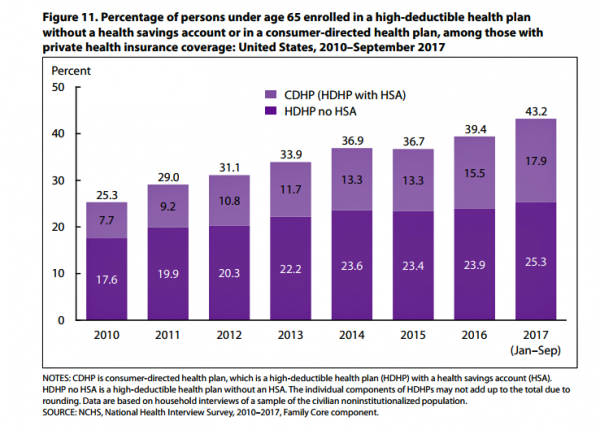

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

Consumer Health and Patient Engagement – Are We There Yet?

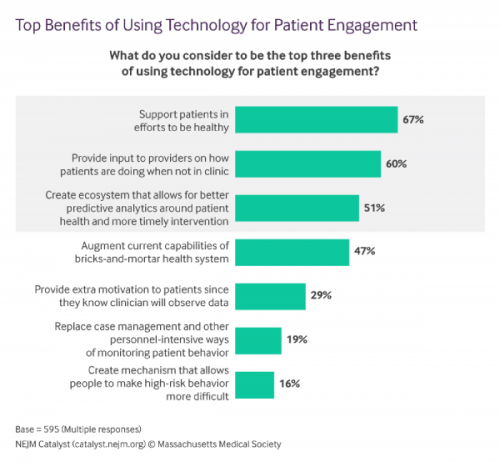

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

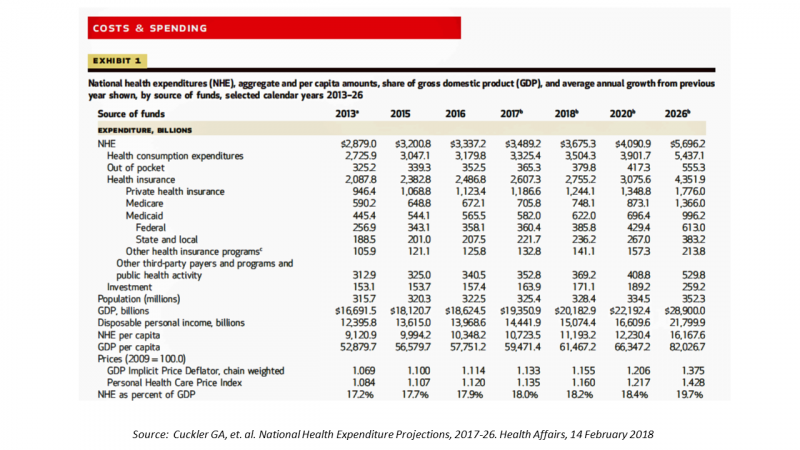

The $4 Trillion Health Economy of 2020

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

Getting Real About Social Determinants of Health

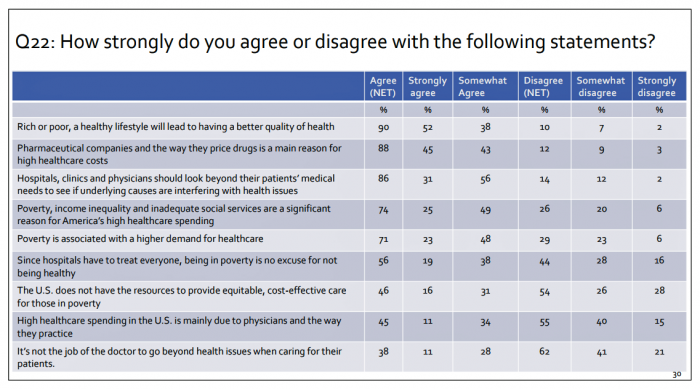

New research points out that real people live real lives, and our assumptions about social determinants of health (SDOH) may need to be better informed by those real lives. I read three reports in the past week sobering up my bullish #SDOH ethos dealing with food deserts, transportation, and health service access — three key social determinants of health. To remind you about the social determinants, here’s a graphic from Kaiser Family Foundation that summarizes the key pillars of SDOH. Assumption 1: Food deserts in and of themselves diminish peoples’ healthy nutrition lifestyles. Low-income households who are exposed to the same food-buying

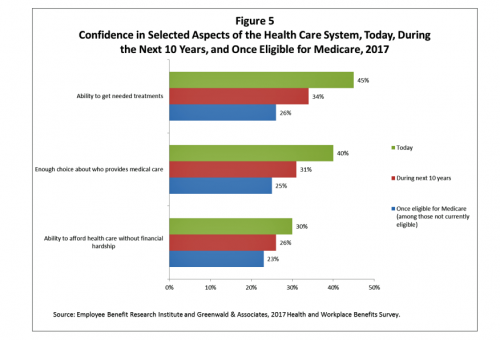

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

What Healthcare Can Learn from A Pig and Piggy Bank via Santander Bank

When patients feel disrespected in a medical exam room, they will be less likely to follow instructions they receive from a doctor. Research from the Altarum Institute revealed this fundamental finding. The chart shows that feeling respected reduces a patient’s diabetes medication adherence by a factor of nearly 2x, and is a risk factor for poorly managed diabetes. Furthermore, consumers who feel disrespected by providers are three times more likely to not believe doctors are accurate sources of information than consumers who do feel respected. And, patients with diabetes who do not feel respected are one-third more likely to have poorly

Healthy Living in Digital Times at CES 2018

Connecting Life’s Dots, the organization Living in Digital Times partners with CES to deliver conference content during the show. At CES 2018, LIDT is connecting a lot of dots to help make health streamline into daily living. Robin Raskin, founder, kicked off LIDT’s press conference setting the context for how technology is changing lifestyles. Her Holy Grail is to help make tech fun for everybody, inclusive for everybody, and loved by everybody, she enthused. LIDT has been a presence at CES for many years, conceiving the contest the Last Gadget Standing, hosting tech-fashion shows with robots, and supporting a young innovators

Most Americans Say Healthcare is #1 Policy Issue Entering 2018

Concerns about health care are, by a large margin, the top domestic policy issue U.S. voters identified as they enter 2018. The proportion of Americans citing healthcare as the top public agenda priority grew by 50% since 2016, from 31% two years ago to 48%. Taxes rank #2 this year, garnering 31% of Americans’ concerned, followed by immigration, which has remained flat cited by about one-in-four Americans. The Associated Press (AP)-NORC Center for Public Affairs Research polled 1,444 U.S. adults 18 and over between November 30 and December 4, 2017 for this survey. While one-half of Americans would like the

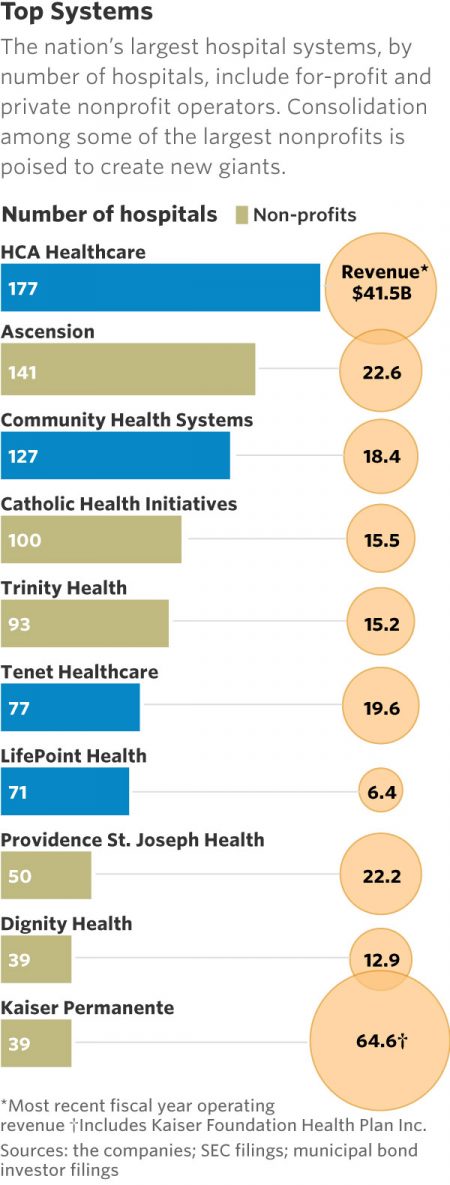

Will Getting Bigger Make Hospitals Get Better?

This month, two hospital mega-mergers were announced between Ascension and Providence, two of the nation’s largest hospital groups; and, between CHI and Dignity Health. In terms of size, the CHI and Dignity combination would create a larger company than McDonald’s or Macy’s in terms of projected $28 bn of revenue. (Use the chart of America’s top systems to do the math). For context, other hospital stories this week discuss in southern New Jersey. And this week, the New Jersey Hospital Association annual report called the hospital industry the “$23.4 billion economic bedrock” of the state. Add a third important item

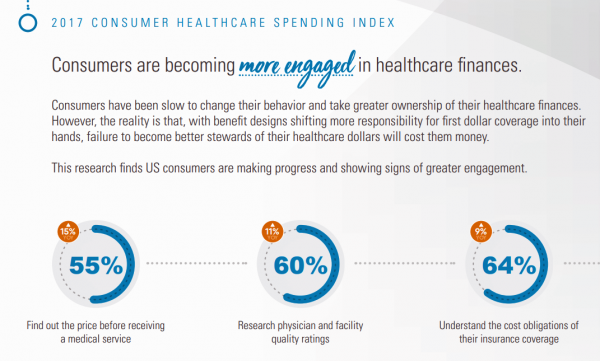

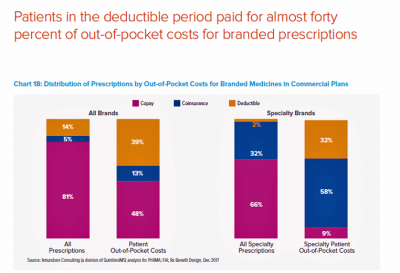

Patients Continue to Grow Healthcare Consumer Muscles, Alegeus’s 2017 Index Finds

Patients’ health consumer muscles continue to get a work out as more people enroll in high-deductible health plans and face sticker shock for health insurance premiums, prescription drug costs, and that thousand-dollar threshold. The 2017 Alegeus Healthcare Consumerism Index finds growth in patients’, now consumers’, interest and competence in becoming disciplined about planning, saving, and spending for healthcare. Overall, the healthcare spending index hit 60.1 in 2017, up from 54.4 in 2016. This is a macro benchmark that represents most consumers exhibiting greater healthcare spending engagement with eyes on cost as well as adopting purchasing behaviors for healthcare. Underneath that

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

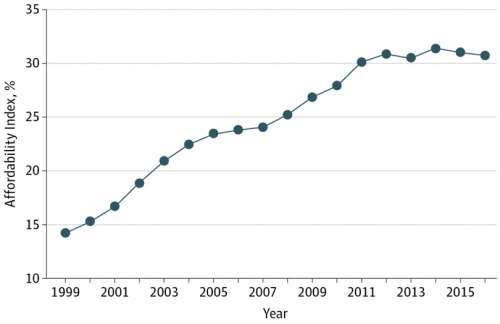

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

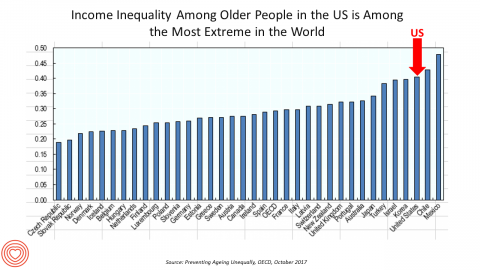

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

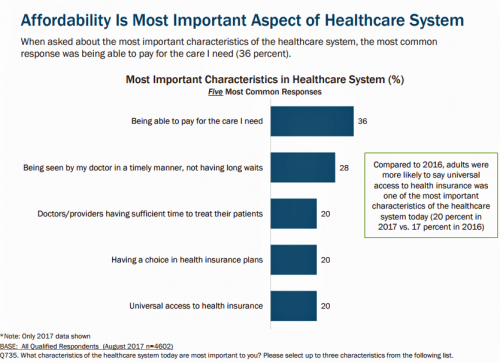

Most Americans Are Concerned About Healthcare Policy, and Costs Top the List of Concerns

4 in 5 Americans are aware of potential changes to healthcare policy brewing in Washington, DC. 92% of them are concerned about those changes, according to Healthcare Consumers in a Time of Uncertainty, the fifth annual survey from Transamerica Center for Health Studies. Peoples’ most-shared fears are losing their coverage for pre-existing conditions, out-of-pocket spending, and a ban on lifetime limits. That boils down to one thing: cost. That is, cost, for having to spend money on services not-covered by their health insurance plan; cost for out-of-pocket items under-insured, denied, or requiring coinsurance or co-payments; and, catastrophic costs that rise beyond

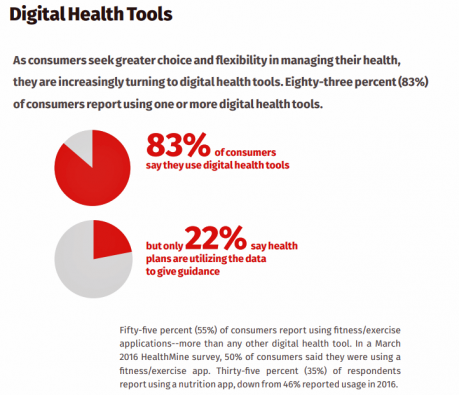

What Health Plans Must Learn from Amazon

One in two U.S. consumers told Aflac that enrolling in health insurance should feel like an experience on Amazon. But health consumers still lack that high benchmark retail experience with health plans, based on new research published in HealthMine’s 2017 Health Intelligence Report focusing on communication and digital healthcare tools. “Most members believe health plan communications are impersonal and centered around bills rather than healthcare guidance,” HealthMine asserts in the introduction to the report. That’s about as un-Amazon as we can imagine. Top findings from HealthMine’s research are that: 3 in 4 consumers don’t think their health insurance plan

What Patients Feel About Technology, Healthcare Costs and Social Determinants

U.S. consumers feel positive about the roles of technology and social determinants in improving healthcare, but are concerned about costs, according to the 2017 Patient Survey Report conducted for The Physicians Foundation. The survey gauged patients’ perspectives across four issues: the physician-patient relationship, the cost of healthcare, social determinants of health, and lifestyle choices. Two key threads in the research explain how Americans feel about healthcare in the U.S. at this moment: the role of technology and the cost of health care. First, the vast majority of consumers view technology, broadly defined, as important for their health care. 85% of people

Consumers Use Digital Health Tools But Still Struggle with Health Literacy

While more U.S. patients are use digital health tools and take on more clinical and financial decision making for their health care, people also have gaps in health engagement and health literacy. Three studies published in early October 2017 provide insights into the state of healthcare consumerism in America. The 2017 UnitedHealthcare Consumer Sentiment Survey found that a plurality of Americans (45%) turn first to primary care providers (doctors or nurses) as their source for the first source of information about specific health symptoms, conditions or diseases. 28% of people also use the internet or mobile health apps as their

The Patient Is The Vector: Health 2.0 – Day 2 Learnings

Question: “What is the opposite of ‘patient-centered care?'” asked a panelist on Day 1 of the 11th Annual Health 2.0 Conference. Answer: “‘Physician-centered care.'” Even physicians today see the merits of patient engagement, as this survey from New England Journal of Medicine found earlier this year. Since the launch of the first Health 2.0 Conference in 2007, the patient has played a growing role in session content and, increasingly, on the big stage and panel breakout sessions. A panel I attended on Day 2 convened five developers of patient engagement platforms and digital tools to help healthcare look and

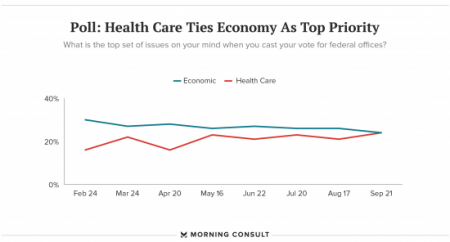

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

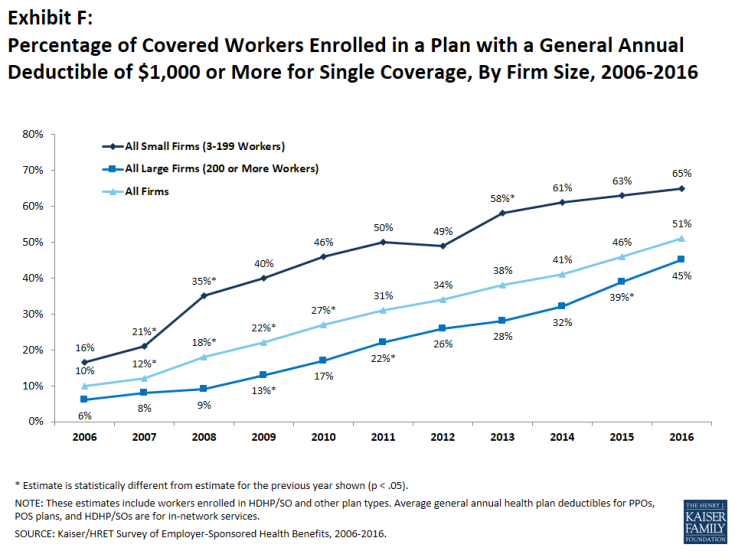

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

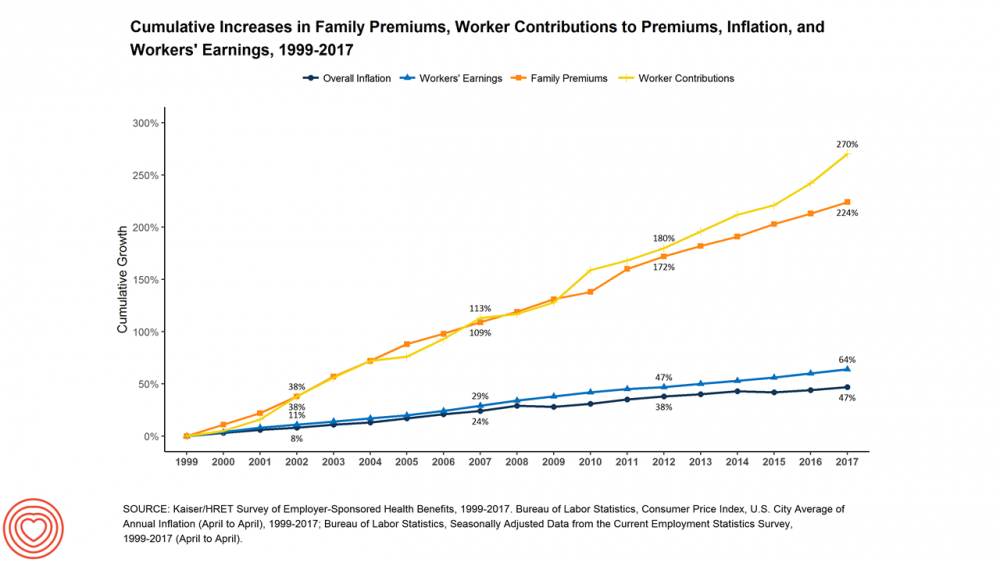

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

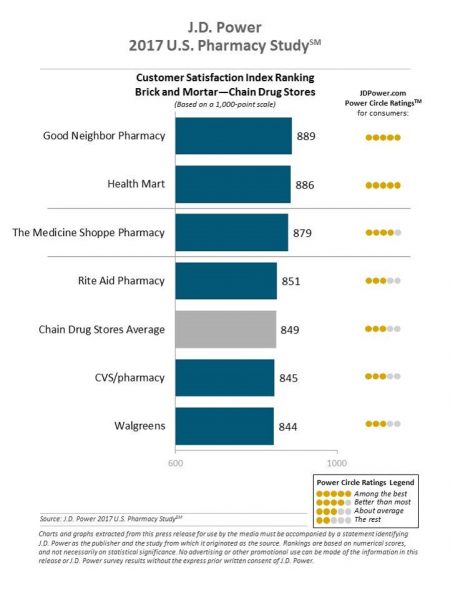

Decline in Pharmacy Reputations Related to Prescription Drug Prices, J.D. Power Finds

Cost is the number one driver among consumers declining satisfaction with pharmacies, J.D. Power found in its 2017 U.S. Pharmacy Study. Historically in J.D. Power’s studies into consumer perceptions of pharmacy, the retail segment has performed very well, However, in 2017, peoples’ concerns about drug prices negatively impact their views of the pharmacy — the front-line at the point-of-purchase for prescription drugs. In the past year, dissatisfaction with brick-and-mortar pharmacies related to the cost of drugs and the in-store experience. For mail-order drugs, consumer dissatisfaction was driven by cost and the prescription ordering process. Among all pharmacy channels, supermarket drugstores

Transparency in Drug Prices, from OTC to Oncology

While on vacation in Bermuda, I found a box of private label ibuprofen for $2.45 for 20 – 200mg tablets, and one for Advil PM for $10.50 for the same number of pills, same strength. I’ve just returned from a lovely week’s holiday. When I travel, whether for work or vacation, it’s always a sort of Busman’s Holiday for me as I love to seek out health destinations wherever I go. So it was natural for me to spot the Dockyard Pharmacy at the port in Hamilton and wander in. I made my way back to the well-stocked pharmacy counter,

Patients’ Healthcare Payment Problems Are Providers’, Too

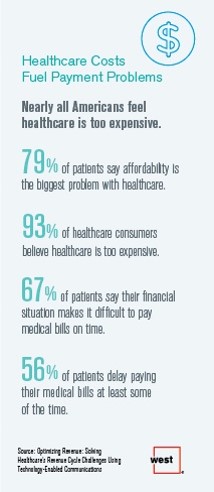

Three-quarters of patients’ decisions on whether to seek services from healthcare providers are impacted by high deductible health plans. This impacts the finances of both patients and providers: 56% of patients’ payments to healthcare providers are delayed some of the time, noted in Optimizing Revenue: Solving Healthcare’s Revenue Cycle Challenges Using Technology Enabled Communications, published today by West. Underneath that 56% of patients delaying payments, 12% say they “always delay” payment, and 16% say they “frequently delay” payment. West engaged Kelton Global to survey 1,010 U.S. adults 18 and over along with 236 healthcare providers to gauge their experiences with

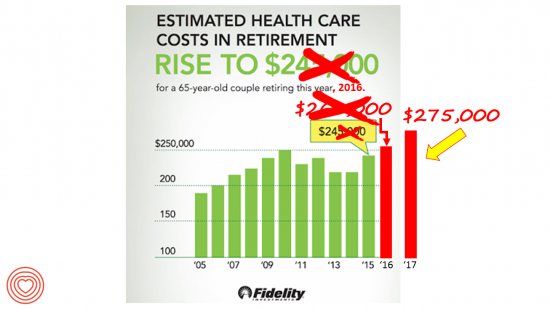

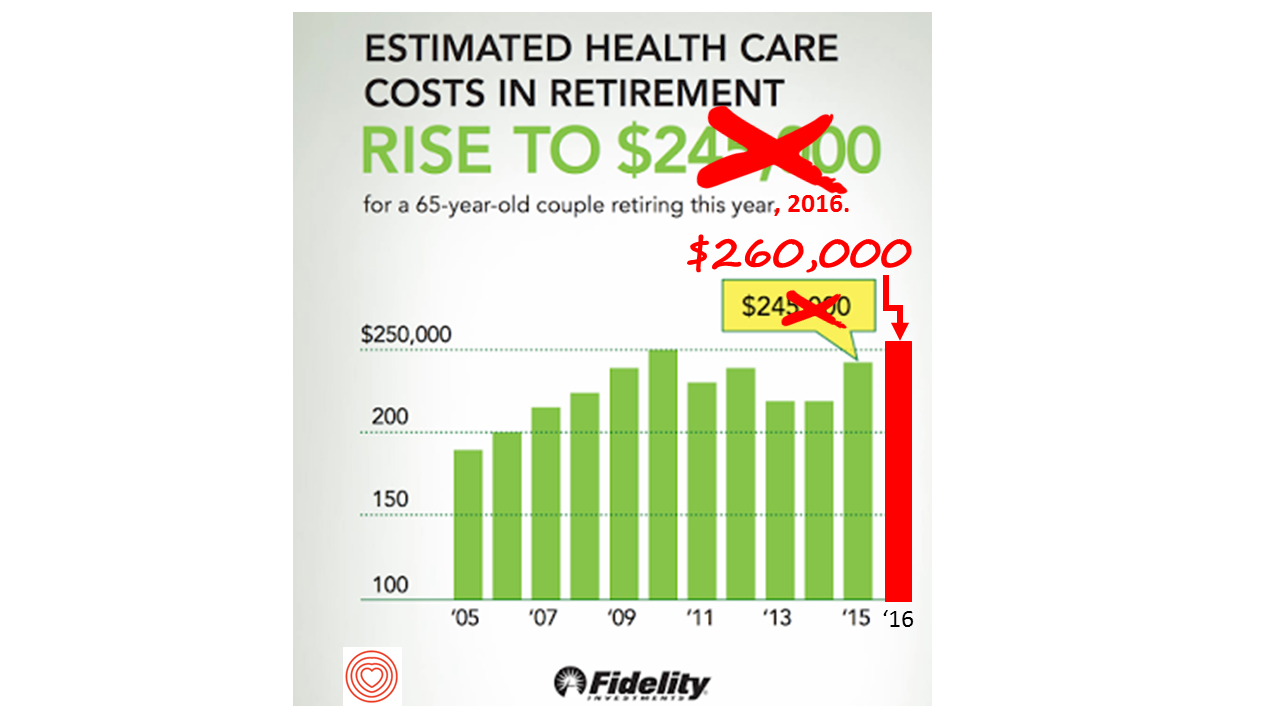

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

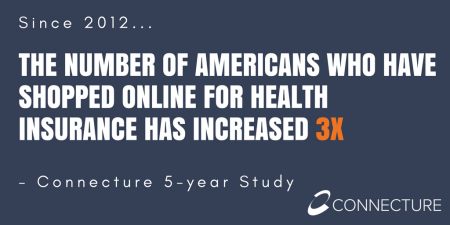

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

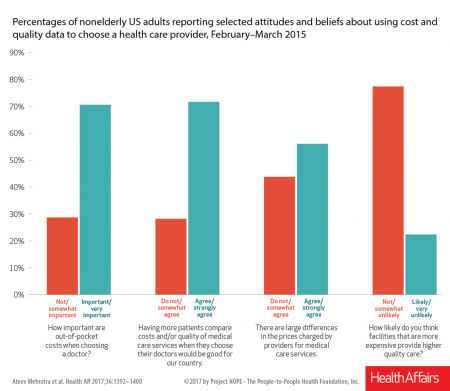

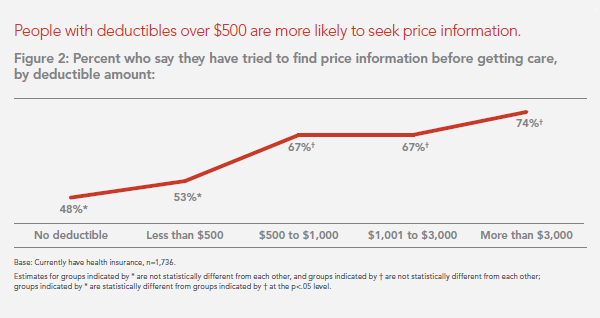

Price-Shopping for Healthcare Still A Heavy Lift for Consumers

Most U.S. consumers support the idea of price-shopping for healthcare, but don’t practice it. While patients “should” shop for health care and perceive differences in costs across providers, few seek information about their personal out-of-pocket costs before getting treatment. Few Americans shop around for health care, even when insured under a high-deductible health plan, conclude Ateev Mehrotra and colleagues in their research paper, Americans Support Price Shopping For Health Care, But Few Actually Seek Out Price Information. The article is published in Health Affairs‘ August 2017 issue. The bar chart shows some of the survey results, with the top-line finding

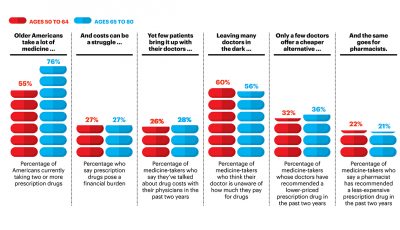

Patients Want Doctors To Know How Much Their Drugs Cost

Patients want their doctors to know what their personal costs for medicines are; 42% of patients also believe their doctor is aware of how much they spend on prescription drugs. However, 61% of these people have not talked with doctors about drug prices. Nor do most doctors have access to this kind of information at the individual patient level. One important tactic to addressing overall healthcare costs, and managing the prescription drug line item in those costs, is discussed in Doctors and Pharmacists: An Underused Resource to Manage Drug Costs for Older Adults, a report on a survey sponsored

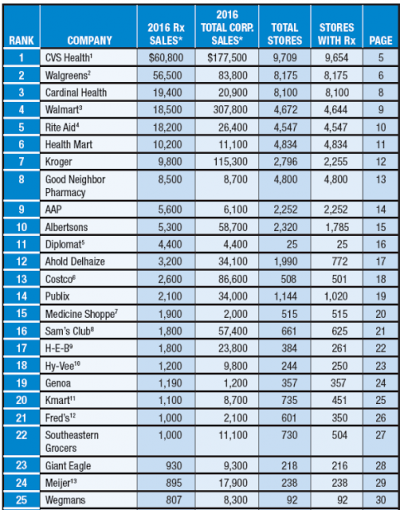

Pharmacies Morph Into Primary Care Health Destinations

The business and mission of pharmacies are being re-shaped by several major market forces, most impactful being uncertain health reform prospects at the Federal level — especially for Medicaid, which is a major payor for prescription drugs. Medicaid covered 14% of retail prescriptions dispensed in 2016, according to QuintilesIMS; Medicare accounted for 27% of retail prescriptions. “But if affordability, accessibility, quality, innovation, responsiveness and choices are among the standards that will be applied to any future changes, pharmacy has strong legs to stand on,” Steve Anderson, president and CEO of the National Association of Chain Drug Stores, said in the PoweRx Top 50

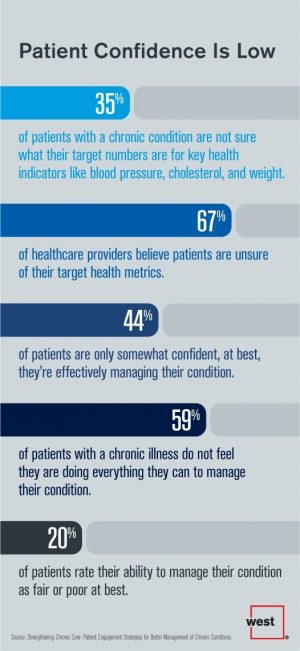

Strengthening Chronic Care Is Both Personal and Financial for the Patient

6 in 10 people diagnosed with a chronic condition do not feel they’re doing everything they can to manage their condition. At the same time, 67% of healthcare providers believe patients aren’t certain about their target health metrics. Three-quarters of physicians are only somewhat confident their patients are truly informed about their present state of health. Most people and their doctors are on the same page recognizing that patients lack confidence in managing their condition, but how to remedy this recognized challenge? The survey and report, Strengthening Chronic Care, offers some practical advice. This research was conducted by West

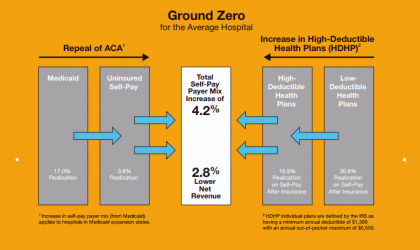

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

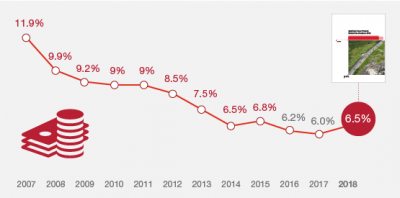

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

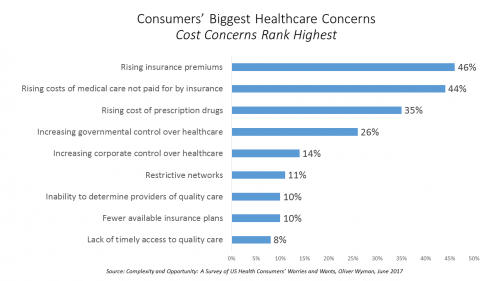

Healthcare Cost Concerns Trump All Others Across the Generations

Patients, evolving into health consumers, seek a better healthcare experience. While most people are pretty satisfied with their medical care, cost and confusion reign. This is the topline finding of a study from Oliver Wyman appropriately titled, Complexity and Opportunity, a survey of U.S. health consumers’ worries and wants. Oliver Wyman collaborated on the research with the FORTUNE Knowledge Group. Consumers’ biggest healthcare concerns deal with costs: rising insurance premiums; greater out-of-pocket costs for care not covered by insurance; and, the growing costs of prescription drugs together rank as the top 3 healthcare concerns in this study. After costs, consumers cite government

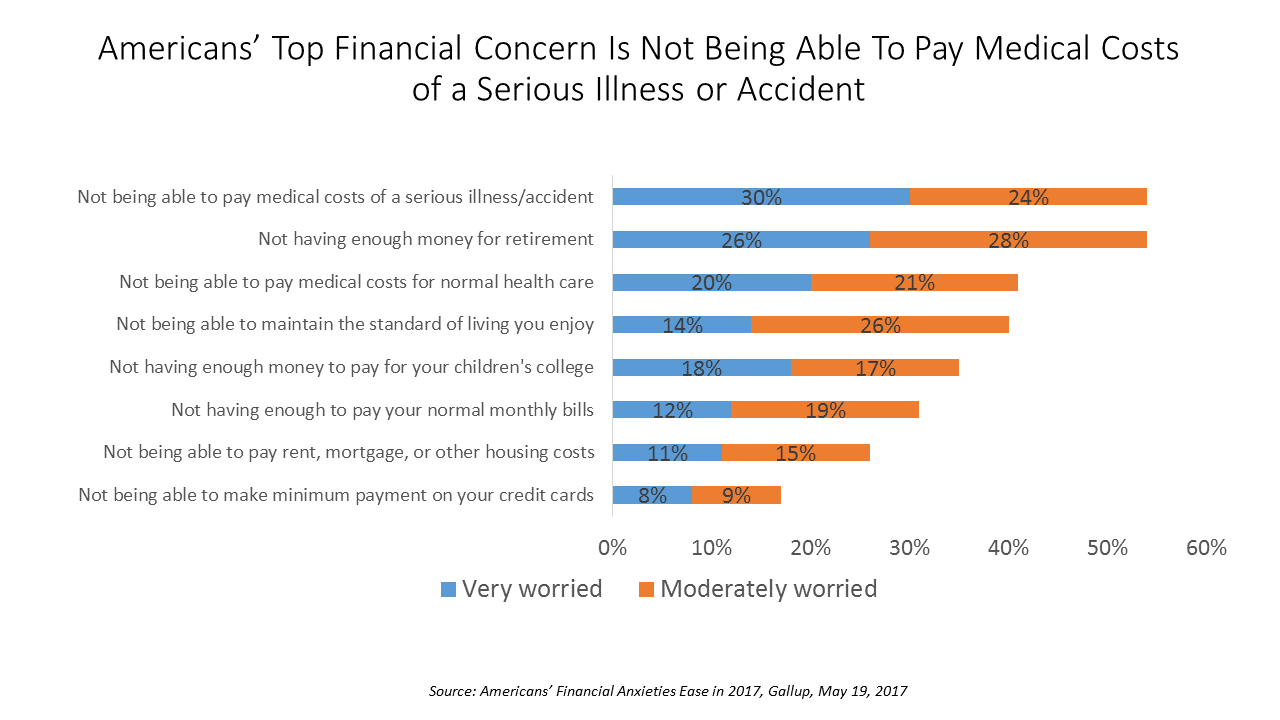

How To Pay For A Serious Medical Illness Tops Americans’ Fiscal Fears

While Americans’ financial worries are softening in 2017, one issue tops the list of fiscal fears: not having enough money to pay the costs involved in a serious illness or accident, Gallup found in a consumer poll fielded in early April 2017. 54% of Americans fear an inability to cover healthcare costs in the event of an accident or serious illness. This percentage was 60% in 2016, and 55% in 2015. This year’s data point ties with Americans financial worry about not having enough money for retirement, but healthcare cost concerns rank higher in terms of being “very worried” versus

Medicines in America: The Half-Trillion Dollar Line Item

Prescription drug spending in the U.S. grew nearly 6% in 2016, reaching $450 billion, according to the QuintilesIMS Institute report, Medicines Use and Spending in the U.S., published today. U.S. drug spending is forecasted to grow by 30% over the next 5 years to 2021, amounting to $610 billion. In 2016, per capita (per person) spending on medicines for U.S. health citizens averaged $895. Specialty drugs made up $384 of that total, equal to 43% of personal drug spending, shown in the first chart. Spending on specialty drugs continues to increase as a proportion of total drug spending: traditional medicines’ share

The Power of Joy in Health and Medicine – Learning From Dr. Regina Benjamin

Former Surgeon General Dr. Regina Benjamin was the first person who quoted to me, “Health isn’t in the doctor’s office. It’s where people live, work, play and pray,” imparting that transformational mantra to me in her 2011 interview with the Los Angeles Times. I wrote about that lightbulb moment here in Health Populi. Dr. Benjamin was the 18th Surgeon General, appointed by President Obama in 2009. As “America’s Doctor,” she served a four-year term, her mission focused on health disparities, prevention, rual health, and children’s health. Today, Dr. Benjamin wears many hats: she’s the Times Picayune/NOLA.com professor of medicine at

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

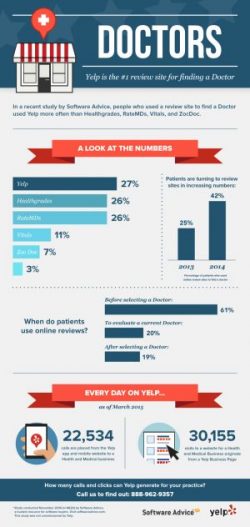

Consumer Healthcare Reviews on Yelp Help

Just as consumers use TripAdvisor, Zagat, OpenTable, and their Facebook pages to review restaurants, hotels, automobiles, and financial services companies, many patients – now health consumers in earnest – have taken to reviewing healthcare services in social networks. Finding reliable, understandable information about healthcare quality and prices is very challenging for most consumers. Are healthcare reviews on social networks statistically valid? An analysis of consumer ratings for New York State hospitals on Yelp, the social network, were positively correlated to objective scores of hospital quality, according to the research published in Yelp for Health: Using the Wisdom of Crowds to

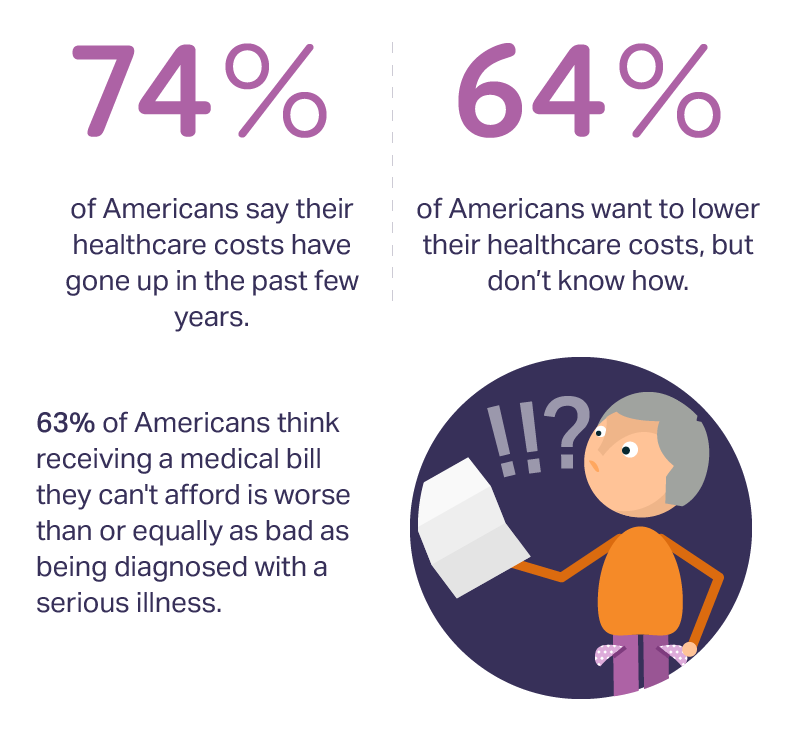

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

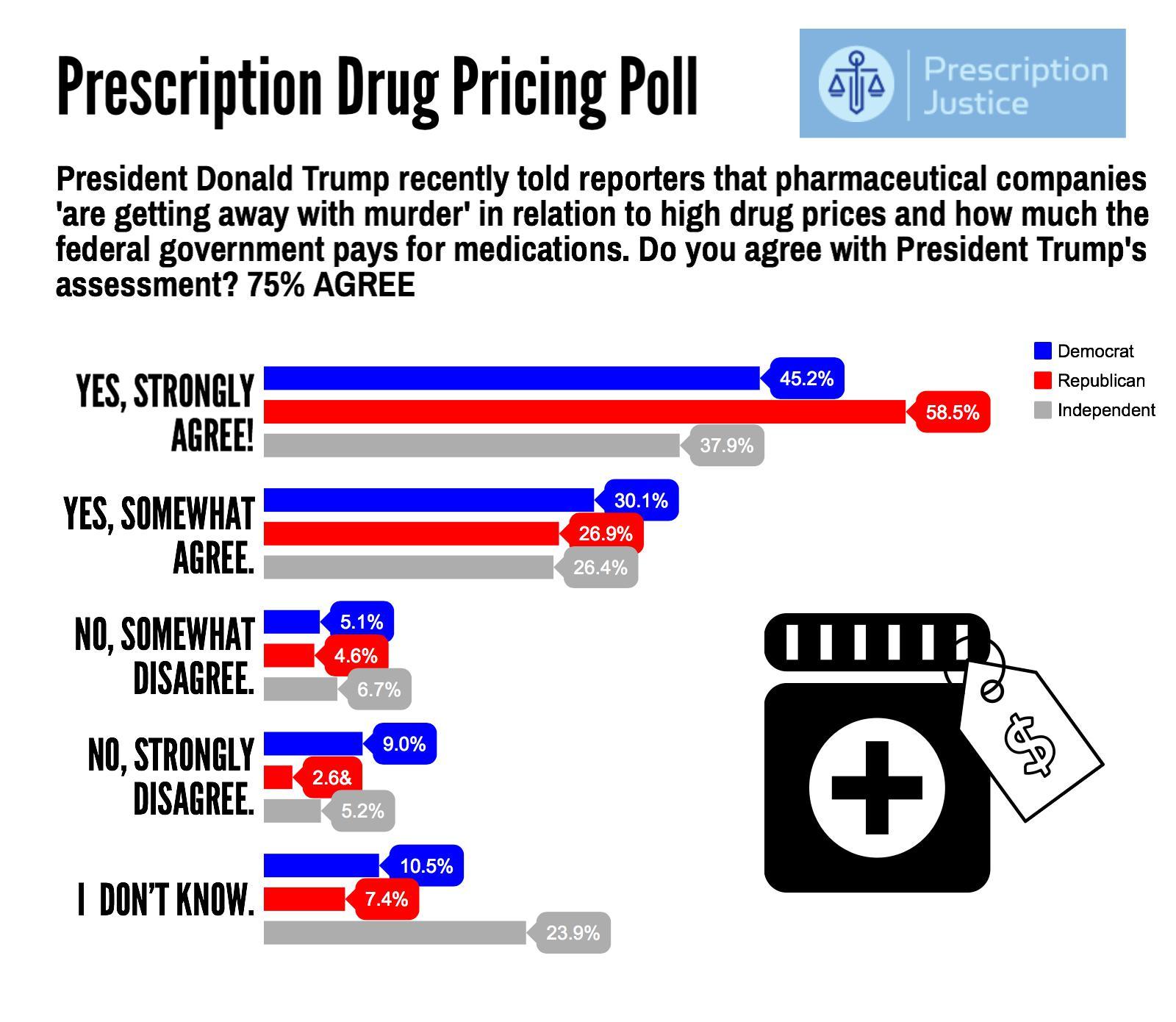

The Healthcare Reform Issue Americans Agree On: Lowering Rx Costs

Yesterday, the Tweeter-in-Chief President Donald Trump tweeted, “I am working on a new system where there will be competition in the Drug Industry. Pricing for the American people will come way down!” Those 140 characters sent pharma stocks tumbling, as illustrated by the chart for Mylan shares dated 7 March 2017. This is one issue that Americans across the political spectrum agree on with the POTUS. The latest Zogby poll into this issue, conducted for Prescription Justice, found 3 in 4 Americans agree that pharmaceutical companies are “getting away with murder,” as President Trump said in a TIME magazine interview

Your Zip Code Is Your Wellness Address

Geography is destiny, Napoleon is thought to have first said. More recently, the brilliant physician Dr. Abraham Verghese has spoken about “geography as destiny” in his speeches, such as “Two Souls Intertwined,” The Tanner Lecture he delivered at the University of Utah in 2012. Geography is destiny for all of us when it comes to our health and well-being, once again proven by Gallup-Healthways in The State of American Well-Being 2016 Community Well-Being Rankings. The darkest blue circles in the U.S. map indicate the metro areas in the highest-quintile of well-being. The index of well-being is based on five metrics, of consumer self-ranking

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Health and Money: Americans’ New Year’s Resolutions for 2017

Health and money are the two issues about which Americans have set New Year’s resolutions, according to the Harris Poll, Americans Look to Get Their Bodies and Wallets in Shape with New Year’s Resolutions. The top goals U.S. consumers have set for 2017 are to: Eat healthier, 29% of all U.S. adults Save more money, 25% Lose weight, 24% Drink more water, 21% Pay down debt, 17% Spend more time with family and friends, 15% Get organized, 15% Travel more, 15% Read more, 14% Improve relationships, 14%. There are some marked differences between American men versus women across these resolutions;

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

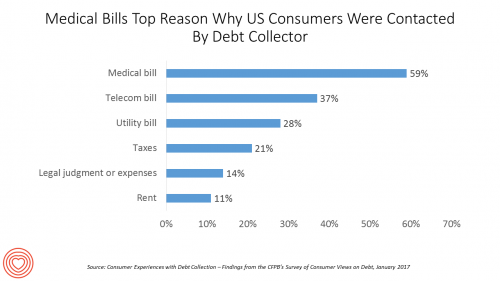

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

You Don’t Know What You’ve Got ‘Til It’s Gone: More Americans Liking the ACA

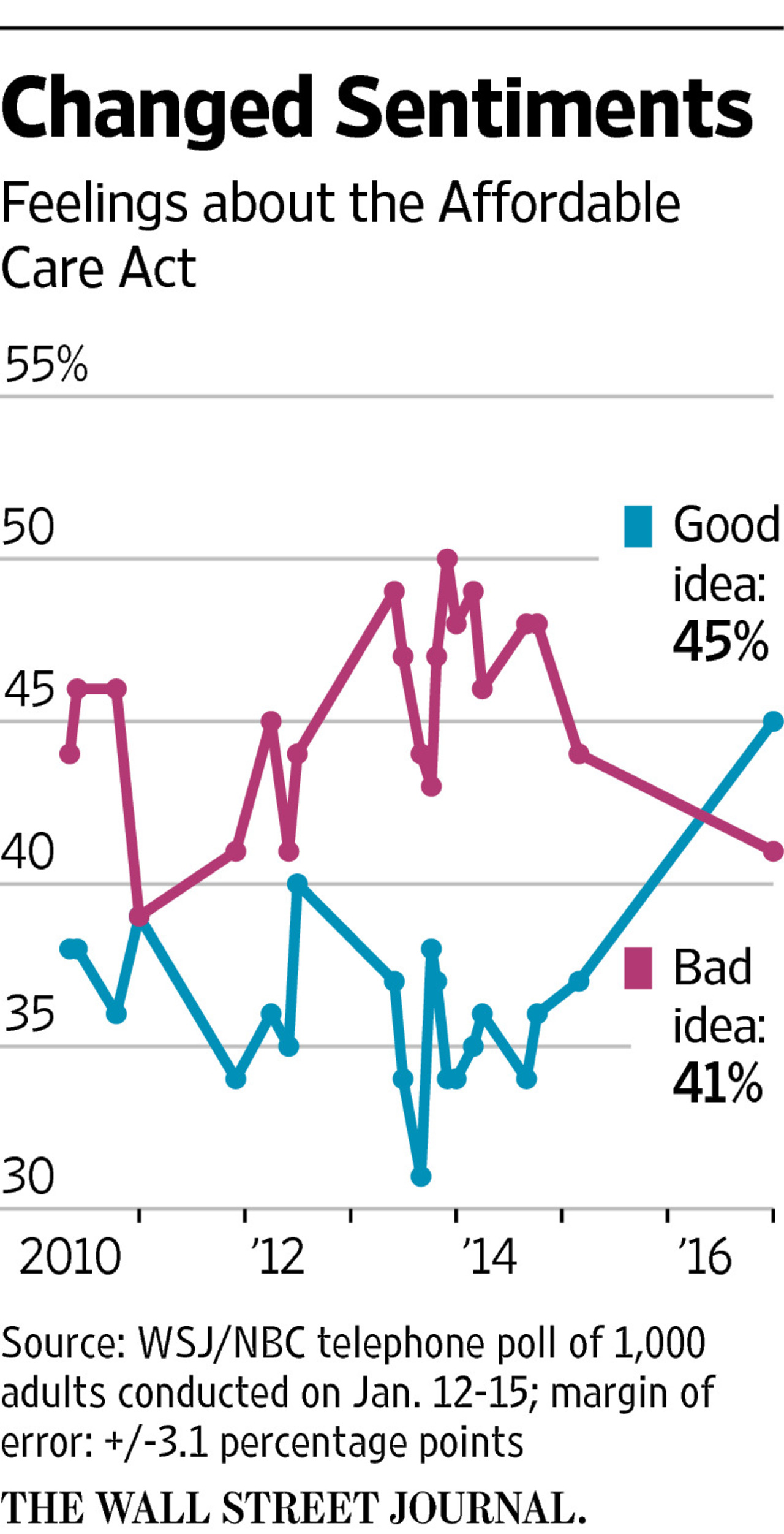

It’s human nature to take what we have for granted. But it wasn’t all that long ago that millions of Americans were uninsured. Since the advent of the Affordable Care Act (ACA), American voters’ feelings about the plan were split roughly 50/50, with slightly more U.S. voters, at the margin, disliking Obamacare than liking it. “Don’t it always seem to go that you don’t know what you’ve got ’til it’s gone,” Joni Mitchell sang in her iconic song, “Big Yellow Taxi.” In the lyrics, Mitchell was referring back in 1970 to land development and eroding public green space. “You paved

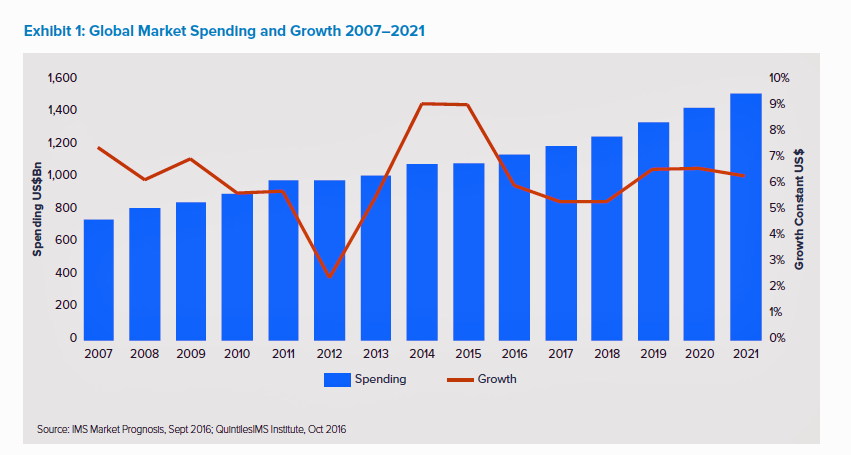

A Growing Medicines Bill for Global Health Consumers to 2021

The global market for spending on medicines will high $1.5 trillion by 2021, according to the latest forecast from QuintilesIMS. Drug spending grew about 9% in the past two years, and is expected to moderate to 4 to 7 percent annually over the next five years. That dramatic 9% growth was heavily driven by new (expensive) specialty drugs to treat Hepatitis C (e.g., Harvoni and Sovaldi) and cancer therapies that hit the market in the past couple of years. There will be a “healthy level” of new innovative meds coming out of the drug pipeline in the next several years

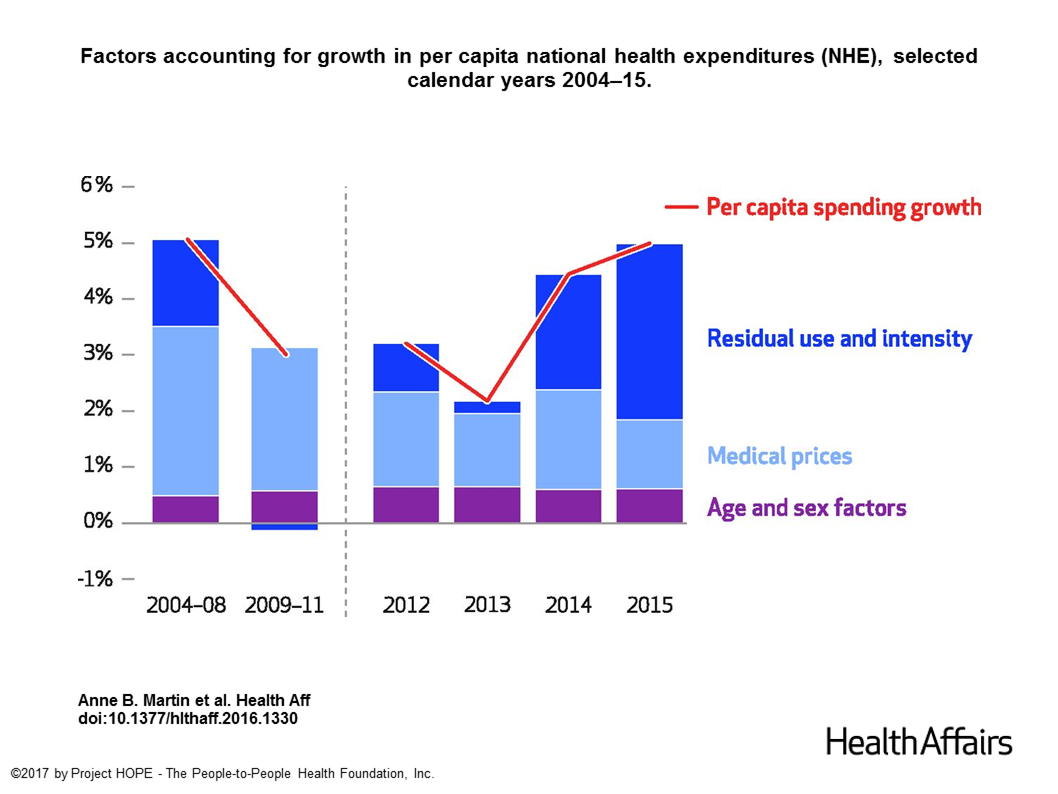

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

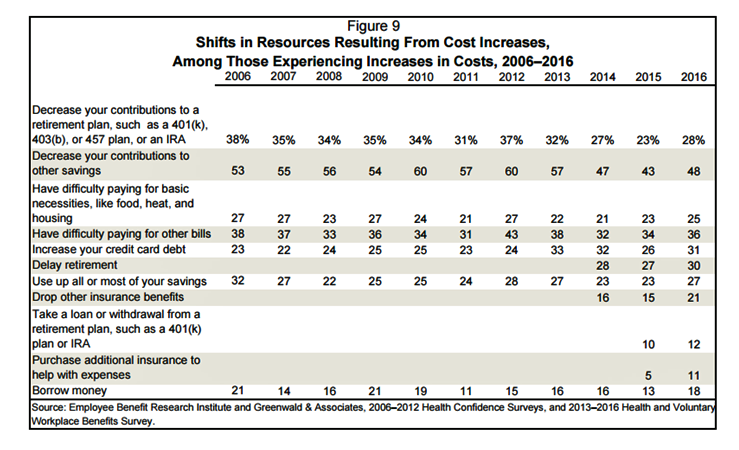

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

43% of Americans Worry About How They’ll Pay for Health Care

4 in 10 Americans are worried about how they’ll pay for health care, according to Americans’ Views on Current Trade and Health Policies, a poll conducted jointly between the Harvard T.H. Chan School of Public Health and Politico. There are no significant party differences between Democrats and Republicans regarding peoples’ worrying about their ability to pay medical costs in the next year. But there are differences in geography, with 53% of people in the South significantly more worried about health care costs compared with other regions of the U.S. Who’s to blame for the high costs of health care that

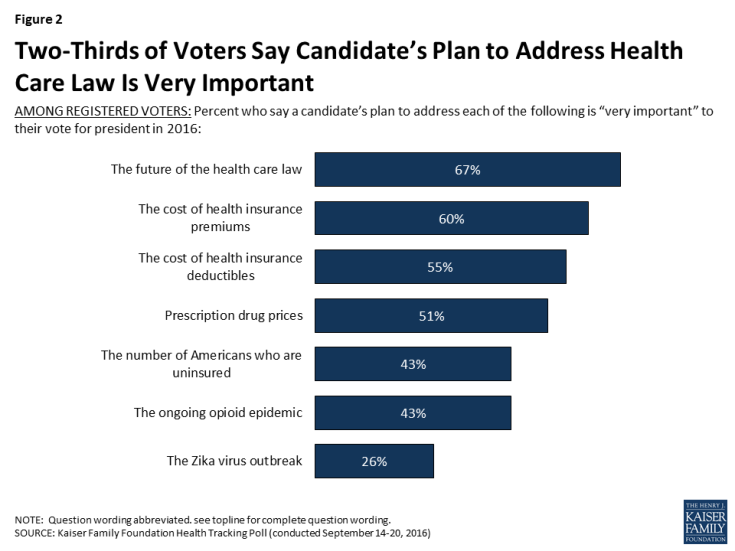

Costs of Care and the ACA Top Voters’ Healthcare Issues

Two in three US voters put the future of the Affordable Care Act as the #1 healthcare issue in the 2016 President election. The ACA is closely followed by healthcare costs — for insurance premiums, deductibles, and prescription drugs, according to the September 2016 Kaiser Health Tracking Poll. The opioid addiction and mortality epidemic is a top healthcare issue for 43% of US voters, and the Zika virus, among 26% of voters. Note that more supporters of Hillary Clinton are healthcare-oriented voters than people who favor Donald Trump. Uninsurance and costs, in addition to the future of the ACA, rank

Let’s Go Healthcare Shopping!

Healthcare is going direct-to-consumer for a lot more than over-the-counter medicines and retail clinic visits to deal with little Johnny’s sore throat on a Sunday afternoon. Entrepreneurs recognize the growing opportunity to support patients, now consumers, in going shopping for health care products and services. Those health consumers are in search of specific offerings, in accessible locations and channels, and — perhaps top-of-mind — at value-based prices as defined by the consumer herself. (Remember: value-based healthcare means valuing what matters to patients, as a recent JAMA article attested). At this week’s tenth annual Health 2.0 Conference, I’m in the zeitgeist

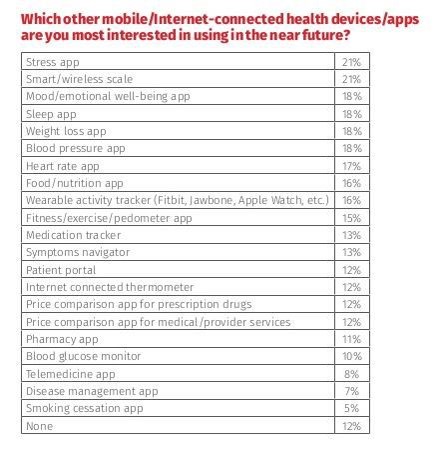

Most Digital Health Consumers Say They Benefit from Connected Health

Managing stress, weight, mental health, sleep, and heart function are among the top-most desired reasons already-connected health consumers are interested in further connecting their health, according to The 2016 HealthMine Digital Health Report. The most popular tools people use to digitally manage their health deal with fitness and exercise (among 50% of connected health consumers), food and nutrition (for 46%), and weight loss (for 39%). 3 in 4 people who use digital health tools say they have improved their health by connecting to these tools. 57% of digital health users also say going health-digital has lowered their healthcare costs. The survey

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

Most US Doctors Say They Ration Patients’ Healthcare

Rationing has long been seen as a common practice in national, single-payer health systems like the UK’s National Health Service and Canada’s national health insurance program (known as “Medicare”). However, over half of U.S. physicians say they ration care to patients. In a peer-reviewed column in the Journal of General Internal Medicine published in July 2016, Dr. Robert Sheeler and colleagues at the Mayo Clinic, University of Iowa, and University of Michigan, found that 53% of physicians surveyed personally “refrained” in the past six months from using specific clinical services that would have provided the “best patient care” due to cost.

The Future of Retail Health in 2027

As consumers gain more financial skin in the game of paying for health care, we look for more retail-like experiences that reflect the Burger King approach to consuming: having it our way. For health are, that means access, convenience, transparency and fair costs, respect for our time, and a clear value proposition for services rendered. That doesn’t happen so much in the legacy health care system — in hospitals and doctors’ offices. It has already begun to happen in retail health settings and, especially, in the changing nature of pharmacies. Retail Health 2027, a special supplement to Drug Store News

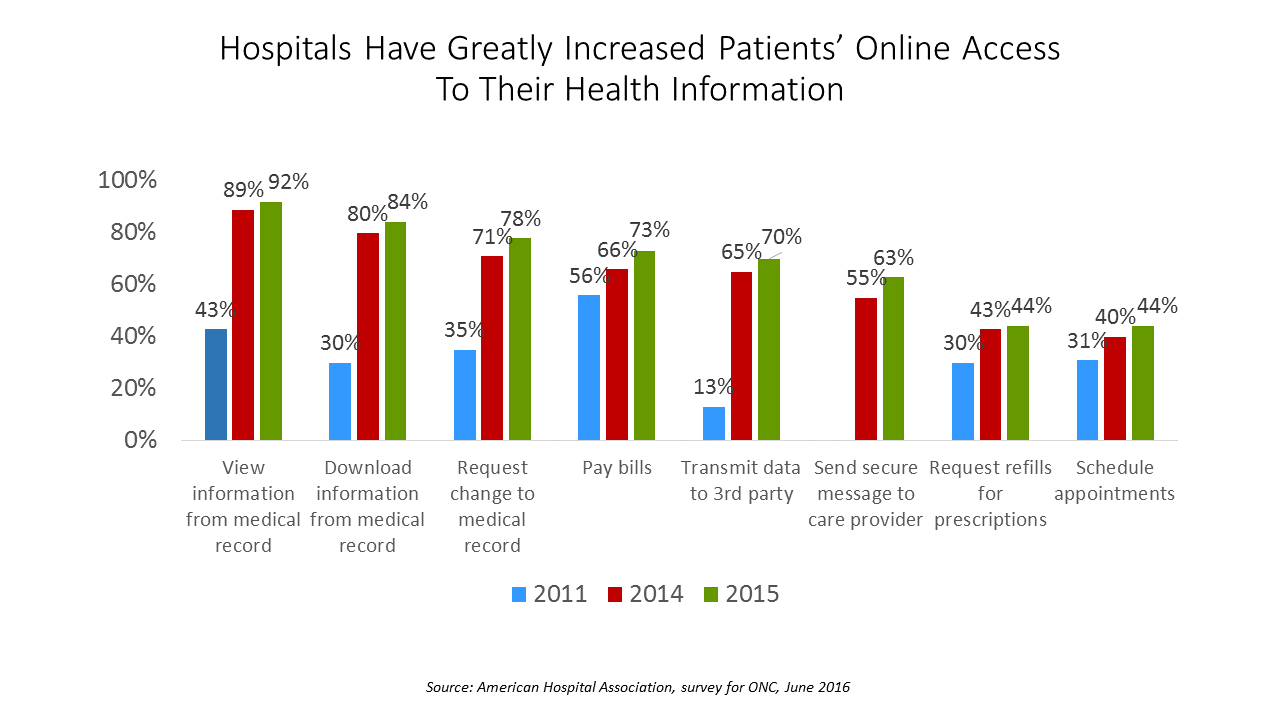

More Hospitals Extend Online Patient Access to EHRs

A majority of U.S. hospitals could enable patients digital access to their personal medical records in 2015. Specifically, nearly all US hospitals offer patients the opportunity to view their medical records online in 2015. Eight in 10 hospitals were able to download patient information from their medical record as well as enable patients to request a change to that record, according to a Trendwatch report from the American Hospital Association (AHA), Individuals’ Ability to Electronically Access Their Hospital Medical Records, Perform Key Tasks is Growing. Over the past several years, hospitals have made significant capital investments in buying, adopting, and

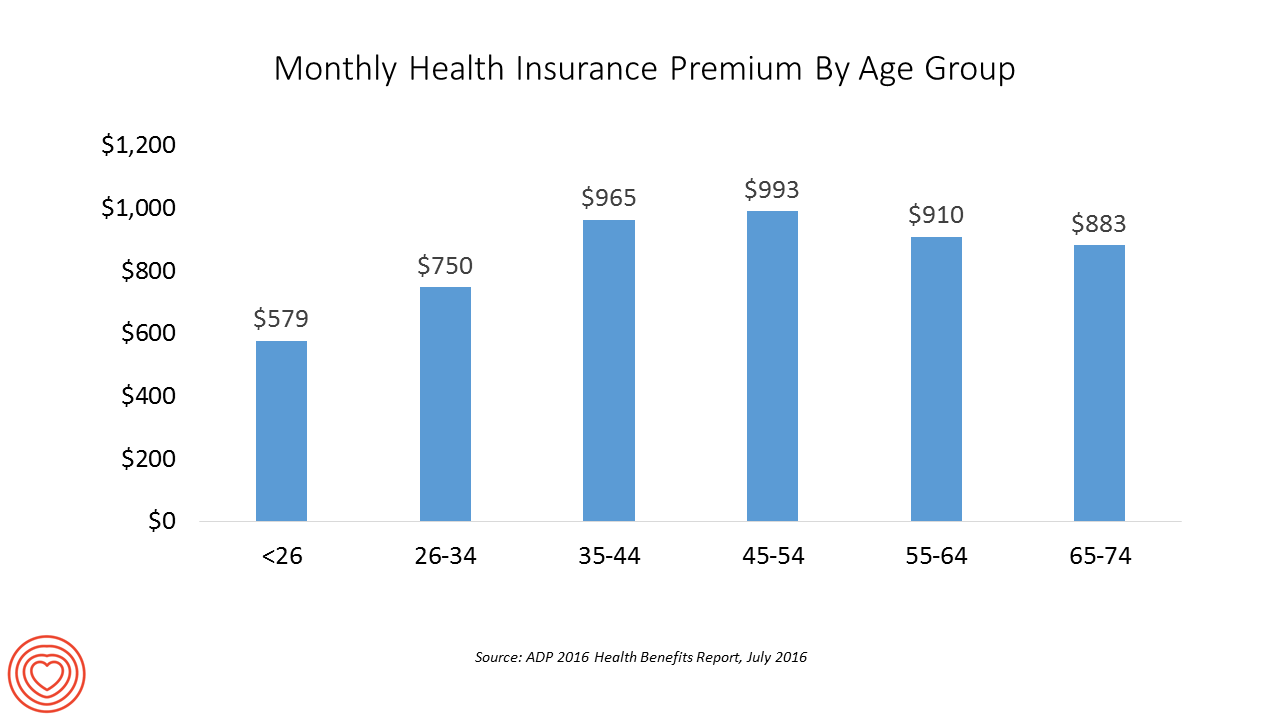

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

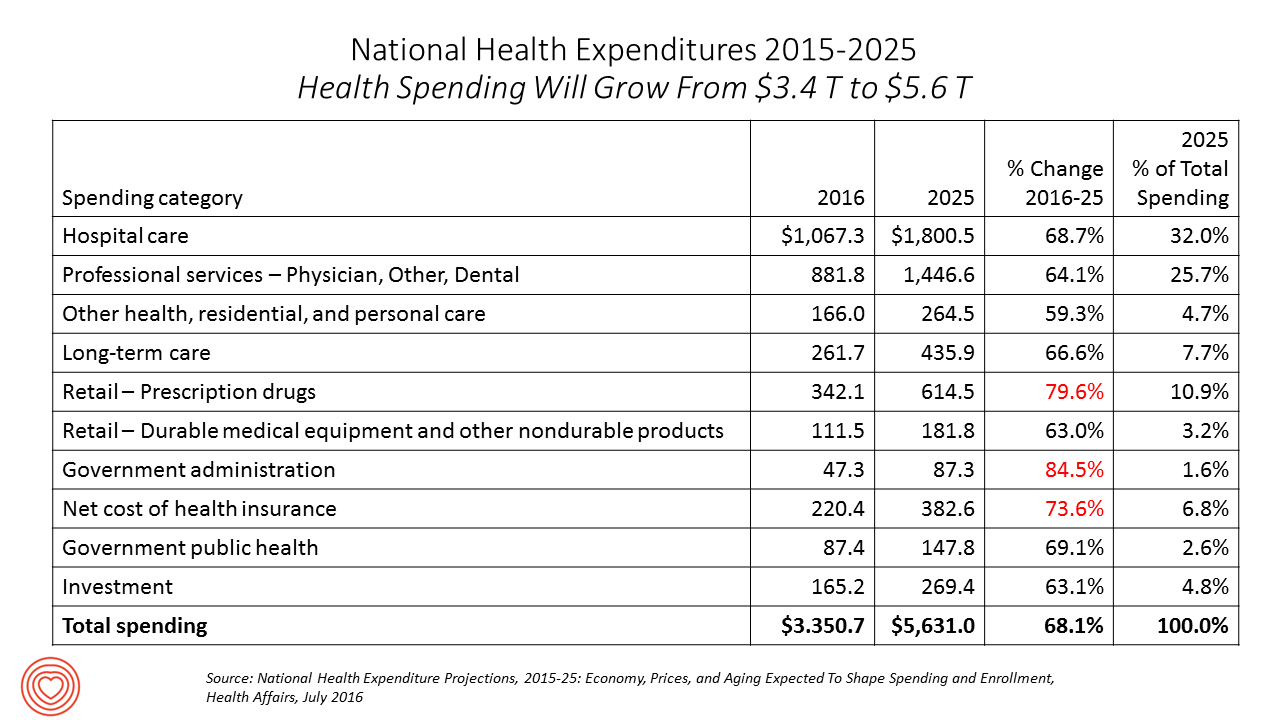

U.S. Health Spending Will Comprise 20% of GDP in 2025

Spending on health care in America will comprise $1 in every $5 of gross domestic product in 2025, according to National Health Expenditure Projections, 2015-25: Economy, Prices, And Aging Expected to Shape Spending and Enrollment, featured in the Health Affairs July 2016 issue. Details on national health spending are shown by line item in the table, excerpted from the article. Health spending will grow by 5.8% per year, on average, between 2015 and 2025, based on the calculations by the actuarial team from the Centers for Medicare and Medicaid Services (CMS), authors of the study. The team noted that the Affordable Care

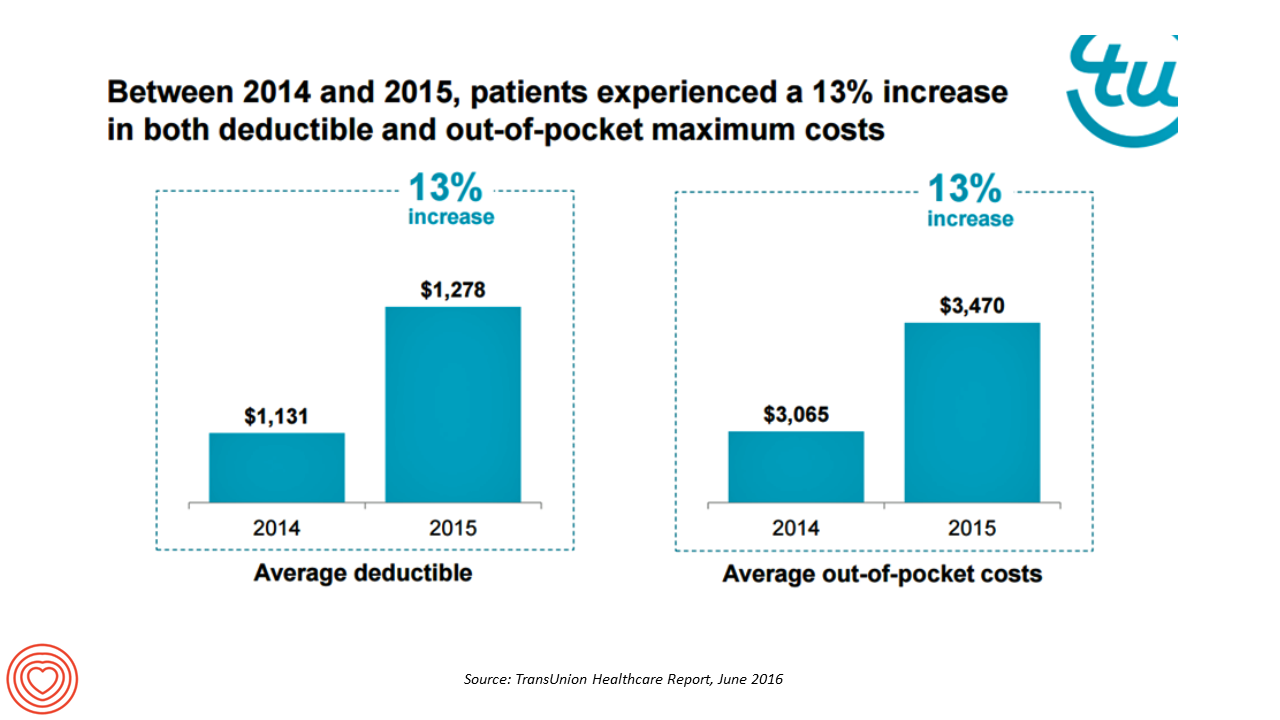

More Patients Morph Into Financially Burdened Health Consumers

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016. Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015. In

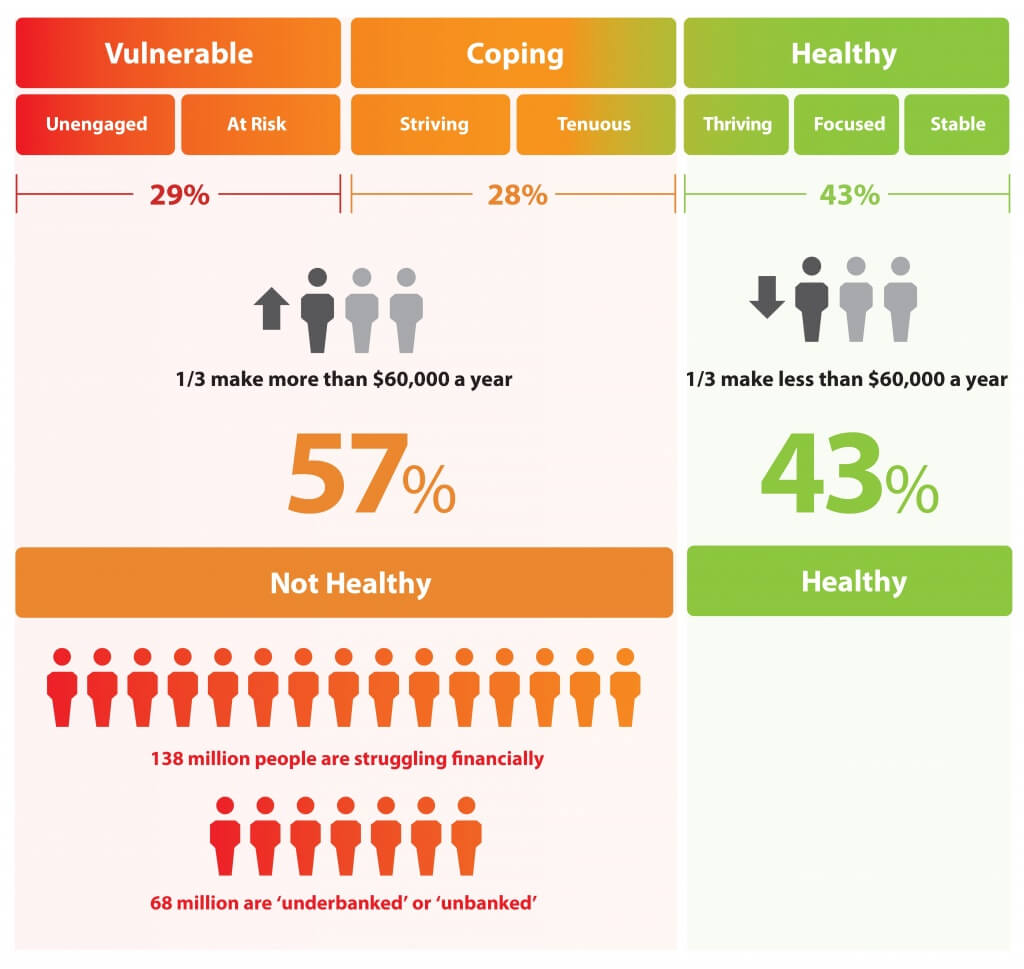

What Financial Health Means to Me: It’s Baked Into Wellness

Today is Financial Wellness Day. Do you know how financially well you are? Let me take a crack at that answer, even though I haven’t seen your bank account (which you may not even have as over 20% of people in the US are, as financial services companies would call you “un-banked” or “under-banked”.) You have some level of fiscal stress, ranging from a little to a lot. You aren’t taking all of your summer vacation your employer extends to you. You’re spending around $1 in every $5 of your household budget on health care. And your sleep isn’t as

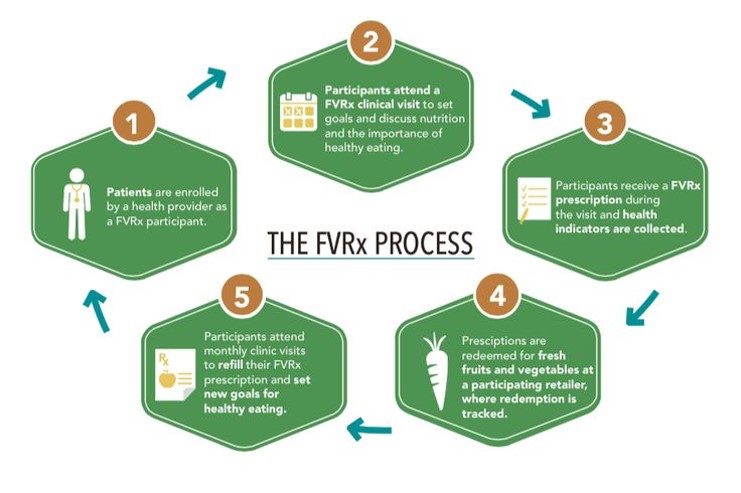

Prescriptions for Food: the New Medicine

Hippocrates is often quoted as saying, “Let food be thy medicine and medicine be thy food.” While some researchers argue that Hippocrates knew the difference between ‘real’ medicine and clinical therapy, there’s no doubt he appreciated the social determinant of health and wellness that food was 1,000 years ago and continues to be today. Taking a page, or prescription note, from the good doctor’s Rx pad, food retailers, healthcare providers, local food banks, and State healthcare programs are working the food-as-medicine connection to bolster public health. One approach to food-as-medicine is promoting the purchase of fresh fruits and vegetables — the

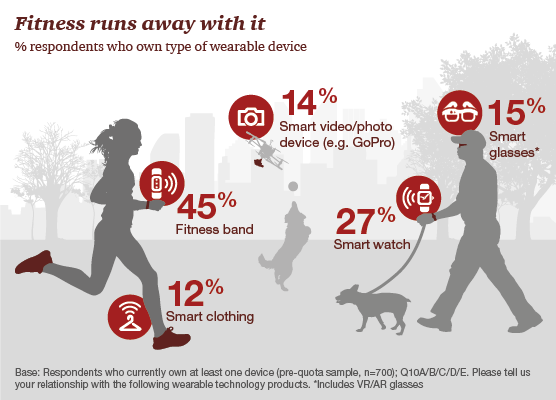

One in Two People Use Wearable Tech in 2016

Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC. Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing. Specifically, 45% of people own a fitness band, such as a Fitbit, the most popular device in this

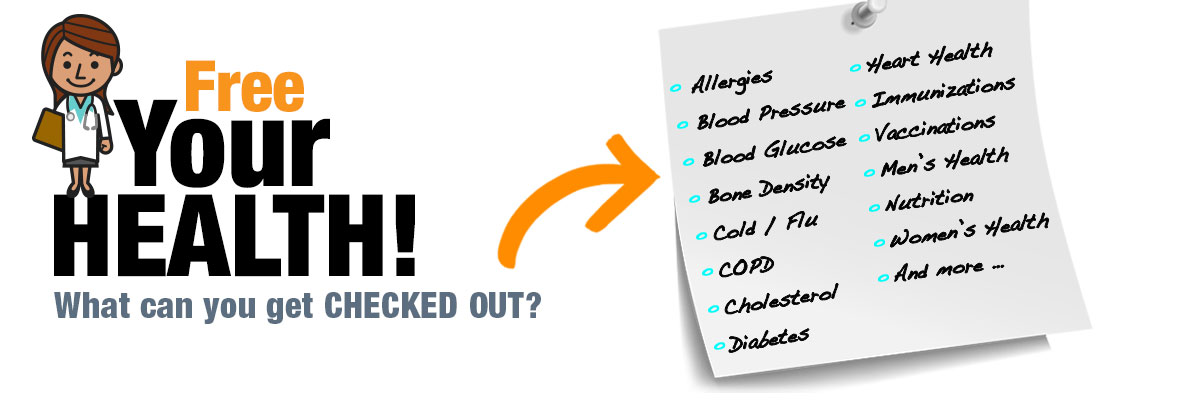

GoHealthEvents, An Online Source For Consumer Retail Health Opportunities

“Health comes to your local store,” explains the recently-launched portal, GoHealthEvents. This site is a one-stop shop for health consumers who are seeking health screenings and consults in local retail channels like big box stores, club stores, drug stores, and grocery stores. Events covered include cholesterol, diabetes, heart health, nutrition, osteoporosis, senior health, vaccinations and immunizations. By simply submitting a zip code, a health consumer seeking these kinds of services can identify where and when a local retailer will provide it. I searched on my own zip code in suburban Philadelphia, and found the following opportunities taking place in the

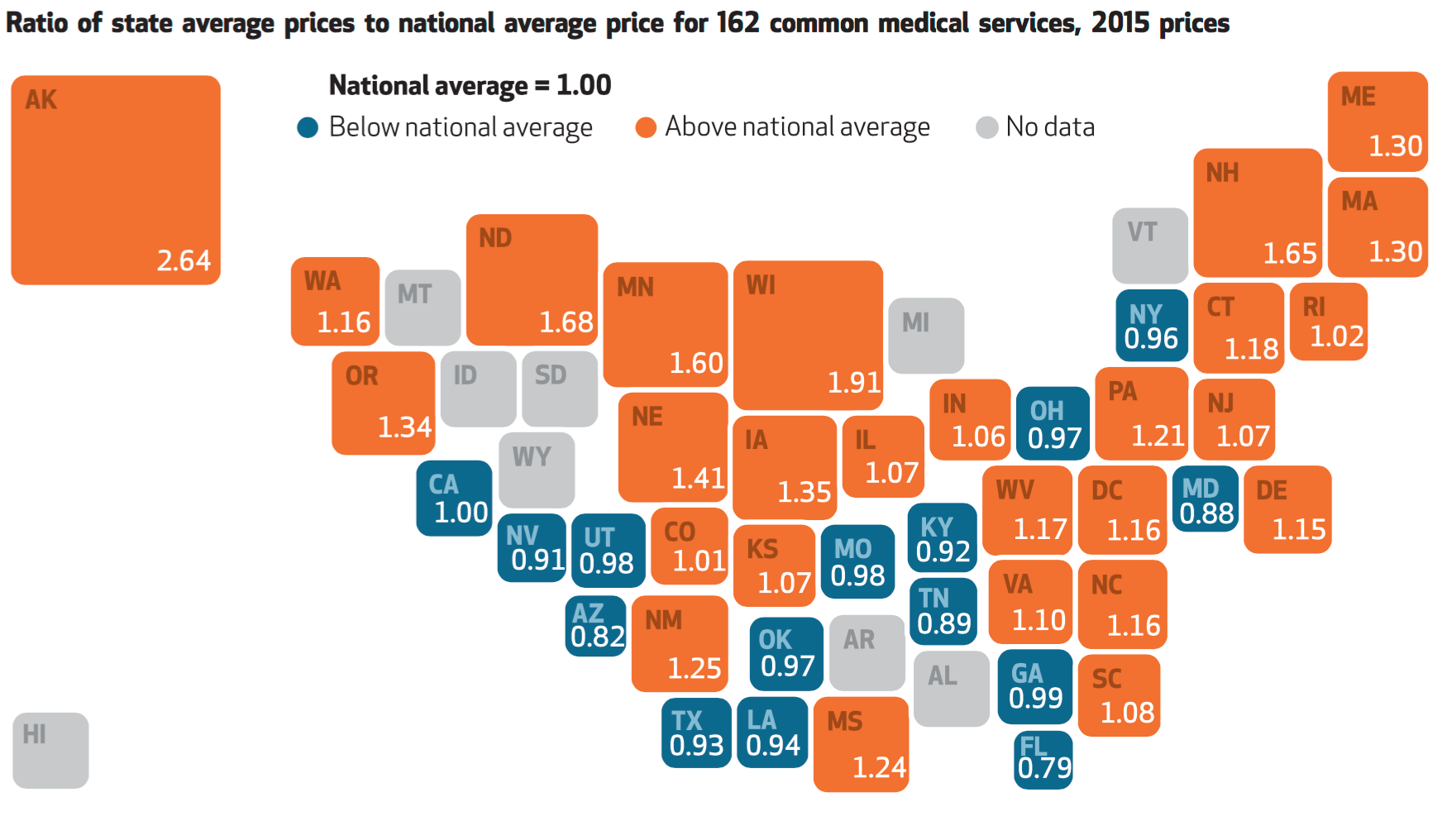

For Healthcare Costs, Geography is Destiny

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

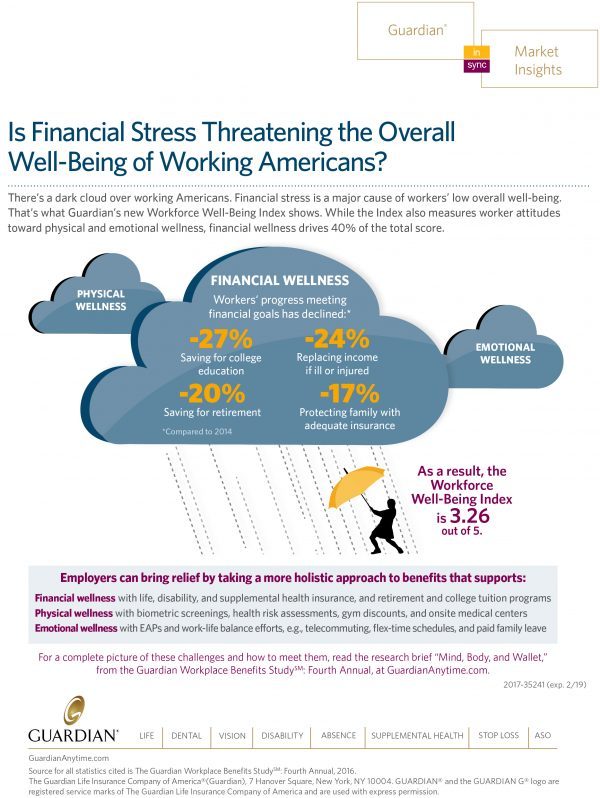

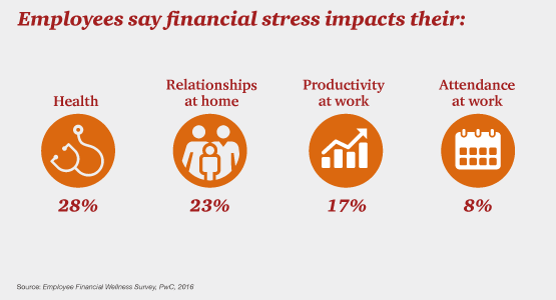

Money, Stress and Health: The American Worker’s Trifecta

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

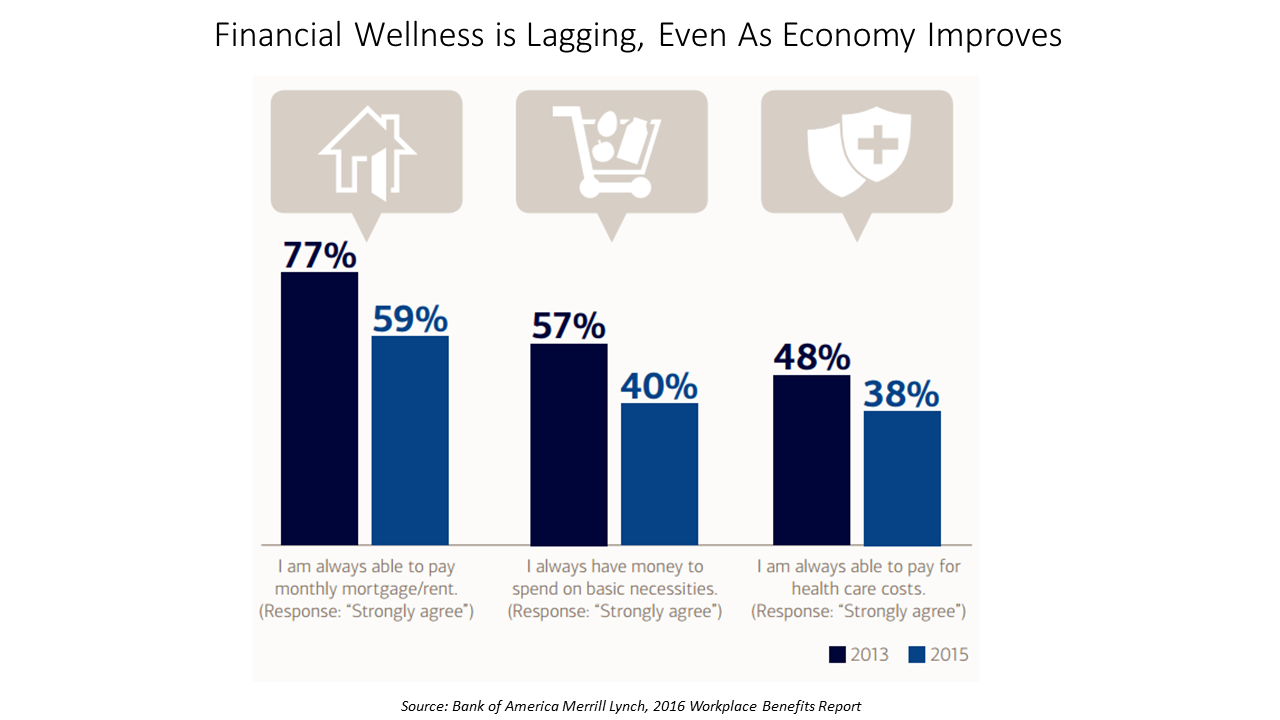

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

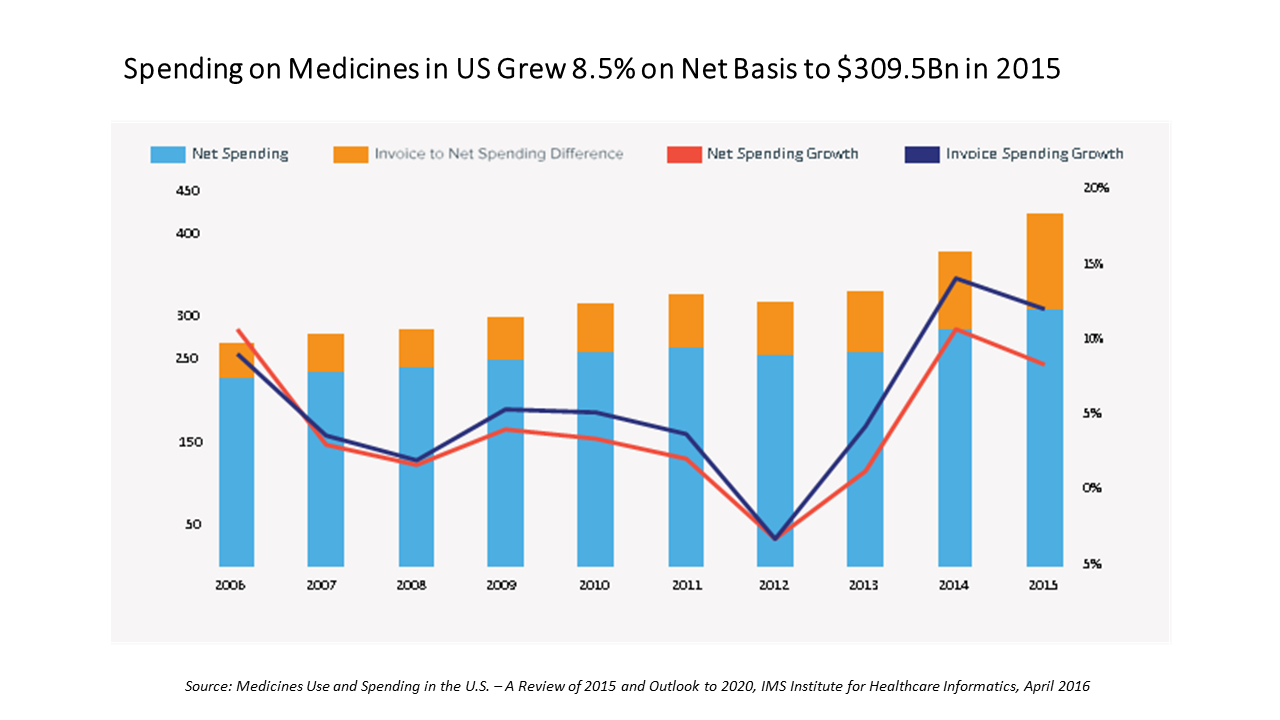

Expect Double-Digit Rx Cost Growth to 2020 – Implications for Oncology

In the U.S., spending on prescription medicines reached $425 bn in 2015, a 12% increase over 2014. For context, that Rx spending comprised about 14% of the American healthcare spend (based on roughly $3 trillion reported in the National Health Expenditure Accounts in 2014). We can expect double-digit prescription drug cost growth over the next five years, according to forecasts in Medicines Use and Spending in the U.S. – A Review of 2015 and Outlook to 2020 from IMS Institute of Healthcare Informatics. The biggest cost growth driver is specialty medicines, which accounted for $151 bn of the total Rx spend

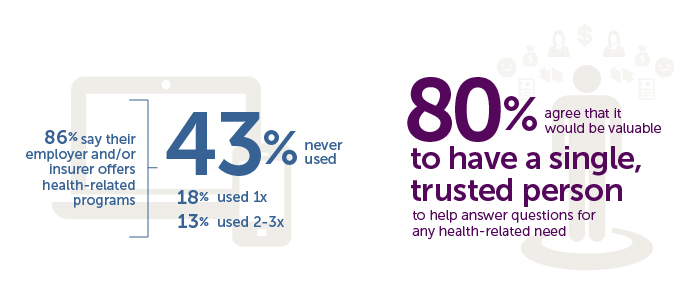

People Want Healthcare Sherpas

8 in 10 Americans would like one trusted person to help them figure out their health care, according to the Accolade Consumer Healthcare Experience Index Poll, conducted by The Harris Poll. The study gauged how Americans feel about their healthcare, especially focusing on employer-sponsored health insurance. One-third of people (32%) aren’t comfortable with navigating medical benefits and the healthcare system; a roughly percentage of people aren’t comfortable with their personal knowledge to make financial investments, either (35%). Buying a car, a home, technology and electronics? Consumers are much more comfortable shopping for these things. Consumers say that the most onerous

The Link Between Eating and Financial Health

People who more consistently track their calories and food intake are more likely to be fiscally fit than people who do not, suggesting a link between healthy eating and financially wellness. I learned this through a survey conducted in February 2016 among 4,118 people using the Lose It! mobile app, which enables people to track their daily nutrition. Some 25 million people have downloaded Lose It! The app is one of the most consistently-used mobile health tools available in app stores. The Rutgers School of Environmental and Biological Sciences has explored the financial impact of improved health behaviors, asserting that,

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

The New-New Health Fair – Care Goes Shopping

As consumers’ growing financial skin in the health care game compels them to seek care in lower-cost settings, the pharmacy business recognizes the opportunity to provide healthcare services beyond the core business of filling prescriptions. This month, Drug Store News (DSN) published a special section called which profiles several pharmacy companies’ expanding reach into retail health – in particular, re-defining the concept of the “health fair.” A health fair is “an educational and interactive event designed for outreach to provide basic prevention and medical screening to people in the community,” according to the latest Wikipedia definition. But the health fairs described

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

Yes, Virginia, There Really Are Healthcare Consumers: McKinsey

“There’s no such thing as a healthcare consumer. No one really wants to consume healthcare,” naysayers tell me, critical of my all health-consmer-all-the-time bully pulpit. But, touché to my health consumer-critics! I’ve more evidence refuting the healthcare consumer detractors from McKinsey in their research report, Debunking common myths about healthcare consumerism, from the team working in McKinsey’s Healthcare Systems and Services Practice. Their survey research among over 11,000 U.S. adults uncovered 8 myths about the emerging American health consumer, including: Healthcare is different from other industries Consumers know what they want from healthcare and what drives their decisions Most consumers

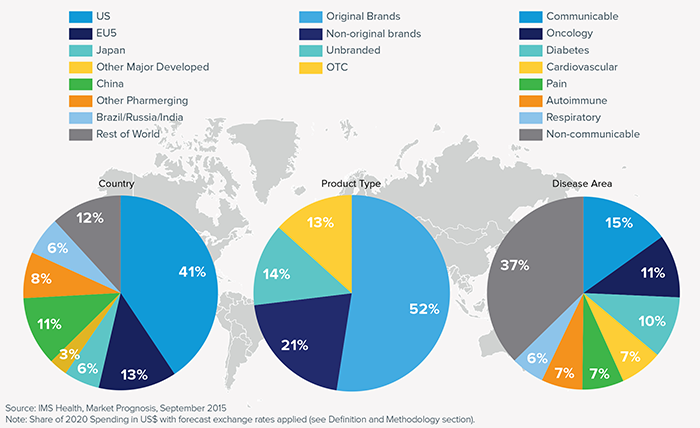

The U.S. Will Cover the Bulk of Medicines Spending in 2020

U.S. spending on medicines will approach $590 billion in 2020, increasing 34% over 2015, IMS Institute for Healthcare Informatics projects in its forecast, Global Medicines Use in 2020. Growth in spending will be attributable to innovation (new products), price increases and some patent losses of exclusivity (e.g., branded drugs going generic). The U.S. will cover the bulk of drugs spending in 2020 at 41% of the world medicines market, shown in the first pie in the first chart. U.S. medicines spending dwarfs any other country or region in the world, including China which is expected to account for 11% of

American health citizens hungry for cost controls

Most Americans support price controls on drug and medical device manufacturers, hospitals, and payments to doctors, along with allowing Medicare to negotiate drug prices. U.S. health citizens, now consumers, have been experiencing sticker-shock when it comes to prices on medical bills upon hospital discharge, leaving the doctor’s office, filling a prescription at a pharmacy or receiving a specialty drug recommended for a serious medical condition. The HealthDay/Harris Poll of 5 November 2015 quantifies their observation that Americans Want Bold Steps to Keep Health Care Costs in Check. The topline of the Poll shows that: 73 percent support price controls on

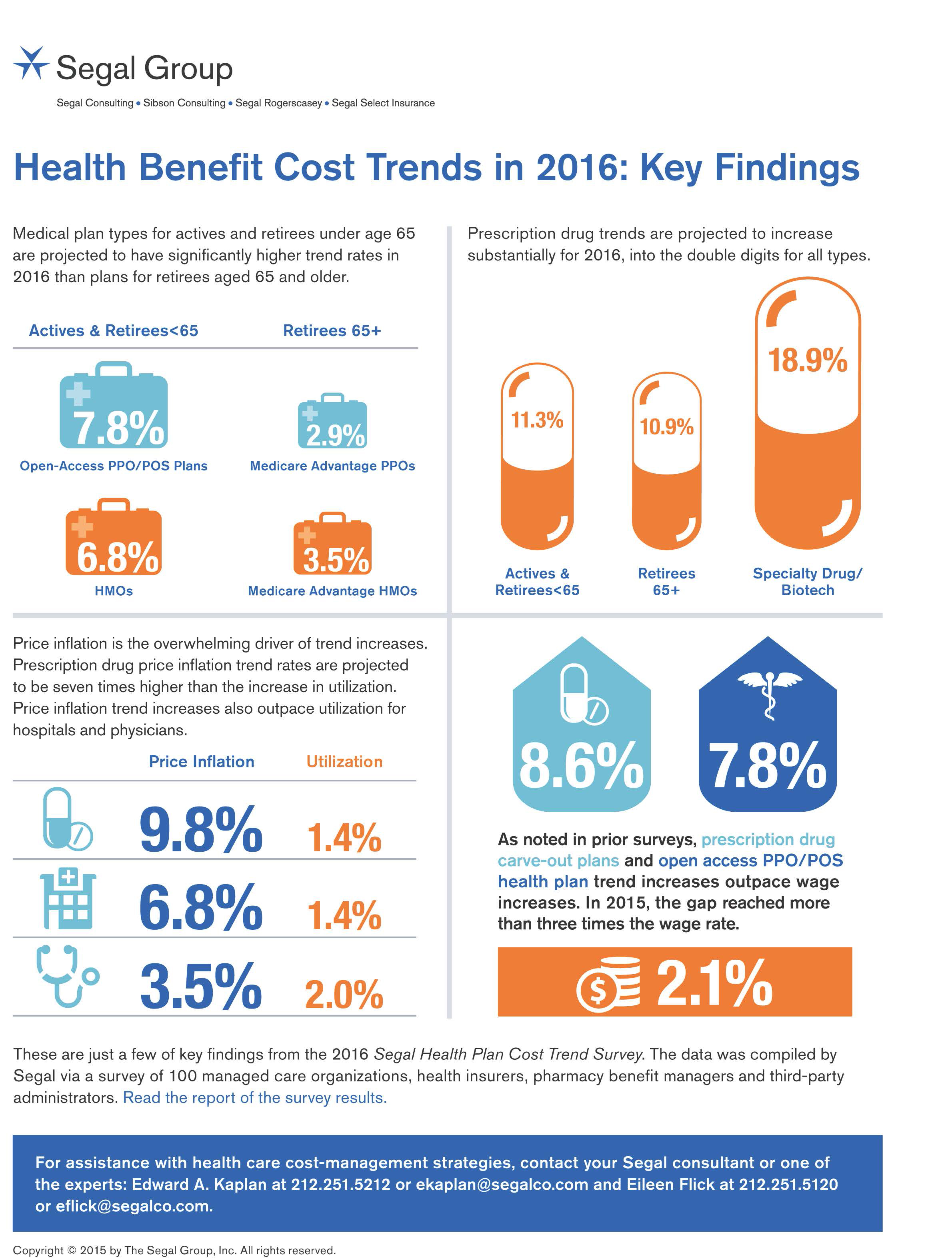

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

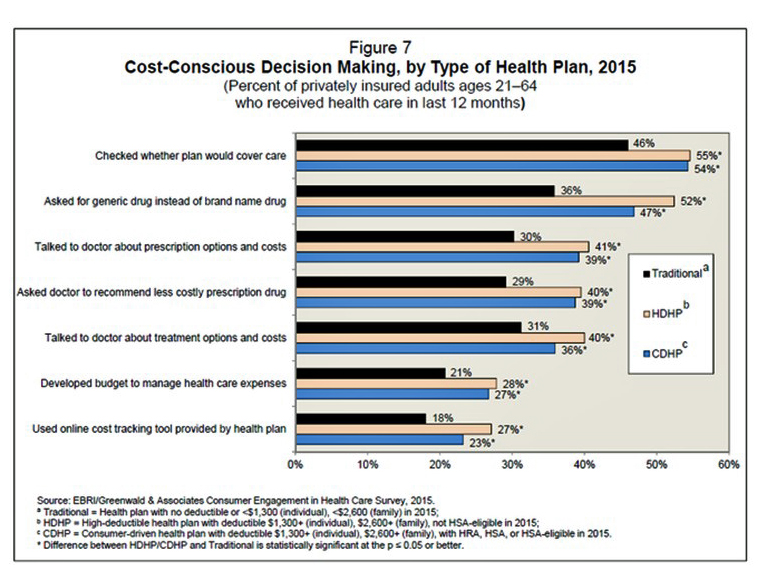

Employers pushing consumerism for health benefits in 2016

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

People-powered health/care – celebrating Patient Independence & Empowerment

In the growing shared economy, one centerpiece is people-powered health – co-creating, shared decision-making, and a greater appreciation for the impact of social on health. As we approach the mid-point of 2015, there are several signposts pointing to people-powered health/care. FasterCures launched the Science of Patient Input Project, with the objective of getting the patient’s voice into clinical discovery and decision-making. This video describes the intent of the program and its potential for people-powered health and user/patient-centered drug design, beyond the pure clinical efficacy of therapies. Another example of people-powered health comes from The Wall Street Journal dated 29 June 2015, which

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

Telehealth goes retail

In the past couple of weeks, a grocery store launched a telemedicine pilot, a pharmacy chain expanded telehealth to patients in 25 states, and several new virtual healthcare entrants received $millions in investments. On a parallel track, the AMA postponed dealing with medical ethics issues regarding telemedicine, the Texas Medical Association got stopped in its tracks in a case versus Teladoc, and the Centers for Medicare and Medicaid Services (CMS) issued a final rule for the Medicare Shared Savings Program that falls short of allowing Accountable Care Organizations (ACOs) to take full advantage of telehealth services. These events beg the

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

All women are health workers

The spiritual and emotional top the physical in women’s definition of “health,” based on a multi-country survey conducted in Brazil, Germany, Japan, the UK and the U.S. The Power of the Purse, a research project sponsored by the Center for Talent Innovation, underscores women’s primary role as Chief Medical Officers in their families and social networks. The research was sponsored by health industry leaders including Aetna, Bristol-Myers Squibb, Cardinal Health, Eli Lilly and Company, Johnson & Johnson, Merck & Co., Merck KGaA, MetLife, Pfizer, PwC, Strategy&, Teva, and WPP. The study’s summary infographic is titled How the Healthcare Industry Fails

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Capital investments in health IT moving healthcare closer to people

In recent weeks, an enormous amount of money has been raised by organizations using information technology to move health/care to people where they live, work, and play… This prompted one questioner at the recent ANIA annual conference to ask me after my keynote speech on the new health economy, “Is the hospital going the way of the dinosaur?” Before we get to the issue of possible extinction of inpatient care, let’s start with the big picture on digital health investment for the first quarter of 2015. Some $429 mm was raised for digital health in the first quarter of 2015,

Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.