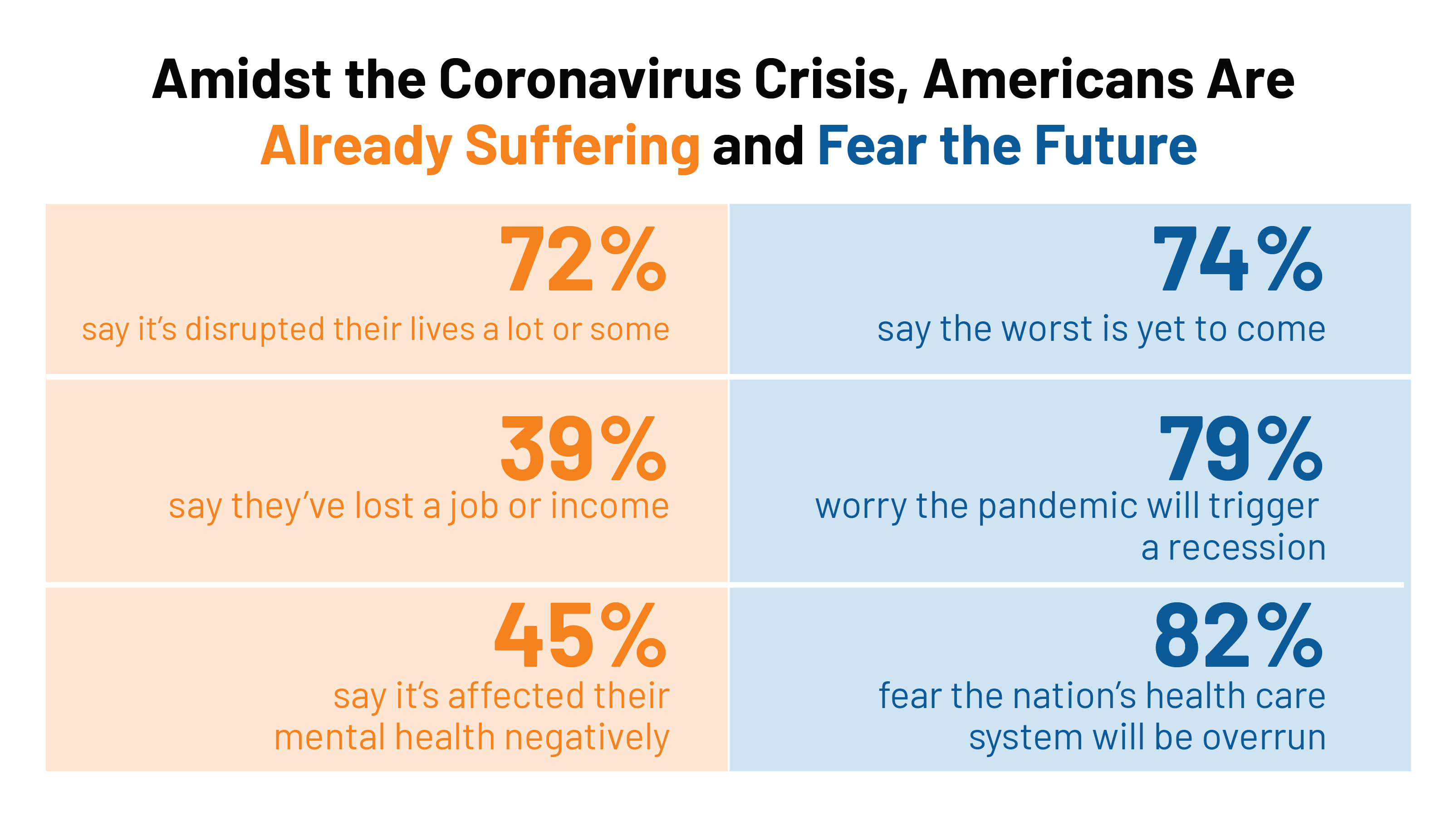

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

Consumers Seek Health Features in Homes: How COVID Is Changing Residential Real Estate

The coronavirus pandemic has shifted everything that could “come home,” home. THINK: tele-work, home schooling for both under-18s and college students, home cooking, entertainment, working out, and even prayer. All of this DIY-from-home stuff has been motivated by both mandates to #StayHome and #WorkFromHome by government leaders, as well as consumers seeking refuge from contracting COVID-19. This risk-shift to our homes has led consumers to re-orient their demands for home purchase features. Today, home is ideally defined as a safe place, offering comfort and refuge for families, discovered in the America at Home Study. The Study is a joint project of

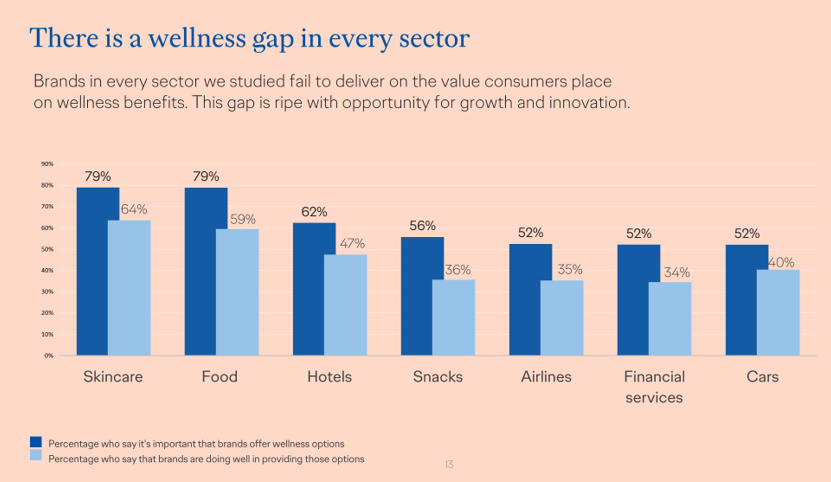

The COVID-19 Pandemic Has Accelerated Our Demand for Wellness – Learning from Ogilvy

Every company is a tech company, strategy consultants asserted over the past decade. The coronavirus pandemic has revealed that every company is a health and wellness company now, at least in the eyes of consumers around the world. In The Wellness Gap, the health and wellness team at Ogilvy explores the mindsets of consumers in 14 countries to learn peoples’ perspectives on wellness brands and how COVID-19 has impacted consumers’ priorities. A total of 7,000 interviews were conducted in April 2020, in Asia, Europe, Latin America, and North America — including 500 interviews in the U.S. The first chart illustrates

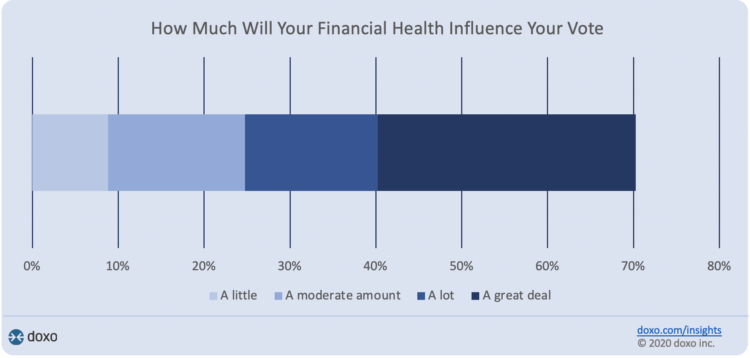

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

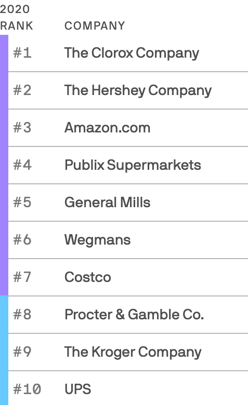

We Are All About Hygiene, Groceries, and Personal Care in the Midst of the Coronavirus Pandemic

Pass me the Clorox…tip the UPS driver…love thy grocer. These are our daily life-flows in the Age of COVID-19. Our basic needs are reflected in the new 2020 Axios-Harris Poll, released today. For the past several years, I’ve covered the Harris Poll of companies’ reputation rankings here in Health Populi. Last year, Wegmans, the grocer, ranked #1; Amazon, #2. In the wake of the COVID-19 pandemic, U.S. consumers’ basic needs are emerging as health and hygiene, food, and technology, based on the new Axios-Harris Poll on the top 100 companies. This year’s study was conducted in four waves, with the

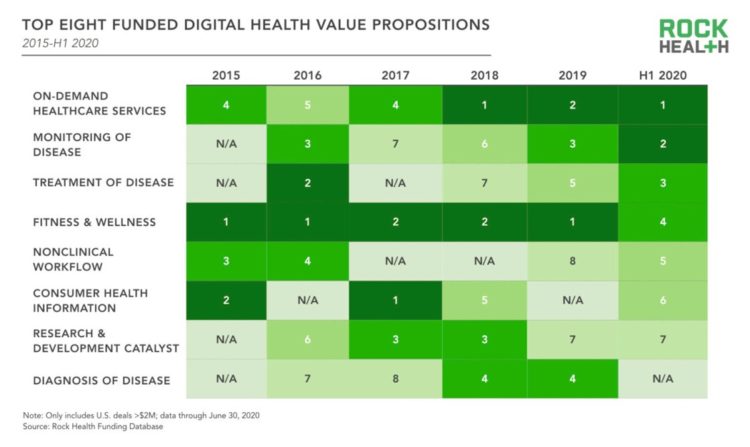

Faster Pace for Corporate Investments and Behavioral Health in COVID-Driven Digital Health Era

The pace of digital health investments quickened in the first half of 2020, based on Rock Health’s look at health-tech financing in mid-year. Digital health companies garnered $5.4 billion in the first half of the year, record-setting according to Rock Health. Underneath this number were very big deals, shown by the size of the blue bubbles in the first graphic from the report. Note that in H1 2020, the average deal size exceeded $25 mm. Among the largest deals valued at over $100 mm were ClassPass (raising $285 mm), in the business of virtual fitness classes; Alto Pharmacy, a digital

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

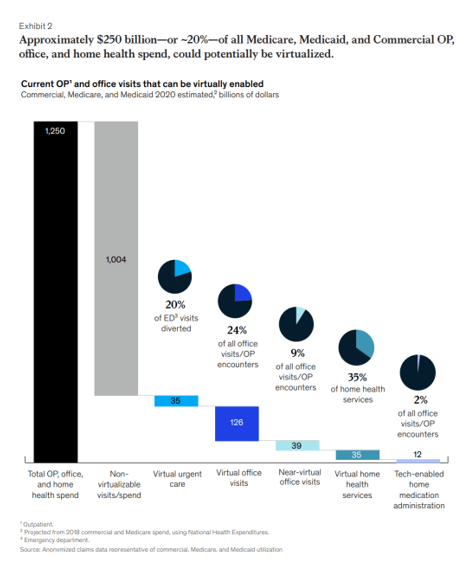

Telehealth Is Just Healthcare Now – One Post-COVID Certainty, Three Reports

As we wrestle with just “what” health care will look like “after COVID,” there’s one certainty that we can embrace in our health planning and forecasting efforts: that’s the persistence of telehealth and virtual care into health care work- and life-flows, for clinicians and consumers alike and aligned. There’s been a flurry of research into this question since the hockey-stick growth of telemedicine visits were evident in March 2020, just days after the World Health Organization uttered the “P-word:” pandemic. Three recent reports (among many others!) bolster the business and clinical cases for telehealth in America in terms of: A

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

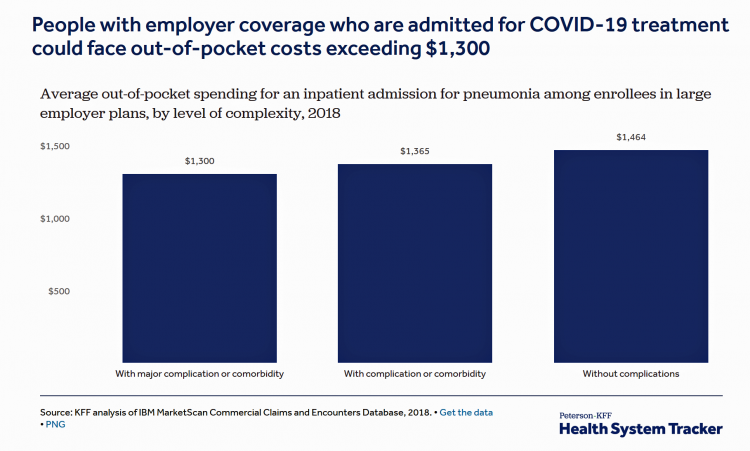

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

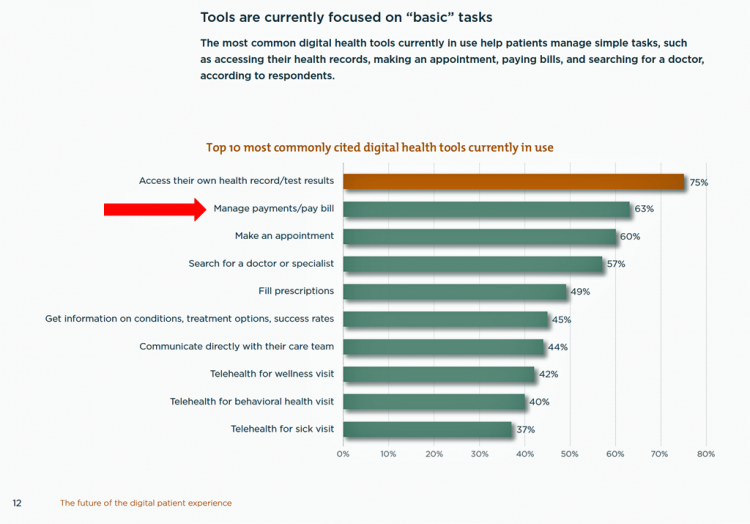

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

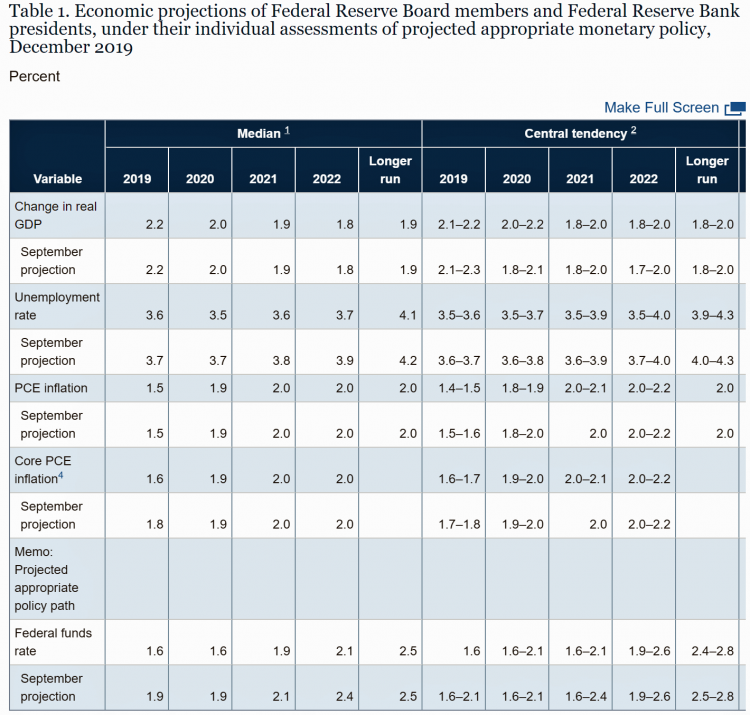

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

Health@Retail Update: Kroger and Hy-Vee Morph Grocery into Health, Walmart’s Health Center, CVS/housing and More

With our HealthConsuming “health is everywhere” ethos, this post updates some of the most impactful recent retail health developments shaping consumers’ health/care touchpoints beyond hospitals, physicians, and health plans. For inspiration and context, I’ll kick off with Roz Chast’s latest New Yorker cartoon from the February 3rd 2020 issue — Strangers in the Night, taking place in a Duane Reade pharmacy. Roz really channels the scene in front of the pharmacy counter, from Q-tips to vitamins and tea. And it’s hummable to the tune of, well, Strangers in the Night. Check out the 24-hour pharmacist under the pick-up sign. Now,

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

Worrying About Possible Recession Compels Health Consumers to Seek Less Care

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space. Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care. Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll. The other side of this personal health

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

On Amazon Prime Day, What Could Health Care Look Like?

Today is July 15, and my email in-box is flooded with all flavors of Amazon Prime’d stories in newsletters and product info from ecommerce sites — even those outside of Amazon from beauty retailers, electronics channels, and grocery stores. So I ask on what will probably be among the top ecommerce revenue generating days of all time: “What could health care look like when Amazon Prime’d?” I ask and answer this in my book, HealthConsuming, as chapter 3. For context, this chapter follows two that explain how patients in the U.S. have been morphing into health consumers based on how health

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

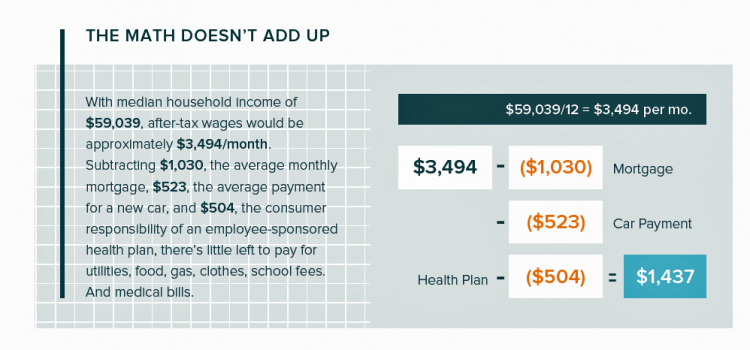

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

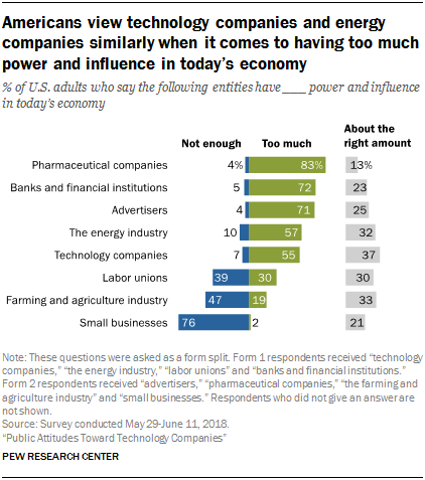

What the Pew Data on Americans’ Views on Technology Means for Healthcare

Most Americans say that pharmaceutical manufacturers, banks, advertisers, energy firms, and tech companies have too much power and influence in today’s American economy, according to Public Attitudes Toward Technology Companies, a research report from the Pew Research Center. A plurality of Americans says labor unions and farming and agriculture have too little power, along with a majority of people who believe that small business lacks sufficient power in the current U.S. economy. This data point is part of a larger consumer survey on Americans’ attitudes about the growing role of technology in society, particularly with respect to political and social impacts.

Good Coffee + Engaging Design + Banking = Financial Health

As I walked by windows with Marvel-inspired superhero characters, I stopped to read their talk-bubbles: “strengthen your savings, power your financial quest, be the hero of your money, be one with your budget.” The top-line message here is that you can be your own fiscal superhero. The sign read, Capital One Cafe with Peet’s Coffee. But was it a bank branch or a cafe? I asked myself, passing by this sign yesterday morning at the corner of Walnut and 18th Streets in center city Philadelphia. It’s both, as it turned out, and when I entered I found a welcoming, beautifully

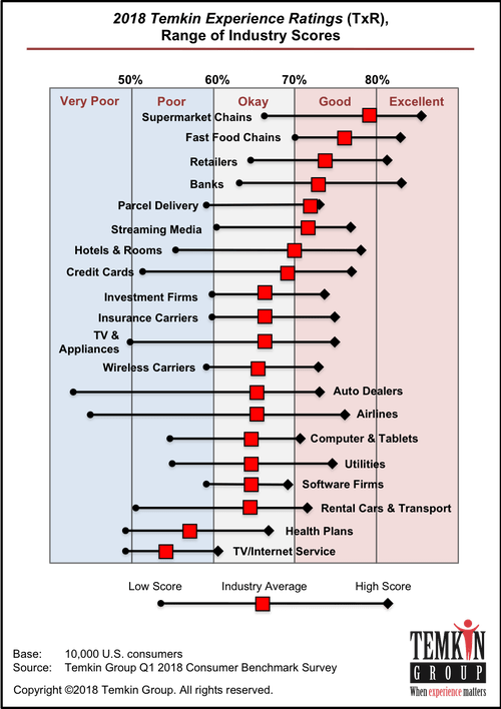

What Would Healthcare Feel Like If It Acted Like Supermarkets – the 2018 Temkin Experience Ratings

U.S. consumers rank supermarkets, fast food chains, retailers, and banks as their top performing industries for experience according to the 2018 Temkin Experience Ratings. Peoples’ experience with health plans rank at the bottom of the roster, on par with rental cars and TV/Internet service providers. If there is any good news for health plans in this year’s Temkin Experience Ratings compared to the 2017 results, it’s at the margin of “very poor” performance: last year, health plans has the worst performance of any industry (with the bar to the furthest point on the left as “low scoring”). This year, it

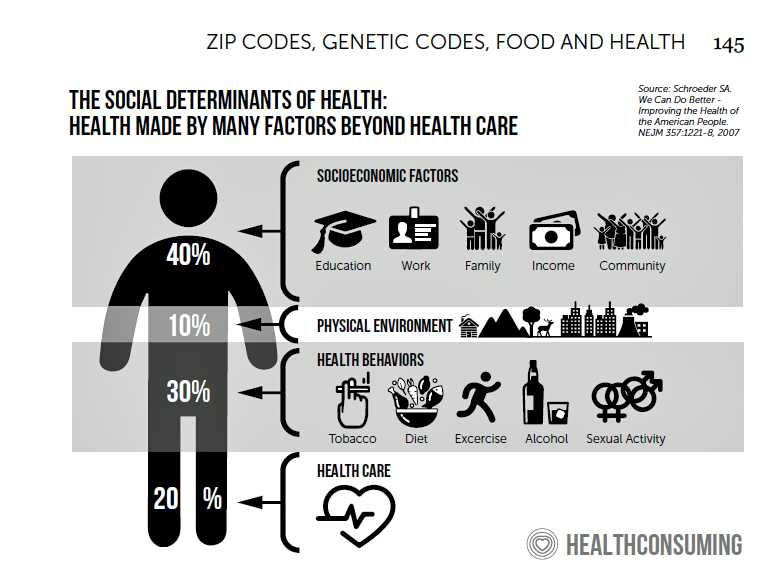

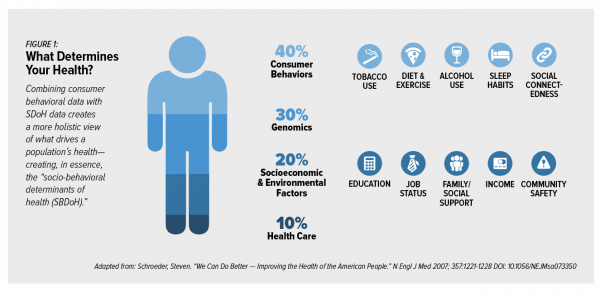

Add Behavioral Data to Social Determinants For Better Patient Understanding

“Health agencies will have to become at least as sophisticated as other consumer/retail industries in analyzing a variety of data that helps uncover root causes of human behavior,” Gartner recommended in 2017. That’s because “health” is not all pre-determined by our parent-given genetics. Health is determined by many factors in our own hands, and in forces around us: physical environment, built environment, and public policy. These are the social determinants of health, but knowing them even for the N of 1 patient isn’t quite enough to help the healthcare industry move the needle on outcomes and costs. We need to

Consumer Health and Patient Engagement – Are We There Yet?

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

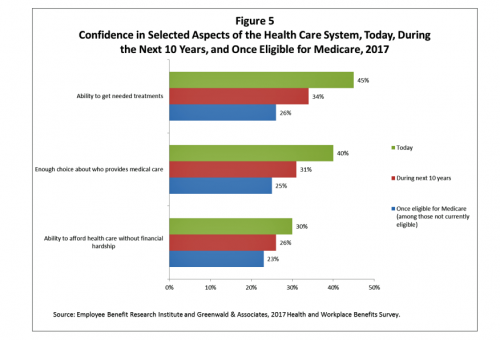

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

Calling Out Health Disparities on Martin Luther King Day 2018

On this day appreciating the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group

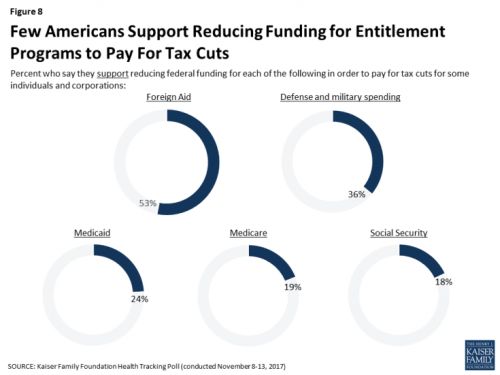

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

Health (Healthcare, Not So Much) Abounds in Prophet’s Top 50 Brands

U.S. consumers’ most-valued brands include Apple, Google, Amazon, Netflix, Pinterest, Android, Spotify, PIXAR, Disney and Samsung, according to the 2017 Brand Relevance Index from Prophet. The top 50 are shown in the first chart. On the second chart, I’ve circled in red the brands that have reach into healthcare, health, fitness, and wellness. Arguably, I could have circled every brand in the top 50 because in one way or another, depending on the individual, people find health “everywhere” that’s relevant to them based on their own definitions and value-systems. This is Prophet’s third year conducting this study, and I was

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

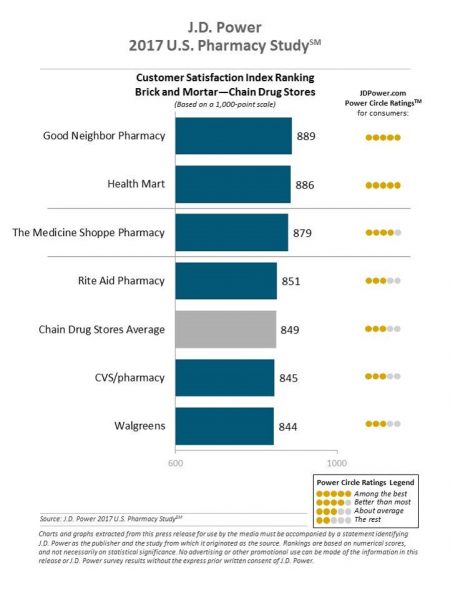

Decline in Pharmacy Reputations Related to Prescription Drug Prices, J.D. Power Finds

Cost is the number one driver among consumers declining satisfaction with pharmacies, J.D. Power found in its 2017 U.S. Pharmacy Study. Historically in J.D. Power’s studies into consumer perceptions of pharmacy, the retail segment has performed very well, However, in 2017, peoples’ concerns about drug prices negatively impact their views of the pharmacy — the front-line at the point-of-purchase for prescription drugs. In the past year, dissatisfaction with brick-and-mortar pharmacies related to the cost of drugs and the in-store experience. For mail-order drugs, consumer dissatisfaction was driven by cost and the prescription ordering process. Among all pharmacy channels, supermarket drugstores

Transparency in Drug Prices, from OTC to Oncology

While on vacation in Bermuda, I found a box of private label ibuprofen for $2.45 for 20 – 200mg tablets, and one for Advil PM for $10.50 for the same number of pills, same strength. I’ve just returned from a lovely week’s holiday. When I travel, whether for work or vacation, it’s always a sort of Busman’s Holiday for me as I love to seek out health destinations wherever I go. So it was natural for me to spot the Dockyard Pharmacy at the port in Hamilton and wander in. I made my way back to the well-stocked pharmacy counter,

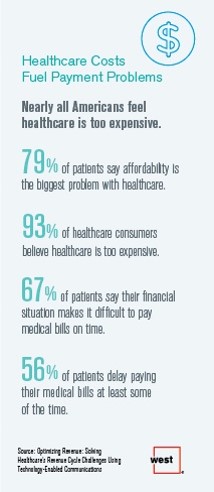

Patients’ Healthcare Payment Problems Are Providers’, Too

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

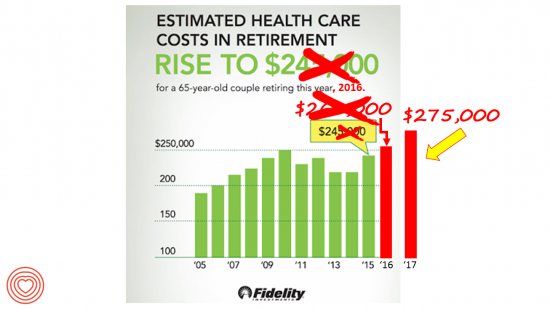

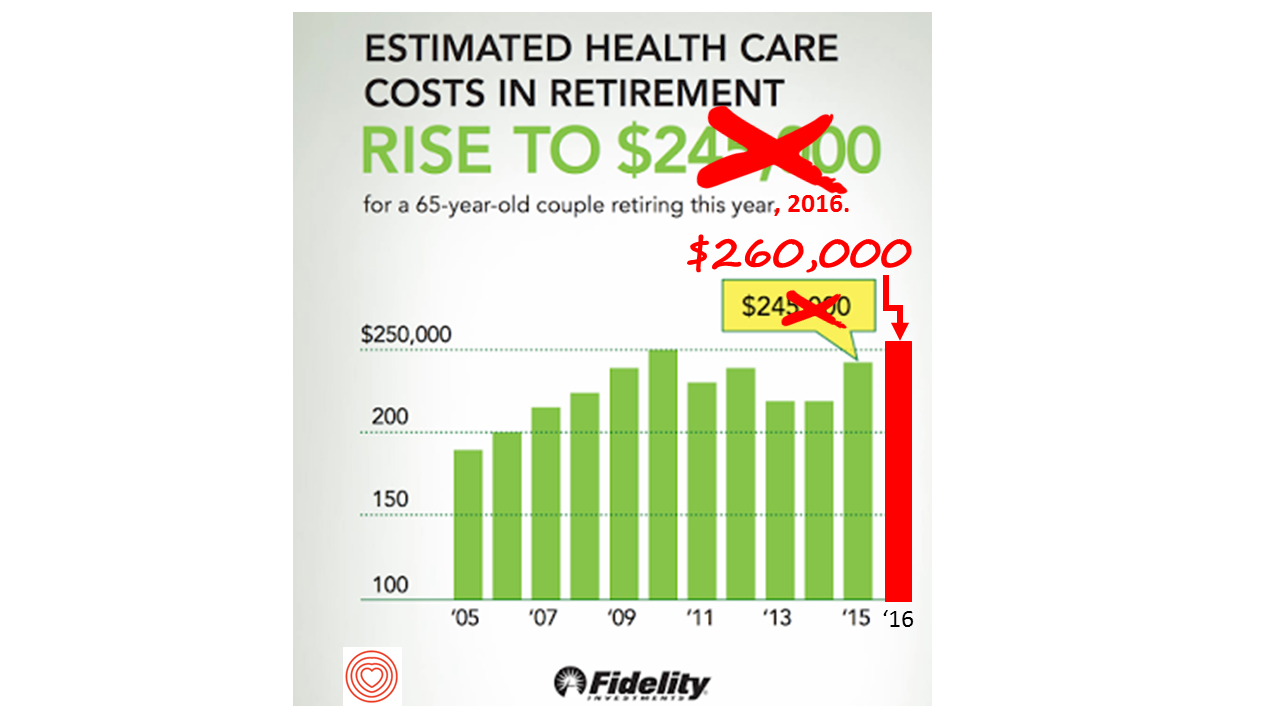

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

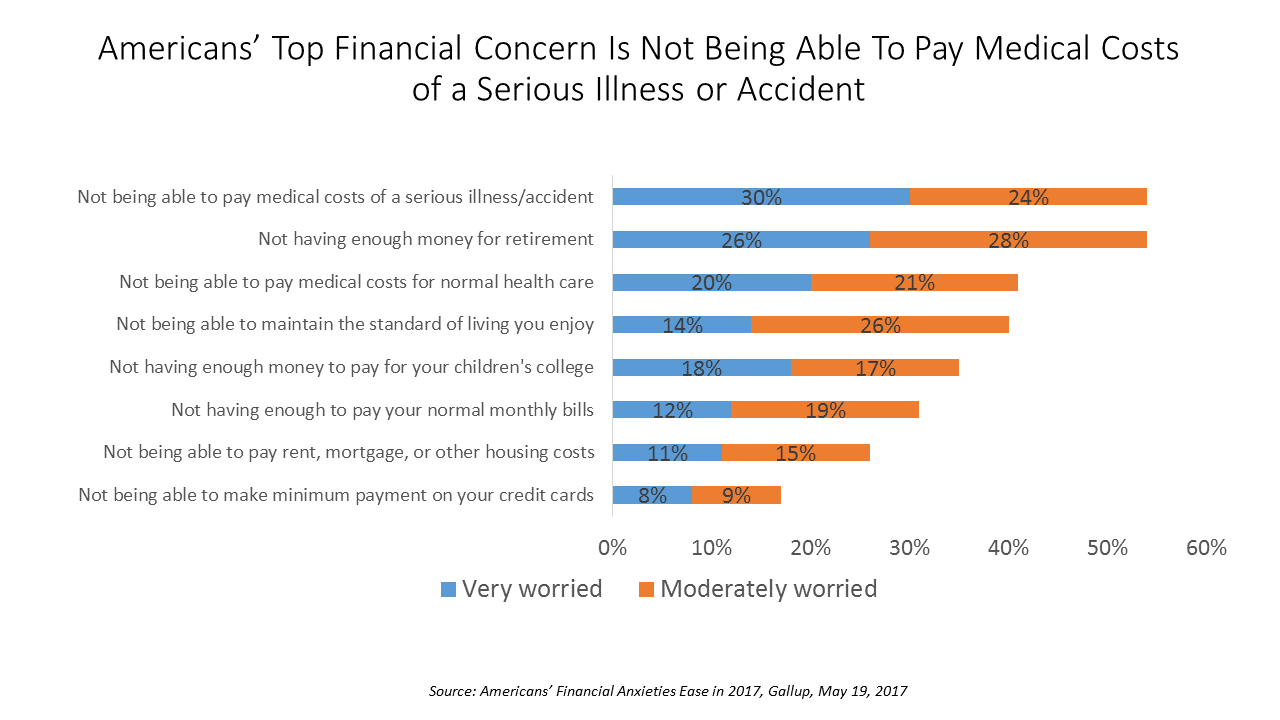

How To Pay For A Serious Medical Illness Tops Americans’ Fiscal Fears

While Americans’ financial worries are softening in 2017, one issue tops the list of fiscal fears: not having enough money to pay the costs involved in a serious illness or accident, Gallup found in a consumer poll fielded in early April 2017. 54% of Americans fear an inability to cover healthcare costs in the event of an accident or serious illness. This percentage was 60% in 2016, and 55% in 2015. This year’s data point ties with Americans financial worry about not having enough money for retirement, but healthcare cost concerns rank higher in terms of being “very worried” versus

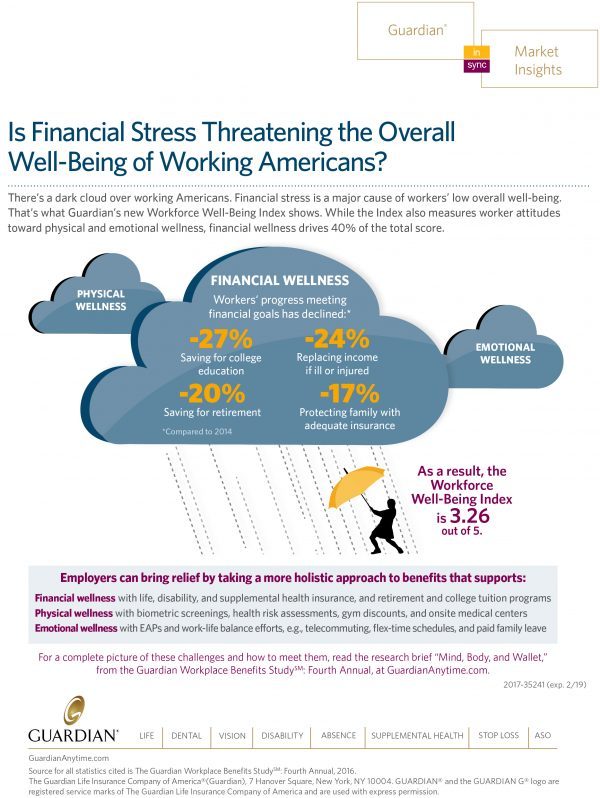

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

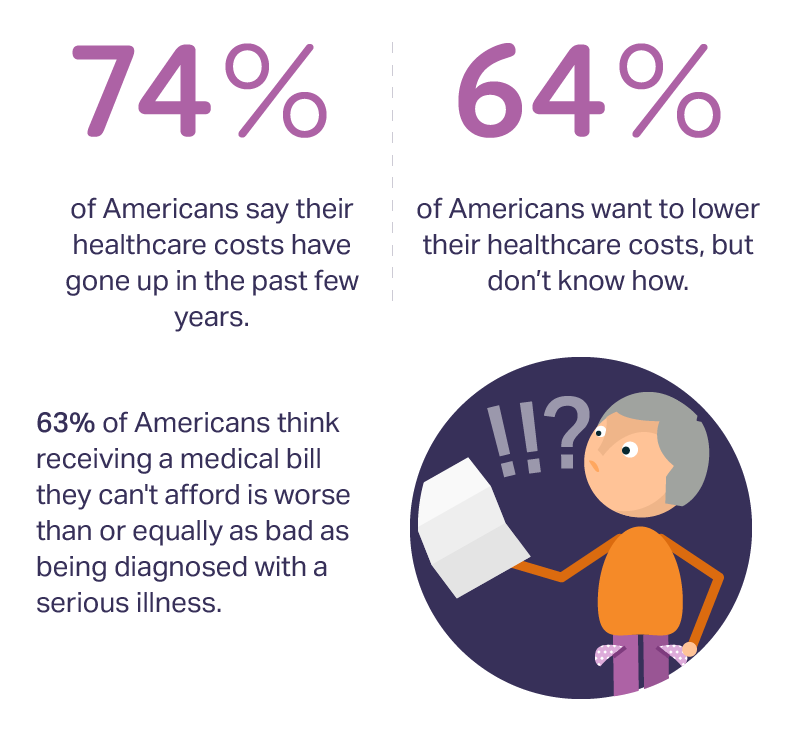

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

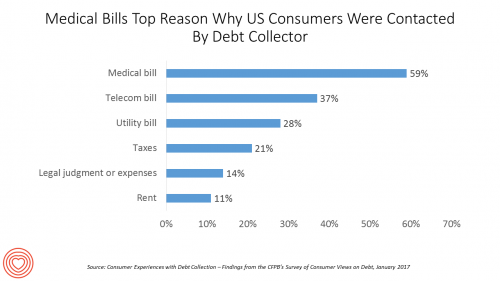

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

Digital Health Update from Silicon Valley Bank

Who better than a financial services institution based in Silicon Valley to assess the state of digital health? Few organizations are better situated, geographically and sector-wise, than SVB Analytics, a division of Silicon Valley Bank based in, yes, Silicon Valley (Santa Clara, to pinpoint). The group’s report, Digital Health: Opportunities for Advancing Healthcare, provides an up-to-date landscape on the convergence of healthcare and technology. SVB Analytics defines digital health as “solutions that use digital technology to improve patients’ health outcomes and/or reduce the cost of healthcare.” The report provides context for the digital health market in terms of health care costs,

What Retail Financial Services Can Teach Healthcare

“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems. You could substitute “healthcare providers” for “banks and insurance companies,” because traditional health industry stakeholders are equally behind the consumer demand for digital convenience. This report has important insights relevant to health providers, health plans and suppliers (especially for

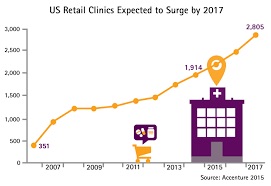

Retail Health Landscape Expanding Through Clinic Growth, Accenture Forecasts

The Old School retail clinic is going beyond checking your child’s ear infection and sore throat, giving immunizations and filling out back-to-school forms just-in-time over LaborDay weekend. The new-new retail clinic is supporting patients’ chronic disease management, partnering with academic medical centers, and bolstering medication management. Accenture’s bullish forecast is titled “US Retail Health Clinics Expected to Surge by 2017,” making the case that these brick-and-mortar providers are shifting from a relatively limited retail scope to a broader and deeper clinical focus. The so-called surge in the number of retail clinics is projected to be nearly 50% growth between 2014 and 2017,

Sports and the Internet of Things: the Scoop & Score podcast

From elite soccer and football fields to youth athletes in public school gyms, wearable technology has come to sports bringing two big benefits of gathering data at the point of exercise: to gauge performance and coach back to the athlete in real time, and to prevent injury. I discussed the advent of the Internet of Things in sports on the Scoop and Score podcast with Andrew Kahn, sports journalist and writer, and Stephen Kahn, sports enthusiast and business analyst. [In full disclosure these two Kahn’s are also my brilliant nephews.] We recorded the podcast on July 14, 2015, the day

Bridging a Commercialization and Design Chasm, StartUp Health Allies With Aurora Health Care

Startup Health, the health/care entrepreneur development company which has helped launch over 100 health/tech companies since “starting up” in 2011, announced a collaboration with Aurora Health Care today. This is one of the first ventures of its kind, linking up health/tech entrepreneurs with a health care provider organization as a living lab, or in the words of Unity Stoakes, Startup Health Co-Founder, a “collaboratory.” I spoke with Unity before the announcement went public, and learned that Startup Health sought a partner with shared values focused on getting innovations into patient care that could transform the healthcare delivery system. “Every single

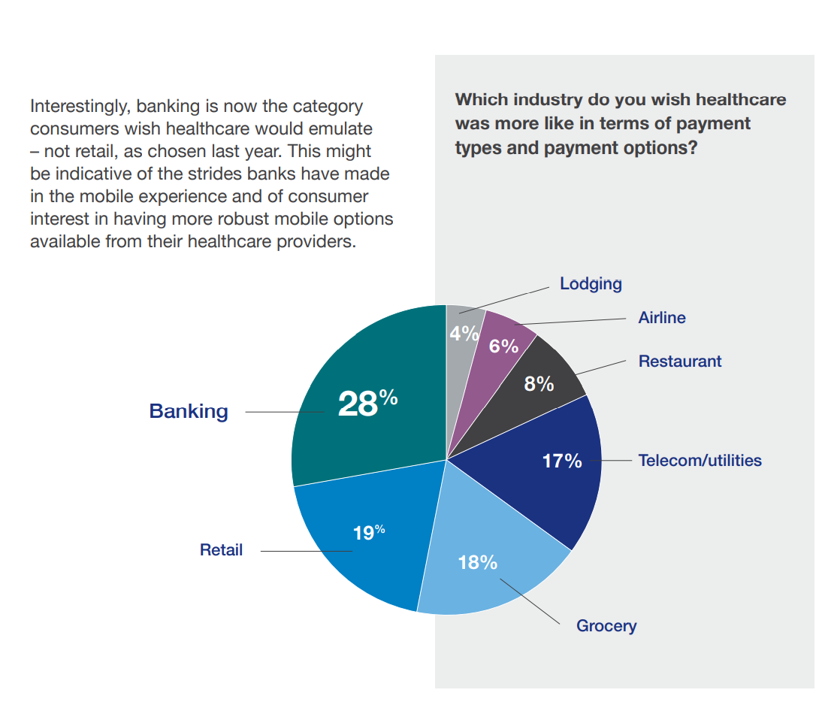

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

Fiscal and physical fitness: TD Bank makes the link

What does a bank have to do with health? Plenty, if you listen to 70% of consumers who say that financial health has a positive impact on physical health. TD Bank released the Fiscal Fitness survey this week, finding that consumers make a direct connection between fiscal and physical fitness. That’s what we here at THINK-Health refer to as financial wellness. TD learned that 80% of consumers made a health resolution in the New Year and 69% of people made a financial resolution 40% of people want to save more and spend less, and 42% want to get healthy and

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

Your health score: on beyond FICO

Over one dozen scores assessing our personal health are being mashed up, many using our digital data exhaust left on conversations scraped from Facebook and Twitter, via our digital tracking devices from Fitbit and Jawbone, retail shopping receipts, geo-location data created by our mobile phones, and publicly available data bases, along with any number of bits and pieces about ‘us’ we (passively) generate going about our days. Welcome to The Scoring of America: How Secret Consumer Scores Threaten Your Privacy and Your Future. Pam Dixon and Robert Gellman wrote this well-documented report, published April 2, 2014 by The World Privacy Forum.

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

Health costs up, credit down: health consumers face tightening credit markets in the face of rising medical costs

People who received health care in the U.S. between the second quarters of 2012 and 2013 faced 38% higher out-of-pocket costs, growing from $1,862 to $2,568 in just one year. These were payments for common procedures like joint replacements, Caesarean sections, and normal births. At the same time, consumers’ access to revolving credit lines fell by $1,000 over the twelve months. (Credit lines here include bank-issued credit cards, store credit cards, and home equity loans). The TransUnion Healthcare Report from TransUnion, the credit information company, paints a picture of tightening money for all consumers in the face of rising household

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

The new era of consumer health risk management: employers “migrate” risk

The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees. Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most

A new medical side-effect: out-of-pocket health care costs

When we say the phrase “side effects,” what do we think of? The FDA says that “all medicines have benefits and risks. The risks of medicines are the chances that something unwanted or unexpected could happen to you when you use them. Risks could be less serious things, such as an upset stomach, or more serious things, such as liver damage.” There’s a new risk in town in health care, and it’s the equivalent of an upset stomach when it comes to a co-pay for a branded on-formulary drug, or liver damage if it involves a coinsurance percent of “retail”

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

Money and health, migraines and sleep: how stress directly impacts health and wealth

There’s an issue that doctors and patients don’t discuss that’s among the most important contributors to ill health: it’s money, and it’s something Alexandra Drane calls an “Unmentionable.” Alex, Founder, Chief Visionary, and Board Chair at Eliza Corporation, coined Unmentionables as those aspects of daily living which everyone deals with, but few like to talk about: like sex (whether too much, too little), drugs (abusing), drinking (too much), toileting problems (such as incontinence or pooping problems), sleep trouble, and caring for others (not ourselves so much). These daily life challenges can negatively impact health, with financial stress being one of

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The importance of being banked for getting health insurance

While having money in the bank is always a prescription for feeling well, having a bank account is a precursor to getting health insurance under the Affordable Care Act. That fact could prevent millions of people who are eligible for health insurance premium subsidies under health reform from enrolling in a health plan. The issue of banking the un-banked in health is a little talked-about detail that, if overlooked, will scuttle the best-laid plans for health reform. That’s because if people enroll in health insurance, their monthly premiums will need to be debited from a bank account. So, without a

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...